Charged Up!

TLC’s Roadmap to Electrifying the

For-Hire Transportation Sector in New

York City

Taxi & Limousine Commission | Electrification Report 2022

32

Table of Contents

Executive Summary

6

Why Electrification?

8

State of the Industry

10

Letter from the Chair

4

Costs of Electrification

14

EV-Specific Savings

16

Existing Incentives for EVs

18

Recommendations

20

EV-Centric Regulations

36

Expand Types of EV in Use

36

FHV Licensure Pause & Impact of EV-Specific Licenses

38

Uber & Lyft’s Electrification Commitments

39

Electrification in Other Jurisdictions

40

Recommendations

42

Conclusion: Outreach Eorts & Electrification Commitments

44

Acknowledgments

46

Charger Coverage

28

Current State of DC Fast Charging in NYC

28

DC Fast Charging & Driver Residence

28

DC Fast Charging in High-Volume Trip Areas

30

DC Fast Charging at JFK & LaGuardia Airport

31

Criteria for Future Development of DC Fast Charging

32

Level 2 Charging

34

Recommendations

35

EV Supply Equipment (EVSE) Installation & Purchasing Cost

22

DC Fast Charging Station Costs

24

Level 2 Charging Station Costs

25

Recommendations

26

Taxi & Limousine Commission | Electrification Report 2022

54

Letter from the Chair

A

decade ago, imagining a fully electric TLC fleet seemed far out of reach. In early

2012, only 441 electric vehicles (EVs) were registered across the five boroughs, not

much more than one for every 19,000 residents. None of them were TLC-licensed

vehicles. Today, nearly 17,000 NYC-registered EVs traverse the city’s roads, and one

out of every hundred TLC vehicles is an EV. Now we can not only imagine a fully electric fleet,

we are already building it. This report is the beginning of a roadmap, with a goal nothing short

of electrifying the vast majority of TLC vehicles by the end of this decade.

Never has it been more important for our city and our nation to embrace EVs.

According to the most recent data from the National Oceanic and Atmospheric Administration,

October 2022 marked the 454th consecutive month with global temperatures above the

20th-century average. Greenhouse gas emissions are at an all-time high. Data from the United

Nations and the World Meteorological Organization indicate that climate and weather-related

disasters have increased five-fold over the last 50 years. Unless we reduce carbon emissions

quickly and decisively, we and our children face a world of constant, catastrophic natural

events with all the destabilizing social repercussions. If there is any world we don’t want to

imagine, that’s up there at the top.

Creating a better world starts with imagining it, then bravely taking concrete,

perseverant steps forward. At TLC, the future we are imagining and moving towards is exciting

and real: one in which the world has come together to not only reverse humanity’s eect

on global warming, but one where this agency has directly contributed to a more livable

and enjoyable city. When you step out to hail a cab or a for-hire vehicle in 2030, the air you

breathe will have the lowest levels of air pollution in the city’s recorded history. The streets

will also be cleaner, safer, and quieter.

That future is latent in our past too. You’ll learn later in this report that the first EV in NYC

was actually a taxi. I find incredible inspiration in that. The solution was there 125 years ago,

waiting for us! We are embracing it with determination, optimism, and a firm vision.

David Do, Chair

New York City Taxi and Limousine Commission

“Creating a better

world starts with

imagining it, then

bravely taking

concrete, perseverant

steps forward.”

Taxi & Limousine Commission | Electrification Report 2022

76

Charging Coverage

Currently, there are limited publicly accessible fast charging stations near areas with high trip volumes,

including in neighborhoods adjacent to the Manhattan core and at or near the city’s airports. The

neighborhoods where most owner-drivers live are also underserved by Level 2 chargers. This includes

Eastern Queens, Southeast Brooklyn, and the Bronx. Drivers who live in New York City are less

likely to have access to at-home charging, underscoring the importance of Level 2 chargers in these

neighborhoods.

EV-Centric Regulations

As a regulatory agency, TLC can create a favorable environment for EV adoption and broaden its rules

to accommodate more EV models. This includes issuing new licenses for EVs to facilitate EV growth.**

Other jurisdictions have already implemented GHG reduction standards for the for-hire industry that

could serve as a model for New York City.

Targeted outreach and engagement are also important in supporting TLC licensees to navigate the

dynamic EV market. Many TLC-licensed drivers remain apprehensive about electrification despite data

showing no substantial dierence in trips and earnings between EVs and ICE vehicles operating for

hire in New York City.

Charged Up! envisions TLC’s electrification as a collaborative eort, with its analysis informed by

engagement with industry stakeholders and partner agencies, including the City Department of

Transportation (DOT) and Department of Citywide Administrative Services (DCAS), Con Edison, New

York Power Authority (NYPA), and the U.S. Department of Energy’s Clean Cities Coalition, Empire

Clean Cities (ECC). Implementing the recommendations in this plan will require TLC to continue close

coordination with other organizations and industry members so that we can work towards a clean for-

hire transportation sector powered by electric vehicles.

To support electrification through regulations that target EVs, TLC recommends exploring

GHG emission reduction standards for high-volume for-hire service companies (HVFHS),

*

adding limited numbers of all-electric vehicle licenses and expanding approved EV taxi

models.

* High-volume for-hire service is a license category for TLC-licensed FHV bases that dispatch more than 10,000 trips per day. Currently, Uber

and Lyft are in this category.

** In 2018, TLC paused the issuance of new for-hire vehicle licenses with an exemption for wheelchair accessible vehicles and for drivers in

lease-to-own agreements. In October 2022, TLC lifted the for-hire vehicle license pause to allow 1,000 new licenses for EVs.

Executive Summary

The New York City Taxi & Limousine Commission (TLC) is committed to transitioning the vast majority

of its licensed fleet to electric vehicles (EVs) by 2030 as part of global and local eorts to address

climate change and improve air quality.

*

Charged Up! is TLC’s roadmap to support this movement,

outlining ways to support TLC’s EV drivers, incentivize more EVs, and support the for-hire industry’s

charging needs.

According to TLC estimates, TLC-licensed vehicles produced around 600,000 tons of CO2 in Fiscal

Year 2022 while on-shift, representing roughly 4% of total emissions for New York City’s transportation

sector. EV adoption by TLC-licensed industries would have a profound impact on reducing New York

City’s greenhouse gas (GHG) emissions.

New York City’s for-hire transportation landscape presents distinct challenges to electrification,

with high daily mileage driven due to high trip volumes, drivers living in the outer boroughs and in

environmental justice communities, as well as the various charging needs of industry stakeholders.

Given these considerations, the report identifies policy levers and formulates the following

recommendations to address three major barriers that currently impede the expansion of for-hire EVs:

Cost

The upfront cost of an EV is a challenge for some TLC licensees due to fewer available models than

internal combustion engine (ICE) vehicles and a limited used vehicle market. However, ICE to EV

price parity may come within the next 2-6 years, and EVs oer lower maintenance costs, reduce fuel

expenses, and have access to financial incentives. The cost of installing EV charging equipment is

also a barrier for businesses and owner-drivers despite existing incentives such as the Con Edison

PowerReady program.

**

* The TLC intends to electrify the entirety of the high-volume sector, which represents approx. 80% of its current fleet, along with a significant

portion of its taxi fleet by 2030.

** Owner-drivers are defined as TLC-licensed drivers who own and operate their own for-hire vehicles regardless of vehicle license type.

TLC recommends exploring more robust financial incentives targeting the for-

hire transportation sector, including tax deductions, grants and an EV driver pay

standard. To address electric vehicle supply equipment (EVSE) construction costs,

TLC recommends pursuing federal EVSE grants, exploring mechanisms to fund EVSE

construction and the creation of a Charging Accelerator program that streamlines the

process for TLC-licensees seeking to install charging equipment such as assisting with

grant application, securing permits and providing technical assistance.

To provide TLC licensees with charging coverage reflective of industry needs, TLC

recommends developing partnerships with key stakeholders and advocating for

strategic placement of charging stations that minimize interruption to drivers’ business

hours.

Taxi & Limousine Commission | Electrification Report 2022

98

Before the advent of gasoline-powered vehicles, electric taxis were the norm in New York City.

*

Over

a century later, TLC is committed to transitioning the vast majority of its licensed fleet to EVs by 2030.

Electrification of the for-hire transportation sector reduces GHG emissions and curbs the impacts of

climate change. In fiscal year 2022, TLC-licensed vehicles conducted approximately 250,700,000 trips

that transported passengers across New York City and beyond.

**

Of these trips, ICE vehicles produced

at least 600,000 metric tons of carbon dioxide, which represents about 3.75% of the total emissions

of New York City’s transportation sector.

***

The transportation sector as a whole represents nearly 30%

of New York City’s total emissions.

****

Due to their substantial road time and mileage, it is estimated

that the emissions reduction impacts of electrifying one rideshare vehicle is akin to electrifying three

personal vehicles.

*****

At such magnitude, widespread adoption to EVs from the for-hire transportation

sector will greatly reduce GHG emissions and improve air quality for New Yorkers.

******

* “The Electric Taxi Company You Could Have Called in 1900”, Madrigal A.

** Calculation includes the taxi, street hail livery (green cab), and for-hire vehicle sectors.

*** Total emissions for the New York City transportation sector were calculated based on a study from the Citizen’s Budget Commission: TLC

GHG emissions were calculated for all taxi, HVFHV and street-hail liveries by linking driver trip data to each vehicle’s CO2 emissions based

on vehicle type and MPG. Only emissions from trips conducted within NYC and while drivers were on-shift were accounted for.

**** See: “Curbside Level 2 Charging Project FAQ”, NYC DOT

***** “Emissions Benefits of Electric Vehicles in Uber and Lyft Services”, Jenn A.

****** Studies estimate that trac pollution from ICE vehicles is responsible for 17% of emissions of fine particulate matter (PM2.5) in New York

City, the leading urban air pollutant.

TLC’s electrification goals align with a host of legislation and initiatives at the local, state, and federal

levels aimed at reducing greenhouse gas emissions. At the state and city level, various plans and laws

have been put forth, including “OneNYC 2050” plan published pursuant to Local Law 84 of 2013, and

the New York State Community Leadership and Climate Protection Act.

*

In addition, in September of

2022, Governor Kathy Hochul announced that all new vehicles sold in New York State will need to be

zero-emission by 2035.

**

For TLC-licensed drivers, shifting to an EV brings long term financial benefits. The recent spike

in gas prices increased driver expenses, reducing their take-home pay. Furthermore, as the auto

industry increases production of EVs complemented by regulatory policies curbing the presence of

ICE vehicles on the road, it is likely that a robust used EV market will develop, providing drivers with

aordable vehicle options. The abundance of fiscal incentives combined with the anticipated growth

of the used EV market creates an opportune time for EV adoption.

* The New York State Climate Leadership and Community Protection Act (CLCPA) has an overarching goal for NYS to reduce GHG emissions

by 85% by 2040. New York City has also committed to reducing greenhouse gas emissions by 80 percent by 2050, reflected in Local Law 66

of 2014 and various sustainability plans, including New York City’s Roadmap to 80 x 50.

** https://www.governor.ny.gov/news/governor-hochul-drives-forward-new-yorks-transition-clean-transportation

Why Electrification?

TAXI

“...it is estimated that the

emissions reduction impacts

of electrifying one rideshare

vehicle is akin to electrifying

three personal vehicles.”

Taxi & Limousine Commission | Electrification Report 2022

1110

State of the Industry

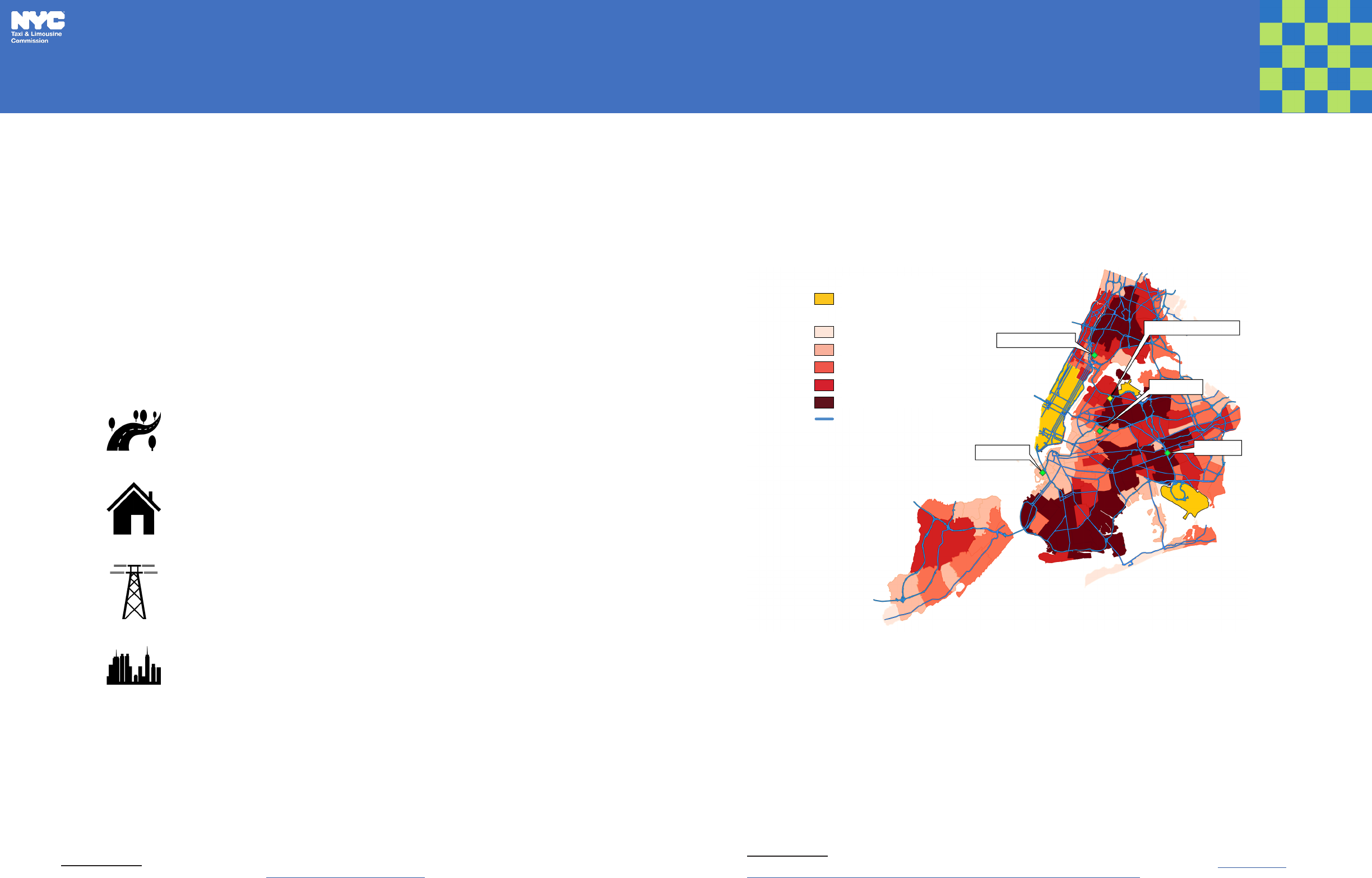

Source: Data on driver residence is based on TLC data and EJ map is based on

environmental justice area census tract designation

Figure 1: Environmental Justice Communities and Top TLC-Licensed Driver Residence by

Zip Code

A majority of TLC-licensed drivers are

immigrants and reside in environmental

justice (EJ) communities, areas in the city

where the impacts of climate change and

other environmental challenges disproportionally

impact the community relative to the city as a

whole.

*

These communities typically have

lower income and fewer resources to protect

themselves from the harmful impacts of climate

change.

* An Environmental Justice Area (EJ Area) ais a low-income community located in the city or a minority community located in the city. The

thresholds for determining low-income and minority communities were set in local law 64 of 2017 and based on US Census data.

Top TLC-Licensed Driver Residence by Zip Code

Not EJ Area

Potential EJ Area

EJ Area

Taxi & Limousine Commission | Electrification Report 2022

1312

35

40

45

50

55

60

65

70

Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22

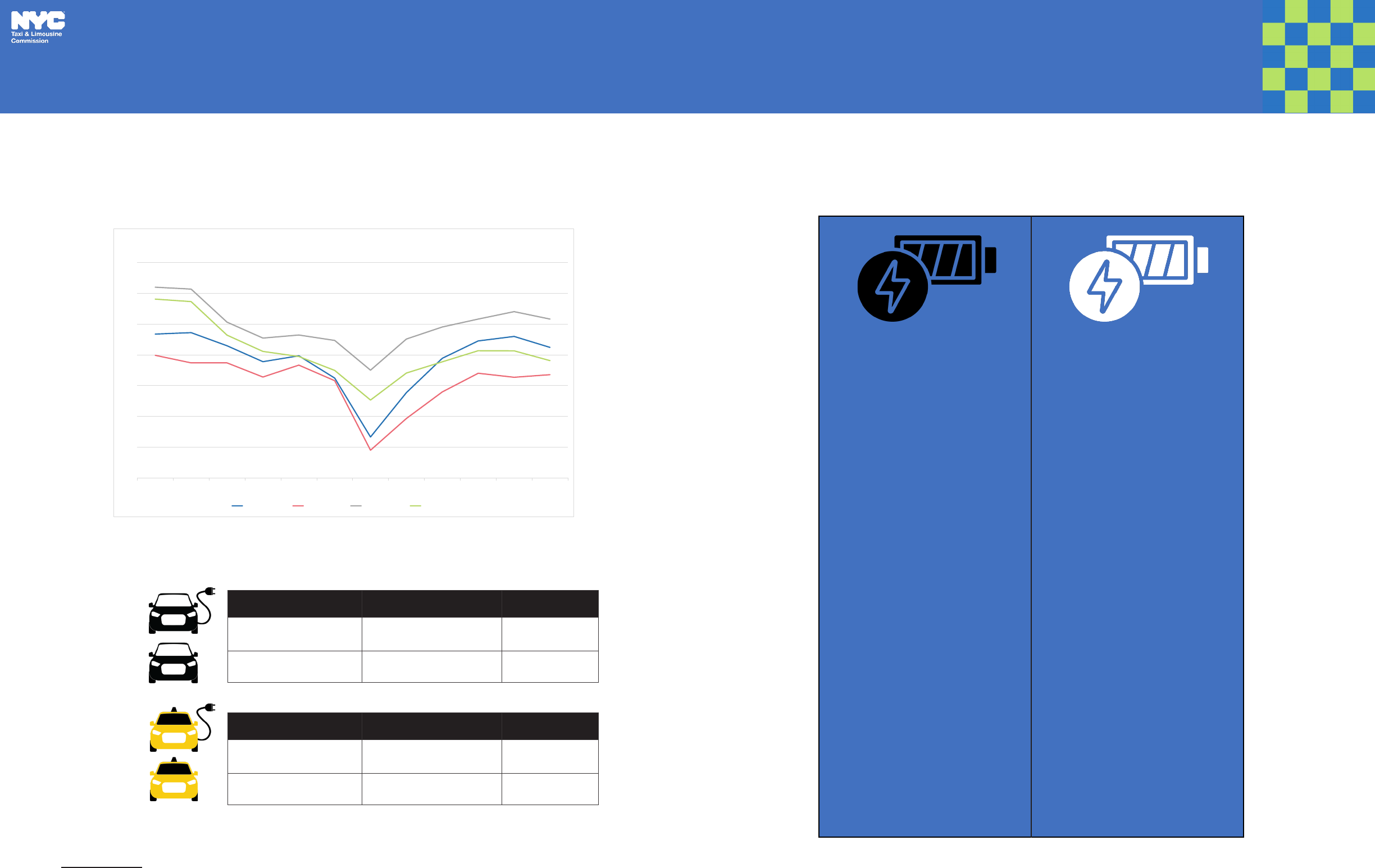

Average Daily Mileage ICE and EVs

ICE FHV EV FHV ICE Taxi EV Taxi

Source: TLC Data

Source: TLC Data

Average Trip Length Average Trip Duration Average Fare

EV: 5.6 miles EV: 20 minutes EV: $27.05

ICE: 5.4 miles ICE: 19 minutes ICE: $27.05

EV FHVs

ICE FHVs

EV Taxis

ICE Taxis

Average Trip Length Average Trip Duration Average Fare

EV: 3.9 miles EV: 15 minutes EV: $15.62

ICE: 4.2 miles ICE: 16 minutes ICE: $16.56

TLC-licensed EVs currently operate similarly to TLC-licensed ICE vehicles. Additionally, TLC-licensed

EV drivers earn similar wages, drive similar mileage, and have mostly similar trip lengths as their ICE-

driving counterparts (Figure 2 and 3).

*

This applies to both taxis and for-hire vehicles (FHVs).

Figure 2: Comparison of ICE Vehicles and EVs by Average Daily Mileage Driven

Figure 3: ICE Vehicles and EV Comparisons by Industry

* Analysis is based on trip data from July 2021 to June 2022.

Understanding EV Charging Time and Uses:

• 100 to over 200 miles

of battery range gained

from 30 minutes of

charging.

• Energy outputs vary

but DCFC technology

is improving and will

allow for vehicles to

charge even faster.

• DCFC allows for

charging directly

before or after the

shift and even during,

without drastically

changing operations.

• DCFC is best installed

in o-street parking

facilities.

• DCFC requires

substantial electrical

grid capacity and costs

substantially more than

L2 charging.

• 25 miles of battery

range gained from

1 hour of charging

assuming 6.6 kW

charging power.

• A full-time TLC driver

needs to charge at

least 6 hours per Level

2 use to gain 150 miles.

• L2 is a good option for

o-shift charging.

• L2 charging equipment

is installable on

curbsides, commercial

sites, and residential

buildings.

DC Fast Charging

(DCFC)

Level 2 (L2)

Taxi & Limousine Commission | Electrification Report 2022

1514

Costs of Electrification

EVs are more expensive than comparable ICE vehicles due to limited vehicle model availability and

the absence of a robust used EV market. A closer look at the manufacturer suggested retail prices

(MSRPs) of TLC-licensed vehicles shows an average price dierence of $6,000 - $8,000 between EVs

and ICE vehicles (Figure 4).

Figure 4: ICE and EV Price Dierential

*

* Analysis is based on TLC-licensed vehicles and referencing their MSRPs on Kelley Blue Book’s website.

ICE Sedans

Average

MSRP:

$39,439

ICE SUVs

Average

MSRP:

$41,739

EV

Average

MSRP:

$47,683

$8,244 price

dierential

EV

Average

MSRP:

$47,683

$5,944 price

dierential

2024 2025 2026 2027 2028

Car

Crossover

SUV

150

mile

200

mile

250

mile

150

mile

200

mile

250

mile

150

mile

200

mile

250

mile

For TLC drivers who drive full-time, a long battery range is a critical point of consideration as it

minimizes charging needs. Based on research conducted by the International Council on Clean

Transportation, longer range vehicles will reach price parity with their ICE counterparts around 2028

(Figure 5).

Figure 5. Price Parity Timeline for EVs Based on Vehicle Type and Range

*

* The graphic was created from report by the International Council on Clean Transportation. Representative models for cars are Ford Fusion,

Honda Accord, Nissan Altima; for crossovers, Ford Escape, Honda CR-V, Toyota RAV4; and for SUVs, Ford Explorer, Honda Pilot, and Toyota

Highlander.

Taxi & Limousine Commission | Electrification Report 2022

1716

EV-Specific Savings

Maintenance

Although EVs are currently more expensive to

acquire, maintenance expenses and fuel costs

are lower compared to ICE vehicles because

EVs do not pay for routine expenses like oil

changes and annual emissions tests. According

to a June 2021 study from the Oce of Energy

Eciency & Renewable Energy, EVs have a

Total Scheduled Maintenance Cost per mile

of $0.061 compared to $0.101 for ICE vehicles,

amounting to a 40% reduction (Figure 6).”*

Fueling

“Maintenance

expenses and fuel

costs are lower

compared to ICE

vehicles.”

Figure 6. Comparison of Total Scheduled Maintenance Cost per Vehicle Type

ICE

Cost per

mile: $0.101

$5,050

per 50,000

miles

$3,050

per 50,000

miles

ICE = Internal Combustion Engine

EV = Electric Vehicle

EVs

Cost per

mile: $0.061

EV fueling costs vary widely depending on charging equipment used (Level 1, 2 or DC fast charging),

location, time-of-use, utility rate, and energy consumption.

For FHVs and taxis, a DC fast charger’s speedy charging time minimizes interruption to a driver’s

operating hours. In New York City, the average price of DC fast charging is currently $0.39/kWh,

which amounts to around $18 per charge.

*

*

The cost of Level 2 charging is cheaper relative to DC fast

charging. In partnership with Con Ed, New York City’s Department of Transportation (DOT) currently

operates Level 2 chargers at curbside and municipal garage locations where drivers pay $2.50

per hour between 6 a.m. and 9 p.m. and $1 per hour for overnight charging. With Level 2 charging

sessions usually lasting between 4-6 hours, typical cost per charge can go from $4 to $15 depending

on length and time of day.

**

*

* “Battery Electric Vehicles Have Lower Scheduled Maintenance Costs than Other Light-Duty Vehicles”

** Cost per charge is measured under the assumption that a driver typically charges their battery from 20% to 80% each session. DC fast

charging costs are based on public information reported by the following service providers in New York City: New York City Department of

Transportation, Revel, EvGo, Electrify American, Blink Charging, and AeroVironment.

*** https://www1.nyc.gov/html/dot/downloads/pdf/curbside-level-2-charging-pilot-faq.pdf. Note that o-street Level 2 charging is cheaper than

curbside.

Using the following set of assumptions, a full-time TLC driver is projected to pay approximately $3,430

in EV charging costs annually:

If the same set of assumptions is applied to an ICE vehicle with 30 MPG and the current gas price

of $4.00 per gallon

*

, fuel cost is estimated to be $4,700 annually, a 37% dierence (Figure 7). The

projected fuel cost dierence is likely to be much greater than 37% when accounting for incentives

such as Con Edison’s SmartCharge program and the 15% discount for TLC-drivers at publicly

accessible city-owned charging stations.

**

Furthermore, a 2020 Consumer Reports examined the nine most popular EVs on the market and

compared their long-term costs to the most popular ICE vehicles. The examination found that over the

course of a vehicle’s life, when accounting for repair and maintenance costs, fuel costs, and federal

incentives, EVs can oer savings of $6,000 to $10,000.

***

Figure 7. Annual Fuel Expenses Between ICE and EV

* $4.00 is the average weekly gas price in New York City from January 2022 to mid-October 2022 according to data from the U.S. Energy

Information Administration

** SmartCharge New York

*** “Electric Vehicle Ownership Costs: Today’s Electric Vehicles Oer Big Savings for Consumers,” Harto

**** Note that each Level 2 use warrants about 6 hours of charging time to gain 150 miles.

***** Certain parking garages in New York City charge additional parking fee in addition to using their charging plugs.

Average Annual

Fuel Cost $4,700

Average Annual

Charging Cost

(70% DCFC/30% L2)

$3,430

Drives

35,000 miles

a year.

Uses DC fast

charging for

70% of annual

charging needs

and Level 2

charging for

the remainder

(30%).****

Has a car with

approximately

253 miles in

range with an

eciency rate

of 31 kWh per

100 miles.

Pays an

average utility

price of $0.39/

kWh for DC fast

charging.

Pays $1/hour for

overnight Level

2 charging.

Does not pay

an additional

parking fee.*****

Taxi & Limousine Commission | Electrification Report 2022

1918

Existing Incentives for EVs

Various incentives are available to help oset some costs associated with purchasing and operating

an EV. For TLC-licensed drivers living in New York City, these include vehicle acquisition, reduced

tolling, and charging incentives (Figure 8).

Figure 8: Current EV Incentives

Note that New York State currently has a tax credit for electric wheelchair accessible vehicles (WAVs).

However, as discussed in more detail below, there are currently no WAV EVs available in the U.S.

*

The newly signed Inflation Reduction Act of 2022 makes significant expansions and revisions to the

federal tax credit for purchasing EVs. The following provisions significantly impact TLC-licensed drivers

and the for-hire sector at large:

* New York State Tax Law Section 606.

** At the time of writing this report, 87% of TLC-licensed EVs are makes and models that are eligible for this credit. The Tesla Model S and X

are not eligible because their MSRPs are over $80,000.

Federal

Clean Vehicle Credit

Inflation Reduction

Act of 2022

$7,500

NY State

Drive Clean Rebate

Rebate is available

for new EV purchase

or lease

$2,000

High-Volume

For-Hire Services

Uber and Lyft oer

EV-related incentives

for EV rental,

charging and more.

ConEdison

SmartCharge NY

Cash incentives for

charging at o-peak

times (12pm-8am)

No Cash Limit

Port Authority

Green Pass Program

Discount on bridges

and tunnels in NYC

(o-peak hours)

30% o

NYS Thruway

Green Discount Plan

Discounts on NYS

Thruway tolls

10% o

Used EVs are now eligible for a tax credit, up to $4,000 or 30% of the

purchase price, whichever is less.

The credit cannot be used for a sedan priced over $55,000, or a van, SUV,

or pickup truck priced over $80,000.**

The credit is now transferable to a car dealer, at point of sale, and buyers

do not have to claim it on their tax return.

Current federal tax incentives provide credits to individuals purchasing

certain EVs whose manufacturers have not yet sold 200,000 models and

begin phasing out the tax credit after that threshold. Starting in 2023, the

200,000-vehicle cap will be lifted, and eligibility will be restored for large

manufacturers that were otherwise ineligible (Tesla, GM, Toyota, etc.).

To receive the full amount of the credit, final assembly of the EV must be

done in North America.

Taxi & Limousine Commission | Electrification Report 2022

2120

Recommendations

To address the higher upfront EV costs and build upon existing incentives for EV purchasing, TLC

recommends the following:

Work with state and federal partners to advocate for robust

financial incentives aimed at for-hire transportation sector

drivers and owners, including through tax deductions,

rebates, and discounts.

Explore the development of a grant program for owner-

drivers that would provide financial assistance for the

purchase of EVs, which could be funded through a

surcharge on trips or from direct financial assistance from

the federal, state, or city government.

Work closely with Empire Clean Cities (ECC) and other key

partners to host events that educate drivers and licensees

on electrification and provide drivers the opportunity to

get behind the wheel and pump of EVs and EV supply

equipment (EVSE).

Support EV adoption with targeted outreach to owners and

other industry members. This could include information on

grant and subsidy opportunities, connecting emerging EV

start-ups with industry leaders, and facilitating opportunities

for partnership between for-hire and taxi businesses and

electrification research and technology firms.

Assess driver pay for EV drivers to ensure there is

adequate compensation for charging time, recognizing

that EV charging takes significantly longer than fueling ICE

vehicles.

Work with Port Authority to explore priority treatment of EVs

at airports.

1

2

3

4

5

6

Taxi & Limousine Commission | Electrification Report 2022

2322

A dilemma in the current EV market is the tension between drivers’ concern for lack of charging

availability and developers’ apprehension to build charging infrastructure without a strong market

demand. Like the cost of EVs, the installation of EVSEs can also be prohibitively expensive.

DC fast charging and Level 2 charging are both useful for vehicle owners, each serving a distinct

purpose depending on charging needs. Within the for-hire transportation sector, the construction of

DC fast charging stations will be most relevant to bases and garages whose fleet size and vehicle

usage warrant faster charging speed and a need for powerful electrical grid.

On the other hand, the development of Level 2 chargers will be most relevant for owner-drivers with

access to private parking as they can use these chargers during o-shift hours.

In New York State, several incentives exist for building charging infrastructure (Table 1).

Table 1: Current EVSE Funding Programs

Program Support Granted Qualifying Entities

Alternative Fuels and EV

Recharging property credit

*

Credit of 50% of installation

costs; maximum credit of

$5,000

Entities who install EV charging

stations

Department of Environmental

Conservation ZEV

Infrastructure Grant

**

Maximum of $250,000

per location & $500,000

per municipality to cover

equipment, site preparation

and other costs

Municipal entities

Con Edison PowerReady

program

***

Between 50%-100% of L2

and DCFC installation costs

covered

Public or private entities

installing EV charging stations

National Electric Vehicle

Infrastructure (NEVI) program

****

$175M over 5 years for

charging stations along

designated highway corridors

in NY State

Federal funding awarded to

NYS DOT

* “Alternative Fuels and Electric Vehicle Recharging Property Credit,” New York State Department of Taxation and Finance

** “2022 Zero-emission Vehicle Infrastructure Grants for Municipalities,” New York State Department of Environmental Conservation

*** PowerReady Electric Vehicle Program, ConEd

**** National Electric Vehicle Infrastructure (NEVI) Program, New York State Energy Research and Development Authority

For entities such as fleet operators seeking to install EV charging stations at their businesses or

owner-drivers seeking to install chargers at their homes, the most comprehensive and relevant

incentive is the PowerReady program, especially given that the vast majority of New York City is

considered a Disadvantaged Community (DAC) according to Con Edison (Figure 9).

*

Figure 9: Portion of Costs covered by PowerReady Program

**

* https://www.coned.com/en/about-us/media-center/news/20210629/electric-vehicle-charging-superhub-opens-in-brooklyn-with-support-of-con-

edison-incentives; For a visualization of DAC in NY State, see ’EV Charging Capacity’ in the Con Edison Hosting Capacity Web Application

** Note that only certain components of EVSE construction costs are eligible under the PowerReady program. Costs related to the EV

charger itself, which can include maintenance, station installation or the station purchasing cost are not eligible. Eligible costs include, among

other things, any grid updates to the utility transformer (handled by the utility) outside of the property line.

Private access or

propietary L2 or DCFC

50%

Up to

L2 at Multi-Unit Dwellings

and Public non-propietary

DCFC in a disadvantaged

community (DAC)*

100%

Up to

Public non-propietary

L2 and DCFC

90%

Up to

EV Supply Equipment (EVSE)

Installation & Purchasing Cost

Taxi & Limousine Commission | Electrification Report 2022

2524

Given the PowerReady program’s criteria and much of New York City’s DAC classification, a TLC-

aliated entity seeking to install a publicly accessible DC fast charger would need to cover the cost

of the purchase and setup of the EV charger, as well as any customer and utility side infrastructure

upgrade costs not covered by the PowerReady program.

*

A portion of the installation required to

handle the additional load generated by an EV charger, such as upgrades to the panel or permitting

costs, would be covered by PowerReady. DC fast charger station costs can vary widely depending

on the model – for example, a mid-range ChargePoint model costs $52,000.

**

Estimates of DC

fast charger hardware costs range from $28,401 for a networked 50kW charger to $140,000 for a

networked 350kW charger.

***

While the cost of installing a DC fast charger is steep, fleet electrification can provide savings when

compared to relying on fossil fuels. Con Edison’s fleet savings calculator gives some insight into

potential fuel savings (Figure 10).

Figure 10: Potential EV Fleet Savings

****

The savings that electrification can bring to fleet owners who choose to install DC fast chargers merit

consideration when thinking about the cost of charging station construction. Although fuel costs are

currently typically borne by drivers, and not fleet owners, fuel savings from electrification could benefit

both parties in the long term.

* Charger installation costs vary widely, but generally range between $50,000 and $100,000. While PowerReady funding for DACs is currently

exhausted, it is expected that more funding for projects that meet this criteria will become available in the future.

** ChargePoint Express 250 CPE250, Smart Charge America

*** “Estimating Electric Vehicle Charging Infrastructure Costs Across Major U.S. Metropolitan Areas,” Nicolas M. Due to recent increases in the

costs of metals and items necessary to build DC fast chargers, charger costs can be volatile.

**** The savings estimates are calculated for a 10x Passenger Sedan fleet, with an average mileage of 96 miles a day (the average mileage for

a TLC-licensed vehicle) and assumes a gasoline price of $4.00 per gallon and 24/7 fast charger availability for the fleet-specific chargers.

For the purchase and installation of Level 2 charging stations, the cost considerations are somewhat

dierent. Among TLC’s licensees, the owner-driver population will be able to make the greatest use of

these chargers. They can benefit from the following incentives:

In terms of station costs, Level 2 chargers are less expensive than DC fast chargers, but prices can

vary widely depending on certain factors:

DC Fast Charging Station Costs Level 2 Charging Station Costs

For Level 2 chargers built in multi-unit dwellings that are within DAC,

the PowerReady program will cover up to 100% of eligible costs. For

publicly accessible plugs, the PowerReady program will cover up to

90% of eligible costs.

For individual owner-drivers seeking to install private L2 chargers

at their residence, the PowerReady program will cover up to 50% of

eligible costs.

Depending on the model purchased, a Level 2 charging station

typically costs between $1,000 and $4,000 per port.

Depending on what upgrades may be needed to an electrical panel,

installation costs can go from $2,000 to $10,000.

*

* Installing a Charging Station, NYSERDA

Hardware Cost

Installation Cost

Electric Fleet

Fossil Fuel Fleet

Annual fossil

fuel cost:

$57,831

Annual

fuel savings:

$43,228

Annual

maintenance

savings:

$52,976

Annual

electricity

cost:

$14,603

Annual

maintenance

cost:

$160,501

Annual

maintenance

cost:

$107,525

Taxi & Limousine Commission | Electrification Report 2022

2726

Recommendations

To address the high upfront cost of charging station hardware and allow entities seeking to install

chargers to make use of existing incentives for charging stations, TLC recommends the following:

Create a Charging Accelerator program that streamlines

the charging installation process for TLC licensees seeking

to install charging equipment, including assistance with

grant application, securing a charging permit, and providing

technical assistance to fleet garages and owner-drivers.

Explore the development of a surcharge on trips to fund the

construction of charging infrastructure and EVSE.

Conduct an in-depth scan of federal, state, and NGO

grant programs to fund research and entrepreneurial

opportunities for charging infrastructure. TLC will coordinate

with DOT, DCAS, ECC and the Mayor’s Oce for support

and collaboration in applying for these programs.

1

2

3

Taxi & Limousine Commission | Electrification Report 2022

2928

Charger Coverage

Given the high mileage TLC-licensed drivers travel each day, strategic placement of a robust DC fast

charging and Level 2 charging network is critical in supporting EV drivers.

Figure 11. Current State of DC Fast Charging in New York City

Even though DC fast

charging is currently

concentrated

in the outer

boroughs, there is

a gap between the

existing charging

infrastructure and

drivers’ charging

needs.

DC Fast Charging & Driver Residence

Figure 12: TLC-Licensed Driver Residence and DC Fast Charging Stations

Driver Residence by Zip Code and DCFC Stations

Many TLC-licensed drivers who operate EVs

charge their vehicles directly before or after

their trips. To make charging easier for drivers,

installing DC fast chargers in areas of driver

residence could help drivers fuel up more

seamlessly. The current DC fast charging

network does not align well with driver

residence as they are often in areas with a low

density of driver population. Notably, DC fast

charging stations are missing in the Bronx and

south Brooklyn, and Eastern Queens, all of

which are areas with a high concentration of

drivers. City agencies such as the DOT and

DCAS are moving ahead with plans to build a

more equitable charging network by situating

more DC fast charging in the outer boroughs.

*

* “Electrifying New York”, NYC DOT

Source: TLC Data

and Alternative

Fuels Data Center

(AFDC), U.S.

Department of

Energy

Current State of DC Fast Charging in NYC

Revel

Charging

Site

JFK has

20 DCFC

plugs.

Many

taxi &

FHV trips

start &

end at

JFK

There is

currently no

DCFC at

LaGuardia

DCFC Coverage

• 169 DCFC plugs,

majority are Tesla

SuperChargers

• Largest Station: Revel

Brooklyn, 25 chargers

• 70% of plugs in

Brooklyn and Queens

• 57% of plugs are

exclusively for Tesla

vehicles

• 9 stations have at least

10 plugs

• DC fast charging is vital in all parts of New York City because of their quick charging time, including

in areas of high trip volumes, residential neighborhoods where TLC drivers live, and near

major highways. Drivers can use DC fast chargers before, during, or after their shift.

• Level 2 chargers are more meaningful when placed in neighborhoods where drivers live and at

fleet facilities to allow for overnight charging.

1 - 85

85 - 329

329 - 701

701 - 1203

1203 - 4739

NYC DOT Public DCFC Stations*

Source: Alternative Fuels Data Center (AFDC), U.S. Department of Energy

*

* TLC-licensed drivers are eligible for a 15% discount at NYC DOT Public DCFC Stations.

Number of driver residences by zip code

Taxi & Limousine Commission | Electrification Report 2022

3130

DC Fast Charging in High-Volume Trip

Areas

DC Fast Charging at JFK & LaGuardia

Airport

Figure 13: TLC Drop-O Count by Taxi Zones and DC Fast

Charging Stations

Source: TLC Data and Alternative Fuels Data Center (AFDC), U.S. Department of Energy

Source: Alternative Fuels Data Center (AFDC), U.S. Department of Energy

JFK and LaGuardia Airport are two locations where TLC drivers conduct consistent and frequent trips.

Since the pandemic, airport trips by the FHV sector and the taxi industry have steadily increased as

travel demand has picked up. In the first half of 2022, JFK and LaGuardia had a combined monthly

average of 291,347 pickups and 334,408 drop-os per airport.

Currently, TLC EV drivers heavily utilize DC fast charging at JFK. Due to the nature of the for-hire

industry, drivers are unlikely to station at the airport for several hours using a Level 2 charger, making

DC fast charging more suitable at airports. While there are two DC fast charging stations with 22 plugs

at JFK, LaGuardia has not yet opened a DC fast charging station. DC fast charging at LaGuardia is

a priority given that for-hire trip numbers for LaGuardia and JFK are similar, especially among FHVs,

despite JFK handling roughly twice as many passengers as LaGuardia annually.

*

Port Authority has committed to new airport development including closely working with NYPA to

expand charging at both New York City airports.

**

Table 2: Current Charging Plug Counts by Airport

* https://www.panynj.gov/airports/en/statistics-general-info.html

** “Clean Air - Environmental Initiatives: Port Authority of New York and New Jersey”

Airport Level 2 Plugs DC Fast Charging Plugs

LaGuardia 9 0

JFK 10 24

Certain areas of New York City

are considered high trip volume

areas where drivers make

frequent pickups and drop-

os. This includes the central

business district in Manhattan

and the two airports in Queens.

These are opportunity zones

for a robust charging network

to support drivers during their

shifts and mitigate range anxiety.

Currently, DC fast chargers are

not eciently distributed in areas

where drivers make frequent

stops. In Midtown Manhattan,

only two DC fast charging

stations are available to support

a heavy concentration of for-hire

trips.

DC Fast Charging Locations

Drop-O Count

1 - 197,391

197,391 - 445,661

445,661 - 777,092

777,092 - 1,585,155

1,585,155 - 4,519,624

Taxi & Limousine Commission | Electrification Report 2022

3332

Currently, TLC’s Woodside Inspection Facility meets these criteria and is the potential site for a publicly

accessible fast charging station built with TLC-licensed drivers in mind. Based on the three elements

mentioned above, this report has identified additional examples of areas that would be suitable for

future DC fast charging stations (Figure 14). All these areas have existing EV charger hosting capacity

according to Con Edison’s Hosting Capacity Portal, with some already being targeted for private

investment from companies like Revel:

Figure 14: Ideal Future DC Fast Charging Locations

Red Hook, Brooklyn: Midway between areas of high driver residence in South Brooklyn and the

Manhattan core, easily accessible via major roadways, former industrial area with existing grid capacity

for charger installation.

*

Grand Concourse, The Bronx: Excellent connection to expressways including proximity

to I-87 which will receive NEVI program EVSE funding, connections to Manhattan and LaGuardia, near

neighborhoods where many drivers live.

Maspeth, Queens: Excellent highway access, concentration of taxi garages and bases, industrial

hub with minimal congestion from private vehicles.

Jamaica, Queens: Easy access to JFK via Van Wyck Expressway and proximity to neighborhoods

where many drivers reside.

* Revel Transit recently received a NYS Clean Transportation prize for their plans to build EV charging in Red Hook. “Governor Hochul

Announces Ten Grand Prize Winners in the $85 Million New York Clean Transportation Prizes Program”.

Criteria for Future Development of DC

Fast Charging

As the number of TLC-licensed EVs grows, New York City’s DC fast charging network must evolve

accordingly to meet the demand. To maximize usage of DC fast chargers for TLC licensees, future

charger placement should consider the following elements:

Proximity to highways: DC fast chargers should be easily accessible from

highways to facilitate transit to and from areas of high trip volumes.

Driver residence: To improve ease of access, chargers should be in or near

major residential neighborhoods where drivers live.

Grid capacity: Certain areas have the electrical load capacity to handle

additional chargers without the need for extensive infrastructure upgrades,

making EVSE installation easier and avoiding prolonged installation time.

*

Close to high-volume trip areas: Trips conducted by TLC-licensed drivers are

concentrated around the Manhattan core (below W 110th and E 96th St.) and

airports. DC fast chargers in or adjacent to these areas would be most useful

for drivers.

* For an overview of EV charging capacity, see the Con Edison Hosting Capacity Application

Source: TLC Data

Manhattan Core & Airports

1 - 83

83 - 337

337 - 722

722 - 1208

1208 - 4603

Major Roadways

Grand Concourse

Red Hook

Jamaica

Maspeth

TLC Woodside Facility

Driver Residence (by zip code)

Taxi & Limousine Commission | Electrification Report 2022

3534

Level 2 Charging

While DC fast charging is the most eective charging solution for the for-hire sector, public Level 2

charging is also valuable for drivers when placed strategically in areas of high demand for o-shift

charging. The presence of Level 2 is of particular importance as it can oset the need for DC fast

charging and divert trac away from fast charging to Level 2 during times of high utilization.

TLC licensees who own and operate their vehicle would benefit from Level 2 chargers located close to

their homes. These vehicles are likely to be parked at or near drivers’ homes, as opposed to garages

or other large lots owned by fleet operators.

Currently, there is a mismatch between Level 2 charging infrastructure located heavily in central

and lower Manhattan, while owner-drivers are concentrated in Queens, Brooklyn, and the Bronx

(Figure 15). There are current eorts underway by NYC DOT to expand public Level 2 charging

outside of Manhattan. This will improve Level 2 charging access for drivers as currently 59% of all

Level 2 chargers are located in Manhattan, many of which are in Midtown and Downtown. Outside of

Manhattan, Brooklyn hosts 20% of the city’s Level 2 charging followed by 15% in Queens, which has

the greatest number of TLC owner-drivers, while the Bronx only has 3%.

*

Figure 15: Current Level 2 Charging Stations and Owner-Driver Concentration by

Neighborhood

* Based on data from the Alternative Fuels Data Center

Level 2 Charging Stations

0 - 49

49 - 138

138 - 240

240 - 448

448 - 868

Borough Neighborhood

Queens Elmhurst

Queens Jackson Heights

Queens Woodside

Queens Flushing-Willets Point

Brooklyn Bensonhurst

Queens South Ozone Park

Queens Jamaica

Queens Sunnyside

Bronx Concourse-Concourse

Village

Brooklyn Kensington

Recommendations

Advocate on behalf of TLC-licensees for the construction

of a robust fast charging network by partnering with city

agencies, Port Authority, Con Edison, NYPA, and industry

licensees to install driver-friendly chargers in easily

accessible locations where drivers make frequent trips and

take rest breaks, to minimize disruption to drivers’ work

schedules.

1

Build publicly accessible charging at the new Woodside

Inspection Facility, which represents a point of congregation

with easy access to the BQE for all TLC drivers, as well as

being in an area that many drivers call home.

2

Support the strategic deployment of Level 2 charging in

neighborhoods with high owner-driver concentrations.

This aordable charging option allows for areas with TLC-

licensees who own their cars to utilize curbside charging

when not working.

3

Source: TLC Data

4

Ensure that drivers have access to aordable and reliable

charging by continuing to build partnerships with NYC

DOT, DCAS, NYPA, and private EVSE providers and make

information on charging readily available to drivers.

5

Inform and educate drivers, technology firms, and industry

leaders on the availability of charging and potential grant

opportunities.

Top 10 Owner-Driver Residency by Neighborhood

Source: TLC data on

driver residence and

the Alternative Fuels

Data Center for Level 2

charging locations

Taxi & Limousine Commission | Electrification Report 2022

3736

EV-Centric Regulations

In regulating the for-hire and taxi industry, TLC can maximize its regulatory powers and work with other

public stakeholders to encourage vehicle owners towards electrification. Several policy issues will

need to be addressed to ensure TLC licensees can convert to EVs.

Expanding types of EVs used by TLC licensees: TLC will need to closely follow

emerging EV technology. The agency began this process with the Battery Electric Vehicle (BEV) Taxi

Pilot and will continue to adjust its rules to accommodate new EVs and new technology, including WAV

EVs.

Issuing new EV licenses: To promote EVs while ensuring a competitive FHV market, TLC will

prioritize EV applications in its issuance of new licenses.

Setting electrification targets for High-Volume For-Hire Services: In line with

commitments made by rideshare companies aiming to achieve full electrification in the US by 2030,

TLC will explore GHG reduction plans.

Expand Types of EVs In Use

2021-2022 TLC BEV Taxi Pilot

In 2021, TLC established a BEV Pilot Program to allow for a greater number of EV models to be used

as taxis. Prior to this pilot, medallion owners were limited to one option for EVs that met TLC vehicle

specifications, the Tesla Model 3.

The Pilot successfully showed the viability of EVs as taxis – no crashes or major infractions were

reported for any of the participating vehicles. The smooth ride and increased comfort of the vehicles

proved attractive for both drivers and passengers.

Driver participants expressed their reliance on public fast charging to refuel their vehicles, notably

Revel’s Brooklyn facility and fast chargers at JFK airport. However, they also highlighted the lack of a

comprehensive fast charging network in New York City as a major challenge.

Based on the results of the pilot evaluation, TLC is actively working to adopt new rules that will allow

for a greater number of EV make and model options for taxi owners to ensure flexibility as the industry

transitions to all EV.

Accessibility of EVs

TLC is committed to ensuring accessible for-hire transportation for all New Yorkers. One significant

challenge to achieving an all-EV licensed fleet is the lack of an accessible EV model in the U.S.

*

In

order for the TLC-licensed fleet to transition to electric vehicles, wheelchair accessible EVs must be

available.

As part of the agency’s eorts, TLC has engaged in conversations with auto manufacturers about

their plans to produce an accessible EV that can be used as a licensed vehicle in New York City.

Several companies have cited their interest in and development of an EV capable of conversion to an

accessible vehicle. However, several challenges to large -scale adoption include:

* In Europe, the Nissan eNV200 and the Renault Kangoo ZE are both available as electric models. The Kangoo ZE is already in use as a taxi

in Switzerland, while the eNV200 has been adopted as an accessible taxi in Great Britain.

Modifications to current EVs would require major changes that could

ultimately result in the research and development of an entirely new

model.

Manufacturers have indicated that the vehicle would ideally be used

for accessible for-hire transportation and for the delivery of goods.

Many of the newest all-electric makes and models are geared towards

the luxury market, which typically does not include mini-vans, which

are the most appropriate vehicle class for conversion to a wheelchair

accessible vehicle.

The earliest reports of these types of vehicles entering the market is

2024, but the timeline may be much longer.

Taxi & Limousine Commission | Electrification Report 2022

3938

FHV Licensure Pause & Impact of

EV-Specific Licenses

To promote the use of electric vehicles and foster the demand for EV charging, TLC will focus its

issuance of new FHV licenses on EVs. TLC has already committed to issuing up to 1,000 new FHV

licenses beginning in early 2023 that will be limited to use with electric vehicles. Based on interviews

in January of 2021 with FHV owner-drivers who received EV-restricted licenses under the previous

EV exemption to the FHV license pause, in most instances the pause exemption was their reason for

obtaining an EV rather than an ICE vehicle.

However, even after the EV pause exemption was no longer in eect, TLC-licensed EVs continued

to increase, showing promising signs of ICE to EV conversion as well. TLC EV drivers largely depend

on publicly accessible DC fast chargers. DC fast charging stations are expensive to install, and with

limited electric vehicle adoption in New York City, many charging equipment firms are discouraged

from entering the market because of a potential lack of demand. By allowing all-electric FHV licenses,

TLC will likely see continued growth in EV adoption and increased demand for fast charging. New

York City DOT and NYPA are expanding their own public fast charging networks to make the business

case for charging infrastructure in New York. TLC can do its part to encourage charger installation by

creating demand through the issuance of limited numbers of EV-only FHV licenses.

Lyft

Uber

In-app

hybrid

and EV

options

In-app

hybrid

and EV

options

Zero-

emissions

worldwide

All new

vehicles

are EVs

100%

electric miles

driven by

rental cars

100%

EVs

Zero-

emissions in

U.S., Canada

& Europe

2022 2026 2028 2030 2040

Uber and Lyft’s Electrification

Commitments

Uber and Lyft have both publicly announced their commitments to electrification (Figure 16).

*

Their

electrification plans show regional variation, often reflecting policies enacted at the state or local level

in the respective operating region.

Figure 16: Uber and Lyft Electrification Timeline

Relative to policies in the U.S., Uber has a more robust electrification plan in certain European

countries or cities as a result of targeted government policies. For example, in London, Uber launched

its Clean Air Plan in 2019 to make every car on Uber’s app electric by 2025.

**

As part of the initiative,

a Clean Air fee is collected from each trip, which is then made available to help drivers transition to an

EV.

* “Climate Assessment and Performance Report”, Uber and “The Path to Zero Emissions: 100% Electric Vehicles by 2030“, Lyft

** Additional information on Uber’s ”Clean Air Plan”

Taxi & Limousine Commission | Electrification Report 2022

4140

Electrification In Other Jurisdictions

Legislation targeting EVs in for-hire transportation has increased in recent years. In the U.S., states and

localities are developing and implementing more robust electrification programs (Figure 17).

The climate legislation adopted by these jurisdictions imposed various requirements targeting

transportation network companies (TNCs) such as Lyft and Uber to force them to electrify, including

fees, surcharges, and GHG emission reduction plans

As enacted in California, the Clean Miles Standard (CMS) requires extensive data reporting from

TNCs, and TLC is already a national leader in data collection, as one of the first jurisdictions to require

TNCs to provide trip records, including driver income data, to the agency. Using TNC data, TLC could

report on the number of passenger miles which is already collected, by a vehicles’ make, model, and

fuel economy. Additional components of the CMS encourage TNCs to utilize shared rides, reduce

deadheading and increase utilization, and allow regulatory compliance credits for TNCs that make

connections to active transportation and transit.

*

The CMS encourages TNCs to lead electrification eorts, while introducing regulations to ensure

that current and future TNCs are held to a standard. TLC already has many of the regulations to

enforce some of these policies, including a specific license class that would be regulated under these

standards due to the high trip counts it generates.

**

* “Proposed Clean Miles Standard Regulation”

** “High Volume For-Hire Services”, NYC TLC

Figure 17. Electrification Legislation in Dierent U.S. Jurisdictions

California’s Clean Miles Standard requires TNCs operating in California to accomplish two key items

by 2030: 1) reduce GHG emissions to zero grams per passenger mile traveled and 2) ensure 90% of all

vehicle miles traveled (VMT) are completed by EVs, gradually increasing the targets until this point.

*

Washington D.C. adopted wide-ranging climate legislation in 2019, with an element specifically

focused on TNCs.

**

By 2045, all commercial motor carriers, limousines, and taxis certified to operate

in the District must be 100% zero-emission vehicles (ZEVs). TNCs are also required to develop and

submit a GHG emission reduction plan to the District every two years.

Massachusetts adopted an omnibus climate package, which included its own focus on TNC

electrification.

***

Under the law, Massachusetts will develop a program to reduce greenhouse gas

emissions from TNCs, including setting requirements for electrification and emissions.

Colorado established the Clean Fleet Enterprise in 2021 to incentivize the adoption of EVs by private

and public vehicle fleets, specifically naming TNCs.

****

The state imposes fees on prearranged rides of

30 cents per ride, reduced to 15 cents per ride in a carshare or ZEV, with the proceeds used to help

TNCs and other owners or operators of vehicle fleets electrify by reducing up-front costs of acquiring

EVs among other initiatives.

*****

* To reduce GHG emissions, Uber and Lyft are allowed to utilize a variety of mechanisms beyond just electrifying their fleet. This includes

reducing distances driven without passengers - also known as “deadhead miles,” increasing the number of passengers carried per trip, or

investing in public transportation infrastructure. See “Clean Miles Standard - California Air Resources Board“

** Clean Energy DC Omnibus Amendment Act of 2018. See also DC ST § 50-741.

*** Chapter 179 of the Acts of 2022, §47 - https://malegislature.gov/Laws/SessionLaws/Acts/2022/Chapter179

**** Colo. Rev. Stat. Ann. § 25-7.5-103

***** Id. See also Prearranged Ride Fee | Department of Revenue - Taxation (colorado.gov) last accessed Sep. 1, 2022.

California:

Clean Miles

Standard

(2021)

Colorado: CleanFleet

Enterprise (2021)

Massachusettes:

Omnibus Climate

Package (2022)

Washington DC: Clean

Energy DC Omnibus

Amendment Act (2018)

Taxi & Limousine Commission | Electrification Report 2022

4342

Recommendations

Develop regulatory interventions to support EV transition,

including the exploration of GHG emission reduction

standards, the feasibility of a Clean Miles Standard (CMS) in

New York City, vehicle technology standards and charging

interventions.

Expand the adoption of EVs through TLC-specific incentives

and the limited release of FHV licenses for EVs.

Collaborate with state and city authorities to ensure that

TLC licensees are provided the support to convert to

electric as mandates and other electrification policies are

enacted in the coming decades.

Dedicate TLC resources to support the agency’s

electrification initiatives to ensure that TLC has strong

technical expertise and regulatory knowledge to

dynamically respond to the emerging EV industry.

Expand the list of approved EV models for taxis.

Continue to work with original equipment manufacturers

and advocate for the development of a wheelchair

accessible electric vehicle.

1

2

3

4

5

6

Taxi & Limousine Commission | Electrification Report 2022

4544

T

LC recognizes that drivers need continuous support navigating the fast-growing EV industry as

technology evolves, and the agency is committed to the inclusion of drivers and businesses that

will be most impacted by electrification in the planning and policy development process. As

more EV-related policies and initiatives are steadily enacted across all levels of government, TLC’s

EV outreach and engagement eorts are critical in furthering EV adoption. TLC will join interagency

projects that benefit drivers, educate drivers on EV incentives and benefits, and address concerns

stemming from misconceptions many drivers may have.

TLC-licensed vehicles and drivers are an integral part of New York’s transportation fabric and creating

an all-electric future will require a coordinated and collaborative eort between other city and state

agencies, as well as private companies and non-profit organizations. New York City DOT, DCAS, Port

Authority, NYPA, NYSERDA, Empire Clean Cities, and many others will be vital partners in building a

charging network, creating a strong regulatory framework, incentivizing electrification and innovation,

and engaging and educating new EV drivers and businesses.

Charged Up! provides an electrification blueprint as the industry embarks on the conversion of over

100,000 vehicles to all electric. This includes short-term actionable items for TLC that are beginning

now and soon, as well as long-term policy levers and initiatives to be more closely examined and

evaluated before implementation.

Conclusion

Outreach Eorts & Electrification Commitments

In the short-term, TLC commits to:

1. Issuing FHV licenses for EVs. In the September 2022 FHV Licensing Pause Report, TLC

announced that 1,000 FHV licenses would be made available to all-electric vehicles.

2. Passing rules that make vehicle specifications in the BEV Taxi Pilot permanent. The agency

presented the findings and Pilot evaluation to the Commission in November 2022.

3. Collaborating with Empire Clean Cities to host a “Ride and Drive” event that will allow TLC

drivers to get behind the wheel of an electric vehicle and speak with EV industry leaders.

Additionally, TLC will work with ECC to establish a strong online resource page for TLC licensees

regarding electrification.

4. Continuing to work closely with partners at New York City DOT to promote their agency’s EVSE

implementation and connect TLC drivers to their aordable and discounted charging.

In the long-term, TLC commits to:

1. Exploring strategic policy levers that could push for increased electrification including a GHG

reduction plan and policy for HVFHV companies, an EV purchase grant program, and pilot

programs for advanced EV technology.

2. Engaging with emerging technology companies, EVSE firms, and TLC licensees. TLC will apply

to grant programs and other funding opportunities to allow for pilot programs or other innovative

solutions combatting EV barriers.

At TLC, the agency commits to:

1. Opening publicly accessible DC fast chargers at the Woodside inspection facility.

2. Electrifying TLC’s fleet of agency vehicles. TLC has already purchased several Ford Mach-E

vehicles for the enforcement fleet. TLC will work closely with NYPD, which has already begun

using the Mach-E, to evaluate the eectiveness of EV police cars and devise a plan to implement

more of these vehicles into the agency’s licensed fleet. TLC’s current fleet of 116 vehicles will

convert to all electric in the future, as DCAS has committed to procuring 4,000 EVs between 2021

and 2025 to replace outgoing city vehicles.

*

3. Install extensive charging at the Woodside Inspection Facility to support future EV agency fleet

vehicles and provide a convenient fast-charging station for TLC-licensees.

* “2021 Clean Fleet Update“, NYC DCAS.

The profound impact of reducing the industry’s GHG emissions through vehicle electrification cannot

go unrecognized. Through coordination and collaboration with electrification partners, strategic policy

initiatives, and strong driver engagement, TLC will be able to support our licensees in the dramatic

shift towards a clean for-hire transportation sector powered by electric vehicles.

Acknowledgments

Project Team

Allison Gao / Policy Analyst

Raphael Gernath / Policy Analyst

Ted Metz / Policy Analyst

Assistant Commissioner for Policy

James DiGiovanni

First Deputy Commissioner

Ryan Wanttaja

Additional Thanks

John Cruz / Former Data Analyst

Chris Morote / Data Analyst

Laura Popa / Former Deputy Commissioner of Policy and Legislative Counsel

Arden Armbruster & Kacie Rettig / Graduate Policy Interns

TLC acknowledges sta from the following organizations and agencies who reviewed and provided feed-

back on drafts of this report: Con Edison, Empire Clean Cities, NYC Department of Transportation, NYC

Mayor’s Oce of Climate and Environmental Justice, and Oce of the Chief Climate Ocer.

Design

Katie Miller / Multi-Media Coordinator

Back to Top