2020

Table of Contents

Chair of the Board of Directors' Letter to Shareholders .....................................................................................4

Chief Executive Officer's Letter to Shareholders ...............................................................................................6

Management’s Discussion and Analysis..........................................................................................................9

Overview of Cineplex.................................................................................................................................. 10

Business Strategy......................................................................................................................................... 20

Cineplex’s Businesses.................................................................................................................................. 21

Overview of Operations............................................................................................................................... 27

Results of Operations...................................................................................................................................30

Balance Sheets.............................................................................................................................................45

Liquidity and Capital Resources..................................................................................................................48

Adjusted Free Cash Flow and Dividends..................................................................................................... 55

Share Activity ..............................................................................................................................................56

Seasonality and Quarterly Results ............................................................................................................... 58

Related Party Transactions ..........................................................................................................................60

Significant Accounting Judgments and Estimation Uncertainties ............................................................... 60

Accounting Policies .....................................................................................................................................62

Risks and Uncertainties ............................................................................................................................... 63

Controls and Procedures..............................................................................................................................73

Subsequent Events.......................................................................................................................................74

Outlook........................................................................................................................................................

75

Non-GAAP Measures .................................................................................................................................. 77

Reconciliation: World Gaming Network LP................................................................................................ 82

Financial Statements and Notes ....................................................................................................................84

Management’s Report to Shareholders.........................................................................................................84

Independent Auditor’s Report....................................................................................................................... 85

Consolidated Balance Sheets........................................................................................................................91

Consolidated Statements of Operations........................................................................................................ 93

Consolidated Statements of Comprehensive Income....................................................................................94

Consolidated Statements of Changes in Equity ............................................................................................ 95

Consolidated Statements of Cash Flows....................................................................................................... 96

Notes to Consolidated Financial Statements.................................................................................................97

Investor Information .................................................................................................................................... 162

Letter from the Chair of the Board

Dear fellow shareholders,

It is my pleasure to address you today as the Chair of the Board of Directors

of Cineplex Inc. As a former Cineplex board member and previous Chair of

the Board, I am honoured to be back leading this great group of Directors

and to be part of an organization that I believe in so strongly.

In light of the ongoing public health concerns related to the spread of

COVID-19, this year Cineplex will once again host a hybrid in-person and

virtual Annual General Me

eting (“AGM”) on Wednesday, May 19, 2021.

Registered shareholders and duly appointed proxyholders can participate in-

person or via live webcast, which will include voting on the motions put

forward and the ability to ask questions, all in real-time.

During a year that challenged us all, the Board remained guided by our

corporate strategy, took strong, decisive action to ensure the ongoing

viability of the Company and upheld our commitment to protect employees

and support customers and communities.

Navigating A Year Like No Other

When I look back on 202

0, I am extremely proud of the Cineplex team for managing through what was a truly

unprecedented year in the company’s history. We began with a strong focus and commitment to completing the

proposed Cineworld transaction, which was ultimately repudiated by Cineworld and is now in litigation.

Then the pandemic hit in early March and the negative impact was significant for both the movie exhibition

industry around the world, and the other industries in which we operate. Pivoting with great agility, the team’s

top priorities were to protect the heal

th and safety of employees and guests, as well as manage costs and address

liquidity options to solidify the financial health of the Company. As a result, Cineplex significantly reduced

operating and capital expenditures, worked with partners to abate or defer payments, initiated a number of

liquidity measures, and focused on growing and supporting our diversified and online businesses. In anticipation

of re-opening, the team also developed an industry-leading health and safety program to ensure that employees

and guests feel comfortable when t

hey return to our venues.

Continued Good Governance and Corporate Citizenship

Throughout this past year, the Board worked closely with senior management to ensure the financial health of

the Company, in addition to focusing on our strategic direction and long-term value creation for shareholders

beyond the current pandemic environment. All Directors have been extremely focused and involved, holding 21

full board meetings in 2020 to address the unusual challenges.

Further, Cineplex’s dedication to being a good corporate citizen and community partner was made all the more

evi

dent this year, through our ongoing support of local communities across the country during the COVID-19

pandemic. Just one example of this includes hosting our annual Community Day fundraiser in 2020, which

traditionally welcomes guests across Canada into our theatres for a morning of free movies. Instead of the in-

theatre event, Cineplex raised money for Food Banks Canada by donating $1 from certain transactions on the

Cineplex Store, as well as through our food delivery services.

Cineplex Inc.

Letter to Shareholders

CINEPLEX INC. 2020 ANNUAL REPORT

LETTER TO SHAREHOLDERS

4

Commitment to Inclusion and Diversity

As we continue to prioritize inclusion and diversity within Cineplex, I am proud to report that our Board currently

includes four members who identify as women, who together represent 44% of the Directors or 50% of the

independent Directors. The Board also includes four members who identify as minorities, who together represent

44% of the Directors. Finally, three members of executive management of the Company, including its major

subsidiaries, identify as women, representing 38% of executive management.

In addition to the Company’s long standing commitment to inclusion, in 2020, Mr. Jacob signed the Black North

Initiative CEO Pledge – acknowledging the existence of anti-Black systemic racism in Canada and ensuring that

inclusion remains at the core of Cineplex’s workplace culture. The pledge includes a commitment to hire a

minimum of one Black leader to fill an executive or Board member role in Canada by 2025. Also, in response

to the social injustice happening in North America, Cineplex launched its ‘Understanding Black Stories’

collection – a curated collection of films to help educate and inform perspectives on Black storytelling and

culture that were available as free rentals on the Cineplex Store.

Path Forward: The Future is Bright

Throughout 2020, the team took necessary actions to address the ongoing impact of the pandemic and liquidity

needs of the company. We focused on the other revenue-generating areas of our business, including Cineplex

Digital Media, our expanded food delivery services and our online Cineplex Store, and will continue to focus on

all revenue sources as we emerge from the pandemic. Cineplex is moving toward the next phase of its future.

We are all looking forward to reopening the entire circuit of theatres and entertainment venues, which together

with the pent-up consumer demand and abundance of film product available, gives us confidence for a bright

future ahead.

On behalf of the entire Board, I extend our thanks and appreciation to the management team and to all employees

for their hard work, passion and dedication during what has been the toughest year in Cineplex’s history. I look

forward to connecting with you at our AGM, but should you wish to contact me directly, please send an email

to boardchair@cineplex.com.

Sincerely yours,

Phyllis Yaffe

Chair of the Board, Cineplex Inc.

boardchair@cineplex.com

Cineplex Inc.

Letter to Shareholders

CINEPLEX INC. 2020 ANNUAL REPORT

LETTER TO SHAREHOLDERS

5

Letter from the CEO

Dear fellow shareholders,

This has truly been a year like no other in the history of our company.

The impact of COVID-19 has been wide-spread and has dramatically

affected so many industries, including entertainment and movie

exhibition. As expected, given our mandated closures, capacity

restrictions and the shifts in the film release slate, our annual results were

significantly impacted.

Our teams worked diligently throughout the year to mitigate the negative

effects of COVID-19, support the Company’s long

-term stability and

implement industry leading operating procedures focused on the health,

safety and well-being of our employees and guests. We remained laser-

focused on minimizing cash burn, extracting value from all of our assets,

and implementing liquidity measures to see us through the pandemic

recovery period. We adapted with agility and created a leaner, more

resilient Cineplex and laid the groundwork to set us on a path to create a

stronger, more successful organization for the future.

Focused Response to COVID-19

Throughout the year, our team w

orked harder than ever to adapt our operations, control costs, and strengthen

Cineplex’s financial position. We significantly reduced capital expenditures and our two primary operating costs:

payroll and lease costs.

During mandated closure periods, we temporarily laid off our part-time field workforce, our full-time employees

voluntarily took temporary salary reductions and we realigned and consolidated our corporate teams,

permanently eliminating 130 full-time roles across the Cineplex ecosystem. We also benefited from

approximately $57 million in

wage subsidies, primarily through the Canada Emergency Wage Subsidy program

(“CEWS program”) and worked with our landlord partners to obtain relief that materially reduced net cash lease

outflows by approximately $73 million. With the second wave of COVID-19 resulting in another round of

widespread temporary closures from late 2020 into 2021, we were pleased to hear that the CEWS program was

extended through June 2021. We are also continuing discussions with our landlord partners for further relief as

we r

espond to the pandemic crisis together.

Additionally, in an effort to further reduce our operating costs, we eliminated all discretionary spending, and

worked with our suppliers to renegotiate and revise contracts.

Gold Standard in Health & Safety Protocols

Our top priority is the health and safety of our employees and our guests. During the Canada-wide shut down

between March and June 2021, we used that time to carefully re-examine our health and safety processes and

procedures and worked with the country’s top infectious disease experts to develop and impl

ement an industry-

leading program. We made sure that our guests would feel confident and relaxed returning to our venues.

Detailed information about the measures we have put in place is available on Cineplex.com, but at a high-level,

our strategy centres around three key components – enhanced cleaning, reducing capacity to ensure physical

distancing and leveraging technology to ease operations and reduce physical touchpoints between our employees

and guests. It’s also important to note that there remains no claim of COVID-19 transmission in a cinema to date

– globally. As a worldwide industry, we have all focused on the safety of our guests and will continue to do so.

Cineplex Inc.

Letter to Shareholders

CINEPLEX INC. 2020 ANNUAL REPORT

LETTER TO SHAREHOLDERS

6

A Leaner, More Resilient Cineplex

In response to the challenges faced in 2020, we adapted with agility and created a leaner, more resilient Cineplex.

We scrutinized our business divisions, analyzed our structures and challenged every assumption, in an effort to

streamline our operations, and more importantly, improve our profitability for the long-term. We took a strategic

look at the structure of our business divisions, our partnerships and programs, and made some tough, but

necessary decisions, to reduce overheads, operating expenses and capital commitments. We re-aligned and

streamlined our corporate and divisional operating structures to improve efficiencies, and reduced the number

of capital projects, recognizing that this isn’t the time to invest in large development projects.

While we were able to dramatically reduce our cash burn, we also focused on the other revenue-generating areas

of our business, which were not as heavily impacted by COVID-19. These included Cineplex Digital Media, our

expanded food delivery services through SkipTheDishes and Uber Eats, and our online Cineplex Store, which

experienced significant growth with a massive 39% increase in registered users from the prior year, to 1.9 million

total users. As Canadians were forced to stay home, the Cineplex Store, which is a key differentiator for us from

our peers, provided us with the opportunity to meaningfully engage with our guests through our digital platform,

and offer them the chance to view film content directly in their homes.

Overall, in the short and medium term, we are focusing on a smaller number of projects and priorities supported

by a sustainable financial model.

Strengthening our Financial Position

Cineplex has a unique suite of assets like no other exhibitor in the world, allowing us to extract additional value

and strengthen our financial position beyond the current pandemic environment. A key example of this was in

the fourth quarter, when we entered into an agreement to enhance and expand the SCENE loyalty program,

receiving $60 million from Scotiabank.

We raised over $300 million in additional financing in 2020, in the form of convertible unsecured subordinated

debentures and subsequent to year end raised another $250 million in the form of senior secured second lien

notes. We obtained additional relief under our credit facilities, which subsequent to year end, was extended

through to the fourth quarter of 2021. We also began the sale process of our Head Office, which was completed

subsequent to year end for $57 million and expect to receive approximately $66 million in tax refunds in early

2021, as a result of the tax losses created in 2020.

These initiatives, combined with our ongoing focus on minimizing costs, will provide the liquidity we need to

see us through the pandemic recovery period as vaccines are rolled out, restrictions are lifted and a return to

normalcy begins.

Undeniable Recovery of the Industry

Although the pandemic has lasted longer than any of us initially expected, we know that the exhibition,

amusement and leisure industries will recover. The box office numbers coming out of countries where theatres

are currently operating, like Japan, China and Australia have exceeded expectations and, in some cases, have

broken all-time records. Closer to home, we experienced record-breaking opening results from our newest

location of Playdium in Dartmouth, Nova Scotia, which opened in February 2021. We know our guests will be

looking for safe and affordable out of home entertainment experiences coming out of the pandemic and our focus

is how best to leverage and capitalize on this desire.

With the vaccine roll-out underway and restrictions starting to ease in certain regions, our team is looking

forward to safely reopening the rest of our circuit of theatres and entertainment venues across Canada. Recent

theatre reopenings have proven very successful and we anticipate a return to more normal operating conditions

in the near future. We have all been cooped up for over a year and are longing to come back together as a

Cineplex Inc.

Letter to Shareholders

CINEPLEX INC. 2020 ANNUAL REPORT

LETTER TO SHAREHOLDERS

7

community and take part in social experiences. That desire, combined with the buildup of strong film content

for both this year and next, means there is a lot to look forward to.

As I look back on 2020, I am extremely proud of the ‘One Cineplex’ team and want to thank them for their focus,

agility and willingness to make sacrifices as we worked together to accomplish all that we did. I also want to

thank our Board of Directors for their ongoing support and sound advice during these unprecedented times.

Finally, I want to thank our customers, partners, guests and investors for their ongoing support and belief in

Cineplex.

The bottom line is that Cineplex will make it through this tough time. We have fortified the financial position of

our company, secured the financing we need to see us through, and developed the ‘gold standard’ in health and

safety protocols to safely welcome guests back. We remain confident in our strategy and will continue to take

all necessary actions to ensure Cineplex not only survives the pandemic, but thrives for years to come.

Sincerely,

Ellis Jacob

President and CEO, Cineplex Inc.

Cineplex Inc.

Letter to Shareholders

CINEPLEX INC. 2020 ANNUAL REPORT

LETTER TO SHAREHOLDERS

8

MANAGEMENT’S DISCUSSION AND ANALYSIS

February 10, 2021

The following management’s discussion and analysis (“MD&A”) of Cineplex Inc. (“Cineplex”) financial condition

and results of operations should be read together with the consolidated financial statements and related notes of

Cineplex (see Section 1, Overview of Cineplex). These financial statements, presented in Canadian dollars, were

prepared in accordance with Canadian generally accepted accounting principles (“GAAP”), defined as

International Financial Reporting Standards (“IFRS”) as set out in the Handbook of the Canadian Institute of

Chartered Professional Accountants.

Unless otherwise specified, all information in this MD&A is as of December 31, 2020 and all amounts are in

Canadian dollars.

Non-GAAP Measures

Cineplex reports on certain non-GAAP measures that are used by management to evaluate performance of Cineplex.

In addition, non-GAAP measures are used in measuring compliance with debt covenants. Because non-GAAP

measures do not have standardized meanings, securities regulations require that non-GAAP measures be clearly

defined and qualified, and reconciled to their nearest GAAP measure. The definition, calculation and reconciliation

of non-GAAP measures are provided in Section 18, Non-GAAP measures.

Forward-Looking Statements

Certain information included in this MD&A contains forward-looking statements within the meaning of applicable

securities laws. These forward-looking statements include, among others, statements with respect to Cineplex’s

objectives, goals and strategies to achieve those objectives and goals, as well as statements with respect to

Cineplex’s beliefs, plans, objectives, expectations, anticipations, estimates and intentions. The words “may”, “will”,

“could”, “should”, “would”, “suspect”, “outlook”, “believe”, “plan”, “anticipate”, “estimate”, “expect”,

“intend”, “forecast”, “objective” and “continue” (or the negative thereof), and words and expressions of similar

import, are intended to identify forward-looking statements. Forward-looking statements also include, statements

pertaining to:

• Cineplex’s outlook, goals, expectations and projected results of operations, including factors and

assumptions underlying Cineplex’s projections regarding the duration and impact of a novel strain of

coronavirus (“COVID-19”) pandemic on Cineplex, the movie exhibition industry and the economy in

general, as well as Cineplex’s response to the pandemic related to the closure of its theatres and

location-based entertainment (“LBE”) venues, employee reductions and other cost-cutting initiatives

and increased expenses relating to safety measures taken at its facilities to protect the health and well-

being of guests and employees;

• Cineplex’s expectations with respect to net cash burn, liquidity and capital expenditures, including its

ability to meet its ongoing capital, operating and other obligations, and anticipated needs for, and

sources of, funds; and

• Cineplex’s ability to execute cost-cutting and revenue enhancement initiatives in response to the

COVID-19 pandemic.

The COVID-19 pandemic has had an unprecedented impact on Cineplex, along with the rest of the movie exhibition

industry and other industries in which Cineplex operates, including material decreases in revenues, results of

operations and cash flows. The situation continues to evolve and the social and economic effects are widespread. As

an entertainment and media company that operates spaces where guests gather in close proximity, Cineplex’s

business has been significantly impacted by the actions taken to control the spread of COVID-19. These actions

include, among other things, the temporary closure of theatres and LBE venues, the introduction of social distancing

measures and restrictions including those on capacity. There is limited visibility on when these restrictions will be

lifted in many of the markets in which Cineplex operates and how quickly guests will return to Cineplex’s locations

once its operations resume due to prolonged safety concerns and adverse economic conditions. Cineplex is actively

monitoring the situation and is adapting its business strategies as the impact of the COVID-19 pandemic evolves.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 1

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

9

Cineplex Inc.

Management's Discussion and Analysis

By their very nature, forward-looking statements involve inherent risks and uncertainties, including those described

in Cineplex’s Annual Information Form (“AIF”), and in this MD&A. Those risks and uncertainties, both general

and specific, give rise to the possibility that predictions, forecasts, projections and other forward-looking statements

will not be achieved. Certain material factors or assumptions are applied in making forward-looking statements and

actual results may differ materially from those expressed or implied in such statements. Cineplex cautions readers

not to place undue reliance on these statements, as a number of important factors, many of which are beyond

Cineplex’s control, could cause actual results to differ materially from the beliefs, plans, objectives, expectations,

anticipations, estimates and intentions expressed in such forward-looking statements. These factors include, but are

not limited to, the duration and impact of the COVID-19 pandemic on Cineplex, the movie exhibition industry and

the economy in general, as well as Cineplex’s response to the COVID-19 pandemic as it relates to the closure of its

theatres and LBE venues, employee reductions and other cost-cutting initiatives, and increased expenses relating to

safety measures taken at its facilities to protect the health and well-being of customers and employees; Cineplex’s

expectations with respect to liquidity and capital expenditures, including its ability to meet its ongoing capital,

operating and other obligations, and anticipated needs for, and sources of, funds; Cineplex’s ability to execute cost-

cutting and revenue enhancement initiatives in response to the COVID-19 pandemic; risks generally encountered in

the relevant industry, competition, customer, legal, taxation and accounting matters; the outcome of any litigation

surrounding the termination of the Cineworld transaction (described below); and diversion of management time on

litigation related to the Cineworld transaction.

The foregoing list of factors that may affect future results is not exhaustive. When reviewing Cineplex’s forward-

looking statements, readers should carefully consider the foregoing factors and other uncertainties and potential

events. Additional information about factors that may cause actual results to differ materially from expectations and

about material factors or assumptions applied in making forward-looking statements may be found in the “Risks and

Uncertainties” section of this MD&A.

Cineplex does not undertake to update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by applicable Canadian securities law. Additionally, we

undertake no obligation to comment on analyses, expectations or statements made by third parties in respect of

Cineplex, its financial or operating results or its securities. All forward-looking statements in this MD&A are made

as of the date hereof and are qualified by these cautionary statements. Additional information, including Cineplex’s

AIF, can be found on SEDAR at www.sedar.com.

1. OVERVIEW OF CINEPLEX

Cineplex is a top-tier Canadian brand that operates in the film entertainment and content, amusement and leisure,

and media sectors. As a leading entertainment and media company, Cineplex welcomes millions of guests annually

through its circuit of theatres and LBE venues across the country. In addition to being Canada’s largest and most

innovative film exhibitor, Cineplex also operates businesses in digital commerce (Cineplex Store), food service,

alternative programming (Cineplex Events), cinema media (Cineplex Media), digital place-based media (Cineplex

Digital Media “CDM”) and amusement solutions (Player One Amusement Group “P1AG”). Additionally, Cineplex

operates an LBE business through Canada’s destinations for ‘Eats & Entertainment’ (The Rec Room), and

entertainment complexes specifically designed for teens and families (Playdium). Cineplex is a joint venture partner

in SCENE, Canada’s largest entertainment loyalty program.

Cineplex’s theatre circuit is concentrated in major metropolitan and mid-sized markets. As of December 31, 2020,

Cineplex owned, leased or had a joint venture interest in 1,667 screens in 162 theatres from coast to coast as well as

eight LBE venues in four provinces.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 2

Cineplex Inc.

Management's Discussion and Analysis

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

10

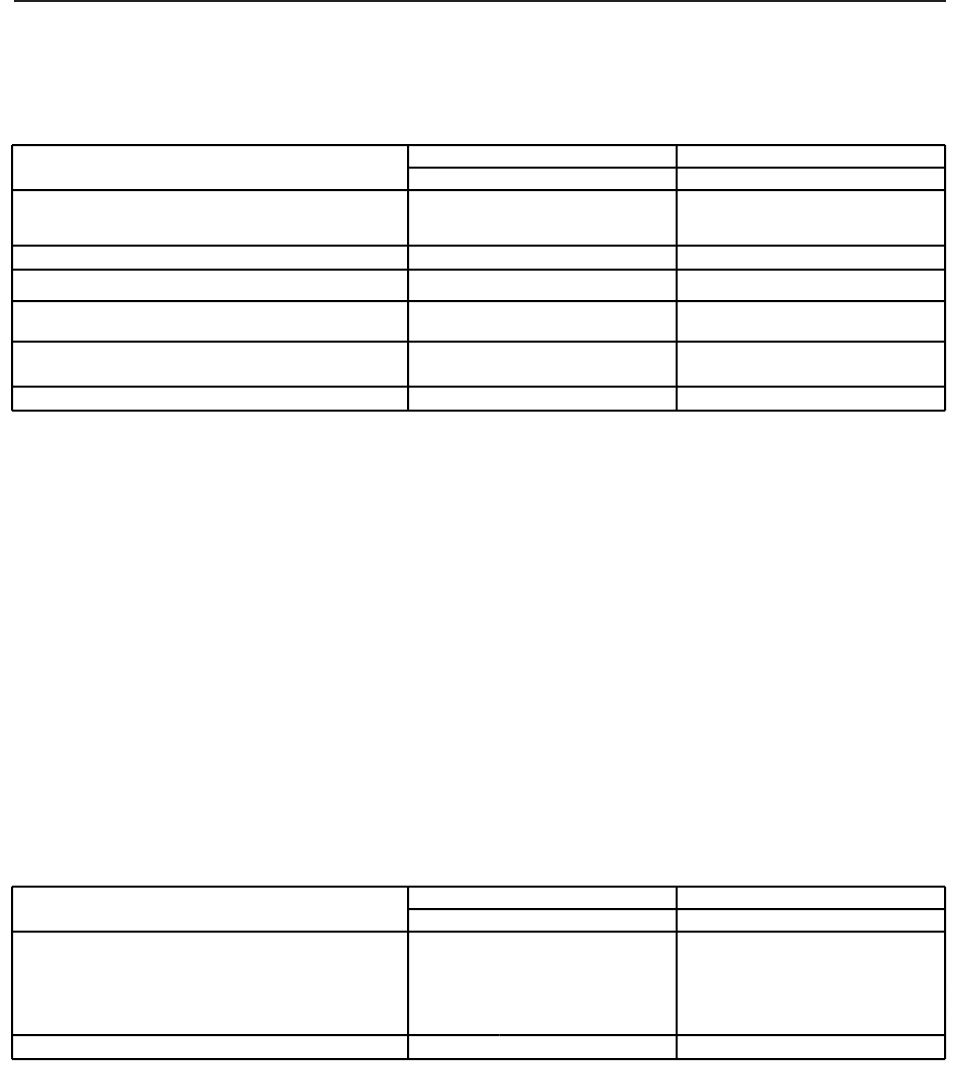

Cineplex

Theatre locations and screens at December 31, 2020

Province

Locations Screens

3D Digital

Screens UltraAVX

IMAX

Screens (i)

VIP

Auditoriums

D-BOX

Auditoriums

Recliner

Auditoriums

Other

Screens (ii)

Ontario 68 730 358 41 13 48 48 108 10

Quebec 18 230 91 10 3 4 7 12 —

British Columbia 24 231 125 16 3 15 16 39 1

Alberta 19 208 112 20 2 11 16 78 6

Nova Scotia 12 91 44 1 1 — 2 — 1

Saskatchewan 6 54 28 3 1 3 3 16 1

Manitoba 5 49 26 1 1 3 2 — —

New Brunswick 5 41 20 2 — — 2 — —

Newfoundland &

Labrador 3 20 9 — 1 — 1 — —

Prince Edward Island 2 13 6 — — — 1 — —

TOTALS 162 1,667 819 94 25 84 98 253 19

Percentage of

screens 49 % 6 % 1 % 5 % 6 % 15 % 1 %

(i) All IMAX screens are 3D enabled. Total 3D screens including IMAX screens are 844 screens or 51% of the circuit.

(ii) Other screens includes 4DX, Cineplex Clubhouse and ScreenX.

Cineplex - Theatres, screens and premium offerings in the last eight quarters

2020 2019

Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Theatres 162 164 164 164 165 165 165 165

Screens 1,667 1,687 1,687 1,687 1,693 1,695 1,695 1,692

3D Digital Screens 819 826 826 826 826 827 826 824

UltraAVX Screens 94 94 94 94 94 93 93 90

IMAX Screens 25 25 25 25 25 25 25 25

VIP Auditoriums 84 84 84 84 84 79 79 75

D-BOX Locations 98 99 99 99 97 92 92 89

Recliner Screens 253 221 221 221 213 182 182 173

Other Screens 19 19 19 19 17 5 4 4

Cineplex - LBE - at December 31, 2020

Province The Rec Room Playdium

Ontario 3 2

Alberta 3 —

Manitoba 1 —

Newfoundland & Labrador 1 —

TOTALS 8 2

1.1 RECENT DEVELOPMENTS

Response to COVID-19 and going concern

In early 2020, the outbreak of COVID-19 was confirmed in multiple countries throughout the world and on March

11, 2020, it was declared a global pandemic by the World Health Organization. In response, Cineplex immediately

introduced enhanced cleaning protocols and reduced theatre capacities to promote social distancing. By mid-March,

each of Canada’s provinces and territories had declared a state of emergency resulting in, among other things, the

mandated closure of non-essential businesses, restrictions on public gatherings and quarantining of people who may

have been exposed to the virus.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 3

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

11

Cineplex Inc.

Management's Discussion and Analysis

On March 16, 2020, Cineplex announced the temporary closure of all of its theatres and LBE venues across Canada,

as well as substantially all route locations operated by P1AG. On April 1, 2020, in response to applicable

government directives and guidance from Canadian public health authorities, Cineplex announced that the closure of

its theatres and LBE venues across Canada would remain in effect and that the reopening of such locations would be

reassessed as further guidance is provided by Canadian public health authorities and applicable government

authorities.

Cineplex was able to reopen a limited number of venues in late June, and as government restrictions across the

country were eased, additional locations were opened. On August 21, 2020, Cineplex became one of the first of all

the major film exhibitors in the world to reopen its entire circuit of theatres across Canada, including location based

entertainment venues. During this period, Cineplex continued its negotiations with landlords, finalizing the majority

of discussions and realizing material reductions in rent payments for both the closure period in the second, third, as

well as for the fourth quarter and future periods.

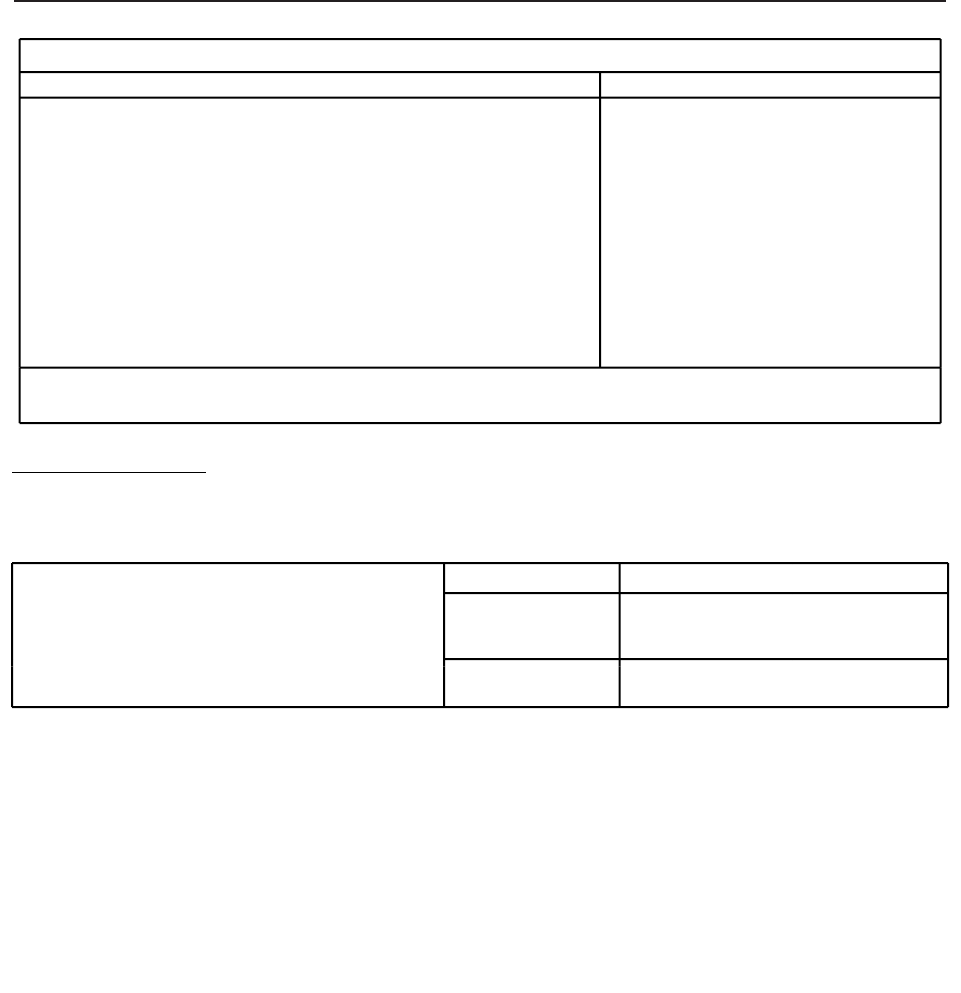

In Canada, most provinces have adopted a phased approach to reopening businesses. The following table reflects the

current status of reopening to the date of this MD&A. The reopening plans are subject to change from time to time.

Province Theatres Restaurants

British

Columbia

All cinemas closed as of November 24, 2020.

a

Restaurants limited to 50% capacity as of

November 24, 2020.

Alberta All cinemas closed as of December 31, 2020.

All indoor dining closed as of December 13,

2020.

Saskatchewan

a

Cinemas open at 30 per auditorium.

a

Restaurants open.

Manitoba All cinemas closed as of November 12, 2020. All indoor dining closed as of November 20,

2020.

Ontario

Cinemas will begin reopening in Ontario on February 10 with

additional regions scheduled to reopen on February 16 and 22.

Restaurants will begin reopening in Ontario on

February 10 with additional regions scheduled

to reopen on February 16 and 22.

Quebec All cinemas closed as of November 11, 2020. All indoor dining closed as of November 11,

2020.

New

Brunswick

a

Cinemas open at 50 per building.

a

Restaurants open.

Nova Scotia

a

Cinemas open at 100 per auditorium.

a

Indoor dining open as of January 4, 2021.

Prince Edward

Island

a

Cinemas open at 200 per building, no more than 50 per auditorium.

a

Indoor dining permitted with a limit of up to 50

patrons.

Newfoundland

a

Permitted since June 24.

a

Permitted since June 8.

Limit of 50 persons per auditorium or 50% capacity, whichever is less.

To mitigate the negative impact of COVID-19 and support its long-term stability, Cineplex has undertaken a variety

of measures including:

Liquidity measures:

• entered into amendment agreements with The Bank of Nova Scotia as administrative agent to the seventh

amended and restated credit agreement that provided Cineplex with certain financial covenant relief in light

of the COVID-19 pandemic and its effects on Cineplex’s business. Refer to Section 7.4, Credit Facilities

and Section 16, Subsequent events, for a summary of key terms of the First, Second and Third Credit

Agreement Amendments;

• issued convertible unsecured subordinated debentures for net proceeds of $303.0 million (the

“Debentures”) (see Section 9.1, Convertible debentures);

• entered into an agreement to enhance and expand the SCENE Scotiabank Loyalty program receiving $60.0

million with respect to the reorganization.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 4

Cineplex Inc.

Management's Discussion and Analysis

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

12

• focused on revenue driving opportunities including the expansion of Cineplex Store offerings and

expansion of food home delivery from theatres and LBE venues; and

• filed corporate tax returns for income tax recoveries in a timely manner

Cost reduction and subsidy measures:

• temporary layoffs of all part-time and full-time hourly employees as well as a number of full-time

employees who chose a temporary layoff rather than a salary reduction;

• reduced full-time employee salaries by agreement with such employees during the second and third

quarters;

• suspended or deferred current capital spending and reviewing all capital projects to consider either deferral

or cancellation;

• reduced non-essential discretionary operational expenditures (such as spending on marketing, travel and

entertainment);

• implemented a more stringent review and approval process for all outgoing procurement and payment

requests;

• continued negotiations with landlords for rent relief, including abatements and converting fixed rent to

variable rent depending on attendance, until attendance returns to previous levels;

• worked with major suppliers and other business partners to modify the timing and quantum of certain

contractual payments;

• reviewed and applied for government subsidy programs where available, including municipal and

provincial property tax and energy rebates or subsidies;

• applied for the ongoing Canada Emergency Wage Subsidy (“CEWS”) made available by the Government

of Canada since March 2020;

• applied for the ongoing Canada Emergency Rent Subsidy (“CERS”), which was launched by the

Government of Canada as a result of government mandated lockdowns, providing a variable subsidy for

rent and other occupancy-related costs incurred from September 27, 2020 through June, 2021;

• continued evaluation of Cineplex’s eligibility under other relief programs; and

• continued the suspension of dividends;

In addition to cost savings associated with the temporary layoffs of its employees, reductions in salaries and other

mitigation efforts, Cineplex has suspended or deferred certain capital spending and is reviewing all capital projects

to consider further deferrals or cancellations and has plans to reduce purchases of property, plant and equipment (net

of tenant inducements) to approximately $50.0 million over the next 12 months.

The COVID-19 pandemic has had a material negative effect on all aspects of Cineplex’s businesses resulting in

material decreases in revenues, results of operations and cash flows. Since March 15, 2020, Cineplex has

experienced a net cash burn of approximately $15 million to $20 million per month as a result of having to close its

theatres and LBE venues (for Q4 2020 net cash burn was $74.3 million for the three months or approximately $24.8

million monthly) (see Section 18, Non-GAAP measures). When used in this MD&A, net cash burn is calculated as

adjusted EBITDAaL (see Section 18, Non-GAAP measures) less cash interest (excluding amounts with respect to

lease obligations), provision for income taxes and net capital expenditures.

As some of Cineplex’s largest expenses, such as film cost and cost of food services, are fully variable, during the

closure of its theatres and LBE venues Cineplex focused on reducing its largest fixed and semi-fixed expenses,

including those attributed to theatre payroll and theatre occupancy. As a result of the measures described above and

below, including receipt of assistance under the CEWS, Cineplex was able to materially reduce theatre payroll

expenses from $41.9 million reported in the fourth quarter of 2019 to approximately $5.2 million in the fourth

quarter of 2020. In total, Cineplex has received approximately $57.0 million in wage subsidies to end of the fourth

quarter, primarily under the CEWS program. With respect to theatre occupancy expenses, Cineplex has worked with

its landlord partners to obtain relief measures, which resulted in significantly reduced cash rent being paid in 2020

subsequent to the lockdowns. During the fourth quarter Cineplex was able to reduce occupancy costs by

approximately $14.9 million. Including the sale of certain restrictive lease rights to landlords during the third

quarter, on an annual basis Cineplex was able to materially reduce net cash lease outflows by approximately $72.5

million. The focus was on identifying opportunities for lease-related abatements during the closure period,

converting fixed components of rent to variable rent during the reopening period and looking for other opportunities

to extract value under its existing lease agreements. With the second wave of COVID-19 resulting in another round

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 5

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

13

Cineplex Inc.

Management's Discussion and Analysis

of closures in the fall and winter of 2020/2021, Cineplex continues to work with landlord partners to obtain further

relief.

Since the closure of its theatres and LBE venues in March 2020, Cineplex diligently prepared for their safe

reopening, with the health and well-being of its employees and guests being its top priority. Cineplex carefully re-

examined all of its buildings and processes, so that when its theatres and LBE venues reopened, it had implemented

an industry-leading program with end-to-end health and safety protocols.

Some of the new measures implemented on reopening included:

• launching reserved seating in all auditoriums across Canada; seating options are automatically blocked off

to ensure proper distance in every direction between guests;

• reducing capacity in all auditoriums to allow for physical distancing in accordance with government

regulations;

• enhancing cleaning practices throughout our facilities, with particular focus on high-contact surfaces,

restrooms and seats;

• accepting debit and credit payments only, with the exception of gift card purchases;

• limiting food offerings in theatres;

• ensuring employees have the personal protective equipment they need and as required by provincial

regulations; and

• making hand sanitizer readily available for guests and employees throughout the buildings.

Although restrictions on social gatherings were partially lifted in many of the markets in which Cineplex operated

during the third quarter, social gathering restrictions were reinstituted in the fourth quarter with the increased

number of COVID-19 cases throughout the country. The second wave of increased cases during the fall months

resulted in several provinces across Canada implementing mandatory lockdown measures which have resulted in

prolonged mandatory theatre closures and operating restrictions on the LBE businesses. Due to the uncertainty of the

timing of the reductions of many government-imposed restrictions and the potential long-term effects that the

COVID-19 pandemic may have on the exhibition and amusement and leisure businesses, COVID-19 may have a

prolonged negative impact on Cineplex’s operations. In addition, with the global delay of exhibitors reopening,

specifically those in California and New York, distributors shifted the release dates of major movie titles out of 2020

into 2021 and beyond, in an effort to maximize box office revenues on the eventual release of such titles. This

included the following releases: Godzilla vs. Kong, Black Widow, Fast & Furious 9, Cruella, Peter Rabbit 2,

Venom: Let There Be Carnage, Minions: The Rise of Gru, Top Gun: Maverick, Shang-Chi and the Legend of the

Ten Rings, Space Jam: A New Legacy, Jungle Cruise, The Suicide Squad, The King’s Man, A Quiet Place Part II,

Dune, No Time To Die, Eternals, Ghostbuster: Afterlife, Mission: Impossible 7, Spider-Man 3, West Side Story and

The Matrix 4.

In addition, a limited number of previously expected theatrical releases have instead been redirected to streaming

services. The impact of the reduction of new releases in the fourth quarter as a result of these changes in

combination with the ongoing and potentially expanded restrictions on the reopening of Cineplex’s businesses, also

negatively impacted the timing of Cineplex’s return to profitability.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 6

Cineplex Inc.

Management's Discussion and Analysis

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

14

In December 2020, Health Canada approved and authorized the Pfizer-BioNTech and Moderna COVID-19 vaccines

for use in Canada with the first doses arriving during the holiday season. Canada has begun the inoculation process

of Canadians, starting with front line workers and high-risk individuals with plans to start vaccinating the general

population during the spring of 2021, and having all Canadians immunized by the fall of 2021. The efficient rollout

of vaccines is a significant leap forward to the return of normalcy and end of the COVID-19 pandemic. However,

the supply and roll-out of approved vaccines in Canada has been inconsistent to date and there can be no assurance

that vaccines will be widely available or distributed as currently anticipated, which would delay a return to

normalcy.

With the unknown duration of the pandemic and yet to be determined timing of the phased complete reopening of

Cineplex’s businesses, as well as consumers’ future risk tolerance regarding health matters, it is not possible to

know the impact of the pandemic on future results. However, Cineplex is optimistic that the exhibition and

amusement and leisure industries will recover over time. Cineplex believes consumer demand for the theatrical

experience combined with a backlog of anticipated releases of strong film content will help drive visitation, and that

LBE activities will increase as people seek out-of-home experiences they have been restricted from enjoying for

almost a year.

Management continues to pursue all viable options to maintain adequate liquidity to fund operations for the

currently anticipated duration of the pandemic. During the fourth quarter, Cineplex entered into an agreement to

enhance and expand the SCENE Scotiabank Loyalty program receiving $60.0 million with respect to the

reorganization. In addition, Cineplex continues to explore other measures to maintain adequate liquidity, including

but is not limited to planned asset sales such as Cineplex’s head office building in Toronto which was completed

subsequent to year end, additional financing sources and amendments to existing credit facilities. All proceeds are

used to repay the Credit Facilities, in part as a permanent reduction.

As of December 31, 2020, Cineplex was in compliance with all financial covenants under the terms of its senior

secured credit facilities (“Credit Facilities”). However, with potential ongoing closures and delayed film releases,

management’s forecasts indicate a potential breach of covenants within the next twelve months as a result of the

ongoing pandemic. Management’s forecasts may change materially as the impact of COVID-19 on Cineplex’s

business is better understood over the course of time. A violation of its covenants would represent an event of

default under the terms of the Credit Facilities, enabling the lenders to demand immediate repayment of all amounts

due. See section 16, Subsequent Events, for a description of certain amendments to the Credit Facilities entered into

after year end.

As of December 31, 2020, Cineplex had a cash balance of $16.3 million and $153.8 million available under its

Credit Facilities subject to the liquidity covenants set forth in the Credit Facilities as amended (see Section 16,

Subsequent events). Cineplex also reported a loss from continuing operations during the year of $624.0 million and

an accumulated deficit of $903.4 million. Subsequent to year end, Cineplex entered into an amendment to the credit

agreement governing the Credit Facilities to obtain certain financial covenant relief from the syndicate of lenders

under its Credit Facilities, see Section 16, Subsequent Events. Cineplex continues to pursue a variety of options to

maintain adequate liquidity to fund operations for the currently anticipated duration of the pandemic and is

investigating additional sources of financing including further asset sales, such as the sale of the head office

completed subsequent to year end, however as of the date of this MD&A, no further financing had been concluded,

and there can be no assurance that such financing initiatives will be successful.

Cineplex has prepared its condensed consolidated financial statements on a going concern basis, which presumes it

will continue its operations for the foreseeable future, and will be able to realize its assets and discharge its liabilities

and commitments in the normal course of business as they become due. While Cineplex currently has sufficient

liquidity to satisfy its immediate financial obligations, there can be no assurance that the steps that management is

taking will provide sufficient liquidity in the near term to meet its ongoing obligations, nor can it be assured that it

will be able to obtain additional financing at favorable terms, or at all. These material uncertainties lend significant

doubt about the Company’s ability to continue as a going concern and, accordingly, the appropriateness of the use of

accounting principles applicable to a going concern. The consolidated financial statements do not reflect adjustments

and classifications of assets, liabilities, revenues and expenses which would be necessary if Cineplex were unable to

continue as a going concern. Such adjustments could be material.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 7

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

15

Cineplex Inc.

Management's Discussion and Analysis

Cineworld Transaction

On December 15, 2019, Cineplex entered into an arrangement agreement (the “Arrangement Agreement”) with

Cineworld Group, plc (“Cineworld”), pursuant to which an indirect wholly-owned subsidiary of Cineworld agreed to

acquire all of the issued and outstanding common shares of Cineplex (“Shares”) for $34 per share in cash (the

“Cineworld Transaction”). The Cineworld Transaction was to be implemented by way of a statutory plan of

arrangement under the Business Corporation Act (Ontario).

On June 12, 2020, Cineworld delivered a notice (the “Termination Notice”) to Cineplex purporting to terminate the

Arrangement Agreement. In the Termination Notice, Cineworld alleged that Cineplex took certain actions that

constituted breaches of Cineplex’s covenants under the Arrangement Agreement including failing to operate its

business in the ordinary course. In addition, Cineworld alleged that a material adverse effect had occurred with

respect to Cineplex. Cineworld’s repudiation of the Arrangement Agreement has been acknowledged by Cineplex

and the Cineworld Transaction will not proceed. Cineplex vigorously denies Cineworld’s allegations. The

Arrangement Agreement explicitly excludes any “outbreaks of illness or other acts of God” from the definition of

material adverse effect and all of Cineworld’s allegations stem from an outbreak of illness and act of God

(COVID-19). Cineplex believes that Cineworld had no legal basis to terminate the Arrangement Agreement and

that Cineworld breached the Arrangement Agreement and its other contractual obligations because, among other

failures, it did not use reasonable best efforts to obtain approval under the Investment Canada Act as soon as

reasonably practicable (“ICA Approval”). If Cineworld had complied with its obligation to obtain ICA Approval,

Cineplex believes the ICA Approval would have been obtained and the Cineworld Transaction would have closed

well before the outside date for completion in the Arrangement Agreement. No amounts are due to be paid by

Cineplex as a result of the Termination Notice and no amounts have been accrued in the financial statements with

respect to the Termination Notice.

On July 3, 2020, Cineplex announced that it had commenced an action in the Ontario Superior Court of Justice

against Cineworld and 1232743 B.C. Ltd. seeking damages arising from what Cineplex claims was a wrongful

repudiation of the Arrangement Agreement. The claim seeks damages, including the approximately $2.18 billion

that Cineworld would have paid upon the closing of the Cineworld Transaction for Cineplex’s securities, reduced by

the value of the Cineplex securities retained by its security holders, as well as compensation for other losses

including the failure of Cineworld to repay or refinance Cineplex’s approximately $664 million in debt and

transaction expenses. Cineplex has also advanced alternative claims for damages for the loss of benefits to its

security holders, and to require Cineworld to disgorge the benefits it improperly received by wrongfully repudiating

the Cineworld Transaction.

Cineplex claims that Cineworld breached its contractual obligations and its duty of good faith and honesty in

contractual performance. Cineworld purports to rely upon alleged adverse impacts of COVID-19 on Cineplex’s

business to terminate the Arrangement Agreement, which it is not entitled to do. The contractual agreements

between the parties expressly exclude outbreaks of illness, such as the COVID-19 pandemic, as a circumstance

entitling Cineworld to terminate the Arrangement Agreement. Without any legal right to avoid its contractual

obligations, Cineworld intentionally chose to breach its obligations, including its obligation to obtain ICA Approval.

On July 6, 2020, Cineworld announced that it would defend Cineplex’s claim, and on September 2, 2020, filed its

Statement of Defence and Counterclaim in which it denied Cineplex’s claims and advanced a counterclaim seeking

reimbursement of an unspecified amount for costs incurred with respect to the transaction and an unspecified

amount for punitive damages. Cineplex responded to Cineworld’s defence and counterclaim on September 15, 2020,

denying all claims levied by Cineworld.

While a trial date has been set for September 2021, due to uncertainties inherent in litigation, it is not possible for

Cineplex to predict the timing or final outcome of the legal proceedings against Cineworld or to determine the

amount of damages, if any, that may be awarded. Further, even if Cineplex’s action against Cineworld is successful,

Cineworld may not have the ability to pay the full amount of any damages awarded.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 8

Cineplex Inc.

Management's Discussion and Analysis

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

16

1.2 FINANCIAL HIGHLIGHTS

Financial highlights Fourth Quarter Full Year

(in thousands of dollars, except theatre attendance in

thousands of patrons and per Share and per patron

amounts) 2020 2019 Change (i) 2020 2019 Change (i)

Total revenues (ii) $ 52,452 $ 443,220 -88.2 % $ 418,263 $ 1,665,146 -74.9 %

Theatre attendance 786 16,849 -95.3 % 13,065 66,360 -80.3 %

Net (loss) income from continuing operations $ (230,403) $ 4,668 NM $ (624,001) $ 36,516 NM

Net loss from discontinued operations $ — $ (1,196) NM $ (4,952) $ (7,625) NM

Net (loss) income $ (230,403) $ 3,472 NM $ (628,953) $ 28,891 NM

Box office revenues per patron (“BPP”) (iv) $ 9.23 $ 10.79 -14.5 % $ 10.17 $ 10.63 -4.3 %

Concession revenues per patron (“CPP”) (iv) $ 9.06 $ 6.81 33.0 % $ 6.99 $ 6.73 3.9 %

Adjusted EBITDA (iv) $ (32,097) $ 106,529 NM $ (55,866) $ 405,786 NM

Adjusted EBITDAaL (iii) (iv) $ (65,948) $ 62,327 NM $ (182,815) $ 230,546 NM

Adjusted EBITDAaL margin (iii) (iv) (125.7) % 14.1 % -139.8 % (43.7) % 13.8 % -57.5 %

Adjusted free cash flow (iv) $ (30,530) $ 39,127 NM $ (161,870) $ 168,455 NM

Adjusted free cash flow per Share (iv) $ (0.482) $ 0.618 NM $ (2.556) $ 2.660 NM

Earnings per Share (“EPS”) from continuing operations -

basic and diluted (iii) $ (3.64) $ 0.08 NM $ (9.85) $ 0.58 NM

EPS from discontinued operations - basic and diluted $ — $ (0.02) NM $ (0.08) $ (0.12) -33.3 %

EPS - basic and diluted (iii) $ (3.64) $ 0.06 NM $ (9.93) $ 0.46 NM

(i) Throughout this MD&A, changes in percentage amounts are calculated as 2020 value less 2019 value.

(ii) All amounts are from continuing operations. See Section 13, Accounting policies.

(iii) 2020 includes expenses related to the Cineworld Transaction and associated Litigation in the amount of $1.3 million for the fourth quarter

and $4.1 million for the full year.

(iv) See Section 18, Non-GAAP measures.

In response to the second wave of COVID-19, increased operating restrictions for non-essential businesses in

addition to new government mandated lockdown measures were implemented across Canada, resulting in the

closure of most of Cineplex’s theatres and LBE venues by the end of the year. Total revenues for the fourth quarter

of 2020 decreased 88.2%, or $390.8 million to $52.5 million as compared to the prior year period, due to the

ongoing material negative impact of the COVID-19 pandemic on Cineplex’s business operations. For the periods

when venues were open, Cineplex reported box office revenues of $7.3 million and food service revenues of

$10.5 million including theatre food service revenue of $7.1 million, home delivery revenues of $2.8 million and

LBE food service revenues of $0.6 million. Media revenues of $12.5 million were mainly from digital place-based

media revenues which recognized the majority of its $11.1 million of revenue from creative and support services.

Amusement revenues of $13.6 million were primarily from route operations including family entertainment centres

(“FEC”) and equipment sales. As a result of the ongoing negative impact of COVID-19, adjusted EBITDAaL

decreased $128.3 million to a loss of $65.9 million as compared to the prior year period and adjusted free cash flow

per Share decreased $1.100 to $(0.482) per Share.

Reflecting the impact of the business closures and reduced operations that began in March and continued through

the rest of the year, total revenues for the year ended December 31, 2020 decreased by $1.2 billion, or 74.9% as

compared to the prior year period. Adjusted EBITDAaL decreased $413.4 million to a loss of $182.8 million

1.3 KEY DEVELOPMENTS IN 2020

The following describes certain key business initiatives undertaken and results achieved during 2020 in each of

Cineplex’s core business areas:

FILM ENTERTAINMENT AND CONTENT

Theatre Exhibition

• Government operating restrictions and mandated closures during the fourth quarter resulted in the closure

of most of Cineplex’s theatres by the end of the year.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 9

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

17

Cineplex Inc.

Management's Discussion and Analysis

• Reported annual box office revenues of $132.8 million, a 81.2% decrease from 2019 as a result of the

impact of the COVID-19 pandemic on theatre operations commencing at the end of the first quarter.

• Opened two new ScreenX auditoriums: Scotiabank Theatre Halifax in Nova Scotia and Cineplex Cinemas

Ottawa in Ontario.

• Converted four auditoriums to recliner seating during the year.

• Announced a multi-year agreement with Universal Filmed Entertainment Group that provides theatrical

exclusivity of their film releases for a shortened window of a minimum of 17 days up to a maximum of 31

days after which the studio will have the option to make its title available on Premium Video on Demand

(“PVOD”).

• Launched Private Movie Nights offering up to 20 guests to enjoy a private moving-screening experience

with more than 1,000 movies to choose from.

Theatre Food Service

• Reported annual theatre food service revenues of $91.4 million, a 79.5% decrease from 2019 as a result of

the impact of COVID-19 on theatre operations.

• Expanded alcohol beverage service to an additional four theatres, now totaling 91 (not including VIP

auditoriums).

• Increased focus on home delivery services with Uber Eats and Skip the Dishes as a result of the theatre and

LBE restrictions and closures, reporting annual theatre food service delivery revenues of $8.4 million.

During the year, added five additional locations to the Uber Eats delivery platform, and seven additional

locations to the Skip the Dishes platform.

Alternative Programming

• Alternative Programming (Cineplex Events) included the feature release of On The Rocks, concerts

included Stevie Nicks 24 Karat Gold and the re-release of Break The Silence: The Movie starring BTS

along with anime title Fate/stay night [Heaven’s Feel] III, Akira 4K.

• Cineplex released the feature 100% Wolf on October 9, 2020 across the country with the exception of

Quebec. While theatres did continue to shut down in most markets, the film remained on-screen through

mid-December and was in Cineplex’s top five films for the quarter.

Digital Commerce

• Experienced significant growth for the Cineplex Store benefiting from PVOD releases including Wonder

Woman 1984 and The Croods: A New Age.

• Total registered users for Cineplex Store increased by 39% from the prior year, reaching over 1.9 million

users.

• Cineplex Store continued to show significant growth with a 36% increase over the prior year in active

monthly users and an increase of 57% in device activation compared to the prior year.

• Cineplex offered a collection of “Understanding Black Stories” films that were available free to rent or

stream to support the Black Lives Matter movement.

MEDIA

• Reported annual media revenues of $65.4 million, a decrease of $131.4 million or 66.8% compared to the

prior year.

Cinema Media

• Cinema media reported annual revenues of $23.6 million in 2020, a decrease of $91.8 million or 79.6%,

due to decreases in show-time and pre-show advertising as a result of theatre closures and limited film

releases.

Digital Place-Based Media

• Reported annual revenues of $41.8 million in 2020, a decrease of $39.6 million or 48.6%, compared to

2019 mainly due to decreases in recurring revenue and lower project installation revenues as a result of

COVID-19 and reductions in customers’ business.

AMUSEMENT AND LEISURE

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 10

Cineplex Inc.

Management's Discussion and Analysis

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

18

Amusement Solutions

• Reported annual revenues of $62.5 million in 2020 ($2.5 million from Cineplex theatre gaming and $60.0

million from all other sources of revenues), a decrease of $126.6 million as compared to the prior year. The

decrease is due to closures and capacity restrictions of route operations that remained in effect for a

majority of the year and decreased distribution sales as a result of the negative economic impact of

COVID-19 across all markets.

Location-based Entertainment

• Increased operating restrictions for non-essential businesses in addition to new government mandated

lockdown measures were implemented across Canada in response to the second wave of COVID-19,

resulting in closures of most LBE locations.

• Reported total annual revenues of $25.5 million including food service revenues of $9.1 million,

amusement revenues of $15.4 million and other revenues of $1.0 million, a decrease of $53.7 million or

67.8% as compared to 2019 due to closures and capacity restrictions on locations that were able to open.

• Opened The Rec Room at Seasons of Tuxedo in Winnipeg, Manitoba, on February 18, 2020, the eighth

location of The Rec Room.

• Terminated its partnership with Topgolf in the third quarter of 2020.

LOYALTY

• Membership in the SCENE loyalty program increased by 0.1 million in 2020, reaching 10.4 million

members at December 31, 2020.

• Cineplex entered into an agreement with Scotiabank to bring together the full benefits of SCENE with

Scotia Rewards, Scotiabank’s flexible customer loyalty program. The repositioning includes adding new

rewards partners, driving value through future consolidation of SCENE and Scotia Rewards. Cineplex

received cash proceeds of $60.0 million for the reorganization of its joint operation with SCENE.

• During the year, SCENE announced a strategic three-year extension with its long-standing partners at

Recipe Unlimited Corporation.

CORPORATE

• On June 12, 2020, Cineworld delivered the Termination Notice to Cineplex purporting to terminate the

Arrangement Agreement (See section 1.1, Recent Developments). Cineplex has commenced legal action

against Cineworld for its wrongful termination of the Agreement.

• On June 29, 2020, Cineplex and Cineplex Entertainment Limited Partnership entered into an amendment

agreement with The Bank of Nova Scotia, as administrative agent, and the lenders from time to time named

therein, to the seventh amended and restated credit agreement with a syndicate of lenders (See section 7.4

Credit Facilities).

• Cineplex completed the offering of $316.3 million aggregate principal amount of convertible unsecured

subordinated debentures on July 17, 2020.

• In July, Cineplex announced a cost restructuring program incurring $8.3 million in related costs during the

year.

• On June 29,2020, Cineplex sold its interest in WorldGaming Network for a nominal amount.

• Cineplex announced the appointment and return of Phyllis Yaffe to the Board of Directors. Ms. Yaffe

returned to the role of Board Chair, replacing Ian Greenberg who did not stand for re-election at the Annual

and Special Meeting of shareholders held in October 2020.

• On November 12, 2020, Cineplex and Cineplex Entertainment Limited Partnership entered into the Second

Credit Agreement Amendment with the Bank of Nova Scotia, as administrative agent, and the lenders from

time to time named therein, to the seventh amended and restated credit agreement with a syndicate of

lenders (see section 7.4, Credit Facilities).

• During the year, Cineplex initiated a process to sell its head office building located at 1303 Yonge Street

and 1257 Yonge Street, Toronto, Ontario. Subsequent to period end, Cineplex completed a sale-leaseback

transaction for cash proceeds of $57.0 million (see Section 16, Subsequent Events).

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 11

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

19

Cineplex Inc.

Management's Discussion and Analysis

2. CINEPLEX’S BUSINESS AND STRATEGY

Cineplex’s mission statement is “Passionately delivering exceptional experiences.” All of its efforts are focused

towards this mission and it is Cineplex’s goal to consistently provide guests and customers with exceptional

experiences.

Cineplex’s operations are primarily conducted in four main areas: film entertainment and content, media,

amusement and leisure and location-based entertainment, all supported by the SCENE loyalty program. Cineplex’s

key strategic areas of focus include the following:

• Continue to enhance and expand Cineplex’s presence as an entertainment destination for Canadians in-

theatre, at-home and on-the-go;

• Capitalize on core media strengths and infrastructure to provide continued growth of Cineplex’s media

business both inside and outside theatres;

• Develop and scale amusement and leisure concepts by extending existing capabilities and infrastructure;

• Drive value within businesses by leveraging opportunities to optimize value, realize synergies,

implement customer-centric technology and leverage big data across the Cineplex ecosystems; and

• Pursue opportunities that capitalize on Cineplex’s core strengths.

Cineplex uses the SCENE loyalty program and database as a strategic asset to link these areas of focus and drive

customer acquisition and ancillary businesses.

Diversified Entertainment and Media Company

Key elements of this strategy include going beyond movies to reach customers in new ways and maximizing

revenue per patron. Cineplex has implemented in-theatre initiatives to improve the overall entertainment experience,

including increased premium offerings, enhanced in-theatre services, alternative pricing strategies, continued

development of the SCENE loyalty program and initiatives in theatre food service such as optimizing and adding

product offerings and improving service execution. The ultimate goal of these in-theatre customer service initiatives

is to maximize revenue per patron and increase the frequency of movie-going at Cineplex’s theatres.

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 12

Cineplex Inc.

Management's Discussion and Analysis

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

20

While box office revenues (which include alternative programming) continue to account for the largest portion of

Cineplex’s revenues, expanded theatre food service offerings, cinema media, digital place-based media, amusement

and leisure, the Cineplex Store, promotions and other revenue streams have increased as a share of total revenues.

Cineplex is committed to diversifying its revenue streams outside of the traditional theatre exhibition model through

its media and amusement and leisure businesses.

As a result of the impact of the COVID-19 pandemic on Cineplex’s business, Cineplex’s attention has shifted to

respond to the impacts of the COVID-19 pandemic by implementing a variety of measures to reduce costs and has

placed an increased focus on the safe reopening of its business (see Section 1.1 Response to COVID-19).

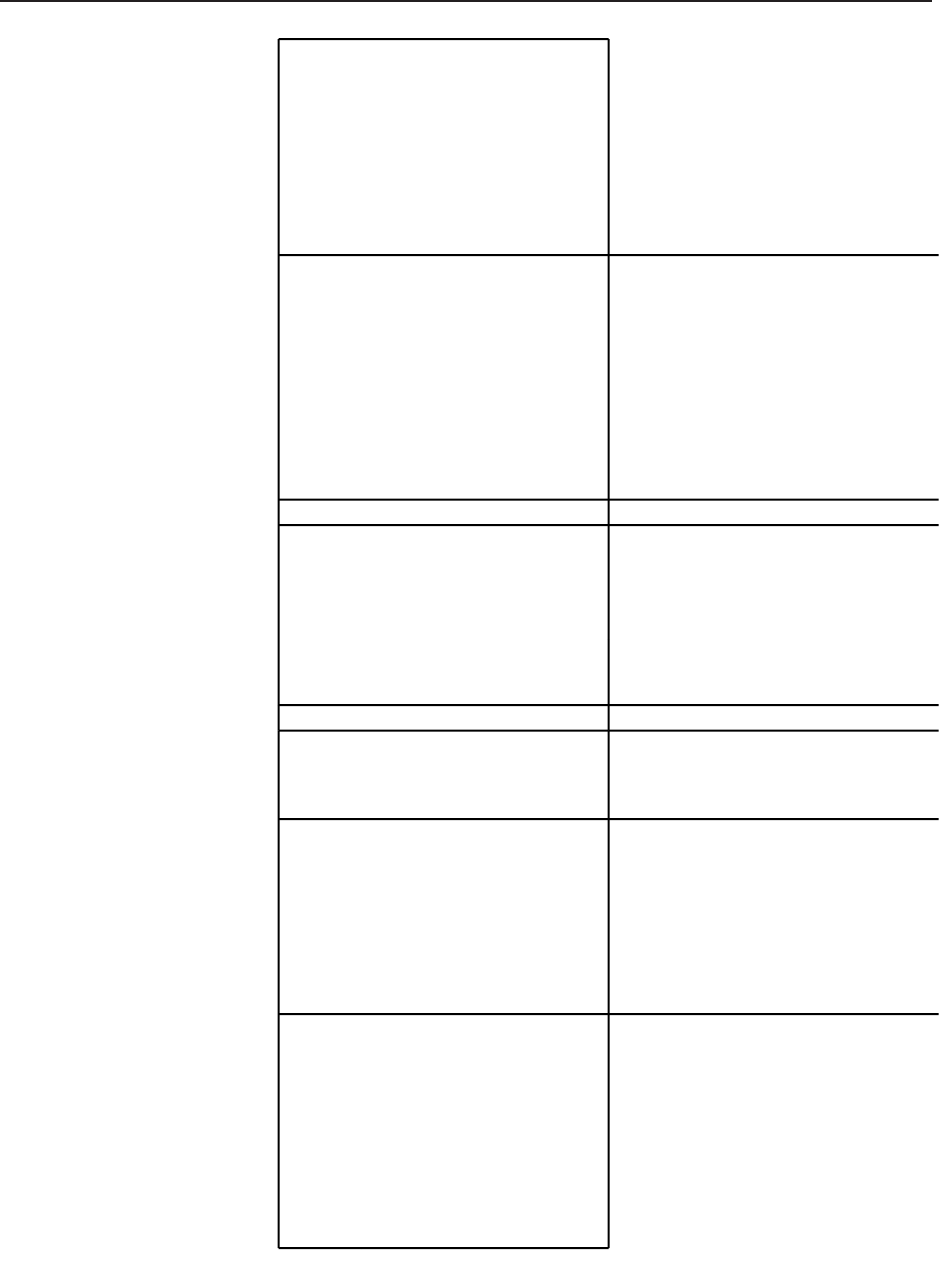

Adjusted EBITDAaL

(millions) (i)

$222.9

$224.7

$247.3

$230.5

$(182.8)

2016

2017

2018

2019

2020

Adjusted EBITDAaL

Margin (i)

15.1% 14.5% 15.3% 13.8%

(43.7)%

2016 2017 2018 2019 2020

(i) 2020 includes expenses related to the Cineworld Transaction and associated Litigation in the amount of $4.1 million.

3. CINEPLEX’S BUSINESSES

During 2020, all aspects of Cineplex’s business were materially negatively impacted by COVID-19. Despite this

impact, the following reflects management’s belief that its business will return when it is able to reopen theatres and

LBE venues without restrictions. Cineplex’s operations are primarily conducted in four main areas: film

entertainment and content, media, amusement and leisure and location-based entertainment, all supported by the

SCENE loyalty program.

FILM ENTERTAINMENT AND CONTENT

Theatre Exhibition

Theatre exhibition is the core business of Cineplex. Box office revenues are highly dependent on the marketability,

quality and appeal of the film product released by the major motion picture studios.

The motion picture industry consists of three principal

activities: production, distribution and exhibition.

Production involves the development, financing and

creation of feature-length motion pictures. Distribution

involves the promotion and exploitation of motion

pictures in a variety of different channels. Theatrical

exhibition is the primary channel for new motion picture

releases and is the core business function of Cineplex.

Source: Movie Theatre Association of Canada ("MTAC")

Canadian Industry Box Office

(in millions)

$994.0 $992.5 $1,031.3 $1,022.0

$235.0

2016 2017 2018 2019 2020

Cineplex Inc.

Management’s Discussion and Analysis

—————————————————————————————————————————————

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT’S DISCUSSION & ANALYSIS 13

CINEPLEX INC. 2020 ANNUAL REPORT

MANAGEMENT'S DISCUSSION AND ANALYSIS

21

Cineplex Inc.

Management's Discussion and Analysis

Cineplex believes that the following market trends are important factors in the growth of the film exhibition industry

in Canada:

• Importance of theatrical success in establishing movie brands and subsequent movies. Theatrical exhibition

is the initial and most important channel for new motion picture releases. A successful theatrical release

which “brands” a film is often the determining factor in its popularity and value in “downstream”

distribution channels, such as transactional video-on-demand (“TVoD”), Blu-ray, pay-per-view,

subscription video-on-demand as well as network television.

• Continued supply of successful films. Studios are increasingly producing film franchises, such as Star

Wars, Fast & Furious and Jurassic Park. Additionally, new franchises continue to be developed, such as

the films in the Marvel and DC universes. When the first film in a franchise is successful, subsequent films

in the franchise benefit from existing public awareness and anticipation. The result is that such features

typically attract large audiences and generate strong box office revenues. The success of a broader range of

film genres also benefits film exhibitors. In 2021, the studios are currently planning to release a strong slate

of films, including Godzilla vs. Kong, Black Widow, Fast & Furious 9, Cruella, Peter Rabbit 2, Venom:

Let There Be Carnage, Minions: The Rise of Gru, Top Gun: Maverick, Shang-Chi and the Legend of the

Ten Rings, Space Jam: A New Legacy, Jungle Cruise, The Suicide Squad, The King’s Man, A Quiet Place

Part II, Dune, No Time To Die, Eternals, Ghostbuster: Afterlife, Mission: Impossible 7, Spider-Man 3, West

Side Story and The Matrix 4. In spite of changing release models, Cineplex remains confident that there

will continue to be significant theatrical releases.

• Convenient and affordable form of out-of-home entertainment. Cineplex’s BPP was $10.17 and $10.63 in

2020 and 2019 respectively. Excluding the impact of Cineplex’s premium-priced product, BPP was $9.18

and $9.17 in 2020 and 2019 respectively. The movie-going experience continues to provide value and

compares favorably to alternative forms of out-of-home entertainment in Canada such as professional

sporting events or live theatre, and with Cineplex, SCENE members enjoy the ability to earn points towards

Cineplex products as well as discounts and special offers.

• Providing a variety of premium and enhanced guest theatre experiences. Premium priced theatre offerings

include 3D, 4DX, UltraAVX, VIP, IMAX, D-BOX, ScreenX and Cineplex Clubhouse. BPP for premium-

priced product was $14.04 in 2020, and accounted for 28.1% of total box office revenues in 2020. Recent