NAIC Model Laws, Regulations, Guidelines and Other Resources—4

th

Quarter 2018

© 2018 National Association of Insurance Commissioners 632-1

TRAVEL INSURANCE MODEL ACT

Table of Contents

Section 1. Short Title

Section 2. Scope and Purposes

Section 3. Definitions

Section 4. Licensing and Registration

Section 5. Premium Tax

Section 6. Travel Protection Plans

Section 7. Sales Practices

Section 8. Travel Administrators

Section 9. Policy

Section 10. Regulations

Section 11. Effective Date

Drafting Note: This Travel Insurance Model Act is intended to be enacted as a standalone chapter of the insurance code with appropriate cross references to

seamlessly incorporate provisions such as licensing and premium tax into the adopting state’s existing statutory structure. Alternatively, sections such as the

licensing and premium tax provisions that may fit into other sections of an adopting state’s statutory structure could be pulled from the Model and incorporated

into the sections of the adopting state’s insurance code that address those topics.

Section 1. Short Title

This Act shall be known as the “Travel Insurance Model Act.”

Section 2. Scope and Purposes

A. The purpose of this Act is to promote the public welfare by creating a comprehensive legal framework within

which Travel Insurance may be sold in this state.

B. The requirements of this Act shall apply to Travel Insurance that covers any resident of this state, and is sold,

solicited, negotiated, or offered in this state, and policies and certificates are delivered or issued for delivery

in this state. It shall not apply to Cancellation Fee Waivers or Travel Assistance Services, except as expressly

provided herein.

C. All other applicable provisions of this state’s insurance laws shall continue to apply to Travel Insurance

except that the specific provisions of this Act shall supersede any general provisions of law that would

otherwise be applicable to Travel Insurance.

Section 3. Definitions

As used in this Act:

A. “Aggregator Site” means a website that provides access to information regarding insurance products from

more than one insurer, including product and insurer information, for use in comparison shopping.

B. “Blanket Travel Insurance” means a policy of Travel Insurance issued to any Eligible Group providing

coverage for specific classes of persons defined in the policy with coverage provided to all members of the

Eligible Group without a separate charge to individual members of the Eligible Group.

C. “Cancellation Fee Waiver” means a contractual agreement between a supplier of travel services and its

customer to waive some or all of the non-refundable cancellation fee provisions of the supplier’s underlying

travel contract with or without regard to the reason for the cancellation or form of reimbursement. A

Cancellation Fee Waiver is not insurance.

D. "Commissioner" means the commissioner of insurance of this state.

Drafting Note: Insert the title of the state’s chief insurance regulatory official wherever the term "Commissioner" appears.

Travel Insurance Model Act

632-2

© 2018 National Association of Insurance Commissioners

E. Solely for the purposes of Travel Insurance, “Eligible Group” means two (2) or more persons who are

engaged in a common enterprise, or have an economic, educational, or social affinity or relationship,

including but not limited to any of the following:

(1) Any entity engaged in the business of providing travel or travel services, including but not limited

to: tour operators, lodging providers, vacation property owners, hotels and resorts, travel clubs,

travel agencies, property managers, cultural exchange programs, and common carriers or the

operator, owner, or lessor of a means of transportation of passengers, including but not limited to

airlines, cruise lines, railroads, steamship companies, and public bus carriers, wherein with regard

to any particular travel or type of travel or travelers, all members or customers of the group must

have a common exposure to risk attendant to such travel;

(2) Any college, school, or other institution of learning, covering students, teachers, employees, or

volunteers;

(3) Any employer covering any group of employees, volunteers, contractors, board of directors,

dependents, or guests;

(4) Any sports team, camp, or sponsor thereof, covering participants, members, campers, employees,

officials, supervisors, or volunteers;

(5) Any religious, charitable, recreational, educational, or civic organization, or branch thereof,

covering any group of members, participants, or volunteers;

(6) Any financial institution or financial institution vendor, or parent holding company, trustee, or agent

of or designated by one or more financial institutions or financial institution vendors, including

accountholders, credit card holders, debtors, guarantors, or purchasers;

(7) Any incorporated or unincorporated association, including labor unions, having a common interest,

constitution and bylaws, and organized and maintained in good faith for purposes other than

obtaining insurance for members or participants of such association covering its members;

(8) Any trust or the trustees of a fund established, created or maintained for the benefit of and covering

members, employees or customers, subject to the Commissioner’s permitting the use of a trust and

the state’s premium tax provisions in [refer to Section 5 herein or, if not used, the state’s existing

premium tax provisions] of one or more associations meeting the above requirements of Paragraph

(7) above;

(9) Any entertainment production company covering any group of participants, volunteers, audience

members, contestants, or workers;

(10) Any volunteer fire department, ambulance, rescue, police, court, or any first aid, civil defense, or

other such volunteer group;

(11) Preschools, daycare institutions for children or adults, and senior citizen clubs;

(12) Any automobile or truck rental or leasing company covering a group of individuals who may

become renters, lessees, or passengers defined by their travel status on the rented or leased vehicles.

The common carrier, the operator, owner or lessor of a means of transportation, or the automobile

or truck rental or leasing company, is the policyholder under a policy to which this section applies;

or

(13) Any other group where the Commissioner has determined that the members are engaged in a

common enterprise, or have an economic, educational, or social affinity or relationship, and that

issuance of the policy would not be contrary to the public interest.

F. “Fulfillment Materials” means documentation sent to the purchaser of a travel protection plan confirming the

purchase and providing the travel protection plan’s coverage and assistance details.

NAIC Model Laws, Regulations, Guidelines and Other Resources—4

th

Quarter 2018

© 2018 National Association of Insurance Commissioners 632-3

G. “Group Travel Insurance” means Travel Insurance issued to any Eligible Group.

H. “Limited Lines Travel Insurance Producer” means a

(1) Licensed managing general agent or third-party administrator,

(2) Licensed insurance producer, including a limited lines producer, or

(3) Travel Administrator.

I. “Offer and Disseminate” means providing general information, including a description of the coverage and

price, as well as processing the application and collecting premiums.

J. “Primary Certificate Holder”, specific to Section 5, Premium Tax, means an individual person who elects

and purchases Travel Insurance under a Group Policy.

K. “Primary Policyholder”, specific to Section 5, Premium Tax, means an individual person who elects and

purchases individual Travel Insurance.

L. “Travel Administrator” means a person who directly or indirectly underwrites, collects charges, collateral or

premiums from, or adjusts or settles claims on residents of this state, in connection with Travel Insurance,

except that a person shall not be considered a Travel Administrator if that person’s only actions that would

otherwise cause it to be considered a Travel Administrator are among the following:

(1) A person working for a Travel Administrator to the extent that the person’s activities are subject to

the supervision and control of the Travel Administrator;

(2) An insurance producer selling insurance or engaged in administrative and claims-related activities

within the scope of the producer’s license;

(3) A Travel Retailer offering and disseminating Travel Insurance and registered under the license of a

Limited Lines Travel Insurance Producer in accordance with this Act;

(4) An individual adjusting or settling claims in the normal course of that individual’s practice or

employment as an attorney-at-law and who does not collect charges or premiums in connection with

insurance coverage; or

(5) A business entity that is affiliated with a licensed insurer while acting as a Travel Administrator for

the direct and assumed insurance business of an affiliated insurer.

M. “Travel Assistance Services” means non-insurance services for which the consumer is not indemnified based

on a fortuitous event, and where providing the service does not result in transfer or shifting of risk that would

constitute the business of insurance. Travel Assistance Services include, but are not limited to: security

advisories; destination information; vaccination and immunization information services; travel reservation

services; entertainment; activity and event planning; translation assistance; emergency messaging;

international legal and medical referrals; medical case monitoring; coordination of transportation

arrangements; emergency cash transfer assistance; medical prescription replacement assistance; passport and

travel document replacement assistance; lost luggage assistance; concierge services; and any other service

that is furnished in connection with planned travel. Travel Assistance Services are not insurance and not

related to insurance.

N. “Travel Insurance” means insurance coverage for personal risks incident to planned travel, including:

(1) Interruption or cancellation of trip or event;

(2) Loss of baggage or personal effects;

(3) Damages to accommodations or rental vehicles;

Travel Insurance Model Act

632-4

© 2018 National Association of Insurance Commissioners

(4) Sickness, accident, disability or death occurring during travel;

(5) Emergency evacuation;

(6) Repatriation of remains; or

(7) Any other contractual obligations to indemnify or pay a specified amount to the traveler upon

determinable contingencies related to travel as approved by the Commissioner.

Travel Insurance does not include major medical plans that provide comprehensive medical protection for

travelers with trips lasting longer than six (6) months, including for example, those working or residing

overseas as an expatriate, or any other product that requires a specific insurance producer license.

Drafting Note: States may wish to consider making a clear distinction between Travel Insurance and other similar, yet distinct coverages. For example, in 43

states, insurers file collision damage insurance (CDI) for vehicles rented during insured travel as Travel Insurance, while in 6 states, insurers file CDI as Travel

Insurance only if it is ancillary to other Travel Insurance coverages, such as for travel cancellation or interruption. One state requires CDI to be filed under

Private Passenger Auto Physical Damage [line 21.1].

Drafting Note: Policies with travel components that provide major medical coverage providing comprehensive medical protection for trips with durations of

six months or longer are not prohibited by this definition but are outside the scope of this model law and may be regulated under other applicable provisions

of the state’s insurance code, rather than under this model law. Some states may also believe that standalone major medical coverage that only provides

comprehensive medical protection for trips with durations of less than six months should be filed as an individual health or group health travel product. If an

adopting state believes that additional clarity is necessary, the state may choose to insert the following: [For policies that provide major medical coverage

providing comprehensive health protection for trips with durations of six months or longer, see section X of the state insurance code.] [For policies that provide

standalone major medical coverage that only provide comprehensive medical protection for trips with durations of less than six months, see section X of the

state insurance code.]

O. “Travel Protection Plans” means plans that provide one or more of the following: Travel Insurance, Travel

Assistance Services, and Cancellation Fee Waivers.

P. “Travel Retailer” means a business entity that makes, arranges or offers planned travel and may offer and

disseminate Travel Insurance as a service to its customers on behalf of and under the direction of a Limited

Lines Travel Insurance Producer.

Drafting Note: States that have recently adopted Travel Insurance producer licensing and registration laws or regulations may refer to the applicable definitions

adopted therein rather than restating them in this section.

Section 4. Licensing and Registration

A. The Commissioner may issue a Limited Lines Travel Insurance Producer License to an individual or business

entity that has filed with the Commissioner an application for a Limited Lines Travel Insurance Producer

License in a form and manner prescribed by the Commissioner. Such Limited Lines Travel Insurance

Producer shall be licensed to sell, solicit or negotiate Travel Insurance through a licensed insurer. No person

may act as a Limited Lines Travel Insurance Producer or Travel Insurance Retailer unless properly licensed

or registered, respectively.

B. A Travel Retailer may offer and disseminate Travel Insurance under a Limited Lines Travel Insurance

Producer business entity license only if the following conditions are met:

(1) The Limited Lines Travel Insurance Producer or Travel Retailer provides to purchasers of Travel

Insurance:

(a) A description of the material terms or the actual material terms of the insurance coverage;

(b) A description of the process for filing a claim;

(c) A description of the review or cancellation process for the Travel Insurance policy; and

(d) The identity and contact information of the insurer and Limited Lines Travel Insurance

Producer.

NAIC Model Laws, Regulations, Guidelines and Other Resources—4

th

Quarter 2018

© 2018 National Association of Insurance Commissioners 632-5

(2) At the time of licensure, the Limited Lines Travel Insurance Producer shall establish and maintain

a register, on a form prescribed by the Commissioner, of each Travel Retailer that offers Travel

Insurance on the Limited Lines Travel Insurance Producer’s behalf. The register shall be maintained

and updated by the Limited Lines Travel Insurance Producer and shall include the name, address,

and contact information of the Travel Retailer and an officer or person who directs or controls the

Travel Retailer’s operations, and the Travel Retailer’s Federal Tax Identification Number. The

Limited Lines Travel Insurance Producer shall submit such register to the state insurance department

upon reasonable request. The Limited Lines Travel Insurance Producer shall also certify that the

Travel Retailer registered complies with 18 USC

§1033. The grounds for the suspension, revocation

and the penalties applicable to resident insurance producers under [insert applicable reference to

insurance code], shall be applicable to the Limited Lines Travel Insurance Producers and Travel

Retailers.

(3) The Limited Lines Travel Insurance Producer has designated one of its employees who is a licensed

individual producer as the person (a “Designated Responsible Producer” or “DRP”) responsible for

the compliance with the Travel Insurance laws and regulations applicable to the Limited Lines

Travel Insurance Producer and its registrants.

(4) The DRP, president, secretary, treasurer, and any other officer or person who directs or controls the

Limited Lines Travel Insurance Producer’s insurance operations complies with the fingerprinting

requirements applicable to insurance producers in the resident state of the Limited Lines Travel

Insurance Producer.

(5) The Limited Lines Travel Insurance Producer has paid all applicable licensing fees as set forth in

applicable state law.

(6) The Limited Lines Travel Insurance Producer requires each employee and authorized representative

of the Travel Retailer whose duties include offering and disseminating Travel Insurance to receive

a program of instruction or training, which is subject, at the discretion of the Commissioner, to

review and approval. The training material shall, at a minimum, contain adequate instructions on

the types of insurance offered, ethical sales practices, and required disclosures to prospective

customers.

C. Any Travel Retailer offering or disseminating Travel Insurance shall make available to prospective

purchasers brochures or other written materials that have been approved by the travel insurer. Such materials

shall include information which, at a minimum:

(1) Provides the identity and contact information of the insurer and the Limited Lines Travel Insurance

Producer;

(2) Explains that the purchase of Travel Insurance is not required in order to purchase any other product

or service from the Travel Retailer; and

(3) Explains that an unlicensed Travel Retailer is permitted to provide only general information about

the insurance offered by the Travel Retailer, including a description of the coverage and price, but

is not qualified or authorized to answer technical questions about the terms and conditions of the

insurance offered by the Travel Retailer or to evaluate the adequacy of the customer’s existing

insurance coverage.

D. A Travel Retailer employee or authorized representative, who is not licensed as an insurance producer may

not:

(1) Evaluate or interpret the technical terms, benefits, and conditions of the offered Travel Insurance

coverage;

(2) Evaluate or provide advice concerning a prospective purchaser’s existing insurance coverage; or

(3) Hold himself or itself out as a licensed insurer, licensed producer, or insurance expert.

Travel Insurance Model Act

632-6

© 2018 National Association of Insurance Commissioners

E. Notwithstanding any other provision in law, a Travel Retailer whose insurance-related activities, and those

of its employees and authorized representatives, are limited to offering and disseminating Travel Insurance

on behalf of and under the direction of a Limited Lines Travel Insurance Producer meeting the conditions

stated in this Act, is authorized to receive related compensation, upon registration by the Limited Lines Travel

Insurance Producer as described in Subsection B(2) above.

F. Responsibility: As the insurer’s designee, the Limited Lines Travel Insurance Producer is responsible for the

acts of the Travel Retailer and shall use reasonable means to ensure compliance by the Travel Retailer with

this Act.

G. Any person licensed in a major line of authority as an insurance producer is authorized to sell, solicit and

negotiate travel insurance. A property and casualty insurance producer is not required to become appointed

by an insurer in order to sell, solicit, or negotiate travel insurance.

Drafting Note: States that have already implemented a licensing and registration law or regulation consistent with the NCOIL Limited Lines Travel Insurance

Model Act and NAIC Uniform Licensing Standard 34 (Limited Lines Travel Insurance Standard) may choose to cross-reference that law or regulation instead

of using the language set forth in this Section. States that have not yet implemented such a law or regulation with respect to Travel Insurance may choose to

incorporate this Section under their existing producer licensing laws.

Section 5. Premium Tax

A. A travel insurer shall pay premium tax, as provided in [insert reference to the state’s existing premium tax

provision] on Travel Insurance premiums paid by any of the following:

(1) An individual primary policyholder who is a resident of this state;

(2) A primary certificate-holder who is a resident of this state who elects coverage under a Group Travel

Insurance policy; or

(3) A Blanket Travel Insurance policyholder that is a resident in, or has its principal place of business

or the principal place of business of an affiliate or subsidiary that has purchased Blanket Travel

Insurance in this state for eligible blanket group members, subject to any apportionment rules which

apply to the insurer across multiple taxing jurisdictions or that permit the insurer to allocate premium

on an apportioned basis in a reasonable and equitable manner in those jurisdictions.

B. A travel insurer shall:

(1) Document the state of residence or principal place of business of the policyholder or certificate-

holder, as required in Section 5A; and,

(2) Report as premium only the amount allocable to Travel Insurance and not any amounts received for

Travel Assistance Services or Cancellation Fee Waivers.

Section 6. Travel Protection Plans

A. Travel Protection Plans may be offered for one price for the combined features that the Travel Protection

Plan offers in this state if:

B. The Travel Protection Plan clearly discloses to the consumer, at or prior to the time of purchase, that it

includes Travel Insurance, Travel Assistance Services, and Cancellation Fee Waivers as applicable, and

provides information and an opportunity, at or prior to the time of purchase, for the consumer to obtain

additional information regarding the features and pricing of each; and

C. The Fulfillment Materials:

(1) Describe and delineate the Travel Insurance, Travel Assistance Services, and Cancellation Fee

Waivers in the Travel Protection Plan, and

(2) Include the Travel Insurance disclosures and the contact information for persons providing Travel

Assistance Services, and Cancellation Fee Waivers, as applicable.

NAIC Model Laws, Regulations, Guidelines and Other Resources—4

th

Quarter 2018

© 2018 National Association of Insurance Commissioners 632-7

Section 7. Sales Practices

A. All persons offering Travel Insurance to residents of this state are subject to the Unfair Trade Practices Act

at [insert reference to NAIC model Unfair Trade Practices Act (#880)], except as otherwise provided in this

Section. In the event of a conflict between this Act and other provisions of the [insurance code] regarding

the sale and marketing of Travel Insurance and Travel Protection Plans, the provisions of this Act shall

control.

B. Illusory Travel Insurance. Offering or selling a Travel Insurance policy that could never result in payment

of any claims for any insured under the policy is an unfair trade practice under [insert reference to NAIC

model Unfair Trade Practices Act (#880)].

C. Marketing

(1) All documents provided to consumers prior to the purchase of Travel Insurance, including but not

limited to sales materials, advertising materials, and marketing materials, shall be consistent with

the Travel Insurance policy itself, including but not limited to, forms, endorsements, policies, rate

filings, and certificates of insurance.

(2) For Travel Insurance policies or certificates that contain pre-existing condition exclusions,

information and an opportunity to learn more about the pre-existing condition exclusions shall be

provided any time prior to the time of purchase, and in the coverage’s Fulfillment Materials.

(3) The Fulfillment Materials and the information described in Section 4B(1)(a)-(d) shall be provided

to a policyholder or certificate holder as soon as practicable, following the purchase of a Travel

Protection Plan. Unless the insured has either started a covered trip or filed a claim under the Travel

Insurance coverage, a policyholder or certificate holder may cancel a policy or certificate for a full

refund of the Travel Protection Plan price from the date of purchase of a Travel Protection Plan until

at least:

(a) Fifteen (15) days following the date of delivery of the Travel Protection Plan’s Fulfillment

Materials by postal mail; or

(b) Ten (10) days following the date of delivery of the Travel Protection Plan’s Fulfillment

Materials by means other than postal mail.

For the purposes of this section, delivery means handing Fulfillment Materials to the policyholder

or certificate holder or sending Fulfillment Materials by postal mail or electronic means to the

policyholder or certificate holder.

(4) The company shall disclose in the policy documentation and Fulfillment Materials whether the

Travel Insurance is primary or secondary to other applicable coverage.

(5) Where Travel Insurance is marketed directly to a consumer through an insurer’s website or by others

through an Aggregator Site, it shall not be an unfair trade practice or other violation of law where

an accurate summary or short description of coverage is provided on the web page, so long as the

consumer has access to the full provisions of the policy through electronic means.

D. Opt out. No person offering, soliciting, or negotiating Travel Insurance or Travel Protection Plans on an

individual or group basis may do so by using negative option or opt out, which would require a consumer to

take an affirmative action to deselect coverage, such as unchecking a box on an electronic form, when the

consumer purchases a trip.

E. It shall be an unfair trade practice to market Blanket Travel Insurance coverage as free.

F. Where a consumer’s destination jurisdiction requires insurance coverage, it shall not be an unfair trade

practice to require that a consumer choose between the following options as a condition of purchasing a trip

or travel package:

Travel Insurance Model Act

632-8

© 2018 National Association of Insurance Commissioners

(1) Purchasing the coverage required by the destination jurisdiction through the Travel Retailer or

Limited Lines Travel Insurance Producer supplying the trip or travel package; or

(2) Agreeing to obtain and provide proof of coverage that meets the destination jurisdiction’s

requirements prior to departure.

Section 8. Travel Administrators

A. Notwithstanding any other provisions of the [insurance code], no person shall act or represent itself as a

Travel Administrator for Travel Insurance in this state unless that person:

(1) Is a licensed property and casualty insurance producer in this state for activities permitted under that

producer license; or

(2) Holds a valid managing general agent (MGA) license in this state; or

(3) Holds a valid third-party administrator (TPA) license in this state.

B. A Travel Administrator and its employees are exempt from the licensing requirements of [reference to

adjuster licensing act] for Travel Insurance it administers.

C. An insurer is responsible for the acts of a Travel Administrator administering Travel Insurance underwritten

by the insurer, and is responsible for ensuring that the Travel Administrator maintains all books and records

relevant to the insurer to be made available by the Travel Administrator to the Commissioner upon request.

Drafting Note: It is recommended that states review their licensing requirements for each type of entity to determine whether modifications are needed to

conform with the statutory and administrative requirements of the state.

Section 9. Policy

A. Notwithstanding any other provision of the [insurance code], Travel Insurance shall be classified and filed

for purposes of rates and forms under an inland marine line of insurance, provided, however, that travel

insurance that provides coverage for sickness, accident, disability or death occurring during travel, either

exclusively, or in conjunction with related coverages of emergency evacuation or repatriation of remains,

may be filed under either an accident and health line of insurance or an inland marine line of insurance.

Drafting Note: For consistency, states may wish to update their statutory definition of inland marine to include Travel Insurance as defined in this Act. This

provision contemplates that Travel Insurance will be subject to the same state laws and regulations as any other inland marine insurance.

B. Travel Insurance may be in the form of an individual, group, or blanket policy.

C. Eligibility and underwriting standards for Travel Insurance may be developed and provided based on Travel

Protection Plans designed for individual or identified marketing or distribution channels, provided those

standards also meet the state’s underwriting standards for inland marine.

Section 10. Regulations

The Commissioner may promulgate regulations to implement the provisions of this Act.

Section 11. Effective Date

This Act shall take effect 90 days after enactment.

____________________________________

Chronological Summary of Action (all references are to the Proceedings of the NAIC).

4

th

Quarter 2018 (adopted new model).

NAIC Model Laws, Regulations, Guidelines and Other Resources—Fall 2019

TRAVEL INSURANCE MODEL ACT

© 2019 National Association of Insurance Commissioners ST-632-1

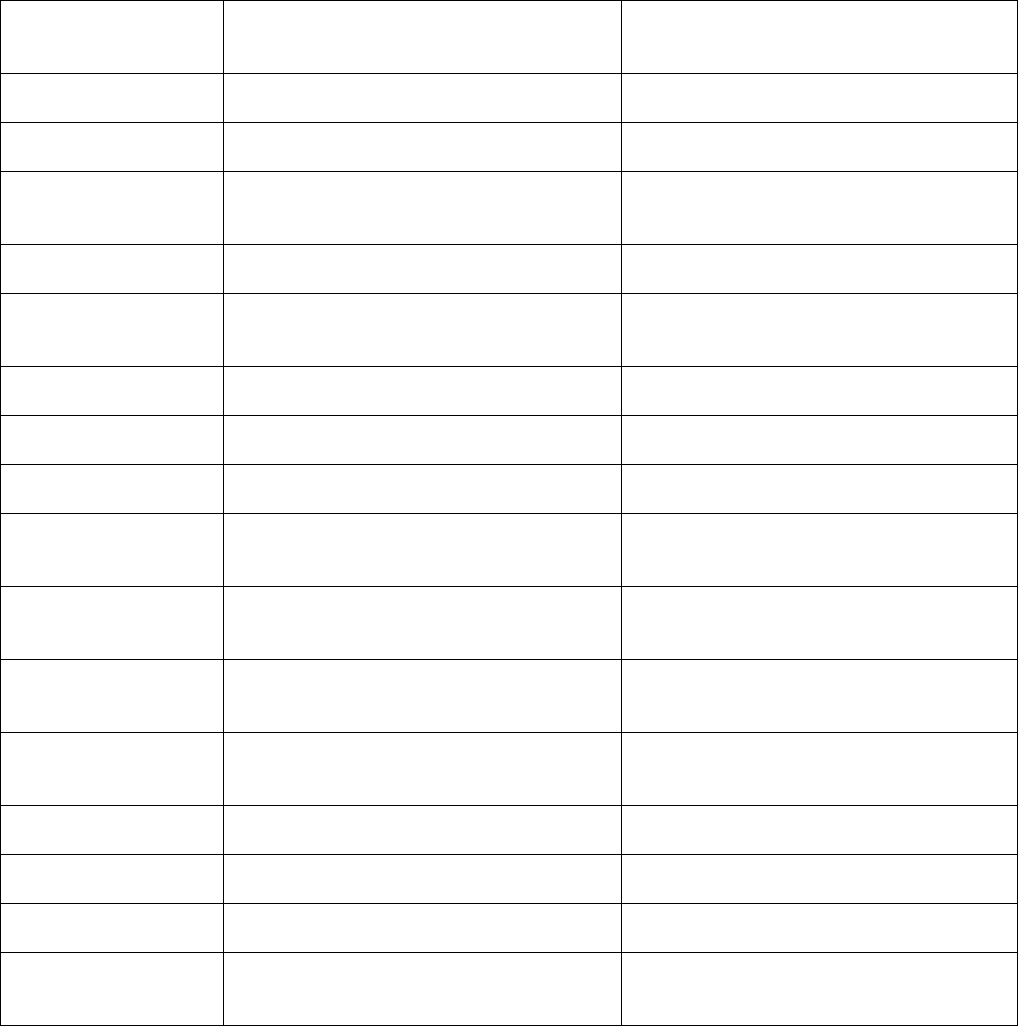

This chart is intended to provide readers with additional information to more easily access state statutes, regulations,

bulletins or administrative rulings related to the NAIC model. Such guidance provides readers with a starting point

from which they may review how each state has addressed the model and the topic being covered. The NAIC Legal

Division has reviewed each state’s activity in this area and has determined whether the citation most appropriately

fits in the Model Adoption column or Related State Activity column based on the definitions listed below. The NAIC’s

interpretation may or may not be shared by the individual states or by interested readers.

This chart does not constitute a formal legal opinion by the NAIC staff on the provisions of state law and should not

be relied upon as such. Nor does this state page reflect a determination as to whether a state meets any applicable

accreditation standards. Every effort has been made to provide correct and accurate summaries to assist readers in

locating useful information. Readers should consult state law for further details and for the most current information.

NAIC Model Laws, Regulations, Guidelines and Other Resources—Fall 2019

TRAVEL INSURANCE MODEL ACT

ST-632-2

© 2019 National Association of Insurance Commissioners

This page is intentionally left blank

NAIC Model Laws, Regulations, Guidelines and Other Resources—Fall 2019

TRAVEL INSURANCE MODEL ACT

© 2019 National Association of Insurance Commissioners ST-632-3

KEY:

MODEL ADOPTION: States that have citations identified in this column adopted the most recent version of the NAIC

model in a substantially similar manner. This requires states to adopt the model in its entirety but does allow for variations

in style and format. States that have adopted portions of the current NAIC model will be included in this column with an

explanatory note.

RELATED STATE ACTIVITY: Examples of Related State Activity include but are not limited to: older versions of the

NAIC model, statutes or regulations addressing the same subject matter, or other administrative guidance such as bulletins

and notices. States that have citations identified in this column only (and nothing listed in the Model Adoption column) have

not adopted the most recent version of the NAIC model in a substantially similar manner.

NO CURRENT ACTIVITY: No state activity on the topic as of the date of the most recent update. This includes states that

have repealed legislation as well as states that have never adopted legislation.

NAIC MEMBER MODEL ADOPTION

RELATED STATE ACTIVITY

Alabama

A

LA

.

C

ODE

§ 27-7-5.2 (2013).

Alaska

A

LASKA

S

TAT

. §§ 21.27.150 to 21.27.152

(2017); BULLETIN 2013-7 (2013).

American Samoa

NO CURRENT ACTIVITY

Arizona

A

RIZ

.

R

EV

.

S

TAT

.

A

NN

. § 20-333 (2014);

BULLETIN 2014-9 (2014).

Arkansas

A

RK

.

C

ODE

A

NN

.

§ 23-64-234 (2019).

California

C

AL

.

I

NS

.

C

ODE

§§ 1752 to1757 (1959/2018).

Colorado

C

OLO

.

R

EV

.

S

TAT

. § 10-2-414.5 (2014).

Connecticut

C

ONN

.

G

EN

.

S

TAT

.

§

38

A

-398

(2017/2018).

Delaware

D

EL

.

C

ODE

A

NN

. tit. 18, §§ 1770 to 1776

(2014).

District of Columbia

NO CURRENT ACTIVITY

Florida

F

LA

.

S

TAT

. § 626.321 (2003/2019).

NAIC Model Laws, Regulations, Guidelines and Other Resources—Fall 2019

TRAVEL INSURANCE MODEL ACT

ST-632-4

© 2019 National Association of Insurance Commissioners

NAIC MEMBER MODEL ADOPTION

RELATED STATE ACTIVITY

Georgia

G

A

.

C

ODE

A

NN

. § 33-23-12 (1981/2019).

Guam

NO CURRENT ACTIVITY

Hawaii

H

AW

.

R

EV

.

S

TAT

. § 431:9A-103;

§ 431:9A-107.5 (2001/2019).

Idaho

I

DAHO

C

ODE

§§ 41-1090 to 41-1097 (2017).

Illinois

215 I

LL

.

C

OMP

.

S

TAT

. § 5/500-10 (2002/2015);

215 ILL. COMP. STAT. § 5/500-108 (2015).

Indiana

I

ND

.

C

ODE

§ 27-1-15.6-2 (2001/2018).

Iowa

NO CURRENT ACTIVITY

Kansas

K

AN

.

S

TAT

.

A

NN

. § 40-4903 (2001/2018).

Kentucky

K

Y

.

R

EV

.

S

TAT

.

A

NN

. § 304.9-020

(2010/2016); 304.9-475 (2012).

Louisiana

L

A

.

R

EV

.

S

TAT

.

A

NN

.

§§

22:1351

to

22:1358

(2017); §§ 22:1782.1 to 22:1782.3 (2014).

Maine

M

E

.

R

EV

.

S

TAT

.

A

NN

. tit. 24-A, §§ 7051 to

7056 (2015); § 1420-F (2005/2015).

Maryland

M

D

.

C

ODE

A

NN

.,

I

NS

., §§ 10-101, 10-122

(1957/2018); §§ 19-1001 to 19-1005 (2018).

Massachusetts

M

ASS

.

G

EN

.

L

AWS

ch. 175, § 162Z (2016).

Michigan

M

ICH

.

C

OMP

.

L

AWS

§ 500.1202 (1956/2016).

Minnesota

M

INN

.

S

TAT

. § 60K.383 (2012).

Mississippi

M

ISS

.

C

ODE

A

NN

. §§ 83-83-1 to 83-83-13

(2015).

NAIC Model Laws, Regulations, Guidelines and Other Resources—Fall 2019

TRAVEL INSURANCE MODEL ACT

© 2019 National Association of Insurance Commissioners ST-632-5

NAIC MEMBER MODEL ADOPTION

RELATED STATE ACTIVITY

Missouri

M

O

.

R

EV

.

S

TAT

. § 375.159 (2013).

Montana

M

ONT

.

C

ODE

A

NN

.

§§

33-17-1401

to

33-17-1404 (2013).

Nebraska

N

EB

.

R

EV

.

S

TAT

. § 44-4068 (2015/2018).

Nevada

N

EV

.

R

EV

.

S

TAT

. §§ 683A.368 to 683A.3695

(2015); § 638A.370 (1971/2010).

New Hampshire

N.H.

R

EV

.

S

TAT

.

A

NN

. §§ 402-L:1 to 402-L:5

(2015).

New Jersey

N.J.

A

DMIN

.

C

ODE

§

11:17-1.2 (1993/2015);

§ 11:17-2.4 (2015).

New Mexico

N.M.

S

TAT

.

A

NN

. § 59A-12-18.1 (2013/2016).

New York

NO CURRENT ACTIVITY

North Carolina

N.C.

G

EN

.

S

TAT

. § 58-33-19 (2013).

North Dakota

N.D.

C

ENT

.

C

ODE

§ 26.1-26-54 (2015).

Northern Marianas

NO CURRENT ACTIVITY

Ohio

O

HIO

R

EV

.

C

ODE

A

NN

.

§

3905.064 (2018).

Oklahoma

O

KLA

.

S

TAT

.

tit.

36,

§§

6710

to

6719

(2018).

Oregon

O

R

.

R

EV

.

S

TAT

. §§ 744.101 to 744.104 (2015).

Pennsylvania

40 P

A

.

C

ONS

.

S

TAT

. §§ 4601 to 4609 (2018).

Puerto Rico

NO CURRENT ACTIVITY

NAIC Model Laws, Regulations, Guidelines and Other Resources—Fall 2019

TRAVEL INSURANCE MODEL ACT

ST-632-6

© 2019 National Association of Insurance Commissioners

NAIC MEMBER MODEL ADOPTION

RELATED STATE ACTIVITY

Rhode Island

R.I.

G

EN

.

L

AWS

§§

27-79-1

to

27-79-13

(2013/2019).

South Carolina

S.C.

C

ODE

A

NN

.

§§

38-43-710

to

38-43-770

(2016).

South Dakota

S.D.

C

ODIFIED

L

AWS

§§

58-30-209

to

58-30-218 (2014).

Tennessee

T

ENN

.

C

ODE

A

NN

.

§§

56-6-1401

to

56-6-1407

(2015).

Texas

T

EX

.

I

NS

.

C

ODE

A

NN

.

§§

4055.151

to

4055.157

(2003/2019); §§ 3504.0001 TO 3504.0007

(2019).

Utah

U

TAH

C

ODE

A

NN

.

§§

31A-23

A

-902

to

31A-23A-907 (2014).

Vermont

4

V

T

.

C

ODE

R.

§§

3-58.1

to

58.8

(2017).

Virgin Islands

V.I.

C

ODE

A

NN

.

tit. 22, § 759 (2017).

Virginia

VA.

C

ODE

A

NN

.

§§

38.2-1887

to 38.2-1890

(2013/2019).

Washington

W

ASH

.

A

DMIN

.

C

ODE

R.

§§

284-17-001

to

284-17-011 (2009/2013).

West Virginia

W.

V

A

.

C

ODE

R.

§

33-12-32b

(2015).

Wisconsin

W

IS

.

S

TAT

.

§

632.977

(2013).

Wyoming

W

YO

.

S

TAT

.

A

NN

.

§

26-9-202

(2001/2017);

§ 26-9-234 (2013).