Panel Data Analysis

Fixed and Random Effects

using Stata

(v. 6.0)

Oscar Torres-Reyna

otorres@princeton.edu

December 2007 http://www.princeton.edu/~otorres/

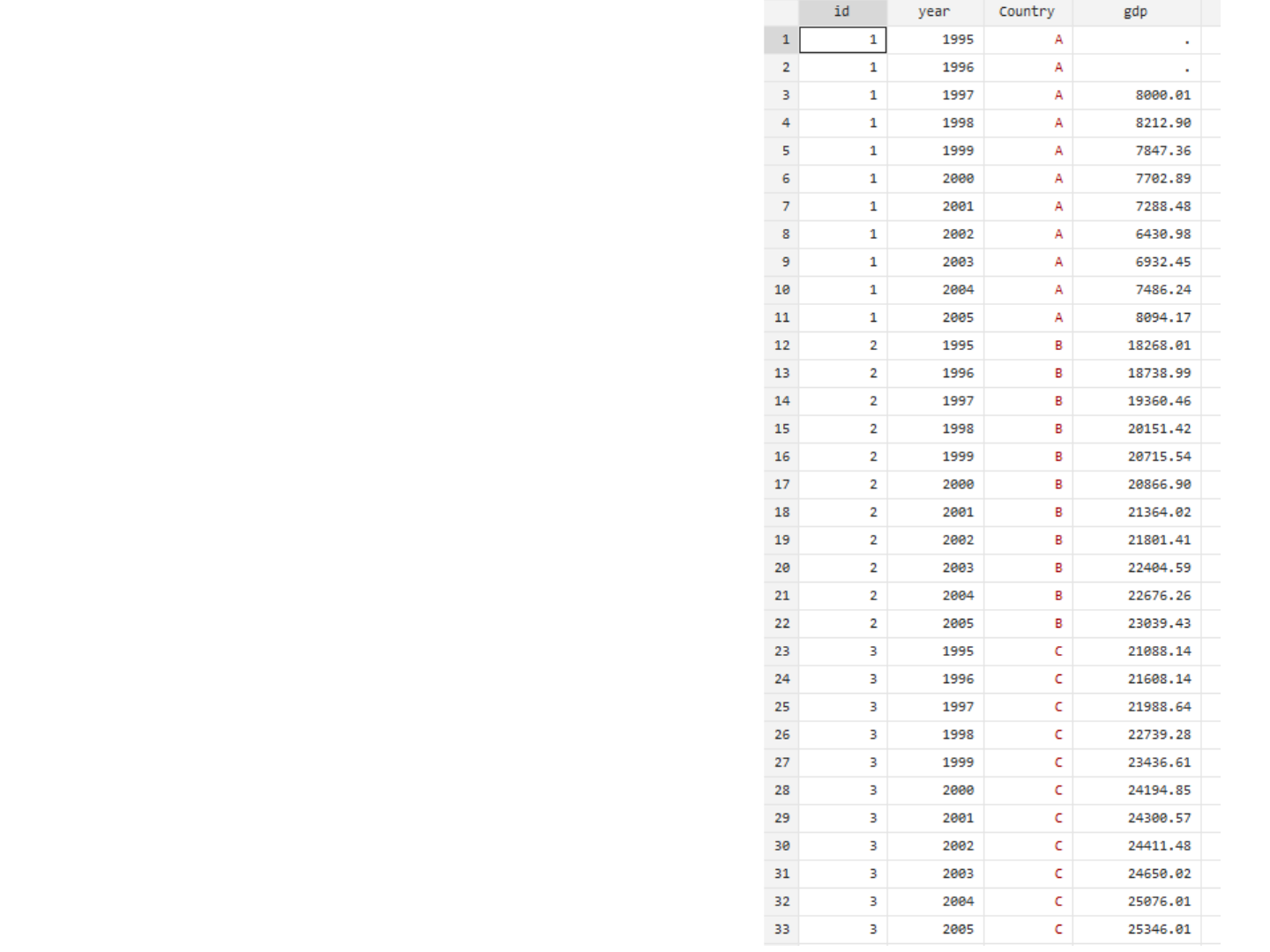

What panel data looks like…

Panel data (also known as

longitudinal or cross-

sectional time-series data)

is a dataset in which the

behavior of entities (i) are

observed across time (t).

(X

it

, Y

it

), i=1,…n; t=1,…T

These entities could be

states, companies, families,

individuals, countries, etc.

See Stock and Watson, Introduction to Econometrics, chapter 10 “Regression with Panel Data”.

OTR 2

Entity

Year Y X1 X2 X3 …..

1 1 # # # # …..

1 2 # # # # …..

1 3 # # # # …..

: : : : : : :

2 1 # # # # …..

2 2 # # # # …..

2 3 # # # # …..

: : : : : : :

3 1 # # # # …..

3 2 # # # # …..

3 3 # # # # …..

Preparing Data into Panel

Data format

OTR 3

The data: the long form

To analyze panel data:

• Variables should be in

columns.

• Entity and time in

rows.

This format is known as

long form.

OTR 4

Entity

Year Y X1 X2 X3 …..

1 1 # # # # …..

1 2 # # # # …..

1 3 # # # # …..

: : : : : : :

2 1 # # # # …..

2 2 # # # # …..

2 3 # # # # …..

: : : : : : :

3 1 # # # # …..

3 2 # # # # …..

3 3 # # # # …..

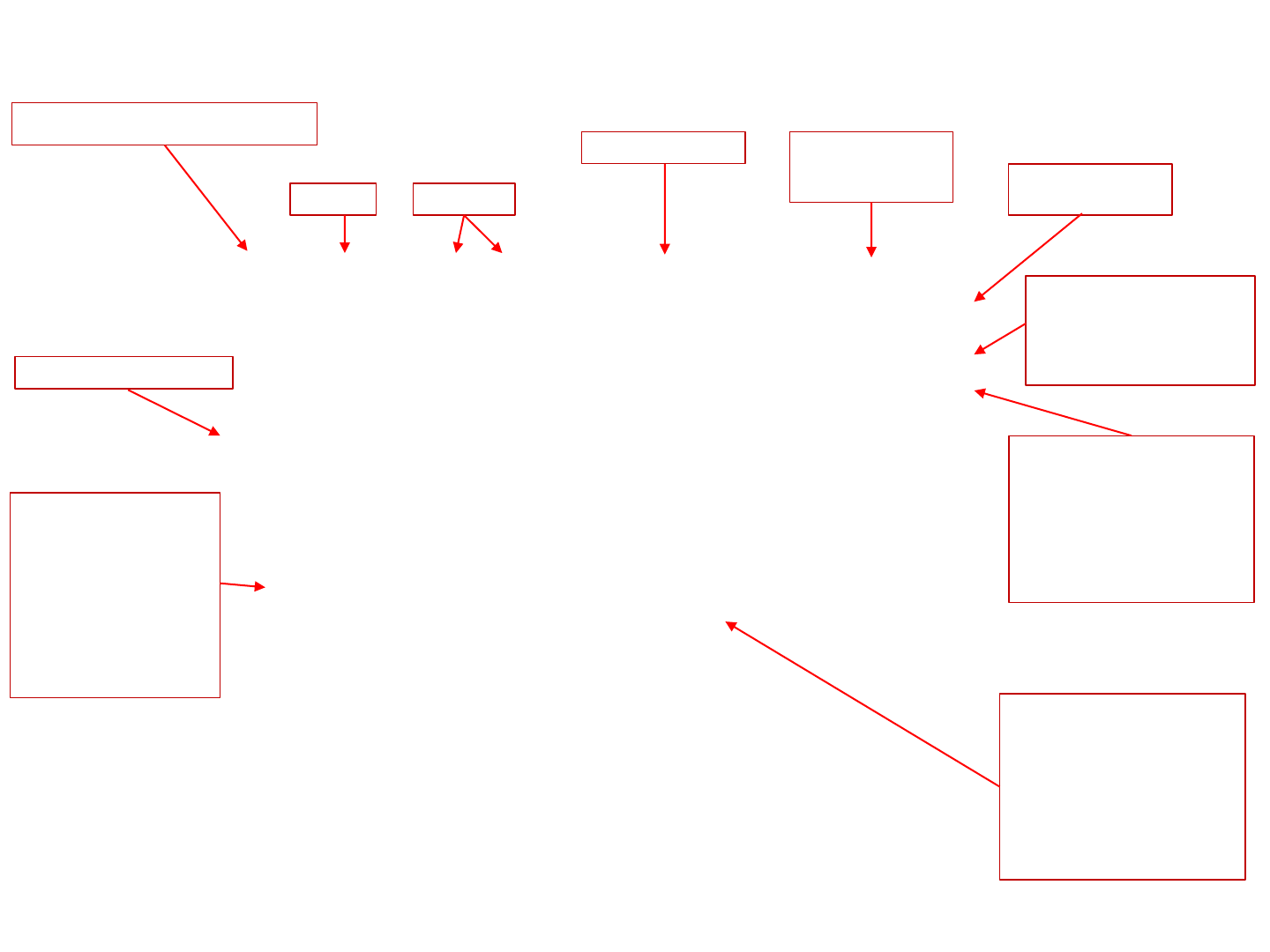

Wide form data (time in columns)

If your dataset is in wide format, either entity or time

are in columns, you need to reshape it to long format

(you can do this in Stata).

Beware that Stata does not like numbers as column

names. You need to add a letter to the numbers

before importing into Stata. If you have something

like the following:

OTR 5

Wide form data (time in columns)

Add a letter to the numeric column names, for example,

an ‘x’ before the year:

OTR 6

Import into Stata

Reshaping from wide to

long

Once in Stata, you can reshape

it using the command

reshape:

OTR 7

gen id = _n

order id

reshape long x , i(id) j(year)

rename x gdp

Type help reshape for more details

Wide form data (entity in columns)

If the wide format data has the entities in column

and time in rows, like this example:

OTR 8

Wide form data (entity in columns)

Import it into Stata:

OTR 9

Reshape wide to long format

Once in Stata, you can reshape it

using the command reshape:

OTR 10

* Adding the prefix ‘gdp’ to column names.

Command ‘renvars’ is user-written, you need

to install it, see note below

renvars A-G, pref(gdp)

gen id = _n

order id

reshape long gdp , i(id) j(country) str

Type help reshape for more details.

You need to install renvars, type:

search renvars

Click on the link for dm88_* then install.

More than one variable in same column

To reshape data from wide to long where more than one variable is in the same

column like the example below, see slides 29 to 32 in this document:

https://www.princeton.edu/~otorres/DataPrep101.pdf#page=29

OTR 11

If you are downloading data from the World Development Indicators, see slide

21 in the link below to get it in the proper panel data form without the need to

reshape: https://www.princeton.edu/~otorres/FindingData101.pdf#page=21

Entity Year Variable Value

A 1 Var1 ###

A 2 Var1 ###

A 3 Var1 ###

A 1 Var2 ###

A 2 Var2 ###

A 3 Var2 ###

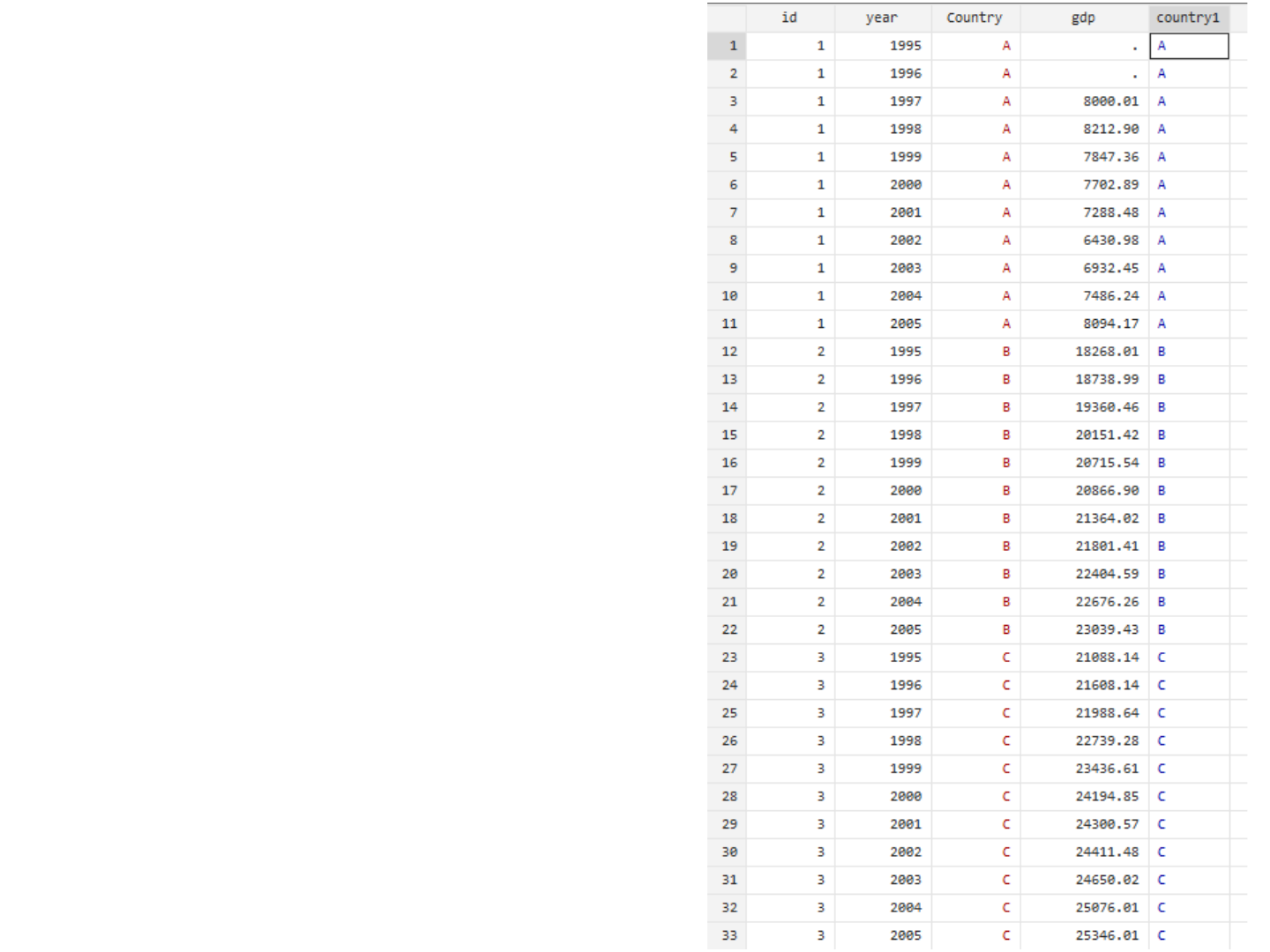

Assign numbers to strings

The encode command assigns

a number to the string variable

in alphabetical order.

The new variable is a labeled

variable where the labels are

the original strings assigned to

specific number.

Notice that string variables

have the color red, while

labeled variables have color

blue.

Type help encode for more

info.

OTR 12

Setting data as panel

Once the data is in long form, we need to set it as panel so we can

use Stata’s panel data xt commands and the time series operators.

Using the example from the previous page type:

xtset country year

string variables not allowed in varlist;

Country is a string variable

Given the error, we need to have ‘country’ in numeric format.

Type

encode country, gen(country1)

Then using ‘country1’ type

xtset country1 year

Panel variable: country1 (strongly balanced)

Time variable: year, 2000 to 2021

Delta: 1 unit

OTR 13

Balanced panel: all entities are

observed across all times.

Unbalanced panel: some entities

are not observed in some years.

Stata algorithms automatically

account for this.

Visualizing panel data

Once the data is set as panel, you can use a series of xt commands

to analyze it. For more information type:

help xt

A useful visualization command is xtline, type:

xtline gdp

OTR 14

Visualizing panel data

* All in one, type:

xtline gdp, overlay

OTR 15

Usage

Panel data deals with omitted variable bias due to heterogeneity in

the data. It does this by controlling for variables that we cannot

observe, are not available, and/or can not be measured but are

correlated with the predictors. Two types:

1. Variables that do not change over time but vary across entities

(cultural factors, difference in business practices across

companies, etc.) → Entity fixed effects.

2. Variables that change over time but not across entities (i.e.

national policies, federal regulations, international

agreements, etc.) → Time fixed effects.

Some drawbacks when working with panel data are data collection

issues (i.e. sampling design, coverage), non-response in the case of

micro panels or cross-country dependency in the case of macro

panels (i.e. correlation between countries).

OTR 16

For a comprehensive list of advantages and disadvantages of panel data see Baltagi, Econometric

Analysis of Panel Data (chapter 1).

FIXED-EFFECTS MODEL

(Covariance Model, Within

Estimator, Individual Dummy

Variable Model, Least Squares

Dummy Variable Model)

OTR 17

The fixed effects idea

Entities have individual characteristics that may

or may not influence the outcome and/or

predictor variables. For example, the business

practices of a company may influence its stock

price or level of spending; attitudes or policies

towards guns in a particular state may affect its

levels of gun violence. Business practices,

cultural, or political variables are, most of the

time unavailable or hard to measure.

OTR 18

The fixed effects idea

Since individual characteristics are not random

and may impact the predictor or outcome

variables, we need to control for them. In this

way, the effect of the predictors will not be

influenced by those fixed characteristics.*

In entity’s fixed effects it is assumed a

correlation between the entity’s error term and

predictor variables. However, an entity’s fixed

effects cannot be correlated with another

entity’s.

OTR 19

* See Stock and Watson, 2003, p.289-290

The model (1)

The entity fixed effects regression model is

i = 1…n ; t = 1….T

Where:

outcome variable (for entity i at time t).

is the unknown intercept for each entity (n entity-specific intercepts).

is a vector of predictors (for entity i at time t) .

within-entity error term ;

overall error term.

Interpretation of the coefficient: for a given entity, when a

predictor changes one unit over time, the outcome will

increase/decrease by units (assuming no transformation is

applied).* Here, represents a common effect across entities

controlling for individual heterogeneity.

OTR 20

* See Bartels, Brandom, “Beyond “Fixed Versus Random Effects”: A framework for improving substantive and statistical

analysis of panel, time-series cross-sectional, and multilevel data”, Stony Brook University, working paper, 2008

The model (2)

The entity and time fixed effects regression model is

i = 1…n ; t = 1….T

Where:

outcome variable (for entity i at time t).

is the unknown intercept for each entity (n entity-specific intercepts).

is a vector of predictors (for entity i at time t) .

is the unknow coefficient for the time regressors (t)

within-entity error term ;

overall error term.

Interpretation of a coefficient: for a given entity, when a

predictor changes one unit over time, the outcome will

increase/decrease by units (assuming no transformation is

applied).* Here, represents a common effect across entities

controlling for individual and time heterogeneity.

OTR 21

* See Bartels, Brandom, “Beyond “Fixed Versus Random Effects”: A framework for improving substantive and statistical

analysis of panel, time-series cross-sectional, and multilevel data”, Stony Brook University, working paper, 2008

Data example

The data used in the following slides was extracted from the World

Development Indicators database:

https://databank.worldbank.org/source/world-development-indicators

Selected variables since 2000, all countries only:

• GDP per capita (constant 2015 US$)

• Exports of goods and services (constant 2015 US$)

• Imports of goods and services (constant 2015 US$)

• Labor force, total

Data was further cleaned to remove regions, subregions, and missing values

across years and variables resulting in 126 countries.

Variable ‘trade’ was added by adding imports + exports.

OTR 22

Setting data as panel

Once the data is in long form, we need to set it as panel so we can

use Stata’s panel data xt commands and the time series operators.

Using the example from the previous page type:

xtset country year

string variables not allowed in varlist;

Country is a string variable

Given the error, we need to have ‘country’ in numeric format.

Type

encode country, gen(country1)

Then using ‘country1’ type

xtset country1 year

Panel variable: country1 (strongly balanced)

Time variable: year, 2000 to 2021

Delta: 1 unit

OTR 23

Balanced panel: all entities are

observed across all times.

Unbalanced panel: some entities

are not observed in some years.

Stata algorithms automatically

account for this.

* Not ideal with many panels

xtline gdppc

OTR 24

* Getting the big picture

xtline gdppc, overlay legend(off)

OTR 25

* Heterogeneity across years

bysort year: egen mean_gdppc = mean(gdppc)

twoway scatter gdppc year, msymbol(circle_hollow) color(gs14) || ///

connected mean_gdppc year, msymbol(diamond) sort ///

ylabel(0(10000)115000, angle(0) labsize(2) format(%7.0fc)) ///

xlabel(2000(1)2021, angle(45) labsize(2) grid) ///

title(GDP per capita (constant 2015 US$)) xtitle(Year, size(2.5)) ///

legend(label(1 "GDPpc per country") label(2 "Mean GDPpc per year"))

OTR 26

Data example – transformations

To log-transformed a variable use the function ln():

gen ln_gdppc = ln(gdppc)

gen ln_labor = ln(labor)

gen ln_trade = ln(trade)

If the variable has negative values, you need to add a value high

enough so the minimum value is over zero (preferable 1). For

example, if the lowest value in ‘varX’ is -1, then type:

gen ln_varX = ln(varX + 2)

The natural log of 1 is zero.

OTR 27

Data example – histograms

OTR 28

hist gdppc

hist labor

hist trade

Data example – histograms

OTR 29

hist ln_gdppc

hist ln_labor

hist ln_trade

Descriptive statistics

. sum gdppc trade labor // Pooled data

Variable | Obs Mean Std. dev. Min Max

-------------+---------------------------------------------------------

gdppc | 2,772 14925.78 19561 261.0194 112417.9

trade | 2,772 2.39e+11 5.33e+11 1.28e+08 5.58e+12

labor | 2,772 1.70e+07 4.54e+07 85987 4.89e+08

. xtsum gdppc trade labor // Heterogeneity by panel and time

Variable | Mean Std. dev. Min Max | Observations

-----------------+--------------------------------------------+----------------

gdppc overall | 14925.78 19561 261.0194 112417.9 | N = 2772

between | 19404.61 293.4895 104003.7 | n = 126

within | 2991.204 -14918.74 52165.38 | T = 22

| |

trade overall | 2.39e+11 5.33e+11 1.28e+08 5.58e+12 | N = 2772

between | 5.20e+11 3.14e+08 4.33e+12 | n = 126

within | 1.27e+11 -1.14e+12 1.49e+12 | T = 22

| |

labor overall | 1.70e+07 4.54e+07 85987 4.89e+08 | N = 2772

between | 4.54e+07 132657 4.53e+08 | n = 126

within | 3154440 -4.24e+07 5.27e+07 | T = 22

OTR 30

See https://www.stata.com/manuals/xtxtsum.pdf

Fixed effects regression using xtreg, fe

OTR 31

. xtreg ln_gdppc ln_trade ln_labor, fe robust

Fixed-effects (within) regression Number of obs = 2,772

Group variable: country1 Number of groups = 126

R-squared: Obs per group:

Within = 0.6267 min = 22

Between = 0.3872 avg = 22.0

Overall = 0.3906 max = 22

F(2,125) = 87.57

corr(u_i, Xb) = 0.1067 Prob > F = 0.0000

(Std. err. adjusted for 126 clusters in country1)

------------------------------------------------------------------------------

| Robust

ln_gdppc | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

ln_trade | .3603947 .0737076 4.89 0.000 .2145182 .5062712

ln_labor | .053167 .1608747 0.33 0.742 -.265224 .371558

_cons | -.9384681 1.075791 -0.87 0.385 -3.067592 1.190656

-------------+----------------------------------------------------------------

sigma_u | 1.1155513

sigma_e | .10989953

rho | .99038791 (fraction of variance due to u_i)

------------------------------------------------------------------------------

Outcome Predictor(s)

Fixed effects option

Controlling for

heteroskedasticity

Total number of

cases (rows)

Total number of entities (i)

If this number is < 0.05 then

your model is ok. This is an F-

test to see whether all the

coefficients in the model are

jointly different than zero.

Two-tail p-values test the

hypothesis that each coefficient is

different from 0 (according to its

t-value).

A value lower than 0.05 will reject

the null and conclude that the

predictor has a significant effect

on the outcome (95%

significance).

The within entity errors u

i

are correlated with the

regressors in the fixed

effects model.

Beta coefficients indicate the

change in the output (y) when

the predictors change one

unit over time. In this

example, all the variables are

log-transformed, the

interpretation is: when the

predictor increases 1% over

time, the output (y) changes

% (elasticity).

Intraclass correlation (rho), shows how much

of the variance in the output is explained by

the difference across entities. In this example

is 99%.

sigma_u = sd of residuals within groups

sigma_e = sd of residuals (overall error term)

Entity and time fixed effects regression using xtreg, fe

OTR 32

. xtreg ln_gdppc ln_trade ln_labor i.year, fe robust

Fixed-effects (within) regression Number of obs = 2,772

Group variable: country1 Number of groups = 126

R-squared: Obs per group:

Within = 0.7083 min = 22

Between = 0.7977 avg = 22.0

Overall = 0.7581 max = 22

F(23,125) = 34.28

corr(u_i, Xb) = 0.7525 Prob > F = 0.0000

(Std. err. adjusted for 126 clusters in country1)

------------------------------------------------------------------------------

| Robust

ln_gdppc | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

ln_trade | .2401329 .0695213 3.45 0.001 .1025416 .3777242

ln_labor | -.2958837 .081081 -3.65 0.000 -.456353 -.1354145

|

year |

2001 | .0119809 .0042779 2.80 0.006 .0035144 .0204475

... ... ... ... ... ... ...

... ... ... ... ... ... ...

2021 | .2878247 .0705454 4.08 0.000 .1482065 .4274428

|

_cons | 7.213881 1.961627 3.68 0.000 3.331578 11.09619

-------------+----------------------------------------------------------------

sigma_u | 1.0561892

sigma_e | .09753735

rho | .99154389 (fraction of variance due to u_i)

------------------------------------------------------------------------------

Outcome Predictor(s)

Fixed effects option

Controlling for

heteroskedasticity

Total number of

cases (rows)

Total number of entities (i)

If this number is < 0.05 then

your model is ok. This is an F-

test to see whether all the

coefficients in the model are

jointly different than zero.

Two-tail p-values test the

hypothesis that each coefficient is

different from 0 (according to its

t-value).

A value lower than 0.05 will reject

the null and conclude that the

predictor has a significant effect

on the outcome (95%

significance).

The within entity errors u

i

are correlated with the

regressors in the fixed

effects model.

Beta coefficients indicate the

change in the output (y) when

the predictors change one

unit over time. In this

example, all the variables are

log-transformed, the

interpretation is: when the

predictor increases 1% over

time, the output (y) changes

% (elasticity).

Intraclass correlation (rho),

shows how much of the

variance in the output is

explained by the difference

across entities. In this

example is 99%.

sigma_u = sd of residuals within groups

sigma_e = sd of residuals (overall error term)

Time fixed effects

Fixed effects regression using xtreg, fe (with lags on predictors)

OTR 33

. xtreg ln_gdppc L1.ln_trade L1.ln_labor, fe robust

Fixed-effects (within) regression Number of obs = 2,646

Group variable: country1 Number of groups = 126

R-squared: Obs per group:

Within = 0.6054 min = 21

Between = 0.3771 avg = 21.0

Overall = 0.3799 max = 21

F(2,125) = 81.17

corr(u_i, Xb) = 0.1265 Prob > F = 0.0000

(Std. err. adjusted for 126 clusters in country1)

------------------------------------------------------------------------------

| Robust

ln_gdppc | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

ln_trade |

L1. | .3385586 .0703993 4.81 0.000 .1992297 .4778875

|

ln_labor |

L1. | .0581167 .1566956 0.37 0.711 -.2520033 .3682367

|

_cons | -.4600892 1.082489 -0.43 0.672 -2.60247 1.682291

-------------+----------------------------------------------------------------

sigma_u | 1.1260807

sigma_e | .10685653

rho | .99107579 (fraction of variance due to u_i)

------------------------------------------------------------------------------

Outcome Predictor(s)

Fixed effects option

Controlling for

heteroskedasticity

Total number of

cases (rows)

Total number of entities (i)

If this number is < 0.05 then

your model is ok. This is an F-

test to see whether all the

coefficients in the model are

jointly different than zero.

Two-tail p-values test the

hypothesis that each coefficient is

different from 0 (according to its

t-value).

A value lower than 0.05 will reject

the null and conclude that the

predictor has a significant effect

on the outcome (95%

significance).

The within entity errors u

i

are correlated with the

regressors in the fixed

effects model.

Beta coefficients indicate

the change in the output

(y) when the predictors one

unit over time (a year

before –”L1.”). In this

example, all the variables

are log-transformed, the

interpretation is: when the

predictor increases 1% over

time (a year before –”L1.”),

the output (y) changes %

(elasticity).

Intraclass correlation (rho),

shows how much of the

variance in the output is

explained by the difference

across entities. In this

example is about 98%.

sigma_u = sd of residuals within groups

sigma_e = sd of residuals (overall error term)

Entity fixed effects regression using reghdfe

OTR 34

. reghdfe ln_gdppc ln_trade ln_labor , absorb(country1) vce(cluster country1)

(MWFE estimator converged in 1 iterations)

HDFE Linear regression Number of obs = 2,772

Absorbing 1 HDFE group F( 2, 125) = 87.57

Statistics robust to heteroskedasticity Prob > F = 0.0000

R-squared = 0.9943

Adj R-squared = 0.9940

Within R-sq. = 0.6267

Number of clusters (country1) = 126 Root MSE = 0.1099

(Std. err. adjusted for 126 clusters in country1)

------------------------------------------------------------------------------

| Robust

ln_gdppc | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

ln_trade | .3603947 .0737076 4.89 0.000 .2145182 .5062712

ln_labor | .053167 .1608747 0.33 0.742 -.265224 .371558

_cons | -.9384681 1.075791 -0.87 0.385 -3.067592 1.190656

------------------------------------------------------------------------------

Absorbed degrees of freedom:

-----------------------------------------------------+

Absorbed FE | Categories - Redundant = Num. Coefs |

-------------+---------------------------------------|

country1 | 126 126 0 *|

-----------------------------------------------------+

* = FE nested within cluster; treated as redundant for DoF computation

Outcome Predictor(s)

Fixed effects option

Controlling for

correlation within

panels

Total number of

cases (rows)

Total number of entities (i)

If this number is < 0.05 then

your model is ok. This is an F-

test to see whether all the

coefficients in the model are

jointly different than zero.

Two-tail p-values test the

hypothesis that each coefficient is

different from 0 (according to its

t-value).

A value lower than 0.05 will reject

the null and conclude that the

predictor has a significant effect

on the outcome (95%

significance).

Beta coefficients indicate

the change in the output (y)

when the predictors change

one unit over time. In this

example, all the variables

are log-transformed, the

interpretation is: when the

predictor increases 1% over

time, the output (y) changes

% (elasticity).

R-squared shows the percent

of the variance in the outcome

explained by the model. The Adj

R-squared, accounts for the

number of variables and their

significant contribution to

explaining the variation in the

output variable.

NOTE: Use reghdfe when controlling for multiple fixed effects or when xtreg,fe cannot run due to the number

of panels.

Entity and time fixed effects regression using reghdfe

OTR 35

. reghdfe ln_gdppc ln_trade ln_labor , absorb(country1 year) vce(cluster country1)

(MWFE estimator converged in 2 iterations)

HDFE Linear regression Number of obs = 2,772

Absorbing 2 HDFE groups F( 2, 125) = 11.37

Statistics robust to heteroskedasticity Prob > F = 0.0000

R-squared = 0.9955

Adj R-squared = 0.9953

Within R-sq. = 0.3050

Number of clusters (country1) = 126 Root MSE = 0.0976

(Std. err. adjusted for 126 clusters in country1)

------------------------------------------------------------------------------

| Robust

ln_gdppc | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

ln_trade | .2401329 .0695213 3.45 0.001 .1025416 .3777242

ln_labor | -.2958837 .081081 -3.65 0.000 -.456353 -.1354145

_cons | 7.381277 1.999695 3.69 0.000 3.423632 11.33892

------------------------------------------------------------------------------

Absorbed degrees of freedom:

-----------------------------------------------------+

Absorbed FE | Categories - Redundant = Num. Coefs |

-------------+---------------------------------------|

country1 | 126 126 0 *|

year | 22 0 22 |

-----------------------------------------------------+

* = FE nested within cluster; treated as redundant for DoF computation

Outcome Predictor(s)

Fixed effects option

Controlling for

correlation within

panels

Total number of

cases (rows)

Total number of entities (i)

If this number is < 0.05 then

your model is ok. This is an F-

test to see whether all the

coefficients in the model are

jointly different than zero.

Two-tail p-values test the

hypothesis that each coefficient is

different from 0 (according to its

t-value).

A value lower than 0.05 will reject

the null and conclude that the

predictor has a significant effect

on the outcome (95%

significance).

Beta coefficients indicate

the change in the output (y)

when the predictors change

one unit over time. In this

example, all the variables

are log-transformed, the

interpretation is: when the

predictor increases 1% over

time, the output (y) changes

% (elasticity).

R-squared shows the percent

of the variance in the outcome

explained by the model. The Adj

R-squared, accounts for the

number of variables and their

significant contribution to

explaining the variation in the

output variable.

Entity fixed effects regression with lags using reghdfe

OTR 36

reghdfe ln_gdppc L1.ln_trade L1.ln_labor , absorb(country1 ) vce(cluster country1)

(MWFE estimator converged in 1 iterations)

HDFE Linear regression Number of obs = 2,646

Absorbing 1 HDFE group F( 2, 125) = 81.17

Statistics robust to heteroskedasticity Prob > F = 0.0000

R-squared = 0.9946

Adj R-squared = 0.9943

Within R-sq. = 0.6054

Number of clusters (country1) = 126 Root MSE = 0.1069

(Std. err. adjusted for 126 clusters in country1)

------------------------------------------------------------------------------

| Robust

ln_gdppc | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

ln_trade |

L1. | .3385586 .0703993 4.81 0.000 .1992297 .4778875

|

ln_labor |

L1. | .0581167 .1566956 0.37 0.711 -.2520033 .3682367

|

_cons | -.4600892 1.082489 -0.43 0.672 -2.60247 1.682291

------------------------------------------------------------------------------

Absorbed degrees of freedom:

-----------------------------------------------------+

Absorbed FE | Categories - Redundant = Num. Coefs |

-------------+---------------------------------------|

country1 | 126 126 0 *|

-----------------------------------------------------+

* = FE nested within cluster; treated as redundant for DoF computation

Outcome Predictor(s)

Fixed effects option

Controlling for

correlation within

panels

Total number of

cases (rows)

Total number of entities (i)

If this number is < 0.05 then

your model is ok. This is an F-

test to see whether all the

coefficients in the model are

jointly different than zero.

Two-tail p-values test the

hypothesis that each coefficient is

different from 0 (according to its

t-value).

A value lower than 0.05 will reject

the null and conclude that the

predictor has a significant effect

on the outcome (95%

significance).

Beta coefficients indicate

the change in the output (y)

when the predictors change

one unit over time. In this

example, all the variables

are log-transformed, the

interpretation is: when the

predictor increases 1% over

time, the output (y) changes

% (elasticity).

R-squared shows the percent

of the variance in the outcome

explained by the model. The Adj

R-squared, accounts for the

number of variables and their

significant contribution to

explaining the variation in the

output variable.

NOTE: must type xtset country1 year, before using lags in reghdfe

A note on fixed effects

“...The fixed-effects model controls for all time-invariant

differences between the individuals, so the estimated coefficients

of the fixed-effects models cannot be biased because of omitted

time-invariant characteristics...[like culture, religion, gender, race,

etc].

One side effect of the features of fixed-effects models is that they

cannot be used to investigate time-invariant causes of the

dependent variables. Technically, time-invariant characteristics of

the individuals are perfectly collinear with the person [or entity]

dummies. Substantively, fixed-effects models are designed to

study the causes of changes within a person [or entity]. A time-

invariant characteristic cannot cause such a change, because it is

constant for each person.” [(Underline is mine) Kohler, Ulrich,

Frauke Kreuter, Data Analysis Using Stata, 2

nd

ed., p.245]

OTR 37

RANDOM-EFFECTS MODEL

(Random Intercept, Partial

Pooling Model)

OTR 38

The random effects idea

The rationale behind random effects model is that, unlike the

fixed effects model, the variation across entities is assumed

to be random and uncorrelated with the predictor or

independent variables included in the model:

“...the crucial distinction between fixed and random effects is

whether the unobserved individual effect embodies elements that

are correlated with the regressors in the model, not whether these

effects are stochastic or not” [Green, 2008, p.183]

If you have reason to believe that differences across entities

have some influence on your dependent variable but are not

correlated with the predictors then you should use random

effects. An advantage of random effects is that you can

include time invariant variables (i.e. gender). In the fixed

effects model these variables are absorbed by the intercept.

OTR 39

Thanks to Mateus Dias for useful feedback.

The random effects idea

Random effects assume that the entity’s error term is not

correlated with the predictors which allows for time-

invariant variables to play a role as explanatory variables.

In random-effects you need to specify those individual

characteristics that may or may not influence the

predictor variables. The problem with this is that some

variables may not be available therefore leading to

omitted variable bias in the model.

RE allows to generalize the inferences beyond the sample

used in the model.

OTR 40

Random effects regression using xtreg, re

OTR 41

. xtreg ln_gdppc ln_trade ln_labor, re robust

Random-effects GLS regression Number of obs = 2,772

Group variable: country1 Number of groups = 126

R-squared: Obs per group:

Within = 0.6110 min = 22

Between = 0.7295 avg = 22.0

Overall = 0.7212 max = 22

Wald chi2(2) = 192.71

corr(u_i, X) = 0 (assumed) Prob > chi2 = 0.0000

(Std. err. adjusted for 126 clusters in country1)

------------------------------------------------------------------------------

| Robust

ln_gdppc | Coefficient std. err. z P>|z| [95% conf. interval]

-------------+----------------------------------------------------------------

ln_trade | .4175909 .0760404 5.49 0.000 .2685543 .5666274

ln_labor | -.1597685 .1312262 -1.22 0.223 -.4169671 .0974302

_cons | .9295612 .6361615 1.46 0.144 -.3172923 2.176415

-------------+----------------------------------------------------------------

sigma_u | .41594682

sigma_e | .10989953

rho | .93474564 (fraction of variance due to u_i)

------------------------------------------------------------------------------

Outcome Predictor(s)

Random effects option

Controlling for

heteroskedasticity

Total number of

cases (rows)

Total number of entities (i)

If this number is < 0.05 then

your model is ok. This is an F-

test to see whether all the

coefficients in the model are

jointly different than zero.

Two-tail p-values test the

hypothesis that each coefficient is

different from 0 (according to its

t-value).

A value lower than 0.05 will reject

the null and conclude that the

predictor has a significant effect

on the outcome (95%

significance).

The between entity errors

u

it

are uncorrelated with

the regressors in the

random effects model.

Beta coefficients indicate the

change in the output (y) when

the predictors change one

unit over time and across

entities (average effect). In

this example, all the variables

are log-transformed, the

interpretation is: when the

predictor increases, on

average, 1%, the output (y)

changes % (elasticity).

Intraclass correlation (rho), shows how much

of the variance in the output is explained by

the difference across entities. In this example

is 99%.

sigma_u = sd of residuals within groups

sigma_e = sd of residuals (overall error term)

FIXED OR RANDOM?

OTR 42

Which to choose?

Whenever there is a clear idea that individual characteristics of

each entity or group affect the regressors, use fixed effects. For

example, macroeconomic data collected for most countries

overtime. There might be a good reason to believe that

countries’ economic performance may be affected by their

own internal characteristics: type of government, political

environment, cultural characteristics, type of public policies,

etc.

Random effects is used whenever there is reason to believe

that individual characteristics have no effect on the regressors

(uncorrelated).

OTR 43

Which to choose?

The Hausman-test tests whether the individual characteristics are correlated with the regressors

(see Green, 2008, chapter 9). The null hypothesis is that they are not (random effects).

xtreg ln_gdppc ln_trade ln_labor, fe

estimates store fixed

xtreg ln_gdppc ln_trade ln_labor, re

estimates store random

hausman fixed random, sigmamore

. hausman fixed random, sigmamore

---- Coefficients ----

| (b) (B) (b-B) sqrt(diag(V_b-V_B))

| fixed random Difference Std. err.

-------------+----------------------------------------------------------------

ln_trade | .3603947 .4175909 -.0571962 .0026039

ln_labor | .053167 -.1597685 .2129354 .012825

------------------------------------------------------------------------------

b = Consistent under H0 and Ha; obtained from xtreg.

B = Inconsistent under Ha, efficient under H0; obtained from xtreg.

Test of H0: Difference in coefficients not systematic

chi2(2) = (b-B)'[(V_b-V_B)^(-1)](b-B)

= 484.43

Prob > chi2 = 0.0000

OTR 44

If Prob > chi2 is < 0.05 use fixed effects

TESTS / DIAGNOSTICS

OTR 45

Do we need time fixed effects?

To see if time fixed effects are needed when running a FE model use

the command testparm. It is a joint F-test to if all years jointly

equal to 0 (type help testparm for more details).

xtreg ln_gdppc ln_trade ln_labor i.year, fe robust

testparm i.year

OTR 46

. testparm i.year

( 1) 2001.year = 0

( 2) 2002.year = 0

( 3) 2003.year = 0

( 4) 2004.year = 0

( 5) 2005.year = 0

( 6) 2006.year = 0

( 7) 2007.year = 0

( 8) 2008.year = 0

( 9) 2009.year = 0

(10) 2010.year = 0

(11) 2011.year = 0

(12) 2012.year = 0

(13) 2013.year = 0

(14) 2014.year = 0

(15) 2015.year = 0

(16) 2016.year = 0

(17) 2017.year = 0

(18) 2018.year = 0

(19) 2019.year = 0

(20) 2020.year = 0

(21) 2021.year = 0

F( 21, 125) = 4.44

Prob > F = 0.0000

The Prob > F is < 0.05, we fail to

accept the null that the coefficients for

the years are jointly equal to zero. In this

case, time fixed effects are needed.

Do we need random effects?

The LM test helps you decide between a random effects regression

and a simple OLS regression. The null hypothesis in the LM test is

that variances across entities is equal to zero. This is, no significant

difference across units (i.e. no panel effect). The command in Stata

is xttset0 type it right after running the random effects model

xtreg ln_gdppc ln_trade ln_labor, re robust

xttest0

. xttest0

Breusch and Pagan Lagrangian multiplier test for random effects

ln_gdppc[country1,t] = Xb + u[country1] + e[country1,t]

Estimated results:

| Var SD = sqrt(Var)

---------+-----------------------------

ln_gdppc | 2.022383 1.422105

e | .0120779 .1098995

u | .1730118 .4159468

Test: Var(u) = 0

chibar2(01) = 19981.51

Prob > chibar2 = 0.0000

OTR 47

Prob > chibar2 < 0.05, we fail to

accept the null hypothesis and conclude

that random effects are needed.

Are the panels correlated? [B-P/LM test]

According to Baltagi, cross-sectional dependence is a problem in macro panels

with long time series (over 20-30 years). The null hypothesis in the B-P/LM test of

independence is that residuals across entities are not correlated. The user-

defined command to run this test is xttest2 (run it after xtreg, fe):

ssc install xttest2

xtreg ln_gdppc ln_trade ln_labor, fe robust

xttest2

. xttest2

Correlation matrix of residuals:

[OMITTED]

Breusch-Pagan LM test of independence: chi2(7875) = 73886.228, Pr = 0.0000

Based on 22 complete observations over panel units

OTR 48

Pr < 0.05, we fail to accept the null hypothesis and conclude that panel are

correlated (cross-sectional dependence).

Are the panels correlated? [Pasaran CD test]

As mentioned in the previous slide, cross-sectional dependence is more of an issue in macro panels

with long time series (over 20-30 years) than in micro panels.

Pasaran CD (cross-sectional dependence) test is used to test whether the residuals are

correlated across entities*. Cross-sectional dependence can lead to bias in tests results (also called

contemporaneous correlation). The null hypothesis is that residuals are not correlated. The command

for the test is xtcsd, you have to install it typing:

ssc install xtcsd

xtreg ln_gdppc ln_trade ln_labor, fe robust

xtcsd, pesaran abs

. xtcsd, pesaran abs

Pesaran's test of cross sectional independence = 9.266, Pr = 0.0000

Average absolute value of the off-diagonal elements = 0.588

OTR 49

Pr < 0.05, we fail to accept the null

hypothesis and conclude that panel

are correlated (cross-sectional

dependence).

Had cross-sectional dependence be present Hoechle suggests to use Driscoll and Kraay standard errors

using the command xtscc (install it by typing ssc install xtscc). Type help xtscc for more

details.

*Source: Hoechle, Daniel, “Robust Standard Errors for Panel Regressions with Cross-Sectional Dependence”,

http://fmwww.bc.edu/repec/bocode/x/xtscc_paper.pdf

Testing for heteroskedasticity

A test for heteroskedasticity is available for the fixed- effects model using the

command xttest3. The null hypothesis is homoskedasticity (or constant

variance). This is a user-written program, to install it type:

ssc install xttest3

xtreg ln_gdppc ln_trade ln_labor, fe robust

xttest3

. xttest3

Modified Wald test for groupwise heteroskedasticity

in fixed effect regression model

H0: sigma(i)^2 = sigma^2 for all i

chi2 (126) = 3.3e+05

Prob>chi2 = 0.0000

OTR 50

We reject the null and conclude

heteroskedasticity.

NOTE: Use the option ‘robust’ to obtain heteroskedasticity-robust standard errors (also known

as Huber/White or sandwich estimators).

Testing for serial correlation

Serial correlation tests apply to macro panels with long time series (over 20-30 years).

Not a problem in micro panels (with very few years). Serial correlation causes the

standard errors of the coefficients to be smaller than they actually are and higher R-

squared. A Lagram-Multiplier test for serial correlation is available using the command

xtserial. This is a user-written program, to install it type:

ssc install xtserial

xtreg ln_gdppc ln_trade ln_labor, fe robust

xtserial ln_gdppc ln_trade ln_labor

. xtserial ln_gdppc ln_trade ln_labor

Wooldridge test for autocorrelation in panel data

H0: no first order autocorrelation

F( 1, 125) = 289.854

Prob > F = 0.0000

OTR 51

Type help xtserial for more details.

We reject the null and conclude

serial correlation.

Fixed Effects using Least

Squares Dummy Variable

model (LSDV)

OTR 53

Using reg, xtreg, reghdfe

reg ln_gdppc ln_trade ln_labor bn.country1, vce(cluster country1) hascons

outreg2 using my_reg.doc, replace ctitle(Using -reg-) keep(ln_trade ln_labor) addtext(Country FE, YES)

xtreg ln_gdppc ln_trade ln_labor, fe robust

outreg2 using my_reg.doc, append ctitle(Using -xtreg-) addtext(Country FE, YES)

reghdfe ln_gdppc ln_trade ln_labor , absorb(country1) vce(cluster country1)

outreg2 using my_reg.doc, append ctitle(Using -reghdfe-) addtext(Country FE, YES)

OTR 54

Using reg, xtreg, reghdfe

reg ln_gdppc ln_trade ln_labor i.year bn.country1, vce(cluster country1) hascons

outreg2 using my_reg1.doc, replace ctitle(Using -reg-) ///

keep(ln_trade ln_labor) ///

addtext(Country FE, YES, Year FE, YES)

xtreg ln_gdppc ln_trade ln_labor i.year, fe robust

outreg2 using my_reg1.doc, append ctitle(Using -xtreg-) ///

keep(ln_trade ln_labor) ///

addtext(Country FE, YES, Year FE, YES)

reghdfe ln_gdppc ln_trade ln_labor , absorb(country1 year) vce(cluster country1)

outreg2 using my_reg1.doc, append ctitle(Using -reghdfe-) ///

addtext(Country FE, YES, Year FE, YES)

OTR 55

OLS No FE / OLS FE

reg ln_gdppc ln_trade, robust

outreg2 using my_reg2.doc, replace ctitle(OLS No FE)

reg ln_gdppc ln_trade bn.country1, vce(cluster country1) hascons

outreg2 using my_reg2.doc, append ctitle(OLS with FE) keep(ln_trade)

OTR 56

OLS No FE / OLS FE

reg ln_gdppc ln_trade bn.country1, vce(cluster country1) hascons

predict ln_gdppc_hat

separate ln_gdppc_hat, by(country1)

twoway connected ln_gdppc_hat1-ln_gdppc_hat99 ln_trade, legend(off) || ///

connected ln_gdppc_hat100-ln_gdppc_hat126 ln_trade, legend(off) || ///

lfit ln_gdppc ln_trade, clwidth(vthick) clcolor(red)

OTR 57

OLS regression (no FE)

Suggested books / references

• Introduction to econometrics / James H. Stock, Mark W. Watson. 2nd ed., Boston: Pearson

Addison Wesley, 2007.

• Econometric Analysis of Panel Data, Badi H. Baltagi, Wiley, 2008.

• Econometric Analysis / William H. Greene. 6th ed., Upper Saddle River, N.J. : Prentice Hall, 2008.

• An Introduction to Modern Econometrics Using Stata/ Christopher F. Baum, Stata Press, 2006.

• Data analysis using regression and multilevel/hierarchical models / Andrew Gelman, Jennifer Hill.

Cambridge ; New York : Cambridge University Press, 2007.

• Data Analysis Using Stata/ Ulrich Kohler, Frauke Kreuter, 2 nd ed., Stata Press, 2009.

• Statistics with Stata / Lawrence Hamilton, Thomson Books/Cole, 2006.

• Statistical Analysis: an interdisciplinary introduction to univariate & multivariate methods / Sam

Kachigan, New York : Radius Press, c1986

• “Beyond “Fixed Versus Random Effects”: A framework for improving substantive and statistical

analysis of panel, time-series cross-sectional, and multilevel data” / Brandom Bartels

http://polmeth.wustl.edu/retrieve.php?id=838

• “Robust Standard Errors for Panel Regressions with Cross-Sectional Dependence” / Daniel

Hoechle, http://fmwww.bc.edu/repec/bocode/x/xtscc_paper.pdf

• Designing Social Inquiry: Scientific Inference in Qualitative Research / Gary King, Robert

O.Keohane, Sidney Verba, Princeton University Press, 1994.

• Unifying Political Methodology: The Likelihood Theory of Statistical Inference / Gary King,

Cambridge University Press, 1989.

OTR 58