City of El Paso

Loan Servicing and Collections Manual

Community + Human Development

EFFECTIVE March 2, 2020

Introduction 3

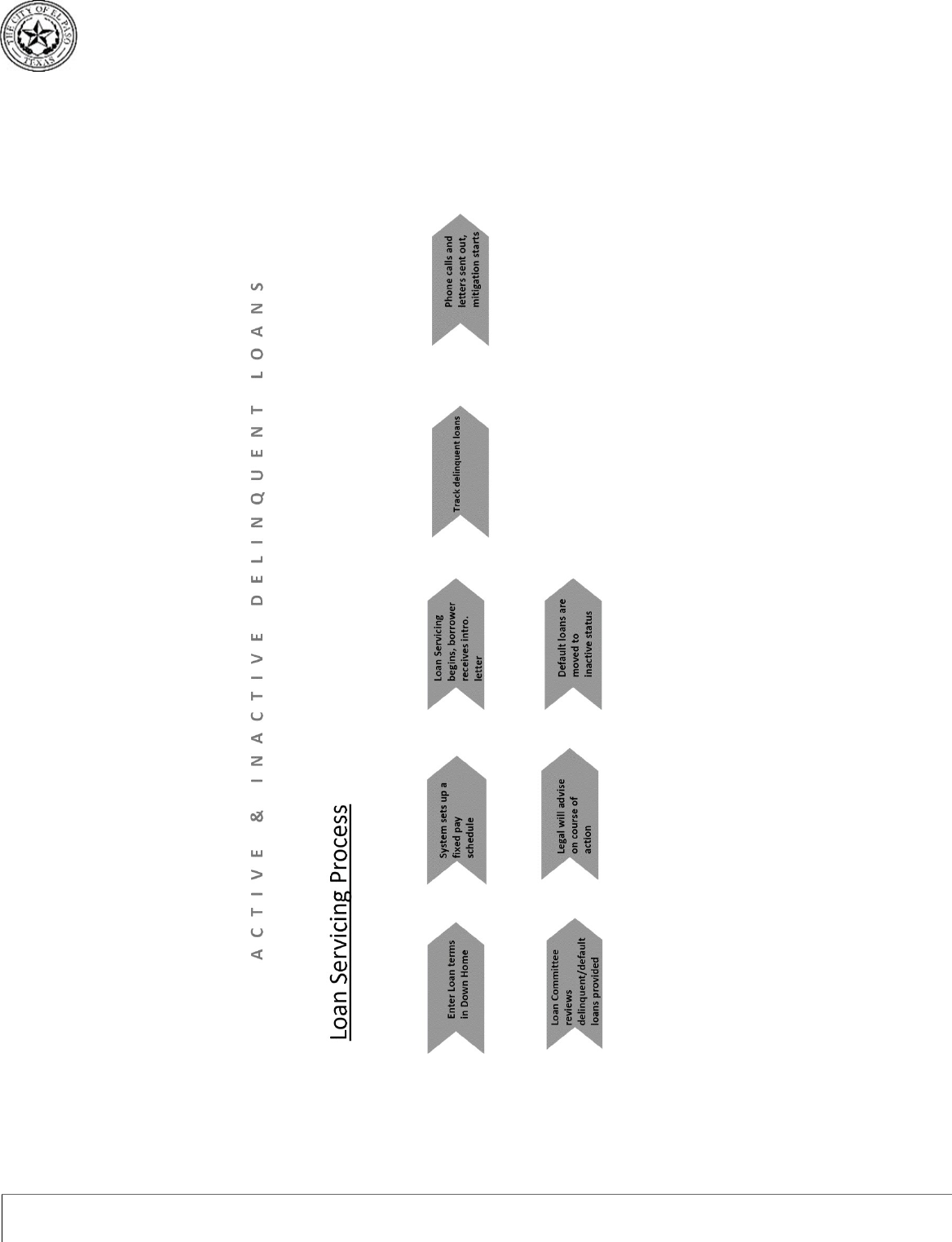

1.0 Loan Servicing & Management Process 4

1.1 Loan Set-Up 4

1.2 Loan Payments 4

1.3 Ach Payments 5

1.4 Loan Pay-Off 5

1.5 Information Security 6

2.0 Collections Procedures 7

2.1 Delinquency Management – Delinquent Letters 7

2.2 Foreclosures 10

2.3 Bankruptcy 10

2.4 Credit Reporting 10

2.5 Reports 10

3.0 Loss Mitigation Process 11

3.1 Servicing Early Delinquency Loans (30-60 Days Past Due) 11

3.2 Borrowers Delinquency 60-90 Days Past Due- Default At Risk Loans 16

3.3 Borrowers Delinquency 90-120 Days Past Due- Default At Risk Loans 17

3.4 Borrowers Ability (Capacity) To Cure Default (Over 120 Days Past Due) 17

3.5 Loan Reclassification 18

3.6 Special Forbearance 20

3.7 Loan Modification 23

3.8 Special Loan Servicing 26

Definitions 30

Appendix A: Servicing of Loan Forms 32

Servicing Of Loan Request Form 32

Forgivable Deferred Payment Loan Promissory Note 35

Builders & Mechanics Lien Contract 36

Deed of Trust 37

Shared Appreciation/Deferred Payment Loan Promissory Note 38

Appendix B: ACH Authorization Form 39

Appendix C: Payment Discount Policy 40

Appendix D: Release of Lien Process 41

Appendix E: Acknowledgment of Handling Sensitive Information 42

Appendix F: Portfolio Reports 43

Table of Contents

Appendix G: Special Forbearance Checklist 45

Appendix H: Loan Modification Checklist 46

Appendix I: Loan Process Flowchart 47

Appendix J: Loan Review Form 48

Appendix K: Behind on Mortgage Brochure 49

Appendix L: Save Your Home Brochure 50

Appendix M: Guidelines for Subordination Agreements 51

Appendix N: Subordination Agreement Request 52

Note: The administrative policies and procedures outlined in this manual supersede all previous

administrative policies and procedures in place prior to, January 1, 2019, that may have been

included in memorandums, emails or other means of communication. All questions or conflicts

with departmental procedures need to be directed to the Administrative Services Division of the

Community and Human Development Department at (915) 212-0139.

3

Introduction

This manual outlines the administrative policies and procedures with respect to the Community Development

Block Grant (CDBG), HOME Program Income (HOME PI) and Empowerment Zone Revolving Loan activities

for the City of El Paso (“COEP”). This manual includes policies on loan procedures for set up, collections, loan

activity and mitigation procedures processed by the COEP. It additionally focuses on the most common situations

encountered during loan collection procedures once a loan is disbursed to the borrower. Under special

circumstances, deviations will be reviewed, approved, and noted in the loan file by the Department of Community

and Human Development.

4

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

1.0 Loan Servicing & Management Process

The practice of making loans includes the responsibility of collecting payments and reconciling customer

accounts. The effectiveness of these activities relies on an accounting system that accurately compiles payment

information while generating timely loan account reports. Subsequently, attention can be focused on procedures

designed to prevent delinquent account balances by reducing late payments and eliminating past due amounts.

These collection procedures when combined, determine the overall collection policy of the Department of

Community and Human Development (DCHD).

After a loan is processed and the mandatory three-day right of rescission has expired, DCHD Senior Accounting

and Loan Collections Specialist will scan copies of the following documents into a shared Community

Development network drive: (See Appendix A)

• Servicing of Loan Request Agreement

• Loan Note

• Secured Grant Note

• Builders and Mechanics Lien & Deed of Trust

• Deed of Trust

• Shared Appreciation/Deferred Payment Loan Promissory Note

DCHD Senior Loan Accounting and Collections Specialist and Grant Accounting Specialist will set-up the loan

in Down-Home system, which is the loan-tracking software system for community development lenders and

utilize by COEP. Borrowers will receive a monthly statement including a payment coupon with instructions on

how to make a payment. At year-end, loan servicing staff will mail a Form 1098, if applicable, postmarked by

January 31

st

of each year.

DCHD Accounting Staff will review the monthly statements

1.1 LOAN SET-UP

Refer to the Down-Home user guide for loan set-up; https://help.downhomesolutions.com/. Updates for the

Down-Home user guide should be requested to the Down-Home Director-Administration and Technical Support

Services.

1.2 LOAN PAYMENTS

For the convenience of our customers, the COEP offers the following options for loan payments. The Cashiers

Office at the One Stop Shop (OSS) will receive payments for HUD loans and processes them through the

Accela system.

In Person:

City of El Paso (OSS)

811 Texas Ave.

El Paso, TX 79901

City Hall

Office of the Comptroller

City of El Paso

300 North Campbell

El Paso. Texas 79901

Loan payments can be mailed to:

City of El Paso HUD Loans

P.O. Box 206259

Dallas, TX 75320 - 6259

Community + Human Development,

Attention Loan Servicing,

City of El Paso

801 Texas, City 3, 3rd Floor

El Paso, Texas 79901

5

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

Payments will be posted daily in the Down-Home system. For the loans that did not receive a payment on their

respective deadline and after the 10-day grace period, the DCHD Accounting staff will post a code to indicate a

the loan account is past due.

1.3 ACH PAYMENTS

ACH is defined as Automatic Clearing House, which represents electronic withdrawals from the clients’ bank

accounts for monthly loan payments. At this time, ACH payments will be required to be established for all new

loans. ACH payments will assist in the timely and accurate collection of loan payments thereby minimizing late

payments and late fees. A Direct Payment Authorization Form must be completed in order to participate in this

free service option. A sample of this form is included in Appendix B.

PAYMENT DISCOUNT POLICY

Customers that elect to use ACH for their existing loans with the COEP may qualify for a discount to their loan

if the entirety of the policy below is followed without exception:

1. ACH account is set up and a related ACH responsibility disclaimer is completed and signed by the

customer.

2. The ACH account is kept current and payments are received on a timely basis for 12 full months.

3. A credit of $100.00 will be made to the customer’s account if items 1-2 are in compliance. (See

Appendix C).

Payment discount policy is a one-time promotional offer that will not be extended beyond December 31, 2019.

Enrollment period concluded January 31, 2019.

1.4 LOAN PAY-OFF

Accounts with less than two monthly payments worth of principal balance will be identified, analyzed and tracked

for an imminent pay-off. These borrowers will be contacted by the DCHD Accounting Staff, informing them of

their final pay-off amount balance. After final payment, including other applicable fees received and posted to

the Down-Home system, DCHD Accounting Staff will initiate the process and prepare the documents to record

the release of lien on behalf of the borrower (See Appendix D). This assumes that any and all grant balances have

been either forgiven or paid-off in connection to the referenced loan. As part of the loan payoff process, a request

for a release of lien will be required of the borrower with all required information. A reconciliation will be

completed by the loan servicing staff prior to completing the release of lien.

In some cases where the pay-off balance comes from the lawyer’s collection services; DCHD Accounting Staff

will audit the pay-off statement and will prepare the release of lien documents.

Payoff balances for Single Family and First Time Homebuyer loans shall be calculated based on the terms

stipulated in the loan documents, i.e. Loan Note and Grant Note. A payoff amount will be calculated using the

current principal balance, applicable interest, and any unforgiven or deferred loan balance due.

For example, a First Time Homebuyer loan has a principal loan balance of $7,000.00 with a 0% interest rate. This

loan is tied to a 30-year grant note of $12,000 (1/30th of the amount is forgiven per year). This grant note has

only been forgiven for 8 years, leaving a grant balance of $8,800.00. Therefore, the total payoff of this loan is

calculated of $15,800.00 ($7,000.00 loan balance plus outstanding grant balance of $8,800.00)

6

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

Forgiveness of grant balances may or may not be impacted by the affordability period if specifically stipulated in

the original loan documents; Loan Note, Grant Note, Builder’s and Mechanic’s Lien and Deed of Trust. As an

example, an outstanding grant balance may be considered fully forgiven if the total loan principal balance is paid

in full.

1.5 INFORMATION SECURITY

As part of their access to the Down-Home Loan Management software, all users must sign an Acknowledgment

of Handling Sensitive Information disclosure (See Appendix E).

Any indication of a security breach and or incident related to Down-Home Loan Management software is to be

reported to the Administrative Services Manager and Down-Home support staff in writing Down-Home support

staff will lock the use of the access and request for a password change for all of the software users. Depending on

the severity of the breach and or unauthorized share of sensitive information, the DCHD will alert the Internal

Audit Office, the Office of Information Technology and the authorities.

7

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

2.0 Collections Procedures

Due diligence will be applied to verify all loan account information through a full reconciliation, including

corresponding payments and loan analysis when applicable. The appropriate action is determined on a case-by-

case basis. Each loan has a ten-day (10) grace period beyond the due date. These accounts must be tracked closely

to verify that the following payment is made when promised and that subsequent payments are made on time.

2.1 DELINQUENCY MANAGEMENT – DELINQUENT LETTERS

30 Days Past Due:

If payment is not made, DCHD loan servicing staff will send out a 30-day letter advising the loan customer of the

missed payment and delinquent status. Applicable fees or penalties will be assessed to the borrower for late

payments.

60 Days Past Due:

After 60 days past due, a collection letter will be mailed, informing the borrower that the loan agreement is in

default and a possible consequence will include but not be limited to, submitting a negative report to a major

credit bureau affecting borrower’s creditworthiness. On the 65th day past due, a delinquent borrower will be

contacted by DCHD loan servicing staff.

90 Days Past Due

After 90 days of unsuccessful attempts to bring the account current, the account file will be properly documented,

and a certified collection letter will be mailed by DCHD loan servicing staff. This notice will include the same

points noted above. In addition, the letter will encourage the borrower to call DCHD, this will establish a contact

for obtaining more information to evaluate individual circumstances.

120 Days Past Due

For those accounts that fall behind more than 120 days past due, the loan is considered to be in default. The City

Attorney assigned to DCHD will send a letter to borrower asking for an appointment to meet and discuss the

account and possible remedies within section 3.0 Mitigation Process to clear the delinquency.

At this time, the reasons for delinquency must be documented. The borrower will be informed of the possible

temporary and permanent options available for resolving the delinquency. These options will vary from a referral

to a credit counseling service and/or advising the borrower to seek other financing options to remedy the default

account.

Under no circumstances, will DCHD engage in outside collection efforts by way of personal visits.

Minimum Collection Efforts Timeline

This process timeline will help better visualize when the specific requirements should take place within the

delinquency period and the applicability of these collection efforts are further discussed in the mitigation section

of this manual.

Available options to delinquent borrowers are:

1. Modification Agreement – A modification agreement is used to allow a borrower’s loan term to extend from

three to five years depending on the loan type; up to five years for owner-occupied and up to three years for

an investor-owner. Owner-occupied borrowers must make an initial good faith payment in the amount of 10%

of the total delinquency of the loan. Investor-owned borrowers must make an initial good faith payment

8

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

in the amount of 20% of the total delinquency of the loan. Borrowers will continue to pay a monthly payment

to be determined by the outstanding balance and the extended term, as applicable. The modification will be

in writing, notarized, and it will include the term and amount to be paid. Only borrowers with current status

on their property tax record or current tax payment plan will qualify for this option. If the Borrower’s secured

grant note(s) (forgivable note), if any, has reached maturity, the unforgiven balance remaining will be deferred

and will be forgiven upon full payment of the loan note.

2. Restructuring to Meet 35% Affordable Housing Ratio – If DCHD determines that the owner-occupied

borrower’s total housing cost debt to gross income ratio exceeds 35% and the Borrower makes an initial good

faith payment in the amount of 10% of the total delinquency of the loan and is current on property taxes or a

tax payment plan, the City may restructure the loan such that the remaining portion of the loan principal

balance that is above the 35% ratio, together with accrued interest, if any, less the collection costs, will be

deferred and become immediately due in full and payable upon the sale or transfer of the property, or is

otherwise conveyed (excluding life estates), or upon the date the property ceases to be owner-occupied. The

deferred portion will not accrue interest. This restructuring option is also available to investor-owned

borrowers who reside in the subject property and the property has less than five units.

3. Redetermination - According to Chapter 1, Section VII of the Housing Rehabilitation Program Handbook,

a borrower with an owner-occupied loan can apply to have the interest rate on the loan re-determined. In

particular, Subsection 3(D) would assist many borrowers whose loans were made at a time when interest rates

were high (e.g., 9% and 10%). This option is also available to borrowers who are current on their loan

obligation through DCHD.

4. Assumption –

A.

Assumption of owner-occupied loans through DCHD – Separately or in conjunction with a loan

modification request, the original borrower’s relatives who are within the second degree of

consanguinity (parent, child, brother, sister, grandparent or grandchild) are permitted to assume the

original borrower’s delinquent owner-occupied loan provided that the proposed applicant(s): meets

the relative requirement above; complies with the loan modification requirements in option number 1

above; meets the income eligibility requirements under the current Housing Program Guidelines and

the income does not exceed 80% of the area median income, as determined by HUD; provides proof

of ownership of the subject property; and will reside at the subject property as his/her principal

residence for the remaining term of the loan.

B.

Assumption of investor-owned loans – Separately or in conjunction with a modification agreement

request, an investor-owned loan may be assumed with the prior written consent of the City. In order

for the DCHD to recommend approval of the assumption agreement the following terms and

conditions must be met: (1) the loan must be current or restructured and property taxes be made current

upon loan assumption; (2) the applicant must submit documentation to evidence its financial and

property management capacity and experience with rental housing and low-income housing; (3) If the

affordability period has expired, the City may require a renewed affordability period under negotiable

terms; (4) The City may also consider increasing the interest rate under negotiable terms as part of its

assumption approval; and (5) as applicable, the applicant will attend a DCHD training session on the

HUD rules and regulations governing operation of the rental housing prior to loan assumption.

9

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

Forbearance – Two methods of loan forbearance are available to delinquent borrowers and to borrowers at risk

of delinquency due to extraordinary circumstances; (1) Temporary deferral or reduced loan payments where

interest continues to accrue (where applicable) within a period no longer than six months to the borrower

experiencing extraordinary circumstances, which may be extended if circumstances have not changed or

worsened through a review by staff and approval by Housing Program Manager or Administrative Services

Manager, (2) Temporary modification in which the borrower is permitted to make extra payments to bring the

loan current over a period of twelve months.

Forbearance assistance will only be granted to those loans with a good payment history during the life of the loan,

where property taxes are current or being paid under a tax repayment plan, and when the borrower is experiencing

extraordinary circumstances which negatively affect the borrower’s ability to make timely payments.

For example, borrower’s loss of employment will qualify as an extraordinary circumstance. Deferral or reduction

in the loan payments will not change the annual percentage interest rate and the term of the loan will be extended

to correspond with the additional months for the reduction or deferral requested.

An updated Truth-In-Lending Statement(s) will be provided to the borrower for any loan restructuring or change

in loan terms due to the stated procedures. Only one restructuring agreement shall be permitted during the life of

the loan, except when additional restructuring agreements are authorized by a loan servicing company under

contract with the City or in the case of authorized loan assumptions or forbearance agreements. Any good faith

payment of the required percentage of the delinquency amount on loans for owner-occupied borrowers or

investor-owned borrowers who reside in the subject property and that property has less than five units, may be

paid in installments over a period of six months.

Special Forbearance- A special forbearance is a written agreement between the COEP (lender) and the borrower.

The following conditions must be met in order for the borrower to receive a Special Forbearance:

• Loan must be delinquent for at least 90 days. It cannot be more than 120 days late.

• Loan must not be in foreclosure.

• The COEP may offer borrower debt relief not offered under an informal forbearance plan.

• The maximum amount of delinquency must not be more than 3 months’ worth of loan payments. These

loan payments include principal and interest.

• The special forbearance plan must reinstate the loan on a pre-arranged time table. Loan modification is

may be available once payments are up to date.

• Borrower must prove a loss of income or increase in expenses that led to loan default. The borrower must

also show that income is high enough to reinstate the loan according to the plan.

• During the forbearance, the borrower must live in the property as a primary residence. After the

forbearance is executed and the loan is reinstated, the borrower may sell the property.

• The property must be inspected and be in acceptable condition for the borrower to qualify. Some specified

repairs may be part of the forbearance plan.

Borrower’s written agreement with COEP (lender) must include the term, frequency of payments, and amount of

payments due. Borrower agreement will include any loan payments already missed, and there will be a disclosure

that if the borrower doesn’t succeed in the forbearance plan, borrower home may be foreclosed (only if COEP is

on first lien position).

Loan Forgiveness- A debt may be discharged (also referred to as cancelled or as forgiven) when it is closed out

without collection in full. When a debt is forgiven, the COEP has determined that further active or passive debt

collection will not be taken. Partial or full loan forgiveness is an option based on the borrower’s submittal of a

request for loan forgiveness in compliance with HUD and City regulations. Loan forgiveness requests are

evaluated based on extreme personal hardships (i.e. death, divorce or a catastrophic circumstance) i.e. to avoid a

balloon payment on a deferred loan or exceeding the affordability index of 35%.

10

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

To be considered for loan forgiveness a borrower must submit a full application with all supporting

documentation. The Housing Program Manager or Administrative Services Manager will review and make a final

determination based on the information submitted.

Loan Payoff- See Section 1.4

2.2 FORECLOSURES

Once the DCHD determines that all loan collection efforts and mitigation processes have been exhausted and a

notice is received from the City’s Attorney Office with information on the foreclosure; the foreclosure form and

an audit will be generated by DCHD staff and forwarded to the DCHD Housing Program Manager or

Administrative Services Manager for foreclosure processing. The DCHD will submit the foreclosure package to

the City Attorney office.

2.3 BANKRUPTCY

By filing a petition for bankruptcy, the borrower creates an automatic stay that prohibits all creditors from making

contact or pursuing collection activity. Loans under this category will be closely monitored for collection purposes

only. Notices on these accounts are processed through the City Attorney’s Office. These loans will be identified

manually, and actively monitored for purposes of repayment plan compliance. The City Attorney’s Office will be

notified if the borrower fails to make post-petition payments according to the plan.

2.4 CREDIT REPORTING

DCHD will report its Loan Portfolio to a credit agency in accordance with the Federal Fair Credit Reporting Act

(FCRA), subject to funding appropriations. Deferred payment loans will not be included in the credit reporting

files, however, if a Deferred Loan has reached maturity and has a delinquent account status where no payments

have been made and are due, the City will report on the loan file. DCHD is committed to reporting accurate and

fair information. In addition, DCHD will commit to safeguarding the privacy of information of consumers being

reported to the agency to the extent permitted by law.

2.5 REPORTS

DCHD staff will provide month-end loan activity reports generated by Down-Home software by the 10

th

business

day of the following month. Reports to be distributed on a monthly basis to the Housing Programs Manager and

Administrative Services Manager are as follows: (See Appendix F)

• Transaction Report

• Trial Balance Report

• Portfolio Activity Report – Delinquent Loans

The Transaction Report will show weekly amounts received from borrowers on a cumulative basis showing year-

to-date activity by each fund. The Trial Balance Report generated by Down-Home will show principal balances

and past due amounts by individual loans and sub-fund totals. The Portfolio Activity Report- Delinquent Loans

will be generated on a monthly basis and retained for a permanent record to show the number of delinquent loans

by aging.

11

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

3.0 Loss Mitigation Process

Both the City and borrowers have responsibilities under loss mitigation. While each option involves specific

actions, some policies apply to all of the options, and some City actions are performed whether or not any of the

loss mitigation strategies are used. This section describes the general policies, recommended procedures, and

minimum actions that constitute effective loss mitigation techniques.

The City has the authority and the responsibility to use effective actions and strategies to assist borrowers to retain

their homes, and thus reduce losses to the City. Because of its ongoing relationship with the borrower, the City

is in the best position to determine which, if any, loss mitigation strategies are appropriate in a given circumstance.

The City may use any of the following loss mitigation options.

A.

CITY’S LOSS MITIGATION ACTIONS

The City must:

•

Provide a complete and accurate loan-servicing plan that clearly outlines the approved action.

•

Consider all reasonable means to address the delinquency at the earliest possible time.

•

Use payment or credit scoring tools, if available, to identify high-risk borrowers that may need more

attention, rather than wait until standard contact dates.

•

Inform the borrower(s) of available loss mitigation options and the availability of housing counseling

before the end of the second month (60th day) of delinquency. (Ensuring that the borrower receives the

HUD publication 9692HC available at http://portal.hud.gov/hudportal/documents/huddoc?id=9692-

HC.pdf concerning HUD-Counseling is acceptable, as well as documentation in the servicing and

collection notes of conversations with the borrower concerning mitigation options).

•

Evaluate each delinquent loan once they become greater than 30 days past due but no later than the 120th

day of delinquency (default) to determine which loss mitigation option is appropriate.

•

Use loss mitigation whenever feasible to avoid foreclosure.

•

Reevaluate each delinquent loan monthly until the delinquency is cured or the mitigation action is

complete

•

Initiate foreclosure, deed in lieu of foreclosure or assumption within six months (180 days) of default

unless a different loss mitigation option is being pursued aggressively, and ensure that all actions taken

are documented.

•

Initiate foreclosure timely on vacant and abandoned properties, if applicable.

•

Retain a complete audit trail showing all loss mitigation actions.

3.1 SERVICING EARLY DELINQUENCY LOANS (30-60 DAYS PAST DUE)

The purpose of all collection efforts is to bring all delinquent loans back to a current status in as short of a time

as possible. The majority of one or two payment delinquencies will be addressed by either voluntary reinstatement

by borrowers, or through traditional collection methods outlined in Section 2.0 Collection Procedures. That

section details conditions for forbearance plans, modifications, restructures assumptions, (with the exception of

Single Family Owned rehabilitation loans, which do not permit assumptions) and deeds-in-lieu of foreclosure

(DIL). DIL should be used only in extreme hardship or involuntary inability to pay.

While a loss mitigation process is designed to address serious delinquencies, any of the City’s efforts to cure loans

that are past due for 30 days or more contribute to the goal of helping residents in areas of need retain

homeownership or affordable rental units and reduce the City’s losses. Thus, effective loss mitigation begins in

the early stages of servicing delinquent loans. It is the City’s responsibility to validate and document the

borrower's capacity under the terms of the loss mitigation workout recommendation intended to prevent default.

12

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

A.

EARLY INTERVENTION

To facilitate a successful loss mitigation intervention, the DCHD will attempt to first make verbal followed

written contact with the borrower if the payment is not received by the 26th day after it is due. Before an

account becomes 60 days past due and if there is no contact or payment arrangement in place, the City must

send a certified letter to the borrower requesting an interview in an effort to resolve the past-due account. The

earlier the City makes contact with the delinquent borrower and identifies the cause of the default, the more

likely it is that the default will be cured, and the borrower will be able to keep the home or affordable rental

units. It is critical that the City make all decisions in a manner consistent with fair housing and lending

principles.

B.

CAUSE OF DELINQUENCY

The City should identify the underlying cause of the delinquency at the earliest stage of borrower contact and

determine if the problem is permanent or temporary. A borrower whose ability to support the loan debt has

been permanently reduced through death, divorce, or permanent disability is unlikely to cure the default

through a repayment plan. Such a borrower should be evaluated for either an assumption, loan modification,

restructure or forgiveness, which may result in a reduction of the mortgage payment, reduction in balance

through forgiveness or a pre-foreclosure sale, which allows a transition to more affordable housing. In some

cases, a loan modification might result in higher payments due to the capitalizing the arrearage. This option

may be feasible if the borrower's financial situation will accommodate a higher payment.

A borrower who needs credit, legal, or employment assistance to resolve temporary financial problems will

be referred to the appropriate housing, employment or financial counseling, such as a HUD certified housing

counseling agencies, Texas Workforce Commission (for unemployment situations) or Legal Aid (for legal

matters) via an advisory notice along with all City loan notices.

C.

DEFAULT PREVENTION COUNSELING

A borrower who receives early counseling is much more likely to bring the loan current. The City strongly

recommends financial counseling to borrowers and has established working relationships with counseling

agencies i.e. Project Bravo and GECU. The City will provide to the borrower before the 45th day of

delinquency HUD publication 2008-5-FHA, Save Your Home: Tips to Avoid Foreclosure, rev January 2014.

This may not be feasible, however, if the borrower has filed a bankruptcy petition and, in the opinion of the

City's legal counsel, providing a copy of the pamphlet would be a violation of the bankruptcy stay. In such

cases, the City should keep documentation of this fact in the servicing file.

D.

INFORMAL FORBEARANCE PLANS

An informal forbearance plan is a written repayment agreement lasting for 3 months or less. Such a plan is

the first and best means to ensure that a one or two-month delinquency does not escalate beyond the borrower's

ability to cure. In such a plan, the City should carefully review the borrower's financial situation and arrange

payment terms that the borrower can realistically keep, and the delinquency can be cured.

E.

DEFAULT STATUS OF THE LOAN

Loss mitigation options are intended to provide relief to a borrower who is delinquent or facing imminent

default. For the purposes of this mitigation process, the default is defined as any loan that has failed to perform

under any covenant of the mortgage or deed of trust for 120 days or more or is at risk of default.

If the borrower's circumstances warrant, the City may create accommodations such as a special forbearance

agreement, loan modification, restructure, or an assumption, (with the exception for Single Family Owned

Rehabilitation loans, which do not permit assumptions) available to a borrower whose failure to perform is

involuntary and likely to continue. If the delinquency is incurable, a disposition option such as a pre-

13

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

foreclosure sale or a deed-in-lieu of foreclosure is recommended immediately because the borrower has no

realistic opportunity to replace the lost income or reduce expenses sufficiently to meet loan obligation through

other options.

Any attempt to deliberately manufacture or misrepresent pertinent facts about a borrower's financial or another

qualifying status may disqualify the borrower from participating in loss mitigation options and result in civil

or criminal penalties.

F.

OWNER OCCUPANCY

Generally, the borrower's eligibility for any of the reinstatement, special forbearance, or loan modification,

restructure, or assumption (with the exception of Single Family Owned rehabilitation loans, which do not

permit assumptions) options should be based on occupancy of the property as a, their principal residence. Loss

mitigation retention or disposition options may be considered if the property has been recently vacated due to

one of the following, but not limited, to special circumstances:

• Employment transfer

• Natural disaster

• Medical condition

The City must receive HUD concurrence to make an exception for a non-occupant borrower who is seeking

relief through a pre-foreclosure sale (PFS), or deed-in-lieu of foreclosure (DIL) when it is clear that the subject

property was not purchased as a rental investment or used as a rental for more than 12 months. The City

maintains the documents justifying such an exception in the servicing file.

A loan secured by an abandoned property is not eligible for a reinstatement option. However, a disposition

option may be used after HUD approves it when the property has been recently vacated by circumstances

related to the default that are beyond the borrower's control, such as a job transfer or death. The City submits

thorough documentation of such circumstances to HUD and keeps related notes in the servicing file.

G.

OTHER ELIGIBILITY FACTORS

A borrower who has a pending/active Chapter 13 bankruptcy may be considered for loss mitigation options;

however, the City must fully document the borrowers pending plan with items such as, but not limited to, a

copy of the proposed/confirmed trustee plan. In addition, the City must obtain trustee approval prior to a loss

mitigation plan execution. If the City’s agreement, investor guidelines, or applicable law, restricts or prohibits

compliance with any steps outlined in this guide, the City must maintain evidence in the loan file documenting

the nature of any deviation from the provided guidance.

H.

CURABLE DEFAULT

When the delinquency is curable, and the borrower is committed to remaining in the home, the City should

consider reinstatement options in this order:

1. Special forbearance

2. Loan modification

3. Special loan servicing modification

4. Restructure

5. Assumption; if not a single-family owner-occupied rehabilitation loan

14

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

I.

NON-CURABLE DEFAULT

When the delinquency is not curable, and/or the borrower is not committed to remaining in the home, the City

must consider disposition options in this order:

1. Assumption; if not a single-family owner-occupied rehabilitation loan

2. Pre-Foreclosure sale

3. Deed-In-Lieu of Foreclosure

4. Foreclosure (City in first lien position)

J.

OPTION PRIORITY

The following waterfall of loss mitigation workout alternatives must be adhered to:

1. Informal Forbearance

2. Special Forbearance

3. Loan Modification

4. Special Loan Servicing

5. Assumption; if not a single-family owner-occupied rehabilitation loan

6. Pre-Foreclosure Sale

7. Deed-In-Lieu – When a property owner surrenders the deed to the property to their lender in exchange

for being relieved of the mortgage debt

In some cases, the waterfall of loss mitigation alternatives may warrant utilizing a disposition workout in-lieu

of a retention workout based on the borrower's involuntary inability to pay.

K.

MONTHLY EVALUATION

As long as the account remains delinquent, the City reevaluates the status of each loan each month following

the 90-day review and maintains documentation of the evaluations in its Down-Home servicing or collection

software. The evaluation may be as simple as notes in the collection system that the borrower's payments

under special forbearance are made as agreed. Reports generated by servicing systems that track repayment

plans are adequate for documentation purposes.

L.

EVALUATING THE BORROWERS FINANCIAL CONDITION

For any loss mitigation option, the City must obtain detailed financial information from the borrower.

The City may ask the borrower to give this information on a form of its choice that collects the data elements

similar to those shown on the Request for Mortgage Assistance (RMA) Form:

https://www.hmpadmin.com/portal/programs/docs/hamp_borrower/rma_english_081315.pdf

If the borrower is cooperative, the information may be taken during a telephone interview if it is a complete

picture of the borrower's financial information. Regardless of how the financial information is initially

obtained, the City should request the borrower provide evidence to support the income with current paystubs

and/or a profit and loss statement if the borrower is self-employed. In addition, the City should obtain a credit

report to verify debts, and any other forms of verification the City deems appropriate.

Once the City has the borrower's complete financial information, it should analyze the borrower's current and

future ability to meet the monthly mortgage obligation by estimating the borrower's assets and surplus income

as follows.

15

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

• Determine the borrower's current monthly net income making necessary adjustments for income

fluctuations.

• Determine the borrower’s normal monthly living expenses (food, utilities, etc.) including debt service on

the mortgage and other scheduled obligations. Make adjustments for obligations due over the term of the

proposed special forbearance agreement, or in the case of all other options, for a minimum of three months.

• Any child support or alimony obligations should be documented with a court order to determine the

monthly obligation.

• Subtract expenses from income to determine the amount of surplus income available each month.

• Divide surplus income by total monthly expenses to determine the surplus income percentage.

All detailed financial information used to determine the borrower's financial capacity must be dated within 90

days from the date of receipt by the City. The City must communicate a decision to the borrower within 30

days of receiving a complete loss mitigation package.

The DCHD will exercise judgment to ensure that the workout option selected reasonably reflects the

borrower’s ability to pay. A borrower with sufficient surplus income or other assets is asked to cure the debt

through a repayment option.

M.

INCOME VERIFICATION

The City shall document its process in determining each borrower's income scenario. When verifying the

income of a borrower the City should use good business judgment consistent with how they evaluate

borrowers when modifying loans held in their own portfolio but at a minimum provide the following:

Wage or Salary Income:

• Paystubs not more than 90 days old at the time of submission to the City, that covers at least 30 days of

earned income.

• Borrowers most recent W-2 or executed tax returns

Self-Employment Income:

• Most recent quarterly or YTD profit and loss statement along with a copy of the most recent executed Tax

Return. Audited financial statements are not required

Other/Benefit Income:

• Bonus, commission, tips, overtime, etc. income must be documented with reliable third-party evidence

that such income is consistent and likely to continue.

• Benefit income including but not limited to social security, disability, public assistance, and Supplemental

Nutrition Assistance Program (SNAP) benefits can be considered income for the purpose of loss

mitigation. Benefit income must be documented through award letter, exhibits, or benefits statements from

the provider or evidence of receipt to the borrower.

Non- Taxable Income:

• The City, at its discretion, may utilize the gross-up income which is not subject to Federal Taxes. With

Gross Income, the City must document and support this amount and should use the same tax rate for Gross

Income that the borrower used to calculate his/her tax from the previous year.

N.

NON-BORROWER INCOME

Income from a non-borrower who also occupies the property may be used to support payments under all loss

mitigation options with the following restrictions:

16

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

• Occupancy must be fully verified

• The City should conduct a financial review of the entire household income and expenses to determine if

there is sufficient surplus income to pay back the arrearages

• The City should consult their legal counsel to determine if the asset is eligible for loss mitigation since the

Non-Borrower is not on the original debtor

• When a borrower uses a non-borrower household member's income in qualifying for a loss mitigation

home retention option and that non-borrower household member will be included on the modified note,

the non-borrower household member must sign all required loss mitigation documentation.

O.

DIVORCE-LEGAL SEPARATION

In instances where borrowers are divorced or legally separated a lender can exclude an obligated borrower

when determining eligibility for all loss mitigation options, providing the court has deemed the borrower not

responsible for the loan. The remaining obligated borrower must provide the fully executed legal document

(i.e. Divorce Decree) that shows the court's order, as well as an executed Quit Claim if necessary. If

documented, the divorced/separated party does not need to sign any required documentation for the purposes

of loss mitigation.

P.

INELIGIBLE BORROWER

If the borrower is not eligible for any loss mitigation alternative based on information secured from the

borrower in person or telephone interview, the City should advise the borrower of the reason(s) and allow the

borrower at least seven calendar days to submit additional supporting information that might have an impact

upon the City's evaluation. The City will retain the financial analysis and supporting documentation and make

it available for compliance reviews. Collection actions may continue.

Q.

COMBINED OPTION

Loss mitigation options may be used alone or in combination to resolve an existing default. There are some

limitations, however:

• Special forbearance may be combined with a loan modification. The combination of options is sequential,

not simultaneous.

• Pre-foreclosure sale may be combined with a deed-in-lieu provision in case the property does not sell

within the time required.

• The City may combine a special forbearance plan with a loan modification when there is any doubt about

a borrower's long-term income stability. To reduce the risk of a workout failure, the borrower can

demonstrate the ability to support the debt by making at least three monthly payments at the modified

amount before executing a modification.

3.2 BORROWERS DELINQUENCY 60-90 DAYS PAST DUE- DEFAULT AT RISK LOANS

When the delinquency is curable, and the borrower is committed to remaining in the home, the City should

consider reinstatement with the following mitigation options in this order:

• Special forbearance

• Loan modification

• Special loan servicing modification

• Restructure

• Assumption; if not a single-family owner-occupied rehabilitation loan

17

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

3.3 BORROWERS DELINQUENCY 90-120 DAYS PAST DUE- DEFAULT AT RISK LOANS

A.

90 DAY REVIEW

The City evaluates each delinquent housing loan that it services when monthly installments are due and

unpaid for 91 days, and considers all loss mitigation techniques to determine which, if any, are appropriate.

To meet this evaluation requirement, the City's early involvement in the delinquency is demonstrated by

contact with the borrower to gather sufficient information about the borrower's circumstances, intentions,

and financial condition. This is especially important in light of the borrower's possible reluctance to

discuss financial difficulties. While the City cannot be responsible if a borrower fails to respond to

repeated contacts, the City must clearly document mailed efforts to reach the borrower within 90 days of

the default.

B.

When the delinquency is curable, and the borrower is committed to remaining in the home, the City

should consider reinstatement with the following mitigation options in this order:

1. Special forbearance

2. Loan modification

3. Special loan servicing modification

4. Restructure

5. Assumption; if not a single-family owner-occupied rehabilitation loan

6. Review possible partial or full loan forgiveness request (application and supporting

documents)

7. Each individual HUD loan, subject to partial or full loan forgiveness, shall be reviewed and

evaluated with all supporting documentation by the Director of Community and Human

Development. The director will either approve or disapprove partial or full loan forgiveness

3.4 BORROWERS ABILITY (CAPACITY) TO CURE DEFAULT (OVER 120 DAYS PAST DUE)

A.

The City should obtain as much information as possible regarding the borrower's capacity and willingness

to cure the default. When it becomes apparent that an informal forbearance plan will not be sufficient to

resolve the delinquency, the City should evaluate whether a more formal loss mitigation strategy would

be acceptable.

B.

Mitigation Options:

When the delinquency is not curable, and/or the borrower is not committed to remaining in the home, the City

must consider disposition options in this order:

1. Assumption; if not a single-family owner-occupied rehabilitation loan

2. Assignment of rents (affordable rental units)

3. Pre-Foreclosure sale

4. Deed-In-Lieu of Foreclosure

a. Pre-Foreclosure Sale of the Property

A borrower who does not have the ability to cure the delinquent loan, but who has sufficient equity to sell

the property and repay the arrearage from the sale proceeds, should be assisted in doing so within 60 days

showing an executed earnest money contract. This assistance may include a written agreement that

provides a short-term reduction or suspension of payments for 60 days and credit reporting pending the

closing of the property sale within an additional 30 days of the execution date of the earnest money

contract. The City has full responsibility in assisting the borrower in such a case.

b. Deed in Lieu of Foreclosure (City at first lien position)

Deed in Lieu of Foreclosure is a deed instrument in which the borrower conveys all interest in real property

to the lender (COEP) to satisfy a loan that is in default and avoid foreclosure proceedings.

18

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

Acceptance of a lieu deed terminates the liability of the borrower and all other persons liable for the debt

unless there is an agreement to the contrary made contemporaneously with the lieu deed transaction.

19

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

c. Foreclosure (City at first lien position)

The City must have considered all feasible loss mitigation options before initiating foreclosure. The City

must document all of the options it considered and retain such information for review. If the borrower has

abandoned the property, loss mitigation home retention alternatives are not options before initiating the

foreclosure.

3.5 LOAN RECLASSIFICATION

(Loan inactivity by the borrower with no loss mitigation for 3 years or more)

Loans are reclassified as “Currently Not Collectible” (CNC) only in the event that all other loss mitigation

actions described herein have been exhausted. The city records all assets at the original cost (carrying

amount), though there are cases where assets can be initially or subsequently recorded at their fair values

or become delinquent and subsequently default. Eventually, it may become apparent that the amount

recorded for an asset is too high or uncollectible, so management decides to reduce or even eliminate the

amount of the asset. This is known as taking a write-off. Article V, Section 55 of the Texas State

Constitution; however, does not allow for write-offs as it relates to the State, its Counties and

Municipalities. The Legislature shall have no power to release or extinguish, or to authorize the releasing

or extinguishing, in whole or in part, the indebtedness, liability or obligation of any corporation or

individual, to this State or to any county or defined subdivision thereof, or other municipal corporation

therein, except delinquent taxes which have been due for a period of at least ten years. (Article V, Section

55, Texas State Constitution) (Amended Nov. 8, 1932.)

LOAN RECLASSIFICATION PROCESS (Following 3 years Classified as Default)

A.

After three years of no activity or responsiveness from debtors with regard to debt collection efforts, loans

will be referred to the Office of the Comptroller by the Department of Community and Human Development

Administrative Services Division for a loan reclassification consisting of moving defaulted loan balances

from the “Active” category into an established “Currently Not Collectible (CNC)” category in the General

Ledger. The Office of the Comptroller will then also adjust the deferred revenue associated with the

defaulted loan and increase the allowance for the uncollectable accounts accordingly. If in the future, the

opportunity arises to collect on the identified defaulted loan, the Office of the Comptroller will then

reestablish the loan as “Active” and receipt the payment in order to clear the loan balance.

B.

The city records all assets at the original cost (carrying amount), though there are cases where assets can be

initially or subsequently recorded at their fair values or become delinquent and subsequently defaulted.

Eventually, it may become apparent that the amount recorded for an asset is too high or uncollectible, so

management decides to reduce or even eliminate the amount of the asset. This is known as taking a write-

off. Article V, Section 55 of the Texas State Constitution; however, does not allow for write-offs as it relates

to the State, its Counties and Municipalities. The Legislature shall have no power to release or extinguish, or

to authorize the releasing or extinguishing, in whole or in part, the indebtedness, liability or obligation of

any corporation or individual, to this State or to any county or defined subdivision thereof, or other

municipal corporation therein, except delinquent taxes which have been due for a period of at least ten

years. (Article 5, Section 55, Texas State Constitution) (Amended Nov. 8, 1932.)

20

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

C.

TIME TO INITIATE ACTION

If the City uses one of the loss mitigation options or initiates foreclosure within six months of the date of

default. This requirement is considered satisfied if any of the following actions have occurred within the six-

month period:

• The loan is brought current or paid off

• The borrower executes a special forbearance agreement

• The loan is modified

• The borrower executes a pre-foreclosure sale agreement

• The borrower executes a deed-in-lieu of foreclosure

• The City initiates the first legal action to begin foreclosure

D.

CITY REPORTING

The City reports these actions in the month they occur or, if after the monthly cut-off date, in the next reporting

cycle using the appropriate status in Down-Home servicing system.

E.

EXTENTION REQUESTS

If the City initiated a special forbearance or loan modification but is unable to complete it, the City may

request approval from HUD to extend the timeframe to initiate foreclosure provided the loss mitigation option

was begun prior to the timeframe that foreclosure was to be initiated. To qualify for the extension, the City

provides evidence that it analyzed the borrower's complete financial situation and evaluated the appropriate

loss mitigation options. In addition, the City reports the loss mitigation initiative using the appropriate status

in the monthly default status report.

The City may request an extension from HUD for completing a deed-in-lieu of foreclosure. If the City attempts

a repayment plan (not special forbearance), the City may request an extension before the timeframe to initiate

foreclosure expires and explains why an extension is necessary.

F.

OPTION FAILURE

If loss mitigation options fail, the City may either commence or recommence foreclosure, or initiate another

loss mitigation option. Failure occurs when:

• The borrower does not perform under the terms of a written special forbearance agreement for 60 days

Or

• The borrower does not perform under the terms of a special forbearance (trial period) used as a condition

of loan modification or special loan servicing approval for 30 days. The City must continue to perform

outreach efforts to borrowers for other workout alternatives. Borrowers financial capacity will dictate

whether a retention or disposition workout alternative is feasible.

• There is no signed contract of sale within 3 months of a pre-foreclosure sale agreement; or if there is a

signed contract of sale, settlement has not occurred within 6 months of the agreement; or the borrower

notifies the City of withdrawal from the agreement; or the City notifies the borrower in writing that it has

terminated the agreement.

21

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

G.

DOCUMENTATION

For each claim, the City must maintain evidence in its servicing notes and collection history systems of its

compliance with loss mitigation guidelines as well as supporting documentation including all communications

with any outside agency. The City’s servicing notes and collection history systems contain evidence of

compliance with counseling and other actions on loans that do not result in a claim.

H.

SERVICING PLAN

The City must maintain a servicing plan when a loan is 90 days delinquent and a method other than foreclosure

is approved to resolve the delinquency. The loan review form in Appendix F should be used to communicate

servicing plan data to the agency. For pre-foreclosure sales and deed-in-lieu of foreclosure alternatives, the

City must submit the Disposition (PFS/DIL) Cost-Benefit Analysis along with the servicing plan.

I. DELEGATED LOSS MITIGATION

HUD delegates authority to the City of El Paso in regards to implementing and enforcing loss mitigation

procedures.

Under this delegation, the City has the authority to review and decide all loss mitigation options provided for

in this guide without the need for agency concurrence.

J. OPTION CHECKLISTS

The Special Forbearance and Loan Modifications checklist show the most important actions for each loss

mitigation process. See Appendices G-H. Their use is optional and need not be submitted with the servicing

plan submitted to the Agency.

3.6 SPECIAL FORBEARANCE

A special forbearance agreement is a written plan that may gradually increase monthly payments in an amount

sufficient to repay the arrearage and/or temporarily reduce or suspend payments for a short period. A special

forbearance agreement may also involve payments for several months followed by a loan modification (Trial

Plan). The agreement provides the borrower with relief not typically afforded under an informal repayment

agreement. Examples of provisions in a special forbearance agreement include a repayment term of four or

more months; suspending or reducing payments for one or more months to allow the borrower to recover from

the cause of default; or an agreement to allow the borrower to resume making full monthly payments while

delaying repayment of the arrearage.

An informal forbearance is a plan lasting 3 months or less to cure short-term delinquency. A special

forbearance is a plan that involves one of the following:

• Full repayment: Monthly payments in an amount sufficient to repay the arrearage over time, typically less

than or equal to six months.

• Unemployment or disaster forbearance: Reduced or suspended monthly payments while the borrower(s)

resolves the hardship, such as unemployment, followed by an evaluation for other home preservation

options if needed.

• Trial period: Remittance of monthly modified payments for a period, generally three months (or four

months for borrowers facing imminent default), followed by a permanent loan modification.

22

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

At no time does the maximum arrearage under a special forbearance plan exceed the equivalent of 12 months

of principal, interest, taxes and insurance.

A.

LOAN ELIGIBILITY

The loan is a minimum of 30 days delinquent but not more than 12 payments delinquent and is not in

foreclosure when a special forbearance agreement is executed. A loan that had previously been referred to

foreclosure may be removed from foreclosure status after executing a special forbearance. The City suspends

foreclosure, on the advice of its legal counsel, subject to the borrower's performance under the terms of the

special forbearance agreement, if the suspension is stated in writing in the agreement.

B.

PROPERTY ELIGIBILITY

The City must conduct an inspection to verify that the property has no physical conditions that adversely affect

either the borrower’s continued use or ability to support the debt. Normally a simple curbside inspection is

sufficient; however, a borrower will not be able to support payments under a special forbearance plan if the

property is in such a deteriorated condition that repairs will drain the borrower's monthly resources. The City

must use good business judgment to determine if an interior inspection should be utilized. The analysis of the

borrower's surplus income should consider obvious property maintenance expenses.

The use of good business judgment is imperative. If significant deferred maintenance is a contributing cause

of the default, it may be appropriate to provide a period of mortgage forbearance during which specified

repairs are completed at the borrower's expense. If the property is in extremely poor physical condition, a

special forbearance plan that allows a reduction or suspension of payments without a requirement to repair

the property may not offer a permanent solution.

C.

BORROWER ELIGIBILITY

Special forbearance may be offered to a borrower who has recently experienced a verified loss of income or

an increase in living expenses. Such a borrower should be the owner-occupant of the property securing the

Special Forbearance loan and committed to occupying the property as a primary residence during the terms

of the special forbearance agreement.

D.

FINANCIAL ANALYSIS

The City's responsibility is to validate and document the borrower's capacity under the terms of the

recommendation. The City Determines that the borrower has the capacity to resume full monthly payments

and bring the loan a current status under the terms of a forbearance plan. The City does this by projecting the

borrower’s surplus monthly income for the duration of the special forbearance period. The proposed

repayment terms must be consistent with the borrower's ability to pay. The following documentation must be

obtained in order to determine the financial capacity of the borrower:

• Special Forbearance Loan Servicing Plan

• Letter from borrower outlining involuntary inability to pay/hardship

• Income Documentation as stated in the overview section

• Credit Report

• Detailed budget

• Documentation of any other sources of income to be used in the evaluation

23

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

Excluding documentation from prior years, all financial information must be dated within 90 days from the

date of receipt by the City. If the City’s' financial analysis determines that, the borrower either does not or

will not, have the ability to resume full monthly payments in the near future; special forbearance should not

be used. The City should then consider other loss mitigation options.

E.

UNEMPLOYMENT

When it has been determined, that the reason for default is unemployment and the borrower does not have

any immediate opportunities for re-employment, HUD extends additional latitude to the City to mitigate

losses.

The City has the authority to enter into a forbearance agreement with a borrower who is unemployed or

significantly underemployed and seeking re-employment at the time the borrower's financials are being

analyzed. The terms of this forbearance shall be the lesser of 12 months or a term that would not cause the

dollar amount of the borrower's delinquency to exceed 12 months of the borrower's scheduled monthly

payment (which includes taxes and insurance for those loans where such expenses are escrowed) if applicable.

The amount of the partial payment made, if any, by the borrower will be contingent upon the City's financial

analysis of the borrower. As a condition of the forbearance agreement, the borrower must pursue employment

during the terms of the forbearance agreement. Additionally, the borrower must contact the City if their

employment status changes.

The City is required to verify the borrower's employment status monthly and restructure the forbearance

agreement or evaluate the borrower for another option, such as a loan modification, when the borrower's

employment status changes. As with all HOME and CDBG-RLF loans standard forbearance agreement, all of

the requirements apply to these Special Provisions.

F.

COMBINING OPTIONS

Special forbearance may either be used alone or be combined with a loan modification. For example, if a

borrower is expected to recover from the cause of the default and resume making full monthly payments, but

will not have adequate surplus income to repay the arrearage, the City may establish a special forbearance

agreement. Such an agreement allows the borrower to demonstrate recovery from the financial problem by

making three payments (or four payments for imminent default) at the modified amount. Upon successful

completion of the special forbearance payments, the delinquent amount is capitalized into the modified loan.

G.

DOCUMENTATION

The City and the borrower executed a written agreement that clearly defines the term, frequency of payments,

and amounts due under the special forbearance plan. The agreement acknowledges previously missed

payments and states that failure to comply with its terms can result in foreclosure. There is no maximum

length for a special forbearance agreement and the City may allow as much time as is reasonable based on the

borrower's repayment ability.

An acceptable agreement should:

• Provide the borrower with relief not available under an informal forbearance plan

• Bring the loan current, unless it is combined with a loan modification

• Not at any time allow the total arrearage amount to exceed the equivalent of 12 P-I-T-I (Principal Interest

Taxes Insurance) payments

24

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

• Not allow late fees to be charged while the borrower is performing under the terms of a special forbearance

agreement

• Permit allowable foreclosure costs and late fees accrued before the special forbearance agreement is

executed to be included as part of the repayment schedule. However, such costs and late fees are collected

only after payment of all principal, interest, and escrow advances. The loan is never considered delinquent

only because the borrower has not paid late fees or other foreclosure costs.

H.

REVIEW AND RENEGOTIATION

The City reviews the status of a special forbearance plan each month and takes appropriate action if the

borrower is not complying with the terms of the plan. A plan may be renegotiated if the borrower's financial

circumstances change; however, under a renegotiated plan, the loan should not be more than 12 months

delinquent.

3.7 LOAN MODIFICATION

A loan modification is a permanent change in one or more of the terms of a loan that results in a payment the

borrower can afford and allows the loan to be brought current. Loan modifications may include a change in

the interest rate, even below the market rate if necessary. They may include capitalization of all or a portion

of the arrearage (PITI) and/or re-amortization of the balance due. Capitalization may also include foreclosure

fees and costs that are associated with the current foreclosure action, deficits in tax and insurance accounts,

past due annual fees imposed by the City, but not late charges or the City’s fees.

A modification may be appropriate for a borrower who has experienced a permanent or long-term reduction

in income or an increase in expenses, or who have recovered from the cause of the default, but does not have

sufficient surplus income to repay the arrearage through a repayment plan. To qualify for a modification, the

borrower has a documented ability to support the monthly mortgage debt after the terms of the loan are

modified. If necessary to support repayment ability, the loan term after re-amortization may be extended on a

case-by-case basis from the date of the loan modification.

Not all loans are appropriate for modification. Loans that best support modifications include those with above-

market interest rates; lower loan to value ratios; and/or mature terms (i.e., paid down ten years or more) a

significant household income change, (i.e. death in the family, increase in living expenses or loss of income or

under income and other). The modification is valuable when the arrearage can be capitalized into the loan

balance and/or the interest rate is adjusted not to exceed the current market rate so that the borrower can better

afford the resulting monthly payment.

A.

LOAN ELIGIBILITY

To modify a defaulted note under loss mitigation:

• The loan is not in foreclosure at the time the modification is executed; however, a loan removed from

foreclosure status may be modified.

• The default is due to a verified loss of income or increase in living expenses.

Note: The City may, at its discretion, modify a loan that is not delinquent but is in imminent danger of default;

(i.e. will soon become delinquent due to known circumstances).

25

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

B.

PROPERTY ELIGIBILITY

While the modification option does not have a loan-to-value restriction, and an appraisal is not required, the

City must conduct an inspection to verify that the property has no physical conditions that adversely impact

the borrower's continued use or ability to support the debt. Normally a simple curbside inspection is sufficient;

however, a borrower will not be able to support payments under a special forbearance plan if the property is

in such a deteriorated condition that repairs will drain the borrower's monthly resources. The City must use

good business judgment to determine if an interior inspection should be utilized. An analysis of the borrower's

surplus income should consider anticipated property maintenance expenses. If the property is in extremely

poor physical condition, a modification may not offer a resolution of the default. Costs to complete needed

repairs may not be capitalized as part of a modification agreement, and the borrower may not receive any cash

as a result of the modification.

C.

BORROWER ELIGIBILITY

A modification may be offered to a borrower who has stable surplus income, which, while not sufficient to

repay the original loan and the arrearage, is sufficient to support the monthly payments under the modified

rate. It is the City's responsibility to validate and document the borrower's capacity under the terms of the

modification. The borrower must be the owner-occupant who is committed to occupying the property as a

primary residence. A modification must not be used to bring a loan current before a sale or assumption.

D.

FINANCIAL ANALYSIS

The City will determine if the borrower has the capacity to support mortgage payments at the modified

amount. The City determines the borrower's financial condition and projects the borrower’s stable source of

dependable income to support a minimum of three months payments. The loan is not modified if the City

determines that the borrower does not have the ability to support the modified monthly payment.

The following documentation must be obtained in order to determine the financial capacity of the borrower:

• Servicing Plan

• Letter from borrower outlining involuntary inability to pay/hardship

• Income Documentation as stated in the overview section

• Credit Report

• Detailed budget

Excluding documentation from prior years, all financial information must be dated within 90 days from the

date of receipt by the City.

E.

COMBINING OPTIONS

A modification may be used alone or as part of repayment, or special forbearance agreement. If a borrower

needs time to resolve the default, but will eventually be able to support the debt at the modified payment, a

modification may be included at the final step in a repayment plan or special forbearance. An existing

repayment plan or special forbearance may also be converted to modification if the borrower’s circumstances

change.

F.

MODIFICATION TERMS

The following apply to loan modifications:

• The modification results in a fixed-rate fully amortizing loan

26

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

• The modified interest rate may not exceed the original note

• The modification brings the loan current

The City may reduce the note interest rate below the market rate if necessary to resolve the default. Discount

fees associated with rate reductions are not reimbursable. All or a portion of the P-I-T-I arrearage (principal,

interest, and escrow items) if applicable may be capitalized into the loan balance, including foreclosure fees

and costs that are associated with the current foreclosure action, deficits in tax and insurance accounts and

past due annual fees imposed by the City.

Late fees may not be capitalized. If the City is unable to waive the late charges, the City may collect the late

fees from the borrower either through a lump sum payment or through a repayment plan separate from, and

subordinate to, the modification agreement. The modified principal balance may exceed the loan's original

principal balance. The modified principal balance may exceed 100% loan-to-value. The City may amortize

the total unpaid amount due over the remaining terms of the loan, or if necessary, extend the term on a case-

by-case basis from the date of the loan modification.

G.

LIEN STATUS

The City reserves the right to be in first-lien or subordinate to a second lien, to ensure affordability of the

First Time Home Buyer, Single Family Owner Occupied Rehabilitation or Multi-family Rental loan

modification compliance with any applicable state or Federal laws and regulations.

H.

DOCUMENTATION

The City ensures that the modification documentation preserves the initial lien position of the loan. The City

will make a determination in accordance with state law as to whether it is necessary to record the modification

agreement in order to maintain the lien position. Copies of executed, not recorded, modification agreements

must be maintained on the loan-servicing file.

I.

DISCLOSURES

The City complies with any disclosure or notice requirements applicable under state or federal law.

J.

FAILURE

If the loan becomes delinquent on or after 120 days following modification, it shall be treated as a new default

and serviced accordingly. Since the City maintains the lien status of the loan subsequent to modification, any

amount that is not in the initial lien position is not guaranteed by the City and is not subject to a claim. If a

claim is submitted, the City reserves the right to request documentation (legal or otherwise) establishing the

loan's lien status.

K.

SUBSEQUENT USE

If a loan has been modified within the previous two years, the re-default risk is presumed to increase following

a subsequent modification. Before granting a modification in this circumstance, the City must validate the

borrower has experienced a change in circumstances that led to a separate default or imminent default

unrelated to the first. Any such decision must be documented and placed in the servicing file. A subsequent

modification should be an unusual occurrence, and the cause of the second default should not be related to

the original reason for default.

27

CITY OF EL PASO LOAN SERVICING & COLLECTIONS MANUAL

L.

LOAN NOTE GUARANTEE

The terms of the Loan Note Guarantee (LNG) may change. The LNG may be extended to coincide with the

terms of a loan modification that meets the eligibility criteria as previously noted in this manual in the

eligibility section. Any loss on the modified loan is limited to the lesser of 90 percent of the original loan

amount or the sum of the first 35 percent of the loss and 85 percent of the balance of the loss.

M.

THE CITY’S REPORTING

The City reports these actions in the month they occur or, if after the monthly cut-off date, in the next reporting

cycle using the appropriate Down Home status. In addition, the City retains a copy of the executed loan

modification in the servicing file and alerts the Administrative Services Division within 30 days of execution

and no later than 60 days. The agreement should contain the following key data elements:

• Borrower and co-borrower name(s) and ID number(s)

• Effective re-amortization date

• Unpaid principal re-amortized

• Eligible interest and costs capitalized

• Sum of re-amortized principal and capitalized interest and costs

• Interest rate

• Maturity date

3.8 SPECIAL LOAN SERVICING

The City has the authority to approve the modification of single-family housing and multi-family rental

housing loans that are in default or facing imminent default with terms extended on a case-by-case basis from