1

How Essential Is Essential Air Service?

The Value of Airport Access for Remote Communities

Austin J. Drukker

University of Arizona

May 2023

Essential Air Service is a federal government program that provides subsidies to airlines that

provide commercial service between certain remote communities and larger hubs, which

proponents argue are justified because driving to larger airports would be prohibitively

expensive for residents of these communities. I estimate the value of Essential Air Service to

local communities using a revealed-preferences approach by formulating and estimating a

discrete-choice model of domestic air travel purchases that incorporates passengers’

geographical proximity to alternative airports. I estimate the model using proprietary data

containing millions of domestic airline passengers’ residential ZIP codes coupled with their

choice of airline product. Simple data tabulations reveal that most travelers living in regions

receiving subsidized service have several alternative airports to choose from and generally

prefer to drive to larger airports. A counterfactual policy simulation using the estimated model

finds that, in aggregate, community members value subsidized commercial air service from

their local airport at $16 million per year, compared to an annual cost of over $290 million.

Keywords: airport, airline, subsidy, public finance, substitution, discrete choice

JEL Codes: H54, L93, R53

I. INTRODUCTION

For the last half century, the US domestic aviation industry has operated in a largely unregulated market

environment. The Airline Deregulation Act of 1978 removed federal government control over fares, routes,

flight frequency, and the entry of new airlines, leading to improvements in service, decreases in fares, and

increases in the number of flights, passengers, and miles flown. Today, passenger aviation is a major

component of the modern global economy, contributing about 5 percent to US gross domestic product

annually (IATA, 2019; FAA, 2020). According to the International Civil Aviation Organization, 4.5 billion

passengers globally flew on scheduled air service in 2019, and the Federal Aviation Administration (FAA)

provides air traffic control services for more than 2.9 million airline passengers per day (FAA, 2022).

According to the Consumer Expenditure Survey, about 13 percent of US households purchased at least one

airline ticket in 2019 and spent an average of $3,873 on airfare.

Although the Airline Deregulation Act was largely viewed as a success, there was fear among some at

the time of its passage that small communities would be left behind in its wake as airlines shifted their

operations to serve large, profitable markets. To assuage this fear, Congress established Essential Air

Service (EAS) in 1978, which required carriers to continue providing scheduled air service at pre-

2

deregulation levels—typically two round trips per day—to eligible communities using subsidies if

necessary. Although EAS was originally set to expire after 10 years, under the assumption that air traffic

would eventually become self-sustaining, Congress reauthorized EAS for another 10 years in 1988 and

made it permanent in 1996. As of June 2022, costs for the program have ballooned to over $340 million

per year despite fewer communities being eligible today compared to in 1978. Given that EAS still exists

nearly a half century after Congress originally intending it to expire, it is reasonable to ask whether EAS

still achieves its stated purpose of efficiently and effectively connecting remote communities to commercial

air travel opportunities.

1

Understanding the value of EAS to the communities it serves requires understanding the trade-offs

faced by travelers. A key trade-off that community members face is whether to fly from their local airport,

which may be more convenient but offer fewer choices, or to drive to a larger airport, which may be far

away but offer more choices. To study this trade-off, I analyze proprietary choice data derived from credit

card transactions that link travelers’ airline product choices with their home ZIP code. The data, which have

not been used in any previous economic studies, allow me to easily compute travelers’ driving time to

alternative airports.

2

Hence, driving time is an observable product characteristic whose marginal value to

consumers can be estimated using standard econometric techniques.

The proprietary choice data reveal several important insights about airline markets previously not

known to researchers and policymakers. First, since I am able to directly observe which airports are chosen

by residents of a particular geographical area, it is relatively straightforward to determine which airports

effectively serve the same region.

3

While the presence of multiple airports in a region does not in itself

imply that the airports provide substitutable services, the growth of air travel demand since the early 1990s

has attracted entry by airlines at different airports within the same region, suggesting a potentially important

role for spatial interactions in the airline industry that have been largely overlooked by previous research.

4

1

The Airline Deregulation Act (92 Stat. 1733) requires the Department of Transportation to “consider the desirability

of developing an integrated linear system of air transportation whenever such a system most adequately meets the air

transportation needs of the communities involved.”

2

To my knowledge, only two academic papers (Yirgu and Kim, 2021; Yirgu, Kim, and Ryerson, 2021) have used

these data, and both papers use only a small geographical subset, in contrast to my data sample which covers the entire

United States from 2013 to 2019.

3

See Fournier, Hartmann, and Zuehlke (2007). Studies that have considered regions with multiple airports vary widely

in which airports to include. Berry and Jia (2010, p. 11) consider six regions to have airports that are “geographically

close.” de Neufville (1995) lists nine regions served by more than one airport. Brueckner, Lee, and Singer (2014)

attempt to empirically estimate which airports serve the same metropolitan region based on competition spillovers and

specify 13 regions as having multiple competing airports. Drukker and Winston (forthcoming) consider 22 regions to

have multiple competing airports.

4

Studies that consider aspects of spatial competition in non-airline markets include Manuszak and Moul (2009) and

Dorsey, Langer, and McRae (2022) (gasoline); Smith (2004) and Katz (2007) (supermarkets); Davis (2006) (movie

theaters); Ho and Ishii (2011) and Hatfield and Wallen (2022) (banking); and Murry (2017) and Murry and Zhou

(2020) (car dealerships). Studies that consider aspects of spatial competition in airline markets include Fournier,

3

Relatedly, since I am able to observe the home ZIP code of an airport’s users, it is relatively

straightforward to determine the geographical boundary of an airport’s catchment area (the area from which

an airport draws its customers). Administrative and survey data from a variety of sources suggest that most

airports draw customers from a large geographical area, but most previous studies of the airline industry

have assumed airports have relatively small catchment areas, typically the geographical boundaries of a

city.

5

Proper market definition is of first-order concern for almost any industry analysis because it directly

influences the scope of available substitutes for consumers and the degree of competition faced by suppliers.

Excluding certain viable airports from travelers’ choice sets may rule out important substitution patterns,

and estimates derived from narrowly defined choice sets will tend to overstate airlines’ market power by

understating travelers’ ability to substitute to alternative products, which in turn could have significant

implications for merger evaluations and antitrust enforcement.

6

The ability to view travelers’ choice sets is particularly useful for evaluating the costs and benefits of

EAS, since implicit in much of the debate surrounding the program is the assumption that members of

communities receiving EAS-subsidized service would have no other viable alternatives for accessing

commercial air travel apart from subsidized service from their local airport. My choice data allow me to

see which airports residents of an arbitrary geographical area actually use, allowing me to directly check

this assumption.

7

Simple tabulations of the proprietary choice data reveal a key insight about the nature of

EAS community members’ choice sets, namely, that despite their ostensible isolation from the rest of the

national air transportation system, members of most EAS communities rarely choose to fly on EAS-

subsidized flights from their local airport and instead generally prefer to drive to airports of various sizes

offering more products with better characteristics. From an econometric perspective, failing to consider

these viable alternatives in travelers’ choices sets will make EAS appear more valuable than it actually is

because travelers will appear less price sensitive due to having fewer substitutes. From a policy perspective,

Hartmann, and Zuehlke (2007), Hess and Polak (2005, 2006), Ishii, Jun, and Van Dender (2007, 2009), Mahoney and

Wilson (2014), Brueckner, Lee, and Singer (2014), McWeeny (2019), and Drukker and Winston (forthcoming).

5

Airlines For America’s 2019 annual survey found that 37 percent of passengers reported flying from an airport that

was not the closest to their home or office at some point in the previous year. McWeeny (2019) found that a significant

share of travelers surveyed at San Francisco International Airport drove from as far away as Sacramento (a 2-hour

drive) and that 57 percent of passengers surveyed at San Francisco International Airport bypassed an airport that was

closer to their home. Ishii, Jun, and Van Dender (2007) found that travelers located closest to San Francisco

International Airport most often departed from there, but passengers closest to San Jose International Airport or

Oakland International Airport often chose to fly from a different airport. Yirgu, Kim, and Ryerson (2021) report

significant airport leakage for small and medium-sized airports in the Midwest United States.

6

The US Department of Justice uses a narrow city-pair market definition in cases involving airline mergers. See, for

example, their complaint against the proposed merger between American Airlines and US Airways (78 Fed. Reg.

71377) and their complaint against the Northeast Agreement between American Airlines and JetBlue Airways

(https://fingfx.thomsonreuters.com/gfx/legaldocs/zjpqkrdlmpx/plaintiffs-brief-american-airlines-2022.pdf).

7

Bao, Wood, and Mundy (2015) and Lowell et al. (2011) compute the cost of subsidizing flights to the cost of

subsidizing bus service to the same location. They do not consider the costs of subsidizing bus service to alternative

airports.

4

the revelation that EAS community members frequently choose to drive to alternative airports undermines

EAS’s raison d’être to provide an essential service to communities that would otherwise have no other

options to connect to the national air transportation system.

8

An added benefit of the proprietary choice data is that I can see the home location of any airport’s users,

which allows me to determine the extent to which an EAS-subsidized airport serves residents of the

community. Knowledge of the home location of EAS-subsidized airport users is policy relevant because

the purpose of EAS is to connect residents of the community to commercial air travel. Without the ability

to link purchases to the home location of purchasers, it would not be possible to determine who are the

primary users of EAS-subsidized service. Tabulations of the data reveal that the majority of EAS-subsidized

airport users are not residents of the communities in which the airport is located. This finding has important

fiscal policy implications because all users of EAS airports benefit from subsidized ticket prices, regardless

of residency status, implying a majority of EAS funds go toward subsidizing nonresidents of EAS

communities. The problem is further compounded by the fact that nonresidents who use EAS-subsidized

airports tend to have higher incomes than residents, which raises serious distributional concerns about the

program.

To formally estimate the value that EAS community members derive from the program, I formulate

and estimate a discrete-choice model of air travel demand. I formulate my demand model using a nested

logit utility specification that closely resembles the canonical models of Berry, Carnall, and Spiller (1996,

2006) and Berry and Jia (2010). A key component of my model is the inclusion of driving time as a product

characteristic, which allows me to directly estimate the implicit monetary costs of driving to alternative

airports. I estimate my model using the generalized method of moments with a combination of macro and

micro data, as described by Berry, Levinsohn, and Pakes (2004) and Petrin (2002). Macro moments are

constructed using aggregate data containing information about airline products, their characteristics, and

the number of travelers who choose each product, and micro moments are constructed using the proprietary

choice data. Intuitively, the micro moments capture spatial variation between driving time and travelers’

choices (and non-choices), which is used to identify travelers’ preferences for driving.

9

A useful feature of the discrete-choice modeling framework is that it allows me to analyze

counterfactual policy experiments by estimating consumer surplus under two alternative scenarios. In

particular, I consider a counterfactual policy experiment in which all EAS subsidies are eliminated, which

8

Grubesic and Matisziw (2011) thoroughly studied EAS community members’ access to a variety of alternative

airports, but their data do not allow them to study the extent of their use.

9

McWeeny (2019) uses a similar revealed-preferences approach, which, unlike the stated-preferences approach used

by Landau et al. (2016), Daly, Tsang, and Rohr (2014), Adler, Falzarano, and Spitz (2005), Hess and Polak (2006),

Merkert and Beck (2017), and Hess, Adler, and Polak (2007), does not rely on self-reported or speculative valuations

of trip components.

5

would cause commercial service to cease at most airports currently served by EAS-subsidized airlines. The

difference between consumer surplus computed before and after the elimination of commercial service at

EAS airports reveals community members’ implicit value of the EAS program, and a simple comparison

between the costs and benefits of the program can be used to determine whether EAS subsidies are justified.

I conduct my counterfactual policy experiment using data from 2019 for 107 EAS communities in the

continental United States. The analysis reveals that the members of these 107 communities collectively

value subsidized service from their local airport at $16 million annually, a paltry amount compared to EAS’s

cost in 2019 of over $290 million. Furthermore, this estimate likely overstates the effects of eliminating

EAS subsidies, since commercial service might not cease at all formerly eligible communities.

Disaggregating the results by airport reveals that desirable routes tend to be flown by legacy airlines

operating in a seemingly competitive environment, which is suggestive of rent-seeking behavior to the

extent EAS subsidies act as entry barriers for competitors.

The remainder of this paper is organized as follows. In Section II, I provide a brief history and overview

of Essential Air Service. In Section III, I describe my data and present several novel insights based on

descriptive statistics. In Section IV, I formulate an empirical model of demand, and in Section V, I describe

the estimation strategy and sources of identification. In Section VI, I present the estimation results and

perform post-estimation checks. In Section VII, I present the results of my counterfactual policy analysis

to compute the consumer surplus that communities derive from EAS and consider distributional

implications. Section VIII concludes with a summary of the findings, policy recommendations, and

suggestions for future research.

II. ESSENTIAL AIR SERVICE

The EAS program provides subsidies to airlines to provide regular service to eligible communities.

10

,

11

To be eligible for EAS, a community must be located more than 70 miles from the nearest medium or large

hub airport, require a per-passenger subsidy rate of $200 or less ($1,000 or less if the community is farther

than 210 miles from a hub), and have 10 or more enplanements per day.

12

EAS typically subsidizes one

airline to provide two to four round trips per day, six days per week, from an EAS community to a larger

hub. Although EAS eligibility is based on a community’s distance to the nearest medium or large hub,

10

A handful of communities participate in the Alternate EAS program, which allows communities to forgo traditional

EAS for a prescribed amount of time in exchange for a flexible grant. In 2019, all communities participating in the

Alternate EAS used their funds to subsidize charter air service.

11

EAS contracts do not give an airline the exclusive right to serve a community, and airlines may decide to serve a

community under an EAS contract without the use of subsidies.

12

See Appendix C for a summary of the legal statutes and DOT practice regarding eligibility determination. Tang

(2018) provides an excellent primer on EAS, its history, and eligibility requirements.

6

airlines that receive EAS contracts are not required to fly passengers to the nearest hub nor to a medium or

large hub.

13

Airlines compete for EAS contracts through a bidding process, and the DOT typically receives 1–3

proposals per airport every 1–3 years, when EAS contracts typically expire. By law, the DOT must take

into account the views of the community when deciding which proposal to accept, as well as the carrier’s

service reliability and any arrangements it has with larger carriers at the hub. Notably, subsidy cost is not

among the factors the DOT is required by law to consider when evaluating bids, and if more than one carrier

proposes to offer service then local officials are under no obligation to favor the proposal that entails the

lowest cost to the federal government.

EAS has long been a target of critics who have derided the program as wasteful spending and an

inefficient means of connecting rural communities to commercial air travel, arguing that the statutes

governing EAS do not encourage cost efficiency and that the market, not government subsidies, should

decide which airports survive. But community stakeholders argue that EAS provides an essential service to

communities that would otherwise lose access to commercial air travel, arguing that EAS community

members value their local airport and without government subsidies the airport would cease to be

commercially viable. Several papers have argued that ending EAS subsidies would not necessarily reduce

service at eligible communities.

14

But the question of whether and the extent to which EAS community

members value their local airport has not been studied and is one that I take up in the present paper.

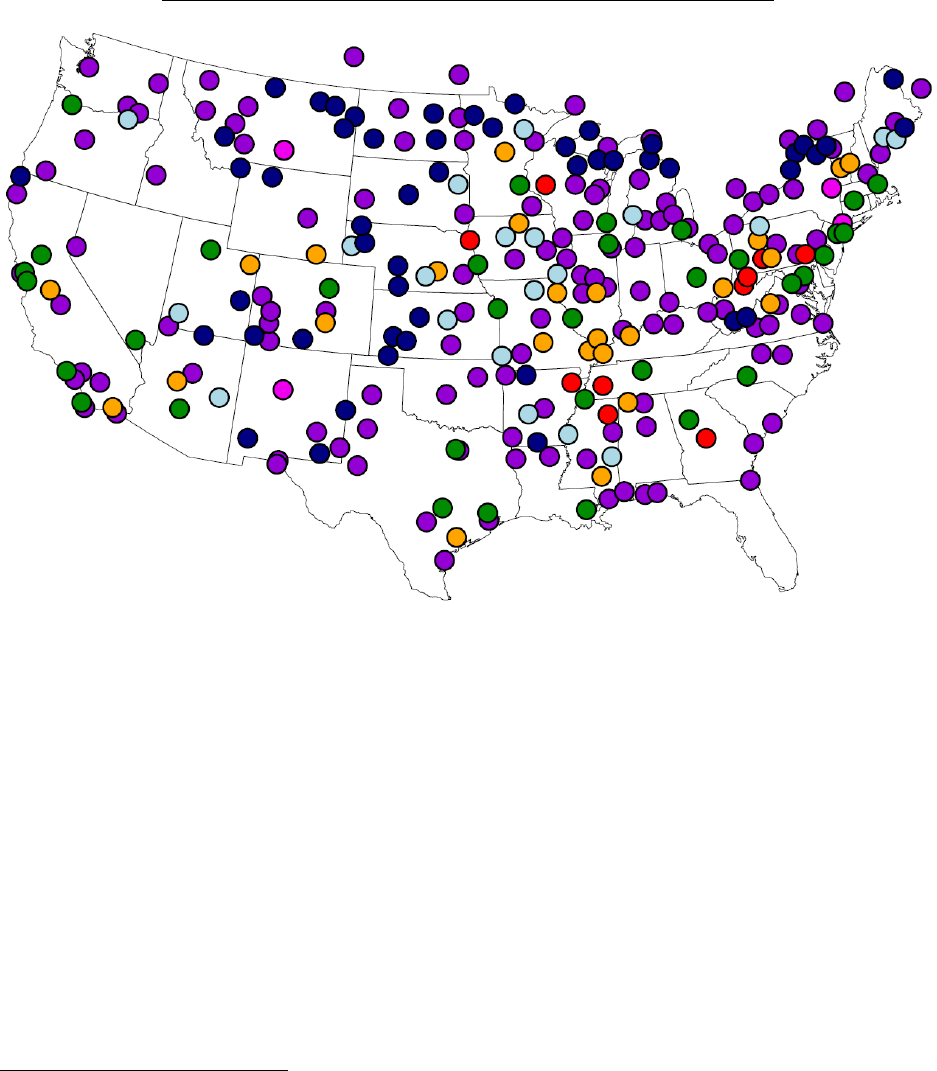

Figure 1 shows the locations of 107 airports receiving EAS-subsidized service as of September 2021.

15

Following the Eno Center for Transportation’s (2018) convention, red dots represent communities that are

between 70 and 100 miles from a medium or large hub, orange dots represent communities that are between

100 and 150 miles from a medium or large hub, light blue dots represent communities that are between 150

and 210 miles from a medium or large hub, and dark blue dots represent communities that are more than

210 miles from a medium or large hub (DOT, 2021c). The green dots correspond to medium or large hubs

that are nearest to EAS communities or which are used by airlines serving EAS communities even if not

geographically closest (DOT, 2019a, 2022b).

13

For example, Cape Air currently serves several EAS communities in Montana through their small hub at Billings

Logan International Airport. See Appendix C for the FAA’s definition of hub size.

14

Cunningham and Eckard (1987) suggest that EAS subsidies may have actually reduced flight frequency because

EAS contracts serve as entry barriers that discourage competition. Morrison and Winston (1986) note that service to

small communities actually increased following deregulation—suggesting EAS subsidies mask profit opportunities.

Bao, Wood, and Mundy (2015) note 10 of the 34 EAS communities that have had their EAS subsidies terminated

since 1993 have experienced a substantial increase in their outbound passenger levels. Furthermore, subsidized airlines

currently provide commercial service alongside unsubsidized airlines at several EAS airports, most notably Allegiant

Air, which serves five currently eligible communities and one formerly eligible community.

15

Appendix Table H3 lists the status of the 51 communities that have lost their EAS eligibility since 1989.

7

Figure 1. The Locations of EAS Airports and Their Nearest Hubs

Source: Federal Aviation Administration.

Notes: Green dots are medium or large hubs that are geographically closest to EAS communities or are

used by EAS-subsidized carriers. Red, orange, light blue, and dark blue dots are EAS airports located less

than 70 miles, 70–100 miles, 100–210 miles, and more than 210 miles, respectively, from the nearest

medium or large hub.

Although it would appear from Figure 1 that many EAS communities face considerable barriers to

access commercial air travel without the assistance of EAS, the color-coding belies the full picture by

restricting the notion of viability to medium hubs or larger. Figure 2 presents a fuller picture, augmenting

Figure 1 by including a host of viable airports that are classified as smaller than medium hubs. For example,

Figure 1 suggests Butte in southwest Montana is relatively isolated, located 6 hours to Salt Lake City to the

south and 10 hours to Portland or 9 hours to Seattle to the west. But Figure 2 reveals that there are four

additional airports within a 3-hour drive from Butte: Great Falls International Airport, Missoula Montana

Airport, Helena Regional Airport, and Bozeman Yellowstone International Airport, a small hub served by

8 major airlines flying to more than 20 destinations. The pink dots correspond to small hubs that are or have

8

been used by airlines to serve certain EAS communities, but which are too small to factor into the distance

calculation for maximum allowable per-passenger subsidies.

16

Figure 2. The Locations of EAS Airports and Viable Nearby Airports

Sources: Federal Aviation Administration; Airlines Reporting Corporation.

Notes: See the notes to Figure 1. Pink dots are small hubs that are or have been used by EAS-subsidized

carriers. Purple dots are airports used by a nontrivial share of EAS community members.

16

For example, Yellowstone Regional Airport in Cody, Wyoming, is only about 100 miles from Billings Logan

International Airport, but since Billings is considered a small hub it does not factor into the distance calculation; Salt

Lake City International Airport is the nearest large hub (about 450 miles away), so a carrier serving Yellowstone

Regional Airport would be exempt from the $200 per-passenger subsidy limit (DOT, 2019a).

9

III. DATA AND DESCRIPTIVE STATISTICS

Before describing the model and estimation strategy, I describe the data used to estimate the model and

present several figures showing the key features of the data. The data come from six primary sources. Table

1 (presented at the end of this section) provides summary statistics for several key variables.

A. Market Locator

The primary data set used for the analysis comes from the Airlines Reporting Corporation’s (ARC’s)

Market Locator tool. Owned by the airline industry, ARC acts as a clearing system for all travel agencies,

including online travel agencies such as Booking Holdings, Expedia Group, and their subsidiaries, which

process about 35 percent of all domestic tickets sold in the United States. According to ARC, the clientele

is representative of the universe of domestic leisure and unmanaged business travelers.

17

About 20 percent

of all tickets that come through the ARC clearing system are sent to a credit card processing company that

matches customers’ chosen product to their credit card billing ZIP code.

18

The data are associated with the

point of sale of the airline ticket purchaser, which is likely to be the passenger in most cases.

19

Thus, the

data are a roughly 7 percent representative sample of US domestic leisure passengers.

The Market Locator data contain monthly passenger counts by ZIP code for 2013–19. Tabulations of

the Market Locator data reveal which airports travelers drive to without a priori selecting which airports to

include in a traveler’s choice set. For example, Figure 3 shows the 8 airports most commonly chosen by

residents of Decatur, Illinois and their respective market shares. In 2019, Cape Air received $3.065 million

to offer 24 nonstop round trips per week to O’Hare International Airport (ORD) and 12 nonstop round trips

per week to St. Louis Lambert International Airport (STL) from Decatur Airport (DEC), with fares to

Chicago starting at $59 one way and fares to St. Louis starting at $29 one way (DOT, 2017, 2019a; Cape

Air, 2018). According to the DOT (2019a), Decatur Airport had 17,066 passengers (both directions) in

2019, corresponding to a $180 per-passenger subsidy. Despite Cape Air offering unusually low prices,

tabulations of the Market Locator data reveal that only 7 percent of travelers flew from Decatur to either

Chicago or St. Louis, while 21 percent of travelers drove 2 hours and 15 minutes to St. Louis, 27 percent

of travelers drove 3 hours to Chicago, and 27 percent of travelers drove 1 hour to Central Illinois Regional

17

As noted by Yirgu, Kim, and Ryerson (2021), business travelers are more inclined to purchase tickets directly from

airlines rather than through third-party agents, meaning they are less likely to show up in the Market Locator data.

18

The ability to link tickets with billing ZIP codes is only limited by the credit card processing company used for the

transaction; otherwise, there are no selection criteria for determining which tickets can be linked with billing ZIP

codes. The credit card processing companies generally do not process American Express cards, so there is a slight bias

against business travelers to the extent business travelers are more likely to pay with American Express cards.

19

Although the traveler’s point of origin is typically within proximity to the purchaser’s point of sale, this would not

be the case if, for example, the purchaser and passenger were in different locations or, more frequently, if the traveler

purchased one-way tickets individually.

10

Airport (BMI), a non-hub primary commercial service airport served by four major airlines. The remaining

travelers drove to Springfield’s Abraham Lincoln Capital Airport (SPI), Urbana–Champaign’s Willard

Airport (CMI), Indianapolis International Airport (IND), or Peoria International Airport (PIA).

Figure 3. Market Shares for Airports Chosen by Residents of Decatur

Source: Airlines Reporting Corporation.

Notes: See the notes to Figure 2. DEC is an EAS-subsidized airport in Decatur, Illinois. Market shares

conditional on flying are shown as percentages after the airport codes. The dotted lines indicate travelers

drove from Decatur to the indicated airport to take a departing flight. The dashed line indicates travelers

flew from DEC to the indicated airport en route to a final destination.

The Market Locator data are also useful for determining who the primary users of an EAS-subsidized

airport are, namely, residents of the community or nonresident visitors. Knowing the home location of an

EAS airport’s users is policy relevant because the purpose of EAS is to connect EAS community members

to commercial air travel. To determine the residency status of EAS airport users, I draw geographical

boundaries around the communities as shown in Appendix B—typically the Metropolitan or Micropolitan

Statistical Area(s) encompassing the airport. Residents are then defined as passengers whose ZIP code is

within the geographical region, and nonresidents are those whose ZIP code is outside the region. Overall, I

find that nonresidents make up 57 percent of customers on EAS-subsidized flights. As shown in Appendix

11

Figure H1 and Appendix Table H2, several EAS communities are located very close to national parks, and

airports in these communities likely serve as entry points for visitors; since all customers on EAS-

subsidized flights, regardless of where they live, benefit from lower ticket prices, it is plausible that EAS

serves to subsidizes tourism for these areas, which is not its statutory purpose. Yellowstone Airport, for

example, is used almost exclusively by tourists likely visiting Yellowstone National Park, while residents

of West Yellowstone overwhelmingly prefer to drive 1 hour and 30 minutes north to Bozeman Yellowstone

International Airport.

20

As will be explained in Section V.A, I use the Market Locator data to construct micromoments to be

used for generalized method of moments estimation of the parameters of interest. I thus restrict the sample

of Market Locator data in several ways. First, since several low-cost and ultra-low-cost carriers (including

Southwest Airlines and Allegiant Air) generally do not have contracts with travel agencies or are not

members of ARC, I do not observe travelers choosing products from these airlines.

21

I therefore restrict the

set of airlines to the four legacy carriers: American Airlines, Delta Air Lines, United Air Lines, and US

Airways.

Second, in order to identify substitution between airports, travelers living in an origin region must face

a choice set containing at least two airports. I therefore restrict the origin regions under consideration to

those among the top 40 busiest that contain at least two airports both served by a legacy carrier (see

Appendix Table H1). These include Boston, Chicago, Cincinnati, Cleveland, Dallas, Detroit, Houston, Los

Angeles, Miami, New York, Orlando, San Francisco, Tampa, and Washington, from which I drop Orlando

Sanford International Airport (SFB), Chicago Rockford International Airport (RFD), and St. Pete–

Clearwater International Airport (PIE) because these airports are not served by a legacy carrier.

22

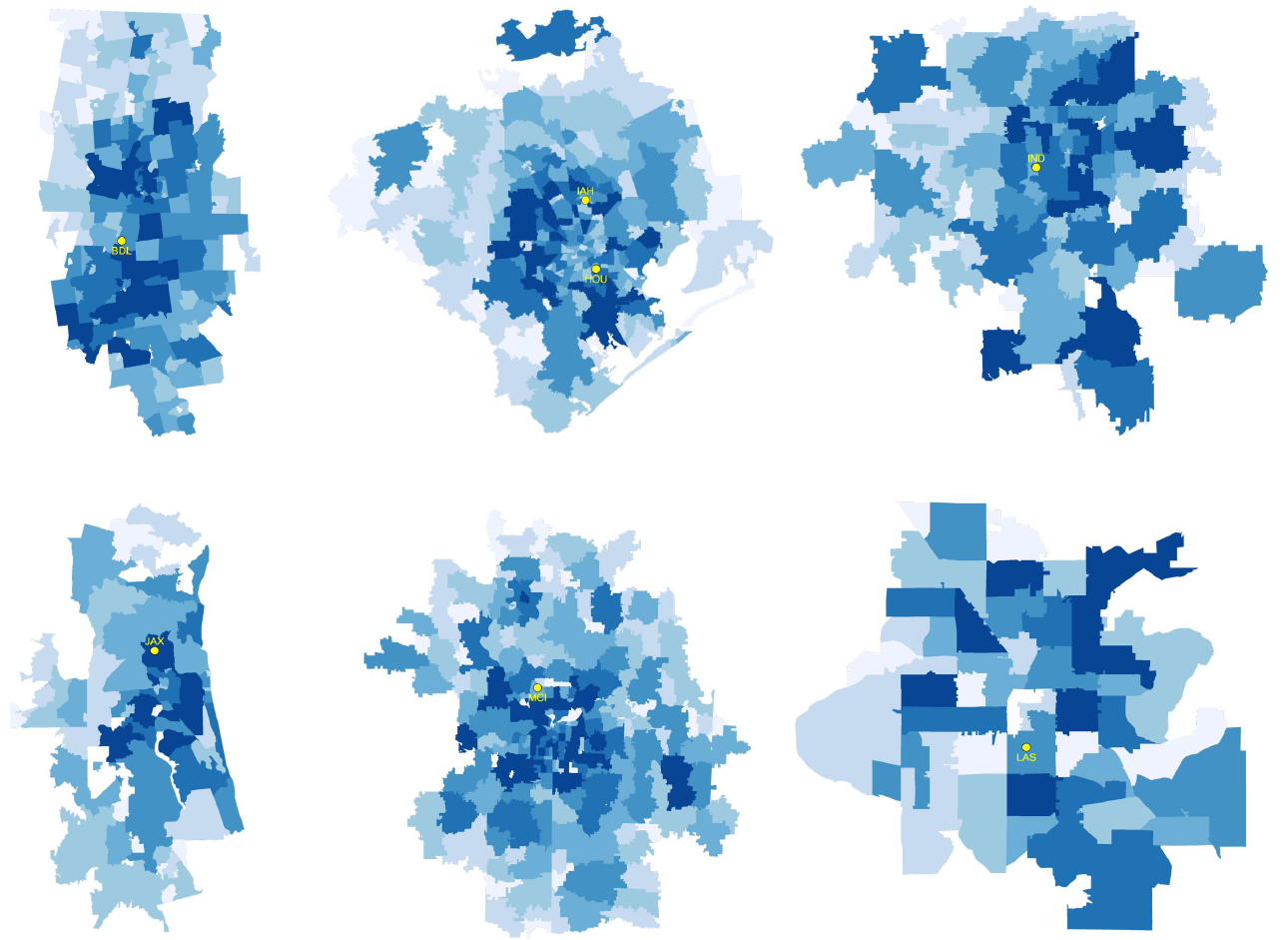

Lastly, I must specify each airport’s catchment area in order to calculate market shares. Market shares

are defined as a given product’s share of the total potential trips from an origin area to a destination city.

Appendix A shows airport locations and the constructed catchment areas for the 40 busiest origin regions,

with darker shading corresponding to areas with higher population density. Appendix Table H1 shows the

land area of each catchment area and the passenger-weighted average drive time to passengers’ chosen

20

As noted by Grubesic and Wei (2013), Yellowstone Airport has the lowest subsidy rate among all EAS airports and

a sparse local population base but has a much higher load factor than the national average, likely due to tourism.

According to the National Park Service, approximately 1.73 million people used the west entrance to Yellowstone

National Park in 2019.

21

Southwest Airlines joined ARC in July 2019 and only shares data for corporate bookings made through its corporate-

client wing SWABIZ.

22

Although Southwest Airlines has nearly 100 percent market share at Chicago Midway International Airport (MDW),

Dallas Love Field (DAL), and Hobby Airport (HOU), the fact that legacy carriers have some market share at these

airports implies the micromoments can still identify the parameters under the generalized method of moments

estimation framework.

12

airport. The market size is assumed to be the total population of the catchment area, or the number of

potential passengers who consider air travel from an origin region to a destination city.

23

B. OpenStreetMap

Driving times between ZIP code centroids were extracted from OpenStreetMap using the Open Source

Routing Machine, a high-performance routing engine for shortest paths in road networks. The

OpenStreetMap data have an advantage over geodesic distance data (as the crow flies), such as the National

Bureau of Economic Research’s ZIP Code Distance Database, because they properly account for vehicle

mode, speed limits, and the nonlinear nature of road networks, although they do not account for delays

caused by traffic. Travel time is based on speed limits for different road types.

C. Airline Origin and Destination Survey

Product characteristics and market shares were constructed using the DOT’s Airline Origin and

Destination Survey (DB1B), a 10 percent quarterly sample of airline tickets from US carriers that contains

detailed itinerary information such as fares, layovers, and carrier identity. As noted in Section V.A, the

DB1B data is used to construct macromoments to be used for generalized method of moments estimation

of the parameters of interest. I consider flights departing from the 40 busiest origin regions and arriving at

the 100 busiest destinations for every quarter from 2013 to 2019, excluding origins in Hawaii, Alaska, and

Puerto Rico. Appendix Table H1 lists the 40 origin regions under consideration and the 76 airports

contained within them, as well as populations of the constructed catchment areas (see Appendix A). I

determine which airports belong in which regions largely based on the recommendations of Brueckner,

Lee, and Singer (2014).

I clean the DB1B sample following standard sample cleaning procedures from the literature:

24

I drop

all itineraries with more than one connection and collapse all coupons with a layover into a single

observation, regardless of the layover airport; the prices for such products (indirect flights) are computed

as the passenger-weighted average price. I drop all itineraries that start and end at different airports (i.e.,

are not round trips), are not economy class for all coupons, and are not flown on the same airline for all

coupons. I drop all itineraries with a fare of less than $11.20 (the September 11 Security Fee for a round-

23

Roughly speaking, market size is “some number of potential passengers who consider air travel” (Berry, Carnall,

and Spiller, 2006, p. 189). Although somewhat arbitrary, Berry, Carnall, and Spiller (2006, p. 189) note that the use

of the geometric mean of the origin and destination city populations as a measure of market size has “both empirical

and (weak) theoretical precedent in the literature on travel demand.” Population of the origin region is a reasonable

measure of market size in my context because my sample of aggregate data is constructed using round-trip tickets,

and passengers who desire to fly from an origin to a destination and back are much more likely to be residents of the

origin region as opposed to residents of the destination city.

24

My sample cleaning procedure closely follows the cleaning procedure described by Severin Borenstein

(http://faculty.haas.berkeley.edu/borenste/airdata.html).

13

trip ticket), such as those booked entirely with airline loyalty points, or greater than $2,500. In addition, I

only consider flights whose ticketing carrier is a reporting carrier, defined as a carrier with more than 0.5

percent of total domestic scheduled service passenger revenues; these include American Airlines, Delta Air

Lines, United Air Lines, US Airways, Southwest Airlines, JetBlue Airways, Alaska Airlines, AirTran

Airways, Virgin America, Allegiant Air, Frontier Airlines, Spirit Airlines, and Sun Country Airlines.

25

D. Airline On-Time Performance

Additional product characteristics such as flight frequency, extra flight time, and layover times were

constructed using the DOT’s Airline On-Time Performance data. Layover times are computed by assuming

passengers choose the itinerary with the shortest possible layover longer than a minimum connection time

of 30 minutes, which is the industry standard for US domestic flights.

E. Zip-Codes.com

Detailed ZIP code demographics were obtained from zip-codes.com’s ZIP Code Database (Business

edition). Several useful demographics included in the database are population (used to construct market

size), racial and gender composition, average home value, median household income, median age, and

congressional district. The data are compiled by zip-codes.com using data from the US Postal Service, US

Census Bureau, Office of Management and Budget, and various private sources.

Figure 4 shows the distribution of median household income for EAS communities alongside the

distribution of median household income for all Core-Based Statistical Areas (CBSAs), where a region’s

median household income is computed as the weighted average of median household incomes across ZIP

codes contained in the region. The median of the distribution for EAS communities is $52,500 compared

to $64,250 for all CBSAs, implying EAS communities generally have lower incomes compared to the

nation as a whole. Combining the demographic data with Market Locator data, Figure 5 shows the

distribution of median household income for users of EAS airports broken down by EAS community

residency status. Residents flying out of an EAS airport tend to have lower incomes than nonresidents flying

into an EAS airport—medians of the distributions $53,400 and $62,800, respectively. Thus, not only do the

majority of EAS funds go toward subsidizing nonresidents of the EAS community, but these nonresidents

also tend to have higher incomes than residents.

25

I exclude Hawaiian Airlines because it primarily serves Hawaii, which I exclude from my set of origin regions.

AirTran Airways merged with Southwest Airlines in May 2011 but was coded separately until January 2015. US

Airways merged with American Airlines in December 2013 but was coded separately until October 2015. Virgin

America merged with Alaska Airlines in April 2016 but was coded separately until April 2018. I classify large regional

carriers under their corresponding marketing carrier.

14

Figure 4. Distributions of Income for EAS Communities and All CBSAs

Source: zip-codes.com.

Note: The densities are constructed using an Epanechnikov kernel with a bandwidth of $5,000.

Figure 5. Distributions of Income for Resident and Nonresident EAS Airport Users

Sources: Airlines Reporting Corporation; zip-codes.com.

Notes: Median household income is based on the ZIP codes of passengers from Market Locator for 2013–

19. The densities are constructed using an Epanechnikov kernel with a bandwidth of $5,000.

15

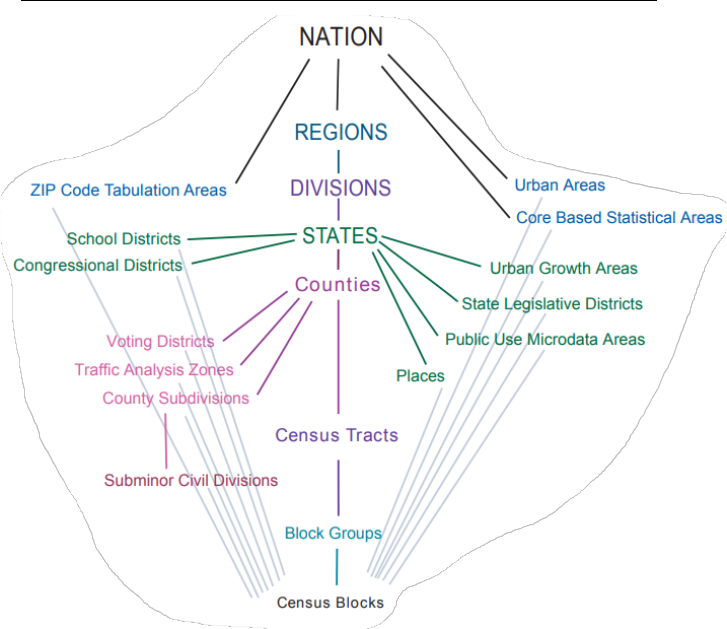

F. American Community Survey

The American Community Survey (ACS) was used to construct income distributions at the ZIP code

level, as explained in Appendix E. The ACS contains information about the number of households living

in each Census block group with income in each of 16 income buckets ranging from $0 to $200,000 and

above. These data were used to construct income distributions at the ZIP code level using a block group to

ZIP code crosswalk obtained from the Missouri Census Data Center. The crosswalk, which provides the

share of the population of each block group that lives in each ZIP code, was used to allocate the number of

households in each block group into each ZIP code. Once block group populations were allocated to ZIP

codes, the total number of households in each ZIP code and income bucket was computed. Finally, the

number of households in each ZIP code and income bucket were converted to population shares by dividing

by the total population of the origin region.

Table 1. Summary Statistics for the Estimation Samples

Variable

Mean

Standard

deviation

Source

Fare (dollars)

186.69

66.87

DB1B

Direct

184.23

66.22

DB1B

Indirect

228.60

63.91

DB1B

Drive time (minutes)

38.4

21.1

Market Locator

Multi-airport region

38.3

21.6

Market Locator

Single-airport region

38.6

20.2

Market Locator

Extra time (minutes)

148

40

DB1B, On-Time

Layover time

83

32

DB1B, On-Time

Flight time

65

25

DB1B, On-Time

Number of daily flights

5.5

3.8

DB1B, On-Time

Direct flight distance (miles)

1,048

632

DB1B

Products per market

8.6

5.2

DB1B

Multi-airport region

11.1

5.6

DB1B

Single-airport region

5.3

1.9

DB1B

Share direct

0.945

DB1B

Share living in multi-airport region

0.657

Market Locator

Share of commercial enplanements

0.862

FAA

Notes: All statistics are passenger-weighted over quarterly data from 2013 to

2019 and are for one way. Drive time is to passengers’ chosen origin. Extra time

variables are for indirect flights. Layover time excludes layovers longer than 4

hours. Share of commercial enplanements is for 2019. See Section IV.A for the

definition of products and markets. See Section IV.B for a description of several

of the product characteristics listed. See Section III.A for the list of multi-airport

regions.

16

IV. MODEL

In this section, I specify a nested logit model of consumer demand for airline products that closely

resembles the canonical models of Berry, Carnall, and Spiller (1996, 2006) and Berry and Jia (2010). The

nested logit model is a workhorse model used in many studies of the airline industry and, as noted by Berry

and Jia (2010), is a parsimonious way to capture the correlation of tastes for different product attributes that

can be evaluated analytically. The key innovation that I make to the canonical nested logit model for air

travel demand is to allow consumers to choose between airports they could fly from and to include driving

time from one’s home to the airport in the traveler’s utility function.

A. Demand Model

In each time period (quarter) and for each region, I assume all potential travelers living in a particular

region decide whether to fly to a particular destination and, conditional on choosing to fly, which product

to purchase. The utility for consumer from choosing product in market is assumed to take the following

form:

where

is the price of product ,

is a vector of observed product characteristics,

is the unobserved

quality of , and

is the driving time from consumer ’s home to the departing airport of product . The

coefficient represents the marginal utility from driving to the airport and the coefficients

and

represent the marginal utilities from airfare and other product characteristics, respectively, where the

subscripts indicate that the coefficients are allowed to differ by individual.

The term

represents consumer ’s idiosyncratic taste for product and is assumed to be

independently and identically distributed type-I extreme value across consumers and products. The term

represents consumer ’s idiosyncratic taste for airline products and is assumed to be distributed such

that the composite error term

with

gives rise to the nested logit model with two nests.

26

The first nest contains all airline products, and the second nest contains only the outside option, which can

be thought of as not flying to a particular destination during a quarter. To facilitate identification, the utility

of the outside good is normalized to

.

Individuals can purchase products that belong to one and only one market , which I define as an

origin–destination pair at a point in time. While most studies of the airline industry define a market to be

26

Cardell (1997) describes the precise distributional assumptions necessary to give rise to such a model. Specifically,

the distribution of

is defined to be the unique distribution parameterized by that has the property that

is distributed type-I extreme value when

is also distributed type-I extreme value.

17

either an airport pair (products flying between two specific airports) or a city pair (products flying between

any of the airports within two cities)—see Brueckner, Lee, and Singer (2014)—I want to consider the

possibility that travelers might drive to an airport from beyond a city’s boundaries. I thus construct broad

geographical areas around airports that could reasonably be considered substitutes and refer to such areas

as origin regions.

27

I assume all products departing from airports within the same origin region and flying

to the same destination airport are within the same market. Formally, I define a market as a directional

region-to-airport pair at a point in time.

28

A product is defined as the airline, origin airport, and service type

(direct and connecting) that gets passengers from one origin region to a destination airport.

All flights from

one airport to another with at most one layover that are operated by the same airline are thus considered the

same product.

29

B. Model Specification

All product characteristics in

are assumed to be exogenous. These include variations on several

variables commonly found in the literature.

30

I include an indicator for whether a product is a direct flight,

since utility should increase if there are fewer connections. I include flight frequency, defined as a product’s

average number of daily departures, since consumers prefer to have flights offered at different times

throughout the day for more flexibility when booking. I include a variable for origin presence, defined as

the number of destinations served by an airline out of the origin airport, to capture the fact that consumers

may be loyal to certain airlines and prefer to depart from airports where it is easier to accumulate frequent

flier miles.

31

Airlines with a larger origin presence at an airport may also offer more convenient flight

schedules, which benefits consumers.

I include a variable for direct flight distance, defined as the minimum distance (in miles) for a direct

flight between the origin region and destination airport, to capture the fact that flights compete with the

27

Appendix A shows the 40 constructed origin regions used in the estimation, and Appendix Table H1 shows their

land areas.

28

Markets are directional in the sense that flights between airports are distinguished by their direction of travel. For

example, flights from New York City to Chicago are a different market than flights from Chicago to New York City.

29

I do not distinguish connecting flights by the airport at which the layover occurs, and I drop all flights with more

than one connection. Berry and Jia (2010) consider products with more than one connection. Unlike Berry and Jia

(2010), I do not consider fares or fare bins in the product definition and instead use the average price weighted by the

number of passengers as a product characteristic.

30

This literature includes, among others, Berry (1990), Berry, Carnall, and Spiller (2006), Berry and Jia (2010),

Ciliberto and Williams (2014), McWeeny (2019), and Ciliberto, Murry, and Tamer (2021).

31

Borenstein (1989), Berry (1990), Morrison and Winston (1989), Evans and Kessides (1993), Berry, Carnall, and

Spiller (2006), and Ciliberto, Murry, and Tamer (2021) emphasize that a larger origin presence increases the value of

frequent flier programs and other airline marketing programs.

18

outside option (including cars, buses, and trains), which become worse substitutes as distance increases; so

utility should increase with distance when there is an outside option.

32

Following Berry and Jia (2010), I include a dummy that equals 1 if the destination is a popular vacation

destination (Hawaii, Florida, Puerto Rico, St. Thomas, Las Vegas, or New Orleans), which helps to fit the

relatively high traffic volume to these destinations that cannot be explained by the other observed product

characteristics.

33

Unobserved factors of demand that affect all markets at a particular point in time, such as

seasonality, macroeconomic fluctuations, or major world events, are controlled for using year and quarter

fixed effects, which help to explain the choice between flying and not flying. Unobserved factors that make

a particular airline more attractive, such as baggage fees, availability of in-flight entertainment, and

friendliness of the crew, are controlled for using airline fixed effects. Unobserved factors that make a

particular airport more attractive, such as parking fees, congestion, and the availability of lounges or food

options, are controlled for using origin airport fixed effects.

The model incorporates heterogeneity in preferences for certain product characteristics, as indicated by

the subscripts on

and

. Specifically, I allow heterogeneity in preferences by income for price,

specified as

and for service type (direct or connecting), specified as

where

is the income of consumer and

for all other characteristics in

besides the direct

flight indicator,

.

34

As shown by Berry and Jia (2010) and McWeeny (2019), higher-income

consumers are less sensitive to price compared to lower-income consumers, so it is reasonable to include a

heterogeneous coefficient on price by income. It is also plausible that higher-income consumers would have

different preferences for service type compared to lower-income consumers, and that service type would

32

Previous papers have opted to indirectly incorporate nonlinear preferences for flight time by including a quadratic

term for flight distance. Berry and Jia (2010, p. 21) argue that air travel demand is inverse U-shaped in distance: “As

distance increases further, travel becomes less pleasant, and demand starts to decrease.” They hence include both flight

distance and flight distance squared to capture the curvature of demand. Ciliberto and Williams (2014, p. 770) note

that “for longer distances air travel becomes relatively more attractive but all forms of travel are less attractive,” so

they include distance, distance squared, and a “measure of the indirectness of a carrier’s service” in their utility

function. McWeeny (2019) includes direct flight distance, direct flight distance squared, extra flight distance, and

extra flight distance squared in his utility function.

33

Berry, Carnall, and Spiller (2006) capture the attractiveness of a particular destination by including a variable for

the temperature difference between the origin and destination in January.

34

Alternatively, let

denote a vector with length equal to the number of exogenous characteristics in

that

equals 1 in the position of the direct flight indicator and equals 0 in all other positions. Then

, where denotes the elementwise Hadamard product.

19

be correlated with price, so it is important to also allow income heterogeneity in preferences for service

type in order to identify ceteris paribus sensitivity to price.

V. MOMENTS, ESTIMATION, AND IDENTIFICATION

I estimate the model using the generalized method of moments (Hansen, 1982), closely following

Berry, Levinsohn, and Pakes (2004) and Petrin (2002). I use three types of moments to estimate the model

parameters. First, I set predicted market shares equal to observed market shares, which, as shown by Berry

(1994), allows me to identify unobserved product quality. Second, I make an orthogonality assumption

about the relationship between unobserved product quality and a set of instruments, which I use to construct

macromoments using market-level data. Third, I construct micromoments by interacting driving times with

observed choices using the individual-level data. Appendix F details how I construct the moments and

provides other estimation details, including how I compute standard errors. After explaining how the

moments are constructed, I explain how the moments identify the parameters.

A. Moments

The first set of moments equate market shares predicted by the model with observed market shares. As

shown by Berry (1994) and others, the distributional assumptions of the composite error term give rise to a

closed-form expression for the model-predicted market share (see Appendix F). Let

denote the model-

predicted market shares, let

denote the market shares observed in the data, and let and denote the

vectors of

and

, respectively, for all products

and markets . The first set of

moments are constructed by setting .

The second set of moments are referred to as macromoments because they are constructed using market-

level data, where the unit of observation is product . I assume that the unobserved product quality

is

uncorrelated with a set of instruments. Since price

is possibly correlated with unobserved product

quality—consumers may be willing to pay a higher price for higher quality that is not observed by the

researcher—I assume the instruments are correlated with price but uncorrelated with a product’s quality.

Formally, let

be a set of exogenous instruments. The moment conditions are

and the

macromoments

are defined as the sample analog of

.

The third set of moments are referred to as micromoments because they are constructed using

individual-level data, where the unit of observation is individual purchasing a product . Specifically, I

compute the micromoments using a random sample of 10,000 individuals from the Market Locator data

living in origin regions with two or more airports each served by legacy carriers (see Section III.A). I form

the moments by equating model-predicted conditional purchase probabilities with data on whether or not

20

an individual purchased a product. Let

if individual purchased product in market and

otherwise. Let

denote the probability that individual purchases product in market conditional on

purchasing an airline product. The moment condition is

and the micromoments

are defined as the sample analog of

.

B. Estimation

Let denote the parameters to be estimated. To reduce the dimensionality of the generalized method

of moments nonlinear parameter search, I follow Conlon and Gortmaker (2020) by rewriting the utility

specification as

where

Let

,

, and

. Grigolon and Verboven (2014) show how

can be recovered for a given value of

using a modified contraction mapping algorithm introduced by

Berry, Levinsohn, and Pakes (1995) (see Appendix F). By partitioning the utility specification in this way,

the parameters

can be consistently estimated via two-stage least squares estimator

using the

instruments

, and the generalized method of moments estimator only has to perform a nonlinear search

over the parameters

.

Following Berry, Levinsohn, and Pakes (2004) and Petrin (2002), I stack the moments

to form the generalized method of moments objective function

, where is a matrix that assigns

weights to the moments. The estimator

searches for parameter values that minimize the objective

function up to some convergence tolerance. Appendix F explains how the matrix is constructed so that

is an efficient estimator.

C. Identification

To identify

, recall that

. The term

represents desirable

characteristics of product that are unobserved to the researcher, which, given the limitations of the data,

21

might include ticket restrictions (such as refundability) and departure time, among others.

35

Product ’s

price

is singled out from the other (exogenous) product characteristics in

to emphasize that special

care must be taken to account for endogeneity: Travelers are willing to pay a higher

for better

characteristics

that are observed by the traveler and the airline but not by the researcher. I allow for

arbitrary correlation between

and

and instrument for

, as explained below.

There are two unobserved variables in this equation:

and

. As explained in Appendix F, I use a

contraction mapping algorithm described by Grigolon and Verboven (2014) to recover

for any value of

, which allows

to be estimated using two-stage least squares, where

is treated as the residual.

Recall that price

is potentially endogenous because product quality

may be correlated with price and

is observed by consumers when making purchases, yet is unobserved by the researcher. Thus, a consistent

estimator of

requires valid instruments

that are correlated with a product’s price but uncorrelated

with a product’s unobserved quality.

Following Berry, Levinsohn, and Pakes (1995) and the large subsequent literature, I form instruments

by exploiting rival product attributes and the competitiveness of the market environment, as products with

closer substitutes should have lower prices, all else equal. The validity of the instruments relies on the

admittedly strong but standard assumption in the literature that market structure is exogenous with respect

to product-level unobserved quality.

36

As noted by Berry and Jia (2010), this assumption is reasonable in

the short run, since market entry decisions involve substantial fixed costs, such as acquiring gate access,

optimizing flight schedules, obtaining aircraft and crew members, and advertising to customers. In addition,

the fact that capacity reduction is costly and that carriers are generally cautious about serving new markets

suggests that the number of carriers is likely to be determined by long-term considerations and uncorrelated

with temporal demand shocks.

In addition to the exogenous product characteristics

, I construct several sets of instruments to aid in

the identification of

. Following Murry (2017), I include the squared difference of each product’s

exogenous characteristics (origin presence, extra time, and flight frequency) from the mean of the

characteristic for competitors in the market. Following Ciliberto, Murry, and Tamer (2021), I include the

exogenous characteristics (origin presence, extra time, flight frequency) of all competitors in a market, as

the authors argue these instruments capture greater variation in the competitive environment than

35

As noted by Berry and Jia (2010), in practice not all products are available at every point of time. For example,

discount fares, which typically require advanced purchase, tend to disappear first. The term

can therefore include

a ticket’s availability, where

is higher for products that are always available or have fewer restrictions and lower

for products that are less obtainable or with more restrictions.

36

Ciliberto, Murry, and Tamer (2021) relax the assumption of exogenous market structure.

22

instruments constructed by summing or averaged characteristics of products within a market.

37

I also

include the share of products in a market that are direct flights, since markets with more direct flights may

be more competitive. I include the number of products in each market, as this instrument will be useful for

identifying (as explained below). Lastly, following Berry and Jia (2010), I include interactions of each

product’s exogenous characteristics (origin presence, direct flight distance, extra time, and flight

frequency).

To identify

, I use the same set of instruments

described above and interact

them with the estimated residuals

, where

is the two-stage least squares

estimator. Since the instruments

are arguably uncorrelated with unobserved product quality

, an

orthogonality argument implies that the sample analog of

, which is the basis for forming the

macromoments. As noted by Berry and Jia (2010), is identified by variation in the market share of the

airline products relative to the outside option as the number of products varies, and a common choice of

instrument is the number of products in each market. The income-specific preference parameters

and

are identified by covariation between travelers’ incomes and the attributes of purchased products.

The micromoments, which are constructed using detailed information on travelers’ home ZIP code relative

to their chosen airport, are particularly useful for identifying , the preference parameter for driving.

38

VI. ESTIMATION RESULTS

In this section, I present the estimation results and post-estimation checks of model fit and

identification.

A. Results

Table 2 presents the estimation results using quarterly data from 2013–19. All estimated coefficients

are statistically significant and have the expected signs. Travelers dislike higher prices and longer driving

times, but higher-income travelers are less sensitive to price. Travelers benefit from the ability to travel to

faraway cities though they prefer to take the most direct route, with higher-income travelers having a

stronger preference for direct flights. Travelers also prefer airline–airport pairs that make it easier to

accumulate frequent flier miles and who offer more daily flights. To interpret the estimated coefficients

from Table 2, it is useful to convert the units into monetary terms, which is done by dividing the coefficient

37

If a carrier does not serve a market, then the value of the instrument enters as a large negative number.

38

Recall that the micromoments were constructed using data from the legacy carriers American Airlines, Delta Air

Lines, United Airlines, and US Airways. Notably, Southwest Airlines is excluded. This restriction does not introduce

bias under the generalized method of moments estimation framework as long as we are willing to assume that

travelers’ preferences for driving are independent of their choice of airline.

23

of interest by the price coefficient estimate adjusted for income. For example, the implied willingness to

pay for a direct flight relative to an indirect flight, all else equal, is $50 for households making $50,000 per

year and $88 for households making $100,000 per year, implying preference for direct flights increases

with income.

Table 2. Model Coefficient Estimates

(1)

Driving time (hours)

–1.686

(0.132)

Price ($100)

–2.669

(0.014)

Price ($100) × income ($100,000)

0.838

(0.111)

Direct flight

0.644

(0.010)

Direct flight × income ($100,000)

0.970

(0.066)

Direct distance (1,000 miles)

0.696

(0.008)

Extra time (hours)

–0.183

(0.003)

Origin presence (100 destinations)

0.285

(0.006)

Number of daily flights

0.125

(0.001)

Vacation destination

0.360

(0.005)

Nesting parameter

0.658

(0.003)

No. of products

346,199

No. of markets

53,912

Notes: The coefficients are estimated using

data from 2013–19 described in the text.

Standard errors are shown in parentheses.

Converting the coefficient on driving time to monetary terms yields an estimate of the marginal value

of travel time savings (VTTS) of $75 per hour for households making $50,000 per year and $92 per hour

for households making $100,000 per year. The estimate for high-income households ($92 per hour) is

reasonably close to the VTTS for business travelers computed using the DOT’s (2016) methodology ($88

per hour), and the estimate for middle-income households ($75) reasonably close to the VTTS for leisure

24

travelers computed using the DOT’s (2016) methodology ($75) (see Appendix D).

39

My estimates of VTTS

are therefore reasonable and consistent with both the recent literature and current DOT (2016) methodology.

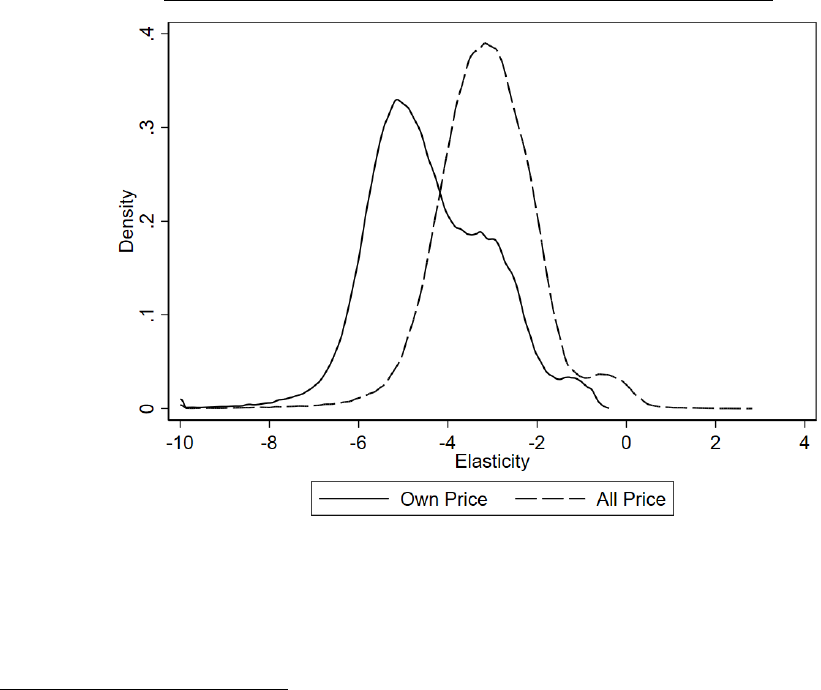

Figure 6 shows the distributions of own-price elasticity (i.e., percentage change in market share from a

percentage change in own price) and all-price elasticity (i.e., percentage change in market share from a

percentage change in price of all products). The median of the own-price elasticities is –4.41 and the median

of the all-price elasticities is –3.12.

40

Figure 7 shows average own-price elasticities for each of the 16

income groups. As expected, own-price elasticity of demand decreases with income, implying higher-

income travelers are less price sensitive.

Figure 6. Distributions of Own- and All-Price Elasticities of Demand

Notes: Own-price elasticity of demand is the percentage change in market share for a product from a 1

percent change in a product’s own price. All-price elasticity of demand is the percentage change in market

share for a product from a 1 percent change in all products’ prices. The densities are constructed using an

Epanechnikov kernel with a bandwidth of 0.05.

39

The DOT’s (2016) methodology for computing the VTTS for leisure travelers is admittedly arbitrary. Specifically,

the DOT (2016) assumes the VTTS for leisure travelers is equal to ½ hourly median income. Using high-frequency

GPS data linking drivers to their choice of gas station, Dorsey, Langer, and McRae (2022) estimate the VTTS as 89

percent of hourly median income. Using large-scale field experiments for Lyft riders, Goldszmidt et al. (2020) estimate

the VTTS as 100 percent of hourly median income. Zamparini and Reggiani (2007) report that the mean VTTS from

a meta-analysis of 90 studies was 83 percent of hourly median earnings.

40

IATA (2008) estimates an own-price elasticity of demand for short-haul, intra–North America markets as –1.65.

McWeeny (2019) finds that a model that does not account for driving time to alternative airports understates own-

price elasticities of demand by about 42 percent. Applying McWeeny’s (2019) adjustment to IATA’s (2008) estimate

would suggest an own-price elasticity of demand for short-haul, intra–North America markets of –2.87. The elasticities

I estimate are at the product level, which are expected to be larger than estimates at the market level.

25

Figure 7. Own-Price Elasticity of Demand by Income

Note: Own-price elasticity of demand is the average over all products for each of the 16 income groups

shown on the horizontal axis.

B. Model Fit and Post-Estimation Checks

Figure 8 shows the empirical distribution of driving times from the Market Locator data alongside the

model-predicted distribution of driving times. The model does a good job of fitting the data: The

distributions are similar in shape and the median driving times are very close, 33 minutes (actual) versus

36 minutes (predicted).

To assess the role of each set of moments in identifying the parameters, I compute Honoré, Jørgensen,

and de Paula’s (2020)

measure of moment informativeness, which measures the relative change in the

asymptotic variance of the estimator from the removal of a set of moments. A large relative change in the

asymptotic variance of a parameter’s estimator suggests the removed moments were informative for

identifying said parameter. I categorize the moments into five groups: (1) six interactions between four

(continuous) exogenous product characteristics (direct flight distance, extra time, origin presence, number

of daily flights) interacted with the estimated residual

; (2) squared differences from the average among

competitors for three (continuous) exogenous product characteristics (extra time, origin presence, number

of daily flights) interacted with the estimated residual

; (3) three (continuous) exogenous product

characteristics (extra time, origin presence, number of daily flights) for 11 competitors interacted with the

0

1

2

3

4

5

6

7

8

9

(–) Own

-Price Elasticity

Annual Income

26

estimated residual

; (4) the number of products in each market and share of products that are direct flights

interacted with the estimated residual

; (5) the sum over all individuals and all products of the difference

between a purchase indicator

and the model-predicted purchase probability conditional on purchase

interacted with driving time

(i.e., micromoments).

Figure 8. Actual and Predicted Distributions of Driving Times to the Airport

Sources: Airlines Reporting Corporation; Open Source Routing Machine.

Notes: Driving time is computed for a random sample of 10,000 passengers from Market Locator for

2013–19. Actual driving time comes from the data. Predicted driving time is

. The

densities are constructed using an Epanechnikov kernel with a bandwidth of 2.5 minutes.

Table 3 shows Honoré, Jørgensen, and de Paula’s (2020)

measure of moment informativeness for

the five groups of moments described above on the estimated parameters for mean price sensitivity (), the

nesting parameter (), drive time sensitivity (), and income-specific price sensitivity (

). The results

confirm the identification intuition explained in Section V.C. The most informative moments for identifying

mean and income-specific price sensitivity are those derived from Ciliberto, Murry, and Tamer’s (2021)

instruments. Identification of drive time sensitivity is driven almost entirely from the micromoments

calculated using the Market Locator data, while these micromoments have almost influence on identifying

any other parameters. Identification of the nesting parameter is driven by the moments that include the

number of products in each market as an instrument, which validates the standard practice in the literature.

27

Table 3. Moment Informativeness

Moments

Mean price

sensitivity

Nesting

parameter

Drive time

sensitivity

Income-specific

price sensitivity

1

0.595

0.522

0.054

1.537

2

0.177

0.227

0.012

0.353

3

9.584

0.629

0.053

2.680

4

2.544

2.331

0.074

0.136

5

0.000

0.024

24.630

0.000

Notes: Moment informativeness is calculated using Honoré, Jørgensen, and de

Paula’s (2020)

measure. Moments listed in the first column correspond to the five

groups explained in the text. The bolded cell in each column indicates the most

informative moment for identifying the column parameter.

VII. COUNTERFACTUAL ANALYSIS OF ESSENTIAL AIR SERVICE

In this section, I use my estimated model to perform a counterfactual policy experiment to determine

the consumer surplus that community members derive from EAS-subsidized commercial service at their

community airports. To do so, I analyze a policy environment in which all EAS subsidies are ended. As

noted in Appendix Table H3, most airports that have lost EAS eligibility no longer have commercial service,

so it is reasonable to assume that ending EAS subsidies would result in an end to commercial service.

However, it is possible that ending EAS subsidies would not end all commercial service—such as at

Hagerstown Regional Airport (HGR), which lost EAS eligibility in 2018 but still has commercial service

offered by Allegiant Air—in which case my counterfactual analysis would overestimate the value of EAS-

subsidized commercial service at an airport. Importantly, my counterfactual analysis does not assume that

all activity at the airport would be eliminated, only that subsidized commercial service would end; an airport

may provide benefits beyond commercial service—such as the ability to fly private planes into and out of

the community—and as shown in Appendix Table H3, all formerly eligible EAS airports still support

general aviation.

A. Data Construction

I use the Market Locator data to link customers’ choice of product with their home ZIP code. Generally,

when EAS community members are observed flying from an airport that is not their local airport, I assume

that they drove there. (Appendix G gives more details about the construction of the data used for the

counterfactual policy experiment.) I use the same notions of products and markets that were used in the

estimation; namely, a market is an origin region to destination airport pair, where in this case the origin

region is an EAS community. Appendix B shows constructed catchment areas for the 107 EAS airports

28

under consideration along with an array of alternative nearby airports. To avoid complications arising due

to airports changing carriers over time, I restrict my counterfactual policy analysis to using data from 2019.

At least two relevant institutional details are worth mentioning. First, EAS-eligible airports are typically

only served by one subsidized carrier at a time flying to one or two hubs.

41

,

42

Second, prices on EAS-

subsidized flights generally exhibit little to no variability within a contract period. Thus, rather than using

DB1B to compute average prices for EAS-originating flights from a sample of itineraries, I extract prices

directly from the subsidized carriers’ EAS proposals to the DOT (listed in Appendix Table H4), which

usually include the airlines’ expected average fares.

EAS community members can be thought of as having two basic choices to access commercial air

travel: via driving a short distance to their local airport for an indirect flight to their final destination, or via

driving a (potentially substantially) longer distance to an alternative airport for a direct flight to their final

destination.

43

An EAS community member’s choice set could include several nearby airports within driving

distance, such as those shown in Appendix B. I restrict the set of alternative airports to those within a 5-

hour drive from the EAS community with non-trivial market shares. Market size is assumed to be the

population of the catchment areas shown in Appendix B.

B. Methodology

The basic idea of the counterfactual policy analysis is to compare the consumer surplus that EAS

community members derive from two alternative choice sets, one that includes the option to fly on an EAS-

subsidized flight and one that does not. I calculate the change in consumer surplus from the removal of

EAS-originating products as the compensating variation using the log-sum approach (de Jong et al., 2007;

Small and Rosen, 1981). As shown by Kling and Thomson (1996), the distributional assumption on the

composite structural error term implies

41