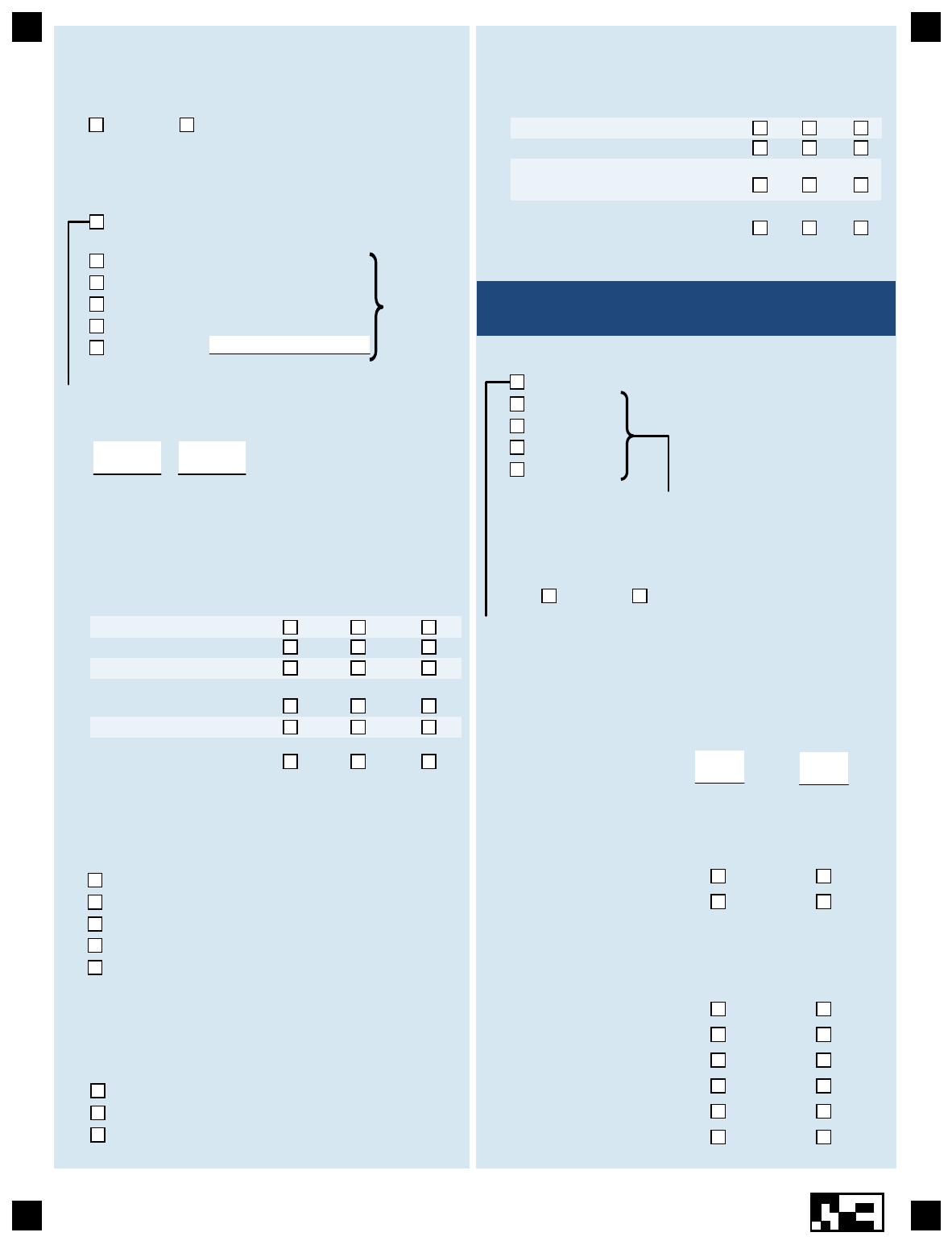

A naonwide survey of mortgage borrowers

throughout the United States

Learning directly from borrowers, like you, about

your experiences will help us improve lending

pracces and the mortgage process for future

borrowers.

The Federal Housing Finance Agency and the

Bureau of Consumer Financial Protection are

working together on your behalf to improve the

safety of the U.S. housing finance system and

ensure all consumers have access to financial

products and services.

We want to make it as easy as possible for you to complete this survey. You can mail back the paper

survey in the enclosed business reply envelope OR complete the survey online. The online version of

the quesonnaire may be easier to complete, because it skips any quesons that do not apply to

you. Online responses are also processed more quickly making it less likely that you will receive

reminders to complete this survey. The online quesonnaire can be completed in either English or

Spanish as explained below.

To complete the survey online

GO TO www.NSMOsurvey.com

LOG IN with your unique survey PIN # found in the accompanying leer

Esta encuesta está disponible en español en línea

Visitealsiowebwww.NSMOsurvey.com

InicielasesiónconsunúmeroPINúnicodelaencuestaquese

encuentraenlacartaadjunta.

You can find more information on our websites - www.fhfa.gov/nsmo and www.consumerfinance.gov

Tell us about your recent mortgage experience

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

We are interested in learning about your experience

purchasing or refinancing either a personal home or a

home for someone else, including rental property.

We look forward to hearing from you.

Privacy Act Notice: In accordance with the Privacy Act, as amended (5 U.S.C. § 552a), the following notice is provided. The

information requested on this Survey is collected pursuant to 12 U.S.C. 4544 for the purposes of gathering information for

the National Mortgage Database. Routine uses which may be made of the collected information can be found in the Federal

Housing Finance Agency’s System of Records Notice (SORN) FHFA-21 National Mortgage Database. Providing the requested

information is voluntary. Submission of the survey authorizes FHFA to collect the information provided and to disclose it as

set forth in the referenced SORN.

Paperwork Reduction Act Statement: Notwithstanding any other provision of the law, no person is required to respond to,

nor shall any person be subject to a penalty for failure to comply with, a collection of information subject to the

requirements of the Paperwork Reduction Act, unless that collection of information displays a currently valid OMB Control

Number.

OMB No. 2590-0012

Expires 4/30/2020

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

1

Directly to a lender, such as a bank or credit union

Through a mortgage broker who works with

Through a builder who arranged financing

Other (specify)

Very Somewhat Not at all

Firm idea Some idea Little idea

Your mortgage lender/broker

Other mortgage lenders/brokers

Real estate agents or builders

Websites that provide information

on getting a mortgage

Material in the mail

1

Not

At All

A

Little

A

Lot

Did you, in the last couple of years, take out or

co-sign for a mortgage loan including a purchase

or any refinance/modification of an existing

mortgage?

1.

Yes

No

Skip to 72 on page 7

Friends/relatives/co-workers

Bankers, credit unions or financial

planners

Housing counselors

N

ewspaper/TV/Radio

When you began the process of getting this

mortgage, how concerned were you about

qualifying for a mortgage?

6.

How firm an idea did you have about the

mortgage you wanted?

7.

Other (specify)

1 2 3 4 5 or more

How many different mortgage lenders/brokers

did you seriously consider before choosing

where to apply for this mortgage?

11.

multiple lenders to get you a loan

Which one of the following best describes how

you applied for this mortgage?

10.

Which one

of the following best describes your

shopping process?

9.

How much did you use each of the following

sources to get information about mortgages or

mortgage lenders?

8.

I picked the loan type first, and then I picked the

I picked the mortgage lender/broker first, and then

mortgage lender/broker

I picked the loan type

2. When did you take out this mortgage? If you took

out or co-signed for more than one mortgage, please

refer to your experience with the most recent

refinance, modification, or new mortgage.

/

yearmonth

I signed

Who signed or co-signed for this mortgage?

Mark all

that apply.

4.

Yes No

Did we mail this survey to the address of the

property you financed with this mortgage?

3.

The money needed at closing

Your credit history o

r

credit score

The income needed to qualif

y

for a mortgage

The down payment needed to

qualify for a mortgage

The mortgage process

The different types of

mortgages available

The mortgage interest rates

available at that time

Very Somewhat

Not

At All

When you began the process of getting this

mortgage, how familiar were you (and any

co-signers) with each of the following?

5.

If you co-signed this loan with others, take into

account all co-signers as best you can when

answering the survey. If no co-signers, answer

based on your own situation.

Spouse/partner including a former spouse/partner

Parents

Children

Other relatives

Other (e.g. friend, business partner)

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

2

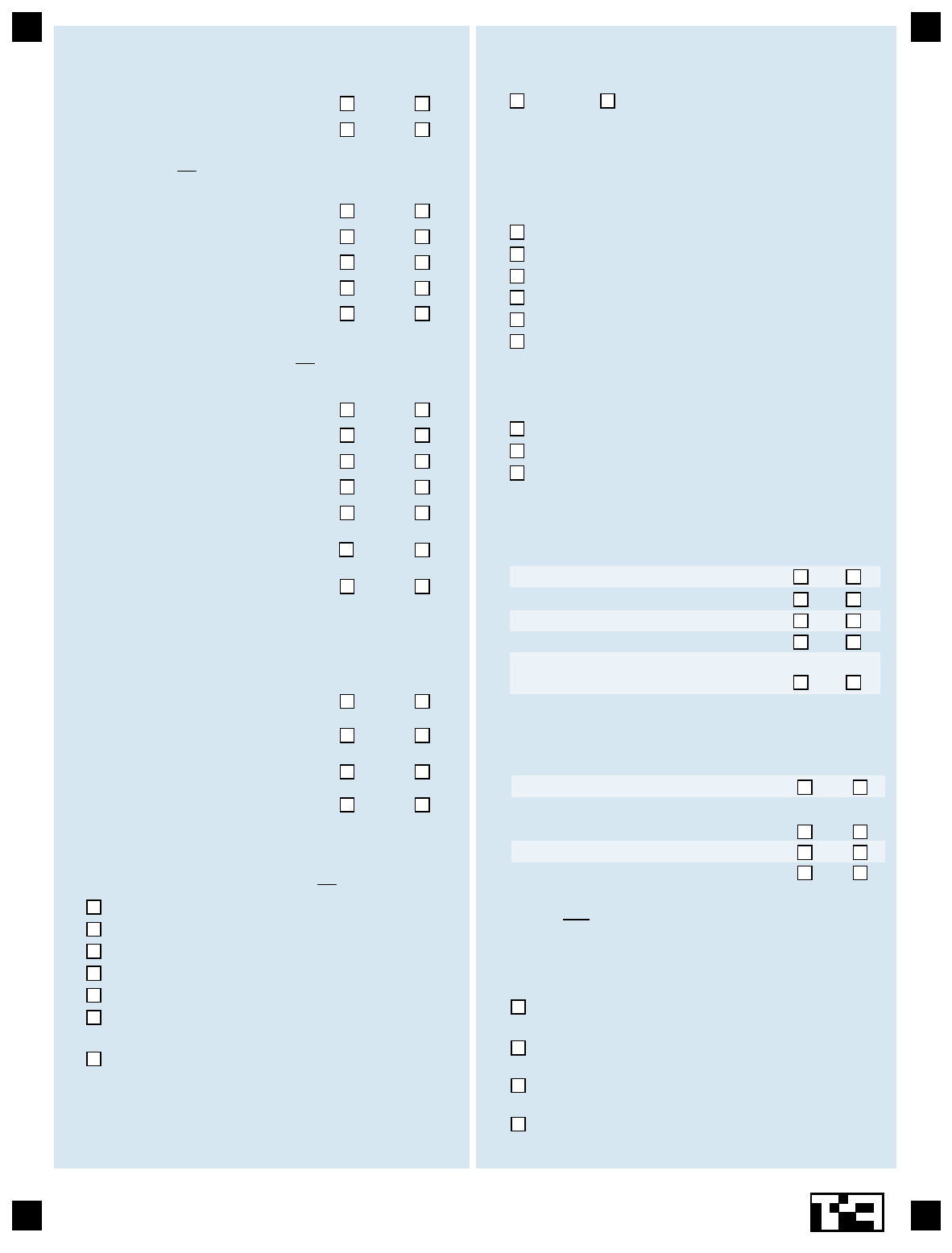

Recommendation from a friend/

relative/co-worker

12. How many different mortgage lenders/brokers

did you end up applying to?

1 2 3 4 5 or more

14. How important were each of the following in

choosing the mortgage lender/broker you used

for the mortgage you took out?

Concern over qualifying for a loan

Information learned from the

"Loan Estimate"

Turned down on earlier application

Searching for better loan terms

Yes No

Having an established banking

relationship

Having a local office or branch nearb

y

Important

Not

Important

13. Did you apply to more than one mortgage

lender/broker for any of the following

reasons?

Used previously to get a mortgage

Mortgage lender/broker is a personal

friend or relative

Paperless online mortgage process

17. How important were each of the following in

determining the mortgage you took out?

Lower interest rate

Lower APR (Annual Percentage Rate)

Not

ImportantImportant

Lower closing fees

Lower down paymen

t

An interest rate fixed for the life

of the loan

Lower monthly payment

A term of 30 years

N

o mortgage insurance

Recommendation from a real

estate agent/home builder

Reputation of mortgage lender/broker

Spoke my primary language, which is

not English

Could provide documents in my primary

language, which is not English

15. Who initiated the first contact between you and

the mortgage lender/broker you used for the

mortgage you took out?

I (or one of my co-signers) did

The mortgage lender/broker did

We were put in contact by a third party

16. How open were you to suggestions from your

mortgage lender/broker about mortgages with

different features or terms?

Very Somewhat Not at all

real estate agent or home builder)

(such as a

Did the "Your home loan toolkit" booklet lead

you to ask additional questions about your

mortgage terms?

19.

Yes No

Yes

No

Don't know

Your lender may have given you a booklet

“Your home loan toolkit: A step-by-step

guide,” do you remember receiving a copy?

18.

Skip to 20

Have to add another co-signer to qualif

y

Resolve credit report errors or problems

Yes

No

Answer follow-up requests for more

information about income or assets

Have more than one appraisal

Redo/refile paperwork due to processing

delays

Delay or postpone closing date

Have your "Loan Estimate" revised

to reflect changes in your loan terms

Check other sources to confirm tha

t

terms of this mortgage were reasonable

20. In the process of getting this mortgage from

your mortgage lender/broker, did you…

Get documents in your primary

language, which is not English

Have the lender/broker translate in your

primary language, which is not English

21. Was the "Loan Estimate" you received from your

mortgage lender/broker…

Easy to understand

Valuable information

Yes No

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

3

In selecting your settlement/closing agent did you

use someone…

During the application process were you told

about mortgages with any of the following?

27. Overall, how satisfied are you that the

mortgage you got was the one with the...

Best terms to fit your needs

Lowest closing costs

Lowest interest rate for which

you could qualif

y

Very Somewhat

Not

At All

28. Overall, how satisfied are you with the…

Mortgage lender/broker

you used

Very Somewhat

Not

At All

No

No

Application process

Information in mortgage

disclosure documents

Loan closing process

Timeliness of mortgage

disclosure documents

Documentation process

required for the loan

Did you take a course about home-buying or

talk to a professional housing counselor?

29.

Yes

No

Skip to 33 on page 4

Did the "Loan Estimate" lead you to…22.

Ask questions of your mortgage lender/

broker

Yes No

Apply to a different mortgage

lender/broker

Seek a change in your loan or closing

23.

Yes

An interest rate that is fixed for the

life of the loan

An interest rate that could change over

the life of the loan

A term of less than 30 years

A higher interest rate in return for lower

closing costs

A lower interest rate in return for paying

higher closing costs (discount points)

Interest-only monthly payments

An escrow account for taxes and/or

homeowner insurance

A prepayment penalty (fee if the mortgage

is paid off early)

Reduced documentation or "easy"

approval

An FHA, VA, USDA or Rural Housing

loan

24.

25. Do you have title insurance on this mortgage?

Selected/recommended by the mortgage

lender/broker, or real estate agen

t

You used previously

Yes

Found shopping around

Did not have a settlement/closing agent

Yes

No

Don't know

Which one best describes how you picked the

title insurance?

26.

Reissued previous title insurance

Used title insurance recommended by

Shopped around

mortgage lender/broker or settlement agent

Skip to 27

30. Was your home-buying course or counseling...

31. How many hours was your home-buying

course or counseling?

Less than 3 hours

3 – 6 hours

7 – 12 hours

More than 12 hours

32. Overall, how helpful was your home-buying

course or counseling?

Very Somewhat Not at all

Yes No

In person, one-on-one

Over the phone

In person, in a group

Online

Settlement agen

t

Required

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

4

To buy a property

To refinance or modify an

To add/remove a co-borrower

To finance a construction loan

To take out a new loan on a

Some other purpose (specify)

4

33. Which one of these reasons best describes this

most recent mortgage?

Skip to 37

37. How important were the following in your

decision to refinance, modify or obtain a new

mortgage?

Change to a fixed-rate loan

Get a lower interest rate

Get a lower monthly paymen

t

Consolidate or pay down other deb

t

Important

Not

Important

Repay the loan more quickl

y

Take out cash

Approximately how much was owed, in total, on

the old mortgage(s) and loan(s) you refinanced?

How did the total amount of your new

mortgage(s) compare to the total of the old

mortgage(s) and loan(s) you paid off?

$ .00

(the property was mortgage-free)

38.

Zero

39.

earlier mortgage

mortgage-free propert

y

35. What percent down payment did you make on

this property?

0%

Less than 3%

3% to less than 5%

5% to less than 10%

10% to less than 20%

20% to less than 30%

30% or more

34. Did you do the following before or after you made

an offer on this house or property?

Before

Offer

After

Offer

Did

Not Do

Contacted a lender to explore

mortgage options

Got a pre-approval or pre-

qualification from a lender

Decided on the type of loan

Made a decision on which

lender to use

Submitted an official loan

application

Skip to 41

Gift or loan from family or friend

Seller contribution

A second lien, home equity loan, or home

equity line of credit (HELOC)

Assistance or loan from a nonprofit or

government agenc

y

Savings, retirement account, inheritance,

or other assets

Proceeds from the sale of another property

Not

UsedUsed

Did you use any of the following sources of

funds to purchase this property?

36.

New amount is lower

New amount is about the same

New amount is higher

Property was mortgage-free

ThisMortgage

When you took out this most recent mortgage or

refinance, what was the dollar amount you

borrowed?

Don't know

$

.00

41.

Pay off other bills or debts

Did you use the money you got from this

new mortgage for any of the following?

College expenses

Yes No

Auto or other major purchase

40.

Home repairs or new construction

Savings

Closing costs of new mortgage

Business or investment

Other (specify)

Bu

y

out co-borrower, e.

g

. ex-s

p

ouse

Did not get money from refinancing

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

5

42. What is the monthly payment, including the

amount paid to escrow for taxes and insurance?

Don't know

.00

$

What is the interest rate on this mortgage?43.

%

Don't know

44. Is this an adjustable-rate mortgage (one that

allows the interest rate to change over the life of

the loan)?

Yes

No

Don't know

45. Which one of the following best describes how

you decided on the interest rate of your

mortgage?

Paid higher closing costs to get lower interest rate

Paid lower closing costs with a higher interest rate

Got a balance between closing costs and interest rate

48. The "Closing Disclosure" statement you received

at closing shows the loan closing costs and other

closing costs separately. What were the loan

closing costs you paid on this loan?

Don't

Know

Does this mortgage have…46.

Yes No

A prepayment penalty (fee if the

mortgage is paid off early)

An escrow account for taxes and/or

homeowner insurance

A balloon paymen

t

Interest-only payments

Private mortgage insurance

49. How were the total closing costs (loan costs and

other costs) for this loan paid?

Yes No

Don't

Know

By me or a co-signer with a check

or wire transfer

Other (specify)

Loan had no closing costs

50. Were the loan costs you paid similar to what you

had expected to pay based on the Loan Estimates

or Closing Disclosures you received?

Yes No

Did you seek input about your closing

documents from any of the following people?

Yes No

Mortgage lender/broker

Trusted friend or relative who is not

a co-signer on the mortgage

Settlement/closing agent

Real estate agen

t

Personal attorne

y

Title insurance agent

Housing counselor

Other (specify)

51.

At any time after you made your final loan

application did any of the following change?

Higher Same

Monthly payment

Interest rate

Other fees

Amount of money needed

to close loan

Lower

47.

Don't know

$

.00

Added to the mortgage amoun

t

By mortgage lender/broker

By seller/builder

52. Did you face any of the following at your loan

closing?

Loan documents not ready at closing

Closing did not occur as originally

scheduled

Three-day rule required re-disclosure

Mortgage terms different at closing than

expected, e.g. interest rate, monthly

payment

More cash needed at closing than

expected, e.g. escrow, unexpected fees

Less cash needed at closing than

expected

Felt rushed at closing or not given time

to read documents

NoYes

Asked to sign blank documents at

closing

Asked to sign pre-dated or post-dated

documents at closing

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

6

ThisMortgagedProperty

57. When did you first become the owner of this

property?

54. At the same time you took out this mortgage,

did you also take out another loan on the

property you financed with this mortgage (a

second lien, home equity loan, or a home equity

line of credit (HELOC))?

Yes

No

Skip to 56

56. How well could you explain to someone the…

Not

At All

Difference between a mortgage's

interest rate and its APR

Process of taking out a mortgage

Difference between a fixed- and

an adjustable-rate mortgage

Difference between a prime and

subprime loan

Amortization of a loan

Consequences of not making

required mortgage payments

Difference between lender's and

owner's title insurance

SomewhatVery

Relationship between discount

points and interest rate

Reason payments into an escrow

account can change

What was the amount of this loan?55.

$ .00

Don't know

What was the purchase price of this property, or

if you built it, the construction and land cost?

58.

$ .00

Don't know

59. Which one of the following best describes how

you acquired this property?

Purchased an existing home

Purchased a newly-built home from a builder

Had or purchased land and built a house

Received as a gift or inheritance

Other (specify)

Yes

No

Skip to 65 on page 7

Single-family detached house

Mobile home or manufactured home

Townhouse, row house, or villa

2-unit, 3-unit, or 4-unit dwelling

Apartment (or condo/co-op) in apartment

Unit in a partly commercial structure

Other (specify)

60. Which one of the following best describes

this property?

61. Does this mortgage cover more than one

unit?

Yes No

62. About how much do you think this property is

worth in terms of what you could sell it for now?

$ .00

Don't know

Do you rent out all or any portion of this

property?

63.

building

/

yea

r

month

.00 per year$

64. How much rent do you receive annually?

Is there any additional problem you encountered

while getting this mortgage that you’d like to tell

us about?

53.

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

7

65. Besides you, the mortgage co-signers, and

renters, does anyone else help pay the

expenses for this property?

Yes No

YourHousehold

72. What is your current marital status?

Married

Separated

Never married

Divorced

Widowed

73. Do you have a partner who shares the

decision-making and responsibilities of

running your household but is not your

legal spouse?

66. Which of the following best describes how you

use this property?

(where you

s

pend the majority of your time)

Skip to 68

Yes No

Please answer the following questions for you and

your spouse or partner, if applicable.

years

years

Spouse/

Partner

You

Sex:

74. Age at last birthday:

75.

68. In the last couple years, how have the following

changed in the neighborhood where this

property is located?

N

umber of homes for sale

N

umber of vacant homes

N

umber of homes for ren

t

N

umber of foreclosures or

short sales

Overall desirability of

living there

House prices

Little/No

Change

Significant

Decrease

Significant

Increase

69. What do you think will happen to the prices of

homes in this neighborhood over the next

couple of years?

Increase a lot

Increase a little

Remain about the same

Decrease a little

Decrease a lot

Become more desirable

Stay about the same

Become less desirable

In the next couple of years, how do you expect

the overall desirability of living in this

neighborhood to change?

70.

71. How likely is it that in the next couple of years

you will…

Sell this propert

y

Move but keep this propert

y

Refinance the mortgage on

this propert

y

Somewhat

Not

At AllVery

Pay off this mortgage and own

the property mortgage-free

76. Highest level of education achieved:

Some schooling

High school graduate

Technical school

Some college

College graduate

Postgraduate studies

You

Spouse/

Partner

Spouse/

Partner

You

Female

Male

67. If primary residence, when did you move

into this property?

/

yearmonth

Primary residence

It will be my primary residence soon

Seasonal or second home

Home for other relatives

Rental or investment property

Other (specify)

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

8

82. Do you speak a language other than English at

home?

Less than $35,000

$35,000 to $49,999

$50,000 to $74,999

$75,000 to $99,999

$100,000 to $174,999

$175,000 or more

Approximately how much is your total annual

household income from all sources (wages,

salaries, tips, interest, child support, investment

income, retirement, social security, and alimony)?

83.

Higher than normal

Normal

Lower than normal

How does this total annual household income

compare to what it is in a "normal" year?

84.

85. Does your total annual household income

include any of the following sources?

Wages or salar

y

Business or self-employmen

t

Interest or dividends

Alimony or child suppor

t

Yes No

Social Security, pension or other

retirement benefits

86. Does anyone in your household have any of the

following?

401(k), 403(b), IRA, or pension plan

Stocks, bonds, or mutual funds (not in

retirement accounts or pension plans)

Certificates of deposi

t

Investment real estate

Yes No

87. Which one of the following statements best

describes the amount of financial risk you are

willing to take when you save or make

in

ves

tm

e

nt

s?

Take substantial financial risks expecting to earn

Take above-average financial risks expecting to

Take average financial risks expecting to earn

Not willing to take any financial risks

substantial returns

earn above-average returns

average returns

Yes No

77. Hispanic or Latino:

N

o

Yes

You

Spouse/

Partner

78. Race: Mark all that apply.

White

Black or African American

American Indian or Alaska Native

Asian

N

ative Hawaiian or Pacific Islande

r

79. Current work status: Mark all that apply.

Self-employed full time

You

Spouse/

Partner

You

Spouse/

Partner

Employed full time

Self-employed part time

Unemployed, temporarily laid-off

or on leave

80. Ever served on active duty in the U.S. Armed

Forces, Reserves or National Guard?

N

ot working for pay (student,

homemaker, disabled)

Retired

Employed part time

Besides you (and your spouse/partner) who else

lives in your household? Mark all

that apply.

81.

Children/grandchildren under age 18

Only on active duty for training in

the Reserves or National Guard

N

ow on active duty

On active duty in the past, but

not now

You

Spouse/

Partner

N

ever served in the military

Children/grandchildren age 18 – 22

Children/grandchildren age 23 or older

Parents of you or your spouse or partner

Other relatives like siblings or cousins

Non-relative

No one else

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

9

Significant

Increase

Owning a home is a good financial

investment

Agree Disagree

Most mortgage lenders generall

y

treat borrowers well

Do you agree or disagree with the following

statements?

88.

Late payments will lower m

y

credit rating

Lenders shouldn't care about any late

payments, only whether loans are

fully repaid

It is okay to default or stop making

mortgage payments if it is in the

borrower's financial interes

t

Most mortgage lenders would offer

me roughly the same rates and fees

91. In the last couple years, how have the following

changed for you (and your spouse/partner)?

Household income

Housing expenses

N

on-housing expenses

92.

In the next couple of years, how do you expect

the following to change for you (and your

spouse/partner)?

Household income

Housing expenses

N

on-housing expenses

Little/No

Change

Significant

Decrease

Significant

Increase

93.

How likely is it that in the next couple of years

you (or your spouse/partner) will face…

Difficulties making your

mortgage payments

Some other personal financial

crisis

A layoff, unemployment, or

forced reduction in hours

Retiremen

t

If your household faced an unexpected

personal financial crisis in the next couple of

years, how likely is it you could…

94.

Pay your bills for the next 3

months without borrowing

Get significant financial help

from family or friends

Significantly increase your

income

Borrow a significant amount

from a bank or credit union

Somewhat

Not

At AllVery

Little/No

Change

Significant

Decrease

89. In the last couple of years, have any of the

following happened to you?

Separated, divorced or partner left

Married, remarried or new partner

Death of a household membe

r

Addition to your household

(not including spouse/partner)

Person leaving your household

(not including spouse/partner)

Disaster affecting your (or you

r

spouse/partner's) wor

k

Moved within the area (less than 50 miles)

Yes No

Disaster affecting a property you own

Moved to a new area (50 miles or more)

Disability or serious illness of

household membe

r

90. In the last couple of years, have any of the

following happened to you (or your

spouse/partner)?

Layoff, unemployment, or reduced

hours of wor

k

Yes No

Promotion

Starting a new job

Starting a second job

A personal financial crisis

Business failure

Retiremen

t

I would consider counseling or taking a

course about managing my finances if

I faced financial difficulties

Somewhat

Not

At AllVery

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)

10

Pleaseusetheenclosedbusinessreplyenvelopetoreturnyourcompletedquestionnaire.

FHFA

1600ResearchBlvd,RCB16

Rockville,MD20850

TheFederalHousingFinanceAgencyandtheBureauofConsumer

FinancialProtectionthankyouforcompletingthissurvey.

Wehaveprovidedthespacebelowifyouwishtoshareadditionalcommentsorfurtherexplainany

ofyouranswers.Pleasedono

t

putyournameoraddressonthequestionnaire.

Foranyquestionsaboutthesurveyoronlineaccessyoucancalltollfree1‐855‐339‐7877.

6501

National Survey of Mortgage Originations (NSMO) Questionnaire, Waves 19 to 22 (2018 Q3 to 2019 Q2)