SPECIAL REPORT

2024 US Footwear and Apparel Brand

Heat Index

2 L.E.K. Consulting

SPECIAL REPORT

Contents

About L.E.K. Consulting

We’re L.E.K. Consulting, a global strategy consultancy working with business leaders to seize competitive advantage and

amplify growth. Our insights are catalysts that reshape the trajectory of our clients’ businesses, uncovering opportunities and

empowering them to master their moments of truth. Since 1983, our worldwide practice — spanning the Americas, Asia-Pacific

and Europe — has guided leaders across all industries from global corporations to emerging entrepreneurial businesses and

private equity investors. Looking for more? Visit www.lek.com.

L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document

are properties of their respective owners. © 2024 L.E.K. Consulting LLC

About the Brand Heat Index ............................................................................. ..3

Footwear ................................................................................................................5

Athletic footwear .............................................................................................6

Casual footwear............................................................................................. 8

Outdoor/rugged footwear .......................................................................... 10

Dress footwear ................................................................................................11

Apparel .................................................................................................................. 13

Athletic clothing..............................................................................................14

Casual clothing ...............................................................................................16

Outdoor clothing ............................................................................................ 17

Dress clothing .................................................................................................18

Conclusion ............................................................................................................ 21

About the Authors ..............................................................................................22

SPECIAL REPORT

About the Brand Heat Index

Each generation has unique perspectives on the brands they desire and the factors

that are most important to them in making brand purchase decisions. L.E.K.

Consulting’s third annual Brand Heat Index reveals which brands are gaining

popularity (i.e., increasing their brand “heat”) across major product categories in

women’s and men’s footwear and apparel, and it uniquely identifies how “brand

heat” diers by generational cohort. The insight provided by the Brand Heat Index is

intended to bring a more nuanced view to brand trajectory and what drives it, which

should ultimately enhance strategic decision-making.

The Brand Heat Index is based on a survey of nearly 4,000 U.S. consumers between

the ages of 14 and 55. Within product categories and generational cohorts, each

brand earns a heat score expressed on a scale of 0-100 — the higher the score, the

hotter the brand. Notably, the Brand Heat Index identifies brands that are on the

steepest positive trajectory with shoppers, not necessarily their relative size or scale.

The survey gathers feedback on brands across four product categories: athletic,

casual, outdoor/rugged

1

and dress.

Category definitions

Use case

category

Footwear examples Apparel examples

Athletic

Running shoes, cross-trainers, basketball shoes,

cleats

Performance tops, athletic shorts, joggers, leggings,

surf/skate clothing

Casual

Sandals, slip-ons, casual flats, casual sneakers,

chukka boots

Denim, cotton T-shirts, sweaters, Oxford shirts, khakis

Outdoor/

rugged

Hiking boots, trail shoes, winter boots

Hiking clothes, fishing clothes, fleeces,

performance jackets

Dress Heels, loafers, Oxfords Suits, dresses

Performance in this year’s Brand Heat Index revealed several noteworthy trends:

• Consumers continue to demand a lot from footwear and apparel brands. While

comfort is a top purchase criterion across most footwear and apparel categories,

brand reputation and style are most oen cited as the drivers of a brand’s

popularity. In order to succeed, apparel and footwear businesses not only need

3 L.E.K. Consulting

SPECIAL REPORT

appealing form and function but must also drive true anity and engagement with

the brand above and beyond the product itself.

• This year, legacy brand leaders continue to feel the heat from relative newcomers,

suggesting these emerging brands have staying power. Aer initially surpassing

Nike last year, On Running remains on top in women’s athletic footwear, while

lululemon is closing the gap versus Nike in women’s athletic apparel (with HOKA

and alo not far behind in their respective categories). The shake-up isn’t just in the

athletic space, as Reformation has now replaced Michael Kors as the top brand in

women’s dress apparel.

• Fast fashion continues its strength in casual apparel, with SHEIN and UNIQLO

being joined by new names like Princess Polly and Cider. Social media and digital

marketing have catalyzed these brands’ rise to the top, which has prompted other

brands (e.g., Steve Madden, UGG, Tommy Hilfiger) to develop similar strategies,

creating a resurgence with younger generations.

• Importantly, brand heat scores can vary meaningfully across genders and

generations. For example, Cole Haan and Ariat have much stronger performance in

men’s footwear than in women’s footwear, while UGG performs dierentially well

with women. From a generational perspective, Vionic, OOFOS and Skechers are in

the top 10 with Generation X but don’t have the same appeal among members of

younger generations.

In the data that follows, the top 10 footwear and apparel brands are ranked by their

heat scores within each product category — both in total and by generational cohort.

How does your brand stack up?

4 L.E.K. Consulting

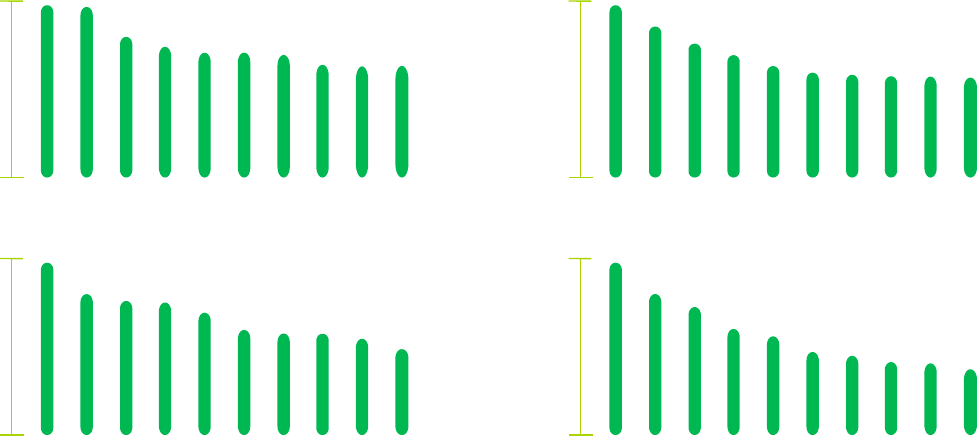

Source: L.E.K. 2024 U.S. Footwear and Apparel Brand Heat Index

Figure 1

Women’s footwear

Figure 1

Women’s footwear

Women’s athletic footwear — Top 10

Women’s dress footwear — Top 10

Brands ranked on a scale of 1-100

On Running

Nike

HOKA

Jordan

adidas

Under Armour

New Balance

NOBULL

Brooks

Reebok

100

100

0

91

89

65

60

51

49

45

39

35

Michael Kors

Steve Madden

Coach

Calvin Klein

kate spade

GUESS

Schutz

Kurt Geiger

Jeffrey Campbell

Vince Camuto

100

100

0

97

94

85

84

58

58

55

52

52

HEYDUDE

Crocs

UGG

Vans

Converse

OluKai

BIRKENSTOCK

Dr. Martens

VEJA

Timberland

100

100

0

76

74

57

55

48

44

43

41

39

Women’s outdoor/rugged footwear — Top 10

Women’s casual footwear — Top 10

UGG

Columbia

Arc'teryx

Chaco

Teva

SOREL

Ariat

Hunter Boots

L.L.Bean

BEARPAW

100

100

0

73

55

55

43

42

39

38

33

32

SPECIAL REPORT

In 2024, competition in the footwear space has become increasingly fierce, with

brand heat scores tightly packed among the leading brands, even in categories (such

as athletic footwear) where legacy players have historically had dominant positions

(see Figures 1 and 2).

Some leaders show consistent strength across genders. HEYDUDE, for example, is still

the hottest casual footwear brand for both men and women, while Nike is a top-two

athletic footwear brand across genders. In dress footwear, Steve Madden is No. 1 and

No. 2 for men’s and women’s, respectively, and is also the only brand to appear in both

lists. In general, women appear to be more excited by emerging brands, with On Running,

HOKA, VEJA, Schutz and others performing more strongly among women than men.

Footwear

5 L.E.K. Consulting

Figure 2

Men’s footwear

Men’s athletic footwear — Top 10

Men’s dress footwear — Top 10

Brands ranked on a scale of 1-100

Nike

Jordan

adidas

Under Armour

On Running

HOKA

New Balance

Champion

PUMA

Reebok

100

100

0

86

70

62

61

58

49

42

41

33

Steve Madden

Tommy Hilfiger

Kenneth Cole

Cole Haan

Ferragamo

HUGO BOSS

Stacy Adams

Beckett Simonon

Sandro Moscoloni

ALDO

100

100

0

98

78

73

73

68

67

59

58

58

HEYDUDE

Timberland

Crocs

Vans

Converse

Polo Ralph Lauren

UGG

Skechers

BIRKENSTOCK

Justin

100

100

0

87

84

78

67

55

52

50

48

47

Men’s outdoor/rugged footwear — Top 10

Men’s casual footwear — Top 10

Timberland

Columbia

Ariat

Arc'teryx

UGG

Cat Footwear

Merrell

Red Wing Shoes

KEEN

L.L.Bean

100

100

0

99

67

65

62

55

51

47

36

33

Figure 2

Men’s footwear

Source: L.E.K. 2024 U.S. Footwear and Apparel Brand Heat Index

SPECIAL REPORT

Athletic footwear

In athletic footwear, a similar cohort of brands rises to the top for both men and

women. Out of the 10 most popular brands for each gender, eight are the same.

However, these brands do not have the same appeal across genders, as their rankings

dier considerably. For example, On Running is the top brand for women but only fih

for men. The most notable changes in the athletic footwear market have been driven

by Generation Z — On Running and HOKA are lauded by this generation for their

comfort, while New Balance’s success is driven by its on-trend style.

In women’s athletic footwear, we see a story similar to last year, with On Running, Nike

and HOKA again taking the top three spots. The competition between On Running

and Nike has been fierce, as they have traded top spots across generations. This year,

On Running leads in Gen Z and Gen X, with both rankings driven by comfort, while

Nike leads with millennials due to its brand reputation and style. On Running, Nike

and HOKA have now created a material gap between themselves and the remainder

of the competition. Jordan and adidas, on the other hand, have maintained their

positions at No. 4 and No. 5, respectively, but have seen declining heat scores overall.

6 L.E.K. Consulting

SPECIAL REPORT

The men’s athletic footwear rankings also show a story similar to last year, but this

consumer is a bit slower to adopt emerging brands. Instead, Nike, Jordan, adidas and

Under Armour again take the top four spots (in that order). NOBULL fell out of the top

10 overall, though it still remains popular among Gen X, while Reebok’s comeback with

younger generations brought it into the top 10 this year (see Figures 3 and 4).

Source: L.E.K. survey and analysis

Figure 3

Women’s athletic footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 On Running 100 On Running 100 Nike 100 On Running 100

2 Nike 91 Nike 96 On Running 93 HOKA 89

3 HOKA 89 HOKA 95 HOKA 80 Nike 69

4 Jordan 65 Jordan 82 Jordan 70 NOBULL 56

5 adidas 60 New Balance 68 adidas 67 adidas 49

6 Under Armour 51 adidas 63 Under Armour 57 Under Armour 48

7

New Balance 49 Tretorn 51 New Balance 49 Jordan 43

8 NOBULL 45 Under Armour 50 NOBULL 43 New Balance 38

9 Brooks 39 Brooks 47 PUMA 42 Brooks 37

10 Reebok 35 Reebok 43 Brooks 40 Reebok 30

Source: L.E.K. survey and analysis

Figure 4

Men’s athletic footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Nike 100 Nike 100 Nike 100 Nike 100

2 Jordan 86 Jordan 91 Jordan 87 HOKA 94

3 adidas 70 adidas 66 adidas 72 On Running 86

4 Under Armour 62 New Balance 51 Under Armour 65 Jordan 78

5 On Running 61 Under Armour 49 On Running 58 Under Armour 77

6 HOKA 58

HOKA

On Running

47

PUMA 49 adidas 75

7

New Balance 49 Champion 48 New Balance 61

8 Champion 42 Champion 45 New Balance 45 PUMA 43

9 PUMA 41 PUMA 37 HOKA 42 Champion 39

10 Reebok 33 Reebok 33 Reebok 36 NOBULL 37

7 L.E.K. Consulting

SPECIAL REPORT

Casual footwear

In casual footwear, brands with distinctive and identifiable silhouettes are the

hottest. HEYDUDE leads in popularity for both men and women, while six other

brands also appear in the top 10 lists for both genders. Notably, Allbirds fell out of the

top 10 for both men and women.

HEYDUDE once again takes the top spot in women’s casual footwear, followed by its

owner, Crocs. HEYDUDE is No. 1 among both millennials and Gen X and No. 3 among

Gen Z. Crocs earns its highest scores among Gen Z and millennials and has improved

its score with Gen X. UGG has climbed in the rankings to No. 3 overall due to its blend

of comfort and style, particularly among Gen Z, where it takes the No. 1 spot. Vans

and Dr. Martens have fallen down the list compared to last year (from No. 3 and No. 6,

respectively), suggesting some cooling o. VEJA, meanwhile, continues its rise, to No.

9; while it performs most strongly with Gen X, it has shown the greatest gains with

Gen Z, which cites its style as being particularly relevant.

HEYDUDE also remains in first place overall in men’s casual footwear and still holds the

No. 1 spot with Gen X. Crocs’ overall brand heat score saw further growth versus last

year, with increases among Gen Z (where it took No. 1) and millennials; Crocs remains in

the No. 3 position overall. Timberland moved into second place overall (from fourth last

year), replacing Vans and taking first place among millennials. Despite Vans’ improved

brand heat score versus last year, its slippage in the rankings was driven by the strength

of the category leaders. Meanwhile, BIRKENSTOCK is new to the men’s list and takes

the No. 9 spot due to strength with Gen Z and millennials, who recognize the brand for

its quality. While Skechers is only No. 8 overall, it vastly overperforms within Gen X, who

appreciates it for its comfort and durability (see Figures 5 and 6).

8 L.E.K. Consulting

SPECIAL REPORT

Source: L.E.K. survey and analysis

Figure 5

Women’s casual footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 HEYDUDE 100 UGG 100 HEYDUDE 100 HEYDUDE 100

2 Crocs 76 Crocs 96 Crocs 82 Skechers 61

3 UGG 74 HEYDUDE 81 Vans 70 OluKai 60

4 Vans 57 Converse 77 UGG 68 UGG 57

5 Converse 55 Dr. Martens 71 Converse 65 OOFOS 54

6 OluKai 48 Vans 62 BIRKENSTOCK 57 VEJA 49

7

BIRKENSTOCK 44

VEJA

BIRKENSTOCK

58

Dr. Martens 53 Crocs 48

8 Dr. Martens 43 Timberland 51 Kizik 47

9 VEJA 41 Calvin Klein 48 Blowfish 44 Rothy’s 40

10 Timberland 39 Timberland 46 Skechers 43 Vans 39

Source: L.E.K. survey and analysis

Figure 6

Men’s casual footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 HEYDUDE 100 Crocs 100 Timberland 100 HEYDUDE 100

2 Timberland 87 HEYDUDE 87 Crocs 95 Skechers 76

3 Crocs 84 Vans 74 HEYDUDE 88 Timberland 66

4 Vans 78 Timberland 69 Vans 82 Vans 61

5 Converse 67 UGG 67

Polo Ralph Lauren

Converse

80

Vionic 54

6 Polo Ralph Lauren 55 Converse 61 Converse 53

7

UGG 52 BIRKENSTOCK 59 BIRKENSTOCK 67 OluKai 50

8 Skechers 50 Vionic 57

Tommy Hilfiger

Lacoste

66

Allbirds

Justin

43

9 BIRKENSTOCK 48 Polo Ralph Lauren 54

10 Justin 47 Justin 52 Skechers 65 Vince 41

9 L.E.K. Consulting

SPECIAL REPORT

Outdoor/rugged footwear

In 2024, the outdoor category was expanded to outdoor/rugged to reflect the

lifestyle and outdoor use cases of more durable, workwear-type footwear. The range

of performance across top 10 brands in outdoor/rugged footwear is quite large,

suggesting lower excitement on the part of the consumer beyond the leading players.

Viewed through the lens of gender, UGG, Columbia and Arc'teryx appear in the top

five brands for both men and women, while the others vary. Ariat makes its debut

on both lists, at No. 3 in men’s and No. 7 in women’s, due to its reputation as quality

western wear and its recent expansion into work footwear.

UGG takes the top spot for women overall by a wide margin (27 points), particularly

dominating among Gen Z (where it nearly doubles the score of second-place

Arc'teryx), though Columbia slightly outpaces it among millennials. Versatile

footwear/sandals are in, with Chaco and Teva near the top of the overall list and

KEEN tied for third among Gen X. Rain boots are less popular, especially with Gen Z,

as Hunter Boots fell down the list and Muck Boots fell o the list entirely.

Men’s outdoor footwear is dominated by work brands, with Timberland leading the

way and Ariat, Cat and Red Wing all showing up in the top 10. While Timberland and

Columbia show strength across generations (always staying in the top three), UGG

is dierentially popular among Gen Z, while Merrell and L.L.Bean are dierentially

popular among Gen X (see Figures 7 and 8).

Source: L.E.K. survey and analysis

Figure 7

Women’s outdoor/rugged footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 UGG 100 UGG 100 Columbia 100 UGG 100

2 Columbia 73 Arc'teryx 56 UGG 97 Columbia 80

3

Arc'teryx

Chaco

55

Teva 54 Chaco 86

KEEN

Ariat

69

4 Columbia 46 Hunter Boots 73

5 Teva 43 Chaco 38

Arc'teryx

SOREL

72

Muck Boots 63

6 SOREL 42 Danner 36 Black Diamond 53

7

Ariat 39 REEF 35 BEARPAW 53 Teva 52

8 Hunter Boots 38 L.L.Bean 31 Salomon 51 Merrell 51

9 L.L.Bean 33 Merrell 30 Teva 47 Hunter Boots 50

10 BEARPAW 32 Ariat 28 Helly Hansen 45 Cat Footwear 49

10 L.E.K. Consulting

SPECIAL REPORT

Dress footwear

In dress footwear, the top 10 brands are quite varied across genders. Steve Madden is

No. 1 and No. 2 on both lists, but no other brands repeat.

While the leaders in women’s dress footwear are fairly consistent with prior years, the

competition is hot, with the top five brands separated by just 15 points. Michael Kors,

Steve Madden and Coach again take the top three spots, followed by established

brands Calvin Klein and kate spade; style and brand appeal are king in this category,

so the top players make sense. Upstart brands Schutz and Kurt Geiger make the top

10 list for the first time this year, scoring particularly well with millennials, while Vince

Camuto performs strongly with Gen X — coming in at No. 2 — but doesn’t make the

top 10 in any other generation.

In men’s, the largest change has been the drop of industry leader Cole Haan to No.

4 from No. 1 overall, driven by decidedly poor performance with Gen Z. Meanwhile,

Steve Madden and Tommy Hilfiger take over the top two spots (up from No. 7 and No.

11, respectively) due to their respective brand reputations and evolving, diverse styles.

However, it’s fair to say the dress footwear category as a whole isn’t overly popular

with Gen Z men, as evidenced by its material awareness of only 10 brands; this is likely

a result of the casualization trend, which predominates among younger generations

and was amplified by the shi to work-from-home.

Source: L.E.K. survey and analysis

Figure 8

Men’s outdoor/rugged footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Timberland 100 UGG 100 Columbia 100 Timberland 100

2 Columbia 99 Timberland 99 Timberland 95 Columbia 97

3 Ariat 67 Columbia 93 Arc'teryx 85 Merrell 77

4 Arc'teryx 65 Red Wing Shoes 69 Ariat 82 Cat Footwear 72

5 UGG 62 Arc'teryx 67 Red Wing Shoes 54

KEEN

Ariat

64

6 Cat Footwear 55 Cat Footwear 57 UGG 52

7

Merrell 51 Ariat 56 Cat Footwear 50 L.L.Bean 55

8 Red Wing Shoes 47 KEEN 49 Black Diamond 42 SOREL 52

9 KEEN 36 L.L.Bean 45 Danner 41

Salomon

Black Diamond

51

10 L.L.Bean 33 Merrell 44 Merrell 38

11 L.E.K. Consulting

SPECIAL REPORT

Source: L.E.K. survey and analysis

Figure 9

Women’s dress footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Michael Kors 100 Steve Madden 100 Michael Kors 100 Michael Kors 100

2 Steve Madden 97 Coach 86 Steve Madden 96 Vince Camuto 73

3 Coach 94 kate spade 81 Coach 95 Coach 72

4 Calvin Klein 85 Michael Kors 76 Calvin Klein 88 Calvin Klein 71

5 kate spade 84 Calvin Klein 70 kate spade 84 Cole Haan 67

6

GUESS

Schutz

58

Jerey Campbell 64 GUESS 66

Steve Madden

Sam Edelman

62

7

Franco Sarto 58 Schutz 59

8 Kurt Geiger 55 Sam Edelman 56 Kurt Geiger 57 kate spade 59

9

Jerey Campbell

Vince Camuto

52

Kurt Geiger 51 Seychelles 55 Nine West 54

10 Dolce Vita 49 Marc Fisher 51 Kenneth Cole 52

Source: L.E.K. survey and analysis

Figure 10

Men’s dress footwear — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Steve Madden 100 Tommy Hilfiger 100 Steve Madden 100 Steve Madden 100

2 Tommy Hilfiger 98 Steve Madden 61 Cole Haan 95 Kenneth Cole 91

3 Kenneth Cole 78 Kenneth Cole 58 Tommy Hilfiger 89 Bruno Magli 88

4

Cole Haan

Ferragamo

73

Ferragamo 57 Ferragamo 75 Cole Haan 76

5

ALDO

HUGO BOSS

49

Stacy Adams 71 ALDO 72

6 HUGO BOSS 68 HUGO BOSS 66 Tommy Hilfiger 69

7

Stacy Adams 67 Stacy Adams 44 Kenneth Cole 65 HUGO BOSS 68

8 Sandro Moscoloni 59 Alden 38 Sandro Moscoloni 63 Joseph Abboud 67

9

Beckett Simonon

ALDO

58

Johnston & Murphy 16 Beckett Simonon 58 Stacy Adams 64

10 Cole Haan 0 Unlisted 57 Unlisted 62

12 L.E.K. Consulting

SPECIAL REPORT

There are several key trends in apparel this year. The usual suspects in fast fashion

(e.g., SHEIN, Fashion Nova) still dominate in casual clothing, though several other

fast fashion players have risen through the ranks (e.g., UNIQLO, Princess Polly, Cider).

Workwear brands (e.g., Carhartt, Levi’s, Duluth Trading Co.) have sustained popularity

in casual clothing, while the outdoor category has seen an increasing number of

specialized technical apparel brands in the top 10 (e.g., Ariat, Huk, Salt Life, Pelagic).

As in footwear, a handful of apparel brands demonstrate consistently strong

performance across genders and generations. Nike is the top athletic apparel brand

for both men and women, while The North Face, Columbia and Patagonia make up

the top three in both women’s and men’s outdoor apparel. Casual and dress apparel

show more brand variation across genders, but SHEIN, Carhartt, Michael Kors and

Calvin Klein exhibit broad appeal (see Figures 11 and 12).

Apparel

Source: L.E.K. 2024 U.S. Footwear and Apparel Brand Heat Index

Figure 11

Women’s clothing

Figure 3

Women’s clothing

Women’s athletic clothing — Top 10

Women’s dress clothing — Top 10

Brands ranked on a scale of 1-100

Nike

lululemon

alo

adidas

Gymshark

Fabletics

Under Armour

Athleta

Alphalete

Vuori

100

100

0

99

82

76

72

72

71

66

64

64

Reformation

Michael Kors

Calvin Klein

Lulus

kate spade

GANNI

Cleobella

Susana Monaco

retrofete

Theory

100

100

0

82

78

78

71

61

59

59

56

50

SHEIN

SKIMS

Carhartt

Fashion Nova

Aritzia

Levi’s

Cider

PrettyLittleThing

ZARA

Princess Polly

100

100

0

87

78

71

65

61

60

59

59

58

Women’s outdoor clothing — Top 10

Women’s casual clothing — Top 10

The North Face

Patagonia

Columbia

Ariat

Moose Knuckles

Arc'teryx

MACKAGE

Cotopaxi

Sherpa

L.L.Bean

100

100

0

82

75

61

57

48

46

42

42

38

13 L.E.K. Consulting

SPECIAL REPORT

Athletic clothing

There is meaningful overlap in the leading brands across genders in athletic clothing.

Nike comes in as the top brand in both men’s and women’s athletic clothing while

eight of the top 10 brands overlap in both lists.

In women’s athletic clothing, lululemon continues to inch closer to Nike atop the

list, with both brands benefiting from their strong brand reputation and on-trend

style. Newer brand alo moved ahead of adidas this year into the No. 3 spot, with

Gymshark and Fabletics in close pursuit — all of them driven by strong reputations

and savvy marketing (e.g., social media, influencer promotions), leading to high

scores among Gen Z. Athleta is back in the top 10 aer narrowly missing inclusion

last year, driven by its strength with Gen X (where it is No. 2), which appreciates its

aesthetic and comfort.

In men’s athletic clothing, legacy brands Nike, adidas and Under Armour are hotter

than in women’s athletic clothing, making up the top three brands; there is a

significant drop-o aer these three, indicating relatively lower competition/true

Source: L.E.K. 2024 U.S. Footwear and Apparel Brand Heat Index

Figure 12

Men’s clothing

Figure 4

Men’s clothing

Men’s athletic clothing — Top 10

Men’s dress clothing — Top 10

Brands ranked on a scale of 1-100

Nike

Under Armour

adidas

Gymshark

Champion

lululemon

Vuori

PUMA

alo

Fabletics

100

100

0

73

73

51

48

47

38

37

34

33

Calvin Klein

Michael Kors

Emporio Armani

Tommy Hilfiger

HUGO BOSS

Ted Baker

Kenneth Cole

Banana Republic

Theory

Perry Ellis

100

100

0

86

85

81

65

60

58

52

47

47

Carhartt

Levi’s

SHEIN

Polo Ralph Lauren

UNIQLO

Duluth Trading Co.

Dickies

Superdry

Peter Millar

Wrangler

100

100

0

79

66

62

58

51

48

48

48

46

Men’s outdoor clothing — Top 10

Men’s casual clothing — Top 10

The North Face

Patagonia

Columbia

Oakley

Arc'teryx

Salt Life

Huk

Ariat

Smartwool

Helly Hansen

100

100

0

76

73

47

43

43

39

38

36

36

14 L.E.K. Consulting

SPECIAL REPORT

dominance in the category. lululemon has jumped up a spot to No. 6 and continues to

make strides with Gen Z in particular. Vuori and alo are the big gainers this year, rising

to No. 7 and No. 9, respectively, with both brands performing more strongly among

millennials and Gen X, primarily due to comfort and brand reputation. As with athletic

footwear, PUMA and Champion make the top 10 for men’s but not women’s athletic

clothing (see Figures 13 and 14).

Source: L.E.K. survey and analysis

Figure 13

Women’s athletic clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Nike 100 lululemon 100 Nike 100 lululemon 100

2 lululemon 99 Nike 94 lululemon 86 Athleta 94

3 alo 82 alo 82 adidas 84

Under Armour

Vuori

89

4 adidas 76 Gymshark 77 Under Armour 75

5

Gymshark

Fabletics

72

Alphalete 75

Fabletics

Champion

71

alo 88

6 Fabletics 69 Nike 86

7

Under Armour 71 adidas 65 alo 65 Fabletics 72

8 Athleta 66 Champion 54 Vuori 64 adidas 68

9

Alphalete

Vuori

64

Athleta 51 Gymshark 62 32 Degrees 67

10 Under Armour 49 Athleta 60 Reebok 54

Source: L.E.K. survey and analysis

Figure 14

Men’s athletic clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Nike 100 Nike 100 Nike 100

Nike

Under Armour

100

2

Under Armour

adidas

73

Gymshark 76 Under Armour 74

3 adidas 74 adidas 68 adidas 82

4 Gymshark 51 Champion 58 Champion 47 alo 47

5

Champion 48 lululemon 57 lululemon 43 lululemon 45

6 lululemon 47 Under Armour 55 Vuori 39 Vuori 44

7

Vuori 38 Fabletics 42 PUMA 36

Hurley

32 Degrees

43

8 PUMA 37 PUMA 40 Reebok 33

9 alo 34 Vuori 39 alo 31 PUMA 42

10 Fabletics 33 alo 37 Fabletics 30 Champion 41

15 L.E.K. Consulting

SPECIAL REPORT

Casual clothing

Women’s casual clothing continues to have a strong fast fashion element to it, with

SHEIN again taking the top spot overall, though its position is notably weaker than

it was last year. Former shapewear brand SKIMS continued its ascent, coming in at

No. 2 overall and No. 1 for Gen Z, while SPANX fell out of the top 10 except for Gen X.

Fashion Nova, PrettyLittleThing and ZARA remain in the top 10. Newer fast fashion

brands Princess Polly and Cider join the list, largely o of their strength in Gen Z

(though they have yet to really register with Gen X); their rise speaks to the ability to

drive growth via TikTok and other social media platforms, particularly with younger

audiences. More traditional brands like Old Navy and Levi’s perform the strongest

among Gen X.

Men’s casual clothing was once again dominated by “work” players this year with

Carhartt, Levi’s, Duluth Trading Co., Dickies and Wrangler all showing up in the top

10. Fast fashion brand SHEIN has lost substantial traction relative to last year (when

it had a score of 94), with consumers directly commenting on pending lawsuits and

poor quality impacting its reputation. Meanwhile, other fast fashion brands are rising

through the ranks to compete with SHEIN, particularly among Gen Z — UNIQLO

made a leap from outside the top 10 to No. 2 for Gen Z, with Topman and Mango also

performing strongly. Older generations are drawn to preppier labels, with Peter Millar

debuting in the top 10 o of its strength in Gen X (see Figures 15 and 16).

Source: L.E.K. survey and analysis

Figure 15

Women’s casual clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 SHEIN 100 SKIMS 100 SHEIN 100 SHEIN 100

2 SKIMS 87 SHEIN 94

SKIMS

Carhartt

81

Fashion Nova 79

3 Carhartt 78 Carhartt 78 Carhartt 78

4 Fashion Nova 71 Aritzia 69 Good American 69 Levi’s 75

5

Aritzia 65 Fashion Nova 67 Fashion Nova 65 Old Navy 64

6 Levi’s 61

Cider

PrettyLittleThing

62

ZARA 63 Duluth Trading Co. 63

7

Cider 60 Princess Polly 61 Good American 62

8

PrettyLittleThing

ZARA

59

ZARA

Princess Polly

61

Old Navy

Levi’s

H&M

56

SPANX 59

9 Free People 58

10 Princess Polly 58 Levi’s 60 SKIMS 52

16 L.E.K. Consulting

SPECIAL REPORT

Outdoor clothing

For both men’s and women’s outdoor apparel, stalwart brands The North Face,

Columbia and Patagonia again top the list in varying permutations regardless of

cohort, suggesting outdoor needs may be more consistent across genders and

generations.

Among women, that group of three (The North Face, Columbia and Patagonia)

tops the list across every generation; The North Face is No. 1 in each generation,

while Patagonia lags with Gen Z relative to other generations. Moose Knuckles

and MACKAGE show greater strength since last year, coming in at No. 5 and No.

7, respectively, as they capitalize on a trend toward investing in stylish premium

outerwear. Ariat, a newcomer to the list at No. 4, performs well across generations,

while accessible, versatile outdoor brands like L.L.Bean and Smartwool perform more

strongly among Gen X.

For men, The North Face, Columbia and Patagonia are again at the top nearly across

the board. Gen Z is the one exception, where Arc'teryx comes in at No. 2 due to its

superb reputation and comfort. Oakley rose to No. 4 from No. 7 last year, largely o

of improvements with older generations. Salt Life and Huk make the top 10 due to

their strong reputations as fishing brands, in particular with Gen X, though notably

these sport-specific brands do not register with women to the same extent. While not

making the men’s top 10 overall, L.L.Bean performs well with older generations.

Source: L.E.K. survey and analysis

Figure 16

Men’s casual clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Carhartt 100 Carhartt 100 Carhartt 100 Carhartt 100

2 Levi’s 79 UNIQLO 95 Levi’s 82 Levi’s 80

3 SHEIN 66 Levi’s 79 Supreme 71

Peter Millar

Taylor Stitch

78

4 Polo Ralph Lauren 62 SHEIN 76 Polo Ralph Lauren 70

5

UNIQLO 58 Polo Ralph Lauren 67 Vince 68 SHEIN 60

6 Duluth Trading Co. 51 Topman 65 SHEIN 65 Polo Ralph Lauren 57

7

Dickies

Superdry

Peter Millar

48

Duluth Trading Co. 60 Superdry 63 Duluth Trading Co. 53

8 Tommy Hilfiger 59 Dickies 58

Old Navy

Dickies

49

9 Mango 58 ZARA 57

10 Wrangler 46 Kith 57 Duluth Trading Co. 55 Wrangler 48

17 L.E.K. Consulting

SPECIAL REPORT

Dress clothing

Calvin Klein and Michael Kors are among the leaders in both men’s and women’s dress

clothing, while the remaining brands dier significantly across genders. Notably,

there is relatively low engagement with dress brands, particularly among Gen Z men.

The top 10 in women’s dress clothing is a mix of specialty retail brands, direct-

to-consumer (DTC) brands and wholesale businesses. Reformation rose to No. 1,

both overall and among Gen Z and millennials; it is viewed as both fashionable and

sustainable. Meanwhile, the rest of the top five remain the same — Michael Kors,

Source: L.E.K. survey and analysis

Figure 17

Women’s outdoor clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 The North Face 100 The North Face 100 The North Face 100 The North Face 100

2 Patagonia 82 Columbia 79 Patagonia 82 Patagonia 87

3 Columbia 75 Patagonia 78 Columbia 78 Columbia 67

4 Ariat 61 Moose Knuckles 75

Ariat

Arc'teryx

52

Ariat 66

5

Moose Knuckles 57 Ariat 74 Smartwool 59

6 Arc'teryx 48 MACKAGE 60 Fjällräven 48 Moose Knuckles 54

7

MACKAGE 46 icebreaker 59

Marmot

Salomon

45

Sherpa 52

8

Cotopaxi

Sherpa

42

Arc'teryx

Cotopaxi

51

Cotopaxi 50

9 Osprey 42 L.L.Bean 46

10 L.L.Bean 38 Kari Traa 50 Sherpa 41 Arc'teryx 40

Source: L.E.K. survey and analysis

Figure 18

Men’s outdoor clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 The North Face 100 The North Face 100 The North Face 100 The North Face 100

2 Patagonia 76 Arc'teryx 80 Patagonia 78 Patagonia 89

3 Columbia 73 Columbia 72 Columbia 74 Columbia 83

4 Oakley 47

Ariat

Patagonia

68

Arc'teryx 59 Huk 69

5

Arc'teryx

Salt Life

43

Oakley 52 Salt Life 64

6 Oakley 59 Salt Life 50 PELAGIC 61

7

Huk 39 Helly Hansen 48 L.L.Bean 42 Oakley 53

8 Ariat 38 Fjällräven 47 Huk 40 Helly Hansen 52

9

Smartwool

Helly Hansen

36

Burton 43

Smartwool

Ariat

39

Cotopaxi

L.L.Bean

49

10 KÜHL 42

18 L.E.K. Consulting

SPECIAL REPORT

Calvin Klein, Lulus and kate spade (though kate spade fell from No. 2 to No. 5). Some

of the top gainers this year include GANNI and Cleobella, largely due to their strength

with millennials, while Lulus tops the list for Gen X — the rest of that generation’s top

10 shows a dierential willingness to invest in their dress wardrobe with premium

brands like MILLY, Veronica Beard and Theory. In addition to the lower engagement

across the category, Gen Z women have limited interest in many of the brands (i.e.,

overall sentiment even in the top 10 is fairly low).

The men’s dress clothing category is again led by Calvin Klein and Michael Kors. Much

like in men’s dress footwear, Tommy Hilfiger has risen in popularity, with a score of 81

versus 69 last year, and has taken over the top spot with Gen Z. Classic brands HUGO

BOSS, Ted Baker and Perry Ellis have all improved their brand heat scores by more

than 10 points, primarily o of strong brand reputations. Ted Baker had the largest

jump (up 33 points), led by Gen X, which rates it as the hottest brand in the category.

Among DTC brands, Suitsupply fell out of the top 10 list overall this year but continued

its ascent with Gen Z, while Bonobos only makes the list for millennials, and Indochino

fell o Gen X’s list. While DTC brands have certainly made a splash, their staying

power requires deeper connection with the consumer to remain top-of-mind.

Source: L.E.K. survey and analysis

Figure 19

Women’s dress clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Reformation 100 Reformation 100 Reformation 100 Lulus 100

2 Michael Kors 82 Calvin Klein 99 GANNI 81 Reformation 98

3

Calvin Klein

Lulus

78

Michael Kors 89 Susana Monaco 80 Michael Kors 93

4 kate spade 87 Maje 75 Halogen 80

5

kate spade 71 Lulus 85 Michael Kors 70 MILLY 75

6 GANNI 61 LK Bennett 61 M.M. LaFleur 69

kate spade

Vince Camuto

73

7

Cleobella

Susana Monaco

59

retrofete

Tadashi Shoji

60

Lulus 62

8 Calvin Klein 61 Veronica Beard 72

9 retrofete 56 HUGO BOSS 56 kate spade 59 Calvin Klein 71

10 Theory 50 Sherri Hill 55 Cleobella 58 Theory 70

19 L.E.K. Consulting

SPECIAL REPORT

Source: L.E.K. survey and analysis

Figure 20

Men’s dress clothing — Top 10, by generation

Total Score Gen Z Score Millennial Score Gen X Score

1 Calvin Klein 100 Tommy Hilfiger 100 Calvin Klein 100 Ted Baker 100

2 Michael Kors 86 Calvin Klein 98

Michael Kors

Emporio Armani

88

Emporio Armani 91

3 Emporio Armani 85 Michael Kors 80 Calvin Klein 80

4 Tommy Hilfiger 81 Suitsupply 71 Tommy Hilfiger 71 Kenneth Cole 79

5

HUGO BOSS 65 Emporio Armani 64 HUGO BOSS 67 HUGO BOSS 76

6 Ted Baker 60

Perry Ellis

Kenneth Cole

52

Banana Republic 62 Michael Kors 73

7

Kenneth Cole 58 Theory 61 Perry Ellis 60

8 Banana Republic 52 Brooks Brothers 49 Joseph Abboud 52 Jos. A. Bank 59

9

Theory

Perry Ellis

47

Banana Republic 46 Bonobos 49

Zegna

Tommy Hilfiger

52

10 HUGO BOSS 44 Kenneth Cole 47

20 L.E.K. Consulting

SPECIAL REPORT

Our Brand Heat Index continues to demonstrate how material dierences in brand

momentum can exist below the surface and how quickly sentiment can change. Once

again, generational dierences in top brand rankings make clear how important it

is to recognize that not all consumers are the same and that a deep understanding

combined with tailored strategies is required in order to win.

This depth of insight has never been more important. As you’ve seen, some industry

leaders have been able to maintain their leadership positions year over year, while

others have been overtaken by newer entrants. The notable rise of up-and-coming

brands, some of which even claimed top spots in key categories/cohorts, shows that

consumers’ consideration sets are expanding, and they’re increasingly willing to

embrace new and innovative brands beyond legacy players. Accordingly, it’s no time

to rest.

We tested some 450 dierent brands across categories to understand their

popularity and the key factors driving it. We invite you to connect with us to learn

more about the Brand Heat Index and gain further insights into how consumers feel

about your brand and why.

Please don’t hesitate to contact us at [email protected]om.

Endnote

1

Previous versions of the survey called the category “outdoor” footwear; expanded to “outdoor/rugged” footwear in 2024.

Conclusion

21 L.E.K. Consulting

SPECIAL REPORT

22 L.E.K. Consulting

About the Authors

Laura Brookhiser

MANAGING DIRECTOR AND PARTNER, BOSTON

Laura Brookhiser, a Managing Director and Partner in L.E.K. Consulting’s Boston oce, is a

member of the Retail and Consumer Products practice with a focus on the home goods, footwear

and apparel sectors (having advised four of the top 10 U.S.-based footwear companies).

Laura has deep experience in M&A, consumer segmentation, brand positioning, new product

development, category expansion, portfolio optimization and organizational transformation.

Jon Weber

MANAGING DIRECTOR AND PARTNER, BOSTON

Jon Weber is a Managing Director and Partner in L.E.K. Consulting’s Boston oce. Jon serves

on the firm’s Global Leadership Team and recently led L.E.K.’s global Retail and Consumer

Products practice. He advises clients on a range of strategic issues, including brand positioning

and consumer insights, growth strategy, digital and channel strategy, pricing and promotions,

customer experience and engagement, performance improvement, and M&A.

Chris Randall

MANAGING DIRECTOR AND PARTNER, BOSTON

Chris Randall is a Managing Director and Partner in L.E.K. Consulting’s Boston oce and serves

as Global Co-Head of the firm’s Consumer sector. Chris has extensive experience in footwear

and apparel, sporting goods, home and household products, and other durable goods. He advises

retailers and brands on a range of critical issues, including growth strategy, brand and marketing

strategy, channel strategy, digital, data analytics, organizational strategy, and M&A.