filed

IN

OPEN

COURT

DEC

1

3

2023

IN

THE

UNI’i'ED

STATES

DISTRICT

COURT

FOR

THE

EASTERN

DISTRICT

OF

VIRGINIA

CLERK,

U.S.

DISTRICT

COURT

NORFOLK.

VA

Norfolk

Division

UNITED

STATES

OF

AMERICA

)

CRIMINAL

NO.

2:23cr89

)

)

V.

Wire

Fraud

18U.S.C.

§

1343

(Counts

1-9,

11)

)

DERICKSON

LAWRENCE,

)

)

Defendant.

)

Mail

Fraud

18

U.S.C.

§

1341

(Count

10)

)

)

)

)

)

18

U.S.C.

§

981(a)(1)(C)

&

28U.S.C.

§

2461

Criminal

Forfeiture

)

)

)

SUPERSEDRIG

INDICTMENT

DECEMBER

2023

TERM

-

at

Norfolk,

Virginia

THE

GRAND

.lURY

CHARGES

THAT:

At

all

times

relevant

to this

Superseding

Indictment,

unless

otherwise

stated:

GENERAL

ALLEGATIONS

Beginning

in

and

around

Februaiy

2016

and continuing

through

in

and

around

1.

December

2019,

in

the

Eastern

District

of

Virginia

and

elsewhere,

defendant,

DERICKSON

LAWRENCE,

devised a

scheme

and

artifice to

defraud,

and

obtain

money

and

property

by

means

of

false

and

fraudulent

pretenses,

representations,

and

promises.

During

the

relevant

time

period,

Victim

Company

operated

several

franchises

of

a

2.

national

restaurant

chain

in

Virginia

and conducted

business

out

of an

office

in

Virginia

Beach,

Virginia.

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 1 of 13 PageID# 89

During

the

relevant

time

period,

defendant

was

the

Chief

Executive

Officer

and

3.

sole

owner

of a

business

called

Marketview,

Inc.

(“Marketview”)

which

conducted

business

out

of a

physical

location

in

Mount

Vernon,

New

York,

where

defendant

also resided.

PURPOSE

OF

THE

SCHEME

4.

The

purpose

of

defendant's

scheme

and

artifice to

defraud

was

for

defendant

to

obtain

money

and

property

to

which

he

was

not

entitled

by

taking

money

that

had

been

entrusted

to

defendant’s

business

to

pay

the

salaries

of

employees

of

Victim

Company

and,

instead,

using

the

funds

for his

personal

use.

WAYS,

MANNER.

AND

MEANS

5.

Marketview

was

paid

by

Victim

Company

to

provide

payroll

services

for

Victim

Company’s

employees,

who

could

elect

to

receive

their

salary

via

direct

deposit

or,

alternatively,

via

an

issued

debit

card.

Defendant

sent

an

employee

of

Victim

Company

located

in

Virginia

Beach,

Virginia,

G.C.,

regular

invoices

for

the

services

provided

by

Marketview.

Those

invoices

were

paid

by

regular

transfers

to a

Wells Fargo

Bank

(“Wells Fargo”) account

controlled

by

defendant

(the

“-9321

Account”).

6.

As

part

of

and

in

furtherance

of

the

scheme,

defendant

had ownership and

control

over,

and

was

the

signatory

for,

various

otlier

business

bank

accounts

for

Marketview

at

Wells

Fargo.

Marketview

employed

only

one

other

individual,

D.A.,

a

part-time

employee

who

assisted

defendant

for

some

period

of time with

the

website

and

a

financial

database.

7.

To

pay

the

salaries

of

its

employees

who

elected

to

receive

their

wages

via

debit

card,

Victim

Company

would

regularly

transfer

funds

from

its

own

accounts

through

an

intermediary

bank

and

into

a

Wells Fargo

business

account

controlled

by

defendant

(the

“Settlement

Account”).

Funds

were

then

withdrawn

by

ACH

debit

from

the

Settlement

2

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 2 of 13 PageID# 90

Account

by

STAR

Processing

(“STAR”),

a

third-party

company

which

handled

the

daily

settlements

for

the

debit

card

transactions

and

facilitated

the

actual

withdrawals

or

purchases

by

employees

using

their

debit

cards.

STAR

charged

Marketview

fees

for

its

services

that

were

paid

from

the

-9321

Account.

As

part

of

and

in

furtherance

of

the

scheme,

defendant

wired

money

which

did not

belong

nor

was

due

to

defendant

from

the

Settlement

Account

into

another

Wells

Fargo

account

controlled

by

defendant

(the

“-7523

Account”),

and

thereafter

transferred

the

funds, via

wire,

to

defendant’s

personal

brokerage

account

with

Scottrade/TD

Ameritrade,

where

defendant

used

the

funds

to

engage

in

speculative

stock

trading,

including

the

purchase

of

call

and

put

options

for

Defendant

never

disclosed

to

Victim

Company

or

companies

like

Amazon,

Tesla,

and

Netflix.

its

employees

that

funds

transferred

into

the

Settlement

Account

were

being

used

for

speculative

stock

trading

or

other

personal

uses.

From

in

and around

March

2017

through

in

and around

October

2019,

approximately

$190,000,000

was

transferred

from

the

Settlement

Account,

through

the

-7523

Account,

and

then

wired

to

defendant’s

personal

brokerage

account

with

Scottrade/TD

Aside

from

a

single transfer

on

February

1,2018,

for

$9,900,

there

were

no

transfers

Ameritrade.

from

defendant’s

brokerage

account

back

into

either

the

Settlement

or

-7523

Accounts.

From

on

or

about

Februaiy^

2018

to

October

2019,

defendant

made

more

than

9.

$25,000

in

wire

transfers

from

the

brokerage

account

to

his

personal

checking

account

at

Capital

One

bank,

which

defendant

used

for

various

personal

expenses

including

restaurants,

a

lawn

care

service,

and

to

pay

tuition.

Defendant

also

withdrew

cash

directly

from

the

Settlement

Account.

10.

As

part

of

and

in

furtherance

of

the

scheme,

defendant

transferred

thousands

of

dollars

from

the

Settlement

Aecount

to

another

account

controlled

by

his

romantic

partner,

M.N.

The

text

associated

with

the

transfers

falsely

puiported

that

they

were

“returns”

to

an

employee

of

3

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 3 of 13 PageID# 91

the

Victim

Company.

For

example,

$600

was

debited

to

the

Settlement

Account

on

January

5,

2018

and

again

on

Februar>'

8,

2018,

pui-portedly

for

a

“return’"

by

the

Victim

Company

to

M.N.

M.N.

was

never

employed

by

Victim

Company.

Defendant

also

used

funds

in

the

Settlement

Account

to

make

loans

to

and/or

pay

invoices

for

M.N.’s

business,

LGN

Materials

and

Solutions,

Inc.

(“LGN”).

On

or

about

November

15,

2017,

$9,600

was

transferred

from

the

Settlement

Account

for

a

“return”

to

M.N.,

and

on

November

17,2017,

M.N.

wrote

a

check

for

$9,600

payable

to

Marketview

for

“REIMBURSEMENT”

that

was

later

deposited

into

the

Settlement

Account.

Later,

on

December

13,2018,

$30,000

was

transferred

from

the

Settlement

Account

into

the

-7523

$27,189.81

of

that

amount

was

then

sent

from

the-7523

Account

via

wire

to

a

company

Account.

in

the

metal

and

polymer

processing

industry

with

the

note

“Payment

for

invoice

PO

NO

1110..

On

December

24,

2018,

$27,500

was

deposited

..

Credit

to

LGN

Materials

and

Solutions

Inc.

into

the

Settlement

Account.

The

transaction description

for

that

deposit

reads:

“[Victim

Company],

CORP

PAY

181224

INV#

LGN

M

ATERIALS

&

SOLUTIONS.

Victim

Company

never

contracted

with

or

had any

business

with

LGN.

In

and around

December

2018,

defendant

began

receiving

notices

from

STAR

that

11.

there

were

insufficient

funds

in

the

Settlement

Account

to

cover

the

use of

the

Marketview

debit

cards

by

the

Victim

Company’s

employees.

On

or

about

September

13,

2019,

STAR

notified

defendant

that

unless

an

outstanding

balance of over

$80,000

was

paid

within

ten

days,

STAR

would

terminate

its

agreement and

cease processing

card

transactions.

On

or

about

September

24,

2019,

STAR

terminated

the

agreement,

ceased

funding

debit

card

transactions,

and

recommended

that

Marketview

“immediately

notify

its

cardholder

clients.

12.

As

part

of

and

in

furtherance

of

the

scheme,

on

or

about

September

25,

2019,

defendant

emailed

G.C.,

an

employee

of

Victim

Company

located

in

the

Eastern

District

of

4

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 4 of 13 PageID# 92

Virginia.

In

that

email,

defendant

did not

disclose

the

more

than

$80,000

debt

to

STAR,

or

the

fact that

STAR

had

terminated

its

agreement

with

Marketview.

Instead,

defendant

wrote:

"fljast

week,

as

you

know,

we

encountered

a

dififcult

service

delivery

problem

with

our

card

vendor.

. .

[i]n

parallel,

we

experienced

some

customer

service

issues

. . .

We

worked

through

the

weekend

and

the

past

two

days

to

fix

and

restore

our

service

levels

to

no

avail.

Yesterday

we

made

the

decision

not

to

submit

the

new

card

request,

until

a

resolution

was

reached,

and

are

informing

you

of

that

decision.

An

alternative

to

the

card

is

or

[sic]

digital

offering,

which

is

part

of what

was

submitted

for

the

hand

book.

I’ll

be

available

to

discuss

further.

”

On

or

about

September

29,

2019,

defendant’s

employee,

D.A.,

sent

defendant

an

13.

email

stating,

among

other

things:

“Running

a

few

queries,

I

see

that

the

majority

of

money

is

held

Amazingly,

no

one

is

by

cardholders

who

haven’t

made

a

single

transaction

in

two

years.

touching

their

money

except

the

people

who

are

still

receiving

paychecks.

For

example,

of

people

who

have

made

at

least

one

transaction

in

2019,

the

account

balance

totals

are

about

137K.

Compare

that

to

the

roughly

450K

TOTAL

[Victim

Company]

cardholder

money

we

have.”

On

September

30,

2019,

the

ending

balance

for the

Settlement

Account—into

which

the

salaries

of

the

Victim

Company’s

employees

had

been

deposited—held

only

$1,745.38.

The

brokerage

account,

on

September

30,

2019,

held

a

closing

balance

of

only

$17.86

and

unrealized

trading

losses

of over

$2,000.00.

As

part

of

and

in

furtherance

of

the

scheme,

on

or

about

October

23,

2019,

14.

defendant

emailed

G.C.,

an

employee

of

Victim

Company

located

in

the

Eastern

District

of

Virginia.

The

email

attached

a

document

entitled

“CONFIDENTIAL

DRAFT

Proposal”

in

which

defendant

wrote,

among

other

things:

"However,

when

you

publish a

defamatory

statement

like

'we

took

their

money and

did

not

pay

them,

’

which

is

a statement

that's

inaccurate

and

not

supported

by

the

facts,

that's

not

operating

in

good

faith.

And

frankly,

it

is

a statement

that

rises

to

the

level

of

libel.

”

"Therefore,

even

with

the

loss

of

STAR

service,

all

remaining

card

holders do

have

a

means

of

access

to

their

funds

through

the

PayPal

service.

”

5

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 5 of 13 PageID# 93

As

part

of

and

in

furtherance

of

the

scheme,

after

sending

the

above

emails,

15.

defendant continued

to

transfer

money

from

the

Settlement

Account

into

the

-7523

Account

and

then

wire funds

to

his

personal

brokerage

account,

including

a

transfer

of

$2,000

on

or

about

October

23,

2019

from

the

Settlement

Account

to

the

-7523

Account

which

defendant

then,

on

or

about

October

24,

2019,

had

sent

via

wire

to

his

personal

brokerage

account.

COUNTSONE

THROUGH

NINE

(Wire

Fraud)

Paragraphs

1

through

15

of

the

General

Allegations

section

of

this

Indictment

are

16.

incorporated

by

reference

as

though

fully

set

forth

herein.

On

or

about

the

dates

listed

below,

in

the

Eastern

District

of

Virginia

and

elsewhere,

17.

DERICKSON

LAWRENCE,

for the

purpose

of executing

the

above-described

scheme

and

artifice

to

defraud

and

to

fraudulently

obtain

money

and

property

by

means

of

materially

false

and

fraudulent

pretenses,

representations,

and

promises,

did

knowingly

transmit

and

cause

to

be

transmitted,

by

means

of a wire

communication

in

interstate

commerce,

certain

writings,

signs,

signals,

pictures,

and

sounds,

each

transmission being

a

separate

count of

this

Indictment

as

indicated:

6

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 6 of 13 PageID# 94

Description

Count

Date

(on or

about)

August

3,

2018

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

invoice

“which

includes

two

processing

periods

-

for

the

month

of

July

2018”

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

invoice

“for

two

processing

periods

for

the

month

of

September

2018”

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

invoice

“for

two

processing

periods

for

the

month

of

February

2019”

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

invoice

“for

two

processing

periods

for the

month

of

May

2019”

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

invoice

“for

two

processing

periods

for

the

month

of

June

2019”

1

October

8,

2018

2

March

8,

2019

3

4

June

7,

2019

July

8,2019

5

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

invoice

“three

processing

periods

for the

month

of

June

2019”

6

August

8,

2019

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

invoice

“which

includes

two

processing

periods

in

the

month

of

August

2019”

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

addressing

the

“difficult

service

delivery

problem”

Email

from

defendant

to

Victim

Company

employee

G.C.

in

Virginia

Beach

attaching

“CONFIDENTIAL

DRAFT

Proposal”

September

13,

2019

7

September

25,

2019

October

23,

2019

9

(In

violation

of

Title

18,

United

States

Code,

Section

1343).

7

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 7 of 13 PageID# 95

COUNT

TEN

(Mail Fraud)

Paragraphs

1

through

15

of

the

General

Allegations

section

of

this

Indictment

are

18.

incorporated

by

reference

as

though

fully

set

forth

herein.

The

Marketview

debit

cards

were

regularly

sent

at

defendant’s

direction

via

United

19.

Parcel

Service

(“UPS”),

a

private

and

commercial

interstate

carrier, to

Victim

Company’s

primary

office

in

Virginia

Beach,

Virginia.

Management

would

then

further

distribute

the

debit

cards

to

the

individual

employees

so

they

could

receive

their

salaries.

In

and around

February

2019, A.S.

was

hired

by

Victim

Company

and,

shortly

20.

thereafter,

received a

debit

card

issued

by

Marketview,

which

had

been

mailed

to

Victim

Company

On

or

about

September

26,

2019, A.S. attempted

to

use

the

debit

card

to

withdraw

via

UPS.

$120.00

from

an

ATM

but

was

unable

to

access

his

funds.

In

and around

February

and

March

2019,

in

the

Eastern

District

of

Virginia

and

21.

elsewhere,

DERICKSON

LAWRENCE,

for

the

purpose

of executing

the

above-described

scheme

and

artifice to

defraud

and

to

fraudulently

obtain

money

and

property

by

means

of

materially

false

and

fraudulent

pretenses,

representations,

and

promises,

did

knowingly

cause

to

be

delivered

by

mail

and

by

private

and

commercial

interstate

carrier

according

to

the

direction

thereon

and

at

the

place

at

which

it

was

directed

to

be

delivered

by

the

person

to

whom

it

was

addressed

the

following

matter:

a

debit

card

for

the

benefit

of

Victim

Company

employee

A.S.

(In

violation

of

Title

18,

United

States

Code,

Section

1341).

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 8 of 13 PageID# 96

COUNT

ELEVEN

(Wire

Fraud)

The

United

States

Small

Business

Administration

(SBA)

was

an

executive-branch

22.

agency

of

the

United

States

government

that

provided

support

to

entrepreneurs

and

small

The

mission

of

the

SBA

was

to

maintain

and

strengthen

the

nation’s

economy

by

businesses.

enabling

the

establishment

and

viability

of small

businesses

and

by

assisting

in

the

economic

recovery

of

communities

after disasters.

As

part

of

this

effort,

the

SBA

enabled

and

provided

for

loans

through

banks,

credit

23.

unions

and

other

lenders.

These

loans

have

government-backed

guarantees.

In

addition

to

traditional

SBA

funding

programs,

The

Coronavirus

Aid,

Relief,

and

Economic

Security

(“CARES”)

Act,

which

was

signed

into

law

in

March

2020,

established

several

new

temporary

programs

and

provided

for the

expansion

of

others

to

address

the

COVID-19

pandemic.

One

of

these

new

programs

was

the

SBA

paycheck

Protection

Program

(“PPP”),

24.

which

provided

for

loans

as a

direct

incentive

for

small

businesses

to

keep

their

workers

on

the

payroll.

Under

this

program,

the

SBA

forgave

all

or

part

of

loans

if

the

applying

business

kept

its

employees

on

the

payroll

for

eight

weeks

and

submitted

documentation

confirming

that

the

loan

proceeds

were

used

for

payroll,

rent,

mortgage

interest,

or

utilities.

Interested

applicants

applied

through

an

existing

SBA

lender

or

any

other

participating

federally

insured

financial

institution.

The PPP

application

process

requires

applicants

to

submit

a

Borrower

Application

25.

Form

through

an

SBA-approved

financial

entity,

signed

by

an

authorized

representation

of

the

business.

The

application

contained

information,

among

other

things,

as

to

the

purpose

of

the

loan,

average

monthly

payroll,

number

of

employees

and

background

of

the

business

and

its

These

figures

were

used

by

the

lender

to

calculate

the

amount

of

money

the

small

owner.

business

was

eligible

to

receive

under

the

PPP.

In

addition,

applicants

had

to

provide

9

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 9 of 13 PageID# 97

documentation

showing

their

payroll

expenses.

Applicants

were

also

required

to

make

good

faith

certifications,

including

that

economic

uncertainties

have

necessitated

their

loan requests

for

continued

business

operations

and

that

they

intend

to

use

loan

proeeeds

only

for the

authorized

The

lenders

relied

on

the

aeeuracy

of

the

information

and

not

any

duplicative

purposes.

contained

in

the

PPP

applications

and

supporting

documents.

However,

individual

PPP

loans

were

issued

by

26.

The

SBA

oversaw

the

PPP.

private,

approved

lenders

who

received

and

processed

PPP

applications

and

the

supporting

documentation,

and

then

made

loans

using

the

lenders’

own

funds,

which

were

100%

guaranteed

by

the

SBA.

Data from

the

application,

including

information

about

the

borrower,

the

total

amount

of

the

loan,

and

the

listed

number

of

employees,

was

transmitted

by

the

lender,

or

by a

partner

on

the

lender’s

behalf,

via

wire

to

the

SBA

in

the

course of processing

the

loan.

For

application

submitted

through

August

8,2020,

the

SBA

used

the

E-Tran

server

located

in

Sterling,

Virginia,

within

the

Eastern

District

of

Virginia,

to

process

the

applicant’s

data

electronically

to

determine

if

a

loan

should be

authorized.

Similarly,

after

its

review,

the

SBA

used

the

E-Tran

computer

server

located

in

Sterling,

Virginia,

to

notify

the

lenders, or

a

partner

on

the

lender’s

behalf,

electronically

if

a

loan

should be

funded.

27.

TD

Bank,

N.A.,

is

a

financial

institution

headquartered

in

Cheny^

Flill,

New

Jersey.

TD

Bank

participated

in

the

PPP

as

a

lender,

and,

as

such,

was

authorized

to

lend

funds

to

eligible

borrowers

under

the

terms

of

the

PPP.

28.

During

the

relevant

time

period,

defendant

was

the

Chief

Executive

Officer

and

sole

owner

of a

business

called

Marketview,

Inc.

(“Marketview”)

which

conducted

business

out

of a

physical

location

in

Mount

Vernon,

New

York,

where

defendant

also resided.

10

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 10 of 13 PageID# 98

Between

in

and around

April

6,

2020

to in

and around

May

13,

2020,

in

the

Eastern

29.

District

of

Virginia

and

elsewhere,

DERICKSON

LAWRENCE,

defendant

herein,

knowingly

devised

and

intend

to

devise

a

scheme

and

artifice

to

defraud

and

for

obtaining

money

and

property

by

means

of

materially

false

and

fraudulent

pretenses,

representations,

and

promises

affecting

a

financial

institution,

for

which

the

defendant

transmitted

and

caused

to

be

transmitted

by

means

of

wire

communications

in

interstate

commerce

certain

writings,

signs,

signals,

and

sounds

for the

purpose

of executing

the

scheme

and

artifice to

defraud

and

for

obtaining

money

by

means

of

materially

false

and

fraudulent

pretenses,

representations,

and

promises.

The

primary

purpose

of

the

scheme

and

artifice to

defraud

was

for

defendant

to

30.

fraudulently

obtain

pandemic-related

benefits

in

the

form

of

SBA

Paycheck

Protection

Program

(PPP)

loans

using

Marketview.

It

was

part

of

the

scheme

and

artifice

that

defendant submitted

an

application

for

a

31.

loan

under

the

PPP

programs

that

contained

false

statements,

misrepresentations,

and

omissions

related

to

Marketview’s

payroll

and

employees.

It

was

further

part

of

the

scheme

and

artifice

that

defendant

falsely

attested

on

the

32.

PPP

loan

applications

that

the

information

provided

in

the

application

and

the

information

provided

in

all

supporting

documents

was

true

and

accurate

in

all

material

respects.

It

was

further

part

of

the

scheme

and

artifice

that

defendant

altered

the

supporting

33.

documentation,

to

wit,

bank

statements,

to

falsely

portray

Marketview’s

2020

payroll

by

concealing

that

the

bank

statements

actually

reflected

account

activity

from

February

2016.

It

was

further

part

of

the

scheme

and

artifice

that,

on

or

about

May

13,

2020,

34.

defendant

received

a

PPP

loan

from

TD

Bank

in

the

amount

of $26,250.00.

(In

violation

of

Title

18,

United

States

Code,

Section

1343).

11

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 11 of 13 PageID# 99

FORFEITURE

THE

GRAND

JURY

FURTHER

FINDS

PROBABLE

CAUSE

THAT:

The

defendant,

DERICKSON

LAWRENCE,

if

convicted of

any

of

the

violations

1.

alleged

in

Counts

One

through

Eleven

of

this

Indictment,

shall

forfeit to

the

United

States,

as

part

of

the

sentencing pursuant

to

Federal

Rule

of

Criminal

Procedure

32.2,

any

properly,

real

or

personal,

which

constitutes

or

is

derived

from

proceeds

traceable

to

the

violation.

If

any

property

that

is

subject

to

forfeiture

above

is

not

available,

it

is

the

intention

of

the

United

States

to

seek an

order

forfeiting substitute

assets

pursuant

to

Title

21,

United

States

2.

Code,

Section

853(p)

and

Federal

Rule

of

Criminal

Procedure

32.2(e).

(In

accordance

with

Title

18,

United

States

Code,

Section

981(a)(1)(C)

and

Title

28,

United

States

Code,

Section

2461(c)).

12

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 12 of 13 PageID# 100

United

States

v.

Derickson

Lawrence,

Criminal

No.

2:23-CR-089

A

TRUE

BILL:

Pursunm

to

E-Go\--’mment

Act,

it;c

origiruil

oi'lhi.s

page

has

been

ilicd

under

sea]

in

liie

Clak’i

OiUcc

FOREPERSON

JESSICA

D.

ABER

UNITED

STATES

ATTORNEY

By:

Assistant

U.S.

Attorneys

United

States

Attorney’s

Office

101

WestMain

Street,

Suite

8000

Norfolk,

VA

23510-1671

Phone;

(757)

441-6331

Fax:

(757)441-6689

Email:

13

Case 2:23-cr-00089-JAG-LRL Document 26 Filed 12/13/23 Page 13 of 13 PageID# 101

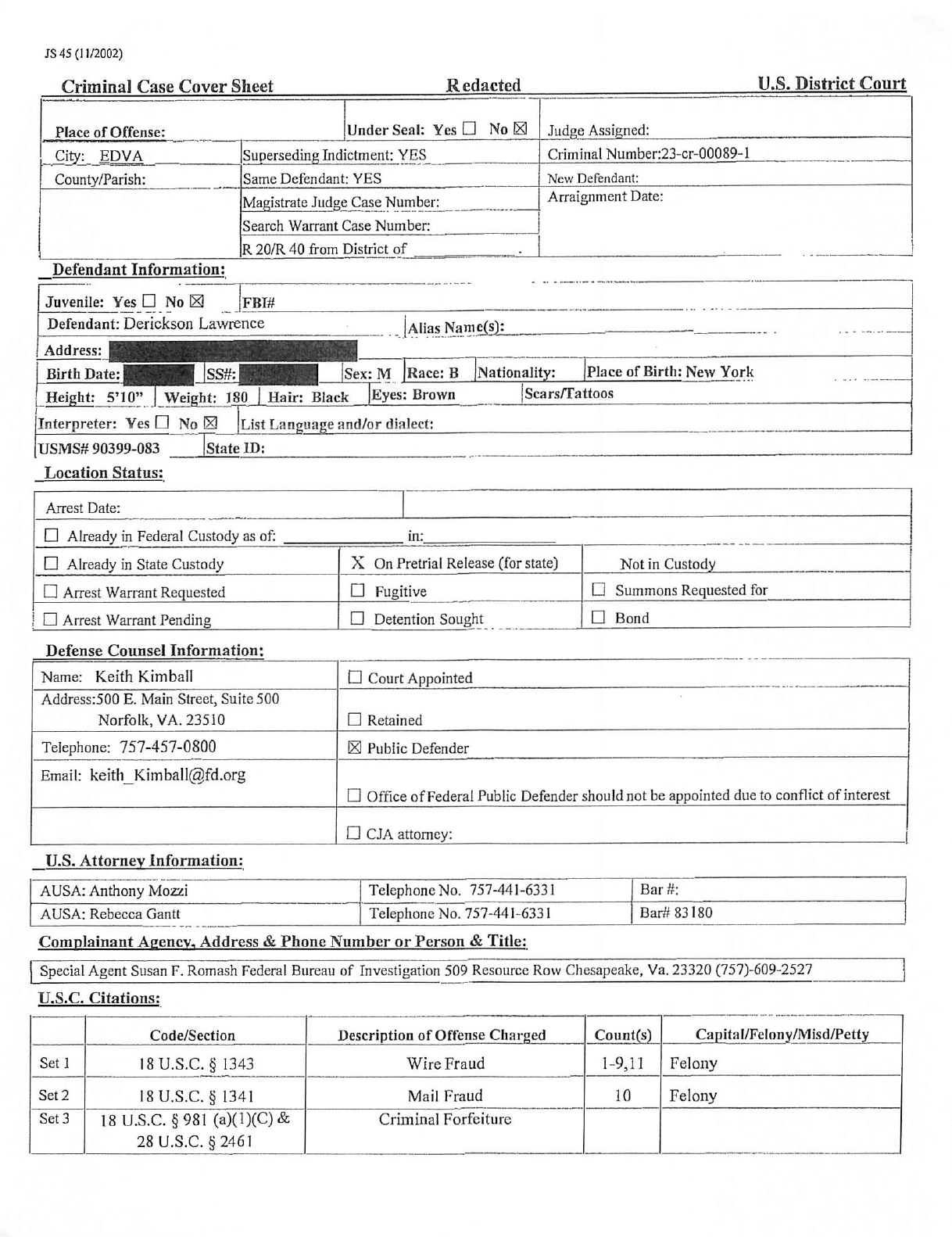

JS 45

(]

1/2002)

l).S.

District

Court

Redacted

Criminal

Case

Cover

Sheet

Under

Seal:

Yes

□

No

Kl

Judge

Assigned:

Place

of

Offense;

Criminal

Number:23-cr-Q0089-l

Superseding

Indictment:

YES

CitVj

_EDyA

County/Parish:

Same

Defendant:

YES

New

Defendant:

Arraignment

Date:

Magistrate

Judge

Case

Number|_

Search

Warrant

Case

Number:

R

20/R40 from

District

of

Defendant

Information;

Juvenile:

Yes

□

No

S

Defendant:

Derickson

Lawrence

FBI#

Alias

Na_ni^s]|

Address:

Place

of

Birth:

New

York

Sex:

M

|Race;

B

|Nationality:

Eyes:

Brown

Birth Date:

SS#:

Scars/Tattoos

Height:

S’lO

Weight;

180

|

Hair;

Black

Interpreter:

Yes

D

No

List

Language

and/or

dialect;

USMS#

90399-083

Location

Status;

State ID:

Arrest

Date:

□

Already

in

Federal

Custody

as

of:

□

Already

in

State

Custody

in:

X

On

Pretrial

Release

(for

state)

Not

in

Custody

□

Summons

Requested

for

□

Fugitive

□

Arrest

Warrant

Requested

□

Bond

n

Detention

Sought

!

□

Arrest

Warrant

Pending

Defense

Counsel

Information:

Name:

Keith

Kimball

□

Court

Appointed

Address:500

E.

Main

Street,

Suite

500

Norfolk,

VA.

23510

n

Retained

Telephone:

757-457-0800

0

Public

Defender

Email:

D

Office of Federal

Public

Defender

should

not

be

appointed

due

to

conflict

of

interest

□

CJA

attorney:

U.S.

Attorney

Information;

Telephone

No. 757-441-6331

Telephone

N^757-44I-6331

Bar

U:

AUSA:

Anthony

Mozzi

Bar#

83180

AUSA:

Rebecca

Gantt

Complainant

Agency,

Address

&

Phone

Number

orPerson

&

Title:

Special

Agent

Susan

F.

Romash

Federal

Bureau

of

Investigation

509

Resource

Row

Chesapeake,

Va.

23320

(757)-609-2527

U.S.C.

Citations:

Capita

l/Felony/Misd/Petty

Comit(s)

Description

of

Offense

Charged

Code/Section

Wire

Fraud

1-9,11

Felony

Setl

18

U.S.C.

§

1343

Mail

Fraud

Felony

10

Set2

18

U.S.C.

§

1341

18U.S.C.

§981

(a)(1)(C)

&

28 U.S.C.

§2461

Criminal

Forfeiture

Set

3

Case 2:23-cr-00089-JAG-LRL Document 26-1 Filed 12/13/23 Page 1 of 1 PageID# 102