1 | www.cignaglobal.com

Individual Plan for Seniors

An introduction to our health plan specically

designed for individuals aged 60 and over

Cigna Global Health Options

Improving the health and

vitality of those we serve.

3 | www.cignaglobal.com

Contents

Get a quote today

If you’d like a personal quote, simply get in touch with your local broker or visit our website. We’ve kept our quote

process as easy and quick as possible and it should only take 2 minutes to create your personalised quote.

Details of how to get in touch with your broker and other helpful information can be found on page 18 of this

brochure.

Important note:

The medical insurance plan presented in this document has been designed to meet the overall needs of

individuals aged 60 year old and over, and not the specic needs of each customer. As such, this plan may not be

suitable for every senior customer and other alternative plans are also available for review during the enquiry

process. The benets included in the Cigna Global plan for Seniors such as the International Outpatient benets

and the International Health & Wellbeing benets are not mandatory to your cover and can be removed from

your quote at any time and from your policy as per the terms and conditions detailed in the Policy Rules. As

outlined on page 12 of this document, you can add or remove deductible, cost share and optional modules to

build a plan that suits your needs.

04 Why choose Cigna Global plan for Seniors

05 Our promise

06 Our clinical support

08 Our digital healthcare tools

09 Our global expertise

10 Our Whole Health services

12 How to create your plan

13 Summary of benets

17 Your deductible and cost share options

18 What you can expect from us

4 | www.cignaglobal.com

Why choose Cigna Global plan for Seniors

Cigna Healthcare is a truly global health insurer with many years of experience providing health insurance across

multiple groups including customers over the age of 60. We understand what you expect from your health insurer

and have designed the Cigna Global plan for Seniors with your needs in mind.

• With roots in healthcare as deep as 230 years, Cigna is a globally recognised and trusted

health services company. Today, we have 189 million customer relationships that we serve in

more than 30 countries and jurisdictions. We look after them with an extensive international

workforce of 70,000 people.

• We have an extensive medical network of over 2.2 million partnerships. Our network is

comprised of trusted hospitals, clinics and medical practitioners around the world, with more

than 300,000 mental and behavioural health care providers, more than 67,000 contracted

pharmacies, and over 150 in-house doctors and nurses. We use our scale to deliver choice,

predictability, aordability and access to quality care for our customers.*

• “I would recommend Cigna Global very highly. (…) They were the only company who were

not concerned of my age.”

Cigna Global customer, age 76, 2020 Trustpilot review

Reassurance of a trusted global health insurer

• Our Cigna Global plan for Seniors is developed based on continuous and comprehensive

market research and by carefully listening to our customers to best address the needs of

individuals over the age of 60. Especially those who enjoy travelling to new destinations and

want to experience life outside of their home country.

A health plan specically designed for you

• Our Cigna Global plan for Seniors encompasses a range of benets to best address the

needs required by you. The core plan provides the essential coverage for hospital stays and

treatments, including surgeons and specialist consultation fees, hospital accommodations,

nursing and medicines. The plan also provides inpatient and outpatient mental health

coverage and coverage for treatment, testing and vaccines as a result of pandemic.

• To cover you more comprehensively we extended the core oer to include outpatient and

wellness benets. This means that you are covered in case of an urgent accident and

emergency admission. Furthermore, you are provided with tools to manage your overall

health and well-being proactively.

Coverage that provides peace of mind

• You will have access to our Clinical Case Management Programme which provides tailored

medical support from Cigna Healthcare doctors and nurses. See pages 6-7 for examples of

how our customers have beneted from the programme.

Personal medical care and support

* Please note, we may, at our sole discretion and without notication, make changes to the Cigna Healthcare network from time to time by

adding and/or removing hospitals, clinics, medical practitioners and pharmacies.

5 | www.cignaglobal.com

Our promise

We understand what it’s like to be globally mobile

Our global presence allows us to access a unique network of professionals and partners,

as highlighted in our Health Blog, so that you can fully prepare yourself for your global adventure.

We’re here to help

• We understand that moving to a new

country can be an exciting but busy time,

and we have resources that can assist you

along your journey.

• The Health Blog on our website has a

host of useful information such as country

guides, information on healthcare systems,

and tips for making the most of your

relocation.

We provide peace of mind

• With an extensive network of over 2.2 million

partnerships, we specialise in delivering

international healthcare with leading medical

providers across the globe to give you peace of

mind.

• Our International Evacuation & Crisis Assistance

Plus™ optional module gives you access to a

worldwide comprehensive crisis assistance

service for your peace of mind while you travel.

We are your Whole Health partner

Whether you are looking for chronic condition management, personalised wellness services

or you require an urgent appointment while abroad, as your Whole Health partner we have you covered.

Convenient healthcare tools and support

• Our team of dedicated doctors and nurses

can provide personalised medical advice

and support.

• Unlimited phone or video doctor

consultations via our Cigna Wellbeing

®

app.

• Our secure online Customer Area will help

you nd a local medical provider.

• Home delivery pharmacy in the USA.

A holistic approach to health

• Our plan provides full cancer care with no

restriction on age.

• We have a range of preventative treatments

and non-symptomatic tests and screenings.

• We oer counselling and coaching sessions

for both emotional and physical support.

• Our clinical programmes help you monitor

and manage any chronic conditions.

We put you rst

You can always count on our dedicated Customer Care team to provide you with

the highest level of service and care in the shortest possible time.

We put you in control

• Our policies are exible and allow you to

create a plan that suits your needs, budget

and gives you peace of mind.

• Your Cigna Global individual policy can be

set up and active within 24 hours.

• Your online Customer Area gives you access

to your policy documents and useful tools.

As well as a range of convenient ways to

contact us.

We put you at the heart of what we do

• Our multilingual Customer Care team are

available for you 24 hours a day.

• Our Customer Care team will provide you

with excellent service wherever you are.

• Direct billing is available with many

providers within our network.

6 | www.cignaglobal.com

We are dedicated to helping you and your family live happier, healthier lives thanks to our clinical expertise.

Senior customers have access to our Clinical Case Management programme which includes the following four

services:

Our clinical support

WHAT HAPPENED?

• A customer had been diagnosed with a brain tumour with a complex and

lengthy treatment plan.

WHAT DID WE DO?

• The customer and their family were supported throughout the treatment

by a Clinical Case Manager. Their Case Manager acted as a single point

of contact in Cigna Healthcare, helping them to understand and navigate

through the whole journey, facilitating access to care and coordinating with

all parties to make the process safer, simpler and smoother.

WHAT WAS THE OUTCOME?

• This help and support from the Cigna Healthcare case manager provided

the family with the peace of mind and reassurance that allowed them to

focus on the recovery of their family member.

WHAT HAPPENED?

• Having experienced a heart attack and a stroke on two separate occasions

during the last 5 years, as well as receiving professional therapy on stress

management, the customer called in with serious concerns relating to his

physical and emotional well-being. Due to an increased workload and other

private responsibilities, the customer was concerned that he was living in

fear of suering from another heart attack.

WHAT DID WE DO?

• The clinical team provided instant support to the customer, helping him

understand his situation and how it could be managed. The clinical team then

explained some exercises for the customer to try and helped establish an

action plan to regain control over his concerns.

WHAT WAS THE OUTCOME?

• Being aware that there are professionals always ready to assist when they

need it most, the customer was grateful and voiced his understanding and

appreciation for the support he had received. Awareness of the 24/7 service

availability if needed also provided the necessary peace of mind.

Case Management

Chronic Condition Programme

Feel supported on your medical journey.

Our Case Management service enables you to receive personalised support and assistance from our dedicated

nurses and doctors when you are diagnosed with a complex condition requiring specialist support.

A helping hand to manage your condition.

Our Chronic Condition programme oers you support if you are suering from a chronic condition, to help you

better understand, manage and improve your condition. You will have access to this programme even if the

condition is a special exclusion as detailed on your Certicate of Insurance.

7 | www.cignaglobal.com

As part of our Clinical Case Management programme, you have access to doctors worldwide for initial

consultations via telephone or video, or to provide you with expert second medical opinions.

Our clinical support

WHAT HAPPENED?

• A customer was feeling heart palpitations and wasn’t comfortable attending

the local hospital which didn’t have any English-speaking doctors. She used

her Cigna Wellbeing

®

App to schedule a video consultation later in the day

and she was able to upload a le with her previous doctor notes.

WHAT DID WE DO?

• The doctor spent time listening to the customer, discussing her symptoms,

medical history, drug allergies and details of other prescribed medicines. The

doctor put the customer at ease and alleviated her concerns.

WHAT WAS THE OUTCOME?

• The customer felt reassured and more informed about her condition. The advice

she received enabled her to book the adequate follow-up tests and get the

help she needed.

WHAT HAPPENED?

• A customer residing in central Europe was diagnosed with a severe cardiac

condition requiring complex heart surgery. He raised concerns to us about

his treatment options.

WHAT DID WE DO?

• Through our Decision Support programme, the customer received advice

from international cardiologists to book follow-up tests prior to undertaking

surgery. We helped him organise the tests and the medical experts were

able to conrm that surgery was the right course of action.

WHAT WAS THE OUTCOME?

• We arranged an appointment with one of the best cardiac surgeons in

his location to carry out the required surgery. The customer felt reassured

knowing this was the right option for them.

Global Telehealth

Decision Support Programme

Doctor consultations, anytime, anywhere.

Our Global Telehealth service gives you access to licensed doctors around the world for non-emergency health

issues. We can arrange a call back appointment for you often on the same day, or you can arrange a telephone

or video consultation from the Cigna Wellbeing

®

app.

Feel reassured thanks to second medical opinions.

Our Decision Support programme gives you access to global medical experts for advice and recommendations

on your individual diagnosis and treatment plan

IMPORTANT NOTE: The case studies referenced above are based on real life events, however, personal

information has been removed and/or amended to protect the identity of our customers.

8 | www.cignaglobal.com

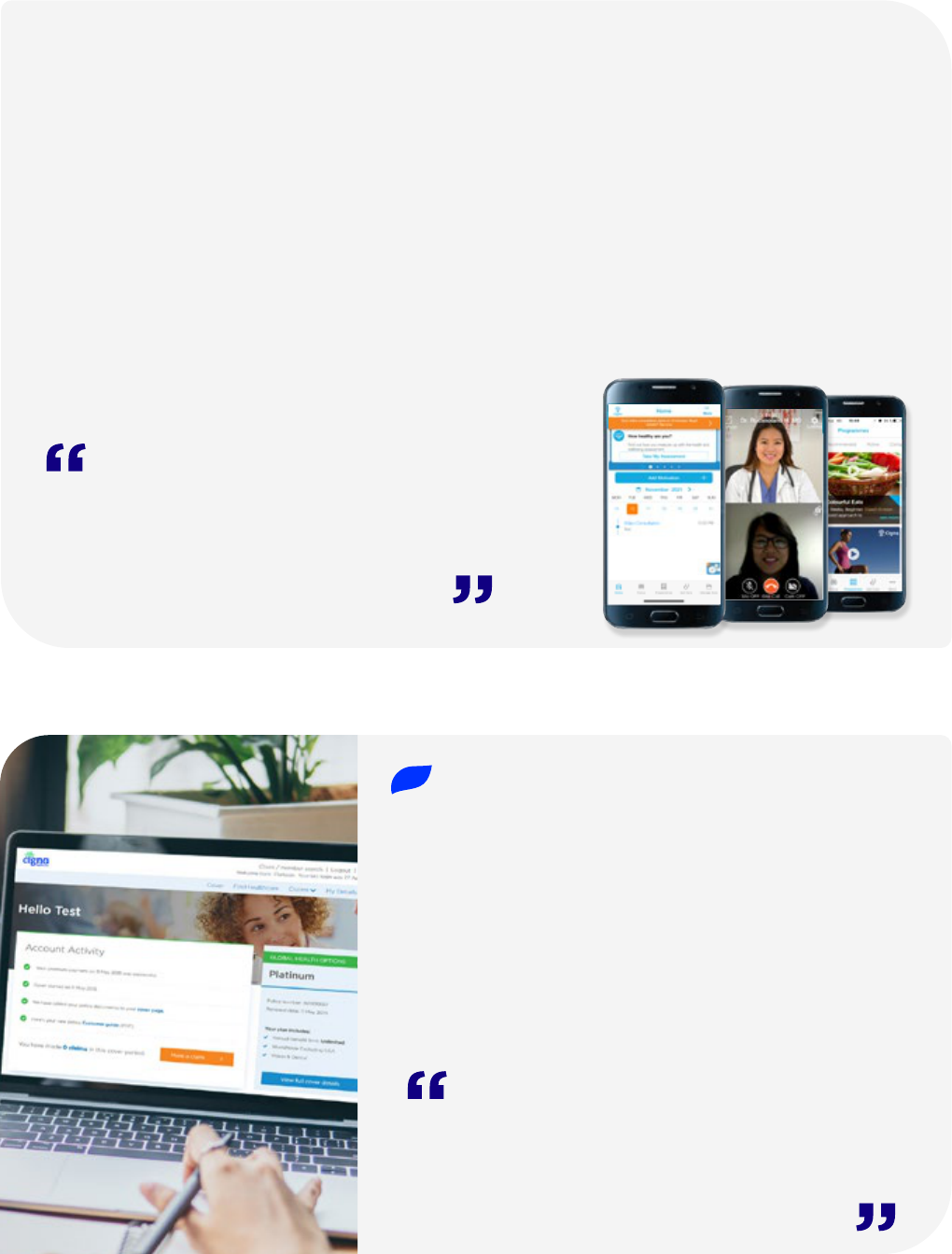

Access care, anytime, anywhere

Log into your secure Online Customer Area

Our digital healthcare tools

We provide you with a host of tools and features to help you manage your health and well-being.

We put you in control

You’ll have access to easy online tools to manage your policy

and submit your claims. With our secure online Customer

Area, you will be able to:

• Access care and easily nd local medical providers;

• Manage your policy and submit and track claims;

• Contact us through our live chat, by messaging us, or by

arranging a callback.

The Cigna Wellbeing

®

App gives you easy access to a suite of healthcare tools, including:

Access Global Telehealth:

Video and phone consultations with

medical practitioners and specialists.

What can I use Global Telehealth for?

• A diagnosis for non-emergency health

issues ranging from acute conditions to

complex chronic conditions

• Non-emergency paediatric care

• Making preparations for an upcoming

consultation

• Discussing a medication plan

Access our Cigna Wellbeing

®

App

Manage your health:

Gain a 360° view of your

health with our health

assessments and access

our chronic condition

management programme

which is led by our highly

experienced nurses who

help you take control of your

chronic condition.

Change behaviour:

Track your biometrics and

access online coaching

programmes designed

to help you make better

decisions relating to

sleep, stress, nutrition and

exercise.

Contacts with Cigna proved very ecient

with excellent communication and good

oer for my needs.

Cigna Global Customer, age 77,

2020, Trustpilot Review

(…) The app and website seemed very easy to

use and our rep through the process was very

supportive and relaxing to deal with.

Cigna Global Customer, 2022,

Trustpilot Review

9 | www.cignaglobal.com

We have an extensive medical network of over 2.2 million partnerships. Our

network is comprised of trusted hospitals, clinics and medical practitioners around

the world.

Our global network of trusted hospitals, clinics, and doctors includes:

• Over 300,000 mental and behavioural healthcare providers.

• More than 67,000 contracted pharmacies.

• Over 150 in house doctors and nurses.

For your convenience, direct billing is available with many of our healthcare

providers within our global network.

Access our Global Network

We understand that moving to a new country or travelling abroad can bring excitement as well as uncertainty

and we are dedicated to ensuring your peace of mind. We provide resources and programmes that are exible to

support globally mobile individuals across the globe. We understand the challenges you might face as a globally

mobile individual.

Through their secure online Customer Area, every Cigna Global policyholder

has access to a Travel Information Portal, which is developed by leading travel

security experts. The portal oers global travel advice, country proles, real

time alerts and health threats, including pandemic and epidemic.

• Global health monitoring system, with alert level, location information

and details for each specic alert

• Extensive country proles, with medical and travel guides for over 195

countries

• Health information, on a wide range of diseases including short videos,

fact sheets and tips for travellers

• Pre-trip advice and information on everything from personal security to

natural hazards.

Convenient Travel Information Portal

Make the most of your globally mobile experience

Visit the Health Blog on our website for a host of useful information such as

country guides, information on healthcare systems, and tips for making the most

of your relocation. You can access the Health Blog on our Cigna Global website.

Learn from the experience of

our globally mobile employees

Find out how to maintain a

healthy lifestyle whilst abroad

Our global expertise

Resources for globally mobile individuals

We are available for

you 24/7 and we will

aim to answer your

call within 20 seconds.

Our multicultural

Customer Care team

can assist you in

many languages.

Contact us in a

manner that works

for you: Live chat,

call us, email us or

request a callback.

10 | www.cignaglobal.com

Our Whole Health services

As part of our International Health and Well-being benets, you will have access to our wellness companion services,

comprising of the Life Management Assistance programme and the Telephonic Wellness Coaching.

Your Wellness Companion Services

• Short-term counselling up to 6

sessions that can be conducted via

telephone, video, or face to face.

• Common examples: managing stress,

providing support for couples’ and

family relationships, dealing with

bereavement, and more.

• In addition to short-term

counsellings, for patients diagnosed

with depression or anxiety, they will

have access to 20 sessions with a

CBT psychologist.

• Live assistance is always available to provide

immediate support and a tangible action

plan and next steps.

• We can provide pre-qualied referrals to

support your work-life balance challenges,

including relocation logistics, child or

eldercare, legal or nancial services.

Emotional support

Practical needs

Manager Assist

• Consultative service

for managers

looking to develop

their people

management skills.

Life coaching

• Matching employees

to a professional

coach to support

their personal and

professional goals.

Career support

Online Cognitive Behavioural

Therapy (CBT) programme

• Self-help programme to build

resilience and improve well-being.

• 7 online sessions, with the option of

email or telephone support from a

counsellor to track your progress.

• Unlimited access for 6 months.

Mindfulness Coaching

• Access 6 coaching sessions with an MBSR-

trained health and wellness professional if you

are experiencing stress, and challenges with

focus and concentration.

• You will receive personalised support, as well as

online resources for self-guided practice.

Behavioural Health

• We can help you reach your

nutrition, tness, sleep, and

weight management goals via our

Telephonic Wellness Coaching.

• You will be matched to your own

wellness coach to identify goals

that are important to you, build

an action plan and receive ongoing

support for lasting changes.

Physical support

You will be matched

with a counsellor or

coach who best meets

your particular needs.

Our CBT programme can help those experiencing mild-to-moderate anxiety, stress or depression.

Support is available

24/7, with multiple

language options*.

We can help with career

development and

performance improvement.

* For certain queries, our Customer Service team may direct you to our in-house team of specialists who are available during working hours

(Monday to Friday from 8am to 8pm CET).

11 | www.cignaglobal.com

Face-to Face

Counselling Support

WHAT HAPPENED?

• “Do you believe Ageism is

a thing?” A customer who

had experienced severe

turmoil throughout his life

asked, after suering from

an identity crisis. Long before

reaching out for support,

due to committing his life to

one career and the fact of

reaching a certain age, he

found himself in a situation

that seemed to have no

positive alternative.

WHAT DID WE DO?

• Through single-session

therapy our specialist

managed to identify the

root cause of the problem

and address the fears of

entering a new chapter of

the customer’s life. Referring

to theories and life-examples,

the clinician managed to

successfully discuss the issue

and recommend a course of

course of action aimed aim to

help the customers.

WHAT WAS THE OUTCOME?

• Emotions and concerns

can cause self-doubt and

make people believe things

that are not always true,

especially if not voiced with

anyone. After one session,

the customer felt energised

and realised the benets of

progressing into generativity

instead of being stagnant in

his retirement.

Wellness Coaching

WHAT HAPPENED?

• A customer contacted us for

support with improving their

eating habits and tness

goals, as they had gained

around 50 pounds, which

had negatively impacted

their physical and mental

health, and overall quality of

life.

WHAT DID WE DO?

• We started by helping the

customer set achievable

goals and create a plan

to incorporate exercise

into their daily routine. We

encouraged the use of a

tness app to track their

activity and food intake,

while also focusing on the

positives they experienced.

By doing so, the customer

felt healthier and more

motivated.

WHAT WAS THE OUTCOME?

• Over the course of six

sessions, with the help of

our experts and digital

technology, the customer

lost 29 pounds. Their health

and tness improved, they

hit their goals and became a

positive role model for their

children.

Practical needs

WHAT HAPPENED?

• A customer reached out

looking for resources for

himself. He explained that

he had a speech disorder

following an accident and

wanted to work on building

his condence for work and

socialising.

WHAT DID WE DO?

• The Elder Care Consultant

was able to work with the

customer to determine the

best course of action to help

him reach his goals. Together

they identied a speech

pathologist to help him work

on his speech and skills, along

with support groups to help

build a support system. He

was also transferred to a

clinician to schedule sessions

to help work through his

anxiety of speaking.

WHAT WAS THE OUTCOME?

• Having listened to the

customers problems,

our consultant provided

educational material

on rebuilding self-

condence and set out

recommendations on a

treatment plan. We used our

best available resources to

nd the support that could

help the customer regain

control over his speech

disorder.

Our Whole Health services

The Wellness Companion service will match you with a qualified counsellor or wellness coach to assist

you with any work, life, personal or family challenge.

IMPORTANT NOTE: The case studies referenced above are based on real life events, however, personal

information has been removed and/or amended to protect the identity of our customers.

Your Wellness Companion Services

12 | www.cignaglobal.com

How to create your plan

Creating a comprehensive, exible Cigna Global plan for Seniors is simple.

1. Your Core Cover

By opting for a core plan that includes International Medical Insurance, Outpatient (optional) and Health &

Wellbeing (optional) benets, you have access to an extensive cover at a discounted price. It gives you essential

cover for hospital stays and treatments, as well as access to a range of outpatient consultations with specialists and

preventative services. You have the choice not to select the Outpatient and \ or the Health & Wellbeing benets as

part of your core plan, as these modules are optional and can be added later on to your cover subject to the terms

and conditions of your policy.

This is the core cover for treatment that you receive under your Cigna Global plan for Seniors:

• Costs for treatment accommodation, hospital

charges and rehabilitation;

• Mental and behavioural health care;

• Cancer care including cancer preventative surgery;

• Outpatient consultations with specialists and medical

practitioners, including a vast range of rehabilitation

treatments;

• Prescribed drugs or dressing that you may require on

an outpatient basis;

• Preventative cancer screenings;

• Non-symptomatic annual routine physical

examinations;

• Access to counsellors for emotional support and

wellness coaches for improved physical well-being.

You have two areas of coverage to choose from:

WORLDWIDE

EXCLUDING USA

WORLDWIDE

INCLUDING USA

You have three currencies to choose from:

£

$

€

EUR GBPUSD

Annual benets

Up to the maximum amount per beneciary per period of cover

$1,000,000 / €800,000 / £650,000

2. Add optional modules

International Evacuation & Crisis Assistance Plus

TM

This optional module provides you with medical

evacuation in the event of an emergency and global

crisis response services.

• Emergency transport to a centre of medical excellence;

• Repatriation home following a serious medical incident;

• Costs for compassionate visits;

• Global crisis response services in the event of a travel

or security risk that may occur while you and your

family are travelling globally.

International Vision & Dental

This optional module provides you with comprehensive

dental and vision cover.

• Preventative, routine and major dental treatments;

• Routine eye examination and costs for glasses and

lenses.

3. Manage your premium

You have the exibility to adjust your premium to suit

your budget with a wide range of:

These are voluntary amounts that you choose to pay that are not covered by your plan.

If you choose a deductible and/or cost share, your premium will be lower than it otherwise would be.

DEDUCTIBLES COST SHARES

4. Manage your payment options

Finally, you have the freedom to choose at which frequency you pay for your policy.

If you choose an annual or quarterly payment, your premium will be slightly lower than it otherwise would be.

MONTHLYANNUALLY QUARTERLY

You can make payments by debit or credit card, or if you pay annually, you can pay by bank wire transfer.

13 | www.cignaglobal.com

International Medical Insurance

Benet Limit

Annual overall benet maximum - per beneciary per period of cover

$1,000,000

€800,000

£650,000

Hospital charges

• Nursing and accommodation for inpatient and daypatient treatment, and recovery room;

• Operating theatre;

• Prescribed medicines, drugs and dressings for inpatient or daypatient treatment only;

• Pathology, radiology and diagnostic tests (excluding Advanced Medical Imaging);

• Treatment room and nursing fees for outpatient surgery (we will only provide the nursing fees whilst a beneciary is

undergoing surgery);

• Intensive care: intensive therapy, coronary care and high dependency unit;

• Surgeons’ and anaesthetists’ fees;

• Inpatient and daypatient specialists’ consultation fees;

• Emergency inpatient dental treatment.

Private room

Hospital accommodation for a parent or guardian

$1,000/€740/£665

Pandemics, epidemics and outbreaks of infectious illnesses

Inpatient cash benet

• Per night up to 30 days per beneciary per period

of cover.

$100/€75/£65

Accident and Emergency Room Treatment

• For necessary emergency treatment.

$500/€370/£335

Transplant services

Kidney Dialysis

Advanced Medical Imaging (MRI, CT and PET scans)

• As part of inpatient, daypatient or outpatient treatment.

$10,000/€7,400/£6,650

Rehabilitation

We will pay for:

• Physiotherapy;

• Occupational therapy;

• Cognitive and Speech therapies; and

• Cardiac and pulmonary rehabilitation.

$5,000/€3,700/£3,325

Up to 30 days

Home nursing

$2,500/€1,850/£1,650

Up to 30 days

Acupuncture & Chinese Medicine

$1,500/€1,100/£1,0

Palliative care

$35,000/€25,900/£23,275

Prosthetic devices

Local ambulance & air ambulance services

Mental and Behavioural Health Care

• As part of inpatient, daypatient or outpatient treatment.

$5,000/€3,700/£3,325

Up to 30 days*

Cancer preventative surgery

70% refund up to

$10,000/€7,400/£6,650

Cancer care

Cancer related appliances

• Includes wigs / headbands and mastectomy bras for cancer patients

$125/ €100/£85 per

lifetime per cancer related

appliance

Congenital conditions

$5,000/€3,700/£3,325

Newborn Care

• The newborn may be required to be medically underwritten.

$25,000/€18,500/£16,500

Up to 90 days

Summary of benets

Paid in full, up to the annual benet maximum, if applicable, for your selected plan per beneciary per period of cover.

Waiting period applies.

Please note, this is a representation of the benets available and does not contain the terms, conditions, and exclusions specic to each benet.

The benets may be subject to change. Please see the Customer Guide for full details.

*Day limit only applies to inpatient and daypatient treatments.

** For treatment incurred in either Hong Kong or Singapore, this benet is only available once the mother has been a beneciary under this policy for a continuous period of at

least 24 months or more.

Our Cigna Global plan for Seniors starts with International Medical Insurance, your inpatient and daypatient

benets. In addition, International Outpatient benets and International Health and Wellbeing benets are also

included in the main cover.

12 MONTHS**

12 MONTHS

14 | www.cignaglobal.com

International Outpatient

Benet Limit

Annual International Outpatient benet maximum - per beneciary per period of cover.

$15,000

€12,000

£9,650

Consultations with medical practitioners and specialists

$2,500/€1,850/£1,650

Telehealth consultations

• Virtual doctor consultations with chosen

healthcare provider.

• Combined benet limit with the consultations with medical practitioners and specialists benet.

$2,500/€1,850/£1,650

Prescribed drugs and dressings

$1,500/€1,100/£1,000

Pathology, Radiology and diagnostic tests (excluding Advanced Medical Imaging)

$2,500/€1,850/£1,650

Outpatient Rehabilitation

We will pay for:

• Outpatient Physiotherapy;

• Outpatient Occupational therapy;

• Osteopathy and Chiropractic treatment;

• Speech therapy;

• Cardiac and pulmonary rehabilitation.

$5,000/€3,700/£3,325

Hormone Replacement Therapy

$250/€185/£165

Acupuncture & Chinese medicine

• Up to a combined maximum of 15 consultations per period of cover.

$2,500/€1,850/£1,650

Durable medical equipment

Hearing Aids

$500/€370/£335

Adult vaccinations

$250/€185/£165

Dental accidents

$1,000/€740/£665

Child and Adolescence Wellbeing health

60+ Care (Chronic Condition Management)

• To cover outpatient treatment and prescribed drugs for the maintenance of the chronic conditions

$500/€370/£335

International Medical Insurance (Continued)

Benet Limit

Out of Area Emergency Hospitalisation Cover

• For beneciaries who do not have Worldwide including USA coverage. Only includes inpatient and daypatient treatment

costs.

$100,000/€75,000/£65,000

Global Telehealth

Global Telehealth with Teladoc

• Video and phone doctor consultations via the Cigna Wellbeing

®

App, or via a referral from our Customer Care team for

non-emergency health issues.

Unlimited consultations

OPTIONAL

MODULE

Paid in full, up to the annual benet maximum, if applicable, for your selected plan per beneciary per period of cover.

Please note, this is a representation of the benets available and does not contain the terms, conditions, and exclusions specic to each benet.

The benets may be subject to change. Please see the Customer Guide for full details.

15 | www.cignaglobal.com

International Health & Wellbeing

Benet Limit

Life Management Assistance programme

• 24/7 access to counsellors for mental and behavioural health support.

Mental Health Support Programme

• Up to 20 face to face counselling sessions per condition per period of cover.

Wellness Coaching

• Access to a personal wellness coach for lasting lifestyle changes.

Routine adult physical examination

$325/€250/£220

Footcare by a Chiropodist or Podiatrist

$225/€165/£150

up to 5 sessions

Cervical cancer screening

$325/€250/£220

Prostate cancer screening

$325/€250/£220

Breast cancer screening

$325/€250/£220

Bowel cancer screening

$325/€250/£220

Skin cancer screening

$325/€250/£220

Lung cancer screening

$325/€250/£220

Bone densitometry

$225/€165/£150

Diabetes screening

$325/€250/£220

Dietetic consultations

• 1 consultation available to all eligible beneciaries

• Up to 4 consultations per period of cover, if medically necessary.

$325/€250/£220

Paid in full, up to the annual benet maximum, if applicable, for your selected plan per beneciary per period of cover.

Please note, this is a representation of the benets available and does not contain the terms, conditions, and exclusions specic to each benet.

The benets may be subject to change. Please see the Customer Guide for full details.

OPTIONAL

MODULE

Updated

Updated

Updated

Updated

Updated

Updated

Updated

Updated

New

16 | www.cignaglobal.com

International Vision & Dental

Benet Limit

Vision Care

Eye Test

• 1 eye examination per period of cover.

$100/€75/£65

Expenses for:

• Spectacle lenses;

• Contact lenses;

• Spectacle frames;

• Prescription sunglasses.

$155/€125/£100

Dental Treatment

Annual Dental benet maximum - per beneciary per period of cover.

$1,250/€930/£830

Preventative

Routine

80% refund

Major restorative

70% refund

Orthodontic treatment

• Available up to 18 years old

40% refund

12 MONTHS

18 MONTHS

3 MONTHS

3 MONTHS

Paid in full, up to the annual benet maximum, if applicable, for your selected plan per beneciary per period of cover.

Waiting period applies.

Please note, this is a representation of the benets available and does not contain the terms, conditions, and exclusions specic to each benet.

The benets may be subject to change. Please see the Customer Guide for full details. *Day limit only applies to inpatient and daypatient treatments.

The following details the optional benets available to add to your core cover. You can add as many optional

benets as you wish to build a plan that suits your needs.

International Evacuation & Crisis Assistance Plus™

Benet Limit

International Medical Evacuation Annual benet maximum - per beneciary per period of cover.

Crisis Assistance Plus™ Programme

• This programme provides time-sensitive advice and coordinated in-country crisis assistance for risks that could impact you

when you’re travelling.

FocusPoint International

®

will

pay for crisis consulting expenses

and other additional expenses

per covered response (up to

a maximum of two physical

incidents per beneciary per

period of cover)

Medical evacuation

Medical repatriation

Repatriation of mortal remains

Travel cost for an accompanying person

Compassionate visit - travel costs

• Up to a maximum of 5 trips per lifetime.

$1,200/€1,000/£800

Compassionate visit - living allowance costs

Per day up to 10 days per visit.

$155/€125/£100

OPTIONAL

MODULE

OPTIONAL

MODULE

17 | www.cignaglobal.com

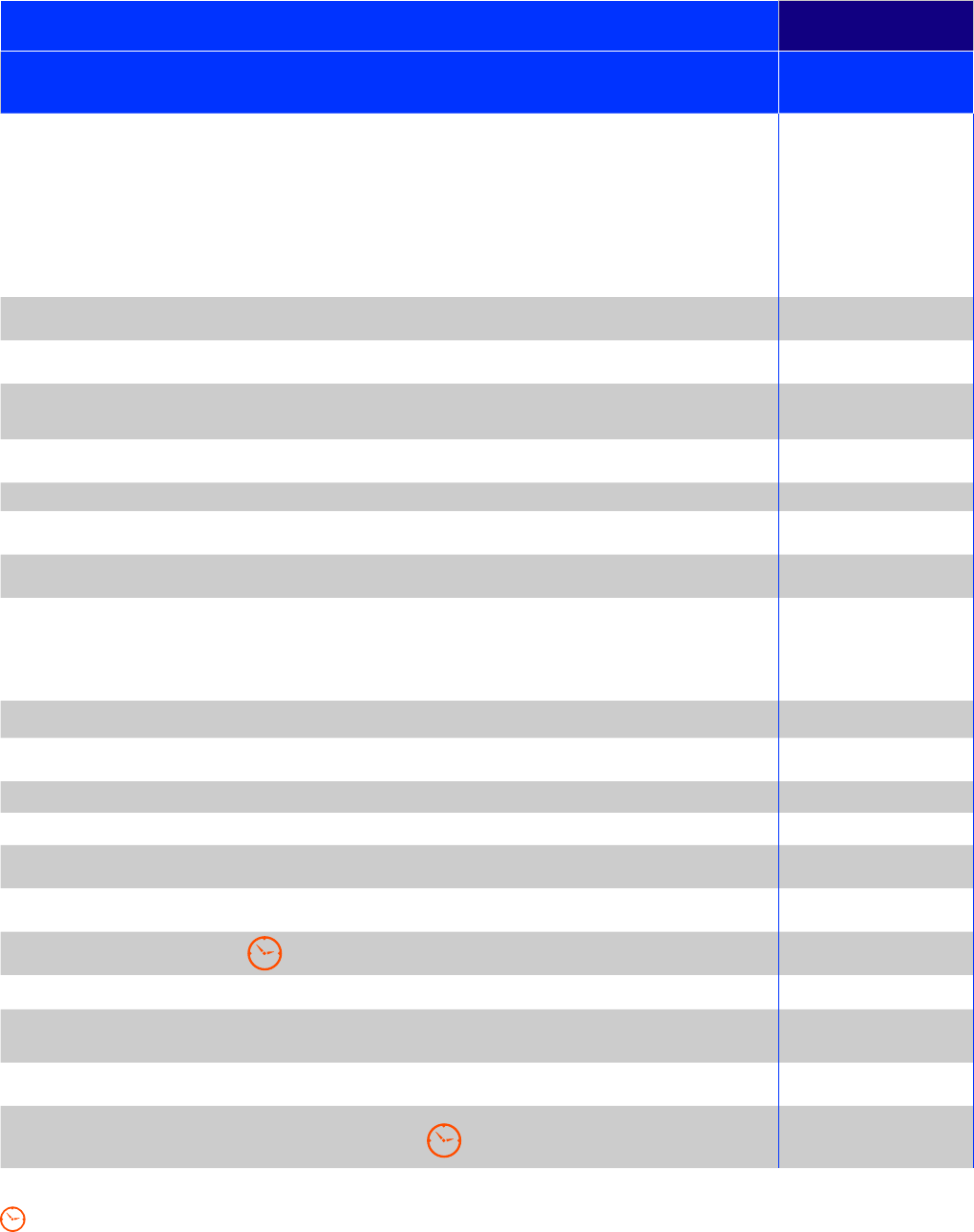

Deductible

This is the amount you must pay towards your

cost of treatment until the deductible for the

period of cover is reached.

Cost Share

This is the cost share

percentage you must

pay toward your cost of

treatment.

Out of Pocket Maximum

This is the maximum amount of

cost share you have to pay per

period of cover.

International

Medical Insurance

$0

$375

$750

$1,500

$3,000

$7, 500

$10,000

€0

€275

€550

€1,100

€2,200

€5,500

€7, 4 0 0

£0

£250

£500

£1,000

£2,000

£5,000

£6,650

0%

10%

20%

30%

$2,000 €1,480 £1,330

$5,000 €3,700 £3,325

International

Outpatient

$0

$150

$500

$1,000

$1,500

€0

€110

€370

€700

€1,100

£0

£100

£335

£600

£1,000

0%

10%

20%

30%

$3,000 €2,200 £2,000

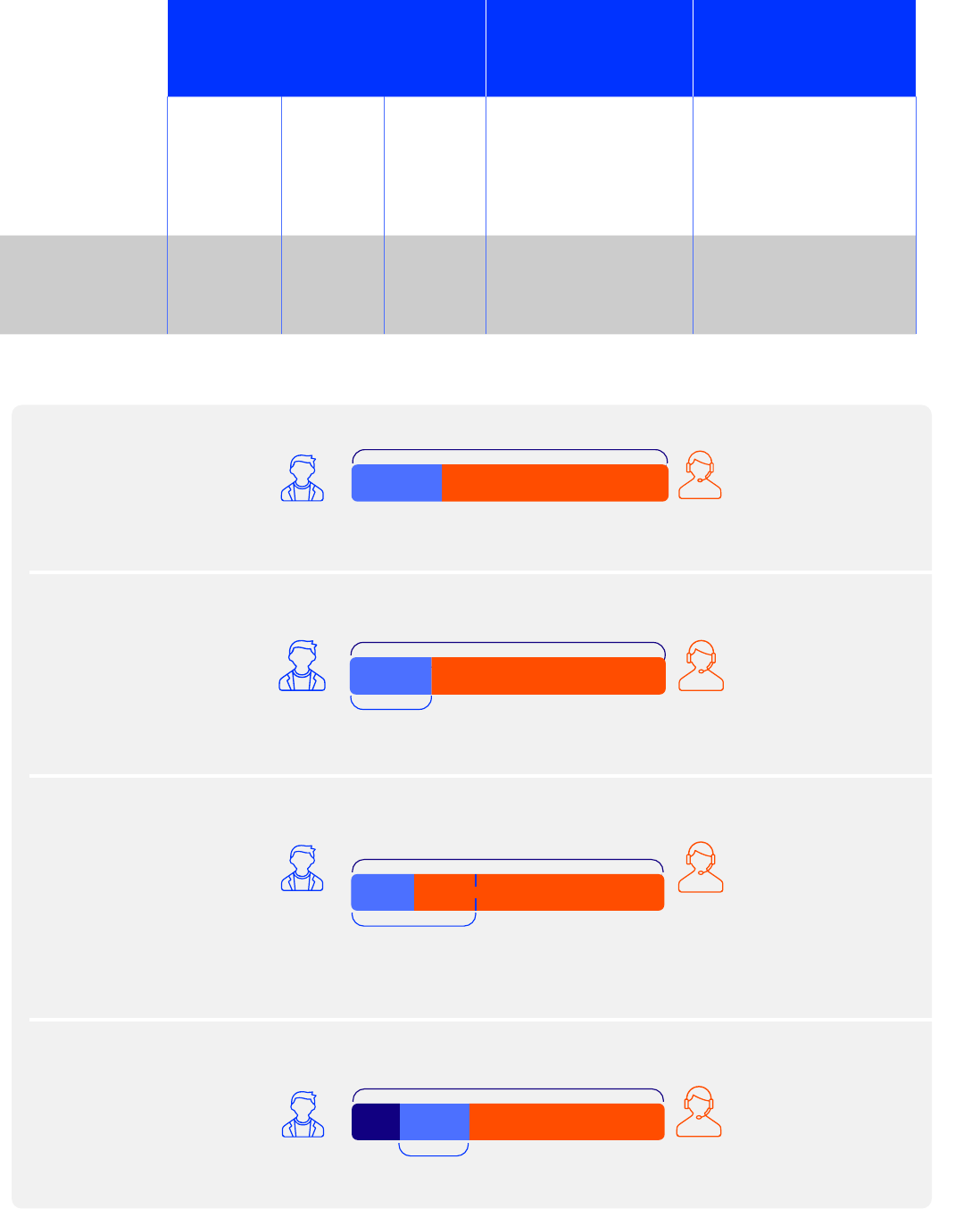

Your deductible and cost share options

Our wide range of deductible and cost share options allow you to tailor your plan to suit your needs. You

can choose to have a deductible and/or a cost share on the International Medical Insurance or International

Outpatient benets. If you do so, your premium will be lower than it otherwise would be.

Claim value: $1,200

Deductible: $375

Once the deductible

amount has been

reached, we pay

for all subsequent

treatment costs for

this period of cover.

$375 $825

You pay the

$375 deductible

We pay

$825

Claim: $1,200

Claim value: $5,000

Deductible: $0

Cost share: 20% = $1,000

Out of Pocket Maximum: $2,000

The amount of cost

share is subject to

the capping eect

of the out of pocket

maximum.

$1,000 $4,000

You pay

the $1,000

cost share

We pay

$4,000

Claim: $5,000

20% of $5,000

is $1,000

Example 1: DEDUCTIBLE

Example 2: COST SHARE

Claim value: $20,000

Deductible: $0

Cost Share: 20% = $4,000

Out of Pocket Maximum: $2,000

The out of pocket

maximum protects

you from large cost

share amounts.

$2,000

$18,000

You pay the

$2,000

cost share

We pay

$18,000

Claim: $20,000

Example 3: COST SHARE AND OUT OF POCKET MAXIMUM

20% of $20,000 is $4,000,

however the out of pocket

maximum limits your costs

to $2,000

Claim value: $20,000

Deductible: $375

Cost Share: 20% = $3,925

Out of Pocket Maximum: $5,000

The deductible is

due before the cost

share is calculated.

$3,925 $15,700

Claim: $20,000

Example 4: DEDUCTIBLE AND COST SHARE

You pay the $375

deductible and

$3,925 cost share

We pay

$15,700

20% of $19,625

is $3,925

$375

If you have selected a deductible and/or cost share, the examples below demonstrate how it works.

18 | www.cignaglobal.com

What you can expect from us

Once you join Cigna Healthcare, your policy documents, including your Cigna Healthcare ID card(s), will be available in

your secure online Customer Area.

Your policy documents include the following:

Customer Guide

Learn how your plan works

and see all the benets you

have access to.

Policy Rules

The terms and conditions,

general exclusions and

denitions of your policy.

Certicate of

Insurance

A record of your plan,

premium, level of cover and

beneciaries.

Cigna Healthcare

ID Card

Proof of your identity and

cover for when you need

treatment.

Customer Guide

Everything you need to know about your plan

Cigna Global Health Options

Policy Rules

Terms, General Exclusions and Definitions

relating to your plan

Cigna Global Health Options

Get a quote today

If you’d like a personal quote, simply get in touch with your local broker.

We’ve kept our quote process as easy and quick as possible and it

should only take 2 minutes to create your personalised quote.

Call us

If you’d like to contact our

Sales team, please reach

out to one of the following

numbers:

Inside the USA:

877 539 6295

Outside the USA:

+44 (0) 1475 492 119

For more contact

information, simply visit

our website

www.cignaglobal.com.

Broker name:

Broker telephone:

Broker rm:

Broker email:

Broker URL:

“

Sheila | Doha

“

We are on hand to help you nd the right health

plan for you and your family.

“

Juliana | California

Agent who was articulate and

knowledgeable. Made a number of calls at

times I was available. Managed all aspects

and questions professionally.

“

“

Condent, knowledgeable Customer Service

Representative Andrew. Reassuring, totally

understood our requirements.

591560 CGHO Senior Plan Sales Brochure EN 02/2024

For policies arranged through our Dubai International Finance Centre oce, under insurance license Cigna Global Insurance Company Limited, the

underwriting agent is Cigna Insurance Management Services (DIFC) Limited which is regulated by the Dubai Financial Services Authority.

Policies in Singapore are underwritten by Cigna Europe Insurance Company S.A.-N.V. Singapore Branch (Registration Number: T10FC0145E), a foreign branch

of Cigna Europe Insurance Company S.A.-N.V., registered in Belgium with limited liability, with its registered oce at 152 Beach Road, #33-05/06 The Gateway

East, Singapore 189721.

“Cigna Healthcare” and the “Tree of Life” logo are registered service marks of Cigna Intellectual Property, Inc., licensed for use by The Cigna Group and

its operating subsidiaries. All products and services are provided by or through such operating subsidiaries, and not by The Cigna Group. Such operating

subsidiaries include Cigna Global Insurance Company Limited, Cigna Life Insurance Company of Europe S.A.–N.V., Cigna Europe Insurance Company S.A.-N.V.

and Cigna Worldwide General Insurance Company Limited. © 2024 Cigna Healthcare

The following statements are applicable to Singapore policies underwritten by Cigna Europe Insurance Company S.A.-N.V.

Singapore Branch:

You may wish to seek advice from a qualied adviser before making a commitment to purchase this product. In the event that

you choose not to seek advice from a qualied adviser, you should consider whether the product in question is suitable for

you. Buying health insurance products that are not suitable for you may impact your ability to nance your future healthcare

needs. If you decide that the policy is not suitable after purchasing it, you may terminate the policy in accordance with the

free-look provision, if any, and we may recover from you any expense incurred by us in underwriting the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit

Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more

information on the types of benets that are covered under the scheme as well as the limits of coverage, where applicable,

please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

Important notes:

The medical insurance plan presented in this document has been designed to meet the overall needs of individuals aged 60 year old and over, and not the

specic needs of each customer. As such, this plan may not be suitable for every senior customer and other alternative plans are also available for review

during the enquiry process. The benets included in the Cigna Global plan for Seniors such as the International Outpatient benets and the International

Health & Wellbeing benets are not mandatory to your cover and can be removed from your quote at any time and from your policy as per the terms and

conditions detailed in the Policy Rules. As outlined on page 12 of this document, you can add or remove deductible, cost share and optional modules to build a

plan that suits your needs.

This document serves only as a reference and does not form part of a legal contract. The information herein is believed accurate as of the

date of publication and is subject to change. This material is intended for informational purposes only and contains a partial and general description of

benets. We recommend that you examine your (product) policy in detail to be certain of precise terms, conditions and coverage. Coverage and benets are

available except where prohibited by applicable law.