MANAGING FOR THE LONG RUN

|

2022 ANNUAL REVIEW

ii

ABOUT OLD REPUBLIC

Our MISSION is to provide quality insurance security and related services to

businesses, individuals, and public institutions, and be a dependable long-term

steward of the trust that policyholders, shareholders, and other important

stakeholders place in us.

Old Republic traces its beginnings to 1923, although several acquired subsidiaries

began operations much earlier. We are primarily a commercial lines underwriter

serving the insurance needs of a large number of organizations, including many of

North America’s leading industrial and financial services institutions.

Our subsidiaries actively market, underwrite, and provide risk management

services for a wide variety of coverages, mostly in the general and title insurance

fields. The breadth of coverages ensures wide diversification and dispersion of

risks. Additionally, Old Republic’s companies focus only on carefully selected

major sectors of the North American economy that are not uniformly exposed to

the same business cycles. Old Republic operates in a decentralized manner that

emphasizes specialization by type of insurance coverage, industry, and economic

sector. Old Republic’s general insurance business ranks among the nation’s 50

largest, while our title insurance business is the third largest in its industry.

Old Republic is one of the nation’s 50 largest shareholder-owned insurance

businesses. We are a member of the Fortune 500 listing of America’s largest

companies. ORI’s performance reflects an entrepreneurial spirit, a necessary long-

term orientation in the management of our business, and a corporate culture that

promotes accountability and encourages the taking of prudent business risks.

A summary below shows our Book Value Annual Compound Total Return and Market

Value Annual Compound Total Return alongside two market indices. We favor

10-year trends, as these likely encompass one or two economic and/or insurance

underwriting cycles.

ORI Book Value

Annual

Compound

Total Return (1)

ORI Market Value

Annual

Compound

Total Return (2)

S&P 500

Index Annual

Compound

Total Return

S&P P&C

Insurance Index

Annual Compound

Total Return

Ten Years 2013 – 2022 11.5% 16.0% 12.5% 16.0%

(1) Calculated as the sum of the annual change in book value per share, plus cash dividends.

(2) Calculated as the sum of the annual change in market value per share, assuming cash dividends are reinvested

on a pretax basis in shares when paid.

According to the most recent edition of Mergent’s Dividend Achievers, Old Republic

is 58th among 111 publicly held companies, out of thousands considered, that

have posted at least 25 consecutive years of annual dividend growth. Moreover,

Old Republic has paid a cash dividend without interruption since 1942 (82 years),

and it has raised the annual cash dividend pay-out for each of the past 42 years.

CONTENTS

2 ORI’s Long Run Focus

Creates Value

3 2022 Annual Report Letter

13 General Insurance Group

21 Title Insurance Group

24 Republic Financial

Indemnity Group

24 Corporate & Other Operations

25 Investment Management

30 Capitalization and Financial

Ratings

31 Ten-Year Financial Summary

32 Ten-Year Operating and

Balance Sheet Statistics

33 Common Share Statistics

34 Consolidated Balance Sheets

35 Consolidated Statements

of Income

35 Consolidated Statements

of Comprehensive Income

36 Consolidated Statements of

Preferred Stock and Common

Shareholders’ Equity

37 Consolidated Statements

of Cash Flows

38 Key Operating Subsidiaries

39 Board of Directors and

Senior Executive Groups

41 The Most Recent Decade

43 Historical and Forward

Looking Statements

11

FINANCIAL HIGHLIGHTS

($ in Millions, Except Per Share Data)

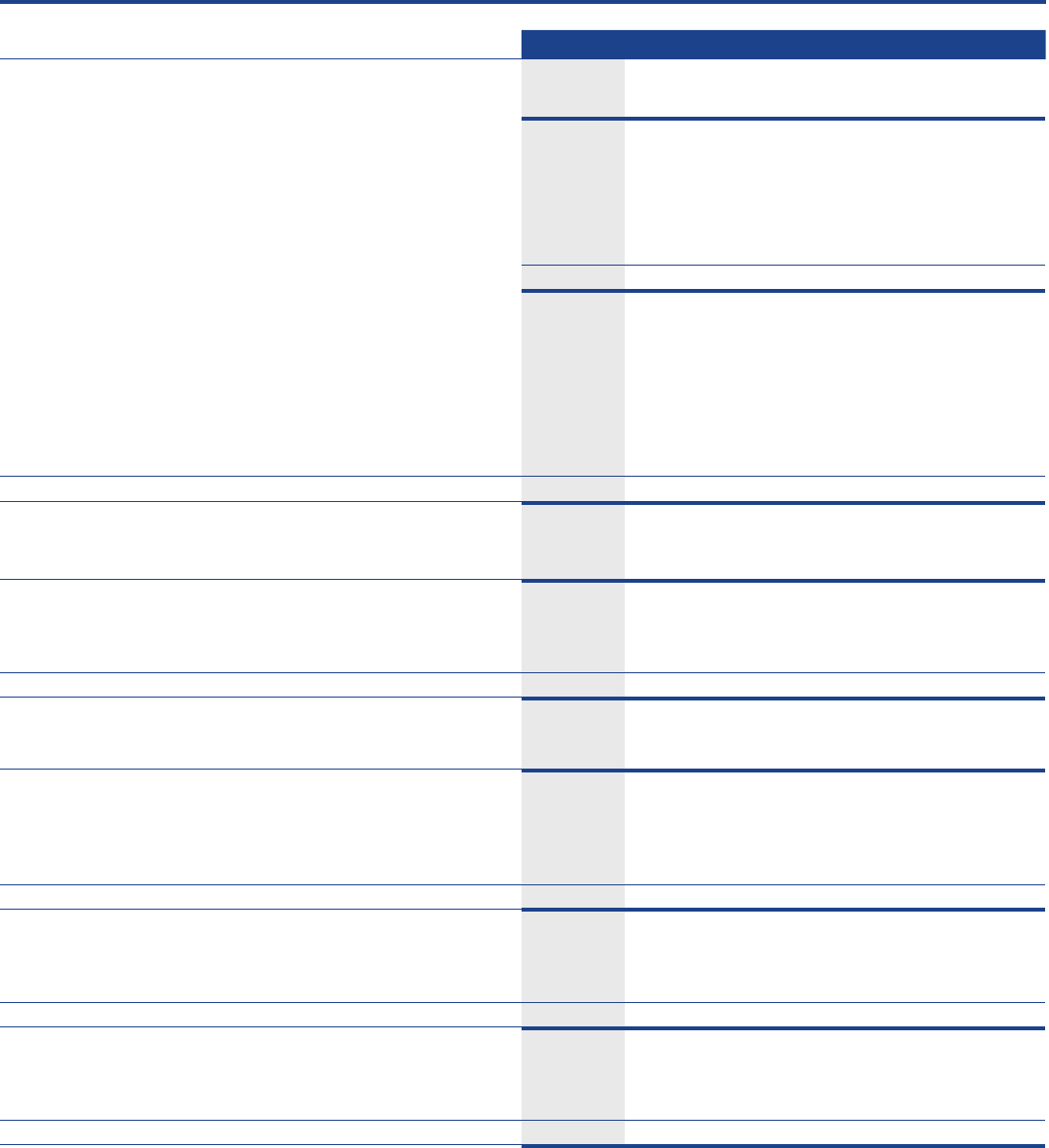

Consolidated Data

2022 2021 % Change

Total Revenues $ 8,083.7 $ 9,341.6 (13.5)%

Pretax Income: Excluding Investment Gains (Losses) 1,058.6 1,164.0 (9.1)

Investment Gains (Losses) (201.1) 758.0 (126.5)

Total Including Investment Gains (Losses) 857.4 1,922.1 (55.4)

Net Income: Excluding Investment Gains (Losses) 845.1 935.9 (9.7)

Net of Tax Investment Gains (Losses) (158.6) 598.4 (126.5)

Total Including Investment Gains (Losses) 686.4 1,534.3 (55.3)

Net Income Per Share-Diluted: Excluding Investment Gains (Losses) 2.79 3.08 (9.4)

Net of Tax Investment Gains (Losses) (0.53) 1.97 (126.9)

Total Including Investment Gains (Losses) 2.26 5.05 (55.2)

Operating Cash Flow 1,170.6 1,311.7 (10.8)

Assets 25,159.4 24,981.8 0.7

Common Shareholders’ Equity: Total 6,166.2 6,893.2 (10.5)

Per Share 21.05 22.76 (7.5)

Cash and Invested Assets Per Share 54.77 55.54 (1.4)

Cash Dividends Per Share* $ 1.92 $ 2.38 (19.3)%

* In addition to the regular quarterly dividend payment of $0.23 per share, a special cash dividend of $1.00 per share was declared in August 2022.

In addition to the regular quarterly dividend payment of $0.22 per share, a special cash dividend of $1.50 per share was declared in August 2021.

Segments of Business

Revenues Pretax Income

2022 2021 % Change 2022 2021 % Change

General Insurance $ 4,315.6 $ 4,042.5 6.8% $ 689.8 $ 589.6 17.0%

Title Insurance 3,882.7 4,449.3 (12.7) 308.8 515.7 (40.1)

RFIG Run-off 30.0 44.1 (32.1) 35.2 32.8 7.3

Corporate & Other 56.5 47.5 19.0 24.6 25.7 (4.3)

Total Operating 8,284.9 8,583.5 (3.5) 1,058.6 1,164.0 (9.1)

Investment Gains (Losses):

Realized From Actual Transactions

and Impairments 62.2 6.9 N/M 62.2 6.9 N/M

Unrealized From Changes

in Fair Value of Equity Securities (263.4) 751.1 (135.1) (263.4) 751.1 (135.1)

Subtotal (201.1) 758.0 (126.5) (201.1) 758.0 (126.5)

Consolidated $ 8,083.7 $ 9,341.6 (13.5)% $ 8 57.4 $ 1,922.1 (55.4)%

FINANCIAL HIGHLIGHTS | 2022 ANNUAL REVIEW

22

ORI’S LONG RUN FOCUS CREATES VALUE

WE MANAGE FOR THE LONG RUN

The insurance business is distinguished from most others in that the prices (premiums) charged

for most products are set without knowing what the ultimate loss costs will be. There also is

no way to know exactly when claims will be paid, which may be many years after a policy was

issued or expired.

OUR SUCCESS COMES FROM FOCUS AND STAYING POWER

Our primary focus is to achieve favorable underwriting results over cycles, and on maintaining a sound financial

condition to support our underwriting subsidiaries’ long-term obligations to policyholders and their beneficiaries. To

achieve both requires adhering to insurance and risk management principles, and emphasizing asset diversification

and quality.

Effectively managing for the long run means we operate with little regard for quarterly or even annual reporting

periods. These time frames are too short. We favor 10-year trends as these likely provide enough time for economic

and/or underwriting cycles to run their course, for premium rate changes and subsequent underwriting results to be

reflected in financial statements, and for reserved loss costs to be quantified with greater certainty.

OUR LONG-TERM PERSPECTIVE CREATES VALUE FOR ALL STAKEHOLDERS

Our performance reflects the success of our long-term strategy for our diversified, specialty insurance businesses.

The General Insurance and Title Insurance segments both focus on providing specialized coverages, products and

related services. This combination allows us to mitigate the effects of cycles while producing sustainable earnings

growth with lower levels of volatility over time.

By applying a long-term perspective, Old Republic has proven itself a reliable insurer and very good investment over

time. Our record stacks up well against other insurers—as well as other successful corporations.

Our commitment to creating long-term shareholder value has created fairly consistent growth in four areas:

1) our quality invested asset base, 2) bottom-line earnings, 3) book value, and 4) cash dividends.

All of these achievements stem from our values, our culture, our strategy of taking prudent business risks, and our

conservative approach to asset and capital management.

2022 ANNUAL REVIEW | ORI'S LONG RUN FOCUS CREATES VALUE

33

2022 ANNUAL REPORT LETTER

Dear shareholders and other important stakeholders:

In 2022, our valued associates, most of whom are also shareholders, continued to diligently

serve the needs of our businesses, our customers, and other important stakeholders. We

are grateful for their dedication to delivering our products and services with excellence and

discipline, which led to Old Republic’s strong operating performance in 2022.

ANOTHER YEAR OF STRONG OPERATING PERFORMANCE

Consolidated pretax income, excluding investment gains (losses), was nearly $1.1 billion compared to

the record $1.2 billion in 2021. Our General Insurance business achieved a new record of $690 million in

pretax income, up from the record $590 million last year. Our Title Insurance business produced $309

million of pretax income, less than the record $516 million in 2021, reflecting the expected effect of higher

interest rates on the real estate market.

Underwriting profit remains strong, as evidenced by the consolidated 91.0% combined ratio in 2022 and

89.9% in 2021.

Operating return on shareholders’ equity (beginning of year) was 12.3% in 2022 and 15.1% in 2021.

Shareholders’ equity ended the year at $6.2 billion, after we returned $862 million to shareholders

through ordinary dividends of 92 cents per share, a special dividend of one dollar per share, and share

repurchases that enabled us to retire 12.6 million shares.

2022 PER SHARE PERFORMANCE

★ Net income per diluted share, excluding investment gains (losses), was $2.79 compared to $3.08 in 2021.

★ Shareholders’ equity per share finished the year at $21.05 compared to $22.76 at year-end 2021.

★ Total market return per share, with dividends reinvested, was 6.7% in 2022 and 45.2% in 2021.

★ Total book value return per share, with the addition of dividends, was 0.9% in 2022 and 21.2% in 2021.

2022 ANNUAL REPORT LETTER | 2022 ANNUAL REVIEW

4

2022 ANNUAL REVIEW | 2022 ANNUAL REPORT LETTER

The table at the end of this letter shows these returns alongside two market indices, tracked back to 1968

when ORI first reported financial results as a publicly traded insurance holding company. We favor 10-year

trends, as these likely include one or two economic and/or insurance underwriting cycles. As can be seen,

our long-term trends outperform these indices. Our performance reflects the success of our long-term

strategy for our diversified, specialty insurance businesses. We remain confident that ORI will continue

creating long-term value for our shareholders and other important stakeholders well into the future.

CONSOLIDATED OPERATIONS SHOW CONTINUED STRENGTH

We focus on pretax income, excluding investment gains (losses) because, in our opinion, this measure

provides a better way to analyze, evaluate, and establish accountability for results. The inclusion of realized

investment gains (losses) in net income can mask trends in operating results, because such realizations are

often highly discretionary. Similarly, the inclusion of unrealized investment gains (losses) in equity securities

can further distort such operating results.

21

2013 14 15 16 17 18 19

Net Income

Net Operating Income

ML5

$ IN MILLIONS

0

200

400

600

800

1,000

1,200

1,400

1,600

22

Consolidated Net Income Trends

Consolidated Net Operating Income Trends

20 2113 14 15 16 17 18 19

ML4

$ IN MILLIONS

-200

0

200

400

600

800

1,000

1,200

1,400

22

Consolidated Net Operating Cash Flow Trends

0.72

0.88

0.73

0.74

0.75

0.76

0.78

0.84

0.92

0.80

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

21

2013 14 15 16 17 18 19

2.24

IN DOLLARS

1.25

1.28

1.46

1.11

ML3

Regular Cash Dividends

Net Operating Income Diluted

Special Cash Dividends

1.84

0.84

1.86

3.08

2.79

22

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

1.50

1.00

1.00

1.00

1.00

Net Operating Income Per Share-Diluted Trends

Cash Dividends Per Share Trends

0

5

10

15

20

25

212013 14 15 16 17 18 19

IN DOLLARS

LR3

Year - End Book Value

Year - End Market Closing Price

22

Book Value Per Share Trends

Market Value Per Share Trends

5

2022 ANNUAL REPORT LETTER | 2022 ANNUAL REVIEW

Sources of Consolidated Income ($ in millions, except share data)

2022 2021 2020 2019 2018 2017

Net premiums and fees earned:

General insurance $ 3,808.6 $ 3,555.5 $ 3,394.2 $ 3,432.4 $ 3,277.1 $ 3,110.8

Title insurance 3,833.8 4,404.3 3,286.3 2,736.0 2,573.1 2,516.5

RFIG run-off 23.2 32.6 45.1 59.2 75.9 122.9

Corporate & other 9.6 11.0 12.0 13.4 14.6 18.8

Consolidated $ 7,675.3 $ 8,003.6 $ 6,737.8 $ 6,241.1 $ 5,940.9 $ 5,769.1

Underwriting and related services income (loss):

General insurance $ 400.9 $ 311.4 $ 151.8 $ 84.9 $ 91.2 $ 84.3

Title insurance 261.3 474.0 305.8 193.4 185.1 206.7

RFIG run-off 28.4 21.3 (5.3) 12.7 29.7 (95.2)

Corporate & other (24.9) (20.9) (17.0) (15.5) (21.9) (28.4)

Consolidated $ 665.8 $ 785.9 $ 435.2 $ 275.6 $ 284.0 $ 167.3

Consolidated underwriting ratio:

Loss ratio:

Current year 35.5% 32.9% 38.2% 41.7% 42.7% 45.7%

Prior years (3.7) (2.7) (1.2) (0.5) (1.3) (2.7)

Total 31.8 30.2 37.0 41.2 41.4 43.0

Expense ratio 59.2 59.7 56.3 54.1 53.5 53.9

Combined ratio 91.0% 89.9% 93.3% 95.3% 94.9% 96.9%

Net investment income:

General insurance $ 358.0 $ 342.4 $ 352.2 $ 356.4 $ 341.0 $ 318.9

Title insurance 47.9 43.8 42.0 41.4 38.8 37.3

RFIG run-off 6.7 11.4 15.2 17.6 20.1 21.7

Corporate & other 46.8 36.5 29.4 35.1 31.7 31.4

Consolidated $ 459.5 $ 434.3 $ 438.9 $ 450.7 $ 431.8 $ 409.4

Interest and other charges (credits):

General insurance $ 69.1 $ 64.2 $ 64.2 $ 71.1 $ 68.3 $ 62.9

Title insurance 0.4 2.1 3.8 4.1 4.6 6.9

RFIG run-off – – – – – –

Corporate & other (a) (2.8) (10.1) (24.3) (35.2) (30.6) (6.9)

Consolidated $ 66.7 $ 56.2 $ 43.7 $ 40.0 $ 42.2 $ 63.0

Segmented and consolidated pretax income (loss)

excluding investment gains (losses):

General insurance $ 689.8 $ 589.6 $ 439.8 $ 370.2 $ 363.9 $ 340.3

Title insurance 308.8 515.7 344.0 230.8 219.3 237.1

RFIG run-off 35.2 32.8 9.8 30.3 49.9 (73.5)

Corporate & other 24.6 25.7 36.7 54.8 40.4 9.9

Consolidated 1,058.6 1,164.0 830.4 686.2 673.7 513.8

Income taxes on above 213.4 228.1 159.6 132.0 117.2 195.7

Net income excluding investment gains (losses): 845.1 935.9 670.8 554.2 556.4 318.0

Consolidated pretax investment gains (losses):

Realized from actual transactions

and impairments 62.2 6.9 14.2 36.6 58.2 211.6

Unrealized from changes in

fair value of equity securities (263.4) 751.1 (156.2) 599.5 (293.8) –

Total (201.1) 758.0 (142.0) 636.1 (235.6) 211.6

Income taxes (credits) on above (42.5) 159.6 (29.8) 133.8 (49.6) (30.8)

Net of tax investment gains (losses) (158.6) 598.4 (112.1) 502.2 (185.9) 242.4

Net income $ 686.4 $ 1,534.3 $ 558.6 $ 1,056.4 $ 370.5 $ 560.5

Consolidated operating cash flow $ 1,170.6 $ 1,311.7 $ 1,185.0 $ 936.2 $ 760.5 $ 452.8

Net income per diluted share

Net income excluding investment gains (losses) $ 2.79 $ 3.08 $ 2.24 $ 1.84 $ 1.8 6 $ 1.11

Realized investment gains 0.16 0.02 0.04 0.10 0.15 0.81

Unrealized investment gains (losses) (0.69) 1.95 (0.41) 1.57 (0.77) –

Net income $ 2.26 $ 5.05 $ 1.87 $ 3.51 $ 1.24 $ 1.92

Cash dividends per share (b) $ 1.92 $ 2.38 $ 1.84 $ 1.80 $ 0.78 $ 1.76

Ending book value per share $ 21.05 $ 22.76 $ 20.75 $ 19.98 $ 17.23 $ 17.72

Closing stock market price per share $ 24.15 $ 24.58 $ 19.71 $ 22.37 $ 20.57 $ 21.38

(a) Includes consolidation/elimination entries.

(b) 2022 includes a special cash dividend of $1.00 per share, 2021 includes a special cash dividend of $1.50 per share, and 2020, 2019 and 2017

include special cash dividends of $1.00 per share.

6

We believe the information presented in the preceeding table highlights the most meaningful indicators of

ORI’s segmented and consolidated financial performance. The information underscores the performance of

our underwriting subsidiaries, as well as our sound investment of their capital and underwriting cash flows.

General Insurance net premiums and fees earned rose 7%, driven by premium rate increases for most

lines of coverage, strong renewal retention, and healthy new business production.

The table below shows the General Insurance combined ratios for the past several years. Our expense ratio

was higher in 2022, generally reflecting a shift in the line of coverage mix toward lines with higher expense

ratios and lower loss ratios. We target combined ratios between 90% and 95% over a full underwriting cycle,

recognizing that quarterly and annual ratios and trends may deviate from this range, particularly given the

long claim payment patterns associated with the business.

General Insurance combined ratios:

2022 2021 2020 2019 2018 2017

Loss ratio 62.1% 64.8% 69.9% 71.8% 72.2% 71.8%

Expense ratio 27.4 26.5 25.6 25.7 25.0 25.5

Combined ratio 89.5% 91.3% 95.5% 97.5% 97.2% 97.3%

During 2022, we launched our newest underwriting subsidiary, Old Republic Excess & Surplus. The start-up

of new ventures by experienced industry experts remains core to our strategy and follows recent launches

of Old Republic Inland Marine in 2021 and Old Republic Residual Market Services in 2018.

We remain optimistic about the continued progress of our General Insurance business. Our long-term

strategy aims to drive profitable growth with a focus on 1) organic growth, 2) new ventures, 3) selective

acquisitions, 4) new product offerings, and 5) new distribution channels; all while continuing our pursuit of

underwriting excellence.

Title Insurance net premiums and fees earned declined 13% due to a significant decline in residential real

estate market activity. Commercial activity was a bright spot, producing record commercial premiums in 2022.

Our Title Insurance business model is based on mitigating and preventing losses rather than assuming

significant underwriting risk. Loss prevention is driven at the front-end of a transaction, and is led by

professionals trained in real estate law who do extensive searches of historical real estate transfers before

policies are issued. As a result, operating expenses are much higher for title insurance when compared with

other types of insurance. However, that also means loss costs are much lower.

The table below shows several years of Title Insurance combined ratios. The higher expense ratio in 2022

generally reflects lower revenues, and the 93.2% combined ratio demonstrates the resiliency of our Title

Insurance business model. We target combined ratios between 90% and 95%, recognizing that quarterly and

annual ratios and trends may deviate from this range, given the cyclicality of real estate markets.

Title Insurance combined ratios:

2022 2021 2020 2019 2018 2017

Loss ratio 2.3% 2.6% 2.3% 2.5% 1.9% 0.8%

Expense ratio 90.9 86.7 88.4 90.5 90.9 91.0

Combined ratio 93.2% 89.3% 90.7% 93.0% 92.8% 91.8%

2022 ANNUAL REVIEW | 2022 ANNUAL REPORT LETTER

7

In 2022, we acquired two independent title agents based on their strong cultural fit and dedication to

customer service in their respective markets.

Our long-term strategy to grow revenues remains focused on 1) organic growth, 2) selective acquisitions, 3)

expansion of our commercial title business, and 4) leading, innovative technology solutions for our independent

agents and customers. We are well positioned for a recovery in the real estate market with an outstanding

team, deep industry relationships, and technological capabilities that differentiate us from competitors.

General Insurance and Title Insurance complement each other exceptionally well. Consistent with ORI’s

long-term strategy, both focus on providing specialized insurance coverages, products and related services.

The customer base for each requires strong financial ratings that are predicated on a strong balance sheet.

General Insurance and Title Insurance share critical complementary enterprise risk management attributes

that enhance the balance and stability of ORI’s business model.

TITLE INSURANCE GENERAL INSURANCE

Capital Light

Low Loss - High Expense

Concentrated Competitors

Real Estate Market Cycle Influenced

Capital Heavy

High Loss - Low Expense

Diverse Competitors

P&C Market Cycle Influenced

RFIG Run-Off is now entirely represented by RMIC’s mortgage guaranty coverages. In 2022, RMIC

produced $35 million of pretax income, excluding investment gains (losses), compared to $33 million in

2021. At the end of 2022, the business had shareholders’ equity of $264 million after paying $140 million

in dividends to the parent company in 2022. Over the next several years, we expect profitability to decline

as premium revenues drop in tandem with insurance risk in-force. We continue to evaluate options to either

continue to run off the business through extinction or to sell the business.

2022 ANNUAL REPORT LETTER | 2022 ANNUAL REVIEW

2013 14 15 16 17 18 19 21

$ IN MILLIONS

ML2

-200

0

200

400

600

800

1,000

1,200

22

RFIG Run-off

Consolidated

General

Title

2013 14 15 16 17 18 19 21 22

$ IN MILLIONS

ML1

RFIG Run-off

Consolidated

General

Title

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

Segmented Pretax Operating Income Trends Segmented Operating Revenue Trends

8

Consolidated Investment Income increased 6% for the year, due primarily to higher fixed income

investment yields. During 2022, we re-allocated part of the investment portfolio from equity securities

(common stocks) to fixed income securities (bonds and notes) to reduce overall risk and in recognition of

the higher investment yields available on fixed income investments. At year-end 2022, approximately 80% of

the fair-valued investment portfolio of $15.9 billion was allocated to fixed income securities and short-term

investments, up from 68% at year-end 2021. The remaining 20% was invested in equity securities, down from

32% the prior year. The rebalancing in 2022, along with ongoing reinvestment into fixed income securities,

increased the ending fixed income portfolio yield from 2.5% at year-end 2021 to 3.3% at the end of 2022.

Our investment management process remains focused on retaining quality investments that produce

consistent streams of investment income. The fixed income portfolio continues to be the anchor for

the underwriting subsidiaries’ obligations. The maturities of our fixed income assets are matched to the

expected liabilities for claim payment obligations to policyholders and their beneficiaries. Our equity

portfolio consists of high-quality common stocks of U.S. companies with long-term records of reasonable

earnings growth and steadily increasing dividends. Dividends from common stocks have been an important

source of investment income, contributing 29% of our total investment income in 2022.

In 2022, we realized $375 million of gains from equity securities, and we offset those gains for tax purposes

with losses from fixed income securities, giving us net realized investment gains of $62 million. At the end

of 2022, net unrealized gains in our equity portfolio were $1.27 billion, while net unrealized losses in our

fixed income portfolio from mark-to-market adjustments were $590 million, which negatively affected book

value return per share.

Old Republic’s investment portfolio is directed in consideration of enterprise-wide risk management

objectives, intended to ensure solid funding of our underwriting subsidiaries’ long-term claim payment

obligations to policyholders and their beneficiaries, as well as the long-term stability of the subsidiaries’

capital base. For these reasons, the investment portfolio does not contain high risk or illiquid asset classes

and has zero or extremely limited exposure to, collateralized debt obligations (CDO’s), credit default and

interest rate swaps, hybrid securities, asset-backed securities (ABS), guaranteed investment contracts

(GIC), structured investment vehicles (SIV), auction rate variable short-term securities, limited partnerships,

derivatives, hedge funds or private equity investments. Moreover, the Company does not engage in hedging

or securities lending transactions, nor does it invest in securities whose values are predicated on non-

regulated financial instruments exhibiting amorphous or unfunded counter-party risk attributes. Pursuant to

our enterprise risk management guidelines and controls, we perform regular stress tests of our investment

portfolio to gain reasonable assurance that periodic downdrafts in market prices do not seriously undermine

our financial strength and the long-term continuity and prospects of our underwriting subsidiaries.

EVALUATING 2022’S PERFORMANCE

IN VIEW OF OUR LONG-TERM BUSINESS STRATEGY

Our long-term strategy is designed to create value for all stakeholders through our focus on providing

specialized insurance coverages, products and related services. Much of our long-term underwriting

success is due to our history of specializing within the P&C and Title insurance markets.

2022 ANNUAL REVIEW | 2022 ANNUAL REPORT LETTER

9

2022 ANNUAL REPORT LETTER | 2022 ANNUAL REVIEW

One important way we support this strategy is through the conservative, long-term management of our

balance sheet. Maintaining a strong financial position gives us the ability to achieve these goals:

★

Support our underwriting subsidiaries’ ability to take on insurance risk and cover the resulting obligations to

policyholders and their beneficiaries

★

Enable our underwriting subsidiaries to remain resilient in the face of recurring marketplace challenges,

adhere to pricing integrity and underwriting standards, and stay away from existing or new business with

poor prospects of sustainable profitability

★

Moderate debt leverage to better ensure control of our destiny

★

Retain enough liquidity to address unforeseen contingencies

★

Pay shareholders a sustainable

and increasing dividend

In 2023, we are celebrating Old Republic’s 100 year anniversary under the banner of 100 Years of

Excellence, which recognizes our rich history and the next chapter of serving specialty niches within the

P&C and Title insurance markets.

We enter 2023 in a strong position:

★

Our associates have significant intellectual capital and are dedicated to our mission

★

We have high retention rates with a loyal and growing customer base

★

We have a strong, high-quality capital base

★

Our balance sheet is solid

Looking forward, we will continue to seek out opportunities to grow our market share through organic

growth, new ventures, select acquisitions, and new product offerings. Our focus on providing specialized

underwriting and risk management expertise to our specialty customers will continue to include investments

in people and technology, and an unrelenting focus on excellence.

Respectfully submitted on behalf of the

Company and its Board of Directors,

Chicago, Illinois Craig R. Smiddy

March 31, 2023 President and Chief Executive Officer

10

2022 ANNUAL REVIEW | 2022 ANNUAL REPORT LETTER

OLD REPUBLIC’S PURPOSE IS INCLUDED IN OUR MISSION STATEMENT:

To provide quality insurance security and related services to businesses, individuals, and public

institutions, and be a dependable long-term steward of the trust that policyholders, shareholders,

and other important stakeholders place in us.

Our Lodestar embodies the Company’s mission by binding organization, purpose, and long-term strategy

into a coordinated whole.

Our Community:

The Public Interest

We’re an insurance business vested

with the public interest. All is done

right, within the law, and with integrity.

Our Customers:

Policyholders & Buyers

of Services

Good things happen when

customers’ legitimate needs

are fulfilled by our people.

Our People: Intellectual

Capital Providers

Our people’s intellectual

talent, know-how, and

honorable work put

capital to efficient use.

Our Capital Providers:

Shareholders & Debt Holders

Capital is the lifeblood of a

financial institution. It is the source

and continuity of the enterprise.

Our MISSION is to Provide Quality Insurance Security and Related Services to

Businesses, Individuals, and Public Institutions and Be a Dependable Long-Term Steward

of the Trust that Policyholders and Other Important Stakeholders Place in Us.

ORI’s Lodestar: Strategic Governance

on Behalf of All Important Stakeholders

Putting It All Together For The Long Run

Old

Republic’s

Lodestar

Our

Customers

Our

Community

Our Capital

Providers

Our

People

Our Community:

The Public Interest

We’re an insurance business vested

with the public interest. All is done

right, within the law, and with integrity.

Our Customers:

Policyholders & Buyers

of Services

Good things happen when

customers’ legitimate needs

are fulfilled by our people.

Our People: Intellectual

Capital Providers

Our people’s intellectual

talent, know-how, and

honorable work put

capital to efficient use.

Our Capital Providers:

Shareholders & Debt Holders

Capital is the lifeblood of a

financial institution. It is the source

and continuity of the enterprise.

Our MISSION is to Provide Quality Insurance Security and Related Services to

Businesses, Individuals, and Public Institutions and Be a Dependable Long-Term Steward

of the Trust that Policyholders and Other Important Stakeholders Place in Us.

ORI’s Lodestar: Strategic Governance

on Behalf of All Important Stakeholders

Putting It All Together For The Long Run

Old

Republic’s

Lodestar

Our

Customers

Our

Community

Our Capital

Providers

Our

People

Our Community:

The Public Interest

We’re an insurance business vested

with the public interest. All is done

right, within the law, and with integrity.

Our Customers:

Policyholders & Buyers

of Services

Good things happen when

customers’ legitimate needs

are fulfilled by our people.

Our People: Intellectual

Capital Providers

Our people’s intellectual

talent, know-how, and

honorable work put

capital to efficient use.

Our Capital Providers:

Shareholders & Debt Holders

Capital is the lifeblood of a

financial institution. It is the source

and continuity of the enterprise.

Our MISSION is to Provide Quality Insurance Security and Related Services to

Businesses, Individuals, and Public Institutions and Be a Dependable Long-Term Steward

of the Trust that Policyholders and Other Important Stakeholders Place in Us.

ORI’s Lodestar: Strategic Governance

on Behalf of All Important Stakeholders

Putting It All Together For The Long Run

Old

Republic’s

Lodestar

Our

Customers

Our

Community

Our Capital

Providers

Our

People

Our Community:

The Public Interest

We’re an insurance business vested

with the public interest. All is done

right, within the law, and with integrity.

Our Customers:

Policyholders & Buyers

of Services

Good things happen when

customers’ legitimate needs

are fulfilled by our people.

Our People: Intellectual

Capital Providers

Our people’s intellectual

talent, know-how, and

honorable work put

capital to efficient use.

Our Capital Providers:

Shareholders & Debt Holders

Capital is the lifeblood of a

financial institution. It is the source

and continuity of the enterprise.

Our MISSION is to Provide Quality Insurance Security and Related Services to

Businesses, Individuals, and Public Institutions and Be a Dependable Long-Term Steward

of the Trust that Policyholders and Other Important Stakeholders Place in Us.

ORI’s Lodestar: Strategic Governance

on Behalf of All Important Stakeholders

Putting It All Together For The Long Run

Old

Republic’s

Lodestar

Our

Customers

Our

Community

Our Capital

Providers

Our

People

Our Community:

The Public Interest

We’re an insurance business vested

with the public interest. All is done

right, within the law, and with integrity.

Our Customers:

Policyholders & Buyers

of Services

Good things happen when

customers’ legitimate needs

are fulfilled by our people.

Our People: Intellectual

Capital Providers

Our people’s intellectual

talent, know-how, and

honorable work put

capital to efficient use.

Our Capital Providers:

Shareholders & Debt Holders

Capital is the lifeblood of a

financial institution. It is the source

and continuity of the enterprise.

Our MISSION is to Provide Quality Insurance Security and Related Services to

Businesses, Individuals, and Public Institutions and Be a Dependable Long-Term Steward

of the Trust that Policyholders and Other Important Stakeholders Place in Us.

ORI’s Lodestar: Strategic Governance

on Behalf of All Important Stakeholders

Putting It All Together For The Long Run

Old

Republic’s

Lodestar

Our

Customers

Our

Community

Our Capital

Providers

Our

People

OLD REPUBLIC INTERNATIONAL CORPORATION

11

2022 ANNUAL REPORT LETTER | 2022 ANNUAL REVIEW

OLD REPUBLIC’S CULTURE, OPERATING PHILOSOPHY, AND INSTITUTIONAL MEMORY:

OLD REPUBLIC INTERNATIONAL CORPORATION

It starts with “we” –

we have each other’s back

We are efficient –

we optimize better and faster

We are humble –

but we are confident

We are patient and

thoughtful

– we don’t

panic or overreact

We are inclusive –

we listen to and respect

others’ points of view

We keep things simple –

we don’t reinvent the wheel or

fix something not broken

We drive out bureaucracy

when we see it

– our

organizational structures are flat

We act with integrity –

we are trustworthy and honest

We do things the right way –

we don’t follow bad competition

We leave politics to politicians –

we are collaborative and collegial

We are creative and

innovative

–

we think outside the box

We drive down decision

making and accountability

–

we are decentralized

We communicate in an open, clear,

consistent, concise manner

–

We are long-term focused –

we don’t let short-term or quarterly

results guide us

w

e tell it like it is

12

OLD REPUBLIC INTERNATIONAL CORPORATION

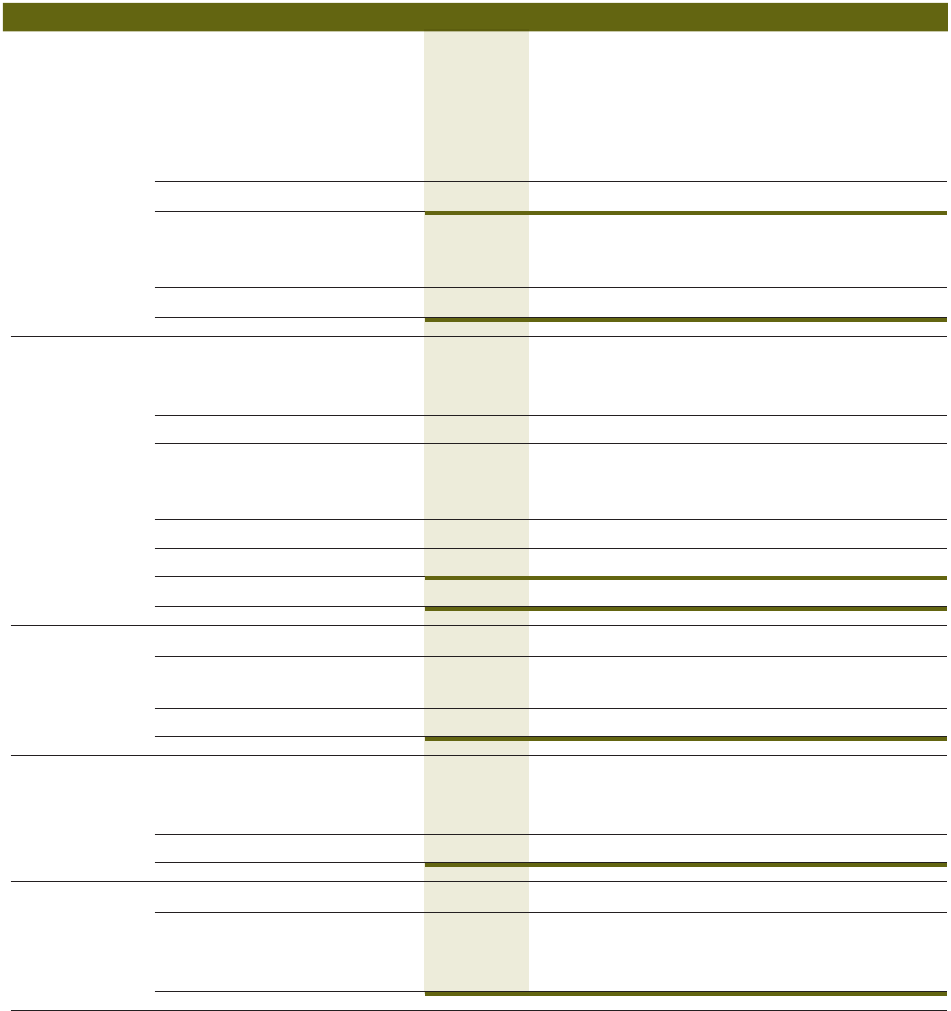

Total Returns Compared to Selected S&P Indices’ Returns

S&P P&C

S&P 500 Insurance

Old Republic International Corporation

(1)

Index

(2)

Index

(2)

Annual Book Value Market Value

Year End Year End Cash Annual Annual Annual Annual

Book Market Dividend Compound Compound Compound Compound

Year Value Price Declared Total Return(*) Total Return(**) Total Return Total Return

1968 $ 0.280 $ 0.472 $ 0.007 18.2% 41.8% 11.0%

1969 0.312 0.336 0.010 15.1% -26.6% -8.4%

1970 0.360 0.528 0.012 19.2% 60.7% 3.9%

1971 0.472 0.840 0.014 34.9% 61.7% 14.3%

1972 0.480 1.240 0.016 5.1% 49.5% 19.0%

1973 0.472 0.456 0.018 2.2% -61.7% -14.7%

1974 0.376 0.408 0.020 -16.1% -6.1% -26.5%

1975 0.288 0.440 0.020 -18.1% 12.7% 37.2%

1976 0.560 0.624 0.011 98.3% 44.4% 23.9%

1977 0.792 0.792 0.022 45.3% 30.4% -7.2%

1978 0.976 0.976 0.033 27.4% 27.4% 6.6%

1979 1.080 1.112 0.052 16.0% 19.3% 18.6%

1980 1.224 0.888 0.054 18.3% -15.3% 32.5%

1981 1.392 1.144 0.054 18.1% 34.9% -4.9%

1982 1.648 1.456 0.056 22.4% 32.2% 21.6%

10 Year Annual Compound Total Return 17.7% 5.7% 6.7%

1983 1.888 2.353 0.058 18.1% 65.6% 22.6%

1984 2.208 2.039 0.059 20.1% -11.2% 6.3%

1985 2.304 3.014 0.062 7.1% 51.4% 31.7%

1986 2.528 2.316 0.065 12.5% -21.0% 18.7%

1987 2.952 1.861 0.068 19.5% -16.7% 5.3%

1988 3.152 2.345 0.071 9.2% 29.8% 16.6%

1989 3.544 2.604 0.076 14.8% 14.3% 31.7%

1990 3.920 2.465 0.081 12.9% -2.2% -3.2% -2.3%

1991 4.456 4.207 0.086 15.9% 74.2% 30.5% 25.3%

1992 5.072 5.896 0.094 15.9% 42.4% 7.6% 17.2%

10 Year Annual Compound Total Return 14.5% 18.1% 16.2%

1993 5.744 5.363 0.102 15.3% -7.3% 10.1% -1.8%

1994 6.112 5.037 0.111 8.3% -4.0% 1.3% 4.8%

1995 7.248 8.415 0.121 20.6% 70.1% 37.6% 35.4%

1996 7.76 8 9. 511 0.148 9.2% 15.1% 23.0% 21.5%

1997 8.312 13.222 0.178 9.3% 41.2% 33.4% 45.5%

1998 9.216 12.000 0.206 13.4% -7.8% 28.6% -6.6%

1999 9.590 7.267 0.262 6.9% -37.5% 21.0% -25.5%

2000 11.000 17.066 0.294 17.8% 142.1% -9.1% 55.9%

2001 12.480 14.938 0.314 16.3% -10.6% -11.9% -8.1%

2002 13.960 14.934 0.336 14.6% 2.0% -22.1% -11.0%

10 Year Annual Compound Total Return 13.1% 12.1% 9.3% 8.1%

2003 15.650 20.288 0.890*** 18.5% 42.4% 28.7% 26.4%

2004 16.940 20.240 0.403 10.8% 1.9% 10.9% 10.4%

2005 17.5 30 21.008 1.312*** 11.2% 10.5% 4.9% 15.1%

2006 18.910 23.280 0.590 11.2% 13.9% 15.8% 12.8%

2007 19.710 15.410 0.630 7.6% -31.5% 5.6% -14.0%

2008 15.910 11.920 0.670 -15.9% -18.0% -37.0% -29.4%

2009 16.490 10.040 0.680 7.9% -10.1% 26.5% 12.4%

2010 16.160 13.630 0.690 2.2% 43.4% 15.1% 8.9%

2011 14.760 8.920 0.700 -4.3% -27.2% 2.1% -0.3%

2012 14.030 10.650 0.710 -0.1% 23.4% 16.0% 20.1%

10 Year Annual Compound Total Return 4.5% 1.7% 7.1% 4.9%

2013 14.640 17.270 0.720 9.5% 70.7% 32.4% 38.3%

2014 15.150 14.630 0.730 8.5% -11.2% 13.7% 15.7%

2015 14.980 18.630 0.740 3.8% 33.4% 1.4% 9.5%

2016 17.160 19.000 0.750 19.6% 6.2% 11.9% 15.7%

2017 17.720 21.380 1.760*** 13.5% 16.9% 21.8% 22.4%

2018 17.230 20.570 0.780 1.6% 4.8% -4.4% -4.7%

2019 19.980 22.370 1.800*** 26.4% 17.8% 31.5% 25.9%

2020 20.750 19.710 1.840*** 13.1% -7.7% 18.4% 6.3%

2021 22.760 24.580 2.380*** 21.2% 45.2% 28.7% 17.5%

2022 $21.050 $24.150 $1.920*** 0.9% 6.7% -18.1% 18.9%

10 Year Annual Compound Total Return 11.5% 16.0% 12.5% 16.0%

55 Year Annual Compound Total Return 12.7% 12.4% 10.1% 10.0%

Sources: (1) Old Republic Database; (2) Standard & Poor’s Indices from S&P Global Market Intelligence LLC. Data for years 1989 and prior is not available for the S&P

P&C Insurance Index.

Notes: (*) Calculated as the sum of the annual change in book value per share, plus cash dividends. (**) Calculated as the sum of the annual change in market value

per share, assuming cash dividends are reinvested on a pretax basis in shares when paid. (***) Includes special cash dividends declared of $1.000, $1.500,

$1.000, $1.000, $1.000, $0.800, and $0.534 per share in 2022, 2021, 2020, 2019, 2017, 2005, and 2003, respectively.

13

GENERAL INSURANCE GROUP | 2022 ANNUAL REVIEW

GENERAL INSURANCE GROUP

Old Republic General Insurance

Group (ORGIG) serves customers in

the U.S. and Canada through a

network of 95 offices in 65 cities.

Each ORGIG underwriting subsidiary specializes in a

property/casualty market niche, offering customized risk

management and insurance solutions. Within our industry

and product specializations, we provide 1) alternative risk

financing solutions (captives, large deductibles, and retro

programs) for large corporations, affinity groups, and

public institutions with complex risks that choose to

retain a significant level of their own risk; 2) traditional risk

transfer and related services for mid-sized companies;

3) specialty insurance products for small companies on

an admitted and non-admitted basis; and 4) home

warranty, auto warranty, and travel insurance products

for individuals. Our brand reflects a tradition of delivering

on promises of financial indemnity and service. This

earned us a reputation for reliability and stability through

insurance market cycles, giving our underwriting

subsidiaries a durable competitive advantage.

60

70

80

90

100

110

120

212013 14 15 16

17 18

19

Old Republic General Insurance Group

Insurance Industry

PERCENT

G3

22

60

70

80

90

100

110

120

Combined Ratio Trends

$ IN MILLIONS

Pretax Income

Net Investment Income

Income (Loss)

21

G2

Underwriting/Service

-100

0

100

200

300

400

500

600

700

2013 14 15 16 17 18 19 22

Sources of Pretax Income Trends

The Group’s underwriting results have outperformed the industry

average in 8 of the past 10 years and 21 of the past 25 years.

14

($ in Millions) 2022 2021 2020 2019 2018

Financial Cash, Fixed Income Securities $ 9,973.1 $ 9,553.4 $ 9,495.9 $ 8,888.5 $ 8,293.6

Position Equity Securities 2,411.4 3,257.3 2,690.4 2,646.7 2,133.0

Other Invested Assets 114.0 100.1 99.8 99.8 107.1

Reinsurance Recoverable 5,574.9 4,928.6 4,345.8 3,804.7 3,488.1

Sundry Assets 3,154.4 2,821.3 2,594.1 2,430.2 2,389.4

$ 21,227.9 $ 20,660.9 $ 19,226.1 $ 17,870.0 $ 16,411.4

Loss Reserves $ 11,521.4 $ 10,709.0 $ 9,974.9 $ 9,267.0 $ 8,756.8

Unearned Premiums 2 ,787.7 2,559.2 2,396.7 2,223.5 2,102.3

Other Liabilities 3,341.8 3,272.9 3,022.5 2,744.3 2,527.5

Equity 3,576.9 4,119.8 3,832.2 3,635.1 3,024.6

$ 21,227.9 $ 20,660.9 $ 19,226.1 $ 17,870.0 $ 16,411.4

Operating Net Premiums Written $ 3,978.2 $ 3,680.9 $ 3,431.3 $ 3,469.0 $ 3,380.4

Results

Net Premiums Earned $ 3,808.6 $ 3,555.5 $ 3,394.2 $ 3,432.4 $ 3,277.1

Net Investment Income 358.0 342.4 352.2 356.4 341.0

Other Income 148.9 144.5 130.3 131.9 121.3

4,315.6 4,042.5 3,876.8 3,920.8 3,739.4

Loss and Loss Adjustment Expenses 2,352.0 2,280.3 2,353.0 2,437.2 2,346.0

Policyholders’ Dividends 12.5 22.7 18.9 27.3 19.8

Sales and General Expenses 1,192.0 1,085.4 1,000.7 1,014.7 941.3

Interest and Other Costs 69.1 64.2 64.2 71.1 68.3

3,625.8 3,452.8 3,436.9 3,550.5 3,375.5

Pretax Operating Income $ 689.8 $ 589.6 $ 439.8 $ 370.2 $ 363.9

Operating Cash Flow $ 898.9 $ 771.8 $ 755.3 $ 654.2 $ 654.7

Underwriting All Coverages Combined:

Statistics Paid Loss Ratio 55.5% 56.8% 60.3% 63.3% 62.6%

Incurred Loss Ratio 61.8% 64.2% 69.3% 71.0% 71.6%

Dividend Ratio .3% .6% .6% .8% .6%

Expense Ratio 27.4% 26.5% 25.6% 25.7% 25.0%

Combined Ratio 89.5% 91.3% 95.5% 97.5% 97.2%

Liability Coverages:

Earned Premiums $ 2,351.3 $ 2,203.8 $ 2,140.2 $ 2,217.5 $ 2,120.9

Loss Ratio 63.3% 68.0% 73.9% 75.5% 75.9%

Dividend Ratio .3% .7% .6% .9% .6%

Other Coverages:

Earned Premiums $ 1,457.3 $ 1,347.6 $ 1,260.3 $ 1,217.2 $ 1,154.8

Loss Ratio 59.3% 57.3% 61.1% 63.0% 63.5%

Dividend Ratio .3% .1% .1% .1% .2%

Composition of Underwriting/Service Income $ 400.9 $ 311.4 $ 151.8 $ 84.9 $ 91.2

Pretax Operating Net Investment Income 358.0 342.4 352.2 356.4 341.0

Income Interest and Other Costs (69.1) (64.2) (64.3) (71.1) (68.3)

Pretax Operating Income $ 689.8 $ 589.6 $ 439.7 $ 370.2 $ 363.9

Key Ratios Net Premiums Written to Equity 1.1x .9x .9x 1.0x 1.1x

Net Loss Reserves to Equity 191% 160% 165% 166% 189%

Cash and Invested Assets to Liabilities 102% 110% 111% 111% 106%

The above summary has been prepared on the basis of generally accepted accounting principles and excludes investment gains and losses.

Old Republic General Insurance Group, Inc.

CONSOLIDATED PROPERTY/CASUALTY INSURANCE BUSINESS

2022 ANNUAL REVIEW | GENERAL INSURANCE GROUP

15

ORGIG delivered another record performance in

2022. It increased net premiums and fees written

by 8% to $4.2 billion, producing $690 million

of pretax operating income. Premium growth

stemmed from healthy customer retention, organic

new business success, and premium rate increases.

Higher profits came from an improved underlying

combined ratio, together with favorable loss reserve

development. Underwriting excellence initiatives

in recent years also positioned our portfolio for

profitable growth in 2023 and beyond.

Our product diversification efforts continued in 2022. Commercial Auto and Workers’ Compensation

comprised 61% of net premiums written in 2022, down from 67% in 2017. We remain bullish on our ability to

expand core lines of coverage while growing at a faster rate in other lines.

While continuing to invest in current operations, we also are launching new ones. Each of our 14

underwriting subsidiaries offers differentiated solutions within specialty product and distribution niches. The

rest of this section outlines each underwriting subsidiary’s contribution to ORGIG’s financial performance,

strength, and growth prospects.

BITCO Insurance Companies (BITCO) has protected industries at the core of the American economy

for over 100 years. We provide specialized insurance programs and related services to these sectors: 1)

commercial construction, 2) forest products, 3) onshore oil and gas, 4) light manufacturing, 5) wholesale/

distribution, and 6) public entities. In addition to traditional risk transfer products, we offer loss sensitive

programs, large deductibles, and construction wrap-up programs. A foundation of our value proposition is to

place our underwriting, claims, risk control, and premium audit teams near the customers we serve.

We also partner with a select group of specialized agents and brokers that share our commitment to

the industries we protect and serve. In 2022, BITCO offered all of its programs coast-to-coast, providing

solutions for middle market, large, and complex customers.

Great West Casualty Company (GWCC) has built an organization with the goal of becoming the premier

provider of insurance products and services for truckers for 65 years. This led it to become one of America’s

largest insurers of trucking companies. We offer comprehensive coverage packages designed to meet the needs

of motor carriers of all sizes.

Our long-term stability is reflected in the deep relationships with the motor carriers we insure. They stay with

us because we understand their industry and how insurance can support it. Trucking clients also appreciate

the expertise of our long-time agency partners, whose commitment to The Difference is Service

®

means

they also deliver on what we promise, every day.

Our long history of profitable growth is enhanced through strategic use of data and technology, along with

segmenting our business. This allows us to be more responsive and to allocate resources where they have

the greatest impact. Continued focus on risk selection and appropriate pricing allowed GWCC to increase

written premiums in 2022 while producing solid profit margins.

GENERAL INSURANCE GROUP | 2022 ANNUAL REVIEW

UNITED STATES

Northeast

9.9% 11.3% 10.9%

Mid-Atlantic 10.0 6.7 6.6

Southeast 15.0 17.0 18.0

Southwest 13.3 13.1 12.9

East North Central 13.8 11.8 11.7

West North Central 13.2 11.3 11.2

Mountain 6.6 7.0 7.2

Western 16.2 18.3 17.8

FOREIGN (Principally Canada) 2.0 3.5 3.7

100.0% 100.0% 100.0%

Geographic Distribution of Direct Premiums Written

2013 2021 2022

16

Old Republic Aerospace, Inc. (ORAE) specializes in insurance products for the North American

aviation industry. We focus on 1) corporate flight departments, 2) public entities, 3) airlines, 4) commercial

operators, and 5) individual owners and operators of light aircraft. Our offering also includes workers’

compensation and aviation products liability coverages.

Integrated claims and risk control services support our dynamic and disciplined approach to underwriting.

Over 30 years of aviation experience gives us the foundation to deliver unique solutions. In 2022, new

products and an expanded geographic footprint brought record new business and a higher market share.

Investments in technology and talent development will allow us to continue to deliver best in class service.

Old Republic Excess & Surplus (ORES) offers non-admitted products distributed through wholesalers

with experienced, service-oriented people and an advanced technology platform. Our teams focus on

out-of-the-box solutions for hard to place small to medium-sized businesses. Throughout 2022, the ORES

team set up the operational infrastructure for a successful launch in early 2023.

Old Republic Home Protection Company (ORHP) offers home service contracts for major systems and

appliances to home sellers and buyers. Our brand is built on almost 50 years of providing comprehensive

coverage, with competent and caring service, at competitive rates. We primarily distribute our products

through a nationwide network of real estate agents and brokers, and serve customers through our

Independent Service Provider Network.

In 2022, increased claim frequency, inflation, and a decline in existing home sales negatively affected

our growth and profitability. Looking ahead, ORHP is well positioned for new business success and has

several new initiatives to improve our renewals of existing contracts. Expected improvements in supply

management, productivity, and market share should help curtail claim trends and generate growth.

Old Republic Insurance Company of Canada (ORICAN) is a federally licensed property/casualty

insurance company based in Ontario. Our principal business concentrates on two areas: underwriting long-

haul trucking and travel insurance programs. We also provide insurance and related services to customers

with cross-border operations in concert with our U.S. affiliates: Great West Casualty Company, Old Republic

Aerospace, Old Republic Insured Automotive Services, and Old Republic Risk Management.

In 2022, the long-haul trucking unit continued to deliver favorable underwriting performance. This resulted

from consistent risk selection and a focused distribution strategy. In addition, our travel insurance premiums

were fueled by a return of international visitors to Canada.

2022 ANNUAL REVIEW | GENERAL INSURANCE GROUP

17

Old Republic Inland Marine (ORIM) offers specialty products and services to a wide range of inland marine

customers. ORIM’s team features industry-leading underwriters with the experience, expertise, and authority

to provide thoughtful and timely underwriting decisions. Our focus is on providing insured and broker partners

with a seamless and efficient user experience: from submission through the full policy lifecycle.

In early 2022, we successfully launched ORIM with a select group of distribution partners. Capitalizing on the

momentum from its proprietary builders’ risk product, ORIM will continue to expand its product offering in 2023.

Old Republic Insured Automotive Services, Inc. (ORIAS) specializes in automobile service contracts,

mechanical breakdown insurance, and other automobile-related products for new and used vehicles.

ORIAS enjoys decades-long partnerships with some of the nation’s largest automotive, financial

intermediary, and related service companies. We provide insured automotive products for more than

5,000 automobile dealers.

In 2022, the automobile market began emerging from pandemic-related supply chain challenges. The

improving market conditions, along with our reputation for providing superior customer service, has us

positioned well in the near term.

Old Republic Professional Liability, Inc. (ORPRO) is a premier underwriter of management and

professional liability insurance. ORPRO writes 1) directors and officers liability, 2) employment practices

liability, 3) fiduciary liability, 4) financial institutions professional liability, 5) transactional liability, 6) lawyers’

professional liability, and 7) miscellaneous professional liability. Our customers are public, private, and

nonprofit organizations and law firms.

ORPRO has served many industries for almost 40 years, and it is a market leader in technology,

biotechnology, and life sciences. Our seasoned and respected underwriting professionals provide bespoke,

flexible, and sophisticated specialty insurance solutions through a network of specialist brokers. Thoughtful

underwriting and high service standards, coupled with effective resolution of complex claims, underlie our

many years of underwriting profitability.

Market conditions for some of ORPRO’s products changed in 2022, as new companies drove down pricing

after successive years of large premium rate increases. Our commitment to long-term profitability and core

underwriting principles helped us navigate this changing market. We continue to invest in talent, data, and

innovation to meet our customers’ evolving needs.

GENERAL INSURANCE GROUP | 2022 ANNUAL REVIEW

18

Old Republic Residual Market Services, Inc. (ORMARKS) serves the workers’ compensation residual

markets. As a national servicing carrier, we provide policy management and claim services, on a fee basis,

to assigned risk policyholders throughout the U.S.

Our management team averages 20 years of experience with national servicing carriers. This gives us deep

knowledge of and long relationships with critically important state regulators, rating bureaus, and product

administrators.

Very few insurance companies operate as a servicing carrier to the workers’ compensation residual

markets. This limited competition, the high barrier to entry, and our extensive expertise position ORMARKS

for growth in the next several years.

Old Republic Risk Management, Inc. (ORRM) serves the casualty needs of large corporate and group

clients in many industries that are core to the North American economy. We do this through our unbundled

claims and risk control business model. We pioneered the alternative market approach to insurance risk

management. ORRM has worked with many Fortune 500 companies and other large publicly held and private

enterprises since the early 1950s. This gives us longstanding and industry-leading expertise in providing

innovative solutions and services for sizable insurance buyers. These offerings include the use of large

deductibles, self-insurance, and captive mechanisms.

Our 2022 results reflected 98% account retention, organic growth, and the ability to attract new customers.

The Old Republic brand is well known in this specialized market. Our competitive advantages include best-in-

class service, product stability, responsiveness, and innovative flexibility to meet customer needs. We remain in

a good position to deliver profitable growth by capitalizing on the strength of our core products and services.

Old Republic Specialty Insurance Underwriters, Inc. (ORSIU) focuses on two segments in the

specialty insurance marketplace. The first provides alternative risk insurance and reinsurance risk transfer

products for public entities and nonprofits. The second offers specialty insurance programs, managed by

independent program administrators, using an unbundled service model for claims and risk control.

Formed in 2015, our dedicated underwriting team averages more than 20 years of insurance and

reinsurance experience. This includes most types of property and liability coverages. We collaborate with

specialized producers that are committed to providing high levels of service and products tailored to

customers’ needs.

2022 ANNUAL REVIEW | GENERAL INSURANCE GROUP

19

In 2022, our profitable results reflected strong client retention, pricing integrity, premium rate increases,

and new customers. In the year ahead, we expect these trends to continue to drive growth in our income,

as we remain focused on underwriting multi-line business with partners that have a deep knowledge in their

specialty niches.

Old Republic Surety Company (ORSC) underwrites contract, fidelity and commercial bonds. These are

serviced through a network of more than 4,500 independent insurance agencies. The solutions we provide

include 1) bid bonds; 2) performance and payment bonds; and 3) maintenance bonds for large, middle

market and smaller growing contractors. We consistently offer superior service and creative underwriting

options in all 50 states.

ORSC partners with hard-working contractors and agents, supporting them with innovative and sometimes

out-of-the-ordinary surety solutions. Our partnerships endure because we serve as a reliable surety advisor

that is committed to helping contractors achieve their goals. While surety bonds are a necessity, we are

determined to deliver more. We are our partners’ ultimate support team, sharing our expertise to analyze

risk and recommend solutions that benefit all parties.

In 2022, we continued to expand our geographic footprint and product offering. This represented the

fifth consecutive year of significant, market-leading growth while maintaining our underwriting margin. We

anticipate being able to deliver profitable growth well into the future.

PMA Companies, Inc. (PMA) is a premier provider of workers’ compensation and casualty insurance,

claims administration, and risk management products and services. Our focus is on large and mid-size

organizations. Originally established in 1915 as an insurance company, we subsequently launched PMA

Management Corp., a third-party administrator (TPA), over 30 years ago. This helped us further capitalize

on our claims and risk management expertise in the large account marketplace. We recently expanded

geographically, adding staff and capabilities in the southwestern and western U.S.

PMA partners with customers to protect their employees and reduce their total cost of risk. About 80% of

2022 premium volume came from loss-sensitive policies and captive insurance arrangements, typically with

clients that require sophisticated claims and risk management services. In addition, we provide tailored

insurance solutions for traditional middle market businesses. PMA specializes in several industries, including

healthcare, manufacturing, wholesale/retail trade, service, and education.

GENERAL INSURANCE GROUP | 2022 ANNUAL REVIEW

20

In 2022, PMA's comprehensive service model and industry specialization led to growth across the insurance

and TPA businesses. Our fee-for-service business also continued to expand. We follow a holistic approach

that integrates pre-loss, time-of-loss, and post-loss strategies and services. Many of our fee-for-service and

insurance clients have gained national acclaim for the results they achieved in partnership with us. PMA’s

long-term strategy will deliver stable underwriting and fee-for-service profitability, measured growth, and

strong customer retention across emerging national capabilities in 2023 and beyond.

LOOKING AHEAD

In 2023, ORGIG will continue to diversify our line of coverage mix, adding new specialty products and

services. For all of our underwriting subsidiaries, everything begins and ends with serving customers. This

includes carefully managing each business to ensure we meet our long-term promises of financial indemnity

to policyholders and their beneficiaries. Our specialty companies will continue to remain sharply focused

on underwriting profitability to ensure we continue our decades-long, industry-leading underwriting record.

This combination of service and profitability allows us to serve the long-term interests of policyholders in

harmony with those of our shareholders and other stakeholders.

2022 ANNUAL REVIEW | GENERAL INSURANCE GROUP

21

TITLE INSURANCE GROUP | 2022 ANNUAL REVIEW

TITLE INSURANCE GROUP

Old Republic Title Insurance Group

(ORTIG) has a national network of

more than 285 branch and subsidiary

offices, with roughly 8,000

independent title agents. ORTIG serves mortgage lenders

and the real estate community. We offer a comprehensive

suite of title insurance and related products and services to

individuals, businesses and government entities. Old

Republic National Title Insurance Company has provided

coverage for over 110 years, while American Guaranty Title

Insurance Company has been in business for more than

130 years.

Mortgage interest rates increased in 2022, reducing

mortgage originations, which led to a decline in revenues.

However, higher commercial transaction activity led to a

corresponding increase in those revenues. We remain

committed to our independent title agency network,

which accounted for over 80% of our premium and fee

revenues in 2022.

$ IN MILLIONS

Pretax Income

Net Investment Income

21

T5

Underwriting/Service Income

0

100

200

300

400

500

600

2013 14 15 16 17 18 19 22

Sources of Pretax Income Trends

60

70

80

90

100

110

120

212013 14 15 16

17 18

19

Old Republic Title Insurance Group

PERCENT

T6

22

Combined Ratio Trends

22

Old Republic Title Insurance Group, Inc.

TITLE INSURANCE AND RELATED REAL ESTATE TRANSFER SERVICES

($ in Millions) 2022 2021 2020 2019 2018

Financial Cash, Fixed Income Securities $ 1,238.3 $ 1,280.3 $ 1,091.0 $ 931.5 $ 843.9

Position Equity Securities 375.9 507.4 401.0 380.5 316.8

Other Invested Assets 14.3 11.0 9.4 9.6 9.3

Title Plants and Records 42.1 42.1 42.3 42.4 42.5

Property and Equipment 181.7 171.9 165.0 156.3 72.9

Sundry Assets 225.0 221.2 211.9 174.5 166.6

$ 2,077.6 $2,234.2 $ 1,920.9 $ 1,695.0 $ 1,452.2

Loss Reserves $ 612.8 $ 594.2 $ 556.1 $ 530.9 $ 533.4

Other Liabilities 351.9 440.0 390.3 342.9 245.1

Equity 1,112.8 1,199.9 974.3 821.1 673.6

$ 2,077.6 $2,234.2 $ 1,920.9 $1 ,695.0 $ 1,452.2

Operating Net Premiums Earned $ 3, 50 0.6 $ 3,960.5 $ 2,894.4 $ 2,414.8 $ 2,283.3

Results Service Fees and Other Income 334.1 444.9 392.9 321.9 290.2

Net Investment Income 47.9 43.8 42.0 41.4 38.8

3,882.7 4,449.3 3,329.3 2,778.1 2,612.4

Loss and Loss Adjustment Expenses 89.1 112.9 75.3 67.4 48.3

Sales and General Expenses 3,484.2 3,818.4 2,906.1 2,475.7 2,340.1

Interest and Other Costs .4 2.1 3.8 4.1 4.6

3,573.8 3,933.5 2,985.3 2,547.3 2,393.1

Pretax Operating Income $ 308.8 $ 515.7 $ 344.0 $ 230.8 $ 219.3

Operating Cash Flow $ 253.5 $ 486.7 $ 362.2 $ 214.9 $ 172.9

Underwriting Paid Loss Ratio 1.8% 1.7% 1.5% 2.6% 2.9%

Statistics (a)

Incurred Loss Ratio 2.3% 2.6% 2.3% 2.5% 1.9%

Expense Ratio 90.9% 86.7% 88.4% 90.5% 90.9%

Combined Ratio 93.2% 89.3% 90.7% 93.0% 92.8%

Composition Underwriting/Service Income $ 261.3 $ 474.0 $ 305.8 $ 193.5 $ 185.1

of Pretax Net Investment Income 47.9 43.8 42.0 41.4 38.8

Operating Interest and Other Costs (.4) (2.1) (3.8) (4.1) (4.6)

Income

Pretax Operating Income $ 308.8 $ 515.7 $ 344.0 $ 230.8 $ 219.3

Key Ratios Premiums and Fees to Equity 3.4x 3.7x 3.4x 3.3x 3.8x

Loss Reserves to Equity 55% 50% 57% 65% 79%

Reserves to Paid Losses (b) 9.2x 9.3x 9.2x 8.1x 8.3x

Cash and Invested Assets to Liabilities 169% 174% 159% 151% 150%

The above summary has been prepared on the basis of generally accepted accounting principles and excludes investment gains and losses.

(a) Loss and expense ratios are measured against combined premiums and fees.

(b) Represents average paid losses for the most recent five years divided into loss reserves at the end of each five-year period.

2022 ANNUAL REVIEW | TITLE INSURANCE GROUP

23

ORTIG’s capital base, which supports our

industry-leading financial position, continues to

benefit from profitable operating results. Our

claim reserves-to-average claim payments ratio

remained among the highest for large national

title insurers. Since 1992, no other title

insurance underwriter has had higher overall

financial strength ratings, as reported by

independent ratings agencies. This recognizes

our competitive advantages: 1) strong operating

performance, 2) sound capital management

practices, 3) conservative reserving, 4) quality

underwriting standards, and 5) a commitment to

providing technology-based solutions to our

independent title agents and customers.

ORTIG’s vision is to blend our history of solid

business practices and expertise with cutting-

edge technology. To achieve this, we are

increasing the use of successful automation

technologies, such as robotic process

automation (RPA), while incorporating artificial

intelligence (AI) technologies. We continue to

embrace innovation to provide two key benefits:

1) to deliver a high level of satisfaction and

confidence for customers, and 2) to enhance

our connection with independent title agents and

other stakeholders in real estate transactions.

LOOKING AHEAD

In 2023, ORTIG will continue to face headwinds challenged by higher mortgage interest rates and a limited

supply of housing. However, underlying strength in employment and wages, along with stabilizing housing

prices, may provide some optimism for purchase activity.

TITLE INSURANCE GROUP | 2022 ANNUAL REVIEW

2013 2021 2022

UNITED STATES

Northeast 17.0% 13.8% 13.7%

Mid-Atlantic 9.8 10.6 9.1

Southeast 26.2 29.0 32.3

Southwest 8.0 9.3 11.1

East North Central 8.6 8.2 8.6

West North Central 7.5 6.0 5.3

Mountain 9.1 12.2 11.3

Western 13.8 10.9 8.6

100.0% 100.0% 100.0%

Geographic Distribution of Direct Premiums Written

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

5,500

6,000

$ IN MILLIONS

$ IN BILLIONS

Refinance Originations

Purchase Originations

Net Premiums & Fees

T4

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

60.2%

39.8%

46.2%

48.7%

35.0%

27.9%

45.6%

63.9%

58.8%

29.7%

41.2%

39.8%

60.2%

53.8%

51.3%

65.0%

72.1%

54.4%

36.1%

20 2113 14 15 16 17 18 19 22

70.3%

1-4 Family Mortgage Origination Trends

Net Premiums & Fees Trends

24

2022 ANNUAL REVIEW | REPUBLIC FINANCIAL INDEMNITY GROUP / CORPORATE & OTHER OPERATIONS

This segment includes Old Republic Life Insurance Company, and Reliable Life Insurance Company in Canada.

Our ongoing life and accident business focuses on occupational accident insurance for independent motor

carriers in the U.S. Both insurers also manage a number of long discontinued products with a naturally declining

premium base, and generally post largely immaterial operating contributions to ORI’s consolidated results.

In addition, this segment also includes

ORI - the parent holding company

and several internal corporate services

subsidiaries that provide enterprise-

wide services, such as investment

management, risk management, and

legal guidance.

RFIG RUN-OFF

Republic Financial Indemnity Group (RFIG) is now entirely represented by Republic Mortgage Insurance Company

(RMIC). Polices issued by RMIC cover losses from defaults on residential mortgages. These policies typically insure

purchase or refinance loans when the borrower has financed more than 80% of the property’s value.

In 2023, RFIG will

continue to see a natural

decline in top-line premium

and bottom-line profit.

In the near term, RMIC

will continue returning

excess capital to the ORI

parent holding company.

Future prospects for the

business include selling

the enterprise or running-

off the business through

extinction.

(a) Results for the CCI coverage are expected to be immaterial in the remaining run-off periods. Effective July 1, 2019,

these results have been reclassified to General Insurance for all future periods.

($ in Millions) 2022 2021 2020 2019 2018

Net Premiums Earned $ 9.6 $11.0 $12.0 $13.4 $14.6

Net Investment Income 46.8 36.5 29.4 35.1 31.7

Other Income – – – – (.1)

56.5 47.5 41.4 48.5 46.3

Loss and Loss Adjustment Expenses 4.0 6.5 7.1 8.8 16.7

General Operating Expenses 27.7 15.1 (2.4) (15.2) (10.7)

31.8 21.7 4.7 (6.3) 5.9

Pretax Operating Income $24.6 $25.7 $36.7 $54.8 $40.4

SUMMARY INCOME STATEMENT

($ in Millions) 2022 2021 2020 2019 2018

Mortgage Insurance (MI)

Net Premiums Earned $ 23.2 $ 32.6 $ 45.1 $ 58.8 $ 74.4

Net Investment Income 6.7 11.4 15.2 17.3 19.2

Loss and Loss Adjustment Expenses (17.5) (1.7) 36.9 32.3 32.1

Pretax Operating Income $ 35.2 $ 32.8 $ 9.8 $ 29.2 $ 46.7

Loss Ratio (75.5)% (5.3)% 81.7% 55.0% 43.2%

Expense Ratio 53.0% 39.9% 30.2% 24.8% 20.0%

Combined Ratio (22.5)% 34.6% 111.9% 79.8% 63.2%

Consumer Credit Indemnity (CCI) Division (a)

Pretax Operating Income $ – $ – $ – $ 1.0 $ 3.2

Total MI and CCI Run-Off Business (a)

Pretax Operating Income $ 35.2 $ 32.8 $ 9.8 $ 30.3 $ 49.9

OPERATING RESULTS

CORPORATE & OTHER OPERATIONS

REPUBLIC FINANCIAL INDEMNITY GROUP

25

INVESTMENT MANAGEMENT | 2022 ANNUAL REVIEW

25

INVESTMENT MANAGEMENT

For decades, we have followed a conservative and disciplined investment strategy.

A TIME-TESTED, LONG-TERM STRATEGY

Our long-term investment strategy helped us consistently meet the goals for investment income while

managing investment risk. Our portfolio features diverse, liquid, and high-quality fixed income and equity

securities. We also match the maturities of our fixed income assets with the expected liabilities for claim

payment obligations to policyholders and their beneficiaries. This combination protects our capital base. It

also gives our subsidiaries a solid foundation for meeting their long-term obligations to policyholders and

their beneficiaries.

We actively manage risk in our portfolio and avoid complexity. That approach has been especially helpful

during challenging market conditions, which can test the integrity of a company’s capital base and its ability

to meet obligations as they come due. Our approach enables us to withstand the difficulties of volatile

financial markets. While changing conditions in domestic and global financial markets occasionally require us

to finetune our investment strategy, we remain true to its basic tenets.

2022 INVESTMENT ACTIVITIES AND PORTFOLIO REVIEW

At year-end 2022, approximately 80% of our $15.8 billion fair-valued investment portfolio was allocated to

fixed income securities and short-term investments. The remaining 20% was invested in equity securities.

This compares to 68% and 32%, respectively, in 2021. The change came from a decision to reduce overall

investment risk by lowering the exposure to equity securities.

Net investment income was $460 million in 2022, up from $434 million in the preceding year. Dividend

income from equity securities decreased 16% to $133 million, reflecting the lower allocation to this area.

However, interest from fixed income securities rose 18% to $332 million, due to an increase in investment

yields and a higher invested balance. The pretax yield on average invested assets (at cost) grew to 3.07%,

compared to 3.02% a year ago.

Net realized gains from disposing of investments were $63.5 million in 2022 compared with $6.9 million a

year earlier. Net unrealized gains decreased to $683 million at year-end, compared with $1.77 billion at the

close of 2021 due primarily to higher interest rates.

25

26

INVESTMENT MANAGEMENT

Consolidated Investments

($ in Millions) 2022 2021 2020 2019 2018

Fixed Income Securities:

Taxable Bonds and Notes $10,876.9 $ 9,686.4 $ 9,433.2 $ 8,796.5 $ 8,182.8

Tax-Exempt Bonds and Notes 869.7 989.2 1,063.5 1,021.7 1,044.8

Short-Term Investments 860.8 565.7 749.6 484.3 354.9

12,6 07.6 11,241.4 11,246.4 10,302.6 9,582.6

Other Invested Assets:

Equity Securities 3,220.9 5,302.8 4,054.8 4,030.5 3,380.9

Sundry 31.2 32.0 28.8 26.0 31.0

Total Investments $15,859.9 $16,576.3 $15,330.1 $14,359.2 $12,994.6

Sources of Consolidated Investment Income

($ in Millions) 2022 2021 2020 2019 2018

Fixed Income Securities:

Taxable $ 296.2 $ 261.3 $ 269.9 $ 280.0 $ 278.4

Tax-Exempt 18.2 19.2 19.8 20.3 20.7

Short-Term Investments 17.9 .1 2.2 10.1 9.8

332.4 280.7 292.1 310.5 309.0

Other Investment Income:

Equity Securities Dividends 132.5 157.5 149.8 141.3 124.0

Sundry 4.3 2.1 3.5 5.8 4.9

136.8 159.6 153.4 147.1 129.0

Gross Investment Income 469.3 440.4 445.6 457.7 438.1

Less: Investment Expenses 9.7 6.1 6.6 6.9 6.2

Net Investment Income $ 459.5 $ 434.3 $ 438.9 $ 450.7 $ 431.8

Net Yield on Average Investments (At Market) 2.8% 2.7% 3.0% 3.3% 3.3%

Consolidated Fixed Income Securities Portfolio Statistics

General Title RFIG

Insurance Insurance Run-off Consolidated

December 31, 2022 Maturities in:

0-5 Years 57.7% 52.2% 99.1% 59.9%

6-10 Years 41.0 46.3 .9 38.8

11 or More Years 1.3 1.5 – 1.3

100.0% 100.0% 100.0% 100.0%

Average Quality Rating A A AAA A+

Average Life of Portfolio (Years):

December 31, 2022 4.4 4.8 1.9 4.3

December 31, 2021 4.4 5.0 1.7 4.4

December 31, 2020 4.3 4.6 2.0 4.3

December 31, 2019 4.2 4.0 1.8 4.1

December 31, 2018 4.6 4.7 2.8 4.5

2022 ANNUAL REVIEW | INVESTMENT MANAGEMENT

27

FIXED INCOME PORTFOLIO

One of our risk management goals is to protect the fixed income portfolio and limit the adverse effects of

interest rate volatility. We guard against falling interest rates by typically buying non-callable bonds. We also

limit our exposure to rising interest rates by buying bonds with a maturity typically no longer than 10 years.

We do not invest in high risk or illiquid asset classes

Our fixed income portfolio consists of U.S. and Canadian government obligations, and corporate bonds.