AnnuAl EndowmEnt REpoRt

Fiscal Year Ended June 30, 2010

Compiled by the Office of the Treasurer of The Regents

University of California, Berkeley Foundation

UC Davis Foundation

The University of California, Irvine Foundation

The UCLA Foundation

University of California, Merced Foundation

UC Riverside Foundation

U.C. San Diego Foundation

University of California, San Francisco Foundation

UC Santa Barbara Foundation

U.C. Santa Cruz Foundation

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

3

univERsity of CAlifoRniA AnnuAl EndowmEnt REpoRt

Table of Contents

Introduction 4

I. Total University Endowment Assets 6

Table 1: Total University Endowment Assets by Donor Designation

Table 2: Total Managed Endowment Assets by Foundation

II. Managed Endowment Funds by Asset Class 8

Table 3: Allocation of Managed Endowment Funds by Asset Class

III. Endowment Fund Investment Performance 9

Table 4: Average Annualized Total Returns

IV. Endowment Fund Investment Management 10

Table 5: Foundation Endowment Assets by Investment Manager

V. Endowment Fund Investment Management Fees 11

Table 6: Endowment Management Fees by Foundation

VI. Gift Fees and Recurring Charges 12

Table 7: Gift Fees and Recurring Charges by Regents and Foundation

VII. Endowment Spending Policies 13

Table 8: Endowment Spending Policies by Regents and Foundation

VIII. Total Foundation Gift Assets 14

Table 9: Total Foundation Gift Assets by Campus

IX. Individual Foundation Reports 15

Berkeley 16

Davis 18

Irvine 20

Los Angeles 22

Merced 26

Riverside 28

San Diego 30

San Francisco 32

Santa Barbara 34

Santa Cruz 36

General Endowment Pool (GEP) 38

XI. 10-Year Historical Performance

Table 10: 10-Year Historical Investment Performance 42

Table 11: 10-Year Historical Benchmark Performance 43

VI. Supplemental 44

XII. Investment Policies 46

XIII. Glossary 48

4

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

BACKGROUND

The history of reporting total

University and Foundation

endowments dates back to

October 1978 when The Regents’

Committee on Educational Policy

adopted a policy for University

Support Groups. In subsequent

years, The Regents charged the

Treasurer’s Office with obtaining

pertinent information regarding

the UC Foundations’ investments

and presenting an annual report

to The Regents. The annual

report includes the investment

philosophy, policies and

performance of each Foundation’s

endowment assets, as well as

those of The Regents’ endowment

assets.

PURPOSE

The Regents’ policy on Support Groups articulates the permissible activities

by affiliated fund-raising organizations to be:

“Gifts to a University Support Group for the benefit of the

University may be accepted and administered only in accordance

with University policies and, except as otherwise specified in

this policy, may not be invested as endowments and shall be

transferred to the University in an expeditious manner to fulfill

the intentions of the donor for allocation and disbursement by

the University.”

The Treasurer’s Office is the designated recipient and investment

manager of The Regents’ endowment assets.

However, in October 1978, The Regents included an exception in this

policy for Foundations only that states:

“A Campus Foundation may hold and invest endowments

and funds functioning as endowments on a long-term basis.

Such investments must be consistent with the terms of the

gift instrument. Investment operations shall be conducted in

accordance with prudent, sound practices to insure that gift

assets are protected and enhanced and that a reasonable return is

achieved, and with due regard for the fiduciary responsibilities of

the Foundation’s governing board….”

As a result of the above exception, donors can designate either The

Regents or the Campus Foundations as the recipient of their gift assets.

Foundations may then choose The Regents (the Treasurer’s Office) and/

or external investment managers to manage their endowment investments.

The Treasurer’s Office acts as a resource to the Foundations and offers

its investment management services and counsel on endowment fund

management issues. This report’s goal is to provide The Regents with a

comprehensive overview of all of the University’s endowment assets.

univERsity of CAlifoRniA AnnuAl EndowmEnt REpoRt

Introduction

5

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

Introduction

DATA SOURCES

State Street Bank is the University’s official “book of record” and calculates

performance of the General Endowment Pool (GEP) supplemented with data

from the University of California Office of the President’s (UCOP) Endowment

and Investment Accounting office. Annual Foundation performance results

in this document prior to 2006 were provided by each Foundation and were

neither audited nor calculated by the Treasurer’s Office or State Street Bank.

Returns for 2006 and later were provided by State Street Bank, except in

extraordinary circumstances. On a quarterly basis, State Street Bank reports

Foundation performance to The Regents and those quarterly reports serve as

official “book of record” to The Regents. Policy benchmark composition was

provided by the Foundations. All annual benchmark returns used in this

report were calculated by The Regents’ Investment Consultant, Mercer, LLC.

Each Foundation supplied a copy of its audited annual financial report. For

the purpose of reporting investment performance, each Foundation received

the same exhibit formats and guidance, and any inconsistencies in definition

and reporting are noted in the charts, tables and discussion.

The Cambridge Associates Endowment Pool Median cannot be reproduced or

redistributed without the express written consent of Cambridge Associates LLC.

PERFORMANCE PRESENTATION

This report focuses primarily on the Foundations’ endowment assets and

their investment performance. Section IX—Individual Foundation Reports—

displays endowed assets by investment manager. Totals for non-endowed assets

and pledges are provided in Section VIII—Total Foundation Gift Assets. The

glossary at the end of this report includes definitions for these asset categories.

PERFORMANCE COMPARISONS

General Endowment Pool: The General Endowment Pool (GEP), established in

1933 and unitized in 1958, is The Regents’ primary investment vehicle for

endowed gift funds. GEP is a balanced portfolio of equities, fixed-income

securities and alternative investments in which all Regental endowment

funds participate, unless payout needs require otherwise. The GEP’s return

is based on unit value.

Cambridge Endowment Pool Median: Cambridge Associates measures returns on

148 college and university endowment pools in its endowment study.

Benchmark: For details regarding each individual Foundation’s benchmark, see

sections IX and XII.

6

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

I

I. Total University Endowment Assets

Table 1 outlines the University’s total endowment assets by donor designation to either The Regents for the benefit of the

campus or to the campus Foundation.

Overall, total endowment assets increased by 12.3% over the last fiscal year, with The Regents’ endowment assets

increasing by 10.2% and Foundation endowment assets increasing by 15.8%. These changes incorporate both new gifts

accepted during the fiscal year and the return on total endowed assets.

The Treasurer’s Office also manages endowment assets of almost $1.1 billion for the benefit of systemwide programs and

administration, including education and research programs, support services and administration. These assets appear in

the table as part of The Regents’ endowment assets.

* Includes GEP, STIP, and separately invested assets, as well as annuity and life income funds. Excludes security lending balances and other accounts receivable and payable.

Table 1

Total University Endowment Assets by Donor Designation

to Regents and Foundation

(Excluding Pledges)

(Market Value $000)

June 30, 2010 June 30, 2009

Campus Regents* Foundation Total Regents* Foundation Total

Berkeley $1,704,527 $895,456 $2,599,983 $1,559,033 $785,758 $2,344,791

Davis 435,081 162,569 597,650 401,579 137,198 538,777

Irvine 50,213 191,147 241,360 45,167 161,036 206,203

Los Angeles 1,102,732 1,058,679 2,161,411 982,212 898,838 1,881,050

Merced 17,791 5,080 22,871 16,251 4,339 20,590

Riverside 37,261 72,771 110,032 32,456 62,692 95,148

San Diego 161,026 316,728 477,754 148,969 282,748 431,717

San Francisco 743,411 510,030 1,253,441 671,904 438,738 1,110,642

Santa Barbara 79,166 98,929 178,095 66,183 87,632 153,815

Santa Cruz 54,987 46,968 101,955 51,407 42,330 93,737

Total Campus

Endowments

4,386,195 3,358,357 7,744,552 3,975,161 2,901,309 6,876,470

Systemwide Programs

and Administration

1,055,030 - 1,055,030 962,322 - 962,322

Total Endowment

Assets

$5,441,225 $3,358,357 $8,799,582 $4,937,483 $2,901,309 $7,838,792

7

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

Table 2

Total Managed Endowment Assets by Foundation

(Excluding Pledges)

(Market Value $000)

June 30, 2010 June 30, 2009

Campus Managed Other* Total Managed Other* Total

Berkeley $875,764 $19,692 $895,456 $693,582 $92,176 $785,758

Davis 162,399 170 162,569 132,639 4,559 137,198

Irvine 192,331 (1,184) 191,147 163,173 (2,137) 161,036

Los Angeles** 1,051,401 7,278 1,058,679 894,907 3,931 898,838

Merced 5,080 0 5,080 4,339 0 4,339

Riverside 72,749 22 72,771 62,670 22 62,692

San Diego 315,376 1,352 316,728 281,251 1,497 282,748

San Francisco 510,030 0 510,030 438,513 0 438,513

Santa Barbara 98,929 0 98,929 87,632 0 87,632

Santa Cruz 46,968 0 46,968 42,330 0 42,330

Regents*** 4,976,985 464,240 5,441,225 4,527,824 409,659 4,937,483

Totals $8,308,012 $491,570 $8,799,582 $7,328,860 $509,707 $7,838,567

* Includes separately invested assets, mortgages, real estate, receivables, and other.

** Includes net receivables, real estate, securities, and other assets.

*** Includes GEP, STIP, and separately invested assets, as well as annuity and life income funds. Excludes security lending balances and other accounts receivable and payable.

For the purpose of this report, we focus on the managed endowment assets held by The Regents and the Foundations,

which include those assets managed by The Regents (Treasurer’s Office) or external managers. Managed endowment assets

do not include those assets categorized as “other endowment assets,” such as separately invested assets, mortgages, real

estate, and receivables.

8

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

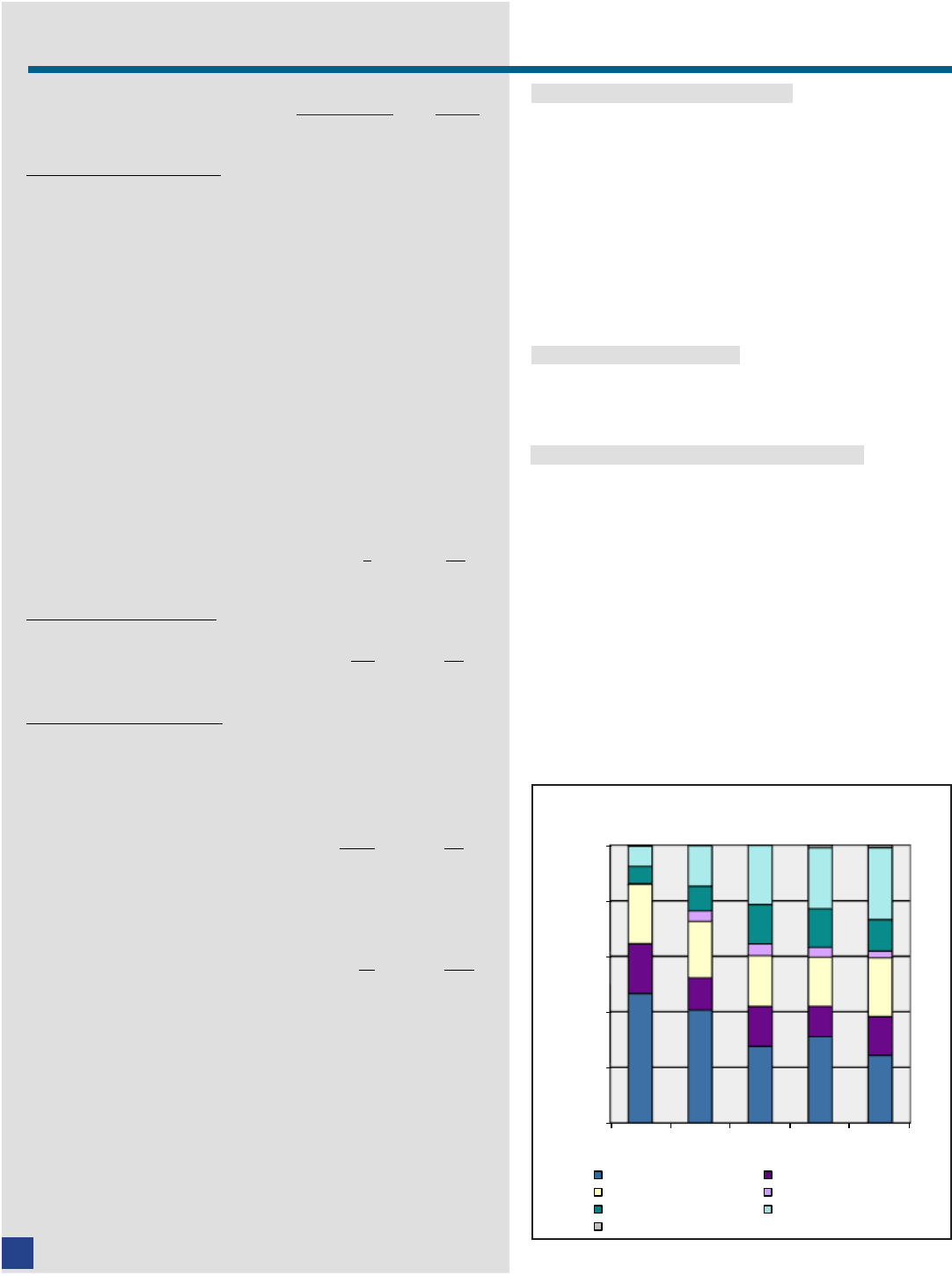

II. Managed Endowment Funds by Asset Class

Because asset allocation is the primary driver of a portfolio’s total return over the long run—with sector and individual

security selection the primary drivers over the short term—any comparison of endowment fund performance should be

viewed in the context of the portfolio’s asset class holdings.

As of June 30, 2010, the allocation of managed endowment funds by asset class for endowment investment portfolios

held by each Foundation, as well as for The Regents’ GEP, are shown below. Table 3 also includes an overall weighted

average allocation of all endowment funds by asset class, as well as the net total returns by campus.

Section IX, beginning on page 15, contains detailed information for each Foundation. These exhibits include a detailed

list of the Foundation’s investment managers and the type of funds they manage.

II

* Alternative Equities consist of private equity funds, real estate, natural resources and other asset types.

** Foundation endowment assets invested primarily in The Regents’ GEP and/or STIP funds.

Note that the method of rounding may produce the appearance of minor inconsistencies in various totals and percentages; however, the differences do not affect the

accuracy of the data.

Table 3

Allocation of Managed Endowment Funds by Asset Class

As of June 30, 2010

Asset Class Allocation

Campus

U.S.

Equity

Non-U.S.

Equity

Alternative

Equities*

U.S.

Fixed Inc.

Non-U.S.

Fixed Inc.

Cash

Equiv.

Absolute

Return

Total

Net Total

Return

Berkeley 15.9% 19.1% 17.1% 15.0% 3.2% 13.2% 16.5% 100.0% 11.7%

Davis ** 18.8 23.5 10.3 15.3 3.1 2.9 26.1 100.0 11.3

Irvine 20.5 17.2 19.7 14.2 3.4 1.9 23.1 100.0 11.0

Los Angeles 15.0 15.8 26.7 12.1 0.0 0.0 30.4 100.0 11.8

Merced ** 19.2 23.9 10.5 15.6 3.1 1.2 26.5 100.0 11.3

Riverside 13.5 29.8 11.5 29.4 3.5 9.2 3.1 100.0 15.8

San Diego ** 24.3 21.2 11.3 13.9 2.4 0.9 26.0 100.0 12.7

San Francisco 16.3 22.5 10.5 16.3 2.0 6.4 26.0 100.0 14.4

Santa Barbara 21.4 28.5 5.5 21.1 2.1 4.3 17.0 100.0 15.0

Santa Cruz ** 18.9 23.5 10.3 15.4 3.1 2.7 26.1 100.0 11.3

Regents’ GEP 19.2 23.9 7.7 18.7 0.0 1.2 29.3 100.0 11.3

Weighted Avg. 18.4% 22.3% 11.4% 17.2% 0.7% 2.7% 27.4% 100.0% 11.7%

9

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

III

III. Endowment Fund Investment Performance

Investment performance for University endowment assets is presented on a net basis, defined as total return after

investment management fees but before any gift fees and administrative charges. While investment management fees vary

across managers and asset classes, the net total return represents the annual experience of a donor’s gift. Table 4 displays

net total returns for fiscal 2010 for The Regents, each Foundation, and the Cambridge Endowment Pool Median for

Colleges and Universities, reported for periods of one, three, five and 10 years. For comparison, the table also includes

the overall one-, three-, five-, and 10-year weighted average returns for all University endowment assets.

* Returns prior to 2006 were provided by the individual Foundations. Returns for 2006 and later were provided by State Street Bank, except in extraordinary

circumstances.

Table 4

Average Annualized Total Returns

Fiscal Year ended June 30, 2010

Campus

1 Year 3 Years 5 Years 10 Years

Berkeley 11.7% -4.0% 4.1% 4.1%

Davis 11.3 -3.4 3.7 3.3

Irvine 11.0 -5.1 2.4 2.9

Los Angeles 11.8 -4.1 3.3 3.4

Merced 11.3 -3.6 3.7 N/A

Riverside 15.8 -2.5 5.2 5.4

San Diego 12.7 -4.1 3.3 2.8

San Francisco 14.4 -4.0 3.1 3.3

Santa Barbara 15.0 -6.6 1.8 2.0

Santa Cruz 11.3 -3.3 3.7 3.1

Regents’ GEP 11.3 -3.6 3.7 3.0

Weighted Average 11.7 -3.8 3.6 3.2

Cambridge Median 12.4 -3.8 4.0 3.9

10

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

IV

IV. Endowment Fund Investment Management

Each Foundation selects the investment manager(s) for its endowment assets. Their choices may include The Regents

(GEP, STIP, UC Private Equity and Real Estate Vintage Equity Programs, and UC Absolute Return Unitized Program),

external managers, and/or the Foundation. Table 5 (below) provides the percentage of endowment assets managed by The

Regents, external managers, the Foundation (Internal), or “Other” (usually assets held separately at the donor’s request).

At the end of fiscal 2010, the Treasurer’s Office managed the majority of the endowment gift assets for four of the 10 UC

Foundations and 19.9% of the UC Foundations’ total endowment gift assets.

* Negative amount represents endowment payout not yet withdrawn from endowment assets.

Table 5

Foundation Endowment Assets by Investment Manager

at June 30, 2010

(Market Value $000)

Campus/Foundation Regents External Internal Other

Berkeley $107,164 12.0% $768,600 85.8% $0 0.0% $19,692 2.2%

Davis 162,399 99.9 0 0.0 0 0.0 170 0.1

Irvine 85,592 44.8 106,739 55.8 0 0.0 -1,184 -0.6

Los Angeles 15,210 1.4 1,040,486 98.3 0 0.0 2,983 0.3

Merced 5,080 100.0 0 0.0 0 0.0 0 0.0

Riverside 966 1.3 71,783 98.6 0 0.0 22 0.0

San Diego 244,140 77.1 70,271 22.2 964 0.3 1,353 0.4

San Francisco 0 0.0 510,030 100.0 0 0.0 0 0.0

Santa Barbara 1,169 1.2 97,760 98.8 0 0.0 0 0.0

Santa Cruz 46,968 100.0 0 0.0 0 0.0 0 0.0

Overall $668,689 19.9% $2,665,669 79.4% $964 0.0% $23,036 0.7%

11

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

V

* For those fees not provided by the Foundation, the report used the same as estimates used by Treasurer’s Office for GEP.

V. Endowment Fund Investment Management Fees

As noted in Section III, investment performance for endowment assets should be presented on a net basis, after investment

management costs but before gift and administration fees. (See Section VI for gift fees and recurring charges.) Each

Foundation was asked to provide an investment management fee schedule for each external manager. State Street Bank

verified the reasonableness of each Foundations’ fee data and the fee data of the GEP and STIP. The last line in the table

below is a weighted average fee based on the information provided and the assets under management at June 30, 2010.

An itemization of each Foundation’s investment management fees—between externally managed endowment gift assets

and assets managed by The Regents—is provided in Table 6.

The total cost of managing the GEP is 140 basis points of average market value. This consists of approximately 1.31%

(131 basis points) attributable to external managers (evidenced as the difference between their gross and net returns),

plus 0.03% (3 basis points) attributable to investment management and custodial expenses, and 0.06% (6 basis points)

attributable to administrative costs.

For funds invested in STIP, approximately 0.06% (6.0 basis points) of average market value is charged to the pool, with

0.03% (3.0 basis points) attributable to investment management and custodial expenses, and 0.03% (3.0 basis points)

attributable to administrative costs associated with the pool.

Table 6

Endowment Management Fees by Foundation

as a Percentage of Market Value

at June 30, 2010

Campus Regents External Wtd. Average

Berkeley 0.06 1.08 0.97

Davis 1.38 - 1.38

Irvine 1.57 0.61 1.04

Los Angeles 1.59 2.21 2.20

Merced 1.40 - 1.40

Riverside - 1.12 1.12

San Diego 1.51 0.22 1.25

San Francisco - 0.76 0.76

Santa Barbara 0.06 0.62 0.61

Santa Cruz 1.38 - 1.38

Overall 1.22 1.41 1.38

12

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

VI

* For more information on Foundation policies on gift fees and recurring charges, see the individual Foundation reports in Section IX.

VI. Gift Fees and Recurring Charges

A synopsis of The Regents’ and each campus’ practices for assessing fees on new gifts, as well as any recurring

administrative charges, are provided in Table 7. As noted in the table, gift fees apply to endowment gifts whether given

to the Foundation or The Regents and to current fund gifts (for use by the campus in the near term). At most campuses,

gift fees and recurring charges support discretionary funds available to the Chancellor, for such efforts as fund-raising,

communications, government and community relations and administrative services associated with these efforts.

In March 1998, The Regents adopted a policy to allow the campuses to recover the reasonable and actual costs related to

campus administration of Regents’ endowments, with the amount to be determined by historical cost data. As noted on

the following chart, each campus listed below collected endowment cost recovery fees on Regents’ gifts of 45 basis points

of the 60-month rolling average market value of funds invested in GEP. The Campus Foundations may also assess an

administrative endowment cost recovery fee on funds they administer.

Table 7

Gift Fees and Recurring Charges by Regents and Foundation

Fees Recurring Charges

The Regents

None A cost recovery fee of 45 basis points (0.45%) on the market value of the

GEP is taken out of the endowment payout annually.

Berkeley

One-time charge of 2.5% of the initial

value of all non-research gifts to the

Regents and Foundation (including

endowments); fee is taken from the

gift principal unless the specified

department elects to pay the fee from

another allowable source.

STIP income on non-endowed gifts is 100% to an unrestricted fund

administered by the chancellor. STIP income earned on new endowment

gifts kept in suspense for six months is paid to the chancellor’s fund to

benefit campus development. An annual administrative fee of 50 basis

points is charged on endowment funds administered by the Foundation.

Davis

6% on all gifts given on or after

October 1, 2004.

The campus and Foundation charge up to 100% of STIP income on current

fund balances. Endowment funds and funds functioning as endowments are

charged an annual administration fee of 30 basis points (0.30%).

Irvine

5% of initial value of all gifts. Annual charge of 0.5% of the market value, plus all interest on current use

private gifts and grants.

Los Angeles

6.5% of initial value of all gifts. 100% of all short-term interest on campus current fund balances, with some

exceptions. Annual endowment cost recovery fee of .5% of the fair market

value, calculated monthly.

Merced

5% of initial value of all gifts. 100% of STIP income on current fund balances.

Riverside

5% of initial value of all gifts. Annual charge of .5% against all existing endowments and endowment-

related gift funds; the campus charges 100% of short-term ordinary income

on campus and Foundation current fund balances.

San Diego

6% of initial value of all gifts. 100% assessment of all short-term investment earnings on current use gift

and private grant balances held in both the campus and the Foundation.

Annual recurring fee of 0.40% on the market value of the Foundation’s

endowment.

San Francisco

4% of initial value of all gifts. 100% of interest income earned on current funds (STIP income). Annual fee

of .40% on all endowment fund assets. A 1% spending fee is charged when

funds are spent for purpose. No fees are charged on gifts for student aid and

capital.

Santa Barbara

2% of initial value of all gifts, as of

June 30, 2010.

Annual endowment cost recovery fee is .45% of the fair market value. 100%

of STIP income on current fund balances.

Santa Cruz

3% of initial value of endowment gifts

and 5% of initial value of current use

gifts.

Annual recurring fee of 0.30% on the 3-year average market value of the

Foundation’s endowment.

13

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

VII

VII. Endowment Spending Policies

A summary of the endowment spending policies for The Regents’ and each university Foundation is shown in Table 8. It

is important to note that a Foundation choosing to invest in The Regents’ GEP, Private Equity Vintage Year Program, Real

Estate Vintage Year Program and/or Absolute Return Unitized Program funds may apply its Foundation spending policy to

those gift assets.

* For more information on Foundation spending policies, see the individual Foundation reports in Section IX.

Table 8

Endowment Spending Policies by Regents and Foundation*

The Regents

(GEP)

Long-term target spending rate of 4.75% of a 60-month (five-year) rolling average market value. In May 2010, The

Regents concurred to continue a rate of 4.75% for expenditure in fiscal year 2010-2011.

Berkeley

The UC Berkeley Foundation endowment payout policy is a range of 4.75% to 5.5% of the 12-quarter moving

average market value of the endowment for a specific payout year. In fiscal year 2009-10, the actual payout rate was

4.75%.

Davis

Long-term target spending rate of 4.35% of a 60-month (5-year) rolling average market value. Effective spending

rate of 4.50% of a 60-month rolling average market value was used in fiscal 2009-2010.

Irvine

The endowment fund spending policy allows for allocation of income equivalent to 4.5% of the moving average

market value of the endowment portfolio. This average market value is computed using the previous 36 months of

portfolio activity. Income earned in excess of the spending rate may be reinvested in endowment principal. Income

available for expenditure is calculated according to a predetermined formula.

Los Angeles

The spending policy for fiscal year 2009-10 was 4.8% of a rolling 36-month average market value calculated

monthly.

Merced

Long-term total return target spending rate of 4.75% of a 60-month (5-year) rolling average market value. A

spending rate of 4.75% was adopted in May 2006 for expenditures in fiscal year 2006-2007, 2007-2008, 2008-2009,

and 2009-2010.

Riverside

The endowment fund payout policy is 4.75% of the average endowment fund market value computed using the

previous 12 quarters of portfolio activity the last of which ended on the March 31 of such fiscal year.

San Diego

Endowment spending during fiscal year 2009-10 was calculated using a predetermined formula at an amount equal

to 3.75% of the five–year average unit market value of the endowment portfolio. Spending is allocated to fund

holders monthly.

San Francisco

A portion of the endowment pool will be expended annually. The amount of the distribution will be determined by the

payout policy of the Foundation, modified by donors’ wishes where applicable. The Foundation policy is to distribute

5% of the market value of the endowment pool calculated on a 36-month rolling average of the market value, subject

to a 6% cap and a 3.5% floor as a percent of the end of year endowment pool market value. The payout rate is

reviewed annually, which may result in modification. The payout is distributed once a year following the close of the

fiscal year. Undistributed income and gains from investment activities are reinvested in the Endowment Pool.

Santa Barbara

The UC Santa Barbara Foundation adopted a total return spending policy for the 2009-2010 fiscal year of 4.75% of

the 60-month rolling average share value, as of December 31, 2008, for the Long Term Endowment Pool/General

Endowment Pool.

Santa Cruz

The UC Santa Cruz Foundation endowment expenditure rate is 4.5% times a three-year moving average of June 30

market values. The endowment expenditure formula is reviewed annually and adjusted accordingly with respect to

prudent concern for campus needs, donor expectations, and current market conditions. In no event will the corpus

be reduced below the amount of the original gift, adjusted by the Gross Domestic Product (GDP) price index,

unless specific language of the endowment agreement so allows.

14

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

Table 9

Total Foundation Gift Assets by Campus

(Market Value $000; totals rounded)

June 30, 2010 June 30, 2009

Campus Endowed Non-Endowed Pledges Total Endowed Non-Endowed Pledges Total

Berkeley $895,456 $170,097 $13,110 $1,078,664 $785,758 $148,198 $25,721 $959,677

Davis 162,569 49,880 8,726 221,175 137,198 90,709 12,233 240,140

Irvine 191,147 12,417 42,390 245,954 161,036 29,152 66,112 256,300

Los Angeles 1,058,679 291,989 204,546 1,555,214 898,838 280,840 173,229 1,352,907

Merced 5,080 174 1,818 7,073 4,339 53 1,146 5,538

Riverside 72,771 16,345 1,283 90,399 62,692 17,457 1,020 81,169

San Diego 316,728 116,037 40,860 473,625 282,748 108,404 44,962 436,114

San Francisco 510,030 170,540 59,325 739,895 438,738 180,301 62,247 681,286

Santa Barbara 98,929 9,402 13,116 121,447 87,632 7,673 13,898 109,203

Santa Cruz 46,968 2,302 1,734 51,004 42,330 2,606 1,201 46,137

Total

Foundation

Assets

$3,358,358 $839,184 $386,908 $4,584,450 $2,901,309 $865,393 $401,770 $4,168,472

VIII. Total Foundation Gift Assets

Table 9 provides total Foundation gift assets by campus, split into endowed, non-endowed assets and pledges, for fiscal

2010 and fiscal 2009. Non-endowed assets include current gift assets (i.e., assets for use in the current year) and trust/life

income assets, but exclude pledges. Note, pledges introduce potential volatility to the asset growth rates.

As Table 9 shows, the Foundations held $3.36 billion in endowment gift assets at June 30, 2010, a 15.8% increase from

the $2.90 billion held at the end of fiscal 2009. Including all non-endowed assets (current assets and trusts/life income

assets) and pledges, the Foundations’ total assets were $4.58 billion, a 10.0% increase over the total of $4.17 billion for

fiscal year 2009.

VIII

15

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

IX

IX. Individual Foundation Reports

The following section of the report contains a summary for each Foundation. Each summary includes the Foundation’s

Investment Objectives, Spending Policy and Gift Fee Policy, Total Assets, and Performance Data.

Foundation assets are categorized as endowed or non-endowed, with endowed assets further broken down by investment

manager. Non-endowed assets include life income and annuity funds, current funds and pledges. Only endowed assets

are shown, and investment results for all Foundations exclude non-endowed assets. The glossary in Section XIII provides

definitions of these asset categories.

In order to provide more meaningful performance comparisons and enable The Regents and other fiduciaries to

better perform their investment oversight responsibilities, the Treasurer, with the Regents’ Investment Consultant, has

augmented the Annual Endowment Report with investment policy and performance benchmarks for each Foundation, as

well as for the GEP.

We have included 10 years of annual fiscal net total returns for each Foundation both in graphical presentation and

tabular form (seven years for Merced). In addition, we have included a chart of the performance of a hypothetical $10,000

gift invested with the Foundation, the Benchmark and in GEP, at the beginning of the 10-year period, and have outlined

the ending gift values and annualized net total returns for the period. The bottom graph assumes all income is reinvested

in the fund (or benchmark) and no distributions are made from it.

Benchmarks

The most important determinant of fund performance and risk is the asset allocation policy established by Fund fiduciaries.

A fund performance benchmark is usually stated in term of percentages (adding to 100%) of a number of market indexes,

such as the Russell 3000 Index for U.S. stocks or the Barclays Capital Index for U.S. bonds. A performance benchmark

may change over time as policy changes both the asset mix and the performance objectives, or benchmarks, for each asset

class.

The Foundations provided the asset allocation and benchmark information summarized in Section XII. Based on the

Foundations’ reported policy, the Regents’ Investment Consultant computed annual and cumulative benchmark returns. They

are shown in Section X, Table 11, along with the Foundations’ annual and cumulative returns, Table 10. In some cases, detailed

information on investment policy in earlier years was not available, and the Treasurer approximated benchmark composition

based on the available information supplied by the Foundations.

In addition, the Active Return, or difference between Fund and benchmark return, is shown in Table 11. Active return is a

measure of the value added by Fund fiduciaries and managers over the policy objective.

The accompanying measures of risk and risk-adjusted returns in Section IX are approximate. In investment analysis, risk is

often measured as volatility, or the variability in returns. It is customary to use monthly returns for these computations.

Because only annual Fund returns were available, these measures of risk and risk-adjusted returns should be viewed as

indicative only; relative rankings may change slightly if monthly returns were used.

16

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

University of California, Berkeley Foundation

Endowment Investment Objectives:

Maintain the purchasing

power of the current assets and all future contributions;

maximize return within reasonable and prudent levels of risk;

maintain an appropriate asset allocation policy that is compatible

with the objectives of GEP, while still having the potential to

produce positive real returns; control costs of administering the

GEP assets and managing the investments; provide investment

results equal or superior to an appropriate peer universe;

limit the risk of large losses by diversification among broad

asset classes (e.g., domestic stocks, international stocks, fixed

income) and among the various styles within individual asset

classes (e.g., “growth” and “value” within domestic equity);

achieve a rate of return which exceeds that of a target-weighted

composite index based on the target asset allocation policy

adopted as follows: 40% Global Equity, 20% Marketable

Alternatives, 10% Private Equity, 9% Real Estate, 9% Energy/

Commodities/Other and 12% Fixed Income; and produce

a sufficient total fund return to provide a range of an annual

4.75% to 5.5% payout (based on a 12-quarter moving average

of market value of endowment principal) to GEP beneficiaries.

Endowment Spending Policy: The UC Berkeley Found-

ation endowment payout policy is a range of 4.75%

to 5.5% of the 12-quarter moving average market

value of the endowment for a specific payout year. In

fiscal year 2009-10, the actual payout rate is 4.75%.

Policy for Gift Fees and Administrative Expenses: (1)

One time charge of 2.5% of the initial value of all non-

research gifts to the Regents and Foundation (including

endowments). The fee is taken from the gift principal

unless the specified department elects to pay the fee

from another allowable source. (2) STIP income on

non-endowed gifts is 100% to an unrestricted fund

administered by the Chancellor. (3) STIP income earned

on new endowment gifts kept in suspense for six months

is paid to the Chancellor’s fund to benefit campus

development. (4) An annual administrative fee of 50 basis

points is charged on endowment funds administered by

the Foundation.

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010

Managed Endowment Funds by Asset Class

as of June 30

U.S. Equity

U.S. Fixed Income

Non-U.S. Equity Non-U.S. Fixed Income

Alternative Equity Absolute Return

Cash

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Externally Managed Funds

U.S. Equity

Dodge & Cox-Equity $32,016 3.6%

TimesSquare Asset Mgmt. 9,420 1.1

Wellington Trust Appreciation 14,456 1.6

Wellington Energy 13,959 1.6

Van Eck 9,686 1.1

Adage Capital 42,150 4.7

DSM Large Cap Growth 12,602 1.4

Advisory Research 7,164 0.8

International Equity Funds

Harbor International Fund 39,094 4.4

Newport Asia Institutional Fund 7,385 0.8

Litman/Gregory Masters' Select Intl 39,737 4.4

Sanderson International Value 27,092 3.0

Acadian - Old Mutual Asset Mgmt 6,427 0.7

Emerging Markets

Grantham, Mayo, Van Otterloo & Co 24,233 2.7

City of London 26,879 3.0

Real Estate

Adelante Capital 14,111 1.6

LBA Realty Fund IV 445 0.0

Lone Star Real Estate Fund 2,116 0.2

Metropolitan Real Estate 4,102 0.5

E I I Int'l Property 12,148 1.4

Fixed Income

PIMCO Commodity Real Return 8,950 1.0

Dodge & Cox-Bond 14,198 1.6

Income Research & Management 86,911 9.7

Eaton Vance High Yield 12,126 1.4

OCM High Yield Limited Partnership 11,425 1.3

Brandywine Global 16,898 1.9

Mondrian Global Fixed Income 11,267 1.3

Private Equity/Venture Capital

Common Fund (VC II - VIII) 9,534 1.1

TCV IV, LP 1,383 0.2

TCV VII, LP 1,026 0.1

Horsely Bridge, VII 3,156 0.4

Summit Venture VI B 3,304 0.4

Sequoia Cap Seed Fund II 859 0.1

Sequoia Cap India Growth Fund II 663 0.1

Sequoia Cap U.S. Growth Fund IV 1,124 0.1

Horsely Bridge, VIII 8,502 0.9

Horsely Bridge Growth, VIII 4,815 0.5

Horsely Bridge International III 7,335 0.8

Horsely Bridge International IV 4,009 0.4

Horsely Bridge International V 181 0.0

Horsely Bridge, IX 1,331 0.1

CF Endowment Venture II - VI 6,833 0.8

TPG Partners V & VI 3,655 0.4

Blackstone Capital Partners V 2,983 0.3

OCM Opportunities Fund VII 5,487 0.6

Legacy Venture IV & V 7,144 0.8

Cerberus Institutional Partners Ser 8,673 1.0

Foundation Capital VI LP 1,998 0.2

CA Resources-Ser Bain Europe III 597 0.1

Kayne Anderson Energy Fund V (QP), LP 98 0.0

Charlesbank Equity Fund VII 328 0.0

Goldman Sachs Vintage V 2,771 0.3

August Capital V 652 0.1

Lone Star Fund VI (US) LP 3,817 0.4

Varde Fund IX/Varde Fund IX-A 9,819 1.1

Commonfund Natural Resources VI 1,433 0.2

Commonfund Natural Resources VII 2,433 0.3

Natural Gas Partners IX LP 1,303 0.1

Park Street Cap Nat Resources III 7,115 0.8

Absolute Returns 147,242 16.4

Total Externally Managed Funds $768,599 85.8%

Regentally Managed Funds

Short Term Investment Pool 107,164 12.0

Total Regentally Managed Funds $107,164 12.0%

Other Endowed Assets

Cash/Cash Equivalent 11,158 1.2

Other Receivables 1,982 0.2

Separately Invested Funds 6,026 0.7

SAM Mortgages 527 0.1

Total Other Endowed Assets $19,692 2.2%

TOTAL ENDOWED ASSETS $895,456 100.0%

17

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

Ending Values 2010 Annualized Returns 2001-2010

Berkeley Benchmark GEP Berkeley Benchmark GEP

$14,959 $13,374 $13,467 4.1% 2.9% 3.0%

University of California, Berkeley Foundation

Ten-Year Performance of a $10,000 Gift

Berkeley Foundation, Foundation Benchmark and GEP

1

The UC Berkeley Foundation’s net total return data excludes the High Income Endowment Pool (a separately managed asset) and Other

Endowed Assets for all periods.

Annual Endowment Returns for Years Ending June 30

Berkeley Foundation, Foundation Benchmark and GEP

$5,000

$15,000

$25,000

$35,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Berkeley Benchmark GEP

-30%

-20%

-10%

0%

10%

20%

30%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Berkeley

1

-5.0% -4.8% 3.4% 17.7% 11.3% 14.8% 20.3% -0.3% -20.6% 11.7%

Benchmark -9.5 -8.1 2.8 17.1 10.3 12.7 16.9 -1.2 -15.6 10.2

GEP -6.9 -9.5 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

18

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

UC Davis Foundation

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Regentally Managed Funds

General Endowment Pool $159,636 98.2%

Short Term Investment Pool 2,762 1.71

Total Regentally Managed Funds $162,399 99.9%

Total Other Endowed Assets $170 0.1%

TOTAL ENDOWED ASSETS $162,569 100.0%

Endowment Investment Objectives: The investment

objective of The UC Davis Foundation is to maximize

the long-term total return, while assuming an

appropriate level of risk, and to provide spendable

income to sufficiently support the University activities

designated by the endowed funds. The investment

policy matches that of GEP.

Endowment Spending Policy: Long-term target spending

rate of 4.35% of a 60-month (5-year) rolling average

market value. Effective spending rate of 4.50% of a

60-month rolling average market value was used in

fiscal 2009.

Policy for Gift Fees and Administrative Expenses: UC Davis

assesses a one-time fee of 6% on all gifts given on or

after October 1, 2004. The campus and Foundation

charge up to 100% of STIP income on current fund

balances. Endowment funds and funds functioning as

endowments are charged an annual administration fee

of 30 basis points (0.30%).

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010

Managed Endowment Funds by Asset Class

as of June 30

U.S. Equity U.S. Fixed Income

Non-U.S. Equity Non-U.S. Fixed Income

Alternative Equity Absolute Return

Cash

19

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

UC Davis Foundation

Annual Endowment Returns for Years Ending June 30

UC Davis Foundation, Foundation Benchmark and GEP

Ten-Year Performance of a $10,000 Gift

UC Davis Foundation, Foundation Benchmark and GEP

Ending Values 2010 Annualized Returns 2001-2010

Davis Benchmark GEP Davis Benchmark GEP

$13,837 $14,213 $13,467 3.3% 3.6% 3.0%

1

The UC Davis Foundation’s net total return data excludes Other Endowed Assets for all periods.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Davis

1

-5.6% -8.3% 5.5% 14.4% 10.2% 11.3% 19.7% -1.4% -17.9% 11.3%

Benchmark -5.9 -7.7 5.0 14.6 9.5 11.1 18.1 0.0 -13.1 9.1

GEP -6.9 -9.5 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

$5,000

$15,000

$25,000

$35,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Davis Benchmark GEP

-30%

-20%

-10%

0%

10%

20%

30%

20

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

University of California, Irvine Foundation

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Externally Managed Funds

Large-Cap Equity Funds

Vanguard Windsor II Fund $6,422 3.4%

JPMorgan 7,768 4.1

Cadence Capital Mgmt 6,696 3.5

Small-Cap Equity Funds

Thompson, Siegel & Walmsley 2,951 1.5

Palisade Capital Management 3,491 1.8

Balanced Equity Funds

Berkshire Hathaway 1,434 0.8

I-Shares 4,115 2.2

Global Equity Funds

Brandes 8,800 4.6

William Blair 9,012 4.7

Bond Funds

Pimco Instl.Total Return 9,773 5.1

Pimco Instl.High Yield 618 0.3

Pimco Instl.Low Duration 6,163 3.2

Pimco Emerging Markets 1,042 0.5

Evergreen 3,788 2.0

Real Estate

TIAA-CREF 6,813 3.6

Alternative Equity

Common Fund 21,337 11.2

PIMCO Bank Loan Opportunities 4,243 2.2

Drum Capital Mgmt 2,273 1.2

Total Externally Managed Funds $106,739 55.8%

Regentally Managed Funds

UC Vintage Year 2003 1,063 0.6

UC Vintage Year 2007 735 0.4

UC Vintage Year 2008 1,588 0.8

UC Real Estate 716 0.4

UC Absolute Return 12,991 6.8

UC Viking Global 10,000 5.2

General Endowment Pool 55,587 29.1

Short Term Investment Pool 2,912 1.5

Total Regentally Managed Funds 85,592 44.8%

Other Endowment Assets $-1,184 -0.6%

TOTAL ENDOWED FUNDS $191,147 100.0%

Endowment Investment Objective: The Irvine Foundation’s

investment objective for its endowment portfolio is to maximize

long-term total return, with a total return objective (net of fees),

measured over a full market cycle, of not less than the rate of

inflation as measured by the CPI, plus 500 basis points. Ideally,

total return should exceed market performance. The investment

policy is 22% U.S. Equity, 22% Non-U.S. Equity, 20% Hedge

Funds, 15% Fixed Income, 8% Private Equity and Venture

Capital, 8% Real Estate, 5% Commodities, and 0% Cash.

Endowment Spending Policy: The endowment fund spending

policy allows for allocation of income equivalent to 4.5% of

the moving average market value of the endowment portfolio.

This average market value is computed using the previous 36

months of portfolio activity. Income earned in excess of the

spending rate may be reinvested in endowment principal.

Income available for expenditure is calculated according to a

predetermined formula.

Policy for Gift Fees and Administrative Expenses: The Irvine

Campus charges a one-time fee of 5% of the initial value of all

Foundation and Regents’ gifts. The fee may be taken (1) from

the principal if specified by the donor, (2) by holding gift in

a suspense account until fee is earned or (3) from another

acceptable fund source. There is also a recurring charge of 0.5%

of the market value of Foundation endowment funds used to

offset the operating costs of managing the endowment for the

Foundation. All interest earned on the balances of current use

private gifts and private grants is credited to the Chancellor’s

Discretionary Fund and used to support ongoing fundraising

efforts at UC Irvine.

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010

Managed Endowment Funds by Asset Class

as of June 30

U.S. Equity U.S. Fixed Income

Non-U.S. Equity Non-U.S. Fixed Income

Alternative Equity Absolute Return

Cash

21

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

University of California, Irvine Foundation

Annual Endowment Returns for Years Ending June 30

Irvine Foundation, Foundation Benchmark and GEP

Ten-Year Performance of a $10,000 Gift

Irvine Foundation, Foundation Benchmark and GEP

1

The UC Irvine Foundation’s net total return data includes a portion of Other Endowed Assets for all periods.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Irvine

1

-3.4% -7.2% 6.5% 15.6% 7.7% 10.9% 18.7% -2.9% -20.6% 11.0%

Benchmark -6.2 -6.6 3.2 15.1 9.3 10.3 19.0 -6.4 -16.1 9.2

GEP -6.9 -9.5 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

Ending Values 2010 Annualized Returns 2001-2010

Irvine Benchmark GEP Irvine Benchmark GEP

$13,371 $12,810 $13,467 2.9% 2.5% 3.0%

$5,000

$15,000

$25,000

$35,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Irvine Benchmark GEP

-30%

-20%

-10%

0%

10%

20%

30%

22

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

The UCLA Foundation

ENDOWED ASSETS

Externally Managed Funds

U.S. Equity Funds

DFA Emerging Markets Core 24,632 2.3%

DFA Emerging Markets Value 42,442 4.0

DFA International Small Co 17,091 1.6

Hansberger Global Investors, Inc. 69,352 6.6

UCLA in-house - I shares Russel Midcap 17,239 1.6

J P Morgan 130/30 Large Cap 33,772 3.2

PIMCO Fundamental Index Plus 13,278 1.3

PIMCO Fundamental Index Plus TR 29,317 2.8

PIMCO International Stock Plus TR 12,320 1.2

Regents General Endowment Pool 3,322 0.3

T Rowe Price Structured Research 30,882 2.9

Timessquare - Corp. Stocks 30,053 2.8

Fixed Income

BGI Tactical Fund 16,029 1.5

PIMCO Total Return Fund 110,089 10.4

SSGA Collateral Fund 812 0.1

Marketable Alternatives

All Blue 17,320 1.6

AQR Capital Management 12,340 1.2

BGI Global Ascent 12,284 1.2

Black River Global Multi Strategy 5,444 0.5

Brevan Howard 17,225 1.6

Brookside Capital 13,529 1.3

Canyon Value Realisation 598 0.1

Carl Marks Strategic Opp 2,249 0.2

Carlson Black Diamond (Relative Value) 9,340 0.9

Davidson Kempner Distressed Opport. 5,531 0.5

Eton Park Overseas 14,514 1.4

GEM Realty Securities, LTD 9,987 0.9

Healthcor Offshore, LTD 9,723 0.9

Highbridge Capital Corporation 13,830 1.3

Ionic Capital International (Relative Val) 10,365 1.0

Maverick Fund 11,387 1.1

MKP Credit Offshore LTD 10,210 1.0

Oaktree Japan Fund 821 0.1

O’Connor Global Fundamental 14,837 1.4

Owl Creek Overseas Fund 14,281 1.3

OZ Asia Overseas 5,793 0.5

OZ Europe Overseas Fund Ltd II 5,288 0.5

OZ Overseas Fund II, Cayman 6,406 0.6

PE Investments 11,709 1.1

Paulson Advantage (Event Driven) 13,717 1.3

Regiment (Relative Value) 10,841 1.0

Samlyn 4,636 0.4

Taconic Opportunity Fund 13,904 1.3

Tiger Asia Overseas Fund 11,016 1.0

Tree Line Asia 7,178 0.7

Vicis Capital Fund Intl 4,221 0.4

Viking Global Equities III (Eqt Long/Short) 13,834 1.3

Winton Diversified Futures 11,858 1.1

Zaxis Offshore Limited 10,528 1.0

Non-Marketable Alternatives

Bain Capital IX 5,532 0.5

Bain Capital X 2,915 0.3

Blackstone Capital Partners V 7,124 0.7

Brentwood Partners III 3,862 0.4

Brentwood Partners IV 3,510 0.3

Charter Oak Partners 301 0.0

Clearstone 3,376 0.3

EOS Partnership 6,731 0.6

Lexington Partners 9,051 0.9

6/30/10 % Endowment

Market Value Funds

($ 000)

Non-Marketable Alternatives continued

Lightspeed Venture 1,353 0.1%

Morgenthaler Partners VII 2,061 0.2

Morgenthaler Partners VIII 2,698 0.3

MPM Bio IV 3,257 0.3

Northgate Private Equity II 3,326 0.3

Northgate Private Equity III 2,278 0.2

Northgate Venture Partners III 2,411 0.2

OCM Asia Principal Fund 2,077 0.2

OCM GFI Power Opp fund II 1,723 0.2

OCM Opportunities Fund V, LP 672 0.1

OCM Opportunities Fund VI, LP 4,069 0.4

OCM Opportunities Fund VII, LP 4,661 0.4

OCM Opportunities Fund VII B, LP 6,313 0.6

OCM Principal Opportunities Fund II 2,732 0.3

OCM Principal Opportunities Fund III 7,878 0.7

OCM Principal Opportunities Fund IV 9,534 0.9

OCM Principal Opportunities Fund V 2,875 0.3

Panorama Capital 3,090 0.3

Pantheon USA Fund VI 11,022 1.0

Permal Private Equity Holding IV 3,162 0.3

Polaris Venture Partners IV 4,402 0.4

RCP Fund III 2,923 0.3

UC Vintage Equity Fund 2003 5,373 0.5

Sevin Rosen 617 0.1

Sigular & Guff 2,694 0.3

Sigular & Guff II 4,263 0.4

Sigular & Guff Small Buyout Opport. 2,422 0.2

Thomas H. Lee Equity V 5,489 0.5

Thomas H. Lee Equity VI 2,301 0.2

Three Arch Capital , LP 3,268 0.3

Three Arch Capital, IV 2,371 0.2

Welsh, Carson, Anderson & Stowe IV 2,248 0.2

Welsh, Carson, Anderson & Stowe VIII 3,192 0.3

Welsh, Carson, Anderson & Stowe IX 5,017 0.5

Welsh, Carson, Anderson & Stowe X 4,236 0.4

Real Estate Funds

DLJ Real Estate IV 3,635 0.3

Heitman R/E 8,047 0.8

Morgan Stanley Real Estate 379 0.0

Prudential Invest Mgt 16,272 1.5

Regents Real Estate 2,220 0.2

Rockpoint Real Estate III 4,262 0.4

Realty Associates VIII 5,289 0.5

TIAA CREF 6,039 0.6

Inflation Hedge

CSAM 16,004 1.5

GMO Forestry Fund 8-B LP 5,330 0.5

Kayne Anderson MLP 16,593 1.6

Lehman Strategic Commodities 5,869 0.6

Timber vest Partners 7,855 0.7

Timbervest Partners II 11,501 1.1

Cash and Other Assets

Cash -167 0.0

Individual Share Holdings 895 0.1

UIP Inv in Hedge Fund -16,406 -1.5

Total Externally Managed Funds 1,051,401 99.3%

Other Endowed Assets

Endowed funds invested in STIP 4,295 0.4

Other 2,983 0.3

Total Other Endowed Assets 7,278 0.7%

TOTAL ENDOWED ASSETS 1,058,679 100.0%

6/30/10 % Endowment

Market Value Funds

($ 000)

23

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

The UCLA Foundation

Endowment Investment Objective: The Foundation’s

investment objective is to maximize long-term total returns

consistent with prudent levels of risk. Investment returns

are expected to preserve or enhance the real value of the

endowment to provide adequate funds to sufficiently

support designated University activities. The endowment’s

portfolio is expected to generate a total annualized rate of

return, net of fees and spending, greater than the rate of

inflation over a rolling five-year period. The investment

policy consists of: 13% U.S. Equity, 14% Non-U.S. Equity,

23% Private Equity, 7% Real Estate, 32% Absolute Return,

and 11% Fixed Income.

Endowment Spending Policy: The UCLA Foundation

Endowment Pool made available for expenditure by fund

holders an amount equal to 4.8% of a rolling 36-month

average market value in fiscal year 2010, calculated

monthly. The spending policy for fiscal 2011 is 5.20%

of a rolling 36-month average market value, calculated

monthly.

Policy for Gift Fees and Administrative Expenses: The

UCLA Foundation charges a one-time fee of 6.5% of the

initial value of all gifts.

Note: Balanced fund decomposed into constituent asset classes.

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010

Managed Endowment Funds by Asset Class

as of June 30

U.S. Equity U.S. Fixed Income

Non-U.S. Equity Non-

U.S. Fixed Income

Alternative Equity Absolute Return

Cash

24

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

Annual Endowment Returns for Years Ending June 30

The UCLA Foundation, Foundation Benchmark and GEP

Ten-Year Performance of a $10,000 Gift

The UCLA Foundation, Foundation Benchmark and GEP

Ending Values 2010 Annualized Returns 2001-2010

Los Angeles Benchmark GEP Los Angeles Benchmark GEP

$14,014 $12,205 $13,467 3.4% 2.0% 3.0%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Los Angeles -1.3% -8.9% 4.5% 15.2% 10.2% 12.9% 17.8% 0.1% -21.1% 11.8%

Benchmark -9.6 -10.5 3.0 16.2 8.8 10.3 17.1 0.6 -19.0 10.1

GEP -6.9 -9.5 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

1

The UCLA Foundation’s net total return data excludes Other Endowed Assets for all periods.

The UCLA Foundation

-30%

-20%

-10%

0%

10%

20%

30%

$5,000

$15,000

$25,000

$35,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Los Angeles Benchmark GEP

25

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

This page intentionally left blank.

26

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

University of California, Merced Foundation

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Regentally Managed Funds

General Endowment Pool $5,080 100.0%

Total Regentally Managed Funds $5,080 100.0%

TOTAL ENDOWED ASSETS $5,080 100.0%

Endowment Investment Objective: UC Merced Foundation’s

investment objectives are: (1) provide investment earnings

adequate to secure the benefits promised and the financial

obligations created by the endowment, and (2) secure,

preserve, and increase the inflation-adjusted value of the Fund.

Endowment Spending Policy: Long-term total return

target spending rate of 4.75% of a 60-month (five-year)

rolling average market value. A spending rate of 4.75%

was adopted in May 2006 for expenditures in fiscal year

2006-2007, 2007-2008, 2008-2009, and 2009-2010.

Policy for Gift Fees and Administrative Expenses: The

University expects that funds privately raised shall support

the development activities of the Chancellor and his staff.

Currently, the University policy to effectuate this principle is

the following: Upon the receipt of all gifts to UCM or the UCM

Foundation, a fee of 5% of the initial value of the gift shall be

assessed and deposited in the Chancellor’s Discretionary Fund

and shall support the necessary operations for the development

function within the Chancellor’s campus administration. The

fee may be taken (1) from the principal if specified by the donor,

(2) by holding the gift in a suspense account until fee is earned

or (3) from another acceptable fund source. Additionally, all of

the STIP income earned on endowments, funds functioning as

endowments and non-endowment gifts shall also be deposited

into the Chancellor’s Discretionary Fund. The Vice President

for Administration shall provide for a scheduled annual

distribution of income and shall assess initial fees on gifts for

deposit in the Chancellor’s Discretionary Fund. The Chancellor

shall waive the assessment of the off-the-top fee on ongoing

interest earnings only in the event that a donor organization

has a written policy which prohibits such fees.

Any waiver shall be communicated in writing from the

Chancellor to the Vice Chancellor for Administration. It is

the responsibility of the Vice Chancellor for Advancement to

establish an appropriate method for notifying donors to the

University and the University Foundation of the fee assessment

and its purposes.

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010

Managed Endowed Funds by Asset Class

as of June 30

U.S. Equity U.S. Fixed Income

Non-U.S. Equity Non-U.S. Fixed Income

Alternative Equity Absolute Return

Cash

27

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

University of California, Merced Foundation

Annual Endowment Returns for Years Ending June 30

University of California, Merced Foundation, Foundation Benchmark and GEP

Seven-Year Performance of a $10,000 Gift

University of California, Merced Foundation, Foundation Benchmark and GEP

Ending Values 2010 Annualized Returns 2003-2010

Merced Benchmark GEP Merced Benchmark GEP

$15,165 $15,586 $15,164 6.1% 6.5% 6.1%

2003 2004 2005 2006 2007 2008 2009 2010

Merced 5.4% 14.7% 10.3% 11.5% 19.8% -1.5% -18.2% 11.3%

Benchmark 5.0 14.6 9.5 11.0 18.1 0.0 -13.1 9.1

GEP 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

-20%

-10%

0%

10%

20%

$5,000

$15,000

$25,000

$35,000

2003 2004 2005 2006 2007 2008 2009 2010

Merced Benchmark GEP

28

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

UC Riverside Foundation

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Externally Managed Funds

International Equity Funds

Oberweis China Opportunities $1,941 2.7%

Janus Overseas 3,814 5.2

Goldman Sachs BRIC 886 1.2

Balanced Funds

TIFF Multi Asset Fund 30,827 42.4

Ivy Asset Strategy 4,191 5.8

First Eagle Global 6,290 8.6

Blackrock Global Allocation 4,089 5.6

Other Equities

Park Street Natural Resources 450 0.6

U.S. Global Resources 4,181 5.7

High Yield Bonds

Fidelity Capital & Income 7,525 10.3

Pioneer Global High Yield 7,589 10.4

Total Externally Managed Funds $71,783 98.6%

Regentally Managed Funds

Short Term Investment Pool 966 1.3

Total Regentally Managed Funds $966 1.3%

Other Endowed Assets $22 0.0%

(primarily real estate, art and receivables)

TOTAL ENDOWED ASSETS $72,771 100.0%

Endowment Investment Objective: The Riverside Foundation’s

long-term investment objectives of the endowment fund are

to produce a relatively predictable and stable payout stream

each year and to grow both the payout stream and the corpus

over time at least as fast as the general rate of inflation, as

measured by the Consumer Price Index. The investment policy

consists of allowable ranges: 50-90% Global Equity and 10-

50% Global Bonds.

Endowment Spending Policy: The endowment fund payout

policy is 4.75% of the average endowment fund market value

computed using the previous 12 quarters of portfolio activity

the last of which ended on the March 31 of such fiscal year.

Policy for Gift Fees and Administrative Expenses: A one-time

Gift Service Fee of 5% is charged on all cash gifts received by

the University based on the principal value of the gift. The fee

is collected either from the initial interest/income earned by

the gift, directly from the gift principal or the recipient of the

gift may provide the fee from another acceptable fund source.

An Administration Cost Recovery Fee is charged against all

existing endowments and endowment-related gift funds at an

annual rate of .50% (50 basis points) of the average rolling

market value of funds eligible invested assets as calculated per

the UCR Foundation spending policy. Campus collects 100%

of short-term ordinary income on campus and Foundation

current fund balances. All proceeds from fees become a

Chancellorial resource intended to help defray development

and gift administration costs.

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010

Managed Endowment Funds by Asset Class

as of June 30

U.S. Equity U.S. Fixed Income

Non-U.S. Equity Non-

U.S. Fixed Income

Alternative Equity Absolute Return

Cash

29

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

UC Riverside Foundation

Annual Endowment Returns for Years Ending June 30

UC Riverside Foundation, Foundation Benchmark and GEP

Ten-Year Performance of a $10,000 Gift

UC Riverside Foundation, Foundation Benchmark and GEP

Ending Values 2010 Annualized Returns 2001-2010

Riverside Benchmark GEP Riverside Benchmark GEP

$16,992 $13,690 $13,467 5.4% 3.2% 3.0%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Riverside

1

0.5% -4.1% 4.1% 18.1% 11.3% 14.2% 21.7% 2.8% -22.1% 15.8%

Benchmark -4.8 -7.8 2.1 18.0 10.4 13.6 20.2 -4.5 -19.4 11.5

GEP -6.9 -9.5 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

1

The Riverside Foundation’s net total return data excludes a portion of Other Endowed Assets for all periods.

-30%

-20%

-10%

0%

10%

20%

30%

$5,000

$15,000

$25,000

$35,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Riverside Benchmark GEP

30

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

U.C. San Diego Foundation

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Externally Managed Funds

Large-Cap U.S. Equity Funds

iShares S&P 500 Index $20,255 6.4%

Mid & Small-Cap U.S. Equity Funds

Vanguard MidCap Index Institutional 6,753 2.1

Vanguard SmallCap Index Fund Institutional 7,489 2.4

International Equity Funds

SSgA MSCI EAFE Index Fund 8,651 2.7

Emerging Market Equity Funds

Vanguard Emerging Market 5,488 1.7

Other Equities

Vanguard Inflation Protected Securities 9,151 2.9

iShares Cohen & Steers Realty Majors REIT 6,559 2.1

Fixed Income

America Movil Bond 341 0.1

U.S. Mex Bond 381 0.1

Real Estate

Prudential PRISA Fund 5,201 1.7

Cash

Cash equivalents held in managed accounts 2 0.0

Total Externally Managed Funds $70,271 22.2%

Internally Managed Funds

Individual Securities 109 0.0%

Real Property 855 0.3

Total Internally Managed Funds $964 0.3%

Regentally Managed Funds

General Endowment Pool 220,014 69.5%

UC Absolute Return Fund 13,020 4.1

UC Real Estate Fund 3,354 1.0

Short Term Investment Pool 594 0.2

UC Vintage Equity Fund 2003 3,487 1.1

UC Vintage Equity Fund 2007 3,671 1.2

Total Regentally Managed Funds $244,140 77.1%

Other Endowed Assets

Art Work 19 0.0%

Partnership 1,297 0.4%

Other 37 0.0%

Total Other Endowed Assets $1,353 0.4%

TOTAL ENDOWED ASSETS $316,728 100.0%*

Endowment Investment Objective: The U.C. San Diego

Foundation’s primary investment goal for its endowment is to

maximize long-term total return, utilizing a diversified portfolio

consistent with prudent levels of risk. Endowment portfolio

performance is expected to preserve or enhance the real value

of the endowment and the purchasing power of the spending.

The portfolio return goal is to achieve an annualized total net

return at least equivalent to, and preferably exceeding, the

endowment spending rate plus inflation, over rolling five and

ten year periods. The investment policy target asset allocation

is 24% U.S. Equity, 22% Non-U.S. Equity, 7% Private Equity,

20% Absolute Return, 10% Real Estate, 7% TIPS/Real Return,

and 10% Fixed Income.

Endowment Spending Policy: Endowment spending during

fiscal year 2009-10 was calculated using a predetermined

formula at an amount equal to 3.75% of the five–year average

unit market value of the endowment portfolio. Spending is

allocated to fund holders monthly.

Policy for Gift Fees and Administrative Expenses: During fiscal

year 2009-10, the San Diego campus assessed a one-time fee of

6% on the initial value of all gifts made to either the Foundation

or The Regents. There was also a recurring charge of 0.40%

annually on the market value of the Foundation’s endowment

funds. All of the gift fees and the endowment fees were used

to provide funding for the centrally managed fundraising and

related operations of the campus. During fiscal 2009-10, the

campus assessed all interest earned on the balances of current

use gift and private grant funds held by both the Foundation

and the campus, which became a chancellorial resource.

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

2010

Managed Endowment Funds by Asset Class

as of June 30

U.S. Equity U.S. Fixed Income

Non-U.S. Equity

Non-U.S. Fixed Income

Alternative Equity Absolute Return

Cash

* The method of rounding may produce the appearance of a minor inconsistency

in the percentage but the difference does not affect the accuracy of the data.

31

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

U.C. San Diego Foundation

Annual Endowment Returns for Years Ending June 30

U.C. San Diego Foundation, Foundation Benchmark and GEP

Ten-Year Performance of a $10,000 Gift

U.C. San Diego Foundation, Foundation Benchmark and GEP

Ending Values 2010 Annualized Returns 2001-2010

San Diego Benchmark GEP San Diego Benchmark GEP

$13,158 $13,762 $13,467 2.8% 3.2% 3.0%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

San Diego

1

-6.9% -9.5% 5.2% 14.5% 10.2% 11.7% 19.3% -1.5% -20.5% 12.7%

Benchmark -5.9 -7.7 5.2 15.3 10.3 11.1 18.1 0.0 -18.3 10.7

GEP -6.9 -9.5 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

1

The U.C. San Diego Foundation’s net total return data excludes Other Endowed Assets for all periods.

-30%

-20%

-10%

0%

10%

20%

30%

$5,000

$15,000

$25,000

$35,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

San Diego

Benchmark

GEP

32

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

Endowment Investment Objective: The San Francisco

Foundation’s primary investment objective for its endowment

portfolio is growth of principal sufficient to preserve purchasing

power and to provide income to support current and future

University activities. Over the long term, it is the goal of the

Foundation that the total return on investment assets should

equal the rate of inflation, plus the payout rate (which is used

to support current activities), plus an amount reinvested to

support future activities.

Endowment Spending Policy: A portion of the endowment pool

will be expended annually. The amount of the distribution will

be determined by the payout policy of the Foundation, modified

by donors’ wishes where applicable. The Foundation policy is

to distribute 5% of the market value of the endowment pool

calculated on a 36-month rolling average of the market value,

subject to a 6% cap and a 3.5% floor as a percent of the end of

year endowment pool market value. The payout rate is reviewed

annually, which may result in modification. The payout is

distributed once a year following the close of the fiscal year.

Undistributed income and gains from investment activities are

reinvested in the Endowment Pool.

Policy for Gift Fees and Administrative Expenses: The

University of California, San Francisco Foundation assesses a

one-time fee of 4% of the initial value of gifts. The University

also assesses a 1% spending fee at the time that funds are

spent for purpose. Gifts for student aid and capital gifts are

exempted from these fees. An annual administrative fee of 40

basis points is charged on endowment funds administered by

the Foundation. In addition, the University assesses a recurring

charge of 100% of interest income earned on current funds

(STIP income). Fees are used by the University to fund central

infrastructure costs, including development and gift and

endowment administration.

University of California, San Francisco Foundation

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Externally Managed Funds

Large Cap Value

Dodge & Cox $30,251 5.9%

Vanguard S&P 500 Index 22,208 4.4

Mid Cap

ValueAct Capital Intl II 10,911 2.1

All Cap

Eagle Capital Management 19,531 3.8

International Equity Funds

Capital Guardian Trust 3 0.0

Gryphon International 25,752 5.0

Silchester 29,152 5.7

Dodge & Cox International Fund 22,618 4.4

International Emerging Equity

Tiedemann Long Duration 6,447 1.3

Westwood Global Invest. Emerging Mkts 17,389 3.4

Aberdeen Emerging Markets 13,601 2.7

Real Estate & Hard Assets

Metropolitan RE Partners III 2,659 0.5

Metropolitan RE Partners Intl II 829 0.2

Shorenstein SRI Nine REIT 1,009 0.2

CommonFund Capital Natural Res. V 1,625 0.3

Denham Commodity Fund V 1,512 0.3

LBA Realty IV 548 0.1

Cambrian Capital Natural Resources 9,508 1.9

PIMCO Commodity Real Return 10,258 2.0

Private Equity--Venture Capital, Distressed Debt

Oaktree Principal Opportunity Fnd III 3,821 0.7

Oaktree Principal Opportunity Fnd IV 2,841 0.6

CommonFund Capital EVP IV 1,282 0.3

CommonFund Capital EVP V 2,227 0.4

CommonFund Capital CVP VI 2,605 0.5

Burrill Biotech Capital Fund LP 767 0.2

TIFF Private Equity Partners 2007 2,097 0.4

TIFF Private Equity Partners 2008 1,457 0.3

Friedman Fleisher & Lowe Cap. Partn. III 556 0.1

Varde Partners Fund IX-A 6,464 1.3

Varde Partners Fund X-B 1,498 0.3

Hedge Fund

Protégé Partners LTD 7,180 1.4

TIFF Absolute Return Fund II 14,891 2.9

Farallon Capital Partners 11,841 2.3

Canyon Value Realization Fund 14,085 2.8

Forrester Offshore - Long/Short 16,494 3.2

Watershed Institutional Partners 11,488 2.3

Sankaty-Prospect Harbor Fund 8,666 1.7

Regiment Capital Special Situations IV 1,839 0.4

Brookside Capital Partners Fund 10,360 2.0

Baupost Value Partners IV 35,670 7.0

Bond Fund

Dodge & Cox 63,033 12.4

Vanguard Inflation Protected 20,219 4.0

Non-U.S. Bond Fund

Colchester Global 10,213 2.0

Cash 32,625 6.4

Total Externally Managed Funds $510,030 100.0%

TOTAL ENDOWED ASSETS $510,030 100.0%

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010

Managed Endowment Funds by Asset Class

as of June 30

U.S. Equity U.S. Fixed Income

Non-U.S. Equity Non-U.S. Fixed Income

Alternative Equity Absolute Return

Cash

33

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

University of California, San Francisco Foundation

Annual Endowment Returns for Years Ending June 30

San Francisco Foundation, Foundation Benchmark and GEP

Ten-Year Performance of a $10,000 Gift

San Francisco Foundation, Foundation Benchmark and GEP

Ending Values 2010 Annualized Returns 2001-2010

San Francisco Benchmark GEP San Francisco Benchmark GEP

$13,894 $12,203 $13,467 3.3% 2.0% 3.0%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

San Francisco

1

-1.5% -6.8% 0.9% 17.2% 10.1% 11.3% 18.2% -7.5% -16.5% 14.4%

Benchmark -6.1 -9.1 4.3 17.2 11.1 10.5 17.1 -6.2 -21.9 11.0

GEP -6.9 -9.5 5.4 14.7 10.3 11.5 19.8 -1.5 -18.2 11.3

1

The UC San Francisco Foundation’s net total return data excludes Other Endowed Assets for all periods.

$5,000

$15,000

$25,000

$35,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

San Francisco Benchmark GEP

-

30%

-

20%

-

10%

0%

10%

20%

30%

34

UC Annual Endowment Report

Fiscal Year Ended June 30, 2010

UC Santa Barbara Foundation

6/30/10 % Endowment

Market Value Funds

($ 000)

ENDOWED ASSETS

Externally Managed Funds

Equity Funds

American Fund $160 0.2%

Andron Fund 1,165 1.2

Long Term Investment Pool 96,435 97.5

Total Externally Managed Funds $97,760 98.8%

Regentally Managed Funds

General Endowment Pool 0 0.0

Short Term Investment Pool 1,169 1.2

Total Regentally Managed Funds $1,169 1.2

TOTAL ENDOWED ASSETS $98,929 100.0%

Endowment Investment Objective: All new endowment gifts are

deposited into the Foundation’s Long Term Investment Pool (LTIP),

held primarily at Goldman Sachs with State Street Bank & Trust

serving as master custodian. Endowment funds are invested in

accordance with the Uniform Prudent Management of Institutional

Funds Act (UPMIFA) and the Endowment Investment Spending

Policies and Guidelines, as adopted by the Board of Trustees.

The Foundation’s investment objects are: 1) Preserve investment

capital and its purchasing power; 2) Generate sufficient resources

to meet spending needs (payouts); and 3) Attain reasonable capital

appreciation through prudent acceptance of risk to enhance the

future purchasing power of the investment capital.

Endowment Spending Policy: The UC Santa Barbara Foundation

adopted UMIFA at the Board meeting in October 1997.In February

2009, the Board adopted UPMIFA. At their February 2008 Board

meeting, the Foundation adopted a total return spending policy

for the 2009-2010 Fiscal Year of 4.75% of the 60-month rolling

average share value as of December 31, 2008, for the Long Term

Endowment Pool/General Endowment Pool.

Policy for Gift Fees and Administrative Expenses: During fiscal

year 2009-10, the Santa Barbara campus did not assess a one-time

fee on the initial value of all gifts made to either the Foundation

or The Regents. The campus implemented a 2% one-time fee

on the initial value of all gifts made to either the Foundation or

The Regents effective July 1, 2010. During fiscal year 2009-10,

the campus charged an Endowment Cost Recovery fee of 0.45%

based upon the market value of the Foundation’s (and The

Regents’) endowment funds that was used to partially offset the

direct operating costs of managing the endowment. During fiscal

2009-10, the campus assessed all STIP interest earned on the

expendable balances of gift and private grant funds held by both

the Foundation and the campus. All of these recurring charges

were used to provide funding for centrally managed fundraising