The analysis presented in this report was completed before the release of the

2020 Decennial Census; therefore, the current estimates may not reflect the true

change since April 1, 2010; however, the direction and magnitude of trends in

the data are presumed to be accurate. HUD will provide an updated report that

incorporates data from the 2020 Decennial Census in the future.

U.S. Department of Housing and Urban Development,

Oce of Policy Development and Research

As of August 1, 2021

Share on:

COMPREHENSIVE HOUSING MARKET ANALYSIS

Shreveport-Bossier City,

Louisiana

Executive Summary 2Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Executive Summary

Housing Market Area Description

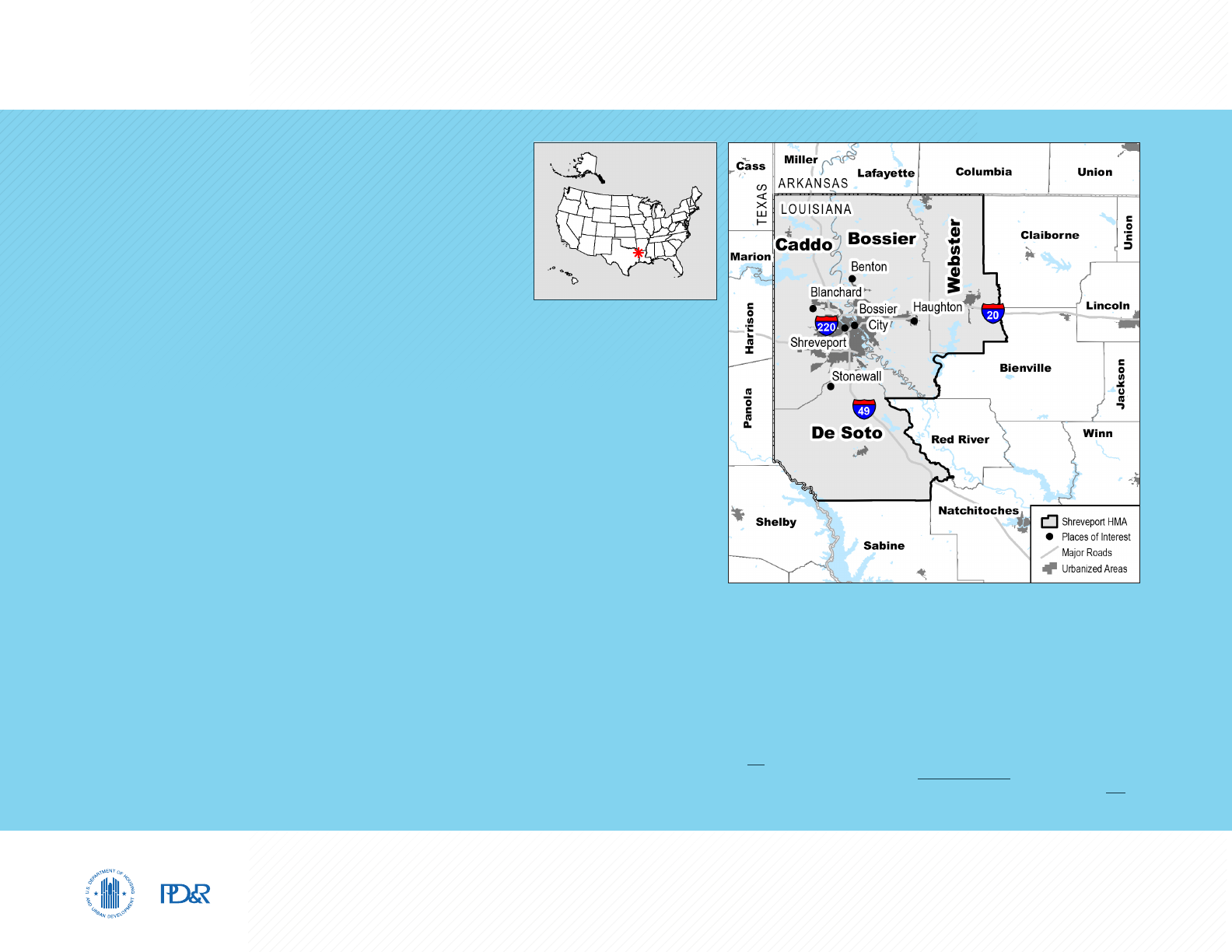

The Shreveport-Bossier City Housing Market Area

(hereafter, Shreveport HMA) is coterminous with the

Shreveport-Bossier City, LA Metropolitan Statistical

Area (MSA), which includes four parishes: Bossier,

Caddo, De Soto, and Webster. The HMA is the

economic hub for northwestern Louisiana, and the

majority of economic activity in the HMA occurs in

the two most populous parishes, Bossier and

Caddo Parishes.

The current population of the HMA is estimated

at 428,800.

Bordered by the states of Arkansas and Texas, the

HMA is part of the socioeconomic region referred

to as the Ark-La-Tex region. Caddo Parish was

named after the Caddo Nation, who were the

original inhabitants of northwest Louisiana. The city

of Shreveport is the largest city of Caddo Parish

and is home to the Shreveport Municipal Memorial

Auditorium, which hosted the Louisiana Hayride

radio show (1948–60). Elvis Presley performed on the

show in 1954, before his stardom, and was offered

a contract for additional performances. The phrase

“Elvis has left the building” was coined upon his last

performance on the Louisiana Hayride in 1956.

Tools and Resources

Find interim updates for this metropolitan area, and select geographies nationally, at PD&R’s

Market-at-a-Glance tool.

Additional data for the HMA can be found in this report’s supplemental tables.

For information on HUD-supported activity in this area, see the Community Assessment Reporting Tool.

Executive Summary 3Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Market Qualifiers

Job loss in the HMA due to the countermeasures

implemented to slow the spread of COVID-19 was

severe; 22,000 jobs were lost during March and

April 2020, and only 51 percent of those jobs had

been recovered through July 2021 (not seasonally

adjusted). During the 3-year forecast period,

nonfarm payrolls are expected to increase at an

average annual rate of 1.8 percent as the HMA

recovers from the economic slowdown caused

by the pandemic.

The sales housing market in the HMA is currently

balanced, with an estimated vacancy rate of

1.3 percent, down from 1.4 percent in 2010. During

the 12 months ending June 2021, the average

existing home sales price increased 15 percent, to

$178,600, and the average new home sales price

decreased 3 percent, to $252,800 (CoreLogic,

Inc.). During the next 3 years, demand is estimated

for 3,300 new homes. The 310 homes under

construction are expected to satisfy some of the

demand in the first year of the forecast period.

The overall rental housing market is balanced,

with a current rental vacancy rate estimated at

7.0 percent, down from 8.0 percent in 2010.

The apartment market is slightly tight, with a

vacancy rate of 4.5 percent during the second

quarter of 2021, down from 6.4 percent a year

earlier, whereas the average apartment rent

increased 8 percent, to $872 (RealPage, Inc.).

During the forecast period, demand is estimated

for 290 new rental units; the 170 units currently

under construction are expected to meet part

of that demand.

Economy

Weak: Before the COVID-19

pandemic, the HMA had been losing

jobs since 2012 except in 2014 and

2018, when nonfarm payroll growth

was moderate.

Rental Market

Balanced: The apartment market

has tightened since a period of

peak vacancy during the second

quarters of 2016 and 2017, when

market conditions were soft.

Sales Market

Balanced: Existing home sales

increased 16 percent during the

12 months ending June 2021,

compared with a decline of

1 percent from a year earlier.

TABLE OF CONTENTS

Economic Conditions 4

Population and Households 9

Home Sales Market 11

Rental Market 15

Terminology Definitions and Notes 18

3-Year Housing Demand Forecast

Sales Units Rental Units

Shreveport HMA

Total Demand 3,300 290

Under Construction 310 170

Notes: Total demand represents the estimated production necessary to achieve a balanced market at the end of the forecast period. Units under

construction as of August 1, 2021. The forecast period is August 1, 2021, to August 1, 2024.

Source: Estimates by the analyst

Economic Conditions 4Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Conditions

Largest Sector: Education and Health Services

The goods-producing sectors have had a significant impact on

economic conditions in the HMA even though they represent a

smaller proportion of jobs than the service-providing sectors;

since 2012, the goods-producing sectors have lost an average

of 1,000 jobs annually.

Primary Local Economic Factors

The economy in the Shreveport HMA depends heavily on the education and

health services, the transportation and utilities, and the professional and

business services sectors because they have been the only sectors to grow

since 2011 (Figure 1). Although the education and health services and the

government sectors each account for 18 percent of the share of nonfarm

payroll jobs in the HMA (Figure 2), the education and health services sector is

the largest sector and has been the fastest growing sector in the HMA since

2011. The prominence of the sector is primarily due to the presence of two

major medical centers, the Willis-Knighton Health System and the Ochsner

Louisiana State University (LSU) Health Shreveport-Academic Medical Center,

a result of a public-private partnership agreement between Ochsner Health

and LSU Health Shreveport established in 2018. Although the transportation

and utilities sector accounts for 4 percent of the nonfarm payroll jobs in

the HMA, it has been the second fastest growing sector since 2011, partly

because of the Port of Caddo-Bossier. Located in southeastern Caddo Parish,

close to rail lines and easily accessible to Interstate Highways 20 and 49, the

inland port provides infrastructure to support manufacturing and warehousing

facilities. Current tenants at the port include warehousing tenants such

as Odyssey Specialized Logistics LLC (formerly ADS Logistics Co., LLC),

which supports the metals industry; Genesis Energy, L.P., which provides

warehousing for refined petroleum and chemical products; and Ternium

USA Inc., which manufactures steel products.

Education & Health Services

18%

Mining, Logging, & Construction 6%

Manufacturing 6%

Transportation

& Utilities 4%

Information 1%

Financial Activities 4%

Professional & Business

Services 11%

Leisure &

Hospitality 11%

Other Services 4%

Federal 3%

State 4%

Local 11%

Total

167.1

Government

18%

Wholesale 4%

Retail 13%

Trade 17%

Figure 2. Share of Nonfarm Payroll Jobs in the Shreveport HMA, by Sector

Notes: Total nonfarm payroll is in thousands. Percentages may not add to 100 percent due to rounding.

Based on 12-month averages through July 2021.

Source: U.S. Bureau of Labor Statistics

Total Nonfarm Payroll Jobs

Goods-Producing Sectors

Mining, Logging, & Construction

Manufacturing

Service-Providing Sectors

Wholesale & Retail Trade

Transportation & Utilities

Information

Financial Activities

Professional & Business Services

Education & Health Services

Leisure & Hospitality

Other Services

Government

-60 -50 10-40 -30 -20 -10 0

Change in Jobs (%)

Figure 1. Sector Growth in the Shreveport HMA, 2011 to Current

Note: The current date is August 1, 2021.

Source: U.S. Bureau of Labor Statistics

Economic Conditions 5Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

The professional and business services sector has been an influential nonfarm

payroll sector in the HMA. In May 2020, the U.S. Air Force Global Strike Command

innovation hub, STRIKEWERX, opened at the Cyber Innovation Center in Bossier

City. STRIKEWERX is a public-private partnership that provides public entry for

businesses and academia to collaborate with the U.S. Air Force Global Strike

Command to provide technological solutions for the Command.

The government sector is the second largest payroll sector in the HMA, and it

includes employees from LSU Shreveport and the cities of Shreveport and Bossier

City. Home to the Air Force Global Strike Command, Barksdale Air Force Base

(BAFB) is the largest employer in the HMA (Table 1) and had an annual economic

impact of $858.4 million during the 2020 fiscal year (United States Air Force).

The third largest nonfarm payroll sector in the HMA is the wholesale and retail

trade sector, followed by the leisure and hospitality sector, which is primarily

supported by the casino gaming industry. The Shreveport HMA has the

second largest gaming industry in the state, following the Lake Charles MSA

(Louisiana State Police, Louisiana Gaming Control Board). Riverboat casinos

and slot machines at Harrah’s Louisiana Downs racetrack, owned by Caesars

Entertainment, Inc., generated approximately $58.6 million in revenue during

July 2021.

Current Conditions and the Impact of

COVID-19 on Nonfarm Payrolls in the HMA

Interventions taken in mid-March 2020 to slow the spread of COVID-19,

including limiting nonessential business activity and discouraging nonessential

travel, worsened already-weak economic conditions in the HMA. Nonfarm

payrolls fell by 22,000 jobs during March and April 2020. Job recovery began

in May 2020, but recovery has been uneven during the first 7 months of 2021.

From May 2020 through July 2021, 51 percent of the jobs lost in the HMA were

recovered. Despite this partial recovery, economic conditions remain weak.

During the 12 months ending July 2021, nonfarm payrolls in the HMA fell by

6,500 jobs, or 3.7 percent, to 167,100 compared with a year ago (Table 2). The

payroll sectors most affected by efforts to slow the spread of COVID-19 were

Table 2. 12-Month Average Nonfarm Payroll Jobs (1,000s)

in the Shreveport HMA, by Sector

12 Months

Ending

July 2020

12 Months

Ending

July 2021

Absolute

Change

Percentage

Change

Total Nonfarm Payroll Jobs

173.6 167.1 -6.5 -3.7

Goods-Producing Sectors

22.5 20.0 -2.5 -11.1

Mining, Logging, & Construction

12.1 10.5 -1.6 -13.2

Manufacturing

10.5 9.5 -1.0 -9.5

Service-Providing Sectors

151.1 147.1 -4.0 -2.6

Wholesale & Retail Trade

28.5 28.2 -0.3 -1.1

Transportation & Utilities

7.0 6.9 -0.1 -1.4

Information

1.6 1.5 -0.1 -6.3

Financial Activities

7.5 7.1 -0.4 -5.3

Professional & Business Services

17.5 17.9 0.4 2.3

Education & Health Services

32.2 30.9 -1.3 -4.0

Leisure & Hospitality

20.8 18.8 -2.0 -9.6

Other Services

6.1 6.0 -0.1 -1.6

Government

29.8 29.9 0.1 0.3

Notes: Based on 12-month averages through July 2020 and July 2021. Numbers may not add to totals due to

rounding. Data are in thousands.

Source: U.S. Bureau of Labor Statistics

Name of Employer Nonfarm Payroll Sector Number of Employees

Barksdale Air Force Base* Government 9,250

Willis-Knighton Health System Education & Health Services 7,425

Ochsner Louisiana State University Health

Shreveport-Academic Medical Center

Education & Health Services 3,000

General Dynamics Information Technology, Inc. Professional & Business Services 1,100

Caesars Entertainment, Inc. Leisure & Hospitality 1,100

Penn National Gaming, Inc. Leisure & Hospitality 1,025

Bally’s Shreveport Casino & Hotel Leisure & Hospitality 1,000

CHRISTUS Health Education & Health Services 900

City of Bossier City Government 750

Boyd Gaming Corporation Leisure & Hospitality 750

Table 1. Major Employers in the Shreveport HMA

*Data include military personnel, who are generally not included in nonfarm payroll survey data.

Note: Excludes local school districts.

Source: Greater Bossier Economic Development Foundation, November 2019

Economic Conditions 6Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

those sectors with jobs that cannot easily be done

remotely. The majority of the losses occurred

in the service-providing sectors, which fell by

4,000 jobs, or 2.6 percent, during this period.

The leisure and hospitality sector accounted for

31 percent of total job losses, declining by 2,000

jobs, or 9.6 percent, compared with a year earlier.

Casinos were severely affected by efforts to slow

the spread of COVID-19. From the beginning of

the pandemic through the end of 2020, gaming

industry companies filed Worker Adjustment

and Retraining Notifications (WARN) with the

Louisiana Workforce Commission to notify nearly

2,300 casino workers in the HMA that they would

be laid off. The education and health services

sector fell by 1,300 jobs, or 4.0 percent, during

the 12 months ending July 2021, partly because

health care and social assistance industry jobs

fell by 1,200, or 4.0 percent. The professional

and business services sector and the government

sector were the only sectors to expand during the

12 months ending July 2021, increasing by 400

and 100 jobs, or 2.3 and 0.3 percent, respectively.

During the 12 months ending July 2021, the

goods-producing sectors declined by 2,500 jobs,

or 11.1 percent, because demand for products fell

and oil production slowed. When companies in

Shreveport HMA Nation

10.0

9.0

8.0

7.0

6.0

5.0

4.0

3.0

Unemployment Rate (%)

Jul-00

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Figure 3. 12-Month Average Unemployment Rate in the Shreveport HMA and the Nation

Note: Based on the 12-month moving average.

Source: U.S. Bureau of Labor Statistics

the oil and gas extraction industry laid off employees in the HMA, the mining, logging, and construction

sector fell by 1,600 jobs, or 13.2 percent, from a year earlier, accounting for 25 percent of total nonfarm

payroll losses. During the 12 months ending July 2021, the manufacturing sector fell 9.5 percent from a

year earlier. In 2020, two large manufacturers, Libbey Inc. and Benteler/Steel Tube, laid off 450 and 375

employees, respectively (Louisiana Workforce Commission, 2020 WARN).

Current Conditions—Unemployment

The unemployment rate in the HMA averaged 7.0 percent during the 12 months ending July 2021,

unchanged from the previous 12 months but down from the recent annual average peak of 8.5 percent

during the 12 months ending March 2021 (Figure 3). By comparison, the unemployment rate in the nation

averaged 6.5 percent during the 12 months ending July 2021, unchanged from a year earlier.

Economic Conditions 7Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Periods of Significance

National Recession Nonfarm Payrolls

Jul-00

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

195

190

185

180

175

170

165

160

Nonfarm Payrolls (in Thousands)

Note: 12-month moving average.

Sources: National Bureau of Economic Research; U.S. Bureau of Labor Statistics

Figure 4. 12-Month Average Nonfarm Payrolls in the Shreveport HMA

2001 Through 2008

As a result of the national recession in the

early part of the decade, nonfarm payrolls in

the HMA fell from 2001 through 2003 by an

average of 1,400 jobs, or 0.8 percent, annually

before increasing an average of 3,100 jobs, or

1.7 percent, annually from 2004 through 2008

(Figure 4). During the 5-year period, the largest

gains were in the professional and business

services sector, which increased an average of

900 jobs, or 5.7 percent, annually, followed by

the wholesale and retail trade and the education

and health services sectors, both increasing an

average of 700 jobs annually, or 2.3 and

2.6 percent, respectively. Part of the expansion

happened because demand for goods and

services increased after people temporarily

relocated from the New Orleans MSA to the HMA

due to the landfall of Hurricane Katrina in 2005.

In 2008, a natural gas mining technique called

fracking made natural gas mining more attractive

to natural gas extraction companies, which led

to an expansion in production at the Haynesville

Shale natural gas field in the HMA. When

production began to expand, the mining, logging,

and construction sector increased by 800 jobs,

or 5.7 percent, in 2008.

2009 Through 2011

Nonfarm payrolls in the HMA fell by 4,500 jobs,

or 2.3 percent, to 188,200 jobs during 2009 as

a result of the national recession that began in late 2007. The impact of the recession was short lived in

the HMA, partly because natural gas extraction activities in the HMA continued to be strong. Economic

conditions improved during 2010 and 2011, and nonfarm payrolls increased by 1,200 jobs, or 0.6 percent,

annually, to 190,500 jobs. The mining, logging, and construction sector rose by an average of 1,400 jobs,

or 8.9 percent, annually during the 2 years.

2012 Through 2019

Nonfarm payrolls trended downward from 2012 through 2019 in the HMA. In 2012, the goods-producing

sectors lost jobs when General Motors Company closed its manufacturing facility and mining and

extraction companies shifted resources to more profitable natural gas fields outside the HMA. As the

number of nonfarm payrolls in the HMA fell, workers began to leave the HMA, leading to a decline in the

demand for goods and services. During 2012 and 2013, nonfarm payrolls fell by an average of 3,300 jobs, or

1.7 percent, annually, to 184,000 jobs. Job losses in the goods-producing sector accounted for 70 percent

of the decline. The decline in the service-providing sectors was less severe, partly because the leisure

and hospitality sector increased by an average of 500 jobs, or 2.0 percent, annually. Bossier Casino

Economic Conditions 8Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Employment Forecast

During the 3-year forecast period, nonfarm payrolls in the Shreveport HMA

are expected to increase at an average rate of 1.8 percent annually. Job

growth is expected to be greatest during the first year of the forecast, with

nonfarm payrolls returning to prepandemic levels anticipated by the end

of the third year. Job gains are expected to be strong in the transportation

and utilities sector as demand for e-commerce goods continues to rise.

Amazon.com, Inc. plans to begin construction on a $200 million robotic

distribution center in Caddo Parish, which is expected to be completed in

2022. The project is expected to create 800 construction jobs and 1,000

permanent jobs. Road infrastructure projects totaling $30 million are expected

to contribute to construction-related employment during the first year of the

forecast period. Jobs in the leisure and hospitality sector are also expected

to increase when local casinos receive state approval for sports betting in

their establishments.

Venture, Inc. opened the Margaritaville Resort Casino in 2013, when up to

1,200 jobs were expected to be created.

Economic conditions in the HMA temporarily improved during 2014, as

nonfarm payrolls increased by 500 jobs, or 0.3 percent, before declining

by 1,400, or 0.7 percent, annually from 2015 through 2017. Although job

losses were most severe among the goods-producing sectors during this

period, the service-providing sectors accounted for 43 percent of the total

losses. Construction of the Integrated Technology Center, located at the

National Cyber Research Park, was completed in 2015, contributing to the

decline in the mining, logging, and construction sector jobs during this

period. The decline in payrolls briefly reversed as the economy in the

HMA expanded by 1,200 jobs, or 0.7 percent, during 2018, with the goods-

producing sectors accounting for 58 percent of the expansion. The service-

providing sectors increased at a slower pace, with the largest gains

occurring in the professional and business services sector, which increased

by 1,500, or 8.8 percent. Gains in the administrative and support and

waste management industries accounted for 53 percent of that increase

to accommodate business expansions in the HMA. In 2019, payrolls fell by

500 jobs, or 0.3 percent. The wholesale and retail trade sector lost the most

jobs during the year because demand for e-commerce goods rose in the

HMA and contributed to the decline in the retail subsector, which accounted

for 86 percent of the loss in the sector. Although the mining, logging, and

construction sector lost 300 jobs during 2019, those losses were partially

offset by jobs added from the $73 million Interstate 20-Interstate 220 BAFB

Interchange Road project that began in May 2019.

Population and Households 9Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population and Households

Current Population: 428,800

Coinciding with weakening economic conditions in the HMA, net

out-migration from the HMA has occurred each year since 2012.

Population Trends

Population growth was stagnant from 2000 to 2003 due to average net

out-migration of 1,750 people annually (Figure 5), as the HMA lost jobs—a

consequence of the national recession. From 2003 to 2004, net in-migration

increased, and the population grew by 3,450, or 0.8 percent, annually.

Population growth in the HMA peaked from 2005 to 2006, up by 6,550

people, or 1.5 percent, when people temporarily relocated to the HMA from

the New Orleans MSA due to Hurricane Katrina. From 2006 to 2009, as people

returned to the New Orleans MSA and nonfarm payrolls fell in 2009, population

growth slowed to an average of 1,700, or 0.4 percent, annually, with average net

out-migration of 550 people. All the population growth during this period was

due to positive net natural change, which averaged 2,250 people each year. The

population increased an average of 4,175, or 0.9 percent, annually from 2009 to

2012. Net in-migration accounted for 47 percent of the population growth during

this period, partly due to increased hiring in the HMA as a result of natural gas

mining activity in the Haynesville Shale natural gas field through 2011. Since

2012, as the economy in the HMA has contracted, the population has declined by

an average of 2,175, or 0.5 percent, annually. Net out-migration has fluctuated,

averaging 3,275 people each year, and net natural change moderated, then

slowed, averaging 1,100 people each year. As of August 1, 2021, the estimated

population of the HMA is approximately 428,800, representing an average

decline of 970, or 0.2 percent, annually since April 2010 (Table 3).

Household Trends

The current number of households in the HMA is estimated at 174,100, relatively

unchanged from April 2010. By comparison, households increased by an

average of 1,375, or 0.8 percent, a year from 2000 to 2010. Currently, an

2000–2001

2001–2002

2002–2003

2003–2004

2004–2005

2005–2006

2006–2007

2007–2008

2008–2009

2009–2010

2010–2011

2011–2012

2012–2013

2013–2014

2014–2015

2015–2016

2016–2017

2017–2018

2018–2019

2019–2020

2020–Current

Current–Forecast

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

-1,000

-2,000

-3,000

-4,000

Population Change

Net Natural Change Net Migration Population Growth

Notes: Data displayed are average annual totals. The forecast period is from the current date (August 1, 2021)

to August 1, 2024.

Sources: U.S. Census Bureau; current to forecast—estimates by the analyst

Figure 5. Components of Population Change in the Shreveport HMA,

2000 Through the Forecast

Population

Quick Facts

2010 Current Forecast

Population 439,811 428,800 428,300

Average Annual Change 2,200 -970 -180

Percentage Change 0.5 -0.2 0.0

Household

Quick Facts

2010 Current Forecast

Households 174,453 174,100 175,200

Average Annual Change 1,375 -35 380

Percentage Change 0.8 0.0 0.2

Table 3. Shreveport HMA Population and Household Quick Facts

Notes: Average annual changes and percentage changes are based on averages from 2000 to 2010, 2010 to

current, and current to forecast. The forecast period is from the current date (August 1, 2021) to August 1, 2024.

Sources: 2000 and 2010—2000 Census and 2010 Census; current and forecast—estimates by the analyst

Population and Households 10Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

estimated 65.7 percent of households, or 114,400,

are homeowners (Figure 6). The homeownership

rate in the HMA has increased since 2010, when

the homeownership rate was 64.8 percent. The

homeownership rate has increased because the

number of owner households has increased since

2010, whereas the number of renter households

has decreased.

Forecast

The pace of population decline in the Shreveport

HMA is expected to slow during the forecast period;

the population is expected to fall to 428,300 by

August 1, 2024, reflecting an average annual

decline of 180, which is relatively unchanged

from the current population estimate. As the HMA

recovers jobs lost during the pandemic, the pace

of out-migration is expected to slow compared

with the pace from 2010 to the current period.

Household growth is expected to average 380, or

0.2 percent, annually, reaching 175,200 households

in the HMA by the end of the forecast period.

67. 4

66.3

65.2

64.1

63.0

180,000

135,000

90,000

45,000

0

2000 2010 Current

Homeownership Rate (%)

Households

RenterOwner Homeownership Rate (%)

67. 0

64.8

65.7

Figure 6. Households by Tenure and Homeownership Rate in the Shreveport HMA

Note: The current date is August 1, 2021.

Sources: 2000 and 2010—2000 Census and 2010 Census; current—estimates by the analyst

Home Sales Market 11Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales Market

Market Conditions: Balanced

During the 12 months ending June 2021, the average sales prices

for new and existing homes increased 12 percent, with an increase

in average existing home sales prices more than offsetting a decline

in average new home sales prices (CoreLogic, Inc.).

Current Conditions

The sales housing market in the Shreveport HMA is currently balanced, with

home sales and home sales prices increasing at a more rapid pace since 2019

compared with 2015 through 2018, when home sales and home sales prices

increased each year by an average of 2 and 1 percent, respectively. The sales

vacancy rate in the HMA is currently estimated at 1.3 percent (Table 4), down

slightly from 1.4 percent in April 2010, when the market was also balanced.

The inventory of available homes for sale was 2.1 months in June 2021—down

from 3.9 months in June 2020 and well below the peak of 6.5 months in

August 2016 (CoreLogic, Inc.). During the 12 months ending June 2021, total

home sales, which includes new and existing homes, increased 14 percent,

to 8,275 homes sold. During the same period, the average home sales price,

which includes new and existing homes, increased 12 percent, to $183,500.

The increase in total home sales and prices during this period is due to

accelerated activity in the existing home sales market, which occurred partly

because of low mortgage interest rates.

New Home Sales

From 2004 through 2006, new home sales in the HMA increased an average

of 37 percent annually, to 700 homes sold in 2006 (Figure 7), partly because

the economy in the HMA generally expanded and net in-migration from

people displaced by Hurricane Katrina rose. The number of new home sales

subsequently

declined and averaged 570 homes sold annually during the

next 2 years as net out-migration ensued. Although nonfarm payrolls fell in

2009, increased mining and extraction of natural gas in the Haynesville Shale

natural gas field contributed to new home sales increasing 50 percent, to

Home Sales

Quick Facts

Shreveport HMA

Nation

Vacancy Rate

1.3% NA

Months of Inventory

2.1 1.4

Total Home Sales

8,275 6,505,000

1-Year Change

14% 16%

New Home Sales Price

$252,800 $416,600

1-Year Change

-3% 3%

Existing Home Sales Price

$178,600 $375,200

1-Year Change

15% 20%

Mortgage Delinquency Rate

5.4% 3.1%

Table 4. Home Sales Quick Facts in the Shreveport HMA

NA = data not available.

Notes: The vacancy rate is as of the current date; home sales and prices are for the 12 months ending June

2021; and months of inventory and mortgage delinquency data are as of June 2021. The current date is

August 1, 2021.

Sources: Vacancy rate—estimates by the analyst; months of inventory—CoreLogic, Inc.; HMA home sales

and prices—CoreLogic, Inc., with adjustments by the analyst; national home sales and prices—Zonda

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

Jun-04

Jun-05

Jun-06

Jun-07

Jun-08

Jun-09

Jun-10

Jun-11

Jun-12

Jun-13

Jun-14

Jun-15

Jun-16

Jun-17

Jun-18

Jun-19

Jun-20

Jun-21

Sales Totals

Existing Home Sales New Home Sales

Source: CoreLogic, Inc.

Figure 7. 12-Month Sales Totals by Type in the Shreveport HMA

Home Sales Market 12Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

820 homes sold in

2009. New home sales continued to rise through mid-2010

before falling to 690 homes sold in 2011 as a result of the expiration of the

first-time homebuyer tax credit in 2010. As jobs declined and net out-migration

occurred, new home sales fell an average of 20 homes, or 3 percent, annually

from 2012 through 2017. As the economy in the HMA expanded in 2018 and the

higher paying manufacturing and professional and business services sectors

continued to add jobs through 2019, new home sales increased an average

of 2 percent annually, to 590 homes sold in 2019. New home sales increased

7 percent, to 630 homes sold in 2020, as interest rates fell. New home sales

began to slow and eventually decline during the first half of 2021, partly due to

input supply shortages in the housing industry. Approximately 570 new homes

were sold in the HMA during the 12 months ending June 2021, down 8 percent

from the number of homes sold during the previous 12-month period.

The sales price for a new home in the HMA fell an average of $310 annually

from 2004 through 2006, to $168,300 (Figure 8), despite increasing new

home sales. From 2007 through 2011, the average new home price increased

an average of $14,000, or 7 percent, annually, to $238,300 because economic

conditions in the HMA were generally strong during this period. As economic

conditions in the HMA weakened, the new home sales price fluctuated,

falling an average of 3 percent, to $224,100, from 2012 through 2013 before

increasing by $6,000 in 2014, when the economy improved. From 2015 through

2016, the price of a new home fell an average of $3,675 annually and then rose

5 percent, to $234,300, in 2017. When economic conditions improved in 2018,

new home sales rose, and the price of a new home increased an average of

$17,200, or 7 percent, annually, to a peak of $268,700 in 2019. The average

new home sales price fell 7 percent, to $250,600, during 2020. During the

12 months ending June 2021, the average new home sales price was $252,800,

down by $8,025 from a year earlier, and 59 percent of new homes sold were

in the $200,000-to-$299,999 sales price range (Figure 9).

35

30

25

20

15

10

5

0

$99k and

Less

$100k to

$199k

$200k to

$299k

$300k to

$399k

$400k to

$499k

$500k and

More

Share of Sales (%)

Existing Sales New Sales

Note: New and existing sales include single-family homes, townhomes, and condominium units.

Source: Zonda, with adjustments by the analyst

Figure 9. Share of Overall Sales Price Range During the 12 Months

Ending June 2021 in the Shreveport HMA

275,000

250,000

225,000

200,000

175,000

150,000

125,000

100,000

75,000

Jun-04

Jun-05

Jun-06

Jun-07

Jun-08

Jun-09

Jun-10

Jun-11

Jun-12

Jun-13

Jun-14

Jun-15

Jun-16

Jun-17

Jun-18

Jun-19

Jun-20

Jun-21

Average Sales Price ($)

New Home Sales Existing Home Sales

Source: CoreLogic, Inc.

Figure 8. 12-Month Average Sales Price by Type in the Shreveport HMA

Home Sales Market 13Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Existing Home Sales and Prices

Existing home sales, which includes resale sales, real estate owned (REO)

home sales, and short sales, increased an average of 4 percent annually,

to 3,675, from 2004 through 2006, as the economy expanded and people

relocated to the HMA following Hurricane Katrina. Existing home sales

declined to 3,600 homes sold during 2007 before increasing an average

of 880 homes, or 20 percent, annually, to 6,250 homes sold in 2010.

Existing home sales fell 8 percent in 2011 due to the expiration of the first-

time homebuyer tax credit in 2010. Although economic conditions in the

HMA generally weakened, existing home sales fluctuated and increased an

average of 120 homes, or 2 percent, annually from 2012 through 2017. From

2018 through 2020, existing home sales increased an average of 4 percent

annually, to 7,225 homes sold in 2020. Beginning in the latter part of 2020,

in response to low mortgage interest rates and rising existing home sales

prices, many homeowners in the HMA decided to “trade up” and sell their

existing homes to buy a larger home. During the 12 months ending June 2021,

existing home sales increased, to 7,700 homes sold, up 16 percent from a

year earlier, when existing home sales fell during the second quarter of 2020

as people chose not to sell their homes because of the pandemic.

Average existing home sales price growth in the HMA followed the trend for

existing homes sold during the mid-2000s. From 2004 through 2006, the

average existing home sales price increased 8 percent annually, to $113,300,

before falling to $113,200 in 2007. As sales of existing homes increased

from 2008 through 2010, the average sales price of an existing home in the

HMA increased an average of $6,425, or 5 percent, annually, to $132,500

before falling slightly to $131,500 in 2011. Mirroring the increase in existing

home sales, from 2012 through 2019, the average price of an existing home

increased 2 percent annually, to $151,500. In 2020, the average price of an

existing home increased by $17,850, or 12 percent. During the 12 months

ending June 2021, the average price of an existing home rose to a new high

of $178,400, up 15 percent from a year earlier.

Delinquent Mortgages and REO Properties

The percentage of seriously delinquent mortgages and real estate owned (REO)

properties in the Shreveport HMA increased from 3.1 percent in April 2020 to

6.7 percent from September 2020 through December 2020 (CoreLogic, Inc.).

In June 2021, 5.4 percent of home loans in the HMA were seriously delinquent

or had transitioned into REO status, down from 5.6 percent a year earlier. By

comparison, the national percentage of seriously delinquent mortgages and

REO properties was 3.1 percent in June 2021, down from 3.6 percent a year

earlier and significantly below the peak rate of 8.6 percent in January 2010.

The share of seriously delinquent mortgages and REO properties in the HMA

during 2020 was lower than the high of 7.5 percent in January 2010 which

was caused by the national recession and foreclosure crisis that began in the

late 2000s. A portion of mortgage borrowers were hit hard by the pandemic-

induced economic downturn, and they participated in mortgage forbearance

programs which were provided for under the $2.2 trillion Coronavirus Aid,

Relief, and Economic Security (CARES) Act. There was a significant increase in

the percentage of mortgages that were 90 days or more delinquent, while the

number of foreclosures and REO properties declined as a result of the increase

in mortgage forbearances. In December 2020, the number of mortgages

90 or more days delinquent increased 161 percent year-over-year, whereas

foreclosures declined 29 percent and REO properties declined 65 percent.

Sales Construction Activity

New home construction activity, as measured by the number of single-family

homes, townhomes, and condominiums permitted, was stronger during the

2000s than during the 2010s, partly because of net in-migration that resulted

from the Hurricane Katrina disaster. From 2003 through 2006, an average of

1,675 homes were permitted annually (Figure 10); during the period, economic

conditions in the HMA improved, and net in-migration peaked. As net out-

migration occurred, sales of new homes in the HMA began to slow in 2007,

and new home construction fell an average of 26 percent annually, to a

Home Sales Market 14Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

low of 940 homes in 2008. From 2009 through

2010, new home sales rose, and new home

construction increased an average of 110

homes, or 11 percent, annually, before falling

1 percent, to 1,150 homes permitted during 2011.

Although new home sales began to decline in

2012, new home construction rose an average

of 4 percent annually, to 1,275 homes in 2014,

before falling an average of 12 percent annually,

to 980 homes in 2016. As jobs in the mining,

logging, and construction and the professional

and business services sectors increased in 2017

and the economy expanded in 2018, new home

construction in the HMA increased an average

of 7 percent annually, to 1,200 homes in 2019.

Due to pandemic-related shortages that began

in 2020, new home construction fell 15 percent,

to 1,025 homes during 2020. During the 12 months

ending July 2021, homebuilding activity rose

11 percent, to approximately 1,075 homes, from

the 970 homes during the 12 months ending

July 2020 (preliminary data).

New Home Developments

Although new homes are being built throughout

the HMA, most new home developments are

being built in the outlying areas of the cities

of Shreveport and Bossier City, and some

construction is occurring in the outer cities of

Benton, Blanchard, Haughton, and Stonewall. The

Old Towne subdivision in the city of Blanchard,

built by E & L Development, Inc., has 82 homes

planned at buildout: currently, 16 have been sold,

of which 5 homes are under construction, and 66 lots are available for sale. Homes are currently priced

between $260,000 for a three-bedroom, two-bathroom home and $380,000 for a four-bedroom, three-

bathroom, and media room home. The Trinity Bluff subdivision in north Shreveport, built by DSLD Homes,

is currently under construction, with 23 homes underway and 4 homes completed; 82 homes are planned

at buildout. Base prices range from $252,990 for a three-bedroom, two-bathroom, 1,848-square-foot home

to $318,990 for a four-bedroom, two-and-one-half-bathroom, 2,941-square-foot home.

Forecast

During the next 3 years, demand is expected for an estimated 3,300 homes in the Shreveport HMA (Table 5). The

310 homes currently under construction will satisfy a portion of the estimated demand during the forecast period.

Demand is expected to be highest during the first year of the forecast period, when job growth is greatest.

2,000

1,500

1,000

500

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

12ME Jul 2020

12ME Jul 2021

Single-Family Homes/Townhomes

Single-Family Homes/Townhomes 12ME

Condominiums

Condominiums 12ME

Figure 10. Annual Sales Permitting Activity in the Shreveport HMA

12ME = 12 months ending.

Sources: U.S. Census Bureau, Building Permits Survey; 2000–2020 final data and estimates by the analyst; past 24 months of data—preliminary

data and estimates by the analyst

Table 5. Demand for New Sales Units in the Shreveport HMA During the Forecast Period

Sales Units

Demand 3,300 Units

Under Construction 310 Units

Note: The forecast period is from August 1, 2021, to August 1, 2024.

Source: Estimates by the analyst

Rental Market 15Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market

Market Conditions: Balanced

The apartment market has tightened since the second quarter of

2016, when the vacancy rate peaked at 8.3 percent and conditions

were soft.

Current Conditions and Recent Trends

Rental housing market conditions in the Shreveport HMA are currently

balanced, with an estimated rental vacancy rate of 7.0 percent, down from

8.0 percent in 2010, when the market was slightly soft (Table 6). In the HMA,

47 percent of the occupied rental stock is single-family rental homes, and

29 percent of occupied rental stock is in structures with five or more units,

typically apartments (2015–19 American Community Survey 5-year data). The

vacancy rates for single-family rental homes in the HMA are often lower and

more stable than apartment vacancy rates. During the second quarter of

2021, the apartment market in the HMA was slightly tight, with a vacancy rate

of 4.5 percent (Figure 11), down from 6.4 percent during the same period

a year earlier (RealPage, Inc.).

Single-Family Rental Market

Approximately 92 percent of the occupied single-family rental stock in the

HMA is detached single-family homes, and 8 percent is attached homes.

Since 2013, the monthly average single-family vacancy rate for professionally

managed detached units has fluctuated by less than 1 percentage point,

ranging from 3.8 to 4.5 percent (CoreLogic, Inc.). The average single-family

vacancy rate for a professionally managed detached unit was 4.4 percent

in July 2021, down 0.1 percentage point from July 2020, and the average

rent for a single-family home decreased 6 percent, to $0.83 per square foot

compared with a year earlier. In July 2021, rents for professionally managed

detached units averaged $968, $1,047, $1,255, and $1,599 for one-, two-,

three-, and four-bedroom homes, respectively.

Rental Market

Quick Facts

2010 (%) Current (%)

Rental Vacancy Rate

8.0 7.0

2006–10 (%) 2015–19 (%)

Occupied Rental Units by Structure

Single-Family Attached & Detached

43.5 47.2

Multifamily (2–4 Units)

14.1 14.1

Multifamily (5+ Units)

33.1 29.3

Other (Including Mobile Homes)

9.3 9.5

Apartment

Market

Quick Facts

Q2 2021 YoY Change

Apartment Vacancy Rate

4.5 -1.9

Average Rent

$872 8%

Table 6. Rental and Apartment Market Quick Facts in the Shreveport HMA

Average Monthly Rent ($) Vacancy Rate (%)

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

950

900

850

800

750

700

650

600

550

Q2 2005

Q2 2006

Q2 2007

Q2 2008

Q2 2009

Q2 2010

Q2 2011

Q2 2012

Q2 2013

Q2 2014

Q2 2015

Q2 2016

Q2 2017

Q2 2018

Q2 2019

Q2 2020

Q2 2021

Vacancy Rate (%)

Average Monthly Rent ($)

Figure 11. Apartment Rents and Vacancy Rates in the Shreveport HMA

Q2 = second quarter. YoY = year-over-year.

Notes: The current date is August 1, 2021. Percentages may not add to 100 due to rounding.

Sources: 2010 vacancy rate—2010 Census; current vacancy rate—estimate by the analyst; occupied

rental units by structure—2006–10 and 2015–19 American Community Survey 5-year data; apartment

data—RealPage, Inc.

Q2 = second quarter.

Source: RealPage, Inc.

Rental Market 16Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Apartment Market

Apartment vacancy rates have fluctuated since 2005, when the impact of

displaced residents from New Orleans, the result of Hurricane Katrina, was

felt throughout the HMA. The average apartment vacancy rate increased

1.9 percentage points, to 6.5 percent, from the second quarter of 2005

through the second quarter of 2006 as evacuees from the Hurricane Katrina

disaster returned to the New Orleans MSA in 2006. As economic conditions

in the HMA continued to strengthen, the apartment vacancy rate fell to

4.2 percent in 2007 before increasing from 2008 through 2009, partly

because new apartment units entered the market. Increased economic

activity, partly related to Haynesville Shale natural gas production, resulted

in the market tightening, and the apartment vacancy rate fell to 1.9 percent

during the second quarter of 2010. As production in the Haynesville Shale

natural gas field began to slow, net in-migration to the HMA slowed as well,

and the apartment vacancy rate began to rise in 2011. In 2012, economic

conditions began to weaken, and net out-migration resumed, but new

apartment construction continued. The apartment vacancy rate rose from

4.5 percent during the second quarter of 2012 to a peak of 8.3 percent

during the second quarter of 2016. The apartment vacancy rate remained

elevated through the second quarter of 2018 because the new apartment

units built earlier in the decade had not been absorbed. As apartment units

were absorbed, the apartment vacancy rate fell 1.4 percentage points from

2019 through the second quarter of 2021.

The average apartment rent in the HMA has trended upward, with less

severe fluctuation than the apartment vacancy rate since 2005. The average

apartment rent increased an average of 3 percent annually from the second

quarter of 2005 through the second quarter of 2011, to $743, before falling

2 percent during the second quarter of 2012, as the rental market began to

soften. As new apartment units offered at higher rents entered the market

in the HMA, the average apartment rent increased an average of 2 percent

annually from the second quarter of 2013 through the second quarter of

2017, to $784. In response to slow absorption of apartment units in the HMA

since 2013, the average apartment rent fell by 1 percent, to $776, during the

second quarter of 2018. As absorption increased and vacancy rates fell, the

average apartment rent increased 5 percent through the second quarter of

2019 before increasing an average of 4 percent annually, to $872 during the

second quarter of 2021.

Market Conditions by Geography

Among the three RealPage, Inc.-defined market areas (hereafter, market

areas) in the Shreveport HMA, the Bossier City market area had the lowest

average apartment vacancy rate, at 4.4 percent, during the second quarter

of 2021, with an average rent of $913. By contrast, the highest vacancy rate,

at 4.6 percent, was in the West Shreveport/De Soto market area; the average

rent in the market area during the second quarter of 2021 was $762. Since

the second quarter of 2020, the East Shreveport market area had the greatest

average rent growth, increasing by $87, or 10 percent, to $937 during the

second quarter of 2021, while the vacancy rate fell 2 percentage points,

to 4.5 percent.

Rental Construction

Rental construction activity in the HMA, as measured by the number of

rental units permitted, was lower during the 2010s than during the 2000s,

partly because of net out-migration and an extended period of increasing

apartment vacancy rates. From 2000 through 2004, an average of 380 units

were permitted each year before increasing by 720 to 1,050 units permitted

in 2005 (Figure 12) as builders responded to the high rate of net in-migration

as a result of the Hurricane Katrina disaster. As evacuees returned to the

New Orleans MSA, rental construction activity in the HMA declined, averaging

560 units annually from 2006 through 2008. In response to the economic

contraction in the HMA, rental construction activity declined in 2009, to

350 units permitted, and declined further, to 220 units permitted, in 2010.

Builders responded to the falling apartment vacancy rate in the HMA from

2009 through 2010 by increasing production. Beginning in 2011, rental

construction activity increased an average of 22 percent annually, to the

Rental Market 17Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

decade high of 480 units in 2014. Subsequently,

rental construction activity slowed in the

HMA during 2015 and 2016, to an average of

140 units annually, but the apartment market

became oversaturated with new units because

net out-migration from the HMA rose. No rental

construction activity occurred from 2017 through

2019, as builders responded to the high vacancy

rates during the mid-2010s. Following 3 years

of no production, construction activity resumed

during 2020, with 170 units permitted.

As a result of a Choice Neighborhood Planning

Grant from the U.S. Department of Housing and

Urban Development, two affordable apartment

developments were built during the mid-2010s: the

40-unit Renaissance at Allendale and the 12-unit

Cora M. Allen Townhomes. Stemming from the

original plan, additional apartment developments

are underway and planned. Currently under

construction, the 68-unit The Heritage at Bayou

Grande I and the 68-unit The Heritage at Bayou

Grande II affordable apartment developments are

expected to be completed by the end of 2021.

Both developments will offer 10 market-rate units,

17 affordable units, and 41 units covered by project-

based vouchers. The larger 122-unit The Heritage

at Bayou Grande III apartment development is in

planning and is anticipated to be completed during

2023. The Heritage at Bayou Grande III is expected

to offer 30 market-rate units, 34 affordable units,

and 58 units covered by project-based vouchers.

Forecast

During the forecast period, demand is estimated for 290 new rental units in the Shreveport HMA (Table 7).

Demand is expected to increase in the second and third years of the forecast period as homeownership

in the HMA moderates. The 170 units currently under construction are expected to satisfy demand through

the second year of the forecast period. The 122-unit The Heritage at Bayou Grande III is expected to be

completed during 2023 and will satisfy the remainder of the demand for rental units in the HMA.

Rental Units

Demand 290 Units

Under Construction 170 Units

Table 7. Demand for New Rental Units in the Shreveport HMA During the Forecast Period

Note: The forecast period is August 1, 2021, to August 1, 2024.

Source: Estimates by the analyst

1,100

1,000

900

800

700

600

500

400

300

200

100

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

12ME Jul 2020

12ME Jul 2021

Rental Units Rental Units 12ME

Figure 12. Annual Rental Permitting Activity in the Shreveport HMA

12ME = 12 months ending.

Note: Includes apartments and units intended for rental occupancy.

Sources: U.S. Census Bureau, Building Permits Survey; 2000–2020 final data and estimates by the analyst; past 24 months of data—preliminary

data and estimates by the analyst

Terminology Definitions and Notes 18Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Terminology Definitions and Notes

A. Definitions

Building Permits

Building permits do not necessarily reflect all residential building activity that occurs in an HMA. Some units are constructed or created without a building

permit or are issued a different type of building permit. For example, some units classified as commercial structures are not reflected in the residential building

permits. As a result, the analyst, through diligent fieldwork, makes an estimate of this additional construction activity. Some of these estimates are included in

the discussions of single-family and multifamily building permits.

Demand

The demand estimates in the analysis are not a forecast of building activity. They are the estimates of the total housing production needed to achieve a balanced

market at the end of the 3-year forecast period given conditions on the as-of date of the analysis, growth, losses, and excess vacancies. The estimates do not

account for units currently under construction or units in the development pipeline.

Existing Home

Sales

Include resale sales, short sales, and REO sales.

Forecast Period 8/1/2021–8/1/2024—Estimates by the analyst.

Home Sales/

Home Sales

Prices

Includes single-family, townhome, and condominium sales.

Net Natural

Change

Resident births minus resident deaths.

Rental Market/

Rental Vacancy

Rate

Includes apartments and other rental units, such as single-family, multifamily, and mobile homes.

Terminology Definitions and Notes 19Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Resales

These are home closings that have no ties to either new home closings (builders) or foreclosures. They are homes that were previously constructed and sold to

an unaffiliated third party.

Seriously

Delinquent

Mortgages

Mortgages 90+ days delinquent or in foreclosure.

B. Notes on Geography

1.

The metropolitan statistical area definition noted in this report is based on the delineations established by the Office of Management and Budget (OMB) in the

OMB Bulletin dated April 10, 2018.

2. Urbanized areas are defined using the U.S. Census Bureau 2010 Census Urban and Rural Classification and the Urban Area Criteria.

C. Additional Notes

1.

This analysis has been prepared for the assistance and guidance of HUD in its operations. The factual information, findings, and conclusions may also be

useful to builders, mortgagees, and others concerned with local housing market conditions and trends. The analysis does not purport to make determinations

regarding the acceptability of any mortgage insurance proposals that may be under consideration by the Department.

2.

The factual framework for this analysis follows the guidelines and methods developed by the Economic and Market Analysis Division within HUD. The analysis

and findings are as thorough and current as possible based on information available on the as-of date from local and national sources. As such, findings or

conclusions may be modified by subsequent developments. HUD expresses its appreciation to those industry sources and state and local government officials

who provided data and information on local economic and housing market conditions.

D. Photo/Map Credits

Cover Photo Adobe Stock

Terminology Definitions and Notes 20Shreveport-Bossier City, Louisiana Comprehensive Housing Market Analysis as of August 1, 2021

Comprehensive Housing Market Analysis Shreveport-Bossier City, Louisiana

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Contact Information

Nancy Smith, Economist

Fort Worth HUD Regional Office

817–978–9415

nancy[email protected]