Country Power

Index 2022

RAY DALIO

© 2022 RAY DALIO

THE CHANGING

WORLD ORDER

COUNTRY POWER INDEX 2022

1

A

s I described in my book Principles for Dealing with the Changing World Order, I automated my way

of looking at the cause/effect relationships that are driving both improvements in and worsenings

of countries’ conditions so that data is fed into a computer that analyzes it and writes a summary

of the current conditions and the long-term prospects for each country. is is done for the world’s

24 leading countries. To understand how it works and how I use it, imagine you are a chess player and that you

built a computerized version of your thinking process that analyzes and makes moves next to you while you also

think through the moves you’d make. While it reflects your thinking, has perfect memory, and can process vast

amounts of data almost instantaneously, the computer has no common sense and isn’t able to pick up on subtle,

non-quantifiable relationships. Your mind and the computer each bring different strengths and weaknesses that

make you together far better than either of you alone. at’s what it’s like.

In my book I showed the computerized assessment of 11 major powers and promised to share updated

versions for 24 countries—those in the G20 plus others that scored as notable global powers—at least annually

on economicprinciples.org. at’s what I’m now doing.

In this memo, I start by showing summary tables of scores of the 18 major determinants across countries

(see Principles for Dealing with the Changing World Order for more details). After that, I show the computer-

generated summaries that describe each country. e text for each country highlights a few of the major gauges

and a few of the stats within each gauge that reflect the broad trends I am seeing. Of course there is a great deal

more below these summaries that I can delve into, though these summaries are good enough for our purposes.

e overall country power score is created by weighing the outputs of the 18 gauges, each of which is

derived as a composite of several stats we aggregate based on relevance, quality, and consistency across countries

and time. Because both the size of a country and the strength of the powers matter, I show measures of the

total power and the per capita power of each country. For more detail on how I these about different types

of measures (in per capita and absolute terms), please see the table at the end of this report, following the

computer-generated country summaries.

To be clear, while these indices aren’t perfect because the data through time isn’t perfect and not everything

can be captured in the data, they do an excellent job of painting the big picture. Additionally, it is worth noting

that we have updated and improved the analysis since the book was published, which is why you may notice

some figures differ slightly in this report compared to the publication. is system is a never-ending work in

progress so you should expect it to evolve and continuously get better. I hope that you will find it as helpful as I

find it. I also hope that these objective measures will lead to people objectively assessing policy makers’ moves

and that that will lead either to better policies or to better policy makers who will make better policies.

[As of April 2022]

EXPANDED ANALYSIS OF THE

CONDITIONS OF, AND PROSPECTS FOR,

THE WORLD’S LEADING COUNTRIES

THE CHANGING WORLD ORDER

2

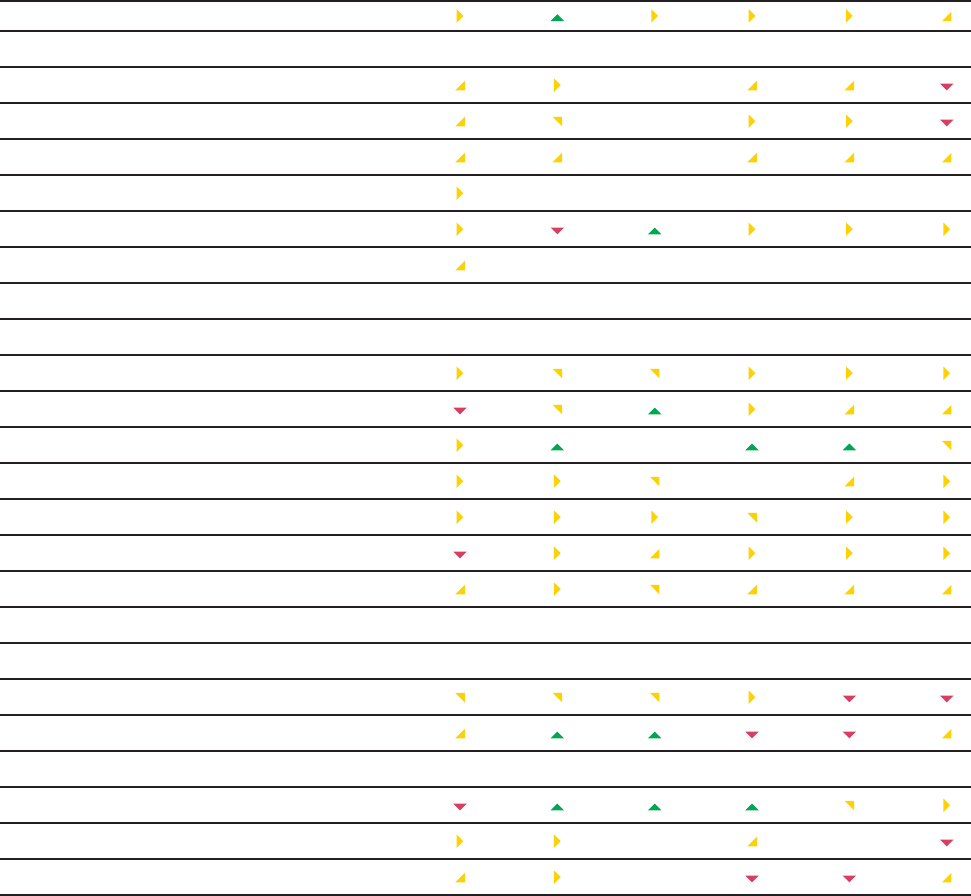

CURRENT READINGS ACROSS MAJOR POWERS

(Z-Score and 20-Year Change Denoted by Arrows)

GAUGE

QUALITY

USA CHN EUR DEU JPN KOR

EMPIRE SCORE (0–1) 0.89

0.76 0.58 0.38 0.33 0.31

THE BIG CYCLES

Economic/Financial Position Reliable -1.5

0.3 -0.9 -0.1 -1.3 0.1

Debt Burden (Big Economic Cycle) Reliable -1.9 0.0 -0.6 0.8 -1.0 0.5

Expected Growth (Big Economic Cycle) Reliable -0.6 0.4 -1.0 -1.0 -1.1 -0.4

Internal Order So-So -2.0 0.2 0.2 0.8 1.1 --- ---

Gaps in Wealth, Opportunity & Values So-So -1.8

0.2 0.1 0.8 1.0 0.0

Internal Conflict

1

(Internal Order; low is bad) Reliable -2.2 0.1 0.3 0.7 1.2 --- ---

External Order

2

So-So -1.3 -1.3 0.3 0.3 0.4 --- ---

KEY EIGHT MEASURES OF POWER

Education Reliable 2.0

1.7 0.4 -0.2 0.1 0.1

Innovation & Technology Reliable 2.1 1.6 0.2 -0.2 0.1 0.2

Cost Competitiveness Reliable -0.4 1.1 -0.6 -0.6 -0.3 0.1

Military Strength Reliable 2.0 0.9 0.4 -0.7 -0.4 -0.4

Trade Reliable 1.1 1.9 1.3 0.5 -0.5 -0.7

Economic Output Reliable 1.7 1.5 1.0 -0.1 -0.1 -0.9

Markets & Financial Center Reliable 2.7 0.2 0.4 -0.2 0.1 -0.6

Reserve Currency Status

3

Reliable 1.9 -0.6 0.3 --- --- -0.5 -0.7 ---

ADDITIONAL MEASURES OF POWER

Geology Reliable 1.6

0.5 -0.6 -0.7 -1.0 -0.9

Resource-Allocation Efficiency So-So 1.4 0.8 -0.8 1.0 0.6 -0.5

Acts of Nature So-So -0.2 --- -0.1 --- 0.1 --- 1.1 --- 1.5 --- 1.6 ---

Infrastructure & Investment Reliable 0.7

2.6 0.4 -0.3 -0.2 0.0

Character/Civility/Determination So-So 1.0 1.6 -1.0 -0.4 0.4 1.0

Governance/Rule of Law Reliable 0.7 -0.6 -0.5 --- 0.7 0.8 -0.2

1

We are still working to expand our internal and external conflict determinants across all countries.

2

External Order based on external conflict gauge vs the global hegemon (USA) or rising power (CHN) as of April 2022.

3

We did not give individual Eurozone countries reserve currency status scores.

ALL THE MAJOR DETERMINANTS ACROSS THE WORLD

e tables on the following pages paint a rich picture of what’s happening and what is likely to happen across

an expanded set of 24 major countries. While this table might look like a bunch of numbers and arrows at first

glance, when you get into it a clearer picture will emerge. In my book, I discuss the determinants in greater

depth in the Determinants Addendum (Chapter 2) and e Future (Chapter 14). e quality of the gauges

in representing the concepts varies. In order to convey the reliability of each gauge, we indicate whether it’s

reliable or so-so. e following page describes how to read the tables.

COUNTRY POWER INDEX 2022

3

CURRENT READINGS ACROSS MAJOR POWERS

(Z-Score and 20-Year Change Denoted by Arrows)

GAUGE

QUALITY

IND GBR FRA RUS SGP CAN

EMPIRE SCORE (0–1) 0.28

0.27 0.26 0.26 0.22 0.22

THE BIG CYCLES

Economic/Financial Position Reliable 1.1

-1.5 -1.0 0.7 --- 0.8 -0.6

Debt Burden (Big Economic Cycle) Reliable 0.5 -1.8 -0.8 1.2 1.6 -0.3

Expected Growth (Big Economic Cycle) Reliable 1.1 -0.7 -0.9 -0.2 --- -0.4 -0.7

Internal Order So-So --- --- -0.3 0.5 -1.2 --- --- --- ---

Gaps in Wealth, Opportunity & Values So-So -0.3

-0.3 1.1 -1.8 -2.1 -0.2

Internal Conflict

1

(Internal Order; low is bad) Reliable --- --- -0.3 -0.1 -0.5 --- --- --- ---

External Order

2

So-So --- --- 0.4 --- --- -2.1 --- --- --- ---

KEY EIGHT MEASURES OF POWER

Education Reliable -1.1

-0.3 -0.5 -0.5 -0.5 -0.2

Innovation & Technology Reliable -1.1 -0.3 -0.5 -0.7 -0.6 -0.6

Cost Competitiveness Reliable 2.4 -0.4 -0.6 0.7 --- 0.2 -0.5

Military Strength Reliable 0.3 -0.2 -0.1 0.6 -2.1 -0.9

Trade Reliable -0.8 -0.5 -0.5 -0.9 -0.7 -0.8

Economic Output Reliable 0.1 -0.6 -0.6 -0.5 -1.5 -1.1

Markets & Financial Center Reliable -0.7 0.0 -0.3 -1.0 -0.4 -0.4

Reserve Currency Status

3

Reliable -0.7 -0.5 --- --- -0.7 --- -0.7 --- -0.6 ---

ADDITIONAL MEASURES OF POWER

Geology Reliable 0.3

-0.8 -0.5 2.1 -0.6 0.7

Resource-Allocation Efficiency So-So 0.3 -0.3 -1.6 -0.1 --- 2.4 0.5

Acts of Nature So-So -2.4 --- 0.3 --- 0.0 -0.1 --- -0.3 --- 1.2 ---

Infrastructure & Investment Reliable -0.3

-0.7 -0.2 -1.0 -0.2 -0.7

Character/Civility/Determination So-So 1.3 -0.3 -1.5 0.2 --- 2.4 0.1

Governance/Rule of Law Reliable -1.1 1.2 0.3 -1.9 2.3 0.7

1

We are still working to expand our internal and external conflict determinants across all countries.

2

External Order based on external conflict gauge vs the global hegemon (USA) or rising power (CHN) as of April 2022.

3

We did not give individual Eurozone countries reserve currency status scores.

e first column shows the determinant being measured. ere are other determinants that aren’t shown

because they are either too subjective or too difficult to quantify (e.g., leadership). e quality of leadership

can’t be measured as objectively as the amount of economic output (e.g., how can you measure whether Donald

Trump was a good leader or a bad one?). e rest of the columns show each country’s score on each determinant,

as well as the recent trend in that score; where we do not have enough data to make a gauge or enough history

to display an arrow, we show dashes to indicate no reading.

THE CHANGING WORLD ORDER

4

CURRENT READINGS ACROSS MAJOR POWERS

(Z-Score and 20-Year Change Denoted by Arrows)

GAUGE

QUALITY

AUS CHE TUR BRZ ITA NLD

EMPIRE SCORE (0–1) 0.22

0.21 0.18 0.18 0.17 0.16

THE BIG CYCLES

Economic/Financial Position Reliable -0.6

-0.1 --- -0.1 -0.4 -1.1 -0.5

Debt Burden (Big Economic Cycle) Reliable -0.7 0.4 -0.5 -0.2 -0.5 0.0

Expected Growth (Big Economic Cycle) Reliable -0.4 -0.7 --- 0.2 -0.4 -1.3 -0.9

Internal Order So-So --- --- --- --- --- --- --- --- --- --- 0.9

Gaps in Wealth, Opportunity & Values So-So 0.3 0.0 -1.1 -2.0 0.9 0.6

Internal Conflict

1

(Internal Order; low is bad) Reliable --- --- --- --- --- --- --- --- --- --- 1.3

External Order

2

So-So --- --- --- --- --- --- --- --- --- --- --- ---

KEY EIGHT MEASURES OF POWER

Education Reliable -0.5

-0.7 -1.7 -1.4 -0.9 -0.7

Innovation & Technology Reliable -0.6 -0.2 -1.0 -1.0 -0.8 -0.3

Cost Competitiveness Reliable -0.6 -0.6 0.9 0.6 -0.7 -0.8

Military Strength Reliable -0.9 -1.2 -0.6 -0.5 -0.7 -1.8

Trade Reliable -1.0 -0.8 -1.2 -1.1 -0.7 -0.6

Economic Output Reliable -1.3 -1.5 -0.7 -0.7 -0.7 -1.4

Markets & Financial Center Reliable -0.4 -0.3 -1.0 -1.0 -0.7 -0.5

Reserve Currency Status

3

Reliable -0.6 --- -0.7 -0.7 --- -0.7 --- --- --- --- ---

ADDITIONAL MEASURES OF POWER

Geology Reliable 1.9

-0.5 -0.6 1.6 -0.7 -0.4

Resource-Allocation Efficiency So-So -0.4 -0.5 -0.2 -1.3 -2.4 0.3

Acts of Nature So-So 1.4 --- 1.2 --- -0.1 --- -2.3 --- -0.9 --- 0.5 ---

Infrastructure & Investment Reliable -0.7

-0.1 -0.5 -1.1 -0.8 -0.4

Character/Civility/Determination So-So 0.1 0.4 0.0 -0.8 -1.4 -0.3

Governance/Rule of Law Reliable 0.9 1.2 -1.2 -2.3 -1.9 1.0

1

We are still working to expand our internal and external conflict determinants across all countries.

2

External Order based on external conflict gauge vs the global hegemon (USA) or rising power (CHN) as of April 2022.

3

We did not give individual Eurozone countries reserve currency status scores.

COUNTRY POWER INDEX 2022

5

CURRENT READINGS ACROSS MAJOR POWERS

(Z-Score and 20-Year Change Denoted by Arrows)

GAUGE

QUALITY

ESP IDN SAU MEX SAF ARG

EMPIRE SCORE (0–1) 0.16

0.15 0.14 0.13 0.09 0.05

THE BIG CYCLES

Economic/Financial Position Reliable -1.3

1.0 1.9 --- 0.3 0.2 -1.0

Debt Burden (Big Economic Cycle) Reliable -1.1 0.6 1.9 --- 0.3 0.2 -0.9

Expected Growth (Big Economic Cycle) Reliable -1.1 0.9 --- --- 0.1 0.0 -0.7

Internal Order So-So 0.0 --- --- --- --- --- --- --- --- --- ---

Gaps in Wealth, Opportunity & Values So-So 0.4

0.1 -3.0 -1.8 -2.8 0.1

Internal Conflict

1

(Internal Order; low is bad) Reliable -0.4 --- --- --- --- --- --- --- --- --- ---

External Order

2

So-So --- --- --- --- --- --- --- --- --- --- --- ---

KEY EIGHT MEASURES OF POWER

Education Reliable -0.9

-1.9 -1.4 -1.3 -1.8 -1.7

Innovation & Technology Reliable -1.0 -1.2 -1.4 -1.3 -1.2 -1.2

Cost Competitiveness Reliable -0.6 2.0 --- --- 0.8 0.8 0.4

Military Strength Reliable -0.9 -0.8 -0.6 -2.1 --- -1.3 -2.1

Trade Reliable -0.9 -1.2 -1.2 -0.9 -1.3 -1.3

Economic Output Reliable -1.0 -0.8 -1.2 -0.8 -1.2 -1.2

Markets & Financial Center Reliable -0.7 -1.1 -1.1 -1.0 -1.0 -1.3

Reserve Currency Status

3

Reliable --- --- -0.7 --- -0.7 --- -0.7 --- -0.7 --- -0.7 ---

ADDITIONAL MEASURES OF POWER

Geology Reliable -0.5

0.4 0.3 -0.3 -0.2 -0.3

Resource-Allocation Efficiency So-So -1.5 1.0 -0.7 -0.3 -0.6 -2.4

Acts of Nature So-So -0.6 --- -2.1 --- -1.9 --- -1.1 --- -2.0 --- -2.0 ---

Infrastructure & Investment Reliable -0.6

-0.6 -0.6 -1.0 -1.1 -1.5

Character/Civility/Determination So-So -0.9 1.3 --- --- 1.3 -0.5 --- -0.7

Governance/Rule of Law Reliable -0.7 -1.3 --- --- -2.3 -1.5 -2.3

1

We are still working to expand our internal and external conflict determinants across all countries.

2

External Order based on external conflict gauge vs the global hegemon (USA) or rising power (CHN) as of April 2022.

3

We did not give individual Eurozone countries reserve currency status scores.

THE CHANGING WORLD ORDER

6

THE POWERS AND PROSPECTS OF THE UNITED STATES

is is our computer generated reading for the United States as of January 2022.

Based on the latest readings of key indicators, the United States appears to be a strong power (#1 among major

countries today) in gradual decline. As shown in the table below, the key strengths of the United States that

put it in this position are its strong capital markets and financial center, its innovation/technology, its strong

military, its high level of education, its reserve currency status, its high economic output, and its wealth of

natural resources. Its weaknesses are its unfavorable economic/financial position and its large domestic con-

flicts. e eight major measures of power are very strong today but are, in aggregate, falling slowly.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For the United States, the big cycles look mostly unfavorable.

e United States is in an unfavorable position in its economic and financial cycles, with a high debt burden

and relatively low expected real growth over the next 10 years (1.3% per year). e United States has significantly

more foreign debts than foreign assets (net IIP is -68% of GDP). Non-financial debt levels are high (274% of

GDP), and government debt levels are high (127% of GDP). e bulk (99%) of these debts are in its own currency,

which mitigates its debt risks. e ability to use interest rate cuts to stimulate the economy is low (short rates at

0.1%), and the country is already printing money to monetize debt. at said, being the world’s leading reserve

currency is a large benefit to the US. If this were to change, it would significantly weaken the US position.

Internal disorder is a high risk. Wealth, income, and values gaps are large (relative to countries of similar per

capita income levels). Regarding Inequality—the top 1% and top 10% in the United States capture 19% and

45% of income (respectively the 8th and 11th highest share across major countries). Our internal conflict gauge

is very high. is gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and

general discontent (based on surveys).

External disorder is a risk. Most importantly, the United States and China, which is fast-rising and the #2

power (all things considered), are having significant conflict as measured by our external conflict gauge. One

example of this is that 79% of Americans today have an unfavorable view of China (up from 45% in 2018).

Looking in more detail at the eight key measures of power—the United States has the largest capital mar-

kets and the strongest financial center among major countries. Its equity markets are a majority of the world

total (59% of total market cap and 66% of volume), and a majority of global transactions happen in USD (55%).

In addition, the United States has the strongest reading on our measures of technology and innovation

among major countries. A moderately large share (14%) of global patent applications, a large share (27%)

of global R&D spending, and a large share (27%) of global researchers are in the United States. e United

COUNTRY POWER INDEX 2022

7

UNITED STATES—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.89 Rank: 1

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Unfavorable -1.5 23

Debt Burden High Debt -1.9 24

Expected Growth 1.3% -0.6 12

Internal Order High Risk -2.0 10

Wealth/Opportunity/Values Gap Large -1.8 19

Internal Conflict Very High -2.2 10

External Order At Risk -1.3 -

Eight Key Measures of Power

Markets & Financial Center Very Strong 2.7 1

Innovation & Technology Very Strong 2.1 1

Military Strength Very Strong 2.0 1

Education Very Strong 2.0 1

Reserve Currency Status Very Strong 1.9 1

Economic Output Very Strong 1.7 1

Trade Strong 1.1 3

Cost Competitiveness Average -0.4 14

Additional Measures of Power

Resource-Allocation Efficiency Strong 1.4 1

Infrastructure & Investment Strong 0.7 2

Geology Strong 1.6 4

Character/Determination/Civility Strong 1.0 6

Governance/Rule of Law Strong 0.7 9

Acts of Nature Average -0.2 14

-

Getting better Getting worse Flat

States also has the strongest military among major countries. A large share (40%) of global military spend-

ing is by the United States, and it has a moderate share (7%) of the world’s military personnel. e United States

also has a mix of other strengths, detailed in the table above.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

8

THE POWERS AND PROSPECTS OF CHINA

is is our computer generated reading for China as of January 2022.

Based on the latest readings of key indicators, China appears to be a strong power (#2 among major countries

today) in rapid ascent. As shown in the table below, the key strengths of China that put it in this position

are its infrastructure and investment, its importance to global trade, its high level of education, its innova-

tion/technology, its people’s self-sufficiency and strong work ethic, and its strong military. e eight major

measures of power are somewhat strong today and are, in aggregate, rising rapidly. In particular, China’s im-

portance to global trade, its innovation and technology, and its importance as a financial center are increasing.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For China, the big cycles look somewhat favorable.

China is in a somewhat favorable position in its economic and financial cycles, with a moderately low debt

burden and relatively high expected real growth over the next 10 years (4.3% per year). China has slightly more

foreign assets than foreign debts (net IIP is 11% of GDP). Non-financial debt levels are high (267% of GDP),

though government debt levels are typical for major countries today (49% of GDP). e bulk (97%) of these

debts are in its own currency, which mitigates its debt risks. e ability to use interest rate cuts to stimulate the

economy is modest (short rates at 2.1%).

Internal disorder is a low risk. Wealth, income, and values gaps are typical (relative to countries of similar per

capita income levels). Regarding Inequality—the top 1% and top 10% in China capture 14% and 42% of income

(respectively the 14th and 13th highest share across major countries). Our internal conflict gauge is average.

is gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and general dis-

content (based on surveys).

External disorder is a risk. Most importantly, China and the United States, which is declining but remains

the #1 power (all things considered), are having significant conflict as measured by our external conflict gauge.

Looking in more detail at the eight key measures of power—China is the largest exporter among major

countries. It exports 14% of global exports. In addition, China has the second strongest position in edu-

cation among major countries. China has a large share of the world’s bachelor’s degrees (20%). China also

has the second strongest reading on our measures of technology and innovation among major countries.

A majority (58%) of global patent applications, a large share (23%) of global R&D spending, and a large share

(23%) of global researchers are in China. China also has a mix of other strengths, detailed in the table above.

COUNTRY POWER INDEX 2022

9

CHINA—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.76 Rank: 2

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Somewhat Favorable 0.3 7

Debt Burden Moderately Low Debt -0.0 11

Expected Growth 4.3% 0.4 3

Internal Order Low Risk 0.2 6

Wealth/Opportunity/Values Gap Typical 0.2 8

Internal Conflict Average 0.1 5

External Order At Risk -1.3 -

Eight Key Measures of Power

Trade Very Strong 1.9 1

Education Very Strong 1.7 2

Innovation & Technology Strong 1.6 2

Economic Output Strong 1.5 2

Military Strength Strong 0.9 2

Cost Competitiveness Strong 1.1 3

Markets & Financial Center Average 0.2 3

Reserve Currency Status Weak -0.6 5

Additional Measures of Power

Infrastructure & Investment Very Strong 2.6 1

Character/Determination/Civility Strong 1.6 2

Resource-Allocation Efficiency Strong 0.8 3

Geology Strong 0.5 6

Governance/Rule of Law Weak -0.6 13

Acts of Nature Average -0.1 12

-

Getting better Getting worse Flat

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

10

THE POWERS AND PROSPECTS OF EUROZONE

is is our computer generated reading for Eurozone as of January 2022.

Based on the latest readings of key indicators, Eurozone appears to be a strong power (#3 among major

countries today) in gradual decline. As shown in the table below, the key strengths of Eurozone are its

importance to global trade, its strong capital markets and financial center, and its reserve currency status.

Its weaknesses are its people’s lower than average work ethic and low self-sufficiency and its relatively poor

allocation of labor and capital. e eight major measures of power are somewhat strong today but are, in ag-

gregate, falling slowly.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Eurozone, the big cycles look somewhat unfavorable.

e Eurozone is in a moderately unfavorable position in its economic and financial cycles, with a moderately

high debt burden and very low expected real growth over the next 10 years (0.3% per year). e Eurozone has

similar levels of foreign debts and foreign assets (net IIP is -0% of GDP). Non-financial debt levels are typical for

major countries today (239% of GDP), though government debt levels are high (103% of GDP). e ability to use

interest rate cuts to stimulate the economy is very low (short rates at -0.6%), and the country is already printing

money to monetize debt.

Internal disorder is a low risk. Wealth, income, and values gaps are typical (relative to countries of similar per

capita income levels). Regarding Inequality—the top 1% and top 10% in the Eurozone capture 11% and 35%

of income (respectively the 21st and 18th highest share across major countries). Our internal conflict gauge

is average. is gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and

general discontent (based on surveys).

Looking in more detail at the eight key measures of power—the Eurozone is the second largest exporter

among major countries. It exports 12% of global exports. In addition, the Eurozone has the second largest

capital markets and the second strongest financial center among major countries. Its equity markets are

a moderate share of the world total (8% of total market cap and 4% of volume), and a large share of global

transactions happen in EUR (30%). e Eurozone also has the second strongest reserve currency among

major countries. A large share of global currency reserves are in EUR (21%), and a large share of global debt

is denominated in EUR (17%).

is page reects our estimate of the power of the Eurozone in aggregate. For most stats, we’re using a aggregate across

the eight major countries in the Eurozone.

COUNTRY POWER INDEX 2022

11

EUROZONE—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.58 Rank: 3

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Moderately Unfavorable -0.9 17

Debt Burden Moderately High Debt -0.6 17

Expected Growth 0.3% -1.0 20

Internal Order Low Risk 0.2 5

Wealth/Opportunity/Values Gap Typical 0.1 9

Internal Conflict Average 0.3 4

External Order At Risk 0.3 -

Eight Key Measures of Power

Trade Strong 1.3 2

Markets & Financial Center Average 0.4 2

Reserve Currency Status Average 0.3 2

Economic Output Strong 1.0 3

Education Average 0.4 3

Innovation & Technology Average 0.2 3

Military Strength Average 0.4 4

Cost Competitiveness Weak -0.6 19

Additional Measures of Power

Infrastructure & Investment Average 0.4 3

Governance/Rule of Law Average -0.5 12 -

Resource-Allocation Efficiency Weak -0.8 18

Geology Weak -0.6 19

Character/Determination/Civility Weak -1.0 21

Acts of Nature Average 0.1 9 -

Getting better Getting worse Flat

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

12

THE POWERS AND PROSPECTS OF GERMANY

is is our computer generated reading for Germany as of January 2022.

Based on the latest readings of key indicators, Germany appears to be a middle-of-the-pack power (#4 among

major countries today) on a flat trajectory. As shown in the table below, the key strengths of Germany are

its high internal order and its effective allocation of labor and capital. e eight major measures of power are

mixed today but are, in aggregate, moving sideways.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Germany, the big cycles look somewhat favorable.

Germany is in a moderately unfavorable position in its economic and financial cycles, with a low debt burden

but very low expected real growth over the next 10 years (0.3% per year). Germany has significantly more foreign

assets than foreign debts (net IIP is 71% of GDP). Non-financial debt levels are typical for major countries today

(184% of GDP), and government debt levels are typical for major countries today (69% of GDP). Germany’s debts

are largely in euros, which increases Germany’s debt risks, since this is not a currency that Germany directly

controls. e ability to use interest rate cuts to stimulate the economy is low for the Eurozone (short rates are at

-0.6%), and Europe is already printing money to monetize debt.

Internal disorder is a low risk. Wealth, income, and values gaps are narrow (relative to countries of similar per

capita income levels). Regarding Inequality—the top 1% and top 10% in Germany capture 13% and 37% of in-

come (both the 16th highest share across major countries). Our internal conflict gauge is low. is gauge measures

actual conflict events (i.e., protests), political conflict (i.e., partisanship), and general discontent (based on surveys).

On the eight key measures of power, Germany looks mixed in aggregate. It has no particularly prominent

strengths or weaknesses that I will call out.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

13

GERMANY—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.38 Rank: 4

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Moderately Unfavorable -0.1 11

Debt Burden Low Debt 0.8 4

Expected Growth 0.3% -1.0 19

Internal Order Low Risk 0.8 3

Wealth/Opportunity/Values Gap Narrow 0.8 4

Internal Conflict Low 0.7 3

External Order At Risk 0.3 -

Eight Key Measures of Power

Trade Strong 0.5 4

Economic Output Average -0.1 6

Education Average -0.2 6

Innovation & Technology Average -0.2 6

Markets & Financial Center Average -0.2 6

Military Strength Weak -0.7 14

Cost Competitiveness Weak -0.6 20

Reserve Currency Status - - - -

Additional Measures of Power

Resource-Allocation Efficiency Strong 1.0 2

Governance/Rule of Law Strong 0.7 8

Infrastructure & Investment Average -0.3 10

Character/Determination/Civility Average -0.4 16

Geology Weak -0.7 21

Acts of Nature Strong 1.1 6

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

14

THE POWERS AND PROSPECTS OF JAPAN

is is our computer generated reading for Japan as of January 2022.

Based on the latest readings of key indicators, Japan appears to be a middle-of-the-pack power (#5 among

major countries today) in decline. As shown in the table below, the key strength of Japan is its high internal

order. Its weaknesses are its unfavorable economic/financial position and its relative lack of natural re-

sources. e eight major measures of power are mixed today but are, in aggregate, falling. In particular, Japan’s

share of global output, its importance to global trade, and its innovation and technology are declining.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Japan, the big cycles look mixed.

Japan is in an unfavorable position in its economic and financial cycles, with a high debt burden and very

low expected real growth over the next 10 years (0.0% per year). Japan has significantly more foreign assets than

foreign debts (net IIP is 70% of GDP). Non-financial debt levels are very high (403% of GDP), and government

debt levels are very high (240% of GDP). e bulk (99%) of these debts are in its own currency, which mitigates

its debt risks. e ability to use interest rate cuts to stimulate the economy is very low (short rates at -0.1%), and

the country is already printing money to monetize debt.

Internal disorder is a low risk. Wealth, income, and values gaps are narrow (relative to countries of similar per

capita income levels). Regarding Inequality—the top 1% and top 10% in Japan capture 13% and 45% of income

(respectively the 15th and 12th highest share across major countries). Our internal conflict gauge is low. is

gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and general discontent

(based on surveys).

On the eight key measures of power, Japan looks mixed in aggregate. It has no particularly prominent

strengths or weaknesses that I will call out.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

15

JAPAN—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.33 Rank: 5

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Unfavorable -1.3 21

Debt Burden High Debt -1.0 20

Expected Growth 0.0% -1.1 22

Internal Order Low Risk 1.1 1

Wealth/Opportunity/Values Gap Narrow 1.0 2

Internal Conflict Low 1.2 2

External Order At Risk 0.4 -

Eight Key Measures of Power

Reserve Currency Status Average -0.5 3

Education Average 0.1 4

Markets & Financial Center Average 0.1 4

Innovation & Technology Average 0.1 5

Economic Output Average -0.1 5

Trade Average -0.5 5

Military Strength Average -0.4 8

Cost Competitiveness Average -0.3 12

Additional Measures of Power

Resource-Allocation Efficiency Strong 0.6 5

Governance/Rule of Law Strong 0.8 6

Infrastructure & Investment Average -0.2 6

Character/Determination/Civility Average 0.4 9

Geology Weak -1.0 24

Acts of Nature Strong 1.5 2

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

16

THE POWERS AND PROSPECTS OF KOREA

is is our computer generated reading for Korea as of January 2022.

Based on the latest readings of key indicators, Korea appears to be a middle-of-the-pack power (#6 among

major countries today) in gradual ascent. As shown in the table below, the key weaknesses of Korea are its

relative lack of natural resources and its relatively small economy. e eight major measures of power are

somewhat weak today but are, in aggregate, rising slowly. In particular, Korea’s share of global output, its inno-

vation and technology, and its relative military strength are increasing.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Korea, the big cycles look mixed.

Korea is in a somewhat favorable position in its economic and financial cycles, with a low debt burden but

relatively low expected real growth over the next 10 years (1.9% per year). Korea has modestly more foreign assets

than foreign debts (net IIP is 27% of GDP). Non-financial debt levels are high (280% of GDP), though govern-

ment debt levels are typical for major countries today (44% of GDP). e bulk (97%) of these debts are in its own

currency, which mitigates its debt risks. e ability to use interest rate cuts to stimulate the economy is modest

(short rates at 1.2%).

At this time, we do not have a read on internal disorder for Korea because we do not have an internal conflict

gauge. Wealth, income, and values gaps are relatively large (relative to countries of similar per capita income

levels). Regarding Inequality—the top 1% and top 10% in Korea capture 15% and 47% of income (respectively

the 12th and 8th highest share across major countries).

Looking in more detail at the eight key measures of power, we would call out its relatively small economy.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

17

KOREA—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.31 Rank: 6

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Somewhat Favorable 0.1 9

Debt Burden Low debt 0.5 7

Expected Growth 1.9% -0.4 10

Internal Order - - - -

Wealth/Opportunity/Values Gap Relatively Large 0.0 12

Internal Conflict - - - -

External Order At Risk - - -

Eight Key Measures of Power

Innovation & Technology Average 0.2 4

Education Average 0.1 5

Military Strength Average -0.4 9

Trade Weak -0.7 9

Cost Competitiveness Average 0.1 11

Markets & Financial Center Weak -0.6 13

Reserve Currency Status Weak -0.7 15 -

Economic Output Weak -0.9 15

Additional Measures of Power

Infrastructure & Investment Average 0.0 4

Character/Determination/Civility Strong 1.0 7

Governance/Rule of Law Average -0.2 11

Resource-Allocation Efficiency Average -0.5 16

Geology Weak -0.9 21

Acts of Nature Strong 1.6 1

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

18

THE POWERS AND PROSPECTS OF INDIA

is is our computer generated reading for India as of January 2022.

Based on the latest readings of key indicators, India appears to be a middle-of-the-pack power (#7 among

major countries today) in ascent. As shown in the table below, the key strengths of India are its strong eco-

nomic and financial position and its cost-competitive labor (on a quality-adjusted basis). Its weaknesses

are its poor innovation and technology for its size population, its weak relative position in education, and

its corruption and inconsistent rule of law. e eight major measures of power are mixed today but are, in

aggregate, rising. In particular, India’s relative military strength, its innovation and technology, and its impor-

tance as a financial center are increasing.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For India, the big cycles look somewhat favorable, though we have a limited read.

India is in a highly favorable position in its economic and financial cycles, with a low debt burden and high

expected real growth over the next 10 years (6.4% per year). India has slightly more foreign debts than foreign

assets (net IIP is -12% of GDP). Non-financial debt levels are low (122% of GDP), though government debt levels

are typical for major countries today (75% of GDP). e bulk (94%) of these debts are in its own currency, which

mitigates its debt risks.

At this time, we do not have a read on internal disorder for India because we do not have an internal conflict

gauge. Wealth, income, and values gaps are relatively large (relative to countries of similar per capita income lev-

els). Regarding Inequality—the top 1% and top 10% in India capture 22% and 57% of income (respectively the

3rd and 4th highest share across major countries). However, a wide wealth gap is less concerning in a fast growing

country like India because the fast growth can create rising prosperity for all.

Looking in more detail at the eight key measures of power—India has the cheapest labor among major

countries. Adjusted for worker quality, labor is significantly cheaper than the global average.

We net this against its bad reading on innovation and technology and its weak relative position in educa-

tion. With innovation and technology—a small share (less than 1%) of global patent applications, a small share

(3%) of global R&D spending, and a moderate share (3%) of global researchers are in India. On years of edu-

cation, India is bad—students have on average 5.9 years of education versus 11.5 in the average major country.

PISA scores, which measure the proficiency of 15-year-old students across countries, are bad—336 versus 483

in the average major country.

COUNTRY POWER INDEX 2022

19

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

INDIA—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.28 Rank: 7

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Highly Favorable 1.1 2

Debt Burden Low Debt 0.5 6

Expected Growth 6.4% 1.1 1

Internal Order - - - -

Wealth/Opportunity/Values Gap Relatively Large -0.3 16

Internal Conflict - - - -

External Order At Risk - - -

Eight Key Measures of Power

Cost Competitiveness Very Strong 2.4 1

Economic Output Average 0.1 4

Military Strength Average 0.3 5

Trade Weak -0.8 12

Markets & Financial Center Weak -0.7 16

Education Weak -1.1 17

Reserve Currency Status Weak -0.7 19

Innovation & Technology Weak -1.1 19

Additional Measures of Power

Character/Determination/Civility Strong 1.3 3

Resource-Allocation Efficiency Average 0.3 8

Geology Average 0.3 9

Infrastructure & Investment Average -0.3 9

Governance/Rule of Law Weak -1.1 15

Acts of Nature Very Weak -2.4 24

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

20

THE POWERS AND PROSPECTS OF UNITED KINGDOM

is is our computer generated reading for United Kingdom as of January 2022.

Based on the latest readings of key indicators, United Kingdom appears to be a middle-of-the-pack power

(#8 among major countries today) on a flat trajectory. As shown in the table below, the key weaknesses of

United Kingdom are its unfavorable economic/financial position and its relative lack of natural resources.

e eight major measures of power are somewhat weak today but are, in aggregate, moving sideways.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For United Kingdom, the big cycles look somewhat unfavorable.

e UK is in an unfavorable position in its economic and financial cycles, with a high debt burden and rela-

tively low expected real growth over the next 10 years (1.2% per year). e UK has slightly more foreign debts

than foreign assets (net IIP is -24% of GDP). Non-financial debt levels are high (262% of GDP), and government

debt levels are high (109% of GDP). e bulk (93%) of these debts are in its own currency, which mitigates its debt

risks. e ability to use interest rate cuts to stimulate the economy is low (short rates at 0.4%), and the country is

already printing money to monetize debt.

Internal disorder is a moderate risk. Wealth, income, and values gaps are relatively large (relative to countries of

similar per capita income levels). Regarding Inequality—the top 1% and top 10% in United Kingdom capture 13%

and 36% of income (respectively the 18th and 17th highest share across major countries). Our internal conflict

gauge is average. is gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and

general discontent (based on surveys).

On the eight key measures of power, United Kingdom looks somewhat weak in aggregate. It has no partic-

ularly prominent strengths or weaknesses that I will call out.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

21

UNITED KINGDOM—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.27 Rank: 8

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Unfavorable -1.5 24

Debt Burden High Debt -1.8 23

Expected Growth 1.2% -0.7 13

Internal Order Moderate Risk -0.3 8

Wealth/Opportunity/Values Gap Relatively Large -0.3 15

Internal Conflict Average -0.3 7

External Order At Risk 0.4 -

Eight Key Measures of Power

Reserve Currency Status Average -0.5 4

Markets & Financial Center Average 0.0 5

Trade Weak -0.5 6

Military Strength Average -0.2 7

Education Average -0.3 8

Innovation & Technology Average -0.3 8

Economic Output Weak -0.6 8

Cost Competitiveness Average -0.4 13

Additional Measures of Power

Governance/Rule of Law Strong 1.2 3

Resource-Allocation Efficiency Average -0.3 13

Character/Determination/Civility Average -0.3 15

Infrastructure & Investment Weak -0.7 16

Geology Weak -0.8 22

Acts of Nature Average 0.3 8

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

22

THE POWERS AND PROSPECTS OF FRANCE

is is our computer generated reading for France as of January 2022.

Based on the latest readings of key indicators, France appears to be a modest power (in the middle third of

countries we rank) on a flat trajectory. As shown in the table below, the key weaknesses of France are its un-

favorable economic/financial position, its people’s lower than average work ethic and low self-sufficiency,

and its relatively poor allocation of labor and capital. e eight major measures of power are somewhat weak

today but are, in aggregate, moving sideways.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For France, the big cycles look mixed.

France is in an unfavorable position in its economic and financial cycles, with a moderately high debt burden

and relatively low expected real growth over the next 10 years (0.5% per year). France has modestly more for-

eign debts than foreign assets (net IIP is -25% of GDP). Non-financial debt levels are high (269% of GDP), and

government debt levels are high (109% of GDP). France’s debts are largely in euros, which increases France’s

debt risks, since this is not a currency that France directly controls. e ability to use interest rate cuts to stim-

ulate the economy is low for the Eurozone (short rates are at -0.6%), and Europe is already printing money to

monetize debt.

Internal disorder is a low risk. Wealth, income, and values gaps are narrow (relative to countries of similar

per capita income levels). Regarding Inequality—the top 1% and top 10% in France capture 10% and 32% of

income (respectively the 22nd and 23rd highest share across major countries). Our internal conflict gauge is

average. is gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and

general discontent (based on surveys).

On the eight key measures of power, France looks somewhat weak in aggregate. It has no particularly

prominent strengths or weaknesses that I will call out.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

23

FRANCE—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.26 Rank: 9

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Unfavorable -1.0 19

Debt Burden Moderately High Debt -0.8 19

Expected Growth 0.5% -0.9 18

Internal Order Low Risk 0.5 4

Wealth/Opportunity/Values Gap Narrow 1.1 1

Internal Conflict Average -0.1 6

External Order At Risk - - -

Eight Key Measures of Power

Military Strength Average -0.1 6

Markets & Financial Center Average -0.3 7

Trade Weak -0.5 7

Economic Output Weak -0.6 9

Innovation & Technology Average -0.5 10

Education Weak -0.5 11

Cost Competitiveness Weak -0.6 21

Reserve Currency Status - - - -

Additional Measures of Power

Infrastructure & Investment Average -0.2 8

Governance/Rule of Law Average 0.3 10

Geology Average -0.5 14

Resource-Allocation Efficiency Weak -1.6 22

Character/Determination/Civility Weak -1.5 23

Acts of Nature Average 0.0 10

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

24

THE POWERS AND PROSPECTS OF RUSSIA

is is our computer generated reading for Russia as of January 2022.

Based on the latest readings of key indicators, Russia appears to be a modest power (in the middle third

of countries we rank) on a flat trajectory. As shown in the table below, the key strengths of Russia are its

strong economic and financial position, its wealth of natural resources, and its strong military. Its weak-

nesses are its corruption and inconsistent rule of law, its poor infrastructure and low investment, and its

relative unimportance as a global financial center. e eight major measures of power are somewhat weak

today but are, in aggregate, moving sideways.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Russia, the big cycles look mixed.

Russia is in a somewhat favorable position in its economic and financial cycles, with a low debt burden and

modest expected real growth over the next 10 years (2.6% per year). Russia has modestly more foreign assets than

foreign debts (net IIP is 33% of GDP). Non-financial debt levels are low (99% of GDP), and government debt

levels are low (15% of GDP). A significant share (24%) of Russia’s debt is denominated in foreign currencies,

which increases its debt risks.

Internal disorder is a moderate risk. Wealth, income, and values gaps are large (relative to countries of sim-

ilar per capita income levels). Regarding Inequality—the top 1% and top 10% in Russia capture 21% and 46%

of income (respectively the 4th and 10th highest share across major countries). Our internal conflict gauge is

high. is gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and general

discontent (based on surveys).

External disorder is a risk. Most importantly, Russia and the United States, which is declining but remains

the #1 power (all things considered), are having significant conflict as measured by our external conflict gauge.

Looking in more detail at the eight key measures of power—Russia has a relatively strong military. A moderate

share (5%) of global military spending is by Russia, and it has a moderate share (8%) of the world’s military personnel.

We net this against its relative unimportance as a global financial center. Its equity markets are a small share

of the world total (less than 1% of total market cap and less than 1% of volume), and a small share of global

transactions happen in RUB (1%).

COUNTRY POWER INDEX 2022

25

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

RUSSIA—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.26 Rank: 10

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Somewhat Favorable 0.7 5 -

Debt Burden Low Debt 1.2 3

Expected Growth 2.6% -0.2 7 -

Internal Order Moderate Risk -1.2 9

Wealth/Opportunity/Values Gap Large -1.8 18

Internal Conflict High -0.5 9

External Order At Risk -2.1 -

Eight Key Measures of Power

Military Strength Strong 0.6 3

Cost Competitiveness Strong 0.7 7 -

Economic Output Average -0.5 7

Reserve Currency Status Weak -0.7 8 -

Education Average -0.5 9

Innovation & Technology Weak -0.7 14

Trade Weak -0.9 17

Markets & Financial Center Weak -1.0 17

Additional Measures of Power

Geology Very Strong 2.1 1

Resource-Allocation Efficiency Average -0.1 9 -

Character/Determination/Civility Average 0.2 10 -

Governance/Rule of Law Very Weak -1.9 20

Infrastructure & Investment Weak -1.0 21

Acts of Nature Average -0.1 11

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

26

THE POWERS AND PROSPECTS OF SINGAPORE

is is our computer generated reading for Singapore as of January 2022.

Based on the latest readings of key indicators, Singapore appears to be a modest power (in the middle third

of countries we rank) in gradual ascent. As shown in the table below, the key strengths of Singapore are its

strong economic and financial position, its people’s self-sufficiency and strong work ethic, its strong rule of

law/low corruption, and its effective allocation of labor and capital. Its weaknesses are its relatively weak

military and its relatively small economy. e eight major measures of power are somewhat weak today but

are, in aggregate, rising slowly.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Singapore, the big cycles look somewhat favorable, though we have a limited read.

Singapore is in a highly favorable position in its economic and financial cycles, with a low debt burden but

relatively low expected real growth over the next 10 years (1.9% per year). Singapore has significantly more for-

eign assets than foreign debts (net IIP is 275% of GDP). Non-financial debt levels are high (319% of GDP), and

government debt levels are high (107% of GDP). A significant share (38%) of Singapore’s debt is denominated in

foreign currencies, which increases its debt risks. e ability to use interest rate cuts to stimulate the economy is

low (short rates at 0.4%).

At this time, we do not have a read on internal disorder for Singapore because we do not have an internal con-

flict gauge. Wealth, income, and values gaps are large (relative to countries of similar per capita income levels).

Regarding Inequality—the top 1% and top 10% in Singapore capture 14% and 46% of income (respectively the

13th and 9th highest share across major countries).

Looking in more detail at the eight key measures of power, we would call out its relatively weak military

and its relatively small economy. A small share (less than 1%) of global military spending is by Singapore, and

it has a small share (less than 1%) of the world’s military personnel.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

27

SINGAPORE—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.22 Rank: 11

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Highly Favorable 0.8 4

Debt Burden Low Debt 1.6 2

Expected Growth 1.9% -0.4 9

Internal Order - - - -

Wealth/Opportunity/Values Gap Large -2.1 22

Internal Conflict - - - -

External Order At Risk - - -

Eight Key Measures of Power

Markets & Financial Center Average -0.4 9

Cost Competitiveness Average 0.2 10

Reserve Currency Status Weak -0.7 10 -

Trade Weak -0.7 10

Innovation & Technology Weak -0.6 11

Education Weak -0.5 12

Military Strength Very Weak -2.1 23

Economic Output Weak -1.5 24

Additional Measures of Power

Character/Determination/Civility Very Strong 2.4 1

Governance/Rule of Law Very Strong 2.3 1

Infrastructure & Investment Average -0.2 7

Resource-Allocation Efficiency Very Strong 2.4 10

Geology Weak -0.6 17

Acts of Nature Average -0.3 15

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

28

THE POWERS AND PROSPECTS OF CANADA

is is our computer generated reading for Canada as of January 2022.

Based on the latest readings of key indicators, Canada appears to be a modest power (in the middle third

of countries we rank) on a flat trajectory. As shown in the table below, the key weaknesses of Canada that

put it in this position are its relatively weak military, its relatively small economy, and its relative unim-

portance to global trade. e eight major measures of power are somewhat weak today and are, in aggregate,

moving sideways.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Canada, the big cycles look somewhat unfavorable, though we have a limited read.

Canada is in a moderately unfavorable position in its economic and financial cycles, with a moderately high

debt burden and relatively low expected real growth over the next 10 years (1.2% per year). Canada has significantly

more foreign assets than foreign debts (net IIP is 60% of GDP). Non-financial debt levels are high (281% of GDP),

and government debt levels are high (99% of GDP). e bulk (91%) of these debts are in its own currency, which

mitigates its debt risks. e ability to use interest rate cuts to stimulate the economy is low (short rates at 0.3%).

At this time, we do not have a read on internal disorder for Canada because we do not have an internal conflict

gauge. Wealth, income, and values gaps are relatively large (relative to countries of similar per capita income

levels). Regarding Inequality—the top 1% and top 10% in Canada capture 15% and 41% of income (respectively

the 11th and 15th highest share across major countries).

Looking in more detail at the eight key measures of power, we would call out its relatively weak military, its

relatively small economy, and its relative unimportance to global trade. A small share (1%) of global military

spending is by Canada, and it has a small share (less than 1%) of the world’s military personnel. Canada exports

just 3% of global exports.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

29

CANADA—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.22 Rank: 12

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Moderately Unfavorable -0.6 15

Debt Burden Moderately High Debt -0.3 14

Expected Growth 1.2% -0.7 14

Internal Order - - - -

Wealth/Opportunity/Values Gap Relatively Large -0.2 14

Internal Conflict - - - -

External Order At Risk - - -

Eight Key Measures of Power

Education Average -0.2 7

Reserve Currency Status Weak -0.6 7 -

Markets & Financial Center Average -0.4 10

Innovation & Technology Weak -0.6 13

Trade Weak -0.8 13

Cost Competitiveness Average -0.5 15

Economic Output Weak -1.1 17

Military Strength Weak -0.9 18

Additional Measures of Power

Geology Strong 0.7 5

Resource-Allocation Efficiency Strong 0.5 6

Governance/Rule of Law Strong 0.7 7

Character/Determination/Civility Average 0.1 11

Infrastructure & Investment Weak -0.7 18

Acts of Nature Strong 1.2 4 -

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

30

THE POWERS AND PROSPECTS OF AUSTRALIA

is is our computer generated reading for Australia as of January 2022.

Based on the latest readings of key indicators, Australia appears to be a modest power (in the middle third

of countries we rank) in gradual ascent. As shown in the table below, the key strength of Australia is its

wealth of natural resources. Its weaknesses are its relatively small economy, its relative unimportance to

global trade, and its relatively weak military. e eight major measures of power are somewhat weak today

but are, in aggregate, rising slowly.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Australia, the big cycles look somewhat unfavorable, though we have a limited read.

Australia is in a moderately unfavorable position in its economic and financial cycles, with a moderately high

debt burden and relatively low expected real growth over the next 10 years (2.0% per year). Australia has modestly

more foreign debts than foreign assets (net IIP is -40% of GDP). Non-financial debt levels are typical for major

countries today (231% of GDP), and government debt levels are typical for major countries today (64% of GDP). e

bulk (95%) of these debts are in its own currency, which mitigates its debt risks. e ability to use interest rate cuts

to stimulate the economy is low (short rates at 0.1%), and the country is already printing money to monetize debt.

At this time, we do not have a read on internal disorder for Australia because we do not have an internal conflict

gauge. Wealth, income, and values gaps are typical (relative to countries of similar per capita income levels).

Regarding Inequality—the top 1% and top 10% in Australia capture 13% and 34% of income (respectively the

17th and 20th highest share across major countries).

Looking in more detail at the eight key measures of power, we would call out its relatively small economy,

its relative unimportance to global trade, and its relatively weak military. Australia exports just 2% of global

exports. A small share (2%) of global military spending is by Australia, and it has a small share (less than 1%)

of the world’s military personnel.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture

the overall strength of a country, I gave considerations to both quantity and quality, but structured things to best capture

who would win in a competition or war.

COUNTRY POWER INDEX 2022

31

AUSTRALIA—KEY DRIVERS OF OUR COUNTRY POWER SCORE

Overall Empire Score (0–1) Level: 0.22 Rank: 13

The Big Cycles Level Z-Score Rank Trajectory

Economic/Financial Position Moderately Unfavorable -0.6 16

Debt Burden Moderately High Debt -0.7 18

Expected Growth 2.0% -0.4 8

Internal Order - - -

Wealth/Opportunity/Values Gap Typical 0.3 7

Internal Conflict - - -

External Order At Risk - - -

Eight Key Measures of Power

Reserve Currency Status Weak -0.6 6 -

Education Average -0.5 10

Markets & Financial Center Average -0.4 11

Innovation & Technology Weak -0.6 12

Cost Competitiveness Weak -0.6 16

Military Strength Weak -0.9 17

Trade Weak -1.0 18

Economic Output Weak -1.3 21

Additional Measures of Power

Geology Very Strong 1.9 2

Governance/Rule of Law Strong 0.9 5

Character/Determination/Civility Average 0.1 12

Resource-Allocation Efficiency Average -0.4 14

Infrastructure & Investment Weak -0.7 17

Acts of Nature Strong 1.4 3

-

Getting better Getting worse Flat

Note: All ranks shown are out of 24, except in the case of Internal Conict & Internal Order (out of 10) and Reserve

Status (out of 19).

THE CHANGING WORLD ORDER

32

THE POWERS AND PROSPECTS OF SWITZERLAND

is is our computer generated reading for Switzerland as of January 2022.

Based on the latest readings of key indicators, Switzerland appears to be a modest power (in the middle third

of countries we rank) in gradual decline. As shown in the table below, the key strength of Switzerland is its

strong rule of law/low corruption. Its weaknesses are its relatively weak military, its relatively small econ-

omy, and its relative unimportance to global trade. e eight major measures of power are somewhat weak

today and are, in aggregate, falling slowly. In particular, Switzerland’s relative military strength, its importance

as a financial center, and its share of global output are declining.

e table below shows our aggregate country power gauge and the major drivers, as well as the rank of each

measure of power across 24 major countries today and the trajectory over the past twenty years.

To understand a country, we start by looking at the big cycles, as well as measures of power that both reflect

and drive the rise and fall of a country. While we refer to these factors individually, they are not separate; they

interact with and reinforce one another to move a country along its cycle.

For Switzerland, the big cycles look mixed.

Switzerland is in a moderately unfavorable position in its economic and financial cycles, with a low debt bur-

den but relatively low expected real growth over the next 10 years (1.2% per year). Switzerland has significantly

more foreign assets than foreign debts (net IIP is 103% of GDP). Non-financial debt levels are high (296% of

GDP), though government debt levels are low (28% of GDP). e bulk (84%) of these debts are in its own cur-

rency, which mitigates its debt risks. e ability to use interest rate cuts to stimulate the economy is very low (short

rates at -0.7%), and the country is already printing money to monetize debt.

At this time, we do not have a read on internal disorder for Switzerland because we do not have an internal conflict

gauge. Wealth, income, and values gaps are relatively large (relative to countries of similar per capita income lev-

els). Regarding Inequality—the top 1% and top 10% in Switzerland capture 11% and 32% of income (respectively

the 20th and 22nd highest share across major countries).

Looking in more detail at the eight key measures of power, we would call out its relatively weak military,

its relatively small economy, and its relative unimportance to global trade. A small share (less than 1%) of

global military spending is by Switzerland, and it has a small share (less than 1%) of the world’s military per-

sonnel. Switzerland exports just 2% of global exports.

Note: With this page, I am calling out a few of the major gauges and a few of the stats within each gauge that reect

the broad trends we are seeing. e aggregate gauges and nal country power score I am showing include hundreds of

individual stats that we aggregate based on relevance, quality, and consistency across countries and time. To best capture