Erasmus University Rotterdam

Erasmus School of Economics

Master Thesis

Data Science and Marketing Analytics

Hedonic Pricing Model for Rotterdam Housing Market

Empowered by Image Recognition and Text Analysis

Methods

Student name: Tomasz POTRAWA

Student ID number: 537444

Supervisor: Dr. A nastasija TETEREVA

Second assessor: Dr. Bas DONKERS

July 22, 2020

The views stated in this thesis are those of the author and not necessarily those of the supervisor, second

assessor, Erasmus School of Economics or Erasmus University Rotterdam.

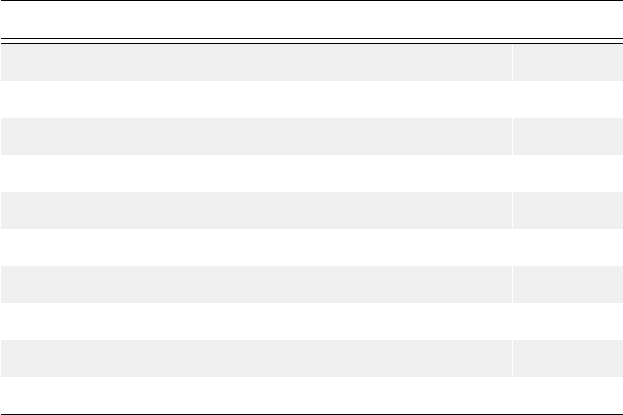

Contents

1 Introduction 3

2 Theoretical background 6

2.1 Hedonic pricing theory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

2.2 Application of hedonic pricing for housing market . . . . . . . . . . . . . . . . . . . . 8

2.3 Methodology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

3 Methodology 15

3.1 Data extraction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Image analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Text analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

3.2 Regression analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Hedonic linear model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Random Forest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

3.3 Model-Agnostic methods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Variable Importance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Partial Dependence Plots . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Local Interpretable Model-Agnostic Explanations (LIME) . . . . . . . . . . . . . . . 22

4 Data and feature extraction 24

4.1 Initial data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

4.2 Image recognition . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

4.3 Text analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

4.4 Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

5 Analysis and results 35

5.1 Regression . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

5.2 Explanatory analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

6 Conclusions 49

7 Appendix 50

1

List of Figures

1 The accuracy of the model versus the number of epochs . . . . . . . . . . . . . . . . 28

2 Correlation plot for numerical variables. . . . . . . . . . . . . . . . . . . . . . . . . . 36

3 Residuals versus Fitted Values . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

4 The Partial Dependence Plot of Living Area . . . . . . . . . . . . . . . . . . . . . . . 44

5 The absolute value of a view on the city versus predicted rental cost . . . . . . . . . 47

6 The absolute value of insolation versus predicted rental cost . . . . . . . . . . . . . . 47

7 The absolute value of water body proximity versus predicted rental cost . . . . . . . 48

8 Auto-correlation plot for residuals of linear model . . . . . . . . . . . . . . . . . . . . 53

9 Normal QQ plot for linear model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

10 Residuals versus fitted values after Box-Cox transformation . . . . . . . . . . . . . . 54

11 Variable importance of the final random forest model . . . . . . . . . . . . . . . . . . 55

List of Tables

1 List of Commonly Used Housing Attributes in Hedonic Price Models (Chin & Chau,

2003). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

2 Variables present in the initial data set . . . . . . . . . . . . . . . . . . . . . . . . . . 26

3 Accuracy of the image recognition models . . . . . . . . . . . . . . . . . . . . . . . . 29

4 Accuracy of the view image recognition model on the property level . . . . . . . . . . 30

5 Descriptive statistics 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

6 Descriptive statistics 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

7 The coefficients of the linear model empowered by image and text features . . . . . . 38

8 The coefficients of the final linear model . . . . . . . . . . . . . . . . . . . . . . . . . 39

9 The summary of regression models . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

10 The comparison of variables’ impact on the prediction between the models . . . . . . 43

11 Frequency of the words appearing in the descriptions . . . . . . . . . . . . . . . . . 50

12 Generalized Variance Inflation Factor for linear regression . . . . . . . . . . . . . . . 52

2

Abstract

This study primarily aimed to address the question of whether using relevant images and

descriptions of rental apartments increases the performance of a hedonic pricing model for the

Rotterdam housing market. Secondarily, an attempt on deriving the hedonic prices of housing

attributes and their dependence on the used regression model was made. With the usage of

convolutional neural nets and text analysis methods, features related primarily to the external

attributes of properties were extracted and transformed into tabular data. Two models were

applied, the OLS regression and the random forest. In both cases using the extracted variables in

addition to the more traditional predictors led to increases in accuracy and explained variation. A

comparison of accuracy metric revealed significant superiority of the random forest over its linear

counterpart. On the contrary to the previous research conducted in the field, the comparison

between both methods was not limited solely to the accuracy metric and included the comparison

of models’ coefficients acquired with the model agnostic methods. It was found that the OLS

regression model, when compared to the random forest, is more likely to overestimate the value

of nonessential structural attributes such as garden or furnishings. This may be a reflection of

the model’s reduced capability of capturing locational aspects. Lastly, based on the obtained

data, and the usage of local interpretable model-agnostic explanations, it was concluded that

the hedonic price of a particular housing attribute is unlikely to be constant and its variability

is dependent on the total value of a property.

Keywords: hedonic price model, housing attributes, image recognition, model-agnostic methods

1 Introduction

The analysis of the real estate market has always been an object of remarkable interest among

researchers. The reason behind this trend is the fact that household prices affect directly the level

of life of a significant part of society. Furthermore, the fluctuations in the real estate market reflect

accurately the macroeconomic phenomena happening in the world, thus making them an interesting

benchmark in the analysis of other social and economical aspects. There have been many different

approaches taken in explaining the household prices so far. One of the most popular methods,

hedonic price modeling, claims that a good which in case of a housing market would be a real

estate, does not possess any utility by itself. Instead the good consists of characteristics that posses

constituted utility (Lancaster, 1966). As such, by comparing the prices of goods that do possess a

given attribute and the goods that do not, it becomes possible to derive the value of the attribute

in the eyes of consumers.

This characteristic of hedonic pricing made it a perfect tool in estimating the value of hardly

tangible assets. In numerous research, applying hedonic pricing on the housing market allowed

measuring the value of aspects such as air quality, green area proximity, a view on the ocean, or the

criminality level in the neighborhood. Hedonic models aim to quantify the importance of these less

tangible assets, therefore making the interpretability of the model a top priority. Consequently, the

3

majority of papers related to hedonic pricing are based on simple statistical models such as linear

regression where the constituted value of the attribute of interest may be easily derived by analyzing

the regression coefficients. Models that could offer more predictive power like neural network or

random forest have remained relatively unpopular in this area of study, due to the complexity of

their interpretation, leaving a space for further research.

Additionally, most of the hedonic price modeling research have been based on simple, tabular

data, obtained often from institutions such as municipalities or real estate agencies. Only recently

the interest in more complex data extraction from sources such as texts and images started growing.

While the automation of the mentioned data extraction is definitely not an easy task, in the long run,

mastering it will allow decreasing the costs of gathering complex data and increase the versatility

and accuracy of future research.

Lastly, in comparison to the traditional housing market, there is relatively little research done

on the rental prices. It applies especially for the measurement of external and locational factors

impacting the rental price of a property such as the proximity of green areas, view from a property,

nearby services etc. While it may be argued that the mentioned type of variables has probably lower

impact on the rental prices than on the selling prices of real estates, it is rather unlikely that these

attributes do not contribute at all to the former.

As such, it has been concluded, that there are a few gaps in the hedonic pricing literature that

this paper aims to fill. First and foremost, the study addresses the functionality of images and texts

in the hedonic pricing of Rotterdam’s rental market. Therefore, the main research question may be

formulated in the following way:

Does including the features that are automatically extracted from the relevant image and text

sources significantly increase the accuracy of the hedonic pricing model of Rotterdam’s rental

housing market?

Additionally, the study focuses on measuring the impact of external factors such as the neighbor-

hood characteristics on the rental prices in Rotterdam. The analysis extends the previous research

of Law et al. (2019) as in order to address the question above, not only maps but also rental offer

photos serve as a source of information for the study.

Furthermore, the comparison between the accuracy of traditional hedonic linear regression and

complex machine learning methods is carried out. While this kind of comparison is definitely not

new in the research area of the housing market, to the best knowledge of the author none of the

previous papers studied the differences in the impact of external variables on the prediction across

the models. The lack of such an approach in the literature may be caused by the cumbersomeness

and the moderate reliability of the methods aiming at explaining the black box model behaviour.

As such it is understandable that the previous research opted to focus on the easily measurable and

comparable accuracy of the models.

4

Nevertheless in the eyes of the author the blind pursuit of the best possible accuracy without

understanding how the prediction is being made is not completely relevant in the context of hedonic

pricing. One could argue that the ability to quantify the constituent value of goods’ characteristics

is the essence of the traditional hedonic model. Once this ability is lost it becomes infeasible to

use the model in deriving the value of assets such as previously mentioned air quality or green area

proximity. Therefore, with the usage of model agnostic methods the paper aims to prove that the

more complex, but often more accurate black box models may also be used to derive the value of

goods’ attributes. The importance of housing attributes in advanced machine learning algorithms

is compared with the traditional hedonic OLS regression coefficients. Furthermore, based on a non-

linear regression model, it is measured how hedonic prices of given attributes change, depending on

the price of a property.

It is worth mentioning here that the study has been designed in a way that for the most part

its methodology and findings should be relatively easily applicable to other cities. Rotterdam is a

major European city with diverse ethnic and religious groups, highly-developed services as well as

the transportation sector and reputable educational institutions. As such, the phenomena specific

for the Rotterdam’s housing market may at least partially be true for many other cities in the world.

Moreover, the data used in the study has been acquired from the rental websites and for the most

part, represents features and attributes valid for any other housing market. This further facilitates

conducting similar research for other cities.

5

2 Theoretical background

In order to prepare for addressing the questions and problems defined for this research, proper

groundwork in the form of a broad literature review was laid. The following section provides an

in-depth overview of what has been already done in the literature with respect to hedonic methods

and real estate appraisal. The first part aims to provide the theoretical background and assumptions

of the hedonic price modeling. Subsequently, the summary of the most relevant real estate appraisal

papers and the insights gathered from them is presented. The last part of this chapter focuses on the

methodology used in particular research, and the comparison between statistical models commonly

used in the area of house market pricing.

2.1 Hedonic pricing theory

Hedonic pricing is a method rooted in the theory of consumer demand developed by Lancaster

(1966). In his work, the author breaks away from the back-then traditional assumption claiming

that a good by itself possesses utility. Lancaster’s innovative approach may be summarised by

three main statements. Firstly, a good, per se, does not provide any utility. Instead, each good

consists of characteristics that posses constituted utility. Secondly, a good is usually characterized

by many attributes, and a single attribute is most of the time shared by multiple goods. Lastly,

according to the author, the combination of goods may possess different characteristics than the

goods would have, if evaluated separately. The value of each attribute in Lancaster’s work is based

on the relationship between the observed prices of the goods and the number of attributes associated

with them (Chin & Chau, 2003).

Even though hedonic pricing is heavily influenced by Lancaster’s theory of demand from 1966, it

was officially formulated a few years later by Rosen (1974). Despite the fact that both Rosen’s and

Lancaster’s models are based on similar assumptions, they do have some significant differences. In the

Lancastrian model, it is claimed that goods, and consequently their characteristics, are aggregated

in groups, which subsequently are purchased by the customer. On the other hand, Rosen states that

goods are usually not acquired in combinations. Instead, for each good customer makes a separate

decision after analyzing the spectrum of brands offering the given good. While both models do not

necessarily contradict each other, they do seem to fit better different kinds of products. Chin & Chau

(2003) argues, that Rosen’s hedonic model is more suited to durable goods while the Lancastrian

model may explain better phenomena related to consumer goods.

Another dimension on which both authors do not come to similar conlusion is the type of rela-

tionship between the price of a good and its characteristics. In Lancaster’s work it is presumed that

the mentioned relation is linear, whereas Rosen postulated that it is more likely for this relationship

to be non-linear. The latter, implies that the implicit price of an attribute is non-constant and

according to Rosen depends on the interaction between the supply and the demand. More precisely,

6

in Rosen’s model the marginal implicit price of an attribute is presented as the partial derivative of

the price function over the given attribute, which always has to be equal to the marginal cost of an

extra unit of the attribute in the market and the individual consumer’s marginal willingness to pay

for the attribute. The latter aspect, which could also be simply called a demand price, is assumed

to be a function of the buyer’s income, the utility level and other variables describing particular

consumer such as tastes and preferences, age or education (Chin & Chau, 2003).

Despite the fact, that Rosen’s model is still seen as a landmark paper, allowing a better under-

standing of multiple fields of economics such as urban, environmental, or labor economics (Green-

stone, 2017), it does suffer from multiple empirical issues. The first is the choice of the functional

form. Throughout the years, multiple types of forms have been applied to hedonic models e.g. lin-

ear, semi-log, or Box-Cox transformation-based. Nevertheless, there is little research on how the

functional function should be chosen (Butler, 1982). Moreover, even with applying more complex

techniques such as Box-Cox transformation aiming at normalizing the distribution of the data, it is

not guaranteed that the transformed data will suit the model and its assumptions. On the other

hand, applying more advanced machine learning methods with less strict requirements may lead

to a situation where measuring the marginal implicit price of an attribute may be challenging or

sometimes even impossible.

Another issue related to hedonic pricing models is the problem of incorrect choice of the at-

tributes, also knows as the misspecification of the variables. In cases when the non-relevant predictor

is included in the model we refer to it as an over-specification, whereas the opposite situation, when

a key variable is not included in the analysis is known as an under-specification. While both cases

are obviously not welcome, it may be argued which one causes more concern and consequently bias

more the results of the hedonic model. Chin & Chau (2003) argues that as a result of an over-

specification predictors are still unbiased and consistent, however, some of them are inefficient. An

under-specification on the other hand results in an estimated biased and inconsistent coefficients.

In the opinion of Butler (1982) as all the estimates of a hedonic price model are in some degree

misspecified, in general, the models with a small number of key attributes should perform well

enough. Overall, Butler suggests to use in the regression only the predictors that are expensive in

producing and are likely to yield additional value in the form of utility. To similar conclusion came

Mok et al. (1995) who concurred that the bias introduced to a model due to missing attribute of a

good is usually small, and does not cause a significant drop in model’s performance in the terms of

prediction and explanatory power. In addition, the author discourages using proxy predictors in a

hedonic price model as they result in biased and inconsistent outcome of an analysis.

The mentioned drawbacks of hedonic pricing are not the only issues related to this method.

The description of each one of them is not in the scope of this paper, however, the last one worth

mentioning is the unrealistic assumption of perfect competition. It implies among the others, that

the information flow between consumers and suppliers is instant and not disrupted in any way. Con-

7

sequently, the model does not take into account the delayed reaction of a market to any changes

or an imperfect estimation of a value (or in this case also utility) of given attributes. As far as

the assumption of the perfect competition is not unique to hedonic models, and therefore, men-

tioned limitations are relatively popular in economical models, hedonic pricing models distinguish

themselves with one major limitation. In real life, it is completely possible that consumers do not

have a full knowledge of every attribute of a good they are considering to purchase. Nevertheless,

they still have to estimate the value/utility of a good on the basis of the knowledge they possess.

Therefore, even the best hedonic model may fail in estimating the constituent price of an attribute

if the consumers fail to perceive it.

All the mentioned limitations did not stop, hedonic pricing from becoming a popular tool in

multiple aspects of economics. It is still widely used in numerous research especially among those

focusing on deriving the value of hardly tangible environmental and sociological aspects such crimi-

nality rate or air pollution. Even though the above summary may seem like an oversimplification of

a complex phenomenon which is hedonic pricing, hopefully, it is sufficient to prove that a hedonic

model is not just a regression analysis aiming at measuring the magnitude of attributes’ coefficients,

but also a theory-based marketing analysis.

2.2 Application of hedonic pricing for housi ng market

Hedonic pricing has been extensively applied in the real estate appraisal research due to the char-

acteristics of a housing market. The fact that real estates may be treated as goods consisting of

multiple separate attributes such as a living area, number of rooms or localization, perfectly matches

the requirements of a hedonic approach. Furthermore, the changes in the housing market prices ac-

curately reflect the macro-economical phenomena happening in the society, which puts a housing

market in the position of a popular benchmark used in other types of analysis. Moreover, the com-

bined versatility of a housing market and hedonic approach in addition to the easily accessible data,

makes it a perfect tool e.g. in estimating the values of environmental features such as air quality

over the world.

The attributes of a property in the hedonic approach tend to be divided into multiple categories

in the literature. In their review of hedonic pricing papers Chin & Chau (2003) propose the division

of characteristics into three main groups. The first one, the locational group consists of real estate

characteristics such as the distance to the central business district (CBD) and the type of view that

a given location has to offer e.g. view on the lake or the golf course. The accessibility to the center of

a city has been found to have an impact on the price of a house in multiple research (McMillan, 1992;

Palmquist, 1992). Similarly, numerous types of views from a property have been proven to influence

the price of an estate (Gillard, 1981; Mok et al., 1995). Moreover, according to Benson et al. (1998)

not only the type of view affects the value of a house, but the quality of it also plays a crucial role.

As an example, in their work, Benson et al. (1998) concluded that the ocean frontage adds 147% to

8

the property’s sales price, while the obstructed, partial view on the ocean only contributes with an

increase of 10% of the price.

The second category, namely the structural attributes, describes the traditional characteristics

of a house such as a living area, the number of bedrooms, or the age of a building. Throughout the

years a plethora of research aimed to quantify the importance of particular construction aspects of

a building on a price. Numerous papers agree on the fact that one of the most important structural

attributes is a floor area followed by the number of rooms, bedrooms, and bathrooms (Ball, 1973;

Garrod, 1992). While the age of building according to multiple research such as D. E. Clark &

Herrin (2000) is negatively related to the estate price, in some analysis (H. J. Li M M Brown, 1980)

it has been proved to have an opposite effect, probably due to a historical value older buildings may

possess. Lastly, additional areas of an estate such as a garage, a basement, a patio, or a storage

in multiple research were also classified as significant predictors in the regression analysis of house

prices (Forrest, 1996; Garrod, 1992).

The last class of attributes relates to a broad range of features characterizing the neighborhood

of a real estate. According to Linneman (1980), these attributes stand for 15% up to 50% of the

standardized variation of a site evaluation model. Previous research divide further the neighbor-

hood characteristics into three subgroups: socio-economic variables, local government/municipality

services, and externalities such as crime rate or traffic noise (Chin & Chau, 2003).

In the past studies, the level of income in the neighborhood (Kain, 1970) and the dominating

ethnicity in the area (Ketkar, 1992) have been found as significant variables impacting the predicted

housing price. In terms of municipality services, the proximity to good schools (D. E. Clark &

Herrin, 2000) and places of worship such as mosques (Carroll, 1996) proved to positively impact

the value of a house. On the contrary, the high criminality rate in an area undoubtedly lowers the

average value of an estate (D. E. Clark & Herrin, 2000). The slightly modified summary of the most

popular variables used in hedonic price models, and their impact on the real estates’ prices prepared

by Chin & Chau (2003) is presented in Table 1 below.

The external factors impacting the housing price have been much more widely covered by

Karanikolas et al. (2011) where the authors provide a summary of insights gathered from numerous

research in that area. In general, the features analyzed in this paper may be divided into four

categories: green areas, water areas, topography, and environmental risks. The first category was

a matter of interest for Bishop (2005) where it was concluded that there is an evident correlation

between the existence of green spaces and the market value of houses. It was estimated that the

houses located nearby green areas may be even up 20% more expensive than their counterparts

without that access.

Similarly, in Wolf (2007) the author found out that potential buyers are willing to pay much

more for a house if it is located nearby an existing park. Moreover, the type of a green area had

a significant impact on the estate price. The traditional parks located in a distance of up to 400

9

Table 1: List of Commonly Used Housing Attributes in Hedonic Price Models (Chin & Chau, 2003).

Attribute Expected effect on housing price

Distance from CBD negative

View of the sea, lakes or rivers positive

View of hills/valley/golf course positive

Obstructed view negative

Locational

Length of land lease positive

Structural

Number of rooms, bedrooms, bathrooms positive

Floor area positive

Basement, garage, storage and patio positive

Building services (e.g. lift, AC) positive

Floor level positive

Structural quality positive

Facilities (e.g. swimming pool,

gym, tennis court)

positive

Age of the building rather negative

Income of residents positive

Proximity to good schools positive

Proximity to hospitals unknown

Proximity to places of worship

(e.g. churches or mosques)

positive

Crime rate negative

Traffic/airport noise negative

Proximity to shopping centers unknown

Proximity to forest unknown

Neighbourhood

Environmental quality

(e.g. landscape, garden, playground)

positive

10

meters increased on average the price by 10% while the existence of nearby parks that were not free

for the public lead to an increase of 20%.

In terms of water areas, their impact on household prices in Arizona have been investigated by

Colby (2003). In general, the prices of estates were higher in cases where water area such as a lake

or a river were located up to 2 kilometers from a house. An estimated increase in the price of 5.9%

was the highest for properties located around 160 meters from the water. On the other hand, it is

worth mentioning that the properties located at a distance of less than 150 meters were cheaper,

probably due to the risk of floods. Nevertheless, the area of Arizona for which the research was

made, is characterized by dry and desert climate giving the paper’s result a specific context.

Another type of external features impacting the price of households refers to the topography

of the real estate’s neighborhood. While the natural landform is not an object of primary focus

in this research, the impact of anthropogenic features of the neighborhood cannot be omitted.

According to Klein (2003) the proximity of a highway negatively impacts the price of real estates

by approximately 8 to 10%. It could mean, that the easiness of communication is not enough to

compensate for noise pollution caused by high-speed roads. Interestingly, the impact of railway

proximity has been estimated to be smaller in Brinckerhoff (2001) and was equal to 6.7% decrease

in the market value of a property.

Due to a much wider range of literature, the gathered insights mostly relate to the value of

real estate, not its rental price. As far as these two are obviously strongly correlated, they may

differ significantly in some aspects, especially in the context of hedonic pricing. In the end, the

hedonic method implies that the value of a good comes from the consumers’ willingness to pay for

its particular attributes. Therefore, the total utility of the same property may be different for a

potential tenant and a potential buyer. As an example, a poorly equipped, small flat close to the

university may be worth much more in the eyes of a student interested in renting a property than

of a working person looking for a property to buy.

The ratio between house price and rental cost has been an object of analysis for S. Clark &

Lomax (2019). The authors reach in the paper quite a few remarkable conclusions on the rent/price

ratio. Firstly, the ratio is the highest for flats, followed by terraced houses, leaving (semi)detached

houses behind. Secondly, most probably due to a handful of rental offers with large living areas,

the ratio has been found to raise with the increase in the surface and the number of bedrooms. In

terms of neighborhood attributes, the ratio turns out to be lower for properties being in proximity

to "healthy retail environment (away from fast-food restaurants, tobacconists and gambling) and

access to health services" (S. Clark & Lomax, 2019). On the contrary, the neighborhood with

high-quality environmental features such as low air pollution and access to green areas, raises the

mentioned price/rent ratio. Finally, S. Clark & Lomax (2019) concluded, that some attributes that

increase the price of a real estate, do not impact its rental price e.g. the distance to a good school

or proximity of amenities.

11

2.3 Methodology

Most of the studies analyzed in the previous section have been based on a traditional, linear hedonic

pricing regression model. While the simplification in the form of linearity assumption, allows an

easy determination of the importance of each attribute characterizing a given good (by analyzing

the coefficients of an OLS regression), it disallows the model to capture more complex, nonlinear

patterns in the data. While it is difficult to distinguish the complexity of patterns in a given data set

prior to the analysis, in his work Rosen (1974) argues that in general, the nonlinearity between the

price of goods and their inherent attributes is likely to happen. The problem can be addressed by

applying advanced machine learning methods. This part of the literature review provides a summary

of research where this type of approach has been used in the context of the housing market.

One of the attempts to compare the performance between the traditional hedonic pricing regres-

sion model and more complex algorithms has been made by Limsombunc et al. (2004). According to

the results, the artificial neural network outperforms the hedonic price model in terms of sheer pre-

dictive power. Moreover, the hedonic model has been criticized by authors, due to its assumptions

and common problems such as data multicollinearity and heteroscedasticity or inability to capture

non-linear patterns.

On the other hand, the authors emphasized the complexity of neural network interpretation and

did not perform any type of variable importance analysis. Furthermore, the paper includes references

to previous research such as Lenk et al. (1997) and Do & Grudnitski (1992) which argue that the

results of a neural network model may be inconsistent and not always outperform regression models.

Another comparison between the performance of hedonic regression and machine learning algo-

rithms has been done by Neloy et al. (2019). On contrary to most of the research in the area of

housing pricing, the authors opted to base their study on rental cost data. The comparison between

linear regression, penalized linear regression, support vector machine, neural network, and multiple

versions of decision tree-based ensemble learning methods, shows the empirical superiority of the

latter. While the differences in the average RMSE between tree-based methods and other machine

learning models were of high magnitude, the differences between variations of random forest in the

form of Bagged Trees, Gradient Boosted and XGBoosted were rather negligible.

Recently Hong et al. (2020) applied a random forest model in price evaluation of Seoul households.

The results of the research were surprisingly good as the average percentage deviation between the

predicted and actual market price was equal to 5.5 (out-of-sample). In comparison, applying the

traditional OLS-based hedonic regression on the same data led to an average percentage deviation

of almost 20. As such, it can be concluded, that decision tree models can be more successful in

predicting house prices, than their traditional linear regression counterparts. Nevertheless, it may

be worth mentioning that the data used in the research was of extremely good quality as it consisted

of 40% of all the transactions made in the area within the last 10 years. Moreover, the data was

12

limited only to one, not diversified district of Seoul. Therefore, achieving such good results with the

usage of a decision tree model only, may not be feasible in most of the cases.

The choice of a regression technique for this research is not an easy task as both, probably most

popular advanced machine learning techniques neural networks and random forest have proved to be

effective in the previous research. Nevertheless, decision tree-based methods seem more reasonable.

As non-linear models, they can capture more complicated patterns in the data than the traditional

hedonic regression. On the other hand, the regression will be based on a relatively simple tabular data

where extremely complicated relations between variables are not expected. In his study Rossbach

(2018) provides empirical results of a comparison between the performance of 179 neural net and

random forest models. In most of the cases, random forest did not come in short in comparison

with its deep learning counterparts. Moreover, the author emphasizes the advantage of tree-based

methods over neural nets in terms of robustness, benefits in cost and time, and especially the easiness

of interpretability.

The superiority of artificial neural networks is usually visible in areas such as text or image anal-

ysis where connections between different predictors may be extremely abstruse. Therefore, random

forest seems like a well-suited model for this research, due to fairly advanced pattern recognition

and the ease of use. The latter will be of most benefit in the later stage of research, where multiple

models will be compared to see if including features gathered from images and other sources signifi-

cantly improves the prediction accuracy. On the other hand, neural networks are probably the best

method to be used in the mentioned image recognition part of the study.

The number of applications where image recognition is being used has been constantly growing

over the last decade. The ability of software to identify patterns, people, and objects from the image

is not only directly used in areas such as driver assistance systems but has also proved to be helpful

in increasing the accuracy of statistical models. In their research Bajari et al. (2019) approached

the topic of measuring inflation based on quality-adjusted prices of different products available at

Amazon. The features of the mentioned goods have not been limited just to conventional ones as

both text and image analysis have been performed. The authors have found that including features

extracted from images as well as texts leads to a significant improvement in model’s performance.

The usage of image recognition in the analysis of the real estate market has been a popular area

of study in recent years. Law et al. (2019) successfully used the Street View and satellite images

to improve the performance of house price evaluation models. Nonetheless, the authors opted to

focus on the accuracy of pricing by using black box model, while the relative importance of different

predictors has not been their top priority. Moreover, Law et al. (2019) work could also be extended

by using text analysis, environmental attributes usually present in hedonic pricing models and images

of property interior.

The last aspect has been studied in papers such as Poursaeed et al. (2018) and You et al. (2017).

In the former, the convolutional neural network has been trained to rank the photos on the scale

13

of one to eight based on the luxury of a property. In the latter, the authors have taken quite an

innovative approach of using recurrent neural network LSTM model in order to predict the price of

the house solely on the basis of photos and location. Typical data e.g. size or number of rooms has

not been used in the research which did not stay in the way of reaching promising results.

Unfortunately, there is one major shortcoming of all the papers cited in the methodological part

of the literature review. All the mentioned research, do apply advanced machine learning algorithms

to the housing market data, nevertheless, their focus is solely put on the prediction accuracy of the

created models. Almost no attention is given to the estimation of the housing attributes importance

and their utility. Therefore, it could be argued that the comparison between the hedonic linear

regression and machine learning methods presented in the cited papers is not fully appropriate, as

the essence of the hedonic price modelling, the value of each attribute of a given good, is being lost

in the pursuit of achieving the best possible accuracy of a prediction.

14

3 Methodology

The methodology used in the research may be divided into three main categories. The first one,

consists of methods used to extract features from complex data sources such as images and text,

and transform the gathered insights into low-dimensional tabular data. The second class includes

the methodology describing the regression models used in the research. The purpose of the methods

present in the last group is to explain the behaviour of the black box model described in the second

category of the section, and determine the importance as well as the impact of particular predictors

on the prediction.

3.1 Data extraction

Image analysis. Using a convolutional neural network (CNN) is a standard approach while build-

ing an image recognition model (F. Li et al., 2019). Convolutional neural nets are constructed

similarly as regular neural networks, they also consist of the input layer, hidden layers, and the

output. The main difference lies in the architecture of the layers. In image recognition models, the

input usually takes the form of A x B x 3 matrices, where A stands for the picture width, B for the

picture height while 3 represents color channel values (RGB). Let’s assume that the pictures fed to

the model have a small size of 100x100 pixels. In regular neural net each neuron in the first fully

connected hidden layer would already have 30000 weights. It is easy to imagine how the number

would scale for larger images. As a result of the regular net architecture, not only the computational

time of the model would be enormous but the number of adjustable weights could easily lead to

overfitting of the algorithm.

Convolutional neural nets deal with this problem by introducing three-dimensional hidden layers,

which size is being reduced in a subsequent processing. The first layer in the model is called

convolutional layer. Its input size is equal to the input image A (width) x B (height) x 3 (depth),

which in consequence usually requires all the images to be scaled to the same size. At this part, the

model analyzes one part of the picture, multiplies its values by a pre-defined smaller matrix known

as a filter or kernel, and then moves to the new part until the whole picture is scanned. The size of

the part of a picture being scanned at one moment is equal to the kernel size, which is one of the

parameters that may be tuned. However, the sizes of 3 x 3 x 3 and 5 x 5 x 3 are the most popular,

mostly due to the fact that they are used in some of the best performing CNNs: GoogleNet and

VGG (Szegedy et al., 2015; Simonyan & Zisserman, 2014). The process of multiplying the input

values with a filter and moving to a new part is in the literature referred to as convolving the filter

with the image (F. Li et al., 2019). The number of times the filter has to convolve with the picture

depends on the kernel size and a parameter known as a stride, which indicates by how many pixels

the filter should "slide".

As the output of the numerous multiplication, a two-dimensional activation map is being created

15

for each filter used. The output of a convolutional layer, created by stacking activation maps along

the depth dimension takes a form of a D x E x C sized matrix, where C substitutes the previous

input image depth of 3, with the value equal to the number of activation maps. D and E again

stand for the width and height of a matrix, however on the contrary to A and B they do not always

match the image size. Instead, their value depends on the number of times the kernel may fit in the

input matrix. Therefore, D and E tend to have smaller values than A and B unless the technique

known as padding is being used. The classic way of padding called "same padding", augments the

input matrix by adding column(s) and row(s) on the matrix borders with imputed values of 0. The

aim of this approach as the name suggests is to equalize the sizes of input and output matrices, so

no data would be lost in the process of transferring data to consecutive layers.

The number of filters used in the convolutional neural net is yet another parameter that may be

tuned. As one could think of filters as feature detectors, it could be argued that the more complex

the patterns that the model aims to capture, the more filters it will need to do it properly. On the

other hand, each filter drastically increases the output of a convolutional layer, thus, increasing the

computational power needed to train a model. As the training process continues, the network learns

filters that are being activated when some specific features of the image are being captured. The

first convolutional layer is responsible for extracting low-level features of an image such as edges

or colors. With each convolutional layer added, the higher-level features start to be captured by

the model. The output of a convolutional layer is subsequently passed to an activation function

layer which in case of a CNN is usually a ReLU function defined as f(x) = max(0, x) which applies

elementwise non-linearity (F. Li et al., 2019). However, in cases of too complex architecture of a

model, the problem with overfitting may appear. Srivastava et al. (2014) propose a relatively simple

way of addressing that problem with a technique called dropout. The key idea of this approach is to

drop out a random set of activations, by setting them to zero. As counter-intuitive as the method

may seem, it forces the model to learn how to correctly classify an image, even when some of its key

attributes are lost.

The next type of layer used in convolutional neural nets is called a pooling layer. Its main

function is to reduce the size of convolved features, and therefore, the number of parameters and

computational time. This goal is again accomplished by analyzing the input matrix by parts. In

case of the most popular approach known as max pooling, for each submatrix which size depends

on the pre-defined kernel, only the maximum value is returned. Then, the process is repeated until

the whole image is traversed and the original matrix is transformed into less-dimensional one.

In each model depending on the needs of the analyst, multiple convolutional, ReLU, and pooling

layers may be used. No matter how many of them are included in the architecture of the model and

what is their order, the final output is being transferred to the fully connected layer (also known as a

dense layer). At this point, the data is being transformed into a column vector, which subsequently

is fed to a regular feed-forward neural net, which in the end returns probability values for each class.

16

Similarly, as in traditional, artificial neural network, the loss and activation functions have to be set

separately for the dense layer.

Convolutional neural networks are also analogous to artificial neural nets in terms of data re-

quirements. Both methods usually require a large amount of training data to perform well. However,

in case of CNN the process of gathering additional data in the form of images is often more cum-

bersome than collecting extra tabular data for ANN. Image augmentation is one of the techniques

allowing artificially increasing the training sample size. The additional observations are created on

the basis of various transformations applied to original photos such as random rotation, shifts in

width and height, zooming or flips. The choice of transformations used in a particular model should

always be adjusted individually, as their functionality depends on the context of images and the

patterns that the model is aiming to recognize.

Text analysis. After the initial analysis of apartment search sites and housing market research,

it has been concluded that there is a considerable amount of information gathered in rental offers’

description that would be difficult to extract from other sources such as images or maps. Therefore,

the text analytics methods are used in the research, however to a limited degree. It appears that

most of the text analytics method e.g. sentiment analysis would probably not bring any additional

value to the study, due to a distinctive nature of the real estates’ descriptions and the type of

language they are written in. As such, the focus of this part of the research is put on a simple

information extraction from the rental offer description.

In general, a rental offer description may contain a lot of useful information about the neighbor-

hood, close services, and potential rental restrictions. On the other hand, the narrative is expected

to be biased as owners do not mention the negative characteristics of their real estates. Moreover,

the descriptions differ significantly between each other, and the information mentioned in some is

missing in the others. Therefore, where possible, the extraction is done in a way that gathered

attributes are easy to categorize or have a dummy form in which, in case of missing data, a de-

fault value may be set. The examples of features and data extraction methodology should help in

understanding that logic:

• Rental restrictions: some landlords do not allow pets, children, students, or smoking persons

in their properties. In order to find if it is a case for a particular property, the description

is searched for the mentioned keywords (smoking, pets, etc.). After finding the position of a

keyword in a description, the surrounding words are searched for contradictions. The range of

the search, usually referred to as a window, is set after the initial analysis of the description

examples, and depends on the most popular grammar structures used. The size of a window

and its (a)symmetry may also vary between the keywords searched for.

• Nearby services: as the type of services mentioned in the descriptions differs, and it is less

17

probable to assume that e.g. if the owner does not mention nearby restaurants there are

indeed no restaurants in the neighborhood, creating dummy variables may not be the best

idea. To overcome this problem, a set of keywords based on the literature review, and common

sense such as hairdresser, market, restaurant, etc. are created. Then, the number of existing

keywords in each description are summed up.

• Additional information: sometimes additional requirements have to be met to rent a prop-

erty. Similarly, with the usage of keywords, sentences with the words “guarantor”, “minimal

income” etc. are found and the window of keywords is searched for the amount of required

money/income.

Additionally, in order not to miss any popularly mentioned features in the descriptions that

could be specific for the Netherlands or the area of Rotterdam, the frequency analysis of words is

performed. Firstly, the popular stop words are removed from the descriptions. Subsequently, the

most popular words are manually screened to see if any potentially important characteristic of a

property or neighborhood has not been omitted.

3.2 Regression analysis

Hedonic linear model. Most of the research using hedonic pricing are based on an Ordinary

Least Squared regression, most commonly called linear regression. The OLS regression model takes

the form of::

y

i

= β

0

+ β

1

x

i1

+ ... + β

p

x

ip

+

i

, (1)

where:

y

i

is the value of a dependent variable for i

th

observation,

β

0

is the intercept term,

β

p

is the regression coefficient of the p

th

independent variable and

i

is the model’s error term.

Let’s recall that in the hedonic model presented by Rosen (1974) the marginal implicit price

of an attribute is presented as the partial derivative of the price function over the given attribute,

which in case of an OLS regression is equal to the value of an attribute’s coefficient. Therefore,

following the linearity of the model the total value of an attribute p for an i

th

observation (good) is

a product of the observation’s value of p and β

p

coefficient.

However, in order to rely on a linear model’s results five main assumptions have to be met:

• The linearity of the data: the relationship between the dependent and independent variables

has to be linear. This assumption can be checked by using scatterplot comparing residuals of

the model with fitted values.

18

• Multivariate normality: the residuals of the model should be normally distributed which can

be checked with a Q-Q plot or with a goodness of fit test such as the Kolmogorov-Smirnov

test.

• Little to no multicollinearity in the data: the independent variables should not be highly

correlated with each other. This assumption can be tested by calculating Pearson’s correlation

coefficients for each pair of predictors and with a Variance Inflation Factor (VIF).

• Little to no auto-correlation: the residuals of the model should not be correlated with each

other which can be checked with the Durbin-Watson test. However, the mentioned test only

checks the correlation between directly neighboring residuals, therefore auto-correlation func-

tion should also be applied to assure that there are no higher-order effects.

• Homoscedasticity: the variance of error terms should be similar at all levels of the independent

variable. Any significant indications of heteroscedasticity may be checked by analyzing the plot

of standardized residuals versus predicted values.

While the interpretation and the ease of use are undoubtedly substantial advantages of an OLS

regression, it is rather a rare case that data in their original form meet all the above assumptions.

Instead, the data transformation using methods such as Box-Cox transformation is often needed.

Nevertheless, the more transformed the data, the less interpretable the results of the model become.

Moreover, it is argued that Box-Cox transformation reduces the accuracy of any single coefficient

(Cassel, 1985). Lastly, no data transformation technique guarantees that the relationship between

variables will become linear, thus, bending or breaking the assumptions of an OLS regression is

sometimes inevitable. If this is the case, applying an OLS regression to such data leads to the

situation where the forecasts, confidence intervals and the insights provided by the model become

inefficient and misleading. To conclude, capturing non-linear patterns in the data with an OLS

regression is a difficult or sometimes even an impossible task. This is problematic in the context of

hedonic price modeling as even in his early work Rosen (1974) claims that some variables such as

budget constraints are likely to be nonlinear.

Random Forest. As argued in the methodological section of the literature review, the decision

tree-based method, random forest seems to be a suitable method for this research. The decision

tree is a non-linear model consisting of multiple conditional statements that separate the data into

smaller nodes. The variable on which the split is performed in a given part of the regression model

is based on the decrease in RSS it would cause. Overall, at each moment the algorithm chooses the

split that leads to the greatest decrease in RSS, then repeats the process for newly created nodes

until a stopping rule is met, or the number of observations in each node is equal to one.

19

The common problem with decision trees is their tendency to grow deep and therefore overfit the

data. Random forest is one of the methods that help in dealing with this problem with the usage of

bootstrapping. Bootstrap method simulates N new data sets by randomly drawing observations with

replacement from the original data set. Subsequently, for each N

th

bootstrapped sample decision

tree model is built. The prediction of the random forest model is an average prediction value among

all N regression trees. The fact that the final prediction is the average score of multiple predictions

helps in dealing with overfitting by reducing the overall variation of the model in comparison to a

single tree (James et al., 2013).

One of the imperfections of this approach is the fact that by default bootstrapped-based trees

are highly correlated. Random forest addresses this problem by allowing only a random subset of

original variables to be used in a single bootstrapped tree. This approach not only decorrelates the

trees, but it also disallows the most important variables to completely dominate the final model. As

each variable appears only in a subset of trees, predictors which would seem to have less impact on

the prediction has more space to act in the final model. The optimal number of predictors used in

each tree is relatively easy to define by applying the grid search and choosing the model with the

best performance in a chosen metric such as RMSE.

The quite important flaw of traditional random forest is its tendency to rank continuous variables

or categorical variables with multiple levels as more important than the others. That is because these

types of variables have more possible options to split the data and therefore are more likely to be

chosen at higher level splits than e.g. binary variable. In case of this research, a significant part

of the data set, especially the features extracted from images have a form of dummy variables.

Therefore, in order to limit the mentioned bias, conditional decision tree-based random forest are

also used. In contrast to regular trees, conditional trees base the splits in the model on the results

of permutation-based significance tests performed for each variable.

3.3 Model-Agnostic methods

In numerous research random forest has proved its superiority over an OLS regression in terms

of prediction accuracy. Nevertheless, this advantage comes at the cost of much more complicated

architecture of a model which in consequence disallows a simple determination of the variables

importance and their impact on the prediction. As previously mentioned in this paper, the issue

is especially troublesome for hedonic price modeling, in which the determination of the marginal

implicit price of an attribute may be treated as the essence of the method. Fortunately, there is a

wide range of methods aiming to uncover the functioning of black box models.

Variable Importance. One of the most standard approaches in determining the importance of

variables used in a black box model is the analysis of the mean decrease in accuracy. The idea of the

method is to permute one predictor in order to decouple its relation with the dependent variable.

20

Subsequently, a new model with the permuted predictor is fitted and its accuracy is measured. The

more the accuracy of the new model decreases in comparison to its original counterpart, the more

important the predictor is deemed. As such by repeating the procedure for each predictor in the

data set, their relative importance can be gathered. While the method may be criticised for its

moderate robustness and unreliability in case of strongly correlated data, it is still an easy and a

fast way to acquire the basic overview of the black box model.

Partial Dependence Plots. The partial dependence plot (PDP) shows the marginal effect a

feature has on the predicted outcome of a machine learning model (Friedman, 2001). In addition, it

allows us to measure in approximation the type of relation the independent and dependent variables

have e.g. linear, monotonic, or complex. PDP is based on a partial dependence function, which in

case of regression is defined as:

ˆ

f

x

S

(x

S

) = E

x

C

h

ˆ

f(x

S

, x

C

)

i

=

R

ˆ

f(x

S

, x

C

)dP (x

C

), (2)

where:

x

S

is the feature for which partial dependence function should be calculated, and

x

C

are all the other predictors featuring in the machine learning model.

While the set S may consist of multiple variables, usually it is limited only to one, as the

PDP visualization in more than two dimensions is difficult to analyze. Partial dependence works

by marginalizing the machine learning model output over the distribution of the features in set C

(Molnar, 2019). That way, the function estimates the relationship between the x

S

feature and the

predicted outcome of the machine learning model. According to Friedman’s approach, the partial

dependence plots are obtained by calculating the following average and plotting it over a range of

x

S

values:

ˆ

f

x

S

(x

S

) =

1

n

P

n

i=1

ˆ

f(x

S

, x

(i)

C

), (3)

where:

n is the number of observations in the train set, and

x

(i)

C

is the value of the i

th

sample for the x

C

features.

An important assumption of a partial dependence function is no serious correlation between

feature(s) x

S

and features x

C

. If this assumption is not satisfied, the averages calculated in the

formula 3 will include data points that are unlikely or even impossible to reach (Molnar, 2019). An-

other drawback of partial dependence plots is the fact that they do not contain feature distribution.

Therefore, the analysis of PDP may be misleading in some parts where not enough data is available.

The partial dependence method may be described as a global function. Based on all the obser-

vations that were fed to a machine learning model, it provides a global relationship between their

21

predictions and a particular feature for which function was estimated.

Local Interpretable Model-Agnostic Explanations (LIME). While the globality of a partial

dependence function may be seen more as a method’s characteristic and not necessarily as a disad-

vantage or limitation, it does not allow us to understand the reasoning of a machine learning method

behind a single prediction. One of the methods which allows this type of analysis is known as Local

Interpretable Model-agnostic Explanations or simply LIME. Originally introduced by Ribeiro et al.

(2016), LIME aims to explain the functionality of a black box method for a specific observation by

fitting a simpler, easier to interpret model also known as a glass-box model at a local scale.

LIME is rooted in the assumption that even the most complex model is linear on a local scale.

In consequence, the assumption implies the key idea of LIME which may be formulated in the

following way: if two observations possess very similar characteristics, they should behave similarly

in a machine learning model. Therefore, if multiple similar observations behave similarly in a black

box model it is possible to fit a prediction model on their basis, that would mimic and consequently

explain how the original model behaves at that locality (Pedersen & Benesty, 2019).

The surrogate model may take numerous forms such as linear regression, LASSO or decision tree.

The only limitation for the chosen type of a model is to be easily interpretable. The accuracy with

which the surrogate model explains the black box algorithm’s behaviour is known in the literature

as a local fidelity (Molnar, 2019). Local fidelity may be used as a metric on the basis of which the

optimal type of local model is chosen.

Mathematically, the local approximation of a black box model may be defined as:

ˆg = arg min

g∈G

L(f, g, π

x

) + Ω(g), (4)

where:

G represents the class of interpretable models,

g is an interpretable model belonging to the class G,

L is the fidelity measure measured with a chosen metric e.g. mean squared error,

f is the black box model for which the local approximation is sought,

π

x

is the proximity measure defining a neighborhood of an instance x in which the approximation

is sought, and

Ω(g) is the g model’s penalty of complexity (Biecek & Burzykowski, 2020).

While the above formula already shed some light on the theory behind LIME, the application

side has been described in an approachable way by Pedersen & Benesty (2019). Firstly for each

prediction to explain the observation is permuted n times. Then, the prediction for each permuted

observation is run with the usage of the original black box model. Subsequently, the distances from

all permutations to the original observation are calculated and converted into similarity score. After

22

selecting the number of features best describing the black box model with Ω(g), a surrogate model

is fitted to the permuted data. While training the local explanatory model the outcome is weighted

for a permuted observation by its similarity to the original observation. Finally, by extracting the

feature weights from the simple model it becomes possible to use these as explanations for the

complex model’s local behavior.

In theory, following the above procedure should allow us to explain the mechanics of any black

box model for every single prediction. Nevertheless, LIME is still a method in a development phase

and as promising as the above statement sounds, it does not always end up being that functional.

As a relatively new method, LIME suffers from a number of issues that have not been yet resolved.

Firstly, there is not much literature available on the tuning of LIME parameters, especially the width

of a smoothing kernel π

x

, which for now has to be tuned with a trial and error approach.

Another problem, the robustness of explanatory models created with LIME causes even more

concern. In Alvarez-Melis & Jaakkola (2018) the authors show that the explanation provided with

LIME for two similar observations may vary significantly. Molnar (2019) also criticizes the stability

of LIME, claiming that the results may change after repeating the sampling process.

23

4 Data and feature extraction

The research has been based not on the prices of properties but the rental costs of real estates

instead. There are numerous reasons for choosing this approach. Firstly, the number of research on

the prices of house rents is relatively limited in comparison to the house prices, while the results of

both may differ significantly (S. Clark & Lomax, 2019). Secondly, obtaining the data in English on

the Dutch market, which is a primary interest of the study, is much easier in case of rentals. In terms

of data, it has been collected only from rental websites and Google Maps, on the contrary to most

of the research mentioned in the literature review, which are based on data received from real estate

agencies. One could argue that the web-scraped data may be of lower quality in some aspects. For

example, there is no certainty that the rental price shown in the offer has not been negotiated, and

is the final rent that the customer agreed to pay. Nevertheless by taking into account the relatively

fast-moving nature of the rental market in large cities limiting the negotiating space, making this

kind of assumptions seems reasonable. On the other hand, gathering data from the rental websites

allows for a more flexible approach in its usage, as the research would not be limited to predefined

data set. Moreover, basing the study on accessible data leads to a situation where the model can be

easily applied to any other city or area.

Another reason for using only data from rental websites is linked to the theory of hedonic

models. One of the most often mentioned characteristics (or even limitations) of hedonic models is

the customers’ willingness to pay more or less for a product depending on the utility of its attributes,

but only the ones that they can perceive. It may be argued that in case of renting an estate, potential

customers do less in-depth research than they would if they wanted to buy it. Therefore, it makes a

rental offer a primary source of information for customers not only in terms of house characteristics

but external factors as well. Nevertheless, it would be naive to assume that people willing to rent a

house do not make any research on their own. As one of the most important features of a real estate

is its location, Google Maps seems like an obvious tool that in a short amount of time, allows us

to gather relatively a lot of knowledge about the neighborhood of a property. Therefore, extracting

features from satellite images plays a significant role in this research.

The core of the data gathered for the research comes from one of the leading rental websites

in the Netherlands. The main reason for limiting the data source only to one web page is the

fact that all rental offers there are presented in English, which is rather uncommon for the Dutch

market. Moreover, the website is well structured and allows for a relatively easy process of web

scraping. Furthermore, as the web page is administrated by real estate brokers the quality of the

data presented in the rental offers is on a very high level. Therefore, the estimated values of the

properties advertised on the website are assumed to be accurate and in consequence, should limit

the number of outliers in the data. Last but not least, it appears that most rental offers are unique,

which is quite a phenomenon when compared to other websites where duplicates appear quite often.

24

4.1 Initial data

The most crucial part of the data describing the main house characteristics has been web-scraped

from the mentioned rental website. Typical variable examples of such data are rental price, type

of a house or living area of a property. As far as most of the data in this section according to the

nomenclature proposed by Chin & Chau (2003) would be defined as structural, some information

such as the name of a street or postal code would match more the Chin’s category locality.

Nevertheless, after investigating multiple rental offers it has been found out, that many offers

differ in the amount of information fields presented to a visitor of the website e.g. energy rating field

is present only in a relatively small number of offers. Therefore, in order to create a reliable data

set some variables have been excluded from the process of web scraping.

The process of gathering data has been fully automated with the usage of R and respective

packages allowing scrapping the data based on HTML and XML code of the website. Firstly, the

links to all the rental offers have been scrapped from the search page with the only filter of the

city being Rotterdam. Over 2000 real estate rental offers have been found and crawled since the

beginning of April till the end of May 2020.

After performing data cleaning the data set consisting of 1844 unique observations has been

created. Moreover, as one of the most important factors in predicting the rental cost of a house is

its location, with the usage of Google Maps API, a set of variables have been collected: the distance

from a house street to the Rotterdam Central Station and the time it takes to travel the distance by

walking, by biking and by public transport. Similarly, the geographical coordinates of each street

appearing in the initial data set in the form of longitude and latitude have been gathered.

Table 2 contains a detailed description of the variables present in the initial data set. Out of

1844 observations, the only missing values appear in variables Construction_year, Bedrooms and

Bathrooms. For the last two variables, they do miss only in case of house type being a single room.

Therefore, it has been decided to substitute the missing values in these cases with 1. In terms of

construction year 721 observations out of 1844 miss this information.

4.2 Image recognition

Simultaneously with scraping typical house characteristics data, images of each rental offer have

been collected. With an average of 22 photos per one offer, over 40000 images have been gathered

in total. Moreover, as one of the goals of the research is to use image recognition models in order

to extract features from the mentioned photos, additional images have been gathered to use them

in training classification models. Around 2000 images from other rental offer websites have been

gathered, this time however, the data came not only from Rotterdam but other Dutch cities as well.

Such an approach allows limiting the potential bias in classification models’ accuracy, which would

be otherwise caused by manual labeling the part of collected photos.

25

Table 2: Variables present in the initial data set

Variable Type Description

House.ID Numeric Unique ID of a house

Street Character Street

URL Character URL

Postal_code Character Postal code

District Factor (64 levels) District

Price Numeric Price in euros

Living_area Numeric Living area in squared meters

Rooms Numeric Number of rooms

Construction_year Numeric Construction year

House_type Factor (3 levels) Is a property a house, a room or a flat?

Bedrooms Numeric Number of bedrooms

Bathrooms Numeric Number of bathrooms

Balcony Factor (2 levels) Does a property have a balcony?

Garden Factor (2 levels) Does a property have a garden?

Storage Factor (2 levels) Does a property have a storage?

Garage Factor (2 levels) Does a property have a garage?

Shower Factor (2 levels) Does a property have a shower?

Bath Factor (2 levels) Does a property have a bath?

Lift Factor (2 levels) Does a property have a lift?

Toilet Factor (2 levels) Does a property have a separate toilet?

Furnished Factor (2 levels) Is a property fully furnished?

Service_cost Factor (2 levels) Are service costs included in the price?

Description Character Description of a property

Time_walking Numeric Travel time by walking in seconds

Time_biking Numeric Travel time by biking in seconds

Time_public Numeric Travel time by public transport in seconds

Longitude Numeric Street’s longitude coordinate

Latitude Numeric Street’s latitude coordinate

26

Subsequently, the process of extracting features that according to the previous research may turn

out significant in predicting housing price has been started. Firstly, the rental offers’ photos have

been initially analyzed. Although unsurprisingly a majority of photos present the inside of a given

estate, it has been found out that most of the offers do feature photos showing the outside of the

building and view from the property as well. Therefore, as this study focuses mostly on the external

factors impacting the rental price in Rotterdam, the decision to analyze the view from properties has

been made. It may be argued to which degree the view from a property is an external, an internal,

or a locational factor. Nevertheless, it is rather safe to assume that view is affected by external

factors such as the height and density of the buildings in the direct neighborhood, thus making it

at least partially externally dependant.

The image recognition process for different types of views has been divided into two sequential

convolutional neural net models. The first model aims to filter the property images and classify them

whether as outside or inside. The model has been trained in a way that outside label is given to

photos of balconies, views from the windows, street images, etc. All the other photos including not

only interior but e.g. graphics illustrating the layout of a flat are classified as inside. Even though

the added value this classification model brings to the data set and the future prediction model is

low, it allows us to simplify the subsequent model.

The goal of a second model is to analyze the outside photos and classify them into four categories:

1. View on the city: category featuring photos with relatively unbroken view on the charismatic

panorama of Rotterdam

2. Green view: category featuring images with a view on a park, a canal or another green area

3. Enjoyable view: arbitrary category featuring images with a pleasant, above the average view

e.g. photos presenting an unbroken view on a neighborhood, river or open areas

4. Other: category featuring all the other images.