Oracle Fusion

Cloud Financials

Implementing Enterprise Structures

and General Ledger

24C

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Contents

Get Help ................................................................................................................................ i

1

Enterprise Structures Introduction

1

Overview of Enterprise Structures .............................................................................................................................................. 1

Enterprise Structures Business Process Model ....................................................................................................................... 4

Guidelines for Configuring Global Enterprises ........................................................................................................................ 6

Model Your Enterprise Management Structure ....................................................................................................................... 7

Overview of Diagnostic Tests for Enterprise Structures Setup ........................................................................................... 11

Enterprise Structures Setup Report ........................................................................................................................................... 11

Setup Data Import and Export for Oracle Fusion Financials ............................................................................................... 12

Initial Configuration ...................................................................................................................................................................... 17

2

Reference Data Sharing

23

Reference Data Sharing .............................................................................................................................................................. 23

Reference Data Sets ..................................................................................................................................................................... 23

Reference Data Sets and Sharing Methods ........................................................................................................................... 24

How Business Units Work with Reference Data Sets ........................................................................................................... 26

How You Create Reference Data Sets in the Enterprise Structures Configurator .......................................................... 29

Assignment of Reference Data Sets to Reference Objects ................................................................................................. 29

Items and Supplier Site Reference Data Sharing .................................................................................................................. 30

FAQs for Reference Data Sharing .............................................................................................................................................. 31

3

Enterprise

37

Define Enterprises ........................................................................................................................................................................ 37

Enterprise Information for Non-HCM Users .......................................................................................................................... 37

Manage Locations ........................................................................................................................................................................ 37

Legal Jurisdictions and Authorities ......................................................................................................................................... 40

4

Geographies

45

Overview of Geographies ........................................................................................................................................................... 45

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

5

Legal Entities

47

Overview ......................................................................................................................................................................................... 47

Model Legal Entities .................................................................................................................................................................... 48

How You Create Legal Entities in the Enterprise Structures Configurator ....................................................................... 51

Create Legal Entities, Registrations, and Reporting Units .................................................................................................. 53

How Legal Employers Work with Payroll Statutory Units and Tax Reporting Units ....................................................... 55

Party Tax Profiles ......................................................................................................................................................................... 55

Considerations for Specifying First-Party Tax Profile Options ........................................................................................... 57

Plan Legal Reporting Units ........................................................................................................................................................ 59

FAQs for Legal Entities ............................................................................................................................................................... 59

6

Financial Structures

61

Overview ......................................................................................................................................................................................... 61

Rapid Implementation ................................................................................................................................................................. 61

Chart of Accounts ......................................................................................................................................................................... 81

Value Sets .................................................................................................................................................................................... 104

Chart of Accounts Structures and Instances ........................................................................................................................ 110

Flexfield Deployment .................................................................................................................................................................. 118

General Ledger Security ............................................................................................................................................................ 123

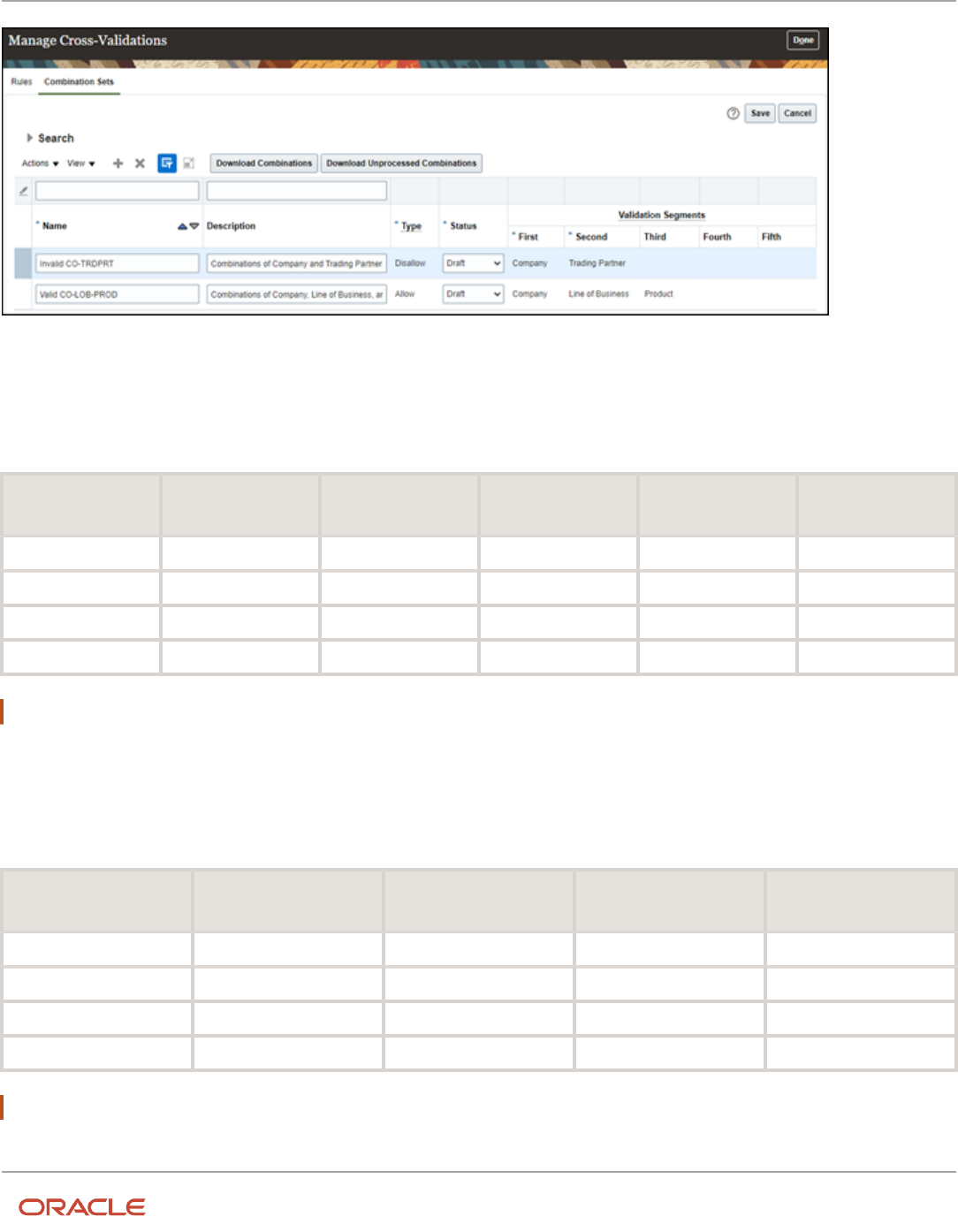

Cross-Validations ........................................................................................................................................................................ 154

Cross-Validation Rules ............................................................................................................................................................... 155

Cross-Validation Combination Sets ........................................................................................................................................ 175

Related Value Sets ..................................................................................................................................................................... 190

Account Hierarchies ................................................................................................................................................................... 196

Account Combinations .............................................................................................................................................................. 225

Accounting Calendars ............................................................................................................................................................... 234

Currencies .................................................................................................................................................................................... 239

Conversion Rate Types .............................................................................................................................................................. 241

Daily Rates ................................................................................................................................................................................... 244

Historical Rates ........................................................................................................................................................................... 249

7

Ledgers

251

Overview ....................................................................................................................................................................................... 251

Ledger Options ........................................................................................................................................................................... 259

Legal Entity and Balancing Segment Assignment ............................................................................................................. 263

Legal Entity-Specific Secondary Ledgers with Controlled Replication from Primary Ledgers .................................. 265

Reporting Currency Balances .................................................................................................................................................. 270

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Accounting Configuration Review and Submission ........................................................................................................... 273

First Period .................................................................................................................................................................................. 293

Opening Balance Initialization for New Reporting Currencies and Secondary Ledgers ............................................. 293

Clearing Accounts Reconciliation ........................................................................................................................................... 302

Average Balance Processing ................................................................................................................................................... 309

FAQs for Ledgers ........................................................................................................................................................................ 313

8

Intercompany Setup

317

System Options ........................................................................................................................................................................... 317

Define Organizations ................................................................................................................................................................. 319

Invoicing Options ....................................................................................................................................................................... 320

Balancing Rules ........................................................................................................................................................................... 321

Allocations ................................................................................................................................................................................... 338

Multitier Intercompany Operations Setup ............................................................................................................................ 349

Examples to Configure Intercompany Organizations ........................................................................................................ 352

9

General Ledger Options

359

Ledger Sets .................................................................................................................................................................................. 359

Data Access Sets ........................................................................................................................................................................ 359

Accounting Automation ........................................................................................................................................................... 360

Accounting and Reporting Sequences ................................................................................................................................. 367

Journal Approval Rules .............................................................................................................................................................. 371

Journal Approval Notifications ............................................................................................................................................... 408

AutoPost ....................................................................................................................................................................................... 425

Manage Journal Reversals ....................................................................................................................................................... 428

Lookups ........................................................................................................................................................................................ 435

Descriptive Flexfields ................................................................................................................................................................ 445

Profile Options ........................................................................................................................................................................... 460

Workflow Transaction Console ............................................................................................................................................... 465

Processing Schedules ............................................................................................................................................................... 470

10

Period Close

471

Overview ....................................................................................................................................................................................... 471

Revaluation .................................................................................................................................................................................. 474

Translation ................................................................................................................................................................................... 489

Foreign Currency Valuation Accounting .............................................................................................................................. 496

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

11

Allocations and Periodic Entries

505

Overview ...................................................................................................................................................................................... 505

Recurring Journals .................................................................................................................................................................... 509

Calculation Manager .................................................................................................................................................................. 515

Allocation Rules ........................................................................................................................................................................... 521

Allocation Rule Sets ................................................................................................................................................................... 539

Allocation Components ............................................................................................................................................................ 546

Allocation Variables .................................................................................................................................................................... 561

FAQs for Allocations and Periodic Entries ........................................................................................................................... 566

12

Business Units

573

Business Units ............................................................................................................................................................................. 573

Business Functions .................................................................................................................................................................... 574

Considerations for Creating Business Units in the Enterprise Structures Configurator ............................................. 576

Copy Business Unit Configurations ....................................................................................................................................... 579

Examples of Override Business Unit Account Segment Values ....................................................................................... 581

Service Provider Models ........................................................................................................................................................... 583

Shared Service Centers ............................................................................................................................................................ 584

Guidelines for Shared Service Centers .................................................................................................................................. 585

13

Workforce Structures and Facilities

587

Divisions and Departments ..................................................................................................................................................... 587

Jobs and Positions ..................................................................................................................................................................... 593

Facility Shifts, Workday Patterns, and Schedules ............................................................................................................... 598

Inventory Organizations and Item Organizations .............................................................................................................. 602

14

Budgets

611

Overview of Budget Uploads .................................................................................................................................................... 611

How General Ledger Budget Balance Import Data Is Processed ..................................................................................... 613

Import Budget Data from a Flat File ...................................................................................................................................... 614

Import Budget Data from a Spreadsheet ............................................................................................................................. 616

Correct Budget Import Errors Using a Spreadsheet ........................................................................................................... 616

Overview of Oracle Hyperion Planning ................................................................................................................................. 617

Overview of Integration with Oracle Enterprise Planning and Budgeting Cloud Service ........................................... 617

15

Financial Reporting

619

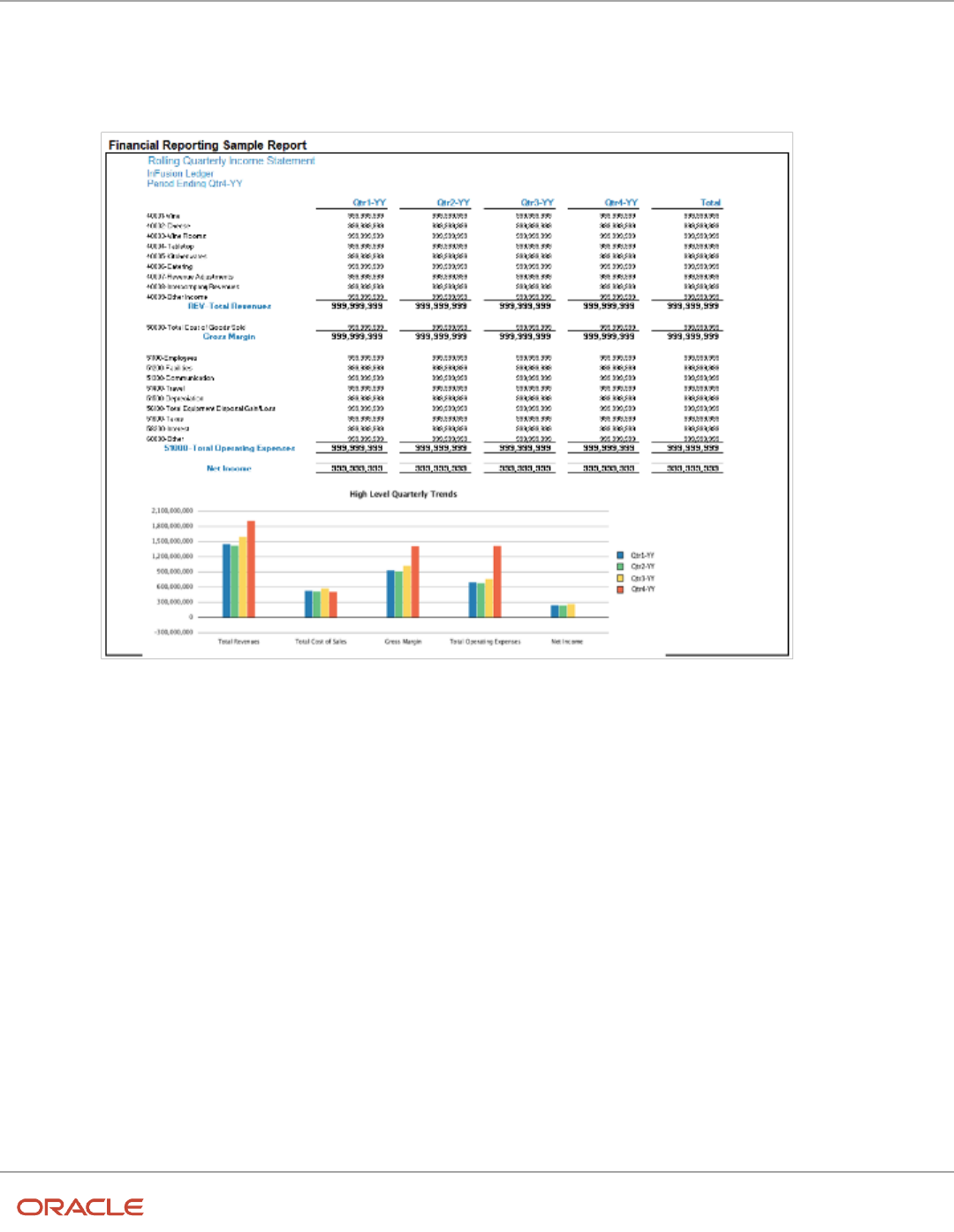

Overview of Financial Reporting Center ............................................................................................................................... 619

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Set Up Financial Reporting Center and Smart View ........................................................................................................... 621

How to Access EPM Narrative Reporting Reports in Financial Reporting Center ....................................................... 624

Considerations for Implementing Financial Reporting Center ........................................................................................ 625

Overview of Financial Reporting Web Studio ...................................................................................................................... 626

Overview of Reporting Web Studio ....................................................................................................................................... 626

How Financial Reporting Reports and Account Groups Are Generated ........................................................................ 627

Create a Financial Report ......................................................................................................................................................... 629

Configure an Account Group .................................................................................................................................................. 635

General Ledger Subject Areas, Folders, and Attributes .................................................................................................... 638

Schedule Financial Reporting Reports ................................................................................................................................. 640

Display Only Segment Value Descriptions in Reports ...................................................................................................... 640

FAQs for Financial Reporting ................................................................................................................................................... 641

16

Accounting Data Archive and Purge

643

Overview of Accounting Data Archive and Purge .............................................................................................................. 643

How You Archive and Purge Accounting Data ................................................................................................................... 645

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Get Help

Get Help

There are a number of ways to learn more about your product and interact with Oracle and other users.

Get Help in the Applications

Use help icons to access help in the application. If you don't see any help icons on your page, click your user image

or name in the global header and select Show Help Icons.

Get Support

You can get support at My Oracle Support. For accessible support, visit Oracle Accessibility Learning and Support.

Get Training

Increase your knowledge of Oracle Cloud by taking courses at Oracle University.

Join Our Community

Use Cloud Customer Connect to get information from industry experts at Oracle and in the partner community. You

can join forums to connect with other customers, post questions, suggest ideas for product enhancements, and watch

events.

Learn About Accessibility

For information about Oracle's commitment to accessibility, visit the Oracle Accessibility Program. Videos included in

this guide are provided as a media alternative for text-based topics also available in this guide.

Share Your Feedback

We welcome your feedback about Oracle Applications user assistance. If you need clarification, find an error, or just

want to tell us what you found helpful, we'd like to hear from you.

You can email your feedback to oracle_fusion_applications_help_ww_grp@oracle.com.

Thanks for helping us improve our user assistance!

i

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Get Help

ii

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

1 Enterprise Structures Introduction

Overview of Enterprise Structures

Oracle Fusion Applications have been designed to ensure your enterprise can be modeled to meet legal and

management objectives.

The decisions about your implementation of Oracle Fusion Applications are affected by your:

• Industry

• Business unit requirements for autonomy

• Business and accounting policies

• Business functions performed by business units and optionally, centralized in shared service centers

• Locations of facilities

Every enterprise has three fundamental structures that describe its operations and provide a basis for reporting.

• Legal

• Managerial

• Functional

In Oracle Fusion, these structures are implemented using the chart of accounts and organization hierarchies. Many

alternative hierarchies can be implemented and used for reporting. You are likely to have one primary structure that

organizes your business into:

• Divisions

• Business Units

• Departments

Align these structures with your strategic objectives.

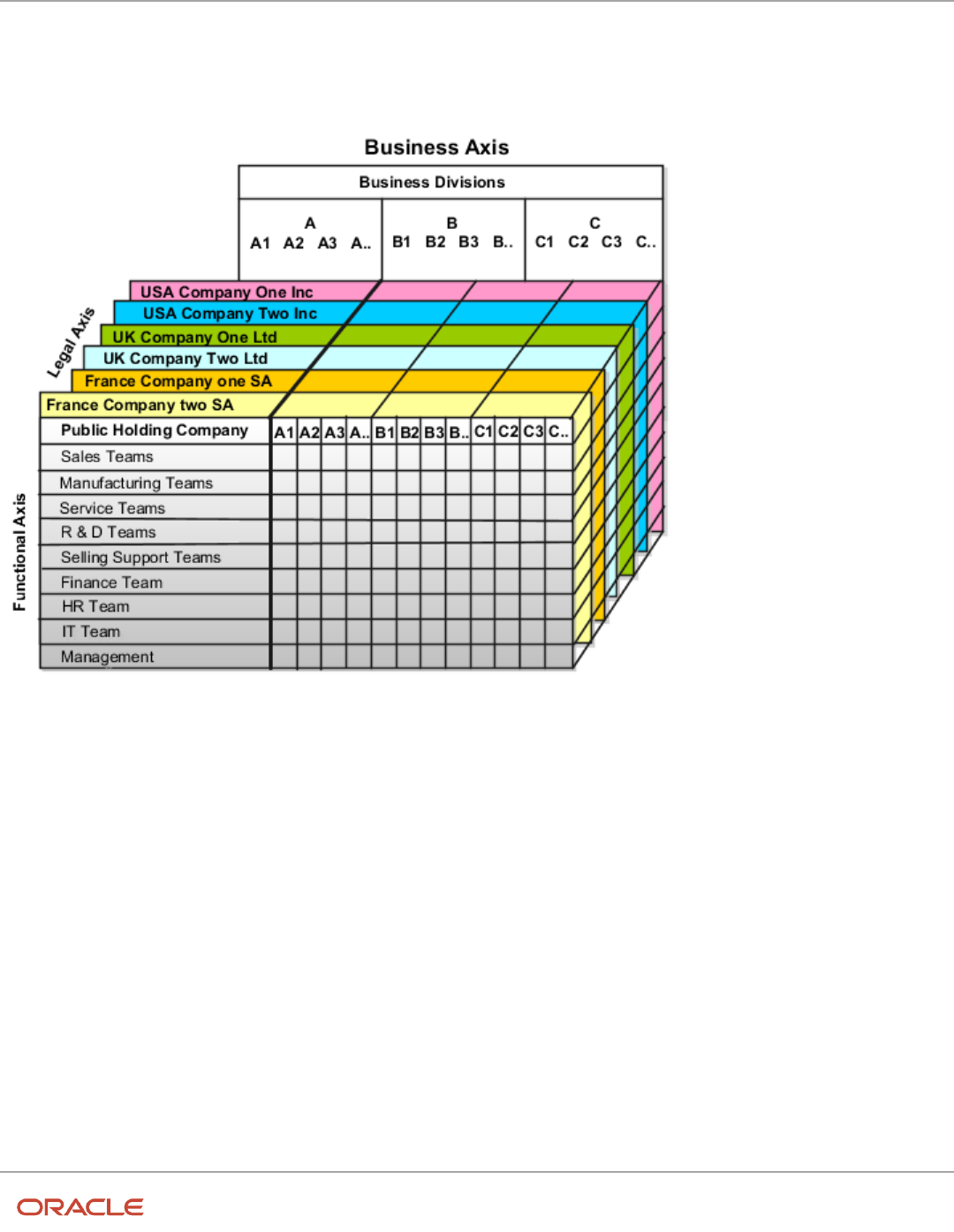

This figure illustrates a grid with Business Axis, representing the enterprise division, Legal Axis representing the

companies, and the Functional Axis representing the business functions.

1

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Legal Structure

The figure illustrates a typical group of legal entities, operating various business and functional organizations. Your

ability to buy and sell, own, and employ comes from your charter in the legal system. A corporation is:

• A distinct legal entity from its owners and managers.

• Owned by its shareholders, who may be individuals or other corporations.

Many other kinds of legal entities exist, such as sole proprietorships, partnerships, and government agencies.

2

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

A legally recognized entity can own and trade assets and employ people in the jurisdiction in which the entity is

registered. When granted these privileges, legal entities are also assigned responsibilities to:

• Account for themselves to the public through statutory and external reporting.

• Comply with legislation and regulations.

• Pay income and transaction taxes.

• Process value added tax (VAT) collection on behalf of the taxing authority.

Many large enterprises isolate risk and optimize taxes by incorporating subsidiaries. They create legal entities to

facilitate legal compliance, segregate operations, optimize taxes, complete contractual relationships, and isolate risk.

Enterprises use legal entities to establish their enterprise's identity within the laws of each country in which their

enterprise operates.

The figure illustrates:

• A separate card represents a series of registered companies.

• Each company, including the public holding company, InFusion America, must be registered in the countries

where they do business.

• Each company contributes to various divisions created for purposes of management reporting. These are

shown as vertical columns on each card.

For example, a group might have a separate company for each business in the United States (US), but have its United

Kingdom (UK) legal entity represent all businesses in that country.

The divisions are linked across the cards so that a business can appear on some or all of the cards. For example, the

air quality monitoring systems business might be operated by the US, UK, and France companies. The list of business

divisions is on the Business Axis.

Each company's card is also horizontally striped by functional groups, such as the sales team and the finance team.

This functional list is called the Functional Axis. The overall image suggests that information might, at a minimum, be

tracked by company, business, division, and function in a group environment. In Oracle Fusion Applications, the legal

structure is implemented using legal entities.

Management Structure

Successfully managing multiple businesses requires that you segregate them by their strategic objectives, and measure

their results. Although related to your legal structure, the business organizational hierarchies don't have to be reflected

directly in the legal structure of the enterprise. The management structure can include divisions, subdivisions, lines

of business, strategic business units, profit, and cost centers. In the figure, the management structure is shown on the

Business Axis. In Oracle Fusion Applications, the management structure is implemented using divisions and business

units as well as being reflected in the chart of accounts.

Functional Structure

Straddling the legal and business organizations is a functional organization structured around people and their

competencies. For example, sales, manufacturing, and service teams are functional organizations. This functional

structure is represented by the Functional Axis in the figure. You reflect the efforts and expenses of your functional

organizations directly on the income statement. Organizations must manage and report revenues, cost of sales, and

functional expenses such as research and development and selling, general, and administrative expenses. In Oracle

Fusion Applications, the functional structure is implemented using departments and organizations, including sales,

marketing, project, cost, and inventory organizations.

3

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Enterprise Structures Business Process Model

In Oracle Fusion Cloud Applications, the Enterprise Performance and Planning Business Process Model illustrates the

major implementation tasks that you perform to create your enterprise structures.

This process includes:

• Set Up Enterprise Structures business process, which consists of implementation activities that span many

product families.

• Information Technology, a second Business Process Model which contains the Set Up Information Technology

Management business process.

• Define Reference Data Sharing, which is one of the activities in this business process and is important in the

implementation of the enterprise structures. This activity creates the mechanism to share reference data sets

across multiple ledgers, business units, and warehouses, reducing the administrative burden and decreasing

the time to implement.

The following figure and table describe the Business Process Model structures and activities.

4

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

The table describes each BPM activity.

BPM Activities Description

Define Enterprise

Define the enterprise to get the name of the deploying enterprise and the location of the headquarters.

Define Enterprise Structures

Define enterprise structures to represent an organization with one or more legal entities. Define

organizations to represent each area of business within the enterprise.

Define Legal Jurisdictions and Authorities

Define information for governing bodies that operate within a jurisdiction.

Define Legal Entities

Define legal entities and legal reporting units for business activities handled by the Oracle Fusion

Applications.

5

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

BPM Activities Description

Define Business Units

Define business units of an enterprise to perform one or many business functions that can be rolled up

in a management hierarchy. A business unit can process transactions on behalf of many legal entities.

Normally, it has a manager, strategic objectives, a level of autonomy, and responsibility for its profit

and loss.

Define Financial Reporting Structures

Define financial reporting structures, including organization structures, charts of accounts,

organizational hierarchies, calendars, currencies and rates, ledgers, and document sequences which

are used in organizing the financial data of a company.

Define Chart of Accounts

Define chart of accounts including hierarchies and values to enable tracking of financial transactions

and reporting at legal entity, cost center, account, and other segment levels.

Define Ledgers

Define the primary accounting ledger and any secondary ledgers that provide an alternative

accounting representation of the financial data.

Define Accounting Configurations

Define the accounting configuration that serves as a framework for how financial records are

maintained for an organization.

Define Facilities

Define your manufacturing and storage facilities as Inventory Organizations if Oracle Fusion

Applications track inventory balances there and Item Organizations if Oracle Fusion Applications only

track the items used in the facility but not the balances.

Define Reference Data Sharing

Define how reference data in the applications is partitioned and shared.

Note: Some product-specific implementation activities aren't listed here and depend on the applications you're

implementing. For example, you can implement Define Enterprise Structures for Human Capital Management, Project

Management, and Sales Management.

Guidelines for Configuring Global Enterprises

Start your global enterprise structure configuration by discussing what your organization's reporting needs are and how

to represent those needs in the Oracle Fusion Cloud Applications.

The following are some questions and points to consider as you design your global enterprise structure in Oracle Fusion

Applications.

• Enterprise Configuration

• Business Unit Management

• Security Structure

• Compliance Requirements

6

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Enterprise Configuration

• What is the level of configuration needed to achieve the reporting and accounting requirements?

• What components of your enterprise do you need to report on separately?

• Which components can be represented by building a hierarchy of values to provide reporting at both detail and

summary levels?

• Where are you on the spectrum of centralization versus decentralization?

Business Unit Management

• What reporting do I need by business unit?

• How can you set up your departments or business unit accounts to achieve departmental hierarchies that

report accurately on your lines of business?

• What reporting do you need to support the managers of your business units, and the executives who measure

them?

• How often are business unit results aggregated?

• What level of reporting detail is required across business units?

Security Structure

• What level of security and access is allowed?

• Are business unit managers and the people that report to them secured to transactions within their own

business unit?

• Are the transactions for their business unit largely performed by a corporate department or shared service

center?

Compliance Requirements

• How do you comply with your corporate external reporting requirements and local statutory reporting

requirements?

• Do you tend to prefer a corporate first or an autonomous local approach?

• Where are you on a spectrum of centralization, very centralized or decentralized?

Model Your Enterprise Management Structure

This example uses a fictitious global company to demonstrate the analysis that can occur during the enterprise

structure configuration planning process.

Scenario

Your company, InFusion Corporation, is a multinational conglomerate that operates in the United States (US) and the

United Kingdom (UK). InFusion has purchased an Oracle Fusion Cloud Enterprise Resource Planning (ERP) solution

including Oracle General Ledger and all of the Oracle Fusion Cloud Applications subledgers. You are chairing a

committee to discuss creation of a model for your global enterprise structure including both your US and UK operations.

7

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

InFusion Corporation

InFusion Corporation has 400 plus employees and revenue of 120 million US dollars. Your product line includes all

the components to build and maintain air quality monitoring applications for homes and businesses. You have two

distribution centers and three warehouses that share a common item master in the US and UK. Your financial services

organization provides funding to your customers for the initial costs of these applications.

The following are elements you must consider in creating your model for your global enterprise structure.

• Your company is required to report using US Generally Accepted Accounting Principles (GAAP) standards and

UK Statements of Standard Accounting Practice and Financial Reporting Standards. How many ledgers do you

want to achieve proper statutory reporting?

• Your managers need reports that show profit and loss (revenue and expenses) for their lines of business. Do

you use business units and balancing segments to represent your divisions and businesses? Do you secure data

by two segments in your chart of accounts which represents each department and legal entity? Or do you use

one segment that represents both to produce useful, but confidential management reports?

• Your corporate management requires reports showing total organizational performance with drill-down

capability to the supporting details. Do you need multiple balancing segment hierarchies to achieve proper

rollup of balances for reporting requirements?

• Your company has all administrative, account payables, procurement, and Human Resources functions

performed at their corporate headquarters. Do you need one or more business units in which to perform all

these functions? How is your shared service center configured?

Global Enterprise Structure Model

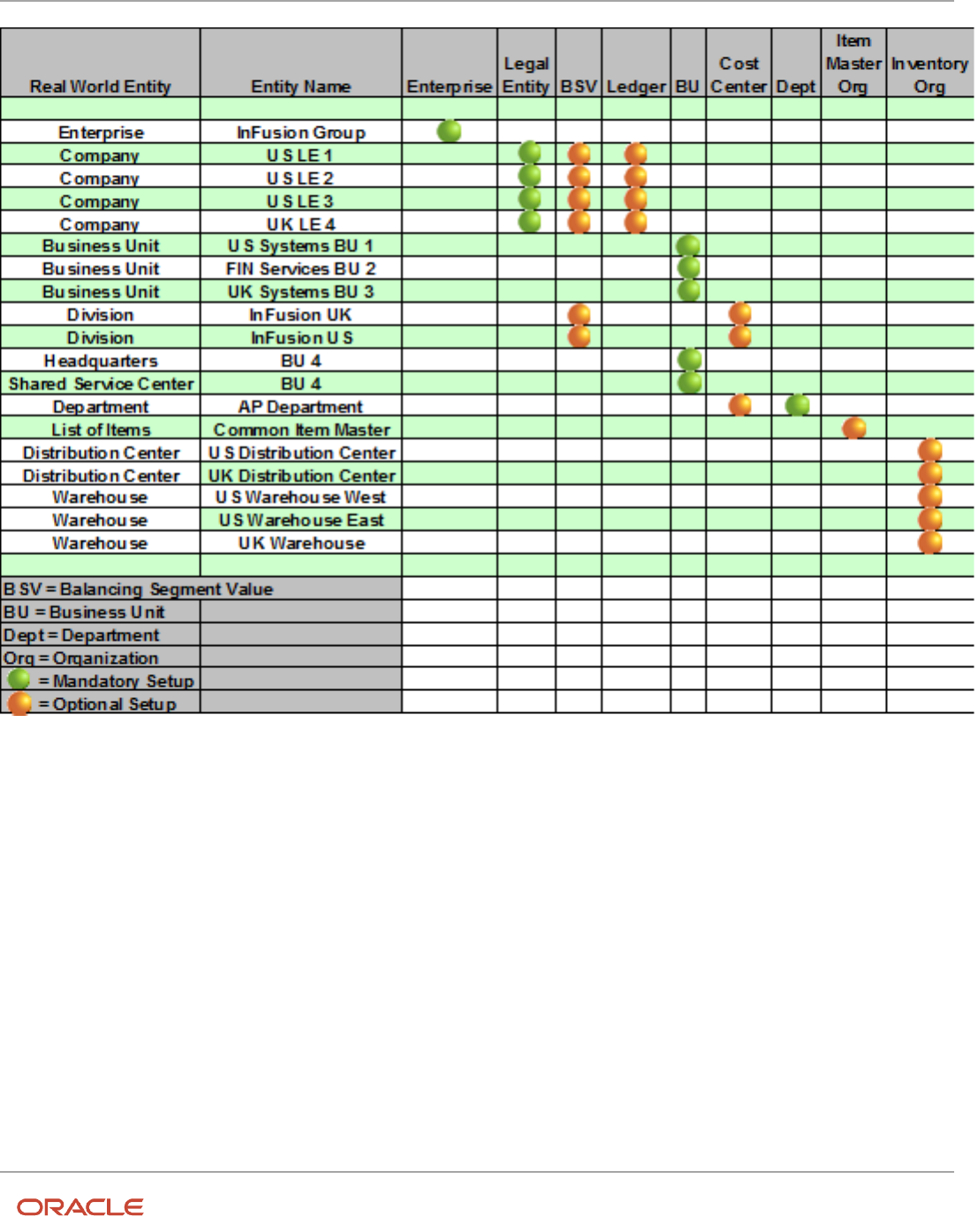

The following figure and table summarize the model that your committee has designed and uses numeric values to

provide a sample representation of your structure. The model includes the following recommendations:

• Creation of three separate ledgers representing your separate legal entities:

◦

InFusion America Inc.

◦

InFusion Financial Services Inc.

◦

InFusion UK Services Ltd.

• Consolidation of results for application components, installations, and maintenance product lines across the

enterprise

• All UK general and administrative costs processed at the UK headquarters

• US Systems' general and administrative costs processed at US Corporate headquarters

• US Financial Services maintains its own payables and receivables departments

8

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

9

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

In this chart, the green globe stands for required and gold globe stands for optional setup. The following statements

expand on the data in the chart.

• The enterprise is required because it serves as an umbrella for the entire implementation. All organizations are

created within an enterprise.

• Legal entities are also required. They can be optionally mapped to balancing segment values or represented

by ledgers. Mapping balancing segment values to legal entities is required if you plan to use the intercompany

functionality. The InFusion Corporation is a legal entity but isn't discussed in this example.

• At least one ledger is required in an implementation in which you record your accounting transactions.

• Business units are also required because financial transactions are processed in business units.

• A shared service center is optional, but if used, must be a business unit.

• Divisions are optional and can be represented with a hierarchy of cost centers or by a second balancing

segment value.

• Departments are required because they track your employees.

• Optionally, add an item master organization and inventory organizations if you're tracking your inventory

transactions in Oracle Fusion Applications.

10

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Note: Some Oracle Fusion Cloud Human Capital Management implementations don't require recording accounting

transactions and therefore, don't require a ledger.

Overview of Diagnostic Tests for Enterprise Structures

Setup

You can run diagnostic tests to perform a health check and data validation on the data for these enterprise structure

setups.

• Chart of accounts

• Value sets and values

• Account hierarchies versions

• Accounting calendars

• Legal entities and legal reporting units

• Ledgers setup

To access the Diagnostic Dashboard and run the diagnostic tests, you must be granted the Application Diagnostics

Regular User job role. After you have been granted the role, you can run the diagnostics tests by selecting the Run

Diagnostics Tests link in the Settings and Actions menu.

Note: If you have the Application Diagnostics Viewer job role, you can view the diagnostic test results, but not run the

diagnostic tests.

Enterprise Structures Setup Report

Validate your enterprise structures configuration using the Enterprise Structures Setup Report. This report provides the

detailed listing of chart of accounts, segments, value sets, ledgers, legal entities, business units, and account hierarchy

information.

Use this auditable report in multiple formats such as HTML, PDF, RTF, Excel, Power Point, and CSV to improve your off-

line analysis requirements.

How it Works

Run as a scheduled process with a value for the Chart of Accounts parameter.

Report Security

The following duty roles are assigned privileges that include managing and reviewing accounting configurations.

• General Accounting Setup Review

• Enterprise Structures Administration

11

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Setup Data Import and Export for Oracle Fusion

Financials

The following table describe the manual tasks that you must complete as part of the setup data export and import

processes for the Oracle Fusion Financials offering.

Section Description

Setup tasks performed before export

Perform these tasks prior to starting export processes for the Financials offering.

Setup tasks performed before import

Perform these tasks prior to starting import processes for the Financials offering.

Setup tasks performed after import

Review and perform the manual setup steps on the target instance as required. Setup data for these

tasks isn't imported from the source instance.

Setup tasks not requiring data import

Perform these tasks on the target instance as required. These setup tasks don't require data import.

Refer to the Oracle Fusion Functional Setup Manager User's Guide for the steps to perform setup data export and

import processes.

Setup Tasks Performed Before Export

Prior to starting the export processes from the source instance, you must verify and update setup for the following task

described in the table. Verifying the setup ensures that data is correctly imported into the target instance.

Activity Name Task Name Setup Steps

Define Chart of Accounts

Manage Account Combinations

Account combinations aren't exported from

the source instance. Before exporting, navigate

to the Manage Chart of Accounts Instance

page on the source instance and verify that

dynamic insertion is enabled for your charts

of accounts. As long as dynamic insertion is

enabled, account combinations are created

automatically as needed on the target instance.

Setup Tasks Performed Before Import

Prior to starting import processes into the target instance, you must verify and update setup for the following task

described in the table.

12

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Activity Name Task Name Setup Steps

Define Common Applications Configuration for

Financials

Define Implementation Users

The import process doesn't include

implementation users and roles associated with

them.

For more information, see Oracle Fusion

Middleware Enterprise Deployment Guide for

Oracle Identity Management.

Setup Tasks Performed After Import

Setup data for the following tasks listed in the table aren't imported. Review these tasks for relevance to your

implementation. For relevant tasks, open the corresponding setup pages from your implementation project to create

the setup on the target instance as needed.

Activity Name Task Name

Define General Ledger Options

Manage Journal Approval Rules

Define Approval Management for

Financials

• Manage Task Configurations for Financials

• Manage Approval Groups for Financials

Define Tax Geographies

Manage Tax Geographies

Define Payables

• Define Automated Invoice Processing Configuration

• Manage Payables Document Sequences

Define Image Processing

Configure Document Capture Parameters

Define Customer Billing Configuration

Manage Salesperson Account References

Define Customer Payments

Manage Receivables Specialist Assignment Rules

Setup data for the following tasks listed in the table aren't imported from the source instance. Review the steps in the

following table to create the setup on the target instance as needed.

Activity Name Task Name Setup Steps

Define Credit Card Data

Extend Employee Matching Rules

Write user-defined PL/SQL code to extend

the predefined criteria for automatically

matching new corporate cards to employees to

incorporate your company-specific criteria. If

you use a user-defined matching rule, then the

PL/SQL package isn't imported to the target

instance. You can create the package in the

target instance or copy the package to the

target instance and compile it.

13

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Activity Name Task Name Setup Steps

Define Customer

Create Customer

Manually create customers, using the Create

Customer task in Functional Setup Manager,

or import customer information by running

the Trading Community Model Data Import

program.

Define Customer

Manage Customers

Manually maintain customer information using

the Manage Customer task in Functional Setup

Manager, or by running the Trading Community

Model Data Import program.

Configure Payment System Connectivity

Manage BI Publisher Templates

Manually import any new or updated BI

Publisher templates. Use the BI Publisher

archiving feature, or alternatively perform the

following steps:

1. Download the template file from the

source Oracle BI Publisher catalog.

2. Update or create a new template in the

target Oracle BI Publisher catalog.

3. Upload the source template file to the

target template.

Define Subledger Accounting Rules

Import Supporting Reference Initial Balances

This task allows upload of initial subledger

balances for supporting references. These

balances aren't imported from the source

instance, but can be loaded directly to the

target instance.

For more information, see Oracle Fusion

Accounting Hub Implementation Guide, Define

Accounting Transformation.

Configure Payment System Connectivity

Integrate External Payment Systems

Setup entities resulting from this integration

are exported and imported through the

Transmission Configuration service. However,

any work performed outside of Oracle Fusion

Applications to integrate with a payment

system must be applied to the production

environment manually. Examples include user-

defined code, routers, or dedicated lines to

facilitate communication.

Define Payments Security

Manage System Security Options

This setup can't be imported and must be set

up again in a production instance. Use the steps

documented in the Oracle Fusion Applications

Post-Installation Guide.

Define Financial Reporting Center

Configuration

Configure Smart View Client for Users

Manually reconfigure the Smart View client to

point to the production instance.

For more information about configuring the

Smart View client for users, see:

14

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Activity Name Task Name Setup Steps

• Oracle Fusion Accounting Hub

Implementation Guide, Define Financial

Reporting

• Oracle Enterprise Performance

Management System Installation and

Configuration Guide for Oracle Enterprise

Performance Management, Installing

Smart View and other topics

• Oracle Hyperion Smart View for Office

User's Guide for Oracle Hyperion Smart

View

Define Financial Reporting Center

Configuration

Define Essbase Database Connection in

Workspace

Manually reconfigure the Essbase database

connection in Hyperion Workspace.

For more information about configuring the

Hyperion Workspace Database Connection, see

Oracle Fusion Accounting Hub Implementation

Guide, Define Financial Reporting,

Define Financial Reporting

Create Financial Statements

Export the financial report definitions from

Workspace in the source environment.

When exporting, you can export a single report,

multiple reports in a .zip file, or an entire folder

structure in a .zip file.

1. Navigator > General Accounting: Financial

Reporting Center > Open Workspace for

Financial Reports.

2. Navigate > Applications > BI Catalog.

3. File > Export.

4. Save the file to the local desktop.

Import the file into Workspace in the target

environment.

1. Navigator > General Accounting: Financial

Reporting Center > Open Workspace for

Financial Reports.

2. Navigate > Applications > BI Catalog.

3. File > Import.

4. Select the file you had saved during the

export.

If you import the folder structure, the entire

structure from the source instance is imported

into the existing structure on the target

instance. This could result in some redundant

folders. In this case, you can reorganize child

folders in the structure on the target instance

and delete any unneeded folders.

Define Period Close Components

Manage Allocations and Periodic Entries

Export the allocation rules, rule sets,

variables, and run time prompt definitions

from Calculation Manager in the source

environment.

15

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Activity Name Task Name Setup Steps

When exporting, you can export at the

application level or at a single rule or rule set

level.

Note:

You must export and import rules for each

application on the Essbase server separately.

1. Navigator > General Accounting: Journals

> Create Allocation Rules.

2. Navigator > Administer > Calculation

Manager

3. File > Export.

4. Save the file to the local desktop.

Import the file into Calculation Manager in the

target environment.

1. Navigator > General Accounting: Journals

> Create Allocation Rules.

2. Navigator > Administer > Calculation

Manager

3. Navigate to File > Import.

4. Select the file you saved during the export.

Define Hyperion Financial Management

Integration

Define Hyperion Financial Management

Configuration

Manually import the rules using the Oracle

Enterprise Performance Management Lifecycle

Management tool.

For more information, see the Oracle Hyperion

Artifact Lifecycle Management Utility User's

Guide.

Define Hyperion Financial Management

Integration

Define ERP Integrator Configuration for

Hyperion Financial Management

Manually import the rules using the Oracle

Enterprise Performance Management Lifecycle

Management tool.

For more information, see the Oracle Hyperion

Artifact Lifecycle Management Utility User's

Guide.

Define Budget Configuration

Define Budget Configuration in Hyperion

Planning

Manually import the rules using the Oracle

Enterprise Performance Management Lifecycle

Management tool.

For more information, see the Oracle Hyperion

Artifact Lifecycle Management Utility User's

Guide.

Define Budget Configuration

Define ERP Integrator Configuration for

Hyperion Planning

Manually import the rules using the Oracle

Enterprise Performance Management Lifecycle

Management tool.

For more information, see the Oracle Hyperion

Artifact Lifecycle Management Utility User's

Guide.

16

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Setup Tasks Not Requiring Data Import

The following tasks in the setup task list are available to support your overall implementation approach. These tasks

listed in the following table don't require any data to be imported. You can perform these tasks on the target instance as

required.

Activity Name Task Name

Define Tax Configuration

• Run Jurisdiction and Rates Upload Program

• Manage Simulator Transactions

Define Fixed Assets Configuration

Verify Data Role Generation for Asset Books

Define Disbursements

Grant Payment Function Access

Configure Payment System Connectivity

View Validations

Initial Configuration

How You Establish Enterprise Structures Using the Enterprise

Structures Configurator

The Enterprise Structures Configurator is an interview-based tool that guides you through the process of setting up a

basic enterprise structure.

By answering questions about your enterprise, the tool creates a structure of divisions, legal entities, business units,

and reference data sets that reflects your enterprise structure. After you create your enterprise structure, you also

follow a guided process to determine whether to use positions, and whether to set up additional attributes for jobs and

positions. After you define your enterprise structure and your job and position structures, you can review them, make

any necessary changes, and then load the final configuration.

17

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

This figure illustrates the process to configure your enterprise using the Enterprise Structures Configurator.

To be able to use the Enterprise Structures Configurator, you must select the Enterprise Structures Guided Flow feature

for your offerings on the Configure Offerings page in the Setup and Maintenance work area. If you don't select this

feature, then you must set up your enterprise structure using individual tasks provided elsewhere in the offerings, and

you can't create multiple configurations to compare different scenarios.

Establish Enterprise Structures

To define your enterprise structures, use the guided flow within the Establish Enterprise Structures task to enter basic

information about your enterprise, such as the primary industry. You then create divisions, legal entities, business

units, and reference data sets. The Establish Enterprise Structures task enables you to create multiple enterprise

configurations so that you can compare different scenarios. Until you load a configuration, you can continue to create

and edit multiple configurations until you arrive at one that best suits your enterprise.

Establish Job and Position Structures

You also use a guided process to determine whether you want to use jobs only, or jobs and positions. The primary

industry that you select in the Establish Enterprise Structures task provides the application with enough information to

make an initial recommendation. You can either accept the recommendation, or you can answer additional questions

about how you manage people in your enterprise, and then make a selection. After you select whether to use jobs or

positions, you're prompted to set up a descriptive flexfield structure for jobs, and for positions if applicable. Descriptive

flexfields enable you to get more information when you create jobs and positions.

18

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Review Configuration

You can view a result of the interview process prior to loading the configuration. The review results, show the divisions,

legal entities, business units, reference data sets, and the management reporting structure that the application will

create when you load the configuration.

Load Configuration

You can load only one configuration. When you load a configuration, the application creates the divisions, legal entities,

business units, and so on. After you load the configuration, you then use individual tasks to edit, add, and delete

enterprise structures.

This table lists the order of creation of business objects by the Enterprise Structures Configurator

Business Object Task

Location Location Details

Division Manage Divisions

Business Unit Manage Business Units

Set Assignment Override Manage Set Assignments

Legislative Data Group Manage Legislative Data Groups

Enterprise Manage Enterprise HCM Information

Job and Position Flexfield

Definitions

Manage Descriptive Flexfields

Legal Entity

• Manage Legal Entities

• Manage Legal Entity HCM Information

• Manage Legal Reporting Unit HCM Information

Organization Tree Manage Organization Trees

How You Roll Back an Enterprise Structure Configuration

The Enterprise Structures Configurator provides the ability to roll back an enterprise configuration.

Roll Back a Configuration Manually

You can manually roll back an enterprise configuration after loading it, for example, because you decide you don't

want to use it. Clicking the Roll Back Configuration button on the Manage Enterprise Configuration page rolls back any

enterprise structures that were created as a part of loading the configuration.

Roll Back a Configuration Automatically

If an error occurs during the process of loading the configuration, then the application automatically rolls back any

enterprise structures that were created before the error was encountered.

19

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

Design an Enterprise Configuration

This example illustrates how to set up an enterprise based on a global company operating mainly in the US and the UK

with a single primary industry.

Scenario

InFusion Corporation is a multinational enterprise in the high technology industry with product lines that include all

the components that are required to build and maintain air quality monitoring systems for homes and businesses.

Its primary locations are in the US and the UK, but it has smaller outlets in France, Saudi Arabia, and the United Arab

Emirates (UAE).

Enterprise Details

In the US, InFusion employs 400 people and has company revenue of 120 million US dollars. Outside the US, InFusion

employs 200 people and has revenue of 60 million US dollars.

InFusion requires three divisions.

• The US division covers the US locations.

• The Europe division covers UK and France.

• Saudi Arabia and the UAE are covered by the Middle East division.

InFusion requires legal entities with legal employers, payroll statutory units, tax reporting units, and legislative data

groups for the US, UK, France, Saudi Arabia, and UAE, to employ and pay its workers in those countries.

InFusion requires a number of departments across the enterprise for each area of business, such as sales and

marketing, and a number of cost centers to track and report on the costs of those departments.

InFusion has general managers responsible for business units within each country. Those business units may share

reference data. Some reference data can be defined within a reference data set that multiple business units may

subscribe to. Business units are also required for financial purposes. Financial transactions are always processed within

a business unit.

Resulting Enterprise Configuration

Based on this analysis, InFusion requires an enterprise with multiple divisions, ledgers, legal employers, payroll statutory

units, tax reporting units, legislative data groups, departments, cost centers, and business units.

This figure illustrates the enterprise configuration that results from the analysis of InFusion Corporation.

20

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

FAQs for Initial Configuration

What happens if I don't use the Enterprise Structures Configurator to set up my

enterprise structures?

The Enterprise Structures Configurator is an interview-based tool that guides you through setting up divisions, legal

entities, business units, and reference data sets.

If you don't use the Enterprise Structures Configurator, then you must set up your enterprise structure using the

individual tasks that correspond to each enterprise component. In addition, you can't set up multiple configurations and

21

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 1

Enterprise Structures Introduction

compare different scenarios. Using the Enterprise Structures Configurator is the recommended process for setting up

your enterprise structures.

What's an ultimate holding company?

The legal entity that represents the top level in your organization hierarchy, as defined by the legal name entered for the

enterprise. This designation is used only to create an organization tree, with these levels:

• Ultimate holding company as the top level

• Divisions and country holding companies as the second level

• Legal employers as the third level

What's the default reference data set?

The reference data set that is assigned to a business unit for all reference data groups, such as grades, locations,

departments, and jobs. You can override the default reference data set for any reference data group.

Related Topics

•

What happens if I override the set assignment?

What happens if I override the set assignment?

For the selected business unit, you can override the default reference data set for one or more reference data groups.

For example, assume you have three reference data groups: Vision 1 SET, Vision 2 SET, and Vision 3 SET, where Vision

SET 1 is the default set for business unit United Kingdom Vision 1 BU. You can override the default so that:

• Grades are assigned to Vision 2 SET.

• Departments are assigned to Vision 3 SET.

• Jobs are assigned to the default set, Vision 3 SET.

When do I create or edit ISO languages?

Edit the names and descriptions of International Organization for Standardization (ISO) languages to determine how

they appear in the application. The ISO languages are a part of the ISO 639 standard.

If any change to the ISO standard doesn't reflect in the application, you can update the ISO alpha-2 code or add

languages to provide up-to-date information.

Can I add or edit time zones?

You usually don't add or edit time zones because all standard time zones are provided. However, you may create time

zones if new zones become standard and the application isn't yet updated with the latest values.

You can rename existing time zones and enable them. Only the enabled time zones are available for all users to select

while setting their regional general preferences.

To add or edit time zones, use the following in the Setup Maintenance work area:

• Functional Area: Application Extensions

• Task: Manage Time Zones

22

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 2

Reference Data Sharing

2 Reference Data Sharing

Reference Data Sharing

Reference data sharing facilitates sharing of configuration data such as jobs and payment terms, across organizational

divisions or business units.

You define reference data sets and determine how common data is shared or partitioned across business entities to

avoid duplication and reduce maintenance effort. Depending on the requirement (specific or common), each business

unit can maintain its data at a central location, using a set of values either specific to it or shared by other business

units.

A common reference data set is available as the default set, which can be assigned to several business units sharing

the same reference data. For commonly used data such as currencies, you can use the common reference data set and

assign it to multiple business units in various countries that use the same currency. In cases where the default set can't

be assigned to an entity, you can create specific sets. The data set visible on the transactional page depends on the

sharing method used to share reference data.

For example, XYZ Corporation uses the same grades throughout the entire organization. Instead of different business

units setting up and using the same grades, XYZ Corporation decides to create a set called Grades, which contains the

grades. All business units in the organization have the Grades set so that the grades can be shared and used.

Note: For specific information about configuring reference data sharing for a particular object or product, refer to the

relevant product documentation.

Related Topics

•

Reference Data Sets

•

Reference Data Sets and Sharing Methods

•

Assignment of Reference Data Sets to Reference Objects

Reference Data Sets

Reference data sets are logical groups of reference data that various transactional entities can use depending on the

business context. You can get started using either the common reference data set or the enterprise set depending on

your implementation requirement.

You can also create and maintain additional reference data sets, while continuing to use the common reference data set.

Consider the following scenario. Your enterprise can decide that only some aspects of corporate policy should affect all

business units. The remaining aspects are at the discretion of the business unit manager to implement. This enables

your enterprise to balance autonomy and control for each business unit.

For example, your enterprise holds business unit managers accountable for their profit and loss, but manages working

capital requirements at a corporate level. Then, you can let managers define their own sales methods, but define

23

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 2

Reference Data Sharing

payment terms centrally. As a result, each business unit has its own reference data set for sales methods and one central

reference data set for payment terms assigned to all business units.

Partitioning

Partitioning reference data and creating data sets provide you the flexibility to handle the reference data to fulfill your

business requirements. You can share modular information and data processing options among business units with

ease. You can create separate sets and subsets for each business unit. Alternatively, you can create common sets or

subsets to enable sharing reference data between several business units, without duplicating the reference data.

The following figure illustrates the reference data sharing method. The user can access the data assigned

to a specific set in a particular business unit, as well as access the data assigned to the common set.

Related Topics

•

Reference Data Sets and Sharing Methods

•

Assignment of Reference Data Sets to Reference Objects

Reference Data Sets and Sharing Methods

Oracle Fusion Cloud Applications reference data sharing feature is also known as Set ID. The reference data sharing

functionality supports operations in multiple ledgers, business units, and warehouses.

As a result, there's a reduction in the administrative burden and the time to implement new business units. For example,

you can share sales methods, or transaction types across business units. You may also share certain other data across

asset books, cost organizations, or project units.

24

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 2

Reference Data Sharing

The reference data sharing features use reference data sets to which reference data is assigned. The reference data sets

group assigned reference data. The sets can be understood as buckets of reference data assigned to multiple business

units or other application components.

Reference Data Sets

You begin this part of your implementation by creating and assigning reference data to sets. Make changes carefully as

changes to a particular set affect all business units or application components using that set. You can assign a separate

set to each business unit for the type of object that's being shared. For example, assign separate sets for payment

terms, transaction types, and sales methods to your business units.

Your enterprise can determine that certain aspects of your corporate policy can affect all business units. The remaining

aspects are at the discretion of the business unit manager to implement. This allows your enterprise to balance

autonomy and control for each business unit. For example, your enterprise holds business unit managers accountable

for their profit and loss, but manages working capital requirements at a corporate level. In such a case, you can let

managers define their own sales methods, but define payment terms centrally. In this example:

• Each business unit has its own reference data set for sales methods.

• One central reference data set for payment terms is assigned to all business units.

The reference data sharing is especially valuable for lowering the cost of setting up new business units. For example,

your enterprise operates in the hospitality industry. You're adding a new business unit to track your new spa services.

The hospitality divisional reference data set can be assigned to the new business unit to quickly set up data for this

entity component. You can establish other business unit reference data in a business unit-specific reference data set as

needed.

Reference Data Sharing Methods

Variations exist in the methods used to share data in reference data sets across different types of objects. The following

list identifies the methods:

• Assignment to one set only, no common values allowed. This method is the simplest form of sharing reference

data that allows assigning a reference data object instance to one and only one set. For example, Asset Prorate

Conventions are defined and assigned to only one reference data set. This set can be shared across multiple

asset books, but all the values are contained only in this one set.

• Assignment to one set only, with common values. This method is the most commonly used method of sharing

reference data that allows defining reference data object instance across all sets. For example, Receivables

Transaction Types are assigned to a common set that's available to all the business units. You need not

explicitly assign the transaction types to each business unit. In addition, you can assign a business unit-specific

set of transaction types. At transaction entry, the list of values for transaction types includes the following:

◦

Transaction types from the set assigned to the business unit.

◦

Transaction types assigned to the common set that's shared across all business units.

• Assignment to multiple sets, no common values allowed. The method of sharing reference data that allows

a reference data object instance to be assigned to multiple sets. For instance, Payables Payment Terms use

this method. It means that each payment term can be assigned to one or more than one set. For example,

you assign the payment term Net 30 to several sets, but assign Net 15 to a set specific only to your business

unit. At transaction entry, the list of values for payment terms consists of only the set that's assigned to the

transaction's business unit.

25

Oracle Fusion Cloud Financials

Implementing Enterprise Structures and General Ledger

Chapter 2

Reference Data Sharing

Note: Oracle Fusion Applications contains a reference data set called Enterprise. Define any reference data that

affects your entire enterprise in this set. Also update the data set going forward as you create reference data items.

Related Topics

•

Items and Supplier Site Reference Data Sharing

•

What reference data objects can be shared across cost organizations?

•

What reference data objects can be shared across project units?

•

What reference data objects can be shared across business units?

•

What reference data objects can be shared across asset books?

How Business Units Work with Reference Data Sets

Reference data sharing enables you to group set-enabled reference data such as jobs or grades to share the data across

different parts of the organization.