EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 1 of 164

MARYLAND STATE RETIREMENT AND

PENSION SYSTEM

STATE RETIREMENT AGENCY

EMPLOYER EDUCATION MANUAL

Published by: The State Retirement Agency Local: 410-625-5555

120 East Baltimore Street Toll Free: 1-800-492-5909

Baltimore, MD 21202-6700 TDD/TTY 410-625-5535

www.sra.state.md.us

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 2 of 164

Table of Contents

INTRODUCTION ...................................................................................... 4

MEMBERSHIP INFORMATION ............................................................... 6

ENROLLMENT ....................................................................................... 11

AUTOMATIC ENROLLMENT ................................................................ 15

PAYROLL REPORTING ........................................................................ 18

REPORTING FOR FULL TIME EMPLOYEES ................................................................................................................................................................. 27

REPORTING FOR PART TIME EMPLOYEES ................................................................................................................................................................. 33

PAYROLL ADJUSTMENTS ................................................................... 43

CONTRIBUTION DEFICIENCIES .......................................................... 61

EMPLOYER PICK UP PROGRAM ........................................................ 64

WORKERS’ COMPENSATION PAYROLL REPORTING ...................... 66

LEAVE OF ABSENCE ........................................................................... 68

PURCHASES OF PREVIOUS SERVICE .............................................. 70

TITLE 37 TRANSFERS .......................................................................... 74

WITHDRAWALS .................................................................................... 79

WORKERS’ COMPENSATION OFFSETS ............................................ 84

RE-EMPLOYMENT AFTER RETIREMENT ........................................... 86

PENSION ALLOWANCE OPTIONS ...................................................... 98

ACTIVE MEMBER DECEASED BENEFITS ........................................ 102

FISCAL YEAR CLOSING / OPENING ................................................. 104

PERSONAL STATEMENT OF BENEFITS (PSB) ................................ 109

MARYLAND PENSION ADMINISTRATION SYSTEM (MPAS) ........... 112

SRA RESOURCES .............................................................................. 113

SAMPLE ATTACHMENTS ................................................................... 117

Form 001 – Application for Membership ............................................................................................................................................................................... 118

Form 004 – Designation of Beneficiary ................................................................................................................................................................................... 120

Form 037 – Election to Transfer Service ................................................................................................................................................................................ 122

Form 026 – Request to Purchase Previous Service ................................................................................................................................................................ 123

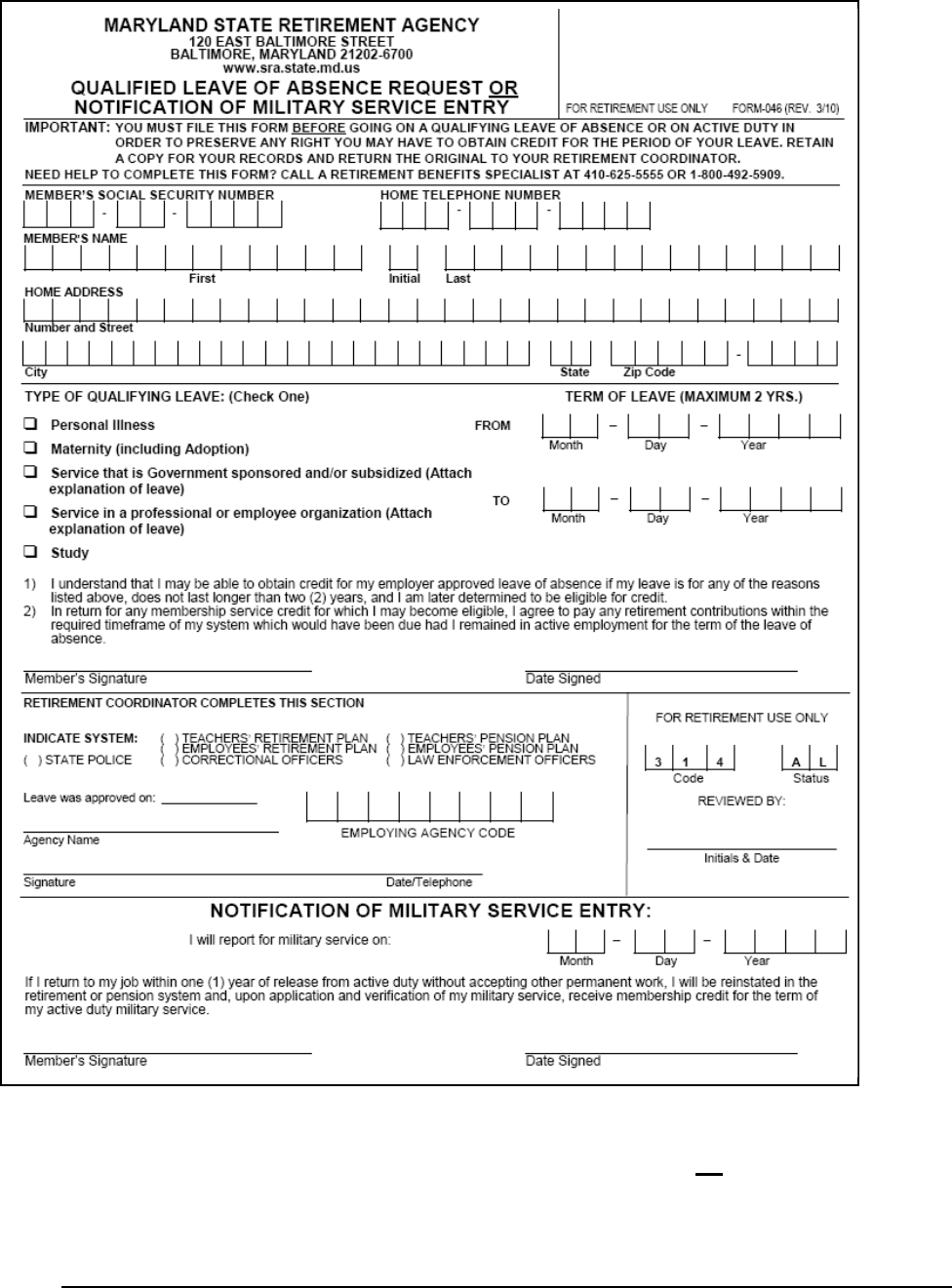

Form 046 – Qualified Leave of Absence Request or Notification of Military Service Entry ......................................................................................... 125

Form 005 – Application for Withdrawal of Accumulated Contributions .......................................................................................................................... 127

Form 193 – Trustee-to-Trustee Distribution Form ............................................................................................................................................................... 131

Form 746 – Acknowledgement of Receipt of Safe Harbor Notice and Affirmative Election ....................................................................................... 133

Form 002 – Legislative Pension Plan Application for Membership ................................................................................................................................... 134

Form 003 – Judges’ Retirement System Application for Membership ............................................................................................................................... 136

Remittance Reconciliation Form For Payroll Data ................................................................................................................................................................ 138

RevenueControlTransmittal ................................................................................................................................................................................................ 139

Form 714 – Prior Period Payroll Adjustment Form .............................................................................................................................................................. 140

Personal Statement of Benefits .................................................................................................................................................................................................. 142

Chapter 392, Laws of 2008 ......................................................................................................................................................................................................... 146

Form 028 - Request for Certification of Annual Salary ........................................................................................................................................................ 147

APPENDIX A – Payroll Reporting Software Program .......................... 148

APPENDIX B – Secure File Upload ..................................................... 154

INDEX .................................................................................................. 160

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 3 of 164

Dear Participating Employer,

On behalf of the Board of Trustees of the Maryland State Retirement & Pension

System (SRPS), we are very pleased to provide you with the SRPS Employer

Education Manual. As a participating employer, you are an important part of our

team and we thank you for all of your cooperation.

The SRPS has created this manual as a supplement to other resources already

available. This manual will help guide you through common topics such as

enrollments, payroll reporting, refunds, transfers of service, re-employment after

retirement, and benefit payment options. It also provides important answers to

many of your daily questions concerning these same topics.

We hope you find this manual useful. We look forward to continuing our

partnership with each of you to ensure the long range stability of the pension

system for our members and retirees.

Thank you.

Sincerely,

Nancy K. Kopp Peter Franchot

Chairman of the Board Vice Chairman of the Board

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 4 of 164

INTRODUCTION

INTRODUCTION

As a qualified plan under section 401(a) of the Internal Revenue Code, the

Maryland State Retirement and Pension System (SRPS) is a defined benefit

plan. The Maryland State Retirement Agency (SRA) is charged with the

fiduciary responsibility for properly administering the retirement and

pension allowances and other benefits, while striving to keep employer

contribution rates as affordable as possible, maximizing investment returns and maintaining an

acceptable level of risk. Members covered under the plans include State employees, teachers, law

enforcement officers, legislators, judges, as well as local government employees whose employers

have elected to participate in the SRPS.

In 1927, the first statewide retirement plan in Maryland (the Teachers’ Retirement System) was

established. Fourteen years later, in 1941, the Employees’ Retirement System was established.

Currently, SRA administers death, disability and retirement benefits to over 119,000 retirees and

beneficiaries, and is an essential element of the future financial security for over 199,000 active

participating members. The following 12 plans are included in the SRPS:

• Teachers’ Retirement System (closed to new members)

• Employees’ Retirement System (closed to new members)

• Correctional Officers’ Retirement System

• State Police Retirement System

• Judges’ Retirement System

• Legislative Pension Plan

• Teachers’ Pension System

• Employees’ Pension System

• Law Enforcement Officers’ Pension System

• Law Enforcement Officers’ Retirement System (closed to new members)

• Local Fire and Police Pension System (closed)

• Local Fire and Police Retirement System (closed)

PURPOSE OF THE EMPLOYER EDUCATION MANUAL

We have developed this manual to assist you in fulfilling your day-to-day responsibilities as an

employer-partner of the SRPS. Our goal is to ensure that proper resources are available to you in

performing your daily duties. We look forward to providing you with the support you require

and, in working together, ensuring a partnership benefiting the thousands of State and local

members and retirees.

ICON KEY

Application/Form

Attachment

ª See for More Info

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 5 of 164

USING THIS MANUAL

This manual has not been designed to make you an expert in retirement issues. Our hope is that

you use this manual to supplement other resources currently available from the SRA. However,

in this manual, we feel we have provided a comprehensive learning and training tool which

should answer most of your questions that occur from day to day.

The manual is in loose leaf form and currently available on our website: www.sra.state.md.us. All

information is current as of the revision date listed in the header of each page. However, from

time to time, SRA will provide updates to the manual to reflect changes in the pension statute or

SRA policy. Updates will be provided electronically and will also be available on our website.

We have compiled this employer education manual as a working tool for your use. However,

please be aware that although it is designed to be comprehensive in the information it provides,

the information outlined in this manual in no way should be taken as the basis for any contractual

right between the SRPS and the employer or member. The information outlined herein does not

replace statutory and regulatory requirements.

SUMMARY

As our employer-partners, we hope this manual provides simple answers and solutions to many

of your basic questions. However, we do understand that during the normal course of business,

more complex questions and issues may arise. In these situations, SRA staff is available to assist

you in providing resolutions in a timely manner. We look forward to continuing our partnership,

which benefits thousands of State and participating governmental members and retirees.

! The information provided in this manual should not be taken as the basis for any contractual

right between the SRPS and the employer or member. The information outlined herein does

not replace statutory and regulatory requirements.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 6 of 164

MEMBERSHIP INFORMATION

GENERAL

Membership in the SRPS is governed by the State Personnel and Pensions

Article, Annotated Code of Maryland, and the Code of Maryland

Regulations (COMAR). SRPS membership is a mandatory condition of

employment for all employees who meet the eligibility and membership

criteria defined in the State Personnel and Pensions Article, and COMAR.

A qualifying employee cannot reject membership, nor can an ineligible employee elect

membership.

Membership in the SRPS includes State and municipal employees, educators, judges, legislators,

State Police, law enforcement officers, and correctional officers. Each of these employee groups

is covered under an individual employee system and plan.

PARTICIPATION ELIGIBILITY

The general rule is that all permanent State employees and all permanent employees of

participating employers are eligible for membership in the SRPS. The position of the employee

and the system(s) that their employer elected to join determine the system of participation. For

example, membership in the Teachers’ Systems is restricted to positions as outlined in the Code

of Maryland Regulations (Title 22, Subtitle 04 - Membership). Actual determination of eligibility

for membership in the Teachers’ Systems is made on a case-by-case basis. Factors affecting

determination for eligibility include a review of the position description as it relates to the

definition in COMAR as well as the member’s past enrollment history.

There are some rules to consider. Membership is contingent upon the permanent employee

being expected (budgeted) to work at least 500 hours in a fiscal year

1

. If the permanent employee

is expected (budgeted) to work 500 hours or more in the fiscal year then membership begins

immediately when the employee is placed on payroll. Once an employee is a member of the

SRPS, he or she must continue to be reported regardless of the number of hours he or she works

in subsequent fiscal years.

Temporary, contractual, and emergency employees are not eligible for membership.

Membership in the SRPS ends if the member:

2

• Is separated from employment for more than:

9 Teachers’ and Employees’ Pension Systems – 4 years

9 Employees’ Retirement System – 4 years

3

9 Teachers’ Retirement System – 5 years

3

9 Law Enforcement Officers’ Pension System – 4 years

4

1

Fiscal year runs from July 1

ST

to June 30

TH

.

2

Individual plan rules vary. For more specific information, please contact the SRA.

3

Membership also ends if a member transfers to the Employees’ or Teachers’ Pension System

4

Membership also ends if a member elects participation in the Deferred Retirement Option Program

ICON KEY

Application/Form

Attachment

ª See for More Info

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 7 of 164

9 Correctional Officers’ Retirement System – 4 years

9 State Police Retirement System – 4 years

5

9 Local Fire and Police Pension System – 4 years (closed)

• Withdraws his or her accumulated contributions, if any;

• Becomes a retiree; or

• Dies.

FREQUENTLY ASKED QUESTIONS

Question: Who is eligible for membership in the SRPS?

Answer: As a general rule, all permanent employees of the State and of participating

government units (PGUs) are eligible for membership in the SRPS. The SRPS is

comprised of multiple individual plans, each with distinct plan rules. An employee’s

position and the plans that his or her employer has elected to join determines which

plan he/she is eligible to participate. The SRA will determine whether an individual

is eligible for membership based upon the pension statutes and Title 22 of the Code

of Maryland Regulations (COMAR).

Question: Are permanent, part-time employees eligible for membership in the SRPS?

Answer: The short answer is yes. In general, membership is mandatory for permanent, part-

time employees who are expected (budgeted) to work at least 500 hours in the fiscal

year.

Question: Are temporary, contractual, and emergency employees eligible for membership in the

SRPS?

Answer: No.

Question: Should an employee who is a current retiree from the SRPS be re-enrolled in SRPS

should they become re-employed?

Answer: If your employer employees a person who is presently receiving a retirement

allowance from the SRPS then you should contact the SRA Enrollment Supervisor

for assistance in determining if the individual is eligible for re-enrollment. In general,

retirees may not re-enroll and accrue additional benefits if they are already a retiree

from the SRPS. However, the provision within the State Retirement System, Judges’

Retirement System, and Legislative Pension Plan are complex and SRA should be

consulted to determine if the individual may re-enroll before you process a new

Application for Membership.

5

Membership also ends if a member elects participation in the Deferred Retirement Option Program

EMPLOYER RESPONSIBILITIES: MEMBERSHIP

9 Each participating employer should be aware of the general membership rules

regarding eligibility for membership in the SRPS.

9 In the event an employer is unsure whether a particular employee should be enrolled in

the SRPS or which plan or system, the employer should contact the SRA for guidance.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 8 of 164

Question: What should an employer do if an employee’s eligibility for membership is

questionable?

Answer: Employers who are unsure whether a specific employee is eligible for membership in

the SRPS should contact the SRA Enrollment Supervisor directly. In some

instances, the SRA will require a copy of the position description to make a final

determination as to eligibility for membership.

6

Question: Are adjunct professors eligible for membership in the Teachers’ Pension System of

Maryland?

Answer: As we understand the nature of an adjunct professor’s employment, he or

she may be employed for a term at a time depending on need. Continued

employment is not guaranteed, but many professors may work for extended periods

of several consecutive years or more. In addition, the University of Maryland System

reports that their adjunct professors are on tenure track and are entitled to all the

benefits of regular faculty.

Certainly, when the nature of an adjunct professor’s employment closely mirrors the

situation outlined above, they should be enrolled into TPS and payroll should be

reported in the normal way. Where the nature of employment differs significantly

from those outlined, specific inquiry should be addressed to the SRA Membership

Supervisor.

Question: When should a position description accompany the membership application for an

employee applying for membership in the Teachers’ Pension System?

Answer: A copy of the employee’s position description should be attached to the membership

application whenever the position title differs from the eligible titles listed in

retirement statute. For Boards of Education, the listed titles are: clerk, helping

teacher, principal, superintendent, supervisor or teacher. Even when the applicant’s

position title is the same as one in the statute, it is helpful to add a descriptive term

to the title to distinguish it from an ineligible position with the same title. As an

example, a teacher is clearly eligible for Teachers’ Pension System membership

unless there is some qualifying condition that would negate eligibility such as short

term substitute or adult education teacher. To avoid the need for clarification, it

would be helpful therefore, to add the term regular or day school to the position title

to make further questioning unnecessary.

For Community Colleges, the classifications that are eligible by statute are:

professional and clerical employees.

For state controlled educational institutions, the eligible classification is faculty

employees.

For public libraries, the eligible classifications are: librarians, clerical employees and

library associates.

6

The Membership Supervisor can be contacted directly at (410) 625-1414.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 9 of 164

Position Classifications Determined to be Eligible for Teachers’ Pension

System Membership by Board of Trustees’ Regulation:

1. Individuals who are eligible for a certificate under Education Article, Title 6,

Annotated Code of Maryland, who perform teaching duties or who perform

administrative or supervisory duties in the teaching field;

2. Principal employees on the central staff who supervise one or more of the

following categories:

a. Transportation,

b. Building operations (includes maintenance, custodial, repair

operations, and security services), or

c. Food Services;

3. Audiologists with proper degrees;

4. Bookmobile drivers who are designated as driver/clerks;

5. Bus attendants for handicapped children;

6. Dietitians with appropriate degrees;

7. Occupational therapists with proper degrees;

8. Professional speech pathologists with proper degrees;

9. Psychiatrists;

10. Psychologists;

11. Psychometrists with proper degrees;

12. Registered nurses;

13. Social workers with appropriate degrees;

14. Classroom teacher aides;

15. Physical therapists; and

16. Braillists.

Position Classifications Ruled Ineligible for Teachers’ Pension System

Membership by Board of Trustees’ Regulation:

7

1. The terms “clerk”, “helping teacher”, “principal”, “superintendent”,

supervisor”, or “teacher” in State Personnel and Pensions Article, §22-

205(a)(1) and §23-206(a)(1), Annotated Code of Maryland, do not include the

employees of a day school in the State under the authority and supervision of

a county board of education or the Baltimore City Board of School

Commissioners.

2. The following employees of a day school are not included within the terms

described above:

8

a. Administrative assistants to the superintendent;

b. Architects;

c. Artists;

d. Assessments specialists;

e. Audiovisual technicians;

f. Bus drivers;

g. Cafeteria and food service workers;

h. Community aides and specialists;

i. Construction workers;

7

COMAR §22.03.02

8

COMAR §22.03.03

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 10 of 164

j. Consultants;

k. Counselor aides and assistants;

l. Custodians;

m. Draftsmen;

n. Driver education aides;

o. Educational TV technicians;

p. Engineers;

q. Financial aid and job counselors;

r. Foreman;

s. Fringe benefits personnel;

t. Health aides;

u. Human relations, equal opportunity, affirmative action personnel;

v. Inspectors;

w. Institutional research and development personnel;

x. Interagency programs and planning personnel;

y. Interns;

z. Janitors;

aa. Laboratory aides/technicians;

bb. Mail room couriers; messengers/clerks;

cc. Maintenance workers;

dd. Media specialists (review and evaluation centers);

ee. Nurses’ aides;

ff. Ombudsmen;

gg. Photographers;

hh. Plant operations personnel;

ii. Printers;

jj. Public relations specialists, specialists in public relations publications

and public information;

kk. Purchasing agents or officials;

ll. Quality assurance personnel and testing and evaluation personnel;

mm. Reading/study skills technicians;

nn. Repairs personnel;

oo. Safety and insurance specialists;

pp. School business managers – administrative assistants;

qq. Security personnel;

rr. Site acquisition personnel;

ss. Site development personnel;

tt. Site planning personnel;

uu. Staff development and career programs personnel;

vv. Statisticians;

ww. Student affairs and student activities personnel;

xx. Therapist aides/assistants;

yy. Transportation personnel;

zz. Warehousemen; and

aaa. An individual who is employed under a federal public service

employment program.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 11 of 164

ENROLLMENT

GENERAL

The enrollment process for eligible employees is a simple, straightforward

process which is crucial to ensuring that each eligible employee receives

proper service credit. Each employee who is eligible for membership in

the SRPS is required to complete and submit an Application for

Membership, Active Member Designation of Beneficiary Form, and a valid

proof of birth date document.

ENROLLMENT

The Application for Membership provides the SRA with essential information about an

employee which allows us to set up the necessary account information.

• Application for Membership (

001, )

(Form 001 applies to all plans except Legislative and Judges)

9

The SRA requires a valid proof of birth date document to accompany the Application for

Membership. An acceptable proof of birth date document includes:

10

• Adoption certificate

• Birth certificate

• Census record from the U.S. Bureau of the Census

• Certified hospital birth record

• Maryland identification card

• Military documentation from any branch of the U.S. Armed Forces

• Naturalization record

• Statement of age card from the county health department or U.S. Bureau of Vital

Statistics

• Unexpired driver’s license

• U.S. passport

It’s important to remember to submit a valid proof of birth date with the Application for

Membership. The SRA cannot process an Application for Membership without a valid proof of

birth date.

The Active Member Designation of Beneficiary Form (

004,) is an essential part of the

enrollment packet. It provides protection in the event a member dies prior to retirement. With a

duly executed beneficiary form on file with the SRA, the SRA will pay any survivor benefits

according to the Active Member Designation of Beneficiary Form. In the absence of the Active

9

Legislative Pension Plan Application for Membership (Form 002) & Judges Retirement System Application for

Membership (Form 003)

10

Code of Maryland Regulations 22.01.05.02

ICON KEY

Application/Form

Attachment

ª See for More Info

! The SRA cannot process an Application for Membership without a valid proof of birth date

document.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 12 of 164

Member Designation of Beneficiary Form, the SRA will pay any survivor benefits to the estate of

the deceased member.

In addition to ensuring that a person is enrolled promptly in the correct system and plan, it is

important to determine if there is any transfer of service issues. A transfer of service issue occurs

when an employee changes employment, which requires participation in a different retirement

plan. The employee may be able to transfer the service credit from the previous retirement

system and/or plan to the current plan. If an employee participated in another Maryland

retirement plan immediately prior to this new enrollment, service credit may be transferred from

the previous system if certain criteria are met. While the employee must initiate any transfer,

employers are in an important position to alert the employee of the transfer criteria. The criteria

are as follows:

• Employment must be continuous meaning there is no break in time between the previous

employment and the current employment (SRPS considers a break of 30 or less days as

continuous employment)

• Employee must request to transfer the service credit within one year of the new

employment (transferring within the one year is critical – the option to transfer the

service credit is lost after the one year).

The form, which must be filed, depends on whether the previous plan was a SRPS plan.

• If the previous plan was a SRPS plan, then use an Election to Transfer Service Form

(

037,). The employee completes an Election to Transfer Service Form and

forwards it to the employer for completion.

• Otherwise submit a Request to Purchase Previous Service Form (026,), which is

completed by the employee and forwarded to the former employer for certification of the

previous membership. The former employer should then forward the completed form to

the SRA. SRA cannot take any action on the request until the former employer’s

certification of previous membership is received.

EMPLOYER RESPONSIBILITIES: ENROLLMENT

9 An Application for Membership is required for each eligible member of the SRPS.

Please ensure that each eligible member is properly enrolled.

9 Review each Application for Membership to ensure that it is complete, accurate and

legible. Information on the form should be typed, if possible, or printed clearly and

accurately and be signed.

9 Along with the Application for Membership, submit an acceptable proof of birth date

document and a Designation of Beneficiary Form.

9 Be sure to complete the Coordinator section at the bottom of the form, including

signature, date, and telephone number.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 13 of 164

FREQUENTLY ASKED QUESTIONS

Question: Is an Application for Membership required from a member who already has an

account established due to employment with another SRPS employer?

Answer: In some instances, yes, a member may be required to submit another Application for

Membership. In general, if the duties of the new position require enrollment in a

different system or plan, then yes, a new Application for Membership is required.

Question: Is a valid proof of birth date document required?

Answer: The SRA requires a valid proof of birth date document with the Application for

Membership. Without a valid proof of birth date document, the SRA cannot

process the Application for Membership.

Question: What are the consequences if an Application for Membership is not submitted?

Answer: If an Enrollment Form is not submitted for an active employee and payroll data is

being reported, the SRA will contact the employer and the employee in writing.

Should an employee not be properly enrolled into membership, he or she will not

receive an annual Personal Statement of Benefits and any benefits becoming due may

be delayed.

In addition, the SRA is now mandated to assess an administrative fee of

$100.00 for each eligible individual who is not properly enrolled into the

system. This fee will be assessed each year until an individual is properly

enrolled.

Question: Why are Application for Membership forms sometimes returned to the employer?

Answer: Application for Membership forms are occasionally returned for additional

information or if incomplete or incorrect information was supplied. The SRA will

provide a written explanation as to the reason for return and the required corrective

action. It’s imperative that each employer take immediate corrective action to ensure

that the Application for Membership form is corrected and resubmitted in a timely

manner.

Question: What happens if the member’s SSN is reported incorrectly on the enrollment form

or the retirement payroll data?

Answer: The SRA utilizes an automated validation process which can assist in identifying

reporting errors. Whenever possible, the SRA will identify and correct the error with

verification from the employer if necessary. However, if the employer is reporting

the SSN incorrectly to SRA within the reported payroll then the employer must

correct the SSN in their payroll system and files. Each time the incorrect SSN is

reported to SRA it will create an additional automatic enrollment account for the

member and until the error is corrected by the employer, the employee will not be

properly enrolled in SRPS.

Question: Must a member complete the Designation of Beneficiary Form?

Answer: The SRA strongly urges all members to complete a Designation of Beneficiary Form.

In the event of a member’s death prior to retirement, the SRA will pay any applicable

death benefit according to the last Designation of Beneficiary Form on file with the

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 14 of 164

SRA. In the absence of beneficiary information, the SRA will pay any applicable

death benefit to the estate of the deceased member.

It is critical that the most recent Designation of Beneficiary form be on file with the

SRA. The SRA cannot accept forms that are not on file with the Agency BEFORE

a member’s death. Forms on file with the employer, but not on file with SRA are

not valid.

Question: Who can be named a beneficiary?

Answer: A member may designate a person, an estate, or an organization (i.e., a charitable

organization) as a beneficiary.

• If a minor child is designated as a beneficiary, the member must designate an

adult custodian to accept payment on behalf of the minor.

• If the member designates “my estate,” the address of the person or business that

will administer the estate must be submitted.

• If the member designates “Trustee as appointed by Agreement of Trust or Will,”

the address of the Trustee or of the person or business that will administer the

trust must be submitted.

• If the member designates a church or charitable organization, the complete

corporate legal name and address must be submitted.

Question: When can members change their designated beneficiary?

Answer: A member may change the designated beneficiary at any time by submitting a new

notarized beneficiary form to the SRA. It is critical for members to keep their

beneficiary designations current, since any payout due to the death of the member

will be paid in accordance with the latest beneficiary designation form on file with

the SRA prior to their death. New beneficiary forms MUST be on file with the SRA

– forms filed with the employer, but not with SRA are not valid.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 15 of 164

AUTOMATIC ENROLLMENT

GENERAL

Automatic Enrollment (AE) is a process that occurs when payroll data is

submitted to the SRA for a previously unreported or non-enrolled

individual. When payroll data is reported, the SRA automated system

searches for an existing record with an identical social security number. If

no existing record is found, the system automatically creates an AE record

to post the incoming data.

11

AE REPORTS

The SRA provides each applicable participating employer with semi-annual listings of those

individuals who are not properly enrolled in the system. Upon receiving the semi-annual listings,

participating employers should review the report and submit the required enrollment forms to

the SRA as soon as possible. Failure to do so may result in fines as required under Senate Bill

375. (State Personnel and Pensions Article, §21-110)

SENATE BILL 375 – IMPOSITION OF ADMINISTRATIVE FEES

During the 2008 legislative session, the Maryland General Assembly passed and the Governor

signed into law Senate Bill 375 – Imposition of Administrative Fees (Chapter 392, Laws of 2008)

(). Senate Bill 375 provides for the imposition of an administrative fee for each eligible

employee that an employer fails to promptly enroll into the SRPS.

Each participating employer will be charged an administrative fee of $100.00 for each individual

who began employment prior to April 1

ST

but was not properly enrolled as of June 30

TH

of each

fiscal year (July 1 – June 30). Each non-enrolled employee must be active after May 31

ST

to be

included in the administrative fee assessment. To assist each employer, SRA will continue to

provide semi-annual reports to employers listing those individuals who have not been properly

enrolled. Invoices for improperly or non-enrolled individuals will be mailed annually in August

based upon enrollment reports generated with an effective date of June 30

TH

. Payment will be

due no later than thirty (30) days from the invoice date.

11

It’s important to ensure the accuracy of social security numbers when reporting payroll data. An incorrect social

security number may result in the creation of an AE record.

ICON KEY

Application/Form

Attachment

ª See for More Info

! Employers will be assessed the $100 fee every year an individual is not properly enrolled.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 16 of 164

SENATE BILL 375 – ESTIMATED TIMELINE

12

Table 1: Estimated Timeline

Key:

a

AE Reports Distributed – AE reports will be generated and distributed to each participating

employer semi-annually (November & April).

b

November Report Correction Period – Period in which employers may submit the necessary

forms or documentation to properly enroll an individual identified as not enrolled from the

November AE Report prior to fee assessment.

c

April Report Correction Period – Period in which employers may submit the necessary forms

or documentation to properly enroll an individual identified as not enrolled from the April

AE Report prior to fee assessment.

d

Fiscal Year Close AE Report – AE Report effective June 30

TH

. Report will identify individuals

at each participating employer who began employment prior to April 1

ST

, have been

active after May 31

ST

, and who have yet to be enrolled properly. The SRA will bill employers

based on this end of fiscal year report.

e

AE Billing to Employers – The SRA will calculate the administrative fee based upon the

fiscal year end AE report. The administrative fee billing will go out to each applicable

employer annually in August.

f

Billing Due Date – Full payment of the administrative fee invoice will be due no later than 30

days from the invoice date.

Note: Any automatic enrollment record created after the April report will be assessed but

will not be included on the report. This usually occurs when retroactive payroll data is

reported.

12

Subject to change

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

AE Reports Distributed

a

Nov Report Correction Period

b

Apr Report Correction Period

c

FY Close AE Report

d

AE Billing to Employers

e

Billing Due Date

f

EMPLOYER RESPONSIBILITIES: AUTOMATIC ENROLLMENT

9 Employers are responsible for ensuring that all eligible employees are properly enrolled

into the SRPS on a timely basis.

9 Upon receipt of the AE Report, employers should make every effort to contact

employees with an AE status code and resolve the reason for non-enrollment.

9 Employers are responsible for payment of any administrative fees assessed by the SRA

per Senate Bill 375.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 17 of 164

FREQUENTLY ASKED QUESTIONS

Question: What are the consequences if an Application for Membership is not submitted?

Answer: If an Enrollment Form is not submitted for an active employee and payroll data is

being reported, the SRA will contact the employer and the employee in writing.

Should an employee not be properly enrolled into membership, he or she will not

receive an annual Personal Statement of Benefits and any benefits becoming due may

be delayed.

In addition, the SRA is now mandated to assess an administrative fee of $100.00 to

the employer for each eligible individual who is not properly enrolled into the

system. This fee will be assessed each year until an individual is properly enrolled.

Question: How will Senate Bill 375 be administered?

Answer: Senate Bill 375 provides for the imposition of an administrative fee for each eligible

employee that a participating employer fails to promptly enroll into the SRPS.

The SRA will continue to provide semi-annual enrollment reports to each employer.

The reports will reflect those individuals who have payroll data reported, but are not

properly enrolled in the system. The SRA provides these reports to assist employers

to identify those individuals who are not properly enrolled and take corrective action;

however, employers cannot solely rely upon the SRA reports.

Annually in August, the SRA will invoice each employer for those employees who

have not been properly enrolled. Employees who began employment prior to April

1

ST

and who are active after May 31

ST

will be identified as of June 30

TH

as not

enrolled. The invoice will be calculated based upon a June 30

TH

report.

Question: Why are Application for Membership forms sometimes returned to the employer?

Answer: Application for Membership forms are occasionally returned for additional

information or if incomplete or incorrect information was supplied. The SRA will

provide a written explanation as to the reason for return and the required corrective

action. It’s imperative that each employer take immediate corrective action to ensure

that the Application for Membership form is corrected and resubmitted in a timely

manner.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 18 of 164

PAYROLL REPORTING

GENERAL

Employers are responsible for reporting accurate payroll data on a timely

basis to SRA. The payroll data reported by employers is used by SRA to

administer all benefits of the SRPS. SRA is responsible for collecting,

reviewing and reconciling the payroll data, and posting and maintaining

payroll data on our files. The Annotated Code of Maryland and the Code

of Maryland Regulations govern the administration of the plans. To facilitate the reporting of

payroll data, SRA, in accordance with Maryland State law, has developed many policies,

programs, and procedures to control the payroll reporting process. Consistent reporting of

payroll data by all employers based upon these policies, programs, and procedures helps to

ensure the integrity of the data used by SRA and provides for accurate communication to

members and correct payments to retirees and beneficiaries.

IMPORTANT DATES FOR PAYROLL REPORTING

State law mandates that all payroll data be reported to SRA no later than 5 business days after the

pay date, and that all employee contributions are to be remitted no later than the pay date. SRA is

mandated by statute to assess a late charge of $250 for each payroll for which the supporting data

is late and interest on the delinquent late charges at 10% per year if the late charge is not

paid by

the date certified by SRA.

13

Furthermore, for employee contributions which are not paid by the

pay date, the employer is assessed a penalty of 10% of the amounts due and interest on

delinquent amounts at 10% per year until paid.

14

PAY PERIOD ENDING DATE VS. PAY DATE

It is important to define and make a distinction between pay period ending dates and pay dates.

This is especially important since Maryland State law mandates that all payroll data be reported to

SRA no later than 5 business days after the pay date, and that all employee contributions are to

be remitted no later than the pay date.

The pay period ending date is the last day of the payroll period in which the employees worked.

The pay date generally follows the pay period ending date by several days to a week since payroll

centers need time to process the payroll. When you report payroll data to SRA, only include days

up to and including the pay period ending date per your payroll schedule. It is also imperative

that you adhere to the annual payroll schedule you submit to SRA at the end of each fiscal year

for the following fiscal year. SRA processes data based upon pay period ending date and the pay

period ending date also controls to which fiscal year the data is included in our files.

OVERVIEW OF PAYROLL REPORTING REQUIREMENTS

Under Title 22.04.01 of the Code of Maryland Regulations (COMAR), each participating

employer must certify certain payroll information to SRA at the end of each pay period. This

information is also required to be submitted to SRA in an acceptable format. The required

payroll information for each member is as follows:

13

SPP, Ann. MD Code §21-314(d)(2)

14

SPP, Ann. MD Code §21-314(d)(1)

ICON KEY

Application/Form

Attachment

ª See for More Info

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 19 of 164

9 The full name, address, and social security number;

9 The retirement system code and employer agency code;

9 The earnable compensation paid during the pay period;

9 The actual hours worked during the pay period (excluding overtime);

9 The budgeted earnable compensation for the position;

9 The budgeted earnable compensation for the position on an annualized basis, as if the

member is regularly employed to perform the same duties on a full-time basis;

9 The standard hours for the position during the pay period as if the member is regularly

employed to perform the same duties on a full-time basis;

9 The budgeted ratio that the position of employment bears to the standard for a full-time

employee;

9 Employer contributions required (applies to State employees only) on a pay period basis;

9 Member contributions required, if any, during the pay period.

Employers must submit payroll information to SRA in a prescribed electronic format (described

in more detail below) and include the following two forms with their data.

9 Remittance Reconciliation Form for Payroll Data ( )

This form tells us the amount of the cash you are remitting based upon the current pay

period and based upon any adjustments to current or prior payroll data reported.(Cash

based upon current pay period data plus or minus cash for your adjustments must equal

the total amount you are remitting.)

9 Revenue Control Transmittal ( )

This form lists the applicable pay period ending date, your employer agency code, and the

proper system to apply the contributions. This form also lists the type of payment, i.e.,

employee contributions or employer contributions.

DETAILED INFORMATION ON PAYROLL REPORTING ELEMENTS

NAME, ADDRESS, & SSN

It’s important that each payroll submission to SRA contain the correct name, home address, and

social security number of each member.

• Social Security Number – 9 position field

o SRA internal process will identify any social security number on incoming payroll

data which does not match an existing record on our files. In these instances, our

automated system will post that specific incoming payroll data to an AE record.

An AE record is a record that has incoming payroll, however lacks the required

enrollment information. From that point, SRA staff with the employer’s

assistance must determine the proper resolution for the new record; whether due

to an incorrect social security number or a new member.

• Name consists of Last – 17 position field, First – 12 position field, and Middle Initial – 1

position field

o The first, middle initial and last name fields are updated automatically with each

payroll update.

o Any required name change for active employees can be accomplished by simply

changing the required information on your regular payroll data submissions at the

end of each pay period. This new data will automatically update to our files.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 20 of 164

o For inactive employees, the employee may notify SRA by signed letter of the

name change. Documentation, such as a marriage certificate or court order, is

required. The employee’s social security number should be included on any

change of name correspondence.

• Address consists of Street Address – 35 position field, Miscellaneous Address – 35

position field, City – 33 position field, State – 2 position field, Zip Code (First 5) – 5

position field, and Zip Code (Last 4) – 4 position field (optional)

o The address fields on SRA files are updated automatically with each payroll

update.

o Any required address change for active employees can be accomplished by simply

changing the required information on your regular payroll data submissions at the

end of each pay period. This new data will automatically update to our files.

o For inactive employees, the employee may notify SRA by signed letter of his/her

new address. The employee’s social security number or member identification

number should be included on any change of address correspondence.

o Accurate reporting of the home address is especially important. It is the address

on record that is used to distribute a personalized Statement of Benefits to all

active members.

SYSTEM AND AGENCY CODE

• System Code – 1 position field

o The system code designates which individual system the employee is a member

of.

o Each individual system has varying specific plan provisions.

o Listing of individual systems: Code

Teachers’ Retirement System 1

Employees’ Retirement System 2

State Police Retirement System 3

Judicial Retirement System 4

Legislative Retirement System 5

Teachers’ Pension System 6

15

Employees’ Pension System 7

16

Law Enforcement Retirement System 8

Law Enforcement Pension System 9

(Note Codes differ for State Agencies – please refer to MS310 payroll form).

• Location Code – 8 position field

o The Agency code is an 8 digit numeric code which is used to identify each

individual employer.

o First four digits assigned by SRA. The last four digits may be by used by local

participating governmental units or contain state appropriation codes. The last

four digits are generally ‘0000’ if not used by the local participating governmental

units.

15

Includes Teachers’ Retirement Bifurcated Plan.

16

Includes Employees’ Retirement Bifurcated Plan.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 21 of 164

EARNABLE COMPENSATION PAID DURING THE PAY PERIOD

• Pay Period Base Salary – 9 position field

o The Pay Period Base Salary represents the gross recurring salary payable at the

end of each pay period during the fiscal year. For full-time employees this can

generally be determined by taking the gross total salary divided by the total

number of regular pay periods for the fiscal year. However, because it is

calculated on the number of hours worked, for full-time employees working less

than standards hours (for example, in a case of leave without pay) the Pay Period

Base Salary can fluctuate for that pay period. For part-time employees the Pay

Period Base Salary should fluctuate based upon Actual Hours Worked.

o The Pay Period Base Salary should not

include overtime, shift differential, bonus,

summer school wages, etc.

o Reflected as both dollars and cents. Do not

round to the nearest whole dollar.

ACTUAL HOURS WORKED DURING THE PAY PERIOD

• Actual Hours Worked (Paid) – 4 position field

o The Hours Worked field reflects the actual number of hours worked (including

annual, personal, sick, and compensatory hours paid) during the pay period. For

full time and part-time employees, the actual hours worked may not exceed the

Total Standard Hours for the pay period.

o Should not

reflect overtime.

o Should not be greater than Total Standard Hours for the pay period.

BUDGETED EARNABLE COMPENSATION FOR THE POSITION ON AN

ANNUALIZED BASIS

• Annual Earnable Compensation – 7 position field

o The Annual Earnable Compensation represents the total earnable salary on an

annualized basis for a full time position.

o For full-time employees, the Annual Earnable Compensation will equal the Actual

Annual Compensation.

o For part-time employees, the Annual Earnable Compensation will represent the

total amount a full-time employee would earn in that position.

o Full dollars only, round cents to the nearest whole dollar.

• Earnable Compensation includes:

o The employer pickup contribution provided for in SPP §21-313, Ann. MD Code

o Contribution made under a salary reduction or supplemental retirement plan in

accordance with SPP, Title 35, Ann. MD Code. (IRC 414(h)(2))

o Longevity pay (Not lump sum). Must be permanent and continuously paid.

o For a member of the State Police Retirement System, flight pay.

o For a member of the Teachers’ Retirement System or the Teachers’ Pension

System, the compensation paid to the member for performing the member’s

regular job responsibilities during the period of the member’s mandatory

assignment that extends beyond the member’s 10-month assignment in

accordance with the standards and guidelines adopted by the State Superintendent

of Schools.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 22 of 164

• Earnable Compensation does not include:

o Bonuses

o Overtime

o Summer school salaries

o Adult education salaries

o Additional temporary payments from special research projects

o Honorariums

o Vehicle stipends

o Retirement Incentives

o Other payments that the Board of Trustees determines are not part of the normal

salary for working the normal time in the member’s position.

STANDARD HOURS FOR THE POSITION

• Standard Hours – 4 position field

o The Standard Hours field reflects the normal or regular hours for a full time

position during each pay period.

o Should not

reflect overtime.

o Minimum standard hours for a position cannot be less than 30 hours per week for

a teacher or ten month employee or 35 hours per week for a 12 month employee.

BUDGETED RATIO OF EMPLOYMENT

• Percentage of Time – 2 position field

o The Percentage of Time field represents the percentage of budgeted time the

employee is scheduled to work in a position.

o For full time employees, fill with zeros.

o For part time employees, fill with the applicable percentage.

o The Percentage of Time should reflect the budgeted hours compared to the

standard hours.

o Does not fluctuate from pay period to pay period.

MEMBER CONTRIBUTIONS

• Member Contribution – 9 position field

o The Member Contribution field represents the actual contribution amount for the

pay period. Denoted in dollars and cents. Do not

round.

! Example, if an employee is employed on a part-time basis at 50%, the reported Budgeted

Ratio of Employment should be 50% reported for each applicable pay period.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 23 of 164

REPORTING REQUIREMENTS

Each participating employer is required to certify and submit payroll information electronically at

the end of each pay period using our prescribed format described below. We no longer accept

any data files containing social security numbers through regular email. While we do still accept

submission of payroll data on CDs or diskettes, we strongly encourage all employers to use our

secure website (https://www.sra.state.md.us/) for the transmission of payroll data. If you need

assistance preparing your data in the prescribed format, SRA will provide a stand-alone

retirement payroll program free of charge that creates the payroll information file in the correct

electronic format. Otherwise, employers are responsible for submitting the payroll information in

the correct electronic format. For more information on the payroll reporting program please see

Appendix A.

Secure File Upload provides employers the ability to upload retirement payroll data directly to

our website in a secure environment. This online payroll reporting is a safe, secure and efficient

way to submit regular retirement payroll data. If you are interested in reporting your payroll data

utilizing the secure file upload utility please contact the Payroll Collections Supervisor at (410)

625-5697. For more information on utilizing the secure website for payroll reporting, please see

Appendix B.

When submitting payroll data to SRA, please be sure to label all reporting media (disk & upload)

with your SRA assigned employer location code and the applicable pay period ending date (PPE).

Please use a separate disk for each pay period ending date.

Diskettes should be sent to SRA at:

State Retirement Agency

Attn: Data Control – Payroll Section

120 E. Baltimore Street, 15

th

Floor

Baltimore, Maryland 21202-6700

Please be sure to allow several days for regular mail. You may utilize express delivery to reduce

time in transit and improve data security.

ELECTRONIC RECORD FORMAT

Positions

Field Name Field Value & Descriptions

1 - 3 Transaction Code "405" Payroll data transaction

4 - 11* Payroll Period Ending Date Month-Day-Century-Year Ex. "01011999"

12 Space Required

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 24 of 164

Positions Field Name Field Value & Descriptions

13 System Code "1" - Teachers Retirement, "2" - Employees

Retirement, "6" - Teachers Pension, "7" -

Employees Pension, “8” LEOPS Retirement, “9”

LEOPS Pension

(Note: State codes differ – refer to MS310 payroll

form).

14 - 21* Employer Location Code As assigned by the State Retirement Agency

22 - 26 Spaces Required

27 Plan Code “8” identifies members of the Contributory

Pension Plan; “ ” identifies members of the Non-

contributory Pension Plan

28 - 36* Social Security Number Required

37 - 53 Last Name Left justified - space from end of data to end of

field.

54 - 65 First Name Left justified - space from end of data to end of

field.

66 Middle Initial As required.

67 - 73* Actual Annual Compensation

(formerly referred to as Actual

Annual Budgeted Base Salary)

For full-time members this amount equals the

annual earnable compensation. For part-time

members, calculated as member’s annual earnable

compensation multiplied by the percentage of

time. Dollars only.

Example: $12,499.88 per year = 0012500

74 - 82* Employee Contribution

Amount

Dollars & cents of employee contribution amount

withheld for the pay period.

Example: 000002680 represents $26.80

83 - 86* Hours Worked The number of actual hours worked during this

pay period, exclusive of overtime.

Example: 0355 represents 35.5 hours. (implied

decimal point)

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 25 of 164

Positions Field Name Field Value & Descriptions

87 - 90* Standard Hours The number of normal or regular hours for the

full-time equivalent position during this pay

period.

Example: 0710 represents 71.0 hours. (implied

decimal point)

91 - 92* Percentage of Time If the member is a full-time employee, fill with

zeros. If the member is a part-time employee,

enter the budgeted part-time percentage into this

field.

Example: “50" represents 50% of full-time,

“00" = 100% .

93 - 101* Pay Period Base Salary Paid Dollars and cents of actual base earnings for the

pay period, exclusive of overtime, shift-

differential, bonus, summer school wages, etc.

Example: 000085495 represents $854.95.

102 - 108* Annual Earnable

Compensation (Full Time

Equivalent Compensation)

(formerly referred to as

Annualized Full-Time Salary)

For full-time members this amount equals the

actual annual compensation. For part-time

members, calculated as member’s actual annual

compensation divided by the percentage of time.

Dollars only.

Example: $12,499.88 per year = 0012500

109 - 124 Spaces Required

125 - 159 Street Address Required for each payroll (primary address line)

160 - 194 Miscellaneous Address Report as necessary. Overflow address field for

additional miscellaneous home address

information such as Apt. B.

195 - 227 City Required for each payroll

228 - 229 State Required for each payroll

230 - 234* Zip Code - First 5 Must be numeric. Use zeros if foreign or

unknown.

235 - 238* Zip Code - Last 4 Must be numeric. Use zeros if foreign or

unknown.

239 - 250 Spaces Required

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 26 of 164

• Filename must be PAYROLL.

• The record format must be setup as a fixed length 250 character ASCII (DOS TEXT)

file.

• All characters must be upper case (capitalized). Lower case characters are not

recognized

by our automated systems.

• Numeric fields as indicated by an “*” in the position column are right justified and

require leading zeroes to fill out the field column. For example, a pay period ending

January 1, 1999 must be reported as “01011999" and not “10199".

• Non-numeric fields (characters) are left justified and any unused positions for that field

name must have spaces. Do not

truncate fields.

• Do not

include carriage returns or line feeds. The data should be continuous with each

successive 250 character record following the preceding record.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 27 of 164

REPORTING FOR FULL TIME EMPLOYEES

Retirement payroll reporting for full time employees is a fairly straight forward process.

However, there are some general guidelines which can make the process easier.

• Full Time Employees

o The Actual Annual Compensation should always equal the Annual Earnable

Compensation for full time employees

o The Actual Hours Worked includes leave hours, such as sick and annual leave,

and compensatory time. However, Total Hours Worked may not exceed Total

Standard Hours.

o Do not report payroll data for members who do not work during the summer

months unless the member elects to receive wage payments during the summer.

For these employees, report zero actual and zero standard hours. Report the

appropriate base bi-weekly pay, actual annual earnable compensation (full-time

equivalent), and any employee contributions due in accordance with your pay

schedule.

o There are a minimum number of standard hours for full time employees. If the

member does not work the minimum number of hours, the employee is

considered part-time and should be reported as a part-time employee. The

minimum number of standard hours for the Teachers’ Systems and the

Employees’ Systems for 10 month employees is 30 standard hours per week. All

other systems, State Police, Legislative, Judges, and Law Enforcement Officers’

have a minimum of 35 standard hours per week.

o Actual hours worked may not exceed the number of standard hours.

o Members do not receive service credit for unworked periods unless the member

files for and is granted a board approved leave of absence (046, ) and upon

completion of the leave, the member requests to purchase the leave period

(026, ). The member must pay any payroll contributions that would have

been due had the member been working plus interest to the billing date.

o Do not report payroll data during the period a member is on a board qualified

approved leave of absence unless the member returns to work before the leave

expiration date.

o For members who have non-contributory pay periods, SRA requires

payroll data

to be reported for each non-contributory pay period. Report zeroes in the

contribution field.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 28 of 164

Example A (Member works 12 months.)

Actual Salary: $52,000

Earnable Salary: $52,000

Cont Rate: 5%

17

# of Pays: 26

# of Contributory Pays: 26

In this example of full time employment, the following is an example of what should be reported

on a biweekly basis:

PPED

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

10/05/09 52000 100.00 70.0 70.0 00 2000.00 52000

Annual payroll data totals in SRA’s records would appear as follows for this employee:

Month

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

Jul $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Aug $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Sept $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Oct $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Nov $52,000 $300.00 210.0 210.0 00 $6,000.00 $52,000

Dec $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Jan $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Feb $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Mar $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Apr $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

May $52,000 $200.00 140.0 140.0 00 $4,000.00 $52,000

Jun $52,000 $300.00 210.0 210.0 00 $6,000.00 $52,000

Total: $2,600.00 1,820.0 1,820.0

Note the following in the example above:

• Actual Annual Compensation equals Actual Earnable Compensation

• Hours Worked equal Standard Hours (example assumes no leave without pay).

• Overtime hours are not

reported.

• Minimum Standard Hours for a 12 month employee are 35 hours per week.

• Percentage of Time is 100% (reported as 00).

• Pay Period Base Salary does not

fluctuate except for the months of November and June,

which have 3 pay period ending dates. (Reminder – Pay Period Base Salary can fluctuate

for a full-time employee if the employee is on leave without pay).

17

Alternate Contributory Pension System

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 29 of 164

Example B (Member is a ten month employee who receives payments over a ten month period):

Actual Salary: $45,000

Earnable Salary: $45,000

Cont Rate: 5%

18

# of Pays: 20

19

# of Contributory Pays: 20

In this example of full time employment, the following is an example of what should be reported

on a biweekly basis:

PPED

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

10/05/09 45000 112.50 60.0 60.0 00 2250.00 45000

Annual payroll data totals in SRA’s records would appear as follows for this employee:

Month

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

Jul

Aug

Sept $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Oct $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Nov $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Dec $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Jan $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Feb $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Mar $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Apr $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

May $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Jun $45,000 $225.00 120.0 120.0 00 $4,500.00 $45,000

Total: $2,250.00 1,200.00 1,200.00

Note the following in the example above:

• Actual Annual Compensation equals Actual Earnable Compensation

• Hours Worked equal Standard Hours (example assumes no leave without pay).

• Overtime hours are not

reported.

• Minimum Standard Hours for a teacher or 10 month employee are 30 hours per week.

• Percentage of Time is 100% (reported as 00).

• Pay Period Base Salary does not fluctuate. (Reminder – Pay Period Base Salary can

fluctuate for a full-time employee if the employee is on leave without pay).

18

Alternate Contributory Pension System

19

10 Month System. Does not receive payments during July or August.

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 30 of 164

Example C (Member is a ten month employee who receives payments over twelve months):

Actual Salary: $45,000

Earnable Salary: $45,000

Cont Rate: 5%

20

# of Pays: 24

# of Contributory Pays: 20

In this example of full time employment, the following is an example of what should be reported

on a biweekly basis (July and August):

PPED

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

7/13/09 45000 0.00 0.0 0.0 00 1875.00 45000

Annual payroll data totals in SRA’s records would appear as follows for this employee:

Month

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

Jul $45,000 $.00 0.0 0.0 00 $3,750.00 $45,000

Aug $45,000 $.00 0.0 0.0 00 $3,750.00 $45,000

Sept $45,000 $225.00 120 120 00 $3,750.00 $45,000

Oct $45,000 $225.00 120 120 00 $3,750.00 $45,000

Nov $45,000 $225.00 120 120 00 $3,750.00 $45,000

Dec $45,000 $225.00 120 120 00 $3,750.00 $45,000

Jan $45,000 $225.00 120 120 00 $3,750.00 $45,000

Feb $45,000 $225.00 120 120 00 $3,750.00 $45,000

Mar $45,000 $225.00 120 120 00 $3,750.00 $45,000

Apr $45,000 $225.00 120 120 00 $3,750.00 $45,000

May $45,000 $225.00 120 120 00 $3,750.00 $45,000

Jun $45,000 $225.00 120 120 00 $3,750.00 $45,000

Total: $2,250.00 1,200.00 1,200.00

Note the following in the example above:

• Actual Annual Compensation equals Actual Earnable Compensation

• Hours Worked equal Standard Hours (example assumes no leave without pay).

• Overtime hours are not

reported.

• Minimum Standard Hours for a 10 month employee are 30 hours per week.

• Percentage of Time is 100% (reported as 00).

• Pay Period Base Salary does not fluctuate. (Reminder – Pay Period Base Salary can

fluctuate for a full-time employee if the employee is on leave without pay).

• Payroll data is reported in July and August because although this individual does not

work

during those months, they do receive regular payments during these months.

20

Alternate Contributory Pension System

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 31 of 164

Example D (Member in a non-contributory plan):

Actual Salary: $20,000

Earnable Salary: $20,000

Cont Rate: 0% (Paid Below Social Security Taxable Wage Base)

# of Pays: 26

In this example of full time employment, the following is an example of what should be reported

on a biweekly basis:

PPED

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

7/13/09 20000 0.00 80.0 80.0 00 769.23 20000

Annual payroll data totals in SRA’s records would appear as follows for this employee:

Month

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

Jul $20,000 0.00 160 160 00 $1,538.46 $20,000

Aug $20,000 0.00 160 160 00 $1,538.46 $20,000

Sept $20,000 0.00 160 160 00 $1,538.46 $20,000

Oct $20,000 0.00 160 160 00 $1,538.46 $20,000

Nov $20,000 0.00 240 240 00 $2,307.69 $20,000

Dec $20,000 0.00 160 160 00 $1,538.46 $20,000

Jan $20,000 0.00 160 160 00 $1,538.46 $20,000

Feb $20,000 0.00 160 160 00 $1,538.46 $20,000

Mar $20,000 0.00 160 160 00 $1,538.46 $20,000

Apr $20,000 0.00 160 160 00 $1,538.46 $20,000

May $20,000 0.00 160 160 00 $1,538.46 $20,000

Jun $20,000 0.00 240 240 00 $2,307.69 $20,000

Total: $0.00 2,080.00 2,080.00

Note the following in the example above:

• Actual Annual Compensation equals Actual Earnable Compensation

• A contribution amount must be reported even when the employee’s year-to-date salary

does not exceed the Social Security Taxable Wage Base. The contribution amount

reported is $0.00.

• Hours Worked equal Standard Hours (example assumes no leave without pay).

• Overtime hours are not reported.

• Percentage of Time is 100% (reported as 00).

• Pay Period Base Salary does not

fluctuate except for the months of November and June,

which have 3 pay period ending dates. (Reminder – Pay Period Base Salary can fluctuate

for a full-time employee if the employee is on leave without pay).

EMPLOYER EDUCATION MANUAL REV: MAY 2010

Employer Use Only Page 32 of 164

Example E (Member works 12 months and has salary change during year.)

Actual Salary: $60,000

Earnable Salary: $60,000

Cont Rate: 5%

21

# of Pays: 26

# of Contributory Pays: 26

In this example of full time employment, the employee was promoted effective with the first pay

period of March 2009.

In this example of full time employment, the following is an example of what should be reported

on a biweekly basis for the last pay in February and first pay in March):

PPED

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

02/16/09 60000 115.38 80.0 80.0 00 2307.69 60000

03/02/09 65000 125.00 80.0 80.0 00 2500.00 65000

Annual payroll data totals in SRA’s records would appear as follows for this employee:

Month

Actual Annual

Compensation Contribution

Hours

Worked

Hours

Standard

% of

Time

Pay

Period

Base

Salary

Actual

Earnable

Compensation

Jul $60,000 $230.76 160 160 00 $4,615.38 $60,000

Aug $60,000 $230.76 160 160 00 $4,615.38 $60,000

Sept $60,000 $230.76 160 160 00 $4,615.38 $60,000

Oct $60,000 $230.76 160 160 00 $4,615.38 $60,000

Nov $60,000 $346.14 240 240 00 $6,923.07 $60,000

Dec $60,000 $230.76 160 160 00 $4,615.38 $60,000

Jan $60,000 $230.76 160 160 00 $4,615.38 $60,000

Feb $60,000 $230.76 160 160 00 $4,615.38 $60,000

Mar $65,000 $250.00 160 160 00 $5,000.00 $65,000

Apr $65,000 $250.00 160 160 00 $5,000.00 $65,000

May $65,000 $250.00 160 160 00 $5,000.00 $65,000

Jun $65,000 $375.00 240 240 00 $7,500.00 $65,000

Total: $3,086.46 2,080 2,080

Note the following in the example above:

• Actual Annual Compensation, Contribution, Pay Period Base Salary, and Actual Earnable