Compensation

disclosures

May 2024

Executive compensation

Compensation discussion and analysis

Trustee compensation

Compensation disclosures

Table of contents

Table of contents

Executive compensation—Compensation discussion and analysis

Human Resources Committee report ....................................................................................................................................................................................................... 1

Executive summary ...................................................................................................................................................................................................................................... 2

Total reward philosophy .............................................................................................................................................................................................................................. 5

Compensation program best practices ................................................................................................................................................................................................... 6

Components of total rewards..................................................................................................................................................................................................................... 7

Independent consultant .............................................................................................................................................................................................................................. 9

Establishing compensation levels ............................................................................................................................................................................................................. 9

Variable compensation funding ................................................................................................................................................................................................................12

Measuring performance .............................................................................................................................................................................................................................13

Performance highlights and compensation decisions for named executive officers ................................................................................................................ 17

Employment agreements ..........................................................................................................................................................................................................................25

Executive compensation—Compensation tables and supplemental information

Summary compensation table .................................................................................................................................................................................................................26

2023 grants of plan-based awards ........................................................................................................................................................................................................ 27

Outstanding plan-based awards ............................................................................................................................................................................................................ 28

Nonqualified defined contribution and other deferred compensation plans ..............................................................................................................................29

Payments and benefits triggered by termination .............................................................................................................................................................................. 30

CEO Pay Ratio Analysis ……………………………………………………………………………………………………….…………………………………………….…………………………………………….….34

TIAA Human Resources Committee processes and procedures

Human Resources Committee processes and procedures ..............................................................................................................................................................35

TIAA Board of Trustees

Independent Trustee gender and tenure demographics……………………………………………………………………………………...36

Independent Trustee compensation

Program overview ........................................................................................................................................................................................................................................ 37

Compensation tables and supplemental information ...................................................................................................................................................................... 38

Compensation disclosures 1

Executive compensation—Compensation discussion and analysis

Executive compensation—Compensation discussion and analysis

Human Resources Committee report

This Compensation Discussion and Analysis (“CD&A”) and accompanying tables describe the associate compensation program of Teachers

Insurance and Annuity Association of America (“TIAA” or the “Company”).

The CD&A has been reviewed and approved by the Human Resources Committee (the “Committee”) of the TIAA Board of Trustees (the

“Board”). The Committee has been delegated by the Board the responsibilities for guiding and overseeing the formulation and application of

compensation and other human resources policies and programs for the Company (the Committee’s charter is available on the Company’s

website, under “Governance documents”). These policies and programs are designed to enable the Company to attract, retain, motivate, and

reward associates who possess the knowledge and experience the Company needs to conduct its business. Furthermore, the Committee also

ensures that these policies and programs are designed and administered in a manner that aligns associate pay with the interests of the

Company’s individual customers and institutional clients (collectively referred to as “participants”).

Although the Company is not subject to the Securities and Exchange Commission (“SEC”) rules governing executive compensation disclosure,

the Committee voluntarily publishes this document for the benefit of the Company’s participants. This disclosure, which embodies the

principles of these rules, has been designed to provide participants with a comprehensive picture of the rationale behind the Company’s

executive compensation decisions.

For almost two decades, the Company has been providing individual participants the opportunity to provide an advisory vote and express their

views on TIAA’s compensation policies, programs, and practices. The focus of the vote is on the actual compensation decisions that were made

for the preceding performance year. Last year, participant support for management’s compensation decisions, pay-for-performance approach

to compensation, and the Company’s transparency in voluntarily disclosing this process remained consistent with past years. The Company

continues to take into consideration the annual participant advisory vote and commentary on executive compensation when making decisions

regarding executive compensation.

Respectfully submitted,

TIAA Human Resources Committee

Kim M. Sharan, Chair

Priya Abani

Jason E. Brown

James R. Chambers

Edward M. Hundert

Gina L. Loften

Ramona E. Romero

Compensation disclosures 2

Executive compensation—Compensation discussion and analysis

Executive summary

This CD&A describes the Company’s compensation program and the 2023 compensation decisions for its named executive officers (“NEOs”) -

the Chief Executive Officer (“CEO”), the Chief Financial Officer (“CFO”), and the next three most highly compensated Executive Committee

(“EC”) members as of the end of the fiscal year:

2023 company highlights

Business Performance

TIAA maintained its superb financial strength in 2023. In recognition of its stability, claims-paying ability, and overall expense

management, the Company continued to hold the highest possible rating from three of the four leading insurance company-rating

agencies.

As financial stewards of the organization and our participants, TIAA was able to generate a record high in total value returned to

participants, which represents our guaranteed interest plus dividends. Other key metrics including Assets Under Management (“AUM”),

Risk Based Capital, and Nuveen Return on Capital produced results favorable to plan. However, due to strategic investments across the

business and challenging macroeconomic conditions, Revenue and Operating Margin were slightly below plan and prior year.

In 2023, the Retirement Solutions business:

o Generated $2.9 billion in TIAA Traditional net flows excluding benefits,

o Returned $10.9 billion in value to participants, up 12% year-over-year due to higher incremental dividends paid to participants,

o Increased our recordkeeping retention rate among Top 1,000 clients by 17% year-over-year,

o Grew TIAA’s RetirePlus assets by 67% year-over-year, reaching $30 billion and approximately 335,000+ participants,

o Improved retirement readiness for individuals through our in-plan financial consultants, delivering 44% more advice

implementations compared to prior year.

o Grew the number of participants actively contributing to the TIAA Traditional annuity by 11% year-over-year,

o Improved our “Mission Metric”, which measures the retirement readiness of our participants, to 42.6%, exceeding our year-end

goal by four percentage points.

Nuveen, the investment manager of TIAA:

o Continued to deliver strong investment performance with 79% of actively managed equity and fixed income funds rated either

four or five stars by Morningstar, and 92% of rated assets beating the five-year peer group median as of December 2023,

o Completed two key acquisitions:

Omni Holdings, making Nuveen one of the largest institutional owners and managers of affordable housing with $6.7

billion in affordable housing AUM,

Compensation disclosures 3

Executive compensation—Compensation discussion and analysis

Arcmont Asset Management, a leading European private debt investment manager, which expands Nuveen’s private

capital capabilities in Europe. The combination of Arcmont and Churchill created Nuveen Private Capital, one of the

largest global private debt managers.

o Built out infrastructure capabilities focusing on digital transition with a strategic investment in Energy Infrastructure Credit and

Snowhawk Partners,

o Accelerated distribution activities with ongoing investments in key markets and segments, such as targeting insurance clients,

which has realized $7.7 billion in sales (38% increase year-over-year) and Defined Contribution Investment Only ("DCIO")

channel with sales reaching $14 billion (51% increase year-over-year),

o Launched 23 new products including multi-asset, custom direct-indexing Separately Managed Accounts ("SMA") strategies in

partnership with Brooklyn Investment Group, Nuveen Churchill private capital income fund, and Nuveen Green Capital C-PACE

fund,

o Raised Nuveen’s brand awareness through high-profile differentiated client experiences such as “Meeting of the Minds” and

“nPOWERED” which has supported Nuveen’s climb in brand rankings globally – up 16 spots across institutional investors to #49

and the highest recorded U.S. Wealth Net Promoter Score with a brand ranking of #15.

The Wealth Management and complementary businesses:

o Completed the sale of TIAA Bank, obtaining regulatory approval on an accelerated timeframe in a tough economic environment,

closed the sale ahead of schedule, delivered on anticipated cost savings, and created and chartered a new trust bank entity to

support our Wealth Management business,

o Grew the Wealth Management business year-over-year with AUM up 5% and Revenue up 4%, which evolved the business

including the hiring of 150 advisors with a year-over-year increase in overall average sales per advisor of 19%,

o Hired and developed leadership team for sales and distribution, product, operations, and chief investment office,

o Completed wins totaling approximately $338 million in AUM with Kaspick, our planned gift and endowment management

services business,

o Secured largest win in the Education Savings team history with the Illinois Direct Sold 529 Plan, which brought in $10 billion in

AUM.

The Product and Business Development organization:

o Continued to broaden our product suite to meet client needs with an emphasis on product design simplicity, product portability,

and compelling value proposition messaging; seven new products were filed and received regulatory approval on four including

Nuveen Lifecycle Income, Target Date Collective Investment Trust, and Guaranteed Funding Agreements,

o The Secure Income Account (“SIA”) series, our newly launched in-plan lifetime income solution offering and available on both

our proprietary recordkeeping platform and third-party recordkeeping platforms, ended its first few months in market with

approximately $150 million in total assets,

o Guaranteed Funding Agreements, our strategic client offering, were launched in 2023 and ended the year with approximately

$300 million in total assets,

Compensation disclosures 4

Executive compensation—Compensation discussion and analysis

Culture and Corporate Responsibility

Guided by our values, heritage, and desire to make a positive impact on our world, TIAA and Nuveen continued to demonstrate

leadership in this space, including our commitment to reaching net zero carbon emissions in the Company’s General Account by

2050, our enterprise-wide responsible business practices and our engagement with management of companies we invest in on

behalf of our clients to influence their Environmental, Social and Governance (“ESG”) policies.

Through 2023, the TIAA General Account Impact Portfolio has deployed $4.7 billion in capital commitments, including $3.5 billion to

affordable housing and $1.2 billion to inclusive growth and resource efficiency opportunities. In 2023, TIAA added meaningfully to its

ESG-related commitments through the acquisition of Omni Holdings and the creation of a new platform for managing and developing

affordable housing properties. Additionally, we have supported the Economic Opportunity Coalition program with $100 million in

deposits in approved community service institutions.

Solidified our leadership in Responsible Investing ("RI"), outpacing all-time sales records in both third-party and affiliated channels

by 10% with record low redemption rates across the platform for existing clients. Increased client engagement by 50% while growing

Nuveen’s RI-Focused Strategy suite to approximately $80 billion in AUM.

For the tenth year in a row, TIAA was named one of the World’s Most Ethical Companies by Ethisphere – one of only six companies in

the financial services industry to win that recognition.

TIAA received several recognitions for diversity, equity, and inclusion (“DEI”), including:

o DiversityInc’s Top 50 Companies for the eleventh year in a row, ranking in the top ten for the fourth consecutive year.

o Forbes Best Employers for Women in 2022-2023 and Diversity 2018-2023.

o Seramount Hall of Fame, having been named to the Seramount list of 100 Best Companies and named a recipient of its annual

Best Companies for Multicultural Women 2021-2023.

TIAA continued to preserve strong levels of engagement and inclusion across the associate population, with index scores for each of

those measures on par with prior years and consistent with industry benchmarks. Our Business Resource Group ("BRG")

participation continues to climb, and voluntary turnover remains low relative to the industry.

Compensation disclosures 5

Executive compensation—Compensation discussion and analysis

Total rewards philosophy

Compensation and benefits programs for the Company’s associates are designed with the goal of providing remuneration that is fair,

reasonable, and competitive. The programs are intended to help the Company recruit, retain, and motivate qualified associates and align their

interests with those of the Company’s participants by linking pay to long-term growth.

These programs are designed based on the following guiding principles:

Performance

The Company believes that the best way to align compensation with the interests of its participants is to link pay directly to Company, business

area, and individual performance, with a focus on sustained long-term financial performance.

Competitiveness

Compensation and benefits programs are intended to be competitive with those provided by companies with whom the Company competes for

talent. In general, programs are considered competitive when they are targeted at the median of these competitor companies. Individuals may

vary from this targeted positioning due to a variety of factors such as tenure, performance, criticality of role, etc.

Cost

Compensation and benefits programs are designed to be cost-effective and affordable, ensuring that the interests of the Company’s

participants are considered.

Consistency

These guiding principles are intended to apply consistently to all associates of the Company, regardless of their level. As such, except for the

provision of executive safety and protection services, there are no other perquisites available exclusively to the Company’s senior executives.

The Company believes that this is an important element in creating an environment of trust and teamwork that furthers the long-term interests

of the organization.

Compensation disclosures 6

Executive compensation—Compensation discussion and analysis

Compensation program best practices

Our compensation program includes key features that align the interests of our associates with the interests of our participants. Moreover, the

program deliberately excludes features that could hinder this critical alignment:

Annual voluntary disclosure of compensation

consistent with SEC rules

No acceleration of long-term award vesting

except in the event of death

Majority of senior executive compensation is

performance-based

No change in control benefits

At least half of senior executives' performance-

based pay tied to long-term goals of the

Company

No special or enhanced associate benefit plan

arrangements for senior executives

Pay-for-performance metrics directly aligned

with key strategic and operational objectives

Except for the provision of executive safety

and protection services, no other perquisites

are available to the Company’s senior

executives.

Incentive plans designed to mitigate

inappropriate or excessive risk-taking

Pay program grounded in market-based,

competitive pay practices

Variable compensation directly tied to

Company affordability metrics

Participants' annual advisory vote and

commentary are taken into consideration when

making pay decisions

Outstanding long-term incentive awards

forfeited in the event of termination for cause

Best Practices Modeled in Our

Program

Practices We Do Not

Engage in or Allow

Compensation disclosures 7

Executive compensation—Compensation discussion and analysis

Components of total rewards

The Company’s total rewards package consists of direct compensation and Company-sponsored benefit plans. Each component is designed to

achieve a specific purpose and to contribute to a total package that is appropriately performance-based, competitive, affordable to the

Company, and valued by the Company’s associates.

Direct compensation program

The total direct compensation for Company associates (including our NEOs) consists of fixed (i.e., base salary) and variable compensation.

Compensation disclosures 8

Executive compensation—Compensation discussion and analysis

Employee benefit plans

The Company provides company-sponsored health, welfare, and retirement plan benefits to associates. This benefits package is designed to

assist associates in providing for their own financial security in a manner that recognizes individual needs and preferences. Associate benefits,

in aggregate, are reviewed periodically to ensure that the plans and programs provided are generally competitive and cost-effective and support

the Company’s human capital needs. Benefit levels are not directly tied to Company, business area or individual performance.

Health and welfare plans

The core health and welfare package includes medical, dental, vision, disability, and basic group life insurance coverage. NEOs are eligible to

participate in these benefits on the same basis as other Company associates.

Retirement and deferred compensation plans

The Company provides qualified and nonqualified retirement and deferred compensation benefits to associates.

■

Retirement Plan and Retirement Benefit Equalization Plan

The TIAA Retirement Plan (“Retirement Plan”) is a tax-qualified defined contribution (money purchase) plan. The plan is intended to help

provide for an associate’s financial security in retirement through Company contributions of a percentage of base salary (which are based

on the associate’s age). NEOs participate in the Retirement Plan on the same basis as all other Company associates. Participation in the

plan begins as soon as associates are hired. Contributions to the plan are directed by participating associates into certain retirement

annuities, mutual funds, and other options.

The TIAA Retirement Benefit Equalization Plan (“Equalization Plan”) is an unfunded, nonqualified plan that works together with the

Retirement Plan to provide for an associate’s financial security in retirement. This plan covers those associates for whom contributions to

the Retirement Plan are limited under federal tax law. The Company contributes an amount equal to the excess of what otherwise would

have been provided under the Retirement Plan if those limits did not apply. Deferrals are credited to notional accounts until distribution.

Participating associates may generally allocate credited amounts among notional investment options. The Company has set aside

amounts (as part of its general assets) that are invested in parallel to the notional investments to cover its obligations under this plan.

Benefits are payable under the Retirement Plan following termination of employment as elected by the participating associate under the

plan. Benefits under the Retirement Benefit Equalization Plan are payable on the later of termination of employment or the participating

associate’s 60

th

birthday. All amounts under the plans are fully vested after three years of service.

Compensation disclosures 9

Executive compensation—Compensation discussion and analysis

■

401(k) Plan and 401(k) Excess Plan

The TIAA Code Section 401(k) Plan (“401(k) Plan”) provides associates the opportunity to save for retirement on a tax-favored basis.

NEOs may elect to participate in the 401(k) Plan on the same basis as all other TIAA associates. The Company provides a matching

contribution equal to 100% of the first 3% of the associate’s base salary contributed to the 401(k) Plan. New associates are automatically

enrolled in the plan, with the option to opt out. Contributions to the plan are directed by participating associates into certain retirement

annuities, mutual funds, and other options.

Associates whose matching contributions are limited under federal tax law may be eligible to defer additional amounts under the

nonqualified TIAA 401(k) Excess Plan (“Excess Plan”). Deferrals under this plan are credited to participating associates’ notional

accounts and generally may be allocated by associates to notional investment options. As with the Equalization Plan, the Company has set

aside amounts that are invested in parallel to the notional investments to cover its obligations under this plan.

Benefits under the 401(k) Plan are generally payable following termination of employment as elected by the associate. Benefits under the

Excess Plan are paid at termination of employment. All associate contributions under the plans are fully vested at all times. The

Company’s matching contributions under the plans are fully vested after three years of service.

■

Retirement Healthcare Savings Plan

The TIAA Retirement Healthcare Savings Plan (“RHSP”) allows associates to make after-tax contributions to a trust that can be used for

post-retirement medical care expenses. The Company provides a matching contribution equal to 100% of the first $750 contributed to

the RHSP. Benefits under the RHSP are only payable following termination of employment. All associate contributions under the plan are

fully vested at all times. The Company’s matching contributions are fully vested after three years of service.

■

Voluntary Executive Deferred Compensation Plan

The TIAA Voluntary Executive Deferred Compensation Plan (“VEDCP”) provides eligible associates, including the NEOs, the opportunity to

defer a portion of their annual cash award and vested TIAA Long Term Performance Plan (“LTPP”) payout.

Deferrals are credited to participating associates’ notional accounts and may be allocated among notional investment options. All amounts

deferred under the plan are fully vested at all times. Payments under the plan may be made in a single lump sum or in annual installments.

As with the other nonqualified deferred compensation plans, the Company has set aside amounts that are invested in parallel to the

notional investments to cover its obligations under this plan.

Perquisites

Except for the provision of executive safety and protection services, there are no other perquisites available exclusively to the Company’s senior

executives.

Independent consultant

Under the authority granted by its charter, the Committee engaged Semler Brossy Consulting Group, LLC (“Semler Brossy”) as its independent

compensation consultant. Consistent with best practices, Semler Brossy does not provide any services to management during its engagement

with the Committee.

Establishing compensation levels

Total direct compensation levels (base salary, annual cash award, and LTPP award) are established based on several factors: Company,

business area, and individual performance, as well as competitive market data analysis. To ensure that pay is competitive with market

practices, the Company conducts benchmarking analyses each year against a relevant competitive peer group.

In general, the Company considers our compensation to be competitive when it is targeted at the median pay levels of our peer group. When

performance exceeds expectations, pay levels are likely to be above target. Conversely, when performance falls below expectations, pay levels

are likely to fall below target.

Compensation disclosures 10

Executive compensation—Compensation discussion and analysis

Allocation of variable compensation

Based on the total funding available for variable compensation (which is discussed in detail below), the CEO, in consultation with the Senior

Executive Vice President, Chief People Officer, and Executive Vice President, Head of Enterprise Total Rewards, allocates the aggregate

variable compensation pool to the Company’s business and support areas, based on their respective relative contributions to the Company’s

overall performance, as determined in the CEO’s discretion.

Determining individual compensation levels

Within the confines of the funding allocated to the respective area, individual variable compensation award determinations by managers are

discretionary, based on individual performance and in the context of market pay levels for a given position. Individual performance is measured

through a formal annual performance evaluation process, which includes year-end performance assessments. Once the individual total direct

compensation decisions have been made, the amount of variable compensation to be awarded as annual cash and LTPP awards is determined

based on a formula that provides for a greater proportion of long-term incentives at higher levels of total direct compensation.

For the NEOs, the Company follows a similar decision-making process in determining appropriate pay levels. In order to ensure that there is

sufficient alignment with the long-term success of the organization, the proportion of variable compensation awarded as long-term incentives

is higher (at least fifty percent of variable compensation) for the NEOs than for other associates.

Chief Executive Officer

Compensation for the CEO is approved by the Board following recommendation by the Committee. The Committee bases its determination on

its assessment of the Company’s overall performance, the CEO’s individual contributions against the achievement of the corporate goals, and

other priorities agreed to by the Board and the CEO, the CEO’s variable compensation target, and market competitive compensation packages

for chief executive officers among firms in the asset management and insurance industries of similar size and complexity.

The comparator group used in the market competitive analysis was developed in 2022 and consists of 19 asset management, insurance and

general financial services companies listed below (the “Peer Group”). These companies were selected on the basis of their size and complexity

in relation to TIAA:

Compensation disclosures 11

Executive compensation—Compensation discussion and analysis

Senior Executive Vice Presidents (“SEVPs”)

Compensation for SEVPs, including those that are NEOs, is approved by the Board (at the recommendation of the CEO and then the

Committee).

Each SEVP has a variable compensation target expressed as a multiple of the SEVP’s base salary. The assigned variable compensation targets

are based on the scope of their roles and competitive market compensation levels with reference to similarly sized asset management firms,

insurance companies, and financial institutions. Utilizing the SEVP’s performance evaluations described above and the variable compensation

target, the CEO develops recommendations based on the overall funding available for variable compensation. Discretion is exercised in

determining the overall total direct compensation to be awarded to the SEVP and the recommended variable compensation mix. At least one-

half of the variable compensation awarded to SEVPs is delivered as LTPP awards.

The Company believes that the discretionary design of its variable compensation program supports its overall compensation objectives by

allowing for significant differentiation of pay based on performance. It provides the flexibility necessary to ensure that pay packages for the

SEVPs appropriately reflect the contributions of each SEVP to the short and long-term success of the organization and to each of their efforts

in reinforcing risk controls and the risk culture of the organization.

The key components of the annual decision-making process in recommending compensation levels for the SEVPs are as follows:

The key members of management who assist the CEO in determining compensation recommendations for the SEVPs are the SEVP, Chief

People Officer (except with respect to her own compensation) and the Executive Vice President, Head of Enterprise Total Rewards.

Compensation disclosures 12

Executive compensation—Compensation discussion and analysis

Variable compensation funding

The Company’s approach to determining appropriate annual variable compensation funding is intended to better drive the Company’s business

strategy, accurately reflect Company performance, and balance the interests of our participants with those of our associates. It ensures that

variable compensation continues to remain affordable, while providing payouts clearly aligned with actual performance and consistent with an

acceptable risk profile.

The following chart summarizes the process for developing the annual variable compensation pool:

Compensation disclosures 13

Executive compensation—Compensation discussion and analysis

Measuring performance

2023 Corporate Quality Scorecard

The Corporate Quality Scorecard (“CQS”) is a key measure of the combined performance of TIAA and is one factor that impacts the annual

variable compensation funding decision. At the beginning of each performance year, management proposes revisions to the CQS to ensure

alignment with current business objectives, and the proposed CQS is reviewed and approved by the Board to ensure that its metrics, targets,

and scaling remain aligned to TIAA’s goals and do not encourage inappropriate or excessive risk-taking.

To ensure alignment between incentive compensation and Company performance, the CQS results are used to directionally size the requested

TIAA variable compensation pool funding for existing associates. For 2023, the CQS continued to include a broad set of metrics that are

designed to reflect the enterprise’s health and performance in a given year and align to the key tenet of TIAA as a retirement company. The

metrics are divided into four categories: Customer, Financial, People, and Strategic, which were weighted as shown in the following table:

Specific strategic objectives, performance measures, and targets are established at the beginning of the year, as are the performance scales

that translate results into CQS scores for each category. The aggregate annual performance result is calculated based on the actual

performance relative to the pre-established targets and the weightings associated with each metric.

A high-level description of the metrics within each category is described below; however, specific targets are not disclosed for competitive

reasons.

Customer

This category has an aggregate weight of 25% on the CQS. The overall result is equal to the weighted average of the results for the six metrics:

Competitive Net Promoter Score – Participant

Quantifies the strength of customer loyalty. Results are collected via an online survey, on TIAA participants only, which capture

responses to the question “How likely would you be to recommend TIAA’s products and services to a friend or colleague?”

Focused Customer Effort Score - Participant

Measures how much effort a customer has to exert to get an issued resolved, a request fulfilled, or a question answered. It

quantifies the customer experience with specific transactions to identify improvement opportunities.

Mission Metric: Percentage of Active Participants Exhibiting Good In-Plan Behaviors

Percentage of active participants that are exhibiting good savings and investing behaviors in their plan.

Percentage of Proprietary Institutional Inflows

Measures the percentage of total Institutional inflows that are proprietary.

Number of Active Participants Using TIAA Traditional

Number of our active participants, within the last 12 months, with assets in TIAA Traditional (excludes assets from the TIAA

associate plans).

Category Total weighting

Customer

25%

Financial

45%

People

10%

Strategic

20%

Total 100%

Compensation disclosures 14

Executive compensation—Compensation discussion and analysis

Retirement Outflows to Competitors

Participants moving their retirement proprietary assets from TIAA to a 3

rd

party intermediary.

Financial

This category has an aggregate weight of 45% on the CQS. The overall result is equal to the weighted average of the results of the five metrics:

Operating Margin

Total revenue less total expenses, before dividends credited to participants.

Operating Expenses

Expense the Company incurs through its normal business operations.

Nuveen Return on Capital %

Measures return on capital for Nuveen via net income divided by average capital.

TIAA Traditional Accumulating Net Flows (excludes Benefits)

Measures accumulating portfolio net flows into TIAA Traditional (excludes assets from the TIAA associate plans).

Wealth Management Margin Percentage

For the Wealth Management business, total revenue less total expenses, before dividends credited to participants.

People

This category has an aggregate weight of 10% on the CQS. The overall result is equal to the weighted average of the results of the four metrics:

TIAA Engagement Index

Average of 4 individual item survey scores that represents the specific emotional outcomes that are critical to associate

engagement within the Company.

TIAA Inclusion Index

Average of 3 individual item survey scores that are critical to measuring associate perception of inclusion within the Company.

Career Mobility Rate

Tracks the relative level of internal career development opportunities by measuring the cumulative sum of internal movement

throughout a given year relative to average headcount.

Composite Diversity Representation

Tracks associate representation across various demographics.

Strategic

This category has an aggregate weight of 20% on the CQS. The overall result is equal to the weighted average of the results of the four metrics:

RetirePlus Implemented Assets

Total in-year net implemented assets including TIAA Traditional and other investments that are included in the RetirePlus models

(excludes assets from the TIAA associate plans).

New Product Development and Product Evolution

Performance measured relative to the execution of defined milestones during the 2023 performance year.

Recordkeeping

Performance measured relative to the execution of defined milestones during the 2023 performance year.

Customer Experience Accelerator Capabilities

Performance measured relative to the execution of defined milestones during the 2023 performance year.

Compensation disclosures 15

Executive compensation—Compensation discussion and analysis

2023 LTPP Scorecard

The LTPP Scorecard is intended to align associate interests with those of our participants both in terms of our accomplishments and our

performance. It also provides greater transparency for both participants and associates. The design, as illustrated below, provides a balanced

solution that enables the Company to attract and retain associates while aligning associates’ interests with the long-term interests of our

participants.

The LTPP Scorecard was designed specifically to balance financial results with prudent risk-taking in order to ensure that there is no incentive

for associates to engage in unnecessary and excessive risk-taking. The results are monitored each year to ensure that the design continues to

properly manage inappropriate risk.

The results of the LTPP Scorecard generally determine the annual change to our LTPP PUV. The number of Performance Units granted and the

value of the Performance Units at vesting are based on the LTPP PUV at grant and at vesting, respectively. Similar to 2022, the 2023 LTPP

Scorecard was designed to align the value of LTPP units with TIAA’s long-term performance against the following key strategic and financial

priorities:

■

Grow TIAA’s assets in a prudent and sustainable manner

■

Maximize risk-adjusted investment performance on a relative basis

■

Effectively manage cost for participants

AUM Growth

This metric tracks the annual growth of all assets under management capturing both our absolute annual investment performance and our

annual net client flow performance, before benefit payouts to participants. This includes the assets of all of our subsidiaries and joint ventures.

Utilizing the AUM metric is a key feature of our design because it provides an incentive to grow assets, which leads to more competitive pricing.

This growth will increase participants’ investment returns. The AUM metric serves to align associate interests with our participants’

investment experience by directly impacting LTPP PUV.

Evaluating company performance

This portion of the formula focuses on our financials and is based on two separate metrics:

Operating Margin (3-year CAGR)

This metric reflects the organizational focus on bottom line value creation for our participants aligned to the LTPP three-year vesting

period. This is achieved by continuing to improve revenues that lead to both increased dividends to participants and superior financial

strength while thoughtfully managing expenses. In addition, dividends paid to participants are excluded from this calculation in order to

insulate this metric from our annual dividend decision.

Compensation disclosures 16

Executive compensation—Compensation discussion and analysis

■

Investment Performance

The intent of this metric is to align TIAA’s investment strategy with outcomes. The metric evaluates our investment performance based

on performance relative to established benchmarks within the asset management industry.

Board discretion

The Board retains overall discretion to adjust the annual LTPP PUV above or below the actual LTPP Scorecard results for

the year, if necessary, to properly fulfill its responsibility to our participants to ensure payout levels are appropriate in light of all relevant

considerations, such as organizational health, capital adequacy, cost effectiveness, and any extraordinary external events or situations.

LTPP PUV

As with the CQS, specific strategic objectives, performance measures, and targets are established and set at the beginning of the year, as are

the performance scales that translate results into LTPP Scorecard scores for each metric. The aggregate annual performance result, called the

LTPP Scorecard factor, is calculated based on the actual performance relative to the pre-established targets associated with each metric, and

is used to determine the increase (or decrease) in LTPP PUV for the performance year.

For 2023, the LTPP Scorecard result was up 11.19% from prior year, resulting from AUM growth combined with positive three-year Operating

Margin growth and strong relative Investment Performance results. The 2023 LTPP Scorecard performance resulted in an increase in the

LTPP PUV to $6,072.0106.

The following chart shows the annual percentage change in LTPP PUV since 2016, relative to the annual total shareholder return for the

companies in our Peer Group for each respective year.

Annual change in LTPP PUV relative to Peer Group Total Shareholder Return

Compensation disclosures 17

Executive compensation—Compensation discussion and analysis

Performance highlights and compensation decisions for the executives who were Named Executive Officers as of

December 31, 2023

The Company maintained its strong performance in 2023 and continued to make significant strides toward its long-term strategic goals, and the

performance of our NEOs was critical to the Company’s success. The following is a summary of the significant achievements of our NEOs that

formed the basis of the 2023 compensation decisions:

Thasunda Brown Duckett, President and Chief Executive Officer

Responsibilities: In her third year as President and CEO, Thasunda Brown Duckett continued to effectively

articulate the Company’s reframed vision and TIAA FRWD strategy to associates and clients. 2023 was a year

of successfully executing on our strategy and advancing our efforts to win in lifetime income, delight our clients,

and strengthen how we operate. Ms. Duckett continued to serve as the primary liaison between the Board, the

CREF Board, and management, while also serving as the primary brand ambassador for the Company.

2023 Performance Highlights:

Ms. Duckett effectively executed on TIAA’s strategy to be the leading retirement company focused on

lifetime income by delighting clients and strengthening operations, powered by Nuveen’s investment

management.

Under Ms. Duckett’s leadership, TIAA maintained its financial strength. In recognition of its stability,

claims-paying ability, and overall expense management, the Company in 2023 continued to hold the

highest possible rating from three of the four leading insurance company rating agencies.

TIAA closed out 2023 as the not-for-profit retirement leader in recordkeeping and lifetime income

solutions, with over $30 billion in total RetirePlus assets, 335,000+ RetirePlus participants,

and 60% of recordkeeping wins since 2022 either in the RetirePlus pipeline, or already won with

RetirePlus.

TIAA successfully engaged with the critically important consultant community through intentional

touchpoints and high-quality engagements such as TIAA TMRW. The engagement has greatly

accelerated RetirePlus adoption with 102 (new and repeat) advisors implementing RetirePlus with at

least one plan from 2021 to 2023.

With Ms. Duckett’s guidance and oversight, the Wealth Management organization codified its strategy

of making financially accretive investments and continued to build the sales team through successful

recruiting and retention efforts, including the hiring of 150 advisors with a year-over-year increase in

overall average sales per advisor of 19%. In addition, completed the largest win in the Education

Savings team history, the Illinois Direct-Sold 529 Plan, which brought in $10 billion in AUM.

Ms. Duckett supported Nuveen’s continued strong investment performance, with 79% of actively

managed funds rated either four or five stars by Morningstar, as of December 2023. Nuveen’s

investment and marketing teams earned more than two dozen industry awards and recognitions for

2023, including seven Lipper Awards.

For the first time in the Company’s history, TIAA has a product that travels outside of the not-for-profit

marketplace: the SIA, reaching more than half a million account holders in 2023.

The Company logged several other firsts in 2023, including delivery of a strategic Guaranteed Funding

Agreement offering to one of the largest university retirement systems (University of California) and

joining the Portability Network Services Partnership as a founding member and its first annuity

provider.

As illustrated by the chart above,

the majority of 2023 compensation

is delivered through variable

compensation awards or “at risk”

awards which are subject to

individual and Company

performance.

Approximately 95% of Ms.

Duckett’s 2023 compensation

is at risk.

Compensation disclosures 18

Executive compensation—Compensation discussion and analysis

Among other 2023 achievements, high points include closing on the TIAA Bank sale ahead of schedule

in July, moving to retire our technology debt while modernizing our tech capabilities, transforming and

simplifying to better serve our clients and grow profitably, driving efficiencies to optimize capital, and

enhancing the caliber of the Company’s talent – including the hire of our Chief Transformation Officer.

Our Mission Metric, which measures the retirement readiness of our participants, improved to 42.6%,

exceeding our year-end goal and total value returned to participants reached a record-high of $11.6

billion in 2023, 12 percent higher than in 2022.

• Ms. Duckett successfully serves as TIAA’s most visible brand ambassador, participating in several

external and internal engagements, including with clients, policy makers, and the media in alignment

with business priorities.

• She gives TIAA access to outlets and stages that the company has not previously enjoyed because of

her profile in the broader financial services industry. This is helping us to bridge beyond the not-for-

profit space where the company has traditionally played.

• To successfully deliver on one of our key strategic initiatives - owning lifetime income across both not-

for-profit and corporate retirement industries - thought-leadership is critical. Ms. Duckett is a key

thought-leader on financial wellness for us and has long been an advocate for financial wellness.

• She made over a dozen visits to institutional clients, meeting with university presidents and chancellors,

retirement committees, chief human resources officers, Nuveen clients, and consulting firms, while also

participating in speaker series, and delivering commencement speeches.

She continued her engagements involving a large number of highly influential external conferences and

meetings with institutional leaders, policy makers, and lawmakers. Examples include giving the keynote

address at the National Association of Student Personnel Administrators national conference,

interviewing Vice President Kamala Harris, meeting with Treasury Secretary Janet Yellen at the Global

Black Economic Forum, attending a HUD Roundtable with HUD Secretary Marcia Fudge, presenting at

TIAA’s Retirement for All Government Relations Conference, offering remarks at the Thurgood Marshall

College Fund HBCU Fly-In, and meeting with New York Governor Kathy Hochul.

• Ms. Duckett invested time in building and strengthening TIAA’s relationships with policymakers, trade

associations, and regulators both at the state and federal levels. The Company hosted a retirement

security policy-focused event to highlight TIAA and Nuveen, and its leaders with policymakers, thought

leaders, industry peers, and clients in Washington, D.C. Ms. Duckett attended a White House event on

economics with other CEOs and incorporated Retirement Bill of Rights messaging and shared copies

with the attendees. She addressed the importance of closing the access gap for the millions who lack

access to retirement plans and the need to provide lifetime income.

Ms. Duckett participated in a number of external activities relevant to TIAA’s business and clients. She

continued to serve as founder and leader of the Otis and Rosie Brown Foundation and as a board

member for NIKE, Inc., Brex Inc., Robert F. Kennedy Human Rights, Sesame Workshop, National Medal

of Honor Museum, Economic Club of New York, University of Houston Board of Visitors, and Dean’s

Advisory Board for the Baylor University’s Hankamer School of Business.

She appeared in numerous articles, including syndicated articles across multiple media outlets – a

profile in Essence Magazine, a cover article in American Banker as part of the Most Powerful Women

issue, and a TIME op-ed on safeguarding Americans’ retirement— generating more than 1.3 billion

media impressions. Her accolades included Fortune's Most Powerful Women (#16), Barron's 100 Most

Influential Women in U.S. Finance, American Banker's Most Powerful Women in Finance (#3),

Thurgood Marshall CEO of the Year, the BET Her Power Award, and the Conference Board Committee

for Economic Development Distinguished Leadership Award.

Compensation disclosures 19

Executive compensation—Compensation discussion and analysis

W. Dave Dowrich, Senior Executive Vice President and Chief Financial Officer

Responsibilities: Mr. Dowrich is the Chief Financial Officer of TIAA. He is responsible for the financial

stewardship of the enterprise and oversaw TIAA’s financial management, including planning, reporting,

accounting, tax, actuarial services, and its general account investment strategies. Additionally, Mr. Dowrich

oversaw Global Supplier Services, the newly established Enterprise Transformation Office, and the launch of

TIAA Ventures.

2023 Performance Highlights:

Under Mr. Dowrich’s leadership, TIAA continued to act as financial stewards of the organization and

our participants, amid challenging macroeconomic conditions. TIAA's AUM grew 9% during the year.

TIAA’s capitalization remains very strong and continues to maintain the highest ratings available with

industry rating agencies. TIAA is one of only three insurance groups in the United States to currently

hold the highest possible rating from three of the four leading insurance company rating agencies.

Value returned to participants grew to a record-high $11.6 billion and Nuveen exceeded its Return on

Capital target.

Mr. Dowrich strengthened how the organization operated by enhancing expense clarity and accuracy,

improving the financial calendar and management reporting, and accelerating decision making through

enhanced insights provided by new frameworks. For example, the new value management framework

was operationalized into business decisions including the pricing process, key segmentation analysis,

and client level strategies to identify financial improvement levers to improve profitability, ensuring

TIAA’s investments drive value creation for our participants.

As a key strategic partner, Mr. Dowrich led critical enterprise-wide initiatives, including:

o Enterprise Transformation in alignment with TIAA FRWD: Mr. Dowrich stood up a dedicated, cross-

functional Transformation Office to ensure close alignment across the enterprise, seamless

integration with key leaders and partners, and executing a rigorous pace of delivery, all while

ensuring change risks are proactively identified and mitigated. This initiative is tasked with

delivering significant revenue and expense improvements over the next three to four years.

o TIAA Ventures: Launched to make early-stage investments through direct and fund investments

that are fully aligned with our businesses and strategy, ending 2023 with several fund and direct

investments.

Mr. Dowrich continues to make TIAA the choice destination for finance and investment professionals.

He restructured the leadership team to increase visibility into TIAA’s core business areas, allowing

more direct alignment to TIAA’s strategic vision. He completed several key hires essential to aligning

with TIAA’s strategic vision, including industry experts to lead TIAA Ventures and TIAA Enterprise

Transformation. He continues to build an inclusive culture focused on talent, mobility, and DEI, while

growing our global footprint to ensure we are operating as efficiently as possible for our participants.

Mr. Dowrich serves on the boards of Scotiabank and Vantage Group Holdings. He also serves on the

boards for academic organizations, such as the Entrepreneurial Network Habitat and the School of

Business at Medgar Evers College.

As illustrated by the chart above,

the majority of 2023 compensation

is delivered through variable

compensation awards or “at risk”

awards which are subject to

individual and Company

performance.

Approximately 90% of Mr.

Dowrich’s 2023 compensation

is at risk.

Compensation disclosures 20

Executive compensation—Compensation discussion and analysis

Jose Minaya, Senior Executive Vice President and CEO, Nuveen

Responsibilities: Mr. Minaya is the CEO of Nuveen, the investment manager of TIAA, where he leads Nuveen’s vision,

strategy, and day-to-day operations and brings together a broad range of solutions provided by Nuveen and TIAA to

drive better outcomes for clients and participants. Mr. Minaya and his leadership team set and execute key growth

initiatives and provide oversight of all investment management teams and client businesses. With $1.1 trillion in

AUM, Nuveen’s diverse investment capabilities span across a broad range of traditional and alternative asset

classes for both institutional and individual investors around the world.

20

23 Performance Highlights:

Under Mr. Minaya’s leadership, Nuveen continues to deliver strong investment performance

with 79% of actively managed equity and fixed income funds rated either four or five stars

by Morningstar and 92% of rated assets beating the five-year peer group median as of

December 31, 2023.

Despite industry pressures from persistent market volatility, Mr. Minaya managed the

business to achieve key financial targets with third-party sales topping $95 billion and an

organic growth rate of 0.7% which outpaced core peer average of -1.5%.

Mr. Minaya progressed Nuveen’s growth strategy focused on enhancing investment

capabilities, expanding distribution, and optimizing our technology and operations

capabilities to meet evolving business needs. He led several key strategic initiatives

including:

o The acquisition of Omni Holdings, making Nuveen one of the largest institutional

owners and managers of affordable housing with $6.7 billion in affordable housing

AUM.

o The acquisition of Arcmont which expands Nuveen’s private capital capabilities in

Europe and strategically complements Churchill Asset Management (Nuveen’s North

American private debt and private equity investment specialist). The combination of

Arcmont and Churchill created Nuveen Private Capital, one of the largest global

private debt managers.

o The build-out of infrastructure capabilities with a strategic investment in Energy

Infrastructure Credit and Snowhawk Partners, focusing on digital transition.

o Accelerated distribution activities with ongoing investments in key markets and

segments such as targeting insurance clients, which has realized $7.7 billion in sales

(38% increase from prior year) and DCIO channel with sales reaching $14 billion

(51% increase from prior year).

o The launch of 23 new products including multi-asset, custom direct-indexing SMA

strategies in partnership with Brooklyn Investment Group (Tax Advantaged Balanced

portfolio and Tax Advantaged Large Cap portfolio), Nuveen Churchill private capital

income fund, and Nuveen Green Capital C-PACE fund.

o Scaling Nuveen’s operating model through investments that have enabled an

enhanced data strategy, integration across Nuveen subsidiary platforms and

improved client experience through streamlined systems, tools, and reporting.

The continuing partnership with TIAA enterprise on key priorities such as the distribution

efforts of lifetime income with Nuveen Retirement Investing and the successful launch of

the Nuveen Lifetime Income Collective Investment Trust series.

As illustrated by the chart above,

the majority of 2023 compensation

is delivered through variable

compensation awards or “at risk”

awards which are subject to

individual and Company

performance.

Approximately 94% of Mr.

Minaya’s 2023 compensation

is at risk.

Compensation disclosures 21

Executive compensation—Compensation discussion and analysis

Raising Nuveen’s brand awareness through high-profile differentiated client experiences

such as “Meeting of the Minds” and “nPOWERED” which has supported Nuveen’s climb in

brand rankings globally – up 16 spots across institutional investors to #49 and the highest

recorded U.S. Wealth Net Promoter Score with a brand ranking of #15.

Solidifying our leadership in RI, outpacing all-time sales records in both third-party and

affiliated channels by 10% with record low redemption rates across the platform for existing

clients. Increased client engagement by 50% while growing Nuveen’s RI-Focused Strategy

suite to over $80 billion in AUM.

Enhancing investments in talent development and retention through programs designed for

different stages of an associate’s career such as Nuveen 101 (signature orientation

program), Nuveen Leadership Development Program, Women in Nuveen, and Elevate Your

Acumen (training).

Serving as the TIAA Executive Sponsor for the “Engage” BRG, championing an inclusive

environment for Asian Associates and Allies, as well as being an active member of the

“Unite” BRG to support professional development and educational opportunities for Latino

and Hispanic associates and allies. Mr. Minaya also continues to progress Nuveen’s DEI

initiatives such as providing transparency of our diversity metrics on Nuveen’s website and

establishing metrics and goals for investment personnel diversity.

Mr. Minaya serves on the boards of multiple companies and charitable organizations, including Moody's,

the Robert Toigo Foundation, the National Forest Foundation, the Investment Committee of the Board

of Regents of the Smithsonian Institution, and the Investment Company Institute. He is also on the

Board of Trustees of Manhattan College and is the Chairman of the Amos Tuck School of Business MBA

Council at Dartmouth College.

Compensation disclosures 22

Executive compensation—Compensation discussion and analysis

John Douglas, Senior Executive Vice President and Chief Legal, Risk & Compliance Officer

Responsibilities: Mr. Douglas is the Chief Legal, Risk and Compliance Officer for TIAA, where he leads the teams

comprising General Counsels, Chief Risk Officers, and Chief Compliance Officers that advance TIAA’s strategic

positioning and enable risk-based business decisions. He also served as Vice Chairperson of TIAA Bank prior to its

sale.

2023 Performance Highlights:

Under Mr. Douglas' leadership, the team provided effective advice, advocacy, and oversight for the evolving

Company and strategy, together with strengthened risk and compliance frameworks that proactively align

with business requirements and regulatory expectations.

Legal, Risk and Compliance (“LR&C”) focused on the implementation of the SECURE 2.0 Act in order to

improve the policy landscape for annuities and increase associate access to retirement plans. TIAA

partnered with trade groups to request administrative delay of the Age 50+ Roth Catch-up Contributions

provision, resulting in a two-year enforcement delay by the IRS. TIAA also launched the “Retirement Bill of

Rights”, to improve lifetime income coverage for those without access to a current workplace retirement

plan.

The organization enabled and negotiated critical strategic transactions including the sale of TIAA Bank,

Nuveen’s acquisition of Arcmont and the formation of Nuveen Private Capital business line with

Churchill/Arcmont and Nuveen's acquisition of a portfolio of assets from Omni Holdings, a leading owner,

operator, and developer of affordable housing in the U.S. LR&C were key in developing solutions for

structural, capital markets, and regulatory challenges, negotiating key agreements, protecting go-forward

interests of TIAA customers, and providing HR-related legal support.

• LR&C responded to new regulations and global rulemaking around ESG and RI, and the launch of new funds

and strategies in multiple jurisdictions and asset classes. They also worked successfully with state

legislatures to enhance opportunities for TIAA Lifetime Income products.

LR&C also led the legislation effort that was passed in both New York houses to allow CREF to become a

separate account of TIAA.

The organization also strengthened Risk & Compliance frameworks by maturing existing capabilities or

introducing new programs in response to evolving regulatory and business expectations.

LR&C plays a critical role in effective oversight over TIAA by facilitating the firm’s Board and internal

Enterprise Risk Management Governance and Committees that oversee the management of risk to

safeguard the mission and financial condition of the Company.

The organization drove industry recognition with TIAA being named a World's Most Ethical Company by

Ethisphere, for the 10th year running in 2023.

LR&C acted upon a robust framework for internal mobility, external hiring, and associate development in

order to further promote DEI, develop our talent, and improve our associate experience.

Mr. Douglas is also the executive sponsor for TIAA’s “SoPro,” a BRG for seasoned, experienced associates,

and allies, which promotes an engaged, productive, multi-generational workforce at TIAA. He also sponsors

and is an active mentor in LR&C’s five-year long mentorship program.

Mr. Douglas participated in a number of external activities relevant to TIAA’s business and clients. He

continued to serve as a board member for Financial Services Volunteer Corps, Rising Star Outreach,

Purpose Legal and Dominican American Education Fund, Inc.

Approximately 90% of Mr.

Douglas’ 2023 compensation is

at risk.

As illustrated by the chart above,

the majority of 2023 compensation

is delivered through variable

compensation awards or “at risk”

awards which are subject to

individual and Company

performance.

Compensation disclosures 23

Executive compensation—Compensation discussion and analysis

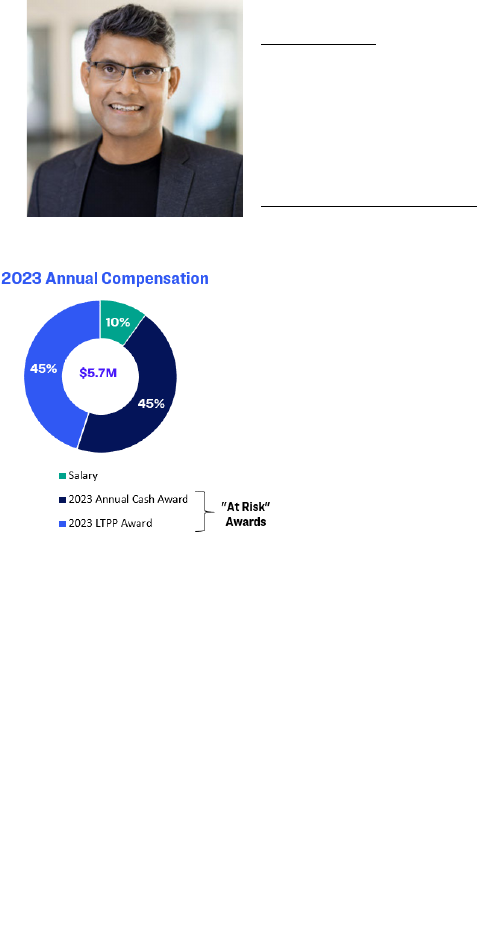

Sastry Durvasula, Senior Executive Vice President and Chief Information & Client Services Officer

Responsibilities: Mr. Durvasula joined TIAA in February 2022 and leads the Global Client Services and Technology

(“CS&T”) organization. He is also responsible for leading the Company’s Global Data and Artificial Intelligence

(“AI”), Global Capabilities Services, Client Tech Labs and Partnerships, and serves on the board of TIAA Global

Capabilities. His team develops and maintains strategic priorities regarding TIAA’s digital-first technology

capabilities for plan sponsors and participants through partnerships across Retirement Solutions, Wealth

Management, Nuveen, and Product.

2023 Performance Highlights:

As part of the multi-year transformational strategy (CS&T 2.0), Mr. Durvasula exceeded delivery of

top strategic priorities across Retirement Solutions, Wealth Management, and Nuveen businesses,

and fueled the Company’s innovation agenda while transforming the core technology.

■

Implemented Lifetime Income Solutions for plan sponsors and participants and advanced RetirePlus

platform, exceeding the annual goal for client adoptions.

■

Delivered the SIA platform and TIAA Retirement Gateway to enable the product to travel outside of

the not-for-profit market. Drove Nuveen’s Asset Management strategic priorities and future-state

operating model for global technology and operations.

■

Attracted top industry talent in critical, forward-thinking subject matters including Head of

Technology Strategy and Transformation, Chief Architect, Head of Enterprise Cloud Platform, and

provided leadership opportunities for top internal talent.

Advanced digital and client experience journeys for the institutional and individual clients, including

the launch of enterprise design studio for rapid delivery of web and mobile capabilities.

Broadened AI solutions in partnership with Google, implementing multiple use cases in the National

Contact Center, and incubated Generative AI technology to deliver personalized participant services.

Leapfrogged the company’s technology ecosystem by delivering cloud based, digital-first, data, and AI

powered platforms to drive forward industry-leading future state environment.

Pioneered co-innovation with clients in the TIAA Client Tech Labs and launched “T3CON – TIAA Tech

Tomorrow’” to promote thought leadership and R&D in emerging technologies. Submitted multiple

patents in cyber, AI, and future state retirement solutions.

Launched NextGen cyber platforms and AI powered operations, advancing Zero Trust Architecture

for client and colleague facing capabilities.

Completed critical upgrades in the enterprise technology infrastructure, including data center

resiliency, NextGen power, and Uninterruptable Power Supply systems and application resiliency

across the enterprise.

Transformed the India locations into a Global Capabilities Center and established integrated teams

and resourcing models for multiple business and functional areas.

Elevated partnerships with leading DEI organizations in the industry, including Blacks in Tech, Society

of Hispanic Professional Engineers (“SHPE”), Girls in Tech, and Society of Women Engineers

(“SWE”), to provide avenues to attract and develop talent and drive inclusive growth and innovation.

Received several prestigious industry awards including CSO50, CIO100, Plan Sponsor Council of

America "Signature Award," and India "Great Places to Work".

Served on the board of global non-profit Girls in Tech as an active advocate and champion of gender

diversity in technology while also being recognized as an AI “Top Voice” in the industry.

Approximately 90% of Mr.

Durvasula’s 2023

compensation is at risk.

As illustrated by the chart above,

the majority of 2023 compensation

is delivered through variable

compensation awards or “at risk”

awards which are subject to

individual and Company

performance.

Compensation disclosures 24

Executive compensation—Compensation discussion and analysis

2023 compensation decisions

Total direct compensation decisions were made for each NEO based on individual performance, their variable compensation target, the overall

performance of the Company and with reference to the compensation paid to comparable market peers. In order to align NEO pay with

Company performance and the experience of our participants, the majority of our NEO’s compensation is in the form of performance-based

variable compensation. Further, to ensure that compensation is linked to the achievement of our participants’ long-term financial goals, at

least half of the variable compensation award made to each NEO is in the form of LTPP awards.

2023 performance year total direct compensation

For greater transparency regarding salary and variable compensation directly attributable to the current performance year, the Company has

adopted a practice of showing actual variable compensation decisions for the current year. While the Summary Compensation Table on page

26 shows compensation for the NEOs as calculated under the SEC disclosure rules, it does not fully reflect the compensation decisions made

for the 2023 performance year—the Summary Compensation Table lists prior-year LTPP awards that were paid out in 2023 rather than the

value of the LTPP award granted for the 2023 performance year. The following table details the total direct compensation decisions made for

our NEOs for the 2023 performance year.

1

The amounts shown represent the annual base salary as of the fiscal year-end for the respective performance year. Messrs. Douglas, Dowrich, and Durvasula received an annual base

salary increase from $550,000 to $600,000, effective February 26, 2023.

2

The amounts shown represent the annual cash award earned for the respective performance year and paid in the following February under the Company’s annual cash award program.

3

The amounts shown represent the LTPP awards for the respective performance year and granted in the following February under the LTPP.

4

Mr. Durvasula joined the Company in February 2022. Per the terms of his offer letter, his minimum variable compensation opportunity for 2022 was $4.7M to offset the forfeited bonus

opportunity from his previous employer.

Thasunda Brown Duckett 2023 1,000,000 6,880,000 10,320,000 18,200,000

President and Chief Executive Officer 2022 1,000,000 6,600,000 9,900,000 17,500,000

% Change 0% 4% 4% 4%

W. Dave Dowrich 2023 600,000 2,400,000 2,400,000 5,400,000

Senior Executive Vice President and 2022 550,000 2,225,000 2,225,000 5,000,000

% Change 9% 8% 8% 8%

Jose Minaya 2023 750,000 5,375,000 5,375,000 11,500,000

Senior Executive Vice President and 2022 750,000 4,875,000 4,875,000 10,500,000

Chief Executive Officer, Nuveen

% Change 0% 10% 10% 10%

John Douglas 2023 600,000 2,375,000 2,375,000 5,350,000

Senior Executive Vice President and 2022 550,000 2,275,000 2,275,000 5,100,000

Chief Legal, Risk & Compliance Officer

% Change 9% 4% 4% 5%

Sastry Durvasula

4

2023 600,000 2,550,000 2,550,000 5,700,000

Senior Executive Vice President and 2022 550,000 2,375,000 2,375,000 5,300,000

Chief Information & Client Services Officer

% Change 9% 7% 7% 8%

Total Direct

Compensation

($)

Chief Financial Officer

Name and

Principal Position

Year

Salary

1

($)

Annual Cash

Award

2

($)

Annual LTPP

Award

3

($)

Compensation disclosures 25

Executive compensation—Compensation discussion and analysis

Employment agreements

Thasunda Brown Duckett

TIAA and Ms. Duckett entered into an employment agreement on February 20, 2021 in connection with her hire. The agreement has an

indefinite term.

Under the agreement, Ms. Duckett’s base salary is $1,000,000 per year. She is eligible for an annual cash award and LTPP award as

determined in the sole discretion of the Board based on company and individual performance. The Board annually reviews Ms. Duckett’s target

annual cash award and LTPP award, provided the target direct compensation opportunity (i.e., salary plus variable compensation) will be no

less than $14,000,000.

The agreement provided Ms. Duckett with additional cash and LTPP awards in recognition of amounts she forfeited with her former employer in

joining TIAA (collectively, the “buyout awards”). With respect to forfeited outstanding equity awards with her former employer, Ms. Duckett

received a cash payment of $4,272,000 in February 2022, a LTPP award with an initial value of $3,077,000 that vested in February 2023 and

a LTPP award with an initial value of $3,346,000 that vested in February 2024. With respect to the forfeited bonus opportunity with her

former employer, Ms. Duckett received a cash payment of $2,166,667 on her start date and a LTPP award with an initial value of $3,250,000

that vested in February 2024.

The Company has not entered into employment agreements with any other NEOs.

Executive compensation – Compensation tables and supplemental information

Compensation disclosures 26

Executive compensation—Compensation tables and supplemental information

Summary Compensation Table

The 2023 Summary Compensation Table below sets forth compensation information relating to 2023, 2022, and 2021. In accordance with

SEC rules, compensation information for each NEO is only reported beginning with the year that such executive became a NEO.

1

The amounts shown represent the actual base salary paid for the year. For Messrs. Douglas, Dowrich, and Durvasula, the amount shown for 2023 reflects the annual base salary

increase from $550,000 to $600,000.

2

The amounts shown represent the annual cash award earned with respect to each performance year listed, payable in February of the following year pursuant to the Company’s

annual cash award program.

3

The amounts shown above for Messrs. Minaya and Douglas represent LTPP payouts made during each performance year listed for LTPP awards that vested in that year. For Ms.

Duckett and Messrs. Dowrich and Durvasula the amounts represent LTPP payouts made in connection with their hires to compensate for forfeited outstanding equity awards with

their former employers. Payout amounts are based on the LTPP PUV as of the preceding December 31 (see page 28 for additional information).

4

The amounts shown include Company contributions made in 2023 to the Retirement Plan and 401(k) Plan on behalf of the NEOs ($42,750 for Ms. Duckett, $43,231 for Mr. Dowrich,

$42,750 for Mr. Minaya, $42,750 for Mr. Douglas and $42,750 for Mr. Durvasula), the Equalization Plan and Excess Plan on behalf of the NEOs ($97,250 for Ms. Duckett, $48,279

for Mr. Dowrich, $62,250 for Mr. Minaya, $48,760 for Mr. Douglas, and $32,093 for Mr. Durvasula), the RHSP on behalf of the NEOs ($750 for each of Ms. Duckett and Messrs.

Dowrich, Minaya, Douglas, and Durvasula) and the HSA employer contribution on behalf of the NEOs ($1,000 for each of Ms. Duckett and Messrs. Minaya, Douglas, and Durvasula