Pasco County Schools

Your 2023 Voluntary Reference Guide

Kurt S. Browning, Superintendent

Pasco County Schools: Table of Contents

It’s time to rock enroll.

Table of Contents

Dental 1

Vision 4

Flexible Spending Account 8

Supplemental Term Life Insurance 10

Disability Benefits 14

Additional Benefits 16

• Accident 18

• Cancer 23

• Critical Illness 28

• Hospital Indemnity 33

• Term to 100 Life Insurance 38

Legal with Identity Theft Protection 42

Electronic Device Protection Program 44

Pasco County Schools: Dental Benefits

Dental Benefits

Provider: Delta Dental

Voluntary dental plans are available to all benefit

eligible employees and their eligible dependents.

What Dental Plans are available?

Pasco Schools offer three dental plans for you to choose from:

• DHMO (Delta Care USA)

• PPO Low Plan

• PPO High Plan

What about the networks?

You will have access to a large network of Delta Dental general

dentists and specialty dentists. With enrollment in the PPO High or

Low plans, you have the freedom to choose to see an in-network or

out-of-network provider.

Delta Dental offers both the Delta Dental PPO and Delta Dental

Premier Networks. By selecting the Delta Dental PPO network, you

will usually achieve greater savings, due to lower negotiated fees.

Additionally in this plan you do have the option of using a dentist not

participating with Delta Dental; however you will need to file paper

claims and it usually results in higher out-of-pocket cost to the member.

If you choose to participate in the DHMO Plan you will have to select

a participating dentist from the DeltaCare USA network. In order to be

covered for services under the DHMO plan, you must have services

provided at your selected DHMO dental office. You can access the

network directories of participating dentists by visiting

deltadentalins.com.

1

2

Pasco County Schools: Dental Benefit

Is there an age limitation for children to see a pediatric dentist?

If you are enrolled in the DHMO plan, your primary dental office must refer your child (under 8 years of age) to a pediatric

dentist. If you are enrolled in the PPO plan- there are no age limits that are applicable.

If you are traveling and experience a dental emergency, please contact Delta Dental customer service and a representative

will assist you with treatment options.

What is a diagnostic & preventive maximum waiver (D&P waiver)?

Your PPO plans includes a D&P Maximum Waiver benefit, allowing you to obtain diagnostic and preventive dental services

without those costs applying towards the plan year maximum. This benefit promotes good oral health and may reduce the

need for more expensive, restorative dental services that can result from undetected oral or related health problems.

Which plans oer an orthodontic benefit?

The DHMO and the PPO High plans offer orthodontic coverage.

Who’s eligible?

Primary enrolled employee, spouse, eligible dependent children to age 26. Coverage will end at the end of the month in

which a dependent child reaches age 26 (unless that dependent child is disabled.)

What is a pre-authorization?

We do encourage you to have your dentist submit a preauthorization request for a reatment plan that will cost more than

$300. This will ensure that any of the procedures your dentist suggests are, in fact, covered benefits. It also gives you a

chance to find out beforehand what your out-of-pocket expenses will be.

What if I need to see a specialist?

Specialists. The DHMO is a “direct referral” plan. This means your general dentist will refer

you to a contracted specialist in your area.

What if I would like a second opinion?

Just let DeltaCare know that you would like another clinical opinion and they will

provide the name of a dentist for you to see.

For more information regarding your dental benefit?

Go to the Employee Benefits Department website and follow the links to Delta Dental.

To locate an in-network provider please visit www.deltadentalins.com.

Do any of the dental plans have a pre-exisiting condition clause?

No. There are no pre-exisiting condition clauses associated with any of the dental plans.

Who’s Eligible:

Primary enrollee, spouse, eligible

dependent children to age 26

High PPO Plan Low PPO Plan DeltaCare USA DHMO

Dental Network In-Network Out-of-Network In-Network Out-of-Network In-Network Only

Dental Networks- Payment Basis PPO

Premier/MPA

PPO PPO 14A

Plan Year Maximum $1,500 per covered member $1,000 per covered member

No Plan Year Max for

covered members

Deductible (Per Member/

Per Family) Per Calendar Year

$75/$225 $75/$225 $75/$225 $75/$225 Office Visit $0 Co-Pay

Diagnostic & Preventive SVC (D&P) 100% 100% 100% 60% D&P $0-$70 Co-Pay

Deductible Waived for D&P Yes Yes Yes Yes N/A

Basic Service 80% 80% 80% 50% DeltaCare Schedule A

Major Services 50% 50% 50% 40% DeltaCare Schedule A

Orthodontics- 3 Treatment Levels

(applies to DHMO only)

50% Not Covered $1900 Child $2100 Adult

Lifetime Ortho Max $1,000 Not Covered N/A

Coverage Eligibility Child & Adult Not Covered Child & Adult

Simple Extractions Basic Basic Basic Basic DeltaCare Schedule A

Complex Oral Surgery Basic Basic Basic Basic DeltaCare Schedule A

Endodontics (Root Canal) Basic Basic Basic Basic DeltaCare Schedule A

Periodontics (Gum Disease) Basic Basic Basic Basic DeltaCare Schedule A

Crowns, Bridges, Inlays, Onlays Major Major Major Major DeltaCare Schedule A

Implants Major Major Not Covered Not Covered

Dental Benefits

Pasco County Schools: Dental Benefits

4

3

Delta Detal DHMO 14A PPO High Plan PPO Low Plan

24 Ded 20 Ded 24 Ded 20 Ded 24 Ded 20 Ded

Employee

Employee Emp

$9.75 $11.70 $22.04 $26.45 $14.72 $17.67

Employee + 1 Dependent $17.06 $20.48 $54.96 $65.95 $35.73 $42.88

EE+ 2 or more Dependents $26.82 $32.18 $75.23 $90.28 $49.88 $59.86

Dental Rates - per pay deductions

Vision Benefits

Provider: Davis Vision by MetLife

Vision coverage is available for Pasco County

employees and their dependents. The vision

plan covers routine eye examinations,

corrective lenses, frames and contact lenses.

What are the benefits?

Option 1 & 2 (one-pair benefit) plan frequencies:

• Exam every January 1st

• Lenses every January 1st

• Two frames every other January 1st

Option 3 (two pair benefit) plan frequencies:

• Exam every January 1st

• Lenses every January 1st

• Two frames every other January 1st

*Note: If you enroll in the vision program your initial enrollment period drives eligibility for your

frames. Whenever the member 1st uses the frame benefit after enrolling is when the frame

benefit frequency begins.

• Member A enrolls 2/15/2023. Member A first uses the frame benefit on 4/10/2023.

Member A is next eligible for frame benefit on 1/1/25.

• Member B enrolls 2/15/2023. Member B first uses the frame benefit on 1/30/2024.

Member B is next eligible for frame benefit on 1/1/26.

Are there any restrictions or limitations?

If you see a Davis Vision participating provider, you will receive full benefits. If you use a

non-participating provider, your benefits will be reduced..

Could I incur additional costs?

Yes, depending upon the plan option that you choose. If you choose option 2 or 3, you will see

in the comparison chart that extra features such as tint or polarized lenses will be covered

without any additional charges. Please refer to the coverage chart for more detail regarding

covered benefits and co-payment costs.

What is the out-of-network reimbursement schedule?

• Eye Examination up to $52 - Frame up to $45

• Spectacle Lenses (per pair) up to:

• Single Vision $55, Bifocal $75, Trifocal $95, Lenticular $95

• Elective Contacts up to $105, Medically Necessary Contacts up to $210

4

Pasco County Schools: Vision Benefits

833-Eye-Life (833-393-5433) or www.metlife.com/mybenefits

How do I receive services from a provider in the network?

• Call the network provider of your choice and schedule an appointment.

• Identify yourself as Davis Vision plan participant.

• Provide the office with the member’s ID number and the date of birth of any covered children needing

services. It’s that easy! The provider’s office will verify your eligibility for services, and no claim forms

or ID cards are required.

For additional information:

Beginning 1/1/2023, please call Metlife at 833-Eye-Life (833-393-5433) with questions or visit our website:

www.metlife.com/mybenefits.

Member Service Representatives are available: 8:00 a.m. to 9:00 p.m. EST Monday-Friday and

9:00 a.m. to 4:00 p.m. EST Saturday. Participants who use a TTY (Teletypewritter)

because of a hearing or speech disability may access TTY services by calling 833-Eye-Life (833-393-5433).

Effective 1/1/2023 the plan becomes Davis Vision by Metlife.Client Codes are no longer used post 1/1/2023.

833-Eye-Life 833-393-5433

metlife.com/mybenefits

Pasco County Schools: Vision Benefits

5

Davis Vision Rates 2023

Option 1: Designer 24 Pay 20 Pay

Employee Only $6.55 $7.86

Employee + One $11.78 $14.13

Family $18.32 $21.99

Option 2: Premier Platinum Plus 24 Pay 20 Pay

Employee Only $10.63 $12.75

Employee + One $19.13 $22.96

Family $29.76 $35.71

Option 3: Premier Platinum Plus 2 Pair 24 Pay 20 Pay

Employee Only $17.92 $21.51

Employee + One $32.26 $38.71

Family $50.18 $60.21

Vision Plans - per pay deductions

DV-MKG18-0293v001 PDF 10/2018

Services Frequency

Plan design options

Option I: Designer

CC#: 2825

Option II: Premier

platinum plus

CC#:2826

Option III: Premier

platinum plus

1

)

CC#: 2827

Eye examination

Includes dilation when professionally indicated

Every

12 months

$10 copayment $10 copayment $10 copayment

Frames

Retail allowance

Every

24 months

Up to $130

plus 20% discount

2

Up to $150

plus 20% discount

2

Up to $150

plus 20% discount

2

Davis Vision frame collection

(in lieu of allowance)

Fashion

Covered in full Covered in full Covered in full

Designer

Covered in full Covered in full Covered in full

Premier

$25 copayment Covered in full Covered in full

Spectacle lenses

Includes single-vision, bifocal, trifocal, lenticular,

polycarbonate lenses, and scratch-resistant & UV

coating, other lens options available

Every

12 months

$15 copayment

$15 copayment

includes most lens

options, Covered in full

$15 copayment

includes most lens

options, Covered in full

Contact lenses (in lieu of eyeglasses)

Retail allowance

Every

12 months

Up to $130

plus 15% discount

2

Up to $150

plus 15% discount

2

Up to $150

plus 15% discount

2

Davis Vision collection

(in lieu of allowance)

Covered in full Covered in full Covered in full

Visually required

Covered in full Covered in full Covered in full

Contact lens evaluation,

Fitting & follow-up care

Every

12 months

$15 copayment $15 copayment $15 copayment

Retail allowance: standard type

Covered in full Covered in full Covered in full

Retail allowance: specialty type

Up to $60

plus 15% discount

2

Up to $60

plus 15% discount

2

Up to $60

plus 15% discount

2

Davis Vision collection

Covered in full Covered in full Covered in full

Visually required

Covered in full Covered in full Covered in full

1

Members have three options available; two pairs of eyeglasses; one pair of eyeglasses & contact lenses; or two dispenses of contact lenses

2

Additional discounts not available at Walmart or Sam’s Club locations

Out-of-network reimbursement rate

Eye examination up to $52 | Frame up to $45

Spectacle lenses (per pair) up to:

Single vision $55, Bifocal $75, Trifocal $95, Lenticular $95

Elective contacts up to $105, Visually required contacts up to $210

Monthly Rates

Option I Option II Option III

Employee Only

$12.59 $19.68 $32.58

Employee + One

$22.64 $35.42 $58.64

Employee + Family

$35.23 $55.10 $91.23

Contact your bene昀ts

department today to enroll.

etietepanbeoeaiiionb

etieantenewponei-e-ie

--anwebiteetieobeneit

taeeetientoeare

noonerepot

Vssf

Pasco County School employees

Pasco County Schools: Vision Benefits

6

833-Eye-Life (833-393-5433) or www.metlife.com/mybenefits

DV-MKG18-0293v001 PDF 10/2018

Please call Davis Vision at 1 (800) 999-5431 with questions or visit our Web site: www.davisvision.com.

Member Service Representatives are available (EST): Monday through Friday, 8:00 AM to 11:00 PM, Saturday,

9:00 AM to 4:00 PM, and Sunday, 12:00 PM to 4:00 PM. Participants who use a TTY (Teletypewriter) because

of a hearing or speech disability may access TTY services by calling 1 (800) 523-2847.

Want additional information?

Spectacle lenses bene昀t

Plan design

Option I: Designer

CC#: 2825

Option II: Premier

platinum plus

CC#:2826

Option III: Premier

platinum plus

/1

)

CC#: 2827

All ranges of prescriptions and sizes Included Included Included

Choice of glass or plastic lenses Included Included Included

Tinting of plastic lenses Included Included Included

Scratch-resistant coating Included Included Included

Polycarbonate lenses Included Included Included

Ultraviolet coating Included Included Included

ddcvcg $35 Included Included

Premium AR coating $48 Included Included

Ultra AR coating $60 Included Included

Ultimate AR coating $85 $85 $85

Standard progressive lenses Included Included Included

Premium progressive lenses $40 Included Included

Ultra progressive lenses $90 $50 $50

Ultimate progressive lenses

$15$5$5

Intermediate-vision lenses $30 Included Included

Blended-segment lenses $20 Included Included

High-index lenses 1.67 $55 Included Included

High-index lenses 1.74 $120 $120 $120

Polarized lenses $75 Included Included

Photochromic glass lenses $20 Included Included

Plastic photosensitive lenses $65 Included Included

Scratch protection plan:

Single vision lenses | multifocal

$20 | $40 $20 | $40 $20 | $40

Value-added features:

Replacement contacts through DavisVisionContacts.com mail-order contact lens replacement service ensures easy,

convenient purchasing online and quick shipping direct to your door. Davis Vision provides you and your eligible dependents

with the opportunity to receive discounted laser vision correction, often referred to as LASIK. For more information, visit

www.davisvision.com.

How do I receive services from a provider in the network?

• Call the network provider of your choice and schedule an appointment.

• Identify yourself as Davis Vision plan participant.

• vdhchhmmsDumdhdfhfycvdchlddgsvcs.

shsyhvdscllvfyyulglyfsv

csdclmfmsDcdsud!

Who are the network providers?

They are licensed providers who are extensively reviewed and credentialed to ensure that stringent standards for quality

service are maintained. Please call 1 (800) 999-5431 to access the Interactive Voice Response (IVR) Unit, which will supply

you with the names and addresses of the network providers nearest you, or you may access our Web site at

www.davisvision.com and utilize our “Find a Doctor” feature.

7

Pasco County Schools: Vision Benefits

8

Pasco County Schools: Flexible Spending Accounts

Medical & Dependent Care Flexible Spending Accounts

Provider: WageWorks

Flexible Spending Accounts

Flexible Spending Accounts are optional benefit plans that allow you to

direct a part of your pay, TAX-FREE, into two accounts, described

below. A Healthcare Flexible Spending Account (HFSA) can be used to

pay for out-of-pocket medical expenses for you and your tax

dependents. These include charges for office visits, amounts toward

your deductible, prescriptions, dental work, eyeglasses, contacts

and lab fees. The Dependent Care Flexible Spending Account (DFSA)

can be used to pay for daycare or elder care expenses.

Your FSA deposits are not taxable income on your W-2. Since

your annual income is reduced, so are your annual taxes.

Medical FSA (Deductions occur 20 times per year)

How the FSA tax advantage works - Medical Flexible Spending

(MFSA)

First, determine your election amount: For the HFSA, the minimum is

$200 and the maximum is $2,850. Your election amount divided by the

number of paychecks that you receive during the plan year will tell you

what will be deducted pre-tax from each pay period.

You get the exclusive FSA debit card

The WageWorks FSA card can be used at any provider or merchant

classified as a medical, dental or vision provider. It is limited to doctor’s

offices, pharmacies, hospitals, dental providers, vision providers, and

medical labs.

Use of the card is optional. You can also use a different form of

payment and then submit the claim to WageWorks on their website

or via their mobile application.

When using the card, please be sure to keep all of your receipts.

You may be required to submit them to WageWorks.. The IRS

requires that you substantiate all charges. WageWorks will

attempt to do so systematically, but may contact you and request

a receipt for your card transactions.

Due to Health Care Reform, over-the-counter (OTC) medicines and

drugs, except for insulin, will require a letter of medical necessity or

prescription from your physician to be reimbursed from your medical

FSA. If you have any questions regarding whether a health-related

supply is eligible please contact WageWorks customer services.

WageWorks 877.924.3967 or visit www.wageworks.com

9

Pasco County Schools: Flexible Spending Accounts

How Do You File a Claim?

Your Flexible Spending Account (FSA) is offered by WageWorks.

With this you will have several conveniences:

• Fast and efficient claim reimbursements

• Multiple claim submission options including online, fax or

regular mail.

• Online account access 24 hours a day/ 7 days a week

• Toll-free customer service assistance, email and web chat

customer service

• Interactive Voice Response System availability 24 hours/ 7 days

a week to check account activity, account balance, and more

• Opportunity to sign up for text/ email notifications of

account activity

How do I avoid losing money?

Pasco Schools allows the “carry over” option that enables you to carry

over from one year to the next a maximum of $550 of unused funds.

If on December 31, you have an unused amount that exceeds the

$550 carry over, it will be forfeited. When making your election, please

consider what your expected out-of-pocket expenses will be for the

coming year for yourself and your tax dependents. The “Carry over”

amount will be available to use after your 2023 account balance

has been exhausted.

Please note that should your employment end during the plan year,

your eligibility ends as of the last day of the month of your termination,

yet you would still have ninety days to submit claims for dates-of-ser-

vice that fell on or before your termination date. Monies not claimed

within ninety days of your termination will be forfeited. Also, you are

not eligible for the carryover of funds unless you are an active partici-

pant on the last day of the plan year or if you extend your FSA via

COBRA thru the end of the year.

Dependent Care Reimbursement FSA Account

(Deductions occur 20 times per year)

A Dependent Care reimbursement account gives you the opportunity

to pay for the first $5,000 of employment-related dependent care

expenses, tax-free. Your eligible dependents are children under

the age of 13 and adults incapable of self-care that you claim as

dependents. The DFSA, the minimum is $200 and the maximum is

$5,000 (if married and filling jointly.) There is a maximumof $5,000 for

the household if it’s two married employees of the board.

What are eligible dependent care expenses?

• Expenses for services provided in your home as long as someone

you claim as a dependent, or other children under age 19 are not

providing these services.

• Expenses for daycare services outside your home at a facility

compliant with state and local laws.

• Dependent care expenses include adult daycare center, after

school program, babysitting (work-related), before and after school

programs, child care, custodial elder care (work-related), elder

care (while you work, to enable you to work or look for work),

senior daycare, and sick childcare.

Questions

Should you have any immediate questions, please contact WageWorks

Customer Service at 877-924-3967. You can also visit our website

at www.wageworks.com

Please note that should your employment end during the plan

year, your eligibility ends as of the last day of the month of

your termination, yet you would still have ninety days to submit

claims for dates-of-service that fell on or before your termination

date. Monies not claimed within ninety days of your termination

will be forfeited. Also, you are not eligible for the carryover of

funds unless you are an active participant on the last day of the

plan year or if you extend your FSA via COBRA thru the end of

the year.

10

Pasco County Schools: Supplemental Term Life Insurance

Basic Term Life Insurance

Pasco County Schools provides an employer-paid basic life

benefit to all benefit eligible employees through Minnesota Life.

You also automatically receive a matching amount of $35,000 of

Accidental Death and Dismemberment coverage as part of your basic

life insurance benefit. This benefit is provided at no cost to you.

Supplemental Life Insurance

In addition to the $35,000 basic term life insurance received, you may

purchase supplemental life insurance for yourself, your spouse and

your children. The supplemental life insurance is an age-banded

benefit; premium amounts are based on your age and the amount of

coverage that you select. During Open Enrollment coverage may

increase by $20,000 with no evidence of insurability required. Any

additional increase over $20,000 will require evidence of insurability

and medical underwriting. During open enrollment, you may increase

your existing supplemental life coverage by one or two $10,000

increments, up to a maximum of 5 times your annual salary or

$300,000, without answering health questions. To apply for coverage

other than what's outlined here, you'll answer three questions about

your health history - along with height and weight.

What is accidental death and dismemberment

(AD&D) insurance?

AD&D coverage is included in your basic life insurance benefit

provided by Pasco County Schools. AD&D means that when your

death or dismemberment results directly from an accidental injury

which is unintended, unexpected and unforeseen the policy pays a

benefit in addition to the basic life insurance benefit. The benefit

amount is equal to the amount of the basic life benefit. For example,

an employee would have $35,000 of AD&D Insurance in addition to

the $35,000 of Basic Life Insurance. There is not an AD&D benefit

associated with supplemental policies.

Employee Supplemental Life

You may purchase supplemental life insurance coverage for yourself

in $10,000 increments up to 5 times your salary or a maximum of

$300,000, whichever is less. If you enroll in coverage as a new benefit

eligible employee, you may apply for up to the maximum amount

of coverage that you are eligible for without having to answer health

questions.

Spouse Life Insurance

As a new employee, when you are first eligible for benefits, you may

purchase coverage in $5,000 increments, up to a maximum of

$25,000 for your spouse, without having to answer health questions.

Spouse supplemental life insurance can be purchased in $5,000

increments, not to exceed 100% of the employee’s coverage or

$150,000 (whichever is less). Any additional elections or increases in

coverage will require you to answer health questions.

If both spouses work for Pasco County Schools, an employee

cannot be covered by their spouse.

Do I need to complete an evidence

of insurability form?

Enrolling for coverage other than what is outlined on page one will

require that you answer three questions about your health history,

along with height and weight. Based on your answers, it will be deter-

mined whether anything further is needed to make a decision to

approve or decline the application. If by any chance your application is

not approved, you will still get any coverage that didn't require the

health questions and it will not affect any coverage you already have.

In the following situations, the life insurance carrier requires applicants

to complete a medical underwriting form (Medical History Statement)

regarding past health history: Evidence of Insurability (EOI) is

required:

• Employees not currently enrolled

• Employees enrolled in supplemental life insurance policy allows

for reinstatement within 1 year. See "Can your insurance be

reinstated after termination?" section on the certificate, who are

requesting an increase in coverage of more than $20,000

• Reinstatement of Benefits: Any request to reinstate a life

insurance benefit

Newly hired employees: Evidence of Insurability (EOI) -

Medical underwriting is not required.

Supplemental Term Life Insurance

Provider: Minnesota Life

Securian Financial lifebenefits.com

11

Pasco County Schools: Supplemental Term Life Insurance

Electronic Evidence of Insurability

Process (EOI)

If you recently elected to increase your group life insurance

coverage by more than $20,000 or you are enrolling for the

first time you must submit a satisfactory Evidence of Insurability

EOI). This year you may complete your EOI online.

Before you begin:

• The process will take 10-30 minutes to complete

• You will not be able to save your work to return later

• An email address is required

• Have your medical records available

• If you have elected spouse coverage, they must complete

their questions during the same session

• Visit www.LifeBenefits.com/SubmitEOI

• Provide your group policy number- 33290

• Enter your access key – pasco

• Complete the word validation

This electronic process is not available for “child”

supplemental life. A paper EOI form must be completed.

It can be obtained on-line in Munis on the page that

the benefit is elected (icon on top of page). Any

new coverage for children with the exception of

new hires will require an evidence of insurability

to be completed. A link to the paper form is

available during open enrollment.

Group policy number - 33290

12

Pasco County Schools: Supplemental Term Life Insurance

How do I designate a beneficiary?

To assign beneficiaries for your Life insurance policy (core and

supplemental), you must use your assigned log-in ID and

password sent to you by Minnesota Life in the mail to sign into

www.lifebenefits.com website to designate your beneficiaries.

You may assign multiple primary and contingent beneficiaries, as

long as the percentages are in whole numbers, and equal 100

percent. Contingent beneficiaries will only receive a benefit if none

of the primary beneficiaries survive you. You can change your

beneficiaries at any time by logging onto lifebenefits.com.

Age Reductions (Supplemental Life only)

Age reductions apply to supplemental life coverage only. Age

reductions will apply the first day of the month following and insured

employee’s 70th and 75th birthdays. The amount of supplemental

insurance on an employee age 70 or older shall be a percentage of

the amount otherwise provided by the plan of insurance. Age 70=65%

of the amount of insurance, Age 75=50% of the amount of insurance.

(Example: $100,000 of coverage reduces to $65,000 at age 70 and

$50,000 at age 75)

Are my life insurance benefits reduced while

I grow older?

Your basic core life insurance benefit ($35,000) does not reduce with

age for active employees. Supplemental policies will reduce with age.

See your certificate of coverage for information regarding benefit

reductions due to age.

Can I collect my life insurance benefit while I am

still living?

Both the Basic Employee Life policy and the supplemental employee

life insurance include an Accelerated Benefit that allows an insured

employee with a “Qualifying Medical Condition” to receive up to 75%

of the amount of the insured’s life insurance. A “Qualifying Medical

Condition” is a terminal illness or physical condition that is reasonably

expected to result in death within 12 months.

The receipt of this benefit may be taxable and may affect your

eligibility for Medicaid or other government benefits or entitlements,

so you should consult your tax or legal advisor before you apply for

an Accelerated Benefit.

How do I submit a claim?

If you need to submit a claim, please contact our Risk Management

at 813-794-2520.

Do I still need to pay my premium of coverage if I

become disabled?

The waiver of premium benefit is available for those who become

totally and permanently disabled prior to age 60. Contact Risk

Management to receive the waiver of Premium Application.

Supplemental Term Life Insurance

Provider: Minnesota Life

Securian Financial lifebenefits.com

13

Pasco County Schools: Supplemental Term Life Insurance

Can I take my life insurance with me if I leave

Pasco County Schools?

You are eligible to “port” (buy) your life coverage to take with you

when you leave employment with Pasco County Schools. This

portability option applies to basic and supplemental life policies. If you

are not in good health, you may be required to “convert” your basic

coverage which will result in a much higher premium amount due.

When you end your employment, you may visit the Employee Benefits

website and download the form to port your policy with

Minnesota Life. It will be your responsibility to download the portability

form and contact Minnesota life to continue your basic or

supplemental insurance benefit. This action must be taken within 60

days of your employment ending.

As part of your participation in this benefit, the following services are

available at no charge:

Travel Assistance

Services include a full range of medical, travel, legal and emergency

transportation services when you travel more than 100 miles from

home or internationally. Medical professional locator services,

assistance replacing lost or stolen luggage, medication, or other

critical items, medical or security evacuation.

Legal Services

You have access to an online library of legal forms, comprehensive

web and mobile resources. Also available is a free 30-minute

consultation with a participating attorney.

Legacy Planning

Access to a variety of information and resources to work through

end-of-life issues: End-of-life planning, final arrangements,

Express Assignment™ for expedited funeral home assignments.

Age

Employee Only

Per $10,000

Per Pay

Spouse Only

Per $5,000

Per Pay

Children Only

Per Pay

18-24 $0.29 $0.15 $0.79

25-29 $0.25 $0.12 —

30-34 $0.29 $0.15 —

35-39 $0.44 $0.22 —

40-44 $0.69 $0.35 —

45-49 $1.14 $0.57 —

50-54 $1.73 $0.86 —

55-59 $2.57 $1.28 —

60-64 $3.66 $1.83 —

65-69 $6.08 $3.04 —

70-74 $10.88 $5.44 —

75 & over $22.20 $11.10 —

Minnesota Life Rates

(Deductions occur 20 times per

year for all employees)

Securian Financial lifebenefits.com

14

Pasco County Schools: Long-Term Disability Benefits (LTD)

Long-Term Disability Benefits (LTD)

Provider: Unum

You may elect to participate in the Long-Term Disability benefit at

a per pay period cost to you. This coverage will pay you a monthly

benefit if you become disabled due to an accident or an illness and

are unable to work. In order to be eligible to receive a benefit,

an employee is required to exhaust all available sick time.

Please keep this in mind when choosing a benefit elimination

(waiting) period.

What is a waiting period?

The elimination period is the length of time you must be continuously

disabled before you can receive benefits. Employees have

the opportunity to choose which elimination (waiting) period fits their

needs. The options on elimination (waiting) periods are:

• 14 days for accident and 14 days for illness

• 30 days for accident and 30 days for illness

• 60 days for accident and 60 days for illness

• 90 days for accident and 90 days for illness

• 180 days for accident and 180 days for illness

What is the maximum dollar amount that

I can elect?

Coverage can be purchased in $100 increments up to a maximum of

60% of your annual salary, beginning at a minimum benefit selection of

$200. LTD premiums are paid by employees on a post-tax basis, so

the LTD benefits paid to employees are not taxed. When calculating

monthly benefits, it is important to note that your disability benefit may

be reduced by deductible sources of income and any earnings you

have while disabled. Deductible sources of income may include such

items as disability income or other amounts you receive or are entitled

to receive under: workers’ compensation or similar occupational benefit

laws; state compulsory benefit laws; automobile liability and no fault

insurance; legal judgments and settlements; certain retirement plans;

salary continuation or sick leave plans; other group or association

disability programs or insurance; and amounts you or your family

receive or are entitled to receive from Social Security or similar

governmental programs.

Unum Disability 800.635.5597

When am I considered disabled?

You are disabled when Unum determines that:

• You are limited from performing the material and substantial duties

of your regular occupation* due to sickness or injury; and

• You have a 20% or more loss of indexed monthly earnings due to

the same sickness or injury.

*After 24 months, you are disabled when Unum determines that due

to the same sickness or injury, you are unable to perform the duties

of any gainful occupation for which you are reasonably fitted by

education, training or experience

How long can LTD benefits continue?

There are two plan choices available:

Plan 1: Pays a monthly benefit up to age 65*.

Plan 2: Pays a monthly benefit for a maximum of 24 months.

*If a participant becomes disabled after age 60, benefits could extend

past age 65. Please refer to the certificate of coverage for the full

benefit duration schedule.There are two plan choices available:

Plan 1: Pays a monthly benefit up to age 65*.

Plan 2: Pays a monthly benefit for a maximum of 24 months.

*If a participant becomes disabled after age 60, benefits could extend

past age 65. Please refer to the certificate of coverage for the full

benefit duration schedule.

15

Pasco County Schools: Long-Term Disability Benefits (LTD)

How do I enroll?

Employees who would like to enroll in the LTD coverage must make

an election on the employee self-service portal. Please make sure to

select the plan details: the elimination (waiting) period, dollar amount

and benefit coverage duration.

Do I need to complete any special forms

to qualify?

Yes. Medical underwriting is required for any new coverage or

increase in coverage with the exception of new hires. An electronic

link will be provided to complete the EOI process.

• Please complete your Statement of Health (Evidence of Insurability)

• Access Code: 2LSY3TR

• You will need the following information before logging in to

complete your Statement of Health (Evidence of Insurability)

• Name, address, date of birth, social security number, gender,

employee annual salary, date of hire, phone number, and

email address

• Medical information such as height, weight, medical treatment

dates, duration, treatment received, medications and dosages,

names and addresses of physicians and hospitals

What is considered a pre-existing condition?

You have a pre-existing condition if:

• you received medical treatment, consultation, care or services

including diagnostic measures, or took prescribed drugs or

medicines in the 3 months just prior to your effective date of

coverage; and

• The disability begins in the first 12 months after your effective

date of coverage.

What if I have a pre-exisiting condition?

Pre-existing conditions apply to any added benefits or increases in

benefits or elimination periods. This limitation will not apply to a

period of disability that begins after the employee has been covered

for 12 months after the effective date of coverage, or the effective

date of any added or increased benefits.

I do not work over the summer. If I am disabled

in the summer can I collect a monthly benefit?

If your pay-type does not require you to work summer months, then

you will not receive a benefit during the summer months, when you

would not be missing scheduled work days.

This summary page provides a brief overview of your LTD Plan.

For a complete explanation of your coverage (exclusions, limitations

and reductions of your coverage) please refer to your Certificate

of Coverage.

How much can my monthly benefit be?

(Annual salary X 60%) /12 This calculation is rounded down

to the closest $100 increment. If you enrolled in a brand new

disability policy during Open Enrollment and you are not

present at work the first day back from winter break the

policy becomes null in void.

16

Pasco County Schools: Additional Coverage

Additional Coverage

You have the opportunity to buy additional coverage through

Allstate for life’s unexpected events.

Guaranteed issued:

• Accident

• Hospital

• Ter

m to Age 100

•

Critical Illness

• Cancer

Accident

Protection for accidental injuries that occur on or off the job. It includes

dislocations or fractures, hospital confinement, ambulance services and

more. You can select and individual or family plan.

Cancer

Receiving a cancer diagnosis can be one of life’s most frightening

events. With Cancer insurance you can rest a little easier. This

coverage pays you a cash benefit to help with the costs associated

with treatments, to pay for daily living expenses and more. You can

select and individual or family plan.

Hospital

The Hospital policy helps you pay for out-of-pocket medical expenses

associated with hospital confinements, other medical procedures

and/or visits. You can select and individual or family plan.

Critical Illness

Critical Illness coverage helps offer financial support if you are

diagnosed with a covered critical illness such as a heart attack, stroke,

and more. This plan also offers an additional wellness benefit for yearly

screenings such as mammogram, Colonoscopy, stress test and more.

New this year is an additional cancer benefit to Plan 1+ and Plan 2+.

You can select and individual or family plan.

Term to Age 100 Life Insurance

You choose the coverage that’s right for you and your family. Premiums

are affordable and remain level to age 100 unless you make changes.

Allstate 800.521.3535

Today, active lifestyles in or out of the home may result in bumps, bruises and

sometimes breaks. Getting the right treatment can be vital to recovery,

but it

can also be expensive. And if an accident keeps you away from work during

recovery, the financial worries can grow quickly.

Most major medical insurance plans only pay a portion of the bills. Our coverage

can help pick up where other insurance leaves off and provide cash to help cover

the expenses.

With Accident insurance from Allstate Benefits, you can gain the advantage of financial

support, thanks to the cash benefits paid directly to you. You also gain the financial

empowerment to seek the treatment needed to be on the mend.

Here’s How It Works

Our coverage pays you cash benefits that correspond with hospital and intensive

care confinement. Your plan may also include coverage for a variety of

occurrences,

such as: dismemberment; dislocation or fracture; ambulance services; physical therapy

and more. The cash benefits can be used to help pay for deductibles, treatment, rent

and more.

Meeting Your Needs

• Guaranteed Issue, meaning no medical questions to answer

• Benefits are paid directly to you unless otherwise assigned

• Pays in addition to other insurance coverage

• Coverage also available for your dependents

• Premiums are aordable and can be conveniently payroll deducted

•

Coverage can be continued; refer to your certificate for details

With Allstate Benefits, you can protect your finances against life’s slips and falls.

Are you in Good Hands? You can be.

Accident Insurance

Protection for accidental

injuries on- and off-the-job,

24 hours a day

Oered to the employees of:

Pasco County

Schools

ABJ30901X-1

*National Safety Council, Injury Facts®, 2017 Edition

DID YOU

KNOW

The number of injuries

suered

by workers in one year, both

on- and o-the-job, includes:*

?

ON-THE-JOB (in millions)

Work

4.4

OFF-THE-JOB (in millions)

Auto

2.2

Home

9.2

Non-Auto

4.0

17

Daniel’s story of injury and treatment turned into a happy ending,

because he had supplemental Accident Insurance to help with expenses.

Daniel was playing a pick-up game of basketball

with his friends when he went up for a jump-shot

and, on his way back down, twisted his foot and

ruptured his Achilles tendon

.

Here’s Daniel’s treatment path:

•

Taken by ambulance to the emergency room

• Examined by a doctor and X-rays were taken

• Underwent surgery to reattach the tendon

• Was visited by his doctor and

released after a

one-day stay in the hospital

• Had to immobilize his ankle for 6 weeks

• Was

seen by the

doctor during a follow-up visit

and sent to physical therapy to strengthen his

leg and improve his mobility

Daniel would go online after each of his treatments

to

file claims. The cash benefits were direct deposited

into his bank account.

Daniel is back playing basketball and enjoying life.

CHOOSE CLAIMUSE

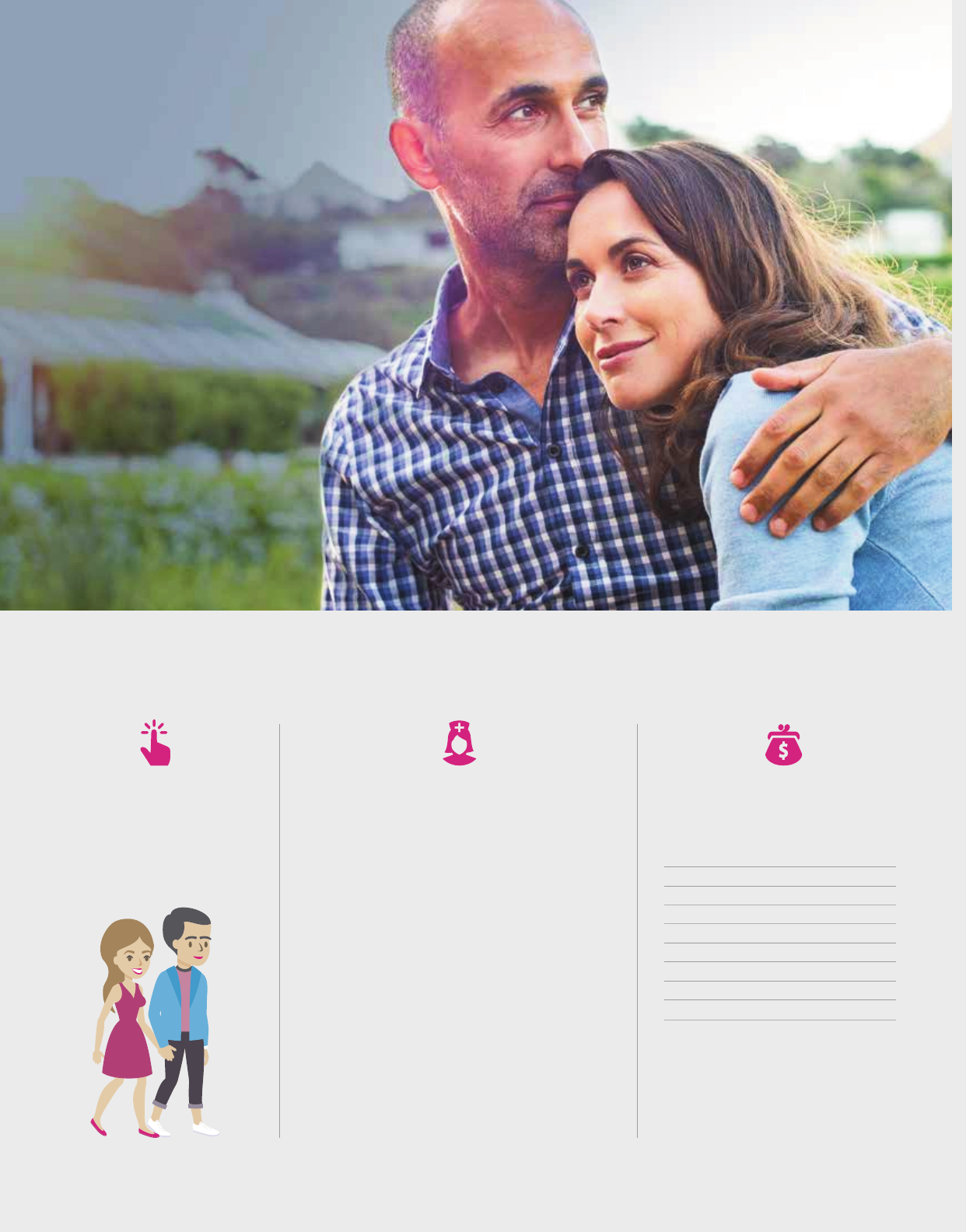

Daniel and Sandy choose

benefits to help

protect their

family if they suffer an

accidental injury.

Meet Daniel & Sandy

Daniel and Sandy are like most active couples:

they enjoy the outdoors and a great adventure.

They have seen their share of bumps, bruises

and breaks. Sandy knows an accidental injury

could happen to either of them. Most

importantly,

she

worries about how they

will pay for it.

Here is what weighs heavily on her mind:

• Major medical will only pay a portion

of the expenses associated with injury

treatments

• They have copays they are responsible

for until they meet their deductible

• If they miss work because of an injury,

they must cover the bills, rent/mortgage,

groceries and their child’s education

• If they need to seek treatment not

available locally, they will have

to pay for it

Ambulance Services

Medicine

Medical Expenses

(Emergency Room and X-rays)

Initial Hospital Confinement

Hospital Confinement

Tendon Surgery

General Anesthesia

Accident Follow-Up Treatment

Physical Therapy (3 days/week)

For a listing of benefits and benefit

amounts, see your company’s

rate insert.

Daniel’s Accident claim paid cash

benefits for the following:

Benefits (subject to maximums as listed on the attached rate insert)

Using your cash benefits

Cash benefits provide you with

options, because you decide

how to use them.

Finances

Can help protect HSAs,

savings, retirement

plans and 401(k)s

from being depleted.

Trave l

Can help pay for expenses

while

receiving treatment

in another city.

Home

Can help pay the

mortgage, continue

rental payments, or

perform needed

home

repairs for after care.

Expenses

Can help pay your family’s

living expenses such as

bills, electricity, and gas.

An easy-to-use website that

offers 24/7 access to important

information

about your benefits.

Plus, you can submit

and check

your claims (including claim

history), request your cash

benefit to be direct deposited,

make changes to personal

information, and more.

Dependent Eligibility

Coverage may include you, your

spouse or domestic partner, and

your children.

1

Multiple dismemberments, dislocations

or fractures are limited to the amount

shown in the rate insert.

2

Up to three

times per covered person, per accident.

3

Two or more surgeries done at the

same time are considered one operation.

4

Paid for each day a room charge is

incurred, up to 30 days for each covered

person per continuous period of

rehabilitation unit confinement, for a

maximum of 60 days per calendar year.

5

Two treatments per covered person, per

accident. *Must begin or be received

within 180 days of the accident. **Within

3 days after the accident.

MyBenefits: 24/7 Access

allstatebenefits.com/mybenefits

BASE POLICY BENEFITS

Accidental Death

*

Common Carrier Accidental Death - riding as a fare-paying passenger on a scheduled common-carrier

Dismemberment

1,

*

-

amount paid depends on type of dismemberment. See Injury Benefit Schedule in rate insert

Dislocation or Fracture

1

-

amount paid depends on type of dislocation or fracture. See Injury Benefit Schedule in

rate insert

Initial Hospitalization Confinement -

initial hospitalization after the eective date

Hospital Confinement -

up to 90 days for any one injury

Intensive Care -

up to 90 days for each period of continuous confinement

Ambulance Services - transfer to or from hospital by ambulance service

Medical Expenses - expenses incurred for medical or surgical treatment. Expenses are limited to physician fees,

X-rays and emergency room services. Includes treatment for dental repair to sound natural teeth if repair is

diagnosed by a dentist as necessary and as a result of injury

Outpatient Physician’s Treatment - treatment outside the hospital for any cause. Payable up to 2 visits per

covered person, per calendar year and a maximum of 4 visits per calendar year if dependents are covered

ADDITIONAL BENEFITS

Hospital Admission** -

first hospital confinement occurring during a calendar year, and 12 months after the eective

date. Payable when a benefit has been paid under the Hospital Confinement Benefit in the base policy

Lacerations** -

treatment for one or more lacerations (cuts)

Burns** -

treatment for one or more burns, other than sunburns

Skin Graft - receiving a skin graft

for which a benefit is paid under the Burns benefit

Brain Injury Diagnosis** -

first diagnosis of concussion, cerebral laceration, cerebral contusion or intracranial

hemorrhage

within three days of an accident. Must be diagnosed within 30 days after the accident by CT Scan, MRI, EEG, PET

scan or X-ray

Computed Tomography (CT) Scan and Magnetic Resonance Imaging (MRI)* -

must first be treated by a

physician within 30 days after the accident

Paralysis** -

spinal cord injury resulting in complete/permanent loss of use of two or more limbs for at least 90 days

Coma with Respiratory Assistance -

unconsciousness lasting 7 or more days; intubation required. Medically

induced comas excluded

Open Abdominal or Thoracic Surgery

3,

**

Tendon, Ligament, Rotator Cu or Knee Cartilage Surgery

3

,

* -

surgery received for torn, ruptured, or severed

tendon, ligament, rotator cu or knee cartilage; pays the reduced amount shown for arthroscopic exploratory surgery

Ruptured Disc Surgery

3

,

* -

diagnosis and surgical repair to a ruptured disc of the spine by a physician

Eye Surgery -

surgery or removal of a foreign object by a physician

General Anesthesia* -

payable only if the policy Surgery benefit is paid

Blood and Plasma** -

transfusion after an accident

Appliance -

physician-prescribed wheelchair, crutches or walker to help with personal locomotion or mobility

Medical Supplies -

purchased over-the-counter medical supplies. Payable only if the policy Medical Expenses

benefit is paid

Medicine -

purchased prescription or over-the-counter medicines. Payable only if the policy Medical Expenses

benefit is paid

Prosthesis* -

physician-prescribed prosthetic arm, leg, hand, foot or eye lost as a result of an accident. Payable only

if a benefit is paid for loss of arm, leg, hand, foot or eye under the Dismemberment benefit

Physical Therapy* -

one treatment per day; maximum of 6 treatments per accident.

Chiropractic services are

excluded. Not payable for same visit for which Accident Follow-Up Treatment benefit is paid. Must take place no

longer than 6 months after accident

Rehabilitation Unit

4

-

must be hospital-confined due to an injury immediately prior to being transferred to rehab.

Not payable for the days on which the Hospital Confinement benefit is paid

Non-Local Transportation

2

-

treatment obtained at a non-local hospital or freestanding treatment center more than 100

miles from your home. Does not cover ambulance or physician’s oce or clinic visits for services other than treatment

Family Member Lodging -

one adult family member to be with you while you are confined in a non-local hospital or

freestanding treatment center

. Not payable if family member lives within 100 miles one-way of the treatment facility. Up to

30 days per accident. Only payable if the Non-Local Transportation benefit is paid

Post-Accident Transportation - after a three-day hospital stay more than 250 miles from your home, with a flight on

a common carrier to return home. Payable only if a benefit is paid for Hospital Confinement

Accident Follow-Up Treatment

5

-

must take place no longer than 6 months after the accident. Payable only if the

policy Medical Expenses benefit is paid. Not payable for the same visit for which the Physical Therapy benefit is paid

19

This brochure is for use in enrollments sitused in FL and is incomplete without the accompanying rate insert.

Rev. 9/18. This material is valid as long as information remains current, but in no event later than September 15, 2021.

Group Accident benefits are provided under policy form GVAP1, or state variations thereof.

The coverage provided is limited benefit supplemental accident insurance. The policy is not a Medicare Supplement Policy.

If eligible for Medicare, review Medicare Supplement Buyer’s Guide available from Allstate Benefits. There may be instances

when a law requires that benefits under this coverage be paid to a third party, rather than to you. If you or a dependent have

coverage under Medicare, Medicaid, or a state variation, please refer to your health insurance documents to confirm whether

assignments or liens may apply.

This is a brief overview of the benefits available under the group policy underwritten by American Heritage Life Insurance

Company (Home Oce, Jacksonville, FL). Details of the coverage, including exclusions and other limitations are included in

the certificates issued. For additional information, you may contact your Allstate Benefits Representative.

The coverage does not constitute comprehensive health insurance coverage (often referred to as “major medical

coverage”) and does not satisfy the requirement of minimum essential coverage under the Aordable Care Act.

Allstate Benefits is the marketing

name used by American Heritage

Life Insurance Company, a subsidiary

of The Allstate Corporation. ©2018

Allstate Insurance Company.

www.allstate.com or

allstatebenefits.com

CERTIFICATE SPECIFICATIONS

Conditions and Limits

When an injury results in a covered loss within 90 days (

unless otherwise stated on the Benefits page)

from the date of an accident and is diagnosed by a physician, Allstate Benefits will pay benefits as

stated. Treatment must be received in the United States or its territories.

Eligibility

Your employer decides who is eligible for your group (such as length of service and hours worked each week).

Dependent Eligibility/Termination

Coverage may include you, your spouse or domestic partner, and your children. Coverage for children

ends

when the child reaches age 26, unless he or she continues to meet the requirements of an eligible

dependent. Spouse/domestic partner coverage ends upon valid decree of divorce/termination of the

domestic partnership or your death.

When Coverage Ends

Coverage under the policy ends on the earliest of: the date the policy or certificate is canceled; the last

day of the period for which you made any required contributions; the last day you are in active

employment, except as provided under the Temporarily Not Working provision; the date you are no

longer in an eligible class; or the date your class is no longer eligible.

Continuation of Coverage

You may be eligible to continue coverage when coverage under the policy ends. Refer to your Certificate

of Insurance for details.

EXCLUSIONS AND LIMITATIONS

Benefits are not paid for: injury incurred before the eective date; act of war or participation in a riot,

insurrection or rebellion; suicide or attempt at suicide; injury while under the influence of alcohol or any

narcotic, unless taken upon the advice of a physician; any bacterial infection (except pyogenic infections

from an accidental cut or wound);

participation in aeronautics unless a fare-paying passenger on a licensed

common-carrier aircraft; committing

or attempting an assault or felony; driving in any race or speed test or

testing any vehicle on any racetrack or speedway; hernia, including complications; serving as an active

member of the Military, Naval, or Air Forces of any country or combination of countries.

Offered to the employees of:

Pasco County Schools

Group Voluntary Accident (GVAP1)

On- and O-the-Job Accident Insurance from Allstate Benefits

EE = Employee; EE + SP = Employee + Spouse;

EE + CH = Employee + Child(ren); F = Family

Injury Benefit Schedule is on reverse

PLAN PREMIUMS

Issue ages: 18 and over if actively at work

BENEFIT AMOUNTS

Benefits are paid once per accident unless otherwise noted here or in the brochure

ABJ30901X-1-Insert-PascoCS

MODE EE EE + SP EE + CH F

Semi-Monthly $7.26 $13.44 $12.30 $18.48

Monthly $14.52 $26.88 $24.60 $36.96

20thly $8.71 $16.13 $14.76 $22.18

BASE POLICY BENEFITS

PLAN

Accidental Death Employee $100,000

Spouse $50,000

Children $25,000

Common Carrier Accidental Death

Employee $500,000

(fare-paying passenger) Spouse $250,000

Children $125,000

Dismemberment

1

Employee $200,000

Spouse $100,000

Children $50,000

Dislocation or Fracture

1

Employee $8,000

Spouse $4,000

Children $2,000

Initial Hospitalization Confinement (pays once) $2,000

Hospital Confinement (pays daily) $800

Intensive Care (pays daily) $1,600

Ambulance Services Ground $800

Air $2,400

Medical Expenses (pays up to amount shown) $600

Outpatient Physician’s Treatment (pays per visit) $50

ADDITIONAL

BENEFITS

PLAN

Hospital Admission (pays once/year) $2,000

Lacerations

(pays once/year) $200

Burns < 15% body surface $400

15% or more $2,000

Skin Graft (% of Burns Benefit) 50%

Brain Injury Diagnosis (pays once) $600

Computed Tomography (CT) Scan and

$100

Magnetic Resonance Imaging (MRI)

(pays once/accident/year)

Paralysis (pays once) Paraplegia $15,000

Quadriplegia $30,000

Coma with Respiratory Assistance (pays once) $20,000

Open Abdominal or Thoracic Surgery $5,000

Tendon, Ligament, Rotator Cu Surgery $2,500

or Knee Cartilage Surgery Exploratory $750

Ruptured Disc Surgery $2,500

Eye Surgery $400

General Anesthesia $400

Blood and Plasma $1,200

Appliance $500

Medical Supplies $20

Medicine $20

Prosthesis 1 device $1,000

2 or more devices $2,000

Physical Therapy (pays daily) $120

Rehabilitation Unit (pays daily) $400

Non-Local Transportation $800

Family Member Lodging (pays daily) $200

Post-Accident Transportation (pays once/year) $400

Accident Follow-Up Treatment (pays daily) $200

Up to amount shown; see Injury Benefit Schedule on reverse. Multiple losses from same

injury pay only up to amount shown above.

21

INJURY BENEFIT SCHEDULE

Benefit amounts for coverage and one occurrence are shown below.

Covered spouse gets 50% of the amounts shown and children 25%.

For use in enrollments sitused in: FL. This rate insert is part of form ABJ30901X-1 and is not to be used on its own.

This material is valid as long as information remains current,

but in no event later than September 15, 2021.

Allstate Benefits is the marketing name used by American Heritage Life Insurance Company (Home Oce, Jacksonville, FL),

a subsidiary of The Allstate Corporation. ©2018 Allstate

Insurance Company. www.allstate.com or allstatebenefits.com.

COMPLETE DISLOCATION PLAN

Hip joint $8,000

Knee or ankle joint

, bone or bones of the foot

$3,200

Wrist joint $2,800

Elbow joint $2,400

Shoulder joint $1,600

Bone or bones of the hand

, collarbone $1,200

Two or more fingers or toes $560

One finger or toe $240

COMPLETE, SIMPLE OR CLOSED FRACTURE PLAN

Hip, thigh (femur), pelvis

$8,000

Skull

$7,600

Arm, between shoulder and elbow (shaft),

$4,400

shoulder blade (scapula), leg (tibia or fibula)

Ankle, knee cap (patella), forearm (radius or ulna), collarbone (clavicle) $3,200

Foot

, hand or wrist

$2,800

Lower jaw

$1,600

Two or more ribs, fingers or toes, bones of face or nose $1,200

One rib, finger or toe, coccyx $560

LOSS PLAN

Life $100,000

Both eyes, hands, arms, feet, or legs, or one hand

$200,000

or arm and one foot or leg

One eye, hand, arm, foot, or leg $100,000

One or more entire toes or fingers $20,000

Knee joint (except patella). Bone or bones of the foot (except toes). Bone or bones of the

hand (except fingers).

Pelvis (except coccyx). Skull (except bones of face or nose). Foot

(except toes). Hand or wrist (except fingers). Lower jaw (except alveolar process).

Protection for the

treatment of cancer and

29 specified diseases

Receiving a cancer diagnosis can be one of life’s most frightening events.

Unfortunately, statistics show you probably know someone who has been

in this situation.

With Cancer insurance from Allstate Benefits, you can rest a little easier. Our coverage

pays you a cash benefit to help with the costs associated with treatments, to pay for

daily living expenses, and more importantly, to empower you to seek the care you need.

Here’s How It Works

You choose the coverage that’s right for you and your family. Our Cancer insurance pays

cash benefits for cancer and 29 specified diseases to help with the cost of treatments

and expenses as they happen. Benefits are paid directly to you unless otherwise assigned.

With the cash benefits you can receive from this coverage, you may not need to use

the funds from your Health Savings Account (HSA) for cancer or specified disease

treatments and expenses.

Meeting Your Needs

• Guaranteed Issue, meaning no medical questions to answer at initial enrollment*

• Includes coverage for cancer and 29 specified diseases

• Benefits are paid directly to you unless otherwise assigned

• Coverage available for dependents

• Waiver of premium after 90 days of disability due to cancer for as long as your

disability lasts (employee only)

• Coverage may be continued; refer to your certificate for details

• Additional benefits have been added to enhance your coverage

With Allstate Benefits, you can protect your finances if faced with an unexpected

cancer or specified disease diagnosis. Are you in Good Hands? You can be.

Cancer Insurance

1

Life After Cancer: Survivorship by the Numbers, American Cancer Society, 2017.

2

Cancer Treatment & Survivorship

Facts & Figures, 2016-2017. *Enrolling after your initial enrollment period requires evidence of insurability.

Oered to the employees of:

Pasco County

Schools

ABJ30903X-1

DID YOU

KNOW

The number of cancer survivors in the

U.S. is increasing, and is expected to

jump to nearly 20.3 million by 2026

2

?

Early detection, improved treatments

and access to care are factors that

influence cancer survival

1

20.3 million

23

Here’s how Tony’s story of diagnosis and treatment turned into a happy ending,

because he had supplemental Cancer Insurance to help with expenses.

Tony undergoes his annual wellness test and is

diagnosed for the first time with prostate cancer.

His doctor reviews the results with him and

recommends pre-op testing and surgery.

Here’s Tony’s treatment path:

• Tony travels to a specialized hospital 400 miles

from where he lives and undergoes pre-op testing

• He is admitted to the hospital for laparoscopic

prostate cancer surgery

• Tony undergoes surgery and spends several hours

in the recovery waiting room

• He is transferred to his room where he is visited

by his doctor during a 2-day hospital stay

•

Tony is released under doctor required treatment

and care during a 2-month recovery period

Tony continues to fight his cancer and follow his

doctor recommended treatments.

CHOOSE CLAIMUSE

Tony chooses benefits to help

protect himself and his wife

if diagnosed with cancer or a

specified disease

Meet Tony

Tony is like anyone else who has been

diagnosed with cancer. He is concerned

about his wife and how she will cope

with his disease and its treatment. Most

importantly, he worries about how he

will pay for his treatment.

Here is what weighs heavily on his mind:

• Major medical only pays a portion of the

expenses associated with my treatment

• I have copays I am responsible for until

I meet my deductible

• If I am not working due to treatments,

I must cover my bills, rent/mortgage,

groceries and other daily expenses

• If the right treatment is not available

locally, I will have to travel to get the

treatment I need

Tony’s Cancer claim paid him cash

benefits for the following:

Cancer Screening

Cancer Initial Diagnosis

Continuous Hospital Confinement

Non-Local Transportation

Surgery

Anesthesia

Inpatient Drugs and Medicine

Physician’s Attendance

Comfort/Anti-Nausea

For a listing of benefits and benefit

amounts, see your company’s

rate insert.

24

Benefits (subject to maximums as listed on the attached rate insert)

HOSPITAL CONFINEMENT AND RELATED BENEFITS

Continuous Hospital Confinement - inpatient admission and confinement, up to 70 days per continuous

confinement

Extended Benefits - daily benefit for continuous hospital confinement lasting more than 70 days. Paid in lieu of all

other benefits except Waiver of Premium

Government or Charity Hospital - confinements in lieu of all other benefits except Waiver of Premium

Private Duty Nursing Services - full-time nursing services authorized by attending physician

Extended Care Facility - confinement must begin within 14 days of a covered hospital stay; payable up to the

number of days of the previous hospital stay

At Home Nursing -

private nursing care must begin within 14 days of a covered hospital stay; payable up to the

number of days of the previous hospital stay

Hospice Care (Freestanding Hospice Care Center or Hospice Care Team) -

terminal illness care in a

facility or at home; one visit per day. Must begin within 14 days of a covered hospital stay

RADIATION/CHEMOTHERAPY

Radiation/Chemotherapy -

covered treatments to destroy or modify cancerous tissue

Blood, Plasma and Platelets -

transfusions, administration, processing, procurement, cross-matching

SURGERY AND RELATED BENEFITS

Surgery* -

based on Certificate Schedule of Surgical Procedures. Does not pay for surgeries covered by other policy benefits

Anesthesia - 25% of Surgery benefit for anesthesia received by an anesthetist

Bone Marrow or Stem Cell Transplant

- autologous, non-autologous for treatment of cancer or specified disease

other than Leukemia, or non-autologous for treatment of Leukemia

Ambulatory Surgical Center -

payable only if Surgery benefit is paid

Second Surgical Opinion -

second opinion for surgery by a doctor not in practice with your doctor

TRANSPORTATION AND LODGING BENEFITS

Ambulance - transfer by a licensed service or hospital-owned ambulance to or from hospital where confined for

cancer or specified disease treatment

Non-Local Transportation -

obtaining treatment not available locally

Outpatient Lodging -

more than 100 miles from home

Family Member Lodging and Transportation - adult family member travels with you during non-local hospital

stays for specialized treatment. Transportation not paid if Non-Local Transportation benefit paid

MISCELLANEOUS BENEFITS

Inpatient Drugs and Medicine -

not including drugs/medicine covered under the Radiation/Chemotherapy benefit

Physician’s Attendance - one inpatient visit by one physician

Physical or Speech Therapy - to restore normal body function

New or Experimental Treatment -

payable if physician judges to be necessary and only for treatment not covered

under other policy benefits

Prosthesis - surgical implantation of prosthetic device for each amputation and breast reconstructive surgery

incident to mastectomies

Comfort/Anti-Nausea Benefit -

prescribed anti-nausea medication administered on outpatient basis

Waiver of Premium** - must be disabled 90 days in a row due to cancer, as long as disability lasts

ADDITIONAL BENEFITS

Cancer Initial Diagnosis - for first-time diagnosis of cancer other than skin cancer

Intensive Care (ICU) a. ICU Confinement - confinements up to 45 days/stay

b. Ambulance - licensed air or surface ambulance service to ICU

Cancer Screening - pays annually for each covered person, when one of the following covered screening tests is

performed: Bone Marrow Testing; Blood Tests for CA15-3 (breast cancer), CA125 (ovarian cancer), PSA (prostate

cancer) and CEA (colon cancer); Chest X-ray; Colonoscopy; Flexible Sigmoidoscopy; Hemoccult Stool Analysis;

Mammography; Pap Smear; Serum Protein Electrophoresis (test for myeloma)

SPECIFIED DISEASES

29 Specified Diseases Covered -

Amyotrophic Lateral Sclerosis (Lou Gehrig’s Disease), Muscular Dystrophy,

Poliomyelitis, Multiple Sclerosis, Encephalitis, Rabies, Tetanus, Tuberculosis, Osteomyelitis, Diphtheria, Scarlet Fever,

Cerebrospinal Meningitis, Brucellosis, Sickle Cell Anemia, Thalassemia, Rocky Mountain Spotted Fever, Legionnaires’

Disease, Addison’s Disease, Hansen’s Disease, Tularemia, Hepatitis (Chronic B or C), Typhoid Fever, Myasthenia

Gravis, Reye’s Syndrome,

Primary Sclerosing Cholangitis (Walter Payton’s Disease), Lyme Disease, Systemic Lupus

Erythematosus, Cystic Fibrosis, and Primary Biliary Cirrhosis

*Two or more surgeries done at the same time are considered one operation. The operation with the largest benefit

will be paid. Outpatient is paid at 150% of the amount listed in the Schedule of Surgical Procedures. Does not pay

for other surgeries covered by other benefits **Premiums

waived for employee only

Using your cash benefits

Cash benefits provide you with

options, because you decide

how to use them.

Finances

Can help protect HSAs,

savings, retirement

plans and 401(k)s

from being depleted.

Trave l

Can help pay for expenses

while

receiving treatment

in another city.

Home

Can help pay the

mortgage, continue

rental payments, or

perform needed

home

repairs for after care.

Expenses

Can help pay your family’s

living expenses such as

bills, electricity, and gas.

An easy-to-use website that

offers 24/7 access to important

information

about your benefits.

Plus, you can submit

and check

your claims (including claim

history), request your cash

benefit to be direct deposited,

make changes to personal

information, and more.

Eligibility

Coverage may include you, your

spouse, and children.

MyBenefits: 24/7 Access

allstatebenefits.com/mybenefits

25

This brochure is for use in enrollments sitused in FL and is incomplete without the accompanying rate insert.

Rev. 9/18. This material is valid as long as information remains current, but in no event later than September 15, 2021.

Group Cancer benefits are provided under policy form GVCP2, or state variations thereof.

The coverage provided is limited benefit supplemental cancer and specified disease insurance. The policy is not a

Medicare Supplement Policy. If eligible for Medicare, review Medicare Supplement Buyer’s Guide available from

Allstate Benefits. There may be instances when a law requires that benefits under this coverage be paid to a third

party, rather than to you. If you or a dependent have coverage under Medicare, Medicaid, or a state variation, please

refer to your health insurance documents to confirm whether assignments or liens may apply.

This is a brief overview of the benefits available under the group policy underwritten by American Heritage Life

Insurance Company (Home Oce, Jacksonville, FL). Details of the coverage, including exclusions and other limitations

are included in the certificates issued. For additional information, you may contact your Allstate Benefits Representative.

The coverage does not constitute comprehensive health insurance coverage (often referred to as “major medical

coverage”) and does not satisfy the requirement of minimum essential coverage under the Aordable Care Act.

Allstate Benefits is the marketing

name used by American Heritage

Life Insurance Company, a subsidiary

of The Allstate Corporation. ©2018

Allstate Insurance Company.

www.allstate.com or

allstatebenefits.com

CERTIFICATE SPECIFICATIONS

Eligibility

Coverage may include you, your spouse, and children.

Termination of Coverage

Coverage under the policy ends on the date the policy is canceled; the last day premium payments were

made; the last day of active employment; or the date you or your class is no longer eligible.

Spouse coverage ends upon divorce or your death. Coverage for children ends when the child reaches

age 26, unless he or she continues to meet the requirements of an eligible dependent.

Conversion Privilege

If coverage terminates for any reason other than non-payment of premiums, the covered person can convert

to an individual policy without evidence of insurability. This may also apply to a dependent whose coverage

terminates.

LIMITATIONS AND EXCLUSIONS

Pre-Existing Condition Limitation

We do not pay benefits for a pre-existing condition during the 12-month period beginning on the date that

person’s coverage starts.

A pre-existing condition is a disease or physical condition for which medical

advice or treatment was received by the covered person during the 6-month period prior to the eective

date of coverage.

Exclusions and Limitations

We do not pay for any loss except for losses due directly from cancer or a specified disease and any

other conditions or diseases caused or aggravated by cancer or a specified disease. Treatment and

services must be received in the United States or its territories.

For those benefits for which we pay actual charges up to a specified maximum amount (except

Radiation/Chemotherapy; Blood, Plasma and Platelets; Prosthesis; New or Experimental Treatment;

and Bone Marrow or Stem Cell Transplant), if specific charges are not obtainable as proof of loss, we

will pay 50% of the maximum benefit.

Hospice Care: Services are not covered for food or meals, well-baby care, volunteers or support for the

family after covered person’s death.

Blood, Plasma and Platelets Limitation:

Does not include blood replaced by donors.

For the Radiation/Chemotherapy benefit, we do not pay for: treatment planning, consultation or

management; the design and construction of treatment devices; basic radiation dosimetry calculation;

any type of laboratory tests; X-ray or other imaging used for diagnosis or monitoring; the diagnostic tests

related to these treatments; or any devices or supplies including intravenous solutions and needles

related to these treatments.

We do not pay the Family Member Transportation Benefit if we pay the personal vehicle transportation