Who is eligible?

You are eligible for Short Term Disability coverage if you are an active

employee in the United States working a minimum of 17.5 hours per week.

What is my weekly

benefit amount?

You can elect to purchase a benefit of 60% of your weekly earnings to a

maximum of $1,000 per week.

How long do I have to

wait to receive

benefits?

The elimination period is the length of time you must be continuously disabled

before you can receive benefits. If your disability is the result of a covered

injury or sickness, you could begin receiving benefits after 30 days.

When would I be

considered disabled?

You are disabled when Unum determines that due to your sickness or injury:

• you are unable to perform the material and substantial duties of your

regular occupation; and

• you are not working in any occupation.

We will pay you a disability benefit after you have received benefits under the

plan for at least 4 consecutive weeks if:

• you begin performing at least one of the material and substantial duties

of your regular occupation or another occupation; and

• you have a 20% or more loss in weekly earnings due to the same

sickness or injury.

You must be under the regular care of a physician in order to be considered

disabled.

*Unless the policy specifies otherwise, as part of the disability claims

evaluation process, Unum will evaluate your occupation based on how it is

normally performed in the national economy, not how work is performed for a

specific employer, at a specific location, or in a specific region.

How long will my

benefits last?

As long as you continue to meet the definition of disability, you may receive

benefits for 9 weeks.

How much does it

cost?

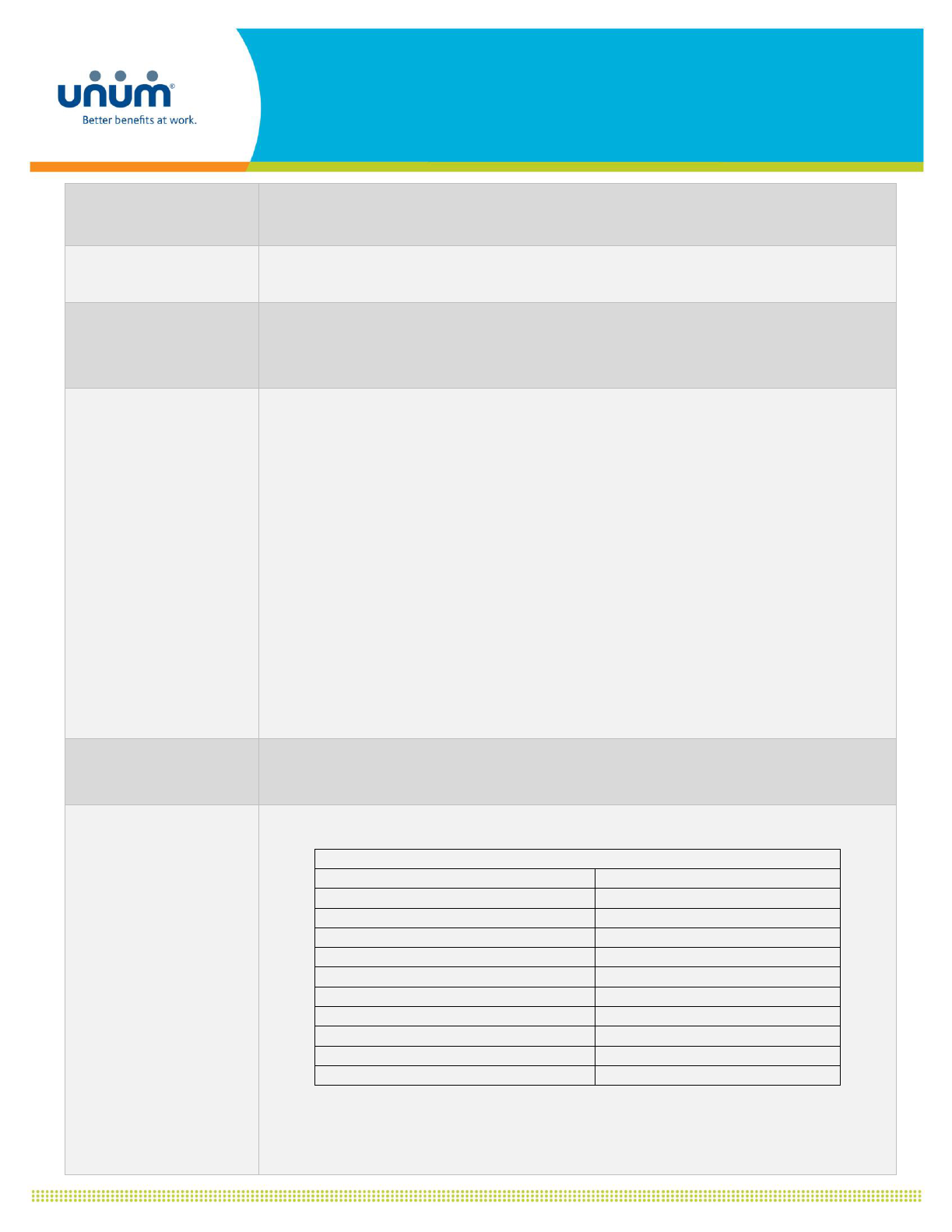

Rates per $10 of weekly benefit

Age

Rates

<25

.171

25-29

.198

30-34

.144

35-39

.117

40-44

.108

45-49

.099

50-54

.117

55-59

.144

60-64

.189

65-99

.207

Killeen Independent School District

Short Term Disability Insurance Highlights

Policy # 572701

Here’s how to calculate your per-paycheck costs

____________ ÷ 52 = ___________ X _________= _________

Annual salary Weekly salary Benefit % Weekly benefit

____________ ÷ 10 = ___________ X _________= _________

Weekly benefit Your rate Monthly cost

____________ X 12 = ___________÷ _________= _________

Monthly cost Annual cost # paychecks Cost per paycheck

If your annual salary exceeds $X, use X as your annual salary for this calculation. Final costs may

vary due to rounding.

When is my coverage

effective?

Please see your plan administrator for your effective date.

What if I am out of work

when the coverage goes

into effect?

Insurance will be delayed if you are not in active employment because of

an injury, sickness, temporary layoff, or leave of absence on the date that

coverage would otherwise become effective.

Can my benefit be

reduced?

Your disability benefit may be reduced by deductible sources of

income and any earnings you have while disabled. Deductible

sources of income may include such items as disability income or other

amounts you receive or are entitled to receive under: workers’

compensation or similar occupational benefit laws; state compulsory

benefit laws; automobile liability and no fault insurance; legal judgments

and settlements; certain retirement plans; other group or association

disability programs or insurance; and amounts you or your family receive

or are entitled to receive from Social Security or similar governmental

programs.

Do I have to take a health

exam to get coverage?

You may receive coverage without answering any medical questions or

providing evidence of insurability if you apply for coverage within 31 days

after your eligibility date. If you apply more than 31 days after your

eligibility date, your coverage will be medically underwritten. You may also

have to provide information about routine, planned, unplanned or ongoing

medical care or consultation. This review may result in coverage being

declined.

Please see your plan administrator for your eligibility date.

Can I receive rehabilitation

and return-to-work

services?

If you are deemed eligible and are participating in the program, Unum will

pay an additional benefit of 10% of your gross disability payment, to a

maximum of $250 per week.

What is not covered?

Benefits would not be paid for disabilities caused by, contributed to by, or

resulting from:

• War, declared or undeclared or any act of war;

• Active participation in a riot;

• Intentionally self-inflicted injuries;

• Loss of professional license, occupational license or certification;

• Commission of a crime for which you have been convicted;

• Any period of disability during which you are incarcerated;

• Any occupational injury or sickness (this will not apply to a partner

or sole proprietor who cannot be covered by law under workers’

compensation or any similar law);

Your plan will not cover a disability due to war, declared or undeclared, or

any act of war.

When does my coverage

end?

Your coverage under the policy ends on the earliest of:

• The date the policy or plan is cancelled;

• The date you no longer are in an eligible group;

• The date your eligible group is no longer covered;

• The last day of the period for which you made any required

contributions;

• The last day you are in active employment except as provided

under the covered layoff or leave of absence provision.

Please see your plan administrator for further information on these

provisions.

Unum will provide coverage for a payable claim which occurs while you are

covered under the policy or plan.

How can I apply for

coverage?

Please see your plan administrator.

You are considered in active employment, if on the day you apply for coverage, you are being paid

regularly by your employer for the required minimum hours each week and you are performing the

material and substantial duties of your regular occupation.

This information is not intended to be a complete description of the insurance coverage available. The

policy or its provisions may vary or be unavailable in some states. The policy has exclusions and

limitations which may affect any benefits payable. For complete details of coverage and availability, please

refer to Policy Form C.FP-1 et al, or contact your Unum representative.

Underwritten by Unum Life Insurance Company of America, Portland, Maine

© 2017 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum

Group and its insuring subsidiaries.

EN-1780 (1-17) FOR EMPLOYEES