University of Michigan, Ann Arbor

Department of Economics

611 Tappan Avenue

Ann Arbor, MI 48109-

1120

lsa.umich.edu/econ/rsqe

734-764-

2567

For Release: 05/17/2024

“The Michigan Model”

Gabriel M. Ehrlich, Director

George A. Fulton & Saul H. Hymans

Directors Emeriti

The U.S. Economic Outlook for 2024–2025

Jacob T. Burton, Gabriel M. Ehrlich, Kyle W. Henson, Daniil Manaenkov, and Yinuo Zhang

University of Michigan

Executive Summary

Long Story Short

We project the U.S. economy to maintain healthy

momentum throughout our forecast window, with a

modest deceleration in the near term. We expect real

GDP growth to average about 2.0 percent annualized in

the second half of 2024, while the unemployment rate

continues inching up to 4.0 percent. Meaningful

progress towards inflation normalization, coupled with a

gradually softening labor market, set the stage for the

first fed funds rate cut of this cycle in September 2024.

Look beyond the Headline

The pace of real GDP growth moderated to an

annualized rate of 1.6 percent in 2024Q1. While net

exports subtracted nearly 0.9 percentage points from

topline GDP growth, the underlying momentum remains

solid. The combined growth contributions of private

consumption and fixed investment added 2.6

percentage points to growth in the first quarter, just 0.2

percentage points behind the 2023Q4 reading.

The recent upward revision in net immigration

estimates for 2022–23 by the CBO suggests that the

brisk economic growth in 2023 was likely supported by

an immigration wave fueling both the demand and the

supply sides of the economy.

Controlled Deceleration in The Labor Market

Monthly payroll job gains have moderated to 246,000

so far in 2024, well above 2019's average pace of

166,000. The headline unemployment rate inched up to

3.9 percent in April after averaging 3.7 percent in

2023H2. We project a continued softening of the labor

market through early 2025.

We revised up our population growth projections for

2024–25 to reflect a higher immigration forecast. This

will boost the size and growth of the population,

primarily in the 25 to 54 age group, resulting in stronger

labor force growth in our forecast.

Potholes along the Last Mile

Coming after the rapid disinflation at the end of 2023,

the recent spike in inflation suggests that the last mile

of inflation normalization may take longer than many

had hoped. The recent rebound has been broad-based

across goods and services. The core PCE price index,

a key metric for forecasting future inflation, was up 2.8

percent year over year in March. The pace of monthly

core PCE inflation previously registered at or below the

2.0 percent annual pace in five of the six months from

July to December 2023, but it spiked to 6.2 percent in

January 2024. Annualized core CPI inflation edged

down to 3.6 percent in April after trending mostly up

since July 2023, but more good data is needed to

reassure the Fed before it begins cutting rates.

PCE housing services inflation stalled around 5.8

percent year over year in February–March after ten

months of continuous disinflation. Leading indicators of

inflation in the rental market are now telling diverging

stories after displaying encouraging downward

progress until 2023Q3. Although we still expect shelter

inflation to slow, the extent of further passthrough of

prices for new tenants into average rents remains

unclear.

The ongoing crisis of affordability in the market

of homes for sale, as well as the significant increase in

immigration, could limit the extent of rental disinflation.

A Few Steps Away from Monetary Easing

Our forecast is consistent with a Fed that will be content

to hold rates steady before beginning to cut slowly. We

project that by the time the Fed begins cutting rates in

September, unemployment will have edged up further

and the annualized pace of core PCE inflation will have

dipped below 3.0 percent. Once cuts begin, we expect

the Fed to proceed slowly—with only one cut in 2024

and three in 2025.

Mixed Signals from the Housing Market

The 30-year fixed mortgage rate has crept up above 7.0

percent again after declining to 6.6 percent at the

2

beginning of 2024. Despite recent improvements in the

number of active for-sale listings, elevated mortgage

rates are locking many potential sellers into the low-rate

mortgages they secured in the past. On the other hand,

annualized sales of new single-family homes increased

from 2023Q4 to 2024Q1, a trend we generally expect to

continue over our forecast period.

We remain cautiously

optimistic about the single-family residential

construction market, which should benefit from the

projected decline in mortgage rates in the second half

of 2024.

Congress Arrives Fashionably Late

Congress passed a full-year funding package by the

end of March, more than five months after fiscal 2024

began. We consider a timely resolution to the fiscal

2025 budget unlikely as well. Because we judge that a

divided government is the most likely outcome of the

2024 elections, our fiscal forecast features the path of

least resistance: a slowdown in discretionary

nondefense spending growth alongside steady

increases in defense spending.

The federal deficit is set to ease slightly thanks to the

recent jump in personal tax revenues. It is projected to

step down from 5.8 percent of GDP in fiscal 2023 to 5.2

percent in fiscal 2025. The privately held debt-to-GDP

ratio is poised to increase from 80.9 percent in 2024Q1

to 84.6 percent in 2025Q4, as sizeable deficits continue.

The 2024–2025 Outlook

Despite the recent spike, our baseline forecast is that

inflation will resume its normalization as shelter costs

decelerate and consumer goods inflation remains

muted.

The year-over-year change in the PCE price

index ticks up from 2.6 percent in 2024Q1 to 2.9 percent

in 2024Q4, before moderating to 2.1 percent by the

second half of 2025. Year-over-year core CPI inflation

lingers around 3.5 percent through the rest of 2024 and

then slows to 2.5 percent by 2025Q4.

We anticipate consumers to begin exercising more

caution as the unemployment rate creeps up slightly in

the second half of 2024. As a result, the growth pace of

GDP is projected to slow to an average of about 2.0

percent annualized in 2024H2. As inflation decelerates

and the effects of the projected policy rate cuts feed

through the economy, growth then accelerates in 2025,

rising to 2.4 percent annualized in 2025Q4.

We expect the labor market to continue cooling off

gradually. The unemployment rate ticks up to 4.0

percent by 2024Q4 and hovers at that level throughout

2025. Job gains continue to slow through 2025Q1, after

which they stabilize around 120,000–130,000 per

month.

We expect the pace of single-family housing starts to

climb by 60,000 units through 2025Q4 after hovering at

1,030,000 units in the near term. We project a gradual

recovery of multi-family starts to an annual pace of

440,000 units by 2025Q4, despite the recent decline in

2024Q1.

The pace of light vehicle sales is expected to start rising

again in 2024H2. The sales pace increases to 15.9

million units by 2024Q4 and reaches 16.2 million by

mid-2025 as economic growth re-accelerates and

interest rates decline. As consumers go for cheaper

vehicle trims, the contribution of vehicle sales to real

GDP will be smaller for the same number of units sold.

3

The Current State of the Economy

Real GDP grew at an annualized pace of 1.6 percent in the first quarter of 2024, a deceleration

of 1.8 percentage points from the previous

quarter. Although that performance fell short

of expectations, the main drivers of growth

remained strong. Chart 1 shows the growth

rate of real GDP and the growth contributions

of its major components over the past two

years. Net exports subtracted nearly 0.9

percentage points from topline GDP growth in

the first quarter after contributing one-quarter of a point in the fourth quarter of 2023. The government's

growth contribution likewise decreased from 0.8 to 0.2 percentage points. Consumption contributed a

healthy 1.7 percentage points to annualized real GDP growth, nonetheless a step down from the 2.2

percentage points in 2023Q4. The combined growth contributions of private consumption and fixed

investment, which we believe to be more informative about the underlying momentum in the economy,

added 2.6 percentage points to growth in the first quarter, just 0.2 percentage points behind the 2023Q4

reading.

Our economic outlook hinges on the near-term trajectory of inflation. The recent spike suggests

that the last mile of inflation normalization may

take longer than many observers had hoped

after the rapid disinflation at the end of 2023.

The Fed targets Personal Consumption

Expenditure (PCE) inflation at an average pace

of 2.0 percent per year. In March, year-over-

year PCE inflation poked up to 2.7 percent,

4

while the 3-month annualized rate jumped to

4.4 percent, reflecting a re-acceleration early

in 2024. This recent rebound has been broad-

based across goods and services, with the

notable exception of motor vehicles and parts.

So-called "supercore" inflation, which

excludes food, energy, and housing,

measures trend inflation not driven by shelter.

Its recent trend has also been discouraging.

The 3-month annualized pace of "supercore" inflation fell below 1.8 percent in the second half of 2023,

close to its pre-pandemic range. However, the recent surge to 4.1 percent on an annualized basis has

introduced new pockets of turbulence on the flight path to a soft landing.

Until recently, PCE housing services inflation had been moderating from its previously high level.

However, it stalled around 5.8 percent year over year in February–March. The PCE housing services

price index includes imputed rental of owner-occupied homes and direct rental costs of all renter

households, whether or not they have moved or signed a new lease. This focus on a broad target

population helps to explain the slow dynamics

of PCE housing services inflation. Measures of

rent inflation for new tenants can potentially

capture timelier trends in the rental market and

help predict the future evolution of the PCE

rental component. Chart 4 displays Zillow's

observed rent index and the Bureau of Labor

Statistics' (BLS) experimental new tenant rent

index. Both measures showed encouraging downward progress until 2023Q3, when the series diverged.

Although we still expect shelter inflation to decelerate, it remains unclear how much further the rental

inflation deceleration will translate to the broader metrics. The ongoing crisis of affordability in the market

5

of homes for sale, as well as the significant increase in immigration, will likely limit the extent of rental

disinflation.

The financial markets entered 2024 pricing in an average of six 25-basis-point (bps) cuts to the

federal funds rate during the year. The painful realization that the Fed's rate cuts would be delayed in the

face of resurgent inflation and a string of strong

jobs reports has put upward pressure on

longer-term rates this year. The yield on 5-year

Treasury debt climbed by 60 bps between

January and April, before retreating by around

10 bps following the FOMC meeting in early

May. The 30-year fixed mortgage rate crept up

above 7.0 percent again, standing at 7.1

percent as of early May. Despite these shifts,

the 48-month new car loan rate has held steady at 7.8 percent since late December, already one of the

highest levels seen since 2001.

One potential explanation for the recent economic strength in the face of much tighter monetary

policy is the ongoing immigration wave. The Congressional Budget Office (CBO) recently updated its

demographic estimates and projections for 2022 through 2054. Chart 6 compares 2021–34 annual

growth rates of the civilian noninstitutional

population estimated by CBO earlier this year

to the resident population projections released

by Census late in 2023. The large upward

divergence in CBO's estimates is due to a

sizable increase in estimated net immigration

in 2022–23 and the higher immigration forecast

for 2024–27, which will boost the size and

growth of the population, primarily in the 25 to

6

54 age group. Correspondingly, we have also

revised our population growth projections for

2024 and beyond, resulting in stronger labor

force growth in the forecast.

The labor market has shown

discernible signs of cooling off recently.

Monthly payroll job gains moderated to

175,000 in April, coming off from their prior 3-

month average of 270,000. Government job gains dropped below 10,000 for the first time since

December 2022, having averaged about

59,000 over 2023. The 3-month moving

average of unemployment rate rounded up to

3.9 percent in April, up from around 3.7 percent

in January. The private job openings rate has

been declining consistently. Data from

Indeed.com, which appears to be a leading

indicator of the private job openings rate,

suggests that the decelerating trend of job

openings is likely to continue in the near term. Overall, we believe that a controlled deceleration in the

labor market is in line with the Fed's goals.

Chart 9 shows the National

Association of Home Builders' (NAHB's)

Housing Market Index alongside the Mortgage

Bankers Association's (MBA's) index of loan

applications for purchases. Mortgage

applications remain at a historically low level,

with the exception of the temporary uptick in

7

loan applications as a result of a brief dip in mortgage rates from late December 2023 to early January.

The NAHB's index, which measures builders' sentiment for single-family sales in the present and for the

next six months along with traffic of prospective buyers, slipped below the 50 threshold in May, likely due

to the recent spike in interest rates. We expect high mortgage rates to restrain residential single-family

construction activity in the near term, but we remain cautiously optimistic that activity will ramp up along

with net immigration.

Mortgage rates that briefly rose toward the 8.0 percent level led to a deceleration of home price

appreciation in the second half of 2023 as the

pace of new for-sale listings began its

recovery. The small re-acceleration of home

prices in early 2024 likely stemmed from rates

temporarily dipping below 7.0 percent around

the turn of the year. The number of active

listings, as reported weekly by the National

Association of Realtors (NAR), has improved

measurably relative to 2023, suggesting that some sellers are finally coming back to the market. As a

result, we expect moderate further home price appreciation over the course of our forecast.

Chart 11 shows the Institute for Supply Management's (ISM's) Purchasing Manager Indices for

manufacturing and services. The

manufacturing index has started to show signs

of recovery this year. It exceeded 50—

indicating expanding activity—in March 2024

for the first time since November 2022,

suggesting that a rebound in manufacturing

activity may be around the corner. However,

the ISM services index came down from 53.4

in January to below 50 in April due to business activity and employment sub-indices falling sharply. A

8

failure of the ISM services index to bounce back strongly in the coming months would be alarming, and

we are watching these data closely.

The light vehicle market remains mired in a funk, likely arising from high interest rates on loans

for vehicle purchases. After a disappointing dip below 15.0 million units in January, the annualized pace

of light vehicle sales averaged 15.7 million in

February–April. The trend pace of sales

appears to be stuck in low gear, hovering

around 15.6 million units for 13 months

already. The rate of domestic light vehicle

assemblies, on the other hand, has been

increasing in the first three months of 2024.

Given the improved inventory situation for new

autos and the return of consumer incentives,

we expect light vehicle sales to tick up later in 2024.

Overall, the state of the economy remains noisy and challenging to interpret. We believe that the

current picture is consistent with a slight deceleration in economic growth in the near term, but healthy

growth throughout our forecast window.

Next, we outline several key policy and economic assumptions underlying our forecast.

Monetary Policy

The Federal Open Market Committee (FOMC) remains committed to bringing inflation down to its

2.0 percent objective. The FOMC has held the federal funds rate steady at 5.25–5.5 percent since July

2023. After the May meeting, FOMC members signaled that the current pause would continue for the

time being. Members made sure to note that "job gains have remained strong" and "there has been a

lack of further progress toward the Committee's 2 percent inflation objective." In addition, the committee

repeated the comment "that the risks to achieving its employment and inflation goals have moved toward

9

better balance over the past year." We interpret this language as signaling that the Fed will not cut rates

at its next meeting in June and is not planning to cut quickly once it starts.

The median economic projection for the federal funds rate among March FOMC meeting

participants indicated no more hikes in this cycle. The median Committee member saw three cuts in 2024

and three or four more in 2025. The Committee maintained its belief that inflation would continue to

normalize, with the participants' median projection of year-over-year PCE price index inflation falling to

2.4 percent by the end of this year and 2.2 percent by the end of 2025. At the same time, the median

projection saw the unemployment rate rising to 4.0 percent this year and 4.1 percent in 2025. It is worth

noting that since the March meeting, the inflation data has largely surprised to the upside, which led Fed

Chair Jay Powell to say, "the recent data have clearly not given us greater confidence and instead indicate

that it's likely to take longer than expected to achieve that confidence."

Core PCE inflation, a key metric for forecasting future inflation, stood at 2.8 percent year over

year in March. This metric has been slowing consistently since the September 2022 reading of 5.5

percent, but the pace of decreases has slowed in 2024. The 3-month average (annualized) rate spiked

to 4.4 percent in March after reaching 1.6 percent in December 2023. The pace of monthly core PCE

inflation previously registered at or below the 2.0 percent annual pace in five of the six months from July

to December 2023, but it spiked to 6.2 percent in January. This resurgence of inflation provides support

for the Fed to hold off on cuts for now. Core non-housing services (roughly a 50-percent slice of private

consumption) was one of the final sectors to

experience disinflation, but as shown on chart

13 it was a significant driver of the recent spike.

The Fed's statutory dual mandate

requires a balanced approach to promoting

maximum employment alongside price

stability. The labor market has held up nicely

so far in 2024. The average monthly pace of

246,000 job gains so far this year is a slight

10

step down from 2023's average of 251,000, although it is much slower than 2022's monthly average of

377,000. The resilience in the labor market gives the Fed a longer runway to ensure above-target inflation

is extinguished prior to pivoting toward lower rates.

The economic costs of reining in inflation would likely be much larger if high inflation were to

become engrained in long-term plans and contracts. The 5-year-to-10-year inflation expectations

measure from the University of Michigan's Surveys of Consumers ticked up to 3.1 percent in May, near

the top of its recent range. However, most measures of inflation expectations have remained reasonably

well-anchored in 2024.

The Fed has been reducing the size of its balance sheet since May 2022. At that time, the Fed

announced a 95 billion dollar per month redemption cap for its securities holdings, and it has been

shrinking its balance sheet by around 80 billion dollars per month since then. On May 1

st

of this year, the

Fed announced that it would slow the pace of decline by establishing a new redemption cap of 60 billion

dollars per month, although the actual amount rolled off will likely be 40–45 billion dollars per month.

We believe that our forecast is consistent with a Fed that will be content to hold rates steady

before cutting slowly. We project the Fed to start cutting rates in the second half of 2024, with the

September FOMC looking like the most likely date for the first cut as of this writing. By that time, we

expect unemployment to edge up further and the annualized pace of core PCE inflation to dip below 3.0

percent, down from 3.7 percent in 2024Q1. With the fed funds rate still around 5.3 percent, the implied

short-term real interest rate near 2.5 percent will likely appear somewhat restrictive given the softening

labor market and normalizing inflation. We

expect the Fed to cut rates slowly, however,

with only one cut in 2024 and three in 2025.

Chart 14 shows our projections for

selected key interest rates. The 3-month

Treasury bill rate declines from 5.2 percent in

2024Q2 to 4.9 percent in 2024Q4 and 4.3

percent in 2025Q4. The 10-year Treasury rate

11

rises from 4.2 percent in 2024Q1 to 4.5 percent in 2024Q2, before edging down to 4.4 percent in 2024Q4

and 4.3 percent in 2025Q4. The yield curve flattens at long last by the end of 2025. Mortgage rates

decline more quickly than longer-term government bond yields as the excess spread that has developed

between them shrinks toward more normal levels in light of the decline in medium-run policy rate

uncertainty. The 30-year conventional fixed-rate mortgage rate rises to 7.0 percent in 2024Q2 before

declining to 6.6 percent in 2024Q4 and 6.0 percent by 2025Q4.

Fiscal Policy

The suspense surrounding a potential federal government shutdown has dissipated for a few

months, as Congress reached an agreement on the full-year funding package for fiscal year 2024 by the

end of March. The FY2024 appropriations bills have set the topline spending total at 1.6 trillion dollars,

with an increase of 26.8 billion dollars in defense spending (from 798 to 825 billion dollars) and a

moderate decline of 61.0 billion dollars in non-defense spending (from 827 to 766 billion dollars)

compared to FY2023. We expect this cut to non-defense spending authorizations to take a while to filter

into actual outlays.

Despite this long-overdue achievement, theatrics persist, as Congress just dodged another

motion to vacate the House speakership following the passage of foreign aid bills in late April. Based on

CBO's estimates, we project that this spending, totaling 95.3 billion dollars, will temporarily increase

defense consumption expenditure and investment further until the end of FY2026. This passage

concluded months of heated discussions in Congress, with Republicans seemingly walking out empty-

handed on the border security bills that had been under the spotlight. Although it remains unclear what

concessions House Democrats may have offered in return aside from defending the speakership, we

judge that additional meaningful fiscal actions are unlikely to occur at least until after the elections.

The Tax Relief for American Families and Workers Act, which passed in the House with an

unusually large margin of 357–50 in January, has stalled in the Senate. The current bill couples increases

in refundable child tax credits with an extension of tax breaks from the Tax Cuts and Jobs Act of 2017

(TCJA), which are set to expire by the end of 2025. Despite bipartisan support for business credits,

12

Republican senators have opposed implementing the lookback policy on child tax credits. Moreover, the

appetite for bipartisan dealmaking is fading as elections approach. Therefore, we believe the bill's chance

of passing the Senate in its present form is quite slim.

The 118

th

Congress still needs to develop and pass a new budget for fiscal 2025 within the next

five months. Unfortunately, it is already off to a rocky start. The president's budget for FY2025, released

in March and proposed an increase of 11 billion dollars in total discretionary spending, largely in line with

the Fiscal Responsibility Act of 2023. The budget proposal has already faced a backlash from

Republicans because of high levels of spending in fiscal 2026 and beyond. The concurrent budget

resolution proposed by the House Budget Committee, on the other hand, contained several deep cuts to

government programs and agencies such as Obamacare and the Internal Revenue Service starting in

fiscal 2026. We anticipate more contentious fights going forward, with a timely resolution seemingly

unlikely.

We continue to believe that a divided government is the most likely outcome of the 2024 elections,

which suggests that enacting substantial revenue-raising or expenditure-cutting reforms will require

compromise. Our forecast features the likely path of least resistance: a slowdown in discretionary

nondefense spending growth alongside steady growth in defense spending.

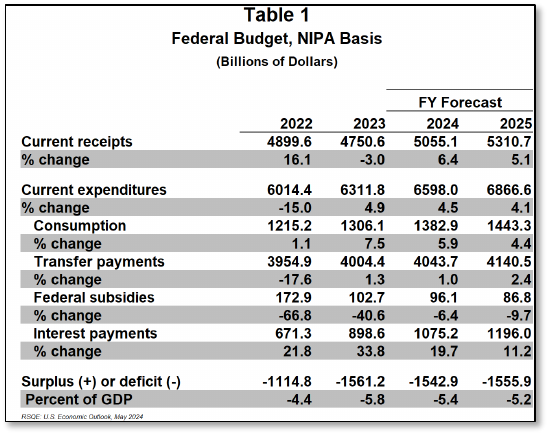

Table 1 shows the data and our projections for the federal budget on a National Income and

Product Accounts basis (NIPA) from fiscal

years 2022 to 2025, broken down by receipts

and major expenditure categories. Federal tax

revenue jumped by more than 200 billion

dollars in 2024Q1, boosted in part by

"declarations and settlements" revenue, which

grew more than 100 billion dollars. That jump

was likely due to the rebound of capital gains

during 2023, as major stock indices

gained

rapidly. As a result, federal receipts are set to grow at a brisk pace of 6.4 percent in fiscal 2024. Receipt

13

growth slows down to 5.1 percent in fiscal 2025 as some business tax incentives from the Tax Cuts and

Jobs Act of 2018 phase out.

We project the growth of federal expenditures to slow down over the next two years, decreasing

from 4.9 percent in fiscal 2023 to 4.1 percent in fiscal 2025. Robust defense spending growth fuels the

momentum in overall federal consumption. Transfer payments are expected to expand by 1.0 percent in

fiscal 2024, and then by a further 2.4 percent in fiscal 2025 due to an increase in transfer payment to

persons. On the other hand, federal subsidies continue shrinking toward their pre-pandemic levels

through fiscal 2024–25.

Interest payments on the federal debt, however, rose by over one-third in fiscal 2023 due to

sharply higher interest rates. In fact, they have exceeded defense consumption expenditures and gross

investment combined since 2023Q4. We expect this state of affairs, which previously occurred only once

in 1998 for a single quarter, to persist throughout our forecast window. The growth of interest payments

will decelerate to 19.7 percent in fiscal 2024 and 11.2 percent in fiscal 2025, but it remains brisk.

We anticipate the federal deficit to ease slightly as a share of nominal GDP in fiscal 2024 and

2025 thanks to the jump in personal tax revenues. The decline will be welcome following its increase

from 4.4 percent to 5.8 percent as a share of GDP over the past two fiscal years. The privately held debt-

to-GDP ratio is poised to increase from 80.9 percent in 2024Q1 to 84.6 percent in 2025Q4, as sizeable

deficits continue, and the Fed tapers the pace of its sales of Treasury security holdings starting from June

2024.

The Housing Market

Mortgage rates have been back on the rise this year, reversing some of the affordability gains

from late last year. The 30-year conventional fixed rate mortgage rate, as reported weekly by Freddie

Mac, has climbed to 7.1 percent from 6.6 percent at the beginning of the year. We expect mortgage rates

to ease in the years ahead, but we project homes to remain significantly less affordable than they were

in the era of three-percent mortgages.

14

Our preferred measure of house prices, the seasonally adjusted S&P CoreLogic Case-Shiller

National Home Price Index, currently extends only through February, so it is too early to assess the effect

the recent increase in rates will have on prices. Movements in house prices tend not to fully offset the

impact of changes in mortgages rates on monthly mortgage payments. We therefore expect the recent

increase in rates to translate to at least some setback in affordability.

More timely indicators of activity in the housing market are sending mixed signals following the

increase in mortgage rates. The Mortgage Bankers Association's index of loan applications for purchases

has come up from its lowest reading in almost 30 years in October 2023, but it remains at a deeply

depressed level. The University of Michigan Survey of Consumers' sentiment indices of conditions for

buying and selling a home have both mostly improved so far in 2024, although they remain much lower

than before the run-up in mortgage rates. Existing single-family home sales have perked up in 2024 to a

3.8 million annual sales pace in March, albeit from a very slow pace at the end of last year. The seasonally

adjusted months' supply of single-family existing homes has averaged 3.3 months in January–March

after rising to 3.6 months in December 2023. While there has been a measurable improvement in the

number of active for-sale listings, we believe that high mortgage rates continue to lock many potential

sellers into the low-rate mortgages they secured in the past. A return to falling mortgage rates should

help to unlock inventory and allow for the return of healthier activity in the market for existing homes.

Chart 15 plots our preferred measure of affordability, our calculation of the ratio between a

mortgage payment on a newly bought home and the average wage income per worker. We estimate that

this ratio climbed to 47.2 percent in the fourth

quarter of 2023, the highest since 1990,

before declining to 44.5 in the first quarter of

2024. As recent mortgage rate increases bite,

we project the affordability ratio to tick up to

45.6 percent in the second quarter before

declining to 41.8 percent by the end of 2025.

That would bring some relief to prospective

15

homebuyers, but house purchases will remain much less affordable than in the years prior to the

pandemic. We estimate that from 2010 through 2019, the mortgage payment on a newly purchased home

averaged just over one-quarter of average wage income per worker.

1

The market for newly built homes features more margins for price adjustment than the existing-

homes market. Home builders can adjust lot and house sizes, finishes, appliances, and other features to

partially compensate for the spike in mortgage rates. The market for new construction has accordingly

held up better than the market for existing homes recently. The low inventory level in the existing homes

market has also cushioned the blow from higher mortgage rates to new construction activity.

Annualized sales of new single-family homes increased from 644,000 in the fourth quarter of 2023

to 667,000 in the first quarter of this year, a trend we generally expect to continue over our forecast

period. Single-family housing starts climbed to an annualized pace of 1,069,000 in the first quarter of

2024, a stark increase from the 834,000 pace from the first quarter of 2023. Months' supply of new single-

family homes for sale stood at 8.3 in March. That level was down from the recent peak of 10.1 months'

supply in July 2022, but above the 7.1 months' supply in July 2023. We believe that a balanced market

is likely to feature under 6 months' worth of supply. The market is working through the supply overhang

that developed in 2022 in fits and starts. We remain cautiously optimistic about the single-family

residential construction market, which should also benefit from the projected decline in mortgage rates

in the second half of 2024.

Multi-family housing starts retreated in 2023 after a banner performance in 2022. The 547,000

multi-family starts in 2022 were the most since 1986. The influx of new product as those starts reached

completion, higher financing costs, flatlining new tenant market rents, and climbing vacancies put a chill

on the multi-family construct market. The 299,000-unit pace in March was the slowest since the depths

of the Covid recession, though the level of permits has held up reasonably well and the projected inflow

of immigrants should help sustain demand for rentals going forward.

1

The mortgage payment is computed assuming no down payment using the contemporaneous average conventional mortgage

rate. As a proxy for mortgage size, we index the median home price in 2012 to cumulative house price growth since that time

as measured by the Case-Shiller Home Prices Index. The average wage is computed by dividing total wage income by the

employment level in the BLS' household survey.

16

Chart 16 shows the historical and forecast paths of year-over-year and quarterly annualized rates

of home price appreciation, as measured by

the seasonally adjusted Case-Shiller Home

Price Index. Based on our internal nowcasting

model and other incoming data, we have

penciled in annualized increases of 5.0

percent in 2024Q1–Q3. Prices then

appreciate by a steady 4.0 percent per year

over the remainder of our forecast period. In

year-over-year terms, we are forecasting the

index to rise by 4.8 percent in 2024Q4 and by 4.0 percent in 2025Q4.

Energy Markets

Oil prices rose by about 15 dollars per barrel between early January 2024 and early April, largely

driven by growing tensions in the Middle East and another extension of supply cuts by the Organization

for Petroleum Exporting Countries and its allies (OPEC+). The most recent extension runs through June

2024. The price of West Texas Intermediate (WTI) crude oil topped 87 dollars per barrel on April 5 in the

immediate aftermath of Israeli strikes on the Iranian embassy in Syria. Fortunately, further escalation has

turned out to be limited, and oil prices have since retreated, with the price of WTI falling to around 80

dollars per barrel. Still, the situation in the region remains volatile.

The price spread between Brent and WTI crude benchmarks used to be very sensitive to flare-

ups of tensions in the Middle East, but the inclusion of U.S. WTI-Midland crude in the Brent basket a year

ago appears to have tamed that volatility. The Brent benchmark is set by the cheapest option in the

basket, with ample U.S. supply capable of smoothing the impact of potential disruptions in the flow of oil

from the Middle East. The spread rose from about 4 dollars per barrel in September 2023 to about 7

dollars in February 2024, but has since retreated to a little over 4 dollars in April despite mutual airstrikes

17

by Israel and Iran. The early-2024 increase likely reflected temporary increases in transportation costs,

as world oil flows adjusted to the Red Sea route disruptions.

The OPEC+ group appears likely to extend its supply cuts beyond June, which will leave the

organization with about 4 million barrels per day (bpd) of spare capacity, as estimated by the Energy

Information Administration (EIA). As a result, the bulk of increased crude production to satisfy growing

global demand will have to originate elsewhere. The EIA estimates that U.S. production growth will

continue despite modest levels of exploratory activity, rising by about 0.8 million bpd between 2023 and

2025 and accounting for around 40 percent of the global increase. The ample spare capacity of OPEC+

is likely to limit the risk of prolonged global oil supply disruptions originating outside the Persian Gulf,

underlying our benign WTI price forecast.

Natural gas inventory stocks were elevated even before the 2023–24 heating season. The

relatively mild winter has pushed natural gas stocks far above their recent normal, severely depressing

spot and near-term futures prices for natural gas. The Henry Hub spot benchmark dipped below 2.0

dollars per million British thermal units (MMBTu) in early February, and averaged just 1.5 dollars in March,

the lowest monthly reading since July 1995. In April and early May, spot prices recovered some ground

but remained below 2.0 dollars. In our modeling, we use the Producer Price Index (PPI) for natural gas

fuels, which aligns better with the price of the one-month ahead futures contract. The index declined

significantly as well, but not as far as the spot price.

These low prices have likely set back production and drilling plans. Domestic production of natural

gas has increased from 108 billion cubic feet per day (bcfpd) in 2022 to 113.1 bcfpd in 2023. The EIA

now projects that domestic natural gas production will dip by 0.7 bcfpd in 2024 before resuming growth

in 2025 as domestic storage stocks move closer to normal levels. More normal future heating seasons

and upward pressure on domestic prices from rapidly growing liquefied natural gas (LNG) exports

underlie our projection for natural gas prices trending toward the 3.0 dollar per MMBTu level over our

18

forecast. U.S. LNG export capacity has doubled in recent years and is projected almost to double again

by 2028 due to the approved projects already

under construction.

Chart 17 shows our forecast for Brent

and WTI crude prices in maize and blue as

well as the PPI for natural gas fuels in green.

We expect the price of WTI to stay around 80

dollars throughout the forecast, falling in real

terms. Likewise, the Brent–WTI spread is

projected to remain stable, at the 4–5 dollars per barrel range. The natural gas PPI rises throughout the

forecast, reflecting the growing pressure on domestic prices as U.S. LNG exports to the rest of the world

continue to ramp up.

19

The Forecast for 2024–2025

Looking past the volatile growth contributions of inventories and net exports, broader economic

momentum has remained very solid so far in 2024. The immigration wave that began in 2021–22 has

likely helped to fuel the brisk economic growth by adding to both the demand and the supply sides of the

economy. The wave is showing few signs of abating yet. Unfortunately, it will likely take a while for Census

and BLS population estimates to accurately reflect this wave. As a result, we expect solid growth of the

labor force over the forecast horizon, far in excess of what one would estimate based on population

projections that do not take recent immigration into account. Factoring in the larger pool of labor, CBO

has recently upgraded its estimate of potential real GDP growth to about 2.5 percent for 2024–26. Recent

news on inflation, however, has not been favorable. Inflation has re-accelerated. Even with the April CPI

report showing some improvement after three hot prints, the Fed will want to see significant further

slowing. As a result, projections for the first fed funds rate cut have moved further into the future. Although

the labor market continues to soften, it appears to remain on the tighter side of "full employment," implying

that the Fed still has space to let tight monetary policy do its job. We suspect a period of below-potential

growth will ultimately be necessary to tame inflation, and we expect it to begin in 2024H2. As monetary

policy eases, we expect growth to rebound toward potential by the end of 2025.

• We project that real GDP growth will rebound to a 2.5

percent annualized pace in 2024Q2, as brisk growth of

domestic final sales continues and the drag from net

exports and inventory investment normalizes.

• We expect the growth pace to decelerate slightly to

average about 2.0 percent over 2024Q3–25Q1, as the

labor market normalizes, consumption growth

moderates, and residential investment stalls out.

• As inflation slows and the effects of the projected policy

rate cuts feed through the economy, real GDP growth

re-accelerates to average 2.4 percent at an annualized

rate by 2025H2.

• Calendar-year GDP growth registers 2.6 percent in

2024 and moderates to 2.1 percent in 2025.

• Led by consumption expenditures, the growth

contribution of final sales to domestic purchasers

remains strong at 2.7 percentage points in 2024Q2 and

then moderates to contribute about 2.3 percentage

points on average to growth over 2024Q3–25Q4.

• Solid growth of investment in equipment and

intellectual property accounts for the growth

contribution of nonresidential fixed investment in the

forecast, while investment in structures is a drag on

growth.

• Residential investment begins adding to growth by

2024Q4, as the new housing sector adjusts to lower

multi-family starts and the rebound in mortgage rates.

• Government consumption expenditures contribute

about 0.2–0.3 percentage points to growth over the

forecast period, largely due to brisk federal defense

and state and local spending growth.

• The combined drag of net exports and inventory

investment on real GDP growth averages about 0.2

percentage points over 2024Q2–25Q4.

20

• The labor market has been cooling off despite its

welcome resilience to higher interest rates. The

headline unemployment rate inched up to 3.9 percent

in April after averaging 3.7 percent in 2023H2.

• Since dropping to 62.5 percent in December 2023, the

labor force participation rate rebounded to 62.7 percent

in March and April. Participation stays at 62.7 percent

throughout the forecast window. The flat participation

rate reflects the opposing forces of ongoing

retirements of the baby boom generation and incoming

immigrants, more of whom will enter the labor force

over time.

• As rates stay higher for longer, the cumulative effects

of previous monetary tightening continue to work their

way through the labor market. The unemployment rate

continues trudging upwards from 3.9 percent in

2024Q2 to 4.0 percent in 2024Q4, where it remains

throughout 2025.

• Payroll employment gains have slowed slightly in

2024. The labor market has averaged 246,000 job

gains per month so far in 2024, weaker than the

251,000 pace in 2023, but still stronger than 2019's

average of 166,000.

• The slowing trend in job gains continues in the forecast

through 2025Q1. Several years of a tight labor market

are likely to spur faster productivity growth over the

next two years. As a result, job growth in 2025 remains

moderate.

• The economy adds 2.5 million jobs during 2024 and

1.5 million during 2025.

• The government sector adds jobs throughout the

forecast, albeit at a much slower pace compared to

2023, as local government employment tops its pre-

pandemic count.

• All-items CPI inflation came in at a 3.8 percent

annualized pace in 2024Q1, while core CPI inflation

registered a 4.2 percent pace. Housing and other

services continued to be the main drivers of CPI

inflation.

• After a setback in 2024Q1, we expect the PCE price

index, the Fed's preferred inflation measure, to resume

its decline toward the Fed's 2.0 percent goal over the

next year (with CPI running slightly ahead), as shelter

costs decelerate and consumer goods inflation stays

muted. The year-over-year change ticks up from 2.6

percent in 2024Q1 to 2.9 percent in 2024Q4, before

slowing to 2.1 percent by the second half of 2025.

• The hot 2024Q1 and cool 2023H2 inflation prints imply

that year-over-year core CPI inflation lingers in the 3.4–

3.6 percent range over 2024Q2–Q4, before slowing to

3.0 percent in 2025Q1 and 2.5 percent by 2025Q4.

• Core CPI inflation slightly outpaces the headline

throughout the forecast, as gasoline price increases

remain largely subdued and food inflation slows.

21

• With the 30-year fixed mortgage rate back above 7.0

percent, new single-family home construction flatlines

between 2024Q2 and 2024Q4, averaging a pace of

1,030,000 units. The pace of single-family housing

starts then climbs by 60,000 units through 2025Q4.

• Driven by a considerable number of units under

construction and a moderate increase in rental

vacancies, multi-family starts fell by more than 200,000

units over four quarters to average 350,000 in 2024Q1.

Multi-family housing starts are projected to rebound to

380,000 units in 2024Q2. We expect multi-family starts

to recover to 440,000 units by 2025Q4.

• We are generally optimistic on new construction,

especially multi-family housing, due to the acute

affordability crisis in the existing home market and an

expected tightening of the rental market from the

ongoing immigration wave.

• Total housing starts gradually improve from 1,410,000

units in 2024Q2 to 1,530,000 in 2025Q4 closer to the

pre-pandemic trend.

• Real investment in equipment grew by 1.0 percent year

over year in 2024Q1, driven by the recovery in

information processing equipment investment after its

dip in 2023Q3. We expect the year-over-year growth

rate of equipment investment to accelerate to 4.6

percent by 2025Q4 as investment in information

equipment remains solid and vehicle investment picks

up.

• The growth rate of intellectual property investment

registered 3.6 percent year over year in 2024Q1,

driven by software development. By 2025Q4, the year-

over-year pace of growth ramps up to 6.2 percent.

• In the near term, the construction of microchip factories

continues to support healthy growth in investment in

nonresidential structures. Year-over-year growth

registered 9.4 percent in 2024Q1. As funds from the

CHIPS Act run out, we project a gradual slowdown,

resulting in 0.3 and 0.8 percent year-over-year

declines in 2024Q4 and 2025Q4, respectively.

• The annualized pace of light vehicle sales has been

stuck around 15.6 million units for a year. Given

expensive financing, the limited availability of cheaper

trim levels has constrained sales.

• Auto loan interest rates appear to have stabilized, while

the CPI for light vehicles has declined in recent months.

Hence, vehicle purchases are gradually becoming

more affordable relative to incomes. As a result, we

project that the pace of sales will start rising again in

2024H2. The sales pace increases to 15.9 million by

2024Q4 and reaches 16.2 million by mid-2025.

• All of the gains are in the light truck category, which

includes pickups, SUVs, and crossovers.

• As consumers go for cheaper vehicle trims, the

contribution of vehicle sales to real GDP will be smaller

for the same number of units sold.

22

• To forecast demand for U.S. exports, we construct a

trade-weighted index of real GDP for five of our major

export markets: Canada, Mexico, Japan, the United

Kingdom, and the euro area. We also track China's

economy, but show it separately because it grows

more quickly.

• After posting similar growth in 2022, the economic

fortunes of China and the five economies diverged in

2023. While China's economy accelerated, the pace of

growth slowed in four of the five other economies. The

euro area and the United Kingdom experienced two

consecutive quarters of real GDP declines, reeling

from tighter monetary policy and the impact of the

Russia–Ukraine war.

• Modest quarterly growth returns to the five-economy

composite in 2024–25, but calendar-year aggregate

growth still retreats to 0.8 percent in 2024 before

accelerating to 1.5 percent in 2025.

• In China, the quarterly growth pace is projected to

settle around 4.5 percent annualized. But strong

2023Q4 and 2024Q1 readings, boosted by strong

industrial output, push the 2024 calendar-year growth

rate to 5.7 percent.

• The current account deficit ballooned between 2020Q1

and 2022Q1, both in absolute terms and relative to

GDP, driven by a huge increase in domestic

consumption of imported goods.

• The continuous improvement in the current account

that began in 2022Q1 finally ended in 2024Q1 with a

jump in imports.

• With respectable domestic and foreign economic

growth, we project a relatively steady current account

deficit of around 3.1–3.2 percent of GDP throughout

the forecast period.

• In nominal terms, the current account deficit widens

from about 900 billion dollars in 2024Q2–Q3 to 970

billion in 2025Q4. The deterioration of our trade

balance for goods is responsible for the bulk of the

current account dynamics.

Risks to the Forecast

Our projections are subject to both known and as yet-unknown uncertainties. The more prominent

known risks can be broadly grouped into three categories: noisy or delayed data masking already

emerging breaks in recent trends, potential future policy actions we did not consider likely enough to

include in our baseline, and possible external shocks.

The economy has held up unexpectedly well in the face of monetary policy tightening over the

past couple of years, carried by robust growth of consumption expenditures. Some cracks may now be

23

emerging in the façade of the consumer, but assessing their seriousness tends to be possible only

retrospectively. Credit card and auto loan delinquencies have been rising for months, growth of revolving

consumer credit appears to be slowing, and sales of new light vehicles seem to be flatlining. Should these

trends continue, the consumption and labor market outlooks could deteriorate significantly.

Inflation re-accelerated in the first three months of the year and has only eased marginally in April,

but we are expecting it to moderate by the end of 2024. Inflation is notoriously hard to forecast, however,

so both upside and downside surprises are quite possible. We would expect any material deviation in

inflation from our forecast path to propagate through to monetary policy, interest rates, consumption and

investment, and labor market outcomes. While we continue to expect rental inflation to moderate,

abysmal affordability in the home purchase market may result in some upward pressure on rents, making

it more difficult for overall inflation to decline all the way toward the Fed's target.

Our outlook for the labor market features a gradual cooldown in growth this year, followed by

moderate but stable job growth in 2025. Yet the demand for labor could cool substantially more quickly

than we have forecast, with rates of unemployment overshooting our medium-run projections. On the

other hand, the recent pace of job gains has likely been boosted by the inflow of fresh immigrants into

the country. These additional workers may have alleviated some supply constraints by filling vacancies

that would not have been filled otherwise and, possibly, restrained wage growth in some industries. Even

if the immigration wave stops, the projected increase in labor force participation among the recent

immigrants as they settle in may outpace that of previous immigration waves, relaxing labor supply

constraints by more than we expect.

In the face of noisy data, FOMC members could end up misreading the state of the economy and

also the effective degree of current policy tightening, which depends on estimates of the neutral policy

rate. Estimates of neutral policy rates are inherently noisy, and even more so in the current environment,

which is fraught with many global economic and political changes. A 2.5 percent neutral rate implies

almost double the degree of policy restriction compared to a 4.0 percent neutral rate. As a result, the

FOMC might find it hard to act decisively against newly emergent inflation or labor market trends, leading

to policy decisions that turn out to have been a mistake ex post.

24

We continue to believe that the most likely outcome of the November 2024 elections is that the

United States will feature divided government in one form or another. We therefore expect the status quo

to persist in fiscal policy. Of course, if the November elections produce a single-party government, the

fiscal trajectory could be very different than we have projected. Control of the executive branch come

2025 will also have considerable implications on its own. Although a second Trump administration would

likely lead to the imposition of major import tariffs on more countries, we note that the Biden administration

has also not shied away from tariffs. We therefore see the uncertainty emanating from the elections as

pertaining more to the conduct of fiscal and monetary policy and the future course of the ongoing wave

of immigration.

With two active wars, the recent exchange of air strikes between Israel and Iran, and abundant

ongoing policy debates linked to these events, geopolitical risks to our outlook are perhaps the most

numerous. The war in Ukraine could plausibly escalate into a broader regional conflict, but it could also

end soon via negotiations, at least for the time being. Chances of a broader conflict in the Middle East

that involves Iran and shuts down the bulk of oil exports from the Persian Gulf also appear to be on the

rise. But the easing of tensions that would facilitate reopening of the Red Sea trade routes also remains

plausible.

Russia and Iran have been successfully evading Western sanctions on their energy exports with

the help of third countries. Likely beneficiaries include China, India, and the United Arab Emirates among

others. This evasion has helped to keep crude oil prices moderate. The United States has threatened to

apply and enforce secondary sanctions on entities helping Russia and Iran to avoid sanctions, but so far

it has not done so, whether from lack of ability or lack of desire. Should the economic tensions between

the United States and China escalate further, however, such enforced secondary sanctions on Chinese

entities could disrupt the global energy market, at least temporarily.

Taking a broader view, if geopolitical tensions and the ongoing wars escalate further, significantly

higher military spending, disrupted supply chains, renewed inflation pressures, and further immigration

waves will be the likely outcomes with the largest economic implications. A broad geopolitical de-

25

escalation, however, is probably less of an upside risk, as the already-damaged relationships are likely

to take time to rebuild.

We consider the balance of risks to the outlook to be somewhat tilted to the downside, since we

believe that the Federal Reserve should be able to offset many of the potential negative shocks we have

described, except for those with a stagflationary impact.