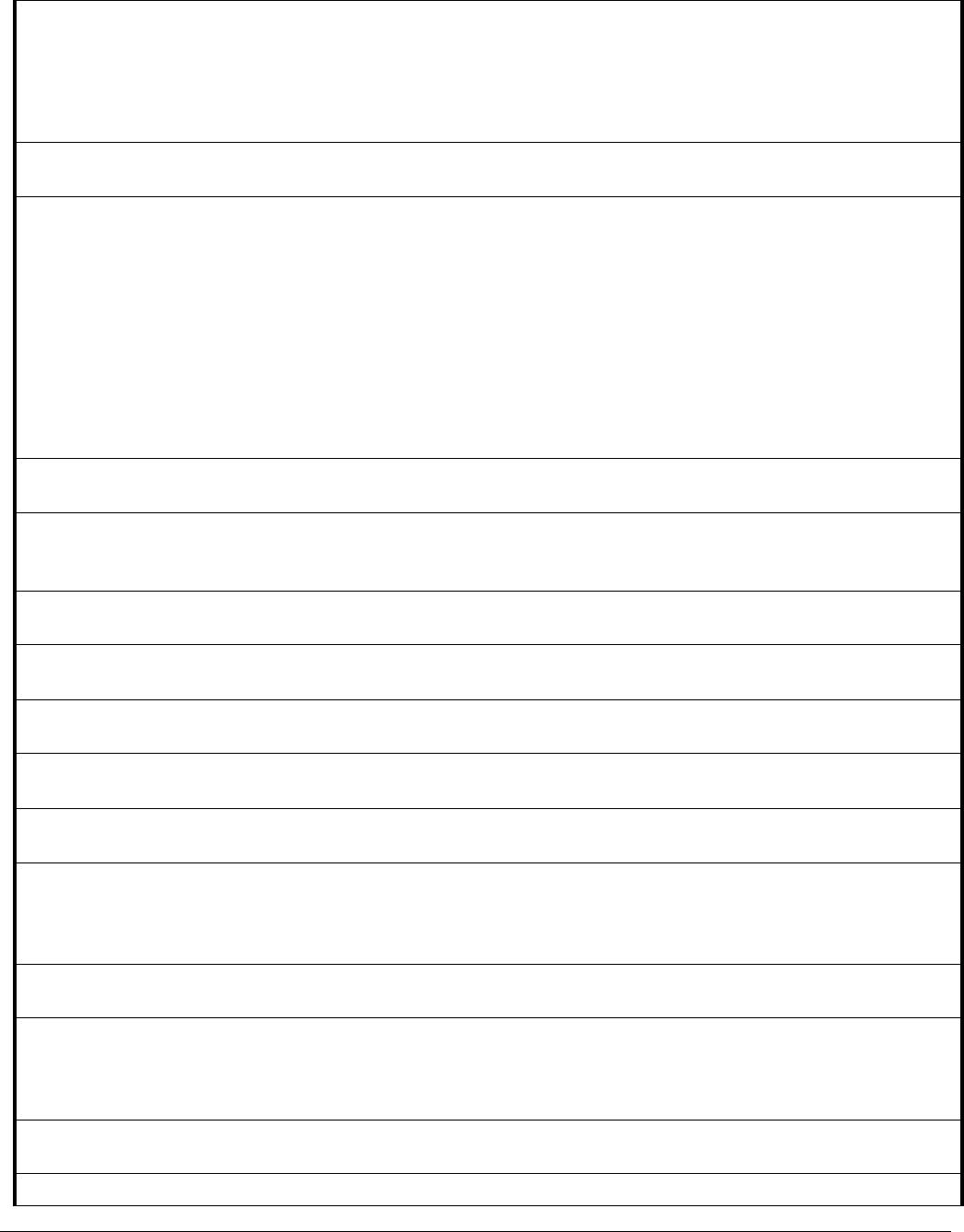

Core Analysis Decision Factors

Bank Name: Page: 1 of 10 Loan Operations and Review

Examination Start Date: Examination Modules (10/19)

LOAN OPERATIONS REVIEW

Core Analysis Decision Factors

Examiners should evaluate the Core Analysis in this section to determine whether an Expanded Analysis is

necessary. Click on

the hyperlinks found within each of the Core Analysis Decision Factors to reference the

applicable Core Analysis Procedures.

Do Core Analysis and Decision Factors indicate that risks are appropriately identified, measured,

monitored, and controlled?

C.1. Are loan policies, approval procedures, and asset concentration limits adequate? Refer to Core

Analysis Procedure #4; Procedures #7-13; Procedures #15-17; & Procedure #32.

C.2. Are loan documentation, review procedures, and internal controls adequate? Refer to Core Analysis

Procedure #9 & Procedures #14-35.

C.3. Are the audit and independent review functions adequate? Refer to Core Analysis Procedure #2;

Procedure #16; & Procedures #40-41.

C.4. Are collateral controls adequate? Refer to Core Analysis Procedure #28.

C.5. Are management reporting and communication systems adequate and accurate? Refer to Core

Analysis Procedure #31 & Procedure #42.

C.6. Does management accurately identify and monitor policy exceptions? Refer to Core Analysis

Procedure #19 & Procedure #43.

C.7. Is the process for loan disbursement, booking, and reconcilement adequate? Refer to Core Analysis

Procedure #14; Procedures #16-17; Procedures #20-21; Procedure #29; & Procedure #32.

C.8. Does senior management effectively supervise this area? Refer to Core Analysis Procedure #3;

Procedures #5-6; Procedures #36-39; & Procedure #43-46.

Core Analysis

Bank Name: Page: 2 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

LOAN OPERATIONS REVIEW

Core Analysis Procedures

Examiners are to consider the following procedures but are not expected to perform every procedure at every bank.

Examiners should complete only the procedures relevant for the bank’s activities, business model, risk profile, and

complexity. If needed, based on other identified risks, examiners can complete additional procedures. References

to laws, regulations, supervisory guidance, and other resources are not all-inclusive.

Preliminary Review

1. Review prior examination reports, prior examination work papers, examination planning

memorandum, and file correspondence to identify previous deficiencies.

2. Review internal and external audit reports to identify areas of concern and significant loan operation

deficiencies. Review current loan review reports and assess any documentation deficiencies or

unsatisfactory practices.

3. Review actions taken by management to correct audit and examination deficiencies.

4. Review all loan operation policies and procedures and consider whether the board has recently

reviewed and approved relevant policies. Appropriate policies generally address:

• Roles;

• Responsibilities;

• Lending authorities;

• Underwriting processes;

• Application and document flows;

• Approval processes; and

• Loan funding methodologies.

5. Discuss with management significant changes in loan operations personnel, service providers, software,

operating procedures, or the planned introduction of new loan products since the last examination.

6. Review board and loan committee minutes for relevant discussions on loan operations.

Core Analysis

Bank Name: Page: 3 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

Policy Considerations

7. Determine whether lending policies are appropriate for the bank’s lending activities. Evaluate the

frequency and timeliness of reviews and updates by the board. Appropriate policies generally address

items such as:

• Limits on:

o The maximum volume of loans to total assets;

o The extension of credit through overdrafts;

o Loan-to-values for various loan types, considering the Interagency Real Estate Lending

Guidelines and the related documentation for valuing the collateral by loan type;

1

o Off-balance sheet credit exposures;

• General guidelines that:

o Set goals for portfolio mix and risk diversification, including plans to monitor and take

appropriate action on existing concentrations to individual borrowers (and their related

interests) and industries;

o Describe approved general fields of lending and the types of loans in each general field;

o Describe the normal trade area and when lenders may extend credit outside the trade area;

o Address loans to insiders;

2

o Set safeguards to minimize potential environmental liability;

o Define parameters for purchased and transferred loans, including loan participations;

o Describe acceptable use of interest reserves;

o Define collateral requirements, pricing, and terms of repayment for various loan types;

o Establish procedures to obtain and review appraisals and evaluations of real estate or other

collateral, as well as to order new appraisals and evaluations;

o Set conditions for granting unsecured loans;

o Establish ongoing documentation review and maintenance of complete and current credit files

on each borrower; and

o Establish the loan review process, credit risk grading system, and watch list;

• Guidelines on troubled loans and losses including:

o Determining, assessing, and reviewing the appropriate level for the credit loss reserve;

3

o Loan modifications and the accounting consequences, including whether the modification meets

the definition of a troubled debt restructuring (TDR);

o Collection and workout procedures; and

o Charge-off practices and appropriate follow up for potential recovery;

• Guidelines on loan documentation including:

o Documentation required by the bank for each type of secured loan;

o Standards for loan presentation sheets and credit memoranda; and

o Standards for proper underwriting and credit file documentation by loan type; and

1

Refer to 12 CFR Part 365, Appendix A (FDIC); or 12 CFR 208, Appendix C (FRB).

2

Refer to 12 CFR Part 215 (Regulation O).

3

Either the Allowance for Loan and Lease Losses (ALLL), or the Allowance for Credit Losses (ACL) for loans and leases

for those institutions that have adopted ASU 2016-13.

Core Analysis

Bank Name: Page: 4 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

• Governance issues such as:

o Lending authority of each loan officer as well as loan committee or executive committee;

o Responsibility of the board to review, ratify, and approve loans;

o A process to approve, track, and report policy exceptions; and

o The time interval for the board’s periodic review of the loan policy, not less than annually.

8. Determine whether the loan policy establishes appropriate underwriting standards for each approved

loan type. Appropriate underwriting standards generally address items such as:

• Loan-to-value limits;

• The borrower’s business or occupation;

• The borrower’s past and current financial condition, income, and cash flow;

• The purpose of all loans granted to the borrower, the source of repayment, loan terms, and

repayment period; and

• The collateral, its value, and the source of valuation.

9. Determine whether incentive compensation programs promote behaviors inconsistent with the bank’s

strategic portfolio objectives and risk tolerances and with safe and sound banking practices.

10. Determine whether repossessed asset and other real estate (ORE) policies are appropriate for the needs

of the bank.

11. Review the charge-off policy. Consider the consistency with regulatory and accounting definitions,

adherence to policy, timeliness, and senior management and board review.

12. Review the appraisal policy to determine whether it conforms to outstanding regulatory requirements.

13. Determine whether the appraisal policy describes the conditions when the bank will obtain a new or

updated appraisal or evaluation of the real estate collateral on an existing Commercial Real Estate

(CRE) loan (e.g., movement into workout or material deterioration in real estate market conditions).

Internal Controls

Core Analysis

Bank Name: Page: 5 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

14. Determine whether appropriate separation of duties exists. Consider items such as:

• Preparing loan documents,

• Posting subsidiary loan records to the core loan application, and

• Disbursing loan proceeds.

15. Evaluate the loan documentation process. Satisfactory loan documentation systems generally address

items such as:

• Assigning responsibility for assembling loan documents;

• Reviewing loan documentation to ensure all required documents and signatures on applications are

present prior to loan approval;

• Performing post-closing reviews of documentation by an independent party to verify that proper

procedures are followed, and all required information is on file, and documents are properly

executed; and

• Securing loan documents during business hours and locking them in a fireproof vault overnight.

16. Determine how new and renewed loans are approved and booked and whether loan officers are able to

renew and extend loans without an independent review.

17. Determine whether controls help ensure loans are booked with the same terms as approved.

18. Determine whether the code of ethics governs loan officers lending to relatives or other related parties.

19. Review management’s procedures to prevent, detect, and respond to lending policy exceptions.

Determine whether deviations from the loan policy are properly approved and documented in

accordance with internal loan policy guidelines.

20. Evaluate reconciliations between subsidiary loan records and the general ledger. Consider the

frequency of reconciliations, the disposition of reconciling amounts, and the separation of duties for

personnel involved.

21. Evaluate controls over loan closings and disbursements. Consider whether:

Core Analysis

Bank Name: Page: 6 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

• Documentation is complete and appropriate waivers are obtained before loans are funded;

• Documentation waivers are excessive;

• Funds are disbursed according to the loan terms; and

• Loan disbursements and general ledger entries are properly controlled.

22. Ascertain whether items held in suspense accounts clear in a timely manner.

23. Evaluate controls over off-balance sheet lending activities.

24. Verify whether commitments are limited in amount, cover a specific period, and indicate the conditions

that must be satisfied before draws will be honored.

25. Evaluate controls over loan participation activities, such as independent credit analysis, prior to

purchase and ongoing.

26. Evaluate loan participation agreements. Appropriate agreements generally:

• Meet the definition of a participating interest

4

as defined by ASC Topic 860;

• Address the timely exchange of information;

• Establish expectations involving participants’ consultation with each other prior to taking action on

defaulted loans; and

• Specify the rights and remedies of the lead bank and participant(s).

27. Evaluate controls over loan renewals and extensions. Consider whether:

• An independent credit analysis is performed prior to renewal or extension;

• The number of loan renewals or extensions complies with internal loan policy limits; and

• The use of interest-only terms is limited.

4

Refer to the definition of Transfers of Financial Assets in the Call Report Glossary for additional information.

Core Analysis

Bank Name: Page: 7 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

28. Evaluate controls regarding collateral held at the bank. Consider whether:

• Collateral held at the bank is documented with pre-numbered forms that provide a customer’s

receipt, ledger record, and loan file copy;

• Physical or negotiable collateral held at the bank is under joint custody; and

• Controls ensure holds on deposit accounts are maintained.

29. Evaluate the process for reconciling loan accounts to the general ledger. Consider whether:

• The frequency that subsidiary loan accounts are reconciled to the general ledger;

• Persons involved in approving loans, disbursing proceeds, accepting payments, or posting

transactions do not have reconciliation authority;

• Reconcilements are reviewed and signed by senior officers; and

• The bank has adequate procedures and timeframes for disposing of stale items.

30. Evaluate controls regarding capitalization of interest.

• Determine whether there are loans with interest not collected in accordance with the terms of the

note, such as loans that have been renewed without full collection of interest, with interest being

rolled into principal, or interest paid from the proceeds of a separate note.

• Determine whether there are loans with modified terms that reduce the interest rate or principal

payment by deferring interest or principal or by restructuring repayment terms. Consider any

formally restructured loans that were returned to accrual status after a partial charge-off or before

collection of interest in arrears.

31. Determine whether management appropriately identifies, measures, monitors, controls, and reports

credit concentration risks by industry, type, person, product, related borrowers, etc.

32. Determine whether loan approvals are properly documented, and verify that loan terms are consistent

with officer, committee, and board approvals.

33. Determine whether credit-scoring models are regularly tested and evaluated to ensure that actual

performance approximates initial projections.

34. Determine whether appraiser selection and appraisal review processes are independent from the

lending function.

Core Analysis

Bank Name: Page: 8 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

35. Determine how appraisers are added to the approved appraiser list and how appraisers are selected for

assignments.

Credit Administration

36. Determine whether appropriate lending authorities exist at the loan officer and committee levels.

37. Determine whether the lending and credit administration staffs are appropriate given the size and

nature of current and planned lending activities.

38. Evaluate the effectiveness of collection and workout procedures.

39. Assess the training and continuing education provided to lending personnel.

Audit or Independent Review

5

40. Determine whether the audit program is sufficient to obtain reasonable assurance that:

• Loans exist and are owned by the institution as of the balance-sheet date;

• Loans are properly classified, described, and disclosed in the financial statements, including fair

values and concentrations of risk;

• Recorded loans include all such assets of the institution and the financial statements include all

related transactions during the period;

• Loan transactions are recorded in the proper period;

• Loans held for sale are properly classified and are stated at the lower of cost or fair value;

• Interest income, fees, and costs and the related balance-sheet accounts (accrued interest receivable,

unearned discount, unamortized purchase premiums and discounts, and unamortized net deferred

loan fees and costs) have been properly measured and recorded;

• Gains and losses on the sale of loans have been properly measured and properly recorded; and

• Credit commitments, letters of credit, guarantees, recourse provisions, and loans that collateralize

borrowings are properly disclosed in the financial statements.

5

Coordinate with the examiners reviewing the internal audit function.

Core Analysis

Bank Name: Page: 9 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

41. Determine whether the audit or independent review program provides sufficient coverage relative to

the institution’s size, scope of lending activities, and risk profile. Appropriate programs generally:

• Recommend corrective action when warranted;

• Verify that corrective action commitments have been implemented;

• Assess separation of duties, internal controls, and supervision of lending activities;

• Determine compliance with internal policies and procedures, and applicable laws and regulations;

and

• Assess the adequacy, accuracy, and timeliness of reports to senior management and the board.

Information and Communication Systems

42. Determine whether managerial reports provide sufficient information relative to the business model,

size, complexity, and risk profile, and evaluate the accuracy and timeliness of reports produced for the

board and management. Reports may include the following types of information:

• Charge-offs and recoveries;

• Concentrations;

• Kiting suspects;

• Legal lending limits;

• Loan extensions and modifications;

• Loan renewals and new loan approvals and denials (above certain dollar amounts);

• Non-conforming loans;

• Non-sufficient funds;

• Out-of-territory lending;

• Policy exceptions;

• Results of internal and external audits;

• Results of loan review;

• Suspense accounts (contents and reconcilements);

• Technical exceptions; and

• Unfunded commitments.

Managerial Effectiveness

PROCEDURES AND PRACTICES

43. Determine how management monitors for compliance with internal policy and limits.

Core Analysis

Bank Name: Page: 10 of 10 Loan Operations And Review

Examination Start Date: Examination Modules (10/19)

44. Review recent audits and examinations to determine the effectiveness of internal audit in identifying

and reporting internal control weaknesses.

45. Determine whether management has addressed and corrected deficiencies cited by internal and

external auditors, loan review, and regulatory agencies.

46. Review board, loan, and audit committee minutes to determine whether relevant issues and audit

findings are being addressed.

End of Core Analysis.