EBRD Mortgage Loan Minimum

Standards Manual

Updated

June

2

011

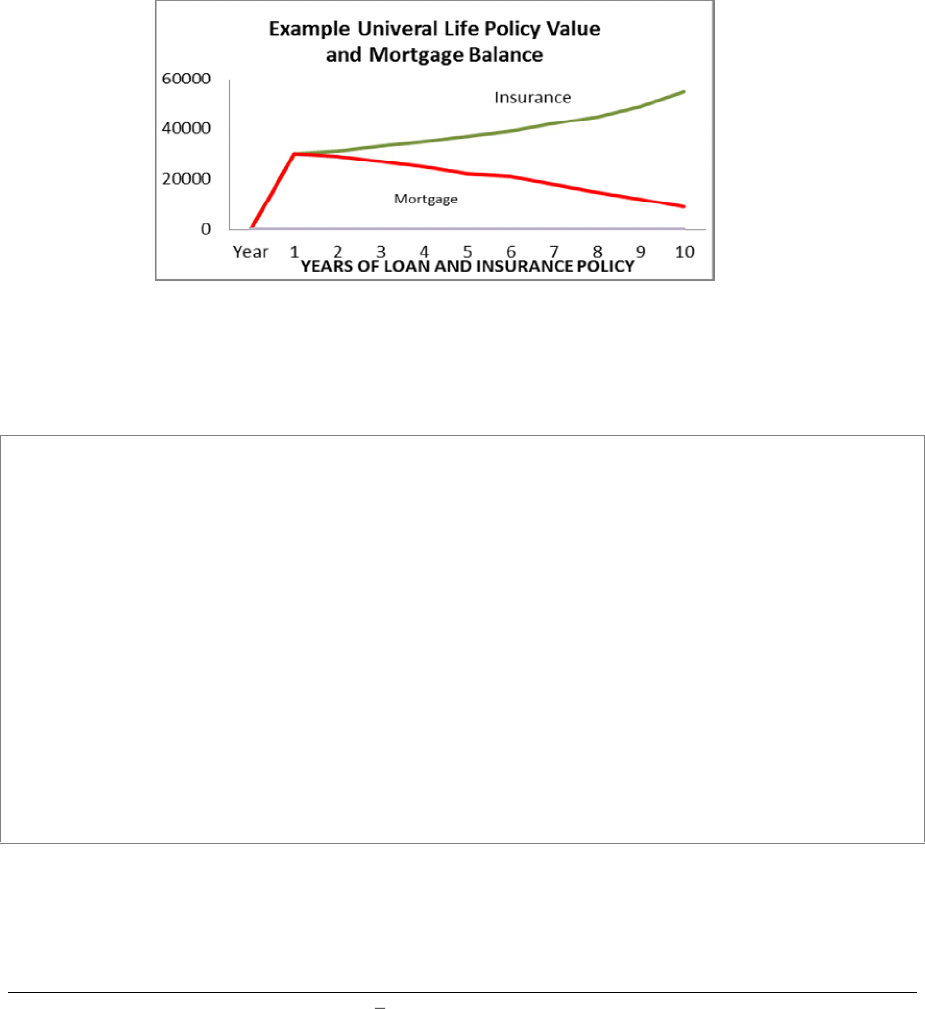

TABLE OF CONTENTS

ACKNOWLEDGEMENTS

..II

INTRODUCTION

.. .3

1.

..........

L

ENDING CRITERIA (MS

01)

..4

2.

...........

MORTGAGE DOCUMENTATI

ON (MS 02)

.

.1

3

3.

..........

MORTGAGE PROCESS AND

BUSINESS OPERATIO

NS (MS 03)

...17

4.

..........

PROPERTY VALUATION (

MS 04)

..

21

5.

.........

PROPERTY OWNERSHIP A

ND LEGAL ENVIRONMENT

(MS 05)

.

26

6.

.........

INSURANCE (MS 06)

.

29

7.

.........

CREDIT AND RISK MANA

GEMENT STANDARDS (MS

07)

33

8.

.........

DISCLOSURES (MS 08)

.

42

9.

.............

BASEL II A

ND III REQUIREMENTS

(MS09) .43

10.

SECURITY REQUIREMEN

TS

. ...

....................

....................

.........................

..................50

11.

.......

MANAGEMENT INFORMATI

ON, IT & AC

COUNT MANAGEMENT (MS

11)

...

52

APPENDICES

A1.

LOAN APPLICATION FORM

A2.

LOAN APPROVAL OFFER LETTER

A3.

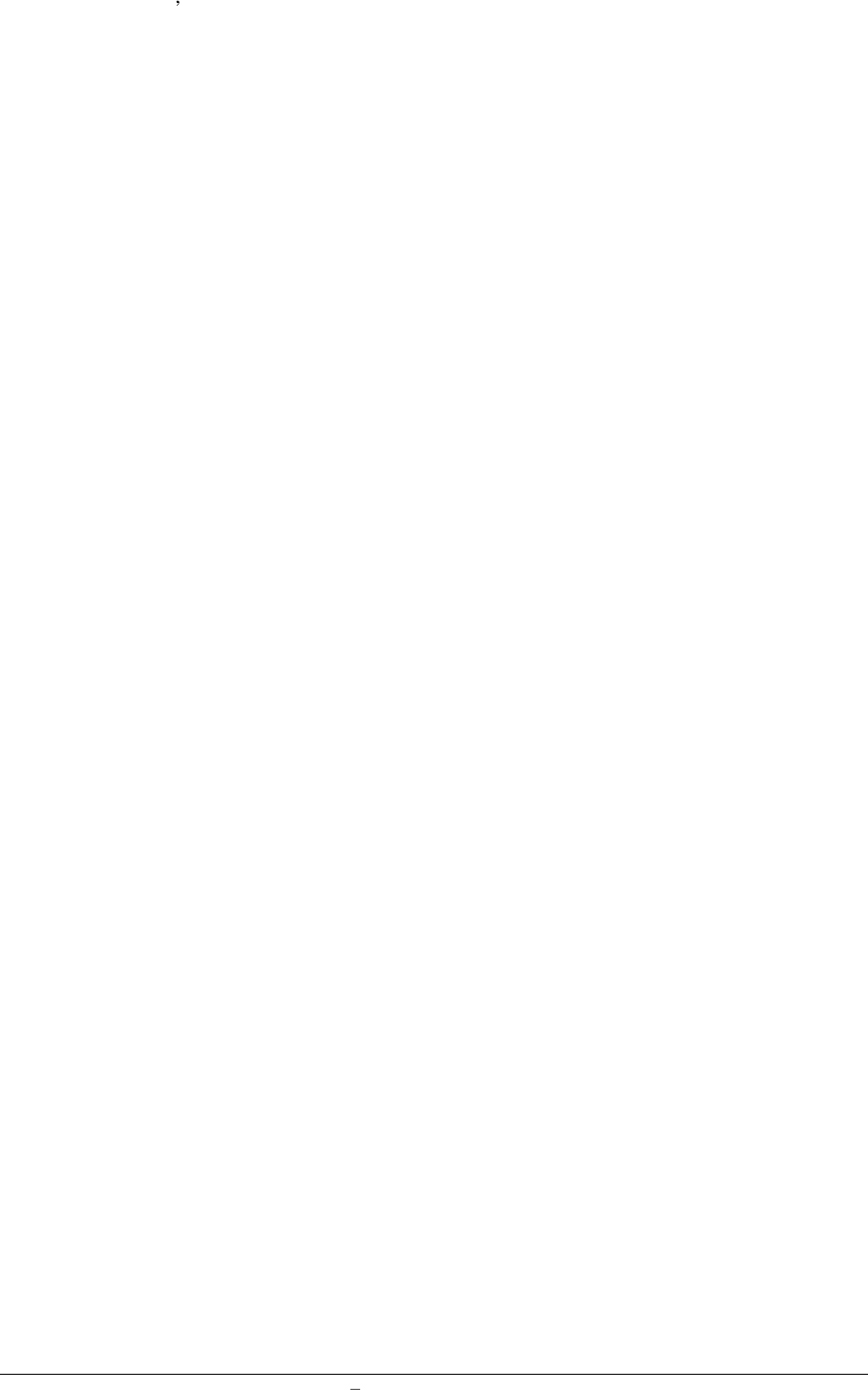

UNDERSTANDING SECURITISATION

A4.

INVESTOR / RATING AG

ENCY SAMPLE REPORT

RESIDENTIAL

MO

RTGAGE

-

BACKED SECURITY

A5.

INVESTOR / RATING AG

ENCY SAMPLE REPORT

COVERED MORTGAGE

BOND

A6.

BIBLIOGRAPHY

A7.

GLOSSARY

A8.

LIST OF MINIMUM STANDARDS

Mortgage Loan Minimum Standards Manual

June 2011

ii

ACKNOWLEDGEMENTS

This

EBRD

Mortgage Loan Minimum Standards Manual (the Mortgage Manual ) was

originally

written on

behalf of the European Bank for Reconstruction and Development (EBRD) in 2004 by advisors working for

Bank of Ireland

International Advisory Services. It was updated in 2007.

In

June

2011, ShoreBank International

Ltd. (SBI) updated

further

the Manual, which was funded by the

EBRD

-

Financial Institutions Business Group

.

The 2011

List of Minimum Standards

(

LMS

)

provide

s

guidance for those lending institutions that will receive

mortgage financing from EBRD. This was produced based on the EBRD Minimum Standards and Best Practice

July 2007

outlined in the Mortgage Loan Minimum Standards Manual

.

In addition to supporting the primary market, the application of these guidelines

should

also ensure that the

mortgage loans will meet requirements for the possible future issuance of Mortgage Bond (

MB

) or Mortgage-

Backed Securities (

MBS

). For a mortgage portfolio to be considered suitable for inclusion in an MB or MBS,

the lending institution must be aware of the prospective requirements of both credit rating agencies and

investors.

We

wish to thank the following for their insights and contributions:

Alexander Tanase (who was the Operation Leader), Andreea Moraru and Sibel Beadle, all from the

EBRD Financial Institutions Group

. Frederique Dahan from OGC also provided very useful comments

;

Olga Gekht, Daniel Kolter and Maria Serrano of Moody s Investors Service, Inc.;

and

SBI Team

Pamela Hedstrom, Mitch

el

Medigovich, Ira Peppercorn, Lauren Moser Counts, Alan

Martinez, Anna Fogel and Georgiana Balanescu.

We also appreciate comments and suggestions from mortgage professionals at Banca Comerciala Rom

an

a

(

BCR,

part of Erste Group) and Banca Transilvania, which have been clients of previous EBRD mortgage

lending programs.

Mortgage Loan Minimum Standards Manual

June 2011

3

INTRODUCTION

This

EBRD Mortgage Manual has been written based on the EBRD List of the Minimum Standards and Best

Practices

- June 2011. This is the third edition outlined in the List of Mortgage Lending Standards to provide

guidance for those lending institutions that will receive mortgage financing from EBRD. All partner banks and

non

-

bank

financial institutions receiving mortgage credit lines from EBRD

should

comply with the List of

Minimum Standards and Best Practices to ensure that, as much as possible, the mortgages underwritten using

EBRD funds are originated and managed in a prudent manner. In addition to supporting the primary market, the

application of these guidelines

sho

uld

also ensure that the mortgage loans will meet requirements for the

possible future issuance of Mortgage Bond (MB) or Mortgage-Backed Securities (MBS). For a mortgage

portfolio to be considered suitable for inclusion in an MB or MBS, the lending institution must be aware of the

prospective requirements of both credit rating agencies and investors. The application of these minimum

standards and best practices is appropriate for the ongoing management of both the primary and secondary

mortgage business.

Th

is

M

anual

should

provide further explanation for each standard or best practice, as required, in the LMS. The

LMS and M

anual

were

updated in

June

2011 and contain recommendations and information based on research

undertaken by

the

EBRD and its consultants. It is not intended to be

definitive

. Further improvements to

mortgage lending practices will be identified as the partner banks and

non

-

bank

financial institutions further

develop this business and this document may be updated from time to time.

Funds used for mortgages not only create a benefit for the financial institutions and the borrowers, they impact

many other industries from construction to insurance and to

appliance

s, just to name a few

.

Historically

, prior

to enlargement and the 2008 global

finan

cial crisis, the mortgage

market

in Europe expanded at a rate of 8

percent per annum and accounted for 40 percent of GDP. However

,

in 2009 the mortgage market in the 27-

country EU grew at only 0.6% reaching EUR 6.1 trillion.

1

The financial crisis demonstrated how important it is to stay with the basic principles of mortgage lending and

not to assume that the trend is always upward. The trends to originate mortgages with lower and lower down

payments, with foreign denominated mortgages and with interest rates that adjusted beyond a borrower s means

show what can happen when these basic principles are not followed.

The M

anual consists of the following chapters:

1.

Product and Lending Criteria (MS

O1)

2.

Mortgage Documentation (MS

O2)

3.

The Structure of a Mortgage

Busi

ness Operation

(

MS

03)

4.

Property Valuation (MS

04)

5.

Property Ownership (MS

05)

6.

Insurance (MS

06)

7.

Credit and Risk Management Standards (MS

07)

8.

Disclosures (MS

08)

9.

Basel II and III Requirements (MS

09)

10.

Security Requirements (MS

10)

11.

Management Information, IT a

nd Account Management (MS

11)

Within most of these chapters, the document outlines the List of the Minimum Standards, Best Practices,

and

Reasons

for Minimum Standards/Best Practices, possible Investor/Rating Agency Issues and further Points to

Note are in

cluded

(see Appendix A8). Further operational information and details are included in the

other

Appendices

.

1

European Mortgage Federation

,

www.hypo.org

Mortgage Loan Minimum Standards Manual

June 2011

4

1.

LENDING CRITERIA

(MS 01)

1.1

Minimum Standards

EBRD has adopted specific lending criteria for local currency and foreign currency mortgage loans to provide

guidance for those lending institutions that have received mortgage financing from EBRD. All partner banks

and financial institutions should comply with the Minimum Standards and Best Practices to ensure that the

mortgages underwritten using EBRD funds are originated and

managed in a prudent manner.

All mortgage products should have certain characteristics. Differentiated standards apply to local currency and

foreign currency mortgages.

This approach is designed to tighten standards on FX loans relative to local currency

l

oans, to create a buffer against devaluation risk. There may be country cases in which macroeconomic volatility

is such that a bias towards local currency mortgages would not be appropriate. In those cases, the standards will

be adjusted as necessary.

MINI

MUM STANDARDS

COMMON FEATURES

MS

01:

The following features should be observed for all types of mortgage products:

Purpose:

Residential properties - purchase, remortgage, build or

improve, including the relevant land, if any principal private

dwelling or "buy

-

to

-

let" houses or apartments.

Product Type:

Constant annuity mortgage only, with full amortisation to

liquidate the debt by the end of the mortgage term.

Property location:

Within the country of the lender.

Borrower:

Nation

als and non-nationals resident in the country. Nationals

and non-nationals resident outside the country purchasing

within the country.

Amount:

Minimum/maximum amount stated - 250,000 Euro equivalent

in local currency.

Loan Term:

Minimum 5 years/maximum

30 years (subject to funding).

Borrower Age:

Minimum

age of legal contract. Maximum (at completion of

the mortgage loan term): legal retirement age, as regulated in

the respective country, unless demonstrable evidence of

sufficient pension and/or other income to support mortgage

payments up to the end of contracted mortgage.

Minimum Standards

Interest Rate:

Interest Rate: Variable or Fixed. Fixed interest rates are

preferable. If they are not available in the country or if the

borrowers opt for variables rates, the lender should

appropriately inform the borrowers about the risks involved.

Teaser rates are not allowed. Interest rate switching from fixed

to variable (or vice-versa) are allowed, but in such cases the

borrower must be notified in writing (at least 3 months in

advance) and should the borrower choose to pre-pay, the

prepayment fee should be waived.

Variable Rate Mortgages (VRM). Where the interest rate

charged to the customer is variable, it should be linked

(indexed) to the relevant reference rate for the loan currency

(e.g. Libor, Euribor, etc.) and contain a margin for profit. The

index should ideally be equitable and independent:

Reasonable efforts should be undertaken by lenders to

link to external indexes, such as those published by

Central Banks;

When this is not possible, lenders can use internal

indexes, but these should be published regularly.

Mortgage Loan Minimum Standards Manual

June 2011

5

Property

Valuation

Should be carried according to Section 4. The LTV limit is to

apply to the lower of either the actual purchase price or the

valuer s estimation. In the event that the purchase price is

higher than the valuer's estimation the lender should lend on

the lesser of these two figures.

Tenure of Property:

Full ownership. Freehold recommended. Leasehold with

minimum of 50 years after the maturity of the loan or legal

maximum, if lower (see MS

05

).

Security Required:

First rank mortgage over the property. Assigned life insurance

for the amount and term of the mortgage. Property insurance

in the joint names of the lender and customer to cover the

re

instatement cost of the property. This policy to be index

linked, if available.

Verification:

Suppo

rting documents as listed in MS

02.

MINIMUM STANDARDS

LOCAL CURRENCY MORT

GAGE LOANS

MS

01:

The lender must adopt the following criter

ia for local currency mortgage l

oans

Currency:

Local currencies only

Loan to Value:

Maximum 80% LTV for owner-occupied properties.

Maximum 70% for buy-

to

-let .

PTI:

Up to 50% of borrower s net income for owner-

occupied

properties. Maximum 35% of bor

rower s net income for buy-

to

-let (For mortgage with higher incomes, lenders may use

the maximum rate, but within the limits of the procedures and

prudential requirements of the Central Bank).

Minimum Standards

Affordability Test

: Use of Net Disposable Income (NDI), Debt Service Ratio

(DSR) model or Payment-

to

-Income (PTI). This model should

stress test the customer s ability to repay by adjusting the

interest rate upwards, usually by 3% (300 basis points). The

model should have a floor limit of funds available for livin

g

expenses.

BEST PRACTICES

LOCAL CURRENCY LOAN

S

Best Practices

BP 01

Local Currency Mortgage Loans

i.

Lenders should also consider introducing geographic and employer

diversification parameters to avoid concentration risk by setting limits on the

percent

age of the portfolio that can be in a particular location or loaned to

staff of a particular employer. The level of geographic diversification will

depend on city size and population.

ii.

For local currency loans maximum 80% LTV unless supported by a mortgage

indemnity guarantee to be exercised in a prudent manner (taking into account

the repayment capacity of the mortgagees) and with creditworthy insurers.

iii.

PTI or DSR: Prudential regulations should be applied.

Mortgage Loan Minimum Standards Manual

June 2011

6

MINIMUM STANDARDS

FOREIGN CURRENCY LO

ANS

MS

01:

The lender must adopt the following criteria for foreign currency mortgage loans:

Currency:

Euro and USD currencies only.

Loan to Value:

Dependent on lender Credit Policy

maximum 70% LTV for

owner

-

occupied properties. Maximum 60%

for buy-

to

-let .

PTI:

Up to 35% of net income for owner-occupied properties.

Maximum 30% of net income for buy-

to

-let (for mortgage

with higher incomes, lenders may use the maximum rate

within the limits of their procedures and prudential

requirement

s of the Central Bank).

Minim

um Standards

Affordability Test

: Same as for mortgage loans denominated in Local Currencies.

In addition, this model should test the customer s ability to

repay in case of depreciation of the local currency (it is

recommended that various degr

ees of depreciation are tested).

BEST PRACTICES

FOREIGN CURRENCY LO

ANS

Best Practices

BP 01

Foreign Currency Mortgage Loans

i.

For hard currency or forex loans maximum 70% LTV unless supported by a

mortgage indemnity guarantee to be exercised in a prudent manner (taking

into account the repayment capacity of the mortgagees) and with creditworthy

insurers.

ii.

Forex loans should be given to individuals whose revenue is in Forex or

Forex

-

linked.

Underwriting Criteria is the practical application of the lender s Credit Policy and the key aspect is to establish

the applicants ability to repay the loan.

In addition to supporting the primary market, the application of these lending criteria will also ensure that the

mortgage loans will meet requirements for the possible future issuance of Mortgage Bond (MB) or Mortgage-

Backed Securities (MBS).

For a mortgage portfolio to be considered suitable for inclusion in an MB or MBS, the

lending institution must be aware of the prospective requirements of both credit rating

agencies and investors.

FURTHER READING

Refer to Appendices A4 and A5 for examples of Residential Mortgage

-

Backed Securities and Covered Mortgage

Bond issues.

1.2 E

stablishing Interest Rates

The credit committee and treasury must have a working relations

hip to establish interest rates for various loan products.

The

interest rate charged to customers should be adequate to cover the bank's cost of funds plus a suitable margin for

profit and operating expenses. Where the interest rate charged to the customer is variable, it should be linked to the

relevant reference rate for the loan currency (e.g. Libor, Euribor, etc.). The index should be equitable and, if possible,

independent.

An organi

s

ation establishes interest rates on several factors; the most importa

nt of which is the Cost of Funds.

Mortgage Loan Minimum Standards Manual

June 2011

7

When establishing an interest rate for a fixed rate loan, the lender must also consider the matter of a matching

maturity. For example, if the lender is a bank and the bank is funding loans from deposits, the average term

of a

loan should be matched to similar time periods for long term deposits. In circumstances where long term

deposits are not customary or available, the bank should consider a hybrid product that has a fixed rate for a

specified period of time, and later

converts to a variable rate.

Variable interest rates have two components which, when added together result in the interest rate the borrower

will pay for a specific period of time.

The components are the cost of funds index, such as an inter-bank offered rate (IBOR) and the margin for profit

and overhead.

For example:

Index IBOR

4.5%

Margin

2.5%

Interest rate

7.0%

The period during which the interest rate is set at 7% is 3 years, then adjusting each one to three years thereafter

for 20 years.

The

borrow

ers

rate changes in line with changes in the market benchmark. The precise mechanics can vary by

lender or country. For example a 'tracker mortgage' usually defines the precise time response for upward and

downward movements to the IBOR rate and may guara ntee a maximum

deviation from this rate.

With regard to Residential Mortgage-Backed Securities (RMBS), these transactions are usually structured so that

the interest to bond holders is struck at IBOR plus a premium expressed in basis points. This might be 1 month or

3 month IBOR plus 50 basis points. Clearly if the underlying mortgages that are securitised are all variable

interest rates it makes sense to have these rates adjustable in similar fashion. Some of the structures might have

a fixed

interest rate

at the outset.

Often with Mortgage Bonds, the interest rate on the underlying bonds may be fixed for a specified duration or

they might be variable. Some countries have preferences for fixed rates - such as Germany - whereas the UK and

Ireland see

many cu

stomers with variable rate mortgages.

Both RMBS and Mortgage Bonds therefore require considerable care and attention as to how

underlying

mortgages are priced and then how the underlying interest rates can be changed. This potentially can affect the

abilit

y for product flexibility

and profitability.

The mechanics of dealing with duration risk and interest rate risk are beyond the scope of this Mortgage

Manual.

1.3 M

ortgage Sales Channels

Loan Origination may be carried out through several channels including direct contact, mail, e-mail, SMS text,

telephone

and other acceptable banking

channels

.

Loan officers can execute marketing campaigns through several methods the first and most effective of which is

direct contact with a prospective borrower. A loan k

iosk

or

desk

located in an existing branch of a bank is most

convenient. Often, banks will develop loan centres with physical locations outside of the bank. Loan centres can

be easier to access and less intimidating to prospective borrowers and can accommodate amenities such as a

play room for young children while the parents participate in the loan process.

Other but less effective methods of soliciting prospective borrowers is through mail, SMS text and telephone.

Typically direct mail has the lowest response rate of 1-

2

percent

; therefore the campaign must be well designed

and targeted to areas where home buyers are most likely to be found, such as apartment houses or flats.

Mortgage Loan Minimum Standards Manual

June 2011

8

Another successful method of loan origination is through wholesale operations. The lender may engage in

purchase agreements with loan originations from third party companies such as affiliates or brokers. In this

method the third party takes the application, coordinates the appraisal and title search and often obtains

verification of i

ncome, employment, assets and liabilities. Wholesale lending operations require the allocation of

greater resources to verify and validate the information provided from third party originators.

Wholesale loan operations require a well

-

designed fraud preven

tion program that addresses methods of fraud,

identification of schemes and which parties to the transaction might present the greatest risk of fraud.

1.4 M

ortgage Market Segments

Once the organisational structure is determined, the Credit Committee and senior management of the

organisation must then consider the market segment it wishes to pursue. Each segment has unique requirements

and borrower characteristics that should be reviewed for compatibility to the culture as well as the investment

objectiv

es of the organisation.

After the organisation determines its target market, the selection of mortgage products that will be sold must be

considered. The following chart identifies the transaction type, its unique characteristic and suggested actions to

ta

ke for managing the type of clients.

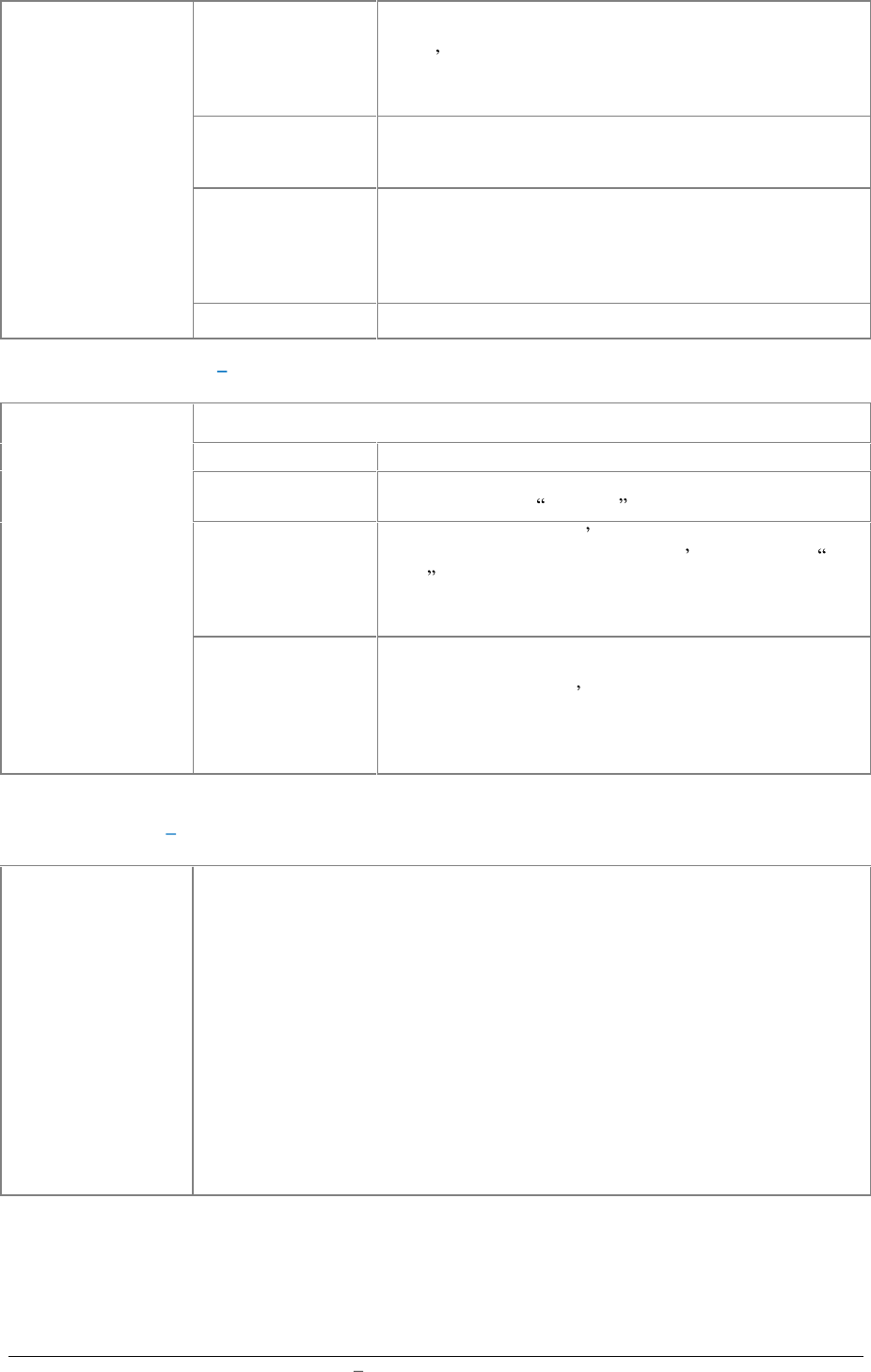

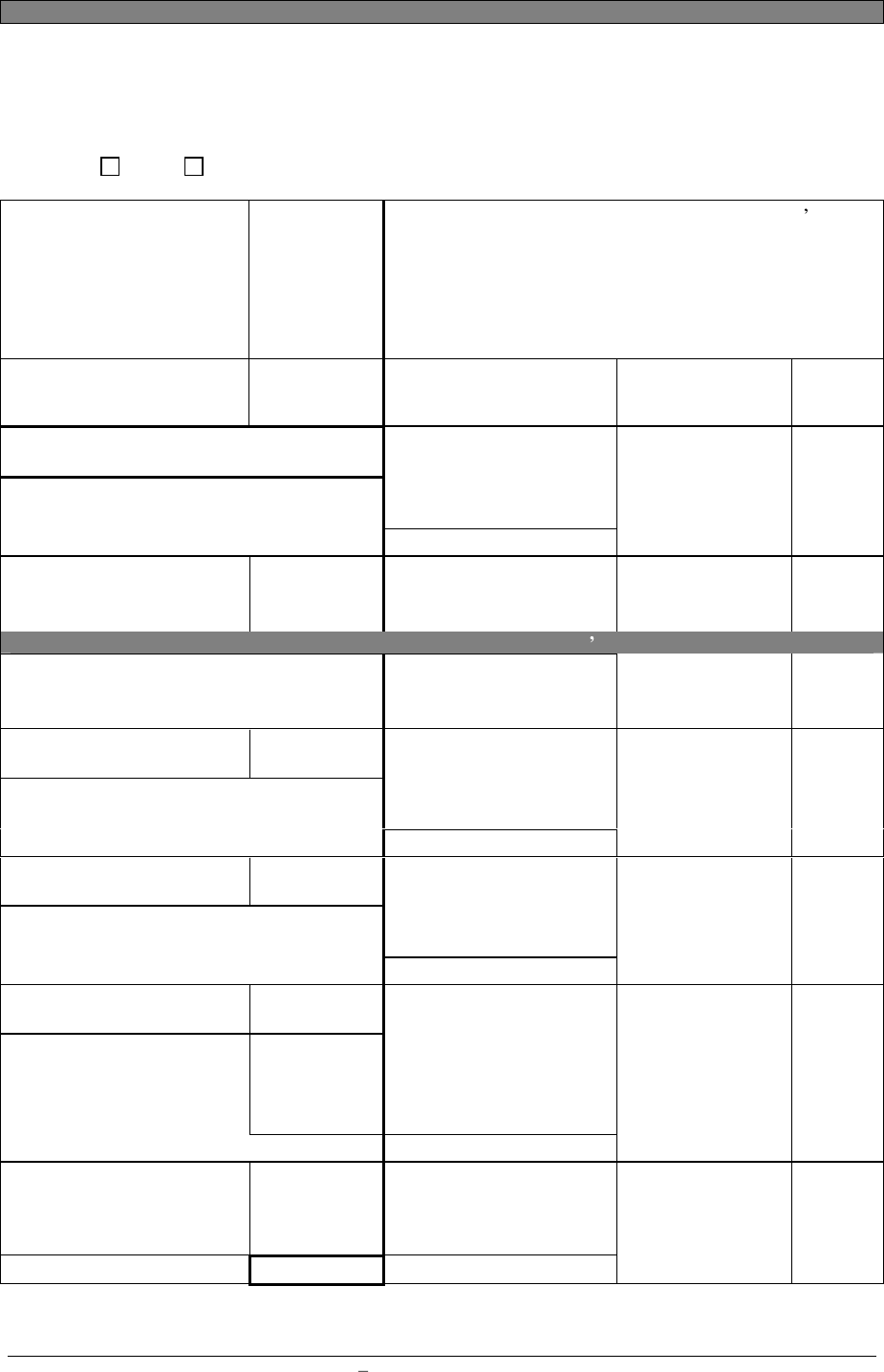

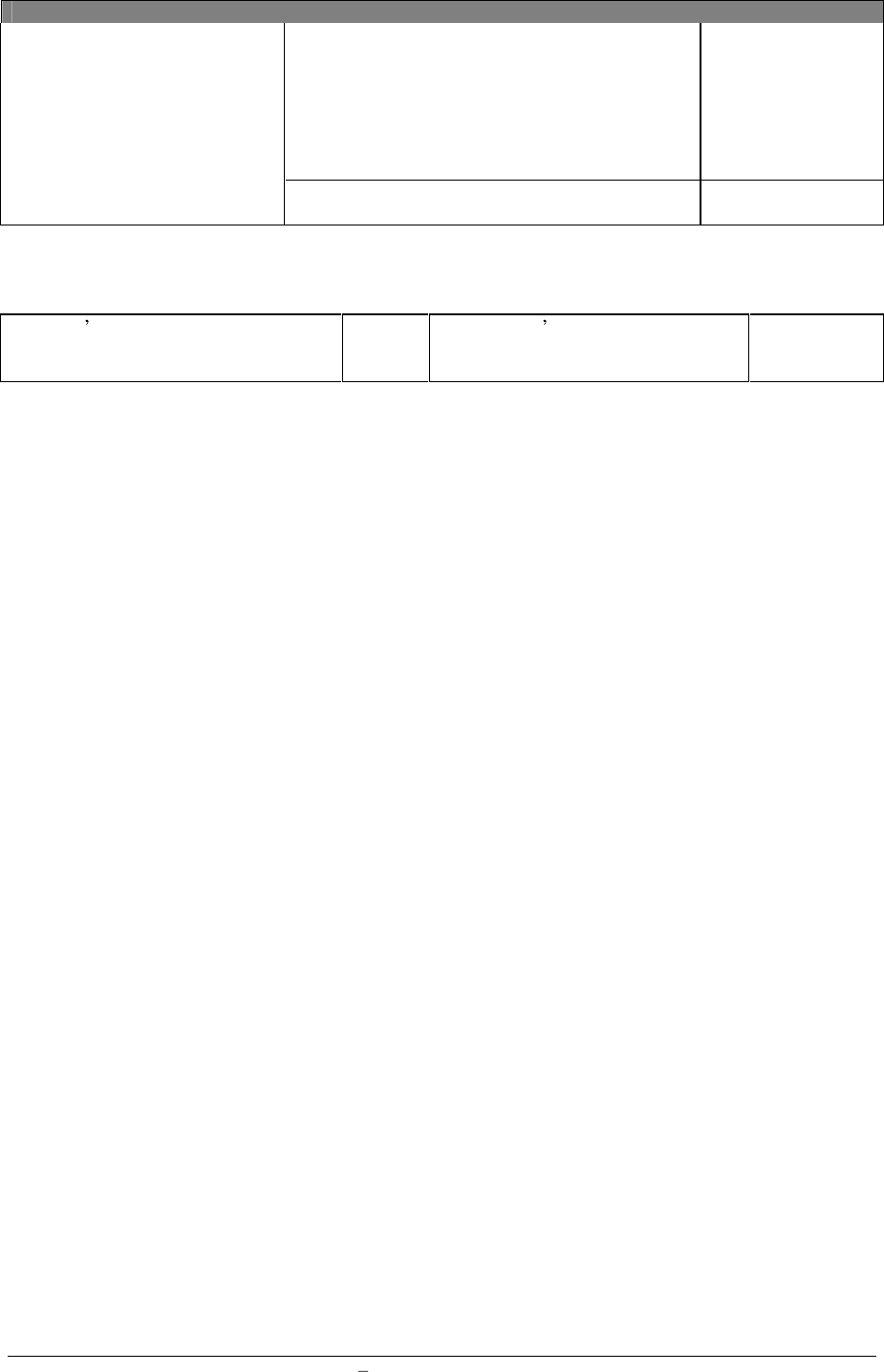

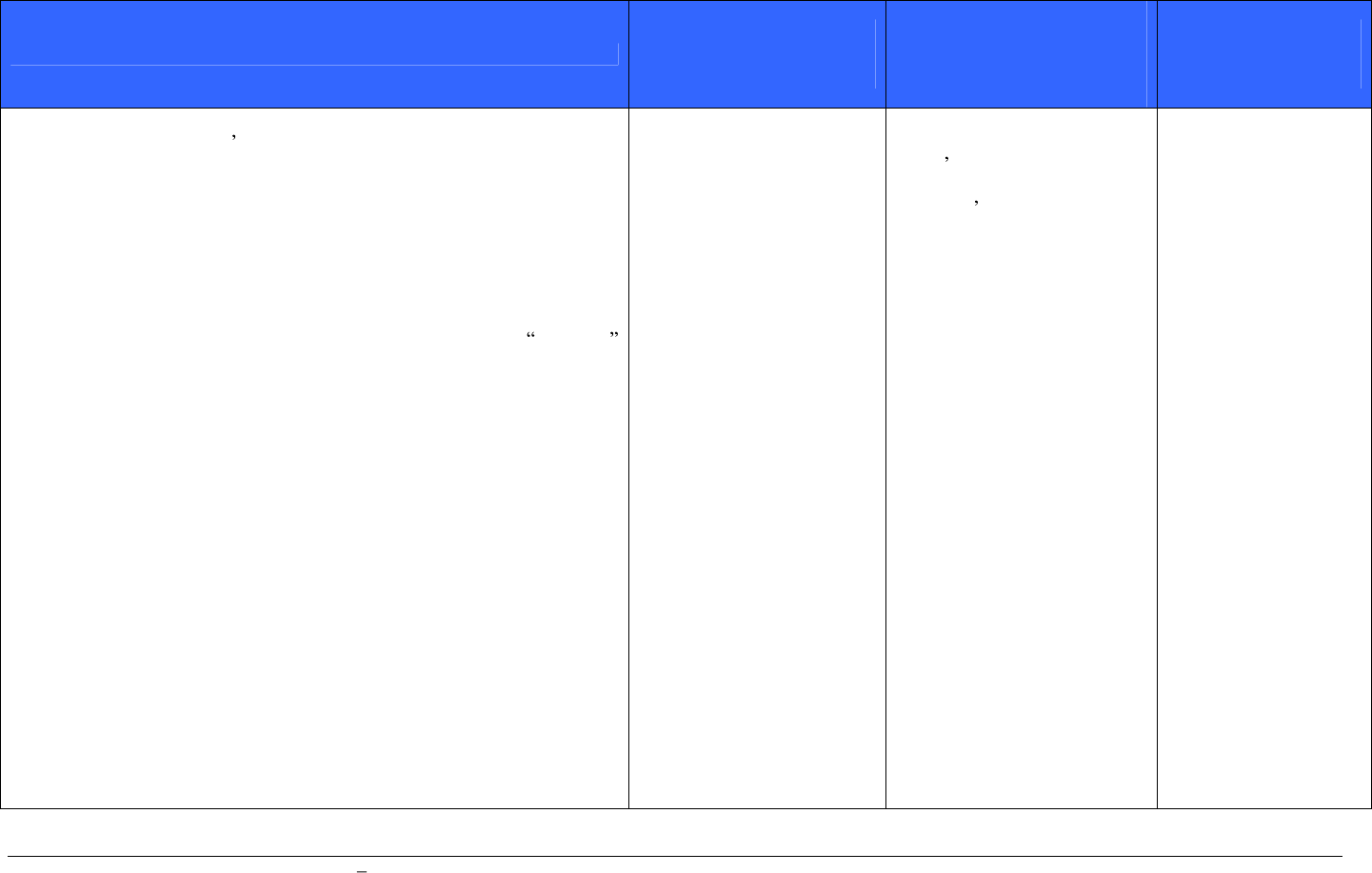

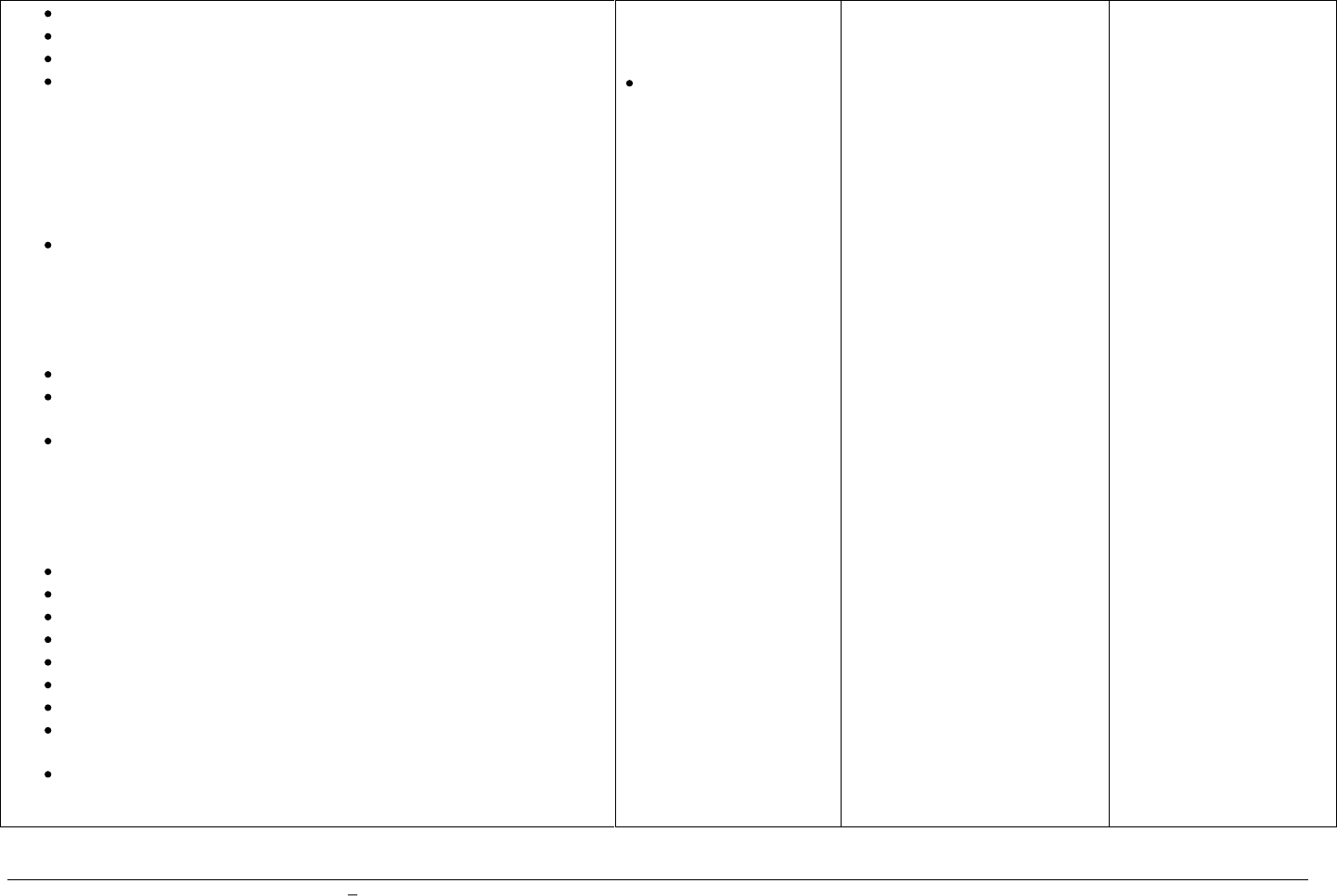

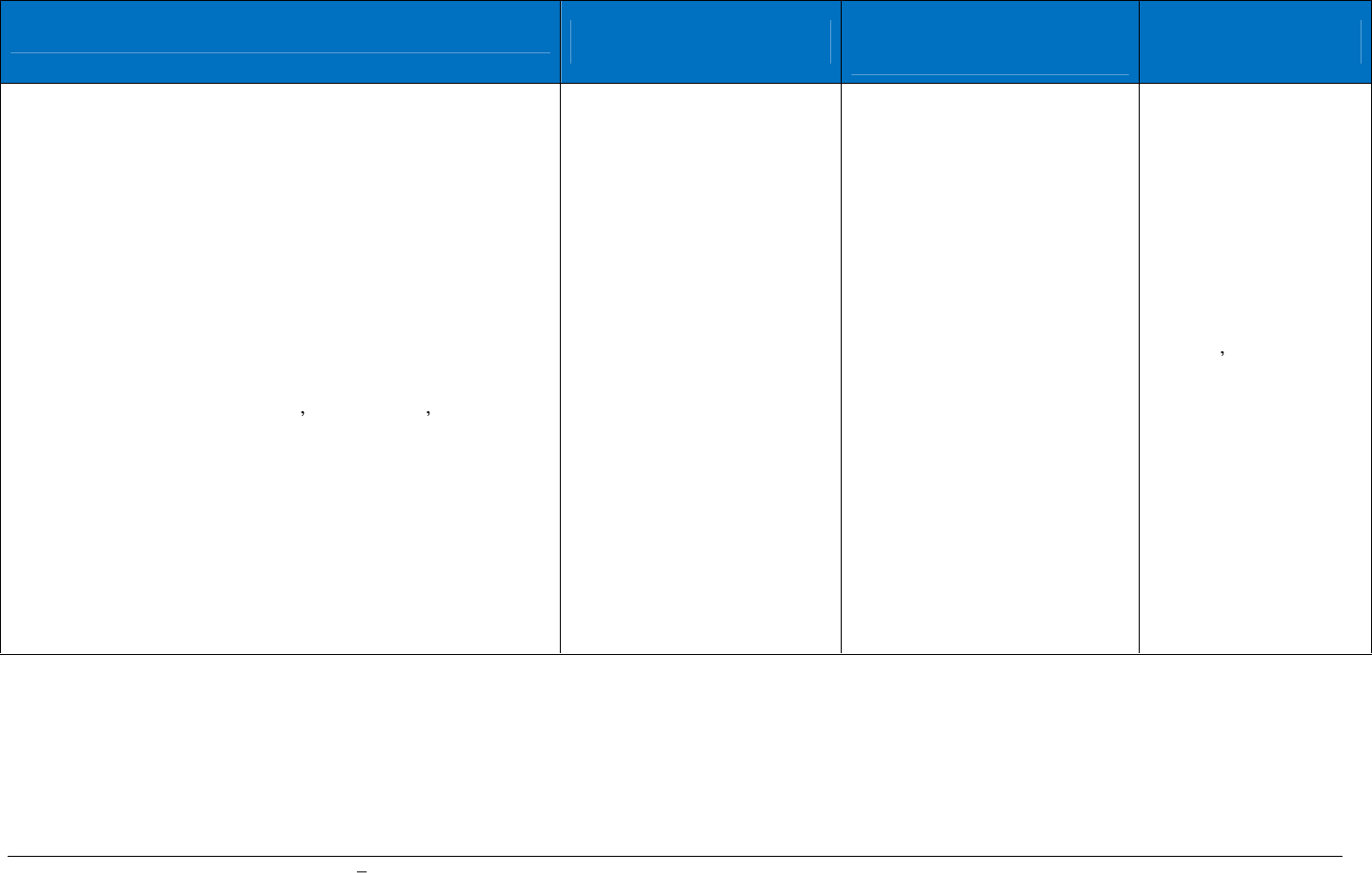

Table

1.

Target market characteristics and actions

Transaction Type

Unique Characteristic

Suggested Actions

Purchase

First time home buyer

The borrower will have no

experience with the process or

knowledge of the responsibilities of

home ownership.

Use loan officers, underwriters and

closers who are current

homeowners. A mature loan

closer/attorney is best suited to

take the time necessary to help the

first time buyer become

comfortable. Most first time home

buyers will need to have each step

and each term explained. Take care

to define terminology used and try

to avoid jargon when describing

terms and covenants in the loan

agreements.

Purchase

Move up

Second home

relocation buyer

This borrower has been through

the

process and generally does not

require the same amount of

attention as the first time home

buyer.

Be sensitive to the amount of time

you are requiring of the move up

buyer. Most will not need detailed

explanation of every detail of the

transaction.

Re

finance

Existing home owner

The objectives of this buyer should

be clearly identified. In most cases,

they are refinancing to lower debt

and/or lower payments.

Quickly identify the benefits that

the borrower will realised when the

transaction is complete. If the

benefit is not obvious, investigate

further the borrower s objectives.

Home Equity

The borrower s objective is to

utilise equity that has been

The lender should inquire as to the

borrower s intended use of the

Mortgage Loan Minimum Standards Manual

June 2011

9

accumulated over a period of years.

Typically the borrower will have a

predetermined use of the funds.

funds

and look for opportunities to

sell the borrower other bank

products; this is known as cross

selling.

Self

-

Build

Or

Owner

-

Builder Projects

Self

- build projects are the highest

risk

loan for a mortgage lending

organisation. Often the loan is based

on the projected cost of materials

and some labour. Typically the

borrower intends to provide most of

the labour themselves. Risks

include poor workmanship, failure

to complete the project or delays in

construction. See more on Self-

Build projects in Chapter 6.

The lender should require the

borrower to provide a construction

budget with the type and grade of

material to be used. The lender

should verify the costs and advance

the loan funds incrementally only

after verification of the work

complete.

1.5

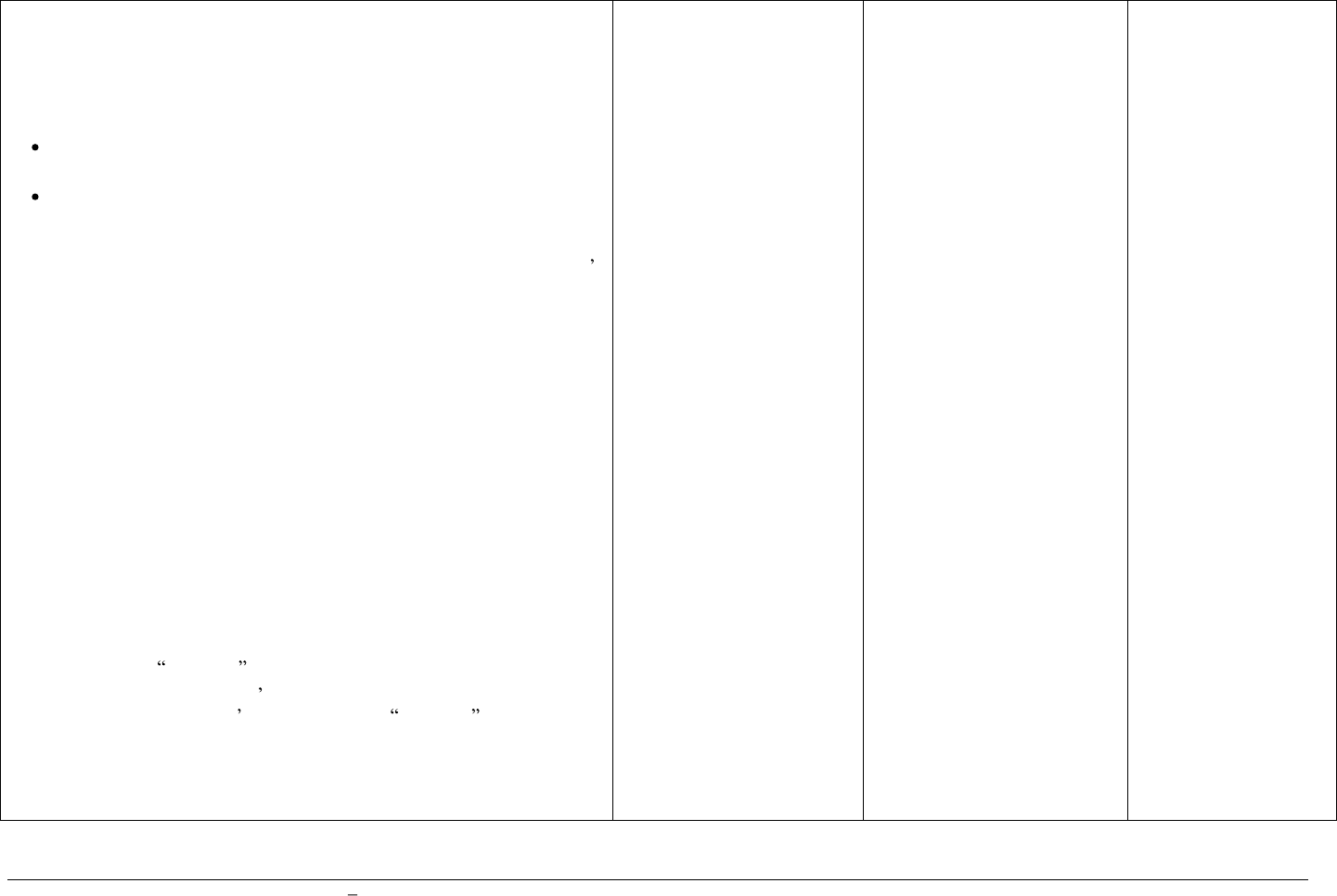

Product Types

The chart below illustrates the type of mortgage loans that are typically offered to home buyers and those who

currently own a home. Loan products should be carefully matched to the objectives of the borrower and the

availability of funds. See more about matching funds in the discussion on interest rates.

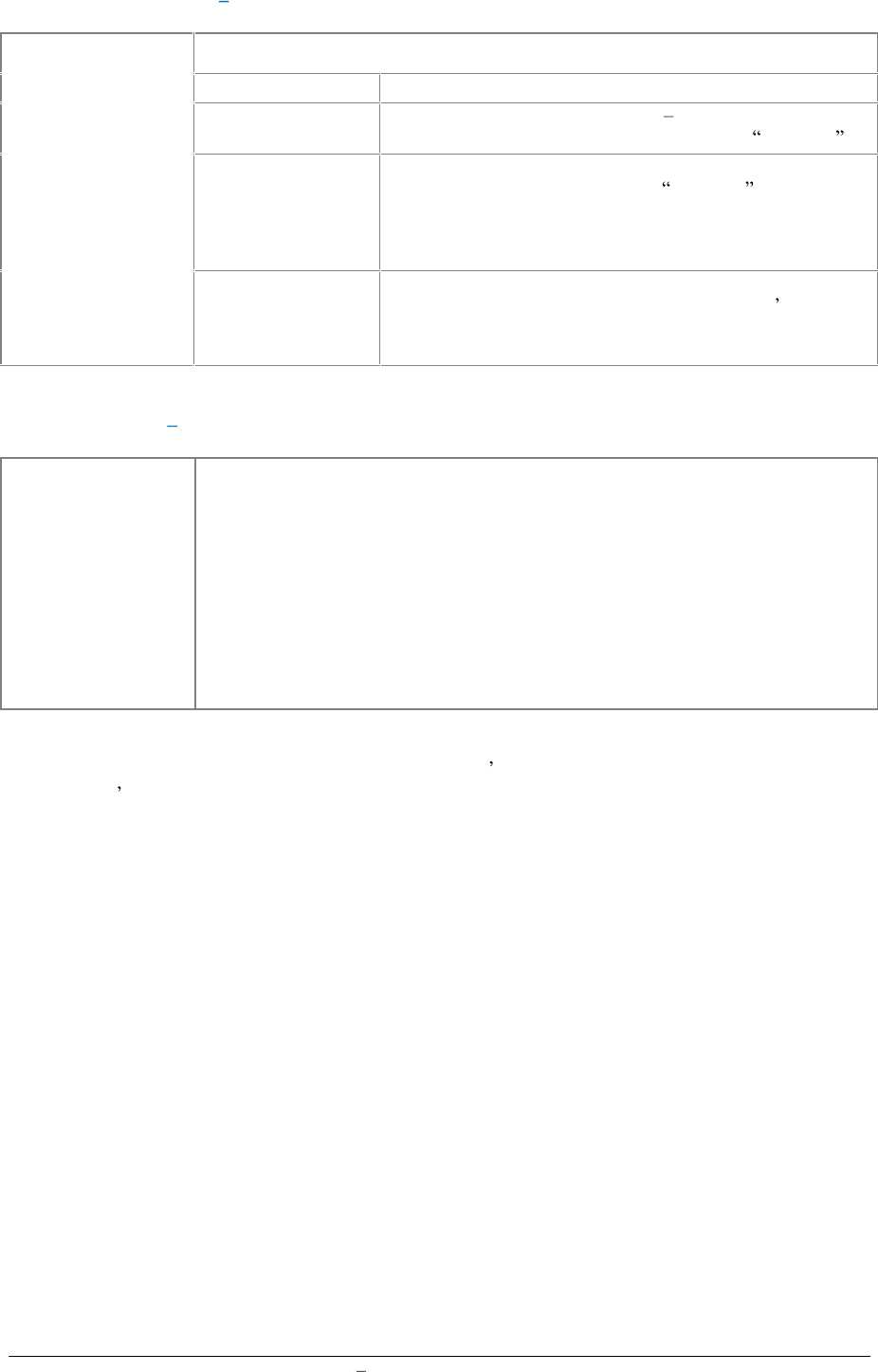

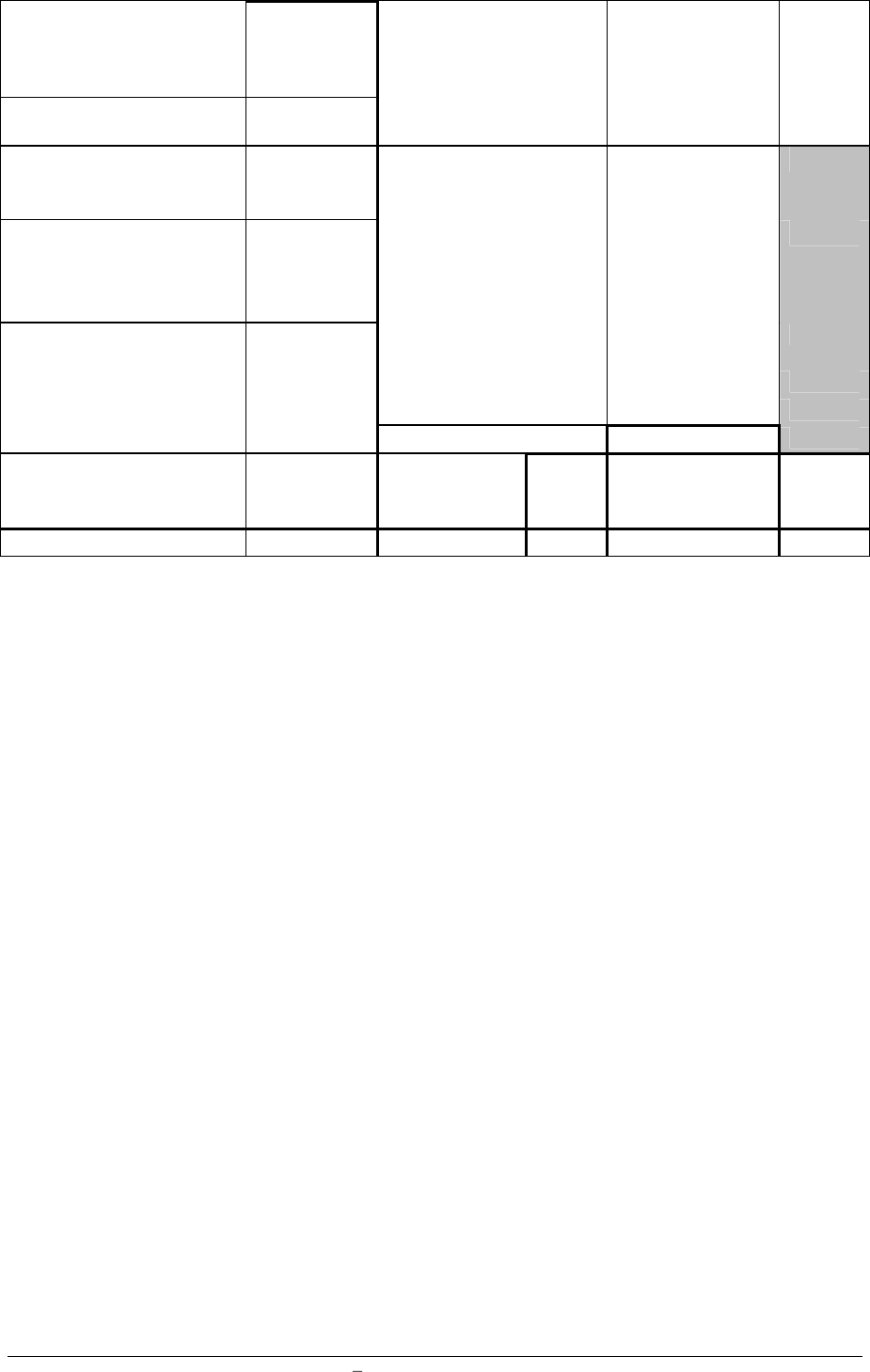

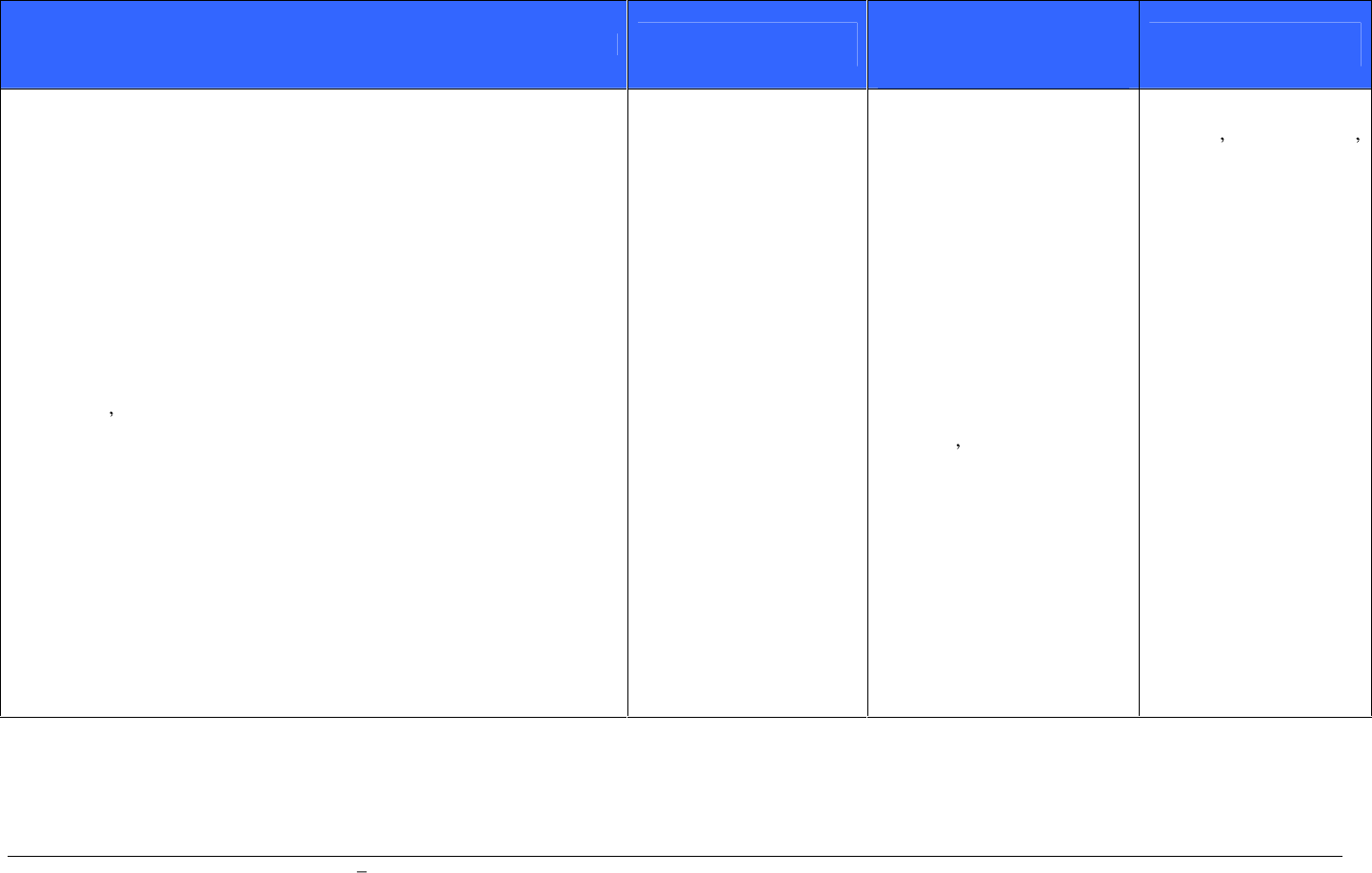

Table

2

.

Mortgage

p

roducts

Product Type

Features

Optimum Borrower

Lien Rank

Fixed Rate

Predictable Principal and Interest payment which

can be amortised for periods of 5, 10, 15, 20 and

25 years.

First time home buyers,

families and borrowers on

fixed income.

First Rank

Variable Rate

(VRM)

The interest rate is tied to a well-known index

and includes a margin in addition to the index

rate. Payments may change each 1, 3 or 5 years

based upon the agreement of the lender and

borrower. Most VRM loans have a lower initial

rate of interest than fixed rate loans. The loan

may be amortised or interest only for an initial

period (say 3 years) and then amortised over the

remaining term of the loan.

Typically, high income

borrowers or young

professionals who expect

their income to increase in

the coming years.

First Rank,

or

on an

exceptional

basis

if the

loan is a

home

equity

loan,

second

rank.

Interest Only

Loans

Monthly payments are calculated on the basis of

the unpaid principal balance at the note rate. This

type of loan requires the borrower to make a

single payment, also known as a balloon

payment at a predetermined date.

This product is best suited

for self-build loans, or loans

for short term purposes.

Borrowers should be

carefully analysed to

determine their ability repay

the balloon payment.

First Rank

Home

Renovation

and Energy

Efficiency

Loans

Monthly payments should be structured as

principal and interest payments over a period of

5, 10 or 15 years. Before issuing the loan the

lender should evaluate the cost of the

improvements and the potential benefits to the

borrower. There are cases where improvements

to a property will extend the economic life of a

house which may be beneficial to the borrower.

Owners of homes and flats

more than 10 years old.

First Rank

Mortgage Loan Minimum Standards Manual

June 2011

10

Self

-

Build and

Owner Builder

Projects

The principal of the loan is disbursed in draws on

a predetermined loan amount based on work that

has been complete. Owner-builder loans are

short term, 1

-

3 years which requires the borrower

to pay off the loan or seek long term financing.

The loan should require interest only payments

on the amount of the unpaid principal balance.

An experienced craftsman

is optimum; however, a

borrower who has trade

skills generally makes a

reasonable risk.

First Rank

1.6 S

elf Build Projects

When a customer owns the land and wishes to construct a home, the construction may be carried out by

eith

er a

'registered

builder' or by 'direct labour , also known as Owner-Builder. In many countries, the construction

industry, with Government approval and support has set up a scheme which provides guarantees on the quality

of

construction of houses. We have examined this scheme in more detail under Insurance in Chapter 6. Once the

scheme is set up, builders are anxious to join because buyers naturally try to purchase properties where the

standard of construction is guaranteed.

Construction lending presents the greatest risks to a lender. The risk of development should be reflected in the

interest rate charged. Critical to the security of the loan is the manner in which the lender releases funds for

construction of the project. There are two methods of constru

ction management:

i.

Phased drawdowns based on a percentage of the work, such as 20%, 20%,

20%

,

10%,

10%

, for

example

ii.

Drawdowns on the actual work or stages which have been completed

Regardless of the method that a lender prefers to follow, all construction loans begin with the analysis of the

construction budget. It is recommended that the lender retain an architect or engineer to carefully analyse the

cost of labour, materials and land.

In most cases the land should be paid in full by the borrower as their equity contribution, see the chart below.

Thereafter, the loan should be analysed to identify the cost per square meter of the project and compare the

costs with similar projects in similar areas. Project costs may vary depending upon the type of construct

ion,

(wood vs. concrete), and the finish of the interior. In addition to hard costs such as bricks and labour,

construction financing includes soft costs such as architectural and engineering fees, permits, insurance and loan

costs. The lender must require course of construction' insurance to protect the lender and borrower in the event

of a catastrophic event while the project is being built.

Analysis of risk of construction loans employs both the Loan to Value Ratio and the Loan to Cost Ratio. The

Loan

to Value ratio is applied on the basis of the finished value of the property, while the Loan to Cost Ratio

considers the total cost of the project, valued by components of land, material and labour and the loan amount.

For example if the project being built is a stand-alone single family home on a residential plot of land the

components should be valued independently. The lender should then make the loan on the lower of the Loan to

Cost or Loan to Value.

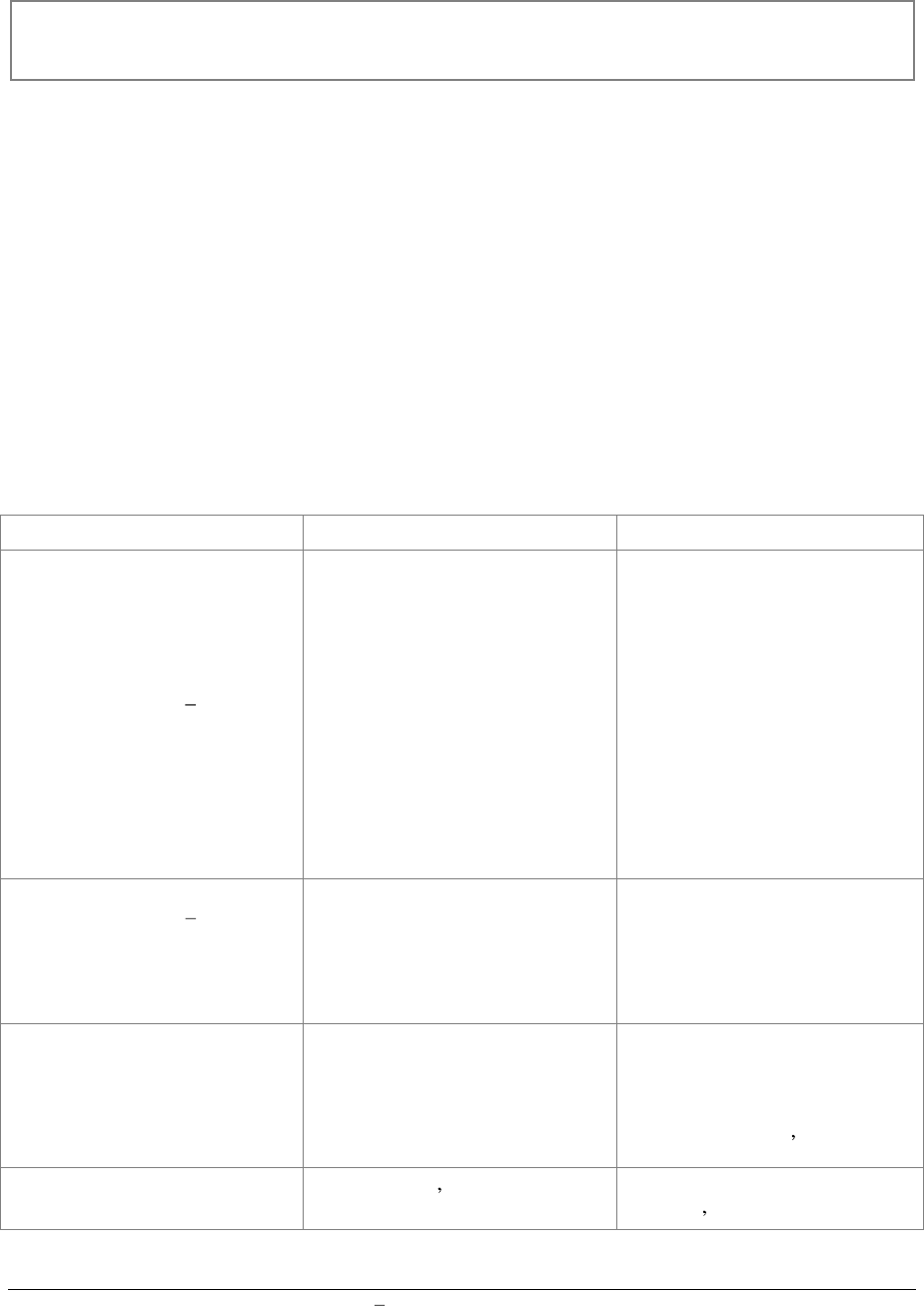

Components

Actual Cost of

Construction

Maximum Loa

n to

Cost @ 80%

Appraised Value

Maximum Loan to

Value @75%

Land

25,000

12,500*

Materials

45,000

36,000

Labour

35,000

28,000

Soft Costs

10,500

8,400

Total

115,500

84,900

145,000

108,750

Table 3.Risk analysis of construction loans

Mortgage Loan Minimum Standards Manual

June 2011

11

*Some lenders will permit the borrower to contribute the value of the land as a portion of their equity in the

project. However, it is highly recommended that the value of the land contribution

typically

not exceed 50% of

the cost of the land

, depending on the country and actual location of the respective land.

Registered Builder/Fixed Price contract

In all instances where a builder is employed the customer should ensure (and the lender should insist)

that only a

fixed price contract is used. Such a contract will assure both the lender and borrower that price increases cannot be

made. It is important to note that in an expanding or emerging economy, fixed priced contracts may not be feasible

as materials and labour increase. In this case, the lender must approve any changes in the contract and/or the

borrower must be prepared to pay for increased costs from their own resources unless the borrower s equity is

substantial enough to keep the Loan to Value at or below the requisite level.

Direct Labour (Owner

-

Builder)

Direct labour means that the borrower is either bu

ilding the house himself/herself or is employing all

the various

skills

-

bricklayers, plumber, electrician or other trades.

Extra diligence is required to ensure that the budget is closely followed. An experience construction loan

manager should be retain

ed to verify all costs incurred by the borrower.

However suitable situations and opportunities will arise - e.g. customer is a building professional and has

previous experience. Undoubtedly a well-managed 'self-build' project will cost the owner less than employing a

builder.

Phased Payments

Borrowers who chose to build a home require a mortgage in the same way as people purchasing a finished

homes do. The

difference is that the need the money in phases or stages.

In many cases the borrower will have begun construction with their own funds first. From a lenders perspective

this ensures commitment and equity contribution. The more of their own funds they use the less likely they are

to default or to abandon the project. For example, if the total cost is 100k and the mortgage is 70k then the

customer s

contribution is

30k -

these funds will be used before the lender will release the phased payments.

The facility offers gradual drawdown of funds typically in tranches as the construction progresses. These ar

e

clearly defined completion points in the project and are:

Stage 1: Site preparation and foundation

Stage 2: Framing

-

exterior walls and roof erected, windows framed and roughed in

Stage 3: Mechanical

electrical, water, heating or cooling systems and i

nsulation

Stage 4: Interior finishes such as plaster and paint applied

Stage 5: Interior trim such as doors, faucets, toilets flooring

Stage 6: Exterior finishes, landscaping, onsite parking

At each stage the lender requires inspection and certification by an architect or other suitably qualified

professional (engineer or quantity surveyor) that the work has been completed satisfactorily prior to

drawdown

of the funds.

When advising a customer on financing a self- build project, it's critical to stress the importance of

thorough

preparation especially in relation to costs and cash flows.

Construction Loan Risks

-

Self Build

Construction lending presents risks unlike that of a traditional mortgage loan. The highest risk is the failure of

Mortgage Loan Minimum Standards Manual

June 2011

12

the contractor

/

owner

-builder to finish the project and to ensure the property meets all applicable

building

codes.

To a lending institution an owner-builder project is more risky since most, if not all of the work will be

performed by the borrower. This person may also be emp

loyed in another trade or profession, which means that

the construction of the subject property may experience delays.

The lender needs to be confident that the customer will see the project through and that cost overruns will be

kept to a minimum. The wor

st

-case scenario for a lender is that the project is abandoned half way through which

leaves the lender with a partially constructed property or a poorly constructed property that is difficult to sell.

Before agreeing to lend on a self

-

build project the l

ender must be satisfied that:

The borrower owns the land unencumbered with appropriate access

The plans meet local authority planning

/permission and by

-

law conditions

In course of construction property valuations will be carried out

During

construction

per

iod,

insurance will be in place

The site will be fully serviced with all utilities

The customer has funds available (i.e. their equity)

These funds will be used before the phased drawdowns commence

The builder is a properly licensed professional and regist

ered with the proper authority

A qualified architect will supervise the

construction

The property will be readily marketable in the event of a forced sale

The completed house will be adequate security to cover the mortgage

Construction Loan Risks

Contrac

tor Build

Buyer s prepayment in

tranches

In some regions, developers will have an apartment building under construction and at the same time will be

promoting the project to the public. Developers will agree to sell a specific unit to a buyer if the buyer agrees to

make a down payment ranging from 20%-30% with future deposits required at specific intervals of 20-

30%

until the agreed upon purchase price is paid in full

by completion of the unit

This type of purchase arrangement requires additional

attenti

on since the specific unit may not be finished when

the borrower makes a loan request from the financial institution for a portion of the purchase price. First, a

l

ender

must carefully evaluate whether the developer/contractor has sufficient financial resources to complete

the project. There have been many cases

where buyers have made substantial payments to developers and where

the developers failed to complete the project. Lenders should not advance any funds to a buyer or developer for

an unfinished unit or home, unless the developer or the lender on his behalf (in escrow) is holding funds

sufficient to complete the unit or home.

Mortgage Loan Minimum Standards Manual

June 2011

13

2.

MORTGAGE DOCUMENTATI

ON

(MS 02)

Documentation plays a critical role in the mortgage lending process. Financial institutions use mortgage

processing forms to capture, store and analyse the substantial amount of information that is necessary to

prudently originate mortgages and to effectively manage them during the years that they are outstanding. Legal

documents embody the contractual relationship between the lender and borrower, and they secure the lending

institution s interest in the properties that serve as collateral for its mortgages.

This Chapter describes the types of documents that lenders typically employ to document and manage their

mortgage programs. Sample forms including a mortgage loan application and mortgage offer letter are included

in Appendices A1 and A2.

EBRD s Minimum Standards require:

i.

Development of all documentation supplied in the mortgage process must involve suitable

qualified

legal

advisers.

ii.

The

Mortgage Application Form

and supplementary materials should include the following details:

Personal details, including postal codes

Occupation and income

Financial assets

Current debt/repayments

Bank account details

Details of legal body

-

according to local legal norms (e.g. lawyer, etc.)

Current living accommodation

Details of property to be purchased/built, including postal codes

Amount of loan required

Full costs of transaction

Source of funds to cover the cost

Type of mortgage required

Ter

m/repayment schedule

Illustration of interest rate/payment changes

The Application Form(s) should meet consumer protection legislation and must include explicit

consent for inquiries to a credit bureau (if relevant to country) or credit information reporti

ng

system.

(See sample application

form in Appendix A1.)

iii.

Lenders must ensure

verification

of the information in the Mortgage Application by requesting the

following documents:

Completion of standard conditions in application form (including authority for lender to sell the

mortgage)

Valuation and/or structural survey report

National identity cards (according to local legislation)

Marriage certificate or proof of marriage, if applicable

Divorce/separation agreements, if applicable

Architect certificates

-

fo

r self

-

build products

Proof of appropriate registration of the property, such as cadastre excerpts or the equivalent

Mortgage Loan Minimum Standards Manual

June 2011

14

It may be that in the case of real estate to be built or under construction, not all the documents mentioned

above will be available upfront, such as valuation report, cadastre excerpts, etc. These should be made

available in due course as agreed with the client.

For Income Verification,

at least one

of the following:

-

Certificate of income from employer

- State certificate of earnings and /or tax paid (or similar documents according to local

legislation)

- For self-employed people: certified audited accounts or local income confirmation, as the

practice may be in the respective country

Independent confirmation real estate taxes are up to date, if

applicable

Savings or loan statements or other justification of source of advanced payments

Rent accounts, if relevant

iv.

The

Mortgage Offer should be documented in an offer letter and/or mortgage loan agreement that is

legally binding, complies with consumer legislation, safeguards the customer and the lender and will

stand in a court of law. The contents of the letter/agreement should include:

Name & address of customer, including its postal code

Address of property being mortgaged, including its postal cod

e

Amount of credit advanced

Period of the agreement

Number of repayments

Total amount repayable

Cost of the credit

Interest rate (APR ("Annual Percentage Rate"), if the practice of the respective country has such a

banking instrument)

Annual Effective Rate (AER). This is the rate used to computer the equivalent, on an annual basis,

of the present value of all loan repayments and charges, future or existing, agreed between the

creditor and the consumer.

Security (mortgage right) required on the financed prop

erty

General conditions

Consents required to enable the sale of mortgage loan and mortgage rights to third parties, transfer

of data to third parties and the appointment of a third party administrator/servicer, including

consent for access to credit bureau

data, if existing in the respective country.

v.

Post sale documentation.

The following, at a minimum, should be provided post sale:

Written confirmation of the key terms of the loan once the contract is signed and subsequent

notification, at least on an annual basis, in cases where the structure of fees change (e.g.,

redemption penalties, statement fee, re

-

mortgage, early repayment charges, etc.).

Annual statements to the borrower detailing the principal outstanding, interest payments made

during the year and

any penalty interest.

Written notification if the mortgage is sold if required under local legislation.

Written notification of early repayment charge and arrears charges applied by the lender in cases of

arrears and repossession policy or equivalent inte

rnal regulations.

vi.

Documentation

will be required throughout the entire mortgage process. A mortgage lender will

develop a wide range of other documents to cover specific activities and situations. The following is a

list of documents the lender should have

:

Consumer guides to process and

products

Loan disclosure forms (see Chapter

8

for more discussion on the content of disclosures)

Mortgage Loan Minimum Standards Manual

June 2011

15

Relevant marketing material

Application form(s) meeting consumer legislation and/or secondary market requirements

Credit asses

sment template, data analysis forms and system input forms

Letter(s) of offer (loan agreement) - meeting legislative and/or secondary market requirements

(including sale to third parties)

Mortgage deed

Certificate of title report

Assignment of insurance po

licies forms

Valuation or

property appraisal form

BEST

PRACTICES

Compliance with consumer protection legislation is mandatory, but best practice would also include a range of

risk warnings

and advice

in the offer letter or loan agreement such as:

Advice

that the home is at risk if payments are missed.

Advice that the variable interest rates may be adjusted (up and down) from time to time and that the

mortgage payments would also be adjusted to reflect the future change, as the case may be.

Advice that movements of exchange rates could increase which effectively reduce the repayments in

the local currency (numerical illustration is recommended)

Advice to obtain independent legal advice before signing the contract.

For foreign currency loans, advice on the risk undertaken by the borrower should it experience an

erratic change in value

.

REASONS FOR BEST PRA

CTICES AND MINIMUM S

TANDARDS

Application and Supporting Documents

The mortgage application form and accompanying authorisation of borrower enables the lender to collect all the

relevant information verifying documentation to adequately assess the application. The interview is a key

activity in the assessment process. Traditionally lenders have gathered information by using a mortgage

application form and this is reinforced by additional facts collected at a face-

to

-face interview. Many businesses

now use an online data collection process in addition to or instead of a mortgage application form but the

required

information does not change.

The data collection

enables the lender to:

Assemble information about the applicants financial circumstance (status) in order to assess if

the

customer will be able to service the repayments on the loan; and

Assemble information relating to the property on which the loan wil

l be secured.

Assessment of ability to repay

and valuation of security go hand in hand but it is the first of these which is most

important. Even with excellent security there is no point in lending to a person who will find it difficult or

impossible to m

aintain regular repayments. Such a situation causes stress and

hardship for the customer and can

lead to unnecessary administrative work, legal expense and loss for the lender.

The ability to repay is discussed in much greater detail in the chapter on Cred

it and Risk

Management.

Most people agree that it is wise for a prospective borrower to have an initial discussion with their lender about

how much of a loan they can afford before selecting a property and completing a formal application. Many

lenders provide a prequalification worksheet which will indicate the level of borrowing available to the customer

subject to documentary

evidence and final approval.

Mortgage Loan Minimum Standards Manual

June 2011

16

Offer Letter or Mortgage Loan Agreement:

The offer letter (when accepted) is the formal commitment between the lender and the customer. Once the

Underwriting Department approves a mortgage the next step is to issue a Letter of Offer or a Mortgage Loan

Agreement. An Offer Letter is a very important legal document and once it is

accepted

by

the customer it b

ecomes

a binding legal contract under which the lender agrees to lend and the customer agrees to borrow a specified

sum of money, for a specified term, at a specified interest rate (defined variable or fixed) with specified security

and on specified terms and conditions. An accepted Letter of Offer is therefore the legal basis of the lenders

relationship with the borrowing customer. In the event of a dispute regarding the loan it is this document that will

be referred to. Accepted Letters of Offer must be treated as one would treat items of security. They should be

retained in the security file. They should not be written on or defaced as this may affect the validity of the Loan.

The terms and conditions in a Letter of Offer will be comprehensive for informa

tion purposes. The key areas are

set

out under the Minimum Standards at the beginning of the Chapter. A range of consents are required of

the

customer including specific consent for the sale of the mortgage for securitisation /mortgage b

ond purposes.

WHAT

INVESTORS AND RATING

AGENCY MAY REQUIRE

Investors and rating agencies require evidence that loan decisions are made on the basis of interview supported

by collection and/or retention of comprehensive data. The application and supporting documents should be

carefully retained for possible review at a later stage by auditors acting on behalf of investors/rating agencies in

the event of a mortgage bond or mortgage

-

backed securities issue.

FURTHER READING

Refer to Appendix A1

for a sample mortgage

application f

orm.

Mortgage Loan Minimum Standards Manual

June 2011

17

3.

MORTGAGE PROCESS AND

BUSINESS OPERATIONS

(MS 03)

The mortgage lending process is the foundation for the largest financial transaction that most consumers will

undertake in their lives. It is imperative that each member of the staff of the lender or mortgage providers

(commercial banks, non-bank f

inanci

al institutions and others), whether they are employed in sales, marketing,

underwriting, processing, legal or in other functions, understands and be committed to a process that is clear,

fair, transparent and consistent. For the protection of both the borrower and the bank, the lender needs to ensure

that the mortgage is within the customers means over the long term and consumers need to be fully aware of

the commitments and risks they are taking.

3.1

Minimum Standards

(MS 03

)

There are several ke

y points in managing the Mortgage Process:

i.

The lender must have a written description of

its

minimum

standards, of the

required

documentation

and of the steps involved in originating a mortgage. This includes the initial contact with the customer,

the mortgage application and any documents that become a part of the mortgage file. This description

should include a flow chart showing the steps involved a written description of each of these steps and

the responsibilities of each party at every stage of the process. The lender should have processes in

place to ensure that staff from all areas of the bank or the lending division that have a material role in

the process receive

sufficient

training to ensure that they understand and are committed to the process.

ii.

T

here should be a clearly defined organisational structure that includes responsibilities, accountabilities

and roles in all aspects of the mortgage process. Additionally, it is recommended that the employees of

the mortgage lend staff understand that their individual performance records are influenced by the long

term performance of the loans they have made.

The

mortgage loan division should be

led

by a highly

experienced Senior Credit Officer who is empowered to oversee all aspects of loan operations. The

mortgage providers should have an audit or quality control unit that reports directly to the CEO or

designated board committee.

T

he

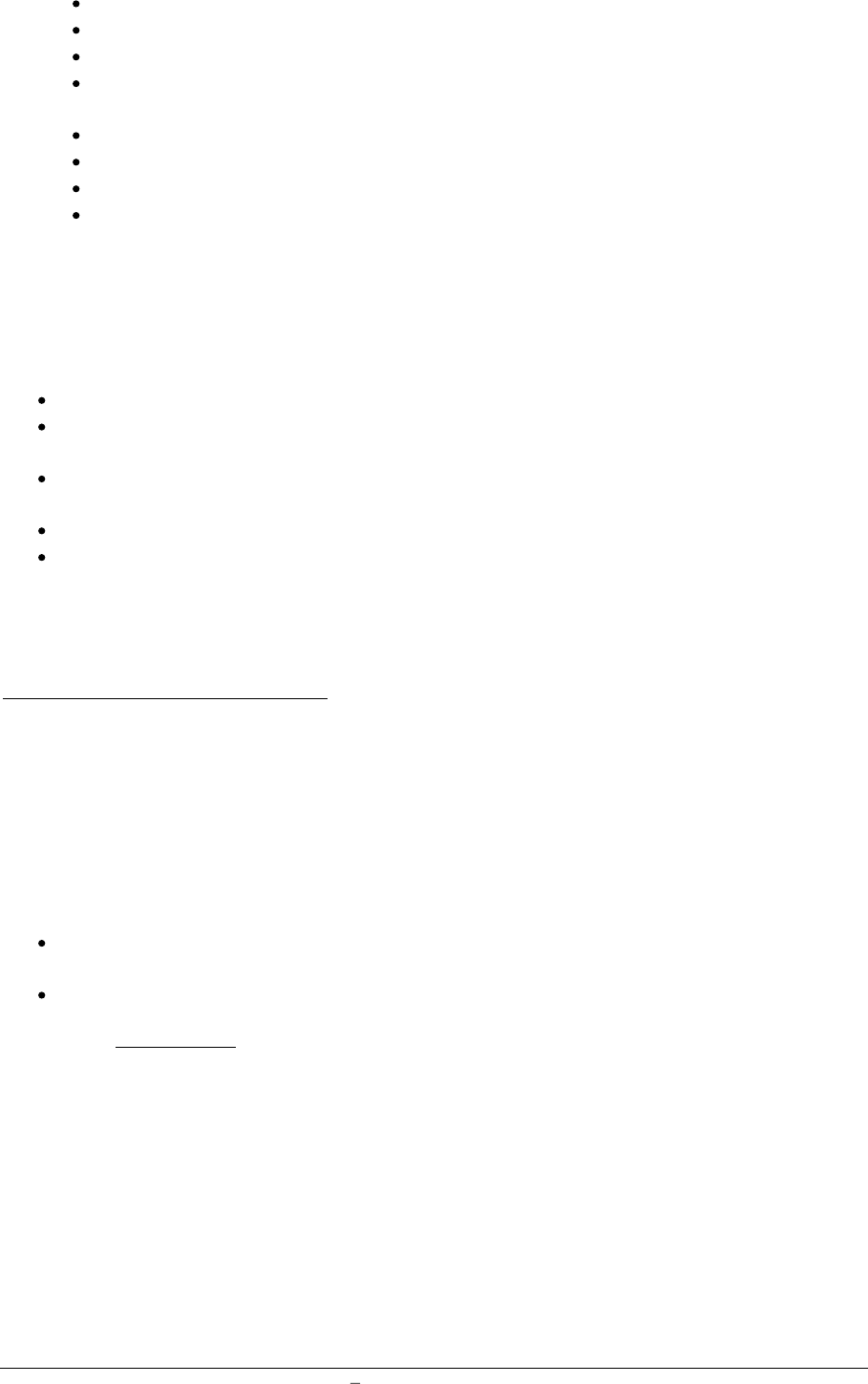

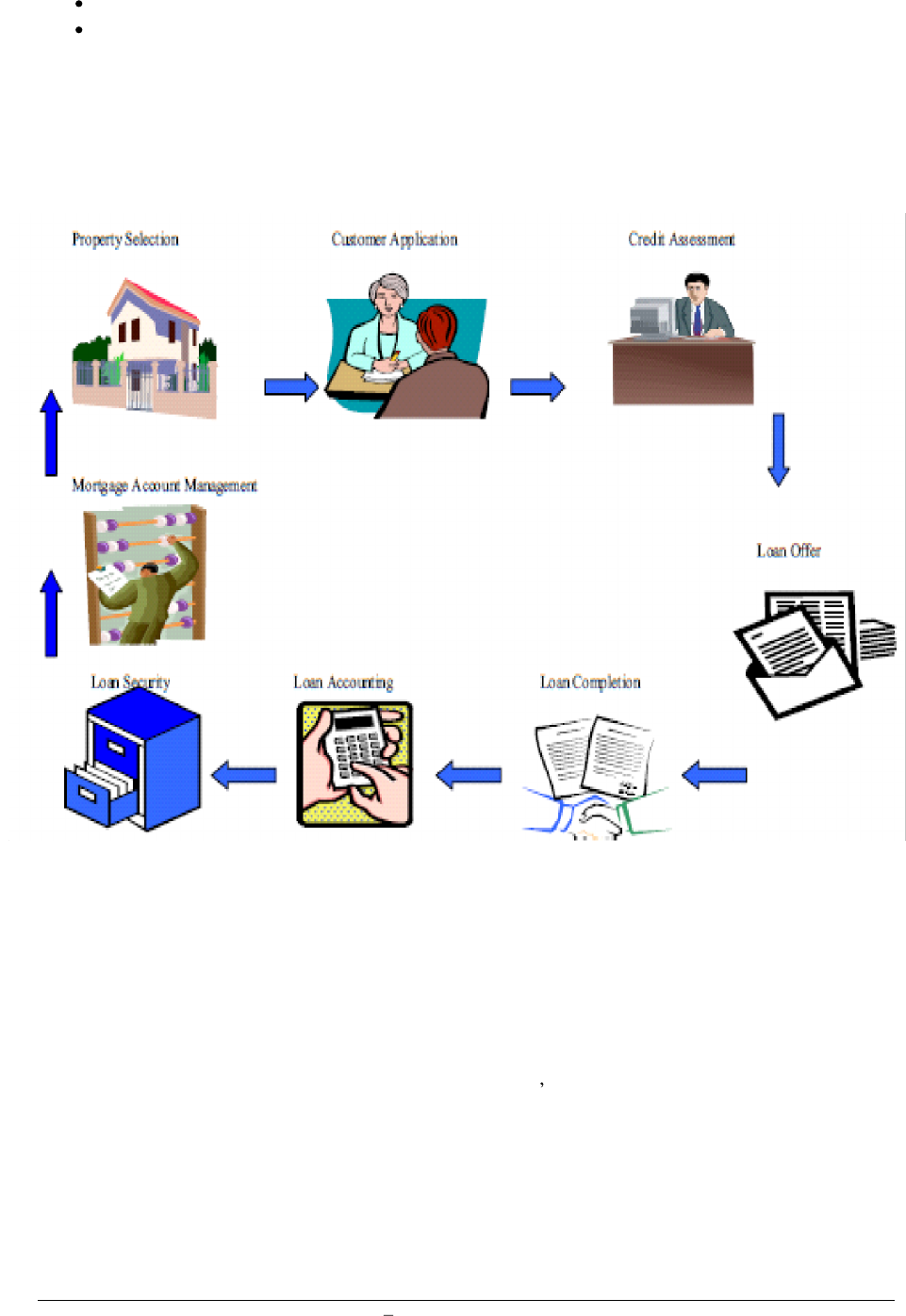

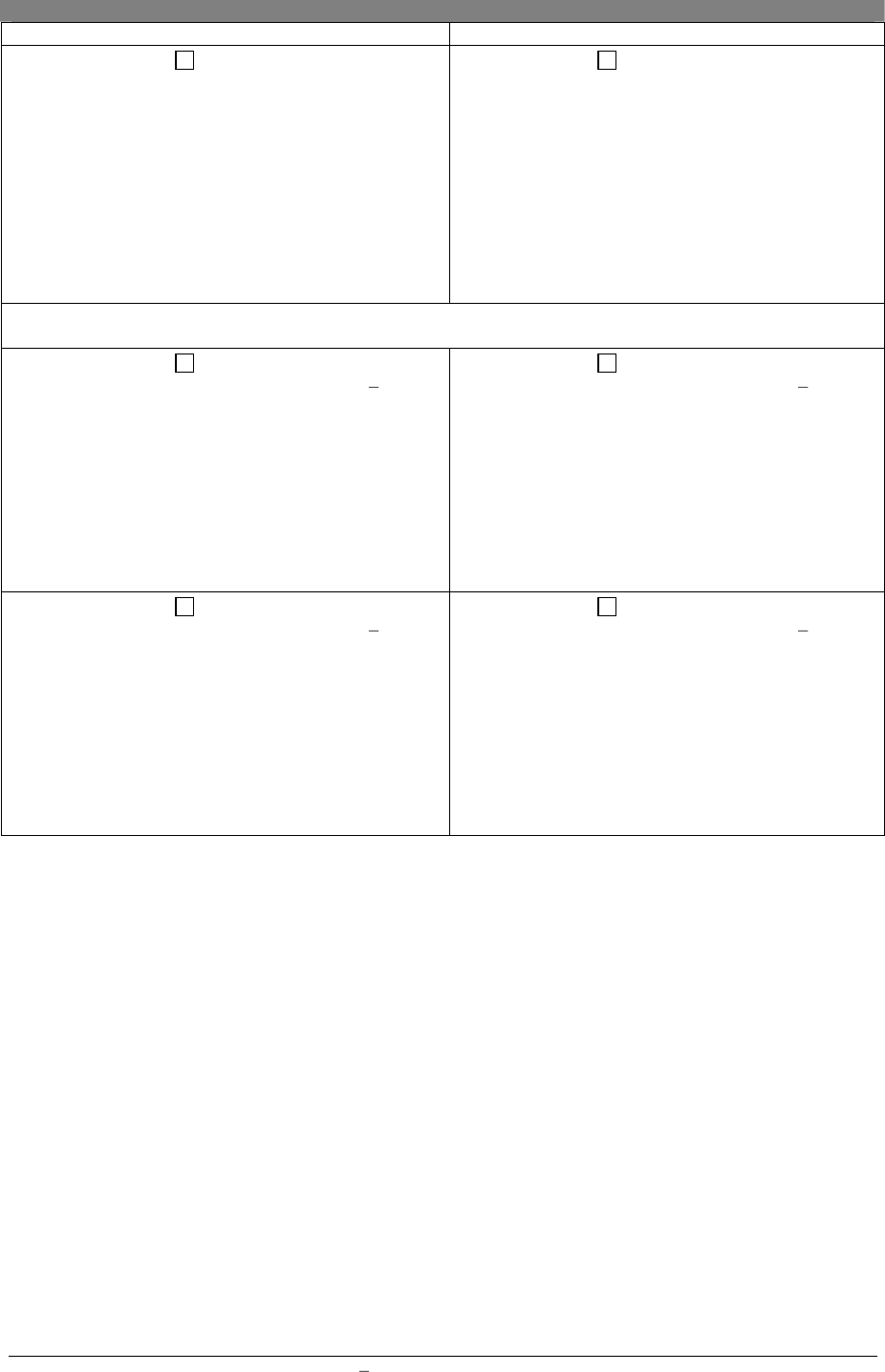

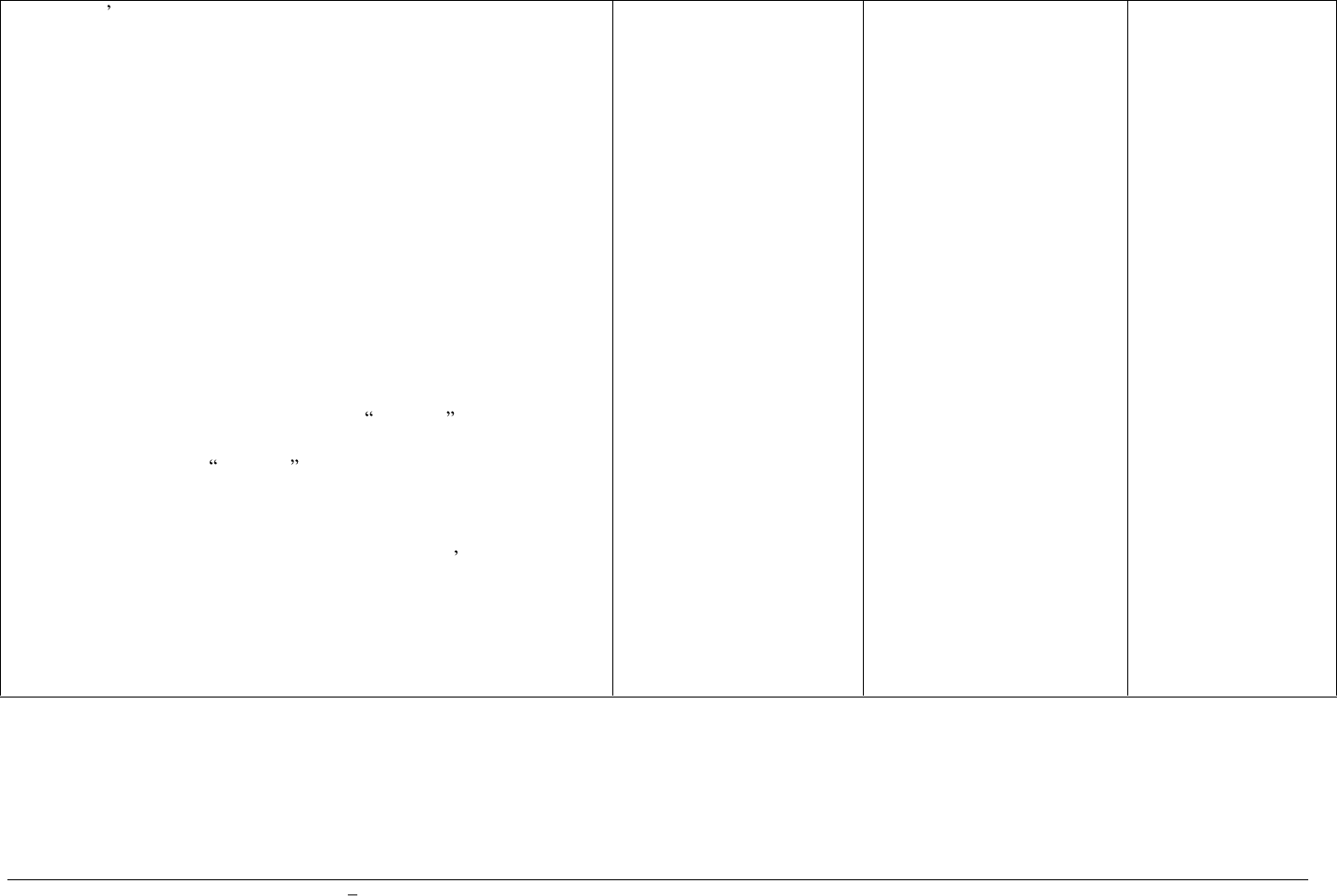

chart below illustrates the various steps both the consumer and lender will take to complete a loan

transaction

:

Customer

identifies a home they wish to purchase

Customer makes application for loan

Bank performs a pre-qualification and advises customer of the probable terms while issuing a offer

letter

Customer accepts or rejects terms

Customer provides documentation to su

pport their application

Bank verifies all information from the borrower and third parties

Approve/defer/decline application

The

Lender obtains a history of property ownership (also known as chain of title ) and evidence that

there are no claims or attachments to the property that would inhibit

the L

ender

from having a first lien

on the property or

B

uyer being subject to obligations of another person

.

P

roper

ty appraised

Loan Committee approval

Legal requirements completed

:

o

The property transfer deed is pre

pared for Seller and Buyers signature

Mortgage Loan Minimum Standards Manual

June 2011

18

o

The Loan Agreement is signed and ready for registration

o

The Mortgage and/or Collateral agreement are properly

executed

and ready for registratio

n

Mortgage drawdown

Mortgage Account Management

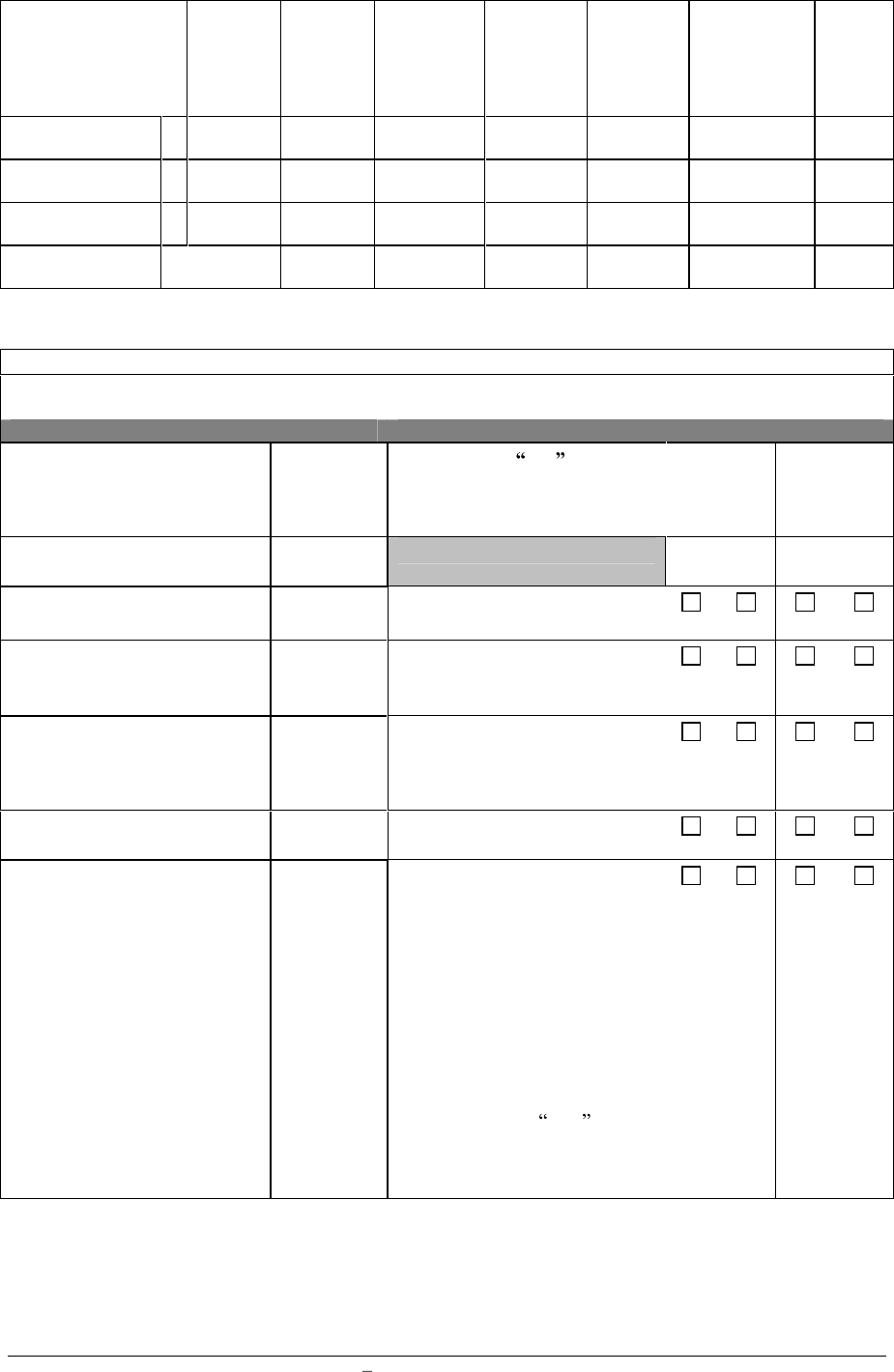

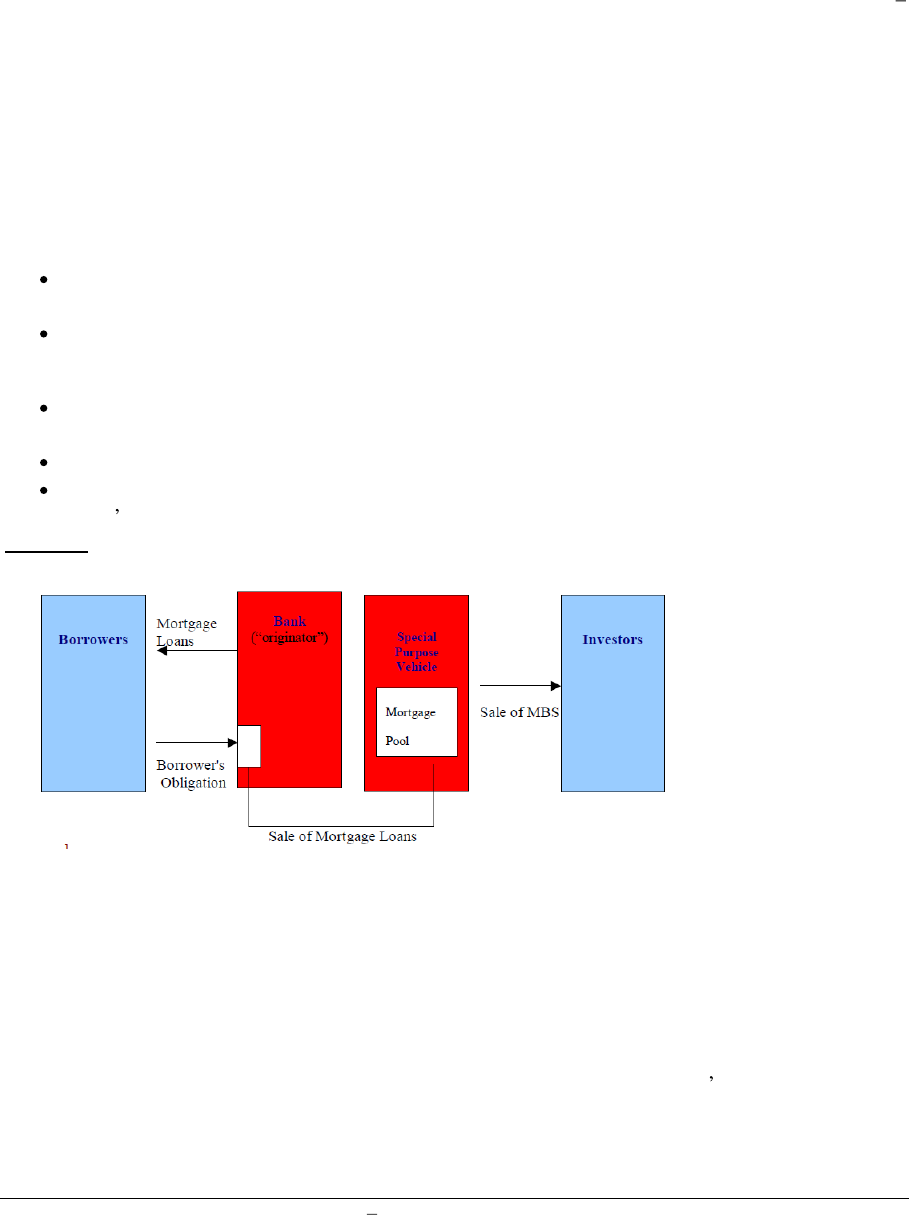

A graphic summary of this process is presented below:

Prior to the launch of a new product or the improvement of an existing product, staff representing marketing,

sales, origination, underwriting, processing and legal should agree that the mortgage structure, the underwriti

ng

process, the standards, the documentation and verification, and the disclosure to consumers serves the long term

interests of the lender and of the potential borrower. This should be done up-front and updated from time to

time, depending on the mortgage market development, with existing products as well.

Markets are built and sustained on both investors and consumers confidence. If the business is well organised

and managed, portfolio performance may be measured and observed for the investor and rating agency to assess

governance risk.

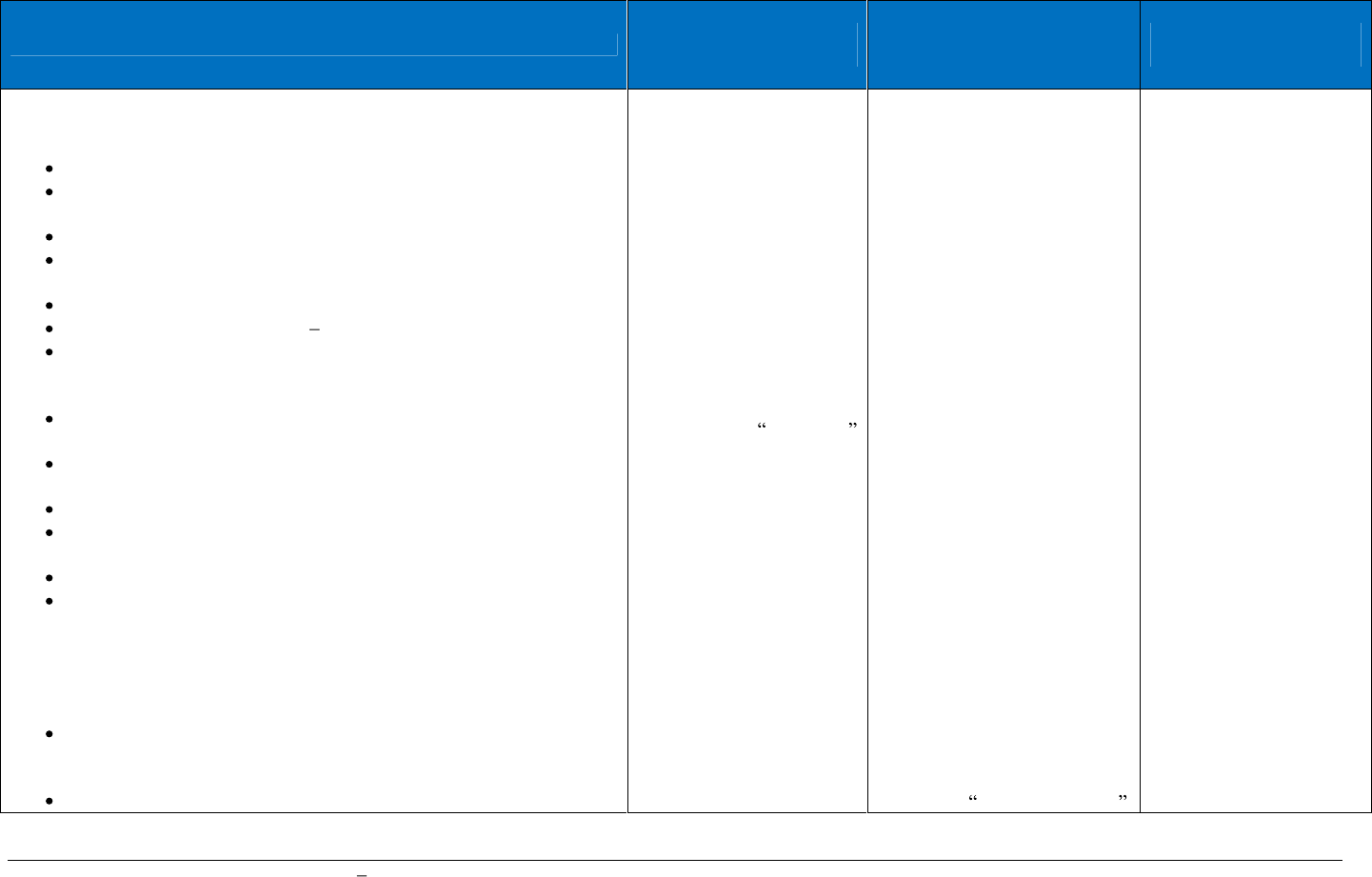

Figure 1.

The M

ortgage Process

Mortgage Loan Minimum Standards Manual

June 2011

19

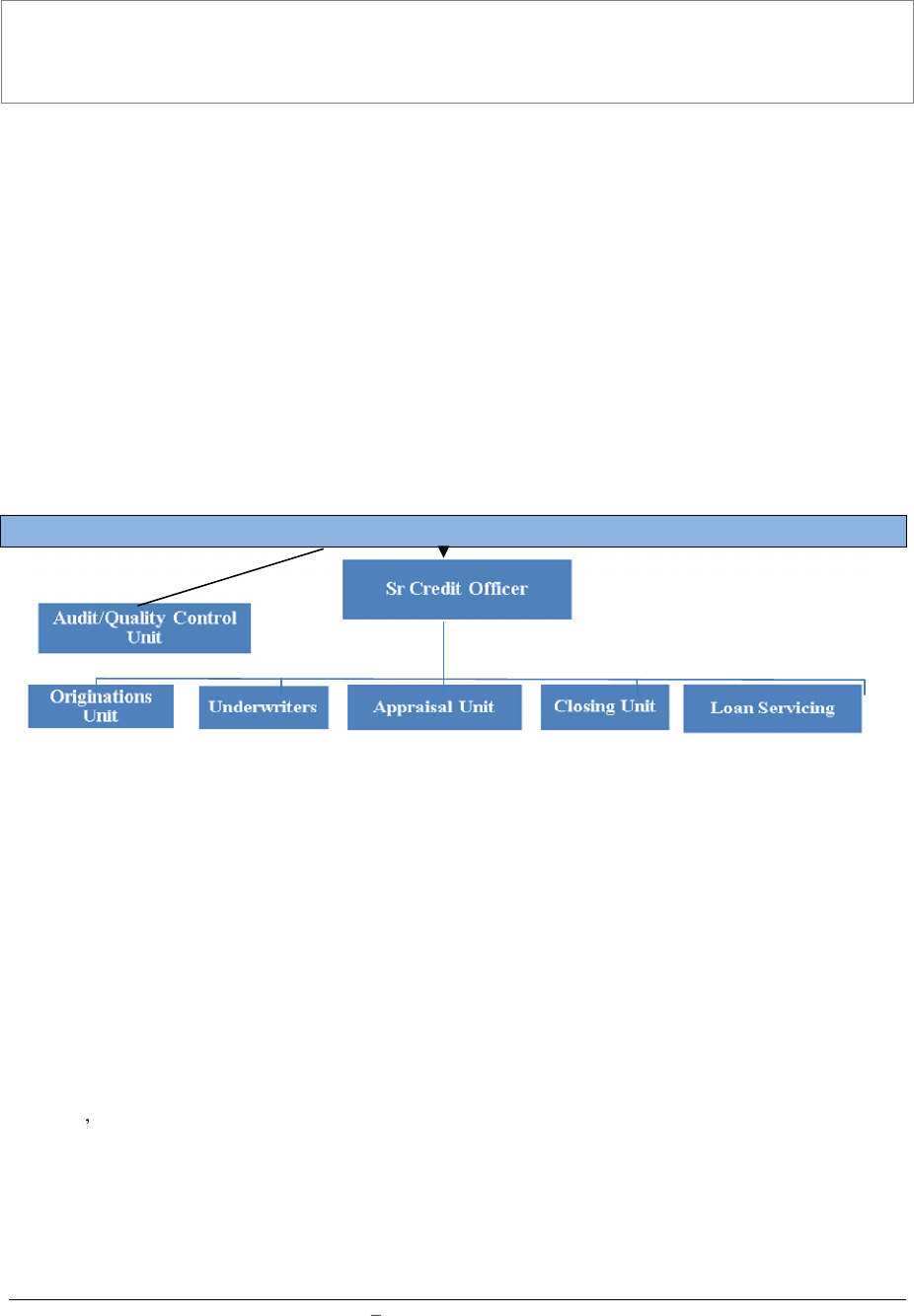

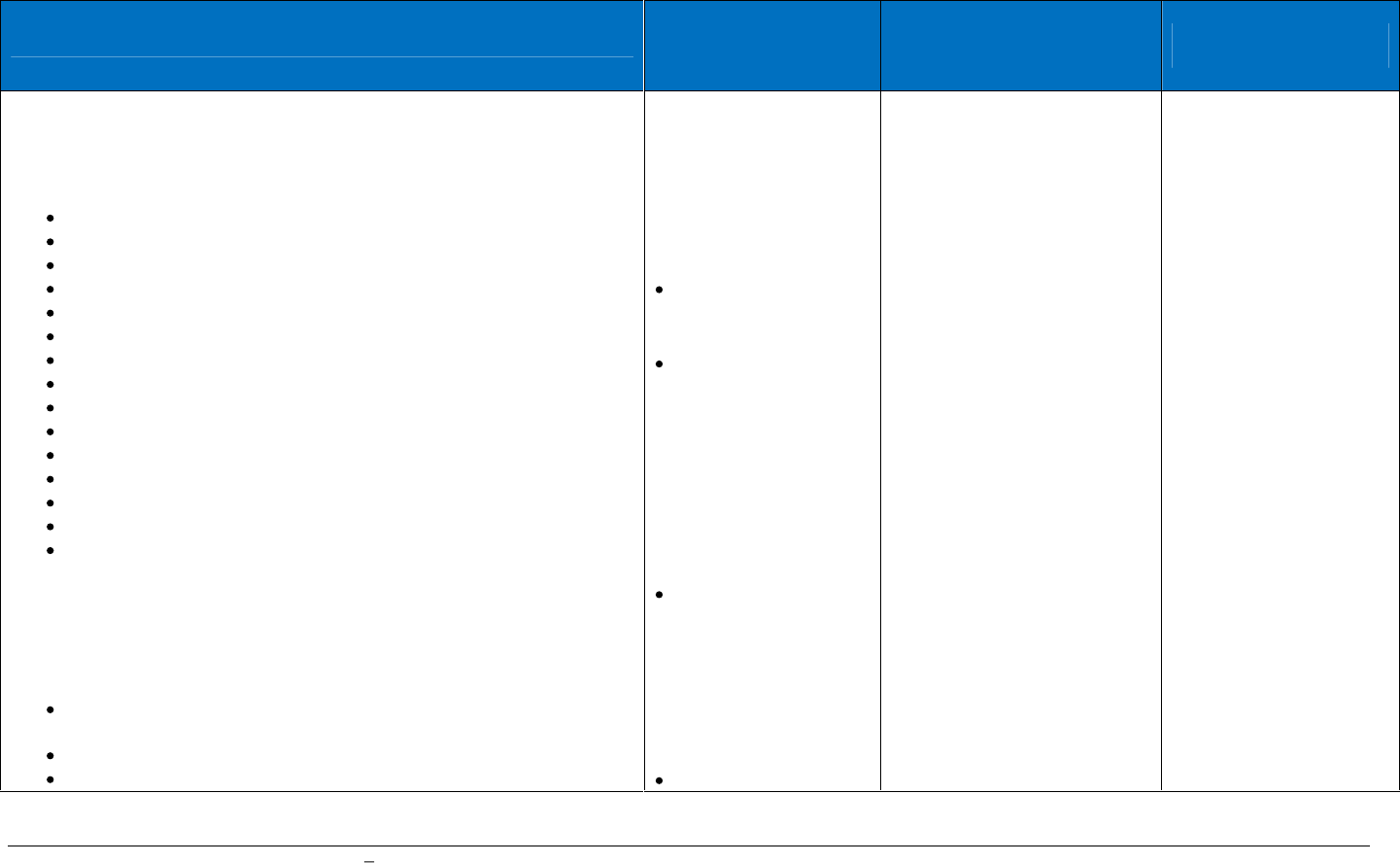

3.2 O

rganisational Structure

MINIMUM STAND

ARDS

Organisational structure begins at the Board of Directors level with the development of Credit Policy and

creation of an Audit Committee who reports to the

Supervisory

Boa

rd

or to an Executive management

and/or an

experienced Chief or Senior Credit Officer.

Mortgage origination lenders should be done according to an approved strategy. As mortgage lending is a long

term business, the lenders should originate their mortgage

loans

with the view that the respective loans will be

retained in their balance sheet for at least

2-

4 years.

Regardless

an

organisational structure the

may

lender adopt, it should be supported by necessary checks and

controls to ensure

mortgage lending a

nd risk mitigation

policies are adhered to.

There are two basic structures for a creating a mortgage operation, each with their unique benefits and risks:

Centrali

sed and Decentralis

ed

.

Centrali

sed loan divisions operate through several Units, including Or

iginations,

Underwriting, Appraisal, Closing and Funding and Loan Servicing. All of the units are located in the same

facility and should participate in loan committee meetings to review loan origination objectives, loan closing to

loan application ratios,

and loan performance.

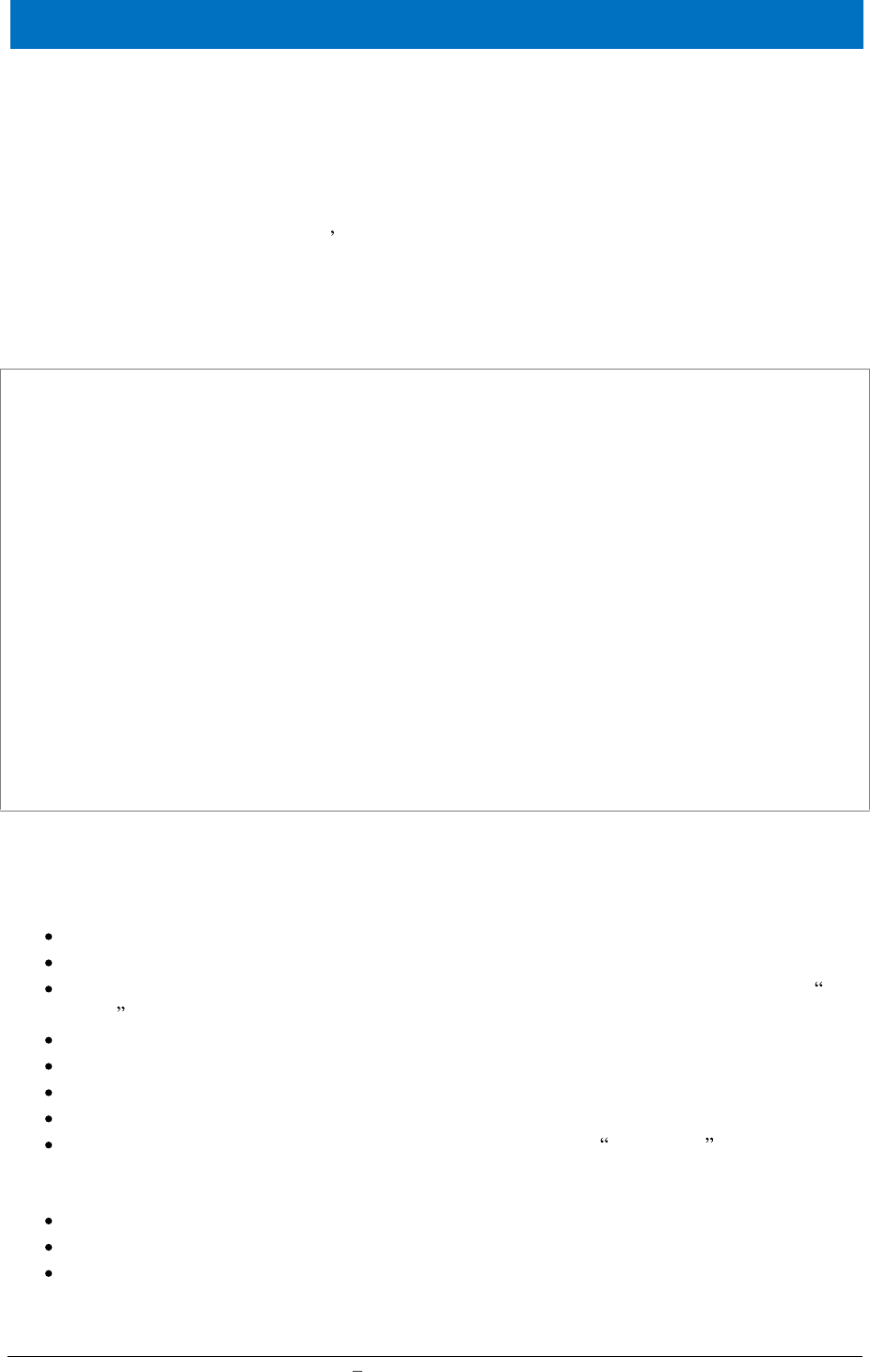

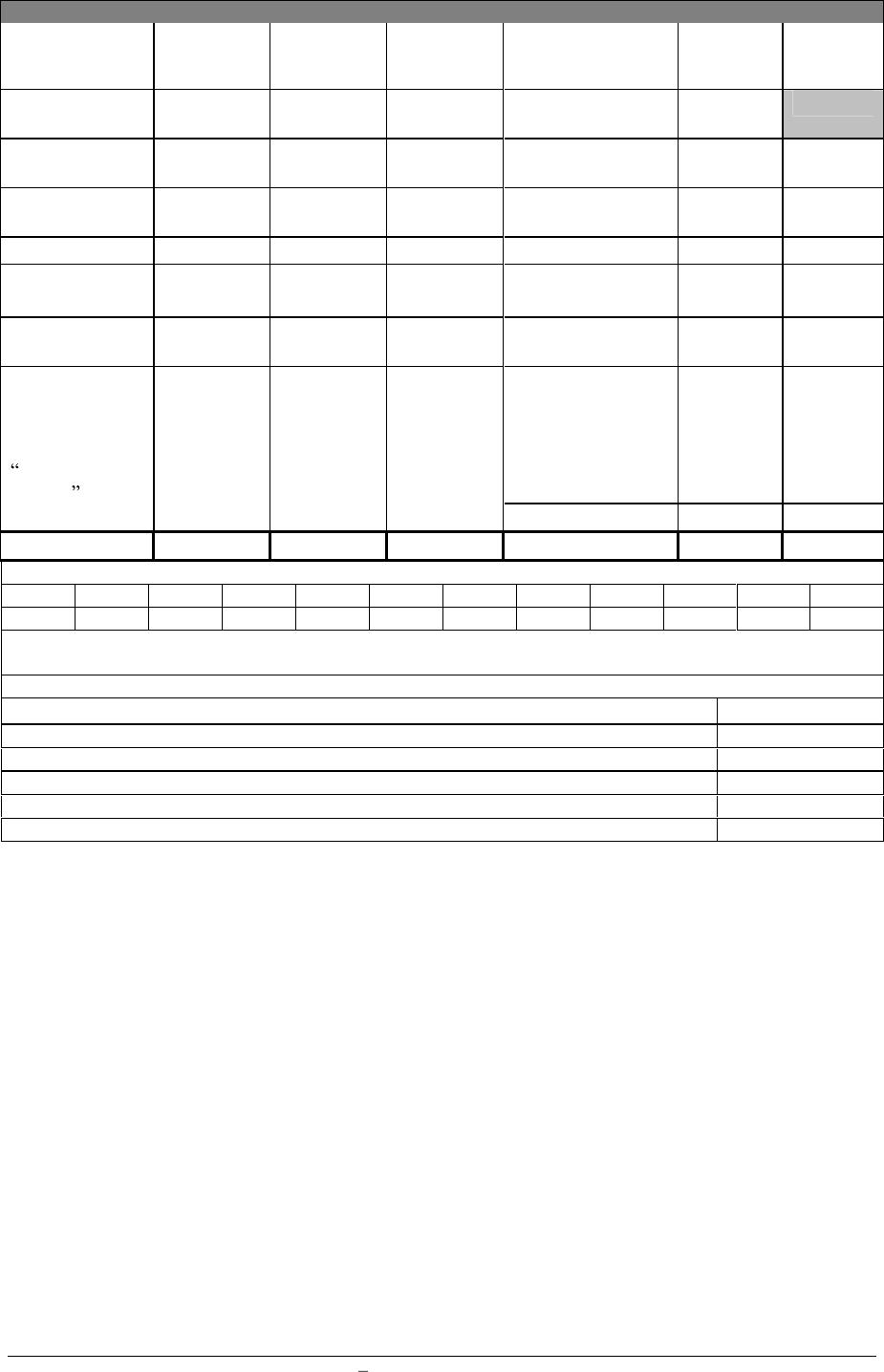

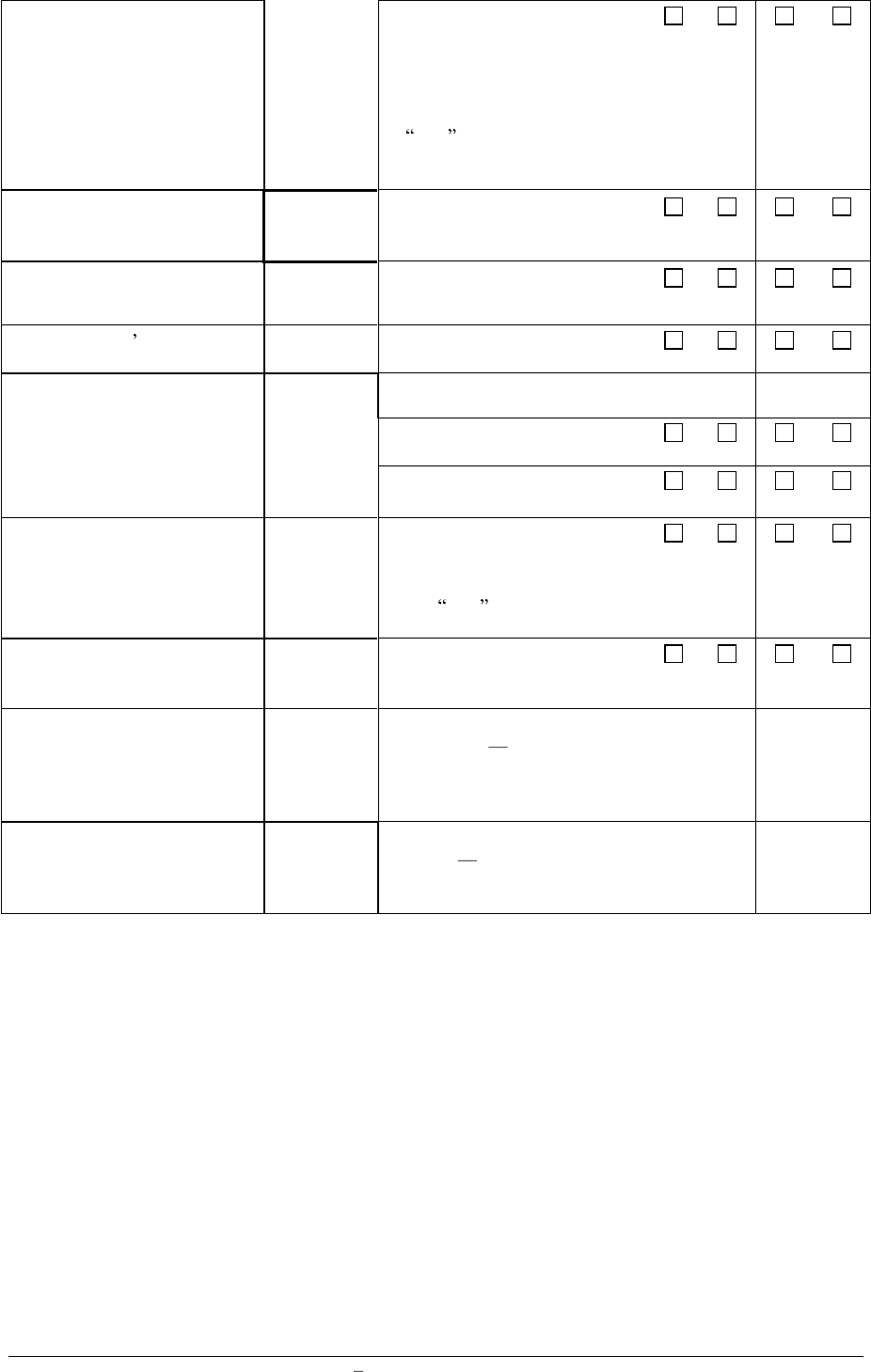

Figure 2: Mortgage Loan Division organisational chart

Executive Management

In each case, as is discussed here each unit or division requires adequate support systems and controls to assure

accuracy of information for decision making purposes, quality service to customers and safeguards against

harmful activities including negligence and fraud.

Overall the Mortgage Loan Division should be managed by a Senior Credit Officer and supporting staff of

managers, department and unit heads. The graph above illustrates a recommended organisational structure for

the Mortgage Loans Division.

As is illustrated, the audit or quality control unit must report directly to the Chief Executive Officer or Audit

Committee of the Board of Directors so as to assure that there is no undue influence from other units.

Within each unit will be staff that performs specific functions. For example the Originations unit will consist of

loan originators or loan officers, and loan processors who build the loan file and verify information

such

as the

borrower s employment, bank balances, and credit. The loan processor function may include requesting the

appraisal and an examination report of the title to the collateral. Sometimes this person is also an analyst who

applies the standards of risk established by the Board of Directors or the Executive Management or

Credit

Committee

of the organisation. The analyst will summarise findings in a report to the Underwriter along with

the loan file.

Mortgage Loan Minimum Standards Manual

June 2011

20

The Closing Unit will be comprised of a person, (perhaps an attorney)

who

prepares the loan documents and

security agreements, coordinates signing the documents and filing the loan documents with the appropriate

ministry and interacts with Treasury to fund the loan request.

Once the transaction is closed and funded, the loan file is transferred to the Loan Servicing Department for

administration. The functions of loan servicing will be discussed later.

Policy Making

Loan policy and credit standards are usually created by the

B

oard of

D

irectors

,

Executive Management

or senior

credit committee. As it relates to the decision of decentralisation the board will require a more robust system of

quality control and delegation of authority for operations.

System procedures such as loan product development, loan pricing, back office support, IT systems and loan

servicing are best left as centralised activities, Loan originations and controlled underwriting may be delegated

to branch or remote operations.

Centralised Loan Originations

Cen

tralised origination is most effective for organisations with a specified number of branches or where actual

working space in a branch is limited. Further, quality control of loan transactions and administration is better

managed since there is no need for

duplicate staff or extensive travel between branches.

Decentralised Loan Originations

When the organisation covers a vast territory or wishes to expand into multiple cities, it may be efficient and

economically viable to create Mortgage Loan Centres where the loan originations activities are closer to the

target population. In a decentralised mortgage loan centre, a loan officer and/or loan underwriter may be

delegated authority up to a predetermined level, to write and approve loans. Loan activity should be closely

monitored for quality and performance by tracking default rates by originator and/or underwriter. Even with a

decentralised system, loan authority can be limited to a predetermined amount. After which all loan requests

over a specific amount to be referred to the central loan committee at the home office, or at a minimum, require

the signature of the Senior Credit Officer. Where a Decentralised model of operation is in place, branch

managers implement bank policy in relation to application standards and documentation, loan assessment, issue

of offer documents, taking and perfecting security, issuing the loan cheque and account and arrears

management. The decentralised model would be supported by regular audit checks and balances by Head Office

to

ensure compliance with policy.

N

ote: Minimum recommended experience

sh

ould be adjusted to local markets conditions.

Branch Loan Originations

Recommended

Minimum

Experience Required

Recommended

Approval

Authority Euro

Loan Officer

>10 years

5,000

-

25,000

Loan Underwriter

>7 years

25,000 -

250,000

Home Office Review

>

7 years

>250,000

Mortgage Loan Minimum Standards Manual

June 2011

21

4.

PROPERTY VALUATION (

MS 04)

Property valuations are one of several tools that the lender uses to assess and mitigate risk in a loan request. The

measure of risk, as it relates to value of a collat

eral property is known as the Loan to Value ratio, expressed as

follows:

Loan amount /property value = LTV

75,000/100,000 = 75% LTV

The lower the L

oan

-

to

-

Value

ratio, theoretically, the lower the risk of loss in the event that the borrower does

not repay the loan; this is due to the fact that the borrower has made a significant financial investment that they

will not want to lose. Said another way, if a borrower is required to have a greater investment, the lender has a

lower risk and the greater motivation for the borrower to repay the debt Therefore, the purpose of the valuation

is to provide the lender with an independent opinion of value of a collateral property on the date on which the

valuation is made.

The Appraiser

Real property valuations are part science and part art both of which require the appraiser to have a high degree

of training and experience. The lender should consider whether it desires to develop and maintain an in-

house

appraisal unit or outsource the process to an independent appraiser

.

If the lender desires to have appraisers as

direct employees, it will be important that the appraiser will not be unduly influenced by the loan o

fficer

to

produce an opinion of value with a predetermined value. The lender must develop a screening process whereby

the appraisal request and the final opinion are reviewed by a manager. Similarly, if the appraiser is an

independent contractor, the appraisal should be requested by the loan processor or risk analyst. In either event

the Senior Credit Officer and/or Loan Committee should carefully assess the qualifications of the appraiser and

whether the appraiser has maintained

on

-

going

educational activities. If the appraiser is in house, the lender

must ensure that there is a separation between the appraisers

and the originators.

MINIMUM STANDARDS

The Lender must ensure that a proper property valuation is done by a reputable and bank approved valuer or

appraiser, and the valuation is based upon closed sales. In assessing the profile of the appraiser, the lender must

ensure that: a) the appraiser is a competent professional and a member of a recognised professional body (if

such bodies exist); b) the appraiser has adequate Professional Indemnity Insurance (if self-employed).At a

minimum, an appraiser should have 1-3 years working as an apprentice for a master appraiser before the lender

considers hiring or contracting with the appraiser. Prior to engaging an independent senior or master appraiser,

the Senior Credit Officer and a member of the quality control unit should review 3-5 appraisals that the

appraiser conducted within the last 12 months. The appraisals should be reviewed for accuracy, clarity and

substance. National standards should apply for authorisation of the evaluators (both of the lenders or

indepe

ndent evaluators, as the case may be).

The Appraisal Process

Real property valuations are made on the basis on three criteria; the market approach; the cost approach and the

income approach.

The Market Approach

An appraiser develops an opinion of value u

sing the market approach by comparing recent sales of similar (like

-

kind) properties, in a reasonable proximity of the property being appraised, also known as the subject .

What to look for: when evaluating the appraiser consider whether the comparables a

re similar.

Mortgage Loan Minimum Standards Manual

June 2011

22

Are the comparables like kind to the subject? If the subject is a 3 bedroom flat of 90 square meters, a 1

bedroom flat of 45 square meters should not be used as a comparable. If no other 3 bedroom flats of

similar room count and size are available, the appraiser should expand the search area. Likewise, a 3

bedroom flat on the second floor may have a higher value than a 3 bedroom flat on the 9

th

floor of a

building that does not have a lift.

Are the comparables within the subjects neighbourhood? Comparables should be from an area within

in 1.6 to 2 kilometres of the subject. If the appraiser cannot find a comparable in that distance the

reasons should be fully explained. The underwriter should ascertain whether the lack of comparables

may be detr

imental to the marketability of the property. For example, if no sales of 3 bedroom flats can

be found in a 2 kilometre radius, the underwriter must ask what is surrounding the property. In the

appraisal report the appraiser should have noted that the subject property was surrounded by

manufacturing plants and industrial sites. The conclusion for the underwriter would then be that the

marketability of the subject will be very limited and the loan should be denied or the LTV significantly

reduced.

Was the sale of the comparables recent? Economies and real estate markets are subject to fluctuation.

The market value of a property may have a wide swing in value in a short as six months time.

Therefore, the appraiser must select sales that are within six months

old and certainly no older than one

year. If there are no sales within either period of time, the appraiser should further discuss this matter in

the report. There are both positive and negative factors for the lack of sales in a neighbourhood such as;

the

neighbourhood is mature and homeowners enjoy their location so much they do not sell. The

positive factor is that the demand out paces supply and prices will be stable or increasing. Alternately,

if there are no sales, the appraiser should note in the rep

ort the number of homes that are for sale. If the

number of homes is significant, it is an indication that citizens are not moving into the area, and instead

are leaving which attributes to an excess supply and little demand, thereby resulting in falling p

rices.

The Cost Approach

The Cost Approached to valuation should be weighed carefully when used as a tool for determining value.

When applying the method of the cost approach of valuation, the appraiser develops an opinion of value based

on the replacement cost of the components of the subject property; those components are land costs, material

costs and labour costs.

Such costs may vary as a result of material shortages or when materials are dumped on

a market. Consequently, the appraiser should reconcile or balance each of the three methods of valuation when

making a final conclusion.

For example: if the subject is a row house consisting of 100 square meters and if the row house is situated on a

50 square meter parcel of land, it can be assumed that the house is a minimum of two stories and may or may

not have a garage. First the appraiser will value the parcel of land with other similar parcels of land. (In a fully

developed city, this may not be possible as all of the residential parcels may have been

sold).

Then the appraiser will consider the components of the subject house:

Is the house made of brick, concrete, steel or wood?

Is the roof wood shingle, asphalt shingle, clay tile or other material?

Are the heating and cooling systems passive (such as

solar) or active such as steam heat or forced air?

Are the interior finishes, such as floors, cabinets, doors and installed plumbing fixtures

2

of high,

medium or low quality?

The appraiser will consult cost reference manuals to determine the cost per square meter of each of the

components and will reconcile the findings with the current cost of labour for each trade to conclude a value.

The cost approach should not be relied on as a sole indicator of value as the cost of labour and materials is

2

In most EU countries, kitchens are not supplied with the house as they are considered personal property and therefore may

not be included in the value of the subject.

Mortgage Loan Minimum Standards Manual

June 2011

23

subject to c

hange. The cost approach is best used for financing construction or rehabilitation loans.

The Income Approach

Using the income approach is best suited for valuing rental or tenanted properties. The appraiser should

evaluate the rental or lease agreement to determine the gross monthly lease amount plus any obligations the

tenant may have to reimburse the owner for certain costs, such as property tax or rental tax if any, insurance or

public utilities such as water, electricity, natural gas, steam or coal.

Th

e appraiser will then use a method known as the Capitalisation Approach to develop and opinion of value

based upon the rate of return that an owner would realise from the Net Operating Income, (NOI), of the subject.

For example: If a property generated 700 per month x 12 months = 8,400 per year. Then if the expenses that

the owner paid were equal to

2,500 per year for taxes and insurance, the NOI would be 5,900.

To take the next step in the valuation process requires the appraiser to evaluate a reasonable rate of return on

capital. For example, a reasonable person might invest money in a low risk savings account with an annual

yield of 2% or that same person might invest in a more aggressive bond fund with a yield of 4%, while still a

more aggressive (and slightly higher risk) will be an investment in a flat with the intent to generate income at,

say 8% per annum. Therefore the formula for determining the purchase price (and therefore value) of a flat that

has a rate of return of

5,900 per year with an 8 CAP, would be 73,750. The formula is below:

5,900/.08= 73,750

In the valuation of a single family flat that is not intended for rental, the appraiser will place lesser weight on

the income approach and more on the market approac

h when reconciling the value using the three methods.

MINIMUM STANDARDS

The Appraisal Report

Appraisal reports should have detailed information about the property including:

Applicant s name

Lenders name

Address of the property, including the postal code

L

egal description as registered in the cadastral or on a survey

A discussion of the location of the property

A discussion of the surrounding neighbourhood and the elements influencing desirability by

prospective buyers

Type of construction material

wood,

brick, concrete or steel

The appraiser should observe and comment on the quality of workmanship, evidence of defects or

hazards that might jeopardise the health and safety of the occupants

The nature of the property, whether residential or mixed use (resid

ential and commercial)

Whether the current use is legal or conforms to use codes established by local authorities.

Physical description of property

o

Whether the property has:

Functional obsolescence

Physical obsolescence

An economic life at least 20 yea

rs e

xceeding the loan term

Estimated age

Estimated remaining physical life of the property

Dimensions/floor area

Number/type of rooms

Vacant or tenanted: If vacant, the appraiser should ascertain, if possible, the length of time the property

has been vacant; if for an extended period of time, the appraiser and or credit officer should further

investigate whether the lengthy vacancy has negatively impacted the physical condition of the property

and/or systems, such as heating, cooling, water and waste water syst

ems.

Mortgage Loan Minimum Standards Manual

June 2011

24

If tenanted or occupied by anyone other than the borrower the appraiser should ascertain the length of

the lease or rental agreement and the amount of rent the tenant pays.

If the property is under construction, the appraiser should ask for and carefully evaluate the budget to

complete the project. Most construction projects exceed their budget, exposing the lender to risks of an

unfinished building.

Evidence (as available) of any soil conditions such as subsidence/landslide, excessive moisture,

excess

ive rocky conditions which could impact the stability of the structure.

Ingress to and egress from the property including:

Rights of way across or through the property

Availability and security of parking

Repairs identified. A repair list should take into consideration health and safety of the structure,

cosmetic improvements and cures for functional and physical obsolescence. The repair list should

provide an opinion of the cost to cure, but should be subject to further evaluation by the Underwriter or

cre

dit analyst.

Environmental Factors. See EBRD s Environmental Procedures for Mortgage Loans (

www.ebrd.com

).

Any extensions or modifications to the original structure that would negatively affect the conclusion of

value, such as a room extension that was not constructed with quality craftsmanship thereby requiring

it to be rebuilt.

Building permits or planning permission (obtained or required as the case may be)

Services

the appraisal should state whether water, natural gas, electricity and/or other utilities, are

available. (Special note should be given to the existence of passive energy systems since such systems

may reduce the monthly expense of the borrower)

If under construction the appraiser should be provided a copy of the approved building plans and the

cost of construction budget. The appraiser should evaluate the stage of construction reached, any

deficiencies noted in the work and an estimate of time to complete the construction. Special attention

should be given to any project that has been delayed or exposed to the elements for more than a few

months as deterioration of unprotected construction materials may shorten the life and undermine the

strength of the material.

When the appraisal is complete, the appraiser should be signed and should include their qualifications and the

name of the firm.

Appraisal reports should be carefully studied by the underwriter and loan analyst. Irregular matters or anomalies

should be addressed and if satisfactory mitigants cannot be employed, the matter should be directed to the

Senior Credit Officer. Mitigants include having the appraiser address irregularities in the conclusion of value;

lowering the loan to value of the loan request or requiring the appraiser to determine a quick sale or distressed