Your Salaried and

Hourly Pension Plan

(Kimberly-Clark

Corporation)

Summary Plan Description

Contents

Introduction.......................................................................................................1

The Kimberly-Clark Corporation Pension Plan.................................................1

Plan History...................................................................................................1

Plan Features...................................................................................................1

Eligibility............................................................................................................3

Employee Eligibility ..........................................................................................3

Service...............................................................................................................4

What Service Means........................................................................................4

Vesting Service................................................................................................4

Military Service..............................................................................................4

Benefit Service.................................................................................................5

Break-in-Service ..............................................................................................6

Break-in-Service and Pension Choice...........................................................6

Impact of Pension Choice ................................................................................7

Benefit Amount.................................................................................................8

Benefit Formulas..............................................................................................8

How the Plan Calculates Your Benefit .............................................................9

How the Plan Calculates Your Average Monthly Earnings............................9

Using the Step Rate Formula ......................................................................10

Using the Minimum Benefit Formula ...........................................................11

Comparing the Benefits From Each Formula ..............................................11

Retirement Benefit..........................................................................................12

Normal Retirement.........................................................................................12

Early Retirement ............................................................................................12

Deferred Retirement ......................................................................................14

Disability Retirement ......................................................................................14

Surviving Spouse’s and Minor's Benefit .........................................................15

Automatic Survivor Benefit ..........................................................................15

Pre-Retirement Survivor Benefit..................................................................15

How the Plan Pays Benefits...........................................................................17

Naming a Beneficiary.....................................................................................17

Payment Options ...........................................................................................17

Basic Benefit..................................................................................................19

Joint and Survivor Annuity (Qualified)............................................................19

Optional Years Certain and Life Annuity ........................................................20

Level Income Variation ..................................................................................20

Lump Sum Payment ......................................................................................21

Kimberly-Clark Corporation

i Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Other Payout Options ....................................................................................21

Lump Sum "Window"...................................................................................21

Small-Benefit Cash-Out "Sweep" ................................................................22

Direct Rollovers..............................................................................................22

Provisions for Scott Heritage Employees ....................................................23

Payment Options ...........................................................................................23

Joint and Survivor Annuity (Non-Qualified) ....................................................24

Lump Sum Payment ......................................................................................24

Direct Rollovers..............................................................................................25

Vesting Service for Part-Time Employees .....................................................25

Restored Employment ...................................................................................25

For Periods Which Terminated Prior to January 1, 1976.............................25

For Periods Which Terminated on or After January 1, 1976 .......................25

Benefit Formula for Employees With Benefit Service

Prior to January 1, 1979...............................................................................26

Grandfathered Benefit....................................................................................27

Temporary Allowance ....................................................................................29

Applying for Benefits .....................................................................................30

Before You Retire ..........................................................................................30

Applying for Retirement Benefits....................................................................30

Survivor Benefits............................................................................................32

Claims Procedures ......................................................................................... 33

Filing a Claim for a Pension Benefit ...............................................................33

If You Want to Request a Review of a Denied Claim.....................................33

Claims for Benefits Other Than Disability Benefits......................................33

Claims for Disability Benefits.......................................................................34

When Benefits Are Not Paid ..........................................................................35

If You Work Past Age 65................................................................................35

Suspension of Benefits ..................................................................................35

When Benefits Must Be Paid .........................................................................36

By Age 70½ or When You Retire ...................................................................36

Plan Information .............................................................................................37

When the Plan May Be Amended or Terminated...........................................37

How Benefits May Be Taxed..........................................................................37

Benefits Administration Committee ................................................................37

How Benefits Are Guaranteed .......................................................................37

Plan Costs......................................................................................................39

If the Plan Is Underfunded .............................................................................39

Mergers, Consolidations, or Transfers ...........................................................39

Kimberly-Clark Corporation

ii Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Kimberly-Clark Corporation

iii Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Transfer of Benefits/Qualified Domestic Relations Order (QDRO).................40

Limitation on Benefits.....................................................................................40

Right of Recovery ..........................................................................................40

Administrative Information ............................................................................41

Plan Details....................................................................................................41

Employment Rights Not Guaranteed .............................................................42

Change of Address ........................................................................................43

Active Employees........................................................................................43

Terminated/Retired Participants, QDRO Alternate Payees,

and Beneficiaries.......................................................................................43

Contact Information........................................................................................44

Your Resources for Benefits Information .......................................................44

Your Benefits Resources (YBR) Web Site .....................................................44

Paperless Delivery of Benefits Communication...........................................44

Password Reset ..........................................................................................44

Internet Security ..........................................................................................45

Kimberly-Clark Benefits Center......................................................................45

Contacting the Benefits Center by Phone ...................................................45

Benefits Center Holiday Schedule...............................................................45

Your Rights Under ERISA .............................................................................. 46

Receive Information About Your Plan and Benefits .......................................46

Prudent Actions by Plan Fiduciaries ..............................................................46

Enforce Your Rights.......................................................................................47

Assistance With Your Questions....................................................................47

Appendix .........................................................................................................49

Eligibility Chart ...............................................................................................49

Introduction

The Kimberly-Clark Corporation Pension Plan

This material constitutes your Summary Plan Description (SPD) of the Kimberly-Clark

Corporation Pension Plan (the Plan) in effect on January 1, 2013. It describes the Plan as it

applies to eligible active salaried and hourly employees listed under the "Eligibility Chart" in the

"Appendix," as well as retired and terminated deferred participants on and after July 1, 1997.

This SPD is intended to be a brief description and, as such, cannot present all the details of

eligibility, benefits, and other Plan provisions. In all cases, the provisions of the formal Plan

document govern. No description in this SPD is intended to change anything in the Plan or to

affect any rights under it.

Plan History

• Prior to March 1, 1996, eligible employees of Scott Paper Company (Scott) were

participants in the Scott Paper Company Retirement Plan for Salaried Employees.

Coincident with the merger with Kimberly-Clark Corporation (Kimberly-Clark, K-C, or the

Company), Scott became Kimberly-Clark Tissue Company.

• Effective March 1, 1996, Kimberly-Clark Tissue Company became the sponsor of the

Plan and the Plan was renamed the Kimberly-Clark Tissue Company Pension Plan for

Salaried Employees.

• Effective December 31, 1998, the Kimberly-Clark Tissue Company Pension Plan for

Salaried Employees was merged and became part of this Plan (the Kimberly-Clark

Corporation Pension Plan).

• Effective December 31, 2009, this Plan was frozen.

Plan Features

The following are features of this Plan:

• Normal Retirement: At age 65, or later, after completing five years as a participant in the

Plan.

• Early Retirement: After completing five years of vesting service, and attaining at least

age 55.

• Disability Retirement: After completing five or more years of vesting service, and

presenting a Disability Insurance Benefit award letter under the Federal Social Security

Act (award letter) stating that your disability began during your employment with the

Company (effective June 1, 2006).

• Vested Retirement: Allowance after completing five years of vesting service.

•

Kimberly-Clark Corporation

1Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Joint and Survivor Annuities.

• Optional Years Certain and Life Benefit Option.

• Social Security Level Income Variation: At early retirement (not disability retirements).

• Pre-Retirement Death Coverage: For surviving spouse of a deferred participant.

• Automatic Survivor Benefit: For surviving spouse of an eligible active employee.

Kimberly-Clark Corporation

2Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Eligibility

Employee Eligibility

You were eligible to participate in this Plan on your date of hire if you were a:

• Regular full-time K-C salaried or non-organized hourly paid employee before

January 1, 1997 who was hired into one of the employee groups listed under the

"Eligibility Chart" in the "Appendix" (K-C employees hired on or after January 1, 1997

aren't eligible for membership in the Plan); or

• Salaried employee of Scott Paper Company who was hired before January 1, 1995 into

one of the employee groups listed under the "Eligibility Chart" in the "Appendix" (Scott

Paper Company and Kimberly-Clark Tissue Company employees hired on or after

January 1, 1995 aren't eligible for membership in the Plan).

This Plan was frozen effective December 31, 2009.

Kimberly-Clark Corporation

3Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Service

What Service Means

The Plan uses your service with K-C and predecessor companies for which K-C gave prior

service credit to determine what benefit you'll receive. The Plan counts two types of service:

• Vesting service; and

• Benefit service.

Vesting Service

The Plan counts your years of vesting service with K-C (including former Scott and Combined

Employment) to determine if you're eligible to receive a benefit from the Plan. The Plan counts

your vesting service from your date of hire. Vesting service consists of:

• Your continuous employment with the Company prior to your severance date; plus

• Periods restored under a break-in-service (including certain authorized leaves of absence

and parental absences).

The Plan credits you with one year of vesting service for each calendar year in which you

complete 1,000 hours of service. You don't receive vesting credit for any partial calendar years

during which you worked less than 1,000 hours. Prior to January 1, 1976, the Plan credited you

with vesting service according to the Plan that was in effect immediately before 1976.

If you're a Scott heritage salaried employee, a different definition of vesting service applies for the

service you earned prior to January 1, 2000. See "Grandfathered Benefit" under the "Provisions

for Scott Heritage Employees" section for more information.

Military Service

Vesting service includes the period of time required by law that you spend in the uniformed

services of the United States, provided you resume employment with K-C within the time period

after becoming eligible for discharge or release from the U.S. uniformed services, during which

your reemployment rights are protected by law.

Additionally, under the Heroes Earnings Assistance Relief Tax (HEART) Act, if you die while on

military leave, your beneficiary will receive any additional benefits required by the HEART Act that

would have been provided to you had you resumed employment prior to your death. This includes

vesting and ancillary death benefits, but not additional accruals.

Kimberly-Clark Corporation

4Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Benefit Service

The Plan uses your years of benefit service (including Scott credited employment prior to

January 1, 1995) to calculate the amount of your benefit. The Plan counts your benefit service

from your date of hire and uses your benefit service in various formulas to calculate your benefit

from the Plan.

The Plan credits you with one year of benefit service for every year you completed the hours of

service required to perform your job on a full-time basis during that year. Hours of service are

hours you worked for K-C or a predecessor company for which K-C gave prior benefit service

credit.

The Plan credits you with hours of service for time away from work due to:

• Vacation;

• Holidays;

• Sick days;

• Other periods of absence specified by the Benefits Administration Committee

(Committee); and

• Time off for military service to the extent required by law.

The Plan doesn't credit you with more hours than you would have regularly received during a

12-month work schedule. In addition, for termination dates on and after September 27, 1995, if

you completed less than 2,080 hours of service during a calendar year, you're credited with a

fractional year of benefit service for that calendar year.

If, during Pension Choice, you chose the Kimberly-Clark Corporation Retirement Contribution

Plan (RCP) for future benefits, your benefit service under this Plan was frozen as of

June 30, 1997. Going forward, this Plan considers your frozen benefit service as your "Past

Service Benefit," and includes this period of frozen benefit service when calculating your benefit.

"Past Service Benefit" is further defined under "Impact of Pension Choice" under this section.

Please Note: Your RCP account is now part of the 401(k) and Profit Sharing Plan.

For purposes of this Plan, all Scott heritage salaried employees had their benefit service under

this Plan frozen as of January 1, 1995.

Kimberly-Clark Corporation

5Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Break-in-Service

The Plan counts your continuous service with K-C. A break-in-service interrupts the vesting

service and benefit service you earn toward your benefit. Any break-in-service may affect your

right to receive a benefit.

You're considered to have a break-in-service if you terminate employment and you worked

500 hours or less during the year you terminate, or in a subsequent calendar year, unless you

were absent due to certain approved leaves such as illness, military service, or maternity leave.

If you completed less than five years of vesting service before your break-in-service, you forfeit

the vesting service you earned before the break. However, the Plan recredits your service if you

completed at least one year of vesting service before the break and you returned to the Company

and completed one year of vesting service after the break. Additionally, if you returned to the

Company and because of a total and permanent disability or death you didn't complete one year

of vesting service after the break, your service is recredited.

If you completed five years of vesting service before your break-in-service, you don't forfeit

the vesting service you earned before the break.

If you're a Scott heritage salaried employee, you have different rules for breaks-in-service that

ended prior to January 1, 2000. See "Grandfathered Benefit" under the "Provisions for Scott

Heritage Employees" section for more information.

Break-in-Service and Pension Choice

As of January 1, 2010, you participate in the 401(k) and Profit Sharing Plan (prior to that date,

you participated in the Kimberly-Clark Corporation Retirement Contribution Plan [RCP]) if:

• During Pension Choice, you elected to stay in this Plan;

• You subsequently terminated employment; and

• You were rehired by Kimberly-Clark after December 31, 1996.

Your vesting service continues to accrue. Any subsequent adjustments in earnings (through

December 31, 2009) are used to calculate the portion of your benefit under this Plan. (See

"Impact of Pension Choice" under this section for more information). However, you're not eligible

to accrue additional benefit service under this Plan.

Kimberly-Clark Corporation

6Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Impact of Pension Choice

If, during Pension Choice, you elected the RCP when it was offered:

• You became a participant in the RCP beginning July 1, 1997 (effective January 1, 2010,

your RCP account became part of the 401(k) and Profit Sharing Plan);

• Your benefit service under this Plan was frozen as of June 30, 1997 (as a result you

haven't accrued any additional periods of benefit service under this Plan since

June 30, 1997);

• Your earnings used to calculate a benefit under this Plan were not frozen until

December 31, 2009; and

• Your vesting service used for eligibility and vesting under this Plan was not frozen (as a

result, you continue to accrue vesting service under this Plan as you continue working for

the Company).

This means that, if you elected the RCP, you'll be eligible to receive a retirement benefit from this

Plan and from the 401(k) and Profit Sharing Plan.

Your retirement allowance under this Plan (Past Service Benefit) is calculated and paid like any

other retirement allowance under the Plan, as described in this SPD. It's subject to the same

rules and conditions. However, it's calculated to take into account your benefit service under this

Plan accrued up to June 30, 1997, recognizing that your future benefits are covered by the 401(k)

and Profit Sharing Plan. The 401(k) and Profit Sharing Plan SPD describes that Plan's benefits.

All eligible employees hired or rehired on or after January 1, 1997 but prior to January 1, 2010

automatically participated in the RCP, and didn't participate or accrue benefit service or additional

benefit service under this Plan. All eligible employees hired or rehired on or after January 1, 2010

automatically participate in the 401(k) and Profit Sharing Plan.

Kimberly-Clark Corporation

7Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Benefit Amount

Benefit Formulas

The Plan calculates your benefit based on:

• Two ways following different formulas (Step Rate Formula and Minimum Benefit

Formula);

• Your pay before you retire or leave K-C;

• Your years of benefit service with K-C;

• Your age; and

• Government regulations and Plan provisions in effect when you start to receive your

benefit.

Please Note: This Plan was frozen effective December 31, 2009. Pay and service were capped

as of that date.

The Plan first calculates your Basic Benefit based on payments for your lifetime only without

considering other payment options. You receive the greater benefit that results from the following

two formulas:

• Step Rate Formula: The standard formula that the Plan uses to determine your benefit

at retirement, based on defined percentages of your Average Monthly Earnings, Pay

Brackets, and your years of benefit service.

• Minimum Benefit Formula: An alternate formula that the Plan uses to determine your

minimum benefit at retirement, based on a defined dollar amount times your years of

benefit service.

Payment options are described under the "How the Plan Pays Benefits" section.

If you're a Scott heritage salaried employee, the Plan uses a different benefit formula to account

for benefit service accrued before January 1, 1979. In addition, you may have you entire benefit

calculated according to a grandfathered formula frozen as of December 31, 1999. (See

"Grandfathered Benefit" under the "Provisions for Scott Heritage Employees" section).

Kimberly-Clark Corporation

8Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

How the Plan Calculates Your Benefit

The Plan considers your "pay" to include generally:

• Wages;

• Overtime;

• Bonuses;

• Sales incentive pay, such as sales commissions; and

• Any military differential paid with respect to any period of active military service in the

uniformed services of the U.S. of more than 30 days.

To the extent deductions decrease your base pay, your pay isn't reduced by pre-tax 401(k) or

other pre-tax benefit contributions, and doesn't include:

• Payments in lieu of vacation;

• Severance pay;

• Compensation paid in any form other than cash;

• Service or suggestion awards;

• Foreign service premiums (after December 31, 1979) and allowances; and

• Any other special or unusual compensation.

The compensation used by the Plan doesn't include annual earnings over the annual limit under

the Code as adjusted each year by the Internal Revenue Service (IRS). For 2009, this amount is

$245,000. This limit is required under IRS rules, and is subject to change.

Your "pay" that the Plan uses to calculate your benefit from the Plan was frozen on

December 31, 2009.

How the Plan Calculates Your Average Monthly Earnings

The Plan's Step Rate Formula uses your Average Monthly Earnings to calculate your benefit. To

calculate your Average Monthly Earnings, the Plan uses the larger of:

• The monthly average of your earnings during your last 60 months of service while you

were an eligible employee; or

• In your last 15 years of service while you were an eligible employee, the monthly average

of your earnings during the five calendar years in which your earnings were their highest

(these years don't have to be consecutive).

If you're a part-time employee, the Plan adjusts your earnings to approximate what they would

have been if you had been a full-time employee.

Kimberly-Clark Corporation

9Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Using the Step Rate Formula

Step Rate Formula

Your Years of Benefit Service

Pay Bracket 1 x 1.125%

x

+ Pay Bracket 2 x 1.425%

+ Pay Bracket 3 x 1.5%

÷

12

=

Your Unreduced Monthly Benefit*

*Any benefit payable to you from the 401(k) and Profit Sharing Plan is in addition to this benefit.

The Pay Brackets are based on the Social Security Taxable Wage Base. The Taxable Wage

Base is set each year by the Social Security Administration and is indexed for inflation. For 2009

and 2010, the Taxable Wage Base was $106,800. This is the amount that the Plan uses in the

frozen benefit calculation (if you retired prior to January 1, 2009, the Plan uses the Taxable Wage

Base in effect on the first day of the year in which you retired). Pay Brackets One, Two, and

Three are determined as follows.

Pay Bracket Your Pay

Pay Bracket One Equals The Lesser of Your Final Average Annual Pay* or

2/3 of the Taxable Wage Base

Pay Bracket Two Equals The Lesser of Your Final Average Annual Pay* or

the Taxable Wage Base, Minus 2/3 of the Taxable Wage Base

Pay Bracket Three Equals Your Final Average Annual Pay* Minus the Taxable Wage Base

* Your final average annual pay is your Average Monthly Earnings times 12.

The Plan doesn't use any Pay Bracket with a value less than zero.

Kimberly-Clark Corporation

10Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Using the Minimum Benefit Formula

This formula calculates a minimum benefit based on your years of benefit service.

Minimum Benefit Formula

$10

x

Your Years of Benefit Service

=

Your Unreduced Monthly Benefit

(maximum $100)

Comparing the Benefits From Each Formula

After calculating a benefit under each formula, the Plan determines which would pay you the

larger benefit. This process determines your Basic Benefit from the Plan. The actual amount you

receive depends on your age and the payment option you select. Any benefit you receive from

Social Security is paid in addition to the Plan's benefit.

Any benefit payable to you from the 401(k) and Profit Sharing Plan is in addition to the benefit

paid under this Plan.

Kimberly-Clark Corporation

11Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Retirement Benefit

Normal Retirement

The Plan's formulas calculate a benefit at normal retirement—the later of age 65, or the date

upon which you complete five years as a participant in this Plan. However, you may be eligible for

an unreduced benefit before reaching normal retirement age.

For a full, unreduced benefit you must be at least:

• Age 65 if you complete five years as a participant in the Plan;

• Age 62 if you complete 10 or more years of vesting service;

• Age 60 or 61, if you complete 30 or more years of vesting service; or

• Age 60 or 61 if you terminate employment with 10 or more years of vesting service and

you would have completed 30 or more years of vesting service had you continued

employment with the Company.

Early Retirement

The benefit from the Plan is reduced if you retire before you're eligible for a full, unreduced

benefit (see the Early Retirement table below for the applicable percentage). You're eligible to

receive a reduced early retirement benefit as early as age 55, if you've completed five years of

vesting service.

If you elect early retirement, your benefit is reduced according to the number of years you retire

before the age you're eligible for a full, unreduced benefit. The amount of the reduction is based

on your age at the time your benefit begins and your years of vesting service.

If you have at least 10 years of vesting service at retirement, the Plan reduces your benefit by 5%

for each year of early retirement. For fractional years, the benefit is reduced 1/12 of 5% for each

full calendar month.

If you have at least five but less than 10 years of vesting service at retirement, your benefit is

reduced by actuarial tables specified in the Plan, which include interest rates and the mortality

table in use by the Plan when your benefit begins. The Early Retirement table illustrates the

actuarial reduction at 5% and the 1983 GAM Unisex Mortality Table. These rates are subject to

change.

The Early Retirement table shows the percentage of the full retirement benefit you'll receive if you

elect early retirement.

Kimberly-Clark Corporation

12Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Find your years of vesting service category along the top. Find the age at which you'll retire and

read across the table to find the percentage of your retirement benefit.

Early Retirement Table

Percentage of Regular Benefit Based on Age and Years of Vesting Service

Vesting

Service

30+ 29 28 27 26 25 24 23-10 9-5

Age

65 100% 100.00%

64 100% 91.78%

63 100% 84.42%

62 100% 77.82%

61 100% 95% 95% 95% 95% 95% 95% 95% 71.87%

60 100% 95% 90% 90% 90% 90% 90% 90% 66.49%

59 95% 95% 90% 85% 85% 85% 85% 85% 61.62%

58 90% 90% 90% 85% 80% 80% 80% 80% 57.20%

57 85% 85% 85% 85% 80% 75% 75% 75% 53.17%

56 80% 80% 80% 80% 80% 75% 70% 70% 49.49%

55 75% 75% 75% 75% 75% 75% 70% 65% 46.12%

Kimberly-Clark Corporation

13Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Deferred Retirement

If you leave the Company before retirement and have at least five years of vesting service, you're

a "deferred participant" and eligible to receive a "deferred benefit" under the Plan. You can collect

this benefit as early as age 55. A deferred benefit is payable as a normal retirement benefit or a

reduced early retirement benefit. Your deferred benefit will be calculated at the time you leave

K-C using the benefit formulas described under the "Benefit Amount" section.

You should keep the Company informed of any address changes so that you receive ongoing

information about the Plan and your eligible benefits. To report an address change, go online to

the Your Benefits Resources

TM

(YBR) Web site or contact the Kimberly-Clark Benefits Center.

See the "Contact Information" section for Web site address and telephone information.

Disability Retirement

You're generally eligible for a disability retirement benefit from the Plan if:

• You've completed five years of vesting service;

• You're disabled and receive a Disability Insurance Benefit award letter under the Federal

Social Security Act (award letter)—effective June 1, 2006;

• The award letter states you were disabled on or before your date of termination of

employment with K-C;

• You haven't initiated a regular retirement under the Pension Plan;

• You apply for a "totally and permanently disabled" (T&PD) retirement benefit after you

receive your award letter; and

• Your request for a T&PD retirement benefit and the award letter are received by the

Kimberly-Clark Benefits Center within three years of your termination of employment.

Disability determinations for prior termination dates (prior to June 1, 2006) were subject to

different standards.

Please Note: This disability retirement provision doesn't apply to deferred participants.

The Plan calculates the disability retirement benefit using the benefit formulas described under

the "Benefit Amount" section. The benefit is not reduced for early payment.

If you're married when you become eligible for a disability retirement benefit, your benefit is

reduced to provide a continuing benefit for your surviving spouse. The monthly benefit paid to you

is 80% of the unreduced benefit amount that's calculated using the formulas described under the

"Benefit Amount" section. If you die before your spouse, your spouse receives a lifetime benefit

equal to 50% of the unreduced disability retirement benefit. If you and your spouse waive the

spouse's benefit in writing, however, you receive 100% of the benefit amount. Your spouse would

not receive a benefit after you die.

Kimberly-Clark Corporation

14Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

If you're not married when you become eligible for a disability retirement benefit, the benefit paid

to you is 100% of the benefit amount for your lifetime. There's no survivor benefit after you die,

even if you're married at the time of your death.

Surviving Spouse’s and Minor's Benefit

The Plan offers a benefit to your surviving spouse and minors.

Automatic Survivor Benefit

The Plan pays an automatic survivor benefit to your survivors if you die while you're a K-C active

employee and you:

• Have five or more years of vesting service; or

• Have reached age 65 and completed five years as a participant in the Plan.

Please Note: This automatic survivor benefit provision doesn't apply to deferred participants.

Your surviving spouse receives 50% of the monthly benefit you earned as of the day before you

died. The Plan calculates this benefit by using the formulas described under the "Benefit Amount"

section, and doesn't reduce the benefit amount for early payment.

If there's no surviving spouse or your surviving spouse dies within 30 days of your death, your

surviving minor children receive the same benefit your surviving spouse would have received,

divided equally among your minor children. The Plan pays benefits to each child until he or she

reaches age 21 (or dies), at which time the benefit is divided among the remaining minor children.

Survivor payments end the month the surviving spouse dies or, for surviving minor children

receiving benefits, the month a child dies or reaches age 21 (whichever occurs earlier).

In addition, a benefit may be payable to your surviving spouse from the Social Security

Administration.

Pre-Retirement Survivor Benefit

The Plan makes a Pre-Retirement Survivor Benefit available to your surviving spouse if you die:

• While eligible for a deferred benefit; but

• Before your benefit begins.

If you die before your benefit begins, your surviving spouse can apply for a Pre-Retirement

Survivor Benefit. The benefit can begin as early as the first of the month following the day you

would have been eligible to receive a benefit (generally age 55). The Plan's early payment

provisions would apply.

Kimberly-Clark Corporation

15Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

The Pre-Retirement Survivor Benefit is a monthly benefit. The Plan calculates this benefit in a

manner similar to how the benefit is calculated under the 50% Joint and Survivor Annuity

payment option.

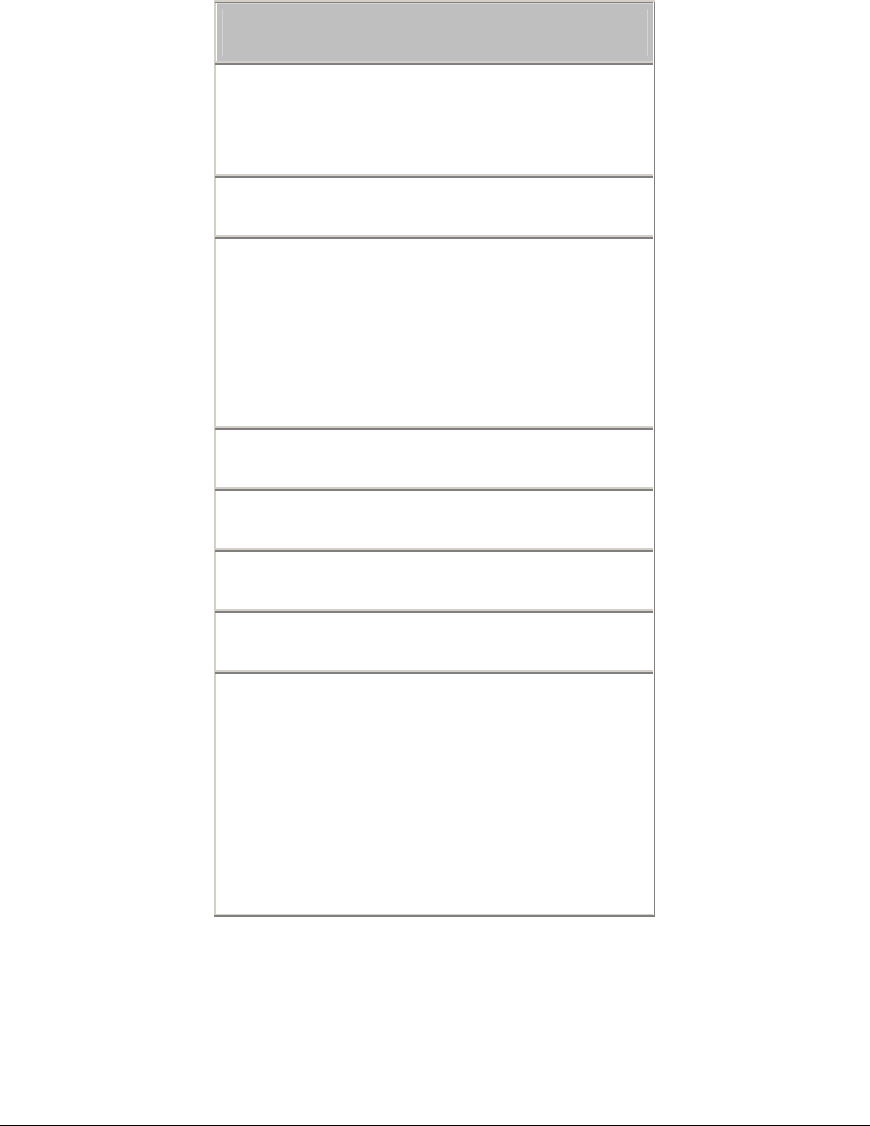

Survivor Benefits

Benefits Automatic Survivor Benefit Pre-Retirement Survivor Benefit

The Plan pays

benefits if:

You die while an active employee with at

least five years of vesting service, or you're

at least age 65 and you've completed five

years as a participant in the Plan.

You leave the Company, you're

eligible for a deferred benefit, and

you die before your deferred benefit

begins.

The benefit amount

for your surviving

spouse:

50% of the monthly benefit you've earned as

of the day you die, calculated according to

the formulas described under the "Benefit

Amount" section, and not reduced for early

payment.

50% of the deferred benefit you

would have been eligible to receive at

retirement (calculated as a 50% Joint

and Survivor payment option).

The benefit amount

for your surviving

minor children (if no

surviving spouse):

The same benefit your surviving spouse

would have received, divided equally among

the minor children, paid until your surviving

minor child reaches age 21 (or dies), at

which time the benefit is divided among the

remaining minor children.

Not available.

Survivor payments

begin:

The month after you die. The month after your surviving

spouse applies for the benefit, but not

earlier than the date you would have

been at least age 55.

Survivor payments

end:

The month your surviving spouse dies, or if

your surviving minor children are receiving

benefits, the month when your youngest

child dies or reaches age 21.

The month your surviving spouse

dies.

Kimberly-Clark Corporation

16Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

How the Plan Pays Benefits

Naming a Beneficiary

Some payment options may require that you designate a beneficiary. Your beneficiary is the

person who receives any outstanding Plan benefits in the event of your death. If you're married,

the law requires you to name your spouse as your beneficiary for a Joint and Survivor Annuity,

unless your spouse agrees otherwise (in writing and in the presence of a notary public). You may

designate anyone for a Certain and Life Annuity payment option. Beneficiary designations are

made at retirement.

Even after you elect a beneficiary, you may change your beneficiary designation at any time

before payments begin. If you divorce before payments begin, any election you may have made

naming your spouse as beneficiary will remain valid unless:

• A Qualified Domestic Relations Order provides otherwise;

• You change your election; or

• You remarry.

The Plan provides for survivor benefits if you're married and your spouse survives you. It also

provides for survivor benefits if you've elected a Joint and Survivor Annuity payment option.

Payment Options

When you retire, you have the opportunity to choose from several payment options for your

monthly benefit. However, once benefits begin, no changes may be made to the form of payment

even if your marital status changes. The payment options are explained as follows.

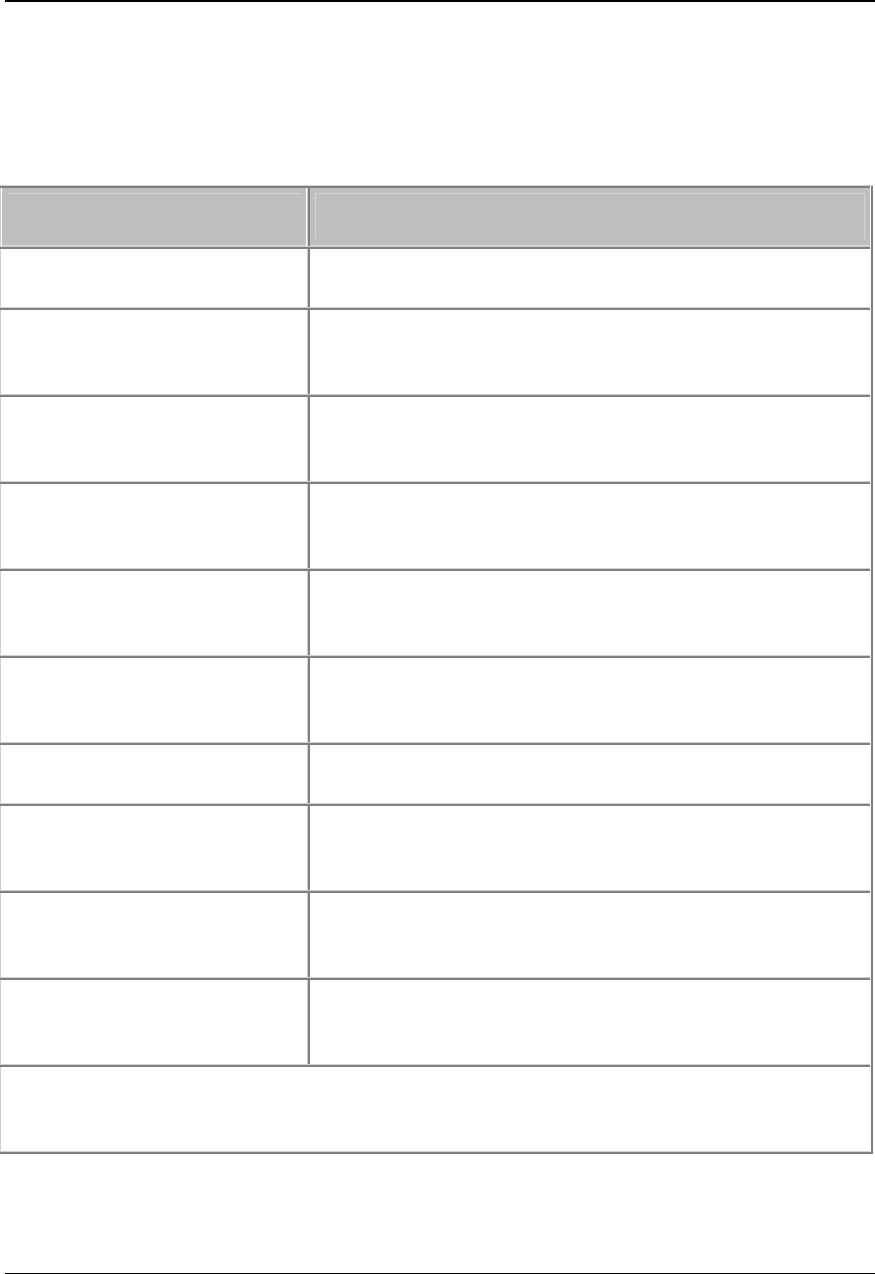

Retirement Benefit Payment Options

Payment Options Who Receives the Benefit

What Other Choices Are

Available

Basic Benefit

You (retiree) only. There's no provision for

a benefit for survivors.

None (other than Level Income

Variation).

Kimberly-Clark Corporation

17Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Kimberly-Clark Corporation

18Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Retirement Benefit Payment Options

Payment Options Who Receives the Benefit

What Other Choices Are

Available

Joint and Survivor

Annuity

You (retiree) and your spouse. Automatic

benefit if you're married when you retire

and you don't elect another payment

option. If you die first, your surviving

spouse receives a benefit until he or she

dies.

The amount of benefit your

surviving spouse receives: 50%,

62½%, 75%, or 100% of your

benefit.

The higher the percentage of

benefit for your surviving spouse,

the lower the benefit for you. You

may not change your surviving

spouse designation or the

percentage after payments begin.

Optional Years Certain

and Life Annuity

You (retiree) and your beneficiary (doesn't

have to be a spouse), if you die before the

end of the specific number of years.

The specific number of "certain"

years the benefit is received: 5, 10,

or 15.

The higher the number of years,

the lower the benefit for you. You

may not change the number of

years after payments begin, but

you can change the beneficiary

designation at any time. However,

spousal consent is required, even if

your spouse is the designated

beneficiary.

Level Income Variation

(Early Retirement Only)

You (retiree) only. This adjusts your

monthly benefit while you're living. It

doesn't affect any survivor's benefit.

Available with any of the above

payment options.

This payment option "levels" your

income so your income stays

approximately the same when age

62 Social Security benefits begin.

Lump Sum Payment (If

the Present Value of

Your Benefit Is $5,000 or

Less)*

You (retiree) or your surviving spouse in

the case of a Pre-Retirement Survivor

Benefit or automatic survivor benefit.

You may request a cash

distribution or a direct rollover into

an IRA, an annuity, or another

employer's tax-qualified plan.

* The Lump Sum Payment applies for all locations effective July 1, 2009. If you're a Scott heritage employee, the Plan

offered a lump sum payment option if the present value of your benefit was $1,000 or less.

Basic Benefit

This form of payment provides the largest monthly allowance under the Plan. It pays you the

amount determined by the Plan formulas for as long as you live. Payments stop at your death.

There are no payments to survivors.

If you're married when payment of your allowance begins, your spouse must consent in writing to

this form of payment.

If you're single when your payment begins, your allowance is paid in this form unless you elect

another form of payment available under the Plan.

Joint and Survivor Annuity (Qualified)

With the Joint and Survivor Annuity payment option, the Plan pays you a reduced monthly benefit

during your lifetime. After your death, the Plan continues to pay a monthly benefit to your

surviving spouse for the rest of his or her life.

If you're married when you elect to begin receiving your benefit, you automatically receive the

50% Joint and Survivor Annuity payment option, unless you waive this option in writing and make

a different election. If you wish to do so, you can elect to provide your spouse with an allowance

after your death equal to 62½%, 75%, or 100% of the reduced amount paid to you. The amount

of the benefit reduction is based on your age, your spouse's age, and the type of Joint and

Survivor Annuity that you elect.

If you waive the Joint and Survivor Annuity payment option, your spouse also must consent in

writing that he or she waives the payment option. Otherwise, the waiver is not valid. The consent

must be in writing and notarized.

With the Joint and Survivor Annuity payment option, the Plan only pays benefits to the spouse

you're married to when you retire, even if you later remarry, unless other provisions are made in a

Qualified Domestic Relations Order (QDRO) in connection with a divorce. The Plan also doesn't

pay survivor benefits if, after you retire, your spouse dies before you do.

If you're a Scott heritage salaried employee, you have another joint and survivor payment option.

(See "Payment Options" under the "Provisions for Scott Heritage Employees" section.)

Kimberly-Clark Corporation

19Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Optional Years Certain and Life Annuity

If you select this payment option, the Plan pays a reduced monthly benefit to you during your

lifetime. After your death, the Plan continues to pay a monthly benefit to your surviving beneficiary

for the remainder (if any) of a specific number of years.

Your beneficiary may be any person. You may change your beneficiary designation at any time

subject to spousal consent as described under "Payment Options" under this section.

If you're married and you elect the Optional Years Certain and Life Annuity payment option:

• Your spouse must provide notarized, written consent that he or she waives the Joint and

Survivor Annuity payment option; and

• If you choose a beneficiary other than your spouse, your spouse must also consent in

writing to the designation of someone other than him or her as beneficiary.

Otherwise, your election is not valid.

Level Income Variation

If you elect early retirement (but not a disability retirement) before age 62, you may elect a Level

Income Variation. This payment option increases the amount of your retirement allowance paid

by the Plan between the time of your early retirement and your attainment of age 62.

The increase is based on the anticipated primary benefit that you'll be eligible to receive from

Social Security at the earliest possible date (currently age 62) under the law in effect at your

retirement. Whether or not you collect that early Social Security benefit, your monthly retirement

allowance will be decreased when you reach age 62 so that, with your anticipated primary Social

Security benefit as calculated at the time of your retirement, your total retirement income during

retirement will be approximately the same.

If, because of the payment option you choose, your benefit is certain to be paid over a time period

of less than 10 years, you may be eligible for a direct rollover. If you don't choose a direct

rollover, tax withholding and/or penalties may apply.

This payment option only affects a participant's retirement benefit. It doesn't affect benefits to

survivors or beneficiaries and may be selected with any of the other payment options.

Kimberly-Clark Corporation

20Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Kimberly-Clark Corporation

21Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Lump Sum Payment

If the present value of your normal, early, disability, or vested retirement allowance or your Pre-

Retirement Survivor Benefit (whichever is applicable) is $5,000 or less, the Plan pays the

allowance or benefit to you in one lump sum. In the case of a Pre-Retirement Survivor Benefit,

the Plan pays the benefit to your surviving spouse.

If the present value of the allowance exceeds $5,000, you receive a monthly payment in

accordance with the payment option you've elected.

When determining the present value, the Plan aggregates your retirement allowance under this

Plan with any retirement allowance payable to you under any other Company-sponsored defined

benefit pension plan. The Plan determines the present value of all lump sum payments according

to:

• The "applicable interest rate" and the "applicable mortality table" as defined in IRS code

Section 417(e) (per the Pension Protection Act), effective January 1, 2008;

• A combination of corporate bond rates; and

• The average annual rate of interest on 30-year Treasury securities for the September

*

immediately before the plan year that your distribution occurs (the Plan uses the standard

mortality table that's used by the IRS on the date the present value is being determined).

Other Payout Options

Lump Sum "Window"

From October 15, 2012 to November 21, 2012, deferred vested participants with a benefit whose

present value exceeded $5,000 as of December 1, 2012, who terminated employment before

August 1, 2012, and hadn't yet begun payment of their benefit, were offered an opportunity to

elect a lump sum form of payment or an immediate annuity (regardless of whether or not they

were otherwise eligible to begin their benefit from the Plan). All lump sum benefits and immediate

annuity benefits for any participant not already eligible to begin his or her benefit on December 1,

2012 were calculated using the Plan's lump sum interest rates and actuarial table. Participants

who couldn't be located by November 21, 2012 weren't eligible for this lump sum window

opportunity. Written spousal consent was required for married participants electing the lump sum.

This program didn't change the pension benefit or eligibility for any participant who didn't elect it.

The Benefit Commencement Date for the payments under this program was December 1, 2012.

Participants who elected and received a lump sum form of payment in this "window" have no

further pension benefit from the Plan.

*

Effective January 1, 2010, September rates are used. Before 2010, December rates were used.

Small-Benefit Cash-Out "Sweep"

Concurrent with the lump sum "window," deferred participants who met the same eligibility

requirements as for the window, but whose benefit had a present value of $5,000 or less as of

December 1, 2012, were given a lump sum or had their benefit rolled into an individual retirement

account (IRA) with Millennium Trust (depending on the present value and the participant's

election). Participants whose benefit had a present value of $1,000 or less were paid out in cash,

unless they elected another form of payment. Participants whose benefit had a present value of

$1,000 weren't sent a payment unless they responded to the automatic payment notice sent out

in October 2012. Participants whose benefit had a present value greater than $1,000, but not

greater than $5,000, had their benefit rolled over to a Millennium Trust IRA, unless they elected

another form of payment.

Direct Rollovers

When you receive a payment from the Plan in the form of a lump sum payment, you may request

that all or a part of the taxable portion of the payment be rolled over to:

• The trustee or custodian of an IRA;

• An annuity; or

• Another employer's tax-qualified plan that accepts such transfers called rollovers.

You receive a payment notice and rollover election statement from the Kimberly-Clark Benefits

Center for the rollover-eligible benefit. If you choose a direct rollover, you're not taxed on the

payment until you later take it out of the IRA or the other employer's plan. If you don't elect a

direct rollover of a lump sum, a mandatory 20% tax withholding applies and a 10% Federal excise

tax may apply if you're younger than age 59½.

Kimberly-Clark Corporation

22Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Provisions for Scott Heritage Employees

Payment Options

If you were an eligible salaried employee at Scott Paper Company (Scott heritage employee) with

service before January 1, 1995, some provisions of the former Scott Paper Company Retirement

Plan for Salaried Employees are available to you in addition to the provisions detailed in this

SPD.

Retirement Benefit Payment Options Applicable to Employees

With Scott Service Prior to January 1, 1995*

Payment Options Who Receives the Benefit What Other Choices Are Available

Joint and Survivor

Annuity

(Non-Qualified)

You (retiree) and your designated

survivor (other than your spouse). If

you die first, your designated

survivor receives a benefit until he

or she dies.

The amount of benefit your designated

survivor receives: 50%, 62½%, 75%, or

100% of your benefit.

The higher the percentage of benefit for

your designated survivor, the lower the

benefit for you. You may not change

your designated survivor or the

percentage after payments begin.

Lump Sum Payment (If

the Present Value of

Your Benefit Is $5,000 or

Less)**

You (retiree) or your surviving

spouse in the case of a Pre-

Retirement Survivor Benefit or

automatic survivor benefit.

You may request a cash distribution or a

direct rollover into an IRA, an annuity, or

another employer's tax-qualified plan.

* In addition to the provisions described under "Payment Options" under the "How the Plan Pays Benefits"

section of this SPD.

** Prior to July 1, 2009, the Plan offered a lump sum payment option if the present value of your benefit was

$1,000 or less.

Kimberly-Clark Corporation

23Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Kimberly-Clark Corporation

24Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Joint and Survivor Annuity (Non-Qualified)

Under this payment option, the Plan pays you a reduced monthly benefit during your lifetime in

order to provide a benefit for a designated survivor other than your spouse after your death. The

amount of the reduction is based on:

• Your age;

• The age of your designated survivor; and

• The type of joint and survivor payment option you've elected.

When you die, the payment option you've specified is paid to your designated survivor for his or

her life. If your spouse is your designated survivor, see "Joint and Survivor Annuity (Qualified)"

under the "How the Plan Pays Benefits" section.

You may elect a 50%, 62½%, 75%, or 100% Joint and Survivor Annuity. When you die, one-half,

sixty-two and one-half percent, three-fourths, or all of your reduced retirement benefit is paid to

your designated survivor for his or her life.

If you're married when the Plan starts paying your benefit, your spouse must consent in writing to

this form of payment since it designates another person as your survivor.

Lump Sum Payment

If the present value of your normal, early, disability, or vested retirement allowance or your Pre-

Retirement Survivor Benefit (whichever is applicable) is $5,000 or less ($1,000 or less for

terminations before July 1, 2009), the Plan pays the allowance or benefit to you in one lump sum.

In the case of a Pre-Retirement Survivor Benefit, the Plan pays the benefit to your surviving

spouse.

If the present value of the allowance exceeds $5,000 (or $1,000 for terminations before July 1,

2009), you receive a monthly payment in accordance with the payment option you've elected.

When determining the present value, the Plan aggregates your retirement allowance under this

Plan with any retirement allowance payable to you under any other Company-sponsored defined

benefit pension plan. The Plan determines the present value of all lump sum payments according

to:

• The "applicable interest rate" and the "applicable mortality table" as defined in IRS code

Section 417(e) (per the Pension Protection Act), effective January 1, 2008;

• A combination of corporate bond rates; and

• The average annual rate of interest on 30-year Treasury securities for the September

*

immediately before the plan year that your distribution occurs (the Plan uses the standard

mortality table that's used by the IRS on the date the present value is being determined).

*

Effective January 1, 2010, September rates are used. Before 2010, December rates were used.

Direct Rollovers

When you receive a payment from the Plan in the form of a lump sum payment, you may request

that all or a part of the taxable portion of the payment be rolled over to:

• The trustee or custodian of an individual retirement account (IRA);

• An annuity; or

• Another employer's tax-qualified plan that accepts such transfers called rollovers.

You receive a payment notice and rollover election statement from the Kimberly-Clark Benefits

Center for the rollover-eligible benefit. If you choose a direct rollover, you're not taxed on the

payment until you later take it out of the IRA or the other employer's plan. If you don't elect a

direct rollover of a lump sum, a mandatory 20% tax withholding applies and a 10% Federal excise

tax may apply if you're younger than age 59½.

Vesting Service for Part-Time Employees

For service earned on or after January 1, 1976 but prior to January 1, 1987, the Plan credits you

with one year of vesting service for calendar years in which you completed more than 435 hours

of service.

For service earned on or after January 1, 1987 but prior to January 1, 1995, the Plan credits you

with one year of vesting service for each calendar year in which you completed more than 869

hours of service.

Restored Employment

Certain prior periods of vesting service are eligible for restoration for Plan purposes, as follows.

For Periods Which Terminated Prior to January 1, 1976

Periods of vesting service that terminated prior to 1976 are eligible for restoration only if they

consisted of at least 30 days of consecutive full-time vesting service. Such periods of vesting

service are eligible for restoration if you completed one additional year of vesting service.

For Periods Which Terminated on or After January 1, 1976

If you were rehired on a regular full-time basis, you were entitled to a restoration of any applicable

prior period of vesting service that included a termination date after 1975 if you completed one

additional year of continuous vesting service on that basis. However, you were entitled to an

immediate restoration of any prior period of vesting service if you were rehired on the same basis

within 12 months of the termination date. In such case, the period between your termination date

and your reemployment was also considered to be vesting service.

Kimberly-Clark Corporation

25Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

If you were rehired on a part-time basis after 1975, you were entitled to a restoration of any

applicable prior period of vesting service at the end of the first subsequent calendar year

(including the year of rehire) during which you accumulated 870 hours worked. However, you

were entitled to an immediate restoration of any prior period of vesting service if you were rehired

on the same basis before incurring a one-year break in service (accumulation of less than 435

hours of service).

Benefit Formula for Employees With Benefit Service Prior to

January 1, 1979

If you're a former salaried employee of Scott and have benefit service (formerly credited

employment) prior to January 1, 1979, your retirement benefit is calculated differently for those

years of benefit service before 1979.

Adjusted Step Rate Formula

1.5% x Your Final Average Annual Pay*

TIMES

Years of Benefit Service Prior to January 1, 1979

PLUS

Your Years of Benefit Service After December 31,

1978

Pay Bracket 1 x 1.125%

x

+ Pay Bracket 2 x 1.425%

+ Pay Bracket 3 x 1.5%

÷

12

=

Your Unreduced Monthly Benefit**

*Your final average annual pay is your Average Monthly Earnings multiplied by 12.

** Any benefit payable to you from the 401(k) and Profit Sharing Plan is in addition to this benefit.

Kimberly-Clark Corporation

26Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Grandfathered Benefit

If you're a Scott heritage employee who was hired by Scott before January 1, 1995 and you were

working for the Company on December 31, 1999, you had a frozen benefit calculated as of

December 31, 1999. This frozen benefit is the greater of the Earnings-Based Formula or the

Alternative Minimum Formula as shown below.

Earnings-Based Formula

0.015 x Average Final Compensation x Benefit

Service

(formerly Credited Employment)

MINUS

0.015 x Social Security Benefit x Benefit Service

(formerly Credited Employment)

Between December 31, 1978 and December 31,

1994*

or

0.5 x Social Security Benefit x Ratio**

DIVIDED BY

12

EQUALS

Your Unreduced Monthly Benefit

* If your projected Credited Employment from the

later of your hire date or December 31, 1978 to your

65th birthday is less than or equal to 400 months.

** If your projected Credited Employment is more

than 400 months. The ratio used in this formula is

your Credited Employment after December 31, 1978

divided by your total projected Credited Employment

to age 65.

Kimberly-Clark Corporation

27Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Grandfathered Benefit As of December 31, 1999

Alternative Minimum Formula

Monthly Rate (based on site from which you retire*)

x

Your Years of Credited Employment

= Your Monthly Benefit

* Frozen Alternative Minimum Benefit Rates By Site

Site

Monthly Benefit Rate

Chester

$38.00

Everett

$40.65

Hattiesburg

$28.00

Marinette

$38.00

Mobile

$38.00

Owensboro

$28.00

San Antonio

$28.00

When you retire or terminate employment, the Plan uses the benefit formulas as described under

the "Benefit Amount" section (including the calculation shown above for any pre-1979 benefit

service). The amount that results will be compared with the frozen amount calculated under the

grandfathered benefit. The method that produces the greater amount will be used to calculate

your retirement benefit from this Plan.

Kimberly-Clark Corporation

28Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Temporary Allowance

If you elect early retirement and the Earnings-Based Formula produces the greater benefit of the

two grandfathered benefit formulas (even if your retirement benefit is determined using the Step

Rate or Minimum Benefit Formula), and payments begin before you reach age 62, you'll receive a

Temporary Allowance until you reach age 62. At age 62 when you first become eligible to receive

your Social Security benefit, the Temporary Allowance will end.

If you retire between the ages of 55 and 62 with at least 10 years of vesting service, the

Temporary Allowance pays the equivalent of the Social Security offset earned up to

December 31, 1999. The Temporary Allowance is calculated using whichever of the following two

formulas produces the greater benefit.

Temporary Allowance Calculation

0.015 x Monthly Social Security Benefit x Benefit

Service

(formerly Credited Employment) After December 31,

1978

OR

IF GREATER

0.015 x Monthly Social Security Benefit x Ratio*

Times

Early Retirement Reduction Factor

EQUALS

Temporary Allowance

(a monthly benefit payable until age 62)

* The ratio used in this formula is your Benefit

Service (formerly Credited Employment) after

December 31, 1978 divided by your total projected

Benefit Service (formerly Credited Employment) to

age 65.

Kimberly-Clark Corporation

29Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Applying for Benefits

Before You Retire

Log on to the Your Benefits Resources (YBR) Web site, or contact the Kimberly-Clark Benefits

Center to request an estimate of your monthly benefit. This estimate will give you an idea of how

much you'll receive from the Plan when you retire. A final calculation will be made when you

retire.

Applying for Retirement Benefits

When you want your benefit payments to begin, log on to Your Benefits Resources (YBR) to

initiate your retirement and make your retirement elections or contact the Kimberly-Clark Benefits

Center. Your request for your normal, early, disability, or deferred retirement benefit should be

made to the Benefits Center within the 60-day period before:

• Your retirement date; or

• The date you want your benefit payments to begin.

However, you cannot make your request later than the 15th of the month prior to the date you

wish your benefit payments to begin. You should log on or call as early as possible within the

60-day period to allow ample time for the Benefits Center to provide you with required

information, such as the payment options available to you, and your spouse's rights if you're

married.

To Begin Retirement Benefits Through YBR

To Begin Retirement Benefits Through the

Benefits Center

This can be a completely paperless procedure,

though you can print verification pages if you wish.

You don't need to sign, copy, or send anything

unless you're married and choose a form of

payment that requires spousal consent. Once you

decide to retire:

• Notify your Team Leader and Human

Resources.

• Update your address through @myHR

portal.

• Log on to YBR.

Once you decide to retire:

• Notify your Team Leader and Human

Resources.

• Update your address through @myHR

portal.

• Contact the Benefits Center.

• Update your e-mail address and mailing

address with the Benefits Center.

• Request your retirement kit.

• Make your pension elections.

Kimberly-Clark Corporation

30Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Kimberly-Clark Corporation

31Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

To Begin Retirement Benefits Through YBR

To Begin Retirement Benefits Through the

Benefits Center

• Update your e-mail address and mailing

address on YBR.

• Click the "My Wealth" tab.

• On the drop-down menu, select "Retire

Now."

• Follow the instructions on the screen.

• Return the required paperwork to the

Benefits Center.

Your authorization to begin your retirement benefits

must be in writing on a Pension Election

Authorization Form (PEA) furnished to you by the

Benefits Center. You must sign the form, and in

some cases it must also be signed by your spouse

and witnessed by a notary public. Your pension

election isn't complete until you provide all the

information required to process it.

If you initiate your retirement—either through a Benefits Center representative or online through

YBR—and you choose a form of payment that requires spousal consent, you'll need to return the

appropriate paperwork to the Benefits Center based on the time frame specified in the

documentation you receive. If you fail to return the signed PEA within the required time period, or

the information is incomplete, the form won't be valid and you'll need to contact the Benefits

Center to start the process over with a later Benefit Commencement Date (BCD).

If applicable, you must return the completed form by:

• The later of the BCD; or

• The earlier of:

o Your initial call date plus 60 days; or

o The last day of the month of your BCD.

If you're eligible to retire and you elect a BCD and then die within 60 days prior to the BCD, your

surviving spouse will receive the greater of the Joint and Survivor Annuity you elected or the Pre-

Retirement Survivor Benefit. If you're single, benefits are paid according to your pension election.

If you're required to return paperwork to the Benefits Center and you do so by the 10th of the

month prior to your BCD, you'll receive a payment on your BCD. If the paperwork is returned after

the 10th of the month but prior to the BCD and within the specified time frame, the first payment

will be on the first of the month following your BCD with a retroactive payment to your BCD.

Survivor Benefits

You should request that someone notify the Kimberly-Clark Benefits Center, as soon as possible,

upon your death. If a survivor option was available under the Plan at retirement and was elected,

the Benefits Center will attempt to notify the designated survivor of the amount of the benefit and

the length of time it will be paid.

The Benefits Center will send the required forms and instructions. The survivor must complete an

application for the survivor benefit and may be asked to provide additional information.

Kimberly-Clark Corporation

32Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

Claims Procedures

Filing a Claim for a Pension Benefit

Most pension benefits are initiated by calling the Kimberly-Clark Benefits Center. Most pension

initiation calls are handled on a routine basis. However, if an issue arises that you can't resolve

with the Benefits Center, you or your beneficiary may file a claim for a pension benefit. To file a

claim, contact the Benefits Center and request a Claim Initiation Form. The form will be sent to

you by postal mail or secure e-mail, whichever you prefer. The form needs to be completed and

returned to the address provided on the form in order for the claim to be researched and

reviewed.

If the claim is denied, you or your beneficiary will generally receive a written notice within 90 days

(45 days for disability benefit claims) of receipt of the claim. The notice will explain the specific

reason for the denial and give you a time frame for providing additional information if the claim is

denied based on incomplete information.

If additional time is required to make a decision, you or your beneficiary will be notified of the

delay within 90 days (45 days for disability benefit claims). This notice will indicate the special

circumstances requiring the extension and the date by which a decision is expected. For claims

other than disability, this extension period may not exceed 90 days beyond the end of the first

90-day period. For a disability claim, this extension may be for 30 days. If another extension is

necessary due to circumstances beyond the Committee's control, another 30-day extension may

be needed. You'll receive notice within the original 30-day extension. The extensions may not

exceed 60 days beyond the first 45-day period.

If You Want to Request a Review of a Denied Claim

Claims for Benefits Other Than Disability Benefits

You or your beneficiary may request a review of a denied claim by writing to the Benefits

Administration Committee (Committee) at the address shown under the "Administrative

Information" section. You must make the appeal within 60 days after you receive the notice that

the claim has been denied.

You may submit with your appeal any additional written comments, documents, records, and

other information relevant to your claim. Upon your request, you'll have reasonable access to,

and copies of, all documents, records, and information relevant to your claim free of charge. If

you decide to appeal, the review will take into account all information in the claim file and any new

information submitted to support the appeal.

The Committee will give the appeal a complete review and provide a written decision, including

reasons, generally within 60 days.

Kimberly-Clark Corporation

33Your Salaried and Hourly Pension Plan (Kimberly-Clark Corporation)-March 2013

If there are special circumstances requiring an extension of time, you or your beneficiary will

receive a notice within 60 days of receiving the appeal indicating the decision will be delayed. A

final decision will be made within 120 days of receiving the appeal.

Claims for Disability Benefits

Any appeal for claims relating to disability benefits must be made within 180 days after your

receipt of the notice of denial of your application. You may submit with your appeal any additional

written comments, documents, records, and other information relevant to your claim. Upon your

request, you'll have reasonable access to, and copies of, all documents, records, and information

relevant to your claim free of charge. If you decide to appeal, the review will take into account all

information in the claim file and any new information submitted to support the appeal. The review

will be conducted by a Subcommittee of the Committee not involved in the initial denial, and who

is not subordinate to those involved in the original decision. The initial denial won't be taken into

consideration by the Subcommittee when your claim is reviewed during appeal.

Prior to June 1, 2006, to the extent that medical judgment was required, the Subcommittee would

consult with a health care professional who had appropriate training and experience in the field of

medicine; who was not consulted in the initial denial of benefit; and was not a subordinate of the

health care professional who was consulted in the initial benefit denial. As of June 1, 2006, the

Disability Insurance Benefit award letter confirms your disability; thus, no medical judgment is

required.

Your appeal will be given a full and fair review and a written decision, including reasons, will

generally be provided within 45 days. However, if special circumstances require a further

extension of time in processing your appeal, you'll receive a written notice within 45 days of

receipt of your appeal indicating the decision will be delayed. A final decision will be made within

90 days of the receipt of your appeal.

After you've exhausted these claim and appeals procedures, you have the right in the case of an

adverse determination to bring a civil action under Section 502(a) of the Employee Retirement

Income Security Act of 1974 (ERISA). No action at law or equity shall be brought to recover

benefits under the Plan until the appeal rights herein provided have been exercised and the

benefits requested in such appeal have been denied in whole or in part. (In other words, you must

complete the claims and appeals procedures as outlined above before you can bring a suit

against the Plan.)