NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State Of New York)

FINANCIAL STATEMENTS

March 31, 2023

Table of Contents

March 31, 2023

Page(s)

Responsibility for Financial Reporting 1

Independent Auditors’ Report 2

Management’s Discussion and Analysis 4

Government-wide Financial Statements

Statement of Net Position 12

Statement of Activities 13

Government Fund Financial Statements

Balance Sheet 14

Statement of Revenues, Expenditures and Changes in Fund Balances 15

Proprietary Fund Financial Statements

Statement of Net Position 16

Statement of Revenues, Expenses and Changes in Fund Net Position 17

Statement of Cash Flows 18

Fiduciary Fund Financial Statements

Statement of Net Position 19

Statement of Changes in Fiduciary Net Position 20

Notes to the Basic Financial Statements 21

Required Supplementary Information

Schedule of NYSERDA’s Contributions of the System Pension Fund 51

Schedule of NYSERDA’s Proportionate Share of the System’s Net Pension Liability 51

Schedule of Changes in Net OPEB Liability (Asset) and Related Ratios 52

Schedule of NYSERDA’s Contributions for OPEB 53

Schedule of Investment Returns- OPEB Trust 53

Independent Auditors’ Report

Members of the Authority

New York State Energy Research and Development Authority:

Report on the Audit of the Financial Statements

Opinions

We have audited the financial statements of the governmental activities, the business-type activities, each

major fund, and the aggregate remaining fund information of the New York State Energy Research and

Development Authority (the Authority), a component unit of the State of New York, as of and for the year ended

March 31, 2023, and the related notes to the financial statements, which collectively comprise the Authority’s

basic financial statements as listed in the table of contents.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects,

the respective financial position of the governmental activities, the business-type activities, each major fund,

and the aggregate remaining fund information of the Authority, as of March 31, 2023, and the respective

changes in financial position and, where applicable, cash flows thereof for the year then ended in accordance

with U.S. generally accepted accounting principles.

Basis for Opinions

We conducted our audit in accordance with auditing standards generally accepted in the United States of

America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards,

issued by the Comptroller General of the United States. Our responsibilities under those standards are further

described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We

are required to be independent of the Authority and to meet our other ethical responsibilities, in accordance

with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinions.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance

with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of

internal control relevant to the preparation and fair presentation of financial statements that are free from

material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or

events, considered in the aggregate, that raise substantial doubt about the Authority’s ability to continue as a

going concern for twelve months beyond the financial statement date, including any currently known

information that may raise substantial doubt shortly thereafter.

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free

from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our

opinions. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not

a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always

detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from

fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions,

KPMG LLP

515 Broadway

Albany, NY 12207-2974

KPMG LLP, a Delaware limited liability partnership and a member firm of

the KPMG global organization of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee.

2

3

misrepresentations, or the override of internal control. Misstatements are considered material if there is a

substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a

reasonable user based on the financial statements.

In performing an audit in accordance with GAAS

and Government Auditing Standards, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or

error, and design and perform audit procedures responsive to those risks. Such procedures include

examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the Authority’s internal control. Accordingly, no such opinion is expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluate the overall presentation of the financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise

substantial doubt about the Authority’s ability to continue as a going concern for a reasonable period of

time.

We are required to communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit, significant audit findings, and certain internal control related matters that

we identified during the audit.

Required Supplementary Information

U.S. generally accepted accounting principles require that management’s discussion and analysis and the

required supplementary information as listed in the table of contents be presented to supplement the basic

financial statements. Such information is the responsibility of management and, although not a part of the basic

financial statements, is required by the Governmental Accounting Standards Board who considers it to be an

essential part of financial reporting for placing the basic financial statements in an appropriate operational,

economic, or historical context. We have applied certain limited procedures to the required supplementary

information in accordance with GAAS, which consisted of inquiries of management about the methods of

preparing the information and comparing the information for consistency with management’s responses to our

inquiries, the basic financial statements, and other knowledge we obtained during our audit of the basic

financial statements. We do not express an opinion or provide any assurance on the information because the

limited procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated June 30, 2023 on

our consideration of the Authority’s internal control over financial reporting and on our tests of its compliance

with certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of

that report is solely to describe the scope of our testing of internal control over financial reporting and

compliance and the results of that testing, and not to provide an opinion on the effectiveness of the Authority’s

internal control over financial reporting or on compliance. That report is an integral part of an audit performed in

accordance with Government Auditing Standards in considering the Authority’s internal control over financial

reporting and compliance.

Albany, New York

June 30, 2023

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

4

The following Management’s Discussion and Analysis (MD&A) of New York State Energy Research and

Development Authority’s (NYSERDA) financial performance provides an overview of NYSERDA’s financial

activities for the fiscal year ended March 31, 2023. The information contained in the MD&A should be

considered in conjunction with the information presented as part of NYSERDA’s basic financial statements.

Following this MD&A are the basic financial statements of NYSERDA with the notes thereto that are

essential to a full understanding of the data contained in the financial statements. NYSERDA’s basic financial

statements have the following components: (1) government-wide financial statements; (2) governmental fund

financial statements; (3) proprietary fund financial statements; (4) fiduciary fund financial statements; and (5)

notes to the basic financial statements.

The government-wide financial statements are designed to provide readers with a broad overview of

NYSERDA’s finances in a manner similar to a private-sector business. The Statement of Net Position

presents information on all of NYSERDA’s assets, deferred outflows of resources, liabilities, and deferred

inflows of resources, and the difference between these is reported as net position. The Statement of

Activities presents information showing how NYSERDA’s net position changed during the fiscal year. All

changes in net position are reported as soon as the underlying event giving rise to the change occurs,

regardless of the timing of the related cash flows. Thus, revenues and expenses are reported in the

Statement for some items that will result in cash flows in future fiscal periods, or which already resulted in

cash flows in a prior fiscal period. The government-wide financial statements present information about

NYSERDA as a whole. All activities of NYSERDA are considered to be governmental activities, with the

exception of the activities of NY Green Bank, which are considered business-type activities.

Governmental fund financial statements focus on near-term inflows and outflows of resources, as well as on

balances of resources available at the end of the fiscal year. Such information may be useful in evaluating a

government’s near-term financing requirements. Because the focus of governmental funds is narrower than

that of the government-wide statements, it is useful to compare the information presented for governmental

activities in the government-wide financial statements. By doing so, the reader may better understand the

long-term impact of the government’s near-term financing decisions. The governmental funds Balance Sheet

and the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances provide

a reconciliation to facilitate the comparison between governmental funds and governmental activities.

Proprietary fund financial statements provide information for business-type activities where NYSERDA

charges fees to customers to recover costs of providing services. NY Green Bank is reported as a

proprietary fund. The proprietary fund financial statements include a Statement of Net Position, a Statement

of Revenues, Expenses and Changes in Fund Net Position, and a Statement of Cash Flows.

The fiduciary fund financial statements report assets held by NYSERDA in a fiduciary capacity for others and

consist of a Statement of Fiduciary Net Position and a Statement of Changes in Fiduciary Net Position.

These funds are not reflected in the government-wide financial statements because the resources of those

funds are not available to support NYSERDA’s programs.

The notes to the basic financial statements provide additional information that is essential for a full

understanding of the information provided in the government-wide, governmental fund, proprietary fund, and

fiduciary fund financial statements.

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

5

BACKGROUND

The mission of NYSERDA is to advance clean energy innovation and investments to combat climate change,

improve the health, resiliency, and prosperity of New Yorkers, and deliver benefits equitably to all. These

efforts are key to developing a less polluting and more reliable and affordable energy system for all New

Yorkers. Collectively, NYSERDA’s efforts aim to reduce greenhouse gas emissions, accelerate economic

growth, and reduce customer energy bills. NYSERDA works with stakeholders throughout New York

including residents, business owners, developers, community leaders, local government officials, university

researchers, utility representatives, investors, and entrepreneurs. NYSERDA partners with them to develop,

invest, and foster the conditions that attract the private sector capital investment needed to expand New

York’s clean energy economy, overcome barriers to using clean energy at a large-scale in New York, and

enable New York’s communities and residents to benefit from energy efficiency and renewable energy.

New York State’s nation-leading climate plan calls for an orderly and just transition to clean energy that

creates jobs and continues fostering a green economy in New York State, as memorialized through the

Climate Leadership and Community Protection Act (“CLCPA”). NYSERDA is charged with coordinating much

of the work to attain New York’s goals as stated in the CLCPA, including driving energy efficiency

improvements to reduce statewide energy use by 185 TBtu, attain a zero-emission electricity sector by 2040

with 70 percent renewable energy generation by 2030, and reach economy wide carbon neutrality around

mid-century. NYSERDA works, directly and through partnerships, to achieve these goals. In so doing, it

strives to attract private investment to better leverage government funding and realize economies of scale.

Consistent with the CLCPA, NYSERDA works to invest or direct resources to ensure that disadvantaged

communities receive at least 35 percent, with the goal of 40 percent, of overall benefits of spending on clean

energy and energy efficiency programs.

Underpinning this critical work, NYSERDA also plays a key role in ensuring energy security for New York

State, by providing the State’s energy policy decision makers with a wide range of data and analyses to

support policy making including the ongoing maintenance of the strategic fuel reserves to ensure an

appropriate supply is available for first responders in the event of a fuel supply emergency.

The funding to carry out initiatives in support of these goals is primarily supported by ratepayer surcharges

collected by utilities on NYSERDA’s behalf through their regular billing processes. Such funding is

determined and overseen by the Public Service Commission (PSC) and documented in various orders

issued by the PSC, including the Clean Energy Fund (CEF) and Clean Energy Standard (CES) orders.

NYSERDA receives some additional variable funding through regional greenhouse gas allowance auction

proceeds that accrue to NYS as a result of its membership in the Regional Greenhouse Gas Initiative (RGGI)

that allow NYSERDA to complement and amplify high-priority energy initiatives that realize benefits in

disadvantaged communities and expand private investment and partnerships without cost to the State.

NYSERDA also receives a small portion of its budget from direct state appropriations to support energy

analysis and planning and energy safety and security activities.

FORWARD LOOKING STATEMENTS

The statements in this management’s discussion and analysis (MD&A) that are not purely historical facts are

forward-looking statements based on current expectations of future events. Such forward-looking statements

are necessarily based on various assumptions and estimates and are inherently subject to various risks and

uncertainties, including, but not limited to, risks and uncertainties relating to the possible invalidity of the

underlying assumptions and estimates and possible changes to or development in various important factors.

Accordingly, actual results may vary from those we presently expect, and such variations may be material.

We therefore caution against placing undue reliance on any forward-looking statements contained in this

MD&A. All forward-looking statements included in this MD&A are made only as of the date of this MD&A and

we assume no obligation to update any such forward-looking statements as a result of new information,

future events or other factors.

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

6

CONDENSED FINANCIAL INFORMATION

The following condensed financial information is presented from NYSERDA’s government-wide financial

statements:

(Amounts in thousands)

Summary of Net Position

Governmental

activities

Bu si n e ss-typ e

activities

Total

March 31,

2023

Total

March 31,

2022

% Change

2023-2022

Cash and investments $920,091 352,

312 1,272,403 1,299,587 -2.1%

Capital assets 21,183 - 21,

183 11,376 86.2%

Loans and financing receivable, net 209,516 681,343 890,859 669,009 33.2%

Residual interest receivable - - - 77,360 -100.0%

Other assets 121,883 6,

659 128,542 65,908 95.0%

Total assets 1,272,673 1,040,314 2,312,987 2,123,240 8.9%

Deferred outflows of resources 26,969 3,936 30,905 32,525 -5.0%

Other liabilities 250,520 939 251,

459 277,089 -9.2%

Non-current liabilities 149,104 - 149,

104 142,911 4.3%

Total liabilities 399,624 939 400,563 420,000 -4.6%

Deferred Inflows of Resources 45,898 6,750 52,648 50,429 4.4%

Net Position:

Net investment in capital assets 11,069 - 11,069 11,376 -2.7%

Restricted 833,910 1,036,561 1,870,471 1,668,224 12.1%

Unrestricted 9,141 - 9,141 5,736 59.4%

Total Net Position $854,120 1,

036,561 1,890,681 1,685,336 12.2%

Total assets increased $189.7 million (8.9%). Cash and investments decreased $27.2 million (-2.1%)

primarily due to the following: NY Green Bank net capital deployed for new and existing transactions, and a

large increase in the accrued Zero-emission credit (ZEC) program receivable based on a higher calculated

generator load as compared to the prior year load calculation. RGGI proceeds far in excess of expenditures

largely offset the decreases of cash and investments in other funds. Capital assets increased primarily due to

the adoption of GASB Statement No. 87, Leases (GASB 87), and GASB Statement No. 96, Subscription-

Based Information Technology Arrangements (GASB 96) as of April 1, 2022. Certain leases where

NYSERDA rents office space from other entities were recorded as lessee right to use capital assets in

accordance with GASB 87 and the balance of these lease assets at March 31, 2023 was $9.7 million.

Certain software license subscriptions NYSERDA contracts with various vendors for, were recorded as

software capital assets in accordance with GASB 96 and the balance of these software assets at March 31,

2023 was $1.6 million.

Loans and financing receivables increased $221.9 million (33.2%), primarily reflecting additional NY Green

Bank loans. In addition, NY Green Bank loans increased, and the residual interest receivable decreased

$77.4 million (-100.0%), due to NY Green Bank repurchasing the remaining balance of loan backed

receivables previously sold, thus reverting the classification of the residual to “Loans and financing

receivables”. Other assets increased $59.3 million (114.7%) primarily due to a $30.0 million increase in the

ZEC program receivable associated with a return to more of a 'normal' one-month lag dollar amount as noted

above (as a driver of the decrease in cash and investments). Additionally, there was an increase of $13.4

million across several Bill-As-You-Go (BAYG) funds’ receivables due to timing of billing and reimbursement

of expenses. Further, a $5.7 million balance as of March 31, 2023 for lease receivables was recognized in

accordance with GASB 87, where NYSERDA is the lessor of various capital assets to other entities.

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

7

Other assets increased $62.6 million (95.0%) mainly due to a large increase in the accrued Zero-emission

credit (ZEC) program receivable of $24.6 million associated with a return to more of a 'normal' one-month lag

dollar amount (the prior year's receivable was less than typical due to billing load at a higher rate because

load had been expected to remain low post-Covid). Additionally, there was an increase in the third-party

receivable of $13.4 million across several Bill-As-You-Go (BAYG) funds due to timing of billing and

reimbursement of expenses.

Deferred outflows of resources decreased by $1.6 million (-5.0%) primarily due to a decrease in the

actuarially-determined deferred outflows related to pension and other post-employment benefits (OPEB).

Total liabilities decreased $19.4 million (-4.6%). Non-current liabilities increased $6.2 million (4.3%) primarily

due to a new balance of $10.0 million of lease obligations as of March 31, 2023 resulting from the adoption

of GASB 87, as well as due to the issuance of bonds to finance the GJGNY revolving loan fund, offset by

scheduled principal payments and early redemptions on previous similar bond issuances.

Other liabilities decreased by $25.6 million (-9.2%); primarily as a result of a large decrease in accounts

payable associated with timing of receipt, approval and payment of invoices received, having no correlation

with expenses. Partially offsetting the decrease in accounts payable, accrued liabilities increased for

estimated invoices not yet received and paid.

Deferred inflows of resources experienced little net change, but it is notable that the adoption of GASB 87

resulted in a balance of $5.7 million as of March 31, 2023 related to future payments receivable by

NYSERDA as lessor. Pension and OPEB related actuarially determined deferred inflows of resources

decreased and largely offset the increase resulting from recording GASB 87’s effect.

Net position increased $205.3 million (12.2%) principally due to an excess of RGGI revenues over expenses

as well as NY Green Bank net operating and non-operating income.

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

8

(Amounts in thousands)

Summary of Changes in Net Position

Governmental

activities

Bu si n e ss-typ e

activities

Total

March 31,

2023

Total

March 31,

2022

% Change

2023-2022

Revenues:

State appropriations $16,664 - 16,664 15,364 8.5%

Utility surcharge assessments 563,347 - 563,347 628,009 -10.3%

Renewable energy credit proceeds 31,730 - 31,730 55,543 -42.9%

Zero-emission credit assessments 590,031 - 590,031 609,021 -3.1%

Allowance auction proceeds 279,363 - 279,363 250,634 11.5%

Third-party reimbursements 53,624 - 53,624 75,035 -28.5%

Federal grants 13,494 - 13,494 7,845 72.0%

Interest subsidy 258 - 258 306 -15.7%

Loans and financing receivables

interest 8,256 34,701 42,957 21,483 100.0%

Gain (loss) on sale of loans &

financing receivables - 920 920 (13,543) 1572.1%

Investment income 20,695 9,808 30,503 (73) 41884.9%

Other Program Revenue 9,690 5,667 15,357 20,006 -23.2%

Total Revenues 1,587,152 51,096 1,638,248 1,669,630 -1.9%

Expenses:

Salaries and benefits 55,157 9,919 65,076 58,529 11.2%

Program expenditures 1,326,330 293 1,326,623 1,314,300 0.9%

Investment related expenses - 812 812

454

78.9%

Program operating costs 1,823 1,832 3,655 3,780 -3.3%

General & administrative costs 10,107 1,806 11,913 14,999 -20.6%

Depreciation 6,686 958 7,644 2,583 195.9%

New York State assessments 13,437 157 13,594 13,594 0.0%

Interest 3,550 36 3,586 3,275 9.5%

Total Expenses 1,417,090 15,813 1,432,903 1,411,514 1.5%

-

Change in Net Position

170,062 35,283 205,345

258,116

-20.4%

Net Position, beginning of year

684,058 1,001,278 1,685,336 1,427,220 n/a

Net Position, end of year $854,120 1,036,561 1,890,681 1,685,336

12.2%

Total revenue decreased $31.4 million (-1.9%). Utility surcharge assessments revenue decreased by $64.7

million (-10.3%) principally due to the final rate-payer funded capitalization of NY Green Bank, in the amount

of $44.3 million, having been completed in the previous fiscal year (the year ended March 31, 2022).

Additionally, the Energy Storage program had much lower funding collected via the Bill-as-You-Go (BAYG)

mechanism due to both lower expenditures in the current fiscal year versus the prior year, as well as the

prior year having included revenues to establish the initial working capital balance for that program.

Renewable energy credit proceeds decreased by $23.8 million (-42.9%) principally due to a large decrease

in Alternative compliance payments. ZEC revenues decreased by $19.0 million (-3.1%) due to both lower

program expenses in the current fiscal year, as well as the prior year having included non-recurring revenues

of $9.1 million. Allowance proceeds increased by $28.7 million (11.5%) due to the average quarterly auction

sale prices being higher than in the prior fiscal year. Third-party reimbursements decreased by $21.4 million

(-28.5%), principally due to much lower receipts related to the Clean Transportation Volkswagen Settlement

Agreement. Loans and financing receivables interest income increased $21.5 million (100.0%) primarily due

to NY Green Bank having larger amounts of deployed capital than in the prior year, as well as an increase in

market interest rates having occurred on variable interest rate loans. The gain on sale of loans and financing

receivables reflects a sale of a position in the NY Green Bank’s portfolio. The prior year loss on sale of loans

and financing receivables was a result of the sale of a portion of the interest-bearing portfolio’s receivables to

a third-party investor in a planned transaction to monetize existing assets to allow capital to be accessible

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

9

faster and thus allow more productive near-term use. The increase in investment income of $30.6 million was

principally due to much higher market interest rates for U.S. Treasury holdings. Other program revenues

decreased $4.6 million (-23.2%) primarily due to lower closing fees earned by NY Green Bank.

Total expenses increased $21.4 million (1.5%). Program expenditures increased $12.3 million (0.9%)

primarily for incentives paid due to an increase in NY-Sun project completions associated with the 2020

increase in funding for the six gigawatt goal of the program (established at that time). The increase in NY-

Sun was partially offset by lower RGGI expenditures. Salaries and benefits expense increased $6.5 million

(11.2%) primarily due to an increase in FTE’s; performance-based salary increases and payments; and from

a retroactive and a current year general salary increase authorized for payment during the fiscal year 2022-

23. Health insurance benefits expense also increased significantly, but was more than offset by much lower

actuarially determined pension benefit expense.

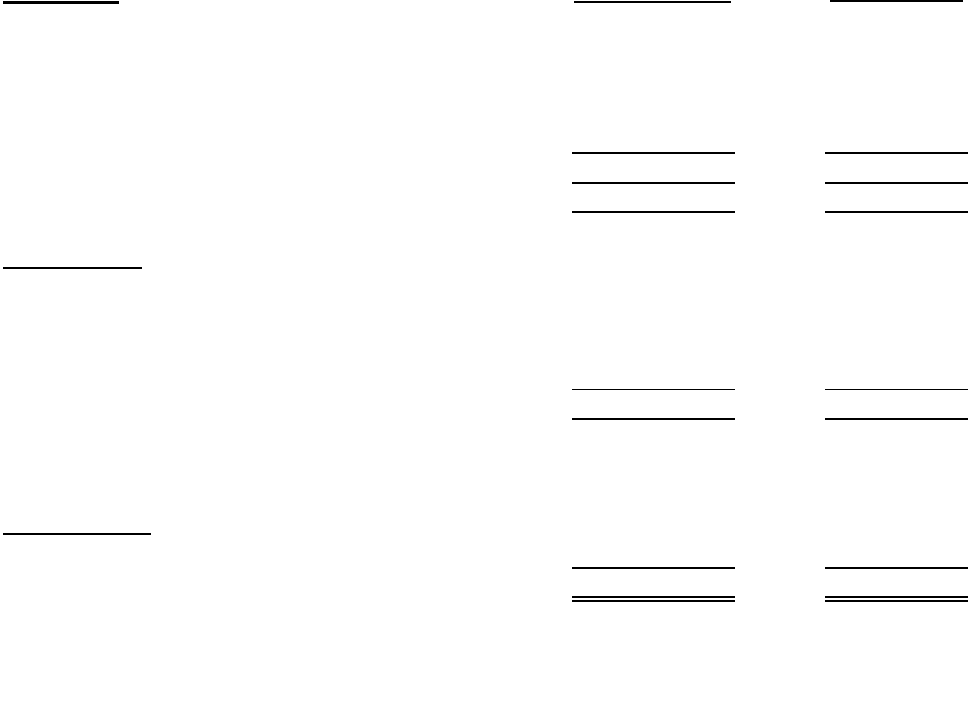

The following charts depict Authority revenues and expenses for the year ended March 31, 2023.

FINANCIAL ANALYSIS OF FUNDS

Total fund balances for the governmental funds increased from $784.9 million to $950.0 million as further

described below:

• The CEF fund balance increased from $76.3 million to $91.0 million principally due to lower program

expenditures without a similar decrease in revenues, due to the timing of receipt of BAYG revenues used

to maintain the projected working capital balance needed.

• The NY-Sun fund balance decreased from $72.5 million to $67.4 million primarily due to expenditures

exceeding BAYG revenues, due to timing differences inherent in the BAYG funding mechanism.

• The CES fund balance increased from $36.9 million to $49.1 million primarily due to Tier 1 REC

Alternative Compliance Payments received, driving revenue to exceed expenditures.

• The RGGI fund balance increased from $184.2 million to $326.3 million principally as a result of higher

auction allowance prices generating greater revenue than was budgeted and expended. A portion of the

additional revenues has since been incorporated into updated stakeholder- and Board-approved

operating plans for the next planning period and is expected to be expended in accordance with those

approved plans. All additional excess revenues collected subsequent to the most recent approved plan

will be incorporated in the next operating plan.

Utility

surcharge

assessments

34.4%

State

appropriations

1.0%

Third-party

reimbursements

3.3%

Federal

grants

0.8%

Investment

income

1.9%

Zero-

emission

credit

assessments

36.0%

Loan

interest

2.6%

Gain on sale

0.1%

Other

2.8%

Allowance

proceeds

17.1%

Revenues

Depreciation &

amortization

0.5%

Interest

0.2%

Program

expenditures

92.6%

Investment

related

expenses

0.1%

Salaries &

benefits 4.5%

NY State

assessments

0.9%

Program

operating

costs 0.3%

General &

administrative

0.8%

Expenses

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

10

• The GJGNY fund balance increased from $269.7 million to $304.1 million principally due to proceeds of

a bond issuance in the current fiscal year, as well as an increase in funding received through the annual

RGGI fund transfer.

• The aggregated Other Funds fund balance decreased from $145.3 million to $120.2 million principally

due to Volkswagen expenditures exceeding revenues for the fiscal year, as a large portion of the funding

had been received and recorded as revenue in the prior fiscal year. Similarly, New Efficiency New York

program expenditures exceeded revenues for the current fiscal year, whereas some funding from this

program had been received and recorded as revenue in the prior fiscal year.

Total net position for the proprietary fund was $1.0 billion at March 31, 2023, as described below:

• NY Green Bank’s net position increased by $35.3 million primarily as a result of higher loans and

financing receivables interest revenue and much higher investment income due to rising market interest

rates.

CAPITAL ASSET AND DEBT ADMINISTRATION

NYSERDA maintains land, buildings, and furniture and equipment in various locations for its corporate

purposes, and additionally has recorded in the current fiscal year, lessee right-to-use assets for office space

NYSERDA rents from others, as well as subscription-based software assets, as a result of adopting GASB

Statement Nos. 87 & 96 as of April 1, 2022. Total capital assets as of March 31, 2023 were $21.3 million, net

of accumulated depreciation. Capital asset additions during the fiscal year ended March 31, 2022 were $3.3

million, primarily for leased software, as well as information technology upgrades, and furniture, fixtures and

equipment.

Total non-current liabilities increased $6.2 million (4.3%) primarily due to the recording of lease obligations

associated with the adoption of GASB 87.

NYSERDA also issues tax-exempt bonds on a conduit basis on behalf of utility companies to finance certain

eligible projects. As of March 31, 2023, approximately $1.5 billion of bonds are outstanding. These bonds are

non-recourse bonds and, as such, are not included in NYSERDA’s financial statements.

ECONOMIC FACTORS

On behalf of the State, NYSERDA manages the Western New York Nuclear Service Center in West Valley,

New York, the site of a former plant for reprocessing used nuclear fuel. Depending upon the clean-up options

selected and agreement on cost sharing with the federal government, these costs could be substantial. It is

anticipated that New York State’s share of future costs for the West Valley site will be provided by New York

State to NYSERDA and will not impact NYSERDA’s current funding. As permitted by Governmental GASB

Statement No. 49, Accounting and Financial Reporting for Pollution Remediation Obligations, no liability has

been recorded in NYSERDA’s financial statements for this contingency due to the expected recoveries from

New York State.

NYSERDA’s programs are impacted by a number of factors including, but not limited to, general economic

conditions, energy prices, energy system reliability, climate change impacts, and energy technology

advancements. Revenues from RGGI allowance auction proceeds in particular can be highly sensitive to

some of the aforementioned factors. NYSERDA has assessed current economic factors including inflation,

increases in prevailing interest rates, supply chain constraints, residual impacts of the COVID pandemic, and

the conflict in Ukraine, and does not foresee material impact on its near-term financial condition or

operations. We will continue to closely monitor program costs and outcomes and adjust proactively with

resilience measures and investments, to mitigate potential impacts from external factors including a changing

climate.

New York State Energy Research and Development Authority

(A Component Unit of the State of New York)

Management’s Discussion and Analysis

For the Year Ended March 31, 2023

Unaudited

11

CONTACT FOR NYSERDA’S FINANCIAL MANAGEMENT

This report is designed to provide a general overview of the finances of NYSERDA for interested parties.

Questions concerning any information within this report or requests for additional information should be

addressed to Pam Poisson, Chief Financial Officer, NYSERDA, 17 Columbia Circle, Albany, NY 12203.

Total

Governmental Business-type March 31,

Activities Activities 2023

ASSETS:

Current assets:

Cash and investments $920,091 352,312 1,272,403

New York State receivable 15,174 -

15,174

T

hird-party billings receivable 66,261 -

66,261

I

nterest receivable on loans 1,672 3,932 5,604

Loans and fi

nancing receivables due within one year, net 25,310 116,143 141,453

Pr

epaid expense 2,029 -

2,029

Ot

her assets 21,949 -

21,949

Tot

al current assets 1,052,486 472,387 1,524,873

Non-current assets:

Loans and financing receivables- long-term, net 184,206 565,200 749,406

Capital assets, net of depreciation and amortization 21,183 -

21,183

Net

pension & OPEB assets 14,798 2,727 17,525

Tot

al non-current assets 220,187 567,927 788,114

Total assets 1,272,673 1,040,314 2,312,987

DEFERRED OUTFLOWS OF RESOURCES:

26,969 3,936 30,905

LIABILITIES:

Current liabilities:

Non-current liabilities due within one year 17,146 -

17,146

Account

s payable 6,026 130

6,156

Ac

crued liabilities 240,926 282

241,208

Unear

ned revenue 3,568 -

3,568

Deposi

ts -

527

527

Total current liabilities 267,666 939

268,605

Non-current liabilities:

Bonds payable 92,817 -

92,817

Deposi

ts 24,041 -

24,041

Ot

her non-current liabilities 15,100 -

15,100

Tot

al non-current liabilities 131,958 -

131,958

Tot

al liabilities 399,624 939

400,563

DEFERRED INFLOWS OF RESOURCES:

45,898 6,750 52,648

NET POSITION:

Net investment in capital assets 11,069 - 11,069

Rest

ricted for specific programs 833,910 1,036,561 1,870,471

Unr

estricted 9,141 -

9,141

Total net position $854,120 1,036,561 1,890,681

See accompanying notes to the basic financial statements.

(Amounts in thousands)

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Statement of Net Position

March 31, 2023

12

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Statement of Activities

For the year ended March 31, 2023

(Amounts in thousands) Total

Business-type March 31,

Activities 2023

Energy West NY Green

CEF

NY-Sun CES RGGI Analysis Valley Other Total Bank

EXPENSES:

Salaries and benefits $21,884 2,384 6,008 8,821 5,861 2,470 7,729 55,157 9,919 65,076

Program expenditures 292,599 189,308 605,312 80,306 7,190 14,543 137,072 1,326,330 293

1,326,623

Investment related expenses -

-

-

-

-

-

-

-

812

812

Program operating costs 264 76 98 (6)

751

35 605 1,823 1,832 3,655

General & administrative expenses 3,992 437 1,103 1,622 1,076 457 1,420 10,107 1,806 11,913

Depreciation & amortization 2,566 333 726 860 716 341 1,144 6,686 958

7,644

NY State assessments 2,928 1,876 6,189 910 156 180 1,198 13,437 157

13,594

Interest 80 9

22 33 22 28 3,356 3,550 36

3,586

Total expenses 324,313 194,423 619,458 92,546 15,772 18,054 152,524 1,417,090 15,813 1,432,903

REVENUES:

Operating grants and contributions

State appropriations -

-

-

182 142 15,257 1,083 16,664 - 16,664

Utility surcharge assessments 276,977 189,527 -

-

12,071 -

84,772

563,347 - 563,347

Renewable energy credit proceeds -

-

31,730 -

-

-

- 31,730 - 31,730

Zero-emission credit assessments -

-

590,031

-

-

-

- 590,031 - 590,031

Allowance auction proceeds -

-

-

279,363 -

-

-

279,363 - 279,363

Third-party reimbursements 28,771 -

33

-

-

2,793 22,027 53,624 - 53,624

Federal grants -

-

-

-

3,495 -

9,999

13,494 - 13,494

Interest subsidy -

-

-

-

-

-

258 258 - 258

Charges for services

Project repayments -

-

-

-

-

-

419 419 - 419

Rentals from leases -

- - - - 6 1,121 1,127 - 1,127

Fees and other income -

-

7,783 -

-

1

360 8,144 5,667 13,811

Loans and financing receivables

interest

229 -

-

-

-

-

8,027

8,256 34,701 42,957

Other

Gain on sale of Loans and financing

receivables -

-

-

-

-

- -

-

920

920

Investment income 2,084 1,701 4,035 6,971 -

-

5,904 20,695 9,808 30,503

Total revenues 308,061 191,228 633,612 286,516 15,708 18,057 133,970 1,587,152 51,096 1,638,248

Increase (decrease) in net position

before transfers

(16,252) (3,195) 14,154 193,970 (64)

3 (18,554) 170,062 35,283 205,345

Transfers 30,471 (2,006) (1,901) (51,937) -

- 25,373 -

- -

C

hange in net position 14,219 (5,201) 12,253 142,033 (64)

3 6,819 170,062 35,283 205,345

N

et position, beginning of period 73,370 72,321 37,415 183,808 3,045 - 314,099 684,058 1,001,278 1,685,336

Net position, end of period $87,589 67,120 49,668 325,841 2,981 3 320,918 854,120 1,036,561 1,890,681

See accompanying notes to the basic financial statements.

Functions/Programs

Governmental Activities

13

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Balance Sheet - Governmental Funds

March 31, 2023

Total

Other March 31,

CEF

NY-Sun CES RGGI GJGNY Funds 2023

ASSETS:

Cash and investments $114,355 89,634 168,151 332,946 98,723 116,282 920,091

Receivables:

New York State 1,621 - 5,683 - - 7,870 15,174

Third-party billings 244 - 46,013 - 3,371 16,633 66,261

Interest on loans 276 - - - 1,396 - 1,672

Loans 6,000 - - - 203,516 - 209,516

Prepaid expense 1,000 - - - - 1,029 2,029

Other assets 1,004 - - - - 20,945 21,949

Due from other funds 3,575 400 - 425 270 - 4,670

Total assets $128,075 $90,034 219,847 333,371 307,276 162,759 1,241,362

LIABILITIES AND FUND BALANCES:

Liabilities:

Accounts payable $1,786 804 289 623 1,948 576 6,026

Accrued liabilities 33,047 21,874 146,503 6,454 672 30,873 239,423

Unearned revenue 2,246 - - 29 594 698 3,567

Deposits - - 23,560 - - 481 24,041

Due to other funds - - 365 - - 4,305 4,670

Total liabilities 37,079 22,678 170,717 7,106 3,214 36,933 277,727

Deferred Inflow of Resources - - - - - 5,656 5,656

Fund Balances:

Nonspendable-not in spendable form 1,000 - - - - 1,029 2,029

Restricted 89,996 67,356 49,130 326,265 304,062 111,029 947,838

Unassigned - - - - - 8,112 8,112

Total fund balances 90,996 67,356 49,130 326,265 304,062 120,170 957,979

Total liabilities and fund balances $128,075 90,034 219,847 333,371 307,276 162,759 1,241,362

Following is a reconciliation of amounts reported differently in the Statement of Net Position:

Total fund balances for governmental funds $957,979

Capital assets used in governmental activities are not current financial resources and

therefore are not reported in the funds 21,183

Long-term liabilities are not due and payable in the current period

and therefore are not reported in the funds (110,265)

Pension & OPEB related deferred outflows and inflows are not reported in govermental funds

(13,274)

Accrued interest expense (1,503)

Net position of governmental activities $854,120

See accompanying notes to the basic financial statements.

(Amounts in thousands)

Major Funds

14

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Statement of Revenues, Expenditures and Changes in Fund Balances - Governmental Funds

For the year ended March 31, 2023

Total

Other March 31,

CEF

NY-Sun CES RGGI GJGNY Funds 2023

REVENUES:

State appropriations $ - - - 182 - 16,482 16,664

Utility surcharge assessments 276,977 189,527 - - - 96,843 563,347

Renewable energy credit proceeds - - 31,730 - - - 31,730

Zero-emission credit assessments - - 590,031 - - - 590,031

Allowance auction proceeds - - - 279,363 - - 279,363

Third-party reimbursements 28,771 - 33 - - 24,820 53,624

Federal grants - - - - - 13,494 13,494

Interest subsidy - - - - 258 - 258

Project repayments - - - - - 419 419

Rentals from leases - - - - 2 1,125 1,127

Fees and other income - - 7,783 - 9 352 8,144

Loan interest 229 - - - 8,027 - 8,256

Investment income (loss) 2,084 1,701 4,035 6,971 1,697 4,207 20,695

Total revenues 308,061 191,228 633,612 286,516 9,993 157,742 1,587,152

EXPENDITURES:

Current expenditures 323,863 194,322 619,312 92,546 7,662 175,035 1,412,740

Debt service:

Principal - - - - 20,825 2,295 23,120

Interest - - - - 2,744 259 3,003

Bond issuance costs - - - - 793 - 793

Capital outlay - - 120 - - 17,331 17,451

Total expenditures 323,863 194,322 619,432 92,546 32,024 194,920 1,457,107

OTHER FINANCING SOURCES (USES):

Lease acquisitions 12,120 12,120

SBITA acquisitions 4,464 4,464

Residential Solar Financing Green Revenue

Bonds issued - - - - 26,500 - 26,500

Transfers in 30,471 1,736 - - 29,937 2,302 64,446

Transfers out - (3,742) (1,901) (51,937) - (6,866) (64,446)

Net other financing sources (uses) 30,471 (2,006) (1,901) (51,937) 56,437 12,020 43,084

Net change in fund balances 14,669 (5,100) 12,279 142,033 34,406 (25,158) 173,129

Fund balances, beginning of year 76,327 72,456 36,851 184,232 269,656 145,328 784,850

Fund balances, end of year $90,996 67,356 49,130 326,265 304,062 120,170 957,979

Following is a reconciliation of amounts reported differently in the Statement of Activities:

Net change in fund balances for govenmental funds $173,129

Capitalization of capital outlays including right of use assets, rather than recording as an expenditure (2,448)

Expenses for compensated absences in the Statement of Activities do not require the use

of current financial resources and therefore are not reported as expenditures in governmental funds (1,251)

Expenses for accrued bond interest in the Statement of Activities do not require the use

of current financial resources and therefore are not reported as expenditures in governmental funds (546)

Pension contributions are not an expense in the Statement of Activities, and GASB 68

pension expense is not a use of current financial resources in the governmental funds 2,919

OPEB contributions are not an expense in the Statement of Activities, and GASB 75

OPEB expense is not a use of current financial resources in the governmental funds 1,639

Bond proceeds are a current financial resource in the governmental funds but are not

reported as revenues in the Statement of Activities (26,500)

Repayment of principal is an expenditure in the governmental funds but the repayment reduces

long-term liabilities in the Statement of Net Position 23,120

Change in net position of governmental activities $170,062

See accompanying notes to the basic financial statements.

(Amounts in thousands)

Major Funds

15

March 31,

2023

ASSETS:

Current assets:

Cash and investments $352,312

Interest receivable on loans 3,932

Loans and financing receivables due within one year, ne

t

116,143

Total current assets 472,387

Non-current assets:

Loans and financing receivables - long term, ne

t

565,200

Net pension & OPEB assets 2,727

Total non-current assets 567,927

Total assets 1,040,314

DEFERRED OUTFLOWS OF RESOURCES:

3,936

LIABILITIES:

Current liabilities:

Accounts payable 130

Accrued liabilities 282

Escrow deposits 527

Total current liabilities 939

Total liabilities 939

DEFERRED INFLOWS OF RESOURCES:

6,750

NET POSITION:

Net position restricted for specific programs $1,036,561

See accompanying notes to the basic financial statements

.

(Amounts in thousands)

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Statement of Net Position

Proprietary Fund

March 31, 2023

16

March 31,

2023

OPERATING REVENUES:

Closing fees $2,950

Undrawn fees 986

Administrative fees 521

Other fees 1,210

Loans and financing receivables interes

t

34,842

Provision for losses on loans and financing receivable

s

(141)

Gain on sale of loans and financing receivable

s

920

Total operating revenue

s

41,288

OPERATING EXPENSES:

Salaries and benefits 9,919

Investment related expense

s

812

Program operating costs 1,832

General & administrative expense

s

1,806

Depreciation 958

NY State assessments 157

Interest 36

Total operating expense

s

15,520

OPERATING INCOME 25,768

NON-OPERATING REVENUES:

Investment income 9,808

Total non-operating revenue

s

9,808

NON-OPERATING EXPENSES:

Program evaluation 293

Total non-operating expenses 293

Change in net position 35,283

Net position, beginning of yea

r

1,001,278

Net position, end of yea

r

$1,036,561

See accompanying notes to the basic financial statements

.

(Amounts in thousands)

N

EW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORIT

Y

(A Component Unit of the State of New York)

Statement of Revenues, Expenses and Changes in Fund Net Position

Proprietary Fund

For the year ended March 31, 2023

17

March 31,

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Closing fees collected $2,930

Undrawn fees collected 715

Administrative fees collected 484

Other fees collected 1,358

Loans and financing receivables interest collected 22,562

Disbursement of escrow deposits 326

Payments to employees & employee benefit providers (10,220)

Payments to suppliers (5,070)

Payment for allocated depreciation (958)

Payments to NYS (157)

Payment for allocated interest (36)

Loans and financing receivables deployed (347,904)

Loans and financing receivables principal repayments 227,479

Net cash used in operating activities (108,491)

Purchase of investments (896,681)

Proceeds from sale of investments 1,004,595

Investment income 5,139

Net cash provided by investing activities 113,053

4,562

14,570

$19,132

$25,768

5

(1,927)

(131,753)

(113)

(202)

326

(302)

(293)

($108,491)

See accompanying notes to the basic financial statements.

Net cash used in operating activities

Operating income

Non-operating expenses unrelated to financing activities

Decrease in accounts payable

Decrease in accrued liabilities

Increase in escrow deposits

Net change in pension & OPEB related accounts

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Statement of Cash Flows

Proprietary Fund

For the year ended March 31, 2023

(Amounts in thousands)

Decrease in third party billings receivable

Increase in interest receivable

Increase in loans and financing receivables

Adjustments to reconcile operating income to net cash used in

operating activities:

Cash and cash equivalents, end of year

RECONCILIATION OF OPERATING INCOME TO NET CASH

USED IN OPERATING ACTIVITIES:

CASH FLOWS FROM INVESTING ACTIVITIES:

Net change in cash & cash equivalents

Cash and cash equivalents, beginning of year

18

OPEB Trust Fund

Custodial Fund

ASSETS:

Cash and investments $66,510 $44,713

Total assets $66,510 44,713

LIABILITIES:

Accrued expenses 4 -

Payabl

e to New York State -

538

Es

crow funds payable -

11,112

Total liabilities 4

11,650

NET POSITION:

Restricted for:

Other postemployment benefits 66,506 -

Other governments and organizations

-

33,063

Total Net position $66,506 $33,063

See accompanying notes to the basic financial statements.

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Statement of Fiduciary Net Position

March 31, 2023

(Amounts in thousands)

19

ADDITIONS: OPEB Trust Fund

Custodial Fund

Employer contributions $2,549 $ -

Utility assessments - 3,017

Escrow deposit receipts - 524

Investment (loss) income (3,367) 137

Less investment management expenses (11) -

Net investment (loss) income (3,378) 137

Total additions, net (829) 3,678

DEDUCTIONS:

Benefits 2,097 -

Reimbursements paid - 3,605

Accrued expenses - 541

Administrative fees 18 -

Total deductions 2,115 4,146

Change in net position (2,944) (468)

NET POSITION:

Net position- beginning of year 69,450 33,531

Net position- end of year $66,506 $33,063

See accompanying notes to the basic financial statements.

(Amounts in thousands)

NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Statement of Changes in Fiduciary Net Position

For the year ended March 31, 2023

20

NEW YORK STATE ENERGY

RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Notes to Basic Financial Statements

March 31, 2023

21

(1) GENERAL

The New York State Energy Research and Development Authority (NYSERDA) is a public benefit

corporation established in 1975 pursuant to Title 9 of Article 8 of the Public Authorities Law of the

State of New York (the State). NYSERDA is included in the State's basic financial statements as a

component unit. NYSERDA's significant functions and programs reported in the Statement of

Activities are summarized below; those which are reported as major funds in the Governmental

Fund Financial Statements are noted parenthetically.

Clean Energy Fund (CEF) Market Development/Innovation & Research (Major fund)

Pursuant to a January 2016 Order (CEF Order), the State Public Service Commission (Commission)

authorized a ten-year commitment through 2025 of approximately $5.3 billion to clean energy

programs through a CEF, from previously authorized or incremental collections. The CEF is

designed to meet four primary objectives: greenhouse gas emission reductions; energy affordability;

statewide penetration and scale of energy efficiency and clean energy generation; and growth in the

State’s clean energy economy. The CEF is a key vehicle to support attainment of specific, time-

bounded goals for energy efficiency, zero-emissions electricity generation, and investment in

disadvantaged communities as articulated in the State’s Climate Leadership and Community

Protection Act.

The CEF Market Development activities are designed to ultimately reduce energy costs, accelerate

customer demand, and increase private investment for energy efficiency and other behind-the-meter

clean energy solutions through strategies including financial support, technical knowledge, data,

education to customers and service providers, and advanced workforce training. The CEF

Innovation & Research activities are designed to invest in cutting-edge technologies that will meet

increasing demand for clean energy including: smart grid technology, renewables and distributed

energy resources, high performance buildings, transportation, and clean tech startup and innovation

development.

The CEF Order provided for a ten-year funding authorization of $3.43 billion for the Market

Development and Innovation & Research activities. Through the CEF Order, funding authorization

was also provided to allocate $781.5 million for NY Green Bank, $960.6 million for NY-Sun, and

$150.0 million for the RPS Program for a 2016 Main Tier solicitation. The NY Green Bank and NY-

Sun programs are presented as separate Programs/Functions in the financial statements as further

described below.

The CEF Order authorized the continuation of previously authorized ratepayer collections for

calendar years 2016 through 2024 for previous program authorizations for the New York Energy

$mart, Energy Efficiency Portfolio Standard, Technology and Market Development, and RPS

programs (the Previously Approved Programs).

To reimburse NYSERDA for actual CEF program expenses, the CEF Order established a “Bill-As-

You-Go” (BAYG) approach for revenue collection effective January 1, 2016. Under this approach,

CEF ratepayer collections are held by the electric and gas utilities and used to reimburse NYSERDA

monthly, provided that the reimbursement allows NYSERDA to maintain a sufficient cash balance

based on projected expenses for the subsequent two-month period, subject to the collection

amounts approved in the CEF Order.

NY-Sun (Major fund)

Approved through a 2012 Commission Order, the NY-Sun program is designed to develop a

sustainable solar industry through a capacity block incentive approach. The NY-Sun program was

initially funded through $216 million reallocated under the Renewable Portfolio Standard (RPS)

NEW YORK STATE ENERGY

RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Notes to Basic Financial Statements

March 31, 2023

22

program. The CEF Order established the incremental collection schedule and reallocation of

uncommitted funds to support program activities approved through the 2012 Order.

Pursuant to May 14, 2020 and September 9, 2021 Orders, the Commission authorized the

expansion of the NY-Sun program through 2025 to meet the established targets under the Climate

Leadership and Community Protection Act and to develop a total of 6 gigawatt (GW) of distributed

solar by 2025 by adding an additional 3 GW of distributed solar. The Orders increased NY-Sun’s

funding by $573 million from existing and any future uncommitted NYSERDA ratepayer funds, and if

necessary, a transfer from NY Green Bank. In an April 14, 2022 Order, the Commission authorized

a further expansion of the program expanding installation targets of the NY-Sun program from 6 to

10 GW of distributed solar generation. The Order increased NY-Sun’s funding by an additional

$1.474 billion for a cumulative authorized funding level of $3.27 billion. The additional $1.474 billion

will be provided to NYSERDA utilizing the existing Bill-As-You-Go mechanism established under the

CEF Framework Order.

Clean Energy Standard (CES) (Major fund)

Pursuant to an August 2016 and subsequent Orders, the Clean Energy Standard was established,

adopting a State Energy Plan goal that 70% of New York’s electricity is to be generated by

renewable sources by 2030 as part of a strategy to reduce statewide greenhouse gas emissions by

40% by 2030. The CES is comprised of a series of deliberate and mandatory actions to enhance

opportunities for customer choice necessary to achieve the State Energy Plan goal. The mandated

actions are divided into two categories, a Renewable Energy Standard (RES) and a Zero-Emissions

Credit (ZEC) requirement. The RES consists of an obligation on Load Serving Entities (LSEs) in

New York State to invest in new renewable generation resources to serve their retail customers

evidenced by the procurement of qualifying renewable energy credits; an obligation on distribution

utilities on behalf of all retail customers to continue to invest in the maintenance of existing at-risk

renewable generation attributes; and a program to maximize the value potential of new offshore

wind resources. As part of the RES component of the program, NYSERDA will offer for sale to the

LSEs at various times Renewable Energy Credits (RECs) produced from, and received under,

contracts with qualifying renewable energy facilities to meet the LSEs’ mandatory compliance

requirements. Alternatively, NYSERDA may receive Alternative Compliance Payments from LSEs in

lieu of their purchasing RECs from NYSERDA. The ZEC requirement consists of an obligation on

LSEs in New York State to invest in the preservation of existing at-risk nuclear zero-emissions

attributes to serve their retail customers, evidenced by the procurement of qualifying ZECs. As part

of the ZEC component, NYSERDA provides support payments for specified nuclear generating

facilities in amounts prescribed by the Commission’s Order based on each facility’s output. The

funding for these payments is collected through ZECs sold to each LSE in amounts calculated for

each LSE’s proportionate share of the statewide energy load. The RES component and the ZEC

component are inter-related but the goals are additive; that is, the carbon benefits of preserving the

nuclear zero-emissions attributes will not count toward achieving the required number of renewable

resources to satisfy the 70% by 2030 goal. The RES and ZEC components will, however, in

combination, contribute toward the State’s comprehensive greenhouse gas reduction goals.

NYSERDA is leading the coordination of offshore wind opportunities in New York State and is

supporting the development of 9,000 megawatts of offshore wind energy by 2035 in a responsible

and cost-effective manner.

In July 2018, the Commission issued an Order Adopting the Offshore

Wind Standard. The Offshore Wind Standard authorized solicitations by NYSERDA, in consultation

with the Long Island Power Authority and New York Power Authority, for first phase of offshore wind

procurements. Through March 31, 2023 NYSERDA has issued three competitive solicitations for

offshore wind to stimulate the development of the domestic offshore wind industry, reduce the cost

of later offshore wind procurements, and allow New York State to realize the direct benefits

associated with the construction, operation, and maintenance of offshore wind resources.

NEW YORK STATE ENERGY

RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Notes to Basic Financial Statements

March 31, 2023

23

An October 15, 2020 Order of the PSC established a new Tier 2 and Tier 4. The Tier 2 Maintenance

program aims to provide targeted, adequate, and prudent support to New York’s existing renewable

resources to ensure their continued operations. Eligible Tier 2 maintenance generators include run-

of-river hydroelectric facilities (5 MW or less) and wind resources that entered commercial operation

prior to January 1, 2003. The Competitive Tier 2 program aims to maximize the contributions and

potential of New York’s existing renewable resources to ensure their continued operations. Eligible

Competitive Tier 2 generators include existing non-state-owned run-of-river hydropower and existing

wind resources located within the State that entered commercial operation prior to January 1, 2015.

The new Tier 4 will increase the penetration of renewable energy into New York City, which is

particularly dependent on polluting, fossil fuel-fired generation. NYSERDA will procure unbundled

environmental attributes associated with renewable generation delivered into New York City. These

environmental attributes include the avoidance of GHG emissions, as well as the avoidance of local

pollutants such as NOx, SOx, and fine particulate matter.

Regional Greenhouse Gas Initiative (RGGI) (Major fund)

RGGI is an agreement among twelve Northeastern and Mid-Atlantic States to reduce greenhouse

gas emissions from power plants. The RGGI states (Participating States) have committed to cap

and then reduce the amount of carbon dioxide that certain power plants are allowed to emit, limiting

the region’s total contribution to atmospheric greenhouse gas levels. The Participating States have

agreed to implement RGGI through a regional cap-and-trade program whereby the Participating

States have agreed to auction annual regional emissions. Rules and regulations promulgated by the

NYS Department of Environmental Conservation (DEC) call for NYSERDA to administer periodic

auctions for annual emissions. Pursuant to these regulations, the proceeds will be used by

NYSERDA to administer energy efficiency, renewable energy, and/or innovative carbon abatement

programs, and to cover the costs to administer such programs.

Green Jobs-Green New York (GJGNY) (Major fund)

GJGNY is a statewide program created by legislation enacted in October 2009 to promote energy

efficiency retrofits in residential, multifamily, small business and not-for-profit buildings, and

authorizes NYSERDA to establish innovative financing approaches through revolving loan funds to

finance such projects. The program will also support sustainable community development and

create opportunities for green jobs. The legislation funded the program with $112.0 million from

RGGI auction proceeds and restricts the use of interest earnings and revolving loan proceeds for

additional programmatic spending. Through March 31, 2023 NYSERDA subsequently transferred

$184.7 million in additional RGGI funds to support program activities.

Energy Analysis

Through this program, NYSERDA provides objective and credible analyses of energy issues to

various stakeholders. The program also includes activities for energy-related emergency planning

and response, and support for State energy planning in an effort to ensure a secure, reliable energy

supply. These program activities are funded primarily by a State assessment on the intrastate gas

and electricity sales of the State's investor-owned utilities.

Furthermore, Energy Analysis staff provide oversight activities pursuant to the State Low-Level

Radioactive Waste (LLRW) Management Act of 1986, whereby NYSERDA is responsible for

ultimately constructing and operating the State’s LLRW disposal facilities, collecting information, and

providing regular reports to the Governor and Legislature on LLRW generation in the State. These

activities are funded annually by State appropriations through a sub-allocation from the New York

State Department of Health.

NEW YORK STATE ENERGY

RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Notes to Basic Financial Statements

March 31, 2023

24

NYSERDA is also responsible for the coordination of nuclear material matters, including serving as

the State liaison with the Nuclear Regulatory Commission.

West Valley

NYSERDA manages, on behalf of the State, the Western New York Nuclear Service Center (West

Valley), which is the site of a former plant for reprocessing used nuclear fuel. Through 1972, the

former plant operator, Nuclear Fuel Services, Inc., generated as a by-product of its reprocessing

operations, more than 600,000 gallons of liquid, high-level radioactive waste, which was stored at

the site. In 1980, Congress enacted the West Valley Demonstration Project Act (West Valley Act).

Pursuant to the West Valley Act, the U.S. Department of Energy (DOE) is carrying out a

demonstration project to: (1) solidify the liquid high-level radioactive waste at West Valley; (2)

transport the solidified waste to a permanent federal repository; and (3) decontaminate and

decommission the reprocessing plant and the facilities, materials, and hardware used in the project.

NYSERDA also maintains, on behalf of the State, the State-Licensed Disposal Area (SDA), which is

a shut-down commercial low-level radioactive waste disposal facility at West Valley. NYSERDA is

evaluating how to remediate and close this facility in accordance with regulatory requirements.

Other

Other represents an aggregate of smaller Programs/Functions. These activities are primarily funded

through Commission Orders, Memorandums of Understanding with various utilities pursuant to

Commission Orders, various third-party reimbursement agreements, and federal energy grants.

NY Green Bank

NY Green Bank, a division of NYSERDA accounted for as a proprietary fund, was established to attract

private sector capital to accelerate clean energy deployment in New York State (the State). To date,

NY Green Bank has participated in transactions by providing: construction and longer-term post-

construction financing and investment, financing to enable developers to aggregate smaller distributed

assets into portfolios at scale, and credit enhancements.

NY Green Bank works to increase the size, volume, and breadth of clean energy investment activity

throughout the State, expand the base of investors focused on New York State clean energy, and

increase clean energy participants’ access to capital. To do so, NY Green Bank collaborates with the

private sector to develop transaction structures and methodologies that overcome typical clean

energy investment barriers, such as challenges in evaluating risk and addressing the needs of

distributed energy and efficiency projects where underwriting may be geared more towards larger

and/or groups of somewhat homogeneous investment opportunities.

NY Green Bank focuses on opportunities that create attractive precedents, standardized practices,

and roadmaps that capital providers can willingly replicate and scale. As funders “crowd in” to a

particular area within the clean energy landscape, NY Green Bank moves on to other areas that

have attracted less investor interest.

As a key component of New York’s CEF, NY Green Bank is structured to be self-sustaining in that it

must ultimately cover its own costs of operation.

Pursuant to various Orders of the Commission, the Commission authorized a total of $1 billion in

funded program capitalization for NY Green Bank which had been fully collected as of March 31,

2022.

NEW YORK STATE ENERGY

RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Notes to Basic Financial Statements

March 31, 2023

25

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of presentation

The basic financial statements include government-wide financial statements, governmental fund

financial statements, proprietary fund financial statements, and fiduciary fund financial statements.

The government-wide financial statements report information on governmental and business-type

activities, and consist of a Statement of Net Position and a Statement of Activities. These

statements exclude information about fiduciary activities where NYSERDA holds assets in a trustee

or fiduciary capacity for others since such assets cannot be used to support NYSERDA’s own

programs.

Net position classifications used in the government-wide financial statements are as follows:

• Net investment in capital assets – amount of capital assets, net of accumulated depreciation,

reduced by the outstanding balances of debt attributable to the acquisition, construction, or

improvement of those assets, and deferred outflows of resources less deferred inflows of

resources, that are attributable to the acquisition, construction, or improvement of those assets or

related debt, excluding any significant unspent related debt proceeds or deferred inflows of

resources

• R

estricted for specific programs – amount of restricted assets and deferred outflows of resources

reduced by liabilities and deferred inflows of resources related to those assets

• U

nrestricted – amount of assets, deferred outflows of resources, liabilities, and deferred inflows of

resources that are not included in the determination of Net investment in capital assets or the

Restricted for specific programs components of net position

The governmental fund financial statements report governmental activities and consist of a Balance

Sheet and a Statement of Revenues, Expenditures, and Changes in Fund Balances. The funds

presented in the governmental funds financial statements are categorized as either major or non-

major funds (the latter are aggregated within “Other”) as required by U.S. generally accepted

accounting principles (U.S. GAAP).

Fund balance classifications used in the governmental fund financial statements are as follows:

• Nonspendable – amounts that cannot be spent because they are not in spendable form

• Restricted – amounts with constraints placed on the use of resources that are legally imposed by

creditors, grantors, contributors, or laws or regulations of other governments that may be imposed

by law through constitutional provisions or enabling legislation

• C

ommitted – amounts that can only be used for specific purposes pursuant to constraints imposed

by formal action of the government’s highest level of decision making. Amounts cannot be used for

any other purposes unless the government removes the specified use

• A

ssigned – amounts are constrained by the government’s intent to be used for specific purposes,

but are neither restricted or committed

• U

nassigned – residual balance is the amount not meeting other fund balance classifications

NYSERDA had no Committed or Assigned Fund Balances as of March 31, 2023. NYSERDA’s

Nonspendable fund balance at March 31, 2023 is composed of prepaid expenses.

NYSERDA administers certain programs on behalf of the Commission and others whereby the

terms of the program sponsor or enabling legislation limit the use of funds to certain program

purposes, and as such, the funds are reported as restricted. Since NYSERDA has multiple

constraints on its resources, restricted funds are considered spent first, committed funds second,

assigned funds third, and unassigned funds last.

NEW YORK STATE ENERGY

RESEARCH AND DEVELOPMENT AUTHORITY

(A Component Unit of the State of New York)

Notes to Basic Financial Statements

March 31, 2023

26

The proprietary fund financial statements, based on an enterprise type fund, report business-type

activities for which a fee is charged to external users for goods or services, and consist of a

Statement of Net Position; a Statement of Revenues, Expenses and Changes in Fund Net Position;

and a Statement of Cash Flows. NY Green Bank is presented in the proprietary fund financial

statements.

The fiduciary fund financial statements report assets held by NYSERDA in a fiduciary capacity for

others and consist of a Statement of Fiduciary Net Position and Statement of Changes in Fiduciary

Net Position. NYSERDA’s fiduciary funds include: (1) funds held for reimbursement to the State for

costs associated with the Low-Level Radioactive Waste Management Act of 1986; (2) funds that,

pursuant to a Cooperative Agreement, must be turned over to the U.S. Department of Energy upon

delivery of the solidified high-level radioactive waste from West Valley to a permanent federal

disposal repository to provide for perpetual care and management of the waste; (3) funds

established pursuant to the 2017 Indian Point closure agreement for community and environmental

benefit that must be transferred to recipients of awards of these funds upon the execution of

cooperative contracts; (4) funds established by the Office of Renewable Energy Siting through