Principles for Dealing with

THE CHANGING

WORLD ORDER

RAY DALIO

© COPYRIGHT 2021

This PDF contains the charts and tables from the book for printing and easy reference.

1

THE CHANGING WORLD ORDER

1500 1600 1700 1800 1900 2000

Inflection during the

Industrial Revolution

Invention of

capitalism (founding

of Dutch Stock

Exchange)

Global real GDP is primarily a mix of European countries before 1870 due to limited

reliable data coverage across other countries before that point

GLOBAL REAL GDP PER CAPITA (LOG)

7

8

9

10

11

0

10

20

30

40

50

60

70

80

1500 1600 1700 1800 1900 2000

Baby

Boom

WWII

WWI,

Spanish flu

pandemic

Thirty Years’ War

Third Plague

pandemic

COVID-19

1557 influenza

pandemic

Flu outbreak

& famine

Dashed line based on experience of Great Britain only

GLOBAL LIFE EXPECTANCY AT BIRTH

CHAPTER 1

THE BIG CYCLE

IN A TINY NUTSHELL

2

THE CHANGING WORLD ORDER

0

100

200

300

400

1500 1600 1700 1800 1900 2000

War of the

Spanish

Succession

Napoleonic

Wars

World

War I

World

War II

Spanish flu

HIV/

AIDS

Indian

and

Chinese

famines

China’s

Great Leap

Forward

Series of Indian

famines

Cocoliztli

epidemics

Thirty Years’ War,

fall of Ming Dynasty,

Indian famine

GLOBAL DEATHS BY CATEGORY (RATE PER 100K PEOPLE, 15YMA)

Conflicts Natural Disasters Pandemics Famines

COVID-19

3

THE CHANGING WORLD ORDER

ESTIMATED DEATHS FROM CONFLICT

(MAJOR POWERS, %POPULATION, 15YMA)

Internal Conflict External Conflict Total

0.0%

0.1%

0.2%

0.3%

0.4%

0.5%

1400 1500 1600 1700 1800 1900 2000

Collapse of Ming Dynasty,

religious wars in Europe

Based on deaths as a share of the population for the major powers and thus will differ

from the estimate of global conflict deaths shown in the prior chart

Chinese

border

wars,

religious

wars in

Europe

Wars of

Religion in

France

Time of

Troubles in

Russia

European

monarchic

wars

Seven

Years’ War

in Europe

Napoleonic

Wars

Ethnic wars

in China

WWI

WWII, Holocaust,

communist revolutions

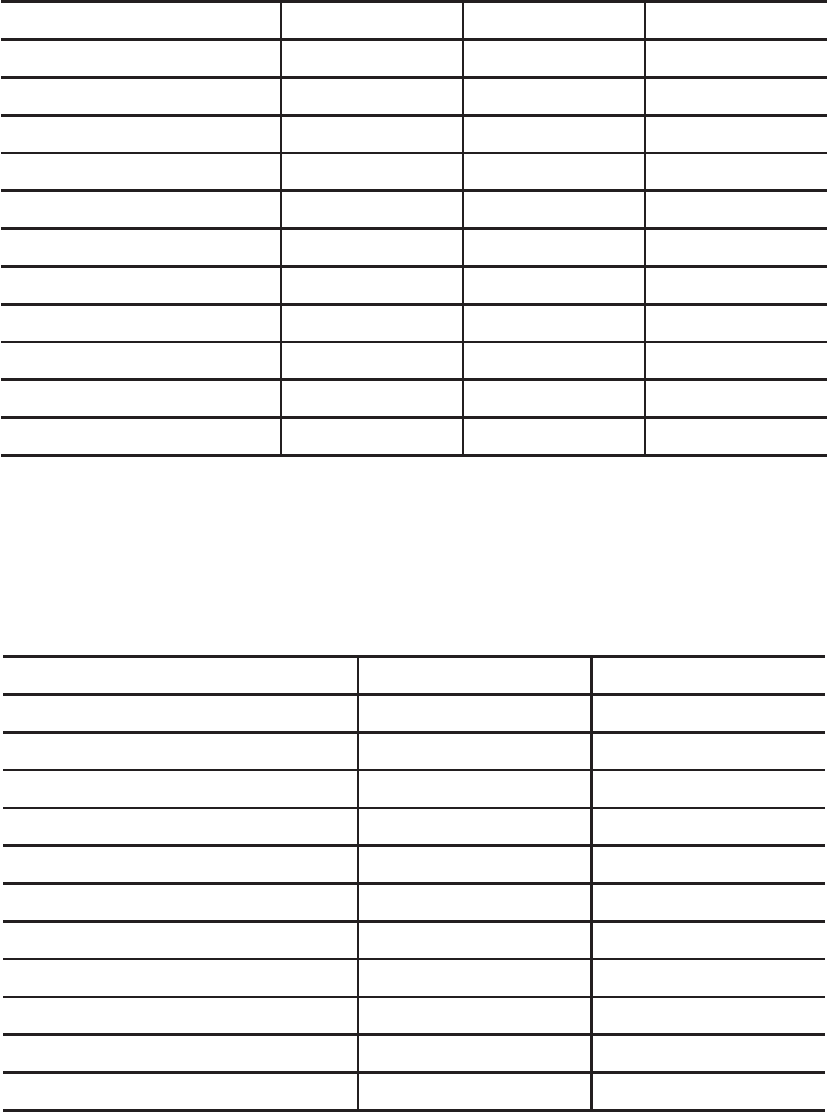

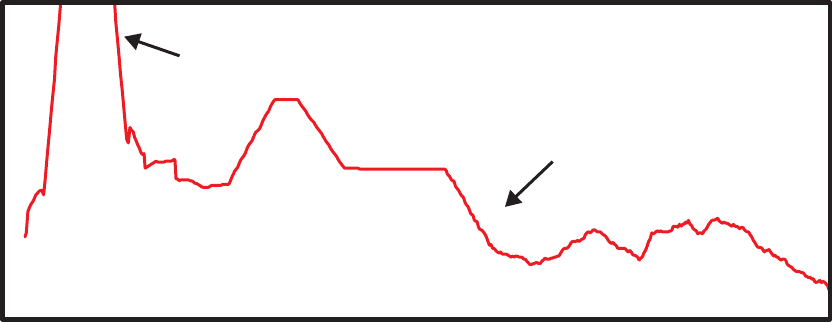

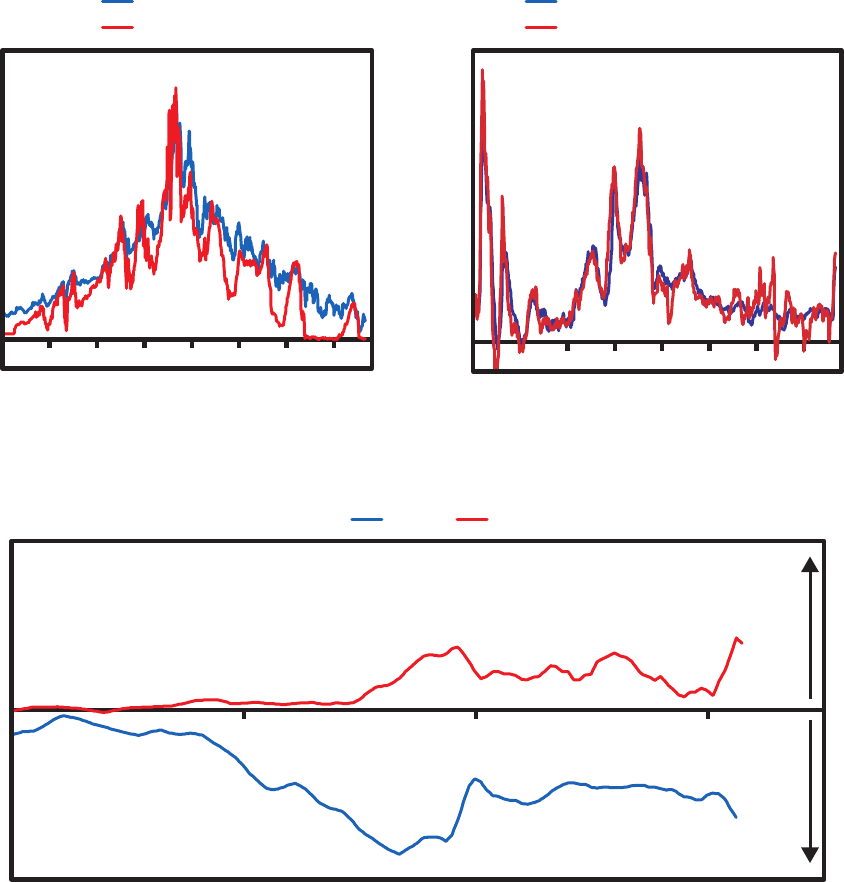

Global RGDP Per Capita (2017 USD, Log) USA Equities Cumulative Return

0

20

40

60

80

100

120

140

160

8.50

8.60

8.70

8.80

1929 1931 1933 1935 1937 1939 1941 1943 1945

~10% fall

~12% fall

4

THE CHANGING WORLD ORDER

0

1

1500 1600 1700 1800 1900 2000

Level Relative to Other Empires (1 = All-Time Max)

RELATIVE STANDING OF GREAT EMPIRES

FranceGermanySpainNetherlands

Ottoman EmpireJapanIndia

United KingdomChinaUnited StatesMajor Wars

Russia

United States

United Kingdom

Netherlands

China

5

THE CHANGING WORLD ORDER

0

1

-120 -80 -40 0408

01

20

Level Relative to Peak (1 = Peak)

Years (0 = Empire Peak)

THE ARCHETYPICAL RISE AND DECLINE BY DETERMINANT

Education Innovation and Technology Competitiveness Military

Trade Economic Output Financial Center Reserve FX Status

THE TOP

THE DECLINETHE RISE

New Orde

rN

ew Order

6

THE CHANGING WORLD ORDER

New Orde

rN

ew Order

Less productive

Overextended

Losing competitiveness

Wealth gaps

Strong leadership

Inventiveness

Education

Strong culture

Good resource allocation

Good competitiveness

Strong income growth

Strong markets and

financial centers

Large debts

Printing money

Internal conflict

Loss of reserve

currency

Weak leadership

Civil war/revolution

13

14

17

18

9

10

1

2

3

4

5

6

7

8

THE TOP

THE DECLINETHE RISE

11

12

15

16

9

11

12

10

13

15

14

16

18

17

1

2

3

4

5

6

8

7

7

THE CHANGING WORLD ORDER

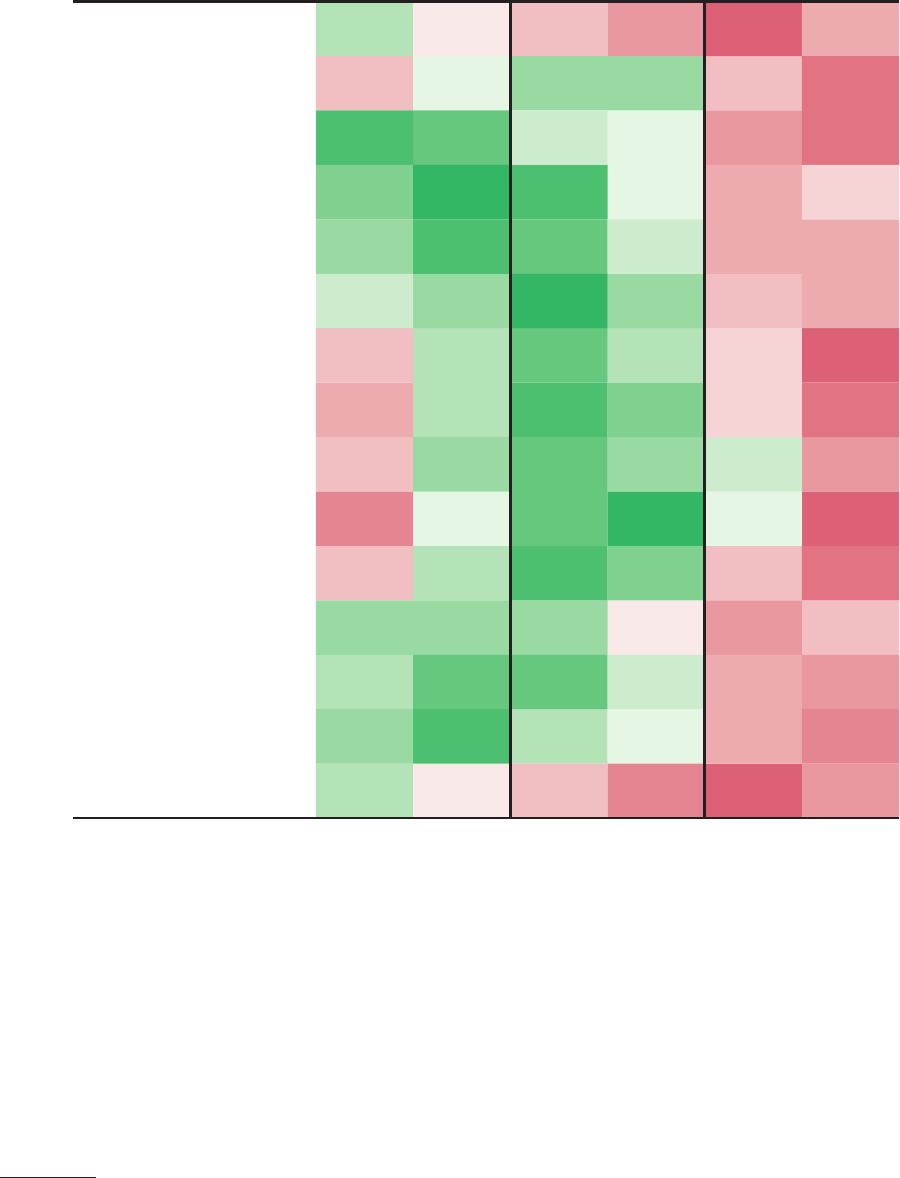

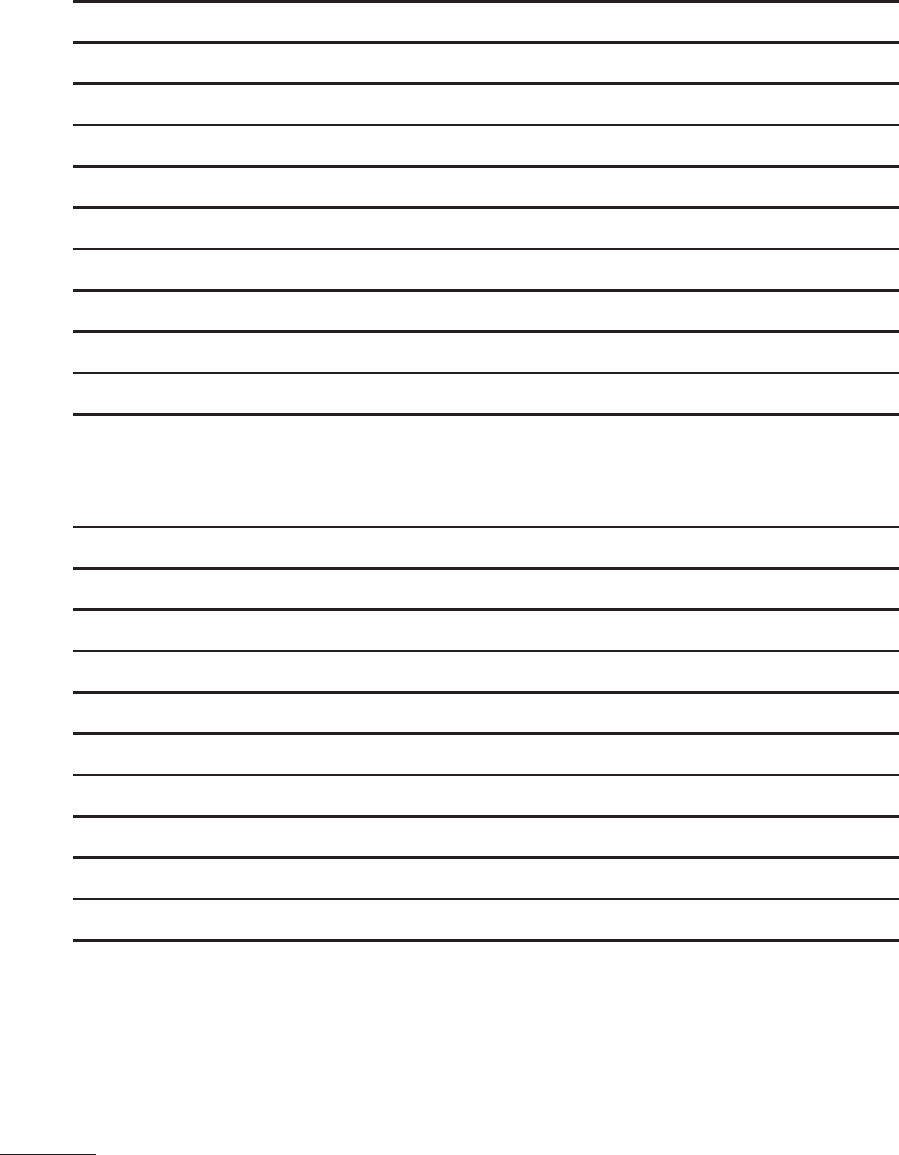

ROUGH QUANTITATIVE SCORING OF

MEASURES BY STAGE IN CYCLE

THE RISE THE TOP THE DECLINE

Debt Burden

(Big Economic Cycle)

Internal Conflict

(Internal Order Cycle)

Education

Innovation & Technology

Cost Competitiveness

Military Strength

Trade

Economic Output

Markets & Financial Center

Reserve Currency Status

Resource-Allocation Effi-

ciency

Infrastructure & Investment

Character/Civility/

Determination

Governance/Rule of Law

Gaps in Wealth,

Opportunity & Values

Dark green = gauge is strong/good

Dark red = gauge is weak/bad

1

1

Acts of nature, external order, and geology are not included in cycle analysis. Readings use proxies for determinants with limited history.

8

THE CHANGING WORLD ORDER

Relative Power

Time

New

World

Order

New

World

Order

United StatesUnited Kingdom

Netherlands

China

CHANGES TO THE WORLD ORDER (CONCEPTUAL EXAMPLE)

End of the Old,

Beginning of the New

(e.g., Dutch to British)

End of the Old,

Beginning of the New

(e.g., British to US)

■

Debt restructuring and debt

crisis

■

Internal revolution (peaceful

or violent) that leads to large

transfers of wealth from the

“haves” to the “have-nots”

■

External war

■

Big currency breakdown

■

New domestic and world

order

■

Debt restructuring and debt

crisis

■

Internal revolution (peaceful

or violent) that leads to large

transfers of wealth from the

“haves” to the “have-nots”

■

External war

■

Big currency breakdown

■

New domestic and world

order

9

THE CHANGING WORLD ORDER

How the Machine Works = (f)…

Case

1

Case

2

Case

3

Case

4

Case

5

Case

6

Case

7

Case

8

Case

9

Case 10,

Etc

Determinant 1 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 2 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 3 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 4 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 5 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 6 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 7 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 8 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 9 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Determinant 10 Effect Effect Effect Effect Effect Effect Effect Effect Effect Effect

Etc

CHAPTER 2

THE DETERMINANTS

10

THE CHANGING WORLD ORDER

Big Debt/Money/Capital Markets/Economic Cycle

THE THREE BIG CYCLES

Geology

ADDITIONAL DETERMINANTS

Education

OTHER KEY DETERMINANTS (EIGHT KEY MEASURES OF POWER)

Big Cycle of Internal Order and Disorder

Big Cycle of External Order and Disorder

Innovation & Technology

Cost Competitiveness

Military Strength

Trade

Economic Output

Markets and Financial Center

Reserve Currency Status

Resource-Allocation Efficiency

Acts of Nature

Unhealthy

Disorder

War

Low

Low

Weak

Weak

Unfavorable

Low

Weak

Weak

Unfavorable

Poor

Disruptive

Healthy

Order

Peace

High

High

Strong

Strong

Favorable

High

Strong

Strong

Favorable

Efficient

Beneficial

Infrastructure and Investment

Character/Civility/Determination

Governance/Rule of Law

Low

Weak

Weak

High

Strong

Strong

Gaps in Wealth, Opportunity & Values

Large

Small

11

THE CHANGING WORLD ORDER

DYNAMICS TO PAY ATTENTION TO

Self-Interest

Desire to Gain Wealth and Power

Learning from History

Multigenerational Psychological Cycle

Time Frame of Decision Making

Individual

Not important

Limited

Decadent

Short-Term

Country

Important

Extensive

Strong

Long-Term

Leadership

Weak

Competent

Openness to Global Thinking

Culture

Class Relationships

Closed

Unproductive

Divisive

Open

Productive

Cooperative

Political Left/Right

Prisoner’s Dilemma

Relationships

Partisan

At War

Lose-Lose

Moderate

Cooperative

Win-Win

Balance of Power

Peace/War Cycle

Unfavorable

War

Favorable

Peace

12

THE CHANGING WORLD ORDER

THE UNIVERSE

COUNTRY

STATE

EMPIRE

HUMANKIND

ALL LIVING THINGS

TRIBE

(i.e., community)

INDIVIDUAL

FAMILY

CHAPTER 2

DETERMINANTS ADDENDUM

13

THE CHANGING WORLD ORDER

Type 3: Fiat Money

(e.g., USD Today)

Maximizes Credit,

Minimizes Credibility

Type 1: Hard Money

(e.g., Metal Coins)

Maximizes Credibility,

Minimizes Credit

Type 2: Claims on Hard Money

(e.g., Banknotes)

Expands Credit,

Compromises Credibility

CHAPTER 3

THE BIG CYCLE OF MONEY,

CREDIT, DEBT, AND

ECONOMIC ACTIVITY

14

THE CHANGING WORLD ORDER

0%

20%

40%

60%

80%

100%

RESERVE CURRENCIES VS GOLD (SPOT FX)

NLD GBR USA

Dutch Empire ends/

collapse of Bank of

Amsterdam

US

Civil War

Great Depression

Inflationary

’70s

WWI

WWII

War of

1812

Napoleonic

Wars

1600 1700 1800 1900 2000

-100%

-80%

-60%

-40%

-20%

0%

20%

40%

1860 1880 1900 1920 1940 1960 1980 2000 2020

SPOT FX VS GOLD

USA GBR DEU FRA ITA

JPN CHE ESP NLD CHN

(1)

(2)

(3)

(5)

(6)

(4)

CHAPTER 4

THE CHANGING

VALUE OF MONEY

15

THE CHANGING WORLD ORDER

2

1

10

100

1,000

10,000

1850 1870 1890 1910 1930 1950 1970 1990 2010 2030

FX TOTAL RETURN VS GOLD (LOG)

ITAUSA GBR DEU FRA

JPN CHEESP NLD

-60%

-40%

-20%

0%

20%

1850 1860 1870 1880 1890 1900 1910

SPOT FX VS GOLD (1850–1913)

ITAUSA GBR DEU FRA

JPN CHE ESP NLD

Broad stability

US Civil War

Falling silver

prices produce

Japanese devaluation

Fiscal crisis

in Spain

2

Due to a lack of data, several charts in this chapter do not show China.

16

THE CHANGING WORLD ORDER

-100%

0%

100%

200%

SPOT FX VS GOLD (1913–1930)

USA GBR DEU FRA ITA

JPN CHE ESP NLD CHN

Post-WWI devaluations

and German hyperinflation

Broad stability

during 1920s

1913 1915 1917 1919 1923 1925 1927 19291921

-100%

-80%

-60%

-40%

-20%

0%

20%

SPOT FX VS GOLD (1930–1950)

USA GBR DEU FRA ITA

JPN CHE ESP NLD CHN

1930 1935 1940 1945 1950

DEU FX restructured in 1948,

effectively confiscating

nearly all financial wealth

17

THE CHANGING WORLD ORDER

-100%

-80%

-60%

-40%

-20%

0%

20%

19681966 1970 1972 1974 1976

SPOT FX VS GOLD (1966–1977)

USA GBR DEU FRA ITA

JPN CHE ESP NLD CHN

End of Bretton Woods

-100%

-50%

0%

50%

98 02 06 10 14 2218

-4%

-2%

0%

2%

4%

6%

REAL LONG RATES

(1998–PRESENT)

SPOT FX VS GOLD

(1998–PRESENT)

98 02 06 10 14 18

USA GBR DEU FRA ITA

JPN CHE ESP NLD CHN

18

THE CHANGING WORLD ORDER

CURRENCY AND GOLD REAL RETURNS OF MAJOR COUNTRIES

SINCE 1850 (VS CPI, ANN)

Country

Real Returns (vs CPI), Ann

1850–Present 1850–1912 1912–Present

Continuous

Govt Bill

Investment

Gold

Continuous

Govt Bill

Investment

Gold

Continuous

Govt Bill

Investment

Gold

United Kingdom 1.4% 0.7% 3.1% -0.1% 0.5% 1.1%

United States 1.6% 0.3% 3.6% -1.0% 0.4% 1.0%

Germany -12.9% 2.0% 3.0% -0.9% -18.2% 3.1%

France -0.7% 0.6% 2.6% -0.3% -2.6% 1.1%

Italy -0.6% 0.3% 4.7% -0.5% -2.6% 0.5%

Japan -0.7% 1.0% 5.0% 0.4% -2.2% 1.2%

Switzerland 1.5% 0.0% 3.4% -0.5% 0.5% 0.3%

Spain 1.4% 1.1% 4.5% 0.1% 0.3% 1.5%

Netherlands 1.4% 0.5% 3.3% 0.0% 0.4% 0.7%

China — 3.3% — — — 3.3%

Average 1.2% 0.9% 3.6% -0.3% -0.1% 1.6%

Data for Switzerland is since 1851; data for Germany, Spain, and Italy is since 1870; data

for Japan is since 1882; data for China is since 1926 (excluding 1948–50). Average return is

un-rebalanced and doesn’t include China.

10

100

1,000

10,000

REAL RETURN OF GOLD (VS CPI, LOG)

USA GBR DEU FRA ITA

JPN CHE ESP NLD CHN

1860 1880 1900 1920 1940 1960 1980 2000 2020

19

THE CHANGING WORLD ORDER

1850 1870 1890 1910 1930 1950 1970 1990 2010 2030

0

4

8

12

16

20

REAL RETURN OF BILLS (VS CPI)

ITAUSA GBR DEU FRA

JPN CHE ESP NLD

20

THE CHANGING WORLD ORDER

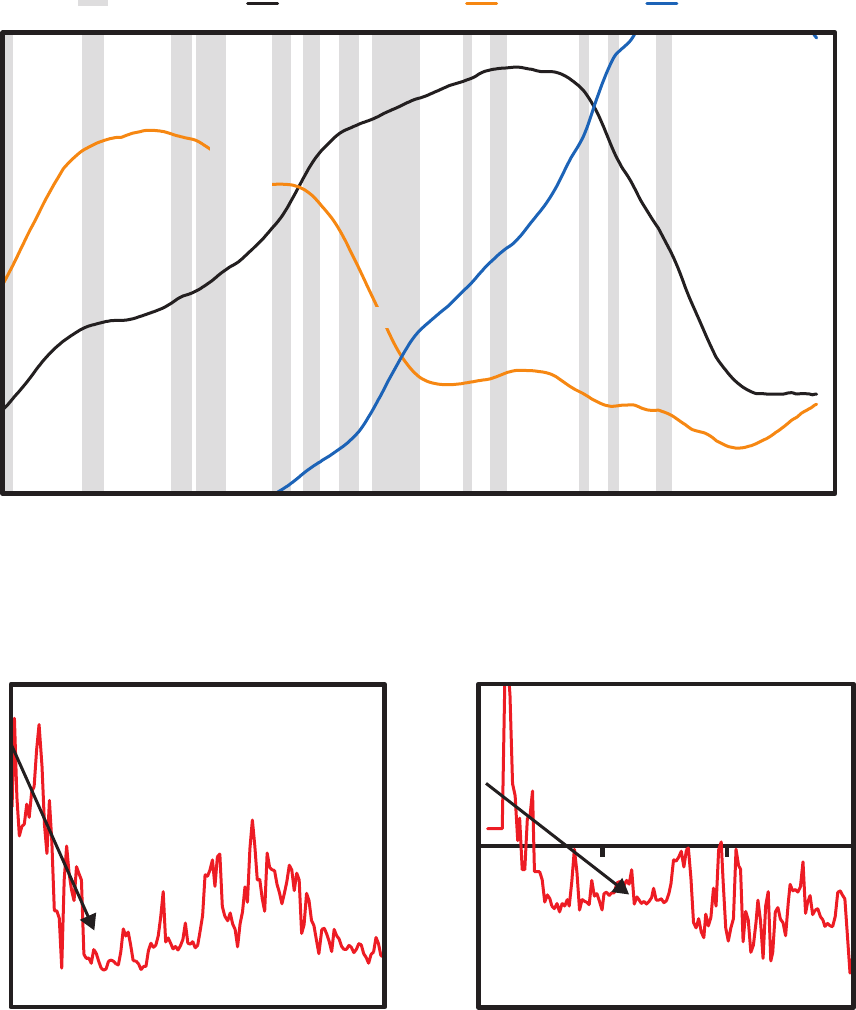

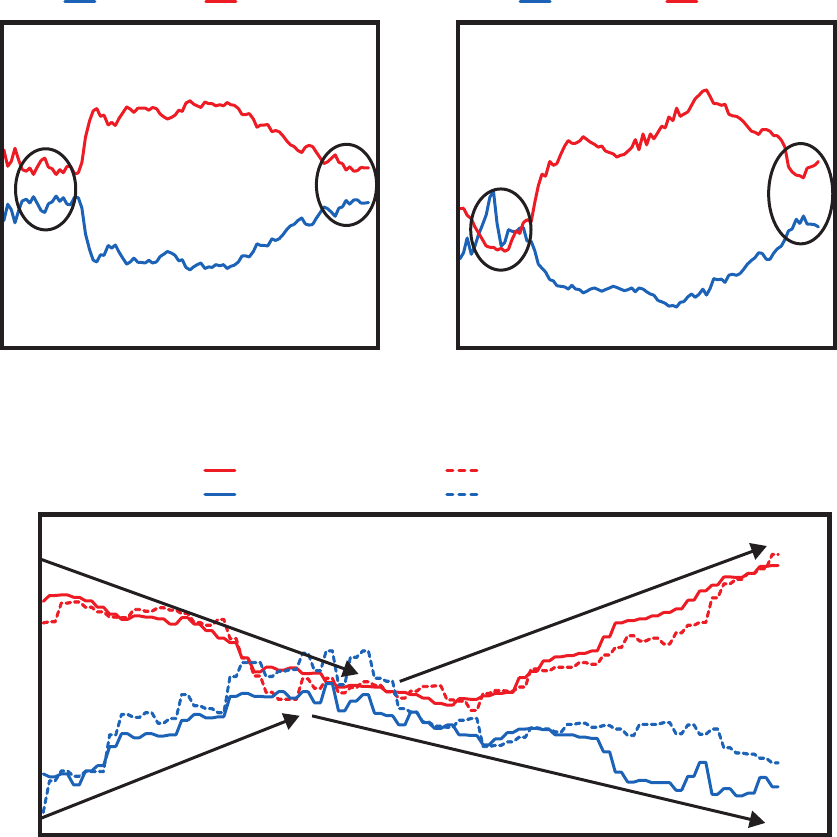

THE TOP

THE DECLINETHE RISE

CHN

USA

Peace and prosperity

Excesses and widening

of wealth and other gaps

New internal order

and new leadership

Resource-allocation

systems and government

bureaucracies are

built and refined

Bad financial

conditions and

intense conflicts

Civil wars and

revolutions

5

6

3

4

1

2

THE TOP

THE DECLINETHE RISE

3 4

2 5

61

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

4

5

61

4

1

2

3

5

6

2

3

4

5

6

CHAPTER 5

THE BIG CYCLE OF INTERNAL

ORDER AND DISORDER

21

THE CHANGING WORLD ORDER

MAJOR CHINESE DYNASTIES AND THEIR STAGES

(WITH INDICATIVE UPWARD EVOLUTION)

Tang

Dynasty

Ming

Dynasty

Qing

Dynasty

Song

Dynasty

Yuan

Dynasty

RC PRC

1000 1200 1400 1600 1800 2000600800

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

5

6

4

1

2

3

4

6

5

1

2

3

MAJOR CHINESE DYNASTIES AND THEIR STAGES

Tang

Dynasty

Ming

Dynasty

Qing

Dynasty

Song

Dynasty

Yuan

Dyn

RCPRC

1000 1200 1400 1600 1800 2000

0

1

Level Relative to Other Empires

(1 = All-Time Max)

600800

1

2

3

5

6

1

2

3

4

4

5

6

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

22

THE CHANGING WORLD ORDER

GLOBAL RGDP PER CAPITA (2017 USD, LOG)

1500 1600 1700 1800 1900 2000

7

8

9

10

11

Emergence

of German

Empire, 2nd

Industrial

Revolution

Panic

of 1873

Peak

of Qing

Dynasty

Invention

of printing

press

(1440)

Dutch

Revolt,

war with

Ottomans

Beginning

of capitalism

(Amsterdam

Stock

Exchange)

Thirty

Years’

War

Collapse

of Ming

Dynasty,

English

Civil War

2nd

Anglo-

Dutch

War

Taj

Mahal,

peak of

Mughal

Empire

Glorious

Revolution,

Great

Turkish

War

South

Sea

Bubble

Seven

Years’

War

American

Revolution

French

Revolution,

collapse of

Dutch Rep

Revolutions

of 1848

1st Industrial Revolution

Taiping

Rebellion,

2nd

Opium

War

Roaring

’20s

Peak of

American

Empire

Digital

Revolution

2008

crisis

Deng

Xiaoping

reforms

Meiji

Restoration

Great

Depression

World

War II

COVID-

19

Collapse

of Qing,

WWI, and

post-war

recession

Napoleonic Wars

Global RGDP is primarily a mix of European countries before 1870 due to limited

reliable data coverage across other countries before that point.

23

THE CHANGING WORLD ORDER

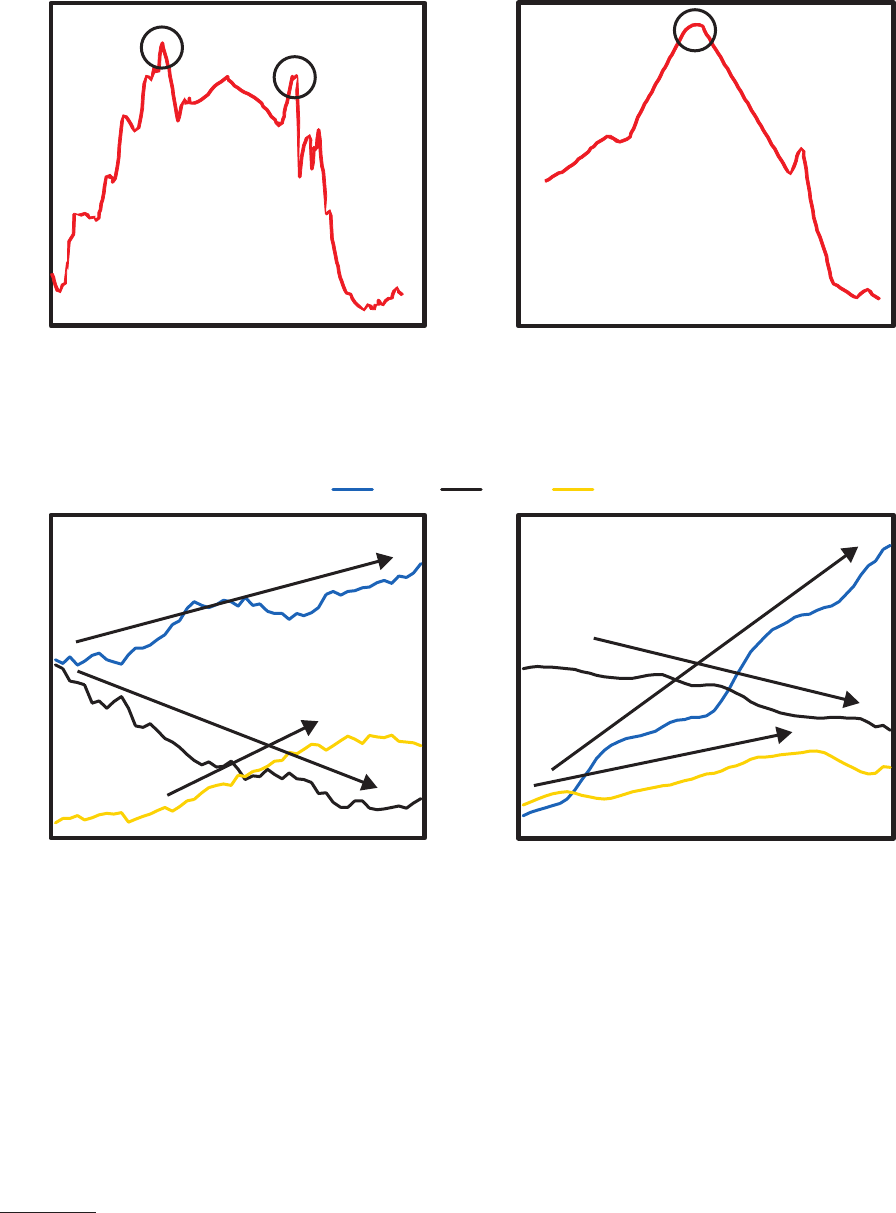

HISTORICAL LIKELIHOOD OF INTERNAL CONFLICT BASED ON SHARE OF

ECONOMIC MEASURES WORSE THAN THRESHOLD (>1Z)

12%

11%

17%

30%

<40% 40–60% 60–80% >80%

Likelihood of Conflict in Next 5 Years

Share of Economic Measures Worse Than Threshold (>1z)

As you go from fewer problems with economic measures to

problems across all measures, the risk of conflict nearly triples

0%

10%

20%

30%

40%

3

3

is chart is based on historical analysis of nine great powers (covering about 2,200 years of history in total). e likelihood of conflict is based on

major cases of civil war, rebellion, and revolution but excludes peaceful revolutions that did not change the existing system. e analysis does not

count the probability of conflict arising in a period when a country is already in the midst of internal conflict (and the five years following) to avoid

counting periods in which economic conditions were bad because of the conflict itself.

24

THE CHANGING WORLD ORDER

CONFLICT COUNTRY BEGAN IN…

Dutch Revolt NLD 1566

English Civil War GBR 1642

Glorious Revolution GBR 1688

American Revolution USA 1775

French Revolution FRA 1789

Cas

-

es that

created

changes

to the

system or

regime

Trienio Liberal ESP 1820

French Revolution of 1848 FRA 1848

Meiji Restoration JPN 1868

Xinhai Revolution CHN 1911

Russian Revolution and Civil War RUS 1917

German Revolution/End of Monarchy DEU 1918

Rise of Hitler/Political Violence DEU 1929

Rise of Japanese Militarists JPN 1932

Spanish Civil War ESP 1936

Chinese Civil War CHN 1945

Jacobite Risings GBR 1745

Pugachev’s Rebellion RUS 1773

Dutch Patriot Revolt NLD 1781

White Lotus Rebellion CHN 1794

German Revolutions of 1848 DEU 1848

Cases

that didn’t

create

changes

to the

system or

regime

Taiping Rebellion CHN 1851

Panthay Rebellion CHN 1856

US Civil War USA 1861

Muslim Rebellion CHN 1862

Paris Commune FRA 1871

Boxer Rebellion CHN 1899

1905 Russian Revolution RUS 1905

National Protection War CHN 1915

6 February 1934 Crisis FRA 1934

25

THE CHANGING WORLD ORDER

EST EUROPEAN DEATHS FROM CONFLICT

(%POP, 15YR MOVING AVG)

Internal Conflict External Conflict Total

0.0%

0.1%

0.2%

0.3%

0.4%

1400 1500 1600 1700 1800 1900 2000

Renaissance,

Age of

Exploration

Wars of Religion,

Thirty Years' War

Enlightenment,

capitalism,

Industrial

Revolution

Napoleonic

Wars

World

Wars

Pax

Britannica,

Second

Industrial

Revolution

EU

integr-

ation

CHAPTER 6

THE BIG CYCLE OF EXTERNAL

ORDER AND DISORDER

26

THE CHANGING WORLD ORDER

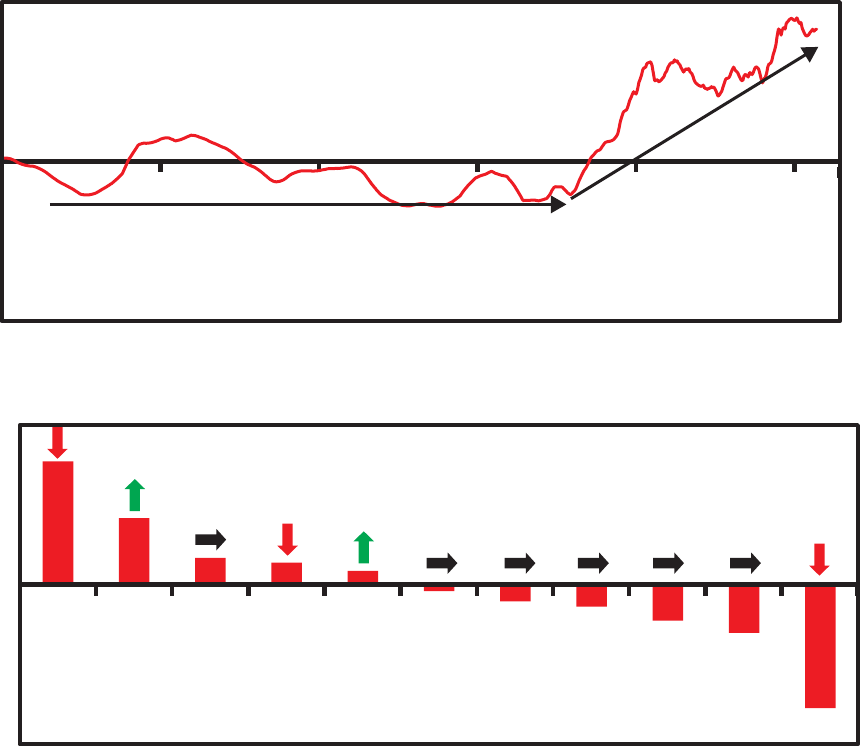

DEU EQUITY RETURNS

(LOCAL FX,

CUMULATIVE EXCESS)

DEU PER CAPITA INCOME

(2017 USD)

1933 1935 1937 1939 1933 1935 1937 1939

5,500

6,500

7,500

8,500

-20%

0%

20%

40%

60%

80%

Equities rise nearly

70% between

January 1933

and 1938

Per capita income rises 22%

between 1933 and 1938

WARTIME ECONOMIC CONTROLS

Rationing

Production

Controls

Price/Wage

Controls

Import or

Export

Restrictions

Takeover of

Central Bank

Allies

United States Yes Yes Yes Yes Yes

United Kingdom Yes Yes Yes Yes Partial

Axis

Germany Yes Yes Yes Yes Ye s

Japan Yes Yes Yes Yes Yes

REGULATIONS IMPACTING ASSETS

Market

Closures

Asset

Price

Controls

Asset

Ownership

Restrictions

FX

Controls

Top

Marginal

Tax Rate

Limits on

New

Issuance

Limits

on Corp

Profits

Allies

United States No Yes Yes Yes 94% — Yes

United Kingdom Yes Yes Yes Yes 98% Yes Yes

Axis

Germany Yes Yes Yes Yes 60% Ye s Yes

Japan Yes Yes Yes Yes 74% Yes Yes

27

THE CHANGING WORLD ORDER

0.0

1.0

2.0

3.0

1940 1942 1944 1946 1948 1950

Markets closed

in Germany

and Japan

Equities in

Germany

perform well

as the Axis

powers

dominate from

1939 to 1942

...while the Japanese

war boom fades more

quickly, with strict

government controls

keeping equity prices flat

In contrast, both US and

UK equities rally almost

continuously after the

1942 Battle of Midway

until the end

of the war...

Massive declines

when markets

reopen

EQUITY RETURN INDEX (USD)

USA GBR DEU JPN

28

THE CHANGING WORLD ORDER

Risk Premiums &

Discount Rates

EUR

USA

Individual

Sectors

CHN

JPN

Rising

Growth

Assets

Rising

Inflation

Assets

Falling

Growth

Assets

Falling

Inflation

Assets

USA

Equities

Credit

Spreads

THE BUILDING BLOCKS OF A WELL-DIVERSIFIED PORTFOLIO

CHAPTER 7

INVESTING IN LIGHT OF THE BIG CYCLE

29

THE CHANGING WORLD ORDER

A LOOK AT ASSET RETURNS ACROSS THE GREAT POWERS

(Real Returns, 10-Year Window, Ann)

UNITED STATES GREAT BRITAIN JAPAN GERMANY

Equity Bond Cash Equity Bond Cash Equity Bond Cash Equity Bond Cash

1900–10 9% 0% 1% 3% 2% 2% 4% 1% 4% 3% 2%

1910–20 -2% -4% -3% -6% -7% -5% 1% -5% -4% -14% -10% -14%

1920–30 16% 7% 5% 10% 8% 7% -3% 12% 10% -24% -95% -86%

1930–40 0% 7% 3% 1% 5% 1% 6% 4% -1% 7% 11% 6%

1940–50 3% -2% -5% 3% -1% -4% -28% -34% -33% -4% -16% -19%

1950–60 16% -1% 0% 13% -1% -1% 27% -1% 5% 26% 5% 2%

1960–70 5% -1% 2% 4% 0% 2% 8% 8% 2% 3% 5% 1%

1970–80 -2% -1% -1% -4% -3% -3% 3% -2% -1% -7% 4% 0%

1980–90 13% 9% 4% 16% 8% 5% 19% 9% 4% 10% 6% 3%

1990–00 14% 6% 2% 12% 8% 5% -7% 9% 2% 13% 7% 3%

2000–10 -3% 8% 0% 0% 4% 2% -3% 4% 1% -2% 6% 2%

2010–20 11% 4% -1% 5% 5% -1% 10% 2% 0% 7% 5% -1%

A LOOK AT ASSET RETURNS ACROSS THE GREAT POWERS

(Real Returns, 10-Year Window, Ann)

FRANCE NETHERLANDS ITALY

Equity Bond Cash Equity Bond Cash Equity Bond Cash

1900–10 1% 3% 2% 5% 1% 1% 3% 4%

1910–20 -7% -8% -6% 1% -6% -3% -9% -8% -6%

1920–30 -2% -1% -4% 1% 11% 6% -6% -5% -1%

1930–40 -10% 2% 0% 2% 6% 3% 4% 5% 5%

1940–50 -20% -22% -23% 2% -3% -6% -13% -30% -30%

1950–60 17% 0% -2% 14% 0% -2% 20% 2% 1%

1960–70 0% 2% 1% 2% 0% 0% 0% 2% 0%

1970–80 -2% -3% 0% -3% 2% -2% -13% -8% -1%

1980–90 16% 9% 5% 16% 7% 5% 15% 4% 6%

1990–00 13% 10% 5% 20% 7% 4% 9% 15% 6%

2000–10 -2% 5% 1% -6% 5% 1% -4% 5% 1%

2010–20 7% 6% -1% 8% 5% -1% 3% 8% -1%

30

THE CHANGING WORLD ORDER

RUSSIA CHINA AUSTRIA-HUNGARY

Equity Bond Cash Equity Bond Cash Equity Bond Cash

1900–10 -2% 3% 4% 7% 6% 3% 4% 3% 2%

1910–20 -100% -100% -36% 3% 1% 4% -9% -10% -8%

1920–30 9% 6% 1% -6% -44% -44%

1930–40 2% -7% -6%

1940–50 -100% -100% -73%

1950–60

1960–70

1970–80

1980–90

1990–00

2000–10 15% -2% 4% 1%

2010–20 7% 4% 1% 2% 2% 0%

4

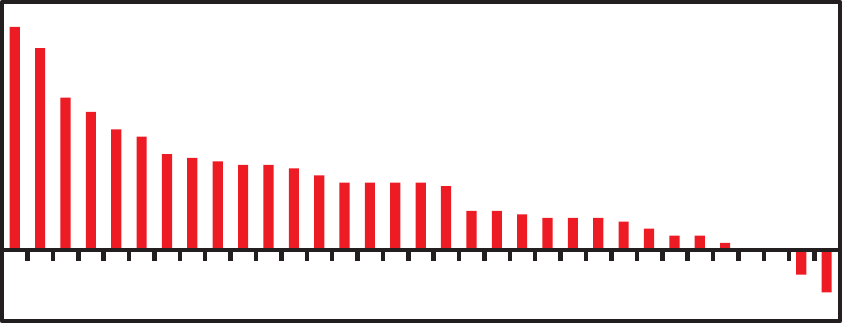

SHARE OF PORTFOLIOS LOSING X% OVER 5 YEARS BY COUNTRY

(60/40 PORTFOLIO, REAL RETURNS)

-50% or worse-90% or worse -25% or worse -10% or worse

0%

20%

40%

60%

80%

100%

1900 1920 1940 1960198020002020

4

For China and Russia, bond data pre-1950 is modeled using hard currency bond returns held as though hedged back to local currency by a domestic

investor; stocks and bonds modeled as full default at time of revolution. Annualized returns assume a full 10-year period even if markets closed during

the decade.

31

THE CHANGING WORLD ORDER

WORST INVESTOR EXPERIENCES (ACROSS MAJOR COUNTRIES)

Major Cases of 60/40 Real Returns Below -40% over a 20-Year Window

Country 20yr Window

Worst 20yr

Return

(Real, Cumul)

Detail

Russia 1900–1918 -100%

The Russian Civil War ended with communist rule,

debt repudiation, and the destruction of financial

markets.

China 1930–1950 -100%

Asset markets closed during WWII and were de

-

stroyed when communist rule took hold in the late

1940s.

Germany 1903–1923 -100%

Weimar Republic hyperinflation led to a collapse in

assets following WWI.

Japan 1928–1948 -96%

Japanese markets and currency collapsed as

markets reopened post-WWII and inflation soared.

Austria 1903–1923 -95%

Similar to Weimar Germany (though less infamous);

hyperinflation led to poor asset returns post-WWI.

France 1930–1950 -93%

The Great Depression, followed by WWII and

German occupation, led to poor returns and high

inflation.

Italy 1928–1948 -87%

Similar to those of other Axis powers, Italian markets

collapsed as WWII concluded.

Italy 1907–1927 -84%

Post-WWI, Italy suffered from economic depression

and high inflation, helping lead to Mussolini’s rise.

France 1906–1926 -75%

The early 20th century saw WWI, followed by France’s

inflationary currency crisis in the early 1920s.

Italy 1960–1980 -72%

Italy endured a series of recessions, high

unemployment rate and inflation, and currency

declines in the 1960–70s.

India 1955–1975 -66%

Post-independence, a series of major droughts

caused weak Indian economic growth and

high inflation.

Spain 1962–1982 -59%

The post-Franco transition to democracy coupled

with the inflationary 1970s strained Spain’s economy.

Germany 1929–1949 -50%

The Great Depression followed by the devastation of

WWII led to a terrible period for German assets.

France 1961–1981 -48%

Like other European nations, the 1960–70s saw weak

-

er growth, currency declines, and high inflation.

UK 1901–1921 -46%

The early 20th century saw World War I, followed by

the depression of 1920–21.

5

5

Cases of poor asset returns in smaller countries such as Belgium, Greece, New Zealand, Norway, Sweden, Switzerland, and across the emerg-

ing world are excluded from this table. Note that for conciseness the worst 20-year window is shown for each country/time period (i.e., including

Germany in 1903–23 precludes including Germany from 1915–35). For our 60/40 portfolios, we assumed monthly rebalancing across the 20-year

window.

32

THE CHANGING WORLD ORDER

PERIODS OF WEALTH CONFISCATION

1900 1920 1940 1960 1980 2000

UK

USA Yes Yes

China Yes Yes

Germany Yes

France

Russia Yes Yes Yes

Austria-Hungary

Italy Yes

Netherlands

Japan Yes

6

PERIODS OF STRICT/RISING CAPITAL CONTROLS

1900 1920 1940 1960 1980 2000

UK Yes Yes Yes Yes

USA Yes Yes

China Yes Yes Yes

Germany Yes Yes Yes Yes

France Yes Yes

Russia Yes Yes Yes Yes Yes Ye s

Austria-Hungary Yes

Italy Yes

Netherlands Yes

Japan Yes Yes

6

While this diagram is not exhaustive, I include instances where I could find clear evidence of each occurring in the 20-year period. For this analysis, wealth

confiscation was defined as extensive seizure of private assets, including large-scale forced, non-economic sales by a government (or revolutionaries in the

case of revolution). Relevant capital controls were defined as meaningful restrictions on investors moving their money to and from other countries and assets

(although this does not include targeted measures directed only at single countries, such as sanctions).

33

THE CHANGING WORLD ORDER

STOCK MARKET CLOSURES ACROSS MAJOR ECONOMIES

Count

Share of Global GDP

10%

20%

30%

40%

50%

0

1

2

3

4

5

6

7

1900 1920 1940 1960 1980 2000 2020

World War I

World War II

9/11

Fall of USSR,

reopening of China's

equity markets

0%

DEATHS IN MAJOR VIOLENT CONFLICTS (%POPULATION)

INTERNAL AND EXTERNAL

1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010

UK 0% 2% 0% 0% 1% 0% 0% 0% 0% 0% 0% 0%

USA 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

China 0% 0% 1% 2% 3% 1% 1% 1% 0% 0% 0% 0%

Germany 0% 3% 0% 9% 15% 0% 0% 0% 0% 0% 0% 0%

France 0% 4% 0% 0% 1% 0% 0% 0% 0% 0% 0% 0%

Russia 0% 4% 5% 10% 13% 0% 0% 0% 0% 0% 0% 0%

Austria-Hungary 0% 2%

Italy 0% 2% 0% 0% 1% 0% 0% 0% 0% 0% 0% 0%

Netherlands 0% 0% 0% 1% 2% 0% 0% 0% 0% 0% 0% 0%

Japan 0% 0% 0% 1% 4% 0% 0% 0% 0% 0% 0% 0%

34

THE CHANGING WORLD ORDER

7

IMPACT OF TAXES ON ROLLING 20-YEAR S&P TOTAL RETURNS

Pre-Tax

Post-Tax

(401[k])

Post-Tax

(Brokerage)

Avg Ann Total Return 9.5% 8.2% 7.9%

Avg Drag from Taxes (Ann Total Return) -1.3% -1.6%

Avg Drag from Taxes (% of Total Returns) -14% -17%

Avg Ann Real Return 6.2% 4.9% 4.6%

Avg Drag from Taxes (Ann Real Return) -1.2% -1.6%

Avg Drag from Taxes (% of Real Returns) -20% -26%

USA FINANCIAL ASSETS SHARE OF TOTAL ASSETS

40%

45%

50%

55%

60%

65%

1900 1920 1940 1960 1980 2000 2020

1929 stock

market bubble

WWII

WWI

FDR

Nifty Fifty

1970s

devaluation

Volcker tightening/

Reagan Revolution

Dot-com

bubble

Housing

bubble

7

Tax impact for 401(k) method applies a 26 percent income tax rate (effective average federal tax rate for top quintile from the Congressional Budget

Office as of 2017) at the conclusion of each 20-year investment period (i.e., tax-free investment growth). Tax impact for brokerage method separately

taxes dividends (at the same 26 percent income tax rate) and capital gains, paying taxes on all capital gains (at a 20 percent rate) from both principal and

dividend reinvestment at the conclusion of each 20-year investment period and netting losses against any gains.

35

THE CHANGING WORLD ORDER

REAL RETURN OF BILLS (VS CPI)

USA GBR DEU FRA ITA JPN CHE ESP NLD

-100%

0%

100%

200%

300%

1900 1920 1940 1960198020002020

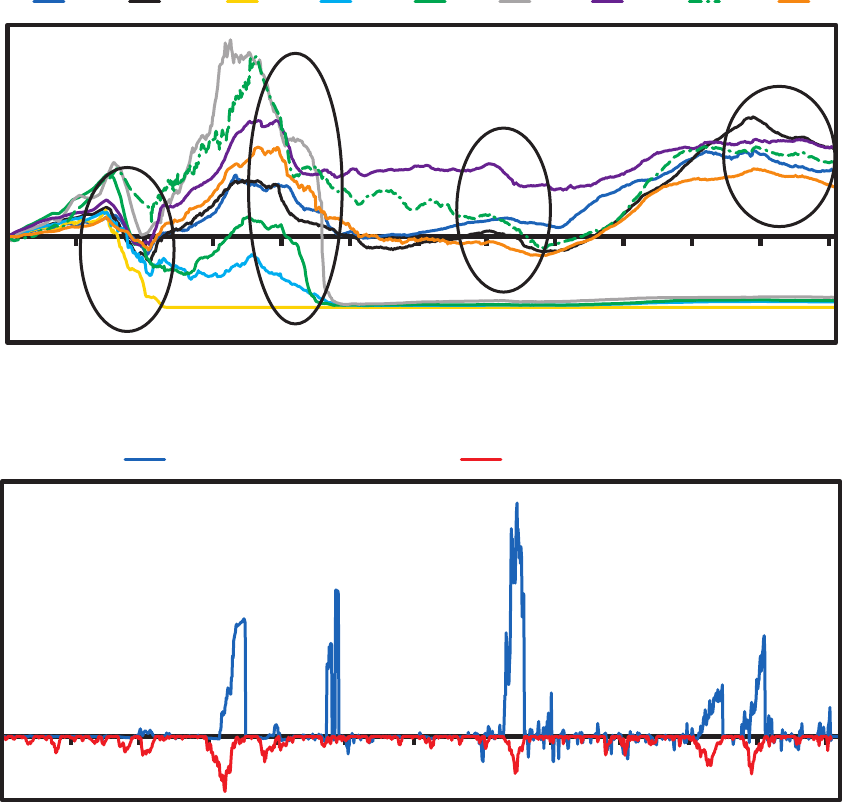

GOLD RETURNS DURING 60/40 DRAWDOWNS

Gold Returns (in Global FX) Global 60/40 Drawdowns

-50%

0%

50%

100%

150%

200%

1900 1920 1940 1960198020002020

36

THE CHANGING WORLD ORDER

REAL BOND YIELD

USA EUR JPN

NOMINAL BOND YIELD

-2%

0%

2%

4%

6%

8%

1900 1925 1950 1975 2000 2025

0%

4%

8%

12%

16%

1900 1925 1950 1975 2000 2025

Near

lowest

ever

Near

lowest

ever

REAL CASH RATE

USA EUR JPN

NOMINAL CASH RATE

Near

lowest

ever

Lowest

since

WWII

-8%

-4%

0%

4%

8%

1900 1925 1950 1975 2000 2025

-3%

0%

3%

6%

9%

12%

15%

18%

1900 1925 1950 1975 2000 2025

37

THE CHANGING WORLD ORDER

NOMINAL PAYBACK

PERIOD (YEARS)

CashBonds

REAL PAYBACK

PERIOD (YEARS)

0

20

40

60

80

100

00 20 40 60 80 00 20

0

40

80

120

160

200

00 20 40 60 80 00 20

Will never get your

buying power back

38

THE CHANGING WORLD ORDER

England

Portugal

Habsburg

Spain

France

Genoa

Venice

German

(non-Habsburg)

Holy Roman

Empire

Ottoman Empire

Russia

Poland-Lithuania

Sweden

Habsburg

Central

Europe

Habsburg

Low

Countries

Habsburg

Italy

Papal

States

Ming China

Fragmented

smaller states

CHAPTER 8

THE LAST 500 YEARS

IN A TINY NUTSHELL

39

THE CHANGING WORLD ORDER

BOOK/MANUSCRIPT PRODUCTION IN

MAJOR EUROPEAN COUNTRIES (MLN)

0

100

200

300

400

500

600

1000 1100 1200 1300 1400 1500 1600 1700 1800

Printing press

Hundreds of millions of

texts produced in each of

the subsequent centuries

500600 700800 900

UK CONSUMER

PRICE INDEX

0.0

0.2

0.4

0.6

0.8

1.0

1300 1400 1500 1600 1700

Spanish

Price

Revolution

SILVER PRODUCTION

FROM MEXICO AND

PERU (METRIC TON)

1520 1600 1680 1760

0

2,000

4,000

6,000

8,000

40

THE CHANGING WORLD ORDER

0

2

4

6

8

10

1360 1416 1472 1528 1584 1640 1696 1752 1808 1864

Treasure voyages and

early Ming expansion

Ming-Qing transition

ROUGH COUNT OF TRIBUTARY AREAS

(BASED ON TRIBUTARY VOYAGES OVER 30YR WINDOW)

41

THE CHANGING WORLD ORDER

Level Relative to Own History (1 = Max)

THE NETHERLANDS: INDEX OF KEY DETERMINANTS

0

1

1500 1600 1700 1800 1900 2000

Major Wars Education Innovation and Technology

Competitiveness Military Trade

Economic Output Financial Center Reserve FX Status

CHAPTER 9

THE BIG CYCLE RISE AND

DECLINE OF THE DUTCH

EMPIRE AND THE GUILDER

42

THE CHANGING WORLD ORDER

DUTCH ARC 1550–1850

Major Wars Netherlands Habsburg Spain United Kingdom

Level Relative to Other Empires (1 = Max)

0.2

0.3

0.4

0.5

0.7

0.6

1550 1600 1650 1700175018001850

Thirty

Years’

War

Innovation

Ships & first

global

corporation

Rising

Inequality

New Order

Congress of

Vienna

External Conflict

4th Anglo-

Dutch War

(1)

(2)

(3)

(4)

(5)

(6)

Economic

Problems

Run on Bank

of Amsterdam

Napoleonic

Wars

Global Empire &

Military Strength

New Order

Dutch

independence

Year of

Disaster

(1672)

Economic

Prosperity &

Reserve FX

War of the

Spanish

Succession

Dutch

Rebellion

& Eighty

Years’ War

HABSBURG SPAIN’S ARC IN THE 1500S AND 1600S

Major Wars Spain Netherlands

Level Relative to Other Empires (1 = Max)

0.1

0.2

0.3

0.4

0.5

0.7

0.6

1500 1540 1580162016601700

New

Order

Union

of Spain

& Holy

Roman

Empire

Innovation

Ships &

Age of

Exploration

Global

Empire

Economic Problems

Multiple sovereign defaults

Internal

Conflict

Start of

Dutch

Revolt

Weak

Leadership

Philip II & III

External

Conflict

New Order

Peace of

Westphalia

Habsburgs

inherit

Spain

Conquest

in the

Americas

Spanish

Armada

defeated

Thirty

Years’

War

Catalan &

Portuguese

rebellion

Habsburg

rule over

Spain ends

(1)

(2)

(3)

(4)

(5)

(6)

43

THE CHANGING WORLD ORDER

SHARE OF MAJOR INVENTIONS

(TRAILING 30 YEARS)

0%

4%

8%

12%

16%

1400 1500 1600 1700 1800 1900

EMPIRE SIZE

(% WORLD, EST)

1400 1500 1600 1700 1800 1900 2000

0%

2%

4%

6%

8%

10%

12%

SHARE OF GLOBAL OUTPUT

1400 1500 1600 1700 1800 1900

2%

3%

4%

5%

6%

7%

SPANISH MARAVEDI COIN (GRAMS OF SILVER, INDEXED)

20

40

60

80

100

120

1500 1550 1600 1650170017501800

Spanish coin devalued

massively during the

17th century

44

THE CHANGING WORLD ORDER

NLD UNIVERSITIES FOUNDED

(% WLD)

NLD BOOKS PUBLISHED

(% WLD)

NLD SHARE OF MAJOR

INVENTIONS (OVER 30 YEARS)

NLD EXPORTS

(% WLD)

0%

2%

4%

6%

8%

1500 1600 1700 1800 1900 2000

0%

10%

20%

30%

40%

1500 1600 1700 1800 1900 2000

0%

2%

4%

6%

8%

10%

12%

1500 1600 1700 1800 1900 2000

0%

10%

20%

30%

1500 1600 1700 1800 1900 2000

45

THE CHANGING WORLD ORDER

MAJOR INVENTIONS (PER MLN POPULATION)

NLD GBR FRA

0

1

2

3

4

5

6

7

8

9

1500 1600 170018001900

Unprecedented

innovation

during Dutch

Golden Age

UK innovation rises

with Industrial

Revolution

France lags

REAL GDP PER CAPITA (2017 USD)

EUR NLD GBR ESP DEU FRA

1,000

2,000

4,000

8,000

1400 1500 1600170018001900

Dutch

outperformance

Spanish decline

British

industrialization

German

catch-up

46

THE CHANGING WORLD ORDER

DUTCH EAST INDIA CO

DIVIDENDS (%GDP)

0.0%

0.2%

0.4%

0.6%

0.8%

1625 1675 1725 1775

5

8

10

13

15

18

20

1550 1600 1650170017501800

Limited debasement

after the founding of

the Bank of Amsterdam

GRAMS OF FINE SILVER PER GUILDER

47

THE CHANGING WORLD ORDER

(A) The Dutch declare independence from Spain

(B) Dutch East India Co, Bank of Amsterdam, and stock exchange founded

(C) First and Second Anglo-Dutch Wars

(D) Seven Years’ War and Shadow Banking Crisis of 1763

(E) Fourth Anglo-Dutch War, run on the Bank of Amsterdam

(F) Dutch East India Co nationalized, downfall of the Dutch Empire

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

1500 1550 1600 1650 1700 175018001850190019502000

DUTCH STANDING RELATIVE TO OTHER GREAT POWERS (EST)

Major Wars Netherlands

(A)

(B)

(C)

(D)

(E)

(F)

Dutch Golden Age

France takes control

of the Netherlands

The Dutch lose

to the British

The Dutch

defeat

the British

Key Events

ACCOUNTS AT BANK

OF AMSTERDAM

BANK OF AMSTERDAM

HOLDINGS (%GDP)

Gold and SilverDeposits

0%

2%

4%

6%

8%

1600 1650 1700 1750 1800

0

1,000

2,000

3,000

1600 1650 1700 1750 1800

48

THE CHANGING WORLD ORDER

-10%

0%

10%

20%

30%

1600 1625 1650 1675 1700 1725 1750 1775

DUTCH EAST INDIA COMPANY BALANCE SHEET (%GDP)

Assets Debt Equity

Dutch East India Company effectively

wiped out in the Fourth Anglo-Dutch War

8

-15

-10

-5

0

5

10

1750 1760 1770 1780 1790 1800

DUTCH EAST INDIA COMPANY PROFIT & LOSS (GUILDER, MLN)

8

is chart only shows the financial results from the Dutch East India Company reported in patria, i.e., the Netherlands. It does not include the parts of

the revenue and debt from its operations in Asia but does include its revenue from goods it sourced in Asia and sold in Europe.

49

THE CHANGING WORLD ORDER

0%

1%

2%

3%

4%

5%

6%

7%

1700 1725 1750 1775 1800

BANK OF AMSTERDAM HOLDINGS (%GDP)

Gold and Silver

As deposit holders exchange their guilder

for gold and silver, the Bank of Amsterdam

loses its holdings in precious metals

0

2

4

6

8

10

12

14

BANK OF AMSTERDAM LOANS OUTSTANDING (GUILDER, MLN)

Govt City Chamber Dutch East India Company

Bank of Amsterdam starts to print

to save Dutch East India Company

1775 1780 1785 1790

50

THE CHANGING WORLD ORDER

0.70

0.80

0.90

1.00

1.10

1775 1780 1785 1790 1795 1800

DUTCH GUILDER

vs Gold vs GBP

(A)

(B)

(C)

(D)

(A) Guilder stable through most of the decline era

(B) Fourth Anglo-Dutch War leads to money printing and initial pressure on

the guilder (run on the Bank of Amsterdam)

(C) Short period of stabilization as investors seek safe havens at the start

of the French Revolution

(D) The French overthrow the Dutch; accounts at the bank basically

wiped out

9

VALUE OF THE

DUTCH GUILDER

0%

20%

40%

60%

80%

100%

1600 1650 1700 1750 1800

BANK OF AMSTERDAM

RESERVE RATIO

(PRECIOUS METAL TO

MONETARY LIABILITIES)

After the Fourth

Anglo-Dutch War, there

is a sharp decline in the

ratio of precious metal to

deposits (as depositors flee)

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

vs Gold vs Silver vs GBP

Stable during Golden Age

1600 1650 1700 1750 1800

9

To fully represent the likely economics of a deposit holder at the Bank of Amsterdam, we assumed depositors each received their pro-rated share of

precious metal still in the bank’s vaults when it closed (that was roughly 20 percent of the fully backed amount, thus the approximately 80 percent

total devaluation).

51

THE CHANGING WORLD ORDER

10

100

1,000

10,000

1600 1625 1650 1675 1700 1725 1750 1775 1800

DUTCH EIC TOTAL RETURNS BY YEAR OF INITIAL INVESTMENT

(100 = STARTING WEALTH, 50YR INTERVALS, LOG)

1610 1660 1710 1760

Returns go from

incredible to devastating

10

100

1,000

1%

3%

5%

7%

9%

1600 1650 1700 1750 1800

1700 1720 1740 1760 1780 1800

TOTAL EQUITY RETURNS

(INDEXED)

Dutch East India Company

British East India Company

GOVERNMENT BOND YIELDS

GBRNLD

52

THE CHANGING WORLD ORDER

0

1

1600 1650 1700 1750 1800

DUTCH BOND PRICES (TERM ANNUITIES)

Fourth Anglo-

Dutch War

and conquest

by France

Start of various

wars in 1672

Rebound after

the wars end,

but fall with the

Glorious Revolution

Series of

military

losses

against

the French

THE CHANGING WORLD ORDER

53

Relative Power

Time

New

World

Order

New

World

Order

United StatesUnited Kingdom

Netherlands

China

CHANGES TO THE WORLD ORDER (CONCEPTUAL EXAMPLE)

CHAPTER 10

THE BIG CYCLE RISE AND

DECLINE OF THE BRITISH

EMPIRE AND THE POUND

THE CHANGING WORLD ORDER

54

0

1

Level Relative to Own History (1 = Max)

UNITED KINGDOM: INDEX OF KEY DETERMINANTS

1550 1600 1650 1700 1750 1800 1850 1900 1950 2000

Major Wars Education Innovation and Technology

Competitiveness MilitaryTrade

Economic Output Financial Center Reserve FX Status

THE CHANGING WORLD ORDER

55

UK ARC 1600–PRESENT

Major Wars United Kingdom Netherlands United States

Level Relative to Other Empires (1 = Max)

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

New Order

Peace of

Westphalia

Global

Empire &

Reserve FX

Innovation

Industrial

Revolution

External

Conflict & High

Indebtedness

Inequality

& Losing

Innovative

Edge

New Order

US-led

Western

Block

New UK-led Order

Congress of Vienna

English Civil War Victorian EraSuez crisis

WWI &

WWII

1600 1700 1800 1900 20001950185017501650

Napoleonic

wars

(1)

(3)

(4)

(5)

(6)

Internal Conflict &

Emergence of Better

Government

Glorious Revolution

(2)

Innovation

Financial innovations,

competition

with the Dutch

2%

3%

4%

5%

6%

7%

8%

9%

10%

1700 1750 1800 1850

-3%

-2%

-1%

0%

1%

2%

3%

1700 1750 1800 1850

GBR GOVT BOND YIELD

GBR GOVT BOND YIELD

(VS MAJOR

COUNTRY MEDIAN)

THE CHANGING WORLD ORDER

56

GBR GOVT REVENUE (%GDP)

Massive expansion of fiscal state

1500 1550 1600 1650 1700 1750 1800

0%

2%

4%

6%

8%

10%

12%

14%

0

2

4

6

8

1500 1600 1700 1800 1900 1500 1600 1700 1800 1900

NLD GBR FRA

MAJOR INVENTIONS

(PER MLN POPULATION)

SHARE OF

MAJOR INVENTIONS

0%

20%

10%

30%

40%

50%

60%

70%

THE CHANGING WORLD ORDER

57

REAL GDP PER CAPITA (2017 USD)

EUR NLD GBR ESP DEU FRA

1,000

2,000

4,000

8,000

1400 1500 1600170018001900

Dutch

outperformance

Spanish decline

British

industrialization

German

catch-up

FRA GBR

FRENCH UNIVERSITIES

FOUNDED (%WLD, 30YR AVG)

0%

10%

20%

30%

40%

50%

1500 1600 1700 1800 1900 1500 1600 1700 1800 1900

LITERACY RATE (% POP)

10%

20%

30%

40%

50%

70%

90%

60%

80%

THE CHANGING WORLD ORDER

58

FRENCH INFLATION (5-YEAR AVG)

-10%

30%

10%

50%

70%

90%

1700 1720 1740 1760 1780 1800 1820

FRENCH CURRENCY VS GOLD (INDEXED, LOG)

.01%

.1%

10%

1%

100%

1,000%

1750 1770 1790 1810 1830 1850 1870

Currency collapse

accelerates from

1792 to 1796

GBR EMPIRE SIZE (% WORLD, EST)

1600 1650 1700 1750 1800 1850 1900 1950 2000

0%

5%

10%

15%

20%

25%

THE CHANGING WORLD ORDER

59

GBR SHARE OF WORLD EXPORTS (% TOTAL)

0%

30%

20%

40%

50%

10%

1700 1800 1900 2000

Between 1850 and 1914,

about 60% of world trade

denominated in pound sterling

0%

20%

40%

10%

30%

50%

60%

70%

INTERNATIONAL INVESTMENTS (% DEV WLD GDP)

1825 1845 1865 18851835 1855 1875 1895 1905

GBR NLD FRA DEU USA

THE CHANGING WORLD ORDER

60

SHARE OF GLOBAL DEBT

IN GBP (EST)

0%

20%

40%

60%

80%

1700 1800 1900 2000

SHARE OF GLOBAL

TRANSACTIONS IN GBP (EST)

0%

10%

20%

30%

40%

50%

60%

1700 1800 1900 2000

USA GBR DEU

INVENTIONS

(% OF GLOBAL INVENTIONS)

10%

20%

30%

40%

50%

1870 1890 19101870 1890 1910

GDP

(% OF GLOBAL GDP)

10%

20%

30%

UK declines as US and

Germany catch up

Rise of

the US

Steady UK decline

10

10

GBR GDP share includes income of countries controlled by the British Empire.

THE CHANGING WORLD ORDER

61

UK WEALTH GAP (TOP 1% WEALTH SHARE)

55%

65%

60%

70%

75%

1800 1820 1840 1860 1880 1900 1920

0%

1%

2%

3%

1870 1913

PUBLIC EDUCATION EXPENDITURE (%GDP)

GBRDEU FRA

Germany outspends both Britain

and France to develop its

education system

I

THE CHANGING WORLD ORDER

62

% OF NOBEL PRIZES WON

FROM 1900 TO 1913

0%

10%

20%

5%

15%

25%

30%

1870 1880 1890 1900 1910 DEU GBR USA

DEU GBR

SHARE OF WORLD PATENT

APPLICATIONS

0%

5%

15%

25%

10%

20%

German patent applications

become a significant share

of the world’s total and

overtake Britain

GBRDEU FRA

2%

10%

18%

26%

6%

14%

22%

1860 1880 1900

RELATIVE SHARES OF WORLD MANUFACTURING OUTPUT

German manufacturing goes from

less than a half of Britain's in 1860... …to around 75% by 1900

THE CHANGING WORLD ORDER

63

GBR DEU

WARSHIP TONNAGE

(THOUSAND TONS)

0

2,000

1,000

3,000

1870 18901880 1900 19101880 19001890 1910 1914

SHARE OF GLOBAL MILITARY

SPENDING (EST, 10YR AVG)

5%

15%

10%

20%

Competition between

Germany and Britain

leads to a ramp-up

in military armament

by both countries

DEU REAL GDP PER CAPITA

40%

80%

120%

160%

40%

80%

120%

160%

JPN REAL GDP PER CAPITA

35 39 43 4737 41 45 49 35 39 43 4737 41 45 49

THE CHANGING WORLD ORDER

64

JPN SPOT FX VS USD

(INDEXED TO 1935)

35 39 43 4737 41 45 49 35 39 43 4737 41 45 49

DEU Black Market Spot FX vs USD

(Indexed to 1935)

DEU Spot FX vs USD (Indexed to 1935)

0

20

60

100

40

80

0

20

60

100

40

80

June 1948:

FX replaced, with

financial asset

holders facing

-90% haircut

11

GBP SHARE OF

GLOBAL RESERVES

(EX-GOLD, EST)

GBP SHARE

OF GLOBAL

DEBT (EST)

GBP SHARE

OF GLOBAL

TRANSACTIONS

(EST)

0%

20%

40%

60%

80%

100%

1900 1960 2020

WWII

1900 1960 2020

0%

10%

20%

30%

40%

50%

60%

70%

1900 1960 2020

0%

10%

20%

30%

40%

50%

11

is chart shows the official exchange rate between dollars and deutschemarks as well as an unofficial (black market) rate that was based on actual

transactions between New York and Germany during that time period. e unofficial rate shows that the true value of the deutschemark was col-

lapsing during the period.

THE CHANGING WORLD ORDER

65

USD/GBP (INV) GBR FX VS GOLD (£/OZ, INV)

0.15

0.25

0.35

0.45

1900 1935 1970

First devaluation

(1946–49):

Convertibility crisis

when the UK removes

capital controls

Second devaluation

(1967): UK gives

up defending

the peg

19351900 1970

2

4

6

8

10

12

14

16

18

20

USD/GBP (INV) GBR REAL FX VS TWI

-20%

-10%

0%

10%

20%

1930 1940 1950 1960

0.15

0.25

0.35

0.45

1930 1940 1950 1960

GBR CURRENT ACCOUNT (%GDP)

-15%

-10%

-5%

0%

5%

10%

15%

1

9301940195

01

960

THE CHANGING WORLD ORDER

66

GBR CURRENT

ACCOUNT (%GDP)

GBR GOLD

RESERVES (OZ, MLN)

60 62 64 66 68 70

20

30

40

50

60

70

80

90

Gold reserves

fall over the

decade,

accelerating

in 1967

-3%

-2%

-1%

0%

1%

2%

3%

60 62 64 66 68 70

Deterioration of the current

account, connected

to EUR recession

GBR REAL FX VS TWI

-10%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

60 62 64 66 68 70

GBR SHORT RATES

(DIFF TO USA)

60 62 64 66 68 70

-1%

0%

1%

2%

3%

4%

5%

Sharp rate hikes

amid currency

defense

USD/GBP (INV)

60 62 64 66 68 70

0.25

0.30

0.35

0.40

0.45

THE CHANGING WORLD ORDER

67

0%

10%

20%

30%

40%

50%

60%

70%

All Countries

Sterling Agreement Countries

Central banks begin selling their sterling

reserves following the devaluation. The

share of the pound collapses.

Sterling Agreement countries promise to

continue holding pounds, but only if 90

percent of their dollar value is guaranteed

by the British government.

1968 1969 1970 1971 1972

0%

5%

10%

15%

20%

1968 1969 1970 1971 1972

AVERAGE SHARE OF POUNDS IN

CENTRAL BANK RESERVES (%TOTAL)

THE EUROZONE COMPARED TO THE US AND CHINA

EUR USA CHN

Empire Score (0 to 1)* 0.55 0.87 0.75

GDP Per Capita (2017 USD, PPP Adj) 41,50460,23616,411

GDP (%WLD, PPP Adj) 13%17% 23%

Population (%WLD) 4% 4% 18%

Exports (%WLD) 12%11% 15%

Military Spending (%WLD) 9% 28%19%

College Grads (%WLD) 13%20% 22%

Patents (%WLD) 11%17% 41%

Nobel Prizes (%WLD) 11%32% 2%

Equity Mkt Cap (%WLD) 8% 55%10%

28%55% 2%

21%62% 2%

*Europe Empire Arc treats major Eurozone countries as single unit for purposes

of comparison.

Intl Transactions in Currency (%WLD)

Official Reserves Held in Currency (%WLD)

THE CHANGING WORLD ORDER

68

DEU FRA ITA ESP GRC

GDP PER CAPITA

(2010 USD)

GDP PER CAPITA

(2010 USD, INDEXED TO 2007)

00 05 10 15 20

20,000

30,000

40,000

50,000

70%

90%

110%

130%

00 05 10 15 20

69

THE CHANGING WORLD ORDER

Level Relative to Own History (1 = Max)

UNITED STATES: INDEX OF KEY DETERMINANTS

0

1

1700 1800 1900 2000

Major Wars Education Innovation and Technology

Competitiveness Military Trade

Economic Output Financial Center Reserve FX Status

CHAPTER 11

THE BIG CYCLE RISE AND

DECLINE OF THE UNITED

STATES AND THE DOLLAR

70

THE CHANGING WORLD ORDER

US ARC 1750–PRESENT

Major Wars United States United Kingdom China

Level Relative to Other Empires (1 = Max)

0.0

0.2

0.4

0.6

0.8

1.0

New Order

Strong Leadership

Founding Fathers

Internal

Conflict

Innovation

2nd Industrial

Revolution

Military Strength

Global Empire

& Reserve FX

New Order

US-led

Western Bloc

WWII

American

Revolution Cold WarWWI

Louisiana

Purchase

Gilded Age &

Progressive Era

1750 1800 1850 1900 1950 2000

Mexican-

American

War

Civil

War

Innovation

Digital

Revolution

(1)

(2)

(3)

(4)

(5)

Rising

Inequality

& High

Indebtedness

80

100

90

110

1912 1915 1918 19191911 1914 19171910 1913 1916

SPOT FX RATE VS USD (INDEXED)

Devaluation against the

dollar during World War I

GBR FRA DEU

71

THE CHANGING WORLD ORDER

0

1

1940 1960 1980 2000 2020

Level Relative to Other Empires (1 = All-Time Max)

RELATIVE STANDING OF GREAT EMPIRES

USA GBRCHN RUS

1945 1965 1985 2005

NUCLEAR WEAPONS STOCKPILE (# WARHEADS, LOG)

USA CHNGBR IND RUS FRA

1

10

100

1,000

10,000

100,000

72

THE CHANGING WORLD ORDER

45 55 65 75 85 95 05 15 45 55 65 75 85 95 05 15

USA Long Rates

USA Short Rates

USA Core Inflation

USA Headline Inflation

0%

4%

8%

12%

16%

20%

0%

4%

8%

12%

16%

20%

1990 2000 20102020

EXPORTS OF GOODS AND SERVICES MINUS IMPORTS

OF GOODS AND SERVICES (REAL, USD BLN, 12MMA)

USA CHN

-1,200

1,200

-600

0

600

Country gets richer

Country gets poorer

73

THE CHANGING WORLD ORDER

20%

60%

100%

140%

180%

1900 1920 1940 1960 1980 2000 2020

When the cycle

changes

New

World Order

When the cycle

changes

PRIVATE SECTOR NON-FIN DEBT (%GDP, 6MMA)

4%

9%

14%

19%

24%

29%

0%

4%

8%

12%

16%

20%

1900 1920 1940 1960 1980 2000 2020

When the cycle

changes

New

World Order

When the

cycle

changes

USA Interest Rates

USA Monetary Base (%GDP)

74

THE CHANGING WORLD ORDER

USA INCOME SHARES

Top 10% Bottom 90%

20%

30%

40%

50%

60%

70%

80%

1920 1970 2020

USA WEALTH SHARES

Top 0.1% Bottom 90%

0%

10%

20%

30%

40%

50%

1920 1970 2020

House Democrat

Senate Democrat

House Republican Senate Republican

IDEOLOGICAL POSITIONS OF THE MAJOR PARTIES

-40%

-30%

-20%

-10%

0%

0%

10%

20%

30%

40%

50%

60%

1900 1920 1940 1960 1980 2000 2020

More

conservative

Less

conservative

Greatest

gap

75

THE CHANGING WORLD ORDER

SHARE OF CONGRESSIONAL MEMBERS’ VOTES

CAST ALONG PARTY LINES

1790 1830 1870 1910 1950 1990 2030

60%

70%

80%

90%

100%

This chart shows the average predictiveness of a given member’s left/right

ideology in determining their vote across chambers for each congressional session

as measured by NOMINATE, an academic model of ideological preference.

0%

10%

20%

30%

40%

50%

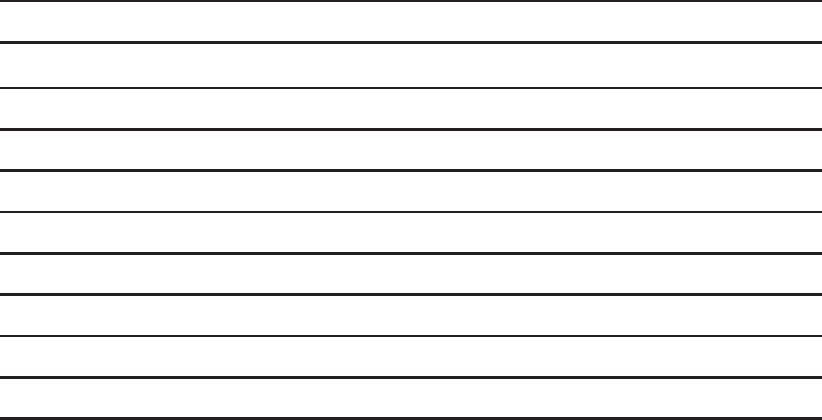

60%

70%

USA Unemployment Rate USA CB Balance Sheet (%GDP)

UNITED STATES

00 20 40 60 80 00 2000 20 40 60

0%

10%

20%

30%

80 00 20

EUR Unemployment Rate EUR CB Balance Sheet (%GDP)

EUROPE

GBR Unemployment Rate GBR CB Balance Sheet (%GDP)

UNITED KINGDOM

JPN Unemployment Rate JPN CB Balance Sheet (%GDP)

JAPAN

00 20 40 60 80 00 20

0%

2%

4%

6%

8%

10%

12%

14%

00 20 40 60 80 00 20

0%

5%

10%

15%

20%

25%

00 20 40 60 80 00 20

0%

10%

20%

30%

40%

50%

00 20 40 60 80 00 20

0%

2%

4%

6%

8%

00 20 40 60 80 00 20

0%

40%

80%

120%

0%

10%

20%

30%

40%

00 20 40 60 80 00 20

76

THE CHANGING WORLD ORDER

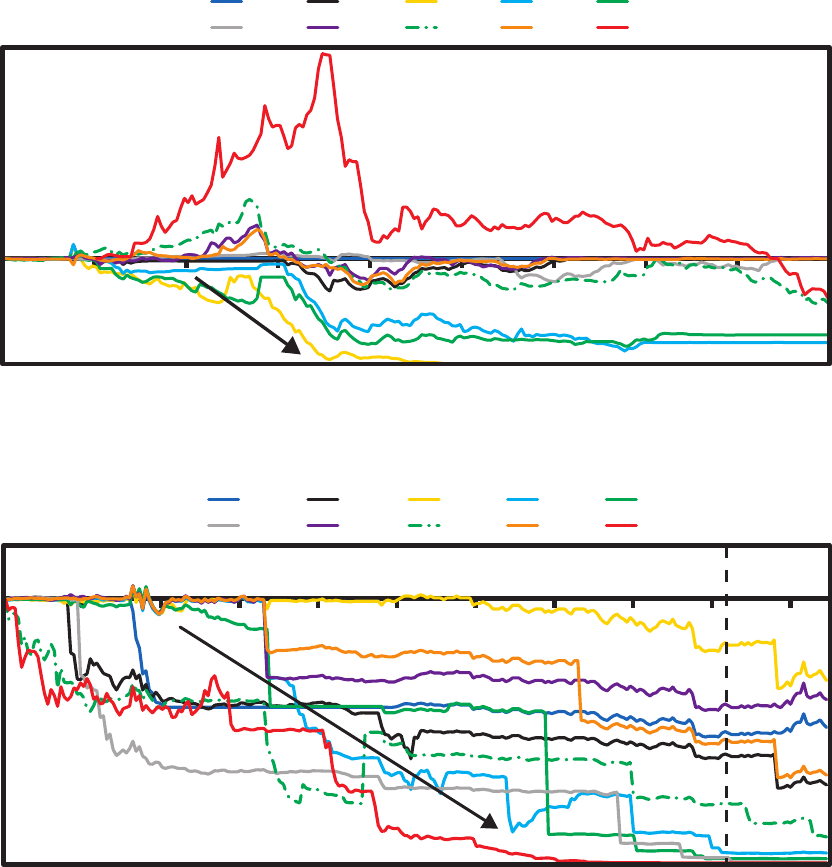

0%

10%

20%

30%

40%

50%

60%

70%

USA Unemployment Rate USA CB Balance Sheet (%GDP)

UNITED STATES

00 20 40 60 80 00 2000 20 40 60

0%

10%

20%

30%

80 00 20

EUR Unemployment Rate EUR CB Balance Sheet (%GDP)

EUROPE

GBR Unemployment Rate GBR CB Balance Sheet (%GDP)

UNITED KINGDOM

JPN Unemployment Rate JPN CB Balance Sheet (%GDP)

JAPAN

00 20 40 60 80 00 20

0%

2%

4%

6%

8%

10%

12%

14%

00 20 40 60 80 00 20

0%

5%

10%

15%

20%

25%

00 20 40 60 80 00 20

0%

10%

20%

30%

40%

50%

00 20 40 60 80 00 20

0%

2%

4%

6%

8%

00 20 40 60 80 00 20

0%

40%

80%

120%

0%

10%

20%

30%

40%

00 20 40 60 80 00 20

77

THE CHANGING WORLD ORDER

0%

10%

20%

30%

40%

50%

60%

70%

USA Unemployment Rate USA CB Balance Sheet (%GDP)

UNITED STATES

00 20 40 60 80 00 2000 20 40 60

0%

10%

20%

30%

80 00 20

EUR Unemployment Rate EUR CB Balance Sheet (%GDP)

EUROPE

GBR Unemployment Rate GBR CB Balance Sheet (%GDP)

UNITED KINGDOM

JPN Unemployment Rate JPN CB Balance Sheet (%GDP)

JAPAN

00 20 40 60 80 00 20

0%

2%

4%

6%

8%

10%

12%

14%

00 20 40 60 80 00 20

0%

5%

10%

15%

20%

25%

00 20 40 60 80 00 20

0%

10%

20%

30%

40%

50%

00 20 40 60 80 00 20

0%

2%

4%

6%

8%

00 20 40 60 80 00 20

0%

40%

80%

120%

0%

10%

20%

30%

40%

00 20 40 60 80 00 20

POLITICAL SPECTRUM 50 YEARS AGO

POLITICAL SPECTRUM 2021

12

12

Shading indicates degree of polarization.

78

THE CHANGING WORLD ORDER

0

1

1500 1600 1700 1800 1900 2000

Level Relative to Other Empires (1 = All-Time Max)

RELATIVE STANDING OF GREAT EMPIRES

FranceGermanySpainNetherlands

Ottoman EmpireJapanIndia

United KingdomChinaUnited StatesMajor Wars

Russia

CHAPTER 12

THE BIG CYCLE RISE OF

CHINA AND THE RENMINBI

79

THE CHANGING WORLD ORDER

Level Relative to Own History (1 = Max)

CHINA: INDEX OF KEY DETERMINANTS

0

1

1800 1850 190019502000

Major Wars Education Innovation and Technology

Competitiveness Military Trade

Economic Output Financial Center Reserve FX Status

Major Wars Rough Estimate of China’s Relative Standing vs Great Powers

0

1

600 800 1000 1200 1400 1600 1800 2000

Tang

Dynasty

Level Relative to Other Empires

(1 = All-Time Max)

Song

Dynasty

Yuan

Dynasty

Ming

Dynasty

Qing

Dynasty

RC PRC

80

THE CHANGING WORLD ORDER

TRANSITIONS ACROSS DIFFERENT TYPES

OF MONEY IN CHINESE HISTORY

Type 1

Type 2

Type 3

Tang

618–

907

Northern

Song

960–

1127

Southern

Song

1127–

1279

Early-

Mid

Qing

1644–

1800

People’s

Rep of

China

1949–

Pres

Yuan

1279–

1368

Ming

1368–

1644

Late

Qing

~1800–

1911

Rep of

China

1911–

1949

13

Inflation pre-1926 quoted in

silver terms, post-1926 in RMB

CHINESE INFLATION (Y/Y)

-10%

0%

10%

20%

30%

1750 1775 1800 1825 1850 1875 190019251950197520002025

Hyperinflation

13

I produced this diagram working with Professor Jiaming Zhu.

81

THE CHANGING WORLD ORDER

CNY VS USD (INV)

GOLD PRICE (IN CNY, INV)

0

2

4

6

8

10

1920 1970 2020

Up = stronger

RMB

1920 1970 2020

0

4,000

8,000

12,000

16,000

Up = stronger

RMB

CHN INFLATION (Y/Y)

CHN REAL GROWTH (Y/Y)

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

1920 1970 2020

-30%

-20%

-10%

0%

10%

20%

30%

1920 20201970

82

THE CHANGING WORLD ORDER

CHINA'S DEVELOPMENT SINCE 1949 AND 1978

1949 1978 2018 ∆ Since 1949 ∆ Since 1978

RGDP Per Capita* 348 609 15,24344x 25x

Share of World GDP 2% 2% 22%12x 11x

Population Below the

Poverty Line ($1.90/Day)**

— 96% 1% at least -96% -96%

Life Expectancy 41 66 77 +36 Yrs+11 Yrs

Infant Mortality Rate

(per 1,000 Births)

200 53 7-96%-86%

Urbanization 18% 18% 59%+41%+41%

Literacy 47% 66% 97%+50%+31%

Avg Yrs of Education 1.7 4.4 7.9

+6.2 Yrs+3.5 Yrs

*USD 2017, PPP-adjusted

**The World Bank only has poverty data back to 1981

83

THE CHANGING WORLD ORDER

UNITED STATES CHINA

1980 Today Change

Change

(%)

1980 TodayChange

Change

(%)

Average Years

of Schooling

11.9 13.6 +1.7 +14% 4.67.9 +3.3 +72%

Govt Spending

on Education

(% of GDP)

5.30% 5.50% 0.20% +4%1.90% 5.20% 3.30% +174%

Est Population w/

Tertiary Education

(Mln)

25 60 +35+140% 3120 +117 +3,900%

Population w/

Tertiary Education

(% Working-Age Pop)

17% 28% 11% +68% 1% 12%11% +2,272%

Population w/

Tertiary Education

(% World)

35% 15% -20% -57% 4% 31%+27%+590%

STEM Majors (Mln) 38+5 +141% 121+21 +4,120%

STEM Majors (% World) 29% 11% -18% -62% 5% 31%+26%+535%

84

THE CHANGING WORLD ORDER

SHARE OF CENTRAL BANK

RESERVES BY CURRENCY

USD 51%

EUR 20%

Gold 12%

JPY 6%

GBP 5%

CNY 2%

Based on data through 2019

CHAPTER 13

US-CHINA RELATIONS

AND WARS

85

THE CHANGING WORLD ORDER

GLOBAL POPULATION (MLN)

0

2,000

4,000

6,000

8,000

0

2,000

4,000

6,000

8,000

1500 1600 18001700 1900 2000 1900 1940 19801920 1960 2000 2020

GLOBAL POPULATION GROWTH (10YR CHG, EST)

-5%

0%

5%

10%

15%

20%

25%

0%

5%

10%

15%

20%

25%

1500 1600 18001700 1900 2000 1900 1940 19801920 1960 2000 2020

Baby Boom

WWIIWWI

Thirty

Years’

War

Collapse

of Ming

Dynasty

Industrial

Revolution

Baby Boom

WWII

WWI

CHAPTER 14

THE FUTURE

86

THE CHANGING WORLD ORDER

14

10

20

40

60

80

30

50

70

10

20

40

60

80

30

50

70

1500 1600 18001700 1900 2000

GLOBAL LIFE EXPECTANCY AT BIRTH

1900 19751925 1950 2000 2025

COVID-19

WWII

Baby

Boom

WWI,

Spanish flu

pandemic

Thirty

Years’

War

Baby

Boom

WWII

WWI,

Spanish flu

pandemic

HIV/AIDS

epidemic

COVID-19

Flu

outbreak

& famine

1557 influenza

pandemic

Third Plague

pandemic

GLOBAL RGDP

PER CAPITA (LOG)

8

7

9

10

11

0

30,000

40,000

10,000

20,000

1500 1600 18001700 1900 2000

GLOBAL RGDP

PER CAPITA (2017 USD)

1900 19801940 2020

Inflection during the

Industrial Revolution

Invention of

capitalism

(founding of

Amsterdam

Stock

Exchange)

14

Importantly, a number of the charts shown on these pages rely on the record from fewer countries further in the past, due to limited reliable data

history. Life expectancy prior to the 1800s is solely based on Great Britain (marked by the dotted line). Global RGDP is primarily a mix of European

countries before 1870. And there are not good records of total wealth prior to the 1900s, so I can’t show you the picture before then.

87

THE CHANGING WORLD ORDER

GLOBAL REAL WEALTH PER CAPITA

(ROUGH ESTIMATE, 2017 USD, LOG)

1900 1920 1940 1960 1980 2000 2020

1,000

10,000

100,000

Collapse of Qing,

WWI, Russian

Revolution, and

Spanish flu

Roaring

’20s

Great

Depression

WWII

PRC

founded

Peak of American

Empire

Great Leap

Forward,

famines

Deng

Xiaoping

reforms

Digital

Revolution

Dot-com

bubble

2008 financial

crisis

COVID-19

GLOBAL RGDP PER CAPITA DRAWDOWNS

-25%

10%

-20%

-10%

-5%

0%

1500 1600 1700 1800 20001900 1900 1920 1960 20001940 1980 2020

-16%

-12%

-8%

-4%

0%

2008

crisis

COVID-19

WWI

WWII

Great

Depression

Panic

of 1819

Anglo-French

War

Dutch Revolt

against Spain

WWI

WWII

COVID-19

2008

financial

crisis

Great

Depression

GLOBAL REAL WEALTH PER CAPITA DRAWDOWNS

-40%

-30%

-20%

-10%

0%

1900 1920 1940 1960 1980 2000 2020

Great

Depression

1970s

stagflation

Collapse of Qing,

WWI, Russian Revolution,

and Spanish flu

WWII

2008 financial

crisis

88

THE CHANGING WORLD ORDER

GLOBAL DEATHS BY CATEGORY

(RATE PER 100K PEOPLE, 15YMA)

FaminesNatural Disasters Pandemics

0

50

100

150

200

250

300

Indian

famine

Spanish flu

HIV/

AIDS

Indian and

Chinese

famines

China’s

Great Leap

Forward

Series of

Indian

famines

Cocoliztli

epidemics

Russian

famine

French

famine

COVID-19

1500 1600 1700 1800 1900 2000

89

THE CHANGING WORLD ORDER

ESTIMATED DEATHS FROM CONFLICT

(MAJOR POWERS, %POP, 15YMA)

Internal Conflict External Conflict Total

1400 1500 1600 1700 1800 1900 2000

0.0%

0.1%

0.2%

0.3%

0.4%

0.5%

Wars of

Religion in

France

European

monarchic

wars

Chinese

border

wars,

religious

wars in

Europe

Collapse of Ming Dynasty,

religious wars in Europe

WWII, Holocaust,

communist

revolutions

Time of

Troubles in

Russia

Seven

Years’ War

in Europe

Napoleonic

Wars

Ethnic wars

in China

WWI

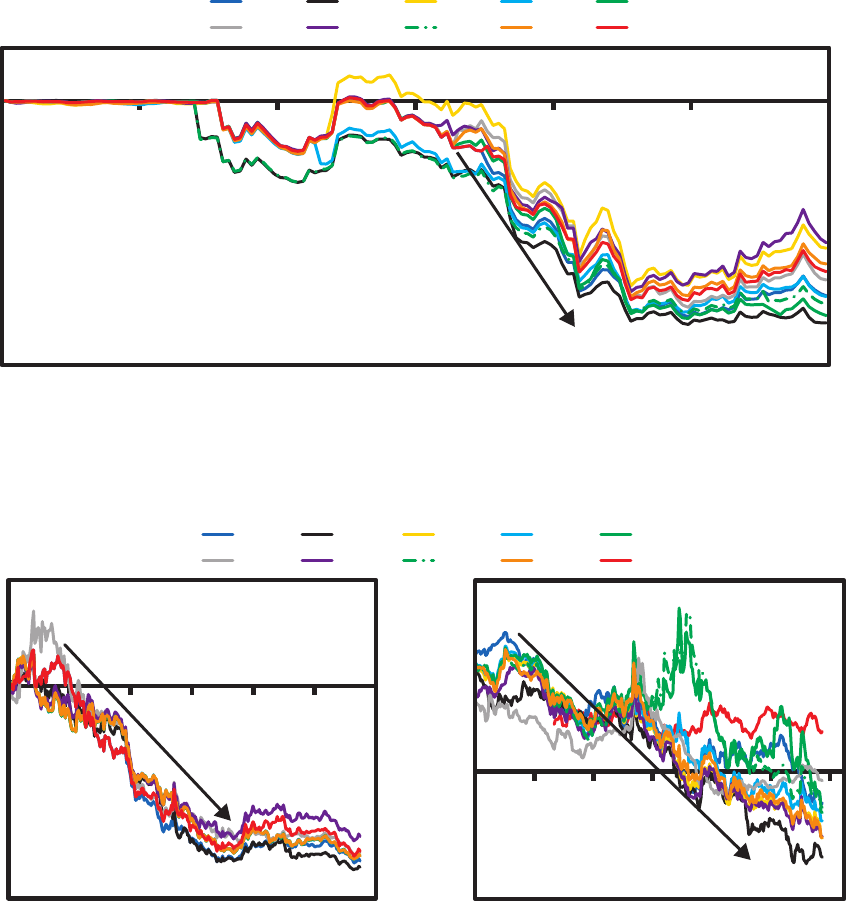

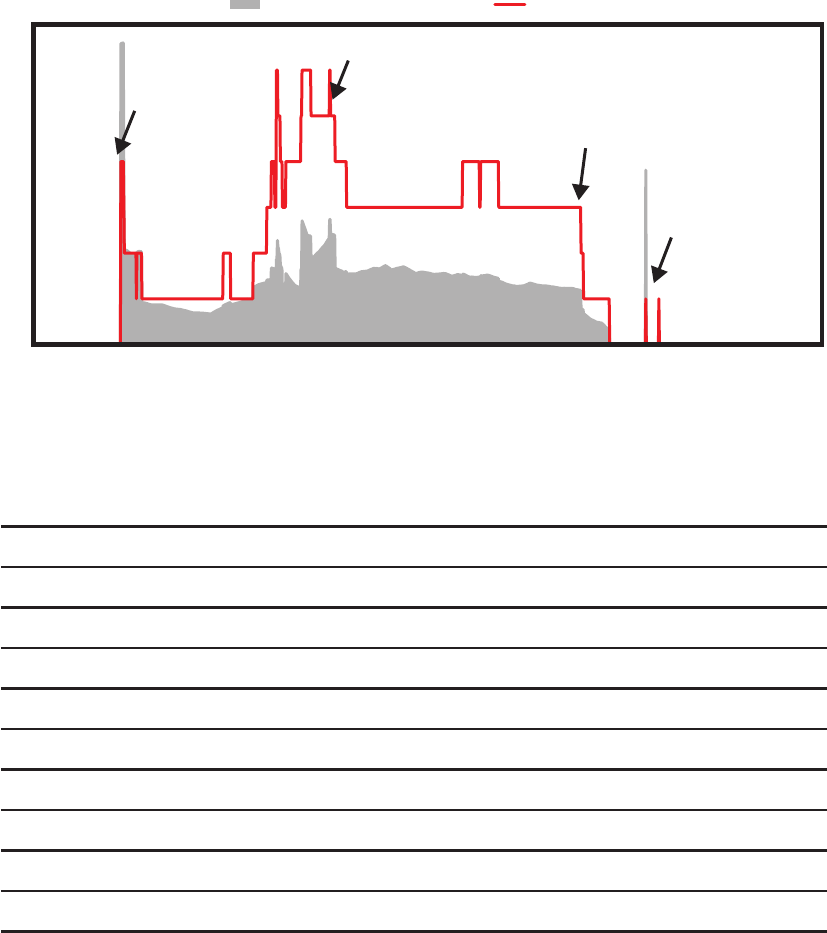

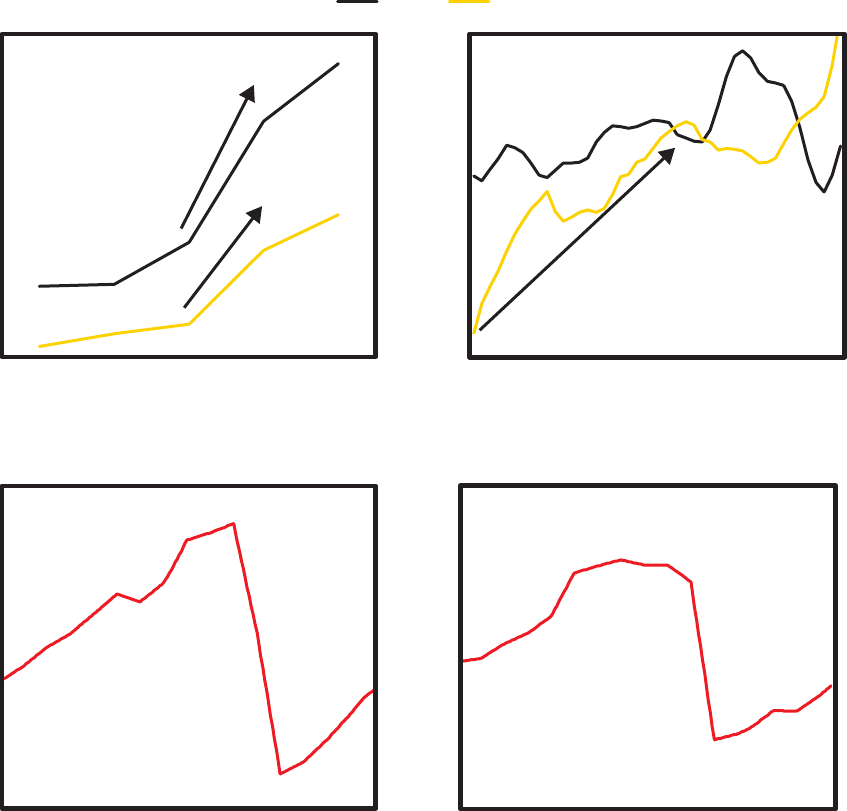

CURRENT INNOVATION AND TECHNOLOGY SCORE

-1.5

1.0

0.0

2.0

0.5

-0.5

1.5

2.5

-1.0

USA JPN GBRCHN DEUEUR NLD ESPRUSFRA IND

15

15

Arrows denote the 20-year change in the gauge.

90

THE CHANGING WORLD ORDER

USA FRA INDESP JPNGBR EUR RUSNLDCHN DEU

-2

-1

0

1

2

DEBT BURDEN (UP = WORSE FINANCIAL POSITION)

USA GBREUR CHNJPN RUS IND

0%

20%

40%

60%

10%

30%

50%

RESERVE CURRENCY STATUS

16

16

Individual European countries are not shown on the reserve currency status gauge due to the European Monetary Union (all these countries use

the euro)—so only the Europe aggregate is shown. e measure shows an average of what share of global transactions, debts, and official central bank

reserve holdings are denominated in each country’s currency.

91

THE CHANGING WORLD ORDER

NLD FRAJPN USACHN ESPGBRDEU RUS

-1.5

0.0

1.5

2.5

-1.0

1.0

-0.5

0.5

2.0

RELATIVE INTERNAL CONFLICT GAUGE Z-SCORE FOR

MAJOR POWERS TODAY (UP = MORE CONFLICT)

1780 1900181020201870 196019301840 1990

1

3

-1

0

2

USA INTERNAL CONFLICT GAUGE Z-SCORE

(UP = MORE CONFLICT)

92

THE CHANGING WORLD ORDER

Political Conflict

-3

0

3

-2

2

-1

1

4

5

1780 1840 1900 1960 2020 1780 1840 1900 1960 2020

Internal Strife

-3

-2

1

3

0

-1

2

USA INTERNAL CONFLICT GAUGE BREAKDOWN

USA

JPN

USA

DEU

GBR

DEU

USA

CHN

USA

GBR

CHN

GBR

CHN

JPN

GBR

JPN

USA

RUS

0.0

-0.8

0.4

-0.4

0.8

LATEST INTERCOUNTRY CONFLICT Z-SCORE

(UP = MORE CONFLICT)

93

THE CHANGING WORLD ORDER

1970 20101980 202020001990

0.0

-0.8

0.4

-0.4

0.8

USA-CHINA CONFLICT GAUGE Z-SCORE

USA EUR FRACHN INDRUS JPN ESPDEUGBR NLD

-1

0

-2

1

2

CURRENT MILITARY STRENGTH (UP = STRONGER)

94

THE CHANGING WORLD ORDER

Indian

famine

Spanish flu

Indian and

Chinese

famines

China’s

Great Leap

Forward

Series of

Indian

famines

Cocoliztli

epidemics

Russian

famine

French

famine

HIV/

AIDS

COVID-19

GLOBAL DEATHS BY CATEGORY

(RATE PER 100K PEOPLE)

FaminesNatural Disasters Pandemics

1500 1600 1700 1800 1900 2000

0

200

400

600

800

1,000

1,200

1,400

0100050015002000 1900 1940 1980 2020

GLOBAL TEMPERATURE

VS 1961–1990 AVG

(ºC, SINCE 0 CE)

Carbon Dioxide Concentration (PPM)

Global Land and Ocean Temperature

Anomalies (ºC)

270

350

430

310

390

1.2

0.0

-0.4

0.8

0.4

Medieval

Warm

Period

Little Ice

Age

-1.0

0.0

1.0

-0.5

0.5

95

THE CHANGING WORLD ORDER

1970 20101980 202020001990

0

150

250

50

100

200

NUMBER OF NATURAL CATASTROPHIC EVENTS

1970 20101980 202020001990

0

150

350

50

100

250

300

200

TOTAL LOSSES FROM CATASTROPHES SINCE 1970

(2020 USD, BLN)

Hurricane

Katrina

Japan, NZ

earthquake

Hurricanes

Harvey,

Irma,

Maria

Annual 5yr Average

96

THE CHANGING WORLD ORDER

NLD

FRA

TUR

CAN

EUR

USA

RUS

SAR

CHN

SGP

PHP

GBR

JPN

ITA

DEU

AUS