Rustamdjan Hakimov; Heller, C.-Philipp; Kübler, Dorothea; Kurino, Morimitsu

Article — Published Version

How to Avoid Black Markets for Appointments with

Online Booking Systems

American Economic Review

Provided in Cooperation with:

WZB Berlin Social Science Center

Suggested Citation: Rustamdjan Hakimov; Heller, C.-Philipp; Kübler, Dorothea; Kurino, Morimitsu

(2021) : How to Avoid Black Markets for Appointments with Online Booking Systems, American

Economic Review, ISSN 1944-7981, American Economic Association, Nashville, Tenn, Vol. 111, Iss. 7,

pp. 2127-2151,

https://doi.org/10.1257/aer.20191204

This Version is available at:

https://hdl.handle.net/10419/235248

Standard-Nutzungsbedingungen:

Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen

Zwecken und zum Privatgebrauch gespeichert und kopiert werden.

Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle

Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich

machen, vertreiben oder anderweitig nutzen.

Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen

(insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten,

gelten abweichend von diesen Nutzungsbedingungen die in der dort

genannten Lizenz gewährten Nutzungsrechte.

Terms of use:

Documents in EconStor may be saved and copied for your personal

and scholarly purposes.

You are not to copy documents for public or commercial purposes, to

exhibit the documents publicly, to make them publicly available on the

internet, or to distribute or otherwise use the documents in public.

If the documents have been made available under an Open Content

Licence (especially Creative Commons Licences), you may exercise

further usage rights as specified in the indicated licence.

American Economic Review 2021, 111(7): 2127–2151

https://doi.org/10.1257/aer.20191204

2127

How to Avoid Black Markets for Appointments

with Online Booking Systems

†

By R H, C.-P H, D K,

M K*

Allocating appointment slots is presented as a new application for

market design. Online booking systems are commonly used by pub-

lic authorities to allocate appointments for visa interviews, driver’s

licenses, passport renewals, etc. We document that black markets for

appointments have developed in many parts of the world. Scalpers

book the appointments that are offered for free and sell the slots to

appointment seekers. We model the existing rst-come-rst-served

booking system and propose an alternative batch system. The batch

system collects applications for slots over a certain time period and

then randomly allocates slots to applicants. The theory predicts and

lab experiments conrm that scalpers protably book and sell slots

under the current system with sufciently high demand, but that they

are not active in the proposed batch system. We discuss practical

issues for the implementation of the batch system and its applicabil-

ity to other markets with scalping. (JEL C92, D47)

Allocation problems where money is not used to coordinate supply and demand

have gained the attention of economists in recent decades. Well-known examples

include the assignment of seats at schools and universities. A related problem

* Hakimov: University of Lausanne & WZB Berlin Social Science Center (email: rustamdjan.hakimov@unil.

Center & Technical University Berlin (email: dorothea.kuebler@wzb.eu); Kurino: Keio University, Faculty

of Economics (email: [email protected]). Liran Einav was the coeditor for this article. We would like to

thank three anonymous referees for their insightful and constructive comments and clear guidance. Our special

thanks go to Renke Fahl-Spiewack at the German Foreign Ofce who inspired us to work on this problem. We

are grateful to Nina Bonge who helped us with conducting the experiments as well as Jennifer Rontganger and

Christopher Eyer for copyediting. We thank Georgy Artemov, Péter Biró, Julien Combe, Bob Hammond, Akshay

Arun Moorthy, Alex Nichifor, Siqi Pan, Antonio Romero-Medina, Yasunari Tamada, Masatoshi Tsumagari, Martin

Van der Linden, Suvi Vasama, Tom Wilkening, Zhibo Xu, and participants of the Berlin Behavioral Economics

Workshop, the European Behavioral Economics Meeting (EBEM) at the University of Bonn, the Conference of

Behavioral Economics and the Economics of Inequality at the University of Edinburgh, and seminar participants

at Keio University, Hitotsubashi University, UTS Sydney, University of Melbourne, University of St. Andrews,

ECONtribute Bonn/Cologne, HSE St. Petersburg, DICE at Düsseldorf University, the MiddEX virtual seminar, and

FAIR at the University of Bergen for their valuable comments. Dorothea Kübler gratefully acknowledges nancial

support from the Deutsche Forschungsgemeinschaft (DFG, German Research Foundation) through CRC TRR190

“Rationality and Competition” and the Cluster of Excellence “Contestations of the Liberal Script” (EXC2055) as

well as the Leibniz SAW project MADEP. Rustamdjan Hakimov acknowledges nancial support from the Swiss

National Science Foundation project 100018_189152. Morimitsu Kurino acknowledges nancial support from JPS

KAKENHI (grant from Japan Society for the Promotion of Science), and F-MIRAI at the University of Tsukuba.

†

Go to https://doi.org/10.1257/aer.20191204 to visit the article page for additional materials and author

disclosure statements.

2128

THE AMERICAN ECONOMIC REVIEW

JULY 2021

involves scheduling appointments at public ofces. Such appointments are provided

for free and are necessary to access many essential public services, such as obtain-

ing a visa or a driver’s license, or renewing a passport. Lately, many authorities

have introduced online booking systems that allow appointment seekers to book

in advance and to avoid queues. Typically, these online booking systems are based

on rst-come-rst-served rules: an authority offers time slots on a website, and

appointment seekers visiting the website can pick any available (not previously

booked) slot.

Such online systems based on rst-come-rst-served rules are vulnerable to

scalping. Scalpers are rms that book slots and sell them to appointment seekers.

Typically, scalpers use software, or bots, to track the system and book slots imme-

diately after they appear. Thus, the rms have a technological advantage when it

comes to booking speed compared to appointment seekers. A black market for

appointment slots implies that the political objective of providing equal access to

the public service, independent of income, may be violated. Moreover, it can be

argued that rms acting as intermediaries prot undeservedly from public services.

1

The vulnerability of the booking system originates from the fact that once slots

become available, they can be booked on a rst-come-rst-served basis. Scalpers

book any open slots with fake names or the names of their customers and sell them.

For appointments booked under fake names, scalpers rst cancel and then immedi-

ately book the slots under the names of their customers. This rebooking of canceled

slots bypasses the barrier imposed by the ID verication of the booking system.

Thus, while it might seem that ID verication would prevent scalping, the scalper’s

advantage of speed in the rst-come-rst-served system effectively circumvents it.

A number of prominent cases have surfaced recently where appointment slots at

public ofces were sold on the market. The introduction of an online booking sys-

tem for appointments with the Irish Naturalisation and Immigration Service Center

in Dublin led to scalping and a collapse of the system.

2

Bots have also been used by

scalpers to book all the slots at the Préfectures in France where foreigners need to

obtain their residence permit. Thus, appointment seekers cannot obtain slots directly

but instead must buy them from the scalpers.

3

Fees of up to US$500 were paid to

scalpers to get an appointment for a visa interview at the German consulates in

Beirut, Tehran, and Shanghai.

4

1

One feature of scalping is that it can help to serve the buyers with the highest valuations. However, we are not

looking for a solution that maximizes the sum of the valuations of appointment seekers who are served. Instead, we

propose a system that guarantees equal access, is ex ante fair by relying on randomization, and is efcient in the

sense that no slots are wasted.

2

Sorcha Pollak, “Bots Used to Block Immigrants in Ireland from Making Visa Appointments,” Irish Times,

https://www.irishtimes.com/news/social-affairs/bots-used-to-block-immigrants-in-ireland-from-making-visa-

appointments-1.3620957 (accessed December 1, 2020).

3

Julia Pascual and Nicolas Corentin, “Titres de séjour: le prospère business de la revente de rendez-vous en pré-

fecture,” Le Monde, https://www.lemonde.fr/societe/article/2019/06/01/titres-de-sejour-le-business-de-la-revente-

de-rendez-vous-en-prefecture-prospere_5470146_3224.html (accessed December 1, 2020).

4

Peter Maxwill, “Ein Termin in der deutschen Botschaft? Das kostet!,” Spiegel, https://www.spiegel.de/politik/

ausland/iran-termine-in-deutscher-botschaft-in-teheran-werden-verkauft-a-1041367.html (accessed December 1,

2020). After the events received press coverage, we were contacted by the German Foreign Ofce to consider the

problem. This was the starting point of our work. An increase in the demand for appointments played a crucial role

in 2014 in Beirut where many Syrian refugees tried to get a visa. The German consulates observed that open slots

were almost immediately taken and that there was a high proportion of no-shows for the booked appointments.

The German Foreign Ofce implemented a number of changes, such as delaying the reopening of slots after their

2129

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

Similar problems have been documented for appointments to obtain a driver’s

license at the Department of Motor Vehicles in some states in the United States.

5

In Berlin, appointment slots at public ofces were offered for money on a private

website.

6

In both instances, policymakers have tried to take legal action, but without

success.

Appointments at public hospitals in China can be booked online, and the cost of

service has to be paid at the moment of booking. Scalpers sell these appointments

at prestigious hospitals for up to 50 times their face value.

7

Thus, scalping can also

be protable when people pay for appointments if the price is not determined by

supply and demand.

The allocation of appointment slots shares some similarities with, but also differs

from, ticket markets for sporting events and concerts as well as air travel tickets. The

organizers of sporting events and concerts often set prices below the market-clearing

price out of fairness or image concerns, and thus face the challenge of resale mar-

kets and scalping. In contrast to these markets, the appointment slots have IDs

attached to them, and scalping occurs despite this feature. We will show how our

proposed booking system for appointments that are free of charge relates to but

differs from solutions proposed for event ticketing (Bhave andBudish 2017, Leslie

andSorensen 2014, Courty 2019). Airline tickets for which scalping is not observed

have IDs attached to them and are allocated through a rst-come-rst-served sys-

tem. However, speed does not matter, since tickets are made available before the

full demand is realized, and airlines do not make canceled tickets available for new

customers at the old price.

We rst study a typical online system for scheduling appointments. We pres-

ent a model of the rst-come-rst-served (“immediate”) system where slots can be

booked instantaneously, and solve for an equilibrium in this system. We demon-

strate that in equilibrium scalpers can protably book and sell slots to appointment

seekers under reasonable parameters of the rst-come-rst-served system.

We propose an alternative system that collects applications in real time, and ran-

domly allocates the slots among applicants (“batch” system). The system works

as follows: a set of slots (batch) is offered, and applications are collected over a

certain time period, e.g., for one day. At the end of the day, all slots in the batch are

allocated to the appointment seekers. Thus, the allocation is in batches, not immedi-

ate as in the rst-come-rst-served system. In the case of excess demand, a lottery

decides who gets a slot. If a slot is canceled, this slot is added to the batch in the next

cancellation, increasing the number of slots, outsourcing the services to private rms, and allocating some slots via

email. However, scalpers are still active. See also “Privatsache Visavergabe” from October 18, 2017.

5

Michael Cabanatuan, “DMV Investigates Startup That Has Disrupted Appointment Process,” San Francisco

Chronicle, https://www.sfchronicle.com/bayarea/article/DMV-investigates-startup-that-has-disrupted-13064509.

php (accessed December 1, 2020).

6

Hannar Beitzer, “Für kostenlose Termine zahlen,” Süddeutsche Zeitung, https://www.sueddeutsche.de/pan-

orama/berliner-buergeraemter-zahlen-fuer-kostenlose-termine-wegen-chaos-1.2581163 (accessed December 1,

2020).

7

Yang Wanli, “Top Medical Authority Says Appointment Scalpers Will Be Punished,” China Daily, http://

www.chinadaily.com.cn/china/2016-01/28/content_23281382.htm (accessed December 1, 2020); and Catherine

Wong, “Ticket Scalpers Selling Hospital Appointments: Beijing Police Arrest 29 Members of Gang Using Ofcial

Booking Apps to Recruit Customers,” South China Morning Post, https://www.scmp.com/news/china/society/

article/1928186/ticket-scalpers-selling-hospital-appointments-beijing-police (accessed December 1, 2020).

2130

THE AMERICAN ECONOMIC REVIEW

JULY 2021

allocation period, e.g., the following day. Thus, the scalper cannot transfer the slot

from the fake name to the customer by way of cancellations and rebookings.

We show that under reasonable parameter restrictions, the scalper not entering

the market is the unique equilibrium outcome of the batch system. The intuition for

this result is that, keeping the booking behavior of the scalper xed, a seeker has the

same probability of getting a slot when buying from the scalper as when applying

directly. Flooding the market with fake applications increases the probability that

the scalper will receive many slots, but he cannot make sure that he gets slots for

his clients, and he cannot transfer slots to the names of the clients. Thus, given the

booking choice of the scalper, the seekers will always prefer to apply directly if the

price for the scalper’s service is positive.

The batch system has two important features relative to the immediate system:

rst, it eliminates the importance of speed, and second, it prevents the possibility

of transferring the identity of the slots booked under fake names to the names of

the clients through cancellations and rebookings. Both features are necessary to

avoid scalping. To see this, consider two alternative systems where only one of the

two features holds, respectively. First, if the scalper is faster than the seekers but

cannot transfer the identity of slots, he can still protably operate in the market if

seekers ask the scalper to book slots on their behalf (as in our experiment and in the

case of train tickets in India discussed in SectionIIIC). Second, in a batch system

where speed does not matter but bookings do not require identication, the scalper

can ood the market with fake applications, is virtually guaranteed to receive all

slots under fake names, and can sell the slots to seekers in a secondary market. This

holds true for some ticket markets for sporting events and concerts (as discussed in

SectionIIIC).

The rst feature of the batch system, namely eliminating the relevance of

speed, parallels the proposal by Budish, Cramton, and Shim (2015) to replace

continuous-time trading at nancial exchanges with frequent batch auctions. Similar

to Budish, Cramton, andShim (2015), we show that an allocation system where

speed determines the priorities creates an advantage for the scalper. In our setup,

however, there is an additional drawback to speed: it makes ID verications irrel-

evant, which is novel. While batch auctions transform competition on speed into

competition on price, the batch booking system transforms competition on speed

into equal access via lotteries. For equal access via lotteries to be effective, ID

checks are needed: these checks are not necessary when an auction is used to elim-

inate scalping.

Based on a parameterized version of the model, we conducted a set of lab exper-

iments. We nd that the scalpers’ choices in the experiment are in line with the the-

oretical predictions: scalpers only persistently and protably enter the market in the

immediate system when demand is high, i.e., when there are enough appointment

seekers to cover the scalper’s costs. Furthermore, in line with the theory, the exper-

iments show that the proposed batch system does not allow the scalpers to make a

prot, and that market entry is rare. Finally, the batch system leads to higher average

welfare for the seekers than the immediate system, as predicted.

For the actual implementation of the proposed batch system, certain features of

the design are crucial. We discuss these practicalities such as the length of the time

interval in which applications for a batch of slots are possible in SectionIII. We also

2131

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

discuss possible alternative measures to ght scalping and show that they do not

preclude scalping under the rst-come-rst-served system or have other undesirable

features. Finally, we discuss a range of other markets with scalping, such as train

tickets, limited edition sneakers, and tickets for sporting events, and consider the

potential usefulness of the batch system in these cases. The main takeaway is that

the applicability of the batch system depends on whether identity checks can be

implemented.

Related Literature.—The importance of speed in high-frequency trading has led

to enormous investments in fast data connections around the world. This feature

relates our contribution to a proposal for the redesign of nancial exchanges by

Budish, Cramton, andShim (2015), as discussed above.

8

Our paper speaks to the literature on the sale and resale of tickets for sporting

events, concerts, popular restaurants, etc. Marketing tools introduced by the orga-

nizers of sporting events have blurred the difference between primary and secondary

markets (for a survey, see Courty 2017). Courty (2019) proposes a centralized ticket

exchange where fans can return tickets that are then randomly allocated to other

fans.

Often, economists take the development of secondary markets as evidence of

underpricing by the original seller and therefore suggest increasing prices or run-

ning auction-like mechanisms to prevent secondary market sellers from prot-

ing. Auctions can be used for ticket sales to reduce arbitrage prots, as in Bhave

and Budish (2017). Alternatively, random allocations of tickets priced below the

market-clearing rate are used, for instance, for the soccer World Cup nal, for

Wimbledon, and for some baseball games in the MLB. More generally, Chakravarty

andKaplan (2013) show that lotteries can be an optimal allocation rule when no

payments are collected.

Speed can be decisive in online auctions where sniping aims at minimizing the

time between the bid and the end of the auction. While sniping can be addressed by

endogenous or unknown auction closing times (Roth andOckenfels 2002; Ockenfels

andRoth 2006; Ariely, Ockenfels, andRoth 2005; Malaga etal. 2010), the scalping

of appointments cannot be prevented by keeping the exact time of the release of new

slots unknown. The software monitoring the booking websites all but guarantees

that the scalper will get every available slot.

When there is no possibility of monetary transfers, the assignment of appoint-

ment slots is a house allocation problem studied in the matching literature (Shapley

andScarf 1974, Hylland andZeckhauser,1979, Abdulkadiro g

̆

lu andSönmez 1998).

9

The existing models cannot analyze the emergence of black markets, and we there-

fore present a new model. Finally, this paper is part of a growing experimental lit-

erature on matching markets surveyed by Roth (2016) and Hakimov and Kübler

(2020), as well as experimental work on the role of market intermediaries for cor-

ruption and collusion, as in Cason (2000) and Drugov, Hamman, andSerra (2014).

8

Relatedly, batch and serial processing of offers in decentralized labor markets are studied by Roth andXing

(1997), where batch processing helps to overcome congestion and thus improves market outcomes.

9

Experiments on house allocation and random serial dictatorship haven been conducted by Chen andSönmez

(2002); Guillen andKesten (2012); and Hugh-Jones, Kurino, andVanberg (2014).

2132

THE AMERICAN ECONOMIC REVIEW

JULY 2021

I. The Model

We build a simple model of appointment allocation in the presence of scalpers,

focusing on how design choices can reduce the protability of scalping. The proofs

of all results are in online Appendix Section A.

There are n (appointment) seekers, indexed by i ∈

{

1, … , n

}

, who need a ser-

vice from a central authority. The central authority meets the seekers face-to-face to

provide the service, and offers m (appointment) slots. The m slots can be obtained

by any agent, not only the seekers. We represent non-appointment-seeking agents by

one rm, called the scalper.

10

A booking system operated by a central authority is a procedure to allocate m

slots to applicants. A system accepts applications with applicant IDs. ID checks are

performed during the appointment, that is, the correct name and passport number

have to be in the system. A seeker can submit at most one application for a slot with

her ID, as the booking system can detect multiple entries of the same name. We

assume that the scalper can costlessly create fake IDs that do not refer to any exist-

ing appointment seekers. He has to replace them with the IDs of seekers in order to

sell the slots. The central authority cannot distinguish true seekers from fake seekers

based on the application for a slot.

Each seeker i has a value of v

i

of obtaining an appointment for any of the m

slots. This value is the seeker’s private information and is called her type. Each v

i

is

independently and identically distributed along some interval [ v

¯

, v

–

] according to the

commonly known distribution function F where v

¯

> 0 . We normalize the value of

getting no slot to zero, and assume that F has a continuous density f ≡ F ′ with full

support.

There is a (black) market for scalping in which the scalper can enter or remain

inactive. The entry cost is c > 0 .

11

If the scalper decides to enter the market, he can

submit as many applications to the booking system as he wants, up to Q . Here, Q

represents the capacity constraint of the scalper to create fake applications. For

analytical simplicity, we assume that Q is sufciently large so that Q > n . In the

market the scalper sets the monopoly price for the service of procuring a slot for

a seeker. We denote by p the price paid by a seeker to the scalper. We assume that

the set of feasible prices is a compact set included in the set of positive numbers,

denoted by ⊆ ℝ

++

.

Seekers observe the price and decide whether to buy a slot from the scalper.

Under any booking system, if the scalper successfully secures a slot for a seeker, the

seeker obtains the slot. If not, the scalper reimburses the seeker for the price she has

paid. How slots are booked depends on which system is in place.

10

We refer to the scalper by the male personal pronoun and to a seeker by the female personal pronoun.

11

We assume that the cost is xed, and can be interpreted as an investment in the technology, i.e., the program-

ming of bots that search for and book slots. In our model, the game lasts for one period. In reality, the scalper might

be active for many periods if the cost for the scalping technology was paid once. However, the booking systems

include captchas and other security features and are constantly updated. Thus, scalpers have to regularly invest in

the software. Scalpers may also have to pay wages to persons who sell slots to customers, which is another source

of costs accruing in every period.

2133

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

Each seeker i ’s payoff depends on her valuation and the price, as well as whether

she obtains a slot:

seekeri’s payoff =

{

v

i

if she obtains a slot directly,

v

i

− p

if she buys a slot at pricepfrom the scalper,

0

if she does not obtain a slot.

The scalper obtains no utility from an appointment slot, but can prot from selling

slots to the seekers. His payoff from selling m ′ ∈

{

0, … , m

}

slots to the seekers is

scalper’s payoff =

{

m ′ p − c

if he sells m ′ slots to seekers,

0

if he is not active.

We assume that the seekers and the scalper are risk neutral.

Under any system, a seeker can either apply for a slot directly or buy the service

of the scalper, not both. The former is called a direct applicant, while the latter

is called a buyer. Let n

b

be the number of buyers, and n

d

be the number of direct

applicants, such that n

b

+ n

d

= n . The number of applications by the scalper is

denoted by n

s

where n

s

≤ Q , and s is the number of slots secured by the scalper

where s ≤ n

s

. The likelihood that the scalper gets s slots and the likelihood of a

direct applicant getting a slot depends on the booking system in place.

The timeline of the game under any booking system is summarized in Figure 1.

Panel A shows the sequence of actions in case the scalper enters the market while

panel B shows the sequence in case he does not. The timing of the game is as follows.

• In t = 0 , seekers learn their valuations privately.

• In t = 1 , the scalper chooses whether to enter the market, which is observable.

If he enters, the scalper sets the price for a slot that is observable, and the game

continues at t = 2 (panel A of Figure1). If the scalper does not enter the mar-

ket, the game continues at t = 3 (panel B of Figure1).

• In t = 2 , if the scalper has entered the market, the seekers simultaneously

decide whether to buy a slot from the scalper or apply for slots directly through

the booking system. The number of buyers is observable for the scalper.

• In t = 3 , if the scalper has entered the market, he chooses the number of appli-

cations n

s

up to capacity Q for the booking system. Those seekers who did not

buy the scalper’s service apply directly to the booking system. The number of

such seekers is denoted by n

d

. If the scalper did not enter, all seekers apply for

slots directly, and thus n

d

= n and n

s

= s = 0 .

• In t = 4 , the booking system is run and payoffs are realized.

The order of moves regarding the booking of slots by the scalper and the buying

decisions of seekers is not crucial for our main results, and we discuss the conse-

quences of changing the order for each booking system in what follows.

The strategy of the scalper determines whether he enters the market and at which

price he offers the slots. It also determines the number of his applications for each

combination of price p and number of buyers n

b

. Every seeker observes the scalper’s

decision regarding entry and price, and then decides whether to buy from the scalper

or to apply for a slot directly.

2134

THE AMERICAN ECONOMIC REVIEW

JULY 2021

We will solve for a symmetric Bayesian Nash equilibrium, or a symmetric equi-

librium in which all seekers use a symmetric strategy, i.e., a strategy that depends

only on types and prices, not on the names of seekers.

A. Immediate Booking System

The immediate system models a rst-come-rst-served online booking system.

In such a system, an application is only observable for the designer if it results in

the booking of a slot. Thus, the maximum number of observable applications is m ,

i.e., n

s

+ n

d

≤ m .

12

The scalper has a technological advantage over the seekers in

the sense that he can secure himself any number of slots up to the total supply with

the help of bots, s = n

s

≤ m . Importantly, the scalper can transfer these slots to

seekers who must pay for his service. This is possible by canceling the slot with the

fake ID and then immediately rebooking it under the name of the seeker.

13

For the sake of simplicity, we model the possibility of cancellations and rebookings

by having the scalper book the slots after he knows the demand of seekers (including

their IDs). This modeling assumption makes cancellations and rebookings unneces-

sary since the scalper knows which seekers are buying from him in a given period.

At the same time, unlike in the real world when seekers observe that there is no

12

This does not preclude a situation of excess demand. However, seekers who do not get a slot directly or

through the scalper cannot be observed.

13

Note that even if the canceled slots are freed up with a delay, a policy that has been adopted by the German

consulates to deter scalping, the scalper will be faster than the seekers in booking them once they appear in the

system. Moreover, the scalper knows for sure that the slot will be offered at some point, early enough for rebooking,

since otherwise the canceled slot is wasted.

t = 0

t = 1

t = 2 t = 4

t = 3

Booking system, supply

of slots, and the number of

seekers are revealed; seekers

learn their valuations.

Scalper learns how many slots

he sold and decides on number

of applications; seekers

who did not buy apply directly.

Scalper enters the market

and sets the price.

Seekers learn the price

and decide to buy or not.

Final payoffs

are realized.

System determines allocation

t = 0

t = 1

t = 2 t = 4

t = 3

Booking system, supply

of slots, and the number of

seekers are revealed; seekers

learn their valuations.

Seekers apply directly.

Scalper decides not

to enter the market.

No actions. Final payoffs

are realized.

System determines allocation

Panel A. Timeline if scalper enters the market

Panel B. Timeline if scalper does not enter the market

F1. T T G

2135

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

possibility of getting a slot except through the scalper, under our modeling assump-

tion appointment seekers need to decide whether to buy before observing the scalp-

er’s actions. Hence, they have to anticipate that the scalper will book all the slots.

14

After the scalper has made his bookings, all remaining slots are assigned to the

direct applicants if there are enough slots available. Otherwise, the remaining slots

are randomly assigned to them. More formally, the assignment is determined as fol-

lows: if the number of buyers is smaller than or equal to the number of slots secured

by the scalper, i.e., n

b

≤ s , each buyer will get a slot for sure and

(

s − n

b

)

slots lead

to no-shows; otherwise (if n

b

> s ), s slots are randomly distributed to n

b

buyers

such that each gets a slot with probability s/ n

b

. The residual supply of m − n

s

slots

is distributed randomly among the direct applicants. Thus, each direct applicant

gets a slot with a probability of ( m − n

s

)/ n

d

. Any remaining open slots are freely

disposed of.

PROPOSITION 1 (Equilibrium in the Immediate System): Let p

∗

be the price that

maximizes the prot of the scalper Π

(

p

)

. In the immediate booking system, there

exists a symmetric equilibrium where on the equilibrium path the following occurs.

15

(i) If Π

(

p

∗

)

≥ 0 , the scalper enters the market, sets price p

∗

, and makes m

applications. Moreover, each seeker follows the symmetric strategy in which

a type above p

∗

buys the service from the scalper, and a type below p

∗

applies

directly and receives a slot with zero probability.

(ii) If Π

(

p

∗

)

< 0 , the scalper does not enter the market, and all seekers apply

directly.

In the equilibrium of the immediate system, the scalper enters the market if the

entry cost is not too high. If the scalper enters, he will book all slots. Then, the only

possibility for seekers to get a slot is to buy it from the scalper.

Example.—Consider a market with 20 seekers competing for 15 slots. The val-

uations of the seekers are uniformly distributed on the interval

[

10,100

]

. The entry

cost is 100. In equilibrium, the scalper enters the market with the prot-maximizing

price of 51 where prices are restricted to be integers. All seekers with valuations

above 51 buy his service. The scalper books all 15 slots with an expected prot of

454. The expected number of slots sold is 10.9, which implies that, on average, 4.1

slots remain unassigned, leading to no-shows despite excess demand.

While the overall welfare of the booking system is not our main interest, we can

distinguish three effects of scalping on welfare in the immediate system. (i) The

entry cost for the scalper creates a deadweight loss. (ii) If there are more seekers

14

When the order of moves is reversed (i.e., the scalper books rst, and the seekers then observe the remaining

slots and decide whether to buy), it is equally straightforward for a scalper to make a prot. This does not require

scalpers to be able to cancel and rebook slots under different names, as shown by the example in SectionIIIC.

15

The scalper’s prot is given as

Π

(

p

)

=

{

∑

k=0

m

(

n

k

)

F

n−k

(

p

)

(

1 − F

(

p

)

)

k

pk − c

if m ≥ n,

∑

k=0

m

(

n

k

)

F

n−k

(

p

)

(

1 − F

(

p

)

)

k

pk +

∑

k=m+1

n

(

n

k

)

F

n−k

(

p

)

(

1 − F

(

p

)

)

k

pm − c

if m < n.

2136

THE AMERICAN ECONOMIC REVIEW

JULY 2021

than slots, the presence of the scalper may improve the allocative efciency. The

reason is that without the scalper, the slots are allocated randomly to seekers, irre-

spective of their valuation. If the scalper is active, only seekers with a high valuation

will obtain slots. (iii) The price charged by the scalper creates inefciencies due to

slots being wasted if there are fewer seekers with a valuation above the price than

available slots.

B. Batch Booking System

We propose the batch booking system as an alternative to the immediate system.

Under the batch system, the central authority collects and pools applications with

IDs during a certain time interval. At the end of the interval, the m slots are allocated

randomly to the applicants. The number of applications is not constrained by the

supply of slots, since the allocation of slots takes place after the period of collect-

ing applications. The batch system eliminates the importance of speed, since the

random allocation gives every applicant the same chance independent of when

she applied within the given time interval. Thus, the scalper has no technological

advantage relative to the seeker, except that he can submit Q applications, while

seekers can submit only one. All canceled slots are allocated in the next or later

batches.

Although the allocation of slots in the batch system takes place over a time

interval, modeling the dimension of time would complicate the analysis with little

additional insight. For simplicity, we model the batch system as a static assign-

ment. The assignment by the batch system is determined in one of the following

two cases:

(i) The total number of applications does not exceed the number of slots, i.e.,

n

d

+ n

s

≤ m . The scalper obtains a slot for each of his applications, n

s

= s ≤ m .

Also, each direct applicant gets a slot. If n

b

≤ n

s

, n

b

slots go to the buyers, and

the remaining slots of the scalper ( n

s

− n

b

) are assigned to fake IDs and lead to

no-shows. If n

b

> n

s

, the s slots are assigned to the buyers whose applications were

submitted by the scalper. Thus, each buyer gets a slot with probability n

s

/ n

b

.

(ii) The total number of applications exceeds the number of slots, i.e., n

d

+ n

s

> m .

The m slots are randomly allocated to applicants with real or fake IDs. Each buyer,

fake ID, and direct applicant get a slot with probability m/( n

d

+ n

s

) .

In the immediate system, the scalper can secure up to m slots for the buyers,

which allows him to preempt the direct applicants completely. By contrast, in the

batch system the scalper cannot secure slots for the buyers with certainty. While

he is almost certain to get the full supply of slots by submitting a large number

of applications with both fake and real IDs, he cannot transfer slots with fake IDs

to the buyers because canceled slots are reallocated only in the next period where

the scalper would again face competition from seekers who apply directly. Thus,

submitting more applications than n

b

reduces the likelihood that he can get slots

for his clients, while submitting fewer applications than n

b

reduces his prot.

We conclude that the scalper makes n

b

applications when observing n

b

(

≥ 0

)

buyers.

Another characteristic of the batch system is that given such optimal behavior of

the scalper, a seeker has the same probability of getting a slot from buying as from

2137

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

applying directly.

16

Thus, since buying a slot is costly for the seeker, she always

prefers to apply directly. The main properties of the batch system are summarized

in Proposition 2.

PROPOSITION 2 (Equilibrium in the Batch System): In the batch booking system,

there exists a symmetric equilibrium where the scalper does not enter the market on

the equilibrium path .

In particular, the scalper not being active is a unique equilibrium outcome

if R < c , where R is an upper bound of the expected revenue, dened as follows:

R =

∑

k=1

n

(

n

k

)

(

2n − k − 1

_

2n − 1

)

2n−k−1

(

k

_

2n − 1

)

k

max

{

n − 1, m

}

_

n

k v

–

.

Just as in the immediate system, the order of moves is not crucial for this result.

In the batch system, the seekers and the scalper essentially move simultaneously.

The condition of uniqueness of the equilibrium outcome is rather mild and likely

to be satised in many settings. Online Appendix Figure A.1 presents the graph of

the function R depending on n for v

–

= 1 . The revenues of the scalper never exceed

0.55. Thus, whenever the entry cost of the scalper is higher than 55 percent of the

highest valuation, not entering the market is the unique equilibrium outcome.

When R > c , there may exist another equilibrium under the batch system in

which the scalper enters the market by threatening to ood the market with appli-

cations in the case of zero buyers. We describe it in Proposition 3 in the online

Appendix. The risk posed by this equilibrium to the authority ghting scalping is

limited, since only a few seekers with high valuations buy from the scalper while

most seekers receive a slot through direct applications. This is in contrast to the

equilibrium under the immediate system where seekers can only get a slot through

the scalper if he is active. Moreover, we believe that it is difcult for the scalper’s

threat to ood the market to be effective. Since all applications are accepted in the

batch system, the seekers can always apply for slots, and even if they do not get a

slot in one batch, they can try again in the next. Thus, they cannot observe the scalp-

er’s activity. This is in contrast with the immediate system where the seekers observe

that no slots can be booked, and therefore seek the scalper’s service.

Example.—Consider again a market with 20 seekers competing for 15 slots, the

valuations of the seekers uniformly distributed on the interval

[

10,100

]

, and the entry

cost of 100. The unique equilibrium outcome prescribes that the scalper does not

enter the market. To see this, note that the condition for a unique equilibrium is sat-

ised with c = 100 > 0.55 ⋅ 100 = 0.55 v

–

.

16

See Lemma 4 in the online Appendix for the scalper’s behavior. To see the equal probabilities of a seeker,

say, for the excess demand case ( m < n ), let n

ˆ

b

and n

ˆ

d

be the number of buyers among the other seekers. If she

applies directly, the probability is m/

(

(

n

ˆ

d

+ 1

)

+ n

ˆ

b

)

; if she buys, it is m/

(

n

ˆ

d

+

(

n

ˆ

b

+ 1

)

)

. See Lemma 5 in the online

Appendix for a complete analysis.

2138

THE AMERICAN ECONOMIC REVIEW

JULY 2021

II. Experiment

We conducted an experiment that serves as a testbed of the proposed batch sys-

tem. We also study the immediate system to understand the conditions under which

scalpers can protably enter the market. The experiment allows us to compare the

observed strategies and outcomes to the equilibrium predictions in a tightly con-

trolled environment.

A. Treatments and Procedures

There are four slots to be allocated in every round, m = 4 . Of the ve seekers

in each market, three are active in every round, while the other two are active in

only half of the rounds, thus n = 3 or n = 5 depending on the round. This design

allows us to vary the demand for slots between rounds.

At the beginning of each round, every participant is informed about her valu-

ation v for a slot, drawn from the uniform distribution over the interval between

50 and 100. Each participant has an ID, which is assigned anew in every round

to ensure anonymity of the feedback across rounds. The ID allows us to iden-

tify seekers and assign slots to them. Every seeker can receive at most one slot

per round. There is one scalper in every round who can enter the market. The

scalper has a value of zero for the slots, but he can book slots and sell them to the

seekers.

The slots are allocated through either the immediate or the batch system. Each

round consists of two steps. Step 1 is the same for both booking systems while step

2 differs between them.

In Step 1.—At the beginning of each round the participants are informed of the

booking system that is in place as well as of the number of active seekers in the

round (three or ve). Each seeker’s valuation for a slot is drawn randomly from the

interval [50, 100]. Each seeker is informed of her own valuation, but the scalper does

not know the valuations. The scalper decides whether to enter the market. Entering

the market entails a xed cost of 150 points for the scalper, c = 150 . If the scalper

enters, he sets the price p that is paid by the seeker if the scalper provides a slot.

The scalper has a choice between the following prices: 15, 20, 25, …, 75, 80, or 85.

Each seeker decides whether she wants to pay for the scalper’s service at the price

or whether she wants to apply directly, i.e., without the scalper.

Step 2.—Differs between the two booking systems.

Immediate System: In step 2, when the scalper enters the market, he learns how

many seekers have bought his service. He can book as many slots as he wants for

free. If the scalper sold a slot to a seeker in step 1, the system assigns him a slot for

the ID of this seeker.

Batch System: In step 2, if the scalper is active in the market (that is, he entered

the market in step 1 at a cost of 150 points), the scalper learns how many seekers

bought his service. He can then submit as many applications for slots as he wants

2139

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

for free. The scalper enters the IDs of the seekers who decided to apply through him

in step 1.

17

We implemented a 2×2 within-subjects design by varying the demand and the

booking system. Before each block of ve rounds, the booking system (immediate

or batch) and the demand for appointments (three or ve seekers) are announced.

Both dimensions remain constant for ve rounds. We refer to the treatments with

the immediate booking system with ve and three seekers as Im5 and Im3, and the

treatments with the batch booking system with ve and three seekers as Batch5

and Batch3. The ve-round block design allows the scalper to develop a reputation,

and the seekers to adjust to the behavior of the scalper and of the other seekers. By

changing the ID of the seekers in every round, we attempt to capture the situation

where new seekers enter the market in every round while the scalper remains active

in multiple periods. Overall, each session of the experiment consisted of 40 indepen-

dent decisions, i.e., 40 rounds.

Online Appendix Table C.1 presents the order of treatments by rounds. Each

treatment was implemented twice, such that we can look at mature behavior in the

second block of ve rounds after subjects have already experienced all four treat-

ments. The order of the treatments was chosen so as to rst allow scalpers to make

a prot in the immediate system with ve seekers (see the equilibrium predictions

below). Then, the treatments follow where the scalper should make no prot by

entering the market. This allows us to study our main research question, namely

whether a change in the booking system from immediate to batch will reduce the

amount of scalping.

Payoffs.—Each seeker has an endowment of 220 points at the beginning of each

ve-round block. Within the course of the ve rounds of a block, points are added to

and deducted from this endowment. If active, a seeker earns her valuation minus the

price if she receives a slot through the scalper. If the seeker receives a slot without

the scalper, she simply earns her valuation without paying anything. If the seeker

does not receive a slot, either with or without the scalper, her payoff is zero in this

round, and her endowment is unchanged. Every seeker who is not active in a block

of ve rounds with low demand receives the equilibrium payoff of the active seek-

ers in this round. This limits potential differences between subjects that are due to

income effects.

The scalper has an endowment of 750 points at the beginning of each ve-round

block, and points are added and deducted to this endowment over the course of the

ve rounds. If the scalper enters the market, he pays 150 points, and he receives

the price times the number of slots sold. Note that the 750-point endowment allows

the scalper to enter the market in every round, even if he does not sell any slots.

Thus, we chose a budget that does not constrain the scalper’s choices. If the scalper

decides not to enter the market in one of the rounds, his endowment is unchanged

in this round.

17

The details of the immediate and batch system implemented in the experiments can be found in online

Appendix Section C.2.

2140

THE AMERICAN ECONOMIC REVIEW

JULY 2021

After every round, all participants received feedback about the allocation of slots:

a slot can be vacant, allocated to a seeker directly, allocated to a seeker through the

scalper, or allocated to a fake ID.

At the end of the experiment, one block was randomly drawn and the nal earn-

ings of this block were paid out in euros. The exchange rate was 1 point = 2 cents.

The experiment lasted, on average, around 100 minutes, and the average payoff was

EUR 14.73, including a show-up fee of EUR 5.

The experimental sessions were run at the WZB TU lab at the Technical University

Berlin. We recruited subjects from our pool with the help of ORSEE by Greiner

(2015). The experiments were programmed in z-Tree (Fischbacher 2007). We con-

ducted 10 sessions, with 24 subjects each. Thus, we end up with 40 independent

matching groups. The data from the experiment and the replication code are avail-

able in Hakimov etal. (2021).

At the beginning of the experiment, printed instructions were given to the sub-

jects (see online Appendix Section C). Participants were informed that the exper-

iment was about the study of decision-making, and their payoff depended on their

decisions and the decisions of other participants. The instructions explained the

details of the experiment and were identical for all subjects. Questions were asked

and answered in private. After reading the instructions, all subjects participated in a

quiz to make sure they understood the main features of the experiment.

B. Predictions

The four treatments differ with respect to the predicted entry of the scalper, the

predicted price of a slot, and the number of slots sold. This results in different prots

for the scalper and payoffs for the seekers.

18

The only treatment where the equi-

librium predicts positive expected prots for the scalper is Im5, where the scalper

chooses the prot-maximizing price of 60, leading to less than four slots being allo-

cated in equilibrium. In Im3, the scalper can at most break even in equilibrium due

to the lower demand. He charges a price of 50 to guarantee that all three seekers are

willing to buy a slot which just covers the entry cost of 150. In Batch3 and Batch5,

the scalper does not enter the market in equilibrium.

We use the stage-game predictions, although subjects play the game for ve

rounds changing the ID numbers of the seekers between rounds to capture that

scalpers are longer-lived than seekers. The repetition can generate multiple equilib-

ria, but playing the stage game Nash equilibrium in every round is a Nash equilib-

rium of the repeated game.

C. Experimental Results

The main questions addressed by the experiment are whether scalping is prot-

able and scalpers enter the market. We also summarize the main ndings regarding

the seekers’ choices. All results reported are signicant at the 5 percent level if not

18

Online Appendix TableC.2 presents a summary of the equilibrium predictions of the stage game by treatments.

2141

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

stated otherwise. For all results, we focus on the second block (i.e., the last ve

rounds) of each treatment .

The batch system was designed to remove the incentives of scalpers to enter the

market, book slots, and sell them to the seekers. We therefore begin by investigating

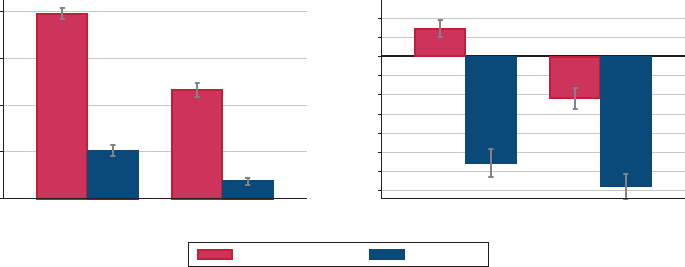

the entry decisions of scalpers across treatments. The left panel of Figure 2 shows the

average proportions of scalpers entering the market in the second block of each treat-

ment. The highest proportion of scalpers in the market is observed in Im5, amounting

to 79 percent, on average, for the last ve rounds of the treatment. This is qualitatively

in line with the equilibrium prediction, according to which scalpers enter the mar-

ket. In the equilibrium with low demand (Im3), the scalpers are indifferent between

entering and not entering the market as the expected prot is zero. We observe, on

average, 47 percent of market entry by scalpers. This proportion is signicantly lower

than in Im5. For the treatments with the batch system, the equilibrium predicts that

scalpers do not enter the market, independent of whether demand is high or low. We

nd 20.5 percent of market entry by scalpers in Batch5 and 7.5 percent in Batch3 in

the last ve rounds of the treatment. This is signicantly lower than in Im5 and Im3.

19

We sum up the ndings as follows.

RESULT 1 (Market Entry): The proportion of market entry by scalpers is highest in

Im5, followed by Im3, while entry is lowest in Batch5 and Batch3.

Are the scalpers’ entry decisions optimal? To answer this question, we turn to

the analysis of the scalpers’ prots. The right panel of Figure2 shows the average

prots conditional on entering the market for each treatment. Only treatment Im5

leads to positive average prots for the active scalpers both in theory and in the

data. However, the realized prots are lower than predicted: equilibrium prots are

19

All pairwise comparisons of the proportion of market entry by scalpers in the last ve rounds of each treat-

ment show signicant differences ( p < 0.01). For the tests, we use the p-values for the coefcient of the dummy of

interest in the probit regression on the dummy for entering the market. Standard errors are clustered at the level of

matching groups and the sample is restricted to the treatments that are relevant to the test.

F2. P M E S () A P ()

Notes: Gray bars represent 95 percent condence intervals. High demand stands for ve seekers (Im5 and Batch5)

while low demand for three seekers (Im3 and Batch3). The gure is based on all decisions in the second block.

−140

−120

−100

−80

−60

−40

−20

0

20

40

Average prot

High demand Low demand

Immediate system Batch system

0

0.2

0.4

0.6

0.8

Proportion of market entry

High demand Low demand

2142

THE AMERICAN ECONOMIC REVIEW

JULY 2021

70.34 while average prots are 22.8, with 36.5 in the last round of the treatment.

Similarly, in Im3 prots are lower than the predicted equilibrium prots of zero.

Turning to the prots of the scalpers in the batch system, the scalpers do not enter the

market in equilibrium, and thus equilibrium prots are zero. As shown by Figure2,

we observe negative prots, conditional on entering the market.

Regarding the booking decisions of scalpers, in Im5 and Im3 scalpers booked the

entire supply of four slots in 91 percent and 87 percent of cases, respectively, after

entering the market. This behavior is close to the equilibrium prediction of 100 per-

cent. In Batch5 and Batch3, the scalpers do not enter the market in 89 percent and

66 percent of all cases, respectively, as predicted in equilibrium, and therefore do

not make any booking decisions. Conditional on out-of-equilibrium entry in the

batch system, scalpers try to block the system by submitting 10 or more applica-

tions in 33 percent and 30 percent of cases in Batch5 and Batch3, respectively. This

points to the attempts of scalpers to block the market, but it is not protable.

The main ndings can be summarized as follows.

RESULT 2 (Prots and Booking Decisions of Scalpers): Scalpers earn positive

prots only in Im5. In the immediate system, in almost 90 percent of cases after

equilibrium entry, the scalpers book all four slots, which is the equilibrium booking

strategy. In the batch system, the majority of scalpers do not enter the market, as

predicted in equilibrium, and therefore do not take any booking decisions.

Appointment Seekers.—We next study the welfare of seekers and the total num-

ber of slots allocated to them. For detailed analyses of the seekers’ behavior, we

refer the reader to online Appendix Section C.5. First, we consider the seekers’ deci-

sions to buy the service from the scalper. Then, we study the welfare of appointment

seekers and the total number of slots allocated.

Figure 3 shows the average payoffs of seekers by treatments. As predicted, the

batch system leads to signicantly higher payoffs for seekers than the immediate sys-

tem, and seekers fare worst in Im5. All pairwise comparisons of treatments with differ-

ent booking systems with the same demand yield signicant differences ( p < 0.01).

20

Regarding absolute levels, the observed average payoffs of seekers are 55 and

73 in Batch3 and Batch5, compared to the prediction of 60 and 75 respectively.

Thus, in the batch system the payoffs of the seekers are slightly below the equilib-

rium payoffs. In Im3 and Im5, the observed payoffs of the seekers are higher than

in equilibrium, namely 30 instead of 15 in Im5 and 51 instead of 25 in Im3. These

deviations from the equilibrium are due to excessive entry of scalpers in treatments

with the batch system, and too little entry in the immediate system.

Summing up, Result 3 states that in line with the equilibrium predictions, a

designer who cares about the utility of seekers should implement the batch system.

RESULT 3 (Payoffs of Appointment Seekers): The average payoffs of appointment

seekers are higher in the batch than in the immediate system for a given demand.

20

The p-values are computed for the coefcients of the dummies of interest in an OLS regression of the seekers’

payoffs; standard errors are clustered at the level of matching groups, and the sample is restricted to treatments of

interest for the test.

2143

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

A potential source of welfare loss are slots that are wasted due to scalping. We

compare the number of slots allocated to seekers by treatments. With high demand,

the proportion of slots allocated to seekers is almost identical in both booking sys-

tems at around 90 percent. With low demand, it is signicantly higher in the batch

system than in the immediate system. For further details on the allocation of slots,

see online Appendix Section C.7.1, and for details on the valuations of the seekers

who receive a slot, see Section C.7.2.

III. Practical Challenges, Alternative Solutions, and Other Markets with Scalping

In this section, we discuss design features of the batch system that are not part of

the model but are important for its implementation. Moreover, we discuss alternative

solutions for the problem of scalping under rst-come-rst-served booking systems

and the applicability of the batch system to other markets with scalping.

A. Practicalities of the Batch System

The theoretical model shows that the batch system makes scalping unprotable,

and the experiments support this prediction. To make the batch system work as

predicted, however, the designer has to carefully choose some additional design

parameters. Our model is static and therefore agnostic about essential details that

can inuence the practical success of the batch system. We have abstracted from the

seekers’ preferences over slots, including the issue of when these preferences arise.

0

20

40

60

80

Average payoff

High demand Low demand

Immediate system Batch system

F3. A P S

Notes: Gray bars represent 95 percent condence intervals. High demand stands for ve seekers (Im5 and Batch5)

while low demand for three seekers (Im3 and Batch3). The gure is based on the second block.

2144

THE AMERICAN ECONOMIC REVIEW

JULY 2021

Length of the Time Interval of Each Batch.—The designer faces a trade-off when

choosing the time interval of a batch.

• Seekers need to have enough time to apply for slots. Sufciently long time

intervals ensure that the scalper cannot book all the slots offered with cer-

tainty, e.g., because seekers do not notice that a new batch is available.

Thus, sufciently long time intervals ensure that the scalper faces competi-

tion from seekers’ direct applications for every batch. For instance, long

time intervals prevent the scalper from ooding the market with applica-

tions for fake IDs for one batch and using a later batch with no competition

from seekers to cancel these slots booked for fake IDs and transfer them to

their clients’ IDs. Note that in the extreme case when the length of the inter-

val is very short, the batch system is essentially equivalent to the immediate

system.

• Seekers want to learn as soon as possible whether they received a slot, and

when the appointment will take place. Short time intervals during which

applications are collected guarantee this while long time intervals mean

that uncertainty regarding the allocation of slots is resolved only after a

considerable period of time. Moreover, long time intervals can make it

impossible to reallocate canceled slots when the appointments take place

before the end of the next allocation procedure. This can lead to welfare

losses.

What is the right length of the time interval for a batch? The answer will depend on

the context. In many cases, it seems reasonable to start with a one-day time interval.

It is long enough to make regular monitoring of the system by the seekers not too

costly and short enough for seekers to learn about the outcome relatively quickly

and make plans.

We suggest monitoring the system of one-day time intervals and looking for signs

of scalping. If the designer observes a high volatility of the probability to obtain a

slot, the time interval should be extended to give seekers a better chance of apply-

ing. However, if the probability of receiving a slot is constant between batches, the

designer may shorten the interval to increase the convenience of the system for the

seekers.

As a complementary measure, to make the batch system more convenient for

seekers and less likely to be protable for scalpers, the designer can provide the

seekers with the option of automatic reapplications for the next batch if their pre-

vious application was unsuccessful. If a seeker opts for this, her application will

remain in the system until she receives a slot. This can help to ensure that there are

direct applications for every batch, thereby decreasing the opportunity for scalpers

to book slots. Depending on the exact context, this could also be the default choice

for all seekers. In this case, the length of the time period of each batch is not essen-

tial, since there is one set of seekers for all batches. This set would change over time

with arrivals of new applicants and departures of those who received a slot. The only

design choice would then be the frequency in which batches are allocated to best

accommodate the seekers’ needs, but this choice would not affect the protability

of scalping.

2145

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

Time at Which Canceled Slots Become Available for Rebooking.—The model

does not specify the exact timing of when canceled slots should reappear in the sys-

tem. To avoid the potential welfare loss of slots that are not used, the designer should

make the canceled slots available immediately after their cancellation in the next

batch. Slots that are canceled late, namely after the last batch was allocated before

the appointment, will be wasted, however. It is crucial to commit to not allocating

them in the last moment, since this would reintroduce an advantage of speed and

incentives for scalping.

Accommodation of Preferences over Slots.—In our theoretical analysis, we

abstract from the fact that seekers might have preferences over specic slots. The

immediate booking system makes it convenient to choose among slots. The batch

system can also accommodate preferences if seekers submit rank-order lists of the

different slots with their application. Instead of a random lottery assigning the slots,

the random serial dictatorship mechanism can be employed. A lottery then deter-

mines the priority of applicants, such that the rst person in the order receives her

highest-ranked slot, the second in the order receives the highest-ranked slots among

those that are still available, and so on.

Time Interval between the Date of the Slot and the First Possibility to Book the

Slot.—One important feature of every booking system is how long in advance the

slots can be booked. A short time interval between the batch being offered and the

date of the slots helps those seekers who realize their demand for appointments

on short notice. The benet of a long time interval is that there are many batches

in which slots can be reallocated in the case of cancellations. In our model, we

assume that seekers know their demand for slots when booking becomes possible,

but this is unrealistic when slots are offered very far in the future. For example, if

there is excess demand for slots and slots are allocated three months in advance,

this would require seekers to make long-term plans, and short-term needs could not

be accommodated. Also, seekers might have an incentive to apply for a slot despite

being uncertain whether they will need it. This can lead to welfare losses when such

seekers frequently cancel a slot or do not show up. For these reasons, it can be useful

to bundle slots arriving soon and slots arriving in the future in the batches to accom-

modate the different needs. Note that the choice of the time interval does not affect

the potential vulnerability of the batch system for scalping but should be chosen

to best accommodate the needs of the seekers in the relevant context. For instance,

slots at consulates can often be booked three months in advance, since the trips for

which the visa are required are usually planned in advance. On the other hand, table

reservations in restaurants are often made available on short notice.

B. Alternative Solutions

One possible alternative to ght scalping is to require a booking deposit, i.e., a

small payment which is refunded when an applicant shows up at her appointment.

We have modeled this policy and characterize the equilibria under the two booking

systems with a deposit in online Appendix Section B in Propositions 4 and 5. While

this policy restricts the set of parameters where scalping is protable in equilibrium

2146

THE AMERICAN ECONOMIC REVIEW

JULY 2021

in the immediate system, it does not preclude scalping with an excess demand for

slots. In the batch system, the scalper’s non-entry is the unique equilibrium outcome

for all parameter values. Thus, the introduction of a deposit does not solve the prob-

lem of scalping in the rst-come-rst-served system, but makes scalping even less

protable in the batch system.

A second possible remedy is the introduction of a cancellation fee. In the imme-

diate system, when the slots are rst booked under fake names and then rebooked

under clients’ names, the cancellation fee is incurred at the moment of rebooking.

Thus, from a modeling perspective, the cancellation fee is equivalent to a deposit,

and Propositions 4 and 5 hold (see online Appendix Section B). Moreover, the

scalper can operate in the immediate system without making use of cancella-

tions, as demonstrated by our experiment and the case of train tickets in India (see

SectionIIIC). Under the batch system, a cancellation fee does not affect the equi-

librium, since there are no cancellations. This is due to the inability of the scalper to

transfer canceled slots to other applicants.

A third possible solution is to provide canceled slots to seekers forming a

physical line instead of making the slots available online. This can prevent the

immediate rebooking of canceled slots by the scalper under the names of his cus-

tomers. But note again that scalping in the immediate system does not require

cancellations and rebookings, as in the Indian Taktal train ticketing scheme.

Even when rebookings are necessary for protable scalping, allowing for lines

at the public ofce defeats the purpose of using an online booking system.

Lines in front of public ofces essentially create another rst-come-rst-served

system.

Another potential solution is tighter control of the booking process itself, e.g., by

introducing ex post verication of the allocation to cancel suspicious applications

such as multiple applications made within a second, or by requiring pre-registration

as a “veried user.” These measures are often observed on sport ticket platforms.

While the measures may render scalping slightly more complicated, the scalper still

has the advantage of speed relative to the seekers. Thus, some seekers with a high

valuation may prefer to pay the scalper and provide him with the registration infor-

mation for a higher chance of getting a slot relative to applying directly (see again

the example of train tickets in SectionIIIC).

Finally, a simple wait list could be employed instead of the rst-come-rst-served

system. Seekers put their name on a wait list or in a virtual queue and are assigned a

slot once it is their turn. Applicants will be on the wait list for some time and will only

be assigned a slot once they have moved up on the list. Typically, the slot assignment

happens shortly before the actual appointment, and not far in advance. This is due

to the possibility of cancellations that need to be accommodated. If a seeker cancels

her slot, all seekers on the wait list are moved upwards. This uncertainty regarding

the exact date and time of obtaining a slot can be a disadvantage when seekers have

to travel a considerable distance for their appointments. Moreover, a waitlist system

can suffer from appointment seekers hoarding slots where people put their names

on the wait list even if they do not need an appointment but expect that this need

may arise in the future. Finally, it is not clear whether the scalper can make prots in

equilibrium. While the speed of bookings does not matter since the waitlist is always

open, the scalper could offer to shorten the waiting time for seekers by canceling

2147

HAKIMOV ET AL.: BLACK MARKETS AND ONLINE BOOKING SYSTEMS

VOL. 111 NO. 7

appointments with fake IDs that he put on the wait list before. We leave a rigorous

analysis of waitlists for future research.

21

Increasing the supply of slots has been suggested as another remedy for scalping.

However, our model shows that scalping can be protable without excess demand.

It is enough that the number of seekers and their valuations are sufcient to cover

the scalper’s costs. Another problem is that the true demand is not easy to gauge in

the immediate system, since applicants who do not receive a slot are not observed. It

is an advantage of the batch system that the market designer can observe the entire

demand for slots, and can adjust the supply if possible.

We believe that our proposed solution is simple and straightforward to imple-

ment. While the small delay (e.g., one day) before nding out the result of an appli-

cation can carry a cost, the costs of alternative systems seem much higher. Most

importantly, unlike all alternative solutions discussed above, the batch system, just

as the immediate system, features online bookings, appointments scheduled at a

predetermined time with no physical lines, and no payments.

C. Other Markets with Scalping

In this subsection, we discuss other markets that are prone to scalping. We also

consider whether our solution is suitable for these markets.

Tickets for Major Sporting Events (Olympic Games, FIFA World Cup, etc.).—

Sporting events and concerts have been the object of scalpers for a long time. Tickets

for such events are often sold out within the rst minutes of being on sale, and are

offered on the black market for a higher price shortly after. Using bots to buy large

numbers of tickets is protable because prices are set below the market-clearing

price.

22

Artists and ticket platforms make attempts to ght scalping, e.g., by offering

tickets to ofcial fans only, but the estimated prot of the resale business is eight

billion dollars per year in the United States alone.

23

Governments have even intro-

duced anti-scalping legislation: the Better Online Tickets Sales Act, also known as

the BOTS Act, was passed by the US Congress in 2016. It outlaws using bots or

other technology for obtaining tickets via online systems to resell them on the sec-

ondary market. However, for the allocation of tickets for the 2018 World Cup, FIFA

collected applications for tickets for each match and category, and in the case of

overdemand for a specic match and price category, a lottery decided who received

the tickets. Scalping was still observed, since people without a matching ticket and

fan ID were allowed to enter the stadium. Without ID verication, the scalper’s strat-

egy of buying many tickets with fake IDs is successful, since he pays less than the

market price and sells the tickets without any constraints later on.

21

An example is the waitlist for apartments in Stockholm where the waiting time has reached 20 years, and

newborn children are put on the waitlist by their parents well before they need housing. See Maddy Savage, “This

Is One City Where You’ll Never Find a Home,” BBC, https://www.bbc.com/worklife/article/20160517-this-is-one-

city-where-youll-never-nd-a-home, (accessed July 15, 2019).

22

For an analysis of these markets, see Courty (2017) and Leslie andSorensen (2014). Courty (2019) studies

the design of resale platforms with ID verication as a potential solution to scalping.

23

See Adrienne Green, “Adele versus the Scalpers,” The Atlantic, https://www.theatlantic.com/business/

archive/2015/12/adele-scalpers/421362/ (accessed December 1, 2020).

2148

THE AMERICAN ECONOMIC REVIEW

JULY 2021