Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … cation-560/2023/a/xml/cycle05/source (Init. & Date) _______

Page 1 of 44 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Publication 560

Cat. No. 46574N

Retirement

Plans

for Small

Business

(SEP, SIMPLE, and

Qualified Plans)

For use in preparing

2023 Returns

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (Tiếng Việt)

Contents

What's New ............................... 1

Reminders ............................... 2

Introduction .............................. 3

Chapter 1. Definitions You Need To Know ....... 5

Chapter 2. Simplified Employee

Pensions (SEPs) ........................ 7

Setting up a SEP ........................ 8

How Much Can I Contribute? ................ 8

Deducting Contributions ................... 9

Salary Reduction Simplified Employee

Pensions (SARSEPs) .................. 10

Distributions (Withdrawals) ................ 12

Additional Taxes ........................ 12

Reporting and Disclosure Requirements ....... 12

Chapter 3. SIMPLE Plans .................. 12

SIMPLE IRA Plan ....................... 13

SIMPLE 401(k) Plan ..................... 16

Chapter 4. Qualified Plans ................. 17

Kinds of Plans ......................... 18

Qualification Rules ...................... 18

Setting up a Qualified Plan ................ 20

Minimum Funding Requirement ............. 21

Contributions .......................... 22

Employer Deduction ..................... 22

Elective Deferrals (401(k) Plans) ............ 24

Qualified Roth Contribution Program ......... 27

Distributions ........................... 28

Prohibited Transactions ................... 31

Reporting Requirements .................. 32

Chapter 5. Table and Worksheets for the

Self-Employed ........................ 34

Chapter 6. How To Get Tax Help ............. 39

Index .................................. 43

Future Developments

For the latest information about developments related to

Pub. 560, such as legislation enacted after it was

published, go to IRS.gov/Pub560.

What's New

Compensation limits for 2023 and 2024. For 2023, the

maximum compensation used for figuring contributions

and benefits is $330,000. This limit increases to $345,000

for 2024.

Elective deferral limits for 2023 and 2024. The limit on

elective deferrals, other than catch-up contributions, is

Jul 5, 2024

Page 2 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

$22,500 for 2023 and $23,000 for 2024. These limits ap-

ply for participants in SARSEPs, 401(k) plans (excluding

SIMPLE plans), section 403(b) plans, and section 457(b)

plans.

Defined contribution limits for 2023 and 2024. The

limit on contributions, other than catch-up contributions,

for a participant in a defined contribution plan is $66,000

for 2023 and increases to $69,000 for 2024.

Defined benefit limits for 2023 and 2024. The limit on

annual benefits for a participant in a defined benefit plan is

$265,000 for 2023 and increases to $275,000 for 2024.

SIMPLE plan salary reduction contribution limits for

2023 and 2024. The limit on salary reduction contribu-

tions, other than catch-up contributions, is $15,500 for

2023 and increases to $16,000 for 2024.

Catch-up contribution limits for 2023 and 2024. A

plan can permit participants who are age 50 or over at the

end of the calendar year to make catch-up contributions in

addition to elective deferrals and SIMPLE plan salary re-

duction contributions. The catch-up contribution limit for

defined contribution plans other than SIMPLE plans is

$7,500 for 2023 and 2024. The catch-up contribution limit

for SIMPLE plans is $3,500 for 2023 and 2024.

A participant's catch-up contributions for a year can't

exceed the lesser of the following amounts.

•

The catch-up contribution limit.

•

The excess of the participant's compensation over the

elective deferrals that aren’t catch-up contributions.

See Catch-up contributions under Contribution Limits and

Limit on Elective Deferrals in chapters 3 and 4, respec-

tively, for more information.

Required minimum distributions (RMDs). Individuals

who reach age 72 after December 31, 2022, may delay re-

ceiving their RMDs until April 1 of the year following the

year in which they turn age 73. This change in the age for

making these beginning RMDs applies to both IRA own-

ers and participants in a qualified retirement plan.

Plans established after end of taxable year. For 2023

and later years, a sole-proprietor with no employees can

adopt a section 401(k) plan after the end of the taxable

year, provided the plan is adopted by the tax filing dead-

line (without regard to extensions).

Increased small employer pension plan startup cost

credit. The Secure 2.0 Act of Division T of the Consolida-

ted Appropriations Act, 2023, P.L. 117-328 (SECURE 2.0

Act), provides that eligible employers with 1–50 employ-

ees are eligible for an increased small employer pension

plan startup cost credit under section 45E of 100% of

qualified startup costs, subject to limitation. The credit for

eligible employers with 51–100 employees remains at

50% of qualified startup costs, subject to limitation. See

the instructions to Form 3800 and Form 8881 for more in-

formation on the startup cost credit.

Employer contributions credit. The Secure 2.0 Act

added an additional startup cost credit under section 45E

available to certain eligible employers, in an amount equal

to an applicable percentage of the employer’s

contributions (not including an elective deferral, as defined

in section 402(g)(3)) to an eligible employer plan, subject

to limitation. See the instructions to Form 3800 and Form

8881 for more information on the employer contributions

credit.

Small employer military spouse participation credit.

The Secure 2.0 Act added a new military spouse partici-

pation credit under section 45AA available to eligible small

employers who maintain defined contribution plans with

specific features that benefit military spouses. See the in-

structions to Form 3800 and Form 8881 for more informa-

tion on the military spouse participation credit.

Designated Roth nonelective contributions and des-

ignated Roth matching contributions. The Secure 2.0

Act of 2022 permits certain nonelective contributions and

matching contributions that are made after December 29,

2022, to be designated as Roth contributions.

Reminders

Small employer automatic enrollment credit. The Fur-

ther Consolidated Appropriations Act, 2020, P.L. 116-94,

added section 45T. An eligible employer may claim a tax

credit if it includes an eligible automatic contribution ar-

rangement under a qualified employer plan. The credit

equals $500 per year over a 3-year period beginning with

the first tax year in which it includes the automatic contri-

bution arrangement, and may first be claimed on the em-

ployer’s return for the year 2020.

Increase in credit limitation for small employer plan

startup costs. The Further Consolidated Appropriations

Act, 2020, P.L. 116-94, amended section 45E. For tax

years beginning after December 31, 2019, eligible em-

ployers can claim a tax credit for the first credit year and

each of the 2 tax years immediately following. The credit

equals 50% of qualified startup costs, up to the greater of

(a) $500; or (b) the lesser of (i) $250 for each employee

who is not a “highly compensated employee” eligible to

participate in the employer plan, or (ii) $5,000.

Note. The SECURE 2.0 Act further amended section

45E to increase the credit for tax years beginning after De-

cember 31, 2022. See What’s New.

See the instructions for Form 3800 and Form 8881 for

more information on the small employer automatic enroll-

ment credit and the small employer startup cost credit.

Restriction on conditions of participation. Effective

for plan years beginning after December 31, 2020, a

401(k) plan can’t require, as a condition of participation,

that an employee complete a period of service that ex-

tends beyond the close of the earlier of (a) 1 year of serv-

ice, or (b) the first period of 3 consecutive 12-month peri-

ods (excluding 12-month periods beginning before

January 1, 2021) during each of which the employee has

completed at least 500 hours of service. Effective for plan

years beginning after December 31, 2024, 3 consecutive

12-month periods are reduced to 2 consecutive 12-month

periods.

Retirement savings contributions credit. Retirement

plan participants (including self-employed individuals)

2 Publication 560 (2023)

Page 3 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

who make contributions to their plan may qualify for the re-

tirement savings contribution credit. The maximum contri-

bution eligible for the credit is $2,000. To take the credit,

use Form 8880, Credit for Qualified Retirement Savings

Contributions. For more information on who is eligible for

the credit, retirement plan contributions eligible for the

credit, and how to figure the credit, see Form 8880 and its

instructions or go to IRS.gov/Retirement-Plans/Plan-

Participant-Employee/Retirement-Savings-Contributions-

Savers-Credit.

Photographs of missing children. The IRS is a proud

partner with the National Center for Missing & Exploited

Children® (NCMEC). Photographs of missing children se-

lected by the Center may appear in this publication on pa-

ges that would otherwise be blank. You can help bring

these children home by looking at the photographs and

calling 1-800-THE-LOST (1-800-843-5678) if you recog-

nize a child.

Introduction

This publication discusses retirement plans you can set

up and maintain for yourself and your employees. In this

publication, “you” refers to the employer. See chapter 1 for

the definition of the term “employer” and the definitions of

other terms used in this publication. This publication cov-

ers the following types of retirement plans.

•

SEP (simplified employee pension) plans.

•

SIMPLE (savings incentive match plan for employees)

plans.

•

Qualified plans (also called H.R. 10 plans or Keogh

plans when covering self-employed individuals), in-

cluding 401(k) plans.

SEP, SIMPLE, and qualified plans offer you and your

employees a tax-favored way to save for retirement. You

can deduct contributions you make to the plan for your

employees. If you are a sole proprietor, you can deduct

contributions you make to the plan for yourself. You can

also deduct trustees' fees if contributions to the plan don't

cover them. Earnings on the contributions are generally

tax free until you or your employees receive distributions

from the plan.

Under a 401(k) plan, employees can have you contrib-

ute limited amounts of their before-tax (after-tax, in the

case of a qualified Roth contribution program) pay to the

plan. These amounts (and the earnings on them) are gen-

erally tax free until your employees receive distributions

from the plan or, in the case of a qualified distribution from

a designated Roth account, completely tax free.

What this publication covers. This publication contains

the information you need to understand the following top-

ics.

•

What type of plan to set up.

•

How to set up a plan.

•

How much you can contribute to a plan.

•

How much of your contribution is deductible.

•

How to treat certain distributions.

•

How to report information about the plan to the IRS

and your employees.

•

Basic features of SEP, SIMPLE, and qualified plans.

The key rules for SEP, SIMPLE, and qualified plans

are outlined in Table 1.

SEP plans. SEP plans provide a simplified method for

you to make contributions to a retirement plan for yourself

and your employees. Instead of setting up a profit-sharing

or money purchase plan with a trust, you can adopt a SEP

agreement and make contributions directly to a traditional

individual retirement account or a traditional individual re-

tirement annuity (SEP-IRA) set up for yourself and each

eligible employee.

SIMPLE plans. Generally, if you had 100 or fewer em-

ployees who received at least $5,000 in compensation last

year, you can set up a SIMPLE IRA plan. Under a SIMPLE

plan, employees can choose to make salary reduction

contributions rather than receiving these amounts as part

of their regular pay. In addition, you will contribute match-

ing or nonelective contributions. The two types of SIMPLE

plans are the SIMPLE IRA plan and the SIMPLE 401(k)

plan.

Qualified plans. The qualified plan rules are more

complex than the SEP plan and SIMPLE plan rules. How-

ever, there are advantages to qualified plans, such as in-

creased flexibility in designing plans and increased contri-

bution and deduction limits in some cases.

Publication 560 (2023) 3

Page 4 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

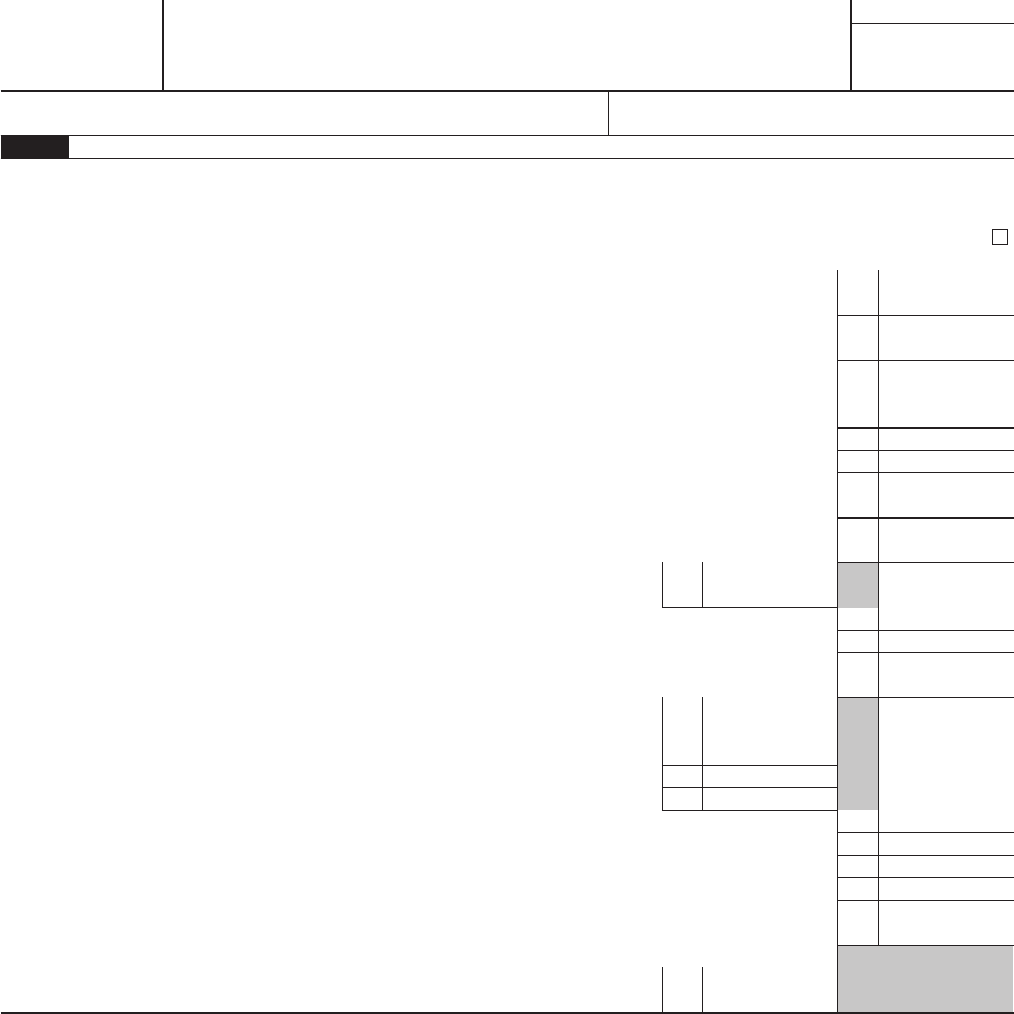

Table 1. Key Retirement Plan Rules for 2023

Type

of

Plan Last Date for Contribution Maximum Contribution Maximum Deduction When To Set Up Plan

SEP Due date of employer's return

(including extensions).

Smaller of $66,000 or 25%

1

of participant's

compensation.

2

25%

1

of all participants'

compensation.

2

Any time up to the due date of

employer's return (including

extensions).

SIMPLE

IRA

and

SIMPLE

401(k)

Salary reduction contributions: 30

days after the end of the month for

which the contributions are to be made.

4

Matching or nonelective

contributions: Due date of employer's

return (including extensions).

Employee contribution:

Salary reduction contribution

up to $15,500; $19,000 if

age 50 or over.

Employer contribution:

Either dollar-for-dollar

matching contributions, up to

3% of employee's

compensation,

3

or fixed

nonelective contributions of

2% of compensation.

2

Same as maximum

contribution.

Any time between January 1

and October 1 of the calendar

year.

For a new employer coming

into existence after October 1,

as soon as administratively

feasible.

Qualified

Plan:

Defined

Contribution

Plan

Elective deferral: Due date of

employer's return (including

extensions).

4

Employer contribution:

Profit-Sharing Plan: Due date of

employer's return (including

extensions). Money Purchase Pan: 8

1/2 months after the end of the plan

year.

Employee contribution:

Elective deferral up to

$22,500; $30,000 if age 50

or over.

Employer contribution:

Money Purchase Pension

Plan: Smaller of $66,000 or

100%

1

of participant's

compensation.

2

Profit-Sharing: Smaller of

$66,000 or 100%

1

of

participant's compensation.

2

25%

1

of all participants'

compensation,

2

plus

amount of elective

deferrals made.

By the employer’s tax-filing

due date, including

extensions, for the taxable

year.

Qualified

Plan:

Defined

Benefit Plan

Contributions must generally be paid in

quarterly installments, due 15 days

after the end of each quarter, with a

final contribution due 8 1/2 months after

the end of the plan year. See Minimum

Funding Requirement in chapter 4.

Amount needed to provide

an annual benefit no larger

than the smaller of $265,000

or 100% of the participant's

average compensation for

the highest 3 consecutive

calendar years.

Based on actuarial

assumptions and

computations.

By the employer’s tax filing

due date (although it’s not best

to set up after the minimum

funding due date).

1

Net earnings from self-employment must take the contribution into account. See Deduction Limit for Self-Employed Individuals in chapters 2 and 4.

2

Compensation is generally limited to $330,000 in 2023.

3

Under a SIMPLE 401(k) plan, compensation is generally limited to $330,000 in 2023.

4

Certain plans subject to Department of Labor (DOL) rules may have an earlier due date for salary reduction contributions and elective deferrals, such as 401(k)

plans. See the “elective deferral” definition in Definitions You Need To Know, later. Solo/self-employed 401(k) plans are non-ERISA plans and don’t fall under DOL

rules.

What this publication doesn’t cover. Although the pur-

pose of this publication is to provide general information

about retirement plans you can set up for your employees,

it doesn't contain all the rules and exceptions that apply to

these plans. You may need professional help and guid-

ance.

Also, this publication doesn't cover all the rules that

may be of interest to employees. For example, it doesn't

cover the following topics.

•

The comprehensive IRA rules an employee needs to

know. These rules are covered in Pub. 590-A, Contri-

butions to Individual Retirement Arrangements (IRAs),

and Pub. 590-B, Distributions from Individual Retire-

ment Arrangements (IRAs).

•

The comprehensive rules that apply to distributions

from retirement plans. These rules are covered in Pub.

575, Pension and Annuity Income.

•

The comprehensive rules that apply to section 403(b)

plans. These rules are covered in Pub. 571, Tax-Shel-

tered Annuity Plans (403(b) Plans) For Employees of

Public Schools and Certain Tax-Exempt Organiza-

tions.

Comments and suggestions. We welcome your com-

ments about this publication and your suggestions for fu-

ture editions.

You can send us comments through IRS.gov/

FormComments. Or you can write to the Internal Revenue

Service, Tax Forms and Publications, 1111 Constitution

Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each com-

ment received, we do appreciate your feedback and will

consider your comments and suggestions as we revise

our tax forms, instructions, and publications. Don’t send

tax questions, tax returns, or payments to the above ad-

dress.

Getting answers to your tax questions. If you have

a tax question not answered by this publication or the How

To Get Tax Help section at the end of this publication, go

to the IRS Interactive Tax Assistant page at IRS.gov/

Help/ITA where you can find topics by using the search

feature or viewing the categories listed.

Getting tax forms, instructions, and publications.

Go to IRS.gov/Forms to download current and prior-year

forms, instructions, and publications.

Ordering forms and publications. Go to IRS.gov/

OrderForms to order current forms, instructions, and

4 Publication 560 (2023)

Page 5 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

publications; call 800-829-3676 to order prior-year forms

and instructions. The IRS will process your order for forms

and publications as soon as possible. Don’t resubmit re-

quests you’ve already sent us. You can get forms and pub-

lications faster online.

Tax questions. If you have a tax question not an-

swered by this publication, check IRS.gov and How To Get

Tax Help at the end of this publication.

1.

Definitions

You Need To Know

Certain terms used in this publication are defined below.

The same term used in another publication may have a

slightly different meaning.

Annual additions. Annual additions are the total of all

your contributions in a year, employee contributions (not

including rollovers), and forfeitures allocated to a partici-

pant's account.

Annual benefits. Annual benefits are the benefits to be

paid yearly in the form of a straight life annuity (with no ex-

tra benefits) under a plan to which employees don't con-

tribute and under which no rollover contributions are

made.

Business. A business is an activity in which a profit mo-

tive is present and economic activity is involved. Service

as a newspaper carrier under age 18 or as a public official

isn’t a business.

Common-law employee. A common-law employee is

any individual who, under common law, would have the

status of an employee. A leased employee can also be a

common-law employee.

A common-law employee is a person who performs

services for an employer who has the right to control and

direct the results of the work and the way in which it is

done. For example, the employer:

•

Provides the employee's tools, materials, and work-

place; and

•

Can fire the employee.

Common-law employees aren't self-employed and can't

set up retirement plans for income from their work, even if

that income is self-employment income for social security

tax purposes. For example, common-law employees who

are ministers, members of religious orders, full-time insur-

ance salespeople, and U.S. citizens employed in the Uni-

ted States by foreign governments can't set up retirement

plans for their earnings from those employments, even

though their earnings are treated as self-employment in-

come.

However, an individual may be a common-law em-

ployee and a self-employed person as well. For example,

an attorney can be a corporate common-law employee

during regular working hours and also practice law in the

evening as a self-employed person. In another example, a

minister employed by a congregation for a salary is a com-

mon-law employee even though the salary is treated as

self-employment income for social security tax purposes.

However, fees reported on Schedule C (Form 1040), Profit

or Loss From Business, for performing marriages, bap-

tisms, and other personal services are self-employment

earnings for qualified plan purposes.

Compensation. Compensation for plan allocations is the

pay a participant received from you for personal services

for a year. You can generally define compensation as in-

cluding all the following payments.

1. Wages and salaries.

2. Fees for professional services.

3. Other amounts received (cash or noncash) for per-

sonal services actually rendered by an employee, in-

cluding, but not limited to, the following items.

a. Commissions and tips.

b. Fringe benefits.

c. Bonuses.

For a self-employed individual, compensation means

the earned income, discussed later, of that individual.

Compensation generally includes amounts deferred at

the employee's election in the following employee benefit

plans.

•

Section 401(k) plans.

•

Section 403(b) plans.

•

SIMPLE IRA plans.

•

SARSEPs.

•

Section 457 deferred compensation plans.

•

Section 125 cafeteria plans.

However, an employer can choose to exclude elective

deferrals under the above plans from the definition of com-

pensation. The limit on elective deferrals is discussed in

chapter 2 under Salary Reduction Simplified Employee

Pension (SARSEP) and in chapter 4.

Other options. In figuring the compensation of a par-

ticipant, you can treat any of the following amounts as the

employee's compensation.

•

The employee's wages as defined for income tax with-

holding purposes.

•

The employee's wages you report in box 1 of Form

W-2, Wage and Tax Statement.

•

The employee's social security wages (including elec-

tive deferrals).

Publication 560 (2023) Chapter 1 Definitions You Need To Know 5

Page 6 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Compensation generally can't include either of the fol-

lowing items.

•

Nontaxable reimbursements or other expense allow-

ances.

•

Deferred compensation (other than elective deferrals).

SIMPLE plans. A special definition of compensation

applies for SIMPLE plans. See chapter 3.

Contribution. A contribution is an amount you pay into a

plan for all those participating in the plan, including

self-employed individuals. Limits apply to how much, un-

der the contribution formula of the plan, can be contrib-

uted each year for a participant.

Deduction. A deduction is the plan contribution you can

subtract from gross income on your federal income tax re-

turn. Limits apply to the amount deductible.

Earned income. Earned income is net earnings from

self-employment, discussed later, from a business in

which your services materially helped to produce the in-

come.

You can also have earned income from property your

personal efforts helped create, such as royalties from your

books or inventions. Earned income includes net earnings

from selling or otherwise disposing of the property, but it

doesn't include capital gains. It includes income from li-

censing the use of property other than goodwill.

Earned income includes amounts received for services

by self-employed members of recognized religious sects

opposed to social security benefits who are exempt from

self-employment tax.

If you have more than one business, but only one has a

retirement plan, only the earned income from that busi-

ness is considered for that plan.

Elective deferral. An elective deferral is the contribution

made by employees to a qualified retirement plan.

•

Non-owner employees: The employee salary reduc-

tion/elective deferral contributions must be elected/

made by the end of the tax year and deposited into the

employee’s plan account within 7 business days (safe

harbor) and no later than 15 days.

•

Owner/employees: The employee deferrals must be

elected by the end of the tax year and can then be

made by the tax return filing deadline, including exten-

sions.

Employer. An employer is generally any person for whom

an individual performs or did perform any service, of what-

ever nature, as an employee. A sole proprietor is treated

as its own employer for retirement plan purposes. How-

ever, a partner isn't an employer for retirement plan purpo-

ses. Instead, the partnership is treated as the employer of

each partner.

Highly compensated employee. A highly compensated

employee is an individual who:

•

Owned more than 5% of the interest in your business

at any time during the year or the preceding year, re-

gardless of how much compensation that person

earned or received; or

•

For the preceding year, received compensation from

you of more than $135,000 (if the preceding year is

2022 and increased to $150,000 for 2023), more than

$155,000 (if the preceding year is 2024), and, if you so

choose, was in the top 20% of employees when

ranked by compensation.

Leased employee. A leased employee who isn't your

common-law employee must generally be treated as your

employee for retirement plan purposes if they do all the

following.

•

Provides services to you under an agreement be-

tween you and a leasing organization.

•

Has performed services for you (or for you and related

persons) substantially full time for at least 1 year.

•

Performs services under your primary direction or con-

trol.

Exception. A leased employee isn't treated as your

employee if all the following conditions are met.

1. Leased employees aren't more than 20% of your

non-highly compensated workforce.

2. The employee is covered under the leasing organiza-

tion's qualified pension plan.

3. The leasing organization's plan is a money purchase

pension plan that has all the following provisions.

a. Immediate participation. (This requirement doesn't

apply to any individual whose compensation from

the leasing organization in each plan year during

the 4-year period ending with the plan year is less

than $1,000.)

b. Full and immediate vesting.

c. A nonintegrated employer contribution rate of at

least 10% of compensation for each participant.

However, if the leased employee is your common-law em-

ployee, that employee will be your employee for all purpo-

ses, regardless of any pension plan of the leasing organi-

zation.

Net earnings from self-employment. For SEP and

qualified plans, net earnings from self-employment are

your gross income from your trade or business (provided

your personal services are a material income-producing

factor) minus allowable business deductions. Allowable

deductions include contributions to SEP and qualified

plans for common-law employees and the deduction al-

lowed for the deductible part of your self-employment tax.

Net earnings from self-employment don’t include items

excluded from gross income (or their related deductions)

other than foreign earned income and foreign housing

cost amounts.

For the deduction limits, earned income is net earnings

for personal services actually rendered to the business.

You take into account the income tax deduction for the de-

ductible part of self-employment tax and the deduction for

6 Chapter 1 Definitions You Need To Know Publication 560 (2023)

Page 7 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

contributions to the plan made on your behalf when figur-

ing net earnings.

Net earnings include a partner's distributive share of

partnership income or loss (other than separately stated

items, such as capital gains and losses). They don’t in-

clude income passed through to shareholders of S corpo-

rations. Guaranteed payments to limited partners are net

earnings from self-employment if they are paid for serv-

ices to or for the partnership. Distributions of other income

or loss to limited partners aren't net earnings from self-em-

ployment.

For SIMPLE plans, net earnings from self-employment

are the amount on line 4 ofSchedule SE (Form 1040),

Self-Employment Tax, before subtracting any contribu-

tions made to the SIMPLE plan for yourself.

Qualified plan. A qualified plan is a retirement plan that

offers a tax-favored way to save for retirement. You can

deduct contributions made to the plan for your employees.

Earnings on these contributions are generally tax free until

distributed at retirement. Profit-sharing, money purchase,

and defined benefit plans are qualified plans. A 401(k)

plan is also a qualified plan.

Participant. A participant is an eligible employee who is

covered by your retirement plan. See the discussions,

later, of the different types of plans for the definition of an

employee eligible to participate in each type of plan.

Partner. A partner is an individual who shares ownership

of an unincorporated trade or business with one or more

persons. For retirement plans, a partner is treated as an

employee of the partnership.

Self-employed individual. An individual in business for

himself or herself, and whose business isn't incorporated,

is self-employed. Sole proprietors and partners are

self-employed. Self-employment can include part-time

work.

Not everyone who has net earnings from self-employ-

ment for social security tax purposes is self-employed for

qualified plan purposes. See Common-law employee and

Net earnings from self-employment, earlier.

In addition, certain fishermen may be considered

self-employed for setting up a qualified plan. See Pub.

595, Capital Construction Fund for Commercial Fisher-

men, for the special rules used to determine whether fish-

ermen are self-employed.

Sole proprietor. A sole proprietor is an individual who

owns an unincorporated business alone, including a sin-

gle-member limited liability company that is treated as a

disregarded entity for tax purposes. For retirement plans,

a sole proprietor is treated as both an employer and an

employee.

2.

Simplified Employee

Pensions (SEPs)

Topics

This chapter discusses:

•

Setting up a SEP

•

How much can I contribute

•

Deducting contributions

•

Salary reduction simplified employee pensions (SAR-

SEPs)

•

Distributions (withdrawals)

•

Additional taxes

•

Reporting and disclosure requirements

Useful Items

You may want to see:

Publications

590-A Contributions to Individual Retirement

Arrangements (IRAs)

590-B Distributions from Individual Retirement

Arrangements (IRAs)

3998 Choosing a Retirement Solution for Your Small

Business

4285 SEP Checklist

4286 SARSEP Checklist

4333 SEP Retirement Plans for Small Businesses

4336 SARSEP for Small Businesses

4407 SARSEP—Key Issues and Assistance

Forms (and Instructions)

W-2 Wage and Tax Statement

1040 U.S. Individual Income Tax Return

1040-SR U.S. Tax Return for Seniors

5305-SEP Simplified Employee Pension—Individual

Retirement Accounts Contribution Agreement

5305A-SEP Salary Reduction Simplified Employee

Pension—Individual Retirement Accounts

Contribution Agreement

8880 Credit for Qualified Retirement Savings

Contributions

8881 Credit for Small Employer Pension Plan

Startup Costs

590-A

590-B

3998

4285

4286

4333

4336

4407

W-2

1040

1040-SR

5305-SEP

5305A-SEP

8880

8881

Publication 560 (2023) Chapter 2 Simplified Employee Pensions (SEPs) 7

Page 8 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

A SEP is a written plan that allows you to make contribu-

tions toward your own retirement and your employees' re-

tirement without getting involved in a more complex quali-

fied plan.

Under a SEP, you make contributions to a traditional indi-

vidual retirement arrangement (called a SEP-IRA) set up

by or for each eligible employee. A SEP-IRA is owned and

controlled by the employee, and you make contributions to

the financial institution where the SEP-IRA is maintained.

SEP-IRAs are set up for, at a minimum, each eligible em-

ployee (defined below). A SEP-IRA may have to be set up

for a leased employee (defined in chapter 1), but doesn't

need to be set up for excludable employees (defined

later).

Eligible employee. An eligible employee is an individual

who meets all the following requirements.

•

Has reached age 21.

•

Has worked for you in at least 3 of the last 5 years.

•

Has received at least $750 in compensation from you

in 2023. The amount remains the same for 2023.

You can use less restrictive participation require-

ments than those listed, but not more restrictive

ones.

Excludable employees. The following employees can

be excluded from coverage under a SEP.

•

Employees covered by a union agreement and whose

retirement benefits were bargained for in good faith by

the employees' union and you.

•

Nonresident alien employees who have received no

U.S. source wages, salaries, or other personal serv-

ices compensation from you. For more information

about nonresident aliens, see Pub. 519, U.S. Tax

Guide for Aliens.

Setting up a SEP

There are three basic steps in setting up a SEP.

1. You must execute a formal written agreement to pro-

vide benefits to all eligible employees.

2. You must give each eligible employee certain informa-

tion about the SEP.

3. A SEP-IRA must be set up by or for each eligible em-

ployee.

Many financial institutions will help you set up a

SEP.

Formal written agreement. You must execute a formal

written agreement to provide benefits to all eligible em-

ployees under a SEP. You can satisfy the written agree-

ment requirement by adopting an IRS model SEP using

Form 5305-SEP. However, see When not to use Form

5305-SEP, later.

TIP

TIP

If you adopt an IRS model SEP using Form 5305-SEP,

no prior IRS approval or determination letter is required.

Keep the original form. Don't file it with the IRS. Also, us-

ing Form 5305-SEP will usually relieve you from filing an-

nual retirement plan information returns with the IRS and

the Department of Labor. See the Form 5305-SEP instruc-

tions for details. If you choose not to use Form 5305-SEP,

you should seek professional advice in adopting a SEP.

When not to use Form 5305-SEP. You can't use

Form 5305-SEP if any of the following apply.

1. You currently maintain any other qualified retirement

plan other than another SEP.

2. You have any eligible employees for whom IRAs

haven’t been set up.

3. You use the services of leased employees, who aren't

your common-law employees (as described in chap-

ter 1).

4. You are a member of any of the following unless all eli-

gible employees of all the members of these groups,

trades, or businesses participate under the SEP.

a. An affiliated service group described in section

414(m).

b. A controlled group of corporations described in

section 414(b).

c. Trades or businesses under common control de-

scribed in section 414(c).

5. You don't pay the cost of the SEP contributions.

Information you must give to employees. You must

give each eligible employee a copy of Form 5305-SEP, its

instructions, and the other information listed in the Form

5305-SEP instructions. An IRS model SEP isn't consid-

ered adopted until you give each employee this informa-

tion.

Setting up the employee's SEP-IRA. A SEP-IRA must

be set up by or for each eligible employee. SEP-IRAs can

be set up with banks, insurance companies, or other quali-

fied financial institutions. You send SEP contributions to

the financial institution where the SEP-IRA is maintained.

Deadline for setting up a SEP. You can set up a SEP for

any year as late as the due date (including extensions) of

your income tax return for that year.

How Much Can I Contribute?

The SEP rules permit you to contribute a limited amount of

money each year to each employee's SEP-IRA. If you are

self-employed, you can contribute to your own SEP-IRA.

Contributions must be in the form of money (cash, check,

or money order). You can't contribute property. However,

participants may be able to transfer or roll over certain

property from one retirement plan to another. See Pubs.

590-A and 590-B for more information about rollovers.

8 Chapter 2 Simplified Employee Pensions (SEPs) Publication 560 (2023)

Page 9 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

You don't have to make contributions every year. But if

you make contributions, they must be based on a written

allocation formula and must not discriminate in favor of

highly compensated employees (defined in chapter 1).

When you contribute, you must contribute to the

SEP-IRAs of all participants who actually performed per-

sonal services during the year for which the contributions

are made, including employees who die or terminate em-

ployment before the contributions are made.

Contributions are deductible within limits, as discussed

later, and generally aren't taxable to the plan participants.

Employer contributions to a SEP-IRA won’t affect the

amount an individual can contribute to a Roth or traditional

IRA.

Unlike regular contributions to a traditional IRA before

2020, contributions under a SEP can be made to partici-

pants over age 70

1

/2. If you are self-employed, you can

also make contributions under the SEP for yourself even if

you are over age 70

1

/2. Participants age 72 or over (if age

70

1

/2 was reached after December 31, 2019) must take

RMDs.

Note. Individuals who reach age 72 after December

31, 2022, may delay receiving their RMDs until April 1 of

the year following the year in which they reach age 73.

Time limit for making contributions. To deduct contri-

butions for a year, you must make the contributions by the

due date (including extensions) of your tax return for the

year.

Contribution Limits

Contributions you make for 2023 to a common-law em-

ployee's SEP-IRA can't exceed the lesser of 25% of the

employee's compensation or $66,000. Compensation

generally doesn't include your contributions to the SEP.

The SEP plan document will specify how the employer

contribution is determined and how it will be allocated to

participants.

Example. Your employee has earned $21,000 for

2023. The maximum contribution you can make to your

employee’s SEP-IRA is $5,250 (25% (0.25) x $21,000).

Contributions for yourself. The annual limits on your

contributions to a common-law employee's SEP-IRA also

apply to contributions you make to your own SEP-IRA.

However, special rules apply when figuring your maximum

deductible contribution. See Deduction Limit for Self-Em-

ployed Individuals, later.

Annual compensation limit. You can't consider the part

of an employee's compensation over $330,000 when fig-

uring your contribution limit for that employee. However,

$66,000 is the maximum contribution for an eligible em-

ployee. These limits increase to $345,000 and $69,000,

respectively, in 2024.

Example. Your employee has earned $260,000 for

2023. Because of the maximum contribution limit for 2023,

you can only contribute $66,000 to your employee’s

SEP-IRA.

More than one plan. If you contribute to a defined contri-

bution plan (defined in chapter 4), annual additions to an

account are limited to the lesser of $66,000 or 100% of the

participant's compensation. When you figure this limit, you

must add your contributions to all defined contribution

plans maintained by you. Because a SEP is considered a

defined contribution plan for this limit, your contributions to

a SEP must be added to your contributions to other de-

fined contribution plans you maintain.

Tax treatment of excess contributions. Excess contri-

butions are your contributions to an employee's SEP-IRA

(or to your own SEP-IRA) for 2023 that exceed the lesser

of the following amounts.

•

25% of the employee's compensation (or, for you,

20% of your net earnings from self-employment).

•

$66,000.

Excess contributions are included in the employee's in-

come for the year and are treated as contributions by the

employee to their SEP-IRA. For more information on em-

ployee tax treatment of excess contributions, see Pub.

590-A.

Reporting on Form W-2. Don't include SEP contribu-

tions on your employee's Form W-2 unless contributions

were made under a salary reduction arrangement (dis-

cussed later).

Deducting Contributions

Generally, you can deduct the contributions you make

each year to each employee's SEP-IRA. If you are

self-employed, you can deduct the contributions you make

each year to your own SEP-IRA.

Deduction Limit for Contributions for

Participants

The most you can deduct for your contributions to your or

your employee's SEP-IRA is the lesser of the following

amounts.

1. Your contributions (including any excess contributions

carryover).

2. 25% of the compensation (limited to $330,000 per

participant) paid to the participants during 2023, from

the business that has the plan, not to exceed $66,000

per participant.

In 2024, the amounts in (2) above increase to $345,000

and $69,000, respectively.

Publication 560 (2023) Chapter 2 Simplified Employee Pensions (SEPs) 9

Page 10 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Deduction Limit for

Self-Employed Individuals

If you contribute to your own SEP-IRA, you must make a

special computation to figure your maximum deduction for

these contributions. When figuring the deduction for con-

tributions made to your own SEP-IRA, compensation is

your net earnings from self-employment (defined in chap-

ter 1), which takes into account both the following deduc-

tions.

•

The deduction for the deductible part of your self-em-

ployment tax.

•

The deduction for contributions to your own SEP-IRA.

The deduction for contributions to your own SEP-IRA

and your net earnings depend on each other. For this rea-

son, you determine the deduction for contributions to your

own SEP-IRA indirectly by reducing the contribution rate

called for in your plan. To do this, use the Rate Table for

Self-Employed or the Rate Worksheet for Self-Employed,

whichever is appropriate for your plan's contribution rate,

in chapter 5. Then, figure your maximum deduction by us-

ing the Deduction Worksheet for Self-Employed in chap-

ter 5.

Carryover of Excess SEP

Contributions

If you made SEP contributions that are more than the de-

duction limit (nondeductible contributions), you can carry

over and deduct the difference in later years. However, the

carryover, when combined with the contribution for the

later year, is subject to the deduction limit for that year. If

you also contributed to a defined benefit plan or defined

contribution plan, see Carryover of Excess Contributions

under Employer Deduction in chapter 4 for the carryover

limit.

Excise tax. If you made nondeductible (excess) contribu-

tions to a SEP, you may be subject to a 10% excise tax.

For information about the excise tax, see Excise Tax for

Nondeductible (Excess) Contributions under Employer

Deduction in chapter 4.

When To Deduct Contributions

When you can deduct contributions made for a year de-

pends on the tax year for which the SEP is maintained.

•

If the SEP is maintained on a calendar-year basis, you

deduct the yearly contributions on your tax return for

the year within which the calendar year ends.

•

If you file your tax return and maintain the SEP using a

fiscal year or short tax year, you deduct contributions

made for a year on your tax return for that year.

Example. You are a fiscal-year taxpayer whose tax

year ends June 30. You maintain a SEP on a calen-

dar-year basis. You deduct SEP contributions made for

calendar year 2023 on your tax return for your tax year

ending June 30, 2024.

Where To Deduct Contributions

Deduct the contributions you make for your common-law

employees on your tax return. For example, sole proprie-

tors deduct them on Schedule C (Form 1040) or Sched-

ule F (Form 1040), Profit or Loss From Farming; partner-

ships deduct them on Form 1065, U.S. Return of

Partnership Income; and corporations deduct them on

Form 1120, U.S. Corporation Income Tax Return, or Form

1120-S, U.S. Income Tax Return for an S Corporation.

Sole proprietors and partners deduct contributions for

themselves on line 16 of Schedule 1 (Form 1040). (If you

are a partner, contributions for yourself are shown on the

Schedule K-1 (Form 1065), Partner's Share of Income,

Deductions, Credits, etc., you receive from the partner-

ship.)

Remember that sole proprietors and partners

can't deduct as a business expense contributions

made to a SEP for themselves, only those made

for their common-law employees.

Salary Reduction Simplified

Employee Pensions

(SARSEPs)

A SARSEP is a SEP set up before 1997 that includes a

salary reduction arrangement. (See the Caution next.) Un-

der a SARSEP, your employees can choose to have you

contribute part of their pay to their SEP-IRAs rather than

receive it in cash. This contribution is called an elective

deferral because employees choose (elect) to set aside

the money, and they defer the tax on the money until it is

distributed to them.

You aren't allowed to set up a SARSEP after

1996. However, participants (including employees

hired after 1996) in a SARSEP set up before 1997

can continue to have you contribute part of their pay to the

plan. If you are interested in setting up a retirement plan

that includes a salary reduction arrangement, see chap-

ter 3.

Who can have a SARSEP? A SARSEP set up before

1997 is available to you and your eligible employees only if

all the following requirements are met.

•

At least 50% of your employees eligible to participate

choose to make elective deferrals.

•

You have 25 or fewer employees who were eligible to

participate in the SEP at any time during the preceding

year.

•

The elective deferrals of your highly compensated em-

ployees meet the SARSEP average deferral percent-

age (ADP) test.

SARSEP ADP test. Under the SARSEP ADP test, the

amount deferred each year by each eligible highly

CAUTION

!

CAUTION

!

10 Chapter 2 Simplified Employee Pensions (SEPs) Publication 560 (2023)

Page 11 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

compensated employee as a percentage of pay (the de-

ferral percentage) can't be more than 125% of the ADP of

all non-highly compensated employees eligible to partici-

pate. A highly compensated employee is defined in chap-

ter 1.

Deferral percentage. The deferral percentage for an

employee for a year is figured as follows.

The elective employer contributions

(excluding certain catch-up contributions)

paid to the SEP for the employee for the year

The employee's compensation

(limited to $330,000 in 2023)

The instructions for Form 5305A-SEP have a

worksheet you can use to determine whether the

elective deferrals of your highly compensated em-

ployees meet the SARSEP ADP test.

Employee compensation. For figuring the deferral

percentage, compensation is generally the amount you

pay to the employee for the year. Compensation includes

the elective deferral and other amounts deferred in certain

employee benefit plans. See Compensation in chapter 1.

Elective deferrals under the SARSEP are included in figur-

ing your employees' deferral percentage even though they

aren't included in the income of your employees for in-

come tax purposes.

Compensation of self-employed individuals. If you

are self-employed, compensation is your net earnings

from self-employment as defined in chapter 1.

Compensation doesn't include tax-free items (or de-

ductions related to them) other than foreign earned in-

come and housing cost amounts.

Choice not to treat deferrals as compensation. You

can choose not to treat elective deferrals (and other

amounts deferred in certain employee benefit plans) for a

year as compensation under your SARSEP.

Limit on Elective Deferrals

The most a participant can choose to defer for calendar

year 2023 is the lesser of the following amounts.

1. 25% of the participant's compensation (limited to

$330,000 of the participant's compensation).

2. $22,500.

The $22,500 limit applies to the total elective deferrals

the employee makes for the year to a SEP and any of the

following.

•

Cash or deferred arrangement (section 401(k) plan).

•

Salary reduction arrangement under a tax-sheltered

annuity plan (section 403(b) plan).

•

SIMPLE IRA plan.

In 2024, the $330,000 limit increases to $345,000, and

the $22,500 limit increases to $23,000.

TIP

Catch-up contributions. A SARSEP can permit partici-

pants who are age 50 or over at the end of the calendar

year to also make catch-up contributions. The catch-up

contribution limit is $7,500 for 2023 and 2024. Elective de-

ferrals aren't treated as catch-up contributions for 2023

until they exceed the elective deferral limit (the lesser of

25% of compensation, or $22,500), the SARSEP ADP test

limit discussed earlier, or the plan limit (if any). However,

the catch-up contribution a participant can make for a year

can't exceed the lesser of the following amounts.

•

The catch-up contribution limit.

•

The excess of the participant's compensation over the

elective deferrals that aren't catch-up contributions.

Catch-up contributions aren't subject to the elective de-

ferral limit (the lesser of 25% of compensation, or $22,500

in 2023 and $23,000 in 2024).

Overall limit on SEP contributions. If you also make

nonelective contributions to a SEP-IRA, the total of the

nonelective and elective contributions to that SEP-IRA

can't exceed the lesser of 25% of the employee's compen-

sation, or $66,000 for 2023 ($69,000 for 2024). The same

rule applies to contributions you make to your own

SEP-IRA. See Contribution Limits, earlier.

Figuring the elective deferral. For figuring the 25% limit

on elective deferrals, compensation doesn't include SEP

contributions, including elective deferrals or other

amounts deferred in certain employee benefit plans.

Tax Treatment of Deferrals

Elective deferrals that aren't more than the limits dis-

cussed earlier under Limit on Elective Deferrals are exclu-

ded from your employees' wages subject to federal in-

come tax in the year of deferral. However, these deferrals

are included in wages for social security, Medicare, and

federal unemployment (FUTA) taxes.

Excess deferrals. For 2023, excess deferrals are the

elective deferrals for the year that are more than the

$22,500 limit discussed earlier. For a participant who is el-

igible to make catch-up contributions, excess deferrals are

the elective deferrals that are more than $30,000. The

treatment of excess deferrals made under a SARSEP is

similar to the treatment of excess deferrals made under a

qualified plan. See Treatment of Excess Deferrals under

Elective Deferrals (401(k) Plans) in chapter 4.

Excess SEP contributions. Excess SEP contributions

are elective deferrals of highly compensated employees

that are more than the amount permitted under the SAR-

SEP ADP test. You must notify your highly compensated

employees within 2

1

/2 months after the end of the plan

year of their excess SEP contributions. If you don't notify

them within this time period, you must pay a 10% tax on

the excess. For an explanation of the notification require-

ments, see Revenue Procedure 91-44, 1991-2 C.B. 733. If

you adopted a SARSEP using Form 5305A-SEP, the notifi-

cation requirements are explained in the instructions for

that form.

Publication 560 (2023) Chapter 2 Simplified Employee Pensions (SEPs) 11

Page 12 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Reporting on Form W-2. Don’t include elective deferrals

in the “Wages, tips, other compensation” box of Form

W-2. You must, however, include them in the “Social se-

curity wages” and “Medicare wages and tips” boxes. You

must also include them in box 12. Check the “Retirement

plan” checkbox in box 13. For more information, see the

Form W-2 instructions.

Distributions (Withdrawals)

As an employer, you can't prohibit distributions from a

SEP-IRA. Also, you can't make your contributions on the

condition that any part of them must be kept in the ac-

count after you have made your contributions to the em-

ployee's accounts.

Distributions are subject to IRA rules. Generally, you or

your employee must begin to receive distributions from a

SEP-IRA by April 1 of the first year after the calendar year

in which you or your employee reaches age 72 (if age

70

1

/2 was reached after December 31, 2019). For more in-

formation about IRA rules, including the tax treatment of

distributions, rollovers, required distributions, and income

tax withholding, see Pubs. 590-A and 590-B.

Note. Individuals who reach age 72 after December

31, 2022, may delay receiving their RMDs until April 1 of

the year following the year in which they reach age 73.

Additional Taxes

The tax advantages of using SEP-IRAs for retirement sav-

ings can be offset by additional taxes that may be im-

posed for all the following actions.

•

Making excess contributions.

•

Making early withdrawals.

•

Not making required withdrawals.

For information about these taxes, see Pubs. 590-A

and 590-B. Also, a SEP-IRA may be disqualified, or an ex-

cise tax may apply, if the account is involved in a prohibi-

ted transaction, discussed next.

Prohibited transaction. If an employee improperly uses

their SEP-IRA, such as by borrowing money from it, the

employee has engaged in a prohibited transaction. In that

case, the SEP-IRA will no longer qualify as an IRA. For a

list of prohibited transactions, see Prohibited Transactions

in chapter 4.

Effects on employee. If a SEP-IRA is disqualified be-

cause of a prohibited transaction, the assets in the ac-

count will be treated as having been distributed to the em-

ployee on the first day of the year in which the transaction

occurred. The employee must include in income the fair

market value of the assets (on the first day of the year)

that is more than any cost basis in the account. Also, the

employee may have to pay the additional tax for making

early withdrawals.

Reporting and Disclosure

Requirements

If you set up a SEP using Form 5305-SEP, you must give

your eligible employees certain information about the SEP

when you set it up. See Setting Up a SEP, earlier. Also,

you must give your eligible employees a statement each

year showing any contributions to their SEP-IRAs. You

must also give them notice of any excess contributions.

For details about other information you must give them,

see the instructions for Form 5305-SEP or Form

5305A-SEP (for a salary SARSEP).

Even if you didn't use Form 5305-SEP or Form

5305A-SEP to set up your SEP, you must give your em-

ployees information similar to that described above. For

more information, see the instructions for either Form

5305-SEP or Form 5305A-SEP.

3.

SIMPLE Plans

Topics

This chapter discusses:

•

SIMPLE IRA plans

•

SIMPLE 401(k) plans

Useful Items

You may want to see:

Publications

590-A Contributions to Individual Retirement

Arrangements (IRAs)

590-B Distributions from Individual Retirement

Arrangements (IRAs)

3998 Choosing a Retirement Solution for Your Small

Business

4284 SIMPLE IRA Plan Checklist

4334 SIMPLE IRA Plans for Small Businesses

Forms (and Instructions)

W-2 Wage and Tax Statement

5304-SIMPLE Savings Incentive Match Plan for

Employees of Small Employers (SIMPLE)—Not

for Use With a Designated Financial Institution

5305-SIMPLE Savings Incentive Match Plan for

Employees of Small Employers (SIMPLE)—for

Use With a Designated Financial Institution

590-A

590-B

3998

4284

4334

W-2

5304-SIMPLE

5305-SIMPLE

12 Chapter 3 SIMPLE Plans Publication 560 (2023)

Page 13 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

8880 Credit for Qualified Retirement Savings

Contributions

8881 Credit for Small Employer Pension Plan

Startup Costs and Auto Enrollment

A SIMPLE plan is a written arrangement that provides you

and your employees with a simplified way to make contri-

butions to provide retirement income. Under a SIMPLE

plan, employees can choose to make salary reduction

contributions to the plan rather than receiving these

amounts as part of their regular pay. In addition, you will

contribute matching or nonelective contributions.

SIMPLE plans can only be maintained on a calendar-year

basis.

A SIMPLE plan can be set up in either of the following

ways.

•

Using SIMPLE IRAs (SIMPLE IRA plan).

•

As part of a 401(k) plan (SIMPLE 401(k) plan).

Many financial institutions will help you set up a

SIMPLE plan.

SIMPLE IRA Plan

A SIMPLE IRA plan is a retirement plan that uses a SIM-

PLE IRA for each eligible employee. Under a SIMPLE IRA

plan, a SIMPLE IRA must be set up for each eligible em-

ployee. For the definition of an eligible employee, see Who

Can Participate in a SIMPLE IRA Plan, later.

Who Can Set up

a SIMPLE IRA Plan?

You can set up a SIMPLE IRA plan if you meet both the

following requirements.

•

You meet the employee limit.

•

You don't maintain another qualified plan unless the

other plan is for collective bargaining employees.

Employee limit. You can set up a SIMPLE IRA plan only

if you had 100 or fewer employees who received $5,000 or

more in compensation from you for the preceding year.

Under this rule, you must take into account all employees

employed at any time during the calendar year regardless

of whether they are eligible to participate. Employees in-

clude self-employed individuals who received earned in-

come and leased employees (defined in chapter 1).

Once you set up a SIMPLE IRA plan, you must con-

tinue to meet the 100-employee limit each year you main-

tain the plan.

Grace period for employers who cease to meet the

100-employee limit. If you maintain the SIMPLE IRA

plan for at least 1 year and you cease to meet the 100-em-

ployee limit in a later year, you will be treated as meeting it

for the 2 calendar years immediately following the calen-

dar year for which you last met it.

8880

8881

TIP

A different rule applies if you don't meet the 100-em-

ployee limit because of an acquisition, disposition, or simi-

lar transaction. Under this rule, the SIMPLE IRA plan will

be treated as meeting the 100-employee limit for the year

of the transaction and the 2 following years if both the fol-

lowing conditions are satisfied.

•

Coverage under the plan hasn’t significantly changed

during the grace period.

•

The SIMPLE IRA plan would have continued to qualify

after the transaction if you had remained a separate

employer.

The grace period for acquisitions, dispositions,

and similar transactions also applies if, because

of these types of transactions, you don't meet the

rules explained under Other qualified plan or Who Can

Participate in a SIMPLE IRA Plan, later.

Other qualified plan. The SIMPLE IRA plan must gener-

ally be the only retirement plan to which you make contri-

butions, or to which benefits accrue, for service in any

year beginning with the year the SIMPLE IRA plan be-

comes effective.

Exception. If you maintain a qualified plan for collec-

tive bargaining employees, you are permitted to maintain a

SIMPLE IRA plan for other employees.

Who Can Participate in a SIMPLE IRA

Plan?

Eligible employee. Any employee who received at least

$5,000 in compensation during any 2 years preceding the

current calendar year and is reasonably expected to re-

ceive at least $5,000 during the current calendar year is

eligible to participate. The term “employee” includes a

self-employed individual who received earned income.

You can use less restrictive eligibility requirements (but

not more restrictive ones) by eliminating or reducing the

prior year compensation requirements, the current year

compensation requirements, or both. For example, you

can allow participation for employees who received at

least $3,000 in compensation during any preceding calen-

dar year. However, you can't impose any other conditions

for participating in a SIMPLE IRA plan.

Excludable employees. The following employees don't

need to be covered under a SIMPLE IRA plan.

•

Employees who are covered by a union agreement

and whose retirement benefits were bargained for in

good faith by the employees' union and you.

•

Nonresident alien employees who have received no

U.S. source wages, salaries, or other personal serv-

ices compensation from you.

Compensation. Compensation for employees is the total

wages, tips, and other compensation from the employer

subject to federal income tax withholding and the amounts

paid for domestic service in a private home, local college

club, or local chapter of a college fraternity or sorority.

CAUTION

!

Publication 560 (2023) Chapter 3 SIMPLE Plans 13

Page 14 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Compensation also includes the employee's salary reduc-

tion contributions made under this plan and, if applicable,

elective deferrals under a section 401(k) plan, a SARSEP,

or a section 403(b) annuity contract and compensation

deferred under a section 457 plan required to be reported

by the employer on Form W-2. If you are self-employed,

compensation is your net earnings from self-employment

(line 4 of Schedule SE (Form 1040) before subtracting any

contributions made to the SIMPLE IRA plan for yourself.

How To Set up a SIMPLE IRA Plan

You can use Form 5304-SIMPLE or Form 5305-SIMPLE to

set up a SIMPLE IRA plan. Each form is a model SIMPLE

plan document. Which form you use depends on whether

you select a financial institution or your employees select

the institution that will receive the contributions.

Use Form 5304-SIMPLE if you allow each plan partici-

pant to select the financial institution for receiving their

SIMPLE IRA plan contributions. Use Form 5305-SIMPLE

if you require that all contributions under the SIMPLE IRA

plan be deposited initially at a designated financial institu-

tion.

The SIMPLE IRA plan is adopted when you have com-

pleted all appropriate boxes and blanks on the form and

you (and the designated financial institution, if any) have

signed it. Keep the original form. Don’t file it with the IRS.

Other uses of the forms. If you set up a SIMPLE IRA

plan using Form 5304-SIMPLE or Form 5305-SIMPLE,

you can use the form to satisfy other requirements, includ-

ing the following.

•

Meeting employer notification requirements for the

SIMPLE IRA plan. Form 5304-SIMPLE and Form

5305-SIMPLE contain a Model Notification to Eligible

Employees that provides the necessary information to

the employee.

•

Maintaining the SIMPLE IRA plan records and proving

you set up a SIMPLE IRA plan for employees.

Deadline for setting up a SIMPLE IRA plan. You can

set up a SIMPLE IRA plan effective on any date from Jan-

uary 1 through October 1 of a year, provided you didn't

previously maintain a SIMPLE IRA plan. This requirement

doesn't apply if you are a new employer that comes into

existence after October 1 of the year the SIMPLE IRA plan

is set up and you set up a SIMPLE IRA plan as soon as

administratively feasible after your business comes into

existence. If you previously maintained a SIMPLE IRA

plan, you can set up a SIMPLE IRA plan effective only on

January 1 of a year. A SIMPLE IRA plan can't have an ef-

fective date that is before the date you actually adopt the

plan.

Setting up a SIMPLE IRA. SIMPLE IRAs are the individ-

ual retirement accounts or annuities into which the contri-

butions are deposited. A SIMPLE IRA must be set up for

each eligible employee. Forms 5305-S, SIMPLE Individual

Retirement Trust Account, and 5305-SA, SIMPLE Individ-

ual Retirement Custodial Account, are model trust and

custodial account documents the participant and the

trustee (or custodian) can use for this purpose.

Contributions to a SIMPLE IRA won't affect the amount

an individual can contribute to a Roth or traditional IRA.

Deadline for setting up a SIMPLE IRA. A SIMPLE

IRA must be set up for an employee before the first date

by which a contribution is required to be deposited into the

employee's IRA. See Time limits for contributing funds,

later, under Contribution Limits.

Notification Requirement

If you adopt a SIMPLE IRA plan, you must notify each em-

ployee of the following information before the beginning of

the election period.

1. The employee's opportunity to make or change a sal-

ary reduction choice under a SIMPLE IRA plan.

2. Your decision to make either matching contributions

or nonelective contributions (discussed later).

3. A summary description provided by the financial insti-

tution.

4. Written notice that their balance can be transferred

without cost or penalty if they use a designated finan-

cial institution.

Election period. The election period is generally the

60-day period immediately preceding January 1 of a cal-

endar year (November 2 to December 31 of the preceding

calendar year). However, the dates of this period are

modified if you set up a SIMPLE IRA plan mid-year (for ex-

ample, on July 1) or if the 60-day period falls before the

first day an employee becomes eligible to participate in

the SIMPLE IRA plan.

A SIMPLE IRA plan can provide longer periods for per-

mitting employees to enter into salary reduction agree-

ments or to modify prior agreements. For example, a SIM-

PLE IRA plan can provide a 90-day election period

instead of the 60-day period. Similarly, in addition to the

60-day period, a SIMPLE IRA plan can provide quarterly

election periods during the 30 days before each calendar

quarter, other than the first quarter of each year.

Contribution Limits

Contributions are made up of salary reduction contribu-

tions and employer contributions. You, as the employer,

must make either matching contributions or nonelective

contributions, defined later. No other contributions can be

made to the SIMPLE IRA plan. These contributions, which

you can deduct, must be made timely. See Time limits for

contributing funds, later.

Salary reduction contributions. The amount the em-

ployee chooses to have you contribute to a SIMPLE IRA

on their behalf can't be more than $15,500 for 2023 and

increases to $16,000 for 2024. These contributions must

be expressed as a percentage of the employee's compen-

sation unless you permit the employee to express them as

a specific dollar amount. You can't place restrictions on

14 Chapter 3 SIMPLE Plans Publication 560 (2023)

Page 15 of 44 Fileid: … cation-560/2023/a/xml/cycle05/source 14:49 - 5-Jul-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

the contribution amount (such as limiting the contribution

percentage), except to comply with the $15,500 limit for

2023 ($16,000 for 2024).

If you or an employee participates in any other qualified

plan during the year and you or your employee has salary

reduction contributions (elective deferrals) under those

plans, the salary reduction contributions under a SIMPLE

IRA plan also count toward the overall annual limit

($22,500 for 2023; $23,000 for 2024) on exclusion of sal-

ary reduction contributions and other elective deferrals.

Catch-up contributions. A SIMPLE IRA plan can per-

mit participants who are age 50 or over at the end of the

calendar year to also make catch-up contributions. The

catch-up contribution limit for SIMPLE IRA plans is $3,500

for 2023 and 2024. Salary reduction contributions aren't

treated as catch-up contributions until they exceed

$15,500 for 2023 ($16,000 for 2024). However, the

catch-up contribution a participant can make for a year

can't exceed the lesser of the following amounts.

•

The catch-up contribution limit.

•

The excess of the participant's compensation over the

salary reduction contributions that aren't catch-up

contributions.

Employer matching contributions. You are generally

required to match each employee's salary reduction con-

tribution(s) on a dollar-for-dollar basis up to 3% of the em-