UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 10-K

______________________________________

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission file number: 001-35967

______________________________________

DIAMOND RESORTS INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

______________________________________

Delaware

46-1750895

(State or other jurisdiction of

(I.R.S. Employer

incorporation or organization)

Identification No.)

10600 West Charleston Boulevard

Las Vegas, Nevada

89135

(Address of principal executive offices)

(Zip code)

(702) 684-8000

(Registrant's telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of each exchange on which registered

Common Stock, par value $0.01 per share New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act. YES x NO o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and

post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the

best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large

accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x

Accelerated filer o

Non-accelerated filer o

Smaller reporting company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o YES x NO

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2015 (the last business day of the registrant’s most recently

completed second fiscal quarter) was $1,446,879,088 based on the last reported sale price on the New York Stock Exchange on June 30, 2015.

As of February 25, 2016, there were 69,705,619 outstanding shares of the common stock, par value $0.01 per share, of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement, to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934, in connection with the registrant's 2016

Annual Meeting of Stockholders, are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

PART I 3

ITEM 1. BUSINESS 5

ITEM 1A. RISK FACTORS 25

ITEM 1B. UNRESOLVED STAFF COMMENTS 40

ITEM 2. PROPERTIES 40

ITEM 3. LEGAL PROCEEDINGS 40

ITEM 4. MINE SAFETY DISCLOSURES 40

PART II 41

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES

OF EQUITY SECURITIES 41

ITEM 6. SELECTED FINANCIAL DATA 43

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 44

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK 68

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 69

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE 69

ITEM 9A. CONTROLS AND PROCEDURES 69

ITEM 9B. OTHER INFORMATION 72

PART III 73

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE 73

ITEM 11. EXECUTIVE COMPENSATION 73

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER

MATTERS 73

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE 73

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES 73

PART IV 74

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES 74

SIGNATURES 79

2

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements, which are covered by the "Safe Harbor for Forward-Looking Statements" provided by the Private

Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate strictly to historical or current facts. We have

tried to identify forward-looking statements in this report by using words such as “anticipates,” “estimates,” “expects,” “intends,” “plans” and “believes,” and

similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could.” These forward-looking statements include, among

others, statements relating to our future financial performance, our business prospects and strategy, anticipated financial position, liquidity and capital needs

and other similar matters. These forward-looking statements are based on management's current expectations and assumptions about future events, which are

inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

Our actual results may differ materially from those expressed in, or implied by, the forward-looking statements included in this report as a result of

various factors, including, among others:

• the effects of our previously announced process to explore strategic alternatives, including the impact on our business, financial and operating

results and relationships with our employees and other third parties (including homeowners associations (“HOA”) and prospective purchasers of

vacation ownership interests (“VOIs” or “Vacation Interests”)) resulting from this process and uncertainty as to whether this process will result in a

transaction or other action that maximizes stockholder value or any transaction or other action at all;

• adverse trends or disruptions in economic conditions generally or in the vacation ownership, vacation rental and travel industries;

• adverse changes to, or interruptions in, relationships with our affiliates and other third parties, including termination of our hospitality management

contracts;

• our ability to maintain an optimal inventory of VOIs for sale overall, as well as in eight multi-resort trusts and one single-resort trust (collectively,

the "Diamond Collections");

• our use of structures for development of new inventory in a manner consistent with our asset-light model, including the risk in these structures that

we will not control development activities or the timing of inventory delivery and the risk that the third parties do not fulfill their obligations to us;

• our ability to sell, securitize or borrow against our consumer loans;

• decreased demand from prospective purchasers of VOIs;

• adverse events, including weather-related and other natural disasters and crises, or trends in vacation destinations and regions where the resorts in

our network are located;

• changes in our senior management;

• our ability to comply with current or future regulations applicable to the vacation ownership industry or any actions by regulatory authorities;

• the effects of our indebtedness and our compliance with the terms thereof;

• changes in the interest rate environment and their effects on our outstanding indebtedness;

• our ability to successfully implement our growth strategy, including our strategy to selectively pursue complementary strategic acquisitions;

• risks associated with acquisitions, including difficulty in integrating operations and personnel, disruption of ongoing business and increased

expenses;

• our ability to compete effectively; and

• other risks and uncertainties discussed in "Item 1A. Risk Factors" and elsewhere in this annual report.

Accordingly, you should read this report completely and with the understanding that our actual future results may be materially different from what we

expect.

Forward-looking statements speak only as of the date of this report. Except as expressly required under federal securities laws and the rules and

regulations of the Securities and Exchange Commission (the "SEC"), we do not have any obligation, and do not undertake, to update any forward-looking

statements to reflect events or circumstances arising after the date of this

3

report, whether as a result of new information or future events or otherwise. You should not place undue reliance on the forward-looking statements included

in this report or that may be made elsewhere from time to time by us, or on our behalf. All forward-looking statements attributable to us are expressly

qualified by these cautionary statements.

On July 24, 2013, Diamond Resorts International, Inc. ("DRII") closed the initial public offering of an aggregate of 17,825,000 shares of its common

stock at the IPO price of $14.00 per share (the "IPO"). In the IPO, DRII sold 16,100,000 shares of common stock, and Cloobeck Diamond Parent, LLC ("CDP"),

in its capacity as a selling stockholder, sold 1,725,000 shares of common stock. Prior to the consummation of the IPO, DRII was a newly-formed Delaware

corporation, incorporated in January 2013, that had not conducted any activities other than those incident to its formation and the preparation of filings with

the SEC in connection with the IPO. DRII was formed for the purpose of changing the organizational structure of Diamond Resorts Parent, LLC ("DRP") from

a limited liability company to a corporation. Immediately prior to the consummation of the IPO, DRP was the sole stockholder of DRII. In connection with,

and immediately prior to the completion of the IPO, each member of DRP contributed all of its equity interests in DRP to DRII in return for shares of common

stock of DRII. Following this contribution, DRII redeemed the shares of common stock held by DRP and DRP was merged with and into DRII. As a result,

DRII became a holding company, with its principal asset being the direct and indirect ownership of equity interests in its subsidiaries, including Diamond

Resorts Corporation ("DRC"). We refer to these and other related transactions entered into substantially concurrently with the IPO as the "Reorganization

Transactions."

Except where the context otherwise requires or where otherwise indicated, references in this annual report on Form 10-K to "the Company," "we," "us"

and "our" refer to DRP prior to the consummation of the Reorganization Transactions and DRII, as the successor to DRP, following the consummation of the

Reorganization Transactions, in each case together with its subsidiaries.

INDUSTRY AND MARKET DATA

Certain market, industry and similar data included in this report have been obtained from third-party sources that we believe to be reliable, including

the ARDA International Foundation, (the "AIF"). Our market estimates are calculated by using independent industry publications and other publicly

available information in conjunction with our assumptions about our markets. We have not independently verified any market, industry or similar data

presented in this report. Such data involves risks and uncertainties and are subject to change based on various factors, including those discussed under the

headings “Cautionary Statement Regarding Forward-Looking Statements” and "Item 1A. Risk Factors" in this report.

TRADEMARKS

Diamond Resorts International

®

, Diamond Resorts

®

, THE Club

®

, Polo Towers & Design

®

, Relaxation . . . simplified

®

, DRIVEN

®

, The Meaning of Yes

®

,

We Love to Say Yes

®

, Vacations for Life

®

, Affordable Luxury. Priceless Memories

TM

, Stay Vacationed

®

, Events of a Lifetime

TM

, Vacations of a Lifetime

TM

and

our other registered or common law trademarks, service marks or trade names appearing in this report are our property. This report also refers to brand names,

trademarks or service marks of other companies. All brand trademarks, service marks or trade names cited in this report are the property of their respective

holders.

4

ITEM 1. BUSINESS

Company Overview

We are a global leader in the hospitality and vacation ownership industry, with a worldwide resort network of 379 vacation destinations located in 35

countries throughout the world, including the continental United States ("U.S."), Hawaii, Canada, Mexico, the Caribbean, Central America, South America,

Europe, Asia, Australia, New Zealand and Africa (as of January 31, 2016). Our resort network includes 109 resort properties with approximately 12,000 units

that we manage and 250 affiliated resorts and hotels and 20 cruise itineraries, which we do not manage and do not carry our brand, but are a part of our resort

network and, through the Clubs (defined below), are available for our members to use as vacation destinations. We offer Vacations for Life

®

--a simple way to

acquire a lifetime of vacations at top destinations worldwide. We believe in the power and value of vacations to create lifelong memories and nurture our

humanity. They are essential to our well-being.

We offer a vacation ownership program whereby members acquire VOIs in the form of points. Members receive an annual allotment of points depending

on the number of points purchased, and, through the Clubs, they can use these points to stay at destinations within our network of resort properties, including

Diamond Resorts managed properties as well as affiliated resorts, luxury residences, hotels and cruises. Unlike a traditional interval-based vacation ownership

product that is linked to a specific resort and week during the year, our points-based system permits our members to maintain flexibility relating to the

location, season and duration of their vacation.

A core tenet of our management philosophy is delivering consistent quality and personalized services to each of our members, and we strive to infuse

hospitality and service excellence into every aspect of our business and each member's vacation experience. This philosophy is embodied in We Love to Say

Yes

®

, a set of Diamond values designed to provide each of our members and guests with a consistent, “high touch” hospitality experience through our

commitment to be flexible and open in responding to the desires of our members and guests. Our service-oriented culture is highly effective in building a

strong brand name and fostering long-term relationships with our members, resulting in additional sales to our existing member base and attracting new

members.

On October 16, 2015, we completed the Gold Key Acquisition, which added six managed resorts to our network, in addition to unsold VOIs and other

assets. On January 29, 2016, we completed the Intrawest Acquisition, which added nine managed resorts to our network, in addition to a portfolio of Vacation

Interests notes receivable, unsold VOIs and other assets. See "Note 1—Background, Business and Basis of Presentation" and "Note 24—Business

Combinations" of our consolidated financial statements included elsewhere in this annual report for the definition of and further detail on the Gold Key

Acquisition and "Note 30—Subsequent Events" for the definition of and further detail on the Intrawest Acquisition.

Our business consists of two segments: (i) hospitality and management services and (ii) Vacation Interests sales and financing.

Hospitality and Management Services. We are fundamentally a hospitality company that manages a worldwide network of resort properties and

provides services to a broad member base. We manage 109 resort properties, as well as the Diamond Collections, each of which holds ownership interests in a

group of resort properties (including a vast majority of our managed resorts). Substantially all of our management contracts automatically renew, and the

management fees we receive are based on a cost-plus structure. As the manager, we operate the front desks, provide housekeeping, conduct maintenance and

manage human resources services. We also operate, directly or by managing outsourced providers of, amenities such as golf courses, food and beverage

venues and retail shops, an online reservation system, customer contact centers, rental, billing and collection, accounting and treasury functions,

communications and information technology services. In addition to resort services, key components of our business are the Clubs, which enable our

members to use their points to stay at resorts in our network. Our Clubs include THE Club, which is the primary Club sold, and provides members with full

membership access to all resorts in our resort network and offers the full range of member services, as well as other Clubs that enable their members to use

their points to stay at specified resorts in our resort network and provide their members with a more limited offering of benefits. We refer to THE Club and

other Club offerings as "the Clubs." The Clubs offer our members a wide range of other benefits, such as the opportunity to redeem their points for (or, in some

cases, purchase for cash) various products and services, including private luxury property rentals, high-profile sporting events, guided journeys and

adventures, various air miles programs and cruises. We believe the Clubs’ offerings enhance the overall experience of our members and, thus, the perceived

value of their memberships. Fees paid by our members cover the operating costs of our managed resorts (including the absorption of a substantial portion of

our overhead related to the provision of our management services), our management fees, maintenance fees for VOIs at resorts that we do not manage that are

held by the Diamond Collections, and, in the case of members of the Clubs, membership dues. As part of our hospitality and management services, we

typically enter into agreements with our managed resorts and the Diamond Collections under which we reacquire VOIs previously owned by members who

have failed to pay their annual maintenance fees or other assessments, serving as the primary source of our VOI inventory that we sell.

5

Vacation Interests Sales and Financing. We sell VOIs principally through presentations, which we refer to as “tours,” at our 61 sales centers, a majority

of which are located at our managed resorts. We generate sales prospects by utilizing a variety of marketing programs, including presentations at our

managed resorts targeted at existing members and current guests who stay on a per-night or per-week basis, overnight mini-vacation packages, targeted

mailings, member referrals, telemarketing, gift certificates and various destination-specific marketing efforts. As part of our sales efforts, and to generate

interest income and other fees, we also provide loans to qualified VOI purchasers.

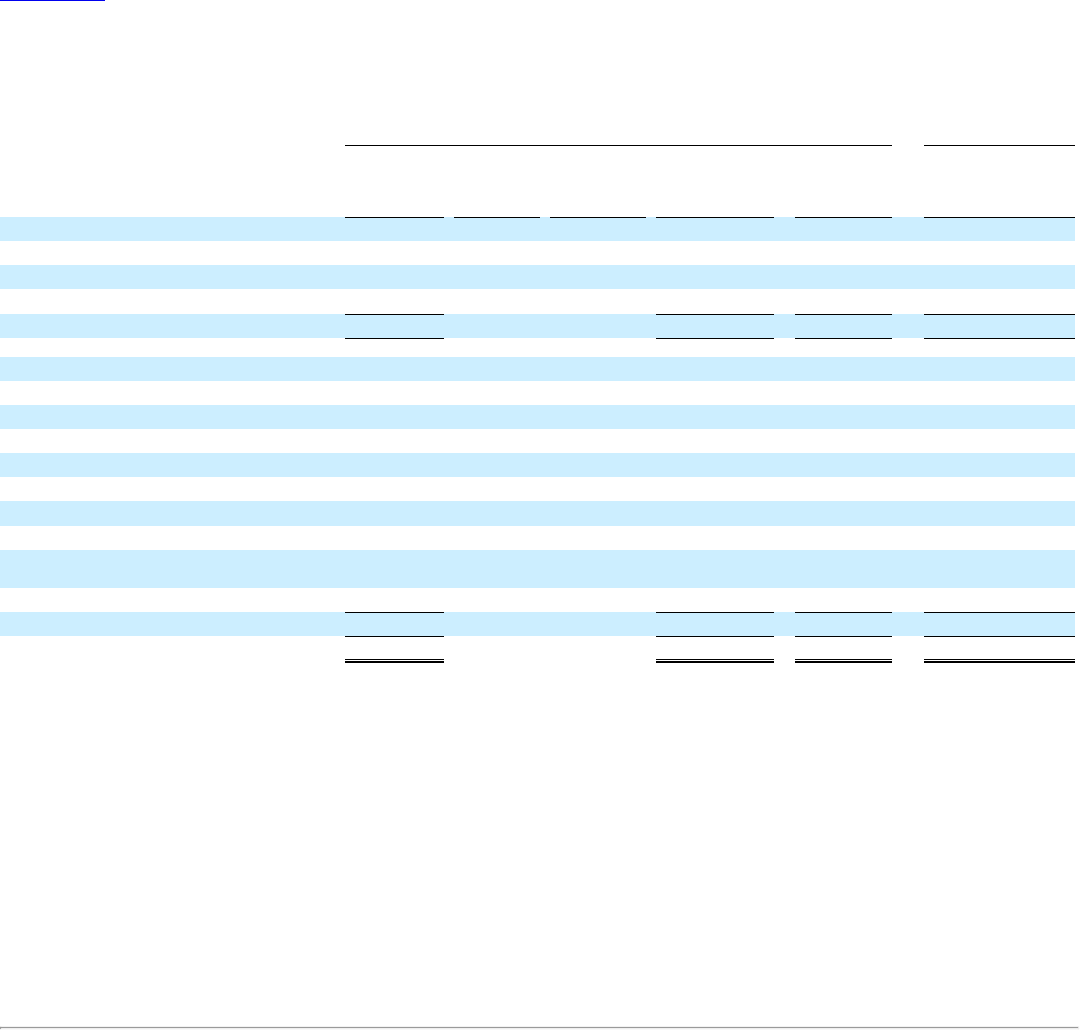

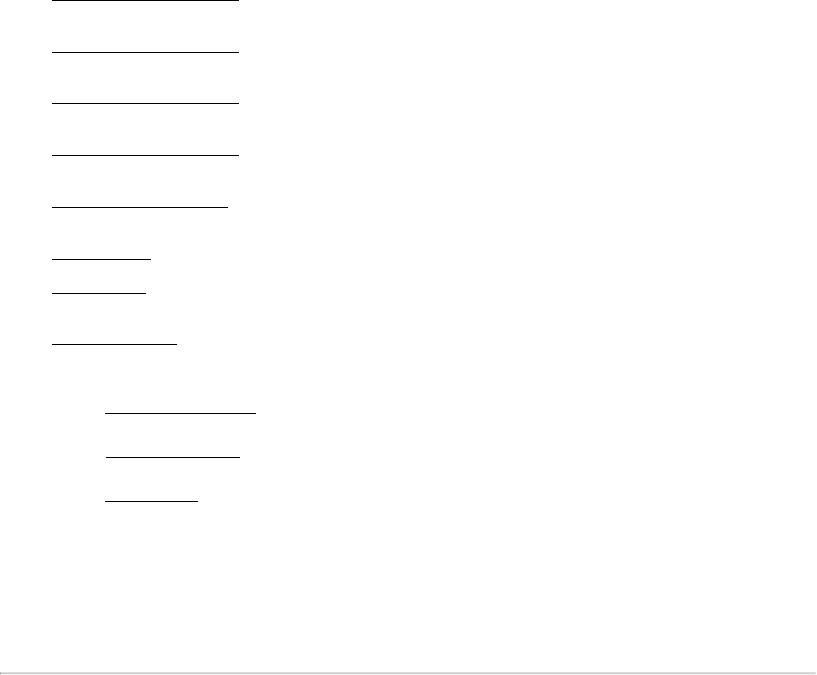

The charts below show the total revenue and net income for each segment of our business for the year ended December 31, 2015 (with the percentages

representing the relative contributions of these two segments):

The Vacation Ownership Industry

The vacation ownership industry enables individuals and families to purchase VOIs, which facilitates shared ownership and use of fully-furnished

vacation accommodations at a particular resort or network of resorts. VOI ownership distinguishes itself from other vacation options by integrating aspects of

traditional property ownership and the flexibility afforded by pay-per-day resorts or hotels. As compared to pay-per-day resort or hotel rooms, VOI ownership

typically offers consumers more space and home-like features, such as a full kitchen, living and dining areas and one or more bedrooms. Further, room rates

and availability at pay-per-day resorts and hotels are subject to periodic change, while much of the cost of a VOI is generally fixed at the time of purchase.

Relative to traditional vacation property ownership, VOI ownership affords consumers greater convenience and a variety of vacation experiences and requires

significantly less up-front capital, while still offering common area amenities such as swimming pools, playgrounds, restaurants and gift shops.

Consequently, for many vacationers, VOI ownership is an attractive alternative to traditional vacation property ownership and pay-per-day resorts and hotels.

Typically, a vacation ownership resort is overseen by an organization generally referred to as a homeowners association ("HOA"), which is administered

by a board of directors, generally elected by the owners of VOIs at the resort. The HOA is responsible for ensuring that the resort is financially sound and

adequately maintained and operated. To fund the ongoing operating costs of the resort, each VOI holder is required to pay its pro rata share of the expenses to

operate and maintain the resort, including any management fees payable to a company to manage and oversee the day-to-day operation of the resort. If a VOI

owner fails to pay its maintenance fee, that owner will be in default, which may ultimately result in a forfeiture of that owner's VOI to the HOA and a

consequent ratable increase in the expense-sharing obligations of the non-defaulted VOI owners.

The management and maintenance of a resort in which VOIs are sold are generally either provided by the developer of the resort or outsourced to a

management company, but, in either case, many developers often regard the management services provided as ancillary to the primary activities of property

development and VOI sales. Historically, certain real estate developers have created and offered VOI products in connection with their investments in

purpose-built vacation ownership properties or converted hotel or condominium buildings. These developers have frequently used substantial project-

specific debt financing to construct or convert vacation ownership properties. The sales and marketing efforts of these developers have typically focused on

selling out the intervals in the development, so that the developer can repay its indebtedness, realize a profit from the interval sales and proceed to a new

development project.

As the vacation ownership industry evolved, some in the industry recognized the potential benefits of a more integrated

6

approach, where the developer's resort management operations complemented its sales and marketing efforts. In addition, the types of product offerings have

also expanded over time, moving from fixed-or floating-week intervals at individual resorts, which provide the right to use the same property each year, or in

alternate years, to points-based memberships in multi-resort vacation networks. These multi-resort vacation networks are designed to offer more flexible

vacation opportunities. In addition to these resort networks, developers of all sizes may also affiliate with vacation ownership exchange companies in order

to give customers the ability to exchange their rights to use the developer's resorts for the right to access a broader network of resorts. According to the AIF, a

trade association representing the vacation ownership and resort development industries, the percentage of resort networks offering points-based products has

been rising in recent years and, due to the flexibility of these types of products, the AIF believes that this trend will continue in the near future as companies

that have traditionally offered only weekly intervals expand their product offerings. Entry into this market, particularly by single site developers, is

expensive and complex due to the need for the necessary support systems, such as the technology requirements, legal know-how and strong business and

inventory controls, to provide such services.

Growth in the vacation ownership industry has been achieved through expansion of existing resort companies as well as the entry of well-known

lodging and entertainment companies that either operate vacation ownership businesses directly or license their brands to other operators of

vacation ownership businesses, including Disney, Four Seasons, Hilton, Hyatt, Marriott, Starwood and Wyndham. The industry's growth can also be

attributed to increased market acceptance of vacation ownership resorts, enhanced consumer protection laws and the evolution from a product offering a

specific week-long stay at a single resort to the multi-resort points-based vacation networks, which offer a more flexible vacation experience.

According to the AIF's State of the Vacation Timeshare Industry Report ("State of the Industry Report"), as of December 31, 2014, the U.S. vacation

ownership community was comprised of approximately 1,600 resorts, representing approximately 198,000 units and an estimated 8.7 million vacation

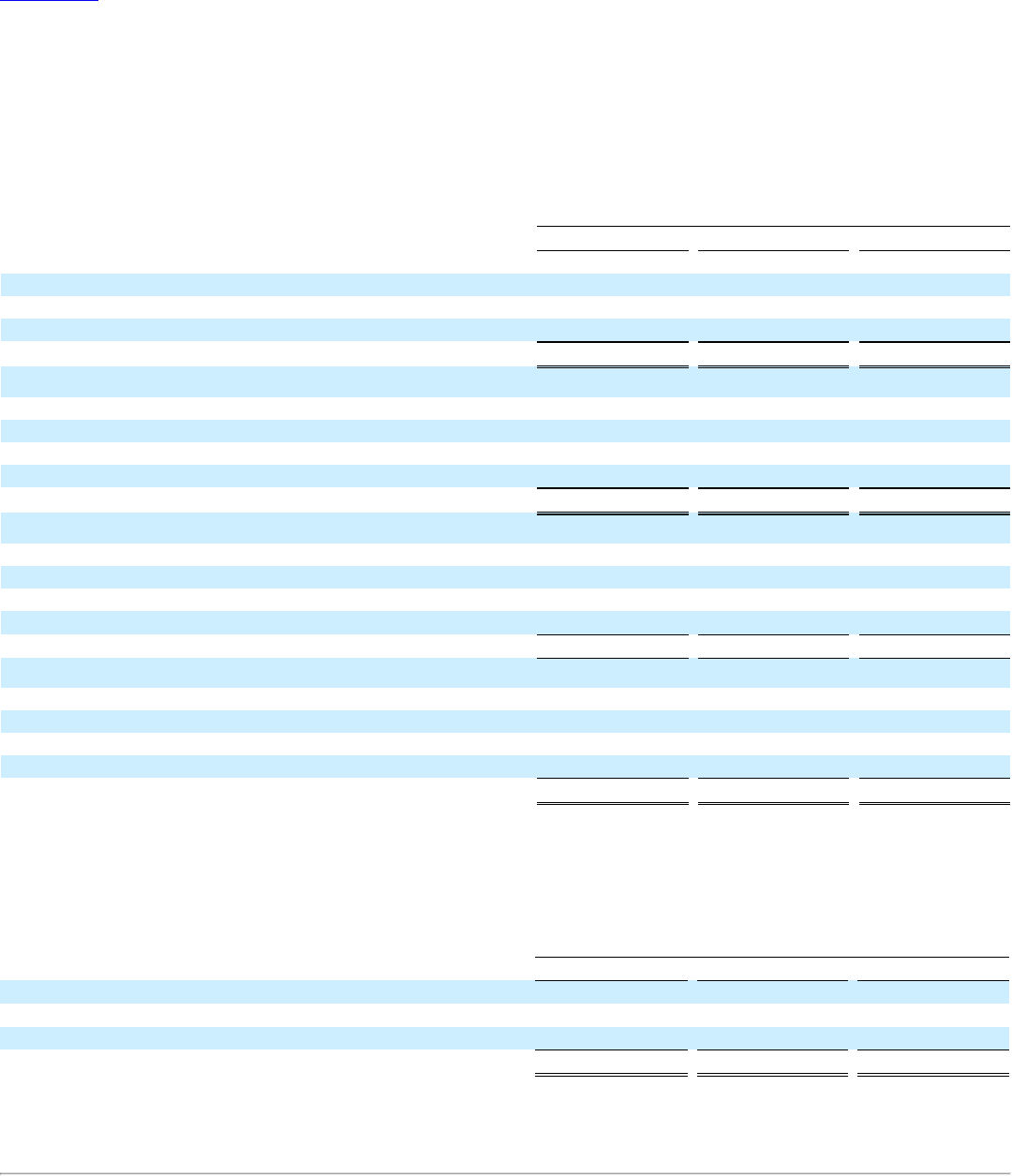

ownership week equivalents. As reported by the AIF and reflected in the graph below, VOI sales during 2009 through 2011 were down significantly from

levels prior to the economic downturn that started in 2008, which the AIF attributes largely to the fact that several of the larger VOI developers intentionally

slowed their sales efforts through increased credit score requirements and larger down payment requirements in the face of an overall tighter credit

environment; however, according to the State of the Industry Report, VOI sales in the U.S. increased by an average of more than 7.0% annually from 2011 to

2014. Based on AIF's Quarterly Pulse Survey reports, this trend of increasing VOI sales continued to accelerate to a 7.8% increase for the first three quarters of

2015 as compared to the same period in 2014.

Source: Historical timeshare industry research conducted by Ragatz Associates and American Economic Group, as of December 31, 2014.

7

We expect the U.S. vacation ownership industry to continue to grow over the long term due to favorable demographics, more positive consumer

attitudes, availability of capital and the low penetration of vacation ownership in North America. According to the AIF's bi-annual 2014 Shared Vacation

Ownership Owners Report (the “Owners Report”), based upon a survey of the U.S. VOI owners, the median household income of VOI owners was $89,500 in

2014, 90% of VOI owners own their primary residence and 67% have a college degree. The Owners Report indicated that 83% of VOI owners rate their

overall ownership experience as good to excellent and that the top four reasons for purchasing a VOI are resort location, saving money on future vacations,

overall flexibility and quality of the accommodations. According to the Owners Report, less than 8% of U.S. households own a VOI. We believe this

relatively low penetration rate of vacation ownership suggests the presence of a large base of potential customers.

The European vacation ownership industry is also significant. According to AIF, based on the latest survey, the European vacation ownership

community was comprised of approximately 1,300 resorts in 2010, representing approximately 88,000 units. In addition, we believe that rapidly-growing

international markets, such as Asia and South and Central America, present significant opportunities for expansion of the vacation ownership industry due to

the substantial increases in spending on travel and leisure activities forecasted for consumers in those markets.

As the vacation ownership industry continues to mature, we believe that keys to success for a company in this industry include:

• Hospitality Focus. Integrating hospitality into every aspect of a guest's vacation experience, including VOI sales, should result in higher levels of

customer satisfaction and generate increased VOI sales, as compared to companies that do not view hospitality as an integral component of the

services they provide.

• Broad, Flexible Product Offering. Offering a flexible VOI product that allows customers to choose the location, season, duration and size of

accommodation for their vacation, based upon the size of the product purchased, coupled with a broad resort network, will likely attract a broader

spectrum of customers.

• Consistent, High-Quality Resort Management. Ensuring a consistent, high-quality guest experience across a company's managed resorts and a brand

the customer can trust should enhance VOI sales and marketing efforts targeted at new customers and increase the potential for additional VOI sales

to existing customers.

• Financing. Providing quick and easy access to consumer financing will often expedite a potential purchaser's decision-making process and result in

additional VOI purchases.

We believe that competition in the vacation ownership industry is based primarily on the quality of the hospitality services and overall experience

provided to customers, the number and location of vacation ownership resorts and hotels in the network, trust in the brand and the availability of program

benefits.

Competitive Strengths

Our competitive strengths include:

A substantial portion of the revenue from our hospitality and management services business converts directly to Adjusted EBITDA.

Substantially all of our management contracts with our managed resorts and the Diamond Collections automatically renew, and under these contracts

we receive management fees generally ranging from 10% to 15% of the other costs of operating the applicable resort or Diamond Collection (with a weighted

average of 13.9% based upon the total management fee revenue for the year ended December 31, 2015). The covered costs paid by our managed resorts and

the Diamond Collections include both the direct resort operating costs and the absorption of a substantial portion of our overhead related to this part of our

business. Accordingly, our management fee revenue results in a comparable amount of Adjusted EBITDA. Generally, our revenue from management contracts

increases to the extent that (i) operating costs (including reserves for capital projects such as renovations and upgrades) at our managed resorts and the

Diamond Collections rise and, consequently, our management fees increase proportionately under our cost-plus management contracts; (ii) we add services

under our management contracts; or (iii) we acquire or enter into contracts to manage resorts not previously managed by us. Adjusted EBITDA is a non-U.S.

GAAP financial measure and should not be considered in isolation from, or as an alternative to net cash provided by (used in) operating activities or any

other measure of liquidity, or as an alternative to net income (loss), operating income (loss) or any other measure of financial performance, in any such case

calculated and presented in accordance with U.S. GAAP. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of

Operations—Liquidity and Capital Resources Indebtedness—Senior Credit Facility" for further discussion regarding our Adjusted EBITDA.

The principal elements of our business provide us with significant financial visibility.

• Management fees from our cost-plus management contracts. All anticipated operating costs of each of our managed

8

resorts and Diamond Collections, including our management fees and costs pertaining to the specific managed resort or Diamond Collection, such as

costs associated with the maintenance and operations of the resort, are included in the annual budgets of these resorts and Diamond Collections.

These annual budgets are approved by the board of directors of each HOA and each Diamond Collection's non-profit members association (each, a

"Collection Association"), as applicable, and are typically finalized before the end of the prior year. As a result, a substantial majority of our

management fees are collected by January of the applicable year as part of the annual maintenance fees billed to VOI owners and released to us as

services are provided. Unlike typical management agreements for traditional hotel properties, our management fees are not affected by average daily

rates ("ADR") or occupancy rates at our managed resorts. In addition, while our management contracts may be subject to non-renewal or termination,

no resort or Diamond Collection has terminated or elected not to renew any of our management contracts during the past five years.

• Fees earned by operating the Clubs. Dues payments for each of the Clubs are billed and generally collected together with the member's related

annual maintenance fees. Substantially all Club dues are collected by January of the applicable year. Members of the Clubs are not permitted to

make reservations or access the applicable Club's services and benefits if they are not current in payment of these dues. The Clubs also provide

specific services to the Diamond Collections, such as call center services, for which the Clubs charge a fee to the Diamond Collections, and are

included in the Diamond Collection maintenance fees. Some of the Clubs offer a tiered loyalty membership whereby additional affiliated resorts and

benefits are made available as the member purchases more points, resulting in higher Club dues for members in a higher loyalty tier.

• VOI sales. Our VOI sales revenue is primarily a function of three levers: the number of tours we conduct, our closing percentage (which represents the

percentage of VOI sales closed relative to the total number of tours at our sales centers) and the sales price per transaction. We generally have a high

degree of near-term visibility as to each of these factors. Before the beginning of a year, we can predict with a high degree of confidence the number

of tours we will conduct that year, and we believe that we can tailor our sales and marketing efforts to effectively influence our closing percentage

and average transaction size in order to calibrate our VOI sales levels over the course of the year.

• Financing of VOI sales in the U.S. We target the level of our consumer financing activity in response to capital market conditions. We accomplish

this by offering sales programs that either encourage or discourage our customers to finance their VOI purchases with us, without compromising our

underwriting standards. As of December 31, 2015, the weighted average Fair Isaac Corporation ("FICO") score (based upon loan balance) for our

borrowers across our existing loan portfolio was 723, and the weighted average FICO score for our borrowers on loans originated by us since 2011

was 757. The default rate on our originated consumer loan portfolio was 7.7% (as a percentage of our outstanding originated portfolios) for 2015,

and ranged from 5.7% to 8.2% on an annual basis from 2011 through 2015.

Our capital-efficient business model requires limited investment in working capital and capital expenditures.

• Limited working capital required. Our hospitality and management services business consumes limited working capital because a substantial

portion of the funds we receive under our management contracts is collected by January of each year and released to us as services are provided.

Moreover, all resort-level maintenance and improvements (except for expenditures related to space owned by us) are paid for by the owners of VOIs,

with our financial obligation generally limited to our pro rata share of the VOIs we hold as unsold VOIs.

• Limited investment capital required. As a result of our VOI inventory strategy, we have limited requirements to build resort properties or acquire real

estate to support our anticipated VOI sales levels. Although the volume of points or intervals that we recover could fluctuate in the future for various

reasons, we reacquire approximately 2% to 5% of our total outstanding VOIs from defaulted owners on an annual basis. This provides us with a

relatively low-cost, consistent stream of VOI inventory that we can resell, and we anticipate that this stream will satisfy a majority of our inventory

needs in the foreseeable future. In certain geographic areas, we may from time to time acquire additional VOI inventory through open market

purchases or other means. We supplement these inventory acquisition strategies with targeted development projects, particularly in attractive

locations where member demand exceeds our existing supply. In these circumstances, we expect that we will generally seek to structure

developments in a manner that limits our financial exposure, including by minimizing the amount of time between when we are required to pay for

the new VOI inventory and when such inventory is sold. For example, in 2015, we entered into an agreement with Hawaii Funding LLC (the "Kona

Seller"), an affiliate of Och-Ziff Real Estate, for the Kona Seller to develop a new resort on property located in Kona, Hawaii, in this manner (the

"Kona Agreement"). Additionally, in a majority of our strategic transactions, we have acquired an ongoing business, consisting of management

contracts, unsold VOI inventory and an existing owner base, which has generated immediate cash flows for us.

• Access to financing. The liquidity to support our provision of financing to our customers for VOI purchases is

9

provided through the Conduit Facility, the $100.0 million loan sale facility with Quorum Federal Credit Union (the "Quorum Facility")

(collectively, the “Funding Facilities”) and securitization financings and, as a result, also consumes limited working capital. See "Item 7.

Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Indebtedness" for

the definition of and further detail of these borrowings.

Our scalable VOI sales and marketing platform has considerable operating leverage and drives increases in Adjusted EBITDA.

We have built a robust and versatile sales and marketing platform. This platform enables us to take actions that directly impact the three levers that

primarily determine our VOI sales revenue: the number of tours we conduct, our closing percentage and the sales price per transaction. Our objective is to

consistently monitor and adjust these three factors to reach an optimum level of VOI sales based on our available VOI inventory. With our scalable sales

platform in place, we do not foresee the need to significantly increase the number of sales centers (other than in connection with business acquisitions) or the

size of our sales support team. Accordingly, we believe our VOI sales business has considerable operating leverage and the ability to drive increases in

Adjusted EBITDA.

Our high level of customer satisfaction results in significant sales of additional VOIs to our members.

We believe our efforts to introduce hospitality, service excellence and quality into each member's vacation experience have resulted in a high degree of

customer satisfaction, driving significant sales of additional VOIs to our existing members who previously purchased points from us, as well as members we

acquired in our strategic acquisitions who purchased points from us for the first time (“Acquired Members”). After an Acquired Member makes his or her first

purchase from us, all future transactions involving that Acquired Member are treated as sales to an existing member. In 2015, approximately 69% of our VOI

sales were to existing members who previously purchased points from us, and approximately 10% of these sales were to Acquired Members. In 2014,

approximately 62% of our VOI sales were to existing members, and approximately 15% were to Acquired Members.

Our accomplished leadership team positions us for continued growth.

We have an experienced leadership team that has delivered strong operating results through disciplined execution. Our management team have taken a

number of significant steps to refine our strategic focus, build our brand recognition and streamline our operations, including (i) maximizing revenue from

our hospitality and management services business; (ii) driving innovation throughout our business, most significantly by infusing our hospitality focus into

our customer interactions; and (iii) adding resorts to our network and owners to our owner base through complementary strategic acquisitions and efficiently

integrating businesses acquired. Certain members of our management team and board of directors have substantial equity interests in our Company that

closely align their economic interests with those of our other stockholders.

Growth Strategies

Our growth strategies are as follows:

Continue to grow our hospitality and management services business.

We expect our hospitality and management services revenue will continue to grow as rising operating expenses at our managed resorts result in higher

revenues under our cost-plus management contracts. We intend to generate additional growth in our hospitality and management services business by (i)

increasing Club membership revenue; (ii) broadening hospitality service and activity offerings for members of the Clubs; including opportunities for our

members to purchase third-party products and services; and (iii) adding services provided to our members under our management agreements and pursuing

additional management and service contracts.

• Increase Club membership revenue. Purchasers of our points, in almost all cases, are automatically granted membership in THE Club. In addition, as

existing members purchase more points and thereby upgrade Club memberships to a higher loyalty tier with additional member benefits, higher fees

are collected. When we complete an acquisition, we typically create a tailor-made Club, introducing a subset of additional resorts and benefits. This

results in an owner base that becomes familiar with the benefits of THE Club, and should therefore be more likely to upgrade and purchase points

from us with membership in THE Club. We also have implemented programs to encourage interval owners at our managed resorts to join THE Club.

• Broaden hospitality service and activity offerings. We intend to continue to make membership in the Clubs more attractive to our members by

expanding the number and variety of offered services and activities, such as airfare, cruises, guided excursions, golf outings, entertainment, theme

park tickets, luggage and travel protection and access to luxury accommodations outside our network of resorts, such as the Diamond Luxury

Selection, a Club member

10

benefit exclusively for our members with large point ownership and, therefore, in a higher loyalty tier. Qualifying members can access The Diamond

Luxury Selection using their points through THE Club for stays within a collection of approximately 2,500 private luxury properties. Additionally,

we now offer to our members in a higher loyalty tier access to luxury cruises, premier vacation adventures and premier sports events (including VIP

access). We believe the Clubs’ offerings enhance the overall experience of our members and, thus, the perceived value of their memberships. As

membership in the Clubs becomes more valuable to consumers through hospitality-focused enhancements, we may be able to increase the dues paid

by members of the Clubs, in addition to commission revenue that we are able to generate as a result of these Club membership enhancements.

• Add services provided to our members under management contracts and pursue additional management and service contracts. We expect to add

services provided to our members under our management contracts, which may result in increased management fees relating to those new services. In

addition, we may purchase or otherwise obtain additional management contracts at resorts that we do not currently manage. Furthermore, we intend

to broaden our business-to-business services on a fee-for-service basis to other companies in the hospitality and vacation ownership industry. For

example, we have, on occasion, entered into fee-for-service agreements with resort operators and hospitality companies pursuant to which we

provide them with resort management services, VOI sales and marketing services and inventory rental services. These types of arrangements can be

highly profitable for us because we are not required to invest significant capital. In the future, in situations where we can leverage our unique

expertise, skills and infrastructure, we intend to expand our provision of business-to-business services on an à la carte basis or as a suite of services to

third-party resort developers and operators and other hospitality companies.

Continue to leverage our scalable sales and marketing platform to increase VOI sales revenue.

We intend to continue to utilize the operating leverage in our sales and marketing platform. While we focus on attracting potential new owners, we will

also continue to market to our existing long-term membership base, and expect that through these efforts and our continuing commitment to ensuring high

member satisfaction, a significant percentage of our VOI sales will continue to be made to our existing members. We will also continue to target the

ownership base at resorts that we now manage as a result of our strategic acquisitions to encourage these prospective customers to purchase our VOIs. While

we anticipate that the bulk of our future VOI sales will be made through our traditional selling methods, we are seeking to more fully integrate the VOI sales

experience into our hospitality and management services. We have found that, by driving innovation throughout our business, most significantly by infusing

our hospitality focus into the sales process and creatively engaging with potential purchasers, we improve potential purchasers' overall experience and level

of satisfaction and, as a result, are able to increase the likelihood that they will buy our VOIs and increase the average transaction size. We have extended this

philosophy of increased engagement and hospitality focus into other sales techniques, and intend to continue to innovate in this area.

Pursue additional revenue opportunities consistent with our capital-efficient business model.

We believe that we can achieve growth without pursuing revenue opportunities beyond those already inherent in our core business model. However, to

the extent consistent with our capital-efficient business model, we intend to:

• Selectively pursue strategic transactions. We intend to continue to pursue acquisitions of ongoing businesses, including management contracts and

VOI inventory, on an opportunistic basis where we can achieve substantial synergies and cost savings. See "Item 7. Management's Discussion and

Analysis of Financial Condition and Results of Operations—Overview" for a discussion of our recent acquisitions. We will evaluate future

acquisitions with a focus on adding additional resort locations, management contracts, new members to our owner base and VOI inventory that we

may sell to existing members and potential customers.

• Prudently expand our geographic footprint. We believe that there are significant opportunities to expand our business into new geographic markets

in which we currently may have affiliations, but do not manage resorts or market or sell our VOIs. We believe that certain countries in Asia and

Central and South America are particularly attractive potential new markets for us due to the substantial increases in spending on travel and leisure

activities forecasted for their consumers. To the extent that we can maintain our high quality standards and strong brand reputation, we are

selectively exploring acquisitions of ongoing resort businesses in these markets and may also pursue co-branding opportunities, joint ventures or

other strategic alliances with existing local or regional hospitality companies. For example, we recently entered into a joint venture with affiliates of

Dorsett Hospitality International, a large hotel developer, owner and operator in Asia, and China Travel International Investment Hong Kong Ltd.,

an investment holding company engaged in the operation of travel destinations (including hotels, theme parks, natural and cultural scenic spots and

leisure resorts), travel agencies and related business operations and invested $1.5 million in this joint venture. We expect the venture to create,

market, sell and service prepaid multiple-year vacation packages and associated benefits to customers in Asia. In addition, we may engage in

targeted development projects, particularly in attractive locations where member demand exceeds our existing supply, in a manner consistent with

our capital-light

11

model, such as our recent agreement with respect to the development of a new resort in Kona, Hawaii. We believe that expansion of our geographic

footprint will produce revenue from consumers in the markets into which we enter and also make our resort network more attractive to existing and

prospective members worldwide.

Our Customers

Our customers are typically families seeking a flexible vacation experience. A majority of our new customers stay at one of the resorts in our network,

either by reserving a unit on a per-night or per-week basis, exchanging points through an external exchange service, or purchasing a mini-vacation package,

prior to purchasing a VOI. We have also generated significant additional sales to our existing members who wish to purchase additional points and thereby

increase their benefit options within our resort network.

We believe a majority of our customers are between 45 and 65 years old. The baby boomer generation is the single largest population segment in the

U.S. and Europe and is our key target market. With the premium resorts in our network and the broad range of benefits that we offer, we believe we are well-

positioned to target an affluent subsection of the baby boomer population.

Our Services

Hospitality and Management Services. We manage 109 resort properties, which are located in the continental U.S., Hawaii, Mexico, the Caribbean and

Europe, as well as the Diamond Collections. As the manager of these resorts and the Diamond Collections, we operate the front desks, provide housekeeping,

conduct maintenance and manage human resources services. We also operate, or outsource the operation of, amenities such as golf courses, food and

beverage venues and retail shops, an online reservation system, customer service contact centers, rental, billing and collection, accounting and treasury

functions and communications and information technology services.

As an integral part of our hospitality and management services, we have entered into inventory recovery and assignment agreements ("IRAAs") with a

substantial majority of the Collection Associations and HOAs for our managed resorts in North America, together with similar arrangements with the

European Collection and a majority of our European managed resorts, whereby we recover VOIs previously owned by members who have failed to pay their

annual maintenance fee or assessments due to, among other things, death or divorce or other life-cycle events or lifestyle changes. Because the majority of the

cost of operating the resorts that we manage is spread across our member base, by recovering VOIs previously owned by members who have failed to pay their

annual maintenance fee or assessments, we reduce bad debt expense at the managed resorts and Diamond Collection level, which is a component of the

management fees billed to members by each resort's HOA or Collection Association, supporting the financial well-being of those managed resorts and the

Diamond Collections.

HOAs. Each of the Diamond Resorts managed resorts, other than certain resorts in our European Collection and Latin America Collection, is typically

operated through an HOA, which is administered by a board of directors. Directors are elected by the owners of VOIs at the resort (which may include one or

more of the Diamond Collections) and may also include representatives appointed by us as the developer of the resort. As a result, we are entitled to voting

rights with respect to directors of a given HOA by virtue of (i) our ownership of VOIs at the related resort; (ii) our status as the developer of the resort; or (iii)

our ownership of points in the Diamond Collections that hold VOIs at the resort. The board of directors of each HOA hires a management company to provide

the services described above, which in the case of all Diamond Resorts managed resorts, is us.

Our management fees with respect to a resort are based on a cost-plus structure and are calculated based on the direct and indirect costs (including the

absorption of a substantial portion of our overhead related to the provision of management services) incurred by the HOA of the applicable resort. Under our

current resort management agreements, we receive management fees generally ranging from 10% to 15% of the other costs of operating the applicable resort

(with a weighted average of 13.9% based upon the total management fee revenue for the year ended December 31, 2015). Unlike typical commercial lodging

management contracts, our management fees are not impacted by changes in a resort's ADR or occupancy level. Instead, the HOA for each resort engages in

an annual budgeting process in which the board of directors of the HOA estimates the costs the HOA will incur for the coming year. In evaluating the

anticipated costs of the HOA, the board of directors of the HOA considers the operational needs of the resort, the services and amenities that will be provided

at or to the applicable resort and other costs of the HOA, some of which are impacted significantly by the location, size and type of the resort. Included in the

anticipated operating costs of each HOA are our management fees. The board of directors of the HOA discusses the various considerations and votes to

approve the annual budget, which determines the annual maintenance fees charged to each owner. One of the management services we provide to the HOA is

the billing and collection of annual maintenance fees on the HOA's behalf. Annual maintenance fees for a given year are generally billed during the previous

November, due by January and deposited in a segregated or restricted account, which is not included in our consolidated

12

balance sheet but is managed by us on behalf of the HOA. As a result, a substantial majority of our fees for February through December of each year are

collected from owners in advance. Funds are released to us from these accounts on a monthly basis for the payment of management fees as we provide our

management services.

Our HOA management contracts typically have initial terms of three to ten years, with automatic renewals. These contracts can generally only be

terminated by the HOA upon a majority vote of the owners (which may include one or more of the Diamond Collections) prior to each renewal period, other

than in some limited circumstances involving cause.

Our HOA management contracts with the managed resorts that are part of the European Collection generally have either indefinite terms or lengthy

remaining terms (approximately 40 years) and can only be terminated for an uncured breach by the manager or a winding up of the European Collection.

No HOA has terminated any of our management contracts during the past five years. We generally have the right to terminate our HOA management

contracts at any time upon written notice to the respective HOA. During the past five years, we have terminated only one HOA management contract and sold

two immaterial HOA management contracts.

Diamond Collections. The Diamond Collections currently consist of the following:

• the Diamond Resorts U.S. Collection (the “U.S. Collection”), which includes interests in resorts located in Arizona, California, Colorado, Florida,

Indiana, Missouri, Nevada, New Mexico, South Carolina, Tennessee, Virginia and St. Maarten;

• the Diamond Resorts Hawaii Collection (the “Hawaii Collection”), which includes interests in resorts located in Arizona, California, Hawaii, Nevada

and Utah;

• the Diamond Resorts California Collection (the “California Collection”), which includes interests in resorts located in Arizona, California and

Nevada;

• the Premiere Vacation Collection (the “Premiere Vacation Collection”), which includes interests in resorts located in Arizona, Colorado, Indiana,

Nevada and Baja California Sur, Mexico;

• the Monarch Grand Vacations (the “Monarch Grand Collection”), which includes interests in resorts located in California, Nevada, Utah and the

Cabo Azul Resort located in San Jose Del Cabo, Mexico;

• the Diamond Resorts European Collection (the “European Collection”), which includes interests in resorts located in Austria, England, France, Italy,

Norway, Portugal, Scotland and Spain;

• the Diamond Resorts Latin America Collection (the “Latin America Collection”), which currently includes interests in the Cabo Azul Resort located

in San Jose Del Cabo, Mexico;

• the Diamond Resorts Mediterranean Collection (the “Mediterranean Collection”), which includes interests in resorts located in the Greek Islands of

Crete and Rhodes; and

• Club Intrawest, which includes interests in resorts located in Canada, Mexico, as well as Florida and California, which was added to our resort

network in connection with the Intrawest Acquisition in January 2016.

Each of the Diamond Collections is operated through a Collection Association, which is administered by a board of directors. Directors are generally

elected by the points holders within the applicable Diamond Collection, subject to limited exceptions.

We own a significant number of points in each of the Diamond Collections (which in the case of the Mediterranean Collection are in the form of shares

but for simplicity are also referred to in this annual report as points), which we hold as inventory. The board of directors of each Diamond Collection hires a

company to provide management services to the Diamond Collection, which in each case is us.

As with our HOA management contracts, management fees charged to the Diamond Collections in the U.S. are based on a cost-plus structure and are

calculated based on the direct and indirect costs (including the absorption of a substantial portion of our overhead related to the provision of our

management services) incurred by the Diamond Collection. Under our current Diamond Collection management agreements, we receive management fees of

15% of the costs of the applicable Diamond Collection (except with respect to our management agreement with the Monarch Grand Collection, under which

we receive a management fee of 10% of the costs of the Monarch Grand Collection). Our management fees are included in the budgets

13

prepared by each Collection Association, which determines the annual maintenance fee charged to each owner and is voted on and approved by the board of

directors of each Collection Association. One of the management services we provide to all of the Diamond Collections is the billing and collection of

annual maintenance fees on the Diamond Collection's behalf. Annual maintenance fees for a given year are generally billed during the previous November,

due by January and deposited in a segregated or restricted account, which is not included in our consolidated balance sheet but is managed by us on behalf of

each Diamond Collection. As a result, a substantial majority of our fees for February through December of each year are collected from owners in advance.

Funds are released to us from these accounts on a monthly basis for the payment of management fees as we provide our management services.

Apart from the management contract for the European Collection and the Mediterranean Collection, our Diamond Collection management contracts

have initial terms of three to ten years, with automatic renewals of three to ten years, and can generally only be terminated by the Diamond Collection upon a

majority vote of the Diamond Collection's members prior to each renewal period, other than in some limited circumstances involving cause. In the case of the

Mediterranean Collection, the management agreement is indefinite and irrevocable. No Diamond Collection has terminated, or elected not to renew, any of

our management contracts during the past five years. We generally have the right to terminate our Diamond Collection management contracts at any time

upon written notice to the applicable Diamond Collection. The management contract for the European Collection has an indefinite term, can only be

terminated by the European Collection for an uncured breach by the manager or a winding up of the European Collection, and may not be terminated by the

manager.

Clubs. Another key component of our hospitality and management services business is our management of the Clubs. We operate a Vacation Interests

exchange program that enables our members to use their points to stay at resorts outside of their home Diamond Collection, as well as other affiliated resorts,

hotels and cruises, for which an annual fee is charged. In addition, the Clubs provide services to the Diamond Collections, such as reservation call center

services and customer services, which are billed on a cost-plus basis to the Diamond Collections directly.

The Clubs offer our members a wide range of other benefits, such as the opportunity to purchase various products and services, including guided

excursions and member events and reservation protection products, for which we earn commissions. See "Our Flexible Points-Based Vacation Ownership

System and the Clubs—The Clubs" for additional information regarding the Clubs.

Vacation Interests Sales and Financing. We market and sell VOIs that provide access to our resort network of 109 Diamond Resorts managed resorts

and 250 affiliated resorts and hotels and 20 cruise itineraries.

The VOI inventory that we reacquire pursuant to our IRAAs provides us with a steady stream of low-cost VOI inventory that we can sell to our current

and prospective members. Our VOI inventory is also supplemented by recovering VOIs previously owned by members who default on their consumer loans,

whether the consumer loans were originated by us or were acquired from third-parties, as well as inventory purchased in strategic acquisitions. In addition, we

may engage in targeted development projects, particularly in attractive locations where member demand exceeds our existing supply.

We have 61 sales centers across the globe, 51 of which are located at managed resorts, six of which are located at affiliated resorts and four of which are

located off-site. We currently employ an in-house sales and marketing team at 49 of these locations and also maintain agency agreements with independent

sales organizations at 12 locations. A relatively small portion of our sales, principally sales of additional points to existing members, are effected through our

call centers. Our sales representatives utilize a variety of marketing programs to generate prospects for our sales efforts, including presentations at resorts

targeted to current members and guests, enhanced mini-vacation packages that we refer to as Events of a Lifetime

TM

, overnight mini-vacation packages,

targeted mailing, telemarketing, gift certificates and various destination-specific local marketing efforts. Additionally, we offer incentive premiums in the

form of tickets to local attractions and activities, hotel stays, gift certificates or meals to guests and other potential customers to encourage attendance at

tours.

We generate our VOI sales primarily through conducting tours at our sales centers. These tours generally include a tour of the resort properties, as well

as an in-depth explanation of our points-based VOI system and the value proposition it offers our members. Our tours are designed to provide guests with an

in-depth overview of our Company, our resort network and benefits associated with membership in THE Club, as well as a customized presentation to explain

how our products and services can meet their vacationing needs. We also conduct tours at various offsite and hotel locations (outside of our managed resorts)

based on potential leads for VOI sales identified through innovative marketing targeted toward individuals with desired demographics.

Our sales force is highly trained in a consultative sales approach designed to ensure that we meet customers' needs on an individual basis. We manage

our sales representatives' consistency of presentation and professionalism using a variety of sales tools and technology. The sales representatives are

principally compensated on a variable basis determined by performance, subject to a base compensation amount.

Our marketing efforts are principally directed at the following channels:

14

• our existing member base;

• consumers who own VOIs sold by businesses we have acquired;

• guests who stay at our managed resorts;

• off-property contacts who are solicited from the premises of hospitality, entertainment, gaming and retail locations;

• participants in third-party vacation ownership exchange programs, such as Interval International, Inc. (“Interval International”), and Resorts

Condominiums International, LLC (“RCI”), who stay at our managed resorts;

• member referrals; and

• other potential customers who we target through various marketing programs.

We employ innovative programs and techniques designed to infuse hospitality into our sales and marketing efforts. For example, we offer enhanced

mini-vacation packages at some of our managed resorts, which we refer to as Events of a Lifetime

TM

, at which our members or prospective customers who

have purchased such packages are invited to dine together, along with our sales team members, and to attend a show, golf outing or other local attraction as a

group over a two-day period. At the end of the stay, our sales team provides an in-depth explanation of our points-based VOI system and the value

proposition it offers our members. In addition, we have an initiative in which select members and guests receive “high-touch” services such as a special

welcome package, resort orientation and concierge services, as part of a pre-scheduled in-person tour. Results from these enhanced programs and initiatives

have been positive. We have found that, by driving innovation throughout our business, most significantly by infusing our hospitality focus into the sales

process and creatively engaging with potential purchasers, we improve potential purchasers' overall experience and level of satisfaction and, as a result, are

able to increase the likelihood that they will buy our VOIs and increase the average transaction size.

Although the principal goal of our marketing activities is the sale of points, in order to generate additional revenue and offset the carrying cost of our

VOI inventory, we use a portion of the points and intervals which we own or acquire the right to use to offer accommodations to consumers on a per-night or

per-week basis, similar to hotels. We generate these stays through direct consumer marketing, travel agents, external websites and our own website and

vacation package wholesalers. We believe that these operations, in addition to generating supplemental revenue, provide us with a good source of potential

customers for the purchase of points.

We provide loans to eligible customers who purchase VOIs through our U.S., Mexican and St. Maarten sales centers and choose to finance their

purchase. These loans are collateralized by the underlying VOI, generally bear interest at a fixed rate, have a typical term of 10 years and are generally made

available to consumers who make a down payment within established credit guidelines. Our minimum required down payment is 10%. From January 1, 2011

through December 31, 2015, our average cash down payment was 20.0% and the average initial equity contribution for new VOI purchases by existing

owners (which take into account the value of VOIs already held by purchasers and pledged to secure a new consumer loan) was 30.2%, which resulted in an

average combined cash and equity contribution of 50.2% for these new VOI purchases.

As of December 31, 2015, our loan portfolio (including loans we have transferred to special-purpose subsidiaries in connection with the Conduit

Facility, Quorum Facility and securitization transactions) was comprised of approximately 64,000 loans with an outstanding aggregate loan balance of

$916.1 million. Our total portfolio includes loans that have been written off for financial reporting purposes due to payment defaults and delinquencies but

which we continue to administer and loans that were originated by us and loans that were acquired in connection with our acquisitions.

Approximately 46,000 of these consumer loans were loans under which the consumer was not in default, and the outstanding aggregate loan balance

was $751.8 million. Approximately 42,000 of these loans were originated by us and approximately 4,000 of the loans were acquired in connection with one

of our acquisitions.

Approximately 18,000 loans within our loan portfolio, with an outstanding aggregate loan balance of $164.3 million, were loans that are in default

(accounts that are greater than 180 days delinquent and have not yet been foreclosed upon or canceled). Approximately 15,000 of these loans that were in

default as of December 31, 2015 were loans acquired by us, including approximately 12,000 already in default at the time we acquired them in connection

with various acquisitions and approximately 3,000 of the loans were not yet in default at the time of the acquisition. Approximately 3,000 of the loans that

were in default in default as of December 31, 2015 were originated by us. The loans originated by us have already been written off for financial reporting

purposes but we continue to administer them until we elect, subject to applicable law, to foreclose or cancel them. Loans that were in default at the time they

were acquired were never included in our loan portfolio and, accordingly, are not part of our provision for uncollectible accounts or reserve for uncollectible

accounts. We elect to recover VOI inventory underlying defaulted loans based on a variety of factors, including our VOI inventory needs and the carrying

costs associated with recapturing the VOI inventory. Consumer loans in default at the time of acquisition represent

15

future sources of low-cost inventory to us.

The weighted-average interest rate for all of the loans in our portfolio as of December 31, 2015 was 14.9%, which includes a weighted average interest

rate for loans in default of 16.4%. As of December 31, 2015, 8.8% of our owner-families had an active loan outstanding with us.

We underwrite each loan application to assess the prospective buyer's ability to pay through the credit evaluation score methodology developed by

FICO based on credit files compiled and maintained by Experian (for U.S. residents) and Equifax (for Canadian residents). In underwriting each loan, we

review the completed credit application and the credit bureau report and/or the applicant’s performance history with us, including any delinquency on

existing loans with us, and consider in specified circumstances, among other factors, whether the applicant has been involved in bankruptcy proceedings

within the previous 12 months and any judgments or liens, including civil judgments and tax liens, against the applicant. As of December 31, 2015, the

weighted average FICO score (based upon loan balance) for our borrowers across our existing loan portfolio was 723, and the weighted average FICO score

for our borrowers on loans we originated since 2011 was 757.

Our consumer finance servicing division includes underwriting, collection and servicing of our consumer loan portfolio. Loan collections and

delinquencies are managed by utilizing modern collection technology and an in-house collection team to minimize account delinquencies and maximize

cash flows. We generally monetize a substantial portion of the consumer loans we generate from our customers through conduit and securitization financings.

We act as servicer for consumer loan portfolios, including those monetized through conduit or securitization financings and receivables owned by third

parties, for which we receive a fee.

Through arrangements with certain financial institutions in Europe, we broker financing for qualified customers who purchase points through our

European sales centers.

Our Resort Network

Our resort network consists of 379 vacation destinations, which includes 109 Diamond Resorts managed properties with approximately 12,000 units

worldwide that we manage, and 250 affiliated resorts and hotels and 20 cruise itineraries (as of January 31, 2016), which we do not manage and which do not

carry our brand name but are a part of our resort network and, consequently, are available for our Club members to use as vacation destinations. Through our

management, we provide guests with a consistent and high quality suite of services and amenities, and, pursuant to our management agreements, we have

oversight and management responsibility over the staff at each location. Of the managed resorts, 47 have food and beverage operations, 49 have a gift shop,

pro shop or convenience store, and 29 have a golf course, leisure center or spa. Most of these amenities are operated by third parties pursuant to leases,

licenses or similar agreements. Revenue from these operations is included in Consolidated Resort Operations Revenue in our consolidated statements of

operations.

Affiliated resorts are resorts with which we have contractual arrangements to use a certain number of vacation intervals or units. These resorts are made

available to members of the Clubs through affiliation agreements. In the majority of cases, our affiliated resorts provide us with access to their vacation

intervals or units in exchange for our providing similar usage of intervals or units at our managed resorts, and no fees are paid by us in connection with these

exchanges. However, in a limited number of circumstances, we receive access to accommodations at our affiliated hotels and cruises through two other types

of arrangements. In the first of these types of arrangements, we pay an upfront fee to an affiliated hotel or cruise company for access to a specified number of

vacation intervals or units, and we incorporate this upfront fee into our calculation for annual dues to be paid by members of the Clubs. In the second of these

types of arrangements, a member who desires to stay at an affiliated hotel for a particular time period deposits points with us and, in exchange, we pay our

affiliated hotel the funds required in order to allow such member access and, in turn, we use the points redeemed to secure a unit, which we then use for

marketing or rental purposes. The benefit of these arrangements, in comparison to traditional exchange companies, is that there is no need to wait for an

owner to deposit their week’s ownership into the program in order to then make it available to members. These arrangements secure availability for our

members in advance and, therefore, tend to provide better customer service and availability.