Chapter 7- Controlled and affiliated service groups

Page 7-1

Controlled and Affiliated Service Groups

Chapter 7

Controlled and Affiliated Service Groups

By

Larry Lawson (Cincinnati)

Reviewer:

Jeff Nelson (Cincinnati)

INTERNAL REVENUE SERVICE

TAX EXEMPT AND GOVERNMENT ENTITIES

Overview

Introduction

The Internal Revenue Code established its Controlled Groups Provisions as

part of the Revenue Act of 1964. They were initially issued as part of a tax

reform package intended to encourage small businesses, which operated in

the corporate form. Over time some medium and large businesses began

taking advantage of the lower tax rates afforded small businesses by

organizing their structure into multiple corporate forms.

The Employee Retirement Income Security Act of 1974 (ERISA) added

sections 414(b) and (c). These sections required that all employees of

commonly controlled corporations, trades or businesses be treated as

employees of a single corporation, trade or business. These Code provisions

used the statutory definition of controlled groups found in section 1563(a) of

the Code.

Section 1563(a) provides mechanical ownership tests, which are used in

determining if a controlled group situation exists.

Sections 414 (b) and (c) did not cover many of the arrangements devised by

employers who attempted to avoid coverage of employees. Congress enacted

section 414(m) pursuant to section 201 of the Miscellaneous Revenue Act of

1980. Section 414 (m) addresses employees of an affiliated service group,

which will be discussed later in this chapter.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-2

Controlled and Affiliated Service Groups

Overview, Continued

Objectives

At the end of this chapter you will be able to:

• Define a controlled group and identify the three forms of controlled

groups.

• Apply section 1563(a) in conjunction with section 414(b) and (c) to

determine if a controlled group is in existence.

• Identify the effect of the attribution rules on controlled groups.

• Determine the impact of sections 414(b) and (c) on the determination

letter process and qualified plans.

In This

Chapter

This chapter contains the following topics:

OVERVIEW ------------------------------------------------------------------------------------------------------------------------1

DEFINITION: CONTROLLED GROUP-------------------------------------------------------------------------------------4

ATTRIBUTION RULES ------------------------------------------------------------------------------------------------------- 11

DETERMINATION LETTER PROGRAM: CONTROLLED GROUP PLANS----------------------------------- 20

CONTROLLED GROUP: EXERCISES------------------------------------------------------------------------------------ 34

SUMMARY ----------------------------------------------------------------------------------------------------------------------- 37

OVERVIEW: AFFILIATED SERVICE GROUP------------------------------------------------------------------------- 38

AFFILIATED SERVICE GROUP ------------------------------------------------------------------------------------------- 40

AFFILIATED SERVICE GROUP: PERFORMANCE OF SERVICE ----------------------------------------------- 49

MULTIPLE AFFILIATED SERVICE GROUP--------------------------------------------------------------------------- 58

ATTRIBUTION RULES FOR AFFILIATED SERVICE GROUPS -------------------------------------------------- 62

MANAGEMENT ORGANIZATIONS -------------------------------------------------------------------------------------- 72

EXERCISES – MANAGEMENT ORGANIZATIONS ------------------------------------------------------------------ 83

DETERMINATION LETTER PROGRAM: AFFILIATED SERVICE GROUPS -------------------------------- 86

THE IMPACT OF SECTION 414(M) ON QUALIFIED PLANS------------------------------------------------------ 90

PROFESSIONAL EMPLOYEE ORGANIZATIONS (PEOS) --------------------------------------------------------- 90

LEASED EMPLOYEES-------------------------------------------------------------------------------------------------------102

INDEPENDENT CONTRACTORS-----------------------------------------------------------------------------------------104

EXERCISES – AFFILIATED SERVICE GROUPS---------------------------------------------------------------------105

AFFILIATED SERVICE GROUP SUMMARY--------------------------------------------------------------------------108

Chapter 7- Controlled and affiliated service groups

Page 7-3

Controlled and Affiliated Service Groups

Chapter 7- Controlled and affiliated service groups

Page 7-4

Controlled and Affiliated Service Groups

Definition: Controlled Group

Section 414(b)

and (c)

The controlled group definition is found in section 414(b) & (c). Section

414(b) covers controlled group consisting of corporations and defines a

controlled group as a combination of two or more corporations that are under

common control within the meaning of section 1563(a).

All employees of companies in the controlled group must be considered to

determine if a plan maintained by a controlled group member meets the

requirements of sections 401, 408(k), 408(p), 410, 411, 415, and 416.

Section 414(c) applies to controlled group of trades or businesses (whether or

not incorporated), such as partnerships and proprietorships. Since section

1563 was written only for corporations, Treasury Regulations 1.414(c)-1

through 1.414(c)-5 mirror the section 1563 controlled group principles.

The definitions and examples used in this chapter refer to both section 414(b)

and 414(c) controlled groups.

Three Types of

Controlled

Groups

A control group relationship exists if the businesses have one of the following

relationships:

− Parent-subsidiary,

− Brother-sister, and

− Combination of the above

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-5

Controlled and Affiliated Service Groups

Definition: Controlled Group, Continued

Parent-

subsidiary

Group

A parent-subsidiary controlled group exists when one or more chains of

corporations are connected through stock ownership with a common parent

corporation; and

− 80 percent of the stock of each corporation, (except the common parent)

is owned by one or more corporations in the group; and

− Parent Corporation must own 80 percent of at least one other corporation.

Sections 1563(a) and 414(b) and (c).

Sections

1563(a) and

414(b) and (c)-

Example 1

The following examples illustrate the parent-subsidiary rules:

Example 1

Redwood Corporation owns:

− 90% of the stock of Bond Corporation,

− 80% of the stock of Greene Corporation, and

− 65% of the stock of Teller Corporation.

Unrelated persons own the percentage of stock not owned by Redwood

Corporation.

Redwood Corporation owns 80% or more of the stock of the Bond and

Greene Corporations. Therefore, Redwood Corporation is the common

parent of a parent-subsidiary group consisting of Redwood, Bond, and

Greene. Teller Corporation is not a member of the group because Redwood

Corporation’s ownership is less than 80%.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-6

Controlled and Affiliated Service Groups

Definition: Controlled Group, Continued

Sections

1563(a) and

414(b) and (c)-

Example 1

(continued)-

Example 2

Example 2

Assume the same facts as in the previous example and assume further that

Greene Corporation owns 80% of the profits interest in XYZ Partnership.

Redwood Corporation is the common parent of a parent-subsidiary group

consisting of Redwood, Bond, Greene and XYZ. The results would be same

if Redwood Corporation, rather than Greene Corporation owned the 80%

interest in XYZ.

Brother- Sister

Group

A brother-sister controlled group is a group of two or more corporations, in

which five or fewer common owners (a common owner must be an

individual, a trust, or an estate) own directly or indirectly a controlling

interest of each group and have “effective control”.

− Controlling interest - 1.414(c)-2(b)(2) – generally means 80 percent or

more of the stock of each corporation (but only if such common owner

own stock in each corporation); and

− Effective control – 1.414(c)-2(c)(2) – generally more than 50 percent of

the stock of each corporation, but only to the extent such stock ownership

is identical with respect to such corporation.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-7

Controlled and Affiliated Service Groups

Definition: Controlled Group, Continued

Example-

Brother-Sister

Ownership Test

Adams Corp and Bell Corp are owned by four shareholders, in the following

percentages:

Percentage of Ownership

Shareholder Adams Corp Bell Corp

A 80% 20%

B 10 50

C 5 15

D 5 15

TOTAL 100% 100%

To meet the first part of the test in section 1563(a)(2)(A), the same five or

fewer common owners must own more than 80% of stock or some interest in

all members of the controlled group.

In this example, the four shareholders together own 80% or more of the stock

of each corporation, the first test is met, since the shareholders own 100%

percent of the stock.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-8

Controlled and Affiliated Service Groups

Definition: Controlled Group, Continued

50 Percent

Test-Example

Shareholder Identical Ownership Percentage in both Corps.

A 20%

B 10

C 5

D 5

TOTAL 40%

To meet the second part of the test in Section 1563(a)(2)(B), the same five or

fewer common owners must own more than 50% of each corporation, taking

into account the stock ownership of each person only to the extent such stock

ownership is identical with respect to each such corporation.

In this example, although the four shareholders together own 80% or more of

the stock of each corporation, they do not own more than 50% of the stock of

each corporation, taking into account only the identical ownership in each

corporation as demonstrated above.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-9

Controlled and Affiliated Service Groups

Definition: Controlled Group, Continued

Example-

Brother-Sister

Group not

established

The following individuals each own 12% to 13% of the stock in Tate Corp

and also Ward Corp.

Individual Percentage of Tate Corp Percentage of Ward

Corp

A 12 12

B 12 12

C 12 12

D 12 12

E 13 13

F 13 13

G 13 13

H 13 13

Any grouping of five of the shareholders will own more than 50% of the

stock in each corporation and all shareholders in any of the groupings will

own identical amounts.

But, Tate and Ward are not members of a brother-sister group because, the

same five or fewer individuals do not own at lease 80% of each corporation’s

stock.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-10

Controlled and Affiliated Service Groups

Definition: Controlled Group, Continued

Combined

Group

A combined group consists of three or more organizations that are organized

as follows:

− Each organization is a member of either a parent-subsidiary or brother-

sister group; and

− At least one corporation is the common parent of a parent-subsidiary; and

is also a member of a brother-sister group.

Combined

Group-

Example

A is an individual owning:

− 80% in York Partnership; and

− 90% in Sharp Corporation

York Partnership owns 85% of Tripp Corporation

York Partnership, Sharp Corporation and Tripp Corporation are each members

of the same combined group of trades or businesses under common control

because

• York Partnership, Sharp Corporation, and Tripp Corporation are each

members of either a parent-subsidiary or a brother–sister group, and

• York is:

Ø the common parent of the parent-subsidiary group consisting of

York and Tripp; and

Ø A member of a brother-sister group consisting of York and Sharp.

Chapter 7- Controlled and affiliated service groups

Page 7-11

Controlled and Affiliated Service Groups

Attribution Rules

Introduction

Attribution is the concept of treating a person as owning an interest in a

business that is not actually owned by that person. Attribution may result

from family or business relationships. Section 1563 attribution is used in

determining a controlled group of businesses, under section 414(b) and (c).

Important Note

Although the following attribution rules are written in terms of stock

ownership, the same principles are applied for organizations that are not

incorporated.

In the case of a:

Ownership relates to the:

Trust or estate Actual interest

Partnership Capital or profits

Sole proprietorship Sole proprietorship

When calculating ownership interests, use the greater of:

− Corporate ownership – voting stock or value of stock

− Partnership ownership – capital or profits

Section 1563

Attribution

Section 1563 contains the rules of attribution used to determine “control” for

the following:

− Controlled groups of corporations (section 414 (b)); and

− Trades or businesses, whether or not incorporation, which are under

common control (section 414 (c)).

Also see Treas. Reg. § 1.414(c)-4.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-12

Controlled and Affiliated Service Groups

Attribution Rules, Continued

General Rules

for Family

Attribution

The following table is a general description of how the family attribution

rules are applied to controlled groups.

Note: the following family attribution rules only apply to a brother-

sister controlled group and do not apply to a parent-subsidiary controlled

group.

THE OWNERSHIP

INTERESTS OF:

Are attributed to:

Spouse Spouse EXCEPTION:

No attribution between

spouses if there is no:

• direct ownership,

• participation in

company, and

• no more than 50%

of business gross

income is passive

investments. See

1.414(c)-4(b)(5)(ii).

Minor child (under age 21) Parent

Parent Minor child (under

age 21)

Parent Adult child (age 21

or older)

ONLY IF: Adult child

owns greater than 50%

of that business.

Adult child Parent ONLY IF: Parent owns

greater than 50% of

that business.

Grandparent Minor or Adult

child

ONLY IF: Minor/Adult

child owns greater than

50% of that business.

Minor or Adult child Grandparent ONLY IF: Grandparent

owns greater than 50%

of that business.

Sibling None None

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-13

Controlled and Affiliated Service Groups

Attribution Rules, Continued

Examples-

family

attribution

The following examples illustrate the family attribution rules:

Example 1-

family

attribution

Ada and Barton are married. Barton is a doctor owning 100% of his medical

practice. Ada is also a doctor and owns 50% of a separate medical practice

(the other 50% is owned by an unrelated doctor).

Barton is not an employee or owner of a direct interest in Ada’s practice and

less than 50% of the gross income in Ada’s practice is from passive

investments. Barton, however, is in charge of significant management

activities for his wife’s practice.

Ada does not directly own an interest or participate in Barton’s practice and

less than 50% of the gross income from Barton’s practice is from passive

investments.

− Barton is attributed the 50% interest that Ada owns in her practice (due to

his participation in Ada’s practice).

− Ada is not attributed any ownership interest in Barton’s practice.

Example 2

Clare, age 25 is the daughter of Dana. Dana owns 75% of XYZ Corporation

and Clare own the remaining 25%.

Since Dana owns more than 50% of XYZ, her ownership is attributed to

Clare.

Since Clare does not own more than 50% of XYZ, her ownership is not

attributed to Dana.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-14

Controlled and Affiliated Service Groups

Attribution Rules, Continued

General Rules

for

Organizational.

Attribution

The following table is a general description of how the attribution rules for

organizations are applied to controlled groups.

The ownership interest: Are attributed to:

From a corporation to its

shareholder

• Applicable to brother-sister

controlled group only.

Corporate ownership interests

attributed, proportionately *, to

shareholders (owning at least 5% of

corporate stock).

From a partnership to its partners

• Applicable to brother-sister

controlled group only.

Partnership ownership interests

attributed, proportionately *, to

partners having at least 5% or more

capital or profits interest.

From a trust to its beneficiaries

• Applicable to brother-sister and

parent-subsidiary controlled

groups.

Trust ownership interests attributed,

proportionately *, to beneficiaries

having 5% or more actuarial

interest.

To an organization None

General Rules –

Orginazational

Attribution

* The interest owned is proportionate to the individual’s share of the

organization’s value.

For example, a shareholder’s interest in a corporation is proportionate share

of the total stock value of the corporation.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-15

Controlled and Affiliated Service Groups

Attribution Rules, Continued

Organizational

Attribution

Rules

The following examples illustrate the organizational attribution rules:

Example 1

Elliott owns 70% of the stock in the Fairfield Corporation. Grant owns 20%

of the stock and four other individuals who each own less than 5% own the

remaining 10%. The Fairfield Corporation has a 30% stock ownership in the

Hale Corporation.

The Hale stock is attributed to Elliott and Grant in proportion to their

ownership interests in the Fairfield Corporation as follows:

Elliott is treated as a 21% owner of Hale Corporation.

• 70% (interest in Fairfield) x 30% (Fairfield’s interest in Hale)

Grant is treated as a .06 % owner of Hale Corporation.

• 20% (interest in Fairfield) x 30% (Fairfield’s interest in Hale)

Since each of the four remaining shareholders of Fairfield Corporation own

less than 5%, they are not treated as owning any interest in Hale Corporation.

Example 2

The Isanti Group is a partnership. Jay owns a 70% interest in Isanti, and

Kendall owns a 30% interest. The Isanti Group owns 50% of the stock of

Lake Investments Corporation.

The Lake stock is attributed to Jay and Kendall in proportion to their

partnership interests in Isanti as follows:

Jay is treated as a 35% owner of Lake Corporation (70% x 50%).

Kendall is treated as a 15% owner of Lake Corporation (30% x 50%).

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-16

Controlled and Affiliated Service Groups

Attribution Rules, Continued

Other Rules

under Section

1563

After an individual is attributed the ownership of a family member, the

interest does not get attributed from the individual to another family member.

However:

1. The ownership interests of an individual may be attributed to more

than one family member.

2. After an individual is attributed the ownership of a corporation,

partnership or trust, the interest may then be taken into account under

other attribution rules.

Options to acquire stock are, generally, treated as stock ownership under IRC

section 1563. Refer to Rev. Rul. 68-601 and North American Industries, Inc.

v. Commissioner, 33 TCM 1275 (1974) for further information.

Example-

Attribution to

More than One

Family

Member-facts

The following example illustrate attribution to more than one family member

DAD

40 %

30 % 20 %

An unrelated person owns the remaining interest in XYZ.

Continued on next page

SON

A

(Age 20)

SON B

(Age 30)

X

YZ

PARTNERSHIP

Chapter 7- Controlled and affiliated service groups

Page 7-17

Controlled and Affiliated Service Groups

Attribution Rules, Continued

Dad-Ownership

percentage

Dad is considered to own a total of 90% of the profits interest in XYZ

Partnership as follows:

• He directly owns 40% of XYZ Partnership,

• He is considered as owning the 30% interest owned by minor Son A, and

• He is also considered as owning the 20% interest of XYZ that is owned by

his adult son. Note that generally, the stock ownership of family members

who are 21 or older are not attributed to an individual. However, such

attribution is required if the individual has effective control. Dad has

more than a 50% ownership of XYZ. See 1.414(b)-4(b)(6).

Son A

Son A is considered to own a total of 70% of the profits interest in XYZ:

− He directly owns 30%, and

− He is considered to own the 40% profits interest owned directly by Dad.

Son A is not, however, considered to own the 20% owned directly by Son B

(and attributed to Dad).

Son B

− Son B is considered to own a total of 20% of the profits interest in XYZ:

− He directly owns 20%, and

− He is not considered to own the 40% interest of XYZ that is owned by his

father. This is because Son B owns only 20% and he would have to own

more than 50% in order for his father’s interest to be attributed to him.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-18

Controlled and Affiliated Service Groups

Attribution Rules, Continued

Other Rules for

Spousal

Attribution

under Section

1563

The following examples illustrate other spousal attribution rules

Example 1

Marian and Mitchell are the parents of Norton, age 25, and Oliver, age 20.

Mitchell has a 45% interest in the Pitkin Corporation and his son, Norton, has

a 55% interest.

ATTRIBUTION BETWEEN SPOUSES:

Marian is treated as owning Mitchell’s 45% interest in Pitkin, assuming the

spousal exception described above is not applicable.

FAMILY ATTRIBUTION IS NOT FURTHER ATTRIBUTED TO

ANOTHER FAMILY MEMBER:

The 45% interest attributed to Marian is not further attributed to Oliver.

This rule would not prevent Mitchell’s interest from being attributed to Oliver

(see below).

Example 2

FAMILY ATTRIBUTION RULES MAY BE APPLIED TO MORE

THAN ONE FAMILY MEMBER:

In addition to attributing Mitchell’s 45% interest in Pitkin to his wife, Marian,

using the rule for attribution between spouses, Mitchell’s 45% interest is also

attributed to Norton. Since Norton is over age 21 and owns more than 50% of

Pitkin, Mitchell’s ownership is attributed again to Norton under the family

attribution rule for parents and adult children.

Since Oliver is under age 21, Mitchell’s 45% interest may be attributed again

to Oliver under the family attribution rule for parents and minor children.

NO ATTRIBUTION BETWEEN SIBLINGS:

The 55% interest owned by Norton is not treated as owned by Oliver.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-19

Controlled and Affiliated Service Groups

Attribution Rules, Continued

Example -

Other Rules for

Organizational

Attribution

under Section

1563

Assume the same facts as in Example 2. In addition, the Pitkin Corporation

has a 50% interest in Rich and Riley, Inc. and Norton is married to Shannon.

ATTRIBUTION RULES APPLIED AFTER ORGANIZATIONAL

ATTRIBUTION:

Norton is considered to own a 50% (100% x 50%) interest in Rich and Riley,

Inc.

• Norton is treated as owning 100% of Pitkin (55% directly and 45%

attributed from his father).

• Shannon is attributed the 50% interest in Rich and Riley, Inc.

Chapter 7- Controlled and affiliated service groups

Page 7-20

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans

Background

The Employee Plans (EP) Determination Letter Program provides a means

whereby plan sponsors may submit their plans to the Service for review. The

Service reviews the form of the plan and, if the plan sponsor elects, reviews

certain operational features as well. If the plan meets the qualification

requirements under 401(a) of the Internal Revenue Code (Code), a favorable

determination letter is issued to the plan sponsor. The letter gives the

employer reliance on the form of plan.

Controlled

Group Pension

Plans

When the sponsor of a qualified retirement plan is part of a controlled group,

all employers of the group must be treated as a single employer to determine

if a plan meets the requirements of sections 401, 408(k), 408(p), 410, 411,

415, 416, and 417.

Rev. Proc 2004-

6 : Required

Information

When a plan sponsor submits a determination letter application (Forms 5300,

5307, 5310 and 6406), question 6 on the applications, asks if the employer is

a member of a controlled group or affiliated service group.

If question 6 is answered “Yes”, Rev. Proc. 2004-6 provides certain

information about the controlled group. The EP Specialist should secure for

review the following information (if not present with the application):

1. All members of the group;

2. Their relationship to the plan employer;

3. The type(s) of plan(s) each member has; and

4. Plans common to all members.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-21

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Example-

Determination

Letter

Application for

a Controlled

Group Plan-

Facts

Corporation A submits a Form 5307 Prototype Application for a

Determination Letter for a Profit Sharing Plan, which indicates that

Corporation A is a member of a controlled group. Along with the application,

the plan sponsor provides a controlled group statement with the following

information.

Example-

Controlled

group

statement

Corp A owns:

− 90% of Corp B,

− 85% of Corp C, and

− 50% of Corp X.

There is only one plan, sponsored by Corp A and members will adopt the

sponsor’s plan.

Plan effective date 1-1-1997

Corp A has 56 employees, Corp B has 20 employees, Corp C has 30

employees and Corp X has 90 employees.

Plan sponsor paid no user fee per EGTRRA section 620, which exempts

small plans from user fees on determination letter requests.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-22

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Application and

controlled

group

statement

review

Since the Service doesn’t rule on the controlled group status of qualified

plans, the analysis performed by the EP Specialist, regarding the controlled

group status of an employer, must include the following:

− Review the controlled group information to determine if the employer’s

status meets the requirements of a controlled group, under sections

1563(a) and 414(b) & (c). If the requirements are met, the employer has

declared that are a member of a controlled group.

− If the requirements of sections 1563(a) and 414(b) & (c) are not met, the

EP Specialist should notify the employer or their representative that based

on sections 1563(a) and 414(b) & (c), the employer status is not a

controlled group member.

The specialist should secure a revised application (with question 6, answered

“No”) or notate the case file with the correct employer status.

Application and

Controlled

Group

Statement

Analysis

Based on the information provided, a controlled group exists between

Corporation A, Corporation B and Corporation C. This is a parent-subsidiary

group, due to the 80% rule. Corporation X is excluded as a member (less

than 80%).

In this example, once the controlled group status is determined, the EP

Specialist should secure the appropriate user fee for a Form 5307 Application.

Since all employees of a controlled are treated as employed by a single

employer, the number of employees exceeds 100 (total # of employees for

Corporations A, B, and C equals 106).

The application is not eligible for user fee exclusion, under EGTRRA section

620.

Once the user fee is received, the application should be reviewed for general

qualification requirements, which are discussed later in this chapter.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-23

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Specific

Instructions

Form 5310

Application for

Controlled

Group Plans

Form 5310, Application or Determination for Terminating Plans, is used by

any plan sponsor or administrator of the pension plan to request a

determination letter on the plan’s qualified status at the time it terminates.

Rev. Proc. 2004-6 states that an application for a determination letter

involving plan termination must also include any supplemental information or

schedules required by the forms or form instructions. For example, the

application must include copies of all records of actions taken to terminate the

plan (such as a board of directors resolution) and a schedule providing certain

information regarding employees who separated from vesting service with

less than 100% vesting.

The Form 5310 application is the last opportunity for the Service to review

the qualified status of the plan before termination. When a Form 5310 is filed

for a plan sponsor who is a member of a controlled group.

The EP specialist should ensure that the controlled group members are treated

as a single employer when applying certain employee plan benefits

requirements.

Also when analyzing the application for employees separated without 100%

vesting, reversion issues, spin-off termination/change in funding and any

other issues addressed in (IRM) 7.12.1, Plan Terminations.

Example-

Termination

Application for

a Controlled

Group Plan-

Assume the same facts in previous example except the application submitted

is a Form 5310 and the application indicated that the termination date is 12-

31-2003. In addition the application states that in 2001, 6 participants were

separated without 100% vesting

The plan document has a 3-year cliff vesting schedule and immediate

participation upon employment.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-24

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Example-

coverage

information

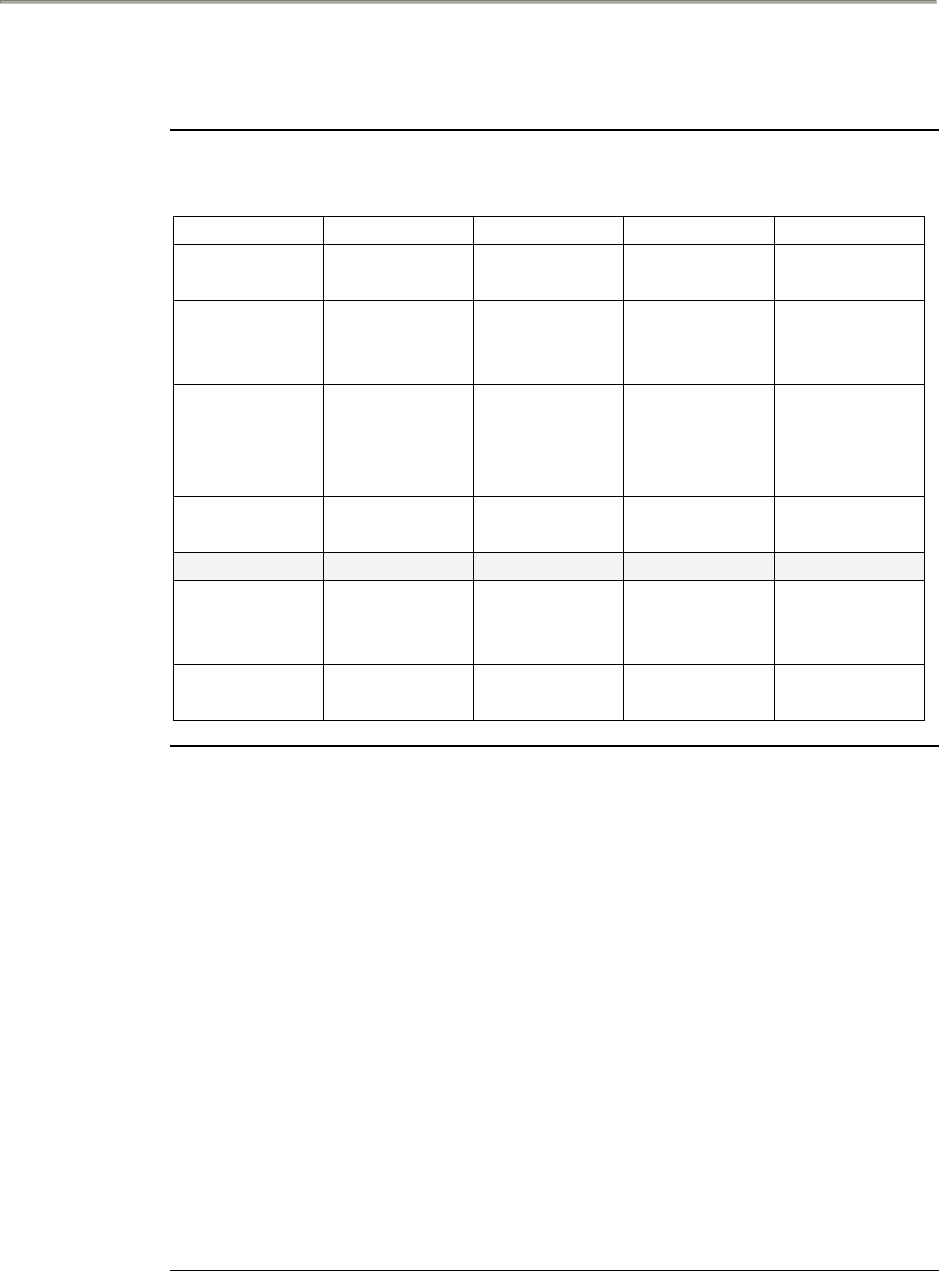

Also the following coverage information was provided:

A B C Total

Total

Employees

56 20 30 106

Highly

Comp.

Employees

4

2

5

11

Highly

Comp.

Employees

Benefiting

4

1

5

10

Ineligible

Employees

9

0

1

10

Total 43 18 24 85

Other

NHCEs not

benefiting

10

2

4

16

NHCEs

Benefiting

33

16

20

69

Application

review for

Form 5310

In addition to the determination made in the previous example (Corporations.

A, B and C are members of a controlled group), the EP Specialist should

secure (if not provided) the following information:

A schedule with the following information for each participant who has

separated from vesting service with less than 100% vesting:

1. Name of participant,

2. Date of hire,

3. Date of termination,

4. Years of participation,

5. Vesting percentage,

6. Account balance/account benefit at the time of separation from

service,

7. Amount of distribution,

8. Date of distribution, and

9. Reason for termination.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-25

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Analysis of

Form 5310

Application for

a Controlled

Group Plan

The analysis should review the information to ensure that the participants,

who separated without 100% vesting, were cashed out properly. Also

investigate if there was any previous service with other members of the

controlled group, and

Consider whether the form requirements of the plan are met and coverage is

adequate. If the facts have materially changed or new legislation has affected

the entity, sufficient information should be requested from the employer to

determine whether all eligible employees are considered for purposes of

coverage.

Results of

Performing

Coverage

Testing for a

Controlled

Group

The coverage information was included to illustrate controlled group

coverage testing under section 410(b).

Results:

The percentage of HCEs benefiting is 91% (HCEs benefiting/total HCEs).

The NHCEs benefiting is 81% (total NHCEs benefiting/total NHCEs)

The final step in the coverage test is to calculate the coverage percentage,

which is 89% (percentage of NHCEs benefiting/Percentage of HCEs

benefiting, which passes coverage).

The application should be reviewed for general qualification requirements,

which are discussed later in this chapter.

Chapter 7- Controlled and affiliated service groups

Page 7-26

Controlled and Affiliated Service Groups

Impact of Section 414(b) and (c) on Qualified Plans

Code Sections

Effected by

Controlled

Group Plans

If two or more corporations, trades or businesses are part of a controlled

group of businesses, the controlled group members are treated as a single

employer when applying certain employee plan benefits requirements.

These requirements are:

1 – Nondiscrimination, IRC 401(a)(4),

2 – Compensation dollar limit under IRC 401(a)(17),

3 – Minimum participation test under IRC 401(a)(26),

4 – Eligibility, IRC 401(a)(3) and 410(a),

5 – Coverage, IRC 410(b),

6 – Vesting, IRC 401(a)(7) and IRC 411,

7 – Section 415 limits,

8 – Top heavy rules IRC 416, and

9 – SEP’s under 408(k) and SIMPLE-IRA plans under IRC 408(p).

Section

401(a)(4)

Section 401(a)(4) requires that contributions under the plan may not

discriminate in favor of those who are highly compensated (as defined in

section 414(q)).

An employee is a highly compensated employee if the employee meets one of

two tests:

− the five-percent owner test ,or

− the compensation test. Section §414(q)(1)

Since all employees of a controlled group are treated as employed by a single

employer, any employee of the related business, who is (or was) a five

percent owner, will be a highly compensated employee.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-27

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Nondiscriminat

ion

The following examples illustrate the impact of section 401(a)(4) on qualified

plans:

Example 1

Tucker Computing, Inc., Smith Mainframe, Inc. and Yuma Software, Inc. are

a controlled group of corporations.

Jack is a participant in the Tucker Computing, Inc. Profit Sharing Plan. Jack

has never had any ownership in Tucker Computing, Inc. and is not a highly

compensated employee.

Prior to the buy out of Smith Mainframe, Inc. by Tucker Computing, Inc.,

Jack was a 30% owner in Smith Mainframe.

Solely as a result of the controlled group relationship, Jack would be deemed

to be a highly compensated employee in the Tucker Computing plan.

Similar issues may result in determining if an employee is highly

compensated under IRC sections 414(q)(1)(B), (C), and (D). See next

Example.

Example 2

Tabor Equipment Co, Inc and Wells Supplies, Inc are members of a

controlled group of corporations.

Wanda is a participant in the Tabor Equipment Co, Inc Profit Sharing Plan.

Wanda’s compensation from Travis is $45,000 and from Wells is $35,000.

Wanda would not be deemed a highly compensated employee based upon her

compensation from Tabor Equipment Co, Inc alone.

However, because all of her compensation from both employers would be

aggregated to determine the “Top Paid Group”, she would be a highly

compensation employee.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-28

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Section

401(a)(17)

Section 401(a)(17) limits the amount of compensation that may be considered

under a qualified plan to $200,000

All of the employees in the controlled group must be considered as if there

were one employer.

Compensation

Limits-

Example

Gordon, Inc. and Bacon, Inc. are unrelated employers who have two separate

money purchase pension plans. Both plans have a 10 percent of compensation

contribution formula.

Bob is an employee of both employers and earns $150,000 from each of

them. In 2000, he received an allocation of $15,000 under each plan.

In 2001, Gordon, Inc. and Bacon, Inc. became members of a controlled group.

For subsequent allocation purposes, Bob’s compensation is limited to

$200,000 (not the $300,000 if counted separately), because one employer

pays his entire compensation. Therefore, the amount that may be allocated to

his account under both plans is limited to $20,000 (not the $30,000 he was

entitled to previously).

Failure to limit Bob’s compensation will result in a violation of section

401(a)(17).

Section

401(a)(26

Section 401(a)(26) requires that a plan must benefit the lesser of 50

employees or 40 percent or more of all employees.

In testing a plan for section 401(a)(26), all employers required to be aggregated

under sections 414(b) and (c), must be treated as a single employer.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-29

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Additional

Participation

Requirements-

Example

Alma and her husband, Clay jointly own 100% of the Caldwell Corporation.

Alma also owns 100% of the capital and 50% of the profits of A & B

Partnership. Clay owns the other 50% profit interest in A & B. Alma is the

only employee in the Caldwell Corporation and there are no common law

employees in A & B Partnership. Alma wants to set up a defined benefit plan

for Caldwell. A & B does not maintain a retirement plan. There are only two

employees, Alma and Clay, in the controlled group.

Caldwell Corporation and A & B Partnership are a controlled group of

businesses under section 414(c) because Alma owns:

• 100% of A & B (the greater of her ownership in the capital or profits), and

• 100% of Caldwell (due to attribution from Clay).

Alma could not set up a defined benefit plan for only the Caldwell

Corporation.

Since both businesses must be treated as a single employer and section

401(a)(26) applies, she would have to cover both employees of the controlled

group in order to have 40% or more employee participation.

Section

401(a)(3)

Section 401(a)(3) requires that a qualified plan satisfy section 410, coverage

and eligibility.

In general, all years of service with an employer must be counted.

Sections 414(b) and (c) require the consolidation of all employees in the

group as if employed by one employer.

Therefore years of service with the following entities must be counted:

− Any member of a controlled group of corporations, or

− A commonly controlled entity, whether or not incorporated.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-30

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Coverage

Creek Manufacturing, Inc. and Dunn, Inc. are members of a controlled group.

Creek maintains a qualified plan in which only their employees may

participate. Dunn employees are not eligible to participate in the plan.

The Creek plan has a one-year service requirement. It must recognize service

with all employers in the controlled group and otherwise meet the coverage

requirements of section 410(b) with reference to the entire group.

You determine that one employee, Mary, had completed three years of service

with Dunn prior to her transfer to Creek. The plan administrator required

Mary to complete a year of service with Creek before including her in the

plan.

In this instance, Mary should have become a participant in the plan as soon as

she started to work for Creek, because she had already completed her year of

service under Dunn.

Failure to have Mary participate immediately in the plan means the plan

violates sections 401(a)(3) and 410(a)(1)(A).

Section

401(a)(7) &

Section 411

Section 401(a)(7) requires that a qualified plan satisfies section

411, vesting.

In general, all years of service with an employer must be counted.

Sections 414(b) and (c) require the consolidation of all employees in the

group as if employed by one employer.

Therefore years of service with the following entities must be counted:

− Any member of a controlled group of corporations, or

− A commonly controlled entity, whether or not incorporated.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-31

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Vesting-

example

Teton corporation is the parent company of subsidiary L. Carmen works for

subsidiary L and commenced employment on September 1, 2000. Teton

corporation maintains a profit sharing plan. The plan only covers employees

of Teton.

On May 1, 2004, Carmen transfers to Teton corporation. In determining

Carmen’s vesting percentage under Tech’s plan, Carmen’s service with

subsidiary L must be counted.

Teton’s plan prescribes a 5-year cliff vesting schedule. Therefore, as of the

vesting period in which Carmen transferred, she already has three years of

service for vesting purposes under L’s plan (although no accrued benefit to

vest in).

Sections 414(b) and (c) require the consolidation of all employees in the

group as if employed by one employer.

Section 415

Section 401(a)(16) requires that a qualified plan must meet the requirements

of Section 415.

Sections 414(b) and (c) require the consolidation of all employees in the

group as if employed by one employer.

Benefits and contributions under all plans maintained by employers in the

group must be aggregated to determine the maximum amount allowed by

section 415.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-32

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

Section 415

Limits-

Example

Starr, Inc. and Upson Ltd. are a controlled group. Each maintains an identical

money purchase plan.

During the 2003 plan year, Sue earns $100,000 from each employer and is a

participant in each plan. She receives an allocation of $25,000 in each.

Since the employers are members of a controlled group, the limitation of

section 415(c)(1)(A) should have been applied by aggregating the allocations

under both plans. This would have limited the total allocations to the lesser

of 25% of compensation or $40,000.

The allocations in this instance result in a disqualification of either one or the

other of the plans due to a violation of sections 401(a)(16) and 415(c)(1)(A).

The actual plan to be disqualified is determined pursuant to Treas. Regulation

section 1.415-9(b)(3)(iii).

Section 416

Section 416, special rules for top-heavy plans

Aggregate all years of service and compensation earned by organizations

within a controlled group for purposes of:

− Minimum contributions and benefits,

− Minimum vesting,

− Determining if a plan is top-heavy.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-33

Controlled and Affiliated Service Groups

Determination Letter Program: Controlled Group Plans,

Continued

SEPs &

SIMPLE-IRA

Section 408(k) establishes the rules for simplified employer plans (SEPs). In

many ways, the rules for SEPs mirror those for qualified plans.

Sections 414(b), (c) and (m) require the consolidation of all employees in the

group as if employed by one employer for the purposes of section 408(k).

Such items as the minimum service requirement of subsection (2)(B) and the

non-discrimination requirements of subsection (3) would have to be applied

as if all the employers in the group constituted a single employer.

Chapter 7- Controlled and affiliated service groups

Page 7-34

Controlled and Affiliated Service Groups

Controlled Group: Exercises

Exercise 1

A Corp owns:

• 90% of the stock of B Corp,

• 80% of the stock of C Corp, and

• 50% of the stock of D Corp.

Unrelated persons own the percentage of stock not owned by A Corp.

C Corp. owns 80% of the profits interest in the XYZ Partnership.

Which of the following constitutes the controlled group and what type of

group?

a. B Corp, C Corp and XYZ Partnership

b. A Corp, B Corp and C Corp

c. A Corp, B Corp, C Corp and XYZ Partnership

d. A Corp, B Corp, C Corp, D Corp and XYZ Partnership

e. B Corp and C Corp

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-35

Controlled and Affiliated Service Groups

Controlled Group: Exercises, Continued

Exercise 2

Assume the same facts as in exercise 1, except C Corp and D Corp are owned

by three unrelated shareholders in the following percentages:

Percentage of Ownership

Shareholder C Corp D Corp

A 80 % 20 %

B 10 50

C 10 30

TOTAL 100 % 100 %

C Corp and D Corp not considered to be a controlled group, Why?

a. To be a controlled group, each of the three shareholders would have to

own 80% or more of the stock of each corporation.

b. Although the three shareholders together own 80% or more of the stock of

each corporation, they do not own more than 50% of the stock of each

corporation taking into account only the identical ownership.

c. To be a controlled group, each of the three shareholders would have to

own 50% or more of the stock of each corporation.

d. In order to satisfy the requirements of section 414(c), there must be a

chain of corporations, connected through stock ownership with a common

parent that owns 80% or more of at least one other organization.

e. C Corp and D Corp constitute an affiliated service group.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-36

Controlled and Affiliated Service Groups

Controlled Group: Exercises, Continued

Exercise 3

X Corp and Y Corp are owned by five unrelated shareholders in the following

percentages:

Percent of Ownership

Shareholder X Corp Y Corp

A 40% 30%

B 20 40

C 35 15

D 5 0

E 0 15

Total 100% 100%

Do X Corp and Y Corp constitute a controlled group of corporations? Why?

a. Yes. All shareholders, together, own at least 80% of each corporation and

no individual shareholder owns more than 50% of either corporation.

b. No. Neither corporation owns at least 80% of the other.

c. No. No individual shareholder owns more than 50% of either

corporation.

d. No. Since D and E do not have ownership in both X Corp and Y Corp,

there cannot be any combined identical ownership.

e. Yes. A, B and C, together, own more than 80% of X Corp and more than

80% of Y Corp and their combined identical ownership is more than 50%.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-37

Controlled and Affiliated Service Groups

Controlled Group: Exercises, Continued

Exercise 4

What are the three types of controlled groups?

a. Parent-subsidiary, Brother-brother and Combined group.

b. Brother-sister, Combined and Parent-child group.

c. Parent-subsidiary, Brother-sister and Combined groups.

d. Husband -wife, Brother-sister and Combined groups.

Summary

Summary

IRC sections 414(b) & (c) were added to the Code because, in the words of

the Senate Committee Report on ERISA: “ The Committee, by this provision,

intends to make it clear that the coverage and nondiscrimination provisions

cannot be avoided by operating through separate corporations instead of

separate branches of one corporation.”

A plan that is maintained by an employer, within a group of employers that

are under common control, must meet the requirements of IRC section 401(a)

as if a single employer employed all employees of the group.

This chapter explains how to recognize a controlled group and the impact on

qualified plans and the Determination Letter process.

In the next section of this chapter, we will discuss Affiliated Service Groups.

Chapter 7- Controlled and affiliated service groups

Page 7-38

Controlled and Affiliated Service Groups

Overview: Affiliated Service Group

Introduction

As you have learned, section 414(b) and (c) require that all employees of

commonly controlled corporations or trades or businesses be treated as

employees of a single corporation or trade or business.

By arranging the ownership of related business entities in an artificial manner,

the definition of "control" under section 414(b) and (c) and the aggregation

rules established by ERISA could be circumvented. In addition, the basic rule

that employee plans provide an exclusive benefit for employees or their

beneficiaries could be violated.

Section 414(m) was enacted to prevent such circumvention by expanding the

idea of control to separate, but affiliated, entities. Proposed Treas. Reg. §

1.414(m) provides that all employees of the members of an affiliated service

group shall be treated as if a single employer employed them.

Objectives

At the end of this section, you will be able to identify situations where the

plan sponsor is a member of an affiliated service group and recognize the

impact on qualified plans. Therefore, you will be able to:

1. Describe the relationship between employers and determine if an

affiliated service group exists.

2. Describe the relationship between a first service organization and an

A-Organization and determine whether an affiliated service group

exists.

3. Describe the relationship between a first service organization and a B-

Organization and determine whether an affiliated service group exists.

4. Describe a management organization situation and determine whether

an affiliated service group exists.

5. Determine how these relationships affect the status of qualified plans.

6. Describe the procedure for processing a affiliated service group

determination letter request.

Describe other employer/employee relationships, such as leased employees,

impendent contractors, professional employee organization and management

organization

Chapter 7- Controlled and affiliated service groups

Page 7-39

Controlled and Affiliated Service Groups

Chapter 7- Controlled and affiliated service groups

Page 7-40

Controlled and Affiliated Service Groups

Affiliated Service Group

History

The Kiddie v. Commissioner 69 T.C. 1055 (1978)) and Garland v.

Commissioner 73 T.C. 5 (1979)) cases addressed the issue of control. The Tax

Court held that where a controlled group situation did not exist, it would not be

necessary to aggregate employees for purposes of testing for coverage and

discrimination.

IRC § 414(m) was enacted to expand the idea of control to separate, but

affiliated, entities. Proposed Treas. Reg. § 1.414(m) provides that all

employees of the members of an affiliated service group shall be treated as if

they were employed by a single employer.

Definition

An affiliated service group is one type of group of related employers and

refers to two or more organizations that have a service relationship and, in

some cases, an ownership relationship, described in IRC section 414(m). An

affiliated service group can fall into one of three categories:

1. A-Organization groups (referred to as “A-Org”), consists of an

organization designated as a First Service Organization (FSO) and at

least one “A organization”,

2. B-Organization groups (referred to as “B-Org”), consists of a FSO and

at least one “B organization”, or

3. Management groups.

First Service

Organization

An FSO must be a "service organization":

− Performance of services is the principal business of the organization as

defined in section 414(m)(3), and Proposed Treas. Reg. § 1.414(m)-2(f) .

− “Organization” refers to a corporation, partnership, or other organization.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-41

Controlled and Affiliated Service Groups

Affiliated Service Group, Continued

A-Org

To be an A-Org, an organization must satisfy a two-part test:

− Ownership Test

The organization is a partner or shareholder in the FSO (regardless of

the percentage interest it owns in the FSO) determined by applying the

constructive ownership rules as specified in section 318(a), and

− Working Relationship Test

• The organization "regularly performs services for the FSO," or

• Is "regularly associated with the FSO in performing services for

third parties.

Facts and circumstances are used to determine if a working

relationship exists. See Proposed Treas. Reg. § 1.414(m)-2(b).

See section 414(m)(2)(A).

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-42

Controlled and Affiliated Service Groups

Affiliated Service Group, Continued

B-Org

To be a B-Org, the organization must meet the following requirements:

− A significant portion of its business must be the performance of services

for a FSO, for one or more A-Org’s determined with respect to the FSO,

or for both,

− The services must be of a type historically performed by employees in the

service field of the FSO or the A-Org’s, and

− Ten percent or more of the interests in the organization must be held, in

the aggregate, by persons who are highly-compensated employees

(pursuant to IRC § 414(q)) of the FSO or A-Org.

A B-Org need not be a service organization.

See IRC § 414(m)(2)(B).

Performance of

Services

The principal business of an organization will be considered the performance

of services if capital is not a material income-producing factor for the

organization, even though the organization is not engaged in a field listed in

Proposed Treas. Reg. § 1.414-(m)-2(f)(2) .

Whether capital is a material income-producing factor must be determined by

reference to all the facts and circumstances of each case. In general, capital is

a material income-producing factor if a substantial portion of the gross

income of the business is attributable to the employment of capital in the

business as reflected, for example, by a substantial investment in inventories,

plant, machinery or other equipment.

Capital is a material income-producing factor for banks and similar

institutions.

Capital is not a material income-producing factor if the gross income of the

business consists principally of fees, commissions or other compensation for

personal services performed by an individual.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-43

Controlled and Affiliated Service Groups

Affiliated Service Group, Continued

Specific fields

Regardless of whether the above subparagraph applies, an organization

engaged in any one or more of the following fields is a service organization:

− Health,

− Law,

− Engineering,

− Architecture,

− Accounting,

− Actuarial science,

− Performing arts,

− Consulting, and

− Insurance.

An

organization

will not be

considered as

performing

services

An organization will not be considered as performing services merely

because:

• It is engaged in the manufacture or sale of equipment or supplies used

in the above fields,

• It is engaged in performing research or publishing in the above fields,

or

• An employee provides one of the enumerated services to the

organization or other employees of the organization, unless the

organization is also engaged in the performance of the same services

for third parties.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-44

Controlled and Affiliated Service Groups

Affiliated Service Group, Continued

Commissioner

may determine

other specific

fields

The Commissioner may determine that a specific business field, not

enumerated in the proposed regulations, is engaged in performing services.

In this case, the above list will be expanded, but only prospectively.

“Organization”

defined

The term "organization" includes a sole proprietorship, partnership,

corporation or any other type of entity, regardless of its ownership format.

A bona fide expense-sharing arrangement, in which the parties involved share

the cost of the office overhead but are not working in unison for common

business purposes, would not be considered an organization. These costs

would include rent, supplies, maintenance and employees' salaries.

Historically

Performed

Services will be considered of a type historically performed by employees in

a particular service field if it was not unusual for the services to be performed

by employees of organizations in that service field (in the United States) on

December 13, 1980.

Professional

Service

Corporations

All the employees of professional service corporations that are members of an

affiliated services group shall be aggregated together and treated as if they

were employed by a single employer for purposes of the employee benefit

requirements.

A professional service corporation:

− Is a corporation that is organized under state law for the principal purpose

of providing professional services,

− Has at least one shareholder who is licensed or otherwise legally

authorized to render the type of services for which the corporation is

organized, and

− Provides the services performed by certified or other public accountants,

actuaries, architects, attorneys, chiropodists, chiropractors, medical

doctors, dentists, professional engineers, optometrists, osteopaths,

podiatrists, psychologists and veterinarians. The Commissioner may

expand the list of services.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-45

Controlled and Affiliated Service Groups

Affiliated Service Group, Continued

Flowchart

Is the organization a

partner or shareholder

in the first service

organization?

Is this an organization,

the principal business

of which is performing

services?

Does it regularly

perform services for

the FSO?

Is capital NOT a

material income-

producing factor?

Is it

associated with the

FSO in performing

services for third

persons?

regularly

This organization

qualifies as a First

Service

Organization.

This organization is

NOTpartofan

Affiliated Service

Group.

This is an

Affiliated

Service Group.

YES

NO

NO

YES

YES

YES

YES

NO

NO

YES

NONO

A-Organization First Service Organization

(FSO)

Affiliated Service Group

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-46

Controlled and Affiliated Service Groups

Flowchart

Is a of

the business of the

organization the

performance of services for

the FSO or the

A-Organization?

significant portion

Is this an organization,

the principal business

of which is performing

services?

Are the services of a type

historically performed by

employees in the service

field of the FSO or the

A-Organization?

Is capital NOT a

material income-

producing factor?

Is ten percent or more of

the interest in the

organizations held, in the

aggregate, by persons

who are designated group

members of the FSO or

the A-Organization?

This organization

qualifies as a First

Service

Organization.

This organization is

NOT part of an

Affiliated Service

Group.

This is an

Affiliated

Service Group.

NO

NO YES

YES

YES

YES

NO

NO

YES

NONO

B-Organization First Service Organization

(FSO)

Affiliated Service Group

Chapter 7- Controlled and affiliated service groups

Page 7-47

Controlled and Affiliated Service Groups

Affiliated Service Group, Continued

Section 414(m)-

Example

Allen Averett, a doctor, is incorporated as Allen Averett, P.C. and this

professional corporation is a partner in the Butler Surgical Group. Allen

Averett and Allen Averett, P.C., are regularly associated with the Butler

Surgical Group in performing services for third parties.

The Butler Surgical Group is an FSO. Allen Averett, P.C. is an A-Org

because it is a partner in the medical group and is regularly associated with

the Butler Surgical Group to perform services for third parties.

Accordingly, Allen Averett, P.C. and the Butler Surgical Group would

constitute an affiliated service group.

As a result, the employees of Allen Averett, P.C. and the Butler Surgical

Group must be aggregated and treated as if they were employed by a single

employer per section 414(m).

First Service

Organization

and an A-Org-

Example

The Everett, Furman and Guilford Partnership is a law partnership with

offices in numerous cities. EFG of Capital City, P.C., is a corporation in

Capital City that is a partner in the law firm. EFG of Capital City, P.C.

provides paralegal and administrative services for the attorneys in the law

firm. All of the employees of the corporation work directly for the

corporation, and none of them work directly for any of the other offices of the

law firm.

The law firm is an FSO. The corporation is an A-Org because it is a partner

in the FSO and is regularly associated with the law firm in performing

services for third parties.

The corporation and the partnership would together constitute an affiliated

service group. Therefore, the employees of EFG of Capital City, P.C. and the

employees of The Everett, Furman and Guilford Partnership must be

aggregated and treated as if they were employed as a single employer per

section 414(m).

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-48

Controlled and Affiliated Service Groups

Affiliated Service Group, Continued

First Service

Organization

and a B-Org-

Example

Reinhardt & Associates is a financial services organization that has 11

partners. Each partner of Reinhardt owns one percent of the stock in Asbury

Corporation. Asbury provides services to the partnership of a type

historically performed by employees in the financial services field. A

significant portion of the business of Asbury consists of providing services to

Reinhardt.

Considering Reinhardt &Associates as an FSO, the Asbury Corporation is a

B-Org because:

1. A significant portion of its business is in the performance of services

for the partnership of a type historically performed by employees in

the financial services field. And,

2. More than 10% of the interests in the Asbury Corporation is held, in

the aggregate, by the highly-compensated employees of the FSO

(consisting of the 11 common owners of Reinhardt and Associates).

Accordingly, the Asbury Corporation & Reinhardt and Associates constitute

an affiliated service group. Therefore, the employees of the Asbury

Corporations and Reinhardt and Associates must be aggregated and treated as

if they were employed by a single employer per section 414(m).

Non Service

Organization-

Example

Dade Properties, Inc. sells land that it has purchased and developed.

Craig is a 25% shareholder of Dade and a 50% shareholder of Craig and Son

Construction Company, Inc. Dade Properties regularly engages the services

of Craig and Son. Although it appears that Dade Properties could be an FSO,

the affiliated service group rules do not apply because Dade Properties is not

a service organization.

Chapter 7- Controlled and affiliated service groups

Page 7-49

Controlled and Affiliated Service Groups

Affiliated Service Group: Performance of Service

Significant

Portion

Proposed Treas. Reg. § 1.414(m)-2(c)(2) specifies that whether providing

services (for the FSO, for one or more A-Org’s or for both,) is a "significant

portion" of the business of an organization will be based on the facts and

circumstances.

The following tests may be used to substantiate the facts and circumstances:

− Service Receipts Safe Harbor Test, and

− Total Receipts Threshold Test.

For additional information, see Proposed Treas. Reg. § 1.414(m)-(2)(c)(2).

Service Receipts

Safe Harbor

The performance of services for the FSO, for one or more A-Org’s, or for

both, will not be considered a significant portion of the business of an

organization if the "service receipts percentage" is less than five percent.

− The "service receipts percentage" is the ratio of:

1. Gross receipts of the organization derived from performing services

for the FSO, for one or more A-Org’s, or for both, to

2. Total gross receipts of the organization derived from performing

services.

− This ratio is the greater of:

1. the ratio for the year for which the determination is being made, or

2. the ratio for the three-year period including that year and the two

preceding years (or the period of the organization’s existence, if less).

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-50

Controlled and Affiliated Service Groups

Affiliated Service Group: Performance of Service, Continued

Total Receipts

Threshold Test

The performance of services for the FSO, for one or more organizations, or

for both, will be considered a significant portion of the business of an

organization if the "total receipts percentage" is ten percent or more.

The "total receipts percentage" is calculated in the same manner as the service

receipts percentage, except that gross receipts in the denominator are

determined without regard to whether they were derived from performing

services.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-51

Controlled and Affiliated Service Groups

Affiliated Service Group: Performance of Service, Continued

Service

receipts-

Example

The income of Cascade Corporation is derived from performing both services

and other business activities. The amount of its total receipts and its receipts

derived from performing services and its total receipts from Starr Corporation

and from all customers is provided below:

Origin of Income All Customers Starr Corp.

Year 1

Services $ 100 $ 4

Total $120

Year 2

Services 150 9

Total 180

Year 3

Services 200 42

Total 240

Service

Receipts

Percentage

In Year 2, the services receipts percentage is the greater of:

1. The ratio for that year ($9/$150, or 6%), or

2. For Years 1 and 2 combined ($13/$250, or 5.2 %).

= 6%

The total receipts percentage is the greater of:

1. The ratio for that year ($9/$180, or 5%), or

2. For Years 1 and 2 combined ($13/$300, or 4.3%).

= 5%

The services receipts percentage is greater than 5% and, therefore, the Service

Receipts safe harbor is not met.

The total receipts percentage is less than 10% and, therefore, the Total

Receipts threshold test is not met.

As a result, for Year 2, facts and circumstances is used to determine whether

performing services for Starr Corporation constitutes a significant portion of

the business of Cascade Corporation.

Chapter 7- Controlled and affiliated service groups

Page 7-52

Controlled and Affiliated Service Groups

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-53

Controlled and Affiliated Service Groups

Affiliated Service Group: Performance of Service, Continued

Total Receipts

Percentage

In Year 3, the services receipts percentage is the greater of:

1. the ratio for that year ($42/$200, or 21%), or

2. for Years 1, 2, and 3 combined ($55/$450, or 12.2%).

= 21%.

The total receipts percentage is the greater of:

1. the ratio for that year ($42/$240, or 17.5%), or

2. for Years 1, 2, and 3 combined ($55/$540, or 10.2%).

= 17.5%

Because the total receipts percentage is greater than 10% and the services

receipts percentage is not less than 5%, a significant portion of the business of

Cascade Corporation is considered to be the performances of services for

Starr Corporation.

For Year 3, therefore, the Cascade Corporation and the Starr Corporation are

part of an affiliated service group within the meaning of section 414(m), and the

employees of both corporations must be aggregated and treated as if they were

employed by a single employer.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-54

Controlled and Affiliated Service Groups

Affiliated Service Group: Performance of Service, Continued

Example-Total

Receipts,

Percentage Test

Marsha Mesa owns one-third of an employee benefits consulting firm,

Benefits by Marsha. Marsha also owns one-third of an insurance agency,

Mesa, Long and Toole Insurance Agency. A significant portion of the

business of Benefits by Marsha consists of assisting the Mesa, Long and

Toole Insurance Agency in developing employee benefit packages for sale to

third persons and providing services to the insurance company in connection

with employee benefit programs sold to other clients of the Mesa, Long and

Toole Insurance Agency.

Additionally, Benefits by Marsha frequently provides services to clients who

have purchased insurance arrangements from the Mesa, Long and Toole

Insurance Agency for the employee benefit plans they maintain. Mesa, Long

and Toole Insurance Agency frequently refer clients to Benefits by Marsha to

assist them in the design of their employee benefit plans. Twenty percent of

the total gross receipts of Benefits by Marsha represent gross receipts from

the performance of these services for the Mesa, Long and Toole Insurance

Agency.

Considering Mesa, Long and Toole Insurance Agency as a FSO, Benefits by

Marsha is a B-Org because:

− A significant portion of the business of Benefits by Marsha (as

determined under the total receipts percentage test) is the performance of

services for Mesa, Long and Toole Insurance Agency of a type

historically performed by employees in the service field of insurance, and

− More than 10% of the interests in Benefits by Marsha is held by owners

of the Mesa, Long and Toole Insurance Agency.

Thus, Mesa, Long and Toole Insurance Agency and Benefits by Marsha

constitute an affiliated service group, and the employees of both companies

must be aggregated and treated as if they were employed by a single

employer.

Continued on next page

Chapter 7- Controlled and affiliated service groups

Page 7-55

Controlled and Affiliated Service Groups

Affiliated Service Group: Performance of Service, Continued

Example-Gross

Receipts

Derived from

Performing

Services

Calvin Cameron is a 60% partner in Decatur, a service organization, and

regularly performs services for Decatur. Cameron is also an 80% partner in

Fleming Brothers. A significant portion of the gross receipts of Fleming

Brothers is derived from providing services to Decatur of a type historically

performed by employees in the service field of Decatur.

If Decatur is an FSO, then Fleming Brothers would be a B-Org because:

− A significant portion of gross receipts of Fleming Brothers is derived