2020 Annual Housing Progress Report

Page 1

STATE OF NEVADA

STEVE SISOLAK

Governor

DEPARTMENT OF BUSINESS & INDUSTRY

HOUSING DIVISION

3300 W Sahara Ste 300 Las Vegas, NV 89102

1830 College Parkway, Suite 200 Carson City, Nevada 89706

Phone: (702) 486-7220, (775) 687-2240, (800) 227-4960

Fax: (775) 687-4040, TDD: (800) 326-6868

www.housing.nv.gov

TERRY J REYNOLDS STEVE AICHROTH

Director Administrator

Date: February 16, 2021

NRS 278.235 – Annual Housing Progress Report

Nevada Revised Statute (NRS) 278 requires jurisdictions in Clark and Washoe Counties to adopt

a Housing Plan as a part of the jurisdiction’s Master Plan. The plan is required to inventory housing

conditions, project future needs and demands, and adopt strategies to provide for all forms of

housing, including that which is affordable. Sub-section NRS 278.235 requires adoption of

measures to maintain and develop affordable housing and the jurisdictions must report how such

measures were used in the prior year. The purpose of the legislation is to encourage local

governments to deploy resources to increase affordable housing. It is this portion of NRS 278

which is addressed in this report.

The following two counties and seven cities are subject to NRS 278.235 reporting:

Clark County City of Boulder City City of Reno

Washoe County City of Henderson City of Sparks

City of Las Vegas

City of Mesquite

City of North Las Vegas

Reports from the jurisdictions are due to the Housing Division annually by January 15. This report

compiles information contained within the jurisdictional reports, analyzes trends to the degree

possible and highlights notable efforts to establish and maintain affordable housing.

In the 2017 legislative session NRS 278.235 was revised to require the Housing Division post the

report on the Housing Division website on or before February 15 of each year rather than submit

it to the legislature. The 2019 legislative session added a provision that links data collected under

NRS 278.235 to the Housing Division’s Low Income Housing Database (LIHD). The LIHD is

2020 Annual Housing Progress Report

Page 2

described in NRS 319.143. It also revised measure A to clarify that governing bodies of cities and

counties may subsidize impact fees and fees for the issuance of building permits and laid out the

conditions for reducing or subsidizing those fees for affordable housing projects. In addition, SB

473 passed into law changing the definition of affordable housing to include housing for

households up to 120% of U. S. Housing and Urban Development’s (HUD’s) Area Median Family

Income (HAMFI). Previously it included households up to 80% of HAMFI. For more information

see the Nevada Electronic Legislative Information System (NELIS), 80

th

Session, Senate Bill 103,

104 and 473.

i

This year’s methodology was the same as the five previous years for the most part. There was a

new method adopted for reporting on rental assistance (under measure K) and supportive services,

(measure L), in southern Nevada. Since most of those type of jurisdiction activities in southern

Nevada are tracked by the Homeless Management Information System (HMIS), an HMIS report

was run to capture these activities more fully. The HMIS report included Coronavirus Aid, Relief,

and Economic Security (CARES) Act housing assistance programs.

2020 HOUSING CONTEXT

The 2020 economic and social context was dominated by the Covid-19 pandemic and reactions to

it. Nevada went from the lowest ever unemployment rate in the series in February (3.6%) to the

highest ever in April (30.1%). The high rate occurred with an initial closure of all non-essential

businesses, including casinos, in an effort to slow down the spread of the virus.

ii

Housing was

affected in many complex ways by unemployment, unemployment insurance and supplements,

Covid-19 related rental assistance programs, low interest rates, social distancing requirements and

multiple eviction moratoria.

Nevada home prices continued to increase through 2020. In October, Las Vegas home prices, as

measured by the Case Schiller repeat sales index, were up six percent over the previous year.

iii

Home prices have been increasing since 2012, with the Las Vegas Case Schiller repeat sales index

increasing 130% over the lows of March 2012, including the increases throughout 2020.

iv

The

Case Schiller index is not available for the Reno area, but average sale price per square foot for

existing homes was up 21% year over year as of November 2020, according to the Lied Institute

Housing Market report. The equivalent statistic for Las Vegas area was 8%.

v

Increases in home

prices occurred nationwide and may be due in part to extremely low mortgage interest rates as well

as a shortage of inventory of homes for sale, partially due to pandemic social distancing.

vi

While

unemployment remained high at 10.1% (preliminary) in November, new companies continued to

come to Nevada in 2020. For example, despite the pandemic, during 2020, the Governor’s Office

of Economic Development approved tax abatements for 13 companies. Eight of these were in

northern Nevada.

vii

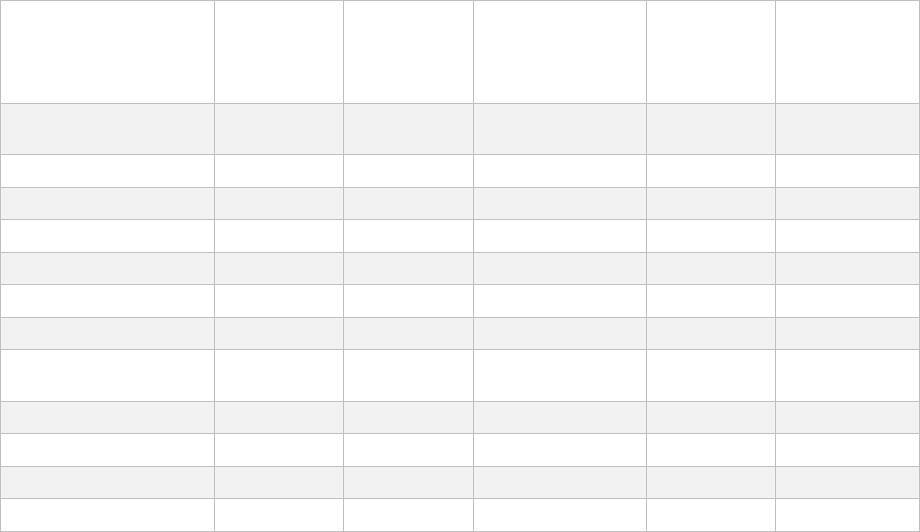

Figure 1 gives the housing opportunity index from the National Association of Home Builders

(NAHB). The index gives the share of homes sold which were affordable to the median income

family. Coming out of the previous recession, the affordability share rose to 87.5% in Reno and

88.7% in Las Vegas-Henderson-Paradise. Affordability has trended downward since then. For the

third quarter of 2020, the affordability index stands at 56.9% for Las Vegas-Henderson-Paradise

and 45.1% in Reno. The Reno index fell nearly five percent from 3

rd

quarter 2019 to 3

rd

quarter

2020, while Las Vegas’ decreased four percent. Affordability decreased this past year despite a

fall in mortgage interest rates both because of increasing home prices and because of decreasing

2020 Annual Housing Progress Report

Page 3

income. For both the second and third quarter of 2020, NAHB reduced HUD’s median family

income to be consistent with their own economic forecast in order to account for lower incomes

due to the pandemic. Nationally the index decreased to 58.3%. Both Reno and Las Vegas-

Henderson-Paradise homes are less affordable than the national average with Reno’s Opportunity

Index below both the national and Las Vegas index since 4

th

quarter 2014.

Figure 1. National Association of Home Builders – Wells Fargo Housing Opportunity Index, 1st

quarter. 2012 to 3rd quarter 2020

89.3

59.4

56.9

86.8

47.7

45.1

78.8

63.6

58.3

0

10

20

30

40

50

60

70

80

90

100

Las Vegas-Paradise, NV Reno-Sparks, NV National

National Association of Home Builders. NAHB-Wells Fargo Housing Opportunity Index.

http://www.nahb.org/en/research/housing-economics/housing-indexes/housing-opportunity-index.aspx accessed 12-

21-2020.

The Census Bureau’s homeownership rate for Nevada increased from 57.8% in 2018 to 58.2% in

2019, continuing the upward trend after the post-recession nadir in 2016.

viii

This homeownership

rate does not yet reflect what has happened during the pandemic of 2020. According to the

experimental Census Pulse data, during the weeks of November 25

th

to December 7

th

, about 7%

of Nevada homeowners reported that they were behind on mortgage payments.

ix

Nationwide,

Freddie Mac estimated that in May 2020, 8% of outstanding mortgages were in forbearance.

x

Nevada rents continued to increase, despite the pandemic. Despite high unemployment, the Federal

supplemental unemployment assistance benefits, eviction moratoria, CARES Act housing

assistance programs as well as concerted efforts on the part of both renters and rental management

companies, seem to have helped keep vacancies low, and even kept rates of rent payment

reasonably high.

xi

Experimental Census Pulse data, however, indicated that 16% of Nevada renters

were behind on rental payments for the period of November 25

th

to December 7

th

.

xii

2020 Annual Housing Progress Report

Page 4

Severe rent burden occurs when a household pays more than 50% of its income for gross rent.

The

proportion of Nevada’s extremely low and very low income (VLI) renter households (household

incomes under 50% of HUD area median family income) experiencing severe rent burden

decreased from 63% in the 2008-2012 period to 57% in the 2013-2017 period.

xiii

HUD’s rent

burden data does not yet reflect how the mix of the improving economy and increases in rent in

the past several years have influenced rent burden nor does it reflect the effects of the pandemic

after that.

The rate of homelessness as measured by the point-in-time homeless count per thousand

population has seen a decrease in Clark County but has been increasing since 2015 in Washoe

County. Both counties are well above the national average rate of point-in-time homelessness per

thousand.

xiv

January 2021 point-in-time counts are not yet available, so any Covid-19 impacts are

not clear.

JURISDICTION HOUSING PLANS & THE TWELVE MEASURES

The jurisdictions subject to NRS 278.235 are required to adopt at least six of twelve specific

measures into their Housing Plan. Accordingly, the Housing Division collects Housing Plans and

information about when to expect the next update from these jurisdictions.

Table 1: Date of Master Plan Housing Element and Identified Update Year

Jurisdiction

Year of Housing Plan

Update Year

Clark County

2019

2024

Las Vegas

2021

2026

North Las Vegas

2018

2021

Boulder City

2009

Unknown

Henderson

2020

2025

Mesquite

2012

2021

Washoe County

2010

2022

Reno

2017

2020

Sparks

2016

2021

Boulder City did not report a scheduled time for an update. Reno was scheduled for an update, but

no new Element was available. For several jurisdictions, housing elements/plans need a clearer

delineation of exactly how at least 6 of the 12 measures have been adopted. Often the measures

which are more related to planning such as subsidization of permits or density bonuses are not

easy to find in the jurisdictions’ new housing elements, particularly for jurisdictions who are using

Consolidated Plans as their Housing Plan updates. In 2018, the City of Henderson submitted a

useful narrative which specified exactly which measures have been adopted and used. City of Las

Vegas has inserted a section on addressing NRS 278.235 in its new draft Affordable Housing

Strategic Plan for 2021 to 2026. Mesquite directly addresses the NRS 278.235 measures in a 2018

draft Housing Element but has not yet accepted a final version of the Element. Other good

examples of specific attention to the 12 measures may be found in City of Sparks, City of Reno,

and City of Boulder City housing elements.

2020 Annual Housing Progress Report

Page 5

ANNUAL HIGHLIGHTS

The jurisdictions, during the period from January 1, 2020 thru December 31, 2020, began funding

or continued to develop or maintain 4,025 affordable units, surpassing last year’s record number

of units “in the pipeline.”

xv

A total of 528 new affordable units were completed and added to the

inventory, with 50% of them targeted to very low income (VLI) households. The jurisdictions also

helped to preserve 751 units; 29 more units were preserved without use of any measure by

jurisdictions. An additional 21 beds of new transitional housing or special population supportive

housing were in the pipeline and 50 transitional beds had finished this year. In addition, 31

homeowners were assisted with repair or rehabilitation funds. A major correction to City of North

Las Vegas Down Payment Assistance inventory of homes added 213 single family units. Only one

project with 108 units converted to a private market property this year. Additional minor changes

brought the total units lost to 125 units. None of those were set aside for VLI households; however,

an unrelated status change gave a loss of 3 VLI units.

Table 2. Summary of Affordable Housing Activity

Category of housing unit or assistance

Total units or households

(includes all nine

jurisdictions)*

% Very Low

Income (VLI)

Single family/mobile home for rent or for sale/owner

occupied with rent or deed restrictions completed

213** 0%

Multi-family rehabilitation completed

780

27%

New multi-family project completed

528

50%

Pipeline projects funded or under construction

4,025

33%

Special population or transitional (not all completed)

71

100%

Single family purchase, rehabilitation or modification

assistance

31 52%

Tenant based rental assistance (TBRA)

15,833

95%

Other housing assistance (application fees, deposits,

utilities)

Not tracked separately NA

Support services, homeless services, other tenant-

based assistance

Not tracked separately NA

*Duplicate units from joint county and city projects were eliminated in totals where known.

**The 213 units are not new units in 2020. They are a correction to the City of North Las Vegas’ inventory of deed-

restricted Down Payment Assistance units.

Both the pandemic and a methodology change affected the tenant-based rental assistance and

supportive services numbers for measures K and L. The CARES Act provided funding for rental

assistance and other housing help for households affected by the Covid-19 pandemic. This greatly

increased households served. In addition, Clark County asked Bitfocus to run an HMIS report on

all rental assistance programs in the Las Vegas Metro region, allowing for a more comprehensive

capture of this activity in the south. To help simplify the Bitfocus report, and avoid duplication,

all households were assumed to receive both rental assistance and supportive services. The

assumption fits well with Clark County Social Service experience of the programs as well as

additional data broken out by service. As a result, supportive services were not tracked separately

this year. CARES Act funding was restricted to households below 120% AMI. However,

demographic data collected by Clark County indicated that most participants were in the VLI

category. Except where more information on income was available, participants were assumed to

be VLI households. Tenant based rental assistance (TBRA) was given to 15,833 households.

xvi

Of

2020 Annual Housing Progress Report

Page 6

these, an estimated 12,500 households were CARES Act participants, nearly four times the 3,333

households participating in non-Covid-19 related rental assistance programs.

The funding for the units and assistance primarily originated from state or federal sources such as

the CARES Act Programs, the HOME Investment Partnerships Program (HOME), National

Housing Trust Fund (HTF), Nevada Account for Affordable Housing Trust Fund, Housing

Opportunities for Persons with AIDS, Emergency Solutions Grants, Low Income Housing Tax

Credits, tax exempt private activity bonds or the Community Development Block Grant.

Incorporation and Use of Measures

NRS 278.235 requires the adoption of six of 12 possible measures (Sub-paragraphs (a) through (l)

of the statute) into the Housing Plan as instruments used in maintaining and developing affordable

housing. The 12 measures, as specified in NRS 278.235, are listed below:

(a) Reducing or subsidizing in whole or in part impact fees, fees for the issuance of building

permits collected pursuant to NRS 278.580 and fees imposed for the purpose for which an

enterprise fund was created.

(b) Selling land owned by the city or county, as applicable, to developers exclusively for the

development of affordable housing at not more than 10 percent of the appraised value of the

land, and requiring that any such savings, subsidy or reduction in price be passed on to the

purchaser of housing in such a development. Nothing in this paragraph authorizes a city or

county to obtain land pursuant to the power of eminent domain for the purposes set forth in

this paragraph.

(c) Donating land owned by the city or county to a nonprofit organization to be used for

affordable housing.

(d) Leasing land by the city or county to be used for affordable housing.

(e) Requesting to purchase land owned by the Federal Government at a discounted price for the

creation of affordable housing pursuant to the provisions of section 7(b) of the Southern

Nevada Public Land Management Act of 1998, Public Law 105-263.

(f) Establishing a trust fund for affordable housing that must be used for the acquisition,

construction or rehabilitation of affordable housing.

(g) Establishing a process that expedites the approval of plans and specifications relating to

maintaining and developing affordable housing.

(h) Providing money, support or density bonuses for affordable housing developments that are

financed, wholly or in part, with low-income housing tax credits, private activity bonds or

money from a governmental entity for affordable housing, including, without limitation,

money received pursuant to 12 U.S.C. § 1701q and 42 U.S.C. § 8013.

(i) Providing financial incentives or density bonuses to promote appropriate transit-oriented

housing developments that would include an affordable housing component.

(j) Offering density bonuses or other incentives to encourage the development of affordable

housing.

(k) Providing direct financial assistance to qualified applicants for the purchase or rental of

affordable housing.

(l) Providing money for supportive services necessary to enable persons with supportive housing

needs to reside in affordable housing in accordance with a need for supportive housing

identified in the 5-year consolidated plan adopted by the United States Department of

Housing and Urban Development for the city or county pursuant to 42 U.S.C. § 12705 and

described in 24 C.F.R. Part 91.

2020 Annual Housing Progress Report

Page 7

See also Attachment A which gives the wording of the entire governing statute, NRS 278.235.

Table 3: NRS 278.235 Measures Incorporated into Master Plans and Used in 2020

Jurisdiction a b c d e f g h i j k l

# of

measures

used

Clark Co.

XX

X

X

X

X

XX

XX

X

XX

XX

XX

6

Boulder City

X

X

X

X

X

X

X

0

Henderson

XX

X

X

X

XX

X

X

XX

XX

4

Las Vegas

X

X

X

X

X

X

XX

XX

XX

3

Mesquite

X

X

X

X

X

X

X

0

N. Las Vegas

XX

X

X

X

XX

XX

XX

4

Washoe Co.

X

X

X

X

X

Y

X

X

Y

XX

3

Reno

XX

X

XX

X

XX

Y

XX

XX

X

6

Sparks

X

X

X

X

XX

X

X

Y

XX

3

# of

jurisdictions

reporting

active use

4 0 1 0 0 0 1 7 1 2 7 6 29

Note: Measures a through l correspond to measures as given in Attachment A.

X indicates that the NRS 278.235 Measure is in the jurisdiction’s Housing Plan.

XX indicates that the NRS 278.236 Measure is in the Housing Plan and the Measure was utilized in 2020.

Y indicates that the Measure was utilized in 2020 but is not incorporated into the jurisdiction’s Master Plan.

Table 3, above, identifies the measures incorporated into each Master Plan and those utilized by

each jurisdiction in 2020. All jurisdictions at least passively met this requirement by incorporating

six measures into their Master Plan. Clark County and City of Reno reported the most diverse use

of the measures with six measures being actively used. Measures H, “Providing money, support

or density bonuses for affordable housing,” K, “Providing money for supportive services necessary

to enable persons with supportive housing needs to reside in affordable housing” and L, “Providing

direct financial assistance to qualified applicants for the purchase or rental of affordable housing”

were the three measures used by the largest number of jurisdictions. Measures used for moderate

income families with 80% to 120% of HUD area median income were not included in Table 3 to

keep table comparable to previous years.

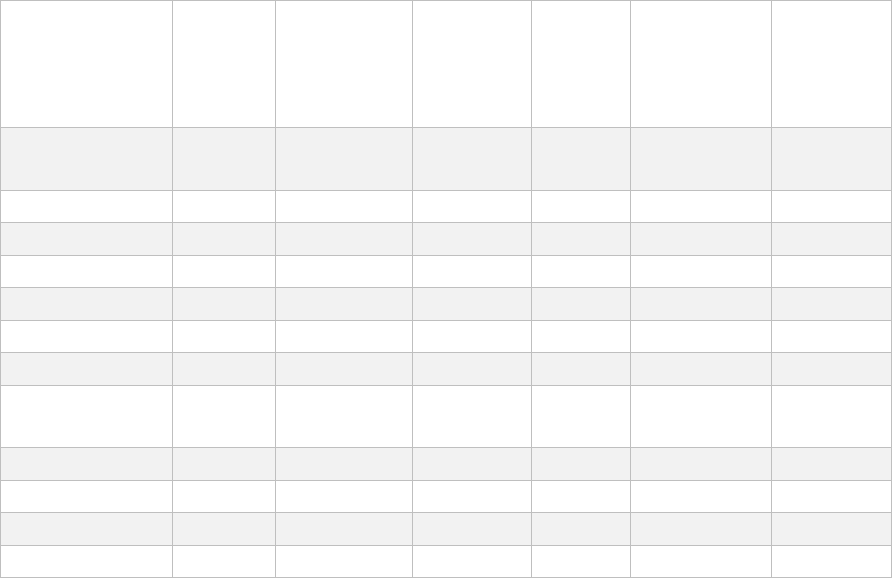

Active Use Time Series and Intensive Use of Measures

Table 3 indicates in 2020 measures were used by the jurisdictions at least 29 times, which is one

less than the 2019 total of 30. Figure 2 shows the total number as reported from 2007 to 2020. The

diversity of active use of measures seems to have stabilized at around 30 since 2014. However, the

reporting methodology has evolved over time, so the stabilization could be due to methodological

changes which have been in place since 2014.

2020 Annual Housing Progress Report

Page 8

Figure 2. Active Use of Measures

38

42

43

40

36

38

40

32

33

28

33

32

30

29

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Table 4. Intensity of NRS 278.235 Measure Use 2020: Number of Projects Associated with

Active Use of Measure

Jurisdiction a b c d e f g h i j k l

# of

measures

used

Clark County

15

0

0

0

0

0

16

16

0

7

57

54

165

Boulder City 0 0 0 0 0 0 0 0 0 0 0 0 0

Henderson 3 0 0 0 0 0 0 7 0 0 4 4 18

Las Vegas

0

0

0

0

0

0

0

9

0

0

4

3

16

Mesquite 0 0 0 0 0 0 0 0 0 0 0 0 0

N. Las Vegas* 2 0 0 0 0 0 0 4 0 0 5 4 15

Washoe

County

0 0 0 0 0 0 0 1 0 0 3 5 9

Reno

4

0

1

0

0

0

0

13

1

1

3

0

23

Sparks

0

0

0

1

0

0

0

4

0

0

3

3

11

Number of

jurisdictions

reporting

active use

24 0 1 1 0 0 16 53 1 8 79 73 256

Note: Measures a through l correspond to measures as given in Attachment A.

*City of North Las Vegas used measure K to rehab owner occupied housing for households with 80-120% HUD Area

Median Family Income. To keep data comparable to previous years it has not been added into the table.

Note that a measure in Table 3 could have been used more than once. To understand more about

the intensity of measure use, the number of projects or programs the measure was used for was

collected on Form 1. Table 4 displays the results for 2020. City of Reno and Clark County, as lead

agencies for their respective regional HOME consortiums, specialized in housing activities and

have the highest measure intensity for their respective regions. Both jurisdictions participate often

in joint projects. The impact of CARES Act housing assistance programs as well as the

2020 Annual Housing Progress Report

Page 9

methodology changes for measures K (direct financial assistance) and L (supportive services) also

stand out, making measures K and L the most often used. The next largest use of measures occurred

with A, subsidizing impact fees and building permits, and H, “Providing money, support or density

bonuses for affordable housing.”

AFFORDABLE HOUSING INVENTORY

Table 5 summarizes changes to the inventory of subsidized housing units in the nine jurisdictions.

The number given in the second column of Table 5, “total existing 2019”, matches the Nevada

Housing Division list of subsidized housing before 2020 additions and subtractions. The total is

tied to a list of subsidized housing for each jurisdiction maintained at the Housing Division and

checked by the jurisdiction each year. Low income housing included on the list are all types of tax

credit properties, private or non-profit properties with project based HUD rental assistance, public

housing, USDA Rural Development multi-family housing, properties owned by regional housing

authorities, and some properties built or assisted with HOME, Nevada Account for Affordable

Housing Trust Funds, National Housing Trust Funds, or Neighborhood Stabilization Program

funding as well as a small number of properties with other miscellaneous funding. To be included

on the list, the properties must either have project based rental assistance, or deed restrictions or

other agreements restricting income levels of occupants or rent levels. Using the lists compiled by

the Housing Division and the jurisdictions there were a total of 28,458 units of subsidized or below

market housing in existence in the designated AHPR jurisdictions at the end of 2019. This was 1%

less than 2018’s inventory unit count.

The third column tracks additions to the inventory in 2020. Only units that are new to the inventory

and reported as completed in 2020 are included. Because HOME funding is an important way that

jurisdictions support affordable housing, often it is most convenient for jurisdictions to report a

project as complete when HOME draws have been completed. Also, jurisdictions cooperate in the

production of housing units. Multiple jurisdictions may support and report the same project,

creating overlap. Overlapping this year were the 65 new units reported by City of Las Vegas and

Clark County, which have been accounted for in the table below and only count towards the total

in Las Vegas, the jurisdiction in which the units reside physically.

The fourth column tallies any units that were previously on the list of subsidized housing but as of

2020 no longer have deed restrictions or other agreements restricting rents or incomes of the

inhabitants. The majority of these are accounted for by exiting tax credit properties. The exiting

units enter the private market, or rarely, are demolished for an alternate land use.

The fifth column gives the total units existing at the end of 2020 (column 2 plus column 3 minus

column 4) while the sixth column gives the percentage increase or decrease in subsidized units.

According to jurisdiction reports, the total increase is 741 units, 5% more than the 704 new units

reported last year. However, it should be noted that the increase would be less than last year if it

weren’t for a sizable inventory correction for North Las Vegas’ single family down payment

assistance program. This year 125 units converted to private market units, meaning that total units

on the subsidized housing list increased in net by 616 units or 2%. The factor most enabling the

growth in 2020 as compared to the loss in 2019, was far fewer units exiting to the private market.

Total at the end of 2020 was 29,074 units.

xvii

2020 Annual Housing Progress Report

Page 10

Table 5: Change in AHPR Jurisdictions’ Affordable Housing Inventory, 2019 to 2020

Jurisdiction

Total Units

End of

2019

Units

Created in

2020*

Units

Converted to

Private Market

in 2020

Total Units

End of

2020

% Year over

Year change

Clark

Unincorporated

7,630 311 0 7,941 4.1%

Boulder City

59

0

0

59

0.0%

Henderson

2,949 0 0 2,949 0.0%

Mesquite

136

0

11

125

-8.1%

Las Vegas

8,529

65

108

8,486

-0.5%

NLV

1,542

365**

0

1,907

23.7%

Clark Total

20,845

741

119

21,467

3.0%

Washoe

Unincorporated

0 0 0 0 NA

Reno

6,500

0

3

6,497

0.0%

Sparks

1,113

0

3

1,110

-0.3%

Washoe Total

7,613

0

6

7,607

-0.1%

Grand Total 28,458

741 125 29,074 2.2%

*Included in this category were new and renovated units new to the inventory that were completed in 2020 for both

multi-family and single-family rentals and single family owner occupied with deed restrictions.

*

*Includes 213 units as a major correction to inventory.

Affordable Housing Inventory Time Series

A time series of the Annual Housing Progress Report (AHPR) inventory of subsidized units is

available from 2014 to the current year. Table 6 gives this time series for all AHPR jurisdictions.

The total change in units from 2014 to 2020 is calculated. In addition, totals for Washoe and Clark

Counties are given along with Nevada demographer population estimates and 2020 population

projections for the two counties. Henderson, Mesquite, North Las Vegas, and Reno experienced a

net gain in total subsidized units over the time period. Clark County, Las Vegas and Sparks

jurisdictions experienced a net loss in total subsidized units over this time. For Clark County as a

whole, there was a net loss of 551 units (3%) while population over the period increased by 13%,

according to the Nevada Demographer estimates and 2020 projection. Washoe County inventory

increased in net by 222 units (3%) but there was a 10% increase in population over the period.

This information is summarized in Figure 3 which shows number of subsidized units per 1,000

population for both counties over the period. Clark County has shown a uniform decrease in this

metric until 2019 and an uptick this past year, while Washoe County experienced an uptick in 2018

and slight decrease again in 2019 and 2020.

2020 Annual Housing Progress Report

Page 11

Figure 3. Subsidized Units per 1,000 Population for Washoe and Clark County, 2014 to 2020

8.0

10.0

12.0

14.0

16.0

18.0

2014* 2015 2016 2017 2018 2019 2020

Clark subsidized units per thousand

Washoe subsidized units per thousand

Table 6. Subsidized Housing Inventory 2014 to 2020 with Demographer Population Estimates

and Projection

Jurisdiction 2014* 2015 2016 2017 2018

a

2019 2020

Change

2014 to

2020

%

Change

2014 to

2020

Clark

Unincorporated

8,411 8,779 8,089 8,219 7,797 7,630 7,941 (470) -6%

Boulder City 59 59 59 59 59 59 59 - 0%

Henderson 2,798 2,935 2,938 2,945 2,951 2,949 2,949 151 5%

Mesquite 111 111 111 111 111 136 125 14 13%

Las Vegas 8,982 8,576 8,594 8,866 8,836 8,529 8,486 (496) -6%

NLV 1,657 1,410 1,414 1,453 1,430 1,542 1,907 250 15%

Washoe

Unincorporated

0 0 0 0 0 0 0 - NA

Reno 6,171 6,200 6,225 6,269 6492 6,500 6,497 326 5%

Sparks 1,214 1,170 1,063 1,063 1113 1,113 1,110 (104) -9%

Total 29,403 29,240 28,493 28,985 28,789 28,458 29,074 (329) -1%

Clark Co. total 22,018 21,870 21,205 21,653 21,184 20,845 21,467 (551) -3%

Washoe Co.

total

7,385 7,370 7,288 7,332 7,605 7,613 7,607 222 3%

Clark Co.

population

2,069,450 2,118,353 2,116,181 2,193,818 2,251,175 2,293,391 2,329,514 260,064 13%

Washoe Co.

population

436,797 441,946 448,316 451,923 460,237 469,801 479,171 42,374 10%

*2014 baseline numbers have been changed to reflect minor corrections made to the baseline the following year.

a

See previous AHPR reports for notes about corrections to 2018 numbers.

Sources: Annual Housing Progress Reports 2015 to 2020, Governor Certified Population Estimates of Nevada's

Counties, Cities and Towns 2000 to 2019, Five Year Population Projections for Nevada and its Counties 2019 to 2024

Based on the 2019 Estimate, Office of the State Demographer for Nevada,

https://tax.nv.gov/Publications/Population_Statistics_and_Reports/

2020 Annual Housing Progress Report

Page 12

JURISDICTION PROGRESS IN CREATING AND MAINTAINING

AFFORDABLE UNITS

As required by NRS 278.235, remaining affordable housing need has been analyzed below in

Tables 7 using information compiled from jurisdiction reports.

Each jurisdiction is required to prepare a five-year Consolidated Plan in order to receive housing

funds from the United States Department of Housing and Urban Development (HUD). As part of

the housing needs analysis contained in the Consolidated Plan, jurisdictions are required to use the

Comprehensive Housing Affordability Strategy (CHAS) data supplied by HUD to investigate how

many affordable housing units are needed for their population. Starting with the 2015 report, the

Housing Division has assigned all jurisdictions the number of affordable units needed (column

two in Table 7) using CHAS data. The CHAS estimate of households with one or more housing

problems and income under 80% HUD Area Median Income (low income) was used for “total

needed” given in column 2. This is a relatively broad and inclusive measure of housing needs. This

estimate was adjusted downward by subtracting out CHAS estimates of housing units that are

affordable to low income households and vacant. This helps account for affordable and available

private market units. The Division assigns this estimate to help make them comparable across

jurisdictions. If a jurisdiction would like to provide an alternate estimate, they may work with the

Division to do so; however, as of the 2020 report none have yet requested this option. The 2013 to

2017 CHAS data estimated 259,000 low income Washoe and Clark County households

experienced one or more housing problems such as housing cost burden, lack of complete kitchen

or plumbing facilities or overcrowding. About 33,000 units were affordable to low income families

and vacant. After adjusting for vacant units, there were an estimated 227,000 households in need

of housing assistance, down one percent from the 2012 to 2016 estimates. The decrease was 1%

in Clark County and in Washoe County was 4%. The largest component of change was a decrease

in households with one or more housing problems that were under 50% of HUD Area Median

Income. Both counties had fewer vacant units. Note that no equivalent numbers are available from

2020 that would reflect need after the Covid-19 Crisis which may have changed housing needs

substantially.

xviii

The third column in the table “Total 2020 Subsidized Units” is total inventory of units at the end

of 2020 as given in Table 5 above.

The column in Table 7 named “Additional Households Assisted in 2020” includes housing

activities such as tenant-based rental assistance provided through jurisdictions as well as down-

payment assistance for single family owners. These activities helped to provide additional

individuals or families with affordable housing during 2020. Tenant based rental assistance is

important to include since most households experiencing a housing problem are experiencing

housing cost burden. If the burdened household is given rental assistance, the housing problem

may be resolved. However, some of these activities do not create long term affordable housing

units. A different total is needed to track long-term affordable inventory (see Table 5 above). A

total of 15,914 additional households were reported to be assisted in 2020. This large increase was

primarily due to CARES Act housing assistance programs.

The final column is the ratio of the assistance (column 3 plus column 4) to need (column 2. It

compares total subsidized low income housing units, rental assistance, and other housing

assistance available at the end of 2020 to total need for affordable units from the CHAS data.

2020 Annual Housing Progress Report

Page 13

Subsidized units and other assistance are expressed as a percentage of total need as measured in

the 2013 to 2017 CHAS estimates. This provides a consistent way to compare the scale of low

income housing activity across jurisdictions to the need for assistance. This year for the AHPR

jurisdictions, the ratio of subsidized units and other assistance to households in need was 20%,

representing a substantial increase in assistance available as compared to need. This increase was

primarily due to the availability of CARES Act housing assistance programs.

The Total Need column is data from 2013 to 2017 and does not reflect the increased need due to

Covid-19 related factors. As an experiment, the Urban Institute’s estimated number of Nevada

renter households under 80% AMI suffering a COVID-19 related job loss (24,000 households)

was added to the Total Need column distributed to match the distribution of HUD household totals

for each jurisdiction.

xix

Table 8 gives an adjusted total need and adjusted assistance as a percentage

of existing need. The ratio of subsidized units and other assistance to household in need was

reduced to 18%. To reduce the ratio to 13% as it was in 2019, approximately 100,000 more

households in need would have to be added. It is possible that there were this many more

households in need, but the experiment may indicate that a greater percentage of households at

least received some degree of help in 2020 than in 2019.

Summary of Remaining Need

Numbers were not truly comparable to 2019 given the large number of households assisted under

the CARES Act programs. For example, the ratio for total AHPR jurisdictions increased from 13%

last year to 20% this year. Despite the larger amount of rental assistance reported by Clark County

this year, Reno still emerged as the jurisdiction with the strongest level of assistance and subsidized

units as compared to its total need. In the southern portion of the state, Clark County

Unincorporated appeared to have the strongest level of assistance at 24%, but largely because most

of the CARES Act rental assistance was credited to them, even though the assistance was used

throughout the Las Vegas Metro area. It is more insightful to look at Clark County as a whole.

It may always be more appropriate to view affordable housing needs by each county rather than

by the individual jurisdictions within them, but that is especially true this year. For the CARES

Act programs, as is true of many of the federal housing assistance programs, there was substantial

cooperation amongst jurisdictions with a regional approach taken to administering the funds.

Although the tenant based rental assistance provided by the jurisdictions is included in column

four, federal housing choice vouchers are not included. The final four rows allow comparison of

the two counties with and without housing choice vouchers. Using Housing Choice Voucher data

available at Housing Authority level, Table 5 demonstrates how housing assistance and subsidized

units available increase substantially when vouchers are considered. Considering voucher

availability, there were approximately four households in need in Washoe and Clark County for

each household assisted.

The 2016 survey of tax credit projects found that 9% of households in Clark County tax credit

funded units and 14% in Washoe County use vouchers.

xx

Estimates below accounted for this

overlap.

xxi

2020 Annual Housing Progress Report

Page 14

Table 7: Analysis of Remaining Affordable Housing Need

Jurisdiction

Total

Need*

Total 2020

Subsidized

Units

Additional

Households

Assisted in

2020*

Ratio of assisted

households to

households in

need

Clark Unincorporated

83,330

7,941

12,460

24%

Boulder City

1,100

59

0

5%

Henderson

21,580

2,949

303

15%

Mesquite

1,645

125

0

8%

Las Vegas

58,840

8,486

1,710

17%

N. Las Vegas

18,495

1,907

453

13%

Washoe

Unincorporated

6,460 0 65 1%

Reno

26,350

6,497

914

28%

Sparks

8,840

1,110

9

13%

Total

226,640

29,074

15,914

20%

Washoe Co. total

without vouchers

41,650 7,607 988 21%

Washoe Co. total with

vouchers

41,650 9,718 988 26%

Clark Co. total without

vouchers

184,990 21,467 14,926 20%

Clark Co. total with

vouchers

184,990 31,490 14,926 25%

*Total need numbers are from before Covid-19; however, households assisted includes CARES Act participants.

Table 8. Experimental Addition of Covid-19 related Renters in Need to Total Need

Jurisdiction

Total Need with

Adjustment for COVID-

19 related

unemployment

Adjusted Assistance

and subsidized units

as % of existing need

Clark

Unincorporated

90,935 22%

BC

1,246

5%

Henderson

24,102

13%

Mesquite

1,821

7%

LV

63,894

16%

NLV

20,094

12%

Washoe

Unincorporated

7,374 1%

Reno

28,549

26%

Sparks

9,685

12%

Total

247,701

18%

2020 Annual Housing Progress Report

Page 15

In 2019, a new baseline number for the subset of units affordable to very low income households

(VLI), that is, 50% of HUD Area Median Family Income (HAMFI) and below, was established.

A unit was considered a part of this inventory if it either had a project-based rental assistance

contract or had set asides for households at 50% of HAMFI or below. Table 9 gives a break-out of

the above information by units affordable to VLI and LI households in 2020. LI households were

defined as households with incomes from 50% to 80% of HAMFI. To compare housing need in

each category like Table 7 above, additional assistance such as tenant-based rental assistance and

owner occupied renovation programs provided through the jurisdictions is added to units to

compare housing effort for each population separately.

Overall, the ratio of housing assistance to need for VLI and LI households was similar this year,

with a ratio of one assisted household to each five in need for both VLI and LI households.

Regionally, the level of assistance for VLI households was highest in Clark County at 21%. In

general, Table 9 looks completely different this year due to the CARES Act Housing Assistance

and the incorporated assumptions about which income groups were served through it. In the south,

the assumption was made that CARES Act housing assistance served VLI households, unless more

detail was available. This assumption was made due to Clark County data on the incomes of

recipients that indicated most households served through the programs had quite low incomes. In

the north, no information on incomes of the recipients was available and in accordance with the

guidelines for the assistance, which allowed households up to 120% of HAMFI to participate,

households were assumed to be in the LI category.

Table 9. Subsidized Units for VLI Households and LI Households

Jurisdiction

VLI

units

2020

Additional

VLI

Households

Assisted in

2020

Ratio of

VLI

Assistance

to VLI

Need

LI

Units

2020

Additional

LI

Households

Assisted in

2020

Ratio of

LI

Assistance

to LI

Need

Clark

Unincorporated

3,591 12,460 28% 4,350 - 16%

Boulder City

59

-

7%

-

-

0%

Henderson

1,268

301

12%

1,681

2

20%

Mesquite

69

-

6%

56

-

12%

Las Vegas

5,828

1,626

19%

2,658

84

14%

NLV

785

415

10%

1,122

-

17%

Clark Total

11,600

14,802

21%

9,867

86

16%

Washoe

Unincorporated

- 65 2% - - 0%

Reno

3,428

160

19%

3,069

704

49%

Sparks

489

5

8%

621

9

24%

Washoe Total

3,917

230

14%

3,690

713

35%

Grand Total

15,517

15,032

20%

13,557

799

19%

With the newly reestablished inventory of VLI units, it was again possible to calculate the

percentage of VLI units for each jurisdiction (Table 10). Overall, 53% of subsidized units either

had project based rental assistance or a set aside for VLI households. The largest percentage of

2020 Annual Housing Progress Report

Page 16

units devoted to VLI households was in Boulder City which has one property with full project

based rental assistance. The second largest percentage of VLI units was in City of Las Vegas with

69%.

Table 10. Percent of Inventory for VLI Households

Jurisdiction

% of Total

Subsidized Inventory for VLI

Households

Clark Unincorporated 45%

Boulder City

100%

Henderson

43%

Mesquite

55%

Las Vegas

69%

NLV

41%

Clark Total

54%

Washoe

Unincorporated

NA

Reno

53%

Sparks

44%

Washoe Total

51%

Grand total

53%

ADDITIONAL ANALYSIS OF HOUSING NEED: TYPES OF HOUSING

PROBLEMS

The total need in Table 7 above concerns low income households, including both renters and

owners, with one or more housing problems minus units that are affordable and available to low

income households from the 2013 to 2017 CHAS data. The analysis below adds additional

information about the four types of problems experienced by this group of low income households.

The four problems tracked in the CHAS data are lack of full kitchen, lack of complete plumbing,

overcrowding or cost burden. Full kitchens are defined as having a sink with faucet, stove or range

and a refrigerator within the housing unit. Full plumbing facilities refer to hot and cold running

water and bathtub or shower within the unit. Overcrowding is more than one person per room

while severe overcrowding is more than 1.5 persons per room, excluding bathrooms and halls.

Housing cost burden occurs when housing costs are greater than 30% of household income and

severe housing cost burden when they are greater than 50% of household income.

xxii

Typically

housing cost burden accounts for the largest proportion of households with a housing problem.

As can be seen in Figure 3, about 64% of the households with incomes under 80% of AMI in Clark

County have full plumbing and kitchen facilities and do not have overcrowding but do have some

degree of housing cost burden while the equivalent percentage in Washoe County was 60%. This

corresponds to about 192,000 households in Clark County and 39,000 in Washoe County. Three

to four percent of households with incomes under 80% AMI have zero or negative income so that

rent burden cannot be calculated, but do not have any of the other three housing problems. Another

2020 Annual Housing Progress Report

Page 17

Figure 4. Type of Housing Problem for 0 to 80% AMI Households, 2013-2017

24%

27%

4%

3%

1%

2%

4%

5%

2%

2%

29%

28%

35%

33%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Clark %

Washoe %

No problems

Burden not calculated, no other problem

Lack of full kitchen and/or plumbing

Crowded but has full kitchen and plumbing

Severely crowded but has full kitchen and plumbing

Full kitchen and plumbing, no crowding but cost burdened

Full kitchen and plumbing, not crowded but severely cost burdened

1

HUD CHAS 2013-2017 from HUD CHAS data query tool:

http://www.huduser.org/portal/datasets/cp/CHAS/data_querytool_chas.html accessed 9-1-2020 and tabulations by

the author.

24% to 27% of this population do not have any of the four housing problems. Households with

overcrowding or lack of full kitchen and plumbing facilities made up 7-10% of those with one of

four housing problems. This corresponds to about 22,000 households in Clark County and 6,000

households in Washoe County who may have an inadequate or overcrowded unit.

xxiii

Homeless families and individuals are not included in the CHAS count of households with housing

problems but clearly a fuller accounting should include consideration of these households. Over

the years from 2011 to 2019, Clark County Continuum of Care (CoC) counted 5,500 to 8,000

homeless individuals each year during the point-in-time count while Washoe County CoC counted

from 750 to 1,250 homeless individuals. Point-in-time counts were a record high in 2019 in

Washoe County (1,256) and a record low in Clark County (5,530).

xxiv

The lack of full kitchen and/or plumbing facilities does not fully capture housing inadequacies. In

some cases, such as an SRO unit, the lack of full kitchen and plumbing facilities within the unit

may still make for safe, decent, and sanitary housing. On the other hand, in many other cases a

2020 Annual Housing Progress Report

Page 18

unit with full kitchen and plumbing facilities may have other severe housing issues such as a lack

of temperature control, holes in the roof, rat infestation, breakdown of electrical wires, etc. The

biennial American Housing Survey (AHS) collects much more detailed information on all types

of housing inadequacies than does the American Community Survey. For Las Vegas in 2017, AHS

estimated 7,000 occupied units in Las Vegas had severe physical problems and an additional

20,600 occupied units had moderate physical problems. There were no estimates for Washoe

County.

xxv

Dollar amount of rent burden for VLI renters

Because cost burden is the most common problem amongst low income households, this issue was

explored further with the 2019 American Community Survey Public Use Microdata Sample

(PUMS). The question explored was, what is the wedge of unaffordability? That is, what amount

of money per month would it take to resolve housing rent burden for the average low income

household? Different costs of alleviating rent burden might suggest different types of solutions.

In contrast to Figure 4, only very low income renter households were included in the analysis.

xxvi

However, the prominence of housing cost burden is similar amongst this group. Using the

equivalent analysis for VLI renter households ,75% of renter households with incomes under 50%

of AMI in Clark County have full plumbing and kitchen facilities and do not have overcrowding

but do have some degree of housing cost burden while the equivalent percentage in Washoe

County was 72%.

Table 11. Rent burden wedge for Nevada VLI households with rent burden, excluding

outliers

xxvii

Amount of

rent burden

wedge

# of rent

burdened

VLIL

households

% of rent

burdened

VLIL

households

household

avg

annual

income

avg monthly

rent burden

wedge

annual cost

of alleviating

% annual

cost

alleviation

less than

$100/month

19,067 15% $20,620 $47 $10,809,988 2%

$100 to

$199/month

16,843 14% $19,749 $146 $29,437,923 4%

$200 to

$299/month

14,472 12% $19,279 $246 $42,797,207 6%

$300 to

$399/month

10,951 9% $17,319 $353 $46,442,998 7%

$400 to

$499/month

13,262 11% $16,064 $445 $70,814,446 10%

$500 to

$599/month

11,969 10% $14,594 $544 $78,181,176 11%

$600 to

$699/month

7,841 6% $11,906 $652 $61,329,225 9%

$700 to

$799/month

6,813 5% $9,952 $742 $60,673,864 9%

$800/month

or more

22,660 18% $12,235 $1,037 $281,956,490 41%

Overall

123,878

100%

$16,311

$459

$682,443,318

100%

2020 Annual Housing Progress Report

Page 19

Table 11 gives the results of the rent burden wedge analysis. For the approximately 124,000 rent

burdened VLI households, the average cost of alleviating their rent burden was $459 a month in

2019. Were this VLI household to receive $459 a month, they would no longer experience rent

burden. The average annual income of these VLI renter households was $16,311. For 15% of these

households, rent burden would be alleviated for an average of $47/month. Households with rent

burden of $800/month or more present the greatest challenge, making up 18% of rent burdened

households but costing about $282 million a year, which would be over 40% of the total cost of

alleviation for all 124,000 renter households.

NOTABLE HOUSING INITIATIVES IN 2020

What stands out this year above all is the rapid deployment of the various CARES Housing

Assistance Programs through which over 12,000 Covid-19 impacted households were reported to

have been helped. These large new programs were set up quickly despite drastic changes in

working conditions due to the pandemic. Seven jurisdictions reported some level of involvement

with new CARES Act programs.

Some delays were reported due to the pandemic, however, for the most part, work continued apace

on new and renovated affordable projects. This past year the number of units in the pipeline was

again the highest reported since this metric has been tracked with the 4,025 units outpacing even

last year’s 3,702. Of the 4,025 units, 2,772 were new construction and 1,253 were renovation

projects. Of the 32 projects in the pipeline, 14 were first included in AHPR this year.

Included in

the list of pipeline projects were six projects with project based sliding scale rental assistance

contracts, joining three other such projects that completed renovation this year. In addition, three

formerly at-risk Bond properties finished renovation, resetting affordability periods for 30 more

years, and four additional renovation projects on formerly at-risk projects were underway.

A total of six new and six renovation projects were completed this year. Perhaps surprisingly,

given the number of units in the pipeline last year, new units finished this year (528) were less

than last year (704). This may be due in part to Covid-19 related delays. However, renovated units

finished were much higher this year (780) than last year (49).

The largest new project to finish this year was in Clark County; Crescendo Senior Apartments will

have 195 one and two bedroom units with 79 of these units set aside for VLI households. Another

notable project finished in the south is Stepping Stone, which provides affordable and accessible

apartments for people with brain injuries. A group home for youth, Eddy House, was completed

in Reno, with the help of fee abatement by the City.

This year far fewer properties exited to the private market; only 125 units converted as compared

to 1,066 last year. Of these 125, 11 LIHTC units in Mesquite exited when existing residents

became homeowners of those units as they exercised the homeownership option on the extended

use agreements. This LIHTC project with homeownership option is the only one like it in the State.

Regional cooperation was again strong in 2020, especially for Clark County, which was involved

in ten joint projects, two of which were completed this year, in addition to regional cooperation on

Covid-19 rental assistance programs.

2020 Annual Housing Progress Report

Page 20

CONCLUSION

Under new and challenging conditions imposed by business closures, social distancing

requirements and other Covid-19 related changes, many jurisdictions were involved in setting up

new rental assistance programs to help households impacted by the virus, as well as implementing

new Covid-19 related aspects of homeless programs. As reported to the Housing Division, over

12,000 households were helped with new CARES Act housing assistance programs. These new

programs helped improve AHPR measures of need. The ratio of households assisted to households

in need increased from 13% last year to 20% in 2020. Household need as measured in this report

did not include households impacted by Covid-19. An experiment to add in newly unemployed

low income renter households to the need column reduced the ratio from 20% to 18%.

The need for affordable units is especially high amongst Nevada’s very low income (VLI)

households. Due to the CARES Act housing assistance programs, the ratio of VLI households

assisted to VLI households in need improved from 10% in 2019 to 20% in 2020. There were five

VLI households in need for each VLI household assisted. For low income households with

incomes from 50% to 80% of HAMFI the ratio remained close to last year’s ratio at 19%, also

close to a ratio of one household assisted for every five in need. These ratios are not completely

reflective of 2020, because of the large number of new households afflicted by Covid-19

unemployment that are not included in the measure of need, which has a considerable time lag.

Over half of the AHPR inventory of affordable units either have project based rental assistance or

are set aside for VLI households with incomes under 50% of HAMFI. Half of new units added

were set aside for households with incomes at 50% AMI or lower. Twenty-seven percent of

renovated units were set aside for VLI households.

Despite the many pandemic-related adaptations required this year, thirty-two multi-family projects

were funded or are currently under construction with a record 4,025 units in the pipeline. Six new

projects with 528 restricted units were completed and six renovation projects with 780 restricted

units were completed, marking considerable progress in preservation. Only 125 units converted to

private market units, which resulted in a net increase in the affordable housing inventory of 403

units. Because of an inventory correction of an additional 213 units, total net increase in inventory

this year was 616 units, the first net gain in three years.

Net inventory as compared to the 2014 baseline was still down 1% for the AHPR jurisdictions.

Some of the projects in the pipeline may have met delays this year due to extra difficulties imposed

by the Covid-19 pandemic. There is considerable hope for additional increases in the inventory of

affordable housing units in 2021.

For further information or to answer questions regarding this report please contact Elizabeth

Fadali at [email protected] or 775.687.2238.

2020 Annual Housing Report

Endnotes

i

https://www.leg.state.nv.us/App/NELIS/REL/80th2019/Bill/6091/Overview

ii

U. S. Bureau of Labor Statistics. Local Area Unemployment Statistics. Seasonally adjusted unemployment rate.

h

ttps://www.bls.gov/lau/

iii

S&P Dow Jones Indices LLC, S&P/Case-Shiller NV-Las Vegas Home Price Index© [LVXRNSA], retrieved from FRED, Federal

Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/LVXRNSA

, January 25, 2021.

iv

Ibid.

v

Lied Center for Real Estate. Nevada Housing Market Update, November 2020. https://liedcenter.unlv.edu/wp-

content/uploads/2020/12/6025_Lied-Housing-Market-Report_Nov-2020.pdf

vi

Friedman, Nicole. Nov. 12, 2020. Home Prices Are Rising Everywhere in the U.S. Wall Street Journal.

vii

GOED Board Meeting Attachments. Dec. 2, 2020 & Sept 16, 2020. Nevada Governor’s Office of Economic Development.

ht

tps://goed.nv.gov/about/notices-agendas/

viii

U.S. Census Bureau accessed through the Federal Reserve Bank of St. Louis. Homeownership Rate for Nevada

h

ttps://research.stlouisfed.org/fred2/series/NVHOWN

Accessed 12-22-2020.

ix

U.S. Census Bureau. Week 20 Household Pulse Survey. https://www.census.gov/data/tables/2020/demo/hhp/hhp20.html accessed

12-23-2020

x

Khater, Sam, et.al. Nov. 17, 2020. Mortgage Forbearance Rates during the COVID-19 Crisis. Freddie Mac

ht

tp://www.freddiemac.com/research/insight/20201117_mortgage_forbearance_rate_during_COVID-19.page

xi

NMHC Rent Payment Tracker Update Webinar January 8, 2021

National Multifamily Housing Council. https://www.nmhc.org/meetings/calendar/webinars/nmhc-rent-payment-tracker-

webinars/nmhc-rent-payment-tracker-update-webinar-january-8-2021/ , ALN Reno and Las Vegas Quarterly Reviews,

https://alndata.com/ , Johnson, Perkins and Griffin, 3

rd

Quarter 2020 Apartment Survey, http://jpgnv.com/

xii

Ibid.

xiii

HUD CHAS data query tool: http://www.huduser.org/portal/datasets/cp/CHAS/data_querytool_chas.html accessed 7-9-2015 and

8-31-2020 with tabulations by the author.

xiv

E. Fadali. 2020. Nevada Affordable Housing Dashboard,

https://housing.nv.gov/uploadedFiles/housingnewnvgov/Content/Programs/HDB/HDB216NVAffordHousingDashboardAccessible202

00821.pdf, Nevada Housing Division.

xv

For four of the renovation projects, jurisdictions did not report using any of the 12 measures. However, they are included for

inventory purposes.

xvi

A small percentage of these households received assistance with mortgage arrears or mortgage payments.

xvii

Where the Housing Division is familiar with units no longer affordable due to expiring participation, the Division shares this

information with the jurisdictions, but this will not include all types of affordable housing. Also, it is possible that low income housing

activity takes place without involvement of the jurisdiction through the twelve measures. In these cases, in so far at the Division is aware

of the activity it will be added into the inventory lists and Form 2 for tracking purposes but may not always be included in reports from

jurisdictions; that is, the housing activity lists from jurisdictions are usually, but not necessarily comprehensive

.

xviii

It is difficult to interpret comparisons between overlapping time periods of the American Community Survey. Comparisons

between overlapping samples emphasize differences between non-overlapping years, in this case 2012 and 2017.

xix

Urban Institute. Oct. 1, 2020. Estimating the Cost of Rental Assistance in Nevada. https://www.urban.org/policy-centers/research-

action-lab/projects/sizing-federal-rental-assistance/nevada

xx

Fadali, E. & Perry Faigin. 2017. Taking Stock 2016: 2016 Annual Affordable Apartment Survey. Nevada Housing Division. P. 30.

ht

tps://housing.nv.gov/uploadedFiles/housingnvgov/content/Public/2016TakingStock20170209.pdf

xxi

U.S. Housing and Urban Development Voucher Management System

ht

tps://www.hud.gov/program_offices/public_indian_housing/programs/hcv/psd

accessed 1-25-2020. Total vouchers for September

for Reno Housing Authority and Southern Nevada Regional Housing Authority are adjusted for overlap with LIHTC units.

xxii

U.S. Housing and Urban Development Office of Policy Development and Research. CHAS: Background

https://www.huduser.gov/portal/datasets/cp/CHAS/bg_chas.html

accessed 8-8-2019

xxiii

HUD CHAS data query tool: http://www.huduser.org/portal/datasets/cp/CHAS/data_querytool_chas.html accessed 8-8-2019 and

tabulations by the author. U.S. Census Bureau American Community Survey Data Subject Definitions

https://www2.census.gov/programs-surveys/acs/tech_docs/subject_definitions/2015_ACSSubjectDefinitions.pdf?# accessed 11-7-

2018

xxiv

U.S. Housing and Urban Development Point in Time Counts 2007 to 2019: https://www.hudexchange.info/resource/3031/pit-and-

hic-data-since-2007/ downloaded 1-8-2020.

xxv

U.S. Census Bureau. 2013 American Housing Survey. Table C-05-AO-M “Housing Problems – All Occupied Units (SELECTED

METROPOLITAN AREAS).” American Factfinder accessed 11-7-2018.

xxvi

Observations representing about 3,700 outlier households, 3% of the population, were excluded from the analysis. These outlier

households had small household sizes and extremely high rents, higher than 95% of the appropriate sized unit. For example, a one-

person very low income renter household with rent burden was considered an outlier if their 2019 gross rent was above $1490. In

comparison, the highest Fair Market Rent for one bedroom units in Nevada in 2019 was $811/month. It is possible that these

2020 Annual Housing Report

households have help paying rent that was not included in their income, or that nursing care or other special needs are included in the

rent.

xxvii

Source: Author analysis of U.S. Census Bureau American Community Survey 2019 1-year Public Use Microdata Sample.

2020 Annual Housing Progress Report

Page 21

Attachment A – NRS 278.235

Below is the governing statute underlying the Annual Housing Progress Report as amended and enrolled in

2019. See

https://www.leg.state.nv.us/App/NELIS/REL/80th2019/Bill/6091/Text for more complete information on

recent amendments.

NRS 278.235 is hereby amended to read as follows:

278.235

1. If the governing body of a city or county is required to include the housing element in its master plan

pursuant to NRS 278.150, the governing body, in carrying out the plan for maintaining and developing

affordable housing to meet the housing needs of the community, which is required to be included in the

housing element pursuant to subparagraph (8) of paragraph (c) of subsection 1 of NRS 278.160, shall adopt at

least six of the following measures:

(a) Reducing or subsidizing in whole or in part impact fees, fees for the issuance of building permits

collected pursuant to NRS 278.580 and fees imposed for the purpose for which an enterprise fund was

created.

(b) Selling land owned by the city or county, as applicable, to developers exclusively for the development

of affordable housing at not more than 10 percent of the appraised value of the land, and requiring that

any such savings, subsidy or reduction in price be passed on to the purchaser of housing in such a

development. Nothing in this paragraph authorizes a city or county to obtain land pursuant to the

power of eminent domain for the purposes set forth in this paragraph.

(c) Donating land owned by the city or county to a nonprofit organization to be used for affordable

housing.

(d) Leasing land by the city or county to be used for affordable housing.

(e) Requesting to purchase land owned by the Federal Government at a discounted price for the creation of

affordable housing pursuant to the provisions of section 7(b) of the Southern Nevada Public Land

Management Act of 1998, Public Law 105-263.

(f) Establishing a trust fund for affordable housing that must be used for the acquisition, construction or

rehabilitation of affordable housing.

(g) Establishing a process that expedites the approval of plans and specifications relating to maintaining

and developing affordable housing.

(h) Providing money, support or density bonuses for affordable housing developments that are financed,

wholly or in part, with low-income housing tax credits, private activity bonds or money from a

governmental entity for affordable housing, including, without limitation, money received pursuant to

12 U.S.C. § 1701q and 42 U.S.C. § 8013.

(i) Providing financial incentives or density bonuses to promote appropriate transit-oriented housing

developments that would include an affordable housing component.

(j) Offering density bonuses or other incentives to encourage the development of affordable housing.

(k) Providing direct financial assistance to qualified applicants for the purchase or rental of affordable

housing.

(l) Providing money for supportive services necessary to enable persons with supportive housing needs to

reside in affordable housing in accordance with a need for supportive housing identified in the 5-year

consolidated plan adopted by the United States Department of Housing and Urban Development for

the city or county pursuant to 42 U.S.C. § 12705 and described in 24 C.F.R. Part 91.

2. A governing body may reduce or subsidize impact fees, fees for the issuance of building permits or fees

imposed for the purpose for which an enterprise fund was created to assist in maintaining or developing a

project for affordable housing, pursuant to paragraph (a) of subsection 1, only if:

(a) When the incomes of all the residents of the project for affordable housing are averaged, the housing

would be affordable on average for a family with a total gross income that does not exceed 60 percent

of the median gross income for the county concerned based upon the estimates of the United States

2020 Annual Housing Progress Report

Page 22

Department of Housing and Urban Development of the most current median gross family income for

the county.

(b) The governing body has adopted an ordinance that establishes the criteria that a project for affordable

housing must satisfy to receive assistance in maintaining or developing the project for affordable

housing. Such criteria must be designed to put into effect all relevant elements of the master plan

adopted by the governing body pursuant to NRS 278.150.

(c) The project for affordable housing satisfies the criteria set forth in the ordinance adopted pursuant to

paragraph (b).

(d) The governing body makes a determination that reducing or subsidizing such fees will not impair

adversely the ability of the governing body to pay, when due, all interest and principal on any

outstanding bonds or any other obligations for which revenue from such fees was pledged.

(e) The governing body holds a public hearing concerning the effect of the reduction or subsidization of

such fees on the economic viability of the general fund of the city or county, as applicable, and, if

applicable, the economic viability of any affected enterprise fund.

3. On or before January 15 of each year, the governing body shall submit to the Housing Division of the

Department of Business and Industry a report, in the form prescribed by the Division, of how the measures

adopted pursuant to subsection 1 assisted the city or county in maintaining and developing affordable housing

to meet the needs of the community for the preceding year. The report must include an analysis of the need for

affordable housing within the city or county that exists at the end of the reporting period.

4. On or before February 15 of each year, the Housing Division shall compile the reports submitted pursuant to

subsection 3 and post the compilation on the Internet website of the Housing Division.

Sec. 2. This act becomes effective on July 1, 2019.

2020 Annual Housing Progress Report

Page 23

Attachment B – Form 1 From Jurisdiction Reports

Clark County – Form 1, 2020 Annual Housing Report

FORM 1: SELECTED SPECIFIED MEASURES FOR CLARK COUNTY

Based upon previous reporting and a review of individual housing plans, NHD has identified the measures incorporated into your jurisdiction’s Housing

Plan (Column A). Please indicate in column B the measures used to assist in maintaining and developing affordable housing during the reporting period.

Please provide a narrative in Column C regarding the success or difficulty in using adopted measures and/or why measures not adopted in the plan

were used. Please note that Housing Qualifies under NRS 278.235 as affordable if it serves with incomes at or below 120 percent of area median

income as determined by the US Department of Housing and Urban Development (HUD) for each jurisdiction.

A

B

C

MEASURE

INCORPORATED

INTO HOUSING

PLAN

USED IN 2020

(PLEASE “X” TO

DENOTE)

NARRATIVE REGARDING

BENEFITS OR BARRIERS

TO USE OF MEASURE

A) Reducing or subsidizing in whole or in part

impact fees, fees for the issuance of building

permits collected pursuant to NRS 278.580 and

fees imposed for the purpose for which an

enterprise fund was created

X X

Policy 6, Page 5, 2019 Housing

Element. Used for 15 affordable

projects; 10 were in progress and 5

projects finishing this year

B) Selling land owned by the city or county, as

applicable, to developers exclusively for the

development of affordable housing at not more

than 10 percent of the appraised value of the land,

and requiring that any such savings, subsidy or

reduction in price be passed on to the purchaser of

housing in such a development.

X

C) Donating land owned by the city or county to a

nonprofit organization to be used for affordable

housing.

X

D) Leasing land by the city or county to be used

for affordable housing.

E) Requesting to purchase land owned by the

Federal Government at a discounted price for the

creation of affordable housing pursuant to the

provisions of section 7(b) of the Southern Nevada

Public Land Management Act of 1998, Public

Law 105-263.

X

F) Establishing a trust fund for affordable housing

that must be used for the acquisition, construction

or rehabilitation of affordable housing.

X

G) Establishing a process that expedites the

approval of plans and specifications relating to

maintaining and developing affordable housing.

X X

Policy 6, Page 5, 2019 Housing

Element. Used for 16 affordable

projects; 11 of these were in progress

and 5 finishing this year

H) Providing money, support or density bonuses

for affordable housing developments that are

financed, wholly or in part, with low-income

housing tax credits, private activity bonds or

money from a governmental entity for affordable

housing, including, without limitation, money

received pursuant to 12 U.S.C. § 1701q and 42

U.S.C. § 8013.

X X

Used for 16 affordable projects; 10

were in progress and 6 finishing this

year.

I) Providing financial incentives or density

bonuses to promote appropriate transit-oriented

housing developments that would include an

affordable housing component.

X

J) Offering density bonuses or other incentives to

encourage the development of affordable housing.

X X

Used for 7 affordable projects; 1 is

complete and 6 in progress.

K) Providing direct financial assistance to

qualified applicants for the purchase or rental of

affordable housing.

X X Used for 57 different programs.

L) Providing money for supportive services

necessary to enable persons with supportive

housing needs to reside in affordable housing in

accordance with the need identified in the

jurisdiction’s Consolidated Plan.

X X Used for 54 different programs.

Boulder City – Form 1, 2020 Annual Housing Report

FORM 1: SELECTED SPECIFIED MEASURES FOR CITY OF BOULDER CITY