DFDS ANNUAL REPORT

2 DFDS ANNUAL REPORT 2011

HEADER

DFDS IS NORTHERN EUROPE’S LARGEST INTEGRATED

SHIPPING AND LOGISTICS COMPANY.

DFDS SEAWAYS OPERATES A NETWORK OF 25 ROUTES

WITH 50 FREIGHT AND PASSENGER SHIPS, WHILE DFDS

LOGISTICS PROVIDES FREIGHT SOLUTIONS IN EUROPE WITH

TRAILERS, CONTAINERS, AND RAIL.

DFDS HAS 5,100 EMPLOYEES IN 20 COUNTRIES WITH

REVENUES OF EUR 1.6 BN. THE COMPANY WAS FOUNDED

IN 1866, IS HEADQUARTERED IN COPENHAGEN, AND LISTED

ON NASDAQ OMX COPENHAGEN.

3DFDS ANNUAL REPORT 2011

HEADER

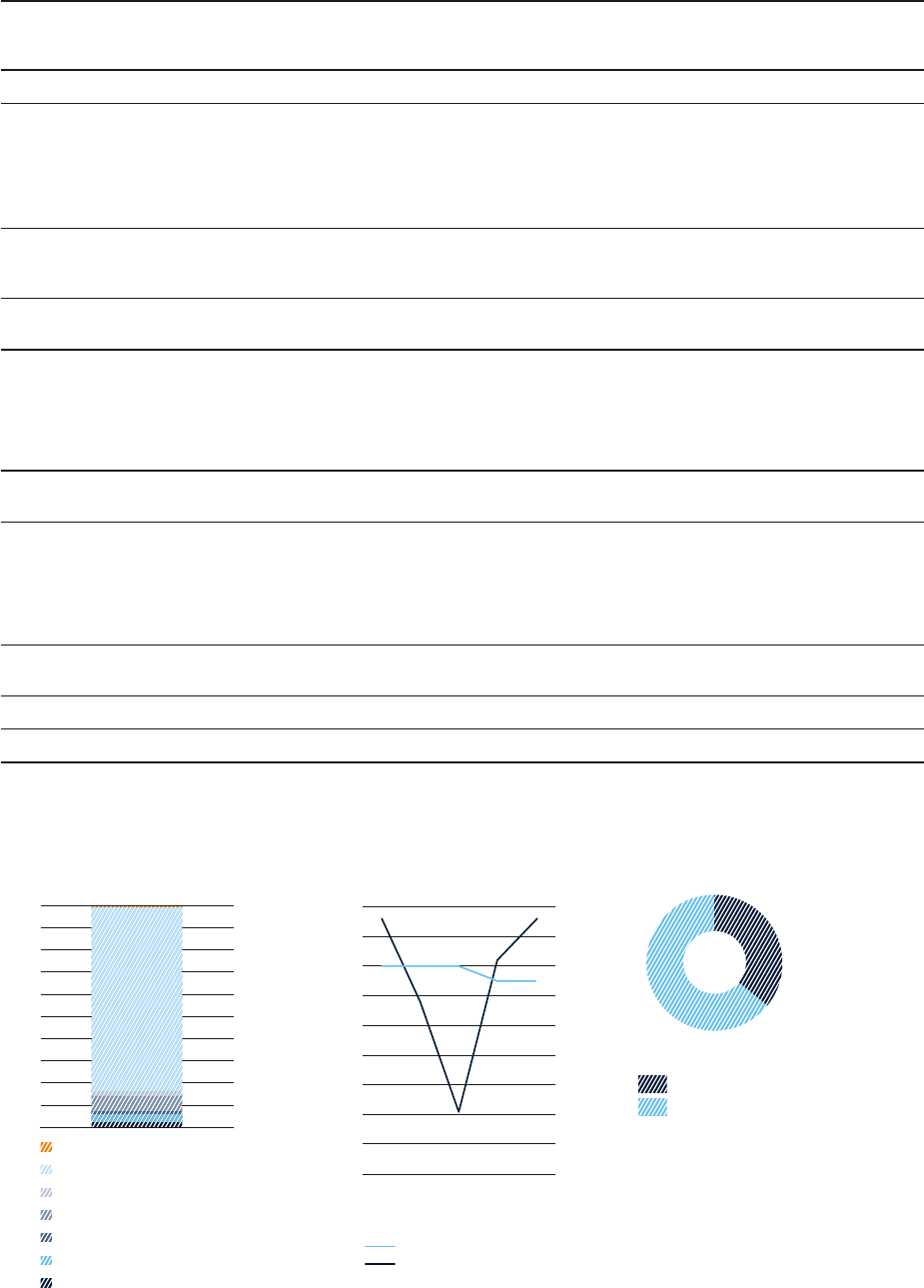

REVE NUE

(DKK bn)

5

4

3

2

1

6

7

8

10

12

11

0

9

2010

2009

2007

2008

2011

DFDS GROUP, PRE-TAX PROFIT

(DKK M)

500

400

300

200

100

800

700

600

0

2010

2007

2008

2009

2011

RETURN ON INVESTED CAPITAL (ROIC)

(%)

5

4

3

2

1

6

7

8

9

10

00

2010

2007

2008

2009

2011

4

5

6

8

9

10

17

18

20

26

33

36

38

56

62

63

64

66

70

71

122

123

124

126

128

130

MANAGEMENT REPORT

Key Figures

Foreword

Connecting Europe

Vision, strategy and goals

Market and competitors

Management report

Growth Strategy

The DFDS Way

Shipping Division

Logistics Division

Risk factors

Shareholder information

CR Report

Financial Review

FINANCIAL STATEMENTS

Income statement

Comprehensive income

Balance sheet

Statement of changes in equity

Cash flow statement

Notes

DFDS Group Companies

Statements

MANAGEMENT REPORT, OTHER

Fleet List

Commercial duties

Executive Managment

Definitions & Glossary

4 DFDS ANNUAL REPORT 2011

KEY FIGURES DFDS GROUP

KEY FIGURES

DKK MILLION

2011

EUR m

1

2011 2010 2009 2008 2007

Income statement

Revenue

2

1,560 11,625 9,867 6,555 8,194 8,310

1,047 7,798 6,921 4,805 - -

581 4,330 3,353 1,970 - -

68 503 407 220 668 720

- - - - 3,799 3,680

- - - - 1,636 1,623

- - - - 1,779 1,932

- - - - 647 703

- - - - 963 986

- - - - 38 106

Operating profit before depreciation EBITDA

2

201 1,495 1,273 804 1,011 1,311

190 1,416 1,221 822 - -

23 171 74 42 - -

12 92 22 60 56 62

- - - - 784 914

- - - - 81 133

- - - - 194 249

- - - - 31 12

- - - - 31 56

- - - - 8 9

Profit on disposal of non-current assets, net 3 26 5 18 45 37

Operating profit EBIT before special items 112 835 580 245 467 758

Special items 12 91 102 71 n.a. n.a.

Operating profit EBIT 124 925 682 174 467 758

Financing, net 25 183 135 154 246 232

Profit before tax 100 742 547 20 221 526

Profit for the year 99 735 522 89 253 412

Profit for the year after minority interests 98 731 509 86 247 400

Profit for analytical purposes 96 716 507 23 227 485

Capital

Total assets 1,717 12,795 13,849 9,298 8,610 9,610

DFDS AS’ share of the equity 927 6,906 6,339 3,641 3,414 3,538

Total equity 935 6,964 6,396 3,688 3,484 3,653

Net interest bearing debt 343 2,555 3,887 4,067 3,425 3,828

Invested capital, average 1,348 10,042 9,061 7,762 7,663 8,107

Average number of employees - 5,096 4,862 3,924 4,301 4,427

Cash flow

Cash flow from operating activities before finance and after tax 191 1,419 929 836 983 1,264

Cash flow from investments 29 219 1,521 1,265 345 151

Acquisition of companies, activities and minority interests 1 8 1,417 39 40 35

Other investments 30 227 104 1,226 305 116

Free cash flow 220 1,638 592 429 638 1,113

Operations and return

Number of operating ships 49 57 51 60 64

Revenue growth, % 17.8 50.5

3

20.0 1.4 10.5

EBITDA-margin, % 12.9 12.9 12.3 12.3 15.8

Operating margin, % 8.0 6.9 2.7 5.7 9.1

Invested capital turnover rate, times 1.16 1.09 0.84 1.07 1.03

Return on invested capital ROIC p.a., % 8.6 7.2 2.1 5.8 8.6

Return on equity p.a., % 10.8 10.2 0.7 6.5 14.5

Capital and per share

Equity ratio, %

54.4 46.2 39.7 40.5 38.0

Financial gearing, times

0.37 0.61 1.12 1.00 1.08

Earnings per share EPS, DKK

50 47 11 32 52

Dividend per share, DKK

14.0 8.0 0.0 0.0 15.0

Number of shares at the end of the period, '000

14,856 14,856 8,000 8,000 8,000

Share price at the end of the period, DKK 355 418 358 399 790

Market value, DKK mill. 5,274 6,210 2,864 3,192 6,320

1

Applied exchange rate for euro as of 31 December 2011: 7,4505

2

During 2010 a new business area structure was introduced and comparative figures per business area are only available from 2009.

3

37% relates to the acquistition of the NorfolklineGroup.

4

Includes two newbuildings for delivery in 2012

5DFDS ANNUAL REPORT 2011

FOREWORD

STRONG 2011 READY FOR

CHALLENGING 2012

Goals for 2011 achieved

In 2011, we succeeded in achieving our

two most important strategic objec-

tives: The planned synergies from the

integration of Norfolkline were reached,

and more, and the earnings from logistics

activities improved significantly.

Record results increase dividend

Annual pre-tax profit for the DFDS Group

was a record DKK 742m. Activities that

do not support Group strategy were dive-

sted, and DFDS entered 2012 as a more

focused and financially strong company.

Without compromising our capacity

to fund future growth, we propose to

increase the annual dividend to DKK 14

per share, equivalent to a payout of DKK

208m.

Contingency for possible mild

recession in 2012

DFDS is strongly positioned, but there

is evidence to suggest that 2012 will

be impacted by a mild recession. In the

first months of the year, demand in the

markets around the North Sea has been

declining, while the Baltic area remains

robust, driven by growth in Russia and

the surrounding countries.

Since August 2011, we have been work-

ing on a contingency plan to address any

decline in freight volumes, which are es-

sential for our financial performance. We

have a plan, and the organisation is ready

to meet any new challenges.

New routes, new competition

The Baltic route network was expan-

ded by two new routes in 2011, and in

February 2012, we launched a new route

between Dover and Calais. Following the

opening of a new competing route in Ja-

nuary 2012, competition has increased in

the freight market between Sweden and

the UK. A number of initiatives have been

launched to meet the new competition.

Just as DFDS is in motion, so is the world

around us.

We are moving closer to our customers

In 2012, DFDS will move even closer

to our customers. To improve customer

service and add value to customers, we

are striving to optimise our understan-

ding of customer needs and execution of

customer service. The Customer Focus

improvement project will start at the

beginning of Q2. The project will involve

the whole Group, and preparations are

underway.

Adding value through social

responsibility

DFDS’s first comprehensive report on

corporate responsibility CR is contained

in this annual report. Continued develop-

ment of DFDS’ role as a responsible

corporate citizen should contribute to ad-

ding value to our customers, employees,

partners, shareholders and other stake-

holders, as well as to the environment.

Our ambition is to be our stakeholders’

preferred partner.

DFDS is ready for new growth

Market conditions in 2012 are expected

to be less favourable than in 2011. We

therefore foresee limited organic growth

– but, on the other hand, we envisage

opportunities to grow through acquisiti-

ons. DFDS is ready for new growth, also

financially.

A huge effort from our staff, close col-

laboration with our partners, and, not

least, our loyal customers have enabled

us to make much greater progress than

anticipated in 2011. Thank you all for

your contribution and co-operation.

NIELS SMEDEGAARD

President & CEO

BENT ØSTERGAARD

Chairman of the board

6 DFDS ANNUAL REPORT 2011

HEADER

ALMA-ATA

ILYTCHOVSK

MINSK

HELSINKI

HALLSBERG

STOCKHOLM

TAULOV

TRONDHEIM

LÜBECK

VERONA

BARI

DAVENTRY

BALLINA

Rail Service 26.10.2011

GRANGEMOUTH

HANNOVER

UST-LUGA

ST. PETERSBURG

RIGA

PALDISKI

KLAIPEDA

SASSNITZ

COPENHAGEN

FREDERICIA

ESBJERG

AARHUS

KARLSHAMN

GOTHENBURG

KAPELLSKÄR

KRISTIANSAND

BREVIK

OSLO

BERGEN

SKOGN

HAMBURG

CUXHAVEN

KIEL

ANTWERP

ROTTERDAM (VLAARDINGEN)

AMSTERDAM (IJMUIDEN)

BRUGGE

ZEEBRUGGE

FAGNANO (VA)

BILBAO

CALAIS

DUNKIRK

DOVER

CHATHAM

TILBURY

FELIXSTOWE

AVONMOUTH

IMMINGHAM

LIVERPOOL

NEWCASTLE

ROSYTH

CLYDEPORT

GREENOCK

WATERFORD

DUBLIN

BELFAST

HARWICH

GHENT

HALDEN

MOSS

BOULOGNE SUR MER

BRUGGE

RATTINGEN

RHOON

HAMINA

IPSWICH

PETERBOROUGH

HELSINGBORG

MOSCOW

LARKHALL

CONNECTING EUROPE

The network combines sea and land transport. 80% of revenues are

generated by freight and 20% by passengers.

The route network comprise routes dedicated to freight and routes

combining passengers and freight. An important success factor is

deployment of ships that satisfies customer’s needs and demand on

individual routes allowing for a combination of satisfied customers

and sound finances.

On the freight side DFDS’ organisation includes local sales offices

and own transport companies. The latter are mostly specialised in

transport solutions combining several modes of transport – sea, road

and rail.

Passenger trips are increasingly sold via the internet, where our goal

is to make it as easy and inspiring as possible for customers to book

their ideal trips.

The capacity of the largest freight ships is 3,0005,000 lanemetres

of freight, while the capacity on combined ships is 1,5003,000

lanemetres. These ships typically have room for 6001,200

passengers. Passenger ships typically have room for 1,5002,000

passengers with a capacity for freight of 1,0001,500 lanemetres.

DFDS’ TRANSPORT NETWORK IS

DRIVEN BY 5,100 EMPLOYEES

CREATING SOLUTIONS FOR FREIGHT

CUSTOMERS AND PASSENGERS

7DFDS ANNUAL REPORT 2011

HEADER

ALMA-ATA

ILYTCHOVSK

MINSK

HELSINKI

HALLSBERG

STOCKHOLM

TAULOV

TRONDHEIM

LÜBECK

VERONA

BARI

DAVENTRY

BALLINA

Rail Service 26.10.2011

GRANGEMOUTH

HANNOVER

UST-LUGA

ST. PETERSBURG

RIGA

PALDISKI

KLAIPEDA

SASSNITZ

COPENHAGEN

FREDERICIA

ESBJERG

AARHUS

KARLSHAMN

GOTHENBURG

KAPELLSKÄR

KRISTIANSAND

BREVIK

OSLO

BERGEN

SKOGN

HAMBURG

CUXHAVEN

KIEL

ANTWERP

ROTTERDAM (VLAARDINGEN)

AMSTERDAM (IJMUIDEN)

BRUGGE

ZEEBRUGGE

FAGNANO (VA)

BILBAO

CALAIS

DUNKIRK

DOVER

CHATHAM

TILBURY

FELIXSTOWE

AVONMOUTH

IMMINGHAM

LIVERPOOL

NEWCASTLE

ROSYTH

CLYDEPORT

GREENOCK

WATERFORD

DUBLIN

BELFAST

HARWICH

GHENT

HALDEN

MOSS

BOULOGNE SUR MER

BRUGGE

RATTINGEN

RHOON

HAMINA

IPSWICH

PETERBOROUGH

HELSINGBORG

MOSCOW

LARKHALL

PORTS OF CALL & SALES AGENCIES

LOGISTICS OFFICES

RAIL SERVICES

ALMA-ATA

ILYTCHOVSK

MINSK

HELSINKI

HALLSBERG

STOCKHOLM

TAULOV

TRONDHEIM

LÜBECK

VERONA

BARI

DAVENTRY

BALLINA

Rail Service 26.10.2011

GRANGEMOUTH

HANNOVER

UST-LUGA

ST. PETERSBURG

RIGA

PALDISKI

KLAIPEDA

SASSNITZ

COPENHAGEN

FREDERICIA

ESBJERG

AARHUS

KARLSHAMN

GOTHENBURG

KAPELLSKÄR

KRISTIANSAND

BREVIK

OSLO

BERGEN

SKOGN

HAMBURG

CUXHAVEN

KIEL

ANTWERP

ROTTERDAM (VLAARDINGEN)

AMSTERDAM (IJMUIDEN)

BRUGGE

ZEEBRUGGE

FAGNANO (VA)

BILBAO

CALAIS

DUNKIRK

DOVER

CHATHAM

TILBURY

FELIXSTOWE

AVONMOUTH

IMMINGHAM

LIVERPOOL

NEWCASTLE

ROSYTH

CLYDEPORT

GREENOCK

WATERFORD

DUBLIN

BELFAST

HARWICH

GHENT

HALDEN

MOSS

BOULOGNE SUR MER

BRUGGE

RATTINGEN

RHOON

HAMINA

IPSWICH

PETERBOROUGH

HELSINGBORG

MOSCOW

LARKHALL

8 DFDS ANNUAL REPORT 2011

VALUE PROPOSITION, STRATEGY AND GOALS

VALUE PROPOSITION,

STRATEGY AND GOALS

The DFDS value proposition

DFDS operates the widest and most

reliable integrated shipping and logistics

network in Europe.

Our customers value the easy access and

positive experience of our freight and pas-

senger services.

The people of DFDS continue to deliver

efficient and innovative transportation

services for our customers as they have

done since 1866.

Strategy principles

DFDS’ strategy is based on four principles:

1. Build European shipping and

logistics network

2. Integrated value-added solutions for

freight customers and passengers

3. Securing freight volumes through

logistics activities and strategic

port access

4. Constant focus on quality and

efficiency in operations.

Strategic priorities and focus

2011: Following the acquisition of Nor-

folkline in July 2010, integration became

DFDS’ highest strategic priority in 2011. The

results of the integration have fully met ex-

pectations and are described on page 1617.

Another priority in 2011 was to turn

around earnings from logistics activities.

This goal was achieved through an im-

provement of Logistics Division’s return

on invested capital to 9.7% from 27.7%

in 2010, corresponding to a turnaround

in operating profit EBIT before special

items of DKK 111m.

2012 The strategic priorities for 2012

focus on two areas:

– Achieving targets for improvement

and efficiency projects

– Ensuring that the organisation is ready

and able to adapt to market changes

on the basis of a contingency plan

– Opening of the new Dover-

Calais route

– Further development of two

new routes opened in the Baltic

Sea in 2011

– Proactive pursuit of consolidation

and expansion opportunities via the

acquisition of activities and companies

Efficiency strategy

DFDS’ operating model is based on

standardisation of the Group’s business

processes. In parallel with the integra-

tion of Norfolkline, the efficiency of the

organisation was improved by centra-

lising Group functions cutting across

business areas: IT, supply chain, technical

maintenance, manning of ships and fi-

nance. DFDS has a presence in around 20

countries, in several of which both freight

and passenger businesses are operated.

The previously separate administrative

functions have now been merged, or are

in the process of being merged, based on

a uniform concept for joint operations.

Since 2008, focused efficiency and

improvement projects have been an

integral part of DFDS’ strategy. In 2012,

four improvement and efficiency projects

will be launched, directed at improving

and streamlining the business unit Chan-

nel; efficiency in transport and logistics

activities; reducing the amount of funds

tied up in working capital; and improving

customer satisfaction and adding value

for customers. The projects are described

in greater detail on page 11.

Growth strategy

To offer transport customers more

efficient solutions, including wider

geographical coverage, DFDS’ strategy

is to expand the network of sea- and land

transport. Rolling out DFDS’ operating

model to more markets will also reduce

unit costs through economies of scale.

Expansion of both the sea- and land-

transport parts of the network will

mainly be achieved by the acquisition

of companies and activities, including

joint ventures. See also page 16.

Business structure

DFDS’ business structure consists of two

divisions: Shipping Division and Logistics

Division. Corporate functions are grouped

into two areas: People & Ships and Finance.

Sales of freight solutions that cut across

business areas and the network in general

are co-ordinated through Freight Sales

Solutions.

Corporate Responsibility CR strategy

To bring greater focus to DFDS’ CR work,

a CR strategy was drawn up in 2011.

CR governance via a new CR Commit-

tee reporting to Group Management will

embed the CR strategy in the organisa-

tion. The ambition is to continuously

create improvements through CR adding

value for DFDS’ stakeholders and support

DFDS’ position as their preferred partner.

Ongoing efforts to lessen environmental

impact are also included in the strategy.

See the complete CR report on p. 3855.

Financial objective

DFDS’ objective is a return on invested ca-

pital of approx. 10%. This can be compared

with the Group’s capital cost, which at the

beginning of 2012 was calculated at 6.5%.

The management report outlines the

current and long-term progress towards

reaching these targets.

9DFDS ANNUAL REPORT 2011

MARKET AND COMPETITORS

MARKET AND COMPETITORS

DFDS’ market

DFDS works as part of the European

transport sector, focusing on Northern

Europe, Eastern Europe and Russia.

DFDS’ routes link ports in the Baltic and

in the North Sea and combine transport

of freight and passengers, depending on

market requirements. DFDS operates

liner services with fixed schedules. DFDS’

transport and logistics activities prima-

rily operate in the same markets covered

by the route network. These services also

support the capacity utilisation of the

route network by specialising in transport

solutions that involve shipping.

DFDS’ competitors

DFDS’ routes compete with other ferry

operators in the North Sea and Baltic

Sea. The main competitors are Cobelfret,

Color Line, P&O Ferries, Stena Line and

Scandlines. The routes also compete with

alternative transport modes, ie. road and

rail, and air transport for passengers. In ad-

dition comes the Eurotunnel on the Chan-

nel. DFDS’ transport and logistics activities

are primarily focused on full- and part-load

transport to markets around the North Sea.

The main competitors are major European

haulage companies such as DHL, DSV and

Kuhne & Nagel, as well as regional and

niche-oriented forwarders and hauliers.

DFDS’ OPERATING MODEL COMBINES SHIPPING AND LAND

TRANSPORT OF FREIGHT AND PASSENGERS. APPROXIM-

ATELY 80% OF REVENUES ARE GENERATED BY FREIGHT

Market development

The shipping segment of the Northern

European passenger market slowed down

in most areas, with an overall decline of

0.5%. The decline on the Channel was pri-

marily due to the more aggressive pricing

policy adopted by Eurotunnel. The total

number of passengers on the Dover Strait

rose by 2.2% in 2011. On the freight

market growth was positive in the Baltic

Sea and declining in the North Sea. The

latter was affected by DFDS’ reduction of

capacity through the consolidation of two

routes. On the Dover Strait, the number of

freight units rose by a total of 5.5%, split

between zero growth in the ferry market

and an increase of 16.0% in Eurotun-

nel’s volumes, driven by an aggressive

pricing policy aimed at achieving a higher

market share.

NORTHERN EUROPE: INTERNATIONAL PASSENGER AND FREIGHT VOLUMES

Passengers Freight units*

2011 2010 ∆ 1110 2011 2010 ∆ 1110

Baltic North 18.0 17.8 1.2% 0.6 0.6 6.5%

Baltic South 11.2 11.4 1.2% 1.8 1.7 4.6%

Kattegat 17.1 17.2 0.6% 0.8 0.8 0.3%

North Sea 2.2 2.2 0.3% 1.3 1.3 3.2%

English Channel, Dover Strait 12.7 12.9 1.7% 2.1 2.1 0.1%

English Channel, West 3.1 3.1 2.3% 0.3 0.3 2.7%

Total shipping 64.3 64.6 0.5% 6.8 6.8 1.0%

Great Belt Bridge 14.8 14.8 0.0% 0.4 0.3 9.1%

Eurotunnel 9.1 8.4 8.3% 1.3 1.1 16.0%

Total bridge and tunnel 23.9 23.2 3.0% 1.6 1.4 14.4%

Source: Shippax, own figures. Figures are incomplete as several shipping companies do not submit information.

* A freight unit corresponds to approx. 13 lane metres

Key customer groups Market segments Success criteria

FREIGHT

accompanied trailers)

industrial goods

automotive, steel, paper, chemicals

and manufacturers of refrigerated goods

contract logistics

PASSENGERS

and without a car

conferences

and safety

10 DFDS ANNUAL REPORT 2011

MANAGEMENT REPORT

MANAGEMENT REPORT

Financial performance

Pre-tax profit improved by 35,7% to DKK

742m.

The improved financial performance

reflects a general improvement in market

conditions in Northern Europe, Eastern

Europe and Russia, as well as positive

contributions from synergies and impro-

vement projects.

The market trend was positive in both

the Baltic Sea and the North Sea in H1. In

H2, market growth continued in the Baltic

Sea, while slowing in the markets around

the North Sea.

In addition, net income from Special

items was DKK 91m. These consisted of

large, non-recurring items, accounting

profits from the sale of activities and as-

sets, and integration and project costs.

Adjusted for special items, pre-tax profit

was DKK 651m, an increase of 46.3%

compared to 2010.

Performance improved in both divisions,

most markedly in Logistics, where a decisi-

ve turnaround was achieved. The Logistics

Division’s EBIT before special items rose

to DKK 109m, from DKK 2m in 2010. This

improvement was based on the realisation

of synergies, including the effects of the

Headlight improvement project.

The Shipping Division’s EBIT before spe-

cial items rose by 27.8% to DKK 847m,

from DKK 663m in 2010. The improve-

ment was primarily driven by market

growth, particularly in the Baltic Sea, and

from the realisation of synergies.

The pre-tax profit for 2011 of DKK 742m

was 6.0% higher than the most recent

expectations for financial performance,

which were for a pre-tax profit of DKK

700m.

Revenue for the year was DKK 11.6bn,

an increase of 17.8% compared to 2010.

This is primarily attributed to the full-ye-

ar effect of the acquisition of Norfolkline,

but also to organic growth, particularly

in freight activities. Revenue growth was

one percentage point lower than pre-

viously envisaged, due to changes in the

elimination of revenue between divisions.

The divisions’ revenues were therefore in

line with the previous expectations.

The average number of employees incre-

ased, primarily due to the full-year effect

of the acquisition of Norfolkline, by 4.8%

to 5,096 in 2011.

The Group’s total assets were reduced

by 7.6% to DKK 12.8bn at the end of

2011. The reduction is primarily due to a

lowering in net-interest-bearing debt to

DKK 2.6bn from DKK 3.9bn, a reduction

of DKK 1.4bn. The ratio between net-

interest-bearing debt and operating profit

EBITDA was therefore reduced to 1.7 by

year end. Equity was DKK 7.0bn at the

end of 2011, corresponding to an equity

ratio of 54.4%.

DFDS thus has a strong financial base for

generating new and profitable growth.

See page 1617 for further details of

DFDS’ growth strategy and the integration

of Norfolkline.

Business development and operations –

significant events

Sales of non-core activities: In order to

further focus the Group portfolio, three

activities that did not underpin the DFDS

strategy were sold in 2011:

The debt free selling price of DKK

110m yielded a profit of DKK 83m,

which is included in the income state-

ment under “Special items”.

sold in June. The debt free selling price

of DKK 182m yielded a profit of DKK

48m, which is included in the income

statement under “Special items”. The

port terminal was surplus to require-

ments after the integration with

Norfolkline.

were discontinued in Q3 2011, when

contracts were sold and chartered ves-

sels returned. This generated a profit of

DKK 5m.

Closure of unprofitable Irish routes and

sale of ships: Following the sale of two

routes on the Irish Sea in late 2010,

the two remaining routes DublinBir-

kenhead/Heysham, as well as a port

terminal in Dublin and sales operations,

were discontinued at the end of January

2011. The two routes had incurred

heavy losses due to significant over-

capacity on the Irish Sea, and it proved

impossible to develop a business plan

to improve results substantially. Nor

was it possible to sell off the routes.

The routes deployed three owned ves-

sels deployed, and a ro-pax ship was

transferred to the Baltic Sea, a ro-ro ship

was transferred to routes between Hol-

land and England, and a ro-pax vessel

was sold.

One-off costs totalling DKK 30m were

incurred in 2011 relating to the closure of

these activities. Proceeds from the sale of

a ship was DKK 179m and an accounting

gain of DKK 17m. Both items are included

under “Special items” in the income

statement.

New routes and more capacity in the

Baltic Sea: Continued improvement in the

economies of Russia and the neigh-

bouring countries led to sustained high

growth in the Baltic Sea freight market

in 2011, and the size and capacity of the

network of routes were expanded:

Klaipeda in Lithuania was upgraded

with the deployment of a newly charte-

red ro-pax ship in September 2011

Karlshamn in Sweden and Klaipeda in

Lithuania was increased in February

2011 with the reallocation of a ro-pax

ship from the Irish Sea

acquired between Kapellskär in Swe-

den and Paldiski in Estonia

HIGHER PROFIT DRIVEN BY INCREASED VOLUMES,

SYNERGIES AND MORE EFFICIENT OPERATIONS

11DFDS ANNUAL REPORT 2011

MANAGEMENT REPORT

2011 between Kiel in Germany and Ust

Luga in Russia

charter agreement with Polferries

on the route between Swinoujsce

in Poland and Ystad in Sweden was

terminated.

Approval of port agreement in Gothen-

burg: In October 2010, DFDS signed

a joint agreement with C. Ports SA to

acquire Älvsborg Ro/Ro AB, which has

signed a 25-year concession agre-

ement on the operation of the Älvsborg

and Arendal ro-ro port terminals in

Gothenburg. Ownership is split 65%

DFDS AS, 35% C. Ports SA. Completion

of the deal is subject to approval by

the competition authorities, which is

still pending.

Delivery of two new freight ships: As

part of an extension of co-operation bet-

ween DFDS and the Danish and German

defence forces regarding the supply

of ship capacity for military transport

newbuildings with a freight capacity of

3,000 lane metres will be delivered in

July and October 2012. They replace

two chartered ships, which will be

redelivered.

Passenger ship sold: The passenger

ship Princess Maria was chartered for

a three-year period, starting in April

2010, to Inflot Cruise and Ferry Ltd., a

company based in St. Petersburg, Rus-

sia. The agreement included a purchase

option, which was exercised in Q3 2011,

resulting in a profit of DKK 9m, which

has been posted under “Profits from the

sale of long-term assets”.

Important events after 2011

On 24 January 2012 a new freight route

opened between Gothenburg and Killing-

holme in direct competition with DFDS’

route between Gothenburg and Imming-

ham. The route was opened by a Swedish

forwarding company. It is expected that

the addition of capacity to the transport

market between Sweden and the UK

will entail a considerable negative profit

impact for DFDS in 2012.

In the beginning of February 2012, DFDS

and Louis Dreyfus Armateurs entered into

an agreement with the Port of Calais con-

cerning calling at Calais for the purpose

of opening a route between Calais and

Dover on 17 February 2012. Since the

opening, the route has been serviced by

one ship, NORMAN SPIRIT. Deployment of

an additional ship on the route is planned.

Improvement and efficiency projects

in 2011 and 2012

Since 2008, several major improvement

and efficiency projects have targeted are-

as where thorough changes are required

to improve performance. The projects

involve a combination of reducing costs,

improving sales work and customer ser-

vice and making organisational changes.

In 2011, focus was on two major improve-

ment and efficiency projects:

Project Headlight 1: Included eight

northern European locations in the

business areas Nordic Transport,

Continental Transport and European

Contract. The focus was on optimising

processes and policies for customer

service, operational planning, procu-

rement of haulage and establishing

a joint equipment pool. The target of

an annual improvement in earnings of

DKK 60m was achieved and forms part

of integration synergies

Project Light Crossing: Covers the

DoverDunkirk route, with a focus on

management processes, systems, reve-

nue optimisation, staffing and optimisa-

tion of bunker consumption. The project

is expected to be completed mid2012.

The target is an annual improvement in

earnings of up to DKK 75m.

In 2012, focus will be on four large impro-

vement and efficiency projects:

Project Headlight 2: The project will

be extended to cover the remaining 12

locations in the Logistics Division with

completion towards the end of 2012.

The target is an additional improve-

ment in earnings of up to DKK 40m

Project Light Crossing: As mentioned

above this project is expected to be

completed in mid2012

Project Customer Focus: The project

aim is to strengthen DFDS’ customer

relations on the basis of a better under-

standing of the context for purchasing

decisions and customer satisfaction re-

garding the service provided by DFDS.

It will also prioritise opportunities for

enhancing value creation for the custo-

mer. The results of the project are ex-

pected to become visible in 2013 as a

general increase in focus on customers,

attraction of new customers, improved

customer retention rates and a greater

degree of engagement with existing

customers. Efficiency of customer-

service processes is also expected

to improve

Project Light Capital: The project aims

to reduce cash tied up in working

capital. A target will be set in Q2 2012

and the first results are expected to be

achieved in Q3 2012.

CEO

FREIGHT SALES SOLUTIONS

HR CREWING TECHNICAL

PEOPLE & SHIPS

SUPPLY CHAIN IT FINANCE

FINANCE

NORDIC

TRANSPORT

CONTINENTAL

TRANSPORT

EUROPEAN

CONTRACT

INTERMODAL

NORDIC

CONTRACT

LOGISTICS DIVISION

NORTH SEA BALTIC SEA CHANNEL PASSENGER

SHIPPING DIVISION

12 DFDS ANNUAL REPORT 2011

Contingency plan for change in 2012

During the summer of 2011, renewed

uncertainty emerged about the economic

outlook in the financial markets. During

the second half of the year, growth in

freight volumes in the North Sea slowed

down. There are, however, still no signs of

a steep decline in freight volumes, as pre-

viously occurred in late 2008 and 2009.

Nonetheless, in August 2011, DFDS began

developing a contingency plan for any

such eventuality. The plan contains 54

measures aimed at mitigating the effects

of a decline in freight volumes of 5%,

10% or 20%. The actions include cost

cutting and structural changes, e.g. clo-

sing routes, the implementation of which

would be conditional on a substantial

decline in volume.

Financial objective

Return on invested capital ROIC, inclu-

ding special items, increased to 8,6% in

2011 from 7.2% in 2010. Excluding spe-

cial items, the return was 7.7% in 2011

compared to 6.1% in 2010.

The Group’s objective is to achieve a

return on invested capital of approx.

10%. DFDS’ cost of capital, or minimum

required rate of return, was calculated at

6.5% in early 2012.

The return on the Group’s invested capital

in 2012 is expected to be on a level with

the cost of capital. Logistics Division’s

return is expected to exceed the objec-

tive, while Shipping Division’s return is

expected to be below the objective.

It is thus first and foremost the Shipping

Division’s return that must be improved.

This improvement is to be generated

mainly by the business areas North Sea

and Channel, where the return in 2012 is

expected to be lower than 10%. One area

of particular focus will be the North Sea,

where approximately half of the Group’s

invested capital is deployed.

The North Sea achieved a satisfactory

level of return in 2011, but due to a com-

bination of declining volumes and greater

competition on routes between Sweden

and the UK, as well as rising variable cost

levels, it is envisaged that the return will

be reduced in 2012. The return on routes

between England and the Continent,

including investment in port terminals, is

also lower than the objective. To improve

the return, both measures to improve

operational efficiency and structural

measures are being considered.

Channel’s return was just 1.1% in 2011

due to a particularly difficult market and

competitive conditions. Price pressure in

the freight market was significant during

the year, due to SeaFrance’s struggle

to escape bankruptcy and Eurotunnel’s

pursuit of a higher market share. Higher

bunker costs also impacted earnings. A

stabilisation of the market situation on

the English Channel is expected to sup-

port a higher level of earnings.

Within the Logistics Division, returns for

Continental Transport and Intermodal are

expected to be lower than the objective

in 2012. In 2011, a significant turnaround

was achieved in Continental Transport’s

earnings, and this positive trend is

expected to continue in 2012, when a

return in line with the cost of capital is

expected. Intermodal’s return is also ex-

pected to improve in 2012, but achieving

a return in line with the objective will

require improvement to the still difficult

market conditions for container activities

between Ireland and the Continent.

BUSINESS MODEL, ASSETS AND

CAPITAL INTENSITY

The business model spans high

and low capital intensity

DFDS’ business model combines shipping,

forwarding and logistics, which involves

different capital intensity in the different

business areas: highest in shipping, lo-

west in forwarding/logistics. The turnover

rate of invested capital was thus 0.9

times in the Shipping Division in 2011,

and 4.6 times in the Logistics Division.

The difference in capital intensity bet-

ween the divisions is partly due to a high

share of owned assets in the Shipping

Division, primarily ships and port termi-

RETURN ON INVESTED CAPITAL ROIC 2011

Invested

capital,

DKK m ROIC 2011, %

Variance vs

capital cost

1

, %

Variance vs

objective

2

, %

Variance vs

objective, DKK m

DFDS Group 9,906 8.6 2.1 1.4 139

Divisions & business units

Shipping Division 8,865 10.2 3.7 0.2 18

North Sea 4,622 9.5 3.0 0.5 23

Baltic Sea 1,364 18.7 12.2 8.7 119

Channel 1,185 1.1 5.4 8.9 105

Passenger 1,140 11.9 5.4 1.9 22

Non-allocated items 744 5.0 11.5 15.0 112

Logistics Division 910 9.7 3.2 0.3 3

Nordic Transport 124 38.5 32.0 28.5 35

Continental Transport 161 5.5 1.0 4.5 7

European Transport 177 29.5 23.0 19.5 35

Intermodal 184 3.9 2.6 6.1 11

Nordic Contract 219 15.2 8.7 5.2 11

Non-allocated items 45 72.6 79.1 82.6 37

Non-allocated, Group 131 31.0 37.5 41.0 54

1

DFDS’ cost of capital was calculated at 6.5% beginning 2011

2

DFDS’ objective is a return of 10.0%

MANAGEMENT REPORT

13DFDS ANNUAL REPORT 2011

nals, contingent in part on their longevity.

The lifespan of ro-ro-based freight and

passenger tonnage is 2535 years, and

the duration of port-terminal leases is

typically 3050 years.

Ro-ro tonnage is also mostly built to meet

the needs of specific routes or regions. It is

therefore built to a lesser degree on spe-

culation as opposed to more standardised

tonnage, e.g. bulk, container and tanker.

Ro-ro-based tonnage, especially passen-

ger ships, is targeted to specific require-

ments concerning the allocation of a

vessel’s capacity between passenger and

freight; configuration of passenger areas;

loading capacity for heavy duty freight;

suspended decks for cars; sailing speed;

and ramps, including requirements for

loading/unloading speed.

Due to this degree of specialisation, ships

are often used on the same route for a great

deal of their lifespan. Small ro-ro freight

ships are the least specialised tonnage, and

are therefore easier to re-allocate between

routes. More specialised tonnage often

requires modification before re-allocation.

Due to the combination of long lifespan

and specialisation of tonnage, shipping

companies’ share of ownership of ro-ro-

based tonnage is typically high, and the

charter market for ro-ro-based tonnage

is generally less liquid and efficient than

container, tank).

Forwarding and logistics are generally less

capital-intensive than shipping. In addition,

the market for leasing of cargo-carrying

equipment, e.g. containers and trailers, is

large and efficient. This facilitates ongoing,

effective decisions on ownership or lea-

sing of assets used in operations.

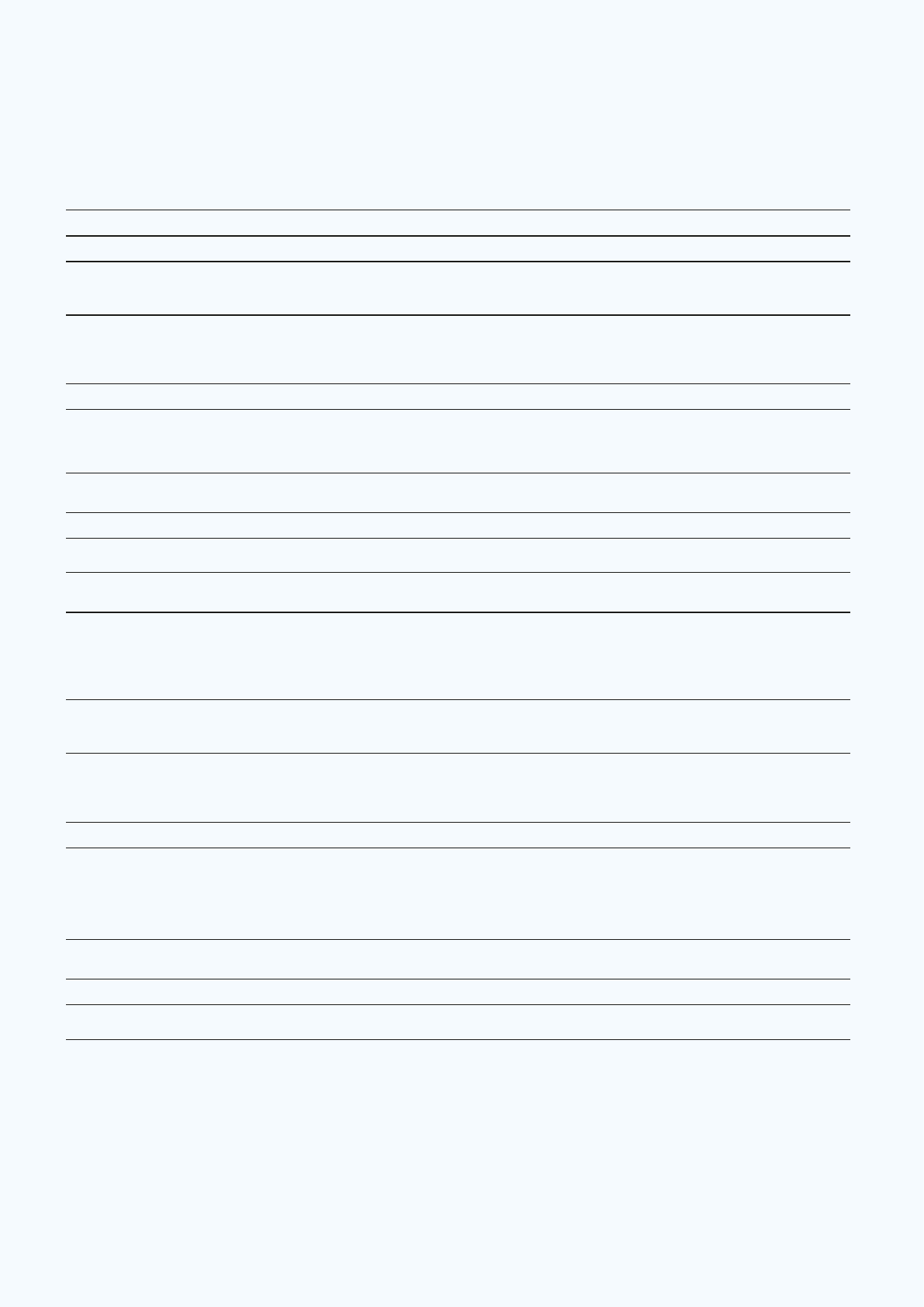

Composition of invested capital

At the end of 2011, total invested

capital was DKK 9,906m, of which 82%

consisted of ships, including newbuil-

dings. Port terminals, land and buildings

amounted to 7%. The capital was split

between divisions with Shipping Division

employing DKK 8,865m, corresponding to

89% of the Group’s total capital. Logistics

Division’s capital amounted to DKK

910m, 9% of total capital.

Capital intensity and EBIT margin

per business area

The business areas’ capital intensity in

2011, expressed as the turnover rate of

average invested capital, ranged from

0.98.9. Based on the objective of a return

on invested capital of 10%, the variation in

capital intensity leads to different targets

for business areas’ EBIT margins.

In the Shipping Division, the objective

requires EBIT margins of 1013%, with

the exception of Passenger, where the

requirement is an EBIT margin of 6.5%.

This is lower than the requirements for

other shipping areas because ships have

been written off over a longer period due

to a higher average age.

In the Logistics Division, the objective re-

quires EBIT margins just below 2% for the

three forwarding and logistics areas, as well

as Intermodal, where operations include

container shipping with 100% chartered

tonnage. In Nordic Contract, ownership of

60% of the tonnage used implies a higher

required EBIT margin than in the other

areas.

Investments in 2011 and future

investment needs

Invested capital was reduced by 7.6% in

2011, as depreciation and sales of assets

exceeded investment. Moreover, working

capital was reduced.

Total gross investments amounted to

DKK 804m in 2011, of which DKK 376m

was related to two ro-ro freight newbuil-

dings for delivery in 2012. In 2012, an

additional DKK 450m will be invested in

the newbuildings before delivery. Other

investments of DKK 200m are expected,

primarily for maintenance of ships,

cargo-carrying equipment and IT systems

development, bringing total investment

to DKK 650m in 2012.

The two newbuildings will be deployed on

the North Sea’s network of routes, repla-

cing two chartered ships that are redelive-

red in 2012. This will lead to an increase

in the area’s invested capital in 2012.

DFDS currently has no other significant

investment commitments. In the business

areas North Sea and Baltic Sea, no need

CAPITAL INTENSITY AND REQUIRED EBITMARGINS 2011

Capital

intensity,

times

1

EBIT-margin

2011, %

EBIT-margin

2

required by

objective, %

Variance

objective vs

required

margin, %

DFDS Group 1.2 7.2 8.6 1.5

Divisions & business units

Shipping Division 0.9 10.9 11.4 0.5

North Sea 0.8 13.2 13.3 0.1

Baltic Sea 1.0 18.2 9.9 8.3

Channel 0.8 1.6 12.7 11.1

Passenger 1.5 8.2 6.5 1.7

Non-allocated items 0.8 10.8 12.0 22.8

Logistics Division 4.6 2.5 2.2 0.4

Nordic Transport 5.3 4.5 1.9 2.7

Continental Transport 5.4 1.1 1.8 0.7

European Transport 5.4 5.6 1.8 3.8

Intermodal 5.7 0.7 1.7 1.0

Nordic Contract 1.8 8.9 5.5 3.4

1

Revenue divided by average invested capital. A low number signifies high capital intensity, and vice versa

2

Calculated as objective, 10% return requirement, divided by capital intensity

MANAGEMENT REPORT

14 DFDS ANNUAL REPORT 2011

RETURN ON INVESTED CAPITAL (ROIC)

AND CAPITAL COST (WACC)

(%)

8

6

7

4

5

2

3

9

2007

2008

2009

2010

2011

1

WACC

ROIC

0

FLEET OVERVIEW AND KEY FIGURES 2011

Total ships Ro-ro ships Ro-pax ships

Passenger

ships

Container

and sideport

ships

Ownership

share, %

Average age

of owned

ships, yrs

DFDS Group 49 24 12 5 8 n.a. n.a.

Divisions & Business Units

Shipping Division

1

37 21 12 4 n.a. 73 n.a.

North Sea 20 19 1 n.a. n.a. 65 9

Baltic Sea 9 2 7 n.a. n.a. 78 15

Channel 4 n.a. 4 n.a. n.a. 75 5

Passenger 5 n.a. 1 4 n.a. 100 19

Logistics Division 8 n.a. n.a. n.a. 8 38 n.a.

Intermodal 3 n.a. n.a. n.a. 3 0 n.a.

Nordic Contract 5 n.a. n.a. n.a. 5 60 12

Chartered out ships 2 1 n.a. 1 n.a. 100 20

Newbuildings

2

2 2 n.a. n.a. n.a. 100 n.a.

1

In the sum one ro-pax ship, which is shared between North Sea and Passenger, is eliminated

2

To be delivered in 2012

PROFIT EXPECTATIONS 2012 PER DIVISION

Division

Revenue

growth

Operating profit EBITDA

before special items Comments

Shipping Division Ca. 0% 1,2201,270

by increased competition and generally declining volumes on

the North Sea market

by increased competition. General increase in bunker cost from

higher oil price

Logistics Division Ca. 0% 180

to balance lower revenue from paper logistics

Non-allocated items n.a. 100

DFDS Group total Ca. 0% 1,3001,350

REVENUE PER DIVISION, 2011

SHIPPING DIVISION (64%)

LOGISTICS DIVISION (36%)

INVESTED CAPITAL (NET ASSETS) 2011,

DKK M

(%)

40

20

10

30

50

90

70

80

60

NET WORKING CAPITAL

GOODWILL

OTHER IMMATERIAL ASSETS

CARGO CARRYING EQUIPMENT

SHIPS

OTHER ASSETS

TERMINALS, LAND AND BUILDINGS

0

100

MANAGEMENT REPORT

15DFDS ANNUAL REPORT 2011

for investment in new tonnage is foreseen

in the next couple of years. Optimisation

of tonnage on the Channel may require

investments. At the end of 2012, the ave-

rage age of Passenger’s tonnage will be 23

years, with an estimated technical lifespan

of min. 30 years. The need for replacement

of this tonnage is being assessed.

Corporate governance

DFDS AS is subject to Danish law and

listed on the NASDAQ OMX Copenhagen.

DFDS’ corporate governance is therefore

based on Danish legislation and regulati-

ons, including Danish company law; the

rules of NASDAQ OMX Copenhagen; the

last Danish version of the recommenda-

has been part of the duty of disclosure

requirements for listed companies since

2006; the company’s statutes; and other

relevant rules.

The following information on corpo -

rate governance is available at

www.dfdsgroup.com:

governance, http://www.dfdsgroup.com/

about/governance/

http://www.dfdsgroup.com/about/

governance/articles/

AGM, http://www.dfdsgroup.com/

investors/annualgeneralmeeting/

previousagm/

Corporate Responsibility CR

The ambition for DFDS’ CR programme is

to continuously create value for our sta-

keholders and be their preferred partner.

At the end of 2011, DFDS set up a com-

mittee on corporate responsibility CR

Committee) in order to embed the work

within the Group’s management and orga-

nisation. The committee’s objective is to

manage the CR programme with reference

to Executive Management. Also appointed

were an officer with global responsibility

for sustainability in the DFDS Group and a

chair of the CR Committee.

See pages 3855 for the CR report, which

contains details of policies, programmes

and results.

Safety and security

The safety of our passengers, crew and

freight, as well as the security of our

ships and port facilities, are of paramount

importance to DFDS.

Our safety and security work is regulated

by international and national codes,

and by the additional objectives and

requirements set by DFDS itself. As per

International Safety Management ISM

guidelines, all safety measures and con-

ditions are regularly reported to all ships.

In addition, all ships regularly report back

on incidents on board.

The main events in 2011 were fires in the

chimney systems of two ships while in

dock, and a vehicle fire on the car deck on

the DoverDunkirk route. All three fires

were quickly and effectively extinguished

by DFDS’ own crews. On the Amster-

damNewcastle route, a passenger fell

overboard and was quickly rescued by

the ship’s own lifeboat and crew.

The CR report on pages 4546 provides

more in-depth information about DFDS’

safety and security work.

Profit expectations 2012

Profits for most of DFDS’ activities are

expected to be unchanged or improved

in 2012. The Logistics Division is overall

expected to achieve improved profits in

2012.

The Shipping Division expects unchanged

profits in three of four business areas

spite of an increasing oil price. The busi-

ness area North Sea will be negatively

impacted by increased competition.

A number of measures is being im-

plemented to counter the increased

competition as well as difficult market

conditions in general, including a higher

cost of bunker.

In February 2012, DFDS opened a new

route with one ship between Dover and

Calais. The route is not expected to make

a positive contribution to operating profit

EBIT in 2012.

As per 2011, freight activities are ex-

pected to make up approximately 80%

of DFDS’ revenue in 2012. Growth in the

freight market is expected to be highest

in the Baltic region, around 24%, and

lowest in the North Sea, where declining

volumes are expected, depending on the

market area. Growth in the passenger

market is expected to follow a similar

pattern.

Significant changes in EU, sparked by the

current debt crisis in several member

states, constitute a risk to the profit

expectation, just as significant increases

in the oil price and currency changes

constitute a risk.

On this background, the expectations for

the Group’s key figures for 2012 are as

follows:

Revenue: Expected to remain on a level

with 2011 as the increase from the

addition of the DoverCalais route will

balance lower revenues in North Sea as

a result of increased competition and

expectations of a general decline in

volumes on the North Sea

Bunker costs: Approx. 69% of bunker

consumption is expected to be hedged

by bunker surcharges and financial

hedging. It is estimated that a price

change of 1% will entail a financial

impact of approximately DKK 6.0m

compared to the oil price level mid-

February 2012, which was approxim-

ately USD 700 per ton

EBITDA before special items: Expected

to be DKK 1.3001.350m 2011: DKK

1.495m). The expected performance

per division is shown on p. 14

EBIT before special items: After depre-

ciation of approx. DKK 700m, operating

profit is expected to be DKK 600650m

2011: DKK 835m)

Pre-tax profit before special items

and tax: A profit is expected of DKK

450500m 2011: DKK 651m)

Special items: No special items are

expected 2011: Net income DKK 91m)

Investments: Total planned invest-

ments are expected to be around DKK

650m in 2012, of which the final two

payments for two freight newbuildings

account for around DKK 450m. The

remaining investments mainly concern

docking of ships and cargo-carrying

equipment. Optimization of tonnage

on the English Channel may in addition

require investments.

MANAGEMENT REPORT

16 DFDS ANNUAL REPORT 2011

GROWTH

DFDS IS READY FOR NEW GROWTH

DFDS has generated profitable growth

in recent years through a combination

of acquisitions and organic growth. The

acquisition of Norfolkline has contributed

to transforming DFDS since mid2010. In

parallel with the integration of Norfolk-

line, the DFDS operating model has been

simplified, based on uniform processes

throughout the company. This supports

rapid integration of new activities and

profitable growth.

DFDS’ growth strategy is focused on

profitable growth, which means that

activities that do not improve the return

on invested capital over a certain period

are restructured, sold off or discontinued.

The growth strategy also emphasises

that activities must support DFDS’ overall

strategy. The latter was not the case for

DFDS Canal Tours and the dry-bulk activi-

ties in Norway, and both were thus sold

to strategic buyers in 2011.

The European market for sea and land

transport as a whole remains fragmented.

As a result, DFDS primarily expects to

achieve growth in the next few years

via acquisitions, complemented by

organic growth.

The growth strategy focuses on:

through the acquisition of companies

and activities, including partnerships

customer service, including capacity

expansion.

As described below, the integration of

Norfolkline, including the sale of non-

core areas and surplus assets, is nearing

completion. DFDS’ operating model and

organisation is therefore now ready to

generate new profitable growth from both

shipping and logistics activities.

THE ACQUISITION OF NORFOLKLINE –

INTEGRATION AND VALUE CREATION

Transformation of DFDS

The acquisition and integration of

Norfolkline has transformed DFDS since

mid2010:

Europe’s largest combined shipping

and logistics company

DKK 5bn, or 77%, to DKK 11.6bn

since 2009

increased by about a third to 5,100

since 2009

have been adapted to the new organi-

sation

achieved critical mass with revenue

of DKK 4.3bn

has been extended to include activities

on the English Channel

section of the North Sea has been

improved with the addition of three

freight routes

introduced.

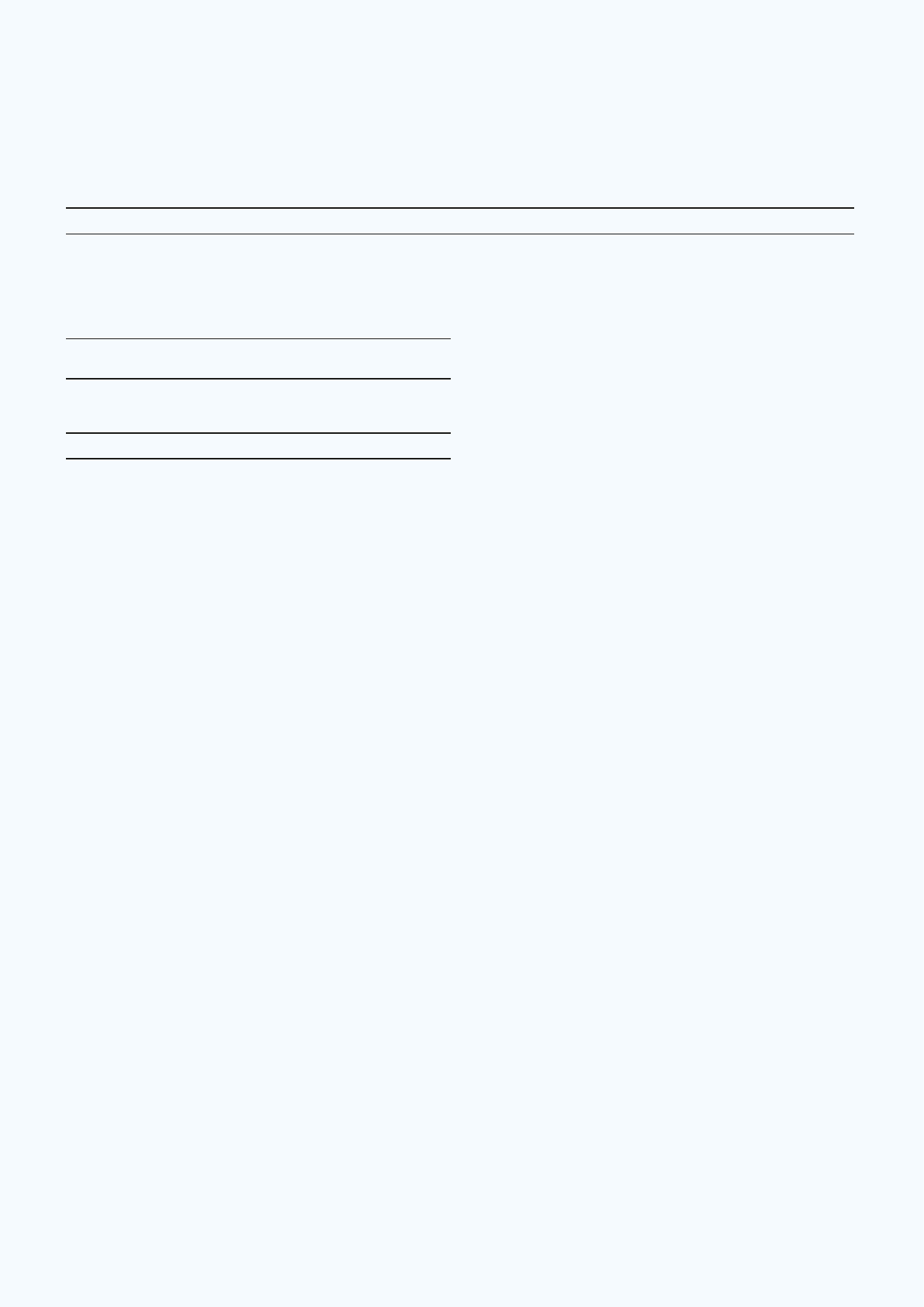

Synergies and costs

At the end of 2011, the total annual

synergies reached DKK 220m, divided

into five main activity areas based on a

total of 82 projects, see table on page

17. Most of the projects were com-

pleted by the end of 2011, although IT

projects are scheduled to be completed

in 2012 as planned.

As shown in the table, synergies for

Logistics and Other in particular have

exceeded expectations. The Headlight im-

provement project helped improve syner-

gies in Logistics, including a reduction in

haulage costs, a joint trailer pool lowered

equipment costs and focus on customer-

level yield management improved.

Other synergies are primarily related to

greater savings arising from the merging

of offices and other organisational

changes.

At the end of 2011, total integration

costs were DKK 147m, which represents

a saving in comparison to the original

cost estimate of approximately DKK

175200m.

Restructuring creates value

Two restructurings were implemented to

ensure that the acquisition of Norfolkline

would lead to profitable growth:

the Irish Sea were discontinued by the

sale of routes and ships and closure of

routes. A ro-pax ship was transferred to

DFDS’ route network in the Baltic Sea

Maasvlakte, Rotterdam.

Total proceeds from the sale of routes,

ships and the port terminal were DKK

715m, equivalent to 28% of the total

debt-free purchase price for Norfolkline,

which was DKK 2.6bn.

Valuable experiences

The successful integration can be at-

tributed to thorough preparation, a high

degree of involvement of employees

in both companies, prioritising internal

and external communication, as well as

detailed reporting and following up on

integration projects. These experiences

have been incorporated into The DFDS

an important platform for future growth

strategy.

GROWTH STRATEGY, INTEGRATION AND VALUE CREATION

COST SYNERGIES FROM INTEGRATION OF DFDS AND NORFOLKLINE

Activity Area of integration

Expected annual

synergies, DKK m

Realized annual synergies

2011, DKK m

Shipping

7080 80

Logistics

3040 61

IT

3040 11

Procurement

3540 38

Other

and other functions

1520 30

Total synergies 180220 220

17DFDS ANNUAL REPORT 2011

GROWTH

SYNERGIES

(DKK m)

JAN

2011

FEB APR MAY JUL AUG OCT NOVJAN

2010

FEB MAR APR MAY JUN AUG OCT NOV TOTAL

50

100

150

250

200

0

Announcement

of transaction

Kick-off

integration

planning

Closing of

transaction

and upgrade

of synergies

to DKK

180-220m

Organisational

restructuring

announced

Divestment of two

routes on Irish Sea

Project Headlight

kick-off

Divestment of

Maasvlakte port

terminal

Closing of two

remaining routes

on Irish Sea

DEC

2009

JUL SEP DEC MAR JUN SEP DEC

QUARTERLY REALIZED SYNERGIESACCUMULATED REALIZED SYNERGIESEXPECTED ACCUMULATED SYNERGIES

18 DFDS ANNUAL REPORT 2011

THE DFDS WAY

THE DFDS WAY

DFDS has successfully undergone major

changes in recent years. We merged

DFDS and Norfolkline, adding more than

a thousand new employees, through

focused improvement projects we deci-

sively turned around several business

areas, and we have improved DFDS’

earnings.

We have come a long way in a short

time and have developed a way of doing

things that works – The DFDS Way.

CUSTOMER

DRIVEN

CONTINUOUS

IMPROVEMENT

BEST

PRACTICE

LEVERAGING

SCALE

PERFORMANCE

CULTURE

OPERATING MODEL

The DFDS Way is common platform for

all employees, it plots a course and a

direction for our operating model and

our behaviours. It is a promise that we

give each other to create value for our

customers and other DFDS stakeholders.

The DFDS Way builds on our experi-

ences. Together with our value pro-

position and strategy, The DFDS

Way forms part of the core of the

way DFDS is managed.

See The DFDS Way video at www.dfdsgroup.com

BY DOING THINGS A LITTLE BETTER EVERY DAY,

WE BECOME A STRONGER COMPANY

19DFDS ANNUAL REPORT 2011

THE DFDS WAY

WE CARE WE SERVE

OUR CUSTOMERS WITH

PASSION WE LISTEN

BEFORE MAKING

DECISIONS WE DO

WHAT WE SAY WE’LL

DO IF WE SEE A

PROBLEM, WE FIX IT

WE LEARN, DEVELOP,

AND IMPROVE

EVERY DAY

BEHAVIOURS

SHIPPING DIVISION

22 DFDS ANNUAL REPORT 2011

SHIPPING DIVISION

BUSINESS AREA OVERVIEW

North Sea Baltic Sea Channel Passenger

Share of Shipping Division

revenue 2011

44% 18% 13% 24%

Routes

Immingham

Copenhagen/Klaipeda

St Petersburg

October 2011

februar 2012

Ships

Port terminals

1

Customer segments

vehicles, paper, steel,

chemicals)

vehicles, forestry products)

without cars

Primary market areas

CIS countries

Europe

Main competitors

1

Subject to approval by competition authorities

STRONG 2011 SUPPORTED BY SYNERGIES AND MARKET

GROWTH OUTLOOK FOR 2012 IS MORE SUBDUED

Business Area Heads:

Passenger

Market overview

Growth was unevenly spread out across

the year and market regions.

The Shipping Division operates the DFDS

route network, divided into four business

areas: North Sea, Baltic Sea, Channel

and Passenger.

DIVISION MANAGEMENT

Head of Division:

President, Shipping Division

Growth momentum from the end

of 2010 continued into Q1 of 2011

whereafter growth levelled off in the

North Sea region. In the Baltic region

demand stayed robust throughout

the year supported by the Russian

economy and an ongoing dispute

between Poland and Russia concer-

ning road licenses for hauliers driving

through Poland.

23DFDS ANNUAL REPORT 2011

SHIPPING DIVISION

The general uncertainty and slow down

in Europe began to impact activity level

in the North Sea region in Q2. Over

the summer renewed and continuing

uncertainty on financial markets has

contributed to dampen growth. Espe-

cially demand on the freight market

between UK and Sweden weakened

during the year. In 2012 freight volumes

in the Baltic region are expected to

continue growing at a level of 24%.

Freight volumes in the North Sea region

are overall expected to decline by

03%, although some market areas are

expected to achieve moderate growth in

volumes. The competitive pressure on

the Channel freight market is expected

to ease during 2012.

Competition on the freight market is, in

general, set to increase in 2012 as the

supply of freight capacity continues to ex-

ceed demand. Surplus tonnage has since

the beginning of 2012 been deployed

between Sweden and UK on a new route

putting pressure on volumes and rates.

Passenger markets remained fairly robust

in 2011 and this trend is expected to

continue in 2012, although demand in the

UK market is expected to weaken further

during the coming year mitigated by the

London Olympics.

Network

DFDS’ network connects Europe through

two integrated divisions, DFDS Seaways

& DFDS Logistics, working together to

provide cost effective and innovative sup-

ply chain solutions for customers.

The network comprises more than 350

weekly shipping departures, strate-

gically located terminals and hubs,

integrated rail services linking shipping

and logistics networks, and IT solutions

supporting network optimization and

efficiency. The network currently covers

20 countries.

Strategic priorities & follow-up

The primary strategic priorities and acti-

ons of 2011 were:

-

nation of synergies, volume and rate

growth, yield and product mix manage-

ment, and improved collaboration with

DFDS Logistics increased operating

profit EBIT before special items by

27.8% in 2011

Severe competitive pressure had redu-

ced earnings in the Channel business

unit and in May an improvement and

efficiency project, Light Crossing, was

launched to support earnings. The

project is expected to be completed

by mid 2012

terminals: In 2011 focus was on mana-

ging the new operational set-up of the

consolidation of two freight routes and

port terminal operations at both ports,

and the conversion of a combined

route to a pure freight route. The total

result of these actions have been a

significant profit improvement which

is part of integration synergies.

2012 presents a number of opportunities

and challenges considering the different

market prospects in the Baltic and North

Sea regions.

Growth is expected to continue in the

Baltic region, and the further development

of two new routes, respectively opened

and acquired in 2011, is a key priority as is

utilizing the capacity added to the network

in 2011. Further expansion of activities in

the region is also a priority. In the North

Sea region, growth is expected to be sub-

dued and decline in some areas. Moreover,

capacity has been added to the market

in both 2011 and the beginning of 2012

which increases competitive pressure.

Longer term, a priority is to assess the

desired level of the ownership share of

freight vessels as this level has increased

to more than 60% in recent years, and

the number of vessels chartered out has

been reduced. The flexibility of the fleet

with regard to adaptation to short term

market changes has thus been lowered in

recent years.

On the Channel, the main priorities are to

achieve the goals of project Light Cros-

sing and to optimise the joint operation

of two routes with the addition of the

new DoverCalais route opened in Fe-

bruary 2012.

ACTIVITY DEVELOPMENT BY

BUSINESS AREA

North Sea

Important events 2011:

of two routes and port terminals

the year

After strong volume growth in Q1 of

10.0%, adjusted for the addition of three

Norfolkline routes in mid 2010, growth

came to a standstill in Q2 and Q3, and

decreased further in Q4.

Volume growth was weakest between

Sweden and UK as demand softened in UK

and the competitiveness of Swedish ex-

ports was reduced by a stronger currency

compared to 2010. Growth between Swe-

den and the Continent was more resilient

driven by automotive volumes, which was

also the case for volumes between Ger-

many and UK. The growth in other market

areas was relatively flat. The overall rate

level was above 2010 with pricing more

firm in some areas than others.

Two major route changes were im-

plemented at the end of 2010 with a

full-year impact in 2011. The consolida-

tion of two routes to one route between

made a significant positive contribution

to the business units improved perfor-

mance. The impact forms part of the

was converted into a pure freight route

with a share of passengers from the for-

mer combined route transferred to DFDS’

passenger route between Amsterdam and

Newcastle. The new freight route strugg-

led to meet expectations in 2011.

Competition increased during 2011 on

the trade between UK and the Continent

with major competitors deploying larger

and newer ships. In January 2012, a new

freight route between Sweden and UK

was opened by a Swedish forwarding

company adding around 30% more capa-

city to the market. As demand in this mar-

ket softened during 2011, the additional

capacity is expected to impact earnings

negatively on DFDS’ two routes between

Sweden and UK significantly in 2012.

The customer mix was stable with a high

share of industrial customers on the

Scandinavian routes. The automotive

sector performed well in 2011 while paper

and steel volumes were more subdued.

Baltic Sea

Important events 2011:

Volume growth remained strong across

routes throughout the year supported by a

high level of demand from the Russian eco-

nomy trading with Germany and Sweden.

Volumes on the corridor between Germany

and Lithuania were also boosted by Polish

restrictions imposed on road licenses for

Russian hauliers. The overall rate level

was above 2010 with firm pricing in most

markets supported by yield management

of peak and off-peak departures.

24 DFDS ANNUAL REPORT 2011

Several changes to the route network

were implemented during 2011. In May

a new route between Germany and

Russia was opened and a route between

Estonia and Sweden was acquired in Oc-

tober. In addition, tonnage and capacity

was upgraded on the routes between

Lithuania and Germany/Sweden. The

charter agreement with Polferries

concerning the route between Sweden

and Poland expired in October and a rail

slot charter between Germany and Lit-

huania was terminated. 2012 will thus

be impacted with the full-year effect of

these changes.

Competition increased during 2011 as

competitors added capacity on the cor-

ridor between Germany and the Baltic

countries. Volume growth is expected to

continue in 2012, albeit at a lower level

of around 24%.Growth is also contingent

on the flow of Russian hauliers between

land and sea.

Accompanied traffic still exceeds unac-

companied traffic in the region. Freight is

predominantly a mixture of machinery,

construction materials and trailers car-

rying consumer products. The imbalance

of volumes between Scandinavia and the

Baltic markets became more pronounced

in 2011, and this trend is expected to

continue.

Irish Sea

Important events 2011:

of January 2011

The exit from the Irish Sea market was

completed in Q1 2011 and entailed one-

off costs of DKK 30m which are reported

as part of special items.

English Channel

Important events 2011:

planned

Total freight volumes on the Dover

Strait increased by 6% and by 0% for

the ferry operators. Eurotunnel’s market

share thus increased in 2011 as the

tunnel operator deployed an aggressive

price policy to regain market share lost

since a fire broke out in the tunnel at

the end of 2008. The push for market

share was especially focused in Q1

and Q2. SeaFrance also gained market

share in the first half of the year through

low pricing as the company sought to

increase revenues to avoid liquidation.

The exceptional competitive pressure

in 2011 resulted in a decrease in freight

rates of more than 10%.

Total passenger volumes on the Dover

Strait increased by 2% and decreased

by 2% for the ferry operators. Eurotun-

nel thus also gained market share on

the passenger market, although to a

lesser extent. Competitive pressure on

the passenger market was less severe

and average seafare per passenger was

maintained on a level with 2010. In mid

November SeaFrance ceased sailings,

creating an overflow of especially

freight volumes, and in January 2012

the company was declared bankrupt.

In November 2011 DFDS deployed a

fourth ship on the DoverDunkirk service

which contributed to increasing freight

and passenger volumes in Q4 2011.

In February 2012 the fourth ship was

transferred to a new route between

Dover and Calais.

SHIPPING DIVISION 2011 2010

DKK m Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY

Revenue 1,704 2,025 2,160 1,909 7,798 1,162 1,465 2,332 1,962 6,921

Operating profit before depreciation

EBITDA and special items 150 429 533 304 1,416 109 332 526 254 1,221

Share of profit of associates 0 0 0 0 0 0 1 1 0 0

Profit/loss on disposal of non-current assets 0 1 9 5 15 0 0 0 2 2

Depreciation and impairment 146 145 138 155 584 120 120 175 145 560

Operating profit EBIT before special items 4 285 404 154 847 11 213 350 111 663

Operating profit margin EBIT, % 0,2 14,2 18,9 7,9 10,9 0,9 14,5 15,0 5,7 9,6

Special items, net 54 69 11 20 133 0 0 16 390 374

Operating profit after special items EBIT 58 354 393 174 980 11 213 334 501 1,037

Invested capital, average 9,231 8,881 8,881 8,904 9,018 7,178 7,122 8,395 9,607 8,134

Return on invested capital ROIC p.a., % 1,0 12,3 16,8 14,8 10,2 0,5 11,4 14,3 20,7 12,0

Lanemetres, '000 5,358 5,350 5,360 5,828 21,896 2,442 2,674 6,635 6,578 18,329

Passengers, '000 718 1,153 1,613 943 4,427 327 483 1,631 938 3,379

An efficiency and improvement project,

Light Crossing, was launched in May 2011

and is expected to run until mid 2012. The

goal of the project is to improve annual

earnings by DKK 75m through cost reduc-

tion, revenue enhancement and organi-

sational changes. Most of the project’s

impact will be achieved in 2012 with full

effect in 2013. Just above 10% of the

project’s goal was achieved in 2011 with

contributions from more efficient bunker

consumption and improved margins on

onboard sales. Bunker consumption per

sailing was reduced by 5% in 2011 and

introduction of new propeller blades will

generate further savings in 2012.

The liquidation of SeaFrance is expected

to contribute to a stabilisation of the

competitive situation during 2012. This

is expected to support an improvement in

earnings in combination with a positive

impact from project Light Crossing.

Passenger

Important events 2011:

Demand on the main passenger markets,

Norway, Denmark, Germany, Holland,

and UK, was stable in 2011 with total

passenger volumes up by 0.8% while the

number of departures was 1.5% lower due

to dockings. The number of passengers per

departure was thus up by 2.3%. Volume

growth was strongest on Amsterdam-

Newcastle where volume was boosted

by passengers formerly travelling on the

-

ted to a pure freight route at the beginning

of 2011. This positive impact, which was

part of integration synergies, was most

SHIPPING DIVISION

25DFDS ANNUAL REPORT 2011

apparent in the first three quarters of the

year as demand on the UK market became

increasingly softer during the year.

A rising oil price increased the bunker cost

by 21% or DKK 46m. The higher cost of

bunker was mitigated by 5% lower con-

sumption per sailing as a result of bunker

saving initiatives, including installation of

new propeller blades on two ships. Just

below 20% of the higher bunker cost was

covered by surcharges.The remainder of

the cost increase was absorbed by lower

depreciations, following a write-down in

2010, increased revenues from seafare and

spending onboard and improved margins.

A new joint passenger booking system,

to be used in all business units trans-

porting passengers, is underway and a

first pilot was tested on EsbjergHarwich.

Full scale implementation is expected to

start in Q3 2012 and will run into 2013

before completion. No major changes in

the competitive situation are expected in

2012, although a continued weakening

of demand in the UK market will impact

earnings and the ability to offset further

increases in bunker costs.

Financial performance

Revenue increased by 12.7% to DKK

7,798m in 2011 primarily due to the full-

year effect of the addition of Norfolkline

and increased activity in Baltic Sea.

Operating profit before depreciations

EBITDA and special items increased by

16.0% to DKK 1,416m in 2011. EBITDA-

margin improved to 18.2% from 17.6%

in 2010 driven by business units North

Sea and Baltic Sea, and a positive impact

from the closing of the Irish Sea business

unit. Operating profit EBIT before special

items was DKK 847m, an increase of

27.8%. Special items amounted to an

income of DKK 133m consisting of ac-

counting profits of DKK 188m from sale

of companies and assets, and integration

costs of DKK 56m.

The invested capital was on average DKK

9,018m in 2011, an increase of 10.9%

primarily due to the full-year effect of

the addition of Norfolkline. The return

on invested capital was 10.2% in 2011

including special items.

SHIPPING DIVISION 2011 2010

DKK m Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY

North Sea

Revenue 877 910 854 873 3,514 617 746 926 873 3,162

EBIT 101 143 125 94 463 88 119 112 61 380

Invested capital 4,688 4,447 4,723 4,622 4,697 4,077 3,784 4,533 4,701 4,248

ROIC, % 8.6 13.7 9.6 7.7 9.5 8.6 12.8 9.3 4.9 7.6

Lanemetres freight, '000 2,650 2,637 2,631 2,589 10,507 1,627 1,785 2,727 2,805 8,944

Passengers, '000 - - - - - - - 22 11 33