PERSONAL ACCIDENT

SMARTPA ENHANCED

PROTECT AGAINST

THE UNEXPECTED

Member of PIDM

The benet(s) payable under eligible product is protected by PIDM up

to limits. Please refer to PIDM’s TIPS Brochure or contact Generali

Insurance Malaysia Berhad or PIDM (visit www.pidm.gov.my)

With SmartPA Enhanced, enjoy comprehensive

protection for you and your family 24/7 anywhere in

the world.

SmartPA Enhanced is the ideal Personal Accident insurance that will help protect you and your

family. While you cannot avoid all accidents that come your way, SmartPA Enhanced gives you

peace of mind with protection against the unexpected.

Get increasing coverage with our Renewal Bonus feature and No Claims Discount benet plus

many other benets for a comprehensive protection.

BENEFITS

High Sum Insured

We cover Accidental Death or Permanent Disablement (including coma) up to

RM1,000,000.

Renewal Bonus up to 120%

Principal sum insured will increase from 15% per year up to 120% upon

renewal of insurance provided there is no claim under Accidental Death or

Permanent Disablement.

Double the Payout

Double the payout up to RM2,000,000 for Accidental Death or Permanent Total

Disablement whilst travelling on a public transport, travelling overseas, during

festive season or being a victim of snatch theft or robbery.

Family Plans Privilege

Extend the protection to your spouse and family with unlimited number of

children and enjoy 3 times sum insured with double payout up to RM6,000,000.

No Claims Discount

Get 10% discount on your renewal premium if you do not make any claims on

your policy.

Cashless Hospital Admission

Guarantees up to RM12,000 for admission at panel hospitals in Malaysia due to

an accident.

Renewable up to age 100

Provides you continuous protection into your golden years.

X2

10%

N

o

C

l

a

i

m

s

D

i

s

c

o

u

n

t

Page 2/8

Accidental Medical Expenses

Covers your medical expenses up to RM12,000 for treatment from a hospital

or clinic due to an accident.

Medical Coverage for Dengue

Pays for medical expenses for the treatment of illness due to Dengue, Zika

Virus, Malaria, Japanese Encephalitis or Chikungunya up to 50% of Medical

Expenses Limit.

Alternative Medical Treatment

Pays up to RM500 per accident for treatment by a registered traditional

medicine practitioner, osteopath, chiropractor, herbalist and/or bonesetter.

Dental and Corrective Surgery

Pays up to RM10,000 for any additional expenses incurred for dental

correction and/or corrective cosmetic surgical operation to the face, neck,

head or chest necessitated by an accident.

Daily Hospitalization Allowance

Up to RM250 daily cash allowance is paid each day to a maximum of 180 days

for hospitalisation due to accident. This is on top of the Medical Expenses

payout!

Compassionate Care Allowance

Covers up to RM3,000 for the expenses incurred for travelling and

accommodation by one family member to take care of and/or accompany the

Insured who is a minor (aged 12 and below), during hospitalization due to

accident.

Weekly Nursing Care Charges

A weekly cash allowance for up to RM1,200 per week for special nursing care

if post-hospitalization nursing care is considered necessary by the hospital.

Ambulance Fees

Pays for the ambulance cost incurred to transport the Insured following an

accident.

Prostheses

Pays for the necessary cost of purchasing wheelchair, articial arm or leg and

crutches.

Repatriation Expenses

Payment for the cost of cremation in the locality where death occurs or the

expenses of transporting the mortal remains back to Malaysia in the event of

death.

Bereavement Allowance

A lump sum payment of up to RM10,000 as bereavement allowance in the

event of Accidental Death, including death due to Dengue, Zika Virus, Malaria,

Japanese Encephalitis or Chikungunya.

Page 3/8

Funeral Expenses

Reimburses the funeral expenses up to RM10,000 in the event of Accidental

Death, including death due to Dengue, Zika Virus, Malaria, Japanese

Encephalitis or Chikungunya.

Cash Relief

Pays lump sum emergency cash up to RM7,500 in the event of Accidental

Death.

Snatch Theft or Robbery

A lump sum payment for loss or damage to personal effects due to snatch

theft or robbery. Police report required (to be made within 24 hours).

Kidnap Benet

Payment of up to RM10,000 lump sum for expenses incurred including hiring

a private investigator. A reward of RM25,000 for information leading to the alive

recovery of the Insured. Full payment of the principal sum insured upon

non-recovery of the kidnapped person after a period of one year from the day

of the kidnap.

Loan Protector up to RM7,500

In the event of Accidental Death, we will reimburse the Insured Person’s

outstanding credit liabilities for credit cards, personal loan, overdraft,

education, housing, car or renovation loans with any banks licensed by Bank

Negara Malaysia.

Personal Liability

Liabilities payment up to RM1,000,000, should you be liable to pay a third

party for accidental bodily injury or accidental property damage.

VALUE ADDED - OPTIONAL

Temporary Total Disablement

An option to include Weekly Benet coverage for yourself and

spouse and be entitled to 104 weeks of weekly benets if the

insured person is unable to attend work as a result of an accident

(as certied by a medical practitioner). Weekly benet payout is up

to RM300 per week!

Page 4/8

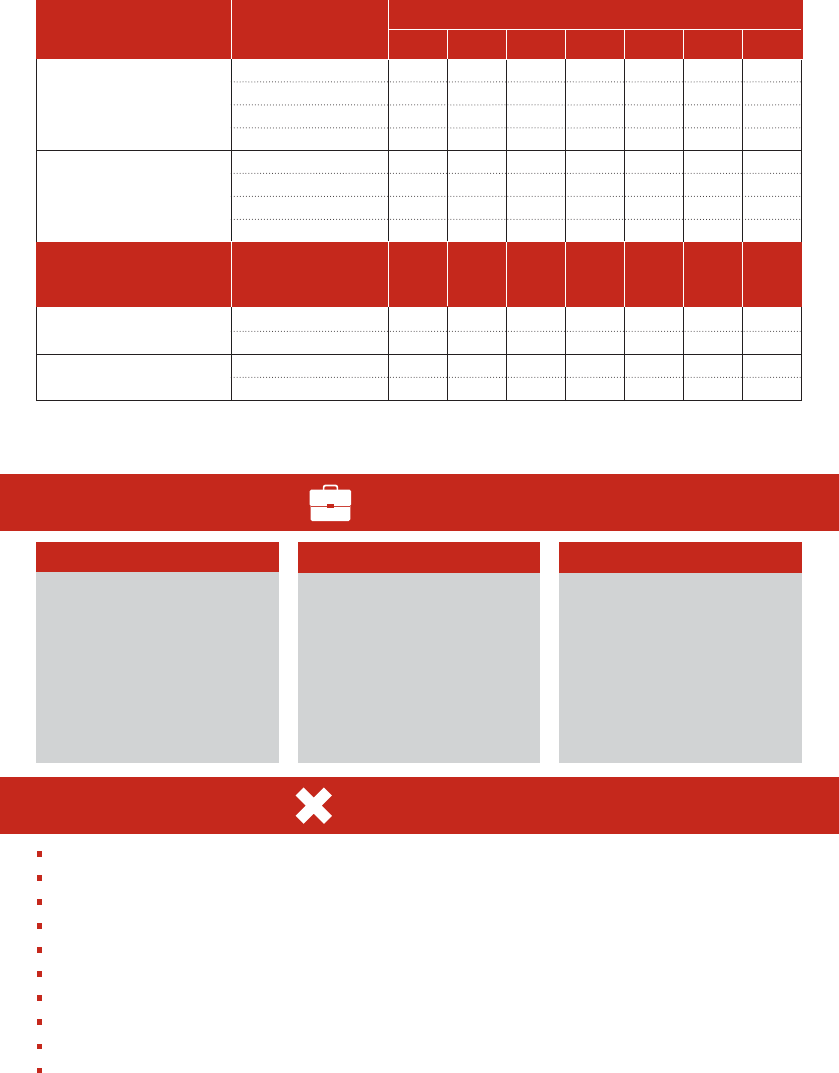

Schedule of Benets

Plan 2 Plan 3 Plan 4 Plan 5 Plan 6

Accidental Death

Sum Insured/Limit of Liability Per Accident (RM)

Limit

Per Adult:

Age <80 years old

Plan 7

1,000,000

Per Adult:

Age ≥80 years old

500,000

Per Child 150,000

Per Family

3,000,000

Benet 1 - Accidental Death

Benet 2 - Accidental Permanent Disablement

Accidental Permanent Total

Disablement

Per Adult:

Age <80 years old

1,000,000

Per Adult:

Age ≥80 years old

500,000

Per Child 150,000

Per Family

3,000,000

Benet 3 - Renewal Bonus

Renewal Bonus

15% per year up to 120% of Principal Sum Insured of Benet 1 and Benet 2

Double IndemnityBenet 4

Per Adult:

Age <80 years old

2,000,000

Per Adult:

Age ≥80 years old

1,000,000

Per Child 300,000

Per Family

6,000,000

Double Indemnity whilst travelling

on public transport, travelling

overseas, being a victim of snatch

theft or robbery or involved in an

accident during festive season

Per Adult/Child 12,000

Per Family 36,000

Benet 5A (i) Accidental Medical

Expenses

Benet 5 - Medical Expenses

Per Adult/Child 500

Per Family 1,500

Benet 5A (ii) Alternative Medical

Treatment

Per Adult 12,000

Benet 5B Cashless Admission Guarantee

Per Adult/Child 10,000

Plan 1

50,000

25,000

7,500

150,000

50,000

25,000

7,500

150,000

100,000

50,000

15,000

300,000

3,000

9,000

500

1,500

3,000

5,000

15,000Per Family 30,000

Benet 5C Dental and Corrective

Surgery

9,000Per Adult/Child 45,000

27,000Per Family 135,000

50Per Day 250

Benet 5D Daily Hospital Allowance

(maximum 180 days)

3,000Per Adult/Child 3,000

9,000Per Family 9,000

Benet 5E Compassionate Care Allowance

500Per Adult/Child 1,200

1,500Per Family 3,600

Benet 5F Weekly Nursing Care

Charges

500Per Adult/Child 500

1,500Per Family 1,500

Benet 5G Local Ambulance Fees

1,000Per Adult/Child 1,000

3,000Per Family 3,000

Benet 5H Prostheses

Benet 6 - Repatriation of Mortal Remains

10,000Per Adult/Child 10,000

30,000Per Family 30,000

Repatriation of Mortal Remains

Benet 7 - Bereavement/Funeral Allowance

5,000Per Adult/Child 10,000

15,000Per Family 30,000

Benet 7A Bereavement Allowance

5,000Per Adult/Child 10,000

15,000Per Family 30,000

Benet 7B Funeral Expenses

2,000Per Adult/Child 7,500

6,000Per Family

100,000

50,000

15,000

300,000

100,000

50,000

15,000

300,000

200,000

100,000

30,000

600,000

4,000

12,000

500

1,500

4,000

5,000

15,000

13,500

40,500

75

3,000

9,000

750

2,250

500

1,500

1,000

3,000

10,000

30,000

5,000

15,000

5,000

15,000

3,000

9,000

200,000

100,000

30,000

600,000

200,000

100,000

30,000

600,000

400,000

200,000

60,000

1,200,000

5,000

15,000

500

1,500

5,000

5,000

15,000

18,000

54,000

100

3,000

9,000

1,000

3,000

500

1,500

1,000

3,000

10,000

30,000

5,000

15,000

5,000

15,000

5,000

15,000

300,000

150,000

45,000

900,000

300,000

150,000

45,000

900,000

600,000

300,000

90,000

1,800,000

6,000

18,000

500

1,500

6,000

10,000

30,000

22,500

67,500

125

3,000

9,000

1,000

3,000

500

1,500

1,000

3,000

10,000

30,000

10,000

30,000

10,000

30,000

5,000

15,000

500,000

250,000

75,000

1,500,000

500,000

250,000

75,000

1,500,000

1,000,000

500,000

150,000

3,000,000

7,000

21,000

500

1,500

7,000

10,000

30,000

27,000

81,000

150

3,000

9,000

1,000

3,000

500

1,500

1,000

3,000

10,000

30,000

10,000

30,000

10,000

30,000

7,500

22,500

750,000

375,000

112,500

2,250,000

750,000

375,000

112,500

2,250,000

1,500,000

750,000

225,000

4,500,000

9,000

27,000

500

1,500

9,000

10,000

30,000

36,000

108,000

200

3,000

9,000

1,000

3,000

500

1,500

1,000

3,000

10,000

30,000

10,000

30,000

10,000

30,000

7,500

22,500 22,500

Benet 7C Cash Relief

Benet 4 - Double Indemnity

Schedule of Benets

Schedule of Benets

Plan 2 Plan 3 Plan 4 Plan 5 Plan 6

Sum Insured/Limit of Liability Per Accident (RM)

Limit

Plan 7

Benet 8

Plan 1

5,000Per Adult/Child 5,000 10,000 10,000 10,000

15,000Per Family 15,000 30,000 30,000 30,000

Benet 9A Kidnap - Lump Sum

Payment

25,000Per Adult/Child 25,000 25,000 25,000 25,000

75,000Per Family 75,000 75,000 75,000 75,000

Benet 9B Kidnap - Reward

50,000Per Adult/Child 100,000 500,000 750,000

1,000,000

150,000Per Family 300,000

1,500,000 2,250,000 3,000,000

Benet 9C Kidnap - Insured not

Recovered

500Per Adult/Child 500 500 500 500

1,500Per Family 1,500 1,500 1,500 1,500

Snatch Theft or Robbery

2,000Per Adult 3,000 7,500 7,500 7,500

Loan Protector

50,000Per Adult/Child 100,000 500,000 750,000

1,000,000

150,000Per Family 300,000

1,500,000 2,250,000 3,000,000

Personal Liability

ADD ON

Benet A1 Class 1 & 2 - Temporary Total Disablement

50Per Adult/Week 75 200 250 300

Temporary Total Disablement

Benet A2 Class 3 - Temporary Total Disablement

50Per Adult/Week 50

5,000

15,000

25,000

75,000

200,000

600,000

500

1,500

5,000

200,000

600,000

125

50

10,000

30,000

25,000

75,000

300,000

900,000

500

1,500

5,000

300,000

900,000

150

N/A N/A N/A N/A

Temporary Total Disablement

Benet 8 - Snatch Theft or Robbery

Benet 9 - Kidnap

Benet 10 - Loan Protector

Benet 11 - Personal Liability

Notes:

1. Eligible age is any person aged from 18 to 69 years old, renewable up to 100 years.

2. Eligible age for children is from 30 days to 18 years of age (or up to 23 years for full-time students).

3. Children are covered 15% for Death and Disability benets and 100% for other benets.

4. Only legal children can be insured (irrespective of number of children).

5. Family Limits apply to Self or Spouse and Children plan and Self, Spouse and Children plan.

Amateur Sports

Disappearance

Drowning

Exposure

Food and/or Drink Poisoning

Hijack

Intoxication by alcohol (except whilst driving)

Motorcycling

Murder and Assault

Poisonous Snake/Insect Bites

Suffocation due to Smoke, Fumes or Poisonous Gas

Scuba Diving

Page 6/8

SPECIAL EXTENSIONS

KEY EXCLUSIONS

Benets

Plan 2 Plan 5 Plan 6

Table of Premium before 6% Service Tax (RM)

Person To Be Insured

Plan 7

Self or Spouse & Children

302 888 1,218 1,583

Self, Spouse & Children 479 1,523 2,124 2,761

Self & Spouse 353 1,270 1,814 2,358

Occupation Class 1 & 2

Premium

Self Only 197 708 1,010 1,313

Self or Spouse & Children

421 1,317 1,817 2,362

Self, Spouse & Children 700 2,342 3,282 4,267

Self & Spouse 560 2,051 2,931 3,810

Occupation Class 3

Self Only 392 1,451 2,077 2,700

Spouse Only 45 120 150 180

Occupation Class 1 & 2

Self Only 45 120 150 180

Spouse Only 70 N/A N/A N/A

Occupation Class 3

Self Only 70 N/A N/A N/A

Optional Benet

(Temporary Total

Disablement)

Plan 2

Plan 3

454

747

587

328

652

1,122

939

662

75

75

70

70

Plan 3

Plan 4

608

1,018

821

458

888

1,549

1,321

933

90

90

N/A

N/A

Plan 4 Plan 5 Plan 6

Person To Be Insured

Plan 7

Plan 1

222

340

234

131

300

482

365

253

30

30

70

70

Plan 1

Notes:

1. Premium is subject to Service Tax

2. Please add RM 10.00 for stamp duty

Accidental Death

Class 1

Professions and occupations

involving non-manual,

administrative or clerical

work solely in ofces or

similar non-hazardous

places

Class 2

Professions and occupations

involving non-manual work

with some exposure to risk

from the environment or

which entail much travel, or

work with mainly supervisory

duties and occasional light

manual work

Class 3

Professions and occupations

involving light manual work

not of particularly hazardous

nature but involving the use

of tools or light machinery

Any unlawful act, willful exposure to danger, suicide or intentional self-injury

Any pre-existing physical or mental defect or inrmity, illness, disease, bacterial or viral infections

HIV and/or any HIV related illness including AIDS and/or any mutant derivatives

Effects of drugs not prescribed by a Physician

Pregnancy or childbirth

Extreme Sports, pot-holing, private hunting trips, ultra marathons, racing other than foot

Flying other than as a passenger in a licensed passenger carrying aircraft

War, invasion, rebellion, revolution

Regular or temporary, military or police duties or re service

Engaging or participating in any professional sports

OCCUPATIONS

Page 7/8

1. Who is eligible?

All Malaysians, Malaysian permanent residents, work permit holders, pass holders or

otherwise legally employed in Malaysia and their spouses/children who are legally residing in

Malaysia. Insured Person are between the ages of thirty (30) days and sixty nine (69) years at

the date of inclusion and renewable up to one hundred (100) years old.

2. Is the medical expenses benet payable per disability?

Yes, we will pay up to the sum insured for medical expenses for each accident and there is no

limit to the number of claims made in any one year.

3. Does this plan pay in addition to any other insurance policy that I may have?

Yes, it pays in addition to any other insurance policy you may have except for Medical

Reimbursement.

4. How will I be entitled for Renewal Bonus?

As long as you renew your policy and there is no claim under Accidental Death or Permanent

Disablement in the preceding year, a 15% Renewal Bonus of the Principal Sum Insured will be

rewarded. Only claims under Accidental Death or Permanent Disablement will affect your

Renewal Bonus.

5. How do I qualify for No Claims Discount?

You will be entitled to a 10% No Claims Discount on your renewal premium as long as no claim

was made in the preceding year. You can qualify for No Claims Discount every year but please

note that the renewal premium is not on a reducing basis.

6. How do I utilize the Cashless Hospital Admission?

You can receive Cashless Hospital Admission at Participating Hospitals (list available at Our

website) by providing your Identity Card number upon admission.

Sign up for SmartPA Enhanced today!

For more information, call your agent or

Generali Customer Service Hotline (603) 2170 8282

Operating Hours: 8.30am to 5.30pm (Monday to Friday excluding public holidays)

SPAE/BR (02/23)

Ask your insurance agent for more details

Generali Insurance Malaysia Berhad (formerly known as AXA Afn General Insurance Berhad)

Reg No: 197501002042 (23820-W) Service Tax Reg. No.: W10-1808-31015017

Registered Address: Ground Floor, Wisma Boustead, 71 Jalan Raja Chulan, 50200 Kuala Lumpur, Malaysia

T +603 2170 8282 F +603 2031 7282

E-mail: customer.ser[email protected] Website: generali.com.my

This brochure is not a contract of insurance. The precise terms, conditions and denitions are specied in the insurance policy.

In the event of differences arising between the English and Bahasa Malaysia versions, the English version shall prevail.

Important Note:

1. Read this brochure before you decide to take out the SmartPA Enhanced Insurance Policy. Be sure to also read through the general terms and

conditions of the Product Disclosure Sheet.

2. You should read and understand the insurance policy and discuss with the agent or contact us directly for more information.