(over)

When to Start Receiving Retirement Benefits

When to Start Receiving Retirement Benets

At Social Security, we’re often asked, “What’s the

best age to start receiving retirement benets?” The

answer is that there’s not a single “best age” for

everyone and, ultimately, it’s your choice. The most

important thing is to make an informed decision. Base

your decision about when to apply for benets on

your personal and family circumstances. We hope the

following information will help you understand how we

t into your retirement decision.

Your decision is a personal one

Would it be better for you to start getting benets

early with a smaller monthly amount for more years

or wait to receive a larger monthly payment for a

shorter period of time? The answer is personal and

depends on several factors, such as your current

cash needs, your current health, and family longevity.

Also, consider if you plan to work in retirement and

if you have other sources of retirement income. You

must also estimate your future nancial needs and

obligations and calculate your future Social Security

benet. Weigh all the facts carefully before making

the crucial decision about when to begin to receive

Social Security benets. This decision affects the

monthly benet you will receive for the rest of your life

and may affect benet protection for your survivors.

Your monthly retirement benet will be

higher if you delay your start date

Your full retirement age varies based on the year you

were born. You can visit www.ssa.gov/benets/

retirement/planner/ageincrease.html to nd your

full retirement age. We base your basic Social

Security benet — the amount you would receive at

your full retirement age — on your lifetime earnings.

However, the actual amount you are entitled to

each month depends on when you start to receive

benets. You can start your retirement benet at any

point from age 62 up until age 70. Your benet will

be higher the longer you delay your start date. This

adjustment is usually permanent. It sets the base for

the benets you’ll get for the rest of your life. You’ll

get annual cost-of-living adjustments and, depending

on your work history, may receive higher benets if

you continue to work.

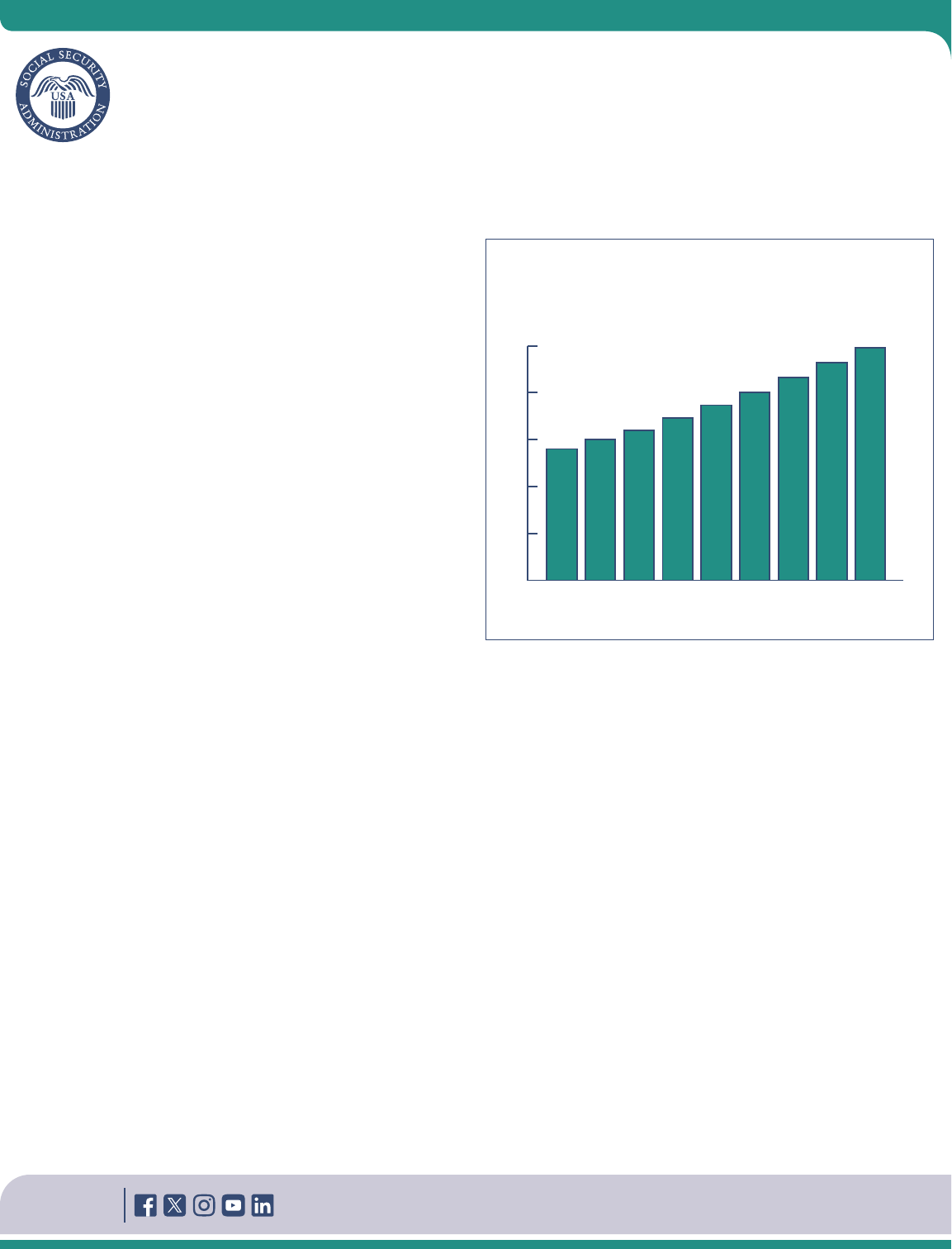

The chart below shows an example of how your

monthly benet amount increases if you delay when

you start to receive benets.

Let’s say you turn 62 in 2024. Your full retirement

age is 67, and your monthly benet that starts at full

retirement age is $2,000. If you start to get benets

at age 62, we’ll reduce your monthly benet 30% to

$1,400 to account for the longer time you receive

benets. This decrease is usually permanent.

If you choose to delay your receipt of benets until

age 70, you would increase your monthly benet

to $2,480. This increase is the result of delayed

retirement credits you earn for your decision to

postpone receipt of benets past your full retirement

age. The benet at age 70 in this example is about

77% more than the benet you would receive each

month if you start to get benets at age 62 — a

difference of $1,080 each month.

Retirement may be longer than

you think

When you think about retirement, be sure to plan for

the long term. Many of us will live much longer than

the “average” retiree, and most women live longer

than men. About 1 out of every 3 65-year-olds today

$0

$500

$1,000

$1,500

$2,000

$2,500

Monthly Benefit Amounts Differ Based on the

Age You Decide to Start Receiving Benefits

Age You Choose to Start Receiving Benefits

Note: This example assumes a benefit of $2,000 at a full retirement age of 67

70

62

$1400

63

$1500

64

$1600

65

$1733

66

$1867

67

$2000

68

$2160

69

$2320

$2480

What Is the Best Age to Start Receiving

Social Security Retirement Benefits?

SSA.gov

will live until at least age 90, and 1 out of 7 will live

until at least age 95. Social Security benets, which

last as long as you live, provide valuable protection

against outliving savings and other sources of

retirement income. Again, you’ll want to choose a

retirement age based on your circumstances, so you’ll

have enough Social Security income to complement

your other sources of retirement income.

Married couples have two lives to

plan for

Your spouse may be eligible for a benet based on

your work record, and it’s important to consider Social

Security protection for surviving spouses. After all,

married couples at age 65 today would typically have

at least a 50/50 chance that 1 member of the couple

will live beyond age 90. If you are the higher earner,

and you delay when you start your retirement benet,

it will result in higher monthly benets for the rest of

your life. If you die rst, it will result in higher survivor

protection for your spouse.

When you receive retirement benets, your children

may also be eligible for a benet on your work record.

This applies if they’re under age 18 or if they have a

disability that began before age 22.

You can keep working

When you reach your full retirement age, you can

work and earn as much as you want and still get your

full Social Security benet. If you’re younger than full

retirement age, and if your earnings exceed certain

dollar amounts, some of your benet payments within

the 1 year period will be withheld.

This doesn’t mean you must try to limit your earnings.

If we withhold some of your benets because you

continue to work, we’ll pay you a higher monthly

benet when you reach your full retirement age. So,

if you work and earn more than the exempt amount,

it won’t, on average, decrease the total value of your

lifetime Social Security benets — it could even

increase that value.

Here is how this works: When you reach full

retirement age, we’ll recalculate your benet to give

you credit for months you didn’t get a benet because

of your earnings. In addition, as long as you continue

to work and receive benets, we’ll check your record

every year to see whether the extra earnings will

increase your monthly benet. You can nd more

information about continuing to work after retirement

on our website at www.ssa.gov/benets/retirement/

planner/whileworking.html.

Don’t forget Medicare

If you plan to delay receipt of benets because you

still work, you’ll still need to sign up for Medicare 3

months before you reach age 65. If you don’t enroll

in Medicare medical insurance or prescription drug

coverage when you’re rst eligible, you can sign up

later. However, you may have to pay a late enrollment

penalty for as long as you have coverage. You can

nd more detailed information about Medicare on our

website at www.ssa.gov/medicare.

More resources

You can nd more information to help you decide

when to start receiving retirement benets at

www.ssa.gov/benets/retirement. If you have

a personal my Social Security account, you can

get your Social Security Statement, verify your

earnings, and get personalized benet estimates

at www.ssa.gov/myaccount.

When you’re ready for benets, you can also apply

online at www.ssa.gov/applyforbenets. If you

want more information about how your earnings affect

your retirement benets, read How Work Affects Your

Benets (Publication No. 05-10069). This pamphlet

has the current annual and monthly earnings limits.

Contacting Us

There are several ways to contact us including online,

by mail, by phone, and in person. If you cannot use

our online services, we can help you by phone when

you call our National toll-free 800 Number.

If you don’t have access to the internet, we offer many

automated services by telephone, 24 hours a day, 7

days a week, so you may not need to speak with a

representative. Call us toll-free at 1-800-772-1213 or

at our TTY number, 1-800-325-0778, if you’re deaf or

hard of hearing. We provide free interpreter services

upon request. For quicker access to a representative,

try calling early in the day (between 8 a.m. and 10

a.m. local time) or later in the day. We are less busy

later in the week (Wednesday to Friday) and later

in the month.

Social Security Administration

Publication No. 05-10147

May 2024 (Recycle prior editions)

When to Start Receiving Retirement Benefits

Produced and published at U.S. taxpayer expense