1/90

Consolidated financial statements

Year ended 31 March 2024

2/90

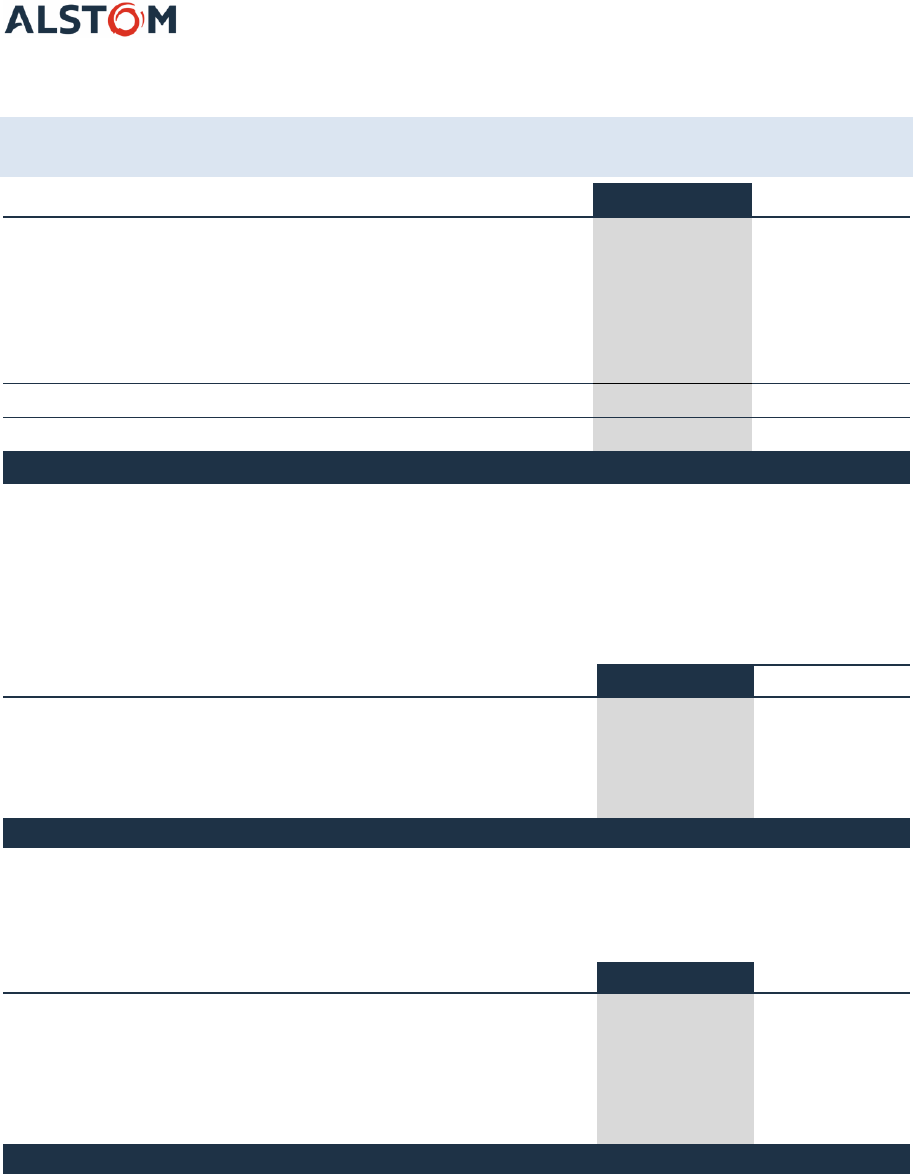

CONSOLIDATED INCOME STATEMENT

Year ended

(in € million)

Note

At 31 March 2024

At 31 March 2023

Sales

(3)

17,619

16,507

Cost of sales

(15,406)

(14,541)

Research and development expenses

(4)

(609)

(580)

Selling expenses

(5)

(383)

(375)

Administrative expenses

(5)

(725)

(721)

Other income/(expense)

(6)

(508)

(369)

Earnings Before Interests and Taxes

(12)

(79)

Financial income

(7)

47

36

Financial expense

(7)

(289)

(139)

Pre-tax income

(254)

(182)

Income Tax Charge

(8)

(6)

(34)

Share in net income of equity-accounted investments (*)

(13)

(17)

112

Net profit (loss) from continuing operations

(277)

(104)

Net profit (loss) from discontinued operations

(9)

(2)

(4)

NET PROFIT (LOSS)

(279)

(108)

Net profit (loss) attributable to equity holders of the parent

(309)

(132)

Net profit (loss) attributable to non controlling interests

30

24

Net profit (loss) from continuing operations attributable to:

• Equity holders of the parent

(307)

(128)

• Non controlling interests

30

24

Net profit (loss) from discontinued operations attributable to:

• Equity holders of the parent

(2)

(4)

• Non controlling interests

-

-

Earnings (losses) per share (in €)

• Basic earnings (losses) per share

(10)

(0.81)

(0.35)

• Diluted earnings (losses) per share

(10)

(0.80)

(0.35)

(*) Including €(122) million loss resulting from the sale of TMH and the derecognition of the Currency Translation Adjustment (see Note 1.2) as of

31 March 2024.

The accompanying notes are an integral part of the consolidated financial statements.

3/90

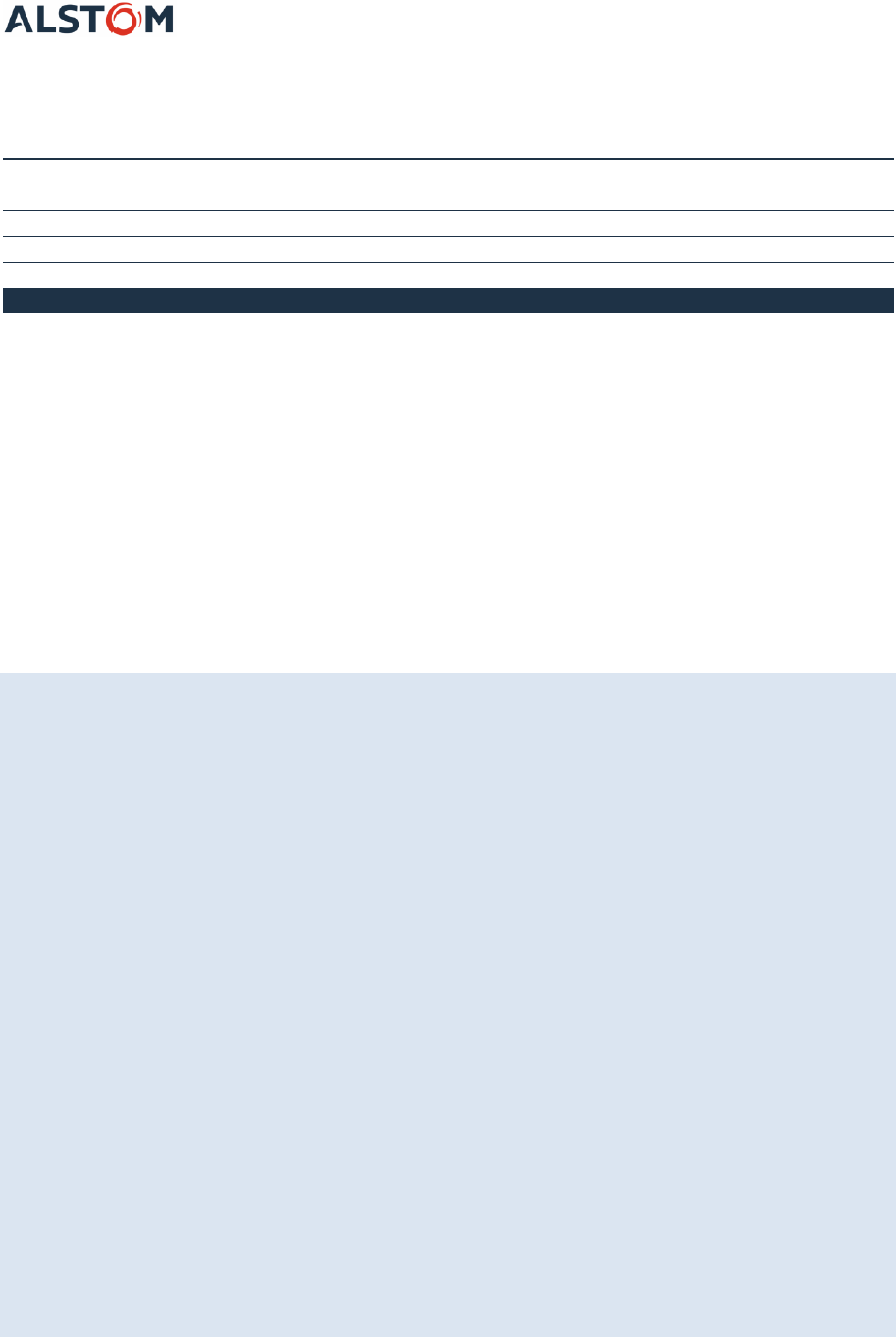

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended

(in € million)

Note

At 31 March

2024

At 31 March

2023

Net profit (loss) recognised in income statement

(279)

(108)

Remeasurement of post-employment benefits obligations

(29)

(135)

256

Equity investments at FVOCI

(13)

/(14)

(8)

9

Income tax relating to items that will not be reclassified to profit or loss

(8)

2

(6)

Items that will not be reclassified to profit or loss

(141)

259

of which from equity-accounted investments

-

-

Fair value adjustments on cash flow hedge derivatives

3

1

Costs of hedging reserve

19

57

Currency translation adjustments (*)

(23)

129

(220)

Income tax relating to items that may be reclassified to profit or loss

(8)

(8)

(5)

Items that may be reclassified to profit or loss

143

(167)

of which from equity-accounted investments

(13)

72

(73)

TOTAL COMPREHENSIVE INCOME

(277)

(16)

Attributable to:

• Equity holders of the parent

(302)

(27)

• Non controlling interests

25

11

Total comprehensive income attributable to equity shareholders arises from:

• Continuing operations

(301)

(23)

• Discontinued operations

(1)

(4)

Total comprehensive income attributable to non controlling interests arises from:

• Continuing operations

25

11

• Discontinued operations

-

-

(*) Includes the CTA recycling impact for the TMH disposal (see Note 1.2) and currency translation adjustments on actuarial gains and losses for €5

million as of 31 March 2024 (€(7) million as of 31 March 2023).

The accompanying notes are an integral part of the consolidated financial statements.

4/90

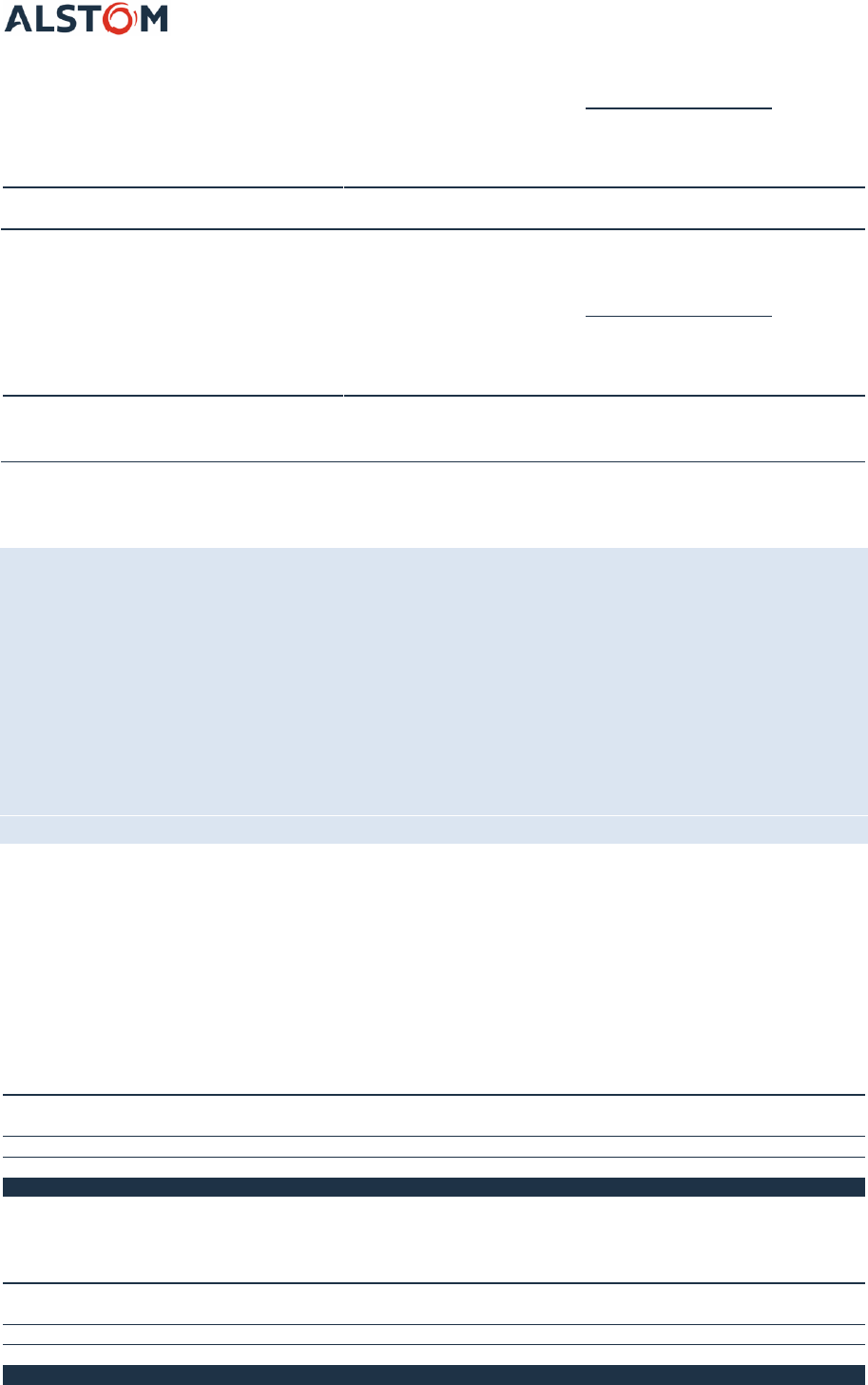

CONSOLIDATED BALANCE SHEET

Assets

(in € million)

Note

At 31 March 2024

At 31 March 2023

Goodwill

(11)

9,093

9,380

Intangible assets

(11)

2,268

2,606

Property, plant and equipment

(12)

2,756

2,481

Investments in joint-venture and associates

(13)

882

1,131

Non consolidated investments

(14)

74

82

Other non-current assets

(15)

497

569

Deferred Tax

(8)

673

596

Total non-current assets

16,243

16,845

Inventories

(17)

3,818

3,729

Contract assets

(18)

4,973

4,533

Trade receivables

(19)

2,997

2,670

Other current operating assets

(20)

3,515

2,728

Other current financial assets

(25)

40

65

Cash and cash equivalents

(26)

976

826

Total current assets

16,319

14,551

Assets held for sale

(9)

691

-

TOTAL ASSETS

33,253

31,396

Equity and Liabilities

(in € million)

Note

At 31 March 2024

At 31 March 2023

Equity attributable to the equity holders of the parent

(23)

8,672

8,997

Non controlling interests

106

105

Total equity

8,778

9,102

Non current provisions

(22)

539

442

Accrued pensions and other employee benefits

(29)

946

923

Non-current borrowings

(27)

2,694

2,657

Non-current lease obligations

(27)

471

501

Deferred Tax

(8)

91

128

Total non-current liabilities

4,741

4,651

Current provisions

(22)

1,612

1,779

Current borrowings

(27)

1,316

396

Current lease obligations

(27)

174

144

Contract liabilities

(18)

7,995

6,781

Trade payables

(16)

3,444

3,640

Other current liabilities

(21)

5,070

4,903

Total current liabilities

19,611

17,643

Liabilities related to assets held for sale

(9)

123

-

TOTAL EQUITY AND LIABILITIES

33,253

31,396

The accompanying notes are an integral part of the consolidated financial statements.

5/90

CONSOLIDATED STATEMENT OF CASH FLOWS

Year ended

(in € million)

Note

At 31 March 2024

At 31 March 2023

Net profit (loss)

(279)

(108)

Depreciation, amortisation and impairment

(11)/(12)

836

886

Expense arising from share-based payments

(30)

19

66

Cost of net financial debt and costs of foreign exchange hedging, net of interest paid and

received (a), and other change in provisions

(26)

33

Post-employment and other long-term defined employee benefits

(13)

4

Net (gains)/losses on disposal of assets

(1)

28

Share of net income (loss) of equity-accounted investments (net of dividends received)

(13)

327

2

Deferred taxes charged to income statement

(8)

(104)

(138)

Net cash provided by operating activities - before changes in working capital

759

773

Changes in working capital resulting from operating activities (b)

(16)

(841)

(167)

Net cash provided by/(used in) operating activities

(82)

606

Of which operating flows provided / (used) by discontinued operations

-

-

Proceeds from disposals of tangible and intangible assets

8

24

Capital expenditure (including capitalised R&D costs)

(485)

(431)

Increase/(decrease) in other non-current assets

(15)

4

24

Acquisitions of businesses, net of cash acquired

(31)

(30)

Disposals of businesses, net of cash sold

73

(65)

Net cash provided by/(used in) investing activities

(431)

(478)

Of which investing flows provided / (used) by discontinued operations

(9)

(8)

(11)

Capital increase/(decrease) including non controlling interests

-

90

Dividends paid including payments to non controlling interests

(61)

(62)

Issuances of bonds & notes

(27)

-

-

Changes in current and non-current borrowings

(27)

877

56

Changes in lease obligations

(27)

(160)

(150)

Changes in other current financial assets and liabilities

(27)

40

5

Net cash provided by/(used in) financing activities

696

(61)

Of which financing flows provided / (used) by discontinued operations

-

-

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS

183

67

Cash and cash equivalents at the beginning of the period

826

810

Net effect of exchange rate variations

(33)

(53)

Transfer to assets held for sale

(2)

2

CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD

(26)

976

826

(a) Net of interests paid & received

(152)

(43)

(b) Income tax paid

(188)

(130)

The accompanying notes are an integral part of the consolidated financial statements.

6/90

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(in € million, except for number of

shares)

Number of

outstanding

shares

Capital

Additional

paid-in

capital

Retained

earnings

Actuarial

gains

and

losses

Cash-

flow

hedge

Currency

translation

adjustment

Equity

attributable

to the

equity

holders of

the parent

Non

controlling

interests

Total

equity

At 31 March 2022

373,391,746

2,614

5,354

1,236

160

(3)

(450)

8,911

113

9,024

Movements in other comprehensive

income

-

-

-

61

242

2

(200)

105

(13)

92

Net income for the period

-

-

-

(132)

-

-

-

(132)

24

(108)

Total comprehensive income

-

-

-

(71)

242

2

(200)

(27)

11

(16)

Change in controlling interests and

others

-

-

-

(1)

4

-

-

3

(0)

3

Dividends convertible into shares

-

-

-

(50)

-

-

-

(50)

(0)

(50)

Dividends paid in cash

-

-

-

(43)

-

-

-

(43)

(19)

(62)

Capital increase by issuance of new

shares

2,432,331

17

35

-

-

-

-

52

-

52

Issue of ordinary shares under long term

incentive plans

4,629,377

32

56

(3)

-

-

-

85

-

85

Recognition of equity settled share-

based payments

-

-

-

66

-

-

-

66

-

66

At 31 March 2023

380,453,454

2,663

5,445

1,134

406

(1)

(650)

8,997

105

9,102

Movements in other comprehensive

income

-

-

-

7

(134)

4

130

7

(5)

2

Net income for the period

-

-

-

(309)

-

-

-

(309)

30

(279)

Total comprehensive income

-

-

-

(302)

(134)

4

130

(302)

25

(277)

Change in controlling interests and

others

-

-

-

(4)

-

-

-

(4)

1

(3)

Dividends convertible into shares

2,435,803

17

41

(58)

-

-

-

-

-

-

Dividends paid in cash

-

-

-

(38)

-

-

-

(38)

(25)

(63)

Issue of ordinary shares under long term

incentive plans

1,401,811

10

-

(10)

-

-

-

-

-

-

Recognition of equity settled share-

based payments

-

-

-

19

-

-

-

19

-

19

At 31 March 2024

384,291,068

2,690

5,486

741

272

3

(520)

8,672

106

8,778

The accompanying notes are an integral part of the consolidated financial statements.

7/90

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

A. MAJOR EVENTS AND CHANGES IN SCOPE OF CONSOLIDATION ............................................................... 9

NOTE 1. MAJOR EVENTS AND MAJOR CHANGES IN SCOPE OF CONSOLIDATION ........................ 9

B. ACCOUNTING POLICIES AND USE OF ESTIMATES .................................................................................. 11

NOTE 2. ACCOUNTING POLICIES ................................................................................................. 11

C. SEGMENT INFORMATION ..................................................................................................................... 21

NOTE 3. SEGMENT INFORMATION .............................................................................................. 21

D. OTHER INCOME STATEMENT ................................................................................................................ 23

NOTE 4. RESEARCH AND DEVELOPMENT EXPENDITURE ............................................................ 23

NOTE 5. SELLING AND ADMINISTRATIVE EXPENSES ................................................................... 24

NOTE 6. OTHER INCOME AND OTHER EXPENSES ........................................................................ 24

NOTE 7. FINANCIAL INCOME (EXPENSES) ................................................................................... 25

NOTE 8. TAXATION ...................................................................................................................... 26

NOTE 9. FINANCIAL STATEMENTS OF DISCONTINUED OPERATIONS AND ASSETS HELD FOR SALE

29

NOTE 10. EARNINGS PER SHARE ................................................................................................... 30

E. NON-CURRENT ASSETS ........................................................................................................................ 31

NOTE 11. GOODWILL AND INTANGIBLE ASSETS ........................................................................... 32

NOTE 12. PROPERTY, PLANT AND EQUIPMENT ............................................................................ 36

NOTE 13. INVESTMENTS IN JOINT VENTURES AND ASSOCIATES .................................................. 39

NOTE 14. NON-CONSOLIDATED INVESTMENTS ............................................................................ 40

NOTE 15. OTHER NON-CURRENT ASSETS ...................................................................................... 41

F. WORKING CAPITAL .............................................................................................................................. 42

NOTE 16. WORKING CAPITAL ANALYSIS ........................................................................................ 42

NOTE 17. INVENTORIES ................................................................................................................. 42

NOTE 18. NET CONTRACT ASSETS/LIABILITIES .............................................................................. 43

NOTE 19. TRADE RECEIVABLES ...................................................................................................... 44

NOTE 20. OTHER CURRENT OPERATING ASSETS ........................................................................... 44

NOTE 21. OTHER CURRENT OPERATING LIABILITIES ..................................................................... 45

NOTE 22. PROVISIONS ................................................................................................................... 45

G. EQUITY AND DIVIDENDS ...................................................................................................................... 47

NOTE 23. EQUITY ........................................................................................................................... 47

8/90

NOTE 24. DISTRIBUTION OF DIVIDENDS ....................................................................................... 47

H. FINANCING AND FINANCIAL RISK MANAGEMENT ................................................................................ 48

NOTE 25. OTHER CURRENT FINANCIAL ASSETS ............................................................................ 48

NOTE 26. CASH AND CASH EQUIVALENTS ..................................................................................... 48

NOTE 27. FINANCIAL DEBT ............................................................................................................ 48

NOTE 28. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT................................. 50

I. POST-EMPLOYMENT AND OTHER LONG-TERM DEFINED EMPLOYEE BENEFITS AND SHARE–BASED

PAYMENTS .................................................................................................................................. 60

NOTE 29. POST-EMPLOYMENT AND OTHER LONG-TERM DEFINED EMPLOYEE BENEFITS ........... 60

NOTE 30. SHARE-BASED PAYMENTS ............................................................................................. 66

NOTE 31. EMPLOYEE BENEFIT EXPENSE AND HEADCOUNT .......................................................... 70

J. CONTINGENT LIABILITIES AND DISPUTES ............................................................................................ 70

NOTE 32. CONTINGENT LIABILITIES ............................................................................................... 71

NOTE 33. DISPUTES ....................................................................................................................... 72

K. OTHER NOTES ...................................................................................................................................... 81

NOTE 34. INDEPENDENT AUDITORS’ FEES .................................................................................... 81

NOTE 35. RELATED PARTIES .......................................................................................................... 81

NOTE 36. SUBSEQUENT EVENTS ................................................................................................... 82

NOTE 37. SCOPE OF CONSOLIDATION ........................................................................................... 84

9/90

Alstom is a leading player in the world rail transport industry. As such, the Company offers a complete range of

solutions, including rolling stock, systems, services as well as signalling for passenger and freight railway

transportation. It benefits from a growing market with solid fundamentals. The key market drivers are urbanisation,

environmental concerns, economic growth, governmental spending and digital transformation.

In this context, Alstom has been able to develop both a local and global presence that sets it apart from many of its

competitors, while offering proximity to customers and great industrial flexibility. Its range of solutions, one of the most

complete and integrated on the market, and its position as a technological leader, place Alstom in a unique situation

to benefit from the worldwide growth in the rail transport market. Lastly, in order to generate profitable growth, Alstom

focuses on operational excellence and its product mix evolution.

The consolidated financial statements are presented in euro and have been authorised for issue by the Board of

Directors held on 7 May 2024. In accordance with French legislation, they will be final once approved by the

shareholders of Alstom at the Annual General Meeting convened for 20 June 2024.

A. MAJOR EVENTS AND CHANGES IN SCOPE OF CONSOLIDATION

NOTE 1. MAJOR EVENTS AND MAJOR CHANGES IN SCOPE OF CONSOLIDATION

1.1. Major events

Sale of North American Signalling Business to Knorr-Bremse AG

On 19 April 2024, Alstom announced that it had entered into a binding agreement with Knorr-Bremse AG, to sell

Alstom’s North American conventional signalling business for a purchase price of around €630 million.

This transaction is part of the comprehensive company action plan that Alstom announced on 15 November 2023,

aimed at reinforcing its leadership position in the rail industry. Closing of the transaction is only subject to customary

conditions, including regulatory approval, and is expected to take place as soon as summer 2024.

Proceeds for Alstom at closing, net of expected tax and transaction costs, are expected to be around €620 million.

As of 31 March 2024, the corresponding assets have been classified as Assets Held for Sale in the consolidated Balance

Sheet (see Note 9.2).

“Autumn” restructuring plan

On 15 November 2023, Alstom announced that it was implementing a comprehensive operational, commercial and

cost efficiency plan (the “Autumn” plan). The Autumn plan aims at accelerating the third phase of the Bombardier

Transportation merger roadmap (optimization). As part of this efficiency plan, Alstom announced an overhead cost

reduction initiative of around 1,500 FTE representing close to 10% of total S&A positions. This plan was presented to

the employee representation bodies during the second semester, and negotiations are ongoing in view of implementing

as from the first semester of the fiscal year 2024/25.

10/90

A total cost of €115 million has been booked during the period, with a remaining balance in provision of €110 million

in the consolidated Balance Sheet (see Note 22) as of 31 March 2024.

1.2. Scope of consolidation

SpeedInnov

Through its affiliate SpeedInnov, a joint venture created in 2015 with ADEME, Alstom focused on its ‘Very high-speed

train of the future’ project, aiming to promote a new generation of very high-speed trainset which will reduce

acquisition and operating costs by at least 20%, optimize the environmental footprint and develop the commercial offer

to improve passenger experience. In this context, Alstom subscribed to a capital increase in this joint venture in an

amount of €13.6 million in October 2023 increasing its stake from 75.48% to 76.39% with no change in the consolidation

method due to the rights granted to the co-investor as per shareholder agreement, the Group assessed it has “Joint

control” over the entity.

Disposal of TMH

On 14 September 2023, the Office of Foreign Assets Control (OFAC) of the US department of Treasury added JSC

Transmashholding (TMH AO) to the Specially Designated Nationals and Blocked Person (SDN) List. TMH AO is the

Russian holding company of TMH Group and is 100% owned by TMH Limited.

The Group further assessed potential exposures arising from the new OFAC sanctions and made the decision to sell its

stake in TMH.

The transaction was closed early January 2024 for an amount of €75 million, carrying value was nil as result of previous

impairment, contributing to the de-risking of the company’s portfolio. The sale resulted in a non-cash loss of €(122)

million due to the recycling of the €(197) million Currency Translation Adjustment accounted for directly in equity since

the acquisition. The net impact of the sale is presented in the line “Share in net income on equity accounted

investments” of the consolidated Income Statement as of 31 March 2024.

11/90

B. ACCOUNTING POLICIES AND USE OF ESTIMATES

NOTE 2. ACCOUNTING POLICIES

2.1. Basis of preparation of the consolidated financial statements

Alstom consolidated financial statements, for the year ended 31 March 2024, are presented in millions of Euros and

have been prepared:

• in accordance with the International Financial Reporting Standards (IFRS) and interpretations published by

the International Accounting Standards Board (IASB) and endorsed by the European Union and whose

application was mandatory as at 31 March 2024;

• using the same accounting policies and measurement methods as at 31 March 2023, with the exceptions of

changes required by the enforcement of new standards and interpretations presented here after.

The full set of standards endorsed by the European Union can be consulted at: http://www.efrag.org/Endorsement.

2.2. New standards and interpretations mandatorily applicable for financial periods beginning on 1 April 2023

Four amendments are applicable at 1 April 2023 and endorsed by European Union:

• Amendments to IAS 1 Presentation of Financial Statements and IFRS Practice Statement 2: Disclosure of

Accounting policies;

• Amendments to IAS 8 Accounting policies, Changes in Accounting Estimates and Errors: Definition of

Accounting Estimates;

• Amendments to IAS 12 Income Taxes: Deferred Tax related to Assets and Liabilities arising from a Single

Transaction;

• Amendments to IAS 12 Income taxes: International Tax Reform – Pillar Two Model Rules.

Due to its size, Alstom is in the scope of the Pillar two Model Rules as released by the OECD, introducing a minimum

corporate income tax rate of 15%. The legislation has been enacted in France and is applicable to Alstom at 1 April

2024. The amendment to IAS 12 Income Taxes – International Tax Reform – Pillar Two Model Rules published by the

IASB and approved by the European Union provides a temporary exception from accounting for deferred taxes arising

from the implementation of the Pillar Two Rules and requires targeted disclosures. At 31 March 2024 the Group has

not accounted for deferred taxes in relation with the Pillar Two Rules.

Alstom is engaged in a project of analysis of the consequences of the legislation and of process preparation to fulfil its

obligations with that regard. Based on a preliminary assessment performed on financial data related to 31 March 2022

and 31 March 2023, Alstom does not expect a material impact of the Pillar two legislation on the consolidated financial

statements.

All the other amendments effective at 1 April 2023 for Alstom have no material impact on the Group’s consolidated

financial statements.

12/90

2.3. New standards and interpretations not yet mandatorily applicable

New standards and interpretations endorsed by the European Union not yet mandatorily applicable:

• Amendments to IAS 1 Presentation of Financial Statements: Classification of Liabilities as Current or Non-

current;

• Amendments to IFRS 16 Leases: Lease Liability in a Sale and Leaseback.

These 2 amendments will be applicable for annual periods beginning after 1 January 2024.

New standards and interpretations not yet approved by the European Union:

• Amendments to IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments: Disclosures: Supplier

Finance Arrangements (applicable for annual periods beginning after 1 January 2024);

• Amendments to IAS 21 The Effects of Changes in Foreign Exchange Rates: Lack of Exchangeability (applicable

for annual periods beginning after 1 January 2025).

The potential impacts of all those new pronouncements are currently being analysed.

2.4. Use of estimates

The preparation of the consolidated financial statements in conformity with IFRS requires management to make

various estimates and to use assumptions regarded as realistic and reasonable. These estimates or assumptions could

affect the value of the Group’s assets, liabilities, equity, net income and contingent assets and liabilities at the closing

date. Management reviews estimates on an on-going basis using information currently available. Actual results may

differ from those estimates, due to changes in facts and circumstances.

The accounting policies most affected by the use of estimates are the following:

Revenue and margin recognition on construction and long-term service contracts and related provisions

The Group recognises revenue and gross margin on most construction and long-term service contracts fulfilling the

requirements for revenue recognition over time, using the percentage of completion method based on cost to cost:

revenue is in that case recognized based on the percentage of costs incurred to date divided by the total costs at

completion. Moreover, when a project review indicates a negative gross margin, the estimated loss at completion is

immediately recognised.

Recognised revenue and margin are based on estimates of total expected contract revenue and cost, which are subject

to revisions as the contract progresses. Total expected revenue and cost on a contract reflect management’s current

best estimate of the probable future benefits and obligations associated with the contract.

Assumptions to calculate present and future obligations take into account current technology as well as the commercial

and contractual positions, assessed on a contract-by-contract basis (one performance obligation corresponding in most

cases to one contract). The introduction of technologically-advanced products exposes the Group to risks of product

failure significantly beyond the terms of standard contractual warranties applicable to suppliers of equipment only.

13/90

Obligations on contracts may result in penalties due to late completion of contractual milestones, or unanticipated

costs due to project modifications, suppliers or subcontractors’ failure to perform or delays caused by unexpected

conditions or events. Warranty obligations are affected by product failure rates, material usage and service delivery

costs incurred in correcting failures.

Although the Group makes individual assessments on contracts on a regular basis, there is a risk that actual costs

related to those obligations may exceed initial estimates. Estimates of contract costs and revenues at completion in

case of contracts in progress and estimates of provisions in case of completed contracts may then have to be re-

assessed.

Estimate of provisions relating to litigations

The Group identifies and analyses on a regular basis current litigations and measures, when necessary, provisions on

the basis of its best estimate of the expenditure required to settle the obligation at the balance sheet date. These

estimates take into account information available and different possible outcomes.

Valuation of deferred tax assets

Management judgment is required to determine the extent to which deferred tax assets can be recognised. Future

sources of taxable income and the effects of the Group global income tax strategies are taken into account in making

this determination. This assessment is conducted through a detailed review of deferred tax assets by jurisdiction and

takes into account past, current and future performance deriving from the existing contracts in the order book, Business

Plan, and the length of carry back, carry forwards and expiry periods of net operating losses.

Measurement of post-employment and other long-term defined employee benefits

The measurement of obligations and assets related to defined benefit plans makes it necessary to use several statistical

and other factors that attempt to anticipate future events. These factors include assumptions about the discount rate,

the rate of future compensation increases as well as withdrawal and mortality rates. If actuarial assumptions materially

differ from actual results, it could result in a significant change in the employee benefit expense recognised in the

income statement, actuarial gains and losses recognised in other comprehensive income and prepaid and accrued

benefits.

Valuation of assets

The discounted cash flow model used to determine the recoverable value of the group of cash generating unit to which

goodwill is allocated includes a number of inputs including estimates of future cash flows, discount rates and other

variables, and then requires significant judgment.

Impairment tests performed on intangible and tangible assets, as well as Right-of-Use related to leased assets are also

based on assumptions. Future adverse changes in market conditions or poor operating results from underlying assets

could result in an inability to recover their current carrying value.

Inventories

Inventories, including work in progress, are measured at the lower of cost and net realisable value. Write-down of

inventories are calculated based on an analysis of foreseeable changes in demand, technology or market conditions in

order to determine obsolete or excess inventories. If actual market conditions are less favourable than those projected,

additional inventory write-downs may be required.

14/90

2.5. Significant accounting policies

2.5.1. Consolidation methods

Subsidiaries

Subsidiaries are entities over which the Group exercises control.

The Group controls an entity when (i) it has power over this entity, (ii) is exposed to or has rights to variable returns

from its involvement with that entity, and (iii) has the ability to use its power over that entity to affect the amount of

those returns.

Subsidiaries are fully consolidated in the consolidated financial statements from the date on which control is transferred

to the Group and deconsolidated from the date that control ceases.

Inter-company balances and transactions are eliminated.

Non-controlling interests in the net assets of consolidated subsidiaries are identified in a specific line of the equity

named “Non-controlling interests”. Non-controlling interests consist of the amount of those interests at the date of

the original business combination and their share of changes in equity since the date of the combination. In the absence

of explicit agreements to the contrary, subsidiaries’ losses are systematically allocated between equity holders of the

parent and non-controlling interests based on their respective ownership interests even if this results in the non-

controlling interests having a deficit balance.

Transactions with non-controlling interests that do not result in loss of control are considered as transactions between

shareholders and accounted for in equity.

Joint arrangements

Joint arrangements are the entities over which the Group has joint control.

The Group jointly controls an entity when decisions relating to the relevant activities of that entity require unanimous

consent of the Group and the other parties who share control.

A joint arrangement is classified either as a joint operation or as a joint venture. The classification is based on the rights

and obligations of the parties to the arrangement, taking into consideration the structure and legal form of the

arrangement, the terms agreed by the parties in the contractual arrangement and, when relevant, other facts and

circumstances (see also Note 13):

• Joint operations

Joint operations are entities in which the Group has rights to the assets and obligations for the liabilities.

The Group recognises the assets, liabilities, revenues and expenses related to its interests in the joint operation. A joint

operation may be conducted under a separate vehicle or not.

• Joint ventures

Joint ventures are entities in which the Group only has rights to the net assets.

Interests in joint ventures are consolidated under the equity method as described in the paragraph below.

15/90

Investments in associates

Associates are entities over which the Group has significant influence. In other words, the Group has the possibility to

participate in decisions related to these entities’ financial and operating policies without having control (exclusive or

joint).

Generally, the existence of significant influence is consistent with a level of voting right held by the Group between 20%

and 50%.

If need be, accounting policies of associates will be standardized with the Group accounting policies.

Interests in associates are consolidated under the equity method in the consolidated financial statements as described

in the paragraph below.

Equity method

The Group accounts for its interests in associates and joint ventures under the equity method. Wherever necessary,

accounting policies of associates and joint ventures have been changed to ensure consistency with the IFRS framework.

Under the equity method, investments in associates are carried in the consolidated balance sheet at cost, including any

goodwill arising and transaction costs. Earn-outs are initially recorded at fair value and adjustments recorded through

cost of investment when their payments are probable and can be measured with sufficient reliability.

Any excess of the cost of acquisition over the Group’s share of the net fair value of the identifiable assets, liabilities and

contingent liabilities of the associate or joint venture recognized at the date of acquisition is recognized as goodwill.

The goodwill is included within the carrying amount of the investment and is assessed for impairment as part of the

investment. In case of an associate or joint venture purchased by stage, the Group uses the cost method to account for

changes from non-consolidated investments category to “Investments in joint ventures and associates”.

Associates and joint ventures are presented in the specific line “Investments in joint ventures and associates” of the

balance sheet, and the Group’s share of its associates’ profits or losses is recognized in the line “Share of net income

of equity-accounted investments” of the income statement whereas its share of post-acquisition movements in reserves

is recognized in reserves.

Losses of an associate or joint venture in excess of the Group’s interest in that associate or joint venture are not

recognized, except if the Group has a legal or implicit obligation.

The impairment expense of investments in associates and joint ventures is recorded in the line “Share of net income of

equity-accounted investments” of the income statement.

According to IAS 28, if the financial statements of an associate used in applying the equity method are prepared as of

a different date from that of the investor, adjustments shall be made for the effects of significant transactions or events

that occur between that date and the date of the investor’s financial statements. In any case, the difference between

the end of the reporting period of the associate and that of the investor shall be no more than three months.

2.5.2. Assets held for sale

Non-current assets held for sale are presented on a separate line of the balance sheet when (i) the Group has made a

decision to sell the asset(s) concerned and (ii) the sale is considered to be highly probable. These assets are measured

at the lower of net carrying amount and fair value less costs to sell.

When the Group is committed to a sale process leading to the loss of control of a subsidiary, all assets and liabilities of

that subsidiary are reclassified as held for sale, irrespective of whether the Group retains a residual interest in the entity

after sale.

16/90

2.5.3. Translation of financial statements denominated in currencies other than euro

Functional currency is the currency of the primary economic environment in which a reporting entity operates, which

in most cases, corresponds to the local currency. However, some reporting entities may have a functional currency

different from local currency when that other currency is used for the entity’s main transactions and faithfully reflects

its economic environment.

Assets and liabilities of entities whose functional currency is other than the euro are translated into euro at closing

exchange rate at the end of each reporting period while their income and cash flow statements are translated at the

average exchange rate for the period.

The currency translation adjustments resulting from the use of different currency rates for opening balance sheet

positions, transactions of the period and closing balance sheet positions are recorded in other comprehensive income.

Translation adjustments are transferred to the consolidated income statement at the time of the disposal of the related

entity.

Goodwill and fair value adjustments arising from the acquisition of entities whose functional currency is not euro are

designated as assets and liabilities of those entities and therefore denominated in their functional currencies and

translated at the closing rate at the end of each reporting period.

2.5.4. Business combinations

Business combinations completed between the 1 January 2004 and the 31 March 2010 have been recognised applying

the provisions of the previous version of IFRS 3.

Business combinations completed from the 1 April 2010 onwards are recognised in accordance with IFRS 3R.

The Group applies the acquisition method to account for business combinations. The consideration transferred for the

acquisition of a subsidiary is the sum of fair values of the assets transferred and the liabilities incurred by the acquirer

at the acquisition date and the equity-interest issued by the acquirer. The consideration transferred includes contingent

consideration, measured and recognized at fair value at the acquisition date.

For each business combination, any non-controlling interest in the acquiree may be measured:

• either at the acquisition-date fair value, leading to the recognition of the non-controlling interest’s share of

goodwill (full goodwill method) or;

• either at the non-controlling interest’s proportionate share of the acquiree’s identifiable net assets, resulting in

recognition of only the share of goodwill attributable to equity holders of the parent (partial goodwill method).

Acquisition-related costs are recorded as an expense as incurred.

Goodwill arising from a business combination is measured as the difference between:

• the fair value of the consideration transferred for an acquiree plus the amount of any non-controlling interests of

the acquiree and;

• the net fair value of the identifiable assets acquired and liabilities assumed at the acquisition date.

17/90

Initial estimates of consideration transferred and fair values of assets acquired and liabilities assumed are finalised

within twelve months after the date of acquisition and any adjustments are accounted for as retroactive adjustments

to goodwill. Beyond this twelve-month period, any adjustment is directly recognised in the income statement.

Earn-outs are initially recorded at fair value and adjustments made beyond the twelve-month measurement period

following the acquisition are systematically recognised through profit or loss.

In case of a step-acquisition that leads to the Group acquiring control of the acquiree, the equity interest previously

held by the Group is remeasured at its acquisition-date fair value and any resulting gain or loss is recognised in profit

or loss.

2.5.5. Sales and costs generated by operating activities

Identification of performance obligations

Most contracts with customers do not contain more than a single performance obligation. Only a contract which is

executed in two stages starting with the supply of goods to a customer followed by services performed on the assets

built (maintenance) include two distinct performance obligations. The transaction price is allocated among the

performance obligations in proportion to the stand-alone selling prices of goods and services.

Contracts may provide customers with the option to acquire additional goods or services. Additional goods sold in the

frame of an option subsequently exercised or through a contract modification are accounted on a cumulative catch-up

basis with the first goods sold and treated, accordingly, as a single performance obligation.

Maintenance contract renewals are accounted for separately from the initial contract.

Service-type warranties are recognised as distinct performance obligations.

Measurement of sales and costs

The amount of revenue arising from a transaction is usually determined by the contractual agreement with the

customer. IFRS 15 provides restrictive guidance on the transaction price estimates and especially on variable

consideration and contract modifications.

The estimation of the transaction price should include variable amounts and/or variation orders to the extent that it is

highly probable that no significant reversal in the amount of cumulative revenues recognized will occur when the

uncertainty associated with these elements is subsequently resolved. The introduction of this constraint on the price

escalation estimates on the one hand, as well as the incorporation of amendments under negotiation on the other

hand, leads to recognize these effects on contract value at a later point in time, when they become enforceable.

In the case of “construction contracts” claims are considered in the determination of contract revenue only when it is

highly probable that the claim will result in additional revenue and the amount can be reliably estimated.

Penalties are first taken into account as an increase of contract costs and in a second step as a reduction of contract

revenue as soon as they are accepted.

Finally, a significant financial component should be introduced positively or negatively on revenue, when timing of cash

receipts and revenue recognition under cost to cost method differ substantially.

Production costs include direct costs (such as material, labour and warranty costs) and indirect costs. Warranty costs

are estimated on the basis of contractual agreement, available statistical data and weighting of all possible outcomes

18/90

against their associated probabilities. Warranty periods may extend up to five years. Selling and administrative

expenses are excluded from production costs.

Recognition of sales and costs

Revenue on sale of manufactured products is recognised according to IFRS 15 at a point in time, i.e. essentially when

the control of the promised goods is transferred to the customer, which generally occurs on delivery. Revenue on short-

term service contracts is also accounted for at a point in time and recognised on performance of the related service. All

production costs incurred or to be incurred in respect of the sale are charged to cost of sales at the date of recognition

of sales.

Revenue on most of “construction contracts” and long-term service agreements is recognised according to IFRS 15

based on the percentage of completion method as they fulfill the requirements for revenue recognition over time: the

stage of completion is assessed on the cost to cost method. Revenue is recognised for each performance obligation

based on the percentage of costs incurred to date divided by the total costs expected at completion. Consequently, the

revenue for the period is the excess of revenue measured according to the percentage of completion over the revenue

recognised in prior periods.

Cost of sales on «construction contracts» and long-term service agreements is computed based on actual costs incurred.

When the outcome of a contract cannot be estimated reliably, but the Group expects to recover the costs incurred in

satisfying the contract, revenue is recognised only to the extent of the costs incurred until such time that the outcome

of the contract can be reasonably measured.

Costs incurred that are attributable to significant inefficiencies in the Group’s performance and that were not reflected

in the price of the contract when the contract was negotiated with the customer should not be included in the

percentage of completion formula and expensed when incurred.

When it is probable that contract costs at completion will exceed total contract revenue, the expected loss at completion

is recognised immediately as an expense. Bid costs are recorded as selling expenses when incurred.

2.5.6. Impairment of goodwill, tangible and intangible assets as well as Right-of-Use related to leased assets

Assets that have an indefinite useful life – mainly goodwill and intangible assets not yet ready to use – are not

amortised. Those assets as well as capitalised R&D are tested for impairment at least annually or when there are

indicators that they may be impaired. Other intangible and tangible assets as well as Right-of-Use related to leased

assets subject to amortisation are tested for impairment only if there are indicators of impairment.

The impairment test methodology is based on a comparison between the recoverable amount of an asset and its net

carrying value. If the recoverable amount of an asset or a cash-generating unit (CGU) is estimated to be less than its

carrying amount, the carrying amount is reduced to its recoverable amount and the impairment loss is recognised

immediately in the income statement. In the case of goodwill allocated to a group of CGUs, the impairment loss is

allocated first to reduce the carrying amount of goodwill and then to the other assets on a pro-rata basis of the carrying

amount of each asset.

A cash-generating unit is the smallest identifiable group of assets that generates cash inflows that are largely

independent of the cash inflows from other groups of assets. If an asset does not generate cash inflows that are largely

independent of other assets or groups of assets, the recoverable amount is determined for a cash-generating unit.

19/90

The recoverable amount is the higher of fair value less costs to sell and value in use. The value in use is elected as

representative of the recoverable value. The valuation performed is based upon the Group’s internal three-year business

plan. Cash flows beyond this period are estimated using a perpetual long-term growth rate for the subsequent years.

The recoverable amount is the sum of the discounted cash flows and the discounted terminal residual value. Discount

rates are determined using the weighted-average cost of capital.

Impairment losses recognised in respect of goodwill cannot be reversed.

The impairment losses recognized in respect of other assets than goodwill may be reversed in a later period and

recognized immediately in the income statement. The carrying amount is increased to the revised estimate of

recoverable amount, so that the increased carrying amount does not exceed the carrying amount that would have been

determined, if no impairment loss had been recognized in prior years.

2.6. Climate change consequences

The Group initiated last year an in-depth analysis of the risks and opportunities related to the consequences of climate

change that could affect its business.

Asset resilience

This consideration led the Group to conduct an assessment of the resilience and adaptation of its sites and facilities to

identify any physical risk, to which it could be exposed due to climate change towards 2050. Based on a detailed review

carried out by an independent third party, the Group measured its exposure to potential physical risks on the basis of

the Global Warming Scenario SSP5 8.5 (“pessimistic scenario”, end of century warming at 3.3 to 5.7°C) and SSO2 4.5

(“optimistic scenario”, end of century warming at 2.1 to 3.5°C). These scenarios could lead to a potential increase of

operating and/or capital expenditure, especially in extreme scenarios. At 31 March 2024, to the best of the Group

knowledge and considering the results of this analysis, Alstom did not identify any triggering events that could change

the environmental risks assessments initiated in March 2023. Therefore, Alstom does not foresee significant

environmental risks that might negatively impact in the coming years the useful lives and/or residual values of non-

financial assets such as intangible, tangible fixed assets as well as rights of use.

Carbon neutrality

The Group is committed to achieve carbon neutrality in its value chain by 2050. The projects decided and deployed in

this trajectory might have an impact on the Group’s investment strategy, research and development expenditure. Also,

the Group is integrating more systematically the transition risks and opportunities into the assessment of its financial

performance and the valuation of its assets and liabilities. At this stage, none of the projects decided or risks or

opportunities identified have led to material impacts on the financial statements. The group will continuously update

and improve its analysis. New projects or elements identified could lead, in the future, to review certain accounting

judgments or estimates.

Impairment tests

The Group's internal business plan used for the impairment tests takes into account growth assumptions which are

consistent with the trends observed in the industry by independent market studies and, confirming a growing demand

for smart and green mobility solutions in the next generations of products and services and for alternatives to diesel.

These impacts are reflected in the long-term growth rate used by the Group, of 3% (see Note 11.1). The Group has also

set carbon reduction targets for its own operations and supply chain leading to an increase in some operating and

20/90

investment costs (eg. processes or systems targeting energy efficiency in factories, development of external or in-house

supply of green energy), with no material impact identified on cash flows so far.

Variable compensation and share-based payment plans

The commitments made by the Group in the fight against global warning are reflected in the variable compensation

targets set for the Group’s senior executives and managers. The Alstom Short Term Incentive (STI) Scheme relies on

the Group’s performance criteria, which have included since 2022/23 a target of reduction in direct and indirect CO2

emissions in the operations (scope 1&2). More than 29,500 employees benefit from such annual variable

compensation. The share-based payment plans, set on annual basis, have included since 2020 a performance condition

related to the reduction of energy consumption in the Group’s products and services offerings. These plans concern

nearly 1,500 beneficiaries. In the latest plan (PSP 2023 – launched in May 2023), this criterion stood for 15% of the

shares allocation (See Note 30).

Committed Guarantee Facility Agreement

In July 2022, the Group extended its Committed Guarantee Facility Agreement (“CGFA”) and included an incentive-

based mechanism linked to sustainability performance criteria. The CGFA is used by the Group for the issuance of

commercial bank guarantees issued for the benefit of its customers in order to guarantee the performance

commitments or any contingent liabilities that it may have towards its customers (see Note 32).

To the best of the Group’s knowledge and at the stage of completion of the projects in progress, the Group has not

identified any significant impact in the preparation of its Consolidated Financial Statements as of 31 March 2024.

Virtual Power Purchase Agreement

By signing a Virtual Power Purchase Agreement (VPPA) on the 10th of July 2023, in order to secure the procurement

of green power certificates for 10 years, Alstom achieves an important milestone to accelerate decarbonisation related

to energy consumption of its facilities and sites in Europe. The power will be purchased as produced from a Spanish

solar asset, for an estimated volume of 160 GWh/year. The solar farm which will be built in Andalusia is expected to

start operating early 2025 and is deemed to cover 80% of Alstom’s electricity consumption in Europe. Accounting-wise,

the VPPA is a split between i) a non-financial host contract (the obligation to deliver the green power certificates from

the producer to Alstom), which is accounted for as an executory contract (application of own use exemption as per

IFRS 9), and ii) a power price related embedded derivative (due to systematic net settlement between the power

contractual price and the power grid market price) which is accounted for at fair value through Profit and Loss. This

contract does not have significant impacts on the Group Financial Statements as of 31 March 2024.

2.7. Amortisation of Purchase Price Allocation

The amortisation expense of assets exclusively acquired in the context of business combinations is accounted in costs

of sales for backlog, product and project, customer relationships, as well as property, plant and equipment in R&D costs

for acquired technology, and in share in net income of equity-accounted investment for investments in Joint Ventures

and Associates. The PPA amortisation impacting the pre-tax income (meaning cost of sales and R&D costs) amounts

to €(369) million at 31 March 2024, compared to €(416) million at 31 March 2023, while the PPA amortisation

impacting the share in net income of equity-accounted investment amounts to €(10) million at 31 March 2024,

compared to €(11) million at 31 March 2023.

21/90

C. SEGMENT INFORMATION

NOTE 3. SEGMENT INFORMATION

The Group financial information is reviewed through multiple axes of analysis (regions, sites, contracts, functions,

products) reflective of the whole organization and the integrated manufacturing process and nature of its products and

services, in particular turnkey solutions. None of these axes taken individually allows for a full comprehensive analysis

of the operating profit nor a segmental information in the balance sheet.

The segment information issued to the Alstom Executive Committee, identified as the Group’s Chief Operating Decisions

Maker (CODM) presents Key Performance Indicators at Group level. Strategic decisions and resource allocation are

driven based on this reporting. The segment information has been adapted according to a similar method as those used

to prepare the consolidated financial statements.

3.1. Sales by product

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Rolling stock

9,123

8,784

Services

4,272

3,817

Systems

1,578

1,476

Signalling

2,646

2,430

TOTAL GROUP

17,619

16,507

3.2. Key indicators by geographic area

Sales by country of destination

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Europe

10,185

9,936

of which France

2,752

2,540

Americas

3,466

2,843

Asia/Pacific

2,424

2,378

Africa/Middle-East /Central Asia

1,544

1,350

TOTAL GROUP

17,619

16,507

22/90

Non-current assets by country of origin

Non-current assets by country of origin are defined as non-current assets other than those related to financial debt, to

employee defined benefit plans and deferred tax assets (See Section E).

(in € million)

At 31 March 2024

At 31 March 2023

Europe

3,860

3,800

of which France

1,479

1,587

Americas

765

816

Asia/Pacific

1,260

1,532

Africa/Middle-East/Central Asia

262

286

Total excluding goodwill

6,148

6,434

Goodwill

9,093

9,380

TOTAL GROUP

15,241

15,814

3.3. Orders Backlog

Product breakdown

(in € million)

At 31 March 2024

At 31 March 2023

Rolling stock

41,215

42,806

Services

34,257

30,741

Systems

8,682

6,330

Signalling

7,746

7,510

TOTAL GROUP

91,900

87,387

Geographic breakdown

(in € million)

At 31 March 2024

At 31 March 2023

Europe

52, 381

49,146

of which France

13,365

13,121

Americas

12,775

13,796

Asia/Pacific

13,390

12,191

Africa/Middle-East /Central Asia

13,354

12,254

TOTAL GROUP

91,900

87,387

During budget exercises, Alstom re-assesses how the company backlog evolution impacts the future sales cycles.

Budget processes are designed to estimate, based on the latest contract costs and planning assumptions, how the

contract sales from backlog can develop over time. The March 2024 backlog contribution to the next three fiscal years

revenue is expected to reach €40 billion to €43 billion range.

3.4. Information about major customers

No external customer represents individually 10% or more of the Group’s consolidated sales.

23/90

D. OTHER INCOME STATEMENT

NOTE 4. RESEARCH AND DEVELOPMENT EXPENDITURE

Research expenditure is expensed as incurred. Development costs are expensed as incurred unless the project they

relate to meets the criteria for capitalisation (see Note 11). Research and Development costs also cover product

sustainability costs booked when incurred.

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Research and development gross cost

(749)

(682)

Financing received (*)

123

103

Research and development spending, net

(626)

(579)

Development costs capitalised during the period

178

142

Amortisation expenses (**)

(161)

(143)

RESEARCH AND DEVELOPMENT EXPENSES

(609)

(580)

(*) Financing received includes public funding amounting to €84 million at 31 March 2024, compared to €65 million at 31 March 2023.

(**) Including €(60) million of amortisation expenses related to purchase price allocation compared to €(61) million at 31 March 2023.

As of end of March 2024, Alstom Group invested €749 million in Research and Development, notably to develop:

• its very high-speed trains Avelia Horizon™;

• its Avelia

stream

TM

;

• its Hydrogen and Battery shunter locomotives & freight locomotives;

• its Coradia stream™ range;

• its Citadis™ USA;

• its Adessia™ commuter;

• its TRAXX

TM

Multi-system 3 locomotives;

• its Green re-tractioning initiatives (battery and hydrogen);

• its digital solutions set, with for instance HealthHub™, to optimize reliability and availability while

maximizing the useful life of components for sustainability improvement;

• its Onvia Control™ L2 A and Onvia Control™ L2 B for Atlas ERTMS;

• its Onvia Cab™ (for ETCS onboard.);

• its CBTC solutions solutions Urbalis Flo™, Urbalis Forward™ and Urbalis Fluence™;

• its Urbalis Vision for Operational Control Centers Urbalis Vision Forward™;

• its Autonomous Mobility solutions for Passengers & Freight trains, where Alstom had a successful GoA4

(Grade of Automation 4) test with SNCF under real mainline operating conditions;

• its new SaaS platform that will enhance the global digital offering;

• its AI-driven solutions, as for example Radioscopy, to optimize radio communication.

24/90

NOTE 5. SELLING AND ADMINISTRATIVE EXPENSES

Selling Costs are expenses incurred in the marketing and selling of a product or a service. Selling Costs typically include

expenditure in the following departments: Market & Strategy, Sales & Business Development and Communication as

well as the direct labour costs of operational population such as engineering working on the tendering phase.

Administrative Costs are structure and operational support costs. Administrative Costs include mostly expenditure of

Headquarter and site functions having a transverse role, in particular Finance, Human Resources, Legal and

Information Systems departments.

Selling and administrative expenses are recognized in charges as incurred.

NOTE 6. OTHER INCOME AND OTHER EXPENSES

Other income and expenses are representative of items which are inherently difficult to predict due to their unusual,

irregular or non-recurring nature.

Other income may include capital gains on disposal of investments (except equity-method investment disposal recorded

on the line “Share in net income of equity-accounted investments”) or activities and capital gains on disposal of tangible

and intangible assets arising from activities disposed or facing restructuring plans, any income associated to past

disposals as well as a portion of post-employment and other long-term defined employee benefits (plan amendments,

impact of curtailments and settlements and actuarial gains on long-term benefits other than post-employment

benefits).

Other expenses include capital losses on disposal of investments (except equity-method investment disposal recorded

on the line “Share in net income of equity-accounted investments”) or activities and capital losses on disposal of

tangible and intangible assets relating to activities facing restructuring plans as well as any costs associated to past

disposals, restructuring costs, rationalisation costs, significant impairment losses on assets, costs incurred to realize

business combinations, litigation costs that have arisen outside the ordinary course of business and a portion of post-

employment and other long-term defined benefit expense.

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Capital gains / (losses) on disposal of business

-

(30)

Restructuring and rationalisation costs

(147)

(65)

Integration costs, impairment loss and other

(361)

(274)

OTHER INCOME / (EXPENSES)

(508)

(369)

As of 31 March 2024, restructuring and rationalisation costs are mainly related to the “Autumn” restructuring plan

(see Note 1.1).

Over the period ended at 31 March 2024, Integration costs, impairment loss and other include mainly:

25/90

• €(142) million of integration costs related to Bombardier Transportation’s integration;

• €(118) million related to some legal proceedings and other risks occurring outside the ordinary course of

business, mainly for two legal proceedings in U.S.A. and Turkey (see Note 33);

• €(30) million related to impairments mainly on write-off of assets due to exit from Russia;

• €(71) million related to other exceptional expenses that are outside of the ordinary course of business by

nature, of which €(36) million of consequential impacts from savings plan initiated in Germany.

NOTE 7. FINANCIAL INCOME (EXPENSES)

Financial income and expenses include:

• Interest income representing the remuneration of the cash position;

• Interest expense related to the financial debt (financial debt consists of bonds, other borrowings, and lease

obligations);

• Cost of commercial and financial foreign exchange hedging (forward points);

• The financial component of the employee defined benefits expense (net interest income (expenses) and

administration costs).

• The significant financing component under IFRS 15.

• Other expenses paid to financial institutions for financing operations;

Interest income and expense related to respectively cash remuneration and financial debt are presented on a gross

basis and are respectively classified in financial income and financial expense in the consolidated income statement.

All other financial items listed above are presented on a net basis. Positive amounts are presented in financial income,

negative amounts are presented in financial expense in the consolidated income statement.

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Interest income

27

10

Interest expense on borrowings and on lease obligations

(180)

(62)

NET FINANCIAL INTERESTS ON DEBT

(153)

(52)

Net gains/(losses) of foreign exchange hedging

20

26

Net financial expense from employee defined benefit plans

(31)

(26)

Financial component on contracts

(19)

(1)

Other financial income/(expenses)

(59)

(50)

NET FINANCIAL INCOME/(EXPENSES)

(242)

(103)

Total financial income

47

36

Total financial expense

(289)

(139)

Net financial income/(expenses) on debt is the cost of borrowings net of income from cash and cash equivalents.

As of 31 March 2024, interest income amounts to €27 million, representing mainly the remuneration of the Group’s

cash position over the period, while interest expenses amount to €(180) million including €(21) million of interest

expenses on lease obligations.

26/90

The net gain of foreign exchange hedging of €20 million includes primarily the amortized cost of carry (forward points)

of foreign exchange hedging implemented to hedge the exposures in foreign currency arising from commercial contracts

and from hedging of intercompany financial positions.

The net financial expense from employee defined benefit plans of €(31) million represents the interest costs on

obligations net of interest income from fund assets calculated using the same discount rate.

The financial component of €(19) million represents the recognition of financial revenue under IFRS15.

Other net financial income/expenses of €(59) million include mainly bank and other fees of which a large part relates

to commitment fees paid on guarantee facilities, revolving facilities and fees paid on bonds.

NOTE 8. TAXATION

The Group computes taxes in accordance with prevailing tax legislation in the countries where income is taxable.

The current income tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the balance

sheet date in the countries where the company’s subsidiaries and associates operate and generate taxable income.

Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax

regulation is subject to interpretation and establishes provisions where appropriate on the basis of amounts expected

to be paid to the tax authorities.

Temporary differences arising between the carrying amount and the tax base of assets and liabilities, unused tax losses

and unused tax credits are identified for each taxable entity (or each tax group when applicable). Corresponding

deferred taxes are calculated at the enacted or substantively enacted tax rates that are expected to apply in the period

when the asset is realised or the liability settled.

Deferred tax assets are recognised for all deductible temporary differences, unused tax losses and unused tax credits

to the extent that it is probable that taxable profits will be available in the future against which the deductible

differences, unused tax losses and unused tax credits can be utilised. The carrying amount of deferred tax assets is

reviewed at each balance sheet date.

Deferred tax liabilities are recognised for all taxable temporary differences, with the exception of certain taxable

temporary differences between the Group’s share in the net assets in subsidiaries, joint arrangements and associates

and their tax bases. The most common situation when such exception applies relates to undistributed profits of

subsidiaries where distribution to the shareholders would trigger a tax liability: when the Group has determined that

profits retained by the subsidiary will not be distributed in the foreseeable future, no deferred tax liability is recognised.

Nevertheless, the exception is no more applicable to investments/subsidiaries being disposed since it becomes probable

that the temporary difference will reverse in the foreseeable future with the sale of the subsidiaries. Therefore, in this

specific case, deferred tax liabilities are recognised.

Deferred tax assets and liabilities are offset when both of the following conditions are met:

• the Group has a legally enforceable right to set off current tax assets against current tax liabilities, and

• the deferred tax assets and liabilities relate to income taxes levied by the same taxation authority.

Deferred tax is charged or credited to net income, except when it relates to items charged or credited directly to other

comprehensive income, in which case the deferred tax is classified in other comprehensive income.

27/90

8.1. Analysis of income tax charge

The following table summarises the components of income tax charge:

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Current income tax charge

(110)

(170)

Deferred income tax charge

104

136

INCOME TAX CHARGE

(6)

(34)

The following table provides reconciliation from the income tax charge valued at the French statutory rate to the actual

income tax charge, free of the temporary additional contributions:

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Pre-tax income

(253)

(182)

Statutory income tax rate of the parent company

25,83%

25,83%

Expected tax charge

65

47

Impact of:

- Difference between normal tax rate applicable in France and normal tax rate in

force in jurisdictions outside France

8

13

- Changes in unrecognised deferred tax assets

(101)

(70)

- Changes in tax rates

(9)

(1)

- Additional tax expenses (withholding tax, CVAE in France and IRAP in Italy)

(31)

(34)

- Permanent differences and other

62

11

INCOME TAX CHARGE

(6)

(34)

Effective tax rate*

n.m.

n.m.

(*) Due to negative pre-tax income, effective tax rate of the period is not meaningful: excluding the effect on the pre-tax income of the €369 million

amortisation of Purchase Price Allocation related to tangibles and intangibles assets (see Note 2.7), effective tax rate is 28%, as compared to 27% as

at 31 March 2023.

Permanent differences and other notably include a €30 million positive impact in relation with tax losses recapture in

Spain.

8.2. Deferred tax assets and liabilities

Year ended

(in € million)

At 31 March 2024

At 31 March 2023

Deferred tax assets

673

596

Deferred tax liabilities

(91)

(128)

DEFERRED TAX ASSETS, NET

582

468

28/90

The following table summarises the significant components of the Group’s net deferred tax assets:

(in € million)

At 31 March

2023

Change in P&L

Change in

equity

Translation

adjustments

and other

changes

At 31 March

2024

Differences between carrying amount and tax

basis of tangible and intangible assets

(141)

(41)

-

6

(176)

Accruals for employee benefit costs not yet

deductible

25

(88)

2

(1)

(62)

Provisions and other accruals not yet deductible

175

23

-

(3)

195

Differences in recognition of margin on

"construction contracts"

80

8

-

(5)

83

Tax loss carry forwards

380

167

-

7

554

Other

(51)

35

(8)

12

(12)

NET DEFERRED TAXES ASSET/(LIABILITY)

468

104

(6)

16

582

The adoption of the amendment to IAS 12 - Deferred tax related to assets and liabilities arising from a single transaction

has no material impact on the Group’s financial statements.

(in € million)

At 31 March

2022

Change in P&L

Change in

equity

Translation

adjustments

and other

changes

At 31 March

2023

Differences between carrying amount and