TAX YEAR 2020

PROPERTY TAXES BILLED IN 2021

COOK COUNTY TREASURER

MARIA PAPPAS

Contents

INTRODUCTION 3

MEDIAN TAX DATA 7

MUNICIPALITY TAX DATA 13

SOUTH/WEST TOWNSHIPS SUMMARY DATA 48

NORTH TOWNSHIPS SUMMARY DATA 55

CITY TOWNSHIPS SUMMARY DATA 62

TOP 50 – HIGHEST RESIDENTIAL AND COMMERCIAL PROPERTY TAX BILLS IN THE CITY OF CHICAGO 79

TOP 50 – HIGHEST RESIDENTIAL AND COMMERCIAL PROPERTY TAX BILLS IN SUBURBAN COOK COUNTY 84

RESIDENTIAL PROPERTY – SOUTH/WEST TOWNSHIPS – TOP 10 HIGHEST TAX BILLS, TOP 10 TAX BILL INCREASES 89

COMMERCIAL PROPERTY – SOUTH/WEST TOWNSHIPS – TOP 10 HIGHEST TAX BILLS, TOP 10 TAX BILL INCREASES 109

2

Introduction

3

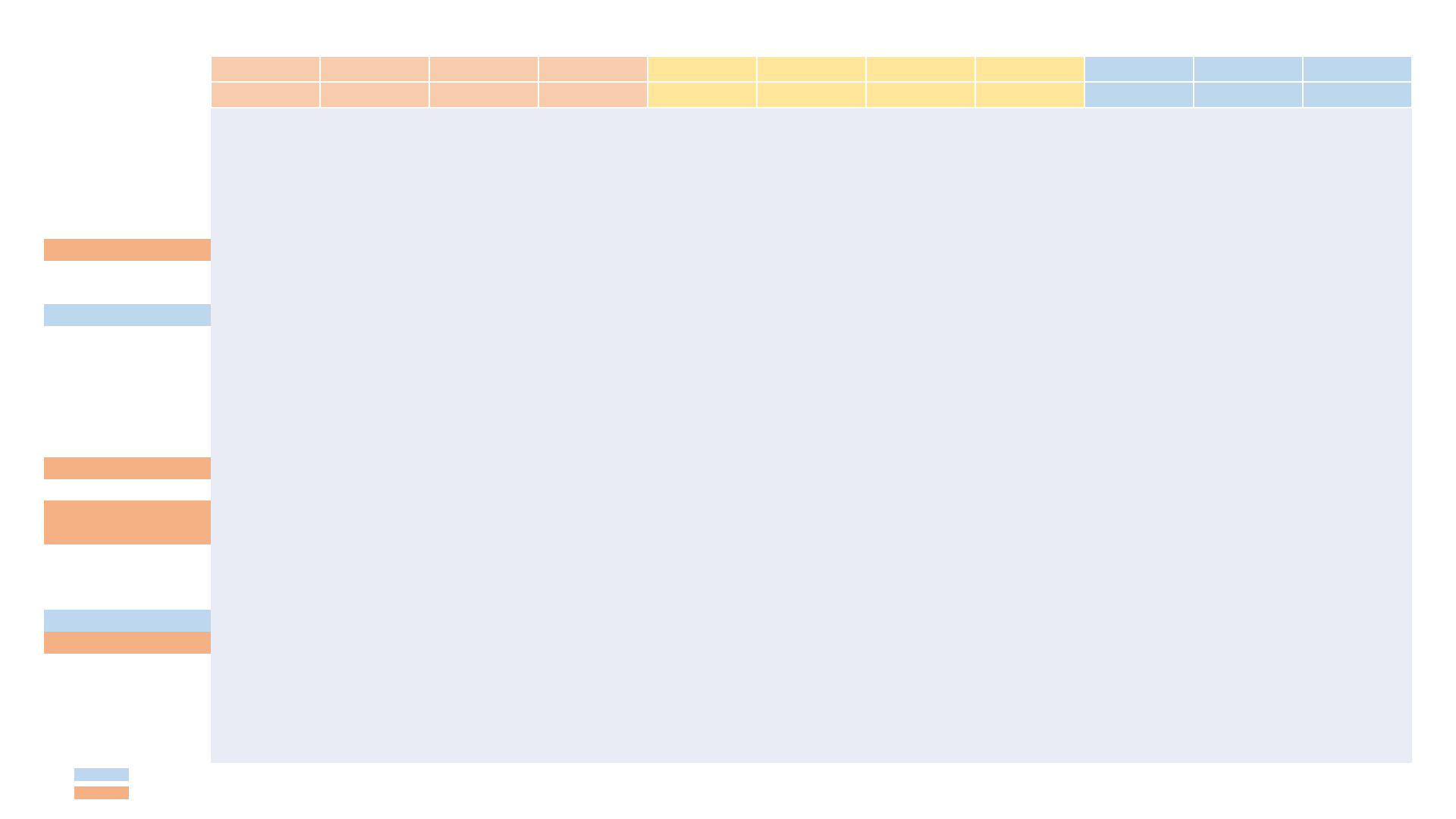

Tax Year 2020 Total Property Taxes Billed in Cook County – (Payable in 2021)

4

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

$8.2 billion

$16.1 billion

Tax Year 2020 Total Property Taxes Billed in Cook County – (Payable in 2021)

5

15.3

15.4

15.5

15.6

15.7

15.8

15.9

16.0

16.1

Tax Year 2019 Tax Year 2020

Total Tax Billed

Tax Year 2020 increase from 2019: 3.425%

Billions

How are property taxes determined?

• School districts, municipalities, park districts and other local governments set the

levy, or the overall amount of taxes to be collected to pay for their operations.

• The assessor estimates the value of properties, and sets homeowner exemptions,

which are then used to determine what portion of the overall tax bill each

property owner pays.

• The clerk determines the tax rates, based on the levies and overall assessed value

in each local government. The assessed value, multiplied by the rate, needs to

equal the total levy.

• The treasurer sends out the bills, collects the money and distributes it to the local

governments that set the levies in the first place.

6

Median Tax Data

7

8

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Median Property Taxes – Countywide (Since 2001)

Commercial Residential

$8,108

$12,698

$2,428

$4,473

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Median Property Taxes - Suburban Cook (Since 2001)

Commercial Residential

9

$11,431

$19,124

$2,805

$5,409

10

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Median Property Taxes - South/West Townships (Since 2001)

Commercial Residential

$8,752

$14,834

$2,485

$4,926

11

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Median Property Taxes - North Townships (Since 2001)

Commercial Residential

$17,044

$27,651

$3,278

$6,015

12

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Median Property Taxes - City of Chicago (Since 2001)

Commercial Residential

$6,276

$9,659

$1,853

$3,341

Municipality Tax Data

13

RESIDENTIAL Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Alsip 90,559,708 89,047,048 1,512,660 1.7%

$26,443,825.92

$26,160,351.51

283,474 1.1%

$4,683.06

$4,488.49

$194.57

Arlington Heights 797,729,257 891,559,955 -93,830,698 -10.5%

$205,741,271.43

$206,357,059.57

-615,788 -0.3%

$7,317.01

$7,347.08

($30.07)

Barrington 82,275,083 90,462,002 -8,186,919 -9.1%

$18,152,581.82

$17,577,246.81

575,335 3.3%

$8,039.40

$7,868.40

$171.00

Barrington Hills 68,366,443 80,705,422 -12,338,979 -15.3%

$17,229,461.63

$17,844,440.37

-614,979 -3.4%

$14,992.65

$15,529.37

($536.72)

Bartlett 122,382,854 137,119,888 -14,737,034 -10.7%

$38,948,351.74

$39,061,083.41

-112,732 -0.3%

$7,207.25

$7,249.88

($42.63)

Bedford Park 3,454,287 3,509,245 -54,958 -1.6%

$1,152,566.09

$1,261,161.55

-108,595 -8.6%

$4,971.59

$5,498.66

($527.07)

Bellwood 89,102,175 67,301,845 21,800,330 32.4%

$32,363,073.35

$25,189,046.40

7,174,027 28.5%

$6,032.80

$4,164.40

$1,868.40

Berkeley 32,363,680 27,009,031 5,354,649 19.8%

$10,198,836.52

$8,364,830.15

1,834,006 21.9%

$6,102.87

$4,670.53

$1,432.34

Berwyn 268,165,446 232,861,159 35,304,287 15.2%

$86,166,607.89

$78,799,172.73

7,367,435 9.3%

$6,383.40

$5,548.64

$834.76

Blue Island 66,885,893 65,188,827 1,697,066 2.6%

$22,679,915.49

$21,874,971.94

804,944 3.7%

$3,356.35

$3,155.24

$201.11

Bridgeview 79,317,305 74,559,252 4,758,053 6.4%

$23,414,278.91

$23,192,134.53

222,144 1.0%

$5,242.24

$4,910.56

$331.68

Broadview 42,833,333 34,667,167 8,166,166 23.6%

$11,448,772.41

$9,609,205.42

1,839,567 19.1%

$4,735.48

$3,695.92

$1,039.56

Brookfield 153,293,964 146,501,688 6,792,276 4.6%

$47,021,485.43

$44,955,656.32

2,065,829 4.6%

$6,228.21

$5,719.08

$509.13

Buffalo Grove 116,844,543 130,345,537 -13,500,994 -10.4%

$32,499,051.17

$32,658,411.35

-159,360 -0.5%

$5,482.64

$5,520.83

($38.19)

Burbank 164,277,896 160,267,525 4,010,371 2.5%

$45,367,283.34

$43,693,190.04

1,674,093 3.8%

$4,818.22

$4,410.30

$407.92

Burnham 10,691,457 10,069,578 621,879 6.2%

$4,709,716.65

$4,463,596.78

246,120 5.5%

$3,438.65

$2,833.72

$604.93

Burr Ridge 112,806,729 114,778,115 -1,971,386 -1.7%

$22,368,128.29

$22,431,306.92

-63,179 -0.3%

$9,426.61

$9,414.76

$11.85

Calumet City 98,156,293 91,002,034 7,154,259 7.9%

$46,450,821.30

$42,836,859.28

3,613,962 8.4%

$3,367.07

$3,257.57

$109.50

Calumet Park 18,410,632 21,690,200 -3,279,568 -15.1%

$6,743,073.45

$7,640,724.78

-897,651 -11.7%

$2,636.84

$2,961.22

($324.38)

Chicago 17,848,332,434 19,671,273,083 -1,822,940,649 -9.3%

$3,550,614,071.89

$3,514,128,143.72

36,485,928 1.0%

$3,340.64

$3,342.27

($1.63)

Chicago Heights 76,866,748 80,363,871 -3,497,123 -4.4%

$31,978,181.51

$32,340,053.49

-361,872 -1.1%

$3,231.27

$3,337.26

($105.99)

Chicago Ridge 56,659,387 53,460,533 3,198,854 6.0%

$16,036,341.45

$15,231,174.88

805,167 5.3%

$3,002.73

$3,063.52

($60.79)

Cicero 229,363,844 184,222,502 45,141,342 24.5%

$74,188,436.16

$65,214,985.48

8,973,451 13.8%

$5,400.44

$4,304.34

$1,096.10

Country Club Hills 65,488,053 64,159,647 1,328,406 2.1%

$33,740,758.42

$32,822,364.84

918,394 2.8%

$5,220.17

$5,004.49

$215.68

Countryside 55,761,616 52,860,903 2,900,713 5.5%

$10,721,513.33

$10,076,080.56

645,433 6.4%

$4,370.92

$4,308.52

$62.40

Crestwood 64,951,379 63,533,957 1,417,422 2.2%

$15,030,161.94

$14,517,076.53

513,085 3.5%

$2,010.07

$1,935.51

$74.56

Deer Park 197,774 232,228 -34,454 -14.8%

$54,897.52

$57,890.23

-2,993 -5.2%

$4,614.70

$4,399.52

$215.18

Des Plaines 450,942,120 505,797,213 -54,855,093 -10.8%

$108,714,313.38

$109,209,289.26

-494,976 -0.5%

$4,708.97

$4,706.19

$2.78

Dixmoor 4,085,846 4,581,031 -495,185 -10.8%

$1,194,647.36

$1,396,331.76

-201,684 -14.4%

$873.15

$1,145.43

($272.28)

Dolton 74,491,438 64,648,623 9,842,815 15.2%

$35,565,901.89

$31,775,181.37

3,790,721 11.9%

$4,368.27

$3,641.56

$726.71

14

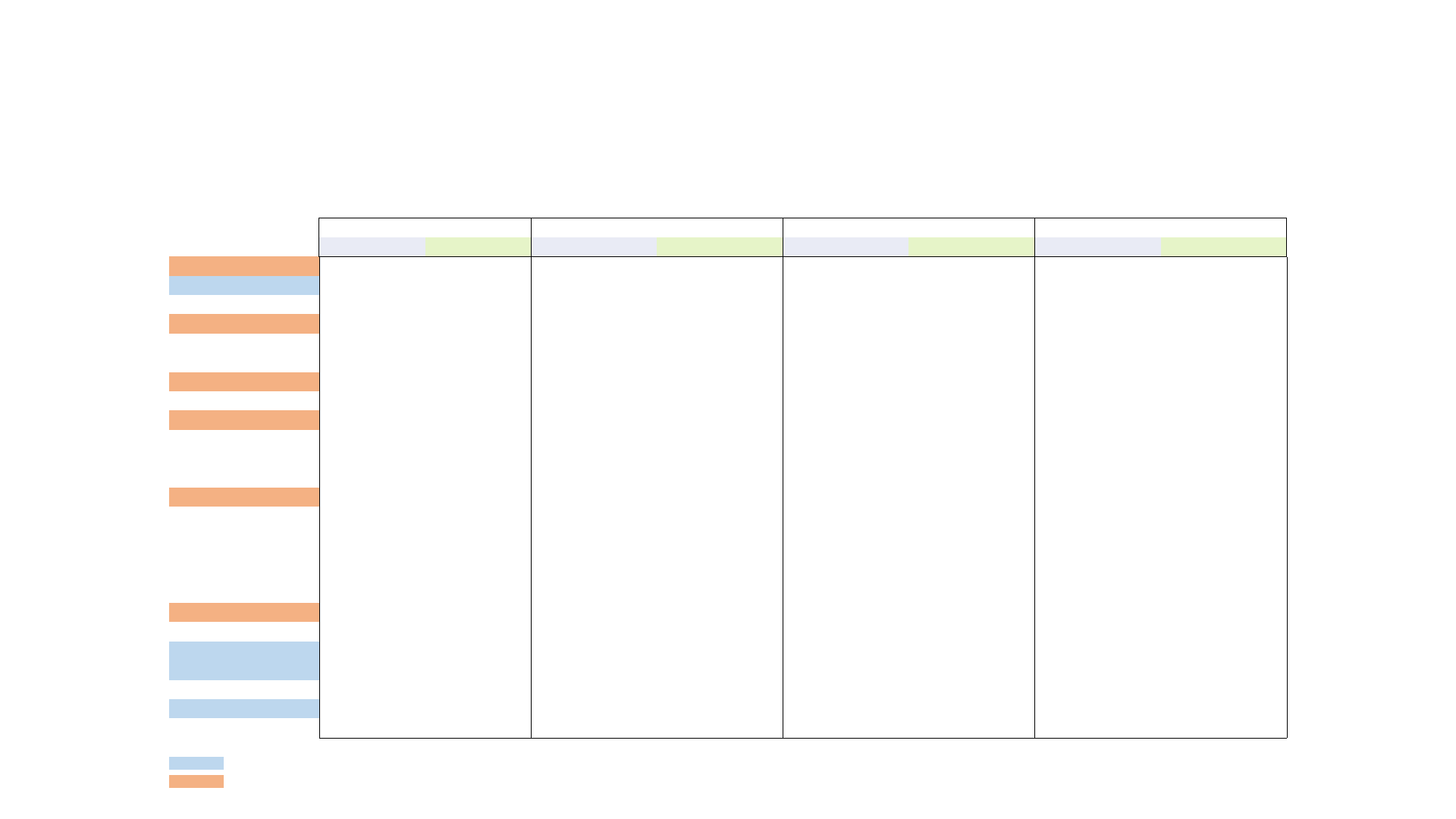

Residential – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

RESIDENTIAL Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

East Hazel Crest 4,630,049 4,741,721 -111,672 -2.4%

$1,987,207.33

$1,958,803.90

28,403 1.5%

$2,945.10

$3,299.12

($354.02)

Elgin 116,122,944 130,286,697 -14,163,753 -10.9%

$32,208,852.67

$32,452,162.11

-243,309 -0.7%

$4,334.82

$4,388.66

($53.84)

Elk Grove Village 266,067,155 299,075,767 -33,008,612 -11.0%

$62,730,342.86

$63,897,275.94

-1,166,933 -1.8%

$4,950.06

$5,008.43

($58.37)

Elmwood Park 165,097,031 186,765,962 -21,668,931 -11.6%

$48,943,261.06

$44,429,955.27

4,513,306 10.2%

$6,606.87

$6,030.70

$576.17

Evanston 783,331,189 873,484,968 -90,153,779 -10.3%

$186,935,173.73

$186,342,017.94

593,156 0.3%

$6,630.07

$6,571.42

$58.65

Evergreen Park 124,920,370 120,423,407 4,496,963 3.7%

$36,358,263.07

$35,909,421.64

448,841 1.2%

$4,690.17

$4,451.34

$238.83

Flossmoor 78,551,652 79,090,993 -539,341 -0.7%

$33,210,290.92

$34,548,593.73

-1,338,303 -3.9%

$8,234.16

$8,540.07

($305.91)

Ford Heights 2,636,488 2,256,328 380,160 16.8%

$1,493,259.98

$1,264,034.19

229,226 18.1%

$518.47

$336.15

$182.32

Forest Park 101,135,762 92,431,123 8,704,639 9.4%

$28,477,368.07

$27,000,813.32

1,476,555 5.5%

$5,508.07

$5,330.51

$177.56

Forest View 4,894,644 4,142,477 752,167 18.2%

$1,471,491.52

$1,350,747.43

120,744 8.9%

$5,563.46

$5,041.34

$522.12

Frankfort 31,486 31,486 0 0.0%

$2,611.45

$2,638.21

-27 -1.0%

$2,611.45

$2,638.21

($26.76)

Franklin Park 90,958,056 103,106,475 -12,148,419 -11.8%

$26,584,101.76

$27,599,433.75

-1,015,332 -3.7%

$4,820.38

$5,034.20

($213.82)

Glencoe 294,164,667 323,472,671 -29,308,004 -9.1%

$78,938,724.58

$77,128,652.58

1,810,072 2.3%

$18,856.25

$18,671.60

$184.65

Glenview 779,751,103 868,922,824 -89,171,721 -10.3%

$175,819,421.64

$167,586,249.48

8,233,172 4.9%

$9,004.77

$8,634.38

$370.39

Glenwood 36,766,146 36,534,639 231,507 0.6%

$14,141,917.16

$14,231,604.47

-89,687 -0.6%

$4,399.18

$4,261.65

$137.53

Golf 12,802,684 14,398,884 -1,596,200 -11.1%

$3,411,908.89

$3,264,067.66

147,841 4.5%

$17,639.39

$16,677.50

$961.89

Hanover Park 88,202,181 99,676,879 -11,474,698 -11.5%

$25,752,979.10

$26,337,462.98

-584,484 -2.2%

$5,382.50

$5,439.42

($56.92)

Harvey 40,829,599 47,781,185 -6,951,586 -14.5%

$21,205,450.18

$23,926,913.62

-2,721,463 -11.4%

$1,514.55

$2,020.05

($505.50)

Harwood Heights 65,081,236 73,892,777 -8,811,541 -11.9%

$13,918,723.58

$13,905,017.69

13,706 0.1%

$5,220.53

$5,198.62

$21.91

Hazel Crest 47,838,488 47,017,729 820,759 1.7%

$22,005,070.07

$20,863,148.17

1,141,922 5.5%

$3,937.71

$3,618.56

$319.15

Hickory Hills 89,100,613 88,484,698 615,915 0.7%

$24,960,395.74

$24,596,196.91

364,199 1.5%

$5,564.66

$5,460.44

$104.22

Hillside 44,882,417 37,719,274 7,163,143 19.0%

$14,014,229.54

$11,727,627.60

2,286,602 19.5%

$5,531.64

$4,167.97

$1,363.67

Hinsdale 69,095,240 69,988,547 -893,307 -1.3%

$14,681,063.07

$14,438,911.52

242,152 1.7%

$16,145.51

$16,530.03

($384.52)

Hodgkins 3,508,507 3,552,221 -43,714 -1.2%

$876,611.30

$883,507.74

-6,896 -0.8%

$5,213.56

$5,418.62

($205.06)

Hoffman Estates 386,671,068 430,014,926 -43,343,858 -10.1%

$107,309,084.33

$106,569,688.84

739,395 0.7%

$6,421.01

$6,383.53

$37.48

Hometown 19,102,109 20,400,089 -1,297,980 -6.4%

$4,923,471.20

$4,964,573.26

-41,102 -0.8%

$2,930.84

$3,116.94

($186.10)

Homewood 106,398,113 103,574,370 2,823,743 2.7%

$38,102,977.49

$37,750,802.13

352,175 0.9%

$5,044.89

$4,737.73

$307.16

Indian Head Park 54,625,685 54,092,904 532,781 1.0%

$11,305,433.99

$11,178,397.38

127,037 1.1%

$4,350.94

$4,209.16

$141.78

Inverness 154,220,244 172,972,170 -18,751,926 -10.8%

$39,925,519.82

$39,748,728.39

176,791 0.4%

$12,594.86

$12,386.31

$208.55

Justice 56,461,847 53,012,735 3,449,112 6.5%

$14,697,537.69

$14,862,109.79

-164,572 -1.1%

$4,470.38

$4,545.97

($75.59)

15

Residential – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

RESIDENTIAL Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Kenilworth 98,810,744 110,871,485 -12,060,741 -10.9%

$27,546,820.67

$27,246,339.40

300,481 1.1%

$28,779.58

$28,944.07

($164.49)

La Grange 227,357,762 227,532,875 -175,113 -0.1%

$56,333,839.48

$56,087,475.39

246,364 0.4%

$8,907.62

$9,050.63

($143.01)

La Grange Park 140,455,291 137,933,801 2,521,490 1.8%

$36,041,616.25

$34,643,417.93

1,398,198 4.0%

$7,679.59

$7,598.34

$81.25

Lansing 108,866,720 110,317,898 -1,451,178 -1.3%

$43,822,234.78

$41,835,849.21

1,986,386 4.7%

$3,864.98

$3,628.93

$236.05

Lemont 210,719,832 211,256,311 -536,479 -0.3%

$44,555,298.33

$42,926,833.97

1,628,464 3.8%

$6,721.36

$6,714.76

$6.60

Lincolnwood 159,566,864 174,199,109 -14,632,245 -8.4%

$40,116,603.99

$39,776,451.66

340,152 0.9%

$7,402.58

$7,513.20

($110.62)

Lynwood 42,739,664 42,124,989 614,675 1.5%

$13,648,540.72

$13,447,914.64

200,626 1.5%

$4,656.90

$4,810.72

($153.82)

Lyons 50,217,215 46,252,694 3,964,521 8.6%

$13,720,066.07

$13,501,008.78

219,057 1.6%

$4,117.67

$3,920.27

$197.40

Markham 31,849,232 37,439,016 -5,589,784 -14.9%

$15,814,375.98

$17,830,262.58

-2,015,887 -11.3%

$2,343.70

$2,959.96

($616.26)

Matteson 98,612,968 97,689,784 923,184 0.9%

$39,144,245.09

$39,657,827.43

-513,582 -1.3%

$5,730.23

$5,651.45

$78.78

Maywood 93,030,495 74,434,459 18,596,036 25.0%

$37,215,870.14

$32,164,519.87

5,051,350 15.7%

$6,330.71

$4,787.54

$1,543.17

McCook 1,828,963 1,888,431 -59,468 -3.1%

$641,563.32

$744,313.96

-102,751 -13.8%

$7,854.19

$8,785.76

($931.57)

Melrose Park 94,064,271 87,082,912 6,981,359 8.0%

$23,901,198.37

$23,000,965.07

900,233 3.9%

$4,567.07

$4,249.03

$318.04

Merrionette Park 7,201,269 7,037,551 163,718 2.3%

$1,806,459.67

$1,726,076.33

80,383 4.7%

$2,824.39

$2,863.93

($39.54)

Midlothian 68,548,082 68,617,272 -69,190 -0.1%

$22,502,230.15

$22,152,588.68

349,641 1.6%

$4,305.76

$4,224.91

$80.85

Morton Grove 249,892,471 280,569,791 -30,677,320 -10.9%

$65,112,793.03

$64,951,385.28

161,408 0.2%

$6,701.93

$6,778.43

($76.50)

Mount Prospect 455,152,668 512,736,640 -57,583,972 -11.2%

$116,025,173.84

$117,587,501.38

-1,562,328 -1.3%

$6,734.84

$6,835.56

($100.72)

Niles 259,251,117 299,074,137 -39,823,020 -13.3%

$55,796,181.02

$56,877,571.73

-1,081,391 -1.9%

$5,097.16

$5,129.28

($32.12)

Norridge 139,388,360 157,124,070 -17,735,710 -11.3%

$28,294,167.77

$28,072,252.12

221,916 0.8%

$5,207.92

$5,202.89

$5.03

North Riverside 53,042,217 50,656,906 2,385,311 4.7%

$12,593,794.23

$11,082,130.18

1,511,664 13.6%

$5,275.29

$4,404.01

$871.28

Northbrook 621,667,249 686,826,202 -65,158,953 -9.5%

$142,522,118.30

$139,063,220.05

3,458,898 2.5%

$10,227.92

$9,885.10

$342.82

Northfield 144,224,481 159,558,356 -15,333,875 -9.6%

$32,325,987.76

$31,895,103.25

430,885 1.4%

$9,463.42

$9,446.81

$16.61

Northlake 51,111,128 54,497,074 -3,385,946 -6.2%

$15,112,164.26

$14,980,551.87

131,612 0.9%

$4,814.95

$4,658.61

$156.34

Oak Brook 321,485 324,351 -2,866 -0.9%

$59,040.36

$56,263.27

2,777 4.9%

$7,123.42

$6,603.36

$520.06

Oak Forest 162,983,017 158,498,548 4,484,469 2.8%

$53,001,408.53

$51,354,436.65

1,646,972 3.2%

$5,626.75

$5,469.97

$156.78

Oak Lawn 370,913,425 370,114,828 798,597 0.2%

$103,058,020.92

$100,611,852.46

2,446,168 2.4%

$4,229.11

$3,980.15

$248.96

Oak Park 543,043,994 528,134,740 14,909,254 2.8%

$175,747,053.48

$177,658,115.78

-1,911,062 -1.1%

$10,422.40

$10,176.22

$246.18

Olympia Fields 41,632,814 42,212,330 -579,516 -1.4%

$16,345,447.94

$16,644,084.72

-298,637 -1.8%

$8,230.69

$8,217.76

$12.93

Orland Hills 41,239,507 43,454,836 -2,215,329 -5.1%

$10,752,155.38

$10,930,663.72

-178,508 -1.6%

$5,270.38

$5,165.80

$104.58

Orland Park 604,216,802 606,223,743 -2,006,941 -0.3%

$144,446,532.70

$141,784,196.84

2,662,336 1.9%

$5,906.05

$5,900.49

$5.56

16

Residential – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

RESIDENTIAL Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Palatine 566,765,051 634,931,007 -68,165,956 -10.7%

$157,197,009.78

$157,826,831.79

-629,822 -0.4%

$5,735.86

$5,779.73

($43.87)

Palos Heights 130,554,407 136,488,211 -5,933,804 -4.3%

$34,428,222.87

$34,812,481.80

-384,259 -1.1%

$6,522.64

$6,521.48

$1.16

Palos Hills 122,905,764 123,521,373 -615,609 -0.5%

$30,802,290.75

$30,276,583.04

525,708 1.7%

$3,614.80

$3,584.85

$29.95

Palos Park 75,409,607 77,987,609 -2,578,002 -3.3%

$17,993,576.80

$17,973,364.78

20,212 0.1%

$7,070.96

$6,914.57

$156.39

Park Forest 38,865,816 42,369,633 -3,503,817 -8.3%

$27,432,577.79

$27,784,158.07

-351,580 -1.3%

$4,238.55

$5,125.98

($887.43)

Park Ridge 537,773,681 603,306,185 -65,532,504 -10.9%

$139,895,341.18

$139,687,325.22

208,016 0.1%

$8,162.78

$8,135.06

$27.72

Phoenix 3,543,507 3,883,818 -340,311 -8.8%

$1,889,531.10

$1,913,649.31

-24,118 -1.3%

$907.63

$1,075.48

($167.85)

Posen 19,276,831 19,492,399 -215,568 -1.1%

$5,669,412.50

$5,494,963.83

174,449 3.2%

$2,559.29

$2,386.09

$173.20

Prospect Heights 121,413,713 136,029,428 -14,615,715 -10.7%

$33,808,250.08

$34,001,437.01

-193,187 -0.6%

$4,624.65

$4,622.29

$2.36

Richton Park 47,581,309 47,801,706 -220,397 -0.5%

$19,025,682.83

$19,148,635.42

-122,953 -0.6%

$4,484.37

$4,487.75

($3.38)

River Forest 193,752,081 188,892,743 4,859,338 2.6%

$54,221,977.70

$53,698,389.95

523,588 1.0%

$13,295.79

$12,990.78

$305.01

River Grove 55,098,974 63,251,457 -8,152,483 -12.9%

$16,108,269.52

$16,340,634.72

-232,365 -1.4%

$5,183.30

$5,227.69

($44.39)

Riverdale 22,556,256 24,541,192 -1,984,936 -8.1%

$12,731,484.14

$14,210,640.37

-1,479,156 -10.4%

$2,660.55

$3,017.83

($357.28)

Riverside 113,666,739 108,550,450 5,116,289 4.7%

$35,811,345.93

$33,458,634.17

2,352,712 7.0%

$10,899.32

$9,677.91

$1,221.41

Robbins 11,619,707 9,999,874 1,619,833 16.2%

$3,697,048.46

$3,077,265.32

619,783 20.1%

$1,319.34

$1,023.16

$296.18

Rolling Meadows 168,701,153 187,244,576 -18,543,423 -9.9%

$45,901,918.02

$45,748,541.65

153,376 0.3%

$5,002.24

$5,042.18

($39.94)

Roselle 30,734,242 34,533,659 -3,799,417 -11.0%

$8,105,495.16

$8,186,256.58

-80,761 -1.0%

$4,959.64

$5,042.32

($82.68)

Rosemont 21,526,852 24,326,678 -2,799,826 -11.5%

$6,135,111.69

$5,765,253.20

369,858 6.4%

$5,373.64

$4,733.73

$639.91

Sauk Village 19,715,770 25,338,427 -5,622,657 -22.2%

$6,422,537.31

$7,793,332.15

-1,370,795 -17.6%

$2,115.11

$2,260.88

($145.77)

Schaumburg 567,695,917 635,284,067 -67,588,150 -10.6%

$141,581,833.16

$142,739,901.84

-1,158,069 -0.8%

$5,033.39

$5,067.18

($33.79)

Schiller Park 59,461,029 67,701,146 -8,240,117 -12.2%

$17,450,214.57

$17,064,910.75

385,304 2.3%

$4,868.40

$4,803.81

$64.59

Skokie 571,250,701 639,372,504 -68,121,803 -10.7%

$144,129,547.94

$145,329,896.26

-1,200,348 -0.8%

$5,810.68

$5,901.57

($90.89)

South Barrington 127,871,793 145,078,572 -17,206,779 -11.9%

$29,893,200.11

$29,904,415.72

-11,216 0.0%

$15,398.69

$15,292.00

$106.69

South Chicago Heights 12,493,259 14,313,968 -1,820,709 -12.7%

$3,521,650.85

$3,898,841.54

-377,191 -9.7%

$2,243.30

$2,347.50

($104.20)

South Holland 104,196,240 98,832,434 5,363,806 5.4%

$40,908,241.33

$38,505,523.52

2,402,718 6.2%

$5,347.85

$4,724.75

$623.10

Steger 17,730,170 19,781,308 -2,051,138 -10.4%

$4,735,894.83

$5,122,513.34

-386,619 -7.5%

$1,313.24

$1,433.43

($120.19)

Stickney 34,019,385 28,661,735 5,357,650 18.7%

$9,816,400.19

$8,872,900.69

943,500 10.6%

$4,953.92

$4,192.05

$761.87

Stone Park 12,233,429 10,554,394 1,679,035 15.9%

$4,579,131.99

$4,088,079.07

491,053 12.0%

$5,628.84

$4,221.12

$1,407.72

Streamwood 242,931,459 272,759,506 -29,828,047 -10.9%

$71,167,789.61

$71,180,746.73

-12,957 0.0%

$5,026.64

$5,040.59

($13.95)

Summit 37,437,172 38,191,700 -754,528 -2.0%

$12,649,828.10

$13,521,142.45

-871,314 -6.4%

$4,954.19

$5,222.17

($267.98)

17

Residential – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

RESIDENTIAL Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality

Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Thornton

8,770,273

9,186,590

-

416,317

-

4.5%

$3,313,547.34

$3,302,003.27

11,544

0.3%

$3,292.66

$3,325.44

($32.78)

Tinley Park

370,432,477

378,263,006

-

7,830,529

-

2.1%

$109,256,532.16

$108,039,889.92

1,216,642

1.1%

$5,718.03

$5,856.80

($138.77)

Unincorporated

784,314,860

844,732,939

-

60,418,079

-

7.2%

$177,165,165.97

$175,688,505.07

1,476,661

0.8%

$4,719.05

$4,726.94

($7.89)

University Park

51,050

49,229

1,821

3.7%

$22,868.08

$22,284.81

583

2.6%

$7,926.34

$7,444.79

$481.55

Westchester

163,115,610

163,167,989

-

52,379

0.0%

$37,507,573.39

$36,171,735.57

1,335,838

3.7%

$5,211.81

$4,905.81

$306.00

Western Springs

267,601,380

264,467,335

3,134,045

1.2%

$58,830,468.37

$57,011,530.71

1,818,938

3.2%

$10,309.31

$10,311.16

($1.85)

Wheeling

204,841,798

230,144,343

-

25,302,545

-

11.0%

$58,637,515.78

$59,873,045.65

-

1,235,530

-

2.1%

$4,655.66

$4,755.72

($100.06)

Willow Springs

67,323,793

68,480,402

-

1,156,609

-

1.7%

$16,862,928.59

$17,409,164.44

-

546,236

-

3.1%

$5,735.52

$6,035.79

($300.27)

Wilmette

596,418,714

660,465,518

-

64,046,804

-

9.7%

$142,989,317.73

$141,308,950.90

1,680,367

1.2%

$11,881.54

$11,737.86

$143.68

Winnetka

444,431,802

498,011,243

-

53,579,441

-

10.8%

$109,866,610.01

$112,270,640.24

-

2,404,030

-

2.1%

$20,740.37

$21,218.28

($477.91)

Worth

54,067,218

51,660,144

2,407,074

4.7%

$16,096,819.32

$15,690,326.43

406,493

2.6%

$4,440.90

$4,232.13

$208.77

18

Residential – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

Commercial Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Alsip 144,694,055 126,007,830 18,686,225 14.8%

$55,241,338.25

$49,787,191.42

5,454,147 11.0%

$31,256.68

$26,956.33

$4,300.35

Arlington Heights 361,505,260 383,980,014 -22,474,754 -5.9%

$108,716,062.85

$103,501,776.92

5,214,286 5.0%

$29,625.15

$27,833.73

$1,791.42

Barrington 43,106,823 44,263,610 -1,156,787 -2.6%

$10,266,915.55

$9,328,889.08

938,026 10.1%

$17,851.19

$17,034.45

$816.74

Barrington Hills 25,149 25,149 0 0.0%

$6,791.59

$5,958.60

833 14.0%

$3,395.79

$2,979.30

$416.49

Bartlett 22,344,769 21,602,863 741,906 3.4%

$9,124,197.92

$8,089,483.03

1,034,715 12.8%

$34,578.81

$34,537.22

$41.59

Bedford Park 177,178,517 151,901,199 25,277,318 16.6%

$67,334,769.53

$60,328,337.21

7,006,432 11.6%

$53,045.32

$43,331.95

$9,713.37

Bellwood 35,589,303 33,103,410 2,485,893 7.5%

$18,008,997.14

$18,761,050.93

-752,054 -4.0%

$12,959.43

$13,573.24

($613.81)

Bensenville 9,915,066 11,066,186 -1,151,120 -10.4%

$3,295,798.91

$3,343,096.54

-47,298 -1.4%

$26,238.44

$24,744.82

$1,493.62

Berkeley 14,985,832 12,770,090 2,215,742 17.4%

$6,214,728.41

$5,441,414.19

773,314 14.2%

$26,276.00

$23,833.04

$2,442.96

Berwyn 64,939,783 63,944,397 995,386 1.6%

$26,076,898.78

$28,083,215.09

-2,006,316 -7.1%

$13,941.94

$13,888.28

$53.66

Blue Island 38,631,546 36,046,382 2,585,164 7.2%

$17,440,479.82

$16,605,805.78

834,674 5.0%

$12,404.39

$11,456.39

$948.00

Bridgeview 115,687,331 97,806,944 17,880,387 18.3%

$44,728,653.22

$40,050,671.48

4,677,982 11.7%

$27,782.96

$26,118.84

$1,664.12

Broadview 68,841,636 61,992,694 6,848,942 11.0%

$24,393,008.73

$23,274,773.40

1,118,235 4.8%

$15,148.29

$15,078.09

$70.20

Brookfield 17,311,762 15,911,504 1,400,258 8.8%

$6,120,562.44

$5,785,932.50

334,630 5.8%

$10,260.04

$10,093.23

$166.81

Buffalo Grove 24,122,739 25,307,354 -1,184,615 -4.7%

$8,275,147.48

$7,819,685.39

455,462 5.8%

$74,606.00

$68,271.40

$6,334.60

Burbank 43,911,555 40,879,469 3,032,086 7.4%

$15,631,738.70

$14,646,406.72

985,332 6.7%

$15,509.53

$14,062.47

$1,447.06

Burnham 7,915,390 6,990,123 925,267 13.2%

$5,368,377.53

$4,983,742.15

384,635 7.7%

$4,202.62

$4,376.73

($174.11)

Burr Ridge 38,408,613 35,653,068 2,755,545 7.7%

$8,089,451.70

$7,429,247.66

660,204 8.9%

$47,146.83

$48,354.69

($1,207.86)

Calumet City 68,801,080 63,290,007 5,511,073 8.7%

$48,929,537.66

$47,712,419.56

1,217,118 2.6%

$10,233.10

$10,097.65

$135.45

Calumet Park 14,397,017 13,196,369 1,200,648 9.1%

$8,770,060.64

$7,530,845.88

1,239,215 16.5%

$8,601.99

$7,824.25

$777.74

Chicago 16,185,286,893 16,867,113,300 -681,826,407 -4.0%

$3,633,130,057.58

$3,416,449,450.27

216,680,607 6.3%

$9,659.30

$8,898.63

$760.67

Chicago Heights 69,740,591 59,674,596 10,065,995 16.9%

$44,097,700.96

$37,305,301.07

6,792,400 18.2%

$14,272.27

$12,156.64

$2,115.63

Chicago Ridge 70,678,044 72,214,179 -1,536,135 -2.1%

$26,013,038.10

$26,453,773.84

-440,736 -1.7%

$20,686.72

$18,019.87

$2,666.85

Cicero 128,207,659 106,481,081 21,726,578 20.4%

$53,803,398.26

$52,145,745.59

1,657,653 3.2%

$12,631.74

$12,018.43

$613.31

Country Club Hills 17,976,266 16,513,724 1,462,542 8.9%

$11,920,307.84

$11,200,675.45

719,632 6.4%

$62,279.99

$57,920.67

$4,359.32

Countryside 69,544,993 62,966,164 6,578,829 10.4%

$16,157,014.07

$14,768,478.77

1,388,535 9.4%

$23,936.73

$21,665.21

$2,271.52

Crestwood 74,626,974 72,291,763 2,335,211 3.2%

$24,035,199.18

$23,727,118.65

308,081 1.3%

$24,269.85

$20,707.24

$3,562.61

Deerfield 57,181,983 65,987,982 -8,805,999 -13.3%

$14,988,952.78

$15,194,157.02

-205,204 -1.4%

$184,935.81

$162,415.39

$22,520.42

Des Plaines 378,068,558 392,975,049 -14,906,491 -3.8%

$112,516,563.73

$104,482,149.48

8,034,414 7.7%

$22,934.01

$21,061.96

$1,872.05

Dixmoor 11,844,925 8,041,499 3,803,426 47.3%

$6,055,878.24

$4,244,506.31

1,811,372 42.7%

$5,622.88

$4,140.78

$1,482.10

19

Commercial – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

Commercial Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Dolton 27,646,431 23,662,109 3,984,322 16.8%

$19,307,160.53

$18,458,742.88

848,418 4.6%

$17,127.76

$17,126.66

$1.10

East Dundee 1,462,361 1,462,361 0 0.0%

$419,620.16

$386,894.95

32,725 8.5%

$419,620.16

$386,894.95

$32,725.21

East Hazel Crest 3,680,454 3,798,007 -117,553 -3.1%

$2,255,028.15

$2,271,258.72

-16,231 -0.7%

$20,832.01

$17,876.41

$2,955.60

Elgin 52,778,411 55,036,337 -2,257,926 -4.1%

$18,265,344.91

$17,041,018.61

1,224,326 7.2%

$21,572.55

$20,684.33

$888.22

Elk Grove Village 582,697,532 590,919,097 -8,221,565 -1.4%

$157,000,624.23

$144,873,091.96

12,127,532 8.4%

$40,402.68

$34,181.31

$6,221.37

Elmwood Park 26,750,048 29,045,466 -2,295,418 -7.9%

$9,707,334.10

$8,469,503.84

1,237,830 14.6%

$13,560.49

$12,029.70

$1,530.79

Evanston 374,872,181 397,016,679 -22,144,498 -5.6%

$99,243,366.77

$94,167,579.38

5,075,787 5.4%

$23,852.49

$21,998.94

$1,853.55

Evergreen Park 62,135,303 52,007,331 10,127,972 19.5%

$23,711,159.51

$21,038,346.47

2,672,813 12.7%

$12,685.17

$11,900.50

$784.67

Flossmoor 13,826,956 10,886,815 2,940,141 27.0%

$7,102,228.81

$5,830,405.57

1,271,823 21.8%

$26,171.60

$16,763.67

$9,407.93

Ford Heights 2,357,638 1,660,243 697,395 42.0%

$1,874,741.57

$1,320,671.93

554,070 42.0%

$22,733.02

$18,746.14

$3,986.88

Forest Park 54,589,412 49,591,676 4,997,736 10.1%

$17,796,047.73

$17,228,312.57

567,735 3.3%

$17,039.64

$17,085.28

($45.64)

Forest View 21,389,543 16,712,811 4,676,732 28.0%

$7,599,009.93

$6,542,137.43

1,056,873 16.2%

$15,265.97

$15,826.69

($560.72)

Franklin Park 214,355,417 212,276,255 2,079,162 1.0%

$81,023,531.78

$73,861,766.57

7,161,765 9.7%

$18,185.76

$17,048.13

$1,137.63

Glencoe 16,346,623 17,812,696 -1,466,073 -8.2%

$4,472,582.25

$4,337,049.11

135,533 3.1%

$35,416.07

$33,429.73

$1,986.34

Glenview 317,470,041 361,025,922 -43,555,881 -12.1%

$78,964,092.38

$77,351,211.59

1,612,881 2.1%

$39,707.89

$37,660.62

$2,047.27

Glenwood 14,352,828 12,799,278 1,553,550 12.1%

$7,783,172.48

$7,148,325.45

634,847 8.9%

$23,968.56

$18,866.66

$5,101.90

Golf 1,622,595 1,622,595 0 0.0%

$451,424.86

$387,130.27

64,295 16.6%

$225,712.43

$193,565.13

$32,147.30

Hanover Park 27,795,676 28,944,646 -1,148,970 -4.0%

$10,206,591.13

$9,523,613.17

682,978 7.2%

$28,885.09

$28,436.58

$448.51

Harvey 40,715,565 39,725,031 990,534 2.5%

$33,532,358.24

$31,752,889.68

1,779,469 5.6%

$8,263.69

$6,912.65

$1,351.04

Harwood Heights 38,286,966 45,768,875 -7,481,909 -16.3%

$10,025,833.21

$10,572,085.96

-546,253 -5.2%

$14,248.46

$12,164.19

$2,084.27

Hazel Crest 14,366,044 13,444,041 922,003 6.9%

$9,886,715.23

$9,226,747.50

659,968 7.2%

$14,295.94

$14,374.72

($78.78)

Hickory Hills 33,761,274 30,503,687 3,257,587 10.7%

$12,062,606.82

$10,971,620.15

1,090,987 9.9%

$22,926.54

$21,016.91

$1,909.63

Hillside 58,058,941 52,746,237 5,312,704 10.1%

$21,828,423.43

$21,148,728.65

679,695 3.2%

$18,242.30

$17,392.94

$849.36

Hinsdale 1,963,390 1,966,041 -2,651 -0.1%

$426,158.30

$418,581.74

7,577 1.8%

$37,457.93

$26,456.81

$11,001.12

Hodgkins 76,954,578 72,144,848 4,809,730 6.7%

$22,512,847.94

$21,310,743.56

1,202,104 5.6%

$12,640.42

$11,014.54

$1,625.88

Hoffman Estates 229,874,358 235,850,164 -5,975,806 -2.5%

$70,595,445.38

$65,155,209.31

5,440,236 8.3%

$100,072.67

$93,671.29

$6,401.38

Hometown 2,491,149 2,343,352 147,797 6.3%

$924,410.15

$849,163.51

75,247 8.9%

$43,023.91

$30,167.41

$12,856.50

Homewood 48,753,117 45,509,874 3,243,243 7.1%

$23,657,340.23

$22,858,556.64

798,784 3.5%

$20,491.36

$17,467.35

$3,024.01

Indian Head Park 5,074,026 4,366,941 707,085 16.2%

$1,241,002.05

$1,070,780.99

170,221 15.9%

$18,901.75

$13,968.16

$4,933.59

Inverness 5,173,264 7,487,558 -2,314,294 -30.9%

$1,697,940.94

$2,203,745.49

-505,805 -23.0%

$22,318.52

$19,870.08

$2,448.44

20

Commercial – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

Commercial Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Justice 17,961,692 14,890,615 3,071,077 20.6%

$5,955,579.13

$5,410,224.00

545,355 10.1%

$16,959.94

$17,363.41

($403.47)

Kenilworth 3,091,444 3,337,789 -246,345 -7.4%

$885,386.81

$843,071.92

42,315 5.0%

$21,591.35

$19,853.13

$1,738.22

La Grange 49,323,701 42,937,371 6,386,330 14.9%

$13,588,661.23

$11,843,794.34

1,744,867 14.7%

$14,549.63

$14,095.94

$453.69

La Grange Park 15,676,854 14,686,730 990,124 6.7%

$4,523,223.70

$4,228,300.07

294,924 7.0%

$10,803.87

$9,639.14

$1,164.73

Lansing 63,241,063 62,448,106 792,957 1.3%

$36,559,225.74

$35,228,014.49

1,331,211 3.8%

$14,088.85

$13,153.22

$935.63

Lemont 50,739,493 44,963,221 5,776,272 12.8%

$12,066,990.67

$10,399,862.48

1,667,128 16.0%

$9,727.45

$8,160.36

$1,567.09

Lincolnwood 92,664,149 98,242,839 -5,578,690 -5.7%

$26,388,696.57

$25,415,274.12

973,422 3.8%

$20,261.04

$19,568.35

$692.69

Lynwood 14,526,162 14,171,423 354,739 2.5%

$5,372,394.17

$5,238,548.83

133,845 2.6%

$22,346.88

$20,138.48

$2,208.40

Lyons 30,735,591 26,506,205 4,229,386 16.0%

$10,657,158.17

$10,171,578.50

485,580 4.8%

$13,696.80

$13,794.02

($97.22)

Markham 23,213,481 22,704,327 509,154 2.2%

$18,286,039.11

$17,130,762.36

1,155,277 6.7%

$15,920.48

$14,145.28

$1,775.20

Matteson 73,542,429 62,803,374 10,739,055 17.1%

$38,362,646.61

$33,937,181.81

4,425,465 13.0%

$38,194.67

$43,177.61

($4,982.94)

Maywood 27,226,421 27,872,954 -646,533 -2.3%

$15,003,777.11

$17,608,234.14

-2,604,457 -14.8%

$18,086.69

$17,940.93

$145.76

McCook 54,784,084 44,904,491 9,879,593 22.0%

$21,179,633.62

$19,015,273.80

2,164,360 11.4%

$44,409.82

$37,005.82

$7,404.00

Melrose Park 175,909,880 167,291,470 8,618,410 5.2%

$61,780,453.87

$58,355,743.38

3,424,710 5.9%

$17,564.46

$16,001.64

$1,562.82

Merrionette Park 9,894,532 9,841,123 53,409 0.5%

$3,338,934.46

$3,389,042.74

-50,108 -1.5%

$21,452.96

$18,684.18

$2,768.78

Midlothian 19,321,294 17,240,109 2,081,185 12.1%

$8,322,839.25

$7,493,096.34

829,743 11.1%

$9,994.87

$8,952.64

$1,042.23

Morton Grove 97,147,323 102,422,556 -5,275,233 -5.2%

$29,082,162.01

$27,442,681.94

1,639,480 6.0%

$21,783.81

$19,146.01

$2,637.80

Mount Prospect 236,844,314 246,682,777 -9,838,463 -4.0%

$70,287,268.97

$66,141,926.67

4,145,342 6.3%

$37,263.12

$34,921.18

$2,341.94

Niles 258,894,525 268,481,612 -9,587,087 -3.6%

$65,000,198.28

$60,265,717.69

4,734,481 7.9%

$29,181.43

$27,394.49

$1,786.94

Norridge 58,741,865 62,523,844 -3,781,979 -6.0%

$15,041,075.87

$14,223,877.70

817,198 5.7%

$26,135.59

$23,956.90

$2,178.69

North Riverside 43,756,627 49,485,901 -5,729,274 -11.6%

$13,157,743.04

$14,743,354.59

-1,585,612 -10.8%

$10,246.14

$9,010.21

$1,235.93

Northbrook 317,910,652 356,641,233 -38,730,581 -10.9%

$79,074,607.84

$78,338,516.82

736,091 0.9%

$35,998.53

$35,091.99

$906.54

Northfield 50,204,631 51,153,612 -948,981 -1.9%

$11,932,260.70

$10,862,381.59

1,069,879 9.8%

$30,579.33

$31,045.26

($465.93)

Northlake 105,341,160 97,704,475 7,636,685 7.8%

$41,159,565.92

$36,300,568.18

4,858,998 13.4%

$19,830.41

$18,093.88

$1,736.53

Oak Forest 35,307,384 32,878,685 2,428,699 7.4%

$15,193,856.39

$14,427,799.33

766,057 5.3%

$11,275.34

$9,777.54

$1,497.80

Oak Lawn 130,686,749 122,112,732 8,574,017 7.0%

$46,725,023.21

$43,701,749.60

3,023,274 6.9%

$11,093.87

$10,706.28

$387.59

Oak Park 147,202,795 116,642,064 30,560,731 26.2%

$54,183,459.23

$45,143,377.70

9,040,082 20.0%

$25,626.55

$22,814.63

$2,811.92

Olympia Fields 15,952,158 13,962,851 1,989,307 14.2%

$8,211,699.21

$7,334,259.97

877,439 12.0%

$56,936.44

$47,300.93

$9,635.51

Orland Hills 15,386,830 14,333,931 1,052,899 7.3%

$4,329,107.69

$3,939,742.51

389,365 9.9%

$11,472.01

$9,553.73

$1,918.28

Orland Park 272,304,526 279,572,250 -7,267,724 -2.6%

$77,983,235.77

$78,890,468.43

-907,233 -1.1%

$33,639.40

$30,074.25

$3,565.15

21

Commercial – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

Commercial Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Palatine 182,894,545 193,232,309 -10,337,764 -5.3%

$58,595,849.39

$55,502,857.33

3,092,992 5.6%

$33,998.98

$30,733.00

$3,265.98

Palos Heights 41,848,634 39,445,255 2,403,379 6.1%

$13,444,350.07

$12,228,209.33

1,216,141 9.9%

$26,518.19

$25,949.66

$568.53

Palos Hills 26,862,564 26,104,621 757,943 2.9%

$8,681,122.77

$8,303,361.44

377,761 4.5%

$2,315.11

$1,815.19

$499.92

Palos Park 13,736,546 12,578,972 1,157,574 9.2%

$3,601,028.75

$3,202,338.83

398,690 12.4%

$17,135.24

$15,077.78

$2,057.46

Park Forest 11,012,908 9,700,800 1,312,108 13.5%

$12,326,626.85

$10,111,608.40

2,215,018 21.9%

$13,377.34

$9,549.86

$3,827.48

Park Ridge 89,032,952 95,204,989 -6,172,037 -6.5%

$25,913,536.19

$24,668,782.99

1,244,753 5.0%

$20,523.17

$18,388.25

$2,134.92

Phoenix 732,748 669,739 63,009 9.4%

$665,282.83

$566,773.09

98,510 17.4%

$9,736.94

$7,661.50

$2,075.44

Posen 9,048,500 7,418,276 1,630,224 22.0%

$3,685,644.46

$2,993,149.74

692,495 23.1%

$7,300.60

$6,455.87

$844.73

Prospect Heights 38,592,601 38,755,850 -163,249 -0.4%

$12,606,176.95

$11,254,157.08

1,352,020 12.0%

$922.81

$934.21

($11.40)

Richton Park 18,697,408 17,703,097 994,311 5.6%

$9,941,258.78

$9,489,674.46

451,584 4.8%

$37,480.55

$32,232.52

$5,248.03

River Forest 19,189,019 16,342,297 2,846,722 17.4%

$5,830,965.96

$5,073,259.57

757,706 14.9%

$19,678.58

$15,525.59

$4,152.99

River Grove 32,852,481 33,633,636 -781,155 -2.3%

$12,181,713.34

$11,019,081.96

1,162,631 10.6%

$12,998.01

$12,066.75

$931.26

Riverdale 18,362,138 16,055,284 2,306,854 14.4%

$15,859,023.82

$14,463,294.14

1,395,730 9.7%

$18,748.32

$16,096.65

$2,651.67

Riverside 7,813,020 7,423,706 389,314 5.2%

$2,781,375.29

$2,612,855.66

168,520 6.4%

$15,779.00

$14,065.05

$1,713.95

Robbins 6,171,463 5,967,410 204,053 3.4%

$2,717,067.99

$2,727,477.93

-10,410 -0.4%

$4,901.75

$4,231.07

$670.68

Rolling Meadows 158,977,586 175,448,777 -16,471,191 -9.4%

$50,994,313.40

$50,704,292.16

290,021 0.6%

$45,339.16

$40,881.55

$4,457.61

Roselle 7,791,281 8,287,869 -496,588 -6.0%

$2,419,060.39

$2,305,661.80

113,399 4.9%

$88,934.92

$86,290.75

$2,644.17

Rosemont 264,665,268 326,901,958 -62,236,690 -19.0%

$85,253,630.19

$86,162,220.75

-908,591 -1.1%

$154,122.10

$135,254.89

$18,867.21

Sauk Village 22,510,581 20,572,300 1,938,281 9.4%

$10,414,673.04

$8,762,471.04

1,652,202 18.9%

$30,899.09

$24,695.21

$6,203.88

Schaumburg 785,096,859 839,259,138 -54,162,279 -6.5%

$233,252,699.60

$225,177,059.10

8,075,641 3.6%

$58,616.31

$54,880.93

$3,735.38

Schiller Park 80,298,945 88,006,499 -7,707,554 -8.8%

$29,419,112.28

$27,843,499.44

1,575,613 5.7%

$26,123.26

$22,888.93

$3,234.33

Skokie 409,270,691 423,708,734 -14,438,043 -3.4%

$119,705,669.53

$112,535,262.55

7,170,407 6.4%

$14,575.81

$13,269.02

$1,306.79

South Barrington 25,134,148 28,678,434 -3,544,286 -12.4%

$7,179,888.14

$7,343,151.24

-163,263 -2.2%

$37,572.95

$31,912.88

$5,660.07

South Chicago Heights 14,744,626 13,289,258 1,455,368 11.0%

$5,823,300.97

$5,135,077.18

688,224 13.4%

$12,627.99

$11,616.96

$1,011.03

South Holland 63,395,542 58,089,691 5,305,851 9.1%

$35,225,859.26

$33,547,718.61

1,678,141 5.0%

$27,315.27

$24,523.79

$2,791.48

Steger 4,432,355 4,137,008 295,347 7.1%

$1,645,436.87

$1,495,805.77

149,631 10.0%

$2,389.13

$1,907.69

$481.44

Stickney 20,548,292 16,525,849 4,022,443 24.3%

$6,967,083.31

$6,450,974.15

516,109 8.0%

$10,523.17

$13,341.25

($2,818.08)

Stone Park 8,519,262 8,264,913 254,349 3.1%

$4,055,552.69

$4,203,110.31

-147,558 -3.5%

$6,476.48

$5,932.74

$543.74

Streamwood 69,337,891 74,533,567 -5,195,676 -7.0%

$24,904,207.93

$23,789,820.08

1,114,388 4.7%

$35,185.84

$36,658.67

($1,472.83)

Summit 29,159,339 24,938,314 4,221,025 16.9%

$12,257,680.20

$11,202,071.59

1,055,609 9.4%

$11,502.57

$11,581.12

($78.55)

22

Commercial – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

Commercial Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Municipality

Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

Thornton

11,597,054

10,956,677

640,377

5.8%

$6,793,945.48

$6,479,457.74

314,488

4.9%

$19,193.38

$16,756.35

$2,437.03

Tinley Park

104,954,691

98,499,445

6,455,246

6.6%

$39,713,827.32

$36,755,723.13

2,958,104

8.0%

$20,580.80

$17,660.07

$2,920.73

Unincorporated

168,486,140

165,340,774

3,145,366

1.9%

$46,617,457.66

$42,649,030.85

3,968,427

9.3%

$16,836.35

$15,034.94

$1,801.41

University Park

950,000

618,111

331,889

53.7%

$574,749.95

$380,777.56

193,972

50.9%

$574,749.95

$380,777.56

$193,972.39

Westchester

55,952,513

52,201,854

3,750,659

7.2%

$15,069,403.30

$13,881,618.04

1,187,785

8.6%

$7,487.51

$7,754.42

($266.91)

Western Springs

12,798,186

11,864,251

933,935

7.9%

$3,000,902.85

$2,741,613.02

259,290

9.5%

$10,332.86

$9,357.16

$975.70

Wheeling

222,004,860

238,616,441

-

16,611,581

-

7.0%

$80,111,944.71

$78,197,235.08

1,914,710

2.4%

$36,414.31

$34,807.68

$1,606.63

Willow Springs

10,239,135

9,563,319

675,816

7.1%

$3,322,565.64

$3,202,343.03

120,223

3.8%

$15,950.35

$13,886.64

$2,063.71

Wilmette

78,403,460

84,001,094

-

5,597,634

-

6.7%

$19,809,964.48

$18,957,095.50

852,869

4.5%

$35,665.46

$32,659.07

$3,006.39

Winnetka

26,743,261

27,740,610

-

997,349

-

3.6%

$6,902,181.61

$6,515,258.46

386,923

5.9%

$28,810.13

$27,058.58

$1,751.55

Worth

17,218,656

14,648,724

2,569,932

17.5%

$6,651,845.68

$5,977,768.08

674,078

11.3%

$10,574.66

$9,289.16

$1,285.50

23

Commercial – AV Change, Tax Change, Median Tax Change

Majority Population Latino

Majority Population Black

Top 10 - % Change Total Tax Increases

24

RESIDENTIAL Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Rank Municipality Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

1 Bellwood 89,102,175 67,301,845 21,800,330 32.4% $32,363,073.35 $25,189,046.40 $7,174,027 28.5% $6,032.80 $4,164.40 $1,868.40

2 Berkeley 32,363,680 27,009,031 5,354,649 19.8% $10,198,836.52 $8,364,830.15 $1,834,006 21.9% $6,102.87 $4,670.53 $1,432.34

3 Robbins 11,619,707 9,999,874 1,619,833 16.2% $3,697,048.46 $3,077,265.32 $619,783 20.1% $1,319.34 $1,023.16 $296.18

4 Hillside 44,882,417 37,719,274 7,163,143 19.0% $14,014,229.54 $11,727,627.60 $2,286,602 19.5% $5,531.64 $4,167.97 $1,363.67

5 Broadview 42,833,333 34,667,167 8,166,166 23.6% $11,448,772.41 $9,609,205.42 $1,839,567 19.1% $4,735.48 $3,695.92 $1,039.56

6 Ford Heights 2,636,488 2,256,328 380,160 16.8% $1,493,259.98 $1,264,034.19 $229,226 18.1% $518.47 $336.15 $182.32

7 Maywood 93,030,495 74,434,459 18,596,036 25.0% $37,215,870.14 $32,164,519.87 $5,051,350 15.7% $6,330.71 $4,787.54 $1,543.17

8 Cicero 229,363,844 184,222,502 45,141,342 24.5% $74,188,436.16 $65,214,985.48 $8,973,451 13.8% $5,400.44 $4,304.34 $1,096.10

9 North Riverside 53,042,217 50,656,906 2,385,311

4.7% $12,593,794.23 $11,082,130.18 $1,511,664 13.6% $5,275.29 $4,404.01 $871.28

10 Stone Park 12,233,429 10,554,394 1,679,035 15.9% $4,579,131.99 $4,088,079.07 $491,053 12.0% $5,628.84 $4,221.12 $1,407.72

COMMERCIAL Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change % Change Tax Year 2020 Tax Year 2019 Change

Rank Municipality

(w/ 10+ PINs)

Assessed Value Assessed Value Assessed Value Assessed Value Total Tax Total Tax Total Tax Total Tax Median Tax Median Tax Median Tax

1 Dixmoor 11,844,925 8,041,499 3,803,426 47.3% $6,055,878.24 $4,244,506.31 $1,811,372 42.7% $5,622.88 $4,140.78 $1,482.10

2 Ford Heights 2,357,638 1,660,243 697,395 42.0% $1,874,741.57 $1,320,671.93 $554,070 42.0% $22,733.02 $18,746.14 $3,986.88

3 Posen 9,048,500 7,418,276 1,630,224 22.0% $3,685,644.46 $2,993,149.74 $692,495 23.1% $7,300.60 $6,455.87 $844.73

4 Park Forest 11,012,908 9,700,800 1,312,108 13.5% $12,326,626.85 $10,111,608.40 $2,215,018 21.9% $13,377.34 $9,549.86 $3,827.48

5 Flossmoor 13,826,956 10,886,815 2,940,141 27.0% $7,102,228.81 $5,830,405.57 $1,271,823 21.8% $26,171.60 $16,763.67 $9,407.93

6 Oak Park 147,202,795 116,642,064 30,560,731 26.2% $54,183,459.23 $45,143,377.70 $9,040,082 20.0% $25,626.55 $22,814.63 $2,811.92

7 Sauk Village 22,510,581 20,572,300 1,938,281 9.4% $10,414,673.04 $8,762,471.04 $1,652,202 18.9% $30,899.09 $24,695.21 $6,203.88

8 Chicago Heights 69,740,591 59,674,596 10,065,995 16.9% $44,097,700.96 $37,305,301.07 $6,792,400 18.2% $14,272.27 $12,156.64 $2,115.63

9 Phoenix 732,748 669,739

63,009 9.4% $665,282.83 $566,773.09 $98,510 17.4% $9,736.94 $7,661.50 $2,075.44

10 Calumet Park 14,397,017 13,196,369 1,200,648 9.1% $8,770,060.64 $7,530,845.88 $1,239,215 16.5% $8,601.99 $7,824.25 $777.74

Majority Population Latino

Majority Population Black

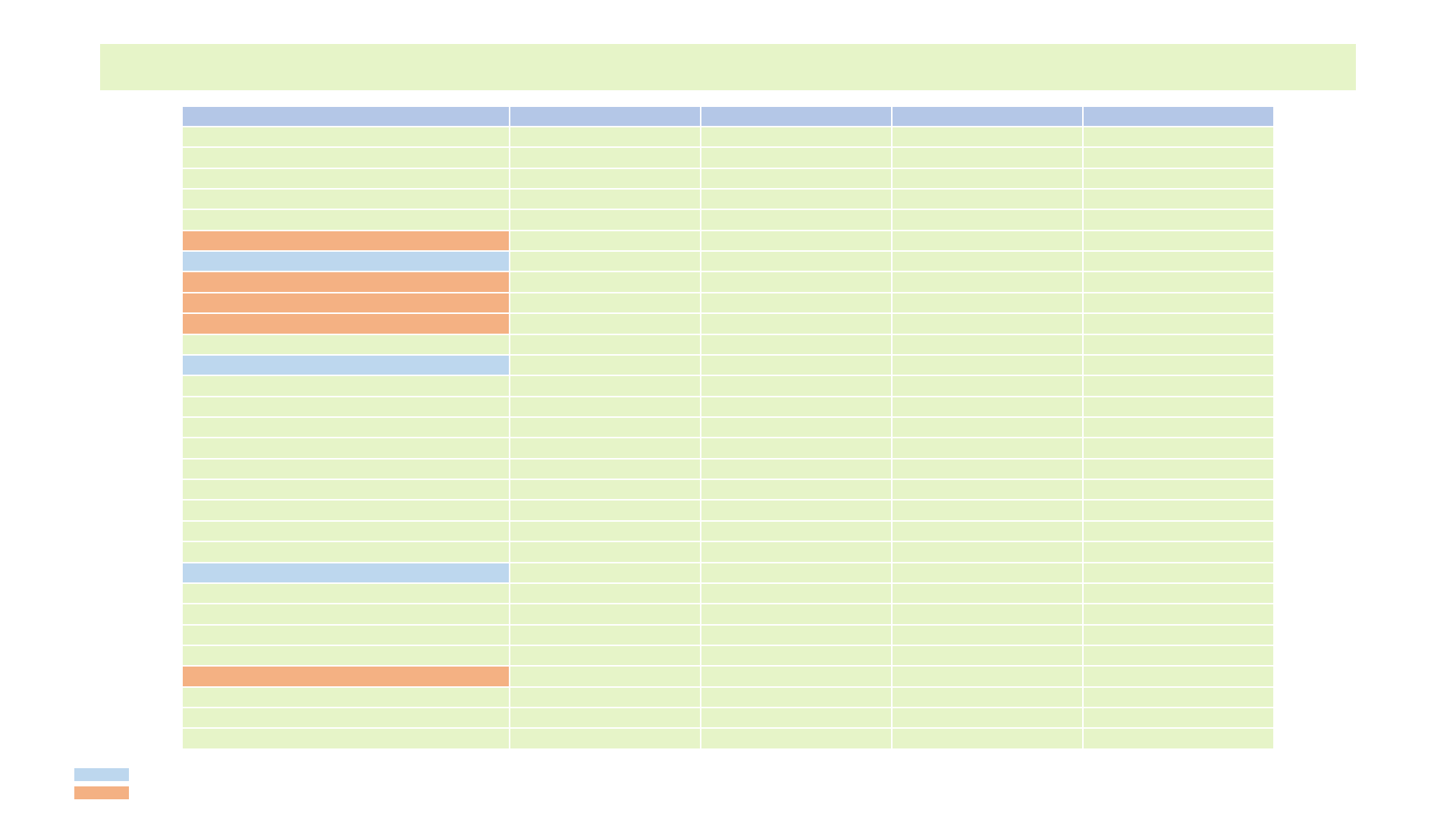

RESIDENTIAL COMMERCIAL % Change - Residential % Change - Commercial

Municipality Total Tax Increase Rank Total Tax Increase Rank Total Tax Total Tax

Bellwood 1 127

28.5%

-

4.0%

Berwyn 14 129

9.3%

-

7.1%

Burnham 21 59

5.5%

7.7%

Calumet City 16 110

8.4%

2.6%

Calumet Park 128 12 -

11.7%

16.5%

Cicero 8 107

13.8%

3.2%

Country Club Hills 42 69

2.8%

6.4%

Dolton 11 97

11.9%

4.6%

East Hazel Crest 56 118

1.5%

-

0.7%

Flossmoor 119 6 -

3.9%

21.8%

Ford Heights 6 3

18.1%

42.0%

Forest View 15 13

8.9%

16.2%

Glenwood 91 50 -

0.6%

8.9%

Harvey 127 82 -

11.4%

5.6%

Hazel Crest 22 63

5.5%

7.2%

Hodgkins 94 81 -

0.8%

5.6%

Lynwood 54 109

1.5%

2.6%

Lyons 52 94

1.6%

4.8%

Markham 126 66 -

11.3%

6.7%

Matteson 106 23 -

1.3%

13.0%

Maywood 7 131

15.7%

-

14.8%

Melrose Park 32 76

3.9%

5.9%

Northlake 68 22

0.9%

13.4%

Olympia Fields 110 28 -

1.8%

12.0%

Park Forest 105 5 -

1.3%

21.9%

Phoenix 104 10 -

1.3%

17.4%

Posen 41 4

3.2%

23.1%

Richton Park 92 95 -

0.6%

4.8%

Riverdale 125 44 -

10.4%

9.7%

Robbins 3 117

20.1%

-

0.4%

Sauk Village 131 8 -

17.6%

18.9%

South Holland 20 90

6.2%

5.0%

Stickney 12 57

10.6%

8.0%

Stone Park 10 126

12.0%

-

3.5%

Summit 121 46 -

6.4%

9.4%

25

There are 35 municipalities

in Cook County with a

majority population Black or

Latino.

The chart to the right

illustrates the change from

2019 to 2020 in total

property taxes for

residential and commercial.

Ford Heights, for instance,

has the sixth highest total

residential property tax

increase and the third

highest commercial

property tax increase

among all Cook County

municipalities.

Majority Population Latino

Majority Population Black

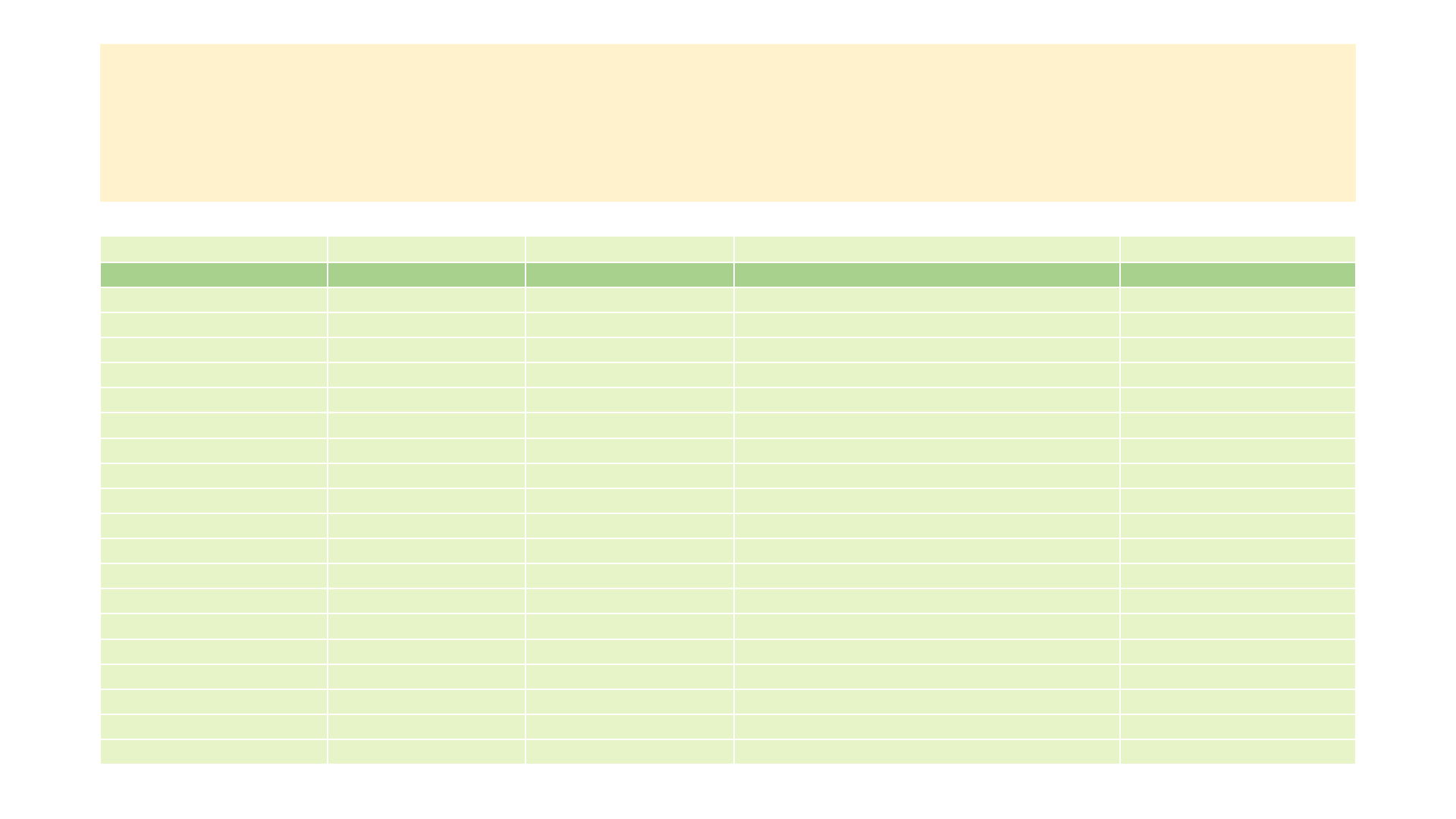

Median Taxes – Municipality

(Commercial and Residential)

26

Ranking (Change) Median 2020 Median 2019 Change

Municipality (136 Total) Commercial Residential Commercial Residential Commercial Residential Commercial Residential

Alsip 22 42 $31,256.68

$4,683.06

$26,956.33

$4,488.49

$4,300.35

$194.57

Arlington Heights 62 88 $29,625.15

$7,317.01

$27,833.73

$7,347.08

$1,791.42

($30.07)

Barrington 95 47 $17,851.19

$8,039.40

$17,034.45

$7,868.40

$816.74

$171.00

Barrington Hills 108 132 $3,395.79

$14,992.65

$2,979.30

$15,529.37

$416.49

($536.72)

Bartlett 115 95 $34,578.81

$7,207.25

$34,537.22

$7,249.88

$41.59

($42.63)

Bedford Park 8 131 $53,045.32

$4,971.59

$43,331.95

$5,498.66

$9,713.37

($527.07)

Bellwood 131 1 $12,959.43

$6,032.80

$13,573.24

$4,164.40

($613.81)

$1,868.40

Bensenville 76 78 $26,238.44

$24,744.82

$1,493.62

$0.00

Berkeley 43 3 $26,276.00

$6,102.87

$23,833.04

$4,670.53

$2,442.96

$1,432.34

Berwyn 114 11 $13,941.94

$6,383.40

$13,888.28

$5,548.64

$53.66

$834.76

Blue Island 88 40 $12,404.39

$3,356.35

$11,456.39

$3,155.24

$948.00

$201.11

Bridgeview 69 25 $27,782.96

$5,242.24

$26,118.84

$4,910.56

$1,664.12

$331.68

Broadview 113 8 $15,148.29

$4,735.48

$15,078.09

$3,695.92

$70.20

$1,039.56

Brookfield 110 20 $10,260.04

$6,228.21

$10,093.23

$5,719.08

$166.81

$509.13

Buffalo Grove 13 92 $74,606.00

$5,482.64

$68,271.40

$5,520.83

$6,334.60

($38.19)

Burbank 78 22 $15,509.53

$4,818.22

$14,062.47

$4,410.30

$1,447.06

$407.92

Burnham 126 16 $4,202.62

$3,438.65

$4,376.73

$2,833.72

($174.11)

$604.93

Burr Ridge 132 71 $47,146.83

$9,426.61

$48,354.69

$9,414.76

($1,207.86)

$11.85

Calumet City 112 54 $10,233.10

$3,367.07

$10,097.65

$3,257.57

$135.45

$109.50

Calumet Park 97 125 $8,601.99

$2,636.84

$7,824.25

$2,961.22

$777.74

($324.38)

Chicago 98 82 $9,659.30

$3,340.64

$8,898.63

$3,342.27

$760.67

($1.63)

Chicago Heights 50 109 $14,272.27

$3,231.27

$12,156.64

$3,337.26

$2,115.63

($105.99)

Chicago Ridge 38 101 $20,686.72

$3,002.73

$18,019.87

$3,063.52

$2,666.85

($60.79)

Cicero 101 7 $12,631.74

$5,400.44

$12,018.43

$4,304.34

$613.31

$1,096.10

Country Club Hills 21 36 $62,279.99

$5,220.17

$57,920.67

$5,004.49

$4,359.32

$215.68

Majority Population Latino

Majority Population Black

Median Taxes – Municipality

(Commercial and Residential) -

Continued

27

Ranking (Change) Median 2020 Median 2019 Change

Municipality (136 Total) Commercial Residential Commercial Residential Commercial Residential Commercial Residential

Countryside 46 63 $23,936.73

$4,370.92

$21,665.21

$4,308.52

$2,271.52

$62.40

Crestwood 28 61 $24,269.85

$2,010.07

$20,707.24

$1,935.51

$3,562.61

$74.56

Deer Park 117 37

$4,614.70

$4,399.52

$0.00

$215.18

Deerfield 4 79 $184,935.81

$162,415.39

$22,520.42

$0.00

Des Plaines 59 75 $22,934.01

$4,708.97

$21,061.96

$4,706.19

$1,872.05

$2.78

Dixmoor 77 122 $5,622.88

$873.15

$4,140.78

$1,145.43

$1,482.10

($272.28)

Dolton 116 13 $17,127.76

$4,368.27

$17,126.66

$3,641.56

$1.10

$726.71

East Dundee 2 80 $419,620.16

$386,894.95

$32,725.21

$0.00

East Hazel Crest 33 126 $20,832.01

$2,945.10

$17,876.41

$3,299.12

$2,955.60

($354.02)

Elgin 92 98 $21,572.55

$4,334.82

$20,684.33

$4,388.66

$888.22

($53.84)

Elk Grove Village 14 100 $40,402.68

$4,950.06

$34,181.31

$5,008.43

$6,221.37

($58.37)

Elmwood Park 74 17 $13,560.49

$6,606.87

$12,029.70

$6,030.70

$1,530.79

$576.17

Evanston 60 64 $23,852.49

$6,630.07

$21,998.94

$6,571.42

$1,853.55

$58.65

Evergreen Park 96 34 $12,685.17

$4,690.17

$11,900.50

$4,451.34

$784.67

$238.83

Flossmoor 10 124 $26,171.60

$8,234.16

$16,763.67

$8,540.07

$9,407.93

($305.91)

Ford Heights 24 44 $22,733.02

$518.47

$18,746.14

$336.15

$3,986.88

$182.32

Forest Park 122 45 $17,039.64

$5,508.07

$17,085.28

$5,330.51

($45.64)

$177.56

Forest View 130 18 $15,265.97

$5,563.46

$15,826.69

$5,041.34

($560.72)

$522.12

Frankfort 118 87

$2,611.45

$2,638.21

$0.00

($26.76)

Franklin Park 84 120 $18,185.76

$4,820.38

$17,048.13

$5,034.20

$1,137.63

($213.82)

Glencoe 56 43 $35,416.07

$18,856.25

$33,429.73

$18,671.60

$1,986.34

$184.65

Glenview 55 23 $39,707.89

$9,004.77

$37,660.62

$8,634.38

$2,047.27

$370.39

Glenwood 18 53 $23,968.56

$4,399.18

$18,866.66

$4,261.65

$5,101.90

$137.53

Golf 3 9 $225,712.43

$17,639.39

$193,565.13

$16,677.50

$32,147.30

$961.89

Hanover Park 107 99 $28,885.09

$5,382.50

$28,436.58

$5,439.42

$448.51

($56.92)

Majority Population Latino

Majority Population Black

Median Taxes – Municipality

(Commercial and Residential) -

Continued

28

Ranking (Change) Median 2020 Median 2019 Change

Municipality (136 Total) Commercial Residential Commercial Residential Commercial Residential Commercial Residential

Harvey 79 130 $8,263.69

$1,514.55

$6,912.65

$2,020.05

$1,351.04

($505.50)

Harwood Heights 51 68 $14,248.46

$5,220.53

$12,164.19

$5,198.62

$2,084.27

$21.91

Hazel Crest 124 26 $14,295.94

$3,937.71

$14,374.72

$3,618.56

($78.78)

$319.15

Hickory Hills 58 57 $22,926.54

$5,564.66

$21,016.91

$5,460.44

$1,909.63

$104.22

Hillside 93 5 $18,242.30

$5,531.64

$17,392.94

$4,167.97

$849.36

$1,363.67

Hinsdale 7 128 $37,457.93

$16,145.51

$26,456.81

$16,530.03

$11,001.12

($384.52)

Hodgkins 70 119 $12,640.42

$5,213.56

$11,014.54

$5,418.62

$1,625.88

($205.06)

Hoffman Estates 12 65 $100,072.67

$6,421.01

$93,671.29

$6,383.53

$6,401.38

$37.48

Homer Glen 119 81

$0.00

$0.00

Hometown 6 118 $43,023.91

$2,930.84

$30,167.41

$3,116.94

$12,856.50

($186.10)

Homewood 31 28 $20,491.36

$5,044.89

$17,467.35

$4,737.73

$3,024.01

$307.16

Indian Head Park 19 52 $18,901.75

$4,350.94

$13,968.16

$4,209.16

$4,933.59

$141.78

Inverness 42 39 $22,318.52

$12,594.86

$19,870.08

$12,386.31

$2,448.44

$208.55

Justice 128 102 $16,959.94

$4,470.38

$17,363.41

$4,545.97

($403.47) ($75.59)

Kenilworth 66 116 $21,591.35

$28,779.58

$19,853.13

$28,944.07

$1,738.22

($164.49)

La Grange 106 113 $14,549.63

$8,907.62

$14,095.94

$9,050.63

$453.69

($143.01)

La Grange Park 83 58 $10,803.87

$7,679.59

$9,639.14

$7,598.34

$1,164.73

$81.25

Lansing 89 35 $14,088.85

$3,864.98

$13,153.22

$3,628.93

$935.63

$236.05

Lemont 72 72 $9,727.45

$6,721.36

$8,160.36

$6,714.76

$1,567.09

$6.60

Lincolnwood 99 110 $20,261.04

$7,402.58

$19,568.35

$7,513.20

$692.69

($110.62)

Lynwood 47 115 $22,346.88

$4,656.90

$20,138.48

$4,810.72

$2,208.40

($153.82)

Lyons 125 41 $13,696.80

$4,117.67

$13,794.02

$3,920.27

($97.22)

$197.40

Markham 64 133 $15,920.48

$2,343.70

$14,145.28

$2,959.96

$1,775.20

($616.26)

Matteson 135 60 $38,194.67

$5,730.23

$43,177.61

$5,651.45

($4,982.94)

$78.78

Maywood 111 2 $18,086.69

$6,330.71

$17,940.93

$4,787.54

$145.76

$1,543.17

Majority Population Latino

Majority Population Black

Median Taxes – Municipality

(Commercial and Residential) -

Continued

29

Ranking (Change) Median 2020 Median 2019 Change

Municipality (136 Total) Commercial Residential Commercial Residential Commercial Residential Commercial Residential

McCook 11 135 $44,409.82

$7,854.19

$37,005.82

$8,785.76

$7,404.00

($931.57)

Melrose Park 73 27 $17,564.46

$4,567.07

$16,001.64

$4,249.03

$1,562.82

$318.04

Merrionette Park 37 93 $21,452.96

$2,824.39

$18,684.18

$2,863.93

$2,768.78

($39.54)

Midlothian 85 59 $9,994.87

$4,305.76

$8,952.64

$4,224.91

$1,042.23

$80.85

Morton Grove 41 103 $21,783.81

$6,701.93

$19,146.01

$6,778.43

$2,637.80

($76.50)

Mount Prospect 45 107 $37,263.12

$6,734.84

$34,921.18

$6,835.56

$2,341.94

($100.72)

Niles 63 89 $29,181.43

$5,097.16

$27,394.49

$5,129.28

$1,786.94

($32.12)

Norridge 48 74 $26,135.59

$5,207.92

$23,956.90

$5,202.89

$2,178.69

$5.03

North Riverside 82 10 $10,246.14

$5,275.29

$9,010.21

$4,404.01

$1,235.93

$871.28

Northbrook 91 24 $35,998.53

$10,227.92

$35,091.99

$9,885.10

$906.54

$342.82

Northfield 129 69 $30,579.33

$9,463.42

$31,045.26

$9,446.81

($465.93)

$16.61

Northlake 67 50 $19,830.41

$4,814.95

$18,093.88

$4,658.61

$1,736.53

$156.34

Oak Brook 120 19

$7,123.42

$6,603.36

$0.00

$520.06

Oak Forest 75 48 $11,275.34

$5,626.75

$9,777.54

$5,469.97

$1,497.80

$156.78

Oak Lawn 109 32 $11,093.87

$4,229.11

$10,706.28

$3,980.15

$387.59

$248.96

Oak Park 35 33 $25,626.55

$10,422.40

$22,814.63

$10,176.22

$2,811.92

$246.18

Olympia Fields 9 70 $56,936.44

$8,230.69

$47,300.93

$8,217.76

$9,635.51

$12.93

Orland Hills 57 56 $11,472.01

$5,270.38

$9,553.73

$5,165.80

$1,918.28

$104.58

Orland Park 27 73 $33,639.40

$5,906.05

$30,074.25

$5,900.49

$3,565.15

$5.56

Palatine 29 96 $33,998.98

$5,735.86

$30,733.00

$5,779.73

$3,265.98

($43.87)

Palos Heights 102 77 $26,518.19

$6,522.64

$25,949.66

$6,521.48

$568.53

$1.16

Palos Hills 104 66 $2,315.11

$3,614.80

$1,815.19

$3,584.85

$499.92

$29.95

Palos Park 54 49 $17,135.24

$7,070.96

$15,077.78

$6,914.57

$2,057.46

$156.39

Park Forest 25 134 $13,377.34

$4,238.55

$9,549.86

$5,125.98

$3,827.48

($887.43)

Park Ridge 49 67 $20,523.17

$8,162.78

$18,388.25

$8,135.06

$2,134.92

$27.72

Majority Population Latino

Majority Population Black

Median Taxes – Municipality

(Commercial and Residential) -

Continued

30

Ranking (Change) Median 2020 Median 2019 Change

Municipality (136 Total) Commercial Residential Commercial Residential Commercial Residential Commercial Residential

Phoenix 52 117 $9,736.94

$907.63

$7,661.50

$1,075.48

$2,075.44

($167.85)

Posen 94 46 $7,300.60

$2,559.29

$6,455.87

$2,386.09

$844.73

$173.20

Prospect Heights 121 76 $922.81

$4,624.65

$934.21

$4,622.29

($11.40)

$2.36

Richton Park 17 84 $37,480.55

$4,484.37

$32,232.52

$4,487.75

$5,248.03

($3.38)

River Forest 23 30 $19,678.58

$13,295.79

$15,525.59

$12,990.78

$4,152.99

$305.01

River Grove 90 97 $12,998.01

$5,183.30

$12,066.75

$5,227.69

$931.26

($44.39)

Riverdale 39 127 $18,748.32

$2,660.55

$16,096.65

$3,017.83

$2,651.67

($357.28)

Riverside 68 6 $15,779.00

$10,899.32

$14,065.05

$9,677.91

$1,713.95

$1,221.41

Robbins 100 31 $4,901.75

$1,319.34

$4,231.07

$1,023.16

$670.68

$296.18

Rolling Meadows 20 94 $45,339.16

$5,002.24

$40,881.55

$5,042.18

$4,457.61

($39.94)

Roselle 40 104 $88,934.92

$4,959.64

$86,290.75

$5,042.32

$2,644.17

($82.68)

Rosemont 5 14 $154,122.10

$5,373.64

$135,254.89

$4,733.73

$18,867.21

$639.91

Sauk Village 15 114 $30,899.09

$2,115.11

$24,695.21

$2,260.88

$6,203.88

($145.77)

Schaumburg 26 91 $58,616.31

$5,033.39

$54,880.93

$5,067.18

$3,735.38

($33.79)

Schiller Park 30 62 $26,123.26

$4,868.40

$22,888.93

$4,803.81

$3,234.33

$64.59

Skokie 80 105 $14,575.81

$5,810.68

$13,269.02

$5,901.57

$1,306.79

($90.89)

South Barrington 16 55 $37,572.95

$15,398.69

$31,912.88

$15,292.00

$5,660.07

$106.69

South Chicago Heights 86 108 $12,627.99

$2,243.30

$11,616.96

$2,347.50

$1,011.03

($104.20)

South Holland 36 15 $27,315.27

$5,347.85

$24,523.79

$4,724.75

$2,791.48

$623.10

Steger 105 111 $2,389.13

$1,313.24

$1,907.69

$1,433.43

$481.44

($120.19)

Stickney 134 12 $10,523.17

$4,953.92

$13,341.25

$4,192.05

($2,818.08)

$761.87

Stone Park 103 4 $6,476.48

$5,628.84

$5,932.74

$4,221.12

$543.74

$1,407.72

Streamwood 133 86 $35,185.84

$5,026.64

$36,658.67

$5,040.59

($1,472.83) ($13.95)

Summit 123 121 $11,502.57

$4,954.19

$11,581.12

$5,222.17

($78.55) ($267.98)

Thornton 44 90 $19,193.38

$3,292.66

$16,756.35

$3,325.44

$2,437.03

($32.78)

Majority Population Latino

Majority Population Black

Median Taxes – Municipality

(Commercial and Residential) -

Continued

31

Ranking (Change) Median 2020 Median 2019 Change

Municipality (136 Total)

Commercial Residential Commercial Residential Commercial Residential Commercial Residential

Tinley Park

34 112

$20,580.80

$5,718.03

$17,660.07

$5,856.80

$2,920.73

($138.77)

Unincorporated

61 85

$16,836.35

$4,719.05

$15,034.94

$4,726.94

$1,801.41

($7.89)

University Park

1 21 $574,749.95

$7,926.34

$380,777.56

$7,444.79

$193,972.39

$481.55

Westchester

127 29 $7,487.51

$5,211.81

$7,754.42

$4,905.81

($266.91)

$306.00

Western Springs

87 83

$10,332.86

$10,309.31

$9,357.16

$10,311.16

$975.70

($1.85)

Wheeling

71 106

$36,414.31

$4,655.66

$34,807.68

$4,755.72

$1,606.63

($100.06)

Willow Springs

53 123

$15,950.35

$5,735.52

$13,886.64

$6,035.79

$2,063.71

($300.27)

Wilmette

32 51

$35,665.46

$11,881.54

$32,659.07

$11,737.86

$3,006.39

$143.68

Winnetka

65 129

$28,810.13

$20,740.37

$27,058.58

$21,218.28

$1,751.55

($477.91)

Worth

81 38

$10,574.66

$4,440.90

$9,289.16

$4,232.13

$1,285.50

$208.77

Majority Population Latino

Majority Population Black

Median Taxes – Municipality

(

Residential – Highest to Lowest Change)

32

Median 2020 Median 2019 Change

Rank Municipality Residential Residential Residential

1 Bellwood

$6,032.80

$4,164.40

$1,868.40

2 Maywood

$6,330.71

$4,787.54

$1,543.17

3 Berkeley

$6,102.87

$4,670.53

$1,432.34

4 Stone Park

$5,628.84

$4,221.12

$1,407.72

5 Hillside

$5,531.64

$4,167.97

$1,363.67

6 Riverside

$10,899.32

$9,677.91

$1,221.41

7 Cicero

$5,400.44

$4,304.34

$1,096.10

8 Broadview

$4,735.48

$3,695.92

$1,039.56

9 Golf

$17,639.39

$16,677.50

$961.89

10 North Riverside

$5,275.29

$4,404.01

$871.28

11 Berwyn

$6,383.40

$5,548.64

$834.76

12 Stickney

$4,953.92

$4,192.05

$761.87

13 Dolton

$4,368.27

$3,641.56

$726.71

14 Rosemont

$5,373.64

$4,733.73

$639.91

15 South Holland

$5,347.85

$4,724.75

$623.10

16 Burnham

$3,438.65

$2,833.72

$604.93

17 Elmwood Park

$6,606.87

$6,030.70

$576.17

18 Forest View

$5,563.46

$5,041.34

$522.12

19 Oak Brook

$7,123.42

$6,603.36

$520.06

20 Brookfield

$6,228.21

$5,719.08

$509.13

21 University Park

$7,926.34

$7,444.79

$481.55

22 Burbank

$4,818.22

$4,410.30

$407.92

23 Glenview

$9,004.77

$8,634.38

$370.39

24 Northbrook

$10,227.92

$9,885.10

$342.82

25 Bridgeview

$5,242.24

$4,910.56

$331.68

Median 2020 Median 2019 Change

Rank Municipality Residential Residential Residential

26 Hazel Crest

$3,937.71

$3,618.56

$319.15

27 Melrose Park

$4,567.07

$4,249.03

$318.04

28 Homewood

$5,044.89

$4,737.73

$307.16

29 Westchester

$5,211.81

$4,905.81

$306.00

30 River Forest

$13,295.79

$12,990.78

$305.01

31 Robbins

$1,319.34

$1,023.16

$296.18

32 Oak Lawn

$4,229.11

$3,980.15

$248.96

33 Oak Park

$10,422.40