Tot wordwide ssets invested in reguted open-end funds:

*

$. triion

United Sttes Europe Asi-Pcific Rest of the word

$33.6 triion $2.5 triion $9.7 triion $4.0 triion

US-registered investment compn tot net ssets: $. triion

Mutu

funds

Exchnge-trded

funds

Trdition

cosed-end funds

Unit investment

trusts

$25.5 triion

$8. triion $249 biion $77 biion

US-registered investment compnies’ shre of:

US corporte

equit

US nd foreign

corporte bonds

US Tresur nd

government genc

securities

US municip

securities

Commerci

pper

33% 22% 5% 27% 22%

US househod ownership of US-registered funds

Number of

househods

owning funds

Number of

individus

owning funds

Percentge of

househods

owning funds

Medin mutu fund

ssets of mutu

fund–owning househods

Medin number

of mutu funds

owned

7.5 miion 20.8 miion 54.4% $25,000 3

US retirement mrket

Tot retirement

mrket ssets

Percentge of househods with

tx-dvntged retirement svings

DC pn nd IRA ssets

invested in mutu funds

$38.4 triion 74% $.9 triion

* Reguted open-end funds incude mutu funds, exchnge-trded funds (ETFs), nd institution funds.

2023 Facts at a Glance

The Investment Compn Institute (ICI) is the eding ssocition representing reguted investment funds. ICI’s mission is to strengthen

the foundtion of the sset mngement industr for the utimte benefit of the ong-term individu investor. Its members incude

mutu funds, exchnge-trded funds (ETFs), cosed-end funds, nd unit investment trusts (UITs) in the United Sttes, nd UCITS nd

simir funds oered to investors in other jurisdictions. ICI so represents its members in their cpcit s investment dvisers to certin

coective investment trusts (CITs) nd reti seprte mnged ccounts (SMAs). ICI hs oces in Wshington DC, Brusses, nd

London nd crries out its interntion work through ICI Gob.

Sixt-fourth edition

ISBN ---

Copright © b the Investment Compn Institute. A rights reserved.

CONTENTS

Letter from the Chief Economist

ICI Senior Research Sta and Acknowledgments

CHAPTER

Worldwide Regulated Open-End Funds

CHAPTER

US-Registered Investment Companies

CHAPTER

US Mutual Funds

CHAPTER

US Exchange-Traded Funds

CHAPTER

US Closed-End Funds

CHAPTER

US Fund Expenses and Fees

CHAPTER

Characteristics of US Mutual Fund Owners

CHAPTER

US Retirement and Education Savings

APPENDIX A

How US-Registered Investment Companies Operate and

the Core Principles Underlying Their Regulation

APPENDIX B

Significant Events in Fund History

INVESTMENT COMPANY FACT BOOK

iv

Letter from the

Chief Economist

I m deighted to present the th edition of the Investment Company Fact Book. This er is

prticur significnt s we ceebrte two miestones in the histor of our industr—the th

nniversr of the mutu fund nd the th nniversr of the individu retirement ccount (IRA).

Mutu funds hve ped pivot roe in democrtizing investing, mking it possibe for

miion Americns to prticipte in finnci mrkets nd chieve their finnci gos. The

growth nd evoution of mutu funds over the pst centur is testment to their enduring

ppe nd the trust investors pce in them. Tht sting power, pus new product innovtions

cross the investment compn industr, hs positioned funds to p eding roe in Americ’s

success over the next ers.

Menwhie, IRAs, ong with (k) pns, hve become cornerstone of retirement svings in

the United Sttes. These vehices oer individus tx-dvntged ws to sve for retirement,

nd their importnce continues to grow s the retirement ndscpe evoves.

The Fact Book remins n essenti resource for understnding these nd other deveopments in

the industr. As ws, it provides comprehensive, dt-driven insights into the industr’s trends

nd ctivities. This er’s edition, ike those before it, ims to inform nd educte, fostering

deeper understnding of the industr nd its roe in heping investors buid nd preserve weth.

As we reect on these miestones nd ook to the future, we remin committed to serving

investors nd the industr. We hope ou wi find this er’s Fact Book vube nd s insightfu

s ever bout funds nd the investors who re on them.

Best regrds,

Sen Coins

Chief Economist

1

LETTER FROM THE CHIEF ECONOMIST

ICI Senior Research Sta

Chief Economist

Sen Coins eds the Institute’s Reserch Deprtment. He oversees

sttistic coections nd reserch on US nd gob funds, finnci

mrkets, the US retirement mrket, finnci stbiit, nd investor

demogrphics. Before joining ICI in , Coins worked t the US

Feder Reserve Bord of Governors nd the Reserve Bnk of New

Zend. He hs PhD in economics from the Universit of Ciforni,

Snt Brbr, nd BA in economics from Cremont McKenn

Coege.

Deput Chief Economist

Rochee (She) Antoniewicz eds the Institute’s reserch eorts

on the structure nd trends of the exchnge-trded fund nd mutu

fund industries, s we s on finnci mrkets in the United Sttes

nd gob. Before joining ICI in , Antoniewicz spent ers

t the Feder Reserve Bord of Governors. She erned BA in

mngement science from the Universit of Ciforni, Sn Diego,

nd n MS nd PhD in economics from the Universit ofWisconsin–

Mdison.

Senior Director of Retirement nd Investor Reserch

Srh Hoden eds the Institute’s reserch eorts on retirement nd

tx poic, s we s investor demogrphics nd behvior. Hoden,

who joined ICI in , heds eorts to trck trends in househod

retirement sving ctivit nd ownership of funds, s we s other

investments inside nd outside retirement ccounts. Before joining

ICI, Hoden served s n economist t the Feder Reserve Bord

of Governors. She hs PhD in economics from the Universit

ofMichign nd BA in mthemtics nd economics from Smith

Coege.

INVESTMENT COMPANY FACT BOOK

2

3

ICI SENIOR RESEARCH STAFF

Senior Director of Sttistic Reserch

Jud Steenstr oversees the coection nd pubiction of week,

month, qurter, nd nnu dt on open-end mutu funds, s we

s dt on cosed-end funds, exchnge-trded funds, unit investment

trusts, nd the wordwide fund industr. Steenstr joined ICI in nd

ws ppointed director of sttistic reserch in . She hs BS in

mrketing from ThePennsvni Stte Universit.

Acknowedgments

Pubiction of the 2024 Investment Company Fact Book ws directed b Jmes Duv, economist,

nd Jud Steenstr, senior director of sttistic reserch, working with Dvid Crfied, writer/editor,

nd Jnet Zvistovich, senior director of cretive. Contributors from ICI’s Reserch Deprtment who

deveoped nd edited nsis, text, nd dt re Irin Atmnchuk, Steven Bss, Miche Bogdn,

Aex Johnson, Shei McDond, Hmmd Qureshi, Doug Richrdson, Cse Rbk, Dn Schrss, nd

Shne Worner.

2023 ICI Research and

Statistical Publications

ICI is the primr source of nsis nd sttistic informtion on the investment compn industr. In

ddition to the nnuInvestment Company Fact Book, the Institute’s Reserch Deprtment reesed

more thn ppers,ICI Viewpointsposts, nd sttistic reports in .

TheInvestment Company Fact Bookremins one of ICI Reserch’s most visibe products. In its

thedition, this ICI pubiction continues to provide the pubic nd poicmkers with comprehensive

summr of ICI’s dt nd nsis.

Ppers

Industr nd Finnci Ansis

■

Accounting for International Exposure in Mutual Fund Performance Evaluation: Evidence from

Target Date Funds, December

■

Summary of Recent ICI Research on First-Mover Advantage, Dilution, and Systemic Risk in

Open-End Funds, December

■

“Ongoing Charges for UCITS in the European Union,2022,” ICI Research Perspective,

October

■

“The Closed-End Fund Market, 2022,”ICI Research Perspective, M

■

“Trends in the Expenses and Fees of Funds, 2022,”ICI Research Perspective, Mrch

■

First-Mover Advantage Among Direct Investors Holding Overlapping Positions and its

Implications for Mutual Funds, Mrch

Retirement nd Investor Reserch

■

“Profile of Mutual Fund Shareholders, 2023,” ICI Research Report, December

■

“Characteristics of Mutual Fund Investors, 2023,” ICI Research Perspective, October

■

“Ownership of Mutual Funds and Shareholder Sentiment, 2023,” ICI Research Perspective,

October

■

“Changes in 401(k) Plan Asset Allocation Among Consistent Participants, 2016–2020,”

ICIResearch Perspective, October

■

Ten Important Facts About 401(k) Plans, October

INVESTMENT COMPANY FACT BOOK

4

5

ICI RESEARCH AND STATISTICAL PUBLICATIONS

■

“How 401(k) Plan Participants Use Loans over Time: An Analysis of Loan Activity of Consistent

401(k) Plan Participants, 2016–2020,” ICI Research Perspective, September

■

Profile of ETF-Owning Households, 2022, August

■

“Defined Contribution Plan Participants’ Activities, First Quarter 2023,” ICI Research Report,Ju

■

When I’m 64 (or Thereabouts): Changes in Income from Middle Age to Old Age, M

■

The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans, 2019,

Apri

■

“What US Households Consider When They Select Mutual Funds, 2022,” ICI Research Perspective,

Apri

■

“What Does Consistent Participation in 401(k) Plans Generate? Changes in 401(k) Plan Account

Balances, 2016–2020,” ICI Research Perspective, Mrch

■

“Defined Contribution Plan Participants’ Activities, 2022,” ICI Research Report, Mrch

■

“The Role of IRAs in US Households’ Saving for Retirement, 2022,” ICI Research Perspective,

Februr

■

“American Views on Defined Contribution Plan Saving, 2022,” ICI Research Report, Jnur

ICI’s ppers with suppement dt tbes contining ddition dt re vibe twww.ici.org/

research.

Ansis nd Commentr: ICI Viewpoints

In ddition to reserch ppers, ICI stff produce nsis nd commentr for the Institute’s

bog,ICIViewpoints. Beow re some exmpes of recent nsis b ICI stff. Pese visit

www.ici.org/viewpointsto find these nd more.

■

Savers Remain Focused on Retirement Goals Through Market Turbulence

■

Falling Fund Fees Continue to Benefit America’s Investors

■

See our fund fees fct sheet:

Five Important Points on Mutual Fund Fees and Expenses

■

Three Myths and Facts About Bank Deposits, Bank Lending, and Money Market Funds

■

Shareholder Activism Threatens Closed-End Funds and Their Investors

■

Setting the Record Straight on Dilution, First-Mover Advantage, and Financial Stability Risk

■

See ICI’s comment letter to the SEC on its proposed Open-End Fund Liquidit Risk Mngement

Progrms nd Swing Pricing; Form N-PORT Reporting.

■

See ICI Global’s comment letter to IOSCO on Liquidit Mngement Too Guidnce.

■

See ICI Global’s comment letter to the FSB on Proposed Revisions to the FSB’s Poic

Recommendtions.

■

Aso, see our Annotated Bibliography of Research on Open-Ended Fund Liquidity Dynamics.

■

First-Mover Advantage: The Theory Is Only as Good as Its Assumptions

INVESTMENT COMPANY FACT BOOK

6

■

A ook t the EU’s Reti Investment Strteg, ICI Viewpoints series

■

Cost Benchmarks in the EU’s Retail Investment Strategy Will Stie Innovation

■

Cross-Border Frictions Within EU Capital Markets Can Drive Up Costs

■

Comparing Apples and Pears: EU UCITS and US Mutual Funds

■

The US Retirement System Is Working

■

How Do ETF and Mutual Fund Investors Dier?

■

Proxy Advisory Firms—Killing Closed-End Funds Softly with Their Policies

■

See our fct sheet highighting the ctivist presence in isted cosed-end funds:

Closed-End Fund Activism

■

The SEC Is Kicking Bank Loan Funds to the Curb

■

See ICI’s comment letter to the SEC on how the SEC’s proposed mendments to the iquidit risk

mngement rue woud ect mutu funds nd ETFs investing in bnk ons.

■

The SEC’s Liquidity Proposal Is Arbitrary and Harmful to Investors

■

See our fct sheet highighting mutu funds’ success in mnging iquidit:

Liquidity Management: A Mutual Fund Success Story

Sttistic Reeses

Trends in Mutu Fund Investing

Month report tht incudes mutu fund ses, redemptions, ssets, csh positions, exchnge ctivit,

nd portfoio trnsctions for the period b investment objectives.

Estimted Long-Term Mutu Fund Fows

Week report tht provides ggregte estimtes of net new csh ows to ctegories of equit, hbrid,

nd bond mutu funds.

Estimted Exchnge-Trded Fund (ETF) Net Issunce

Week report tht provides ggregte estimtes of net issunce to six ctegories of ETFs.

Combined Estimted Long-Term Mutu Fund Fows nd ETF Net Issunce

Week news reese nd report tht provides ggregte estimtes of net new csh ows nd net

issunce to six ctegories of ong-term mutu funds nd ETFs.

7

ICI RESEARCH AND STATISTICAL PUBLICATIONS

Mone Mrket Fund Assets

Week report on mone mrket fund ssets b tpe of fund.

Month Txbe Mone Mrket Fund Portfoio Dt

Month report bsed on dt contined in SEC Form N-MFP tht provides insights into the ggregted

hodings of prime nd government mone mrket funds nd the nture nd mturit of securit hodings

nd repurchse greements.

Retirement Mrket Dt

Qurter report tht incudes individu retirement ccount (IRA) nd defined contribution (DC) pn

ssets, mutu fund ssets inside retirement ccounts, nd estimtes of mutu fund net new csh ows to

retirement ccounts b tpe of fund.

Mutu Fund Distributions

Qurter report tht incudes pid nd reinvested cpit gins nd pid nd reinvested income dividends

of mutu funds b brod investment cssifiction.

Institution Mutu Fund Shrehoder Dt

Annu report tht incudes mutu fund sset informtion for vrious tpes of institution shrehoders,

broken out b brod investment cssifiction.

Cosed-End Fund Dt

Qurter report tht incudes cosed-end fund ssets, number of funds, issunce, redemptions,

distributions, use of everge, nd number of shrehoders b investment objective.

Exchnge-Trded Fund Dt

Month report tht incudes ssets, number of funds, issunce, nd redemptions of ETFs b investment

objective.

Unit Investment Trust Dt

Month report tht incudes the vue nd number of new trust deposits b tpe nd mturit.

Wordwide Reguted Open-End Fund Dt

Qurter report tht incudes ssets, number of funds, nd net ses b brod investment cssifiction of

funds in jurisdictions wordwide.

These nd other ICI sttistics re vibe twww.ici.org/research/stats. To subscribe to ICI’s sttistic

reeses, visitwww.ici.org/pdf/stats_subs_order.pdf.

INVESTMENT COMPANY FACT BOOK

8

LEARN

MORE

Data Tables

The sttistic dt tbes for the 2024 Investment Company Fact Book re vibe onine s Exce fies.

The dt tbes contin historic informtion on US mutu funds, exchnge-trded funds, cosed-end

funds, nd unit investment trusts, s we s informtion on wordwide reguted open-end funds.

SECTION ONE

US Mutual Fund Totals

SECTION TWO

US Closed-End Funds, Exchange-Traded Funds, and Unit Investment Trusts

SECTION THREE

US Long-Term Mutual Funds

SECTION FOUR

US Money Market Funds

SECTION FIVE

Additional Categories of US Mutual Funds

SECTION SIX

Institutional Investors in the US Mutual Fund Industry

SECTION SEVEN

Retirement Account Investing in US Mutual Funds

SECTION EIGHT

US-Registered Investment Companies

SECTION NINE

Worldwide Regulated Open-End Fund Totals

Fct Book Dt Tbes

www.icifactbook.org/24--data-tables.html

9

METHODS AND ASSUMPTIONS

Methods and Assumptions

The foowing methods, uness otherwise specified, pp to dt in this book:

■

Dt for US-registered investment compnies on incude those tht report sttistic informtion

to the Investment Compn Institute. Assets of these compnies re t est percent of industr

ssets.

■

Funds of funds re excuded from the dt to void doube counting.

■

Dors nd percentges m not dd to the tots presented becuse of rounding.

■

Dt for US-registered investment compnies incude exchnge-trded funds tht re not registered

under the Investment Compn Act of .

■

Long-term funds incude equit funds, hbrid funds, nd bond funds.

Dt re subject to revision. Athough informtion nd dt provided b independent sources re beieved

to be reibe, the Investment Compn Institute is not responsibe for their ccurc, competeness, or

timeiness. Opinions expressed b independent sources re not necessri those of the Institute. If ou

hve questions or comments bout this mteri, pese contct the source direct.

CHAPTER

Worldwide Regulated

Open-End Funds

Investors round the word hve historic demonstrted strong demnd for

reguted open-end funds (referred to in this chpter s reguted funds). In the

pst decde, wordwide net ses of reguted funds hve toted $.triion,

nd fund providers hve expnded the vst rr of choices, oering

investors ner , reguted funds. Demnd for reguted funds

strengthened considerb in s mcroeconomic uncertint

receded, which contributed to positive net ses nd percent

increse in tot net ssets. B er-end , reguted funds mnged

$.triion in tot net ssets wordwide.

IN THIS CHAPTER

Wht Are Reguted Funds?

Wordwide Tot Net Assets of Reguted Funds

Size of Wordwide Reguted Funds in Gob Cpit Mrkets

CHAPTER

INVESTMENT COMPANY FACT BOOK

10

1

11

WORLDWIDE REGULATED OPENEND FUNDS

Wht Are Reguted Funds?

The Interntion Investment Funds Assocition (IIFA) defines reguted funds s coective investment

poos tht re substntive reguted, open-end investment funds.* Open-end funds re gener defined

s those tht issue new fund shres (or units) nd redeem existing shres (or units) on demnd. Such

funds re tpic reguted with respect to discosure, the form of orgniztion (for exmpe, s either

corportions or trusts), custod of fund ssets, minimum cpit, vution of fund ssets, nd restrictions

on fund investments (such s imits on everge, tpes of eigibe investments, nd diversifiction of

portfoio investments).

In the United Sttes, however, reguted funds incude not on open-end funds, consisting of mutu

funds nd exchnge-trded funds (ETFs), but so unit investment trusts nd cosed-end funds.

†

In Europe,

reguted funds incude Undertkings for Coective Investment in Trnsferbe Securities (UCITS)—ETFs,

mone mrket funds, nd other ctegories of simir reguted funds—nd terntive investment funds,

common known s AIFs.

In mn countries, reguted funds m so incude institution funds, which re restricted to being sod

to imited number of non-reti investors; funds tht oer gurntees or protection of princip vi

eg binding gurntee of income or cpit; nd open-end re estte funds investing direct in re

estte to substntive degree.

At er-end , fund providers gob oered , reguted funds (Figure.). Europe hd the

rgest number of reguted funds with percent of the tot, whie equit funds were the most numerous

tpes of reguted funds (percent), foowed b bnced/mixed funds (percent), which so hod

equities in their portfoios.

* The primr dt source for wordwide reguted funds is the IIFA. In , the IIFA coected dt on wordwide reguted

funds from jurisdictions. For informtion on individu jurisdictions, see the sttistic dt tbes vibe onine t

www.icifactbook.org/24--data-tables.html. For more detis bout the IIFA dt coection, see Wordwide Definitions of

Terms nd Cssifictions t www.ici.org/info/ww_q3_18_definitions.xls.

† Dt for unit investment trusts nd cosed-end funds re not incuded in this chpter; these funds re discussed in chpter

nd chpter , respective.

INVESTMENT COMPANY FACT BOOK

12

FIGURE

1.1

Number of Wordwide Reguted Open-End Funds

Percentage of funds by region or type of fund, year-end 2023

Type of fundRegion

Number of worldwide regulated open-end funds: 139,982

29

43

7

21

23

17

25

33

2

Asia-Pacific

Europe

United States

Rest of the world

Money market

Other*

Balanced/Mixed

Equity

Bond

* Other funds incude gurnteed/protected funds, re estte funds, nd other funds.

Note: Reguted open-end funds incude mutu funds, ETFs, nd institution funds.

Source: Interntion Investment Funds Assocition

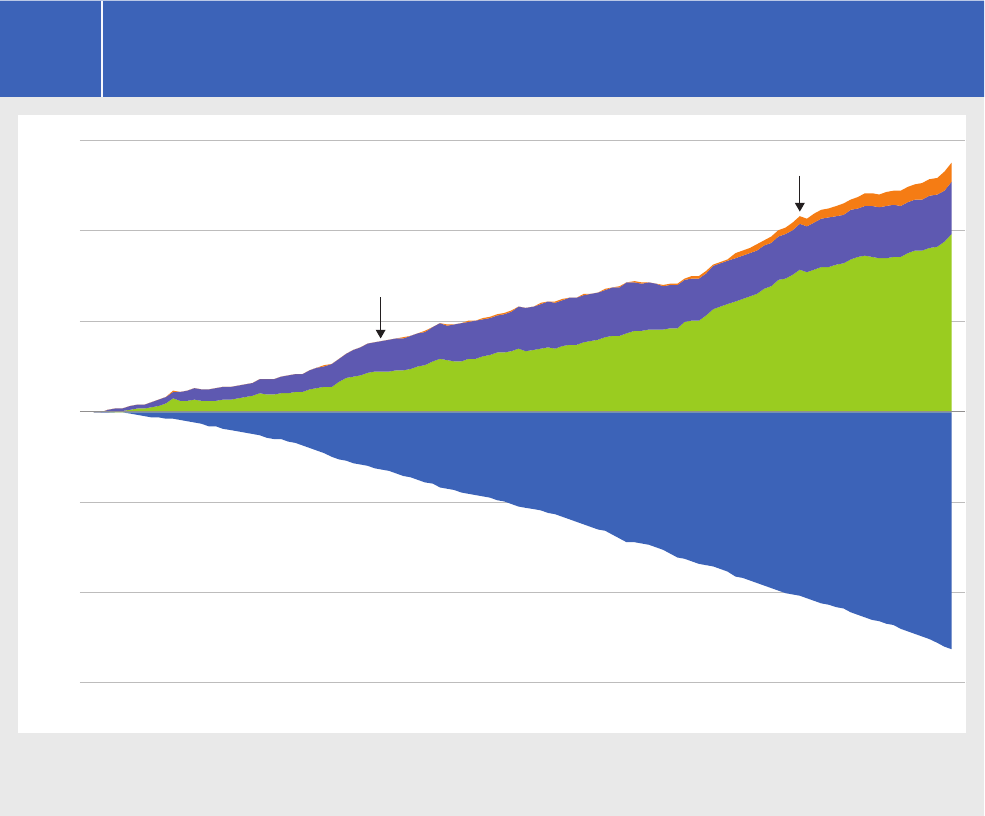

Wordwide Tot Net Assets of Reguted Funds

Wordwide tot net ssets of reguted funds prti rebounded in fter shrp decine in the

previous er (Figure.).* A conuence of mcroeconomic nd geopoitic fctors ected wordwide

cpit mrkets in , eding to notbe increse in the vue of the undering stocks nd bonds hed

b reguted funds. Among the fctors boosting finnci mrkets in :

■

intion esed fster thn expected in mn regions;

■

snchronized centr bnk poices heped curb intion expecttions nd provided some stbiit to

the gob finnci sstem; nd

■

better thn expected mcroeconomic conditions, despite gob geopoitic risks from Russi’s

ongoing invsion of Ukrine, the Isre–Hms wr, tensions between the United Sttes nd Chin

over Tiwn, nd interntion trde disruptions becuse of shipping ttcks in the RedSe.

* In this chpter, uness otherwise noted, dt for tot net ssets nd net ses re denominted in US dors.

13

WORLDWIDE REGULATED OPENEND FUNDS

FIGURE

1.2

Tot Net Assets of Wordwide Reguted Open-End Funds Incresed to $. Triion

in

Trillions of US dollars by type of fund, year-end

20232022202120192017

2

20152013

16.3

15.5

8.0

8.0

3.5

3.3

5.2

4.9

31.8

12.9

10.4

38.2

36.4

60.1

15%

19%

11%

46%

Money market

Bond

Other

1

Balanced/Mixed

Equity

Total number of worldwide regulated open-end funds

106,06097,371113,223122,571137,846139,982131,815

49.3

54.7

70.9

68.9

4.7

5.2

21.8

10.4

4.8

5.9

6.4

24.5

11.8

4.8

6.9

6.7

8.6

6.1

8.8

13.7

33.6

7.0

5.8

8.8

11.5

27.0

7.3

6.4

9%

Other funds incude gurnteed/protected funds, re estte funds, nd other funds.

Dt for Russi re for :Q.

Note: Reguted open-end funds incude mutu funds, ETFs, nd institution funds.

Source: Interntion Investment Funds Assocition

With stock mrkets rising cross the gobe in (percent in the United Sttes, percent in Europe,

nd percent in the Asi-Pcific region*) wordwide tot net ssets of equit funds, which invest

primri in pubic trded stocks, incresed b percent to $.triion t er-end . Bond

funds—which invest primri in fixed-income securities—sw their tot net ssets increse percent

over the sme period, somewht reecting tot returns (cpit gins nd interest income) on bonds in

Europe nd the Asi-Pcific region of percent nd percent, respective.† Net ssets of mone mrket

funds, which re reguted funds restricted to hoding short-term, high-quit debt instruments, so

incresed substnti.

* As mesured b the Wishire Tot Mrket Index, the MSCI Di Tot Return Gross Europe Index, nd the MSCI Di Tot

Return Gross AC Asi-Pcific Index, which re expressed in US dors.

† As mesured b the ICE BofA Pn-Europe Brod Mrket Index (expressed in euros) nd the Boomberg Asin-Pcific Aggregte

Tot Return Index (expressed in Jpnese en), which both cover investment grde securities.

INVESTMENT COMPANY FACT BOOK

14

LEARN

MORE

Tot net ssets of wordwide reguted funds so vried wide b geogrphic region (Figure.). At

er-end , the mjorit of wordwide tot net ssets in reguted funds continued to be hed in the

United Sttes (percent) nd Europe (percent). Strong regutor frmeworks in both jurisdictions

hve contributed to their success. In recent decdes, US-reguted funds hve been bostered b their

vibiit s investment options in tx-dvntged ccounts, such s (k) pns. Menwhie, the

UCITSfrmework hs mn provisions tht ow for the pooing of ssets. These incude pssporting

(i.e., UCITS estbished in one countr cn be sod cross-border into one or more other Europen

countries), the vibiit of UCITS in countries outside of Europe, nd owing dierent shre csses to

be denominted in rnge of dierent currencies or dpted to dierent tx structures.

Reguted funds in the Asi-Pcific region hed nother percent of wordwide tot net ssets. Given the

size of the popution, the rpid incresing economic deveopment nd weth in mn countries, nd

eorts to promote individu ccount-bsed sving nd investing, the region’s reguted fund mrket hs

potenti for continued growth.

Wordwide Reguted Open-End Fund Assets nd Fows

www.ici.org/reserch/stts/wordwide

FIGURE

1.3

The United Sttes Hs the Lrgest Shre of Tot Net Assets of Wordwide Reguted

Open-End Funds

Trillions of US dollars by region, year-end

20232022202120192017*20152013

2.02.3

13.7

13.6

4.8

3.8

3.4

9.1

38.2

36.4

70.9

14%

31%

49%

6%

Asia-Pacific

Europe

United States

Rest of the world

49.3

54.7

68.9

60.1

16.7 17.7

2.9

17.7

6.5

22.1

3.1

18.7

7.2

25.7

33.6

9.7

21.5

4.0

34.1

10.0

23.2

3.6

28.6

19.1

* Dt for Russi re for :Q.

Note: Reguted open-end funds incude mutu funds, ETFs, nd institution funds.

Source: Interntion Investment Funds Assocition

15

WORLDWIDE REGULATED OPENEND FUNDS

Wordwide Net Ses of Reguted Long-Term Funds

Wordwide demnd for reguted ong-term funds (equit, bond, bnced/mixed, nd other) incresed

shrp in , from net redemptions of $biion in to net ses of $biion in

(Figure.). The return to net inows for ong-term funds ws driven b the United Sttes nd Europe,

which hd net inows of $biion nd $biion, respective. Demnd so remined strong in the

Asi-Pcific region in ($biion), which ws driven b net inows in Chin nd Jpn.

FIGURE

1.4

Wordwide Net Ses of Reguted Open-End Long-Term Funds Incresed in

Billions of US dollars by region, annual

0

-500

500

1,000

1,500

2,000

2,500

3,000

3,500

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Total worldwide net sales

Asia-Pacific

Europe

United States

Rest of the world

,

,

,

,

,

,338

,

-

Note: Reguted open-end funds incude mutu funds, ETFs, nd institution funds. Long-term funds incude equit funds, bnced/

mixed funds, bond funds, nd other funds (gurnteed/protected, re estte, nd other funds), but excude mone mrket funds.

Source: Interntion Investment Funds Assocition

INVESTMENT COMPANY FACT BOOK

16

Wordwide net ses of reguted ong-term funds incresed cross most fund ctegories in when

compred with . For exmpe, wordwide net ses of equit funds incresed from net outows of

$biion in to net inows of $biion in (Figure.). The increse in net ses ws ike

ssocited with the gener improvement in gob equit mrkets, s net ows to equit funds hve

historic been reted to word equit returns.

Bond funds so experienced mjor shift in net ses, going from net outows of $biion in

to net inows of $biion in (Figure.). This revers ws primri driven b continuing

deveopments round intion nd interest rtes. Foowing rmpnt intion nd soring interest rtes

in , intion gener fe round the word throughout nd short-term interest rtes stbiized

during the second hf of the er.

The trjector of monetr poic is importnt becuse when interest rtes rise, bond prices f (nd

vice vers). As such, fixed-income investors stnd to gin from n potenti reduction in oci interest

rtes. Addition, ike the experience with equit fund returns nd ows, net ows to bond funds hve

historic been reted to bond returns (see Figure.).

FIGURE

1.5

Wordwide Net Ses of Reguted Open-End Funds Ws Primri from Inows into

Bond Funds

Billions of US dollars by type of fund, annual

0

-500

500

1,000

1,500

2,000

2,500

3,000

3,500

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Total worldwide net sales

Bond

Other*

Balanced/Mixed

Equity

,

,

,

,

,

,338

,

-

* Other funds incude gurnteed/protected funds, re estte funds, nd other funds.

Note: Reguted open-end funds incude mutu funds, ETFs, nd institution funds.

Source: Interntion Investment Funds Assocition

17

WORLDWIDE REGULATED OPENEND FUNDS

LEARN

MORE

Ongoing Chrges for UCITS in the Europen Union

The UCITS Directive hs become gob success stor since its doption in , with net ssets

of €.triion in EU-domicied UCITS t er-end . Investments in these funds re hed b

investors in Europe nd other jurisdictions wordwide. In recent ers, there hs been incresed

ttention to the costs nd chrges pid b shrehoders of investment funds, prticur in Europe.*

For exmpe, in December , the Europen Securities nd Mrkets Authorit (ESMA) issued its

test report investigting costs nd performnce of EU reti investment products.†

Like reguted fund investors in other countries, UCITS investors incur ongoing chrges tht cover

the provision of services, incuding portfoio mngement, dministrtion, compince costs,

ccounting services, eg costs, nd pments to distributors. The tot cost of these chrges is

discosed to investors through either the tot expense rtio (TER), often found in UCITS’ nnu

report nd other mrketing documents, or the ongoing chrges figure (OCF), found in the Ke

Informtion Document (KID).

On n sset-weighted bsis, verge ongoing chrges of equit nd fixed-income UCITS continued

their downwrd trend in (Figure.). Since , sset-weighted verge ongoing chrges

for equit nd fixed-income UCITS hve decined percent nd percent, respective. In ,

the sset-weighted verge ongoing chrge for equit funds fe to .percent from .percent

in . In other words, for ever € invested in , fund shrehoders were chrged €.

in ongoing fees. Addition, the sset-weighted verge ongoing chrges for equit nd fixed-

income funds were beow their respective simpe verges, which indictes tht investors tend to

concentrte their ssets in ower-cost funds.

CONTINUED ON THE NEXT PAGE

* Europen Securities nd Mrkets Authorit, Final Report on the 2021 CSA on Costs and Fees. Avibe t www.esma.

europa.eu/sites/default/files/library/esma34-45-1673_final_report_on_the_2021_csa_on_costs_and_fees.pdf.

† Europen Securities nd Mrkets Authorit, Costs and Performance of EU Retail Investment Products 2023. Avibe

t www.esma.europa.eu/sites/default/files/2023-12/ESMA50-524821-3052_Market_Report_on_Costs_and_

Performance_of_EU_Retail_Investment_Products.pdf.

Ongoing Chrges for UCITS in the Europen Union,

www.ici.org/fies//per-.pdf

INVESTMENT COMPANY FACT BOOK

18

LEARN

MORE

Wordwide Net Ses of Mone Mrket Funds

Wordwide net ses of mone mrket funds toted $.triion in , up from $biion in

(Figure.). The increse in wordwide demnd for mone mrket funds ws spred cross

geogrphic regions but ws primri driven b substnti increse in net inows in the United

Sttes. Investor demnd for mone mrket funds in the United Sttes incresed from $biion in

to $.triion in . In the Asi-Pcific region, mone mrket funds experienced net inows of

$biion in , bout even with the net inows of $biion in .

Investors use mone mrket funds becuse the re profession mnged, tight reguted vehices

with hodings imited to high-quit, short-term debt instruments. As such, the re high iquid, ttrctive,

csh-ike terntives to bnk deposits. Gener, demnd for mone mrket funds is dependent upon

their ieds nd interest rte risk exposure retive to other high-quit fixed-income securities.

Ongoing Chrges for UCITS in the Europen Union,

Trends in the Europen Investment Fund Industr

www.efm.org/node/

FIGURE

1.6

Investors in UCITS P Beow-Averge Ongoing Chrges

Percent

202220212013202220212013

Equity Fixed income

Simple average ongoing charge

Asset-weighted average ongoing charge

1.73

1.38

1.42

1.12

0.93

1.49

1.21

0.98

0.92

0.69

0.67

1.18

Note: Dt excude ETFs.

Source: Investment Compn Institute ccutions of Morningstr Direct dt. See ICI Research Perspective, “Ongoing Chrges

for UCITS in the Europen Union, .”

19

WORLDWIDE REGULATED OPENEND FUNDS

FIGURE

1.7

Wordwide Net Ses of Mone Mrket Funds Incresed Shrp in

Billions of US dollars by region, annual

-500

0

500

1,000

1,500

2,000

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

191

405

82

598

79

706

1,295

673

161

1,524

Total worldwide net sales

Asia-Pacific

Europe

United States

Rest of the world

Source: Interntion Investment Funds Assocition

In the United Sttes, net ses of mone mrket funds incresed becuse of heightened demnd from both

reti nd institution investors. In , mone mrket fund ieds reched their highest eve in more

thn ers. Both reti nd institution investors were ttrcted to the high mrket ieds nd ow

interest rte risk oered b mone mrket funds, especi in ight of the substnti interest rte votiit

tht bond funds were experiencing during this time.

Demnd for mone mrket funds in the Asi-Pcific region is dominted b Chinese mone mrket funds,

which hod the buk of mone mrket fund tot net ssets in the region. The Peope’s Bnk of Chin

owered interest rtes further in , decresing the oci one-er Lon Prime Rte to .percent.

The reduction in the short-term interest rte ws in response to suggish economic performnce.

Regrdess, net inows into mone mrket funds in the Asi-Pcific region remined positive for the er.

INVESTMENT COMPANY FACT BOOK

20

Size of Wordwide Reguted Funds in Gob Cpit Mrkets

Reguted funds continue to be n importnt conduit for octing cpit gob, heping finnce

businesses, governments, nd househod ctivities. As of er-end , wordwide cpit mrkets,

s mesured b the vue of equit nd debt securities outstnding, toted $.triion, of which

reguted funds’ net ssets were percent, or $.triion (Figure.).

The shre of wordwide cpit mrkets hed b reguted funds hs grown over the pst decde.

In , wordwide reguted funds hed percent of wordwide cpit mrkets, compred with

percent in . The remining percent were hed b wide rnge of other investors, such s

centr bnks, sovereign weth funds, pension pns (both defined benefit nd defined contribution),

bnks, insurnce compnies, hedge funds nd privte equit funds, broker-deers, nd househods’

direct hodings of stocks nd bonds.

FIGURE

1.8

Wordwide Reguted Funds Hed Percent of Wordwide Equit nd Debt Mrkets

Trillions of US dollars, year-end

20232013

2013

2023*

Other investors

Total net assets of worldwide regulated open-end funds

127.1

36.4

188.5

68.9

22%

27%

257.4

163.5

* Dt for wordwide debt mrkets re s of September , .

Note: Reguted open-end funds incude mutu funds, ETFs, nd institution funds.

Source: Investment Compn Institute ccutions of dt from the Interntion Investment Funds Assocition, Word Federtion of

Exchnges, Bnk for Interntion Settements, nd Refinitiv

21

WORLDWIDE REGULATED OPENEND FUNDS

Fund Ownership in Mrket-Bsed Versus Bnk-Bsed Economies

Gener speking, jurisdiction’s finnci sstem cn be described s either mrket-bsed or bnk-

bsed depending on how its econom depos svings nd rises cpit for the production of goods nd

services. For exmpe, mn jurisdictions within the Europen Union re considered to hve bnk-bsed

economies, since bnks re more often used to mobiize investor svings nd octe cpit. Converse,

the United Sttes is usu considered mrket-bsed econom since cpit mrkets re the min

conduit for investor svings nd depoing cpit. The structure of cpit oction in n econom is

fctor tht cn inuence the demnd for reguted funds becuse the tend to mke up greter shre of

househod weth in mrket-bsed economies.

In the Europen Union nd Jpn, where investors hve trdition octed svings nd cpit

to bnks, househods hod more of their finnci weth in bnk products. Europen nd Jpnese

househods hod percent nd percent, respective, of their finnci weth in bnks, with more

modest shre in reguted funds (Figure.). B comprison, househods in the United Sttes hod much

ower shre of their finnci weth in bnks nd much rger shre in reguted funds.

FIGURE

1.9

US Househods Hod More of Their Weth in Reguted Funds; Bnk-Centric

Countries Hve Lower Shre

Percentage of household

1

financial wealth, year-end 2023

JapanEuropean Union³United States

53

32

22

12

10

5

Bank deposits and currency

Regulated funds

2

Househods incude househods nd nonprofit institutions serving househods.

For the United Sttes, reguted funds incude tot net ssets hed b mutu funds nd ETFs. For the Europen Union nd

Jpn, reguted funds incude investment fund shres s defined b their respective sstems of ntion ccounts.

Dt for Pond re s of :Q.

Sources: Investment Compn Institute, Feder Reserve Bord, Eurostt, nd Bnk of Jpn

CHAPTER

US-Registered Investment

Companies

Registered investment compnies re n importnt segment of the sset mngement

industr in the United Sttes. US-registered investment compnies p mjor roe in

the US econom nd finnci mrkets nd growing roe in gob finnci mrkets.

These funds mnged $. triion in tot net ssets t er-end ,

rge on behf of more thn miion US reti investors. The industr

hs experienced robust growth over the pst qurter centur from sset

pprecition nd strong demnd from househods due to rising househod

weth, the ging US popution, nd the evoution of empoer-bsed

retirement sstems. US funds supp investment cpit in securities

mrkets round the word nd re importnt investors in the US stock,

bond, nd mone mrkets.

IN THIS CHAPTER

Number nd Assets of Investment Compnies

Americns’ Continued Reince on Investment Compnies

Roe of Investment Compnies in Finnci Mrkets

Growth of Index Funds

Fund Compexes nd Sponsors

Environment, Soci, nd Governnce Investing

Investment Compn Empoment

CHAPTER

INVESTMENT COMPANY FACT BOOK

22

2

23

USREGISTERED INVESTMENT COMPANIES

Number nd Assets of Investment Compnies

There were , investment compnies

*

oered b US finnci services compnies t er-end

(Figure.). The over number of investment compnies is down from decde go s n increse in the

number of exchnge-trded funds (ETFs) on prti oset decreses in the number of unit investment

trusts (UITs), mutu funds, nd trdition cosed-end funds (CEFs).

* The terms investment companies nd US investment companies re used t times throughout this book in pce of US-registered

investment companies. US-registered investment compnies re open-end mutu funds, ETFs, trdition CEFs, nd UITs.

FIGURE

2.1

Most Investment Compn Tot Net Assets Are in Mutu Funds

Year-end 2023

3,750

UITs

$249

Traditional CEFs

3

8,582

Mutual funds

1

$25,519

Mutual funds

$8,085

ETFs

3,304

ETFs²

Total number of funds: 16,038Total net assets: $33,930

Number of funds

402

Traditional CEFs

3

$77

UITs

Total net assets

4

Billions of dollars

Mutu fund dt for number of funds incude mutu funds tht invest primri in other mutu funds.

ETF dt for number of funds incude ETFs tht invest primri in other ETFs.

CEF dt incude on trdition CEFs. CEF dt for tot net ssets incude preferred shre csses.

Tot investment compn ssets incude mutu fund hodings of CEFs nd ETFs.

INVESTMENT COMPANY FACT BOOK

24

Tot net ssets in US-registered investment compnies incresed in to er-end eve

of $.triion, with the vst mjorit hed b mutu funds nd ETFs. US-registered investment

compn tot net ssets were concentrted in ong-term funds, with equit funds one hoding

$.triion—percent of investment compn tot net ssets t er-end (Figure.).

Domestic equit funds (those tht invest primri in shres of US corportions) hed $.triion in net

ssets; word equit funds (those tht invest significnt in shres of non-US corportions) ccounted for

$.triion. Bond funds hed $.triion in ssets, whie mone mrket funds, hbrid funds, nd other

funds—such s those tht invest primri in commodities—hed the remining $.triion.

During , mutu funds recorded n ggregte $biion in positive net new csh ow s demnd

for mone mrket funds overwheming oset outows from ong-term mutu funds (see Figure.).

Mutu fund shrehoders reinvested $biion in income dividends nd $biion in cpit gins

distributions tht mutu funds pid out during the er. Investors continued to show strong demnd for

ETFs, with net shre issunce (which incudes reinvested dividends) toting $biion in (see

Figure.). UITs experienced tot deposits of $biion nd trdition CEFs hd net redemptions of

$miion (seeFigure.).

FIGURE

2.2

The Mjorit of Investment Compn Tot Net Assets Were in Equit Funds

Percentage of total net assets, year-end 2023

46%

Domestic equity funds

19%

Bond funds

13%

World equity funds

17%

Money market funds

5%

Hybrid and other funds

1

Investment company total net assets:

2

$33.9 trillion

The other funds ctegor incudes ETFs—both registered nd not registered under the Investment Compn Act of —tht invest

primri in commodities, currencies, nd futures.

Tot investment compn ssets incude mutu fund hodings of CEFs nd ETFs. CEF dt incude on trdition CEFs. CEF dt for

tot net ssets incude preferred shre csses.

25

USREGISTERED INVESTMENT COMPANIES

Americns’ Continued Reince on Investment Compnies

Househods mke up the rgest group of investors in funds, nd registered investment compnies

mnged .percent of househod finnci ssets t er-end (Figure.). The growth of mutu

funds inside individu retirement ccounts (IRAs) nd defined contribution (DC) pns, prticur

(k)pns, expins some of the incresed househod reince on investment compnies in the pst

three decdes. Mutu funds in IRAs nd DC pns mde up .percent of househod finnci ssets t

er-end , up from .percent in .

FIGURE

2.3

Househods Re More on Investment Compnies—Prt from Incresed Hodings

Inside DC Pns nd IRAs

Percentage of US household financial assets,

1

year-end

20231990

Other household financial assets held in registered investment companies

Mutual funds in IRAs and DC plans²

22.6

1.3

7.3

10.0

6.0

12.7

Househod finnci ssets hed in registered investment compnies incude hodings of mutu funds, ETFs, CEFs, nd UITs. Mutu

funds hed in empoer-sponsored DC pns, IRAs, nd vribe nnuities re incuded.

DC pns incude privte-sector empoer-sponsored DC pns (such s (k) pns), (b) pns, nd pns.

Sources: Investment Compn Institute nd Feder Reserve Bord

INVESTMENT COMPANY FACT BOOK

26

LEARN

MORE

Businesses nd other institution investors so re on funds. For instnce, institutions cn use mone

mrket funds to mnge some of their csh nd other short-term ssets. Institution investors so hve

contributed to the growing demnd for ETFs. Investment mngers—for mutu funds, pension funds,

hedge funds, nd insurnce compnies—use ETFs to invest in mrkets, mnge iquidit nd investor

ows, or hedge their exposures.

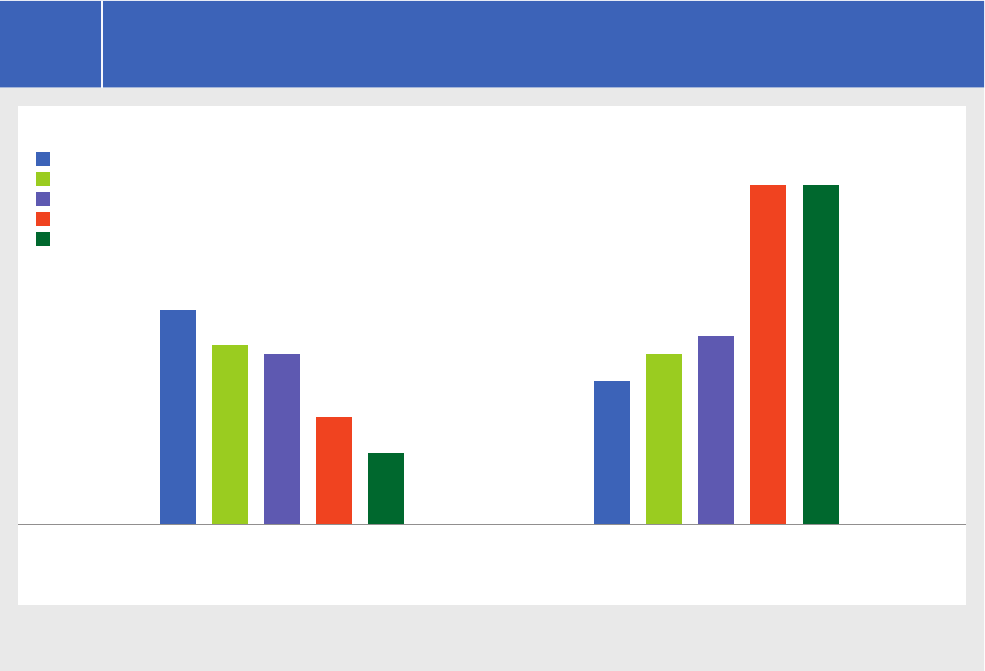

Roe of Investment Compnies in Finnci Mrkets

Investment compnies hve been importnt investors in domestic finnci mrkets for much of the pst

ers. The hve hed rge stbe shre of the securities outstnding cross vriet of sset

csses in recent ers, min through mutu funds. At er-end , investment compnies hed

percent of US corporte equities outstnding, simir to its eve t er-end (Figure.).

Investment compnies hed percent of bonds issued b US corportions nd foreign bonds hed b

US residents t er-end nd percent of the US Tresur nd government genc securities

outstnding. Investment compnies so hve been importnt investors in the US municip securities

mrket, hoding percent of the securities outstnding t er-end . Fin, mutu funds

(primri prime mone mrket funds) hed percent of the US commerci pper mrket— critic

source of short-term funding for mn mjor corportions round the word.

Mone Mrket Fund Resource Center

www.ici.org/mmfs

27

USREGISTERED INVESTMENT COMPANIES

FIGURE

2.4

Investment Compnies Chnne Investment to Stock, Bond, nd Mone Mrkets

Percentage of total market value of securities held by investment companies, year-end

2023

2022

2021

2020

2023

2022

2021

2020

2023

2022

2021

2020

2023

2022

2021

2020

2023

2022

2021

2020

US corporate

equity

US and foreign

corporate bonds*

US Treasury and

government

agency securities

US municipal

securities

Commercial

paper

Long-term mutual funds

Money market funds

Other registered investment companies

22

25

23

8

10

11

10

35

24

33

33

33

18

16

18

15

6

6

5

6

24

23

23

22

69

6

1

1

6

6

13

6

12

16

15

20

19

19

4

5

4

5

26

22

29

27

27

19

20

15

24

14

16

22

17

1

51

8

2

2

3

3

4

2

2

2

* Mone mrket fund hodings of US nd foreign corporte bonds rounded to ess thn . percent in ers.

Sources: Investment Compn Institute, Feder Reserve Bord, nd Word Federtion of Exchnges

INVESTMENT COMPANY FACT BOOK

28

Growth of Index Funds

Index funds re designed to trck the performnce of mrket index. To do this, the fund mnger

purchses the securities in the index or representtive smpe of them—mirroring the index

composition—so tht the performnce of the fund trcks the vue of the index. This pproch to portfoio

mngement is the primr reson tht index funds tend to hve beow-verge expense rtios (see

Figures . nd .).

Index mutu funds were first oered in the s, foowed b index ETFs in the s. B er-end ,

tot net ssets in these two index fund ctegories hd grown to $.triion. Aong with this growth, index

fund ssets hve become rger shre of over fund ssets. At er-end , index mutu funds nd

index ETFs together ccounted for percent of ssets in ong-term funds, up from percent t er-end

(Figure.). Nevertheess, ctive mnged funds sti ccounted for more thn hf of ong-term

fund ssets (percent) t er-end .

FIGURE

2.5

Index Funds Hve Grown s Shre of the Fund Mrket

Percentage of long-term total net assets, year-end

Actively managed mutual funds and ETFs

Index ETFs

Index mutual funds

2023202020152010

72

14

15

81

9

10

52

27

21

60

21

20

40%

28%

19%

48%

Total net assets

Trillions of dollars

$9.9 $14.9$24.8 $27.6

Note: Dt excude mone mrket funds. Dt for ETFs excude non– Act ETFs.

29

USREGISTERED INVESTMENT COMPANIES

The growth in index funds hs been concentrted in funds tht invest primri in US equities, with

percent of inows into index funds over the pst decde going to domestic equit funds. But despite

their significnt growth, index domestic equit mutu funds nd ETFs remin retive sm investors

in the US stock mrkets, hoding on percent of the vue of US stocks t er-end (Figure.).

Active mnged domestic equit mutu funds nd ETFs hed nother percent, whie other investors—

incuding hedge funds, pension funds, ife insurnce compnies, nd individus—hed the mjorit

(percent).

FIGURE

2.6

Index Domestic Equit Fund Shre of US Stock Mrket Is Sm

Percentage of US stock market capitalization, year-end

20232022202120202019201820172016201520142013

Other investors

Actively managed domestic equity mutual funds and ETFs

Index domestic equity mutual funds and ETFs

13

15

71

16

16

68

15

15

69

13

16

71

12

17

71

11

18

71

10

18

72

9

19

72

18

13

68

18

14

69

17

15

68

Sources: Investment Compn Institute nd Word Federtion of Exchnges

INVESTMENT COMPANY FACT BOOK

30

Unit Investment Trusts

Unit investment trusts (UITs) re registered investment compnies with chrcteristics of both mutu

funds nd CEFs. Like mutu funds, UITs issue redeembe shres (ced units), nd ike CEFs, the

tpic issue specific, fixed number of shres. But unike either mutu funds or CEFs, UITs hve

preset termintion dte bsed on the portfoio’s investments nd the UIT’s investment gos. UITs

investing in ong-term bonds might hve preset termintion dte of to ers, depending

on the mturit of the bonds the hod. UITs investing in stocks might seek to cpture cpit

pprecition in few ers or ess. When UIT termintes, proceeds from the securities re pid

tounit hoders or, t unit hoder’s eection, reinvested in nother trust.

UITs f into two min ctegories: debt (or bond) trusts nd equit trusts. Debt trusts re cssified

s txbe or tx-free; equit trusts re cssified s domestic or interntion/gob. The first UIT,

introduced in , hed tx-free bonds, nd historic, most UIT tot net ssets were invested

in bonds. Equit UITs, however, hve grown in popurit over the pst three decdes. At er-end

, ssets in equit UITs fr exceeded those of bond UITs, constituting percent of UIT tot net

ssets (Figure.). The number of trusts outstnding hs decresed, s sponsors hve creted fewer

new trusts nd existing trusts hve reched their preset termintion dtes.

Feder w requires tht UITs hve rge fixed portfoio—one tht is not ctive mnged

or trded. Once the trust’s portfoio hs been seected, its composition m chnge on in ver

imited circumstnces. Most UITs hod diversified portfoio, described in deti in the prospectus,

with securities profession seected to meet stted investment go, such s growth, income,

orcpit pprecition.

Investors cn obtin UIT price quotes from brokerge or investment firms nd investment compn

websites. Some UITs ist their prices on the Nsdq Fund Network. Some broker-deers oer their

own trusts or se trusts oered b ntion recognized independent sponsors. Units of these

trusts cn be bought through their registered representtives. Units cn so be bought from the

representtives of smer investment firms tht se trusts sponsored b third-prt firms.

Though fixed number of units of UIT re sod in pubic oering, trust sponsor is ike to

mintin secondr mrket, where investors cn se their units bck to the sponsor nd other

investors cn bu those units. Even bsent secondr mrket, UITs re required b w to redeem

outstnding units t their net sset vue (NAV), which is bsed on the undering securities’ current

mrket vue.

CONTINUED ON THE NEXT PAGE

31

USREGISTERED INVESTMENT COMPANIES

LEARN

MORE

Unit Investment Trusts,

FIGURE

2.7

Tot Net Assets of UITs Hve Shifted from Tx-Free Debt Trusts to Equit Trusts

Billions of dollars, year-end

2023202220212020201520102005200019951990

3,966 3,750 4,112 4,310 5,188 5,971 6,019 10,072 12,979 12,131

94

78

51

41

74

73

105

73

95

11

6

13

10

23

51

92

5

3

2

4

2

4

8

9

1

80

70

88

34

1

4

68

77

1

4

72

29

48

14

4

Equity trust assets

Taxable debt trust assets

Tax-free debt trust assets

Total number of trusts

Unit Investment Trust Dt

www.ici.org/research/stats/uit

INVESTMENT COMPANY FACT BOOK

32

Fund Compexes nd Sponsors

At er-end , fund sponsors from round the word competed in the US mrket to provide

investment mngement services to fund investors (Figure.). The decine in the number of fund sponsors

since er-end m be due to vriet of business decisions, incuding rger fund sponsors

cquiring smer ones, fund sponsors iquidting funds nd eving the business, or rger sponsors

seing their dvisor businesses. Prior to , the number of fund sponsors hd been incresing s the

econom nd finnci mrkets recovered from the – finnci crisis. Over, from er-end

through er-end , sponsors entered the mrket whie eft, for net decrese of .

FIGURE

2.8

Number of Fund Sponsors Hs Gener Decined Since

20232022202120202019201820172016201520142013

823

873

879

853

848

849

827

805

825

815

797

Total fund sponsors at year-end

Fund sponsors entering

Fund sponsors leaving

82

50

79

29

54

48

51

42

47

77

44

43

42

64

34

56

58

38

44

54

30

48

33

USREGISTERED INVESTMENT COMPANIES

Mn recent entrnts to the fund industr hve dopted soutions in which the fund’s sponsor rrnges

for third prt to provide certin services (e.g., udit, trustee, some eg) through turnke setup. This

ows the sponsor to focus more on mnging portfoios nd gthering ssets. Through n rrngement

known s series trust, the third prt provides services to mutipe independent fund sponsors under

singe compex tht serves s n “umbre.” This cn be cost-ecient becuse the costs of operting

funds re spred cross the combined ssets of number of funds in the series trust.

The incresed vibiit of other investment products hs ed to chnges in how investors re octing

their portfoios. Thepercentge of mutu fund compnies retining ssets nd ttrcting net new

investments gener hs been ower in recent ers. In , percent of fund compexes sw positive

ows to their ong-term mutu funds, whie percent of ETF sponsors hd positive net shre issunce

(Figure.).

FIGURE

2.9

Esier Access to Other Investment Products Hs Dmpened Inows into Long-Term

Mutu Funds

Percentage of fund complexes with positive net ows

Long-term mutual funds

ETFs

20232022202120202019201820172016201520142013

82

33

88

69

49

26

74

28

81

56

79

54

81

43

71

38

93

36

31

38

74

75

Note: Long-term mutu fund dt incude net new csh ow nd reinvested dividends; ETF dt for net shre issunce incude

reinvested dividends.

INVESTMENT COMPANY FACT BOOK

34

The concentrtion of mutu fund nd ETF ssets mnged b the rgest fund compexes hs incresed

over time. The shre of ssets mnged b the five rgest firms rose from percent t er-end to

percent t er-end (Figure.). Some of the increse in mrket shre occurred t the expense

of the midde tier of firms—those rnked from to —whose mrket shre fe from percent in to

percent in .

At est two fctors hve contributed to the rise in industr concentrtion. First, the incresed concentrtion

reects the growing popurit of index funds—the rgest fund compexes mnge most of the ssets

in index mutu funds. Active mnged domestic equit mutu funds hd outows in ever er fter

, whie index domestic equit mutu funds hd inows in most of these ers. Index domestic equit

ETFs hd positive net shre issunce in ech of these ers. Second, gener strong inows over the

pst decde to bond mutu funds nd ETFs (see Figures . nd .), which re fewer in number nd re

ess ike to be oered b smer fund sponsors, heped boost the shre of ssets mnged b rge

fund compexes.

Mcroeconomic conditions nd competitive dnmics cn ect the supp of funds oered for se. Fund

sponsors crete new funds to meet investor demnd nd merge or iquidte those tht do not ttrct

sucient investor interest. A tot of mutu funds nd ETFs opened in , down sight from in

nd ower thn the – nnu verge of (Figure.). The number of mutu fund nd

ETF mergers nd iquidtions incresed substnti— in compred with in .

FIGURE

2.10

Shre of Mutu Fund nd ETF Assets t the Lrgest Fund Compexes Hs Incresed

Percentage of total net assets of mutual funds and ETFs, year-end

Lrgest compexes

Lrgest compexes

Lrgest compexes

Note: Dt for ETFs excude non– Act ETFs.

35

USREGISTERED INVESTMENT COMPANIES

Fund Prox Voting Reects Heterogeneous Industr

Investment compnies re shrehoders of pubic compnies nd hve hed sted shre of

US-issued corporte equities outstnding over the pst sever ers (Figure.). Like n compn

shrehoder, the re entited to vote on prox proposs put forth b compn’s bord or its

shrehoders. Funds norm deegte prox voting responsibiities to fund dvisers, which hve

fiducir dut to vote in the best interest of fund shrehoders.

During prox er (the months tht ended June , ), shrehoders of the ,

rgest US pubic compnies considered , proposs—percent (,) of these were

proposed b mngement nd percent () were submitted b shrehoders. Investment

compnies cst ner .miion votes on these proposs, with ech investment compn voting,

on verge, on bout , seprte prox proposs. Becuse mngement proposs ccount

for the buk of prox proposs, percent of funds’ votes were cst on mngement proposs

reted to uncontested eections of directors, with n ddition percent nd percent reted to

mngement proposs on mngement compenstion nd rtifiction of udit firms, respective.

CONTINUED ON THE NEXT PAGE

FIGURE

2.11

Mutu Funds nd ETFs Enter nd Exit in Competitive Mrket

Number of funds

20232022202120202019201820172016201520142013

Opened funds

Merged/Liquidated funds

596

840

696

460

749

465

688

648

848

458

859

420

880

540

684

706

714

604

740

596

536

618

Note: Dt incude mutu funds tht do not report sttistic informtion to the Investment Compn Institute nd mutu funds tht

invest primri in other mutu funds. ETF dt incude ETFs tht invest primri in other ETFs.

INVESTMENT COMPANY FACT BOOK

36

LEARN

MORE

Fund Prox Voting Reects Heterogeneous Industr,

Investment compnies voted in fvor of mngement proposs percent of the time. The strong

support for mngement prox proposs ike reects tht the vst mjorit of them re not

controversi—percent of mngement proposs were uncontested eections of directors nd

rtifictions of the udit firms tht compnies seected.

During the sme prox er, percent of the votes tht investment compnies cst were on

shrehoder prox proposs. Among the shrehoder proposs, percent were reted

to soci nd environment mtters; percent to shrehoder rights nd nti-tkeover issues;

percent to bord structures nd eections; nd the reminder to compenstion mtters nd

misceneous issues. Shrehoder prox proposs received support from investment compnies,

onverge, percent of the time.

Investment compnies’ support for shrehoder proposs vried considerb depending on rnge

of fctors. These fctors incuded, mong other things, the detis of the propos, the issuer to

whom the propos ppied, nd the bckdrop nd context in which the propos ws set. Investment

compnies tend to oer more support for shrehoder prox proposs tht re ike to increse their

rights s compn shrehoders. For exmpe, investment compnies voted in fvor of shrehoder

prox proposs reted to shrehoder rights or nti-tkeover mesures percent of the time in

prox er .

Investment compnies, on verge, hve provided more imited support for soci nd environment

proposs. In prox er , these proposs received fvorbe vote percent of the time.

Averge eves of support cn msk importnt nunces of how investment compnies vote on such

issues. These kinds of proposs, though cssified gener s “soci nd environment,” cover

wide rr of issues, incuding the environment, diversit in hiring prctices, humn rights mtters,

nd the sfet of compn’s business opertions.

In ddition, these proposs must be viewed in context. For exmpe, suppose virtu identic

proposs re directed to two dierent compnies. An investment compn might view the propos

s pproprite for the first compn, but inpproprite for the second becuse the tter hs red

tken steps to ddress the propos’s concerns.

In short, there is no one-size-fits- description of how funds vote, other thn to s tht investment

compnies seek to vote in the interests of their shrehoders nd in w tht is consistent with their

investment objectives nd poicies.

Prox Voting Resource Center

www.ici.org/proxy_voting

37

USREGISTERED INVESTMENT COMPANIES

LEARN

MORE

Environment, Soci, nd Governnce Investing

Perhps one of the most significnt recent gob trends is the incresing ttention being pid to

environment, soci, nd governnce (ESG) mtters. These mtters vr wide but re gener

considered to incude topics reted to cimte chnge, diversit nd incusion, humn rights, the rights

of compn shrehoders, nd compn compenstion structures. The fund industr is responding to

incresed investor interest in ESG investing b, mong other things, creting new funds tht expicit tior

their investments to specific ESG criteri.

Funds consider ESG fctors to vring degrees. For decdes, some funds hve incorported ESG fctors

into their investment processes s w to enhnce fund performnce, mnge investment risks, nd

identif emerging investment risks nd opportunities, just s the woud consider mcroeconomic or

interest rte risks; idiosncrtic business risks; nd investment exposures to prticur compnies,

industries, or geogrphic regions. Becuse these funds “integrte” ESG fctors into the investment

process, this tpe of investing is known s ESG integrtion.

Funds’ use of ESG integrtion is distinct from funds’ use of “sustinbe investing strtegies,” which use

ESG nsis s significnt prt of the fund’s investment thesis s w to pursue investment returns nd

ESG-reted outcomes.

Approches to ESG Investing

The investment strtegies funds use vr, s do the ws the describe their pproches. This section

describes some of the most common pproches.

■

Excusionr investing: Investment strtegies tht excude, or “screen out,” investments in prticur

industries or compnies tht do not meet certin ESG criteri. This m so be described s

negtive screening, sustinbe investing, or soci responsibe investing (SRI).

■

Incusionr investing: Investment strtegies tht gener seek investment returns b pursuing

strtegic investing thesis focusing on investments tht sstemtic tit portfoio bsed on

ESG fctors ongside trdition finnci nsis. This m so be described s best-in-css,

ESG themtic investing, ESG tit, positive screening, or sustinbe investing.

■

Impct investing: Investment strtegies tht seek to generte positive, mesurbe soci nd

environment impct ongside finnci return. This m so be described s communit,

go-bsed, sustinbe, or themtic investing.

These common pproches to ESG investing re not mutu excusive— singe fund m use mutipe

pproches (e.g., best-in-css fund tht excudes certin tpes of investments). As resut, seeking to

cssif funds tht invest ccording to ESG criteri s soe excusionr, incusionr, or impct cn be

chenging. Apping ICI’s ong-stnding gener pproch to cssifing funds enbes reserch into

these funds (e.g., trcking dt nd monitoring trends).

ESG Resource Center

www.ici.org/esg

INVESTMENT COMPANY FACT BOOK

38

How ICI Ctegorizes Funds for Reserch nd

Sttistic Purposes

ICI seeks to ctegorize funds s objective s possibe b pping predetermined rues nd

definitions to the prospectus nguge of mutu funds, ETFs, nd CEFs, with speci focus on the

“investment objective” nd “princip investment strtegies” sections.

For exmpe, ICI Reserch uses prospectus nguge to determine which of four brod ctegories

to pce fund in: equit, bond, hbrid, or mone mrket. Funds re then pced in subctegories—

for exmpe, cssifing equit funds s rge-, mid-, or sm-cp; or bond funds s investment

grde or high-ied. To keep fund cssifictions up to dte, ICI monitors funds’ prospectuses for

mteri revisions.

This pproch produces fund cssifictions tht re consistent nd retive stbe, which is ver

hepfu when monitoring current nd historic trends in fund dt.

Using ICI’s Approch to Cssif Funds Tht Invest According to ESG Criteri

ICI Reserch exmines the prospectuses of funds to cssif those tht invest ccording to ESG criteri

using the sme pproch tht it does for other ctegories cross funds. In prticur, ICI ooks for

nguge indicting tht fund pces n importnt nd expicit emphsis on environment, soci, or

governnce criteri to chieve certin gos.

Foowing this pproch, in , mutu funds nd ETFs with ssets of $biion were cssified

gener s investing ccording to excusionr, incusionr, or impct investing ESG criteri

(Figure.). The number of ESG-criteri funds hs incresed in ech er since (the er ICI

begn trcking dt for these funds) reecting growing investor interest in these funds. Demnd for

ESG-criteri funds grew stedi between nd but hs since bted—ESG-criteri funds hd

net outows of $biion in (Figure.).

ICI cssifies ESG-criteri funds into groups bsed on the frmeworks or guideines expressed t the

forefront of their princip investment strtegies sections.

■

Brod ESG focus: These funds focus brod on ESG mtters. The consider three eements of ESG

(rther thn focusing on one or two of the considertions) or m incude ESG in their nmes. Index

funds in this group m trck soci responsibe index such s the MSCI KLD Soci Index.

■

Environment focus: These funds focus more nrrow on environment mtters. The m incude

terms such s terntive energ, cimte chnge, cen energ, environment soutions, or ow

crbon in their princip investment strtegies or fund nmes.

■

Reigious vues focus: These funds invest in ccordnce with specific reigious vues.

■

Other focus: These funds focus more nrrow on some combintion of environment, soci, nd/

or governnce eements, but not three. The often negtive screen to eiminte certin tpes of

investments.

39

USREGISTERED INVESTMENT COMPANIES

FIGURE

2.12

Number of Funds Tht Invest According to ESG Criteri Continued to Rise

By focus, year-end

2023202220212020201920232022202120202019

186

58

140

100

484

576

$278

$393

244

64

151

117

730

291

112

178

149

$88

$13

$105

$73

$145

$32

$120

$96

$553

$43

$151

$145

$214

863

$463

$42

$128

$92

$201

$532

$51

$146

$107

$228

417

131

185

130

913

459

137

190

127

Other focus

Religious values focus

Environmental focus

Broad ESG focus

Total net assets

Billions of dollars

Number of funds

Note: Dt incude mutu funds nd ETFs. Dt incude mutu funds tht invest primri in other mutu funds nd ETFs tht invest

primri in other ETFs.

FIGURE

2.13

Demnd for ESG-Criteri Funds Turned Negtive in

Net new cash ow to mutual funds and net share issuance of ETFs, billions of dollars, annual

-20

0

20

40

60

80

20232022202120202019

23

77

51

3

-9

Note: Dt incude mutu funds nd ETFs. Dt incude mutu funds tht invest primri in other mutu funds nd ETFs tht invest

primri in other ETFs.

INVESTMENT COMPANY FACT BOOK

40

Investment Compn Empoment

Registered investment compnies tpic do not hve empoees—insted, the contrct with other

businesses to provide services to the fund. Except for UITs, funds in the United Sttes hve fund bords

tht oversee the mngement of the fund nd represent the interests of the fund shrehoders. Fund

bords must pprove mjor contrcts between the fund nd its service providers, incuding the dvisor

contrct with fund’s investment dviser, who is usu so the fund’s sponsor.

Fund sponsors nd third-prt service providers oer dvisor, recordkeeping, dministrtive, custod,

nd other services to funds nd their investors. Investment compn–reted empoment in the United

Sttes ws .miion in (Figure.). For mn industries, empoment tends to be concentrted

in octions where the industr begn. The sme is true for investment compnies: those octed in

Msschusetts nd New York, er hubs of investment compn opertions, empo percent of fund

industr workers. As the industr hs grown, other sttes—incuding Ciforni, Forid, nd Texs—hve

become mjor centers of fund industr empoment. Fund compnies in these three sttes empoed n

ddition percent of US fund industr empoees in .

41

USREGISTERED INVESTMENT COMPANIES

FIGURE

2.14

Investment Compnies Provide Empoment for . Miion Individus Across the

United Sttes

Estimated number of employees of fund sponsors and their service providers by state, 2021

80,000 or more

25,000 to 79,999

20,000 to 24,999

10,000 to 19,999

3,000 to 9,999

Less than 3,000

Total investment company–related national employment: 1.1 million

Source: Investment Compn Institute ccutions of NAICS dt from The Business Dnmics Reserch Consortium: project of

the Universit of Wisconsin, Institute for Business nd Entrepreneurship.

CHAPTER

US Mutual Funds

A mutu fund is n investment compn tht poos mone from shrehoders

nd invests in portfoio of securities. In , miion individu investors in

.miion US househods owned mutu funds, reing on them to meet ong-term

person finnci objectives, such s prepring for retirement, eduction, or home

purchse. US househods nd institutions so use mone mrket funds s csh

mngement toos. Mutu funds, incuding mone mrket funds, hd

net inows of $biion in , or.percent of er-end tot

net ssets. Chnging demogrphics, portfoio rebncing, nd investors’

rections to US nd wordwide economic nd finnci conditions p

importnt roes in determining how demnd for specific tpes of mutu

funds—nd for mutu funds in gener—evoves.

IN THIS CHAPTER

Overview of Mutu Fund Trends

Deveopments in Mutu Fund Fows

Equit Mutu Funds

Bond Mutu Funds

Growth of Other Investment Products

Mone Mrket Funds

CHAPTER

INVESTMENT COMPANY FACT BOOK

42

3

43

US MUTUAL FUNDS

LEARN

MORE

Overview of Mutu Fund Trends

With $.triion in tot net ssets, the US mutu fund industr remined the rgest in the word t

er-end . The mjorit of US mutu fund net ssets t er-end were in ong-term mutu

funds, with equit funds one mking up percent of US mutu fund net ssets. Mone mrket funds

were the second-rgest ctegor, with percent of net ssets. Bond funds (percent) nd hbrid funds

(percent) hed the reminder.

Investor Demnd for US Mutu Funds

A vriet of fctors inuence investor demnd for mutu funds, such s funds’ biit to ssist investors

in chieving their investment objectives. For exmpe, US househods re on equit, bond, nd hbrid

mutu funds to meet ong-term person finnci objectives, such s prepring for retirement, sving

for emergencies, or sving for eduction. US househods, s we s businesses nd other institution

investors, use mone mrket funds s csh mngement toos becuse the provide high degree of

iquidit nd ccess to previing short-term mrket ieds.

Investor demnd for mutu funds incresed in —driven b significnt inows into mone mrket funds

tht more thn oset outows from ong-term funds. Mone mrket funds experienced strong demnd s

investors were ttrcted to the highest short-term ieds in the more thn ers. B contrst, equit

mutu funds experienced outows in (despite strong stock mrket returns), reecting n ongoing

shift to other products. Addition, bond mutu funds experienced modest outows, which m reect

investors shifting some of their bond fund positions into mone mrket funds to mitigte interest rte risk

mid substnti interest rte votiit.

Month Trends in Mutu Fund Investing

www.ici.org/research/stats/trends

INVESTMENT COMPANY FACT BOOK

44

FIGURE

3.1

Mutu Funds Enter nd Exit the Industr Becuse of Competition nd

Investor Demnd

20232022202120202019201820172016201520142013

172

211

175

177

126

115

340

389

434

288

235

171

225

227

362

482

453

605

661

699

282

291

512

166

342

301

508

228

430

273

406

600

609

465

361

412

340

111

343

170

454

658

Opened mutual funds

Merged mutual funds

Liquidated mutual funds

241

179

Note: Dt incude mutu funds tht do not report sttistic informtion to the Investment Compn Institute nd mutu funds tht

invest primri in other mutu funds.

Entr nd Exit of US Mutu Funds

Mutu fund sponsors crete new funds to meet investor demnd, nd the merge or iquidte those

tht do not ttrct sucient investor interest. A tot of mutu funds opened in , down

substnti from (Figure .). This decine ws driven primri b drop-o in the number of

equit fund unches. During the sme time, the number of mutu funds tht were either merged or

iquidted incresed percent to funds s sponsors eiminted more equit mutu funds from

their ineups.

45

US MUTUAL FUNDS

Investors in US Mutu Funds

Demnd for mutu funds is, in prt, reted to the tpes of investors who hod mutu fund shres. Reti

investors (i.e., househods) hed the vst mjorit (percent) of the $.triion in US mutu fund tot

net ssets t er-end (Figure .). When ooking t on ong-term mutu funds, the shre of net

ssets hed b reti investors ws even higher (percent). Reti investors so hed substnti mone

mrket fund net ssets ($.triion), but this ws retive sm shre (percent) of their tot mutu

fund net ssets ($.triion).

B contrst, institution investors such s nonfinnci businesses, finnci institutions, nd nonprofit

orgniztions hed retive sm portion of mutu fund net ssets. At er-end , institutions

hed percent of mutu fund net ssets (Figure .). The mjorit (percent) of the $.triion

tht institutions hed in mutu funds ws in mone mrket funds, becuse one of the primr resons

institutions use mutu funds is to hep mnge their csh bnces.

FIGURE

3.2

Househods Hed Percent of Mutu Fund Tot Net Assets

Trillions of dollars, year-end 2023