TABLE OF CONTENTS

1. BACKGROUND AND INTRODUCTION .................................................................... 12

1.1 Country Background ................................................................................................ 12

1.2 Project Background .................................................................................................. 13

1.3 Objectives ................................................................................................................ 17

2. NATIONAL REGULATIONS AND INCENTIVES FOR FUEL EFFCIENT AND

ENVIRONMENTAL FRIENDLY VEHICLES ...................................................................... 18

2.1 Policy & Strategy, Legal, Institutional & Regulatory Framework .......................... 18

2.2 Vehicles Import Customs Duties & Applicable Taxes and Incentives .................... 21

2.2.1 Customs Duties & Taxes ..................................................................................... 21

2.2.2 Incentives ............................................................................................................. 24

2.3 Vehicles Registration & Inspection System ............................................................ 27

2.3.1 Vehicles Registration System .............................................................................. 27

2.3.2 Vehicles Inspection System ................................................................................. 29

2.4 Ethiopia’s International Obligation/Participation .................................................... 29

2.5 Formulation of Draft Regulations ............................................................................ 30

2.5.1 Statutory Legislative Process ............................................................................... 30

2.5.2 Non-Statutory Legislative Process ....................................................................... 31

2.6 Conclusion ............................................................................................................... 32

3. BASELINE SETTING FOR VEHICLE EFFICIENCY.................................................. 34

IMPROVEMENT AND EMISSION REDUCTION ............................................................... 34

3.1 Methodology ............................................................................................................ 34

3.1.1 Objective .............................................................................................................. 34

3.1.2 Data Attributes ..................................................................................................... 35

3.1.3 Data Collection .................................................................................................... 35

3.1.4 Data Cleaning....................................................................................................... 36

3.2 Baseline Setting ....................................................................................................... 38

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

2

3.3 Estimating Baseline Fuel Economy ......................................................................... 43

3.3.1 Average Fuel Economy and Annual Emission for New Vehicles ....................... 46

3.3.2 Average Fuel Economy and Annual Emission Considering Age of Vehicle ...... 48

3.4 Conclusion ............................................................................................................... 51

4. VEHICLE STOCK STATISTICS ................................................................................... 52

4.1 Methodology ............................................................................................................ 52

4.1.1 Data Collection .................................................................................................... 52

4.1.2 Classifications ...................................................................................................... 52

4.1.3 Data Cleaning....................................................................................................... 54

4.1.4 Parameters for Data Cleaning .............................................................................. 55

4.2 Vehicle Stock Analysis in Addis Ababa .................................................................. 58

4.2.1 Motorcycles and Tricycles ................................................................................... 58

4.2.2 Gasoline Vehicles ................................................................................................ 59

4.2.3 Diesel Vehicles .................................................................................................... 61

4.3 Vehicle Stock Analysis in Regional Governments .................................................. 65

4.3.1 Motorcycle and Tricycle ...................................................................................... 65

4.3.2 Gasoline Vehicles ................................................................................................ 70

4.3.3 Diesel Vehicles .................................................................................................... 75

4.4 Impact of Vehicle Stock Composition on Fuel Economy ....................................... 84

4.4.1 Motorcycles and Tricycles ................................................................................... 84

4.4.2 Gasoline Vehicles ................................................................................................ 87

4.4.3 Diesel Vehicles .................................................................................................... 88

5. FUEL QUALITY REVIEW AND IMPROVEMENT OF FUEL STANDARD ............ 91

5.1 Fuel Utilization Policy and Consumption ................................................................ 91

5.1.1 Diesel and Gasoline Consumption in Ethiopia from (2006-2012) ...................... 91

5.1.2 The Biofuel Development and Utilization Strategy in Ethiopia .......................... 92

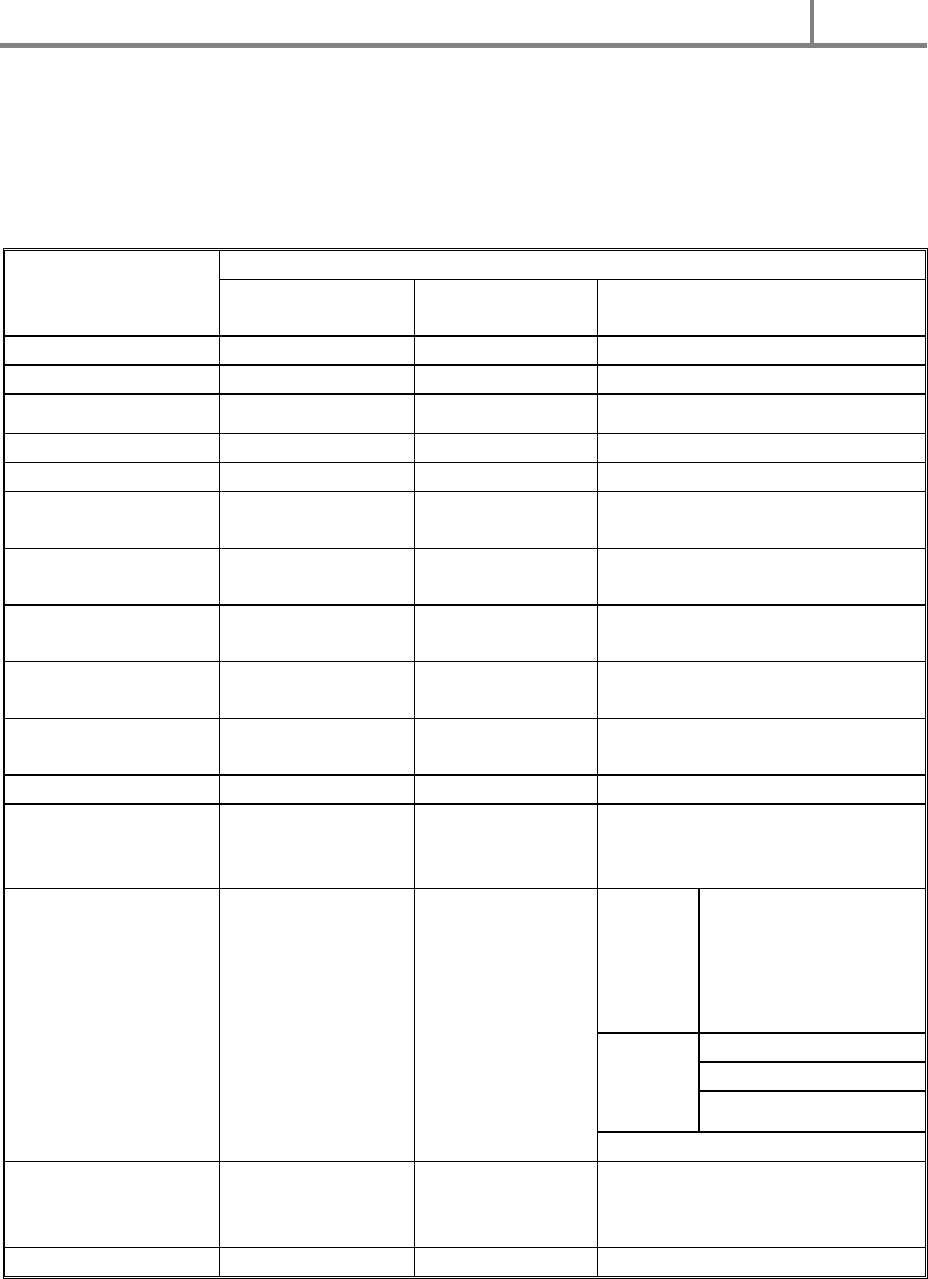

5.2 International and National Fuel Quality Standards .................................................. 94

5.2.1 Parameters Included In the Fuel Quality Studies ................................................. 94

5.2.2 International Fuel Quality Standards ................................................................... 96

5.2.3 Over View of Ethiopian Fuel Specifications ....................................................... 98

5.3 Data Collected on Fuel Quality (historical data) ................................................... 100

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

3

5.3.1 Global and National Sulfur Levels in Fuels ....................................................... 101

5.4 Conclusions and Recommendations ...................................................................... 104

6. ANALYSIS OF IMPACT OF VEHICLE EMISSION ON AIR POLLUTION ....... 106

6.1 Introduction ............................................................................................................ 106

6.2 Methodology .............................................................................................................. 107

6.2.1 Literature Review................................................................................................... 108

6.2.2 Measuring Methods and Instruments ..................................................................... 108

6.3 Measurement Sites ................................................................................................. 110

6.4 Results .................................................................................................................... 111

6.4.1 Carbon Monoxide .................................................................................................. 111

6.4.2 Particulate Matter ................................................................................................... 114

6.4.3 Nitrogen Oxide (NOx) ........................................................................................... 116

6.4.4 Sulfur Dioxide ........................................................................................................ 117

6.5 Trend Projection......................................................................................................... 120

7. TECHNOLOGY OPTIONS AND POLICY MEASURES FOR FUEL EFFICIENT

VEHICLES ............................................................................................................................ 125

7.1 Technology Options for Fuel Efficient and Clean Vehicles .................................. 125

7.1.1 Technology Options for Increasing Fuel economy ............................................ 125

7.1.2 Emission Control Technologies ......................................................................... 129

7.1.3 Alternative Fuels ................................................................................................ 130

7.2 Policy Measures for Promoting Cleaner and Efficient Vehicles ........................... 131

7.2.1 Enhancing Vehicle Efficiency Improvement ..................................................... 131

7.2.2 Use of cleaner fuels ............................................................................................ 133

7.2.3 Emission Control ............................................................................................... 134

8. COST BENFIT ANALYSIS OF POLICY MEASURES .............................................. 139

8.1 Scope of the Life Cycle Cost Analyses ................................................................... 139

8.2 Assumptions and Specifications ............................................................................ 139

8.3 Results of Life Cycle Cost Analyses ..................................................................... 143

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

4

8.3.5 Conclusion ............................................................................................................. 147

9. CONCLUSION AND RECOMMENDATION ............................................................. 150

REFERENCES ...................................................................................................................... 152

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

5

ACRONYM

AACG: Addis Ababa City Government

AU: African Union

BAU Business as Usual

CD Core Diplomatic

CIF Cost, Insurance & Freight

DPF Diesel Particulate Filter

ECRGES Ethiopia’s Climate-Resilient Green Economy Strategy

EFI Electronic Fuel Injection

EPA Environmental Protection Authority

EPE Ethiopian Petroleum Enterprise

ERCA Ethiopian Revenues & Customs Authority

ETH Ethiopia

FDRE Federal Democratic Republic of Ethiopia

FO: Freight on Board

FTA Federal Transport Authority

GFEI Global Fuel Economy Initiative

GHG Green House Gas

GTP: Growth & Transformation Plan

ICCT International Council on Clean Transportation

IEA International Energy Agency

ITF International Transportation Federation

LCC Life cycle costs

No Number

OPEC Organization of Petroleum Exporting Countries

Proc Proclamation

Reg Regulations

SNNPR Southern Nations, Nationalities and People Region

UN United Nations

UNEP Unite Nation Environmental Protection

UNFCCC United Nations Framework Convention on Climate Change

VAT: Value Added Tax

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

6

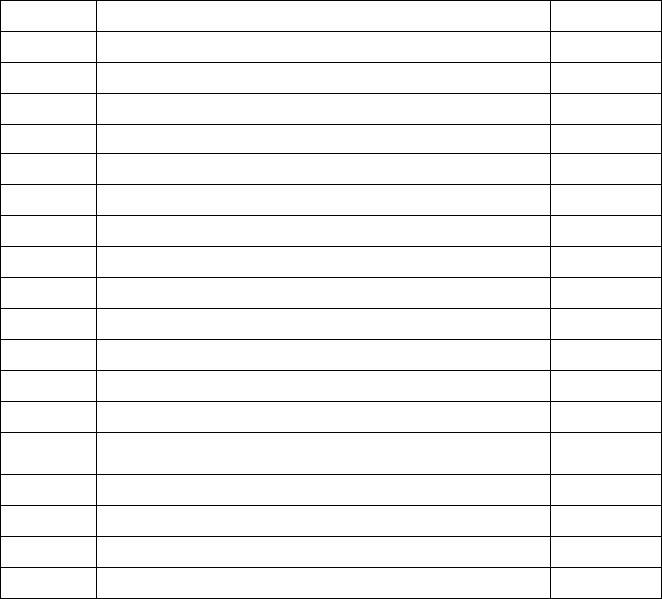

LIST OF TABLES

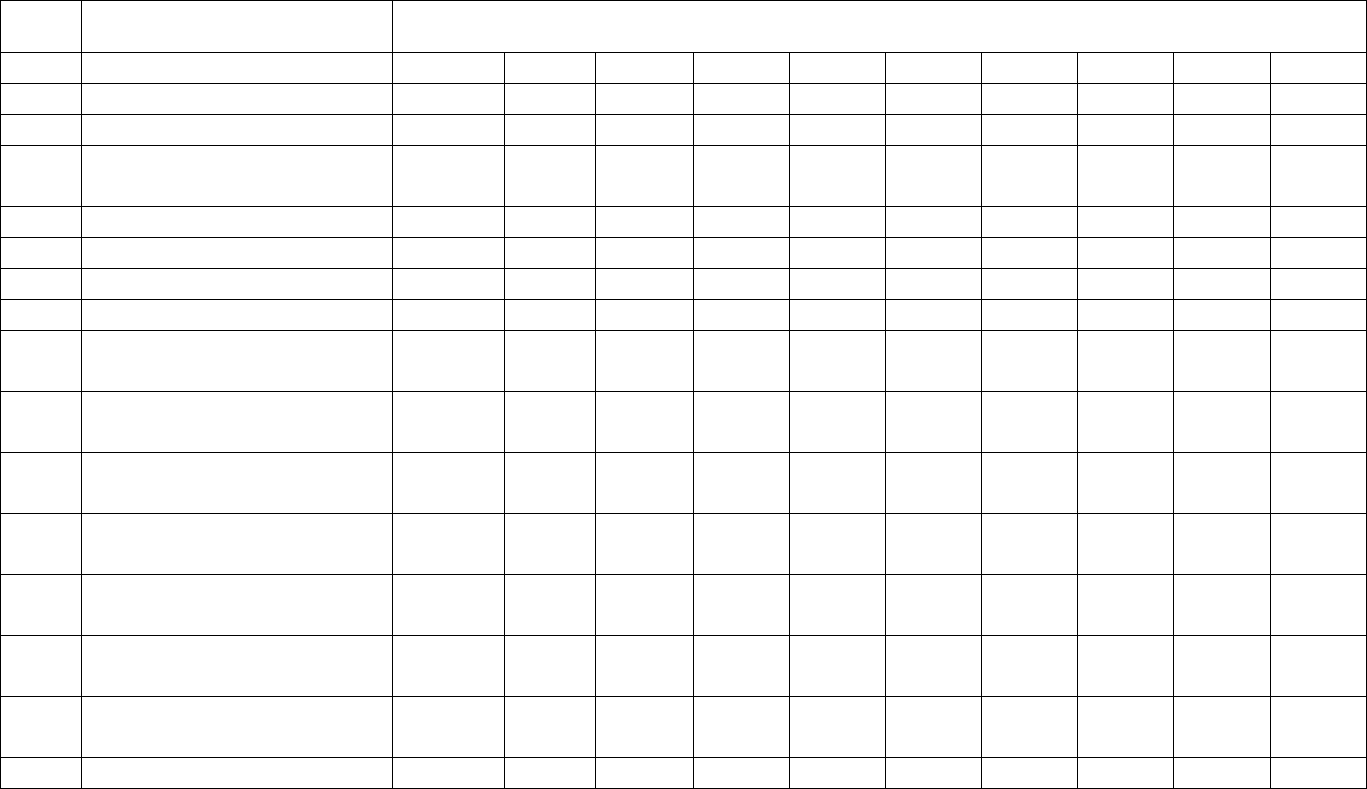

Table 2.1 Custom Duty and Tax Rates of Imported vehicles in Ethiopia

Table 3.1 Example of unstructured raw data in ERCA’s database

Table 3.2 Example cleaned and structured data

Table 3.3 Imported light duty vehicle registered per year

Table 3.4 Locally assembled light duty vehicles per year

Table 3.5 Light duty vehicles registration by condition (New and Used)

Table 3.6 Classification of newly registered LDVs by age group for year 2005, 2008, and

2010

Table 3.7 Classification of registered LDVs by engine displacement volume

Table 3.8 Classification of registered LDVs by body type

Table 3.9 Registration of LDVs by fuel type

Table 3.10 Harmonic Average Fuel Economy and Average Annual Emission for all LDVs

Table 3.11 Harmonic average fuel economy and average annual emission for diesel vehicles

Table 3.12 Harmonic average fuel economy and average annual emission for petrol vehicles

Table 3.13 Harmonic Average Fuel Economy and Annual Emission for all LDVs

Table 3.14 Harmonic Average Fuel Economy and Average Annual Emission for Diesel

Vehicles

Table 3.15 Harmonic Average Fuel Economy and Average Annual Emission for Petrol

Vehicles

Table 4.1 Total vehicles inspected in Addis Ababa and Regions (2010/11)

Table 4.2 Summary of vehicle classification and important parameters

Table 4.3 Summary of vehicle classification by body type and engine capacity

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

7

Table 4.4 Distribution of motorcycles and tricycles in Addis Ababa (Total number of

motorcycles and tricycles: 2084)

Table 4.5 Gasoline vehicle distribution by body type in Addis Ababa

Table 4.6 Light duty diesel vehicle distribution by body type in Addis Ababa

Table 4.7 Cargo diesel vehicle distribution by gross weight in Addis Ababa

Table 4.8 Bus distribution in various categories in Addis Ababa

Table 4.9 Summary of motorcycles and tricycles distribution in Amhara region

Table 4.10 Summary of motorcycles and tricycles distribution by year of manufacture in

Oromia region

Table 4.11 Summary of motorcycles and tricycles distribution in SNNPR region

Table 4.12 Summary of motorcycles and tricycles distribution in Tigray region

Table 4.13 Summary of ET-code motorcycles and tricycles distribution in Addis Ababa and

some regions

Table 14 Gasoline vehicle distribution in Amhara region

Table 4.15 Gasoline vehicle distribution by engine capacity in Oromia region

Table 4.16 Gasoline vehicle distribution by engine capacity in SNNPR

Table 4.17 Gasoline vehicle distribution by body type in Tigray region

Table 4.18 ET-code gasoline vehicle distribution by body type in Addis Ababa and some

regions

Table 4.19 Diesel vehicles distribution by engine capacity in Amhara region

Table 4.20 Diesel vehicles distribution by engine capacity in Benshagul Gumuz region

Table 4.21 Diesel vehicles distribution by engine capacity in Oromia region

Table 4.22 Diesel vehicles distribution by engine capacity in SNNPR region

Table 4.23 Light duty diesel vehicles distribution by body type in Tigray region

Table 4.24 Cargo trucks distribution by gross weight in Tigray region

Table 4.25 Distribution of buses in various categories in Tigray region

Table 4.26 ET-code light weight diesel vehicles distribution by body type

Table 4.27 ET-code cargo trucks distribution by gross weight

Table 4.28 ET-code buses distribution in various categories

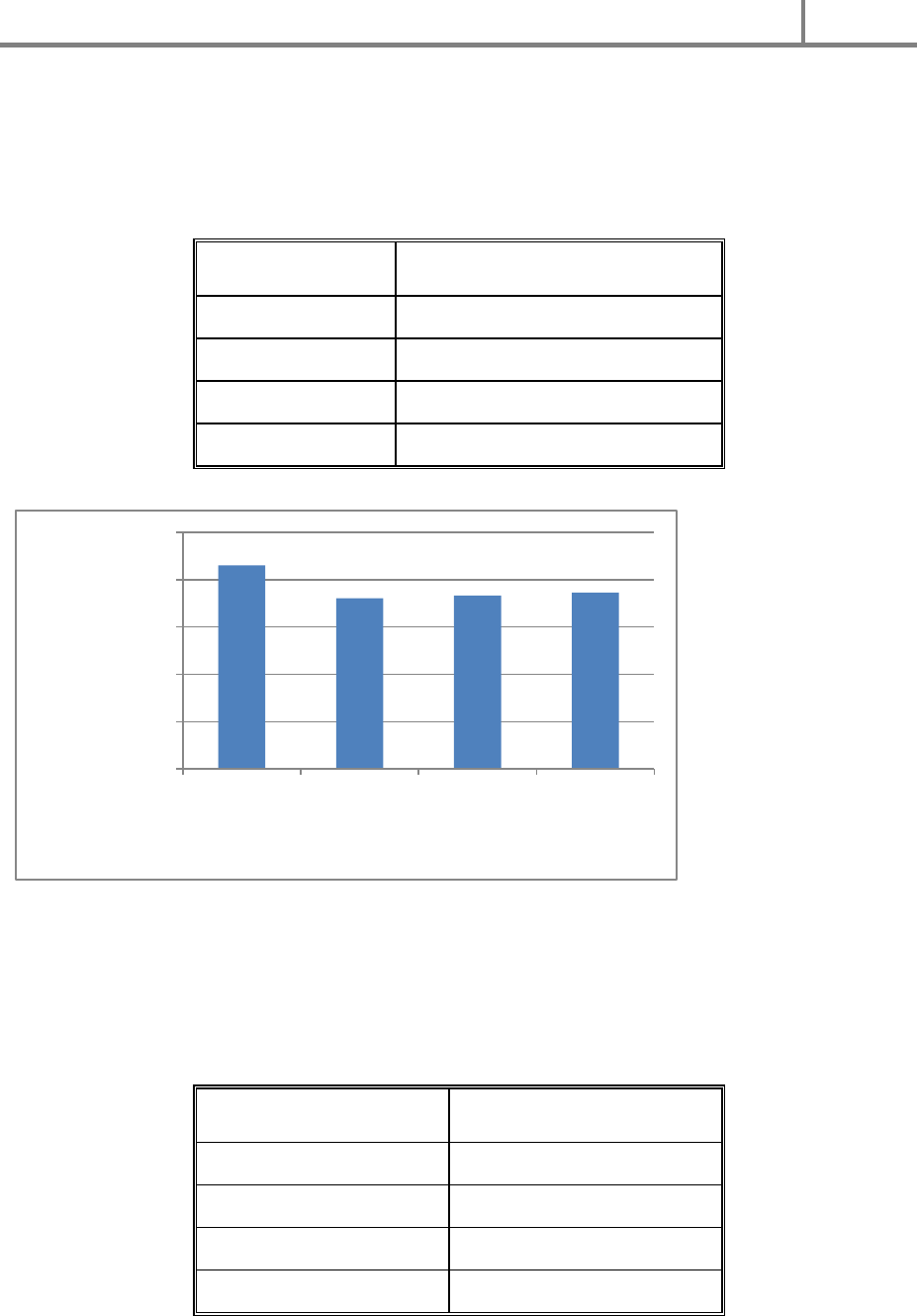

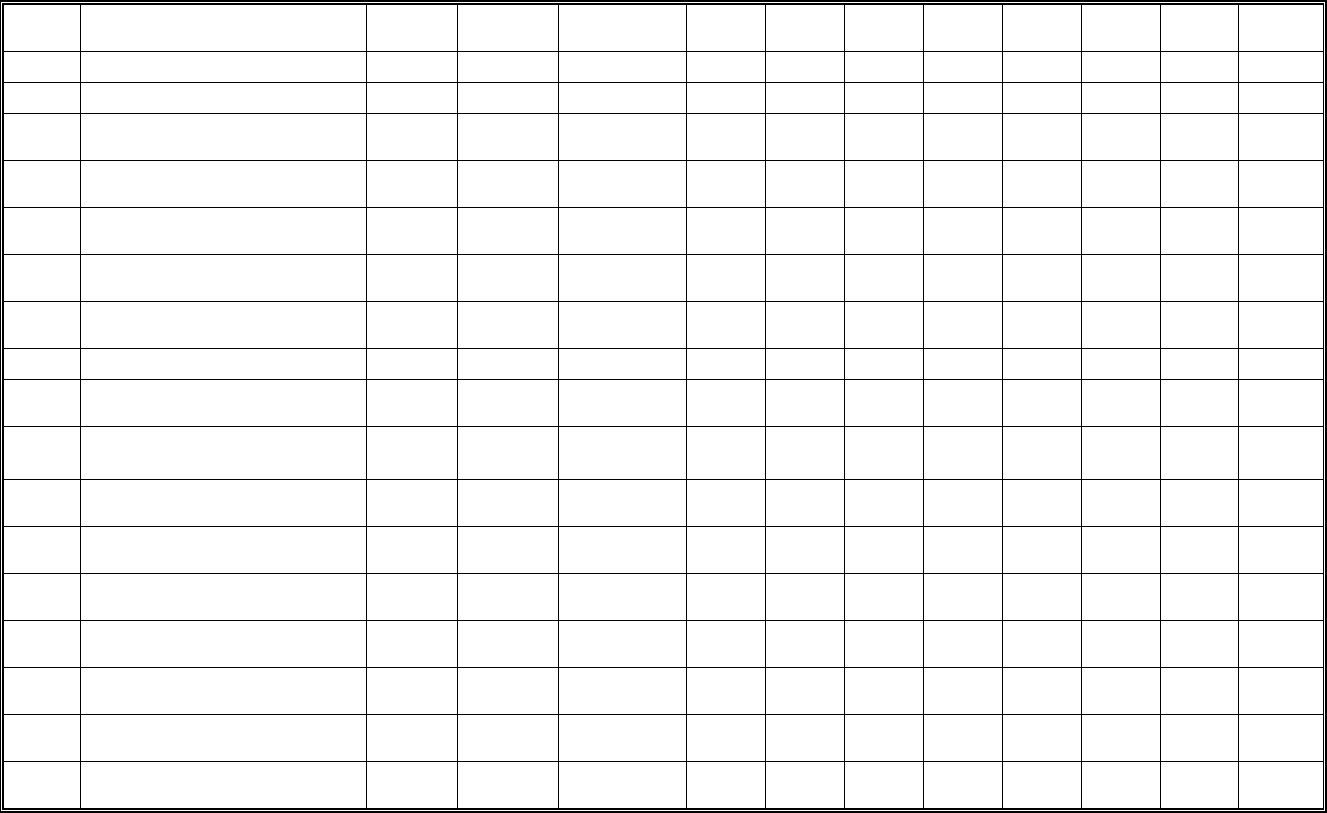

Table 5.1 Petroleum product sales (consumption) quantity in metric ton

Table 5.2 Total amount of ethanol blending from 2008-2012

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

8

Table 5.3 trend of Total blend of ethanol, Gasoline and Diesel (2008-2012)

Table 5.4: Gasoline and Diesel specifications (applicable in Europe 2009-2012)

Table 5.5 STM Specifications for Gasoline and Diesel (2012)

Table 5.6 Ethiopian Specifications for Gasoline and Diesel 2012

Table 5.7 Summary of Gasoline Fuel Quality in 2011

Table 5.8 Summary of Diesel Fuel Quality in 2011

Table 5.9 Summary of Gasoline Fuel Quality in 2010

Table 5.10 Summary of Diesel Fuel Quality in 2010

Table 5.11 Sulfur content of imported Diesel for the previous 8 years

Table 5.12 Sulfur content of imported gasoline (From 2004-2011)

Table 6.1 EPA Ethiopia and WHO air quality guidelines [EPA, 2003; WHO, 2005]

Table 6.2 Measurement sites and location

Table 6.3 CO concentrations at different sites collected during the dry season

Table 6.4 Wet season CO concentration level at different sites

Table 6.5 PM

2.5

concentration data for different sites during the dry season

Table 6.6 PM

2.5

concentration levels at the three sites during the wet season

Table 6.7 Climate data for Addis Ababa [Wikipedia]

Table 6.8 Mileage and fuel consumption per vehicle category in Addis Ababa (2010/2011)

Table 6.9 Annual emissions of pollutants per vehicle category in Addis Ababa (2010/2011)

Table 6.10 Euro II Emission standards in the European Union for passenger cars and light

duty vehicles

Table 6.11 Euro III emission standards for heavy duty diesel vehicles,

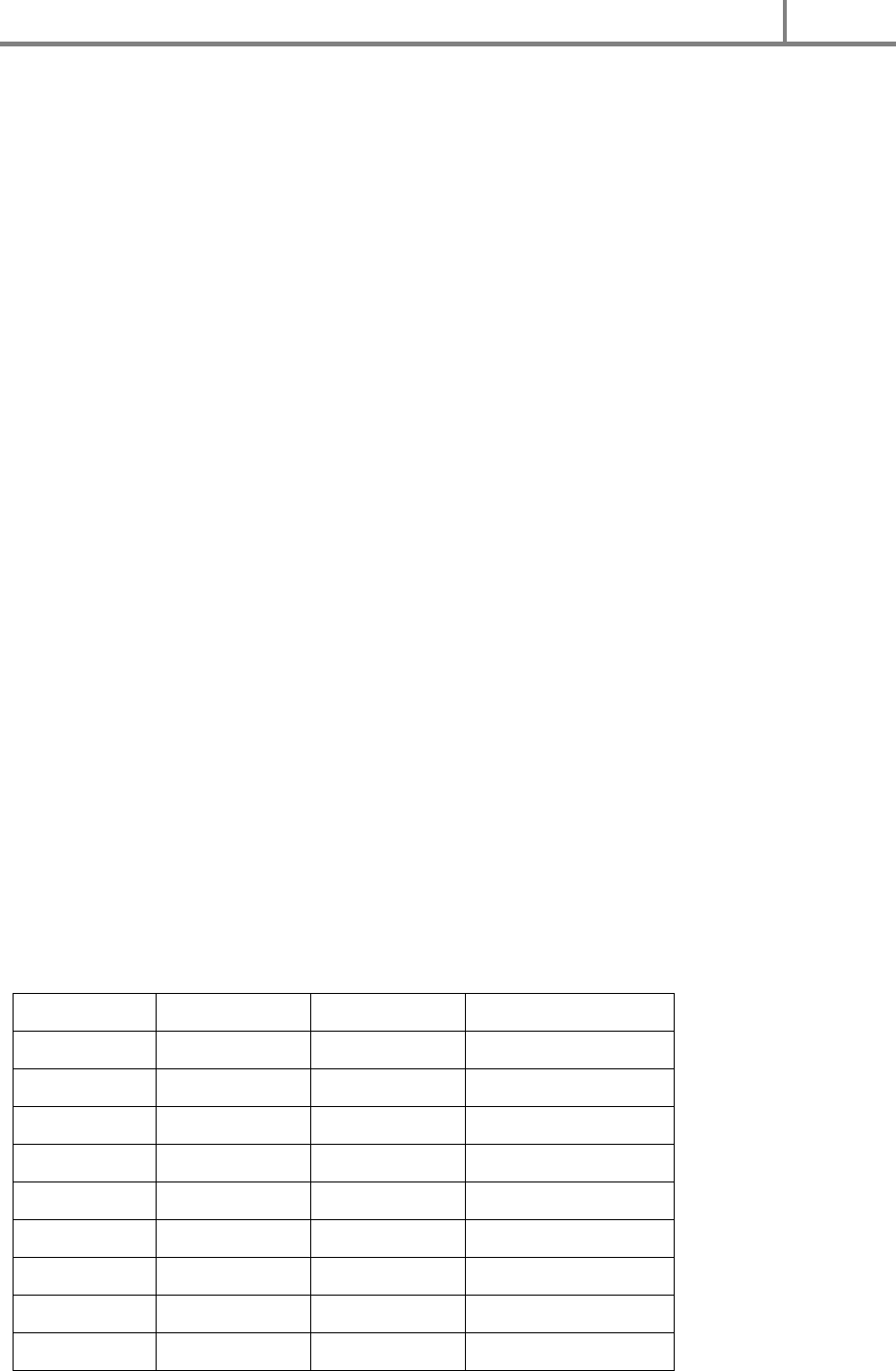

Table 7.1 Fuel Economy Target for 2020

Table 7.2 Fuel Economy Target for 2030

Table 7.3 Fuel economy target for 2050

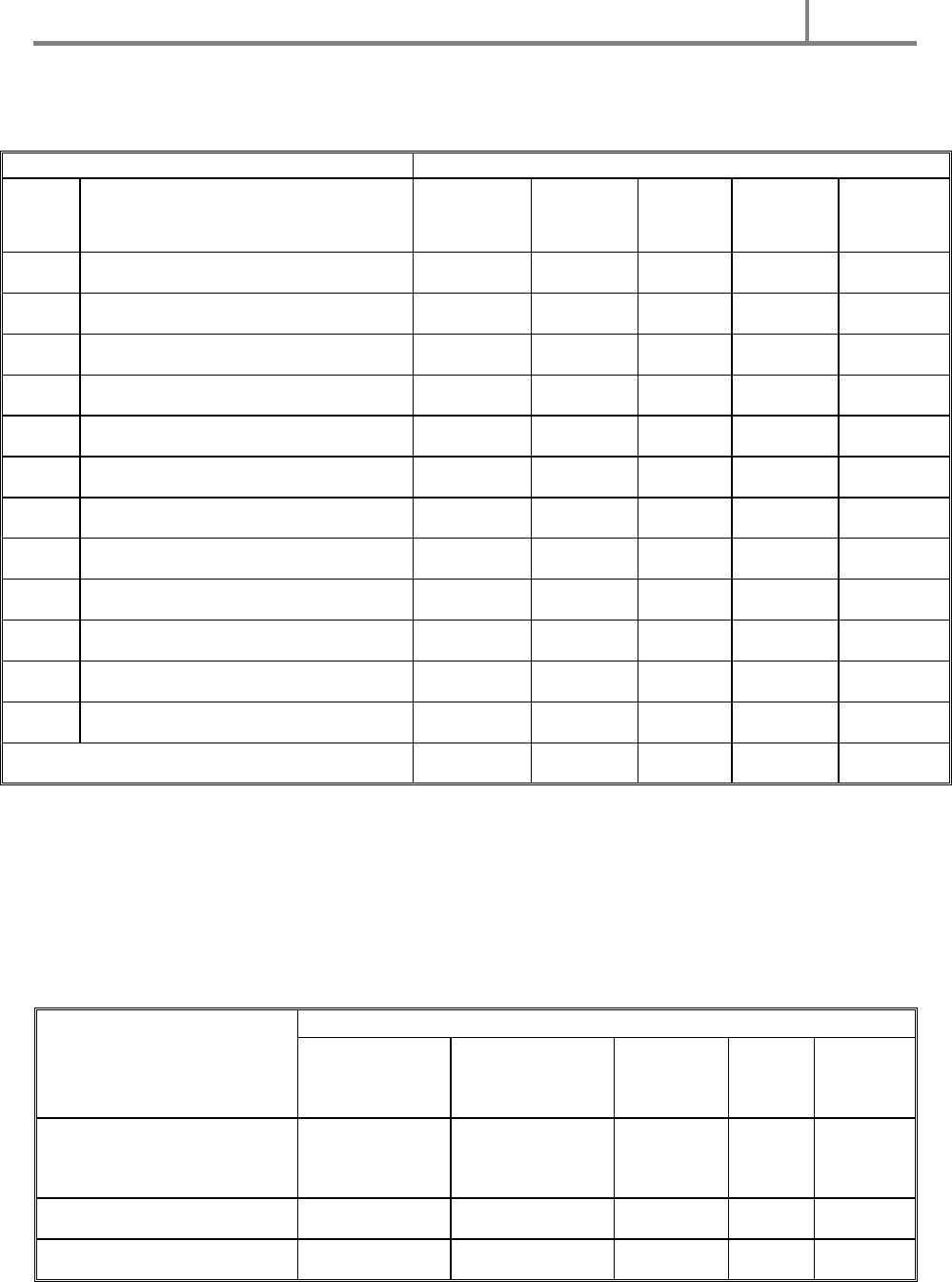

Table 8.1: Life cycle cost of the vehicles with the existing tax regime for 36,000 km/year

mileage

Table 8.2: Life cycle cost of the vehicles for 24,000 km/y mileage and 10 % fuel inflation

and cost of electricity increase 1.3 Birr/kWh

Table 8.3: Life cycle cost of vehicles of different ages under existing fuel price and 5%

annual fuel inflation under consideration assuming annual mileage of 24,000 km

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

9

Table 8.4: Life cycle cost of vehicles of different ages under existing fuel price and 5%

annual fuel inflation under consideration assuming annual mileage of 36,000 km

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

10

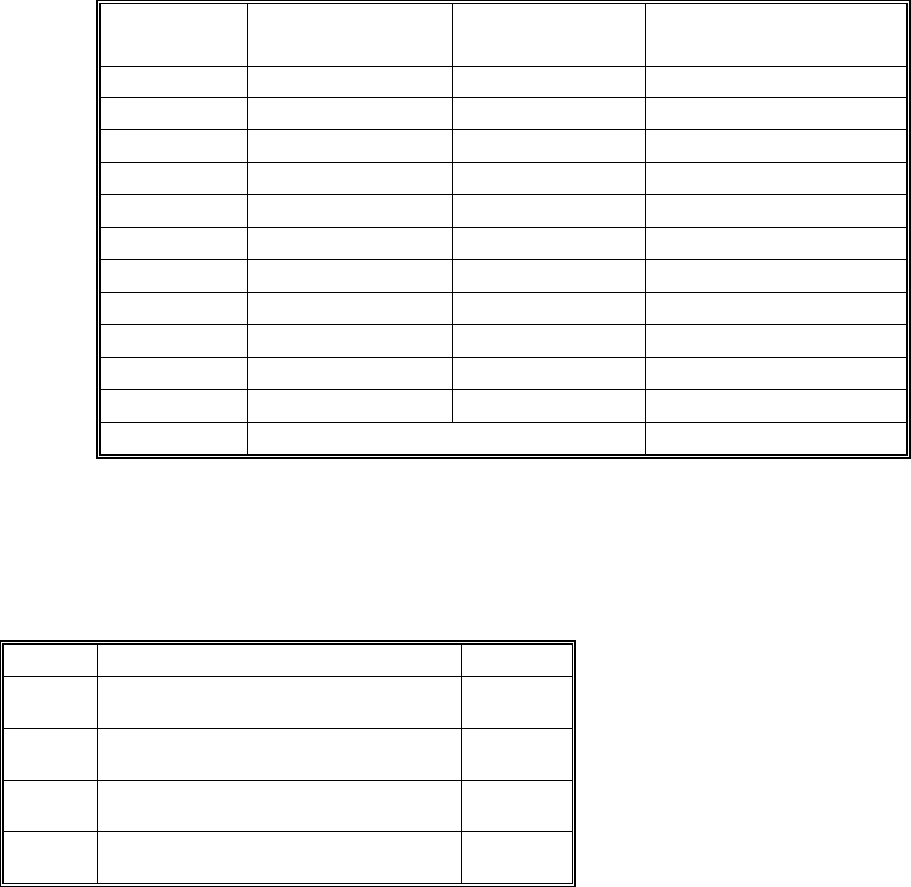

LIST OF FIGURES

Figure 1.1 CO

2

emissions in ton from the transport sector in Ethiopia as per BAU scenario

Figure 3.1 Total LDVs Registration by Year

Figure 3.2 Light duty vehicle registration by condition (New and Used)

Figure 3.3 Number of registered LDVs in different years by age groups

Figure 3.4 Classification of registered vehicles by make

Figure 3.5 Body types of registered LDVs by year

Figure 3.6 Classification of registered LDVs by fuel type

Figure 3.7 Quantity of LD Vehicles registered by fuel type

Figure 3.8 ECE 15 or Urban Drive Cycle

Figure 3.9 EUDC for high power engine

Figure 3.10 EUDC for low power engine

Figure 3.11 Harmonic average fuel economy and average annual emission for all LDVs

Figure 3.12 Average annual emission trend for all type of LDVs

Figure 3.13 Harmonic average fuel economy for all registered LDVs considering aging

Figure 3.145 Average annual emission trend for all registered LDVs in g/km considering

aging

Figure 4.1 Summary of motorcycles and tricycles distribution in Ethiopia by engine capacity

Figure 4.2 Distribution of motorcycles and tricycles in Ethiopia by year of manufacture

Figure 4.3 Distribution of motorcycles and tricycles by fuel type

Figure 4.4 Distribution of gasoline vehicles by engine capacity

Figure 4.5 Summary of gasoline vehicles distribution by year of manufacture

Figure 4.6 Summary of gasoline vehicles distribution by type of air fuel mixture formation

Figure 4.7 Summary of diesel vehicles distribution by year of manufacture

Figure 4.8 Summary of diesel vehicles distribution by type of fuel system

Figure 5.1 Trend of gasoline and diesel consumption

Figure 5.2 Global maximum gasoline sulfur content (source: www.ifqc.org)

Figure 5.3 Global maximum sulfur content of diesel (source: www.ifqc.org)

Figure 5.4 Trend of sulfur content of diesel

Figure 5.5 Trend of sulfur content of gasoline

Figure 6.1 Relative air pollutants (HC& NO

2

) exposure by transportation mode

[www.vtpi.org]

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

11

Figure 6.2 Measured CO concentration at Bole Bridge during the dry season

Figure 6.3 Measured CO concentration at Teklehaimanot Square during the dry season

Figure 6.4 PM

2.5

concentrations at Bole Bridge

Figure 6.5 PM

2.5

concentrations at Teklehaimanot Square

Figure 7.1 Drive system of Hybrid vehicles

Figure 7.2 Battery pack of electric vehicle under the body

Figure 7.3 Three way catalytic converter

Figure 7.4 Availability and enforcement of low sulfur diesel in Middle East

Figure 7.5 Forecasted LD vehicle at present actual growth rate

Figure 7.6 Target average fuel economy of new vehicles of Ethiopia compared to other

countries

Figure 8.1 Toyota Yaris

Figure 8.2 Nissan Leafi

Figure 8.3 Life cycle cost of the vehicles with the existing tax regime in Birr

Figure 8.4 Life cycle cost of vehicles with excise and sur tax exemption

Figure 8.5 Life cycle cost of vehicles different ages under existing fuel price and 5% annual

fuel inflation

Figure 8.6 Projected incremental cost and benefits of low sulfur fuel in China

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

12

1. BACKGROUND AND INTRODUCTION

1.1 Country Background

Ethiopia is a country located in East Africa between 3 and 15

0

N latitude and 33 and 40

o

E

longitude. The total land area is about 1.1 million square kilometers. Ethiopia is bounded to

north and north east by Eretria, to east by Djibouti, to east and south east by Somalia, to south

by Kenya, to south west by South Sudan and to west and to north west by Sudan.

Ethiopia’s population has slightly exceeded 80 million at present that makes it the second

most populous country in Africa. The population is growing at around 2 % per annum. While

most part of the country in central, west and north and south Ethiopia are highlands, the

lowland areas are mostly located in east, south east and the rift valley part of the country.

Most of central, south and western parts of the country receive sufficient rainfall.

Since 1995, Ethiopia is a multi-national Federal Democratic Republic and is currently

governed by the Ethiopian People’s Revolutionary Democratic Front (EPRDF. Ethiopia has

achieved 11% economic in the last 10 years and has planned to reach middle-income status

by 2025. Increasing agricultural productivity and the share of the industry to the economy

are the main strategies. To achieve this goal Ethiopia’s Growth and Transformation Plan

(GTP) is an ambitious development plan of the government that is targeted to lay strong

foundation for industrialization up to 2015.

Ambitious industrial development in the country with conventional path of development can

result in negative environmental impact by increasing GHG emission drastically. To mitigate

this, the government has finalized the preparation of Climate Resilient Green Economy

development strategy in 2011 and began its implementation. The strategy will enable

exploitation of the vast hydropower potential, use of improved stoves in rural areas,

efficiency improvements in livestock value chain, preservation of the forest, utilization of

electricity from hydropower plants for freight transportation by building railway network and

light train transit in cities and use of improved and new technology vehicles with higher

efficiency.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

13

1.2 Project Background

While fuel efficiency of a vehicle is the volume of fuel consumed per unit or specified

distance travelled, fuel economy of a vehicle is considered to be the distance travelled per

unit volume of fuel. The fuel-efficiency of vehicles became a great concern for the first time

when OPEC increased fuel prices in 1970s following the Arab-Israel War in 1973. Within

few years fuel-efficient cars were considered a necessity to mitigate sky-rocketing fuel price.

Starting 1990s, the concern on the global warming made the reduction of fuel consumption of

vehicles very urgent. The global car fleet is predicted to triple by 2050 and over 80% of the

increase will be in developing countries, which will be a burden to the strained global

economy and can accelerate global warming if the current style of industrial development in

the developed countries is followed.

The Global Fuel Initiative (GEFI), which was formed by UNEP. IEA and ITF in 2009 and

joined by ICCT in 2012, sees that there is an opportunity to improve new car fuel efficiency

by 30% by 2020 and 50% by 2030 in a cost effective way [UNEP,2010]. An improvement of

fuel efficiency will result in a proportional reduction on fuel consumption. Hence, it means

that 30 % of fuel will be saved per km traveled by 2020 and 50 % by 2050. The potential for

improvement of vehicle fuel economy can be realized by combination of the following course

of actions:

a) Improvement of fuel efficiency of conventional vehicles by reducing old vehicle

stock. Newer vehicle can have less frictional resistance and higher combustion

efficiency by, lean mixture burning and better electronic control. Improvement of

transmission efficiency by using continuously variable transmission.

b) Use of compact vehicles: vehicles with less body weight and projected area have less

aerodynamic and gravitational resistance and hence consume less fuel.

c) Use of new vehicle technology: Green vehicles are those that are environmentally

friendly compared to conventional gasoline or diesel vehicles. Green vehicles have

higher fuel efficiency or use no fossil fuel and hence, release less emission. This

category of vehicles includes hybrid vehicles, plug-in electric vehicles, fuel cell

vehicles and alternative fuel vehicles. Green vehicles that have completed the

technology development stage and in commercialization phase are: hybrid vehicles,

plug in electric vehicles and alternative fuels.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

14

d) Road improvement

• Roadway expansion reduces congestion delay which reduces fuel

consumption.

• Road condition improvement by frequent repair and street resurfacing reduces

vehicle braking and wear.

e) Changing driving habits: Driving with minimal acceleration and braking or cruising at

constant speed as much as possible

f) Changing transport modalities:- Availability of mass transit reduces passenger cars

on the streets or mileage that has to be covered and can contribute to vehicle fuel

economy.

Road transport is the biggest mode of transport that has a share over 95%, both in freight and

passenger movement in Ethiopia. It is estimated that the vehicle population has exceeded

325,000 and growing by about 10% annually. Most of the vehicles are older than 15 years

and beyond their useful service life. As a result high fuel consumption, emission of

pollutants, and road accident prevail.

The increase in road passenger-km travelled in Ethiopia was forecasted at an annual growth

rate of 8.3%-9.1%. The total passenger transport in passenger-km in Ethiopia is expected to

increase from 40 billion in 2010 to 220 billion in 2030 driven by a strong urbanization.

According Ethiopia’s Climate-Resilient Green Economy strategy, if business goes as usual (

BAU), emissions from the motor vehicles will increase from 5 -ton CO

2

in 2010 to 41ton CO

2

in 2030 as shown in Figure 1.1 [ FDRE,2011].

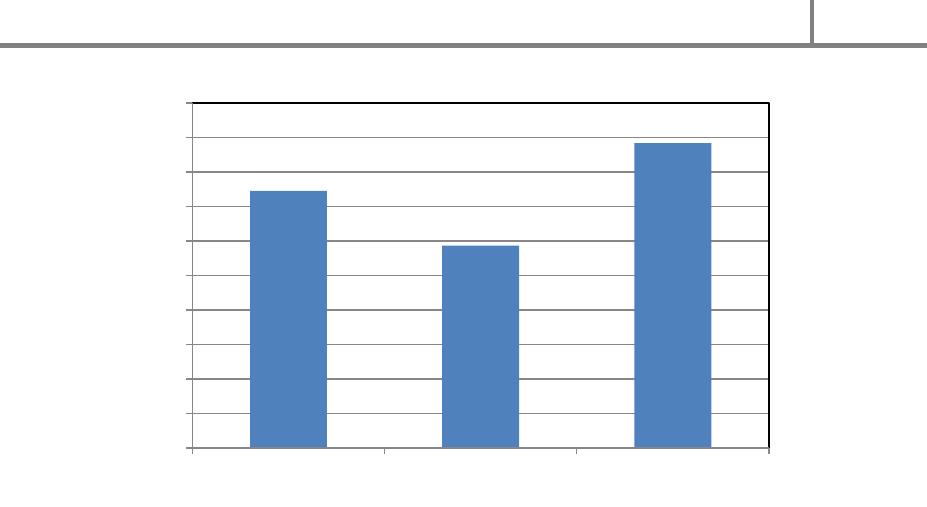

Figure 1.1 CO

2

emissions in million ton from the transport sector in Ethiopia as per BAU

scenario

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

15

As a result GHG emissions of passenger cars will increase from 2.5 million ton in 2010 to

13.1 million ton CO

2

equivalent in 2030 assuming there will be average fuel efficiency

improvement of passenger vehicle fleet by 10% from 2010 to 2030.

By introducing new technologies in the transport sector, the emission of CO

2

is planned to be

reduced down to 13.2 million ton CO

2

in 2030 compared to BAU case. The major courses of

actions proposed by ECRGES are:

• Reducing demand of passenger cars in Addis Ababa by building a light-rail transit

system that goes from east to west and north to south and a bus rapid transit system;

• Improving vehicle fuel efficiency by setting fuel efficiency standards,

• Promoting clean fuels by blending ethanol with gasoline and gasoil with biodiesel

• Adopting hybrid and plug-in electric vehicles,

• Shifting freight transport from road to an electric rail network. Shifting freight to

electric rail is the single largest abatement lever in the Transport sector, with a

potential of 8.9 ton CO

2

reduction.

With regard to using alternative fuels, the plan is to use 15 % ethanol- 85 % gasoline blend

and 5 % biodiesel blend. As there is no limitation, the biodiesel content can be increased

provided enough jatropha or castor seed are cultivated and the oil is extracted and esterified.

The blending of gasoline with 15 % ethanol will not be a problem as excess ethanol will be

available from 10 sugar factories that will be erected in the near future. The use of bio-fuels

will reduce emission of greenhouse gases as well as contribute to stabilizing fuel price.

Ethiopia has signed the United Nations Framework Convention on Climate Change in Rio de

Janeiro, in 1994. According to the terms of the responsibilities of the convention, Ethiopia

has submitted initial communication in 2001 and it is working to contribute to efforts in

reduction of global Green House Gas (GHG) emissions by promoting green economic

development strategy. It is well known that reduction of GHG emissions requires reduction of

fossil fuel consumptions. Hence, Ethiopia is working with United Nations Environment

Program (UNEP) to increase vehicle fuel efficiency by identifying and implementing relevant

policy package.

Motor vehicles produce more air pollutants than any other single human activity. Nearly 50%

of global carbon monoxide (CO), hydrocarbons (HCs) and nitrogen dioxide (NO

2

) emissions

from fossil fuel combustion come from petrol and diesel engines. In city centers and

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

16

congested streets, traffic can be responsible for about 80-90% of these pollutants and this

situation is expected to be severe in cities in the developing countries. Vehicle emissions

mainly result from fuel combustion. The most common type of transport fuels are gasoline

(leaded or unleaded form) for light duty vehicles (such as automobiles) and diesel fuel for

heavy duty vehicles (such as buses, and trucks). For heavy duty vehicles, other commercial

fuels such as biodiesel and compressed natural gas (CNG) are available. These fuels,

especially biodiesel, have lower value of emissions per liter. Carbon dioxide (CO

2

) (a major

greenhouse gas responsible for global warming), is one of the main combustion products

emitted to the atmosphere from vehicle exhaust system. The major pollutants emitted from

gasoline fueled vehicles are CO, HCs, NOx (oxides of nitrogen) and lead (for leaded gasoline

fuel). In addition to these, a vehicle with diesel engine emits sulfur dioxide (SO

2

) if sulfur is

present in the fuel and particulate matter (PM) emissions. Specially, when the injection pump

or nozzle has trouble in functioning properly, the particulate emission becomes high. In

addition to these, a worn-out engine results in blue smoke exhaust due to combustion of

lubrication oil.

Climate change resulting from the greenhouse effects will present significant challenges

including risks to water supply and other resources. Global warming will also increase the

frequency of extreme events such as heat waves and wildfires posing additional risks to

human health and infrastructure. A changing climate will also make it more difficult to meet

air quality standards. Higher temperatures increase the photochemical formation of ozone, as

well as emissions from the natural sources such as plants. It also increases the demand for air

conditioning resulting in the generation of additional electricity and smog forming emissions.

The likelihood of more frequent wildfires also poses a risk for air quality. On the whole,

global warming will make the control of smog-forming emissions more difficult and hence,

meeting air quality standards.

As per the contract between the Federal Democratic Republic of Ethiopia Transport

Authority and Addis Ababa Institute of Technology on “Pilot Global Fuel Economy Initiative

(GFEI) Program/Project in Ethiopia”, the consulting team has prepared this draft final report.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

17

1.3 Objectives

This study focuses on the following main objectives and draws possible intervention options

to minimize the effects of atmospheric pollution and GHG emissions from cars in Ethiopia.

The study:

• Provides baseline data for tracking progress in improvement of vehicle efficiency as

per GFEI guidelines

• Ensures that Ethiopian policymakers have sufficient and updated information in order

to draft appropriate legislations and guidelines for dissemination of more fuel-

efficient vehicles that have fewer emissions of pollutants and GHG.

• Assesses the impact of vehicle emission and fuel quality on the ambient air quality

• Makes the study of GFEI in Ethiopia as a pilot for wide spread application in Africa

• Uses the experience gained for instructing Eastern Africa countries and sharing the

experience on GFEI regional and global conferences.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

18

2. NATIONAL REGULATIONS AND INCENTIVES FOR FUEL

EFFCIENT AND ENVIRONMENTAL FRIENDLY VEHICLES

2.1 Policy & Strategy, Legal, Institutional & Regulatory Framework

Environmental protection has been given an utmost importance in Ethiopia. The FDRE

Constitution (Proc. No. 1/1995) has provided two broad constitutional environmental

objectives: viz., the achievement of clean and healthy environment (see Article 92 (1)), and

the achievement of sustainable development (see Article 43 (1)).

The Ethiopian Environmental Policy and Conservation Strategy of Ethiopia (1997) provide

also detailed & broad directions as to how to realize the two environmental objectives within

the Ethiopian context.

In terms of environmental policy(as related to Atmospheric Pollution & Climate Change), it

has been stated as follows: The policy recognizes that, even at an insignificant level of

contribution of atmospheric green house gases, a firm & visible commitment to the principles

of containing climate change is essential and to take the appropriate control measures to show

concern and then deal with the rest of the world in a struggle to bring about its containment

by those countries which produce large quantities of greenhouse gases.

The recent FDRE’s Government GTP, and the ECRGES also incorporate plans, strategies

and broad programs on to realize the two fundamental environmental objectives within the

Ethiopian context [FDRE, 2011]. The government sees the opportunity to gear the

development of the transport sector to contribute to a sustainable development pathway. The

policy frame work by ECRGES to promote fuel efficient and environmentally friendly

transportation was discussed in chapter 1.

Following the Environmental Policy & Conservation suitable legal and institutional,

including regulatory, framework has also been instituted to achieve the two fundamental

environmental objectives.

Proc. No. 295/2002 provides the institutional & regulatory framework with respect to

environmental protection in Ethiopia. The institutional framework includes the

Environmental Council, the Federal Environmental Protection Authority (EPA), the regional

(including the two City Administrations i.e., Addis Ababa & Dire Dawa) Environmental

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

19

Agencies, and Environmental Units, which are legally expected to be established within each

of the specific development sector institution.

The Environmental Council shall have the power to review proposed environmental policies,

strategies and laws, and issue recommendations to the government (see Article 9 (1), Proc.

No. 295/2002). The draft regulations to be prepared under this project shall then be approved

by the Council of Ministers (see Article 20 Proc. No. 300/2002 (Environmental Pollution

Control Proc.) cum Article 77 (13), Proc. No. 1/1995 of the FDRE Constitution). The basis

for the Council of Ministers legislative action shall be the recommendation submitted to it by

the Environmental Council.

The EPA shall have a number of coordination responsibilities under the law. The EPA thus

shall have the power & duties to coordinate measures to ensure that the environmental

objectives provided under the Constitution and the basic principles set out in the

Environmental Policy of Ethiopia are realized (see Article 6 (1), Proc. No. 295/2002).

Specifically, with respect to environmental pollution & standards, the EPA, in consultation

with the competent agencies, sets environmental standards and ensures compliance with those

standards (see Article 6 (7) Proc. No. 295/20020).

The EPA under the Environmental Pollution Control Law (i.e., Proc. No. 300/2002), has been

provided with the following clear powers & duties with respect to setting environmental

standards. In consultation with competent agencies, the EPA shall formulate practical

environmental standards based on scientific & environmental principles (see Article 6(1)).

Among such possible environmental standards, one of them is air quality standards that

specify the ambient air quality & give the allowable amount of emission for both stationary &

mobile air pollution sources (see Article 6 (1) (b)).

From the project perspective, the competent organizations are meant to be the Ministry of

Transport and Transport Authority. The Ministry of Transport and the Transport Authority

shall also have the legal obligation to cooperate with EPA with respect to setting

environmental standards as related to mobile source of air pollution such as from vehicles. As

per Article 7 (1) (j) of Proc. No. 468/2005, the Transport Authority, in cooperation with the

concerned organs prepares and submits, and upon approval, implements standards related to

the smoke, gas, vapor, and the like emitted from the exhaust pipes of the vehicles and trains

with a view to preventing pollution, taking into account international criteria and the capacity

of the country.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

20

In terms of legal framework, Proc. No. 300/2002, the Environmental Pollution Control

Proclamation is another very relevant law with respect to controlling environmental pollution

including those from vehicular emission.

In terms of guiding any economic development by the principle of sustainable development,

Proc. No. 299/2002, the Law of Environmental Impact Assessment, shall also be relevant.

As related to international obligation & participation of Ethiopia, in terms of GHG reduction,

the following international instruments constitute the required legal framework:

• Proc. No. 439/2005

• Kyoto Protocol Ratification Proclamation, which protocol has been based on the UN

Framework Convention on Climate Change, and has been ratified by the Ethiopian

government.

In terms of the sector (Transport) specific legal regulation, the following proclamations &

regulations are very relevant in determining the legal framework. These are:

• Proc. No. 468/2005 (the Transport Authority establishment law)

• Proc. No. 681/2010 (vehicle identification, inspection & registration law)

• Proc. No. 691/2010 (Ministry of Transport empowerment law)

• Regulations No. 208/2011(road transport traffic control law)

• Regulations No. 74/2001 (motor vehicles & trailers identification, inspection &

registration law).

In terms of customs & tax systems, and incentive related issues, the following constitute the

legal framework:

• Proc. No. 285/2002 (VAT)

• Proc. No. 286/2002 (Income Tax)

• Proc. No. 300/2002 (Environmental Pollution Control Law)

• Proc. No. 622/2009 (Customs Proclamation)

• Proc. No. 691/2010 (Incentives related, as related to the Ministry of Finance &

Economic Development)

• Proc. No. 307/2002 (Excise Tax, Withholding Tax, Income Tax Proclamation)

• Regulations No. 133/2007; (Import Sur Tax, except on those exempted motor

vehicles for freights & passengers, and special purpose motor vehicles)

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

21

The regulation of fuel efficiency & vehicular emission is related to multifaceted legal

institutional & regulatory framework.

2.2 Vehicles Import Customs Duties & Applicable Taxes and Incentives

2.2.1 Customs Duties & Taxes

The customs tariff for imported vehicles shall be based on CIF cost of the vehicle unlike

other goods, which is based on FOB price. The custom & other applicable taxes (tariff) in

relation to vehicles are thus calculated based on CIF cost & as provided under the applicable

customs tariff & respective tax laws.

The following are the information collected from the relevant sources at the ERCA & the

applicable laws. Except those exempted, in relation to vehicles, the possible types of charges

(customs & all taxes) applicable to imported vehicles are the following: customs duty, value

added tax, excise tax, sur tax, and withholding tax. These are shown in Table 2.1.

a) Customs Duty

The applicable law shall be Proc. No. 622/2009 (Customs Proclamation), the Customs tariff

(see Article 45 (1)) & applicable customs related regulations. Customs duty is generally

applicable to all types of vehicles. The customs tariff rate may extend from 10% up to 35%

depending on the weight or capacity of the vehicle under consideration. The customs value

for imported goods shall be the actual total costs of the goods up to the first entry point into

customs territory of Ethiopia (see Article 32 (2) cum Article 33 & 39; see also Article 32-

Article 44 as related to calculation of customs value; Article 51-Article 53 as related to

payment of customs duties and taxes and service charges on imported goods including

vehicles; Article 67-Article 68 as related to relief (tax exemption) procedures). The payment

of customs tariff on goods including vehicles is based on Vol. II Customs Tariff, officially

issued by the ERCA. The latest version is January 2008 based on the 2007 version of the

Harmonized System. Vehicles related customs tariff has been provided under Chapter 87 of

the Customs Tariff Book (see pp 569-577).

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

22

b) Value Added Tax

The legal framework for VAT is Proc. No. 285/2002 and the relevant & applicable VAT

regulations. VAT is generally applicable to all imported goods except those exempted

transactions (see Article 8 cum Article 8 (2) (j), for example). The rate could be 0% (see

Article 7 (2) (b)) or fixed rate i.e., 15%. VAT is applicable to imported goods including

vehicles (see Article 2 (7) and here goods mean all kinds of corporal movable items. The

person who imports vehicles is a VAT payer (see Article 3 (1) (b). In the VAT proclamation

a person carrying out taxable import of goods to Ethiopia, shall be a VAT taxpayer. The

value of a taxable import, as per Article 15 (1), is the customs value of goods determined in

accordance with the customs legislation of Ethiopia, plus the sum of duties & taxes payable

upon the import of the goods into Ethiopia, excluding VAT and income tax withholding.

c) Excise Tax

The legal framework for Excise Tax is Proc. No. 307/2002 and related regulations. Excise

Tax may not be applicable to some types of vehicles. The tax rate may also be different from

vehicles to vehicles. The tax rate extends from 30% up to 100% depending on the capacity of

the vehicle under consideration. The person liable to the payment of excise tax shall be an

importer. Importer means any person (natural or juridical) who imports goods, which are

subjected to the payment of excise tax, in to the country (see Article 2 (2)). To this effect, the

Proclamation under its Schedule (Item No. 15), has provided the following:

• Motor passenger cars, Station Wagons, utility cars & Land Rover, Jeeps, pickups,

other similar vehicles (including motorized caravans), whether assembled with their

appropriate initial component or not follows the following tax categorization;

Item no 15.1: up to 1300 cc 30%;

Item no 15.2: from 1301cc up to 1, 800 cc 60%;

Item no 15.3: above 1 800 cc 100%.

• According to Article 5 (2), the base for computation of excise tax, with respect to

goods imported, shall be based on cost, insurance & freight (CIF).

d) Import Sur Tax:

The applicable law with respect to Import Sur Tax shall be Reg. No. 133/2007. Import Sur

Tax shall apply to all goods imported into Ethiopia except those exempted ones (see Article

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

23

2). The exemption has two aspects: schedule based exemption & non-schedule based

exemption. Under the schedule based exemption & in relation to vehicles, motor vehicles for

freight & passengers, and special purpose motor vehicles are exempted (see Article 5 cum the

Schedule). Non-Schedule based exemption refers to goods imported by persons or

organizations exempted from customs duty by law, directives or by (international) agreement

entered into by the (Ethiopian) government. Import Sur Tax of 10% shall be levied &

collected on all goods imported except the exempted ones. According to Article 4, the basis

of computation for the import surtax shall be the aggregate of CIF value; customs duty, VAT

& Excise Tax Payable on the good.

e) Withholding Tax

The applicable law for withholding tax shall be Proc. No. 286/2002 (Income Tax Proc.)

specifically Article 52, Collection of Tax on Imports. This tax is applicable in relation to

import of goods for commercial use. In particular Article 52 (1) states the follows:

A current payment of income tax shall be collected on Schedule C (Income/Business

Income Tax) income at the time of import of goods for commercial use, and the

collected amount treated as tax withheld that is creditable against the tax payer’s

income tax liability for the year. The amount (as withholding tax) to be collected on

imported goods shall be 3% of the sum of CIF value (see Article 52(2)).

The charge/tax rate may generally be categorized in to three as 0 rates, low rate, and higher

(full) rate.

• Zero rate (0%) applies for the following goods/items: ambulances, fire fighting

vehicles, defense vehicles; vehicles for handicapped (physically challenged)

• Low rate applies for the following one item, namely, tractors: The applicable customs

duty & tax are as follows:

Customs duty 10%;

VAT 15%;

Withholding tax 3%.

There will be no payment of surtax & excise tax.

• Higher (full) rate shall be paid on vehicles either based on seats or horse power (cc).

This is given in Table 2.1.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

24

The vehicles importation system, as related to payment of customs duties and other

applicable taxes including incentive regime is administered at two levels, policy &

operational level.

At the policy level, the policy related to fiscal matters shall be initiated and administered, if

approved by the Ministry of Finance and Economic Development (see Proc. No. 691/2010:

Article 18 and see also Article 67 of Proc. No. 622/2009).

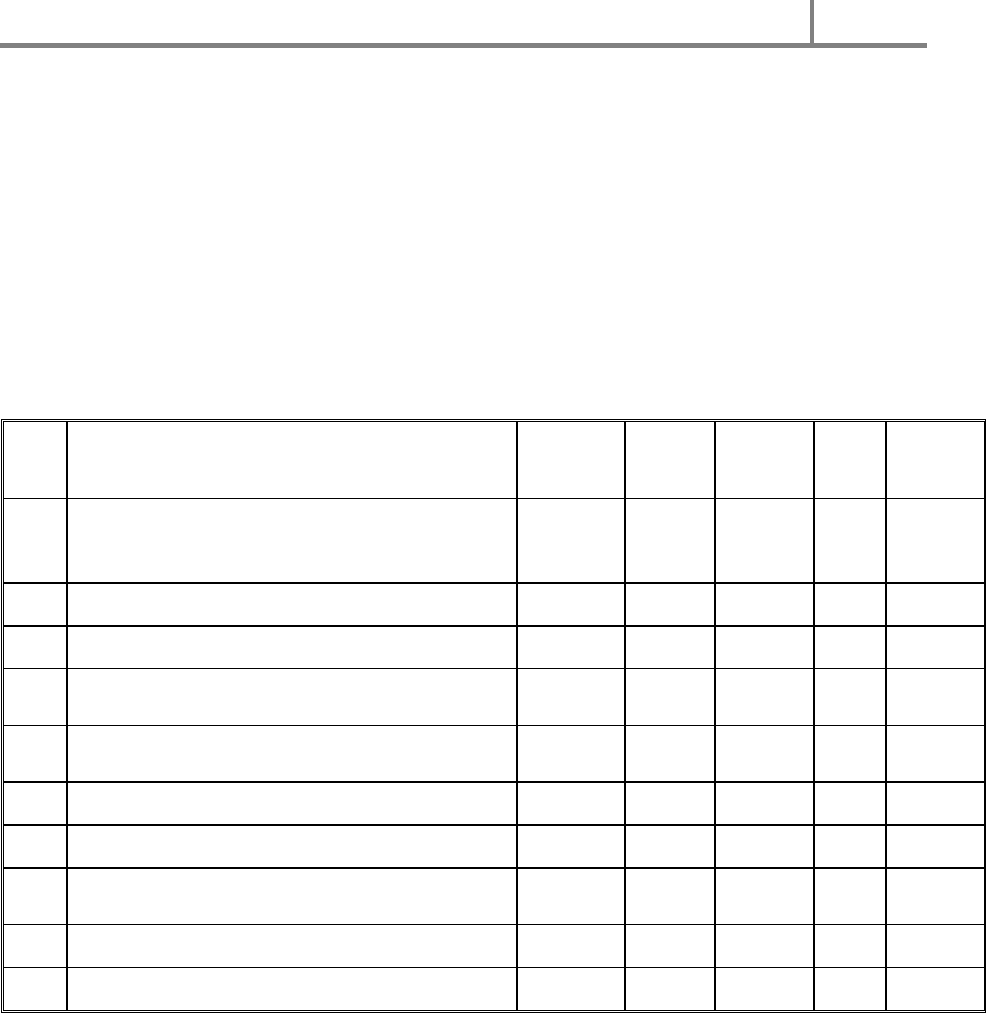

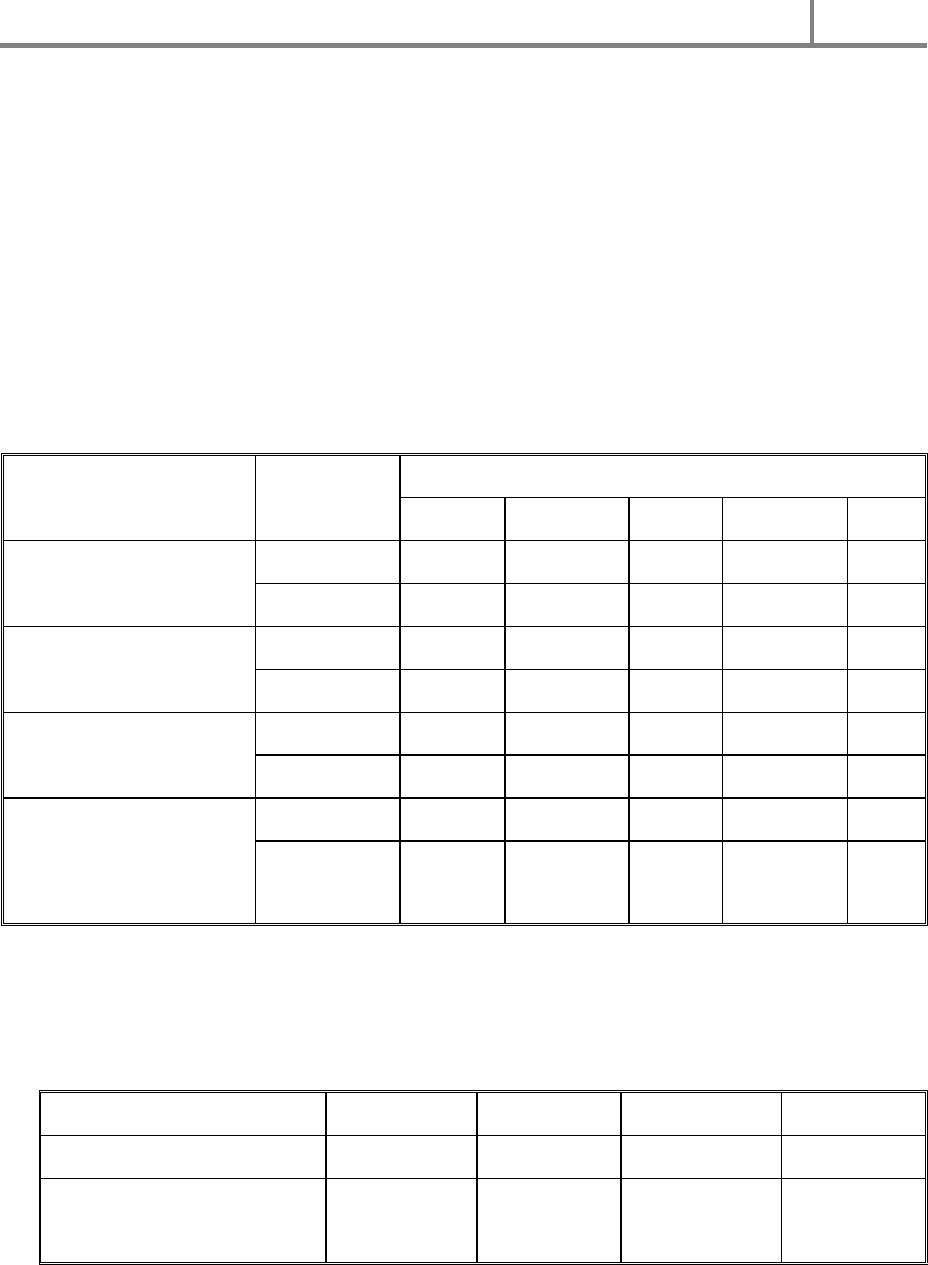

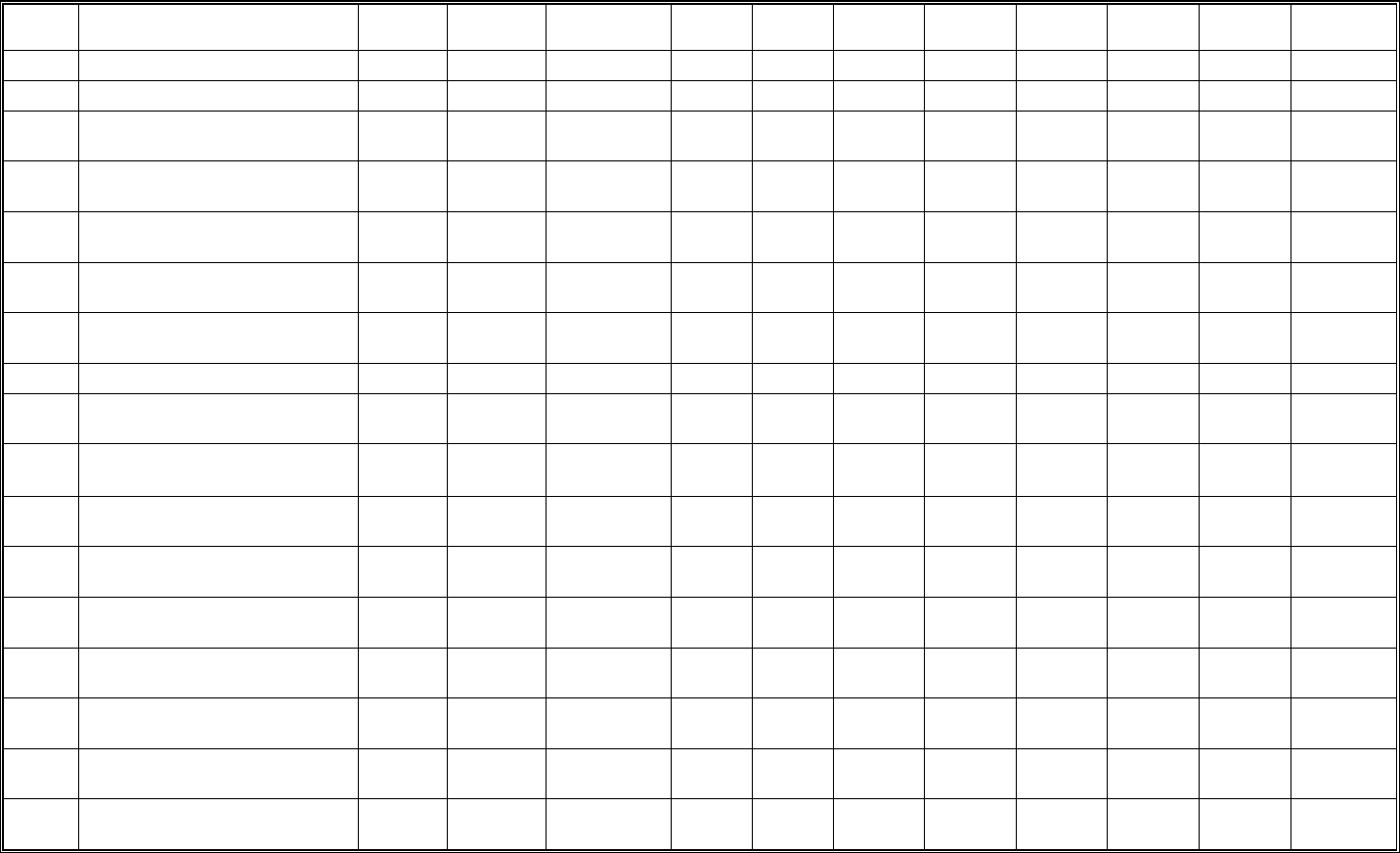

Table 2.1 Custom Duty and Tax Rates of Imported vehicles in Ethiopia

No

Goods /Items

Customs

Duty

%

Excise

Tax

%

Import

Sur Tax

%

VAT

%

With

holding

%

1.

Public Transport

Less than 15 and greater or equal to 10 seats

15 or more seats

35

10

-

-

-

-

15

15

3

3

Passenger cars Less than 10 seats

2.

Cylinder capacity not exceeding 1300 cc

35

30

10

15

3

3.

Cylinder exceeding 1300 cc but less than

1800cc

35

60

10

15

3

4.

Cylinder exceeding 1800 cc not exceeding

3000 cc

35

100

10

15

3

5.

Electric/Battery Vehicles

35

30

10

15

3

Trucks

6.

Cargo vehicles (based on weight) up to

1500 kg

35

-

-

15

3

7.

Cargo vehicles >1500 kg

10

-

-

15

3

8.

Heavy Duty, 5 - 20 ton

10

-

-

15

3

At the operational level the importation of vehicles system, as related to enforcement of

customs duties & other payable taxes on imported vehicles, is administered by the Federal

Revenues & Customs Authority based on the Harmonized System (see Proc. No. 587/2008

(ERCA Establishment Proc.) cum Proc. No. 622/2009: Customs Proc. & other applicable

laws).

2.2.2 Incentives

Each tax related law may provide incentive regime. The incentive regime shall serve as

exemption from the payment of the required tax or customs as provided. Incentives are more

commonly as related to economic objectives than related to environmental objectives.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

25

a) As related to Customs Duty

According to Article 67, Proc. No. 622/2009, duty free privilege with respect to import of

goods may be granted by law, international agreement to which Ethiopia is a party or by

directives to be issued by the Ministry of Finance & Economic Development. There are thus

three options to secure incentives: law, international agreement or directives.

In relation to vehicles, the following enjoy such privilege: ambulances (of different capacities

in a complete state), fire fighting vehicles, defense vehicles, vehicles for handicapped

(physically challenged).

If further privilege is to be provided for other vehicles, it has to be provided by law or by

directives to be issued by the Ministry of Finance & Economic Development (see Article 18

(5), Proc. No. 691/2010 cum Article 67, Proc. No. 622/2009).

b) As related to VAT

According to Article 8 of Proc. No. 285/2002, some exempted transactions have been stated

in Article 8 (2) as follows:

As per Article 8 (2) (j) the following types of import goods are exempt from payment

of VAT to the extent provided by regulations. These are :

Goods (the legal definition of goods also includes vehicles) imported by the

government organizations, institutions or projects exempted from (customs) duties

and other import taxes to the extent provided by law or agreement.

Article 8(4) also provides a possibility of granting exemptions for other goods & services,

due to directives to be issued by the Minister of Finance & Economic Development.

c) As related to Excise Tax

The Excise Tax law (Proc. No. 307/2002) provides the assessment & payment of excise tax

on certain types of vehicles (as per its Schedule) from 30% up to 100% excise tax. The

Excise Tax provides no incentive regime.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

26

d) As related to Import Sur Tax

Import Sur Tax is administered as per Import Sur Tax Reg. No. 133/2007. This law provides

the following exemptions to the following vehicles as per its Schedule. These are: motor

vehicles for freight & passengers, and special purpose motor vehicles.

e) As related to Environmental Objectives

Incentives for environmental objectives have been envisaged under Article 10, Proc. No.

300/2002 (the law of environmental pollution control); given as follows:

Incentives for the introduction of methods that enable the prevention or minimization of

pollution to an existing undertaking shall be determined by the regulations issued under the

proclamation. Importation of new equipment that is destined to control pollution shall, upon

verification by the EPA, be exempted from payment of custom duty.

Article 28 of Reg. No. 25/2007 (of the Addis Ababa City Government) also provides the

following: Incentives for the introduction of methods to an existing undertaking that enable to

prevent or minimize pollution shall be determined by the regulations to be issued by the

Federal Government for the implementation of Environmental Pollution Control Proc. No.

300/2002.

The Federal Government has issued Reg. No. 159/2008 in relation to industrial pollution. The

Federal Government environmental regulations (i.e., Prevention of Industrial Pollution

Council of Ministers Regulations No. 159/2008) deal specifically on industrial pollution.

Although these regulations focus mainly on stationary source of pollution from industrial

source, smoke limits and maximum CO concentration in motor vehicle exhaust is given.

However, the given CO limits are very high.

The incentive regime envisaged under the Federal Government environmental pollution

control proclamation & the Addis Ababa City Regulations, however, are only applicable to

factories. If there is a possibility of interpreting it differently, the content & scope of tax

provisions have to be interpreted restrictively. Therefore, it may not be possible to widen, by

interpretation, the scope of Article 10 (under the proclamation) & Article 28 (under the said

City regulations) to cover vehicles as well.

This obviously requires a policy dialogue to be held with the Ministry of Finance &

Economic Development, based on concrete proposals, to initiate the required incentive

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

27

regime by way of legislative amendment. Legally, the federal EPA is the key institution to

initiate such incentives.

The legislative measure required for consideration of incentives as related to vehicles might

depend on the type of the relevant tax or customs regime: viz., customs duty or VAT or

Excise Tax or Import Sur Tax.

The legislative measure may be required at two levels: at statutory level and/or non-statutory

level. The statutory level amendment may come in two aspects: in relation to amending Proc.

No. 300/2002 & in relation to the tax law at statutory level (say customs duty law or VAT).

The non-statutory legislative amendment or measure may come into picture in the following

way: in relation to a given tax regime law (say Import Sur Tax regulations).

Based on such statutory amendment, the incentive regime has to be provided for vehicles by

the new draft regulations (non-statutory) to be prepared under the present project.

By way of conclusion, the envisaged incentive regime under the environmental pollution

control laws may not be applicable for vehicles. There is a clear legal gap pertaining to

incentives for vehicles. Therefore, a legislative measure, in terms of legislative amendment &

new legal instrument, has to be taken to realize the desired incentive regime for vehicles.

2.3 Vehicles Registration & Inspection System

2.3.1 Vehicles Registration System

Vehicles identification, inspection and registration system is governed by Proc. No.

681/2010. As per the proclamation (see Article 2 (1)) vehicles means any type of wheeled

motor vehicle other than special military vehicles, for use on roads classified as carriage,

bicycle, motor vehicle, semi-trailer & trailer (see also Article 2 (13), Proc. No. 468/2005).

Motor vehicle means (see Article 2 (4)) any vehicle moving on a road by mechanical or

electrical power. The definition for motor vehicle has been broadly defined by Proc. No.

468/2005: Motor Vehicle means a vehicle moving by mechanical or electrical power,

classified as truck, motorcycle, private motor car, public service vehicle, truck, tractor and

special mobile equipment. Each of the items under the definition has been defined legally

separately.

Vehicles, except those exempted by such proclamation, are identified through the registration

system. The exempted groups are the following (see Article 5, Proc. No. 681/2010);

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

28

inventory vehicles; vehicles engaged in international traffic; special mobile equipment with a

maximum speed of less than 20 km per hour; and carriages of handicaps.

The registration system is based on ownership & identification number plate. The

identification number plate is divided into two, federal & regional. The ownership

identification system is similar (except for those only to be issued by the federal government

like embassies, international organizations & aid plates, ETH) both at federal and regional

(including the City of Addis Ababa and Dire Dawa) level, which is identified by different

colors and codes. Those colors & codes, except for temporary, transferrable & special mobile

equipment plate, provide the ownership dimension of the vehicle under consideration.

As per the Schedule, attached to the said Proc., the following 11 (eleven) plates are provided:

Taxi plate; Private Plate; Commercial Plate (see also under ETH Plate); Government Plate

(see also under ETH Plate); Religious & Civic Societies Plate; Temporary Plate; Transferable

Plate; Special Mobile Equipment Plate; Police Plate; Embassies, International Organizations

& Aid Plate; ETH Plate (indicates vehicles engaged in cross country commercial road

transport service or owned by the federal government);

The regional (including the city of Addis Ababa & Dire Dawa) plate types have also been

provided under the same Schedule with their respective abbreviations (like AA to indicate

vehicles registered in Addis Ababa).

Ownership of vehicles may thus conveniently be categorized into the following four groups:

private, government, international & non-government which will include:

• Private; taxi, private & commercial

• Government; government itself & police

• International; embassies & international organizations (UN, AU & CD); and

• Non-governmental; domestic & international: religious & civic societies (domestic),

and international aid organizations;

The ownership dimension may help design the implementation strategy, from which group of

vehicles to commence implementation of the fuel efficiency and the environmental

requirement of vehicular emission reduction.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

29

2.3.2 Vehicles Inspection System

The applicable law (i.e., Proc. No. 681/2010) clearly provides a legal requirement for the

annual inspection (see Article 25) of vehicles except for those exempted under such law (see

Article 26). According to Article 29, there are four vehicles inspection criteria.

Among the inspection criteria environmental criteria is one. According to Article 29 (1) (d), it

is stated as follows: An authorized inspector of an inspection station shall inspect each

vehicle presented for the purpose of establishing the vehicles compliance with environmental

pollution protection standards as per the appropriate law. As per this law (Article 29(2)), the

federal Transport Authority has also been authorized to issue directives to provide for

additional inspection criteria and the implementation of the Article.

Reg. No. 208/2011, as per its Article 10 (1) (a) clearly prohibits the following; No person

may drive on a road any vehicle which is not properly maintained, discharges smoke, vapor,

oil or fuel of higher amount than the appropriate level and which is likely to cause annoyance

or damage to other road users or the environment.

There is no legally prescribed environmentally related standard vehicles inspection criteria

yet. As discussed with relevant informants, the Transport Authority has also not yet issued

the required directives as provided under Article 10 (2) of the said Proclamation (No.

681/2010).

Therefore, based on the new vehicular emission level, the said directives have to be prepared

& issued by the Transport Authority.

2.4 Ethiopia’s International Obligation/Participation

Emission of GHG to the atmospheric environment including from vehicular source is of an

international concern due to its contribution to climate change. Ethiopia, as one of the

member of the international community and therewith to the global environmental system, is

an active participant in the protection of the global environment.

This is evident from the number of legislative ratifications already done with respect to

international environmental agreements by the Ethiopian government. Among the

international environmental agreements ratified by the Ethiopian government, pertaining to

atmospheric environment, the UN Framework Convention on Climate Change (ratified in

1994) and the Kyoto Protocol (ratified in 2005) are few. Ethiopia is not as such a country

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

30

classified as contributor to the atmospheric pollution. Her participation at international level

is based on voluntary and thus on moral obligation basis.

2.5 Formulation of Draft Regulations

The need for drafting new draft regulations with a view to promote fuel efficient vehicles &

therewith to regulate vehicular emission is evident. However, there are some issues to be

discussed, namely, the need to have an ambient air quality standard; the need to establish

vehicular emission standard; under which type of tax law the type of incentive to be

provided; at what level the draft regulations to be issued as regulations; and the scope of

application of the said draft regulations.

Ambient air quality standard is a prerequisite to determine the (vehicular) emission level.

There is no legally established ambient air quality standard in Ethiopia. Such quality standard

has to be determined by law. The initiative has to be taken by the Federal Government EPA

to this effect. There is an already developed draft ambient air quality standard.

The vehicular emission standard has been prepared by adoption, under the current project.

Under which type of tax law the incentive to be provided requires serious discussion by all

stakeholders. The recommendation could be to provide an exemption from Excise Tax and/or

from Import Sur Tax.

Should the provision of incentives for vehicles undergo two legislative processes, statutory &

non-statutory, such legislative process looks as follows.

2.5.1 Statutory Legislative Process

To provide the required incentive regime on environmental objectives, the required

legislative amendment has to be made in relation to Proc. No. 300/2002. This is going to be

done by the House of Peoples Representatives based on the draft amendment proclamation to

be prepared both by the Federal Government EPA in consultation with the Transport

Authority, then to be submitted to the Ministry of Finance & Economic Development. The

draft proclamation may go through the respective standing committees, for their respective

legislative review, before the House deliberates on same for its legislative measure. This is to

be so since the incentive regime touches two dimensions: economic dimension (revenue) &

environmental dimension (protection).

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

31

2.5.2 Non-Statutory Legislative Process

The process to be passed by the draft regulations may look as follows: the draft regulations

have to be prepared by the current project (based on the required inputs emission level,

incentive regime, implementation strategy, scope of application, etc.); the draft regulations

have to be presented for comments by stakeholders in a workshop; comments secured from

the workshop have to be incorporated; the draft regulations have to be submitted by the

Ministry of Transport and Transport Authority to the Federal Government EPA; the EPA

then submits same to the Environmental Council for its due deliberation & recommendation;

the Environmental Council then submits the draft regulations to the Council of Ministers for

its executive action to issue the draft regulations as legally binding & effective regulations.

The following subjects determine the level of government to issue the required regulations:

• legal power on energy matters (given to the Ministry of Water & Energy; see

Article 26 (1)) (j), Proc. No. 691/2010);

• power to formulate minimum emission standard level (through federal EPA as

provided under Article 6, Proc. No. 300/2002);

• power to decide on tax & customs including incentive matters (as per the federal

Constitution (by the House of Peoples Representatives see Article 55 cum Article

96 (1) the provisions which provide the power of the Federal Government on

taxation, specifically, on customs duty & import related taxes);( by the respective

customs duty & tax laws by the Council of Ministers through its respective

regulations); (by the Ministry of Finance & Economic Development (see Article,

18(5), Proc. No. 691/2010);

• power to manage customs & import tax matters on imported goods (by the ERCA

as per Proc. No. 587/2008);

• power to manage vehicles in terms of their classification, registration & inspection

(by the federal Transport Authority as per its establishment law Proc. No.

468/2005 & other transport related laws).

All these issues, unless delegated, are the mandate of the Federal Government. Therefore, the

draft regulations have to be submitted to the Federal Government for its issuance, instead of

submitting same to the AACG.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

32

2.6 Conclusion

This project attempts to address the achievement of double objectives: economic objectives

(in terms of increasing vehicles fuel efficiency) & environmental objectives (in terms of

reducing vehicular emission). Technological dimension is also an integral part of both

objectives.

This part of the project concludes the following:

a) There is no legally established ambient air quality standard in Ethiopia.

b) There is no legally established vehicular emission standard in Ethiopia.

c) The introduction of the vehicular emission standard in Ethiopia imperatively requires

the prior legal establishment of a local ambient air quality standard.

d) The introduction of the vehicular emission standard imperatively requires subsequent

detail administrative directives to be issued by the Transport Authority.

e) The importation of vehicles (as imported goods) is subjected to the assessment &

payment of customs duties and other import taxes: viz., VAT, Excise Tax; Import Sur

Tax including Withholding Tax (the last one being creditable to the tax payer).

f) The excise tax is made dependent on cylinder volume. Thus, it penalizes vehicles that

consume more fuel per km and emit more exhaust per km. Hence, it is indirectly

related to fuel economy and emission. However, the group of vehicles with cylinder

volume less than 1000 c.c. are not given tax incentives compared to the group 1000

c.c. -1300 c.c..

g) The heavy tax on passenger cars with seat capacity less than 10 persons is responsible

to the aging of the fleet.

h) Incentive for vehicles based on new technologies ( hybrid vehicles, electric vehicle

etc.) that result in radically higher fuel economy and lower emission has not yet been

provided in Ethiopia.

i) The granting of legally recognized & established fiscal incentives for importation of

vehicles requires legislative measure at two levels: at proclamation level (as related to

amendment of the pollution control law) & at regulations level (in terms of new

regulations to be prepared under the Project, which may touch one or more of the

import tax laws, viz., VAT, Excise Tax and/or Import Sur Tax).

j) The legislative measure determines at which level of government such measure is to

be taken; by the House of Peoples Representative (in case of amending the pollution

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

33

control proclamation) or by the Council of Ministers (in terms of issuing the new draft

regulations to be /prepared under this Project) or by the Minister of Finance &

Economic Development by issuing directives.

k) The new draft regulations to be prepared under this project shall be applicable in all

regions of Ethiopia.

l) The registration of vehicles system of vehicles is based on ownership of vehicles

(private, government, international & non-governmental) & based on such ownership,

the respective code has been given to vehicles.

m) Environmental objectives & criteria has been recognized under the applicable laws in

terms of annual vehicles inspection, but lack details (directives) for their due

enforcement.

n) The economic & environmental dimensions of the objectives of this project involves

multitude of stakeholders for its implementation; this may include government

institutions (like the Federal Government EPA, FTA, Ministry of Transport, ERCA,

AACG, the Police, relevant ministries (specifically Ministry of Water & Energy,

Ministry of Finance & Economic Development,), the private sector (in terms of

vehicles inspection) & the relevant civic societies (in terms of education).

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

34

3. BASELINE SETTING FOR VEHICLE EFFICIENCY

IMPROVEMENT AND EMISSION REDUCTION

One of the major activities of the study on Pilot Global Fuel Economy Initiative Program in

Ethiopia is vehicle registration data collection, vehicle data analysis, and vehicle performance

determination for the baseline years 2005, 2008 and 2010 from which progress in

improvement of vehicle efficiency will be tracked as per GFEI guidelines (GEFI,2011). The

process ensures that Ethiopian policymakers have improved information in order to draft

appropriate legislations and guidelines for dissemination of more fuel-efficient vehicles that

have less emission of pollutants and GHG, and to assess the impact of vehicle emission and

fuel quality on the ambient air quality. The accomplished tasks and the way forward in this

direction are discussed in the following section.

3.1 Methodology

To undergo the study of the baseline setting for vehicle fuel efficiency improvement and

emission reductions, there is a certain methodology set by Global Fuel Economy Initiative.

The methodology consists of the following steps:

• Setting the objectives

• Collecting vehicle registration data

• Cleaning data

• Structuring data

• Estimating baseline fuel economy

• Report findings

This step by step methodology has been adopted for ease of analysis and comparing the result

of the study to other countries which underwent similar study.

3.1.1 Objective

The main objective for this study is setting a baseline and developing a national vehicle

database, which is necessary to track improvement in fuel economy and reduction of

emission of carbon dioxide and other pollutant per unit vehicle.

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

35

3.1.2 Data Attributes

Depending on the availability of the vehicles data and the objective of database to be

developed, different data attributes might be considered by different organizations. For

instance the International Energy Agency (IEA) specifies twenty four key attributes on Auto

fuel economy database. While the ERCA recorded a maximum of fifteen data attributes for

the purpose of capturing details of vehicles import, collecting taxes and controlling illegal

smuggling into the country. Out of the fifteen data attributes some of them are irrelevant for

the purpose of auto fuel economy database such as CIF, total tax, country of consignment,

chassis number etc. Besides, some important data attributes were not registered for numerous

vehicles in the database. As such there was a need to look for other sources to fill the gap,

specifically internet was one of the major sources among others. In many developing

countries like Ethiopia, it is difficult to find detailed and full-fledged national information

regarding vehicle data as mentioned above, where in this context the GFEI specifies the

absolute minimum data attributes that are required for auto fuel economy database. These

data attributes include key parameters, directly or indirectly, used for quantifying vehicle fuel

efficiency and CO

2

emission calculation which are listed below:

i. Vehicle make and model,

ii. Model production year

iii. Year of first registration, if different from model year

iv. Fuel type

v. Engine size

vi. Domestically produced or imported

vii. New or second hand import

viii. Rated Fuel Economy per model and test cycle basis.

ix. Number of sales by model

3.1.3 Data Collection

Newly registered vehicles are those imported and assembled in the country at a particular

year. The appropriate locations for this data are the database of imported vehicles at

Ethiopian Revenues and Customs Authority (ERCA) and vehicles assembling enterprises.

ERCA is an autonomous federal agency responsible for collecting revenues from customs

Final Report on Pilot Global Fuel Economy Initiative Study in Ethiopia

2012

36

duties and domestic taxes. From ECRA data for newly registered light duty vehicles (LDVs)

for selected years were collected. The vehicle data incorporates brand new vehicles as well as

used ones with gross weight less than3500 kg and having number of seats less than or equal

to 15. Such types of vehicles are known as light duty vehicles.

The light duty vehicles data in this study includes passenger cars and compact cars, saloon

cart car, small sport utility vehicles (SUV), as well as pick-ups.

The data was collected only for the years 2005, 2008, 2010 and 2011. Except for the latter,

the years were selected based on UNEP guidelines for the ‘‘Pilot Global Fuel Economy

Initiative Project in Ethiopia’’.

The second source was from passenger car assembly plants.

3.1.4 Data Cleaning

With respect to the key data attribute suggested by GFEI, the data acquired from ERCA must

be cleaned and structured. The first approach would have been to clean the vehicle data on

the ERCA’s database by removing unnecessary information, but it was found to be very