1

NAACP

UNIT FINANCIAL

&

BOOKKEEPING GUIDE

“The Unit must use the uniform bookkeeping system provided by the National

Office.”

Unit Bylaws (2014) Article V, Section 18

Revised January 2018

Finance Department

NAACP- National Office

NAACP – National Office

Unit Financial & Bookkeeping Guide

2

TABLE OF CONTENTS

Page

INTRODUCTION

3

SECTION 1:

CONVENTION REMINDER & ASSESSMENTS

4

SECTION 2:

ROLE OF THE NATIONAL FINANCE

DEPARTMENT

7

SECTION 3:

UNIT ACCOUNTING, BOOKKEEPING, AND

RECORDING PROCEDURES

9

SECTION 4:

TAX STATUS OF NAACP UNITS

16

SECTION 5:

FUNDRAISING ACTIVITIES

17

SECTION 6:

SECTION 7:

POLICIES & DUTIES

Past Due Assessments

19

22

ATTACHMENTS:

A1 – Filing Forms 1099

23

A2 – Unit Audits

24

A3 – Unit Audit Guide

A4 – Effective Fundraising Tips

26

33

NAACP – National Office

Unit Financial & Bookkeeping Guide

3

Introduction

We, in the National Office, have acknowledged our responsibility to provide meaningful

guidance in the area of Unit financial management. This guidance is a necessary

element of proper governance by a parent organization.

This financial guide shall focus on several areas that are fundamental, yet critical, to the

successful continuance of our organization.

The development of this financial manual was borne out of the necessity to proactively

control five factors:

1. The need to minimize our audit risk by being in total voluntary compliance with all

regulatory agencies, including the IRS, state and local agencies.

2. The need to limit our liability exposures by controlling the events that might impact

the organization negatively, such as an absence of proper due diligence.

3. The need to attain a zero deficiency rating when we are selected for random audit

by a regulatory agency.

4. The need to maintain fiscal integrity through the establishment of accounting

procedures which comply with generally accepted accounting principles and

income tax accounting rules.

5. The need for vital information with which management can effectively, efficiently

and strategically allocate scarce resources in the ever-changing environment in

which NAACP conducts business.

Note: The term “Unit” refers to NAACP Adult Units, Prison Units, College Chapter,

Youth Councils, Jr. Youth Councils and High School Chapters. Much of the

guidance provided herein is also applicable to State/State Area Conferences.

NAACP – National Office

Unit Financial & Bookkeeping Guide

4

SECTION 1: CONVENTION REMINDER & ASSESSMENTS

The 2018 Convention will be hosted in San Antonio, TX from July 14, 2018 to July 18,

2018. Convention attendees are encouraged to pre-register for this year’s National

Convention. Convention packages will be mailed out to all units and the packages will

include the applicable convention assessment due for the respective unit. Units that

intend on participating in the Annual Convention as delegates are required to pay the

convention assessment; units that do not come or that intend on participating as

observers do not have to pay the convention assessment.

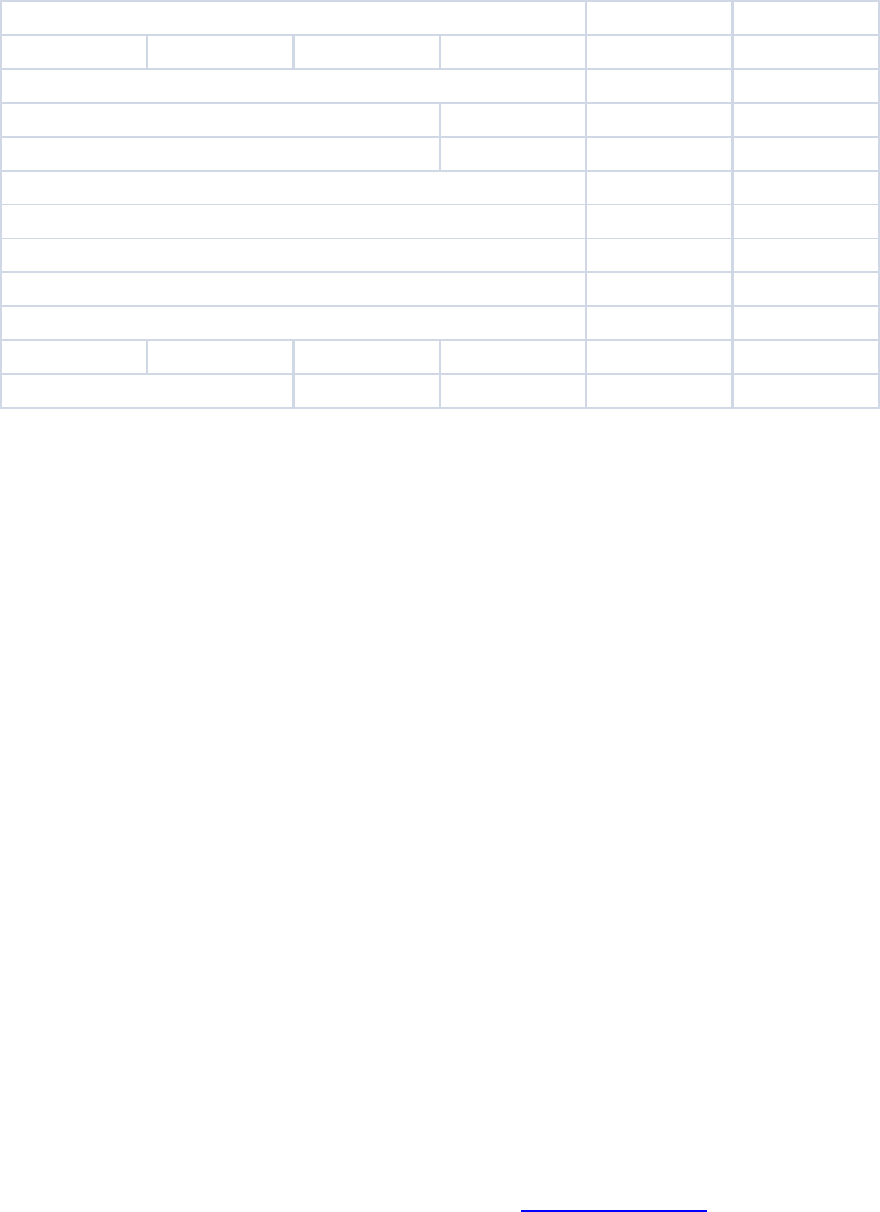

Please see below the convention assessment table and the delegate strength table:

NAACP – National Office

Unit Financial & Bookkeeping Guide

5

CONVENTION ASSESSMENT

State Conferences (Youth and Adult) $100.00

Units with…..

50 to 100 $50.00

101 to 500 $75.00

501 to 1,000 $125.00

1,001 to 2,500 $175.00

2,501 to 5,000 $200.00

5,001 to 7,500 $250.00

Over 7,501 $300.00

Youth and Young Adult Councils $25.00

College Chapters $25.00

VOTING STRENGTH

Representation of Units, Youth Councils, Young Adult

Councils, and College and High School Chapters at the

Annual Convention shall be on the following basis:

Voting Members Delegates

25 to 49 2

50 to 100 4

101 to 500 6

501 to 1,000 8

1,001 to 2,500 10

2,501 to 5,000 12

5,001 to 10,000 14

10,001 to 20,000 16

20,001 to 25,000 18

Over 25,000 - 1 additional vote for every 25,000 members

NAACP – National Office

Unit Financial & Bookkeeping Guide

6

SECTION 1: ASSESSMENTS

As per the Unit Bylaws (2014) Article III, Section 4 et al, Units must remit to the National

Office twenty-five percent (25%) of the net proceeds from fundraising activities, this

includes all contributions/donations that a unit may have received, no later than forty-five

(45) days following the close of the event or at least ninety (90) days prior to the opening

day of the Annual Convention. If the Unit did not host a fundraising event for the year, a

minimum assessment is still due to the National office based upon the total membership

of the Unit as of December 31, 2017 and as recorded by the National office. Units are

required to submit, to the National office, either the net fundraising assessment or the

minimum assessment whichever is bigger but not both. For units that increased their

total membership by thirty-five percent (35%) or higher between January 1, 2016 and

December 31, 2016 they may submit fifteen percent (15%) of their net results from all

fundraising activities instead of twenty-five percent (25%).

Fundraising assessments must be paid in full to the National Office by April 16, 2018.

Units that do not satisfy, in full, their fundraising assessments (both current and prior

years) will be deemed non compliant and will not be eligible to have voting delegates at

the National Convention. Units that become compliant after the April 16, 2018 date will

be eligible to have voting delegates but will be required to pay the non compliant

registration rate.

In addition to paying assessments units are required to file an Annual Financial Report

by March 1

st

each year, all reports received after that date will be assessed a late filing

fee of $100.00. The National office will accept post marked envelopes as well as

electronic submission (email) for the reports.

Following is the minimum assessment table for Units. The assessment table is based on

the total number of members for the Unit as of December 31, 2017:

NAACP – National Office

Unit Financial & Bookkeeping Guide

7

SECTION 2: ROLE OF THE NATIONAL FINANCE DEPARTMENT

Processing of Daily Transactions

Cash receipts

Cash disbursement

Annual reporting

NAACP

NAACP – Special Contribution Fund

CRISIS Publishing Company

Information tax return ( IRS Form 990) for both NAACP and SCF and corporate

tax return (IRS Form 1120) for Crisis

Group Tax Return (Form 990 – filed on behalf of all NAACP units)

Advising NAACP units

Accepting our responsibility to provide timely service and proper guidance to the

NAACP units

We must continue to improve our ability to deliver high quality services to NAACP

units.

Development / evaluation of policies and procedures

Appropriate references – internet websites: www.genie.org (provides information

and resources for the nonprofit community, including publications, links to other

nonprofit resources, answers to frequently asked questions and provocative

opinions.

ANNUAL UNIT MINIMUM ASSESSMENTS

Units with less than 100 members $300.00

Units with 101-500 members $500.00

Units with 501-1,000 members $750.00

Units with 1,001-2,000 members $1,000.00

Units with 2,001-3,000 members $1,500.00

Units with 3,001-3,500 members $2,000.00

Units with 3,501-4,000 members $3,000.00

Units with more than 4,000 members $5,000.00

All youth Units $75.00

NAACP – National Office

Unit Financial & Bookkeeping Guide

8

Monitoring and Reporting

Yearend Financial Reports – acknowledging the critical role of proper financial

management and reporting on the overall operations of the NAACP.

The Finance Department mandates strict compliance with regulations set forth by

the IRS and state and local government regulatory agencies.

SECTION 3 - UNIT ACCOUNTING, BOOKKEEPING, AND REPORTING PROCEDURES

Books and records

Manual v. computerized record keeping systems

Ideally, the Unit accounting system would be computerized. There are several

adequate, yet relatively cheap accounting software packages available (i.e.

Quicken, Quick Books, Peachtree, etc.)

If the Unit does not possess a computer, the financial records should be

maintained in a ledger specifically designed for accounting purposes. Ledgers

such as the Dome Simplified Weekly Bookkeeping Record are readily available at

local stationery stores.

Cash

Each Unit is required to maintain a bank account in the name of the Unit. The

Taxpayer Identification Number (“TIN”) on the bank account is to be that of the Unit,

not the National Office. Officers and members of units are prohibited from using their

NAACP – National Office

Unit Financial & Bookkeeping Guide

9

personal social security numbers when establishing banks accounts in the name of

the unit.

All disbursements are to be made by check

Cash payments to vendors are not permitted. Checks should never be made payable

to “cash”. A Unit may establish a Petty Cash account for minor purchases and other

incidentals if conditions warrant the existence of such an account. If a petty cash fund

is established, adequate records of each transaction must be retained. Units are

allowed to establish and use credit cards in the name of the unit. However the use of

the credit card is limited for securing travel, which is limited to air fare, hotel, and rental

car for business purposes relating to the unit.

Funds may not be withdrawn in any manner other than by check

Two signatures are required on each check

Treasurer and President

The First Vice President may countersign in the absence of the President

Checks must not be pre-signed, and units are strongly prohibited from the use of

signature stamps.

The bank should be notified each time there is a change in authorized signatories and

previous signatories are to be deleted immediately.

All transactions must be properly documented

Documentation, including vendor invoices must be retained for a period of not less

than three years.

Monetary receipts (including checks) must be deposited into the account of the Unit

on a timely basis. The National Office recommends that Unit funds be deposited no

later than the end of the following business day.

Under no circumstances are Unit funds to be commingled with the personal funds

of Unit officers, members or other individuals or entities.

Adequate documentation should be maintained to support each item deposited

into the Unit accounts, the National officer recommends a cash receipt log.

This documentation should provide the details pertaining to the source of the

funds, how they were generated and how they are to be used, if applicable.

NAACP – National Office

Unit Financial & Bookkeeping Guide

10

Unit records are to be reconciled to the bank statements on a monthly basis.

It is recommended that Units limit the number of bank accounts they maintain as

follows:

Operating (checking)

Savings (interest bearing)

ACT-SO, BTS-SIS (restricted funds)

Accounts required by large donors (federal funds)

Reconciliations of Unit bank accounts should be performed by someone who is

an authorized check signer. (i.e. Treasurer)

Investments and marketable securities

If the Unit maintains significant cash balances, excess funds should be invested in an

interest bearing account or other appropriate investment vehicle. Investments are to

be reasonable in the circumstances and are to be made with an appropriate business

purpose.

Investments should be short term (generally with a maturity of less than one year) so

that any inaccessibility of funds does not unduly restrain Unit operations.

Investment vehicle should carry minimum risk

Each investment must be approved in writing by the Unit Executive Committee

(approval should be documented in meeting minutes)

Accounts receivable

The extension of credit to any individual or entity must be approved in advance and

in writing by the Executive Committee of the Unit

Under no circumstances are Units permitted to extend loans

To the extent funds are due to Units from third parties, collection efforts are to be

monitored and reported to the Executive Committee

NAACP – National Office

Unit Financial & Bookkeeping Guide

11

Fixed assets

Adequate records must be maintained detailing all fixed assets owned by the Unit.

Records must include the original cost of each asset and any accumulated

depreciation.

Vendor invoices must be retained for all purchased assets.

The Unit should maintain an inventory list of its assets and include date of

purchase, serial number, model description, etc.

It is the responsibility of the Treasurer to determine if the Unit is required to submit a

Personal Property Tax return to the State.

Other Assets

Prepaid expenses with a life of less than 1 year should be expensed as incurred.

Security deposits should be separately identified to facilitate proper tracking.

Liabilities

“Indebtedness exceeding $300.00 per month in the aggregate shall not be incurred

in the name of, or on behalf of the Unit unless by vote of the Executive Committee”.

Unit Bylaws (2014), Article V Section 15b

“No indebtedness or obligation shall be incurred by the Unit or any of its officers or

agents in the name of National Association for the Advancement of Colored People,

and the National Office shall not be responsible for any indebtedness or obligation

incurred by the Unit or any of its officers or agents.” Unit Bylaws (2014), Article V

Section 16a

Revenues

All funds received by a Unit are to be identified as either “Restricted” or “Unrestricted”

as to their use.

Restricted funds generally include:

- Grants from individuals, corporations, foundations

- Funds for scholarship awards

NAACP – National Office

Unit Financial & Bookkeeping Guide

12

- Program funds (i.e. ACT-SO, Back-to-school / Stay-in-school)

- Bequests that are letter specific

Unrestricted funds generally include:

- Membership dues

- Funds from fundraising activities to support general operations of a unit.

- General donations/contributions from the public or any other

organizations/businesses in the community of the unit.

Proceeds from fund raising activities may be either restricted or unrestricted

depending upon the stated purpose of the fund raising activity. Further Units are

not permitted to restrict funds for general operating expenses, i.e., post office box,

rent, etc. without written approval from the National office.

Membership dues

Membership dues structure is set forth in Unit Bylaws (2014), Article IV, Section

11

The Unit shall remit to the membership department of the National Office, the

National Office’s share of all membership fees within fifteen (15) days of their

receipt.

No NAACP Unit shall retain for the purposes of defraying operation expenses the

National Office share of membership dues and/or fund raising proceeds without prior

approval of the National Office President and CEO.

Unrelated business income

Income generated from a trade or business that is regularly carried on, and is

completely unrelated to the exempt purpose of the NAACP.

An activity will be considered an unrelated business (and subject to unrelated

business income tax; UBIT) if it meets the following three requirements: (1) it is a

trade or business, (2) it is regularly carried on, and (3) it is not substantially related

to the furtherance of the exempt purpose of the organization.

UBIT is captured on IRS Form 990T, which must be filed by the NAACP Unit if

gross income from unrelated business activities, exceeds $1,000 for any calendar

year:

NAACP – National Office

Unit Financial & Bookkeeping Guide

13

Advertising revenue

Commercial activities (i.e. operation of a bookstore or parking facility,

rental income, etc.)

Unrelated business income must be separately reported in the yearend financial

report filed by the Unit. However, the tax liability for unrelated business income

remains with the Unit.

Expenditures

Salary

“Staff may be employed by NAACP Units where budgets warrant such

employment, upon terms and conditions approved by the National President/CEO.

Such staff shall be elected by the Executive Committee of the Unit.”

Salaries should be approved annually by the Executive Committee of the Unit.

Employee v. independent contractor

The key distinction between “employees” and “independent contractors” is

the element of control. An employer-employee relationship exists when the

Unit has the right to control what work an individual does and how the work

gets done.

The IRS has recently audited several NAACP Units and assessed significant

fines ($10,000) upon each Unit for their failure to properly classify workers

as employees.

Unit must withhold payroll taxes from employee salaries and remit the taxes, along

with the employer portion, to the IRS on a scheduled basis.

Unit must also file quarterly employment tax returns (Form 941) and an annual

employment tax return (Form 940). Payroll taxes are “trust fund taxes” and as

such, Unit officers and directors could incur a personal liability for nonpayment to

the IRS.

NAACP – National Office

Unit Financial & Bookkeeping Guide

14

Documentation

Proper supporting documentation must be maintained for each transaction. Proper

documentation includes:

Revenues

Member or donor correspondence

Check remittance advice

Check photocopy

Conference registration / ticket sales logs

Expenses

Properly approved purchase requisitions

Approval should be received in advance of placing order for goods or

services

Vendor invoices

Payment approval

Canceled check

Yearend financial reports

Purpose

Annual report of Unit financial activities

Provides information needed by the National Office for the completion of the

Federal group 990 tax return filed on behalf of all Units.

Failure to submit a yearend financial report will result in the Unit being

omitted from inclusion in the Group Tax Return.

Must be remitted to the Finance Department of the National Office by

March 1

st

each year, or units will assessed a $100.00 late filing fee.

The Annual Financial Report is updated each year and is made available

on the Association’s website at www.naacp.org/resources or

www.naacp.org/field-resources. The video/webinar instructions for the

NAACP – National Office

Unit Financial & Bookkeeping Guide

15

report are this link https://vimeo.com/249894123. This document is

provided in MS Excel format only and all units will be required to complete

the long form. Please note the National office only mails financial reports

upon request.

SECTION 4 - TAX STATUS OF NAACP UNITS

All Units have been designated as 501(c)(4) organizations, only the National Office is a

501(c)(3) organization

A 501 (c) (4) organization is a nonprofit corporation operated exclusively for the

promotion of social justice. Exemption under this Section does not confer deductibility

of contributions by donor to the corporation, but may enable it to avoid the restrictions of

private foundation status, and the restrictions on lobbying and other political activity.

Definition of Social Justice

NAACP Units are strategically designed to operate exclusively as 501 (c) (4) entities for

the promotion of social justice, primarily to further the common good and general welfare

of the people of their communities, such as bringing about civic betterment and social

improvement. In addition, a 501 (c) (4) must benefit a community as a whole. Thus, a

corporation will not qualify under 501 (c) (4) if its activities benefit only its membership

or a select group of individuals.

A 501 (c) (4) corporation may not, as its primary activity, conduct business with the

general public in a commercial manner. Any earnings of such an organization must be

devoted exclusively to charitable, educational or recreations and for our purposes, civil

rights.

A 501 (c) (4) organization may engage in some social activities, some lobbying, and

some political activity. NAACP units were specifically organized as 501 (c) (4)

organizations so that they can (1) seek to increase registration and voting; (2) work for

the enactment of municipal, state and federal legislations designed to improve the

educational , political and economic status of minority groups; (3) seek the repeal of

racially discriminatory legislation; (4) work to improve the administration of justice; (5)

work to secure equal enforcement of the law; (6) keep the National Office informed of all

proposed legislation which affects minority groups.

NAACP Units shall be non-partisan and shall not endorse candidates for public office.

NAACP – National Office

Unit Financial & Bookkeeping Guide

16

Contributions to 501(c)(4) organizations may not be deducted as charitable

contributions by the donor.

Units must not provide acknowledgment letters for contributions made directly to them.

SECTION 5: FUNDRAISING ACTIVITIES

General Solicitation of donations

When soliciting donations, Unit are required to disclose through an express

statement (in a conspicuous and easily recognizable format) that contributions and

gifts are not deductible as charitable contributions for federal income tax purposes,

however they are deductible as an ordinary business expenses.

Solicitations by mail, leaflet, or advertisement in a newspaper, magazine or other

print medium must meet the following IRS requirements:

Include the statement “Contributions or gifts to this NAACP Unit are not

deductible as charitable contributions for Federal income tax purposes”;

The above statement must be in the same size type as the primary message

stated in the body of the letter, leaflet or ad;

The statement is included on the message side of any card or tear off section

that the contributor returns with the contribution; and

The statement is either the first sentence in a paragraph or itself constitutes a

paragraph.

Solicitations by telephone must meet the following IRS requirements:

Include the statement “Contributions or gifts to this NAACP Unit are not

deductible as charitable contributions for Federal income tax purposes.”

NAACP – National Office

Unit Financial & Bookkeeping Guide

17

The statement must be made in close proximity to the request for contributions,

during the same telephone call, by the telephone solicitor; and

Any written confirmation or billing sent to a person pledging to contribute during

the telephone solicitation complies with the requirements for print medium

solicitations.

Solicitation by television must meet the following IRS requirements:

- Include the statement “Contributions or gifts to this NAACP Unit are not tax

deductible”.

- If the statement is spoken, it is in close proximity to the request for contributions;

if the statement appears on the television screen, it must be in large, easily

readable type, and appears on the screen for at least five seconds.

Solicitation by Radio must meet the following IRS requirements:

- Include the statement “Contributions or gifts to this NAACP Unit are not

deductible as charitable contributions for Federal income tax purposes”

- The statement is made in close proximity to the request for contributions during

the same radio solicitation announcement.

Pass through's - Corporate and Foundation Contributions

Effective immediately, the National office will not process pass through

contributions to Units or State/State Area conferences that are intended for

fundraising events or any other programs. Units are encouraged to take advantage

of National’s Collective Action Fund which would allow all units to pass through

funds with a third party (Tides Foundation). These pass throughs are subject to

Tides Foundation terms and conditions.

All Fundraising events

Unit must inform donors that contributions to the Unit are not deductible as charitable

contributions.

For payments to qualify as a charitable contribution they must be a gift. Where

patrons of fund raising activities (such as charity balls, bazaars, banquets, shows

and athletic events) receive a privilege or benefit in connection with a payment to

the unit, the presumption is that the payment was not a gift.

NAACP – National Office

Unit Financial & Bookkeeping Guide

18

Organizations that give donations to Units to support fundraising events are able to

deduct the total contribution as an ordinary business expense, which can be

designated as advertising or promotional.

SECTION 6 – POLICIES & DUTIES

Duties of the Treasurer

The duties of the Treasurer shall be:

a. To receive all monies of the NAACP Unit and promptly deposit the same in

the name of the NAACP Unit in a separate account or accounts in a

responsible bank or trust company. No money shall be withdrawn from any

account except by check signed by the Treasurer and countersigned by the

President.

b. To act as chief financial officer of the NAACP Unit and chair of the Finance

Committee.

c. To make authorized disbursements upon requisition signed by the Secretary

and countersigned by the President. Each requisition shall recite the amount

and purpose of the payment requested. Any requisition exceeding one

hundred dollars or more in the case of Branches, or twenty-five dollars or

more in the case of College Chapters and Youth Councils, must be approved

by the Executive Committee before a check therefore is issued. The NAACP

Unit bylaws may require that requisitions in smaller amounts be approved by

the Executive Committee.

d. To remit through the Secretary to the Association the proportion of

membership fees to which the Association is entitled, as hereinafter

provided, within fifteen calendar days after their receipt.

e. To submit reports to the NAACP Unit and the Executive Committee at all

regular meetings, or whenever required by either body, covering the financial

condition of the NAACP Unit showing receipts and disbursements and

outstanding accounts unpaid since the last report; to submit an Annual

Report to the business of his/her office at the Annual Meeting of the NAACP

Unit, to which shall be appended a statement signed by the President and

Secretary that all funds by the NAACP Unit have been listed in the

Treasurer’s report. A copy of all reports by the Treasurer, when adopted by

the NAACP Unit, shall be forwarded to the National Office.

NAACP – National Office

Unit Financial & Bookkeeping Guide

19

f. All NAACP Units shall require the Treasurer to be bonded at the expense of

said Unit.

g. Submit year-end financial reports to the National Office on or before March

1

st

each year.

Propriety of financial records

All NAACP Unit records are the property of the NAACP and must be properly filed and

safeguarded. The Unit should also require that records be transferred upon change in

leadership/administration.

NAACP – National Office

Unit Financial & Bookkeeping Guide

20

Record retention

Membership dues, net fundraising proceeds, fundraising assessments (as reported in

the yearend financial report), and convention assessments (based on membership

levels)

Tax returns

State, local and payroll

Yearend financial reports

At least 6 years

Documentation supporting tax returns

General ledgers

Check registers

At least 3 years

Purchase requisitions

Vendor invoices

Canceled checks

Payroll taxes

Unpaid trust fund taxes = personal liability

Remittances to National Office

Membership dues

Annual assessments

Includes donations and contributions

Convention assessments

Based on membership levels

In an effort to minimize the mis-posting of NAACP Unit remittances, we request that

NAACP Unit personnel clearly indicate the purpose of each remittance on the face of the

NAACP – National Office

Unit Financial & Bookkeeping Guide

21

check, preferably in the “memo” section. The memo section should include the fiscal

year the payment relates to and the number of the Unit.

SECTION 7 – PAST DUE ASSESSMENTS

The National Board of Directors, at its May 19, 2012 meeting passed the following

Resolution. Please note that the suspension clause of this Resolution pertains to units

failing to have paid assessments ninety (90) days prior to the Annual Convention and

becomes effective January 1, 2013.

All units shall pay outstanding Fundraising Assessments at the same time that a

completed year-end financial report of its annual financial activities is submitted to

the National Office, but no later than ninety (90) calendar days before the Annual

Convention (Unit Bylaws (2014) Article III, Section 4(a) Bylaws for Units). If

assessments are not paid ninety (90) calendar days prior to the Convention; the

unit shall be suspended and not permitted to have delegates and/or alternates

during the national convention. If the assessment is not paid in full by the time of

the state convention, the unit shall not be permitted to have delegates and/or

alternates at the state convention.

The unit may request a review by the National Office of the assessment to

determine its accuracy. If after the review, the unit has not paid by December 31

,

2015, the National Office shall remove all Officers and Executive Committee

Members and shall suspend the charter.

The State/State Area Conference will have an opportunity to reorganize the unit

as directed by the Memberships and Units Committee. The Officers removed may

not seek any elected office for one election cycle.

ATTACHMENTS

A1: Filing Forms 1099

Nonprofit organizations must file with the IRS a Form 1099 for any individual or

unincorporated business to whom they paid $600, or more, for any type of service (but

not for the purchase of goods.) Typical examples are payments for accounting, legal and

NAACP – National Office

Unit Financial & Bookkeeping Guide

22

computer consultant fees; prizes, awards, and honoraria; rent, maintenance, and

contract labor.

A three-tier penalty applies for failing to file correct information returns with the IRS. The

penalty system applies to any (1) failure to file on or before the required filing date, (2)

failure to include required information on the form, and (3) reporting of incorrect

information. To encourage prompt filings and to remedy errors or omissions, the per

return penalties become progressively higher as time passes.

Typical questions asked:

Q. We paid $1,000 to a consulting firm during the past year. Should a Form 1099 be

filed?

R. A Form 1099-MISC should be filed for payments of $600 or more, unless the

consulting firm is a corporation.

Q. We purchased office supplies from a business that is not incorporated. Should we

issue a 1099?

R. No. Payments for goods and merchandise are exempted.

Q. What do we do when we don’t have a Social Security or Employer ID number?

R. Send the payee a Form W-9 requesting the identification number. Meanwhile, file the

1099’s without the ID number and amend the returns as soon as the number is

received to minimize the penalties. Finally, adopt a policy that no payments will be

made in the future until a payee provides an identification number.

Q. Does the IRS really try to match up the amounts reported on 1099’s with those

reported on recipients’ returns?

R. Yes. The 1099 copies sent to the IRS are entered into the IRS’s compliance computer

system for tracing to recipients’ returns. Recipients receive notices if the matching is

not successful.

NAACP – National Office

Unit Financial & Bookkeeping Guide

23

A2: Unit Audits

Absolute right of National Office

Basis of selection

Random

Targeted - Discretion of the President / CEO and Board of Directors of the National

Office

Size of Unit – including amount of revenue earned, expenses incurred and number

of members.

Delinquency in filing Annual Financial Reports and errors or inconsistencies in

Annual Financial Reports filed

Policy pertaining to Unit audits has been adopted by the Board of Directors of the

National Office

Consistent audit findings and violations are as follows:

Documents supporting cash receipts and disbursements are missing.

Cash receipts are not deposited timely.

Bank reconciliations are not prepared timely.

Units maintain an excessive number of bank accounts.

Variances exist between amounts reported on the Annual Financial Report and

internal Unit records.

Units do not maintain a list of property and equipment owned. (property cannot be

owned by a unit).

Membership dues are not properly accounted for.

Units do not properly disclose their tax status as a 501 (c) 4 entity when soliciting

contributions from donors.

Units do not timely remit annual assessment to the National office.

NAACP – National Office

Unit Financial & Bookkeeping Guide

24

Expense vouchers do not exist to support cash disbursements.

Checks are made payable to cash.

Expenses are paid with a Unit credit card.

Checks are disbursed without the signature of the Treasurer.

Checks are signed by the Secretary.

Funds disbursed from restricted ACT-SO and BTS/SIS accounts which do not

relate to the programs.

No uniform filing system exists for storing Unit records.

NAACP – National Office

Unit Financial & Bookkeeping Guide

25

A3 – Unit Audit Guide

Per the Bylaws, Article V, Section 19 (2014). The books of the Unit shall be audited

annually by an auditing system acceptable to the National office.

NAACP-NATIONAL OFFICE

Agreed Upon Procedures for Review of Unit Operations

Financial Reports/Cash

Objectives:

A. Determine that the financial reports are in agreement or reconciled with Unit records.

B. Determine whether the financial report items are properly classified.

C. Determine whether cash balances properly reflect all cash and cash equivalents on hand.

D. Determine whether cash balances are properly classified in the financial report and adequate

disclosure is made of restricted funds.

Audit Procedures:

Performed

By

Date

1) Compare prior year ending cash balance to current year beginning cash

balance.

2) Request bank statements from all banks with which the Unit conducted

business during the year.

3) Obtain bank reconciliations of all bank accounts at the end of the year.

(a) Test clerical accuracy.

(b) Compare book balance to general ledger.

4) Consider performing alternative procedures to ensure that cash balances

are accurate as of year-end.

5) Verify the numerical sequence of checks.

(a)

NAACP-NATIONAL OFFICE

Agreed Upon Procedures for Review of Unit Operations

NAACP – National Office

Unit Financial & Bookkeeping Guide

26

Revenues

Objective:

A. Determine that all receipts are properly recorded by the Unit.

B. Determine whether the Unit properly reported membership revenues and contributions to the

National Office in accordance with the terms and provisions of the Constitution and Bylaws for

Units.

C. Determine whether the National Office received its appropriate share of Unit revenues.

Audit Procedures:

Membership Revenue – Obtain Unit membership records for the year under review and

perform the following procedures:

1) Recalculate membership dues by category based upon the number of

members in each category multiplied by the appropriate dues rate.

2) Select a sample of ___ members and verify receipt of appropriate dues

amount by examining cash receipt records and tracing receipt to deposit

in unit bank account.

3) Examine documentation to determine whether the National Office

received its appropriate share (60%) of membership dues on a timely

basis. Verify receipt with National Office.

NAACP – National Office

Unit Financial & Bookkeeping Guide

27

Contribution Revenue – Obtain a listing of all contributions received during the year by the

unit, including name of contributor, amount contributed, date of contributions, restrictions,

if any, on the use of proceeds contributed and perform the following:

1) Select _____ contributions and trace the receipt to deposit in Unit bank

account.

2) Review correspondence with the contributor and determine what

representations may have been made by the Unit with regard to the

deductibility of the contribution.

3) Ascertain whether donor restrictions and/or reporting requirements, if

any, have been complied with.

Fundraising Revenue – Obtain a list of fundraising activities undertaken by the Unit during

the year and perform the following:

1) Select a representative sample of receipts and trace to deposit in Unit bank

account.

2) Review for reasonableness the methodology used by the Unit in

determining net proceeds from each fund raising activity.

3) Ascertain that the National Office received the appropriate portion (25%)

of net fundraising proceeds. Review correspondence, tickets and all other

solicitation materials distributed in connection with fund raising activities

and ascertain that the Unit has made the proper disclosures regarding the

deductibility of contributions or the cost of tickets purchased. Obtain

copies of all solicitation materials and tickets used in fund raising

activities for submission to the National office.

Other income – Obtain a listing of other income and ascertain the reasonableness of the

amount based upon an understanding of the Unit’s operations. Ascertain that amounts have

been properly recorded and that proper disclosures, if required, have been made.

Select _____ additional deposits posted to the unit’s bank statement and

ascertain that the receipt was properly recorded.

NAACP – National Office

Unit Financial & Bookkeeping Guide

28

NAACP-NATIONAL OFFICE

Agreed Upon Procedures for Review of Unit Operations

Costs and Expenses

Objective:

Determine whether costs and expenses are valid, properly documented and reasonable with regard to the

level of unit operations.

Audit Procedures:

Performed

By

Date

1) Select a representative sample of transactions to be tested.

(a) Review vendor invoices and other supporting

documentation.

(b) Review vendor invoices for proper account distributions.

(c) Compare invoices to entries in the cash disbursements

journal and cancelled checks; observe date, amount,

payee and signatures.

(d) Examine payment voucher for proper approval in

accordance with unit Bylaws.

2) If applicable, select a sample of restricted expenses to be tested.

(ACT-SO, Back-to-School/Stay-in-School or grant expenditures)

3) Examine voided checks for proper cancellation.

NAACP – National Office

Unit Financial & Bookkeeping Guide

29

NAACP-NATIONAL OFFICE

Agreed Upon Procedures for Review of Unit Operations

Salaries and Wages

Objective:

Determine whether salaries and wages are properly recorded.

Audit Procedures:

Performed

By

Date

1) Obtain a list of all Unit employees during the year under review.

Ascertain that each unit staff member was employed under terms and

conditions approved by the National President/CEO.

2) Review the general ledger accounts for salaries and wages and note any

unusual entries.

3) Review the employee personnel file and determine the authorized rate of

pay.

4) Select a representative sample of transactions to be tested.

(a) Test accuracy of gross to net pay.

(b) Compare information on cancelled checks.

(c) Agree salaries and wages to payroll reports filed:

941

W2/W3

1099/1096

5) Ascertain that Unit staff members are not members of the Executive

Committee.

NAACP – National Office

Unit Financial & Bookkeeping Guide

30

NAACP-NATIONAL OFFICE

Agreed Upon Procedures for Review of Unit Operations

General Matters

Performed

By

Date

1) Meet with appropriate Branch representatives, including President,

Treasure and/or other paid staff, if any. Discuss the nature of Unit

activities, including programs, fund raising activities, membership

campaigns, etc. Inquire as to the roles of each Committee established by

the unit.

2) Request copies of minutes of all committee meetings.

3) Request copies of Unit-specific By-laws adopted by the Unit under

review.

4) Determine whether a recent audit of the unit has been performed by an

independent accounting firm, the IRS or any state or local regulatory

agency. Obtain copies of any audit reports or other reports of findings.

5) Request copies of any IRS documentation received by the Unit, including

IRS letters of determination if so requested by the Unit.

6) Obtain Unit accounting records, including general ledgers, trial balances,

subsidiary records, bank statements and membership reports.

7) Obtain a copy of the year-end financial report for the Unit.

8) Obtain copies of any tax returns filed by the unit with the IRS or state tax

authorities, including payroll tax returns.

9) Obtain a listing of all Unit bank accounts and signatories on each account.

10) Request documents from paid preparer of Annual Financial Report.

NAACP – National Office

Unit Financial & Bookkeeping Guide

31

NAACP-NATIONAL OFFICE

Agreed Upon Procedures for Review of Unit Operations

Fixed Assets

Objectives:

A. Determine whether additions and disposals have been properly recorded.

B. Determine whether depreciation expense and accumulated depreciation is reasonable and the

method consistently applied.

C. Determine whether amounts shown as fixed assets are recorded at cost and properly represent

capitalized items.

Audit Procedures:

Performed

By

Date

1) Obtain a list of fixed assets purchased during the year.

2) Verify existence and location.

3) Trace additions and disposals to financial report.

4) Agree purchase amount to cancelled check/bank statement.

NAACP – National Office

Unit Financial & Bookkeeping Guide

32

A4 – Effective Fundraising Tips

BASIC GUIDE TO EFFECTIVE

FUNDRAISING FOR A

NAACP UNIT

INTRODUCTION

It is impossible for NAACP Units to carry out an effective civil rights program without adequate funding. The

information below is designed to provide you with simple, clear and concise strategies for generating revenue.

PLAN YOUR WORK AND WORK YOUR PLAN

The key to successful fund-raising is planning. A good plan that is properly executed will produce memorable

and successful events. Here are some of the basics of fund-raising:

1.

A budget is a map to where we are

going:

The Finance Committee must prepare a budget at the

end of each year for the following year. The budget

is the basis of the Freedom Fund Committee fund-

raising goal for the year.

2.

Failure to plan is a plan for failure:

Every fund-raising activity must be well planned.

The earlier we plan, the better our chance for

success. The Freedom Fund Banquet or event must

have at least six (6) months of planning.

3.

Don’t forget to POP: Plan on Paper:

The banquet must be planned on paper starting with

preparing a budget.

4.

No More $10 Dinners:

We must charge an appropriate ticket price. There

should be no NAACP dinners with less than a $25

ticket, $50 is even better. It is impossible to raise

money with cheap tickets and it also cheapens the

Association.

5.

There must be a division of labor:

The Freedom Fund Committee or Banquet

Committee must not become a one woman/man

show. Everyone can do something and no one can

do everything. Appoint sub-committees in charge

of Corporate Solicitations, Logistics, Program,

Souvenir Journal Ads, Tickets, Non-profit

Solicitations, Church Solicitations, and Public

Relations. The Finance Committee must work

closely with the Freedom Fund Committee.

NAACP – National Office

Unit Financial & Bookkeeping Guide

33

6.

Big Names attract Big Bucks!

Ask corporate and community leaders with

credibility to serve as Honorary Chairpersons and

Co-Chairpersons. Tell them you want to use their

names on the letterhead. Also ask the Honorary

Chairs if they will sign letters, make phone calls and

assign someone from their company to the corporate

sub-committee.

7.

Get free professional help with

marketing and solicitations:

Ask Honorary Chairs or other corporate leaders for

cooperation of their marketing and publicity

departments for help in designing special letterhead

and writing effective letters. Make sure to include

the local television station owners or general

managers among the Honorary Co-chairpersons.

8.

The first impression is the lasting

impression:

Never send a letter or announcement without having

it proofed by someone other than the author. Get

someone who knows English and grammar (teacher,

professor, editor, press person or marketing expert)

to review ALL correspondence before it is sent!

9.

Remember the Blind Bartimaeus

Rule: “Ask for what you want!”

We must ask the right people for the right amount

of money. Solicitation letters must be well written,

grammatically correct, and sent in a timely manner

to the decision maker in the business, organization

or company. Never, ever send a “Dear Sir” or “To

whom it may concern” letter.

10.

No shortcuts, do the research:

Don’t half step, do the necessary research to build a

comprehensive data base of companies and

individuals to solicit from. Ask corporate friends for

their “hot lists” of contributors who give big money.

Buy a copy of the chamber directory.

11.

Make giving user friendly:

Solicitation letters and response form(s) must be

designed to be easily used by the recipient and

potential contributor. Make sure all necessary

information about date, time and place of the event,

the amount requested and deadline are included in

letters and response form(s).

12.

Communicate early and often:

Solicitation letters must be sent at least ninety (90)

days before the event. Follow up letters should be

sent 60 days and 30 days out.

13.

Outreach means to reach out:

We must reach out to businesses, community

groups, organizations and individuals to solicit

support for the event. Unit officers should make

NAACP – National Office

Unit Financial & Bookkeeping Guide

34

presentations to churches, chamber of commerce,

club meetings, and community meetings.

14.

Spread the word:

The Public Relations committee must set up radio

and television interviews at least 30 days out. Public

Service Announcements (PSA) and church

announcements must be sent at least 30 days out.

15.

Program must end the night it starts!

The one NAACP tradition we must end is the all

night program! An Awards Reception before the

banquet to present the less prestigious awards would

make the program shorter. A few major awards

could be presented at the end of the dinner hour. No

banquet should last more than 2 ½ hours.

16.

Only one keynote speaker!

Give every program participant a written script and

a time limit. The entire program should be timed

from start to finish. Never wait on the speaker to

start the program. At the appointed hour, start!

.

17.

Technology makes it look good:

If there is a Woman of the Year or Mother of the

Year contest as part of the banquet, consider having

the contestants presented on large screen video.

18.

Thank everybody:

Within seven (7) days after the banquet, send thank

you letters to all participants.

19.

A few good fund-raisers is better than

many smaller poorly planned ones:

We must not nickel and dime the community year

round. We are in the civil rights business, not the

fund-raising business. Other good fund-raisers are

auctions, celebrity server dinners or luncheons,

Life Membership Luncheons or Breakfasts,

Tribute to Black Women/Men, private movie

screenings and fashion shows.

20.

Our event must become THE event:

Whatever fund-raiser we have, it must be so well

done that it becomes THE event to attend annually.

21.

Our goal is never to “Break even”:

If we just want to break even; it would be better to

hold a mass meeting!