Introduction to the HELOC Product

Offered in Partnership with TCF Bank

Benefits of a HELOC:

Avoid mortgage insurance and mandatory impounds on REMN

Wholesale first mortgage when doing HELOC concurrently

Better interest rate on the first due to lower LTV

HELOC funds may be used to consolidate debt and/or pay off existing

liens

Provides borrower with additional funds for home improvement,

future investments or just a safety net for borrowers with limited

savings

Benefits of a HELOC

REMN Wholesale is partnering with TCF Bank to offer a HELOC product

that will close simultaneously with the first mortgage on conventional

(Fannie Mae/Freddie Mac) transactions. The HELOC allows you to:

Exceed both conforming and high balance county limits without doing a

Jumbo loan

Avoid mortgage insurance on CLTVs greater than 80%

REMN Wholesale will facilitate both the first and the second

HELOCs are consumer loans and are not subject to TRID. An LE and CD

are not required. TCF will issue required HELOC disclosures to the

borrower(s)

Minimum HELOC amount is $25,000

Maximum HELOC amount:

85.01% to 89.99% CLTV: $350,000

85% CLTV and Less: $500,000 (second home max $250,000)

HELOC Overview

Eligible on primary residence and second homes

1-2 unit primary residence with max CLTV 89.99%

1-unit second home with max CLTV 85%

Eligible with purchase, rate/term and cash-out first transactions

Maximum DTI 38%/45%, no exceptions

– Borrower is qualified using the HELOC start rate plus a

payment shock factor of .0018 (HELOC amount multiplied by

.0018)

REMN Wholesale first mortgage underwriting fee with TCF HELOC = $1195

No additional title insurance required for HELOC ≤ $250,000; > $250,000

requires a Jr. Lien or Flag policy. A full title insurance policy for HELOC

amount is required if third lien to ensure TCF second lien position

HELOC Overview (cont.)

Full appraisal from first is acceptable subject to TCF Desk Review

The credit report must be ≤ 80 days old at the time REMN Wholesale

submits the HELOC to TCF

30 year HELOC term:

Draw Period: Years 1-10 with interest-only payments on any draws

Repayment Period: Years 11-30 with principal and interest payment

amortized over the remaining term

TCF origination fee: $295 (deducted from HELOC at close)

TCF annual maintenance fee: $75 (collected with 1st TCF statement)

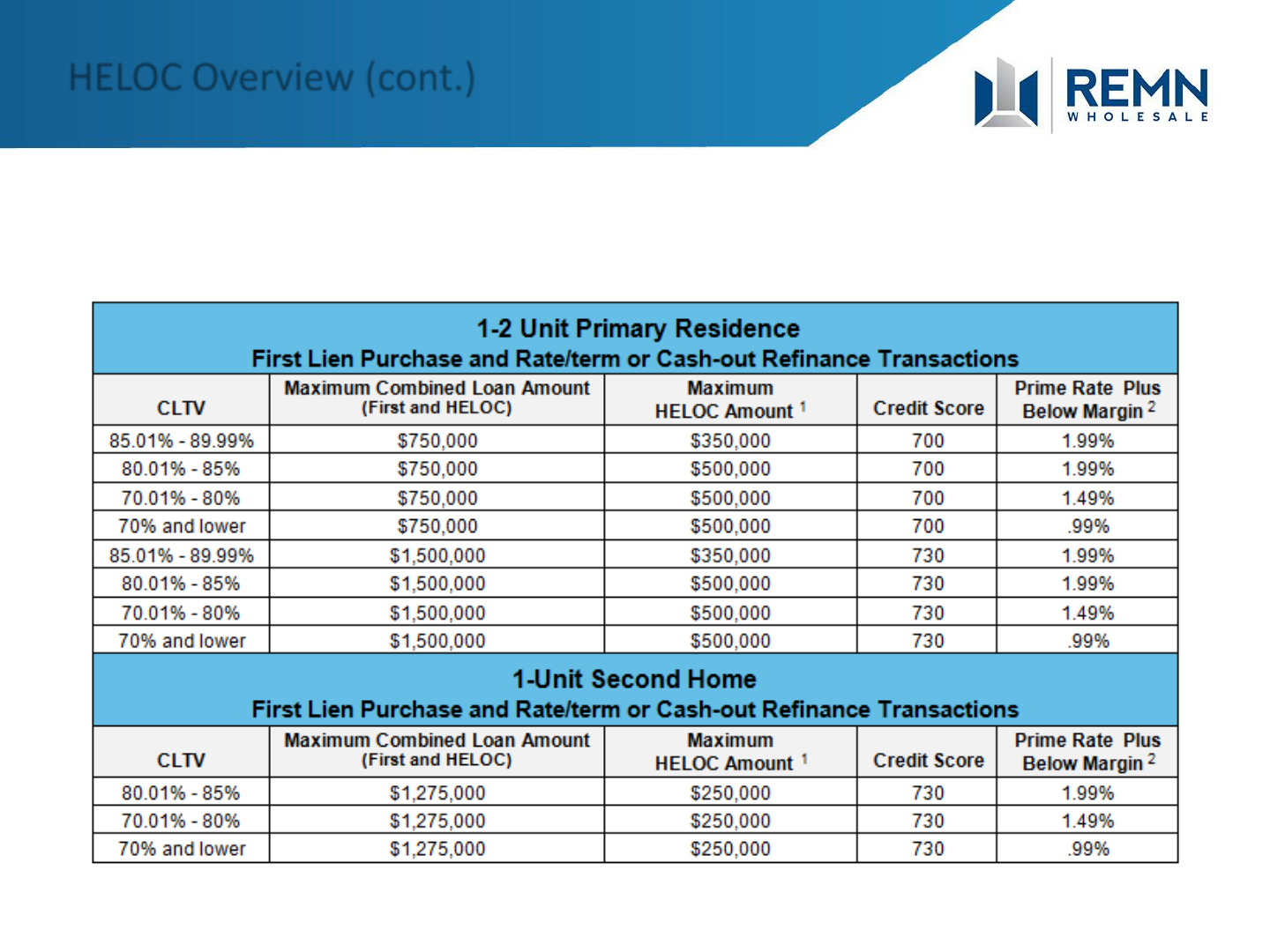

Pricing is the current prime rate plus margin. Margin determined by CLTV,

combined loan amount, and credit score; refer to the HELOC program

guidelines for details

HELOC Overview (cont.)

Eligible in all states with the exception of:

Alabama,

Alaska,

Hawaii,

Louisiana,

Mississippi,

Oklahoma,

Texas,

West Virginia

HELOC Overview (cont.)

Summary of Combined Loan Amount and Credit Score Requirements

HELOC Overview (cont.)

U.S. citizens

Permanent resident aliens with unexpired green card

Non-permanent resident aliens with:

Unexpired passport,

Unexpired eligible work visa (refer to REMN Wholesale guidelines for

REMN Wholesale eligible visa types), and

I-94 Form

NOTE: Non-occupant co-borrowers are ineligible

Eligible Borrowers

Only the primary borrower (the borrower with the highest income) must

meet the minimum credit score requirement detailed on slide 6

NOTE: There is no minimum credit score requirement for the lower wage

earner(s)

Minimum 3 tradelines (total/combined for all borrowers):

One tradeline must be seasoned a minimum of 3 years

Tradelines may be open or closed

Installment account not required

Authorized user accounts do not qualify as tradeline

Credit Score and Tradelines

Bankruptcy

No BK filing in previous 8 years (measured from filing date)

Foreclosure/Short Sale/Deed-in-Lieu

5-year seasoning required. Includes any real estate transaction

settled for less than owed including a loan modification with

principal reduction/forgiveness

Derogatory Credit

Installment Debt

May be excluded from the DTI calculation when the account has ≤

6 payments remaining excluding lease payments; lease payments

included regardless of number of payments remaining

Student Loans

The payment listed on the credit report is used. If not on credit

report/payment deferred then 1% of loan amount for each student

loan is used. IBR payments are eligible

Co-signed Mortgage Debt

May be excluded when documentation provided the other party

has been making the mortgage payment for a minimum of 6

months and the borrower executes a quit claim if on title to the

property

Liabilities

Court Ordered Assignment of Debt

May be excluded from the DTI calculation if the divorce

decree/filed separation agreement assigning the debt to the

spouse/ex-spouse

Mortgage on Additional Properties

If borrower owns additional properties and the mortgage payment

is interest-only the borrower will be qualified using the full PITI

payment

Payoff of Debt

Payoff of debt with proceeds from HELOC is eligible for qualifying.

Revolving account(s) paid off for qualifying are not required to be

closed

Liabilities (cont.)

Salaried Borrowers

1 year employment required; may be combined with education

Current paystubs (minimum 2 required) with YTD income

W-2 for previous year or year-end pay stub

NOTE: If bonus/OT/commission income used to qualify (regardless of

percentage of income) a written VOE or year-end paystub

required

Self-Employed Borrowers

2 year history required; 2 years’ tax returns unless DU/LP allow for

1-year on first mortgage

Employment and Income

2106 expenses not deducted from income

Non-taxable income is not grossed up

Rental income is only used to offset the mortgage payment for the

rental property; any positive cash flow is not added to the borrower’s

income

Bonus income generally averaged over 24 months. A written VOE or

year-end paystub (regardless of percentage of income) is required

Commission/OT is averaged using current YTD and previous year. At TCF

discretion 24 months average may be required. A written VOE or yearend

paystub (regardless of percentage of income) is required

Refer to the HELOC guidelines posted on the REMN Wholesales

website for complete income guidelines

Employment and Income (cont.)

Single family residence

Townhomes

Condos:

Existing projects require 51% owner-occupied;

New projects 70% of the units sold/closed must be owner-occupied

2-units

NOTE: Properties may be on a maximum 10 acres in all states except

Arizona; Arizona maximum of 2 acres

Eligible Properties

The REMN Wholesale Broker Submission Form has been updated to

include the HELOC

Complete the applicable HELOC information along with the

standard conventional loan information

Submit the required HELOC documentation along with the first

mortgage required docs

Brokers must indicate on the REMN Wholesale Broker Submission form

that a TCF HELOC is requested

Submitting the HELOC to REMN Wholesale

The REMN Wholesale underwriter will submit the HELOC to TCF

once the minimum TCF required documents detailed below have

been received/completed:

TCF Notice & Authorization Concerning Your Loan Application (TCF form

765) signed by all borrowers

TCF HELOC Qualifying Worksheet (TCF form 1017) completed by REMN

Underwriting

Mortgage statement(s) for any other financed properties owned by the

borrower or documentation of taxes/insurance paid if not impounded

Written VOE or year-end paystub for prior year if bonus/commission/OT

used for qualifying

New York transactions only: TCF Pre-Application Disclosure and Fee

Agreement (TCF form 1328) signed by all borrowers

Florida transactions only: TCF Anti-Coercion Insurance Notice (TCF form

1376) signed by all borrowers

HELOC File Flow

Additional required documents for REMN Wholesale to submit HELOC to

TCF:

Mortgage statements for any other financed properties owned by the

borrower if applicable or if taxes/insurance not impounded

documentation showing amount of taxes/insurance required

A written VOE or year-end paystub if bonus/commission/OT income is

used for qualifying (regardless of percentage of income)

HELOC File Flow (cont.)

Upon receipt of the submission package from REMN Wholesale, TCF will

mail the following HELOC required disclosures directly to the borrower:

Command Credit HELOC Disclosure

CFPB HELOC Booklet

BSA Disclosure

NOTE: The borrower is not required to sign and return disclosures

HELOC File Flow (cont.)

REMN Wholesale will work directly with TCF to coordinate the

simultaneous closing of the REMN Wholesale first mortgage and the TCF

HELOC.

A complete file flow document is available under the HELOC topic on the

Working With Us page of the REMN Wholesale website at:

www.REMNWholesale.com

HELOC File Flow (cont.)