Exhibit 3 Sent As Paper DocumentExhibit 2 Sent As Paper Document

has duly caused this filing to be signed on its behalf by the undersigned thereunto duly authorized officer.

19b-4(f)(6)

19b-4(f)(5)

Provide a brief description of the proposed rule change (limit 250 characters, required when Initial is checked *).

(Name *)

NOTE: Clicking the button at right will digitally sign and lock

this form. A digital signature is as legally binding as a physical

signature, and once signed, this form cannot be changed.

Senior Vice President and Director of Capital Markets

Policy

(Title *)

07/30/2010

Date

Provide the name, telephone number and e-mail address of the person on the staff of the self-regulatory organization

prepared to respond to questions and comments on the proposed rule change.

Associate Vice President and Associate General CounselTitle *

Contact Information

19b-4(f)(4)

19b-4(f)(2)

19b-4(f)(3)

Extension of Time Period

for Commission Action *

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

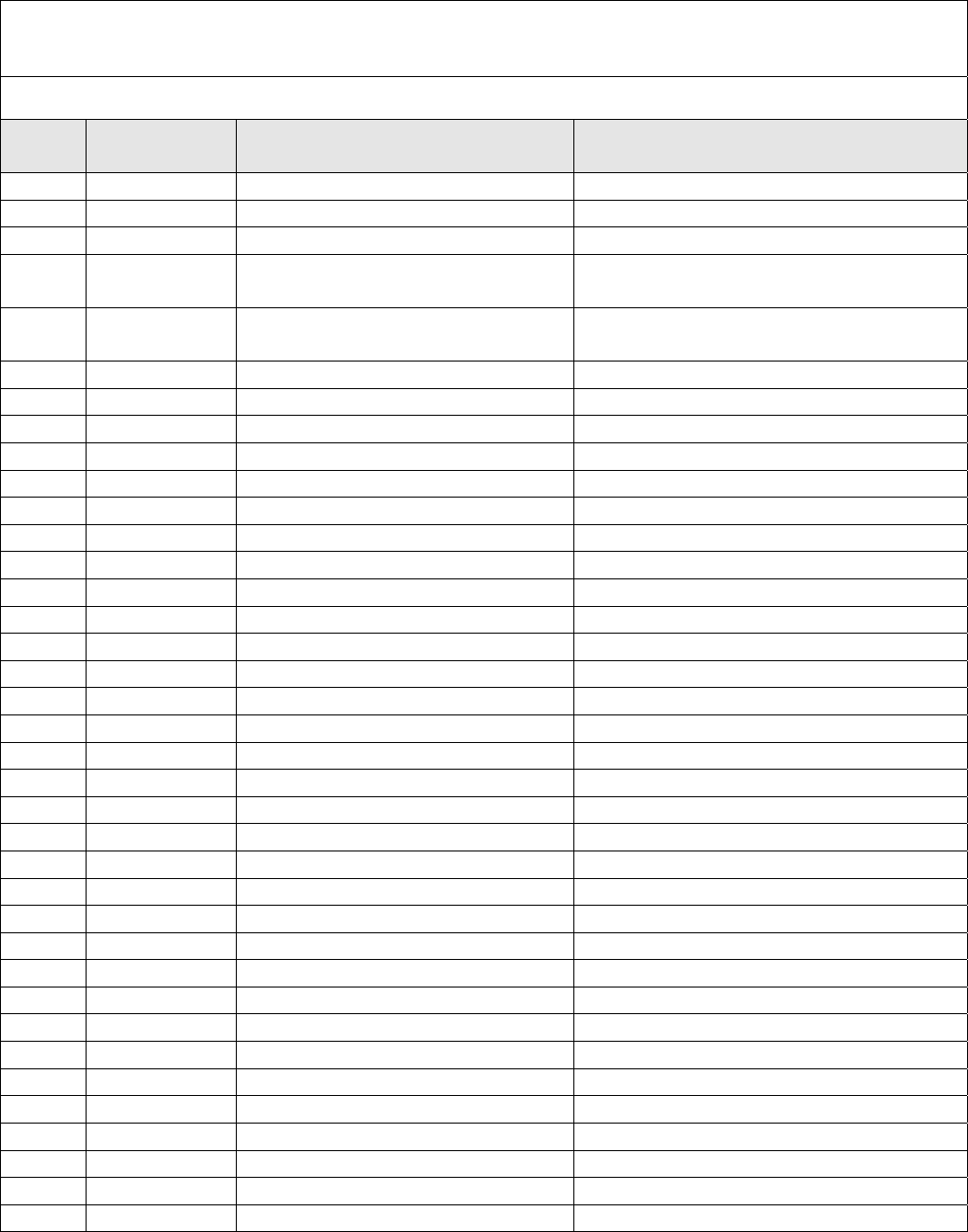

Form 19b-4

Withdrawal

Fax

(202) 728-8264

James Last Name *

Proposed Rule Change by

Pilot

Financial Industry Regulatory Authority

039

- *

2010

Amendment No. (req. for Amendments *)

File No.* SR -

Wrona

jim.wrona@finra.org

(202) 728-8270

Telephone *

E-mail *

First Name *

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934,

Section 19(b)(3)(A) * Section 19(b)(3)(B) *Initial * Amendment *

Pursuant to Rule 19b-4 under the Securities Exchange Act of 1934

Description

Proposed Rule Change to Adopt FINRA Rules 2090 (Know Your Customer) and 2111 (Suitability) in the Consolidated

FINRA Rulebook

Stephanie Dumont,

Stephanie Dumont

By

Section 19(b)(2) *

19b-4(f)(1)

Required fields are shown with yellow backgrounds and asterisks.

Page 1 of * 776

OMB APPROVAL

OMB Number: 3235-0045

Expires: August 31, 2011

Estimated average burden

hours per response............38

Rule

Date Expires *

If the self-regulatory organization is amending only part of the text of a lengthy

proposed rule change, it may, with the Commission's permission, file only those

portions of the text of the proposed rule change in which changes are being made if

the filing (i.e. partial amendment) is clearly understandable on its face. Such partial

amendment shall be clearly identified and marked to show deletions and additions.

Partial Amendment

Add

Remove

View

The self-regulatory organization may choose to attach as Exhibit 5 proposed

changes to rule text in place of providing it in Item I and which may otherwise be

more easily readable if provided separately from Form 19b-4. Exhibit 5 shall be

considered part of the proposed rule change.

Exhibit 5 - Proposed Rule Text

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

For complete Form 19b-4 instructions please refer to the EFFS website.

Copies of any form, report, or questionnaire that the self-regulatory organization

proposes to use to help implement or operate the proposed rule change, or that is

referred to by the proposed rule change.

Exhibit Sent As Paper Document

Exhibit 4 - Marked Copies

Add

Remove

View

Exhibit 3 - Form, Report, or Questionnaire

Add

Remove

View

Exhibit 2 - Notices, Written Comments,

Transcripts, Other Communications

Add

Remove

View

Exhibit 1 - Notice of Proposed Rule Change

(required)

Add

Form 19b-4 Information (required)

Remove

Add

Remove

The full text shall be marked, in any convenient manner, to indicate additions to and

deletions from the immediately preceding filing. The purpose of Exhibit 4 is to permit

the staff to identify immediately the changes made from the text of the rule with which

it has been working.

View

The self-regulatory organization must provide all required information, presented in a

clear and comprehensible manner, to enable the public to provide meaningful

comment on the proposal and for the Commission to determine whether the

proposal is consistent with the Act and applicable rules and regulations under the Act.

View

Exhibit Sent As Paper Document

The Notice section of this Form 19b-4 must comply with the guidelines for

publication in the Federal Register as well as any requirements for electronic filing

as published by the Commission (if applicable). The Office of the Federal Register

(OFR) offers guidance on Federal Register publication requirements in the Federal

Register Document Drafting Handbook, October 1998 Revision. For example, all

references to the federal securities laws must include the corresponding cite to the

United States Code in a footnote. All references to SEC rules must include the

corresponding cite to the Code of Federal Regulations in a footnote. All references

to Securities Exchange Act Releases must include the release number, release

date, Federal Register cite, Federal Register date, and corresponding file number

(e.g., SR-[SRO]-xx-xx). A material failure to comply with these guidelines will result in

the proposed rule change being deemed not properly filed. See also Rule 0-3 under

the Act (17 CFR 240.0-3)

Copies of notices, written comments, transcripts, other communications. If such

documents cannot be filed electronically in accordance with Instruction F, they shall

be filed in accordance with Instruction G.

Add

Remove

View

Page 3 of 776

1. Text of Proposed Rule Change

(a) Pursuant to the provisions of Section 19(b)(1) of the Securities Exchange Act

of 1934 (“Act” or “SEA”),

1

Financial Industry Regulatory Authority, Inc. (“FINRA”)

(f/k/a National Association of Securities Dealers, Inc. (“NASD”)) is filing with the

Securities and Exchange Commission (“SEC” or “Commission”) a proposed rule change

to adopt FINRA Rule 2111 (Suitability) and FINRA Rule 2090 (Know Your Customer)

as part of the Consolidated FINRA Rulebook. The proposed rules are based in large part

on NASD Rule 2310 (Recommendations to Customers (Suitability)) and its related

Interpretative Materials (“IMs”) and Incorporated NYSE Rule 405(1) (Diligence as to

Accounts), respectively. As further detailed herein, the proposed rule change would

delete those NASD and Incorporated NYSE rules and related NASD IMs and

Incorporated NYSE Rule Interpretations.

The text of the proposed rule change is attached as Exhibit 5.

(b) Upon Commission approval and implementation by FINRA of the proposed

rule change, the corresponding NASD and Incorporated NYSE rules and interpretations

will be eliminated from the current FINRA rulebook.

(c) Not applicable.

2. Procedures of the Self-Regulatory Organization

At its meeting on February 11, 2009, the FINRA Board of Governors authorized

the filing of the proposed rule change with the SEC. No other action by FINRA is

necessary for the filing of the proposed rule change. FINRA will announce the

implementation date of the proposed rule change in a Regulatory Notice

to be published

1

15 U.S.C. 78s(b)(1).

Page 4 of 776

no later than 90 days following Commission approval. The implementation date will be

no later than 240 days following Commission approval.

3. Self-Regulatory Organization’s Statement of the Purpose of, and Statutory

Basis for, the Proposed Rule Change

(a) Purpose

As part of the process of developing a new consolidated rulebook (“Consolidated

FINRA Rulebook”),

2

FINRA is proposing to adopt FINRA Rule 2111 (Suitability) and

FINRA Rule 2090 (Know Your Customer). The rules are based in large part on NASD

Rule 2310 (Recommendations to Customers (Suitability)) and its related IMs and NYSE

Rule 405(1) (Diligence as to Accounts), respectively.

3

As further discussed below, the

proposed rule change would delete NASD Rule 2310, IM-2310-1 (Possible Application

of SEC Rules 15g-1 through 15g-9), IM-2310-2 (Fair Dealing with Customers), IM-

2310-3 (Suitability Obligations to Institutional Customers), NYSE Rule 405(1) through

(3) (including NYSE Supplementary Material 405.10 through .30), and NYSE Rule

Interpretations 405/01 through /04.

4

2

The current FINRA rulebook consists of (1) FINRA Rules; (2) NASD Rules; and

(3) rules incorporated from NYSE (“Incorporated NYSE Rules”) (together, the

NASD Rules and Incorporated NYSE Rules are referred to as the “Transitional

Rulebook”). While the NASD Rules generally apply to all FINRA members, the

Incorporated NYSE Rules apply only to those members of FINRA that are also

members of the NYSE (“Dual Members”). The FINRA Rules apply to all FINRA

members, unless such rules have a more limited application by their terms. For

more information about the rulebook consolidation process, see

Information

Notice, March 12, 2008 (Rulebook Consolidation Process).

3

For convenience, the Incorporated NYSE Rules are referred to as the NYSE

Rules.

4

FINRA notes that NYSE Rule 405(4) was eliminated from the Transitional

Rulebook on June 14, 2010 pursuant to a previous rule filing. See

Securities

Exchange Act Release No. 61808 (March 31, 2010), 75 FR 17456 (April 6, 2010)

Page 5 of 776

The suitability and “know your customer” obligations are critical to ensuring

investor protection and fair dealing with customers. Under the proposal, the core features

of these obligations set forth in NASD Rule 2310 and NYSE Rule 405(1) remain intact.

FINRA, however, proposes modifications to both rules to strengthen and clarify them. In

Regulatory Notice

09-25 (May 2009), FINRA sought comment on the proposal. The

current filing includes additional proposed changes that respond to comments.

Item 5 of this filing provides a detailed discussion of the proposed modifications,

comments FINRA received, and FINRA’s responses thereto. In brief, however, the

proposed new suitability rule, designated FINRA Rule 2111, would require a broker-

dealer or associated person to have “a reasonable basis to believe that a recommended

transaction or investment strategy involving a security or securities is suitable for the

customer….”

5

This assessment must be “based on the information obtained through the

reasonable diligence of the member or associated person to ascertain the customer’s

investment profile, including, but not limited to, the customer’s age, other investments,

financial situation and needs, tax status, investment objectives, investment experience,

investment time horizon, liquidity needs, risk tolerance, and any other information the

customer may disclose to the member or associated person in connection with such

recommendation.”

6

(Order Approving File No. SR-FINRA-2010-005); see

also Regulatory Notice 10-

21 (April 2010).

5

See Proposed FINRA Rule 2111(a).

6

See Proposed FINRA Rule 2111(a). As discussed infra at Item 5 of this filing,

FINRA modified various aspects of the proposed information-gathering

requirements in response to comments.

Page 6 of 776

The proposal would add the term “strategy” to the rule text so that the rule

explicitly covers a recommended strategy. Although FINRA generally intends the term

“strategy” to be interpreted broadly, the proposed supplementary material would exclude

the following communications from the coverage of Rule 2111 as long as they do not

include (standing alone or in combination with other communications) a recommendation

of a particular security or securities:

General financial and investment information, including (i) basic investment

concepts, such as risk and return, diversification, dollar cost averaging,

compounded return, and tax deferred investment, (ii) historic differences in

the return of asset classes (e.g., equities, bonds, or cash) based on standard

market indices, (iii) effects of inflation, (iv) estimating future retirement

income needs, and (v) assessment of a customer’s investment profile;

Descriptive information about an employer-sponsored retirement or benefit

plan, participation in the plan, the benefits of plan participation, and the

investment options available under the plan;

Asset allocation models that are (i) based on generally accepted investment

theory, (ii) accompanied by disclosures of all material facts and assumptions

that may affect a reasonable investor’s assessment of the asset allocation

model or any report generated by such model, and (iii) in compliance with

NASD IM-2210-6 (Requirements for the Use of Investment Analysis Tools) if

the asset allocation model is an “investment analysis tool” covered by NASD

IM-2210-6;

7

and

Interactive investment materials that incorporate the above.

8

The proposal also would codify interpretations of the three main suitability

obligations, listed below:

7

FINRA is proposing to adopt NASD IM-2210-6 as FINRA Rule 2214, without

material change. See Regulatory Notice 09-55 (September 2009).

8

See Proposed FINRA Rule 2111.02. As discussed infra at Item 5 of this filing,

FINRA included this exception to the rule’s coverage in response to comments.

Page 7 of 776

Reasonable basis (members must have a reasonable basis to believe, based on

adequate due diligence, that a recommendation is suitable for at least some

investors);

Customer specific (members must have reasonable grounds to believe a

recommendation is suitable for the particular investor at issue); and

Quantitative (members must have a reasonable basis to believe the number of

recommended transactions within a certain period is not excessive).

9

In addition, the proposal would modify the institutional-customer exemption by

focusing on whether there is a reasonable basis to believe that the institutional customer

is capable of evaluating investment risks independently, both in general and with regard

to particular transactions and investment strategies,

10

and is exercising independent

judgment in evaluating recommendations.

11

The proposal, moreover, would require

institutional customers to affirmatively indicate that they are exercising independent

9

See Proposed FINRA Rule 2111.03.

10

See Proposed FINRA Rule 2111(b). The requirement in Proposed FINRA Rule

2111(b) that the firm or associated person have a reasonable basis to believe that

“the institutional customer is capable of evaluating investment risks

independently, both in general and with regard to particular transactions and

investment strategies” comes from current IM-2310-3. As FINRA explained in

that IM, “[i]n some cases, the member may conclude that the customer is not

capable of making independent investment decisions in general. In other cases,

the institutional customer may have general capability, but may not be able to

understand a particular type of instrument or its risk.” FINRA further stated that,

“[i]f a customer is either generally not capable of evaluating investment risk or

lacks sufficient capability to evaluate the particular product, the scope of a

member’s customer-specific obligations under the suitability rule would not be

diminished by the fact that the member was dealing with an institutional

customer.” FINRA also stated that “the fact that a customer initially needed help

understanding a potential investment need not necessarily imply that the customer

did not ultimately develop an understanding and make an independent decision.”

11

See Proposed FINRA Rule 2111(b).

Page 8 of 776

judgment.

12

The proposal also would harmonize the definition of institutional customer

in the suitability rule with the more common definition of “institutional account” in

NASD Rule 3110(c)(4).

13

Finally, the suitability proposal would eliminate or modify a number of the IMs

associated with the existing suitability rule

because they are no longer necessary. Some

of the discussions are not needed because of the changes to the scope of the suitability

rule proposed herein (e.g.

, the proposed rule text would capture “strategies” currently

referenced in IM-2310-3).

14

Others are redundant because they identify conduct

explicitly covered by other rules (e.g., inappropriate sale of penny stocks referenced in

IM-2310-1 is covered by the SEC’s penny stock rules,

15

fraudulent conduct identified in

IM-2310-2 is covered by the FINRA and SEC anti-fraud provisions

16

).

Still other IM discussions have been incorporated in some form into the proposed

rule or its supplementary material. For example, the exemption in IM-2310-3 dealing

with institutional customers is modified and moved to the text of proposed FINRA Rule

12

See Proposed FINRA Rule 2111(b). As discussed infra at Item 5 of this filing,

FINRA substituted this requirement for another in response to comments. FINRA

emphasizes that the institutional-customer exemption applies only if both parts of

the two-part test are met: (1) there is a reasonable basis to believe that the

institutional customer is capable of evaluating investment risks independently, in

general and with regard to particular transactions and investment strategies, and

(2) the institutional customer affirmatively indicates that it is exercising

independent judgment in evaluating recommendations.

13

See Proposed FINRA Rule 2111(b). FINRA is proposing to adopt NASD Rule

3110(c)(4) as FINRA Rule 4512(c), without material change. See Regulatory

Notice 08-25 (May 2008).

14

See Proposed Rule 2111(a).

15

See SEA Rule 15g-1 through 15g-9.

16

See Section 10(b) of the Act; FINRA Rule 2020.

Page 9 of 776

2111.

17

In addition, the explication of the three main suitability obligations, currently

located in IM-2310-2 and IM-2310-3, are consolidated into a single discussion in the

proposed rule’s supplementary material.

18

Similarly, the proposed rule’s supplementary

material includes a modified form of the current requirement in IM-2310-2 that a member

refrain from recommending purchases beyond a customer’s capability.

19

The

supplementary material also retains the discussion in IM-2310-2 and IM-2310-3

regarding the suitability rule’s significance in promoting fair dealing with customers and

ethical sales practices.

20

The only type of misconduct identified in the IMs that is neither explicitly

covered by other rules nor incorporated in some form into the proposed new suitability

rule is unauthorized trading, currently discussed in IM-2310-2. However, it is well-

settled that unauthorized trading violates just and equitable principles of trade under

FINRA Rule 2010 (previously NASD Rule 2110).

21

Consequently, the elimination of the

discussion of unauthorized trading in the IMs following the suitability rule in no way

17

See Proposed Rule 2111(a).

18

See Proposed Rule 2111.03.

19

See Proposed Rule 2111.04.

20

See Proposed Rule 2111.01.

21

See, e.g., Robert L. Gardner, 52 S.E.C. 343, 344 n.1 (1995), aff’d, 89 F.3d 845

(9th Cir. 1996) (table format); Keith L. DeSanto

, 52 S.E.C. 316, 317 n.1 (1995),

aff’d, 101 F.3d 108 (2d Cir. 1996) (table format); Jonathan G. Ornstein, 51 S.E.C.

135, 137 (1992); Dep’t of Enforcement v. Griffith

, No. C01040025, 2006 NASD

Discip. LEXIS 30, at *11-12 (NAC Dec. 29, 2006); Dep’t of Enforcement v.

Puma, No. C10000122, 2003 NASD Discip. LEXIS 22, at *12 n.6 (NAC Aug. 11,

2003).

Page 10 of 776

alters the longstanding view that unauthorized trading is serious misconduct and clearly

violates FINRA’s rules.

The proposed FINRA “Know Your Customer” obligation, designated FINRA

Rule 2090, captures the main ethical standard of NYSE Rule 405(1). As proposed,

broker-dealers would be required to use “due diligence,” in regard to the opening and

maintenance of every account, in order to know the essential facts concerning every

customer.

22

The obligation would arise at the beginning of the customer/broker

relationship, independent of whether the broker has made a recommendation. The

proposed supplementary material would define “essential facts” as those “required to (a)

effectively service the customer’s account, (b) act in accordance with any special

handling instructions for the account, (c) understand the authority of each person acting

on behalf of the customer, and (d) comply with applicable laws, regulations, and rules.”

23

The proposal would eliminate the requirement in NYSE Rule 405(1) to learn the

essential facts relative to “every order.” FINRA proposes eliminating the “every order”

language because of the application of numerous, specific order-handling rules.

24

In

addition, the reasonable-basis obligation under the suitability rule requires broker-dealers

22

See Proposed FINRA Rule 2090.

23

See Proposed FINRA Rule 2090.01. As discussed infra at Item 5 of this filing,

FINRA changed the explanation of “essential facts” in response to comments.

24

See, e.g., SEC Regulation NMS (National Market System), 17 CFR 242.600-

242.612; FINRA Rule 7400 Series (Order Audit Trail System); NASD Rule 2320

(Best Execution and Interpositioning) [proposed FINRA Rule 5310; see

Regulatory Notice 08-80 (December 2008)]; NASD Rule 2400 Series

(Commissions, Mark-Ups and Charges); NASD IM-2110-2 (Trading Ahead of

Customer Limit Order) [proposed FINRA Rule 5320; see

SR-FINRA-2009-090];

and IM-2110-3 (Front Running Policy) [proposed FINRA Rule 5270; see

Regulatory Notice

08-83 (December 2008)].

Page 11 of 776

and associated persons to perform adequate due diligence so that they “know” the

securities and strategies they recommend.

FINRA also is proposing to delete NYSE Rule 405(2) through (3), NYSE

Supplementary Material 405.10 through .30, and NYSE Rule Interpretation 405/01

through /04 because they generally are duplicative of other rules, regulations, or laws.

For instance, NYSE Rule 405(2) requires firms to supervise all accounts handled by

registered representatives. That provision is redundant because NASD Rule 3010

requires firms to supervise their registered representatives.

25

NYSE Rule 405(3) generally requires persons designated by the member to be

informed of the essential facts relative to the customer and to the nature of the proposed

account and to then approve the opening of the account. A number of other existing and

proposed FINRA rules do or will create substantially similar obligations. Proposed

FINRA Rule 2090, discussed herein, would require members to know the essential facts

as to each customer. NASD Rule 3110(c)(1)(C) requires the signature of the member,

partner, officer or manager who accepts the account.

26

A firm’s account-opening obligations also are impacted by FINRA Rule 3310,

which requires a firm to have procedures reasonably designed to achieve compliance with

the Bank Secrecy Act and the implementing regulations. One of those regulations

25

FINRA is proposing to adopt NASD Rule 3010 as FINRA Rule 3110, subject to

certain amendments. See Regulatory Notice 08-24 (May 2008).

26

FINRA is proposing to adopt NASD Rule 3110(c)(1)(C) as FINRA Rule

4512(a)(1)(C), subject to certain amendments. See Regulatory Notice 08-25

(May 2008). Proposed FINRA Rule 4512(a)(1)(C) would clarify that members

maintain the signature of the partner, officer or manager denoting that the account

has been accepted in accordance with the member’s policies and procedures for

acceptance of accounts.

Page 12 of 776

requires the firm to verify the identity of a customer opening a new account.

27

Another

requires due diligence that would enable the firm to evaluate the risk of each customer

and to determine if transactions by the customer could be suspicious and need to be

reported.

28

Moreover, before certain customers can purchase certain types of investment

products (such as options, futures or penny stocks) or engage in certain strategies (such as

day trading), the firm must explicitly approve their accounts for such activity.

29

NYSE Supplementary Material 405.10 is redundant of other FINRA proposed and

existing requirements, and the cross references provided in .20 and .30 are no longer

necessary. NYSE Supplementary Material 405.10 generally discusses the requirements

that firms know their customers and understand the authority of third-parties to act on

behalf of customers that are legal entities. Proposed FINRA Rule 2090 and proposed

FINRA Supplementary Material 2090.01, discussed herein, would require firms to know

the essential facts as to each customer. NYSE Supplementary Material 405.10 also

discusses certain documentation obligations regarding persons authorized to act on behalf

of various types of customers that are legal entities. NASD Rule 3110(c) (Customer

Account Information), however, similarly requires firms to maintain a record identifying

the person(s) authorized to transact business on behalf of a customer that is a legal

27

See 31 CFR 103.122.

28

See 31 CFR 103.19.

29

See, e.g., SEA Rule 15g-1 through 15g-9 (Penny Stock Rules); FINRA Rule 2360

(Options); FINRA Rule 2370 (Security Futures); FINRA Rule 2130 (Approval

Procedures for Day-Trading Accounts).

Page 13 of 776

entity.

30

NYSE Supplementary Material 405.20 and .30 provide cross references to

NYSE Rule 382 (Carrying Agreements) and NYSE Rule 414 (Index and Currency

Warrants), respectively, which are no longer necessary or appropriate for inclusion in

proposed FINRA Rule 2090.

The NYSE Rule Interpretations also are redundant. NYSE Rule Interpretations

405/01 (Credit Reference—Business Background) and /02 (Approval of New

Accounts/Branch Offices) recommend that the credit references and business

backgrounds of a new account be cleared by a person other than the registered

representative opening the account and require a designated person to ultimately approve

a new account. These obligations are substantially similar to the requirements in NASD

Rule 3110(c)(1)(C) and FINRA Rule 3310, discussed above.

NYSE Rule Interpretation 405/03 (Fictitious Orders) states that firm “personnel

opening accounts and/or accepting orders for new or existing accounts should make every

effort to verify the legitimacy of the account and the validity of every order.” The

interpretation contemplates knowing the customer behind the order as part of the process

of ensuring that the order is bona fide. Proposed FINRA Rule 2090 and FINRA Rule

3310 together place similar requirements on firms to know their customers.

To the extent NYSE Rule Interpretation 405/03 seeks to guard against the use of

fictitious trades as a means of manipulating markets, various FINRA rules cover such

activities. FINRA Rule 5210 (Publication of Transactions and Quotations) prohibits

members from publishing or circulating or causing to publish or circulate, any notice,

30

As noted previously, FINRA is proposing to adopt NASD Rule 3110(c) as

FINRA Rule 4512 (Customer Account Information), subject to certain

amendments. See Regulatory Notice 08-25 (May 2008).

Page 14 of 776

circular, advertisement, newspaper article, investment service, or communication of any

kind which purports to report any transaction as a purchase or sale of, or purports to

quote the bid or asked price for, any security unless such member believes that such

transaction or quotation was bona fide. FINRA Rule 5220 (Offers at Stated Prices)

prohibits members from making an offer to buy from or sell to any person any security at

a stated price unless such member is prepared to purchase or sell at such price and under

such conditions as are stated at the time of such offer to buy or sell. Moreover, the use of

fictitious transactions by a member or associated person to manipulate the market would

violate FINRA’s just and equitable principles of trade (FINRA Rule 2010) and anti-fraud

provision (FINRA Rule 2020).

31

NYSE Rule Interpretation 405/04 (Accounts in which Member Organizations

have an Interest) discusses requirements regarding transactions initiated “on the Floor”

for an account in which a member organization has an interest. The interpretation is

directed to the NYSE marketplace. Moreover, Section 11(a) of the Act and the rules

thereunder address trading by members of exchanges, brokers and dealers. For the

reasons discussed above, FINRA believes NYSE Rule 405(1) through (3), NYSE

Supplementary Material 405.10 through .30, and NYSE Rule Interpretations 405/01

through /04 are no longer necessary. They will be eliminated from the current FINRA

rulebook upon Commission approval and implementation by FINRA of this current

proposed rule change.

31

See, e.g., Terrance Yoshikawa, Securities Exchange Act Release No. 53731, 2006

SEC LEXIS 948 (April 26, 2006) (upholding finding that president of broker-

dealer violated just and equitable principles of trade and anti-fraud provisions by

fraudulently entering orders designed to manipulate the price of securities).

Page 15 of 776

As noted in Item 2 of this filing, FINRA will announce the implementation date

of the proposed rule change in a Regulatory Notice to be published no later than 90 days

following Commission approval. The implementation date will be no later than 240 days

following Commission approval.

(b) Statutory Basis

The proposed rule change is consistent with the provisions of Section 15A(b)(6)

of the Act,

32

which requires, among other things, that FINRA’s rules must be designed to

prevent fraudulent and manipulative acts and practices, to promote just and equitable

principles of trade, and, in general, to protect investors and the public interest. The

proposed rule change furthers these purposes because it requires firms and associated

persons to know, deal fairly with, and make only suitable recommendations to customers.

4. Self-Regulatory Organization’s Statement on Burden on Competition

FINRA does not believe that the proposed rule change will result in any burden

on competition that is not necessary or appropriate in furtherance of the purposes of the

Act.

5. Self-Regulatory Organization’s Statement on Comments on the Proposed

Rule Change Received from Members, Participants, or Others

As noted above, the proposed rule change was published for comment in

Regulatory Notice

09-25 (May 2009). A copy of the Notice is attached as Exhibit 2a.

FINRA received 2,083 comment letters, 389 of which were individualized letters and

1,694 of which were form letters. A copy of the index to comment letters received in

response to the Notice

is attached as Exhibit 2b, and copies of the comment letters

received in response to the Notice

are attached as Exhibit 2c.

32

15 U.S.C. 78o-3(b)(6).

Page 16 of 776

Comments came from broker-dealers, insurers, investment advisers, academics,

industry associations, investor-protection groups, lawyers in private practice, and a state

government agency. Commenters had myriad different views regarding nearly every

aspect of the proposal. A discussion of those comments and FINRA’s responses thereto

follows.

SUITABILITY

(Proposed FINRA Rule 2111)

Fiduciary Standard

Although FINRA did not request comment on whether fiduciary obligations

should influence the suitability proposal, more than a thousand commenters raised issues

involving fiduciary obligations. A brief discussion of these issues is thus warranted.

Comments

One commenter suggested that FINRA should consider a fiduciary duty standard

in addition to a suitability standard.

33

Numerous other commenters argued that FINRA

should not move forward with proposed changes to the suitability rule until after

policymakers (e.g., Congress, the SEC, and/or FINRA) determine whether broker-dealers

must comply with fiduciary obligations.

34

One commenter further posited that it would

33

Rex A. Staples, General Counsel for the North American Securities

Administrators Association, July 13, 2009 (“NASAA Letter”).

34

See Joan Hinchman, Executive Director, President, and CEO of the National

Society of Compliance Professionals Inc., June 29, 2009 (“NSCP Letter”);

Clifford Kirsch and Eric Arnold, Sutherland Asbill & Brennan LLP for the

Committee of Annuity Insurers, June 29, 2009 (“Committee of Annuity Insurers

Letter”). In addition, 435 individuals and entities made this point, among others,

using one form letter (“Form Letter Type A”) and 1,197 individuals did so using

another form letter (“Form Letter Type B”).

Page 17 of 776

be easier for firms to implement a single, integrated change to customer care standards

adopted at one time.

35

FINRA’s Response

FINRA notes that the application of a suitability standard is not inconsistent with

a fiduciary duty standard. In this regard, the SEC emphasized in one release that

"investment advisers under the Advisers Act,” who have fiduciary duties, “owe their

clients the duty to provide only suitable investment advice…. To fulfill this suitability

obligation, an investment adviser must make a reasonable determination that the

investment advice provided is suitable for the client based on the client's financial

situation and investment objectives."

36

In another release, the SEC similarly explained

that “[i]nvestment advisers are fiduciaries who owe their clients a series of duties, one of

which is the duty to provide only suitable investment advice.”

37

Suitability obligations constitute a material part of a fiduciary standard in the

context of investment advice and recommendations. It also is important to note that case

law makes clear that, under FINRA’s suitability rule, "a broker's recommendations must

be consistent with his customers' best interests."

38

Thus, the suitability obligations set

35

See NSCP Letter, supra note 34.

36

Release Nos. IC-22579, IA-1623, S7-24-95, 1997 SEC LEXIS 673, at *26 (Mar.

24, 1997) (Status of Investment Advisory Programs under the Investment

Company Act of 1940). See

also Shearson, Hammill & Co., 42 S.E.C. 811 (1965)

(finding willful violations of Section 206 of the Advisers Act when investment

adviser made unsuitable recommendations).

37

Investment Advisers Act Release No. 1406, 1994 SEC LEXIS 797, at *4 (Mar.

16, 1994) (Suitability of Investment Advice Provided by Investment Advisers).

38

Raghavan Sathianathan, Securities Exchange Act Release No. 54722, 2006 SEC

LEXIS 2572, at *21 (Nov. 8, 2006), aff’d

, 304 F. App’x 883 (D.C. Cir. 2008); see

also

Dane S. Faber, Securities Exchange Act Release No. 49216, 2004 SEC

Page 18 of 776

forth in proposed Rule 2111 would not be inconsistent with the addition of a fiduciary

duty at some future date.

39

Scope of the Suitability Rule

FINRA sought comment on two main issues potentially impacting the scope of

the suitability rule: whether to add the term “strategy” to the rule language and whether

to broaden the rule so that it reaches non-securities products. The second issue was not

highlighted in the rule text. Rather, it was raised in a discussion in the Notice seeking

comment.

Strategies

The issue of whether the suitability rule applies to recommended strategies has

been addressed previously. SEC and FINRA discussions in IMs, releases, and notices, as

well as in some decisions, indicate that the current suitability rule applies to certain types

of recommended strategies.

NASD IM-2310-3 (Suitability Obligations to Institutional Customers) provides in

its “Preliminary Statement” that broker-dealers’ “responsibilities include having a

reasonable basis for recommending a particular security or strategy

, as well as having

LEXIS 277, at *23-24 (Feb. 10, 2004) (explaining that a broker’s

recommendations “must be consistent with his customer’s best interests”); Daniel

R. Howard, 55 S.E.C. 1096, 1099-1100 (2002) (same), aff’d, 77 F. App’x 2 (1st

Cir. 2003).

39

FINRA notes as well that the suitability rule is only one of many FINRA

business-conduct rules with which broker-dealers and their associated persons

must comply. Many FINRA rules prohibit, limit, or require disclosure of

conflicts of interest. Broker-dealers and their associated persons, for instance,

must comply with just and equitable principles of trade, standards for

communications with the public, order-handling requirements, fair-pricing

standards, and various disclosure obligations regarding research, trading,

compensation, margin, and certain sales and distribution activity, among others, in

addition to suitability obligations.

Page 19 of 776

reasonable grounds for believing the recommendation is suitable for the customer to

whom it is made.” Similarly, Notices to Members have stated that broker-dealers'

responsibilities under Rule 2310 “include having a reasonable basis for recommending a

particular security or strategy.”

40

Moreover, when the SEC published FINRA’s Online

Suitability Policy Statement, Notice to Members

01-23 (Apr. 2001) (“NTM 01-23”), in

the Federal Register

, the Commission included the following statement in the release:

“The Commission notes that although [NTM] 01-23 does not expressly discuss electronic

communications that recommend investment strategies, the NASD suitability rule

continues to apply to the recommendation of investment strategies, whether that

recommendation is made via electronic communication or otherwise.”

41

A number of SEC decisions also support application of the suitability rule to

recommended strategies. The case often cited as standing for such a proposition is F.J.

Kaufman & Co., 50 S.E.C. 164 (1989), in which the SEC found that the respondent

violated NASD Rule 2310 by recommending an unsuitable strategy to customers. A

number of Commission decisions issued after Kaufman also lend support for applying the

suitability rule to recommended strategies in certain situations. Many of these cases

40

See Notice to Members 96-32, 1996 NASD LEXIS 51, at *2 (May 1996); see also

Notice to Members 05-68, 2005 NASD LEXIS 44, at *11 (Oct. 2005) (stating that

members and their associated persons “should perform a careful analysis to

determine whether liquefying home equity is a suitable strategy for an investor”);

Notice to Members 04-89, 2004 NASD LEXIS 76, at *7 (Dec. 2004) (same).

41

See Securities Exchange Act Release No. 44178, 2001 SEC LEXIS 731, at *28-

29 (April 12, 2001), 66 FR 20697, 20702 (April 24, 2001) (Notice of Filing and

Immediate Effectiveness of FINRA’s Online Suitability Policy Statement).

Page 20 of 776

involved recommendations to purchase securities on margin (which can be viewed as a

strategy).

42

The proposed suitability rule explicitly covers recommended strategies. The

commenters’ views on the inclusion of the term were varied.

o Comments

A number of commenters supported the addition of the term to the rule text.

43

Some commenters requested that FINRA make clear in the supplementary material that

the term “strategy” should be interpreted broadly and include recommendations to hold

an investment.

44

Some of these commenters also believed that firms should have an

affirmative duty to review portfolios that are transferred into a firm and that the lack of a

42

See, e.g., Jack H. Stein, Securities Exchange Act Release No. 47335, 2003 SEC

LEXIS 338, at *15 (Feb. 10, 2003); Justine S. Fischer, 53 S.E.C. 734 (1998);

Stephen T. Rangen, 52 S.E.C. 1304, 1307-1308 (1997); Arthur J. Lewis, 50

S.E.C. 747, 748-50 (1991).

43

See Barbara Black, Director of the Corporate Law Center of the University of

Cincinnati College of Law, and Jill I. Gross, Director of the Investor Rights Clinic

of the Pace University School of Law (“Corporate Law Center & Investor Rights

Clinic”), June 29, 2009; Peter J. Harrington, Christine Lazaro & Lisa A. Catalano,

Securities Arbitration Clinic at St. John’s University, June 25, 2009 (“St. John’s

Letter”); William A. Jacobson and Sang Joon Kim, Cornell Securities Law Clinic,

June 27, 2009 (“Cornell Letter”); Sarah McCafferty, Vice President and Chief

compliance Officer at T.RowePrice, June 29, 2009 (“T.RowePrice Letter”); Peter

J. Mougey and Kristian P. Kraszewski, Levin, Papantonio, Thomas, Mitchell,

Echsner & Proctor P.A., June 29, 2009 (“Mougey and Kraszewski Letter”);

Daniel C. Rome, General Counsel of Taurus Compliance Consulting LLC, June

29, 2009 (“Taurus Letter”).

44

See Cornell Letter, supra note 43; Mougey and Kraszewski Letter, supra note 43;

St. John’s Letter, supra

note 43.

Page 21 of 776

recommendation to make any changes to the portfolio effectively constitutes an implicit

recommendation to retain what is in the account.

45

Other commenters supported the inclusion of the term strategy but asked FINRA

to clarify that the suitability rule would apply only to recommended “strategies resulting

in the purchase, sale or exchange of a security or securities”

46

or where there is a

“reasonable nexus between the recommended investment strategy and a securities

transaction in furtherance of the recommended strategy.”

47

Other commenters stated that

FINRA should define or clarify the term “strategy.”

48

One of these commenters believed

that, without a definition, there would be confusion among firms and FINRA examiners

regarding whether all asset allocation programs and “buy and hold” recommendations

should be viewed as strategies.

49

45

See Mougey and Kraszewski Letter, supra note 43; St. John’s Letter, supra note

43.

46

See Bari Havlik, SVP and Chief Compliance Officer for Charles Schwab & Co.,

June 29, 2009 (“Charles Schwab Letter”).

47

See Amal Aly, Managing Director and Associate General Counsel, Securities

Industry and Financial Markets Association, June 29, 2000 (“SIFMA Letter”);

NSCP Letter, supra

note 34.

48

See NSCP Letter, supra note 34. A number of commenters stated that FINRA

should eliminate the term strategy from the rule but argued that, if FINRA

continues to use it, FINRA needed to clarify what the term means. See

Committee of Annuity Insurers Letter, supra note 34; James Livingston, President

and CEO of National Planning Holdings, Inc., June 29, 2009 (“National Planning

Holdings”); Stephanie L. Brown, Managing Director and General Counsel for

LPL Financial Corporation, June 29, 2009 (“LPL Letter”).

49

See NSCP Letter, supra note 34.

Page 22 of 776

A number of commenters opposed the inclusion of the term “strategy.”

50

However, one of these commenters stated that, if FINRA includes the term in the final

proposal, FINRA should except from the rule’s coverage any information determined to

be “investment education” under the Employee Retirement Income Security Act

(“ERISA”).

51

o FINRA’s Response

FINRA agrees that the term “strategy” should be included in the rule language

and that, in general, it should be interpreted broadly. For instance, FINRA rejects the

contention that the rule should only cover a recommended strategy if it results in a

transaction. As with the current suitability rule, application of the proposed rule would

be triggered when the broker-dealer or associated person recommends the security or

strategy regardless of whether the recommendation results in a transaction.

52

The term

“strategy,” moreover, would cover explicit recommendations to hold a security or

securities. The rule recognizes that customers may rely on members’ and associated

persons’ investment expertise and knowledge, and it is thus appropriate to hold members

and associated persons responsible for the recommendations that they make to customers,

50

See LPL Letter, supra note 48; Committee of Annuity Insurers Letter, supra note

34; Clifford E. Kirsch, Sutherland Asbill & Brennan LLP on behalf of John

Hancock Life Insurance Co., MetLife Inc., and the Prudential Insurance Co. of

America, June 29, 2009 (“Hancock, MetLife and Prudential Letter”); National

Planning Holdings, supra

note 48.

51

See Hancock, MetLife and Prudential Letter, supra note 50 (citing 29 CFR

2509.96-1(d)).

52

See, e.g., Dist. Bus. Conduct Comm. v. Nickles, Complaint No. C8A910051,

1992 NASD Discip. LEXIS 28, at *18 (NBCC Oct. 19, 1992) (holding that

suitability rule "applies not only to transactions that registered persons effect for

their clients, but also to any recommendations that a registered person makes to

his or her client").

Page 23 of 776

regardless of whether those recommendations result in transactions or generate

transaction-based compensation.

In regard to the comment concerning implicit recommendations on portfolios

transferred to a firm, FINRA notes that nothing in the current rule proposal is intended to

change the longstanding application of the suitability rule on a recommendation-by-

recommendation basis. In limited circumstances, FINRA and the SEC have recognized

that implicit recommendations can trigger suitability obligations. For example, FINRA

and the SEC have held that associated persons who effect transactions on a customer’s

behalf without informing the customer have implicitly recommended those transactions,

thereby triggering application of the suitability rule.

53

The rule proposal is not intended

to broaden the scope of implicit recommendations.

As discussed in Item 3 of this rule filing, FINRA also proposes to explicitly

exempt from the rule’s coverage certain categories of educational material as long as they

do not include (standing alone or in combination with other communications) a

recommendation of a particular security or securities. FINRA believes that it is important

to encourage broker-dealers and associated persons to freely provide educational material

and services to customers. As one commenter explained, the U.S. Department of Labor

provided a similar exemption from some requirements under ERISA.

54

53

See, e.g., Rafael Pinchas, 54 S.E.C. 331, 341 n.22 (1999) (“Transactions that were

not specifically authorized by a client but were executed on the client’s behalf are

considered to have been implicitly recommended within the meaning of the

NASD rules.”); Paul C. Kettler

, 51 S.E.C. 30, 32 n.11 (1992) (stating that

transactions broker effects for a discretionary account are implicitly

recommended).

54

See Hancock, MetLife and Prudential Letter, supra note 50 (citing 29 CFR

2509.96-1(d)).

Page 24 of 776

Non-Securities Products

The current suitability rule and the proposed new suitability rule cover

recommendations involving securities. In the Notice seeking comment, however, FINRA

asked whether the suitability rule should cover recommendations of non-securities

products made in connection with the firm’s business. This issue generated the greatest

number of comments, most of which were against extending the rule’s reach.

o Comments

Some commenters favored broadening the suitability rule so that it covers non-

securities products.

55

One commenter stated that the expansion was needed because

broker-dealers market more than just securities and oftentimes customers do not

understand that they may be afforded less protection when purchasing non-securities

products.

56

Another commenter stated that it would be unreasonable for a firm to allow a

non-securities recommendation that was inconsistent with a customer’s suitability

profile.

57

Yet another commenter believed that broker-dealers implicitly already have

similar obligations but favored explicitly applying the suitability rule to non-securities

products.

58

According to this commenter, broker-dealers fail to observe the high

standards of commercial honor and just and equitable principles of trade required by

FINRA Rule 2010 if they recommend any unsuitable financial product, service, or

55

See Mougey and Kraszewski Letter, supra note 43; Taurus Letter, supra note 43.

56

See Mougey and Kraszewski Letter, supra note 43.

57

See Taurus Letter, supra note 43.

58

See Corporate Law Center & Investor Rights Clinic, supra note 43.

Page 25 of 776

strategy to their customers.

59

This commenter argued that the proposal was not an

expansion of broker-dealer obligations; rather the proposal would make explicit what

FINRA’s rules have consistently required from broker-dealers and associated persons.

60

The commenter supported a revision of proposed Rule 2111 to incorporate an explicit

suitability obligation that is not limited to securities.

61

The vast majority of commenters, however, were against applying the suitability

rule to non-securities products.

62

Some argued that FINRA did not have jurisdiction over

59

See Corporate Law Center & Investor Rights Clinic, supra note 43.

60

See Corporate Law Center & Investor Rights Clinic, supra note 43.

61

See Corporate Law Center & Investor Rights Clinic, supra note 43.

62

See, e.g., Michael Berenson, Morgan, Lewis & Bockius LLP on behalf of

American Equity Life Insurance Company, June 23, 2009 (“AELIC Letter”);

Charles Schwab Letter, supra note 46; Committee of Annuity Insurers Letter,

supra note 34; John M. Damgard, President of the Futures Industry Association,

June 29, 2009 (“FIA Letter”); Form Letter Type A, supra note 34; Form Letter

Type B, supra note 34; Hancock, MetLife and Prudential Letter, supra note 50;

James L. Harding, James L. Harding & Associates, Inc., July 1, 2009 (“Harding

Letter”); Mike Hogan, President and CEO of FOLIOfn Investments, Inc., June 29,

2009 (“FOLIOfn Letter”); Ronald C. Long, Director of Regulatory Affairs for

Wells Fargo Advisors, LLC, June 29, 2009 (“Wells Fargo Letter”); LPL Letter,

supra

note 50; John S. Markle, Deputy General Counsel for TD Ameritrade, June

29, 2009 (“TD Ameritrade Letter”); NSCP Letter, supra note 34; Lisa Roth,

National Ass’n of Independent Broker-Dealers, Inc., June 29, 2009 (“NAIBD

Letter”); Thomas W. Sexton, Senior Vice President & General Counsel for the

National Futures Association, June 29, 2009 (“NFA Letter”), SIFMA Letter,

supra

note 47; T.RowePrice Letter, supra note 43; Robert R Carter and David A

Stertzer, Association for Advanced Life Underwriting, June 29, 2009 (“AALU

Letter”); Alan J Cyr, Cyr & Cyr Insurance Services, June 26, 2009 (“Cyr & Cyr

Insurance Services Letter”); F. John Millette, IMG Financial Group, June 23,

2009 (“IMG Financial Group Letter”); Neal Nakagiri, NPB Financial Group,

LLC, June 2, 2009 (“NPB Financial Group Letter”); Richard C. Orvis, Principal

Life Insurance Co., June 23, 2009 (“Principal Life Insurance Co. Letter”).

Page 26 of 776

non-securities products.

63

Some argued against the expansion because they claimed there

is no evidence of abuse resulting from recommendations involving non-securities

products.

64

Some commenters stated that such action is unnecessary because the states

and federal regulators, and in some instances other self-regulatory organizations, already

regulate many non-securities products and services (e.g.

, insurance, real estate,

investment advisers, futures products, etc.).

65

Others claimed that FINRA was ill-suited

to regulate non-securities products because it has no expertise outside securities issues.

66

A few argued that adoption of an enhanced suitability rule would create confusion

regarding whether a recommendation is made “in connection with a firm’s business.”

67

o FINRA’s Response

With the possible exception of potentially duplicative regulation, which FINRA

believes could be addressed in any further expansion of the reach of the rule, FINRA

does not agree with the commenters’ reasoning against extending the scope of the

63

See, e.g., Committee of Annuity Insurers Letter, supra note 34; FOLIOfn Letter,

supra note 62; Form Letter Type A, supra note 34; Form Letter Type B, supra

note 34; Hancock, MetLife and Prudential Letter, supra note 50; LPL Letter,

supra note 48; NSCP Letter, supra note 34; T.RowePrice Letter, supra note 43.

64

See, e.g., AALU Letter, supra note 62; AELIC Letter, supra note 62; Cyr & Cyr

Insurance Services Letter, supra note 59; Principal Life Insurance Co. Letter,

supra note 59.

65

See, e.g., AELIC Letter, supra note 62; Committee of Annuity Insurers Letter,

supra note 34; FIA Letter, supra note 62; Form Letter Type A, supra note 34;

Form Letter Type B, supra note 34; Hancock, MetLife and Prudential Letter,

supra

note 50; Michael T. McRaith, Illinois Department of Insurance Letter, June

29, 2009; NAIBD Letter, supra note 62; NFA Letter, supra note 62; NSCP Letter,

supra

note 34; SIFMA Letter, supra note 47.

66

See, e.g., AALU Letter, supra note 62; Committee of Annuity Insurers Letter,

supra

note 34; Wells Fargo Letter, supra note 62.

67

See, e.g., AELIC Letter, supra note 62.

Page 27 of 776

suitability rule. FINRA acknowledges, however, that future developments in regulatory

restructuring could impact any such proposal. FINRA emphasizes, moreover, that the

proposed new suitability rule (including the explicit coverage of recommended strategies

and expanded list of the types of information that members must seek to gather and

analyze) and the proposed “Know Your Customer” rule together provide enhanced

protection to investors. Consequently, FINRA will not include explicit references to non-

securities products in the rule at this time.

Clarification of the Term “Recommendation”

Consistent with the current suitability rule, the proposed new rule does not define

the term “recommendation.” FINRA received a number of comments regarding the term.

o Comments

Some commenters asked FINRA to define the term “recommendation.”

68

One

commenter believed that FINRA’s failure to define “recommended transaction” will

make it difficult for firms to distinguish recommended transactions from “discussed”

and/or “reviewed” transactions.

69

This commenter stated that the “current compliance

rule of thumb matches customer action within a measured period of time after

information is provided to a customer as a test of whether any resulting transaction was

‘recommended.’”

70

The commenter believes that “the discussion in NTM 01-23 provides

a good foundation upon which FINRA can base the definition.”

71

Another commenter

68

See Barry D. Estell, Attorney at Law, June 24, 2009 (“Estell Letter”); FOLIOfn

Letter, supra note 62; Mougey and Kraszewski Letter, supra note 43.

69

See FOLIOfn Letter, supra note 62.

70

See FOLIOfn Letter, supra note 62.

71

See FOLIOfn Letter, supra note 62.

Page 28 of 776

asked that FINRA reaffirm the principles discussed in NTM 01-23 regarding the term

“recommendation.”

72

Other commenters argued that the term should be defined to

include recommendations to hold securities.

73

o FINRA’s Response

The determination of the existence of a recommendation has always been based

on the facts and circumstances of the particular case and, therefore, the fact of such action

having taken place is not susceptible to a bright line definition.

74

As two commenters

noted, however, FINRA announced several guiding principles in NTM 01-23 regarding

whether a communication constitutes a recommendation. In general, those guiding

principles remain relevant.

For instance, FINRA stated that a communication’s content, context, and

presentation are important aspects of the inquiry. In addition, the more individually

tailored the communication is to a particular customer or customers about a specific

security or strategy, the more likely the communication will be viewed as a

recommendation. FINRA also explained that a series of actions that may not constitute

recommendations when viewed individually may amount to a recommendation when

considered in the aggregate. FINRA stated, moreover, that it makes no difference

whether the communication was initiated by a person or a computer software program.

72

TD Ameritrade Letter, supra note 62.

73

See Estell Letter, supra note 68; Mougey and Kraszewski Letter, supra note 43.

74

FINRA has stated that "defining the term 'recommendation' is unnecessary and

would raise many complex issues in the absence of specific facts of a particular

case." Securities Exchange Act Release No. 37588, 1996 SEC LEXIS 2285, at

*29 (Aug. 20, 1996), 61 FR. 44100, 44107 (Aug. 27, 1996) (Notice of Filing and

Order Granting Accelerated Approval of NASD’s Interpretation of its Suitability

Rule).

Page 29 of 776

Finally, FINRA noted the relevance of determining whether a reasonable person would

view the communication as a recommendation. Thus, for example, FINRA explained

that a broker could not avoid suitability obligations through a disclaimer where—given

its content, context, and presentation—the particular communication reasonably would be

viewed as a recommendation.

75

These guiding principles, together with numerous litigated decisions and the facts

and circumstances of any particular case, inform the determination of whether the

communication is a recommendation for purposes of FINRA’s suitability rule.

76

FINRA

believes that this guidance and these precedents allow broker-dealers to fundamentally

understand what communications likely do or do not constitute recommendations.

75

In the same vein, it is important to note that a customer’s acquiescence or desire

to engage in a transaction does not relieve a broker-dealer or associated person of

the responsibility to make only suitable recommendations. See, e.g., Clinton H.

Holland, Jr., 52 S.E.C. 562, 566 (1995) (“Even if we conclude that Bradley

understood Holland’s recommendations and decided to follow them, that does not

relieve Holland of his obligation to make reasonable recommendations.”), aff’d,

105 F.3d 665 (9th Cir. 1997) (table format); John M. Reynolds, 50 S.E.C. 805,

809 (1991) (regardless of whether customer wanted to engage in aggressive and

speculative trading, representative was obligated to abstain from making

recommendations that were inconsistent with the customer’s financial condition);

Eugene J. Erdos, 47 S.E.C. 985, 989 (1983) (“[W]hether [the customer]

considered the transactions … suitable is not the test for determining the propriety

of [the registered representative’s] conduct.”), aff’d

, 742 F.2d 507 (9th

Cir. 1984);

Dep’t of Enforcement v. Bendetsen, No. C01020025, 2004 NASD Discip. LEXIS

13, at *12 (NAC Aug. 9, 2004) (“[A] broker’s recommendations must serve his

client’s best interests and that the test for whether a broker’s recommendation is

suitable is not whether the client acquiesced in them, but whether the broker’s

recommendations were consistent with the client’s financial situation and

needs.”).

76

To the extent that past Notices to Members, Regulatory Notices, case law, etc., do

not conflict with proposed new rule requirements or interpretations thereof, they

remain potentially applicable, depending on the facts and circumstances of the

particular case.

Page 30 of 776

It also is important to emphasize that both the current and proposed suitability

rules require that a recommendation be suitable when made. Firms may have different

methods of tracking recommendations for a variety of reasons, but the main suitability

obligation is not dependent on whether and, if so, where and how, a transaction occurs.

77

Finally, as noted above, the proposed rule would capture explicit

recommendations to hold securities as a result of FINRA’s elimination of the “purchase,

sale or exchange” language and the addition of the term “strategy.” Accordingly, there is

no reason to define “recommendation” to include recommendations to hold securities.

Information Gathering

The proposal discussed in the Notice seeking comment made two changes to the

type of information that firms and associated persons had to attempt to gather and analyze

as part of their suitability obligation. First, the proposal would have required the firm and

associated person to consider information known by the firm or associated person.

Second, the proposal included an expanded list of information that members and

associated persons would have to attempt to gather and analyze when making

recommendations.

Information Known By the Firm

The proposal discussed in the Notice

would have required members and

associated persons to consider all information about the customer that was “known by the

member or associated person.”

77

See Nickles, 1992 NASD Discip. LEXIS 28, at *18.

Page 31 of 776

o Comments

Some commenters supported requiring firms and brokers to analyze information

known by the firm regardless of how the firm learned of the information.

78

However,

other commenters were opposed to this requirement.

79

Some were opposed because of

the difficulty they believed it would cause for firms with multiple business lines.

80

According to these commenters, customers may provide information for a variety of

different purposes (e.g.

, banking, insurance, or securities transactions) to different

employees working in different departments and recording the information on separate

systems, and a single broker may not have access to all of that information.

81

Other commenters opposed the language on the basis that it might require

associated persons to capture and consider personal information that may not be relevant

to investment decisions and that clients may not want captured in a system or shared with

a broader audience (especially when the associated person has intimate knowledge of a

client through a family relationship or friendship).

82

According to the commenters,

examples may include a diagnosed illness, pending divorce or separation, pending legal

78

See Corporate Law Center & Investor Rights Clinic, supra note 43; St. John’s

Letter, supra note 43; Taurus Letter, supra note 43.

79

See Charles Schwab Letter, supra note 46; Committee of Annuity Insurers Letter,

supra

note 34; FOLIOfn Letter, supra note 62; LPL Letter, supra note 48; NSCP

Letter, supra note 35; SIFMA Letter, supra note 47; TD Ameritrade Letter, supra

note 62.

80

See Charles Schwab Letter, supra note 46; FOLIOfn Letter, supra note 62; NSCP

Letter, supra note 34; SIFMA Letter, supra note 47; TD Ameritrade Letter, supra

note 62.

81

See Charles Schwab Letter, supra note 46; SIFMA Letter, supra note 47.

82

See Committee of Annuity Insurers Letter, supra note 34; National Planning

Holdings, supra

note 48.

Page 32 of 776

action, or other personal problems.

83

Finally, some commenters believed that such a

requirement could be unfair to associated persons in situations where firms are aware of

information about customers but do not pass it along to the associated persons.

84

o FINRA’s Response

FINRA has modified the proposal and no longer refers to facts “known by the

member or associated person.” The current proposal requires the member or associated

person to have reasonable grounds to believe the recommendation is suitable based on

“information obtained through the reasonable diligence of the member or associated

person to ascertain the customer’s investment profile, including, but not limited to, the

customer’s age, other investments, financial situation and needs, tax status, investment

objectives, investment experience, investment time horizon, liquidity needs, risk

tolerance, and any other information the customer may disclose to the member or

associated person in connection with such recommendation.”

“Reasonable diligence” is that level of effort that, based on the facts and

circumstances of the particular case, provides the member or associated person with

sufficient information about the customer to have reasonable grounds to believe that the

recommended security or strategy is suitable. The level of importance of each category

of customer information may vary depending on the facts and circumstances of the

particular case. However, members and associated persons must use reasonable diligence

to gather and analyze the customer information and may only make a recommendation if

they have reasonable grounds to believe the recommendation is suitable. In this regard,

83

See Committee of Annuity Insurers Letter, supra note 34; National Planning

Holdings, supra

note 48.

84

See LPL Letter, supra note 48; SIFMA Letter, supra note 47.

Page 33 of 776

failing to use reasonable diligence to gather the information or basing a recommendation

on inadequate information would violate customer-specific suitability, which requires a

broker-dealer to have a reasonable basis to believe a recommendation is suitable for the

particular investor at issue.

Apart from the new “reasonable diligence” language, the modified proposal also

alters the wording at the end of paragraph (a) of the proposed rule. Instead of requiring

members and associated persons to consider “any other information the member or

associated person considers to be reasonable,” the modified proposal requires them to

consider “any other information the customer may disclose to the member or associated

person in connection with” the recommendation. In light of some of the comments noted

above, FINRA believes it is important to tie this customer information to possible

investment decisions.

Additional Information

The proposal expands the explicit list of types of information that broker-dealers

and associated persons have to attempt to gather and analyze. At present, the suitability

rule requires that broker-dealers and associated persons attempt to gather information

about and analyze the customer’s other security holdings, financial situation and needs,

financial status, tax status, investment objectives, and such other information used or

considered to be reasonable by such member or associated person in making

recommendations to the customer. FINRA expanded that list to include the customer's

age, investment experience, investment time horizon, liquidity needs, and risk tolerance.

Page 34 of 776

o Comments

Some commenters applauded FINRA for placing a clear affirmative duty on firms

to make reasonable efforts to gather a more comprehensive and specific list of facts about

the customer prior to making a recommendation.

85

These commenters believed that the

investing public will benefit because broker-dealers will consider a larger number of

consistent criteria.

86

A few other commenters, while agreeing that such information is relevant in some

situations, stated that obtaining each specified category of information may not be

warranted on every occasion.

87

These commenters requested that FINRA build flexibility

into the rule and not mandate that the member seek to obtain these new categories of

information for every recommended transaction.

88

According to these commenters,

broker-dealers should have discretion to determine what customer information is relevant

to the suitability determination associated with each recommended transaction.

89

If

FINRA does require firms to obtain and capture this information, these commenters also

asked FINRA to establish an effective date for the new rule that recognizes the difficulty

85

See Corporate Law Center & Investor Rights Clinic, supra note 43; Mougey and

Kraszewski Letter, supra note 43; St. John’s Letter, supra note 43; T.RowePrice

Letter, supra note 43.

86

See St. John’s Letter, supra note 43; Mougey and Kraszewski Letter, supra note

43.

87

See Charles Schwab Letter, supra note 46; SIFMA Letter, supra note 47; TD

Ameritrade Letter, supra note 62; Wells Fargo Letter, supra note 62.

88

See Charles Schwab Letter, supra note 46; SIFMA Letter, supra note 47; TD

Ameritrade Letter, supra note 62; Wells Fargo Letter, supra note 62.

89

See Charles Schwab Letter, supra note 46; SIFMA Letter, supra note 47; TD

Ameritrade Letter, supra

note 62; Wells Fargo Letter, supra note 62.

Page 35 of 776

associated with developing, modifying, and implementing forms and systems to request

and capture the proposed new categories of information.

90

Other commenters more strongly objected to the proposed expansion of the list of

items that broker-dealers must attempt to gather and analyze.

91

One commenter argued

that factors such as a customer’s investment experience, time horizon, and risk tolerance

are ones to be considered when reviewing a customer’s portfolio as a whole, not

individual trades.

92

According to this commenter, requiring consideration of such factors

on a trade-by-trade basis will prevent customers from creating a diverse portfolio made

up of securities with different levels of liquidity, risk, and time horizons.

93

This

commenter also stated that requiring firms to attempt to gather information about a

customer’s “other investments” would be difficult because it would require an associated

person to have a complete view of a customer’s entire portfolio.

94

Another commenter

went further and stated that the current list of items in Rule 2310 should be abolished.

95

The commenter stated that “FINRA should adopt a rule that states that broker dealers

should collect sufficient data and perform the analysis that it, in its professional

judgment, deems reasonably necessary to provide the services it offers and advertises to

90

See Charles Schwab Letter, supra note 46; LPL Letter, supra note 48; SIFMA

Letter, supra note 47; Wells Fargo Letter, supra note 62.

91

See FOLIOfn Letter, supra note 62.

92

See LPL Letter, supra note 48.

93

See LPL Letter, supra note 48.

94

See LPL Letter, supra note 48.

95

See FOLIOfn Letter, supra note 62.

Page 36 of 776

consumers.”

96

If that cannot be achieved, the commenter recommends limiting the

information to that discussed in SEA Rule 17a-3.

97

This commenter also argued that

FINRA should detail exactly how firms are required to use each piece of information that

FINRA requires firms to gather.

98

Another commenter stated that FINRA should maintain a standard approach to

the terminology used in relation to this aspect of the rule.

99

As an example, the

commenter noted that the rule proposal uses the term “other investments,” while FINRA

Rule 2330 covering deferred variable annuities uses “existing assets (including

investment and life insurance holdings).”

100

The commenter believed that “other

investments” is overly broad and that FINRA should use the term currently used in Rule

2330.

101

Finally, one commenter argued that money market mutual funds be exempted

from all or some of the requirements to gather information when making

recommendations.

102

According to the commenter, a current exemption from some

96

See FOLIOfn Letter, supra note 62.

97

See FOLIOfn Letter, supra note 62.

98

See FOLIOfn Letter, supra note 62.

99

See National Planning Holdings, supra note 48.

100

See National Planning Holdings, supra note 48.

101

See National Planning Holdings, supra note 48.

102

See Tamara K. Salmon, Senior Associate Counsel for the Investment Company

Institute, June 29, 2009 (“ICI Letter”).

Page 37 of 776

information gathering for transactions in money market mutual funds should continue or

be expanded in the proposed rule.

103

o FINRA’s Response

Under the current suitability rule, broker-dealers must attempt to gather

information on and analyze the customer’s other holdings, financial situation and needs,

financial status, tax status, investment objectives, and such other information used or

considered to be reasonable by the firm or associated person in making recommendations

to the customer. The expanded information in the proposed rule includes the customer’s

age, investment experience, investment time horizon, liquidity needs, and risk tolerance.

FINRA cannot dictate exactly how firms should use each piece of information. As

discussed above, the level of importance of each category of customer information (not

only those in the expanded list) may vary depending on the facts and circumstances of the

particular case. However, failing to use reasonable diligence to gather the information or

basing a recommendation on inadequate information would violate customer-specific

suitability.

FINRA declines one commenter’s request to exempt money market mutual funds

from all or some of the requirements to gather information when making

recommendations. By way of background, the original suitability rule (currently

paragraph (a) of NASD Rule 2310) required firms and brokers to have reasonable

grounds to believe that the recommendation to purchase, sell, or exchange any security is

suitable based upon the facts, if any, disclosed by the customer as to “his other security

holdings and as to his financial situation and needs.” In 1990, the SEC approved

103

See ICI Letter, supra note 102.

Page 38 of 776

amendments that created a second information-gathering requirement (currently

paragraph (b) of NASD Rule 2310).

104

The new paragraph added in 1990 required firms