Page 1 of 7

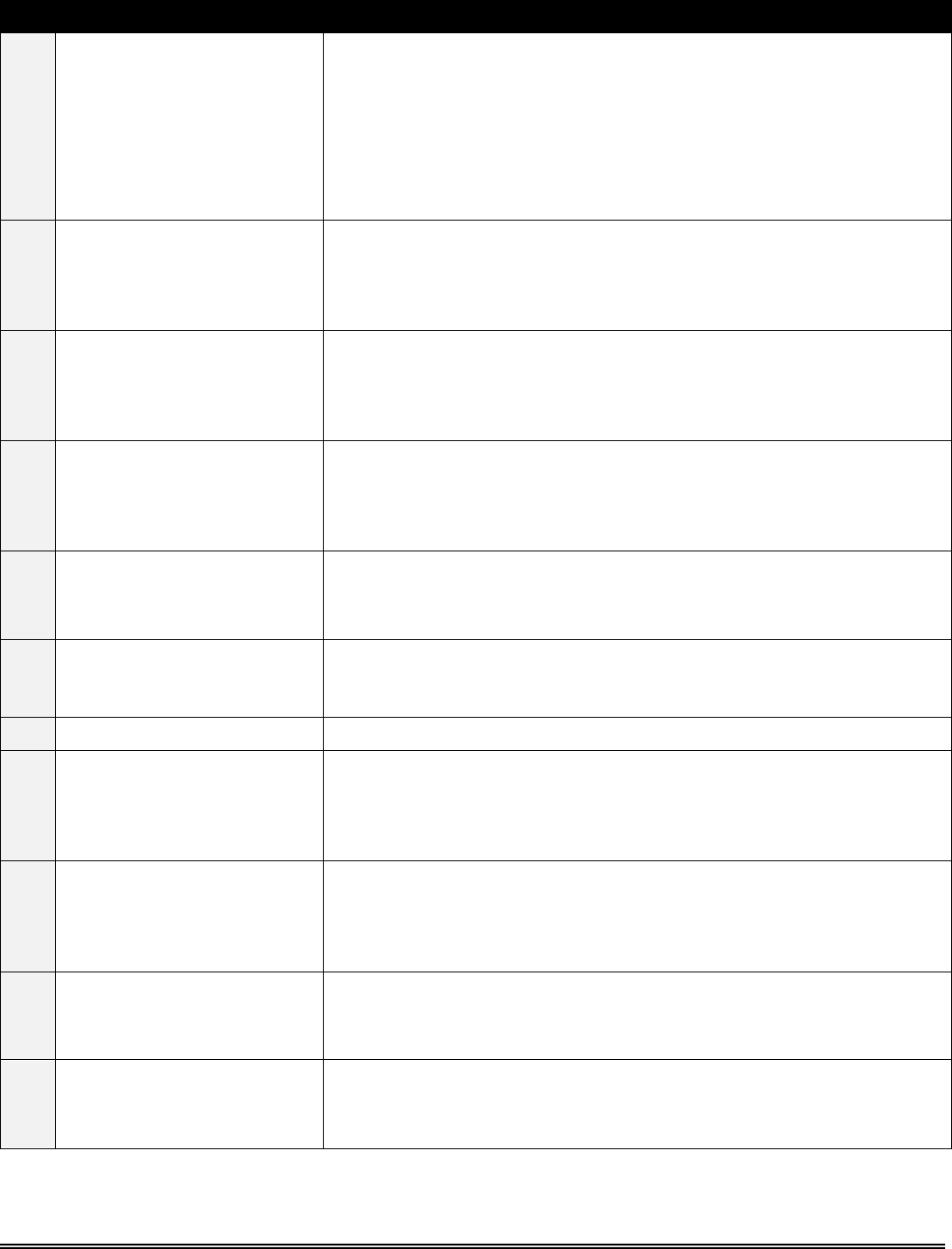

FS Form 7600A Department of the Treasury | Bureau of the Fiscal Service Revised March 2022

UNITED STATES GOVERNMENT

GENERAL TERM & CONDITIONS (GT&C)

INSTRUCTIONS for FS Form 7600A

Agreement Between Federal Program Agencies for Intragovernmental Reimbursable, Buy/Sell Activity - In Accordance with

TFM Volume 1, Part 2, Chapter 4700, Appendix 8.

Required fields for the FS Form 7600A are denoted by an (*)

Additional fields required when an Agency transitions to G-Invoicing are denoted by a (

G

)

https://www.fiscal.treasury.gov/fsservices/gov/acctg/g_invoice/g_invoice_home.htm

NEW OR MODIFIED GT&C

G

General Terms and

Conditions (GT&C) Number

The unique agreement number that must be established between the

Requesting Agency and Servicing Agency which will track each GT&C from

the origination through the completion or termination.

This is a 20 character value (including hyphens) generated by the G-Invoicing

application.

Example: AYYMM-(Req. AID)-(Serv AID)-6 digit sequential #.

Until your Agency transitions to G-Invoicing, each agency should populate

their own unique tracking number in the Agency Agreement Tracking Number

field (below). These numbers do not need to be mutually agreed upon;

however, a mutually agreed upon number could be used if both Agencies

agree on one.

The GT&C number will generate from the G-Invoicing application. Until both

trading partners are using G-Invoicing, agencies will leave this field blank.

Each agency’s internal tracking number should be listed under the Agency

Agreement Tracking Number fields.

*Agency Agreement

Tracking Number

The internal tracking number for the GT&C. This number is generated and

maintained by each Agency’s internal system. Agencies are required to use

this field to associate their own GT&C numbers with the G-Invoicing GT&C.

Note: Many Agencies use this number as a reference in their systems to quickly

identify a GT&C if issues need to be analyzed and resolved.

G

Modification Number

The unique number that identifies a modification to the GT&C. The

modification number is generated by G-Invoicing and added to the end of the

GT&C number after the decimal. This incrementally increases after each

modification.

Note: For a new GT&C, the modification number will be 0.

Until your Agency transitions to G-Invoicing, please increment 1 number for

any modifications.

Authorization of a modification to the GT&C requires approvals by both the

Requesting and Servicing Agencies.

G

Status

Select the current status of the GT&C from the drop-down selection box.

Page 2 of 7

FS Form 7600A Department of the Treasury | Bureau of the Fiscal Service Revised March 2022

DEPARTMENT AND/OR AGENCY INFORMATION

1.

*Agency Name

Enter the G-Invoicing Agency Name that is used for this GT&C. This field is

populated by G-Invoicing as part of an Agency’s account setup.

If the trading partners are in G-Invoicing, the Agency Name on the 7600A

should align with the Agency Account Name within G-Invoicing. However, if

a trading partner is not enrolled in G-Invoicing then the Agency Name should

be as descriptive as possible.

*Group Name

Enter the unique name for the selected Organizational group available in G-

Invoicing. Until your Agency transitions to G-Invoicing, please include a list

of the entities within your Agency that will reference this GT&C on applicable

orders.

Note: Once in G-Invoicing, if the Document Inheritance Indicator is set to Yes

then all groups listed here can access the GT&C.

G

Group Description

The description associated with the group name selected above is populated by

G-Invoicing.

G

Requesting Document

Inheritance Indicator

The Document Inheritance Indicator (DII) identifies whether descendant

organizational groups are allowed to view a document in G-Invoicing below

the Primary Group entering into the GT&C. The default is set to Yes for both

Servicing and Requesting. Servicing Agency can’t update Requesting Agency

DII.

Note: This field is not required until transitioning to G-Invoicing.

Select Yes (Y) or No (N)

G

Servicing Document

Inheritance Indicator

The Document Inheritance Indicator (DII) identifies whether descendant

organizational groups are allowed to view a document in G-Invoicing below

the Primary Group entering into the GT&C. The default is set to Yes for both

Servicing and Requesting. Requesting Agency can’t update Servicing Agency

DII.

Note: This field is not required until transitioning to G-Invoicing.

Select Yes (Y) or No (N)

*Agency Location Code

(ALC)

This is the unique identifier for a federal agency buying/selling goods and/or

services. An ALC is an identifier for an accounting office within an agency

that reports disbursements and collections to Treasury. Enter the 8 digit ALC.

The ALC is available for selection in G-Invoicing. Until your Agency

transitions to G-Invoicing, please locate the appropriate ALC in the

Shared

Accounting Module (SAM).

Note: One to many ALC’s may be listed in this field.

ALC Description

This is the description of the ALC for a federal agency buying/selling goods

and/or services that is generated by G-Invoicing. Until your Agency transitions

to G-Invoicing, please locate the appropriate ALC description in the

Shared

Accounting Module. Please locate the appropriate description in the Trading

Partner Directory in OMB Max. This is the Organization Name plus the

Suborganization Name.

Note: One to many ALC descriptions may be listed in this field. This will

require OMB Max

access.

Subordinate Group

A unique and recognizable name for an Organizational group that is allowed to

use another group's GT&C. This should not include groups that will inherit

access to the GT&C through the Document Inheritance Indicator being set to

Yes.

Page 3 of 7

FS Form 7600A Department of the Treasury | Bureau of the Fiscal Service Revised March 2022

Note: This field is not required until transitioning to G-Invoicing. This field is

limited to 50 groups. Each group name is limited to 100 alphanumeric

characters.

Cost Center

Cost Center is an optional data element within G-Invoicing that Agencies may

use to identify segments within the Organization. Cost Centers can be units

within an Organization where managers are responsible for associated costs

and for adhering to a budget. (Cost Centers are an expense for the

Organization.) If using multiple data elements, please separate each with a

comma.

Business Unit

Business Unit is an optional data element within G-Invoicing that Agencies

may use to identify segments within the Organization. Business Units can be a

segment of an Organization, such as Accounting. If using multiple data

elements, please separate each with a comma.

Department ID

Department ID (Identifier) is an optional data element within G-Invoicing that

Agencies may use to identify segments within the Organization. Department

IDs can be a part of a larger Organization with a specific responsibility or

devoted to one of several major tasks. If using multiple data elements, please

separate each with a comma.

GT&C AGREEMENT INFORMATION

2.

*GT&C Title

The descriptive name given to any GT&C by a Requesting or Servicing

Agency.

3.

G

Order Originating Partner

Indicator

The Order Originating Partner Indicator identifies the trading partner that first

introduces Orders to G-Invoicing under the GT&C agreement. Each GT&C

only allows either the Requesting Agency (R) or the Servicing Agency (S) to

initiate the corresponding Orders, but not both.

Note: This field is not required until transitioning to G-Invoicing.

Select either Requesting Agency (R) or Servicing Agency (S).

4.

*Agreement Period

Agreement Start Date - Enter the date (yyyy/mm/dd) when the GT&C will

begin.

Agreement End Date – Enter the date (yyyy/mm/dd) when the GT&C will

end.

Note: This does not equate to the funding period of availability nor the end of

lagged billing. This is the period that defines when all goods and/or services

will be delivered. All Orders and all Performance Transactions will be bound

by these agreement dates.

5.

Termination Days

Enter the number of days the GT&C requires written notice for termination by

either the Requesting Agency or Servicing Agency.

6.

*Agreement Type

Identifies whether this GT&C will support one (Single) Order or more than

one (Multiple) Orders.

Select the ‘Single Order’ checkbox if this is a one-to-one relationship in which

there is only one Order for the GT&C.

Select the ‘Multiple Orders’ checkbox if this is a one-to-many relationship in

which there is more than one Order for the GT&C.

Page 4 of 7

FS Form 7600A Department of the Treasury | Bureau of the Fiscal Service Revised March 2022

7.

*Advance Payment Indicator

Identifies whether Advance Payments are allowed for the Order(s) supporting

this GT&C.

Select the ‘Yes’ checkbox if Advance Payments are allowed for any or all of

the subsequent Order(s).

Note: If ‘Yes’ is selected, the Servicing Agency Advance Payment Authority

Title and Citation are required upon creation of an Order against this GT&C.

Select the ‘No’ checkbox if Advance Payments are not allowed for the

subsequent Order(s).

8.

*Assisted Acquisition

Indicator

Identifies whether the GT&C will accommodate Assisted Acquisitions. The

Servicing Agency provides acquisition support in awarding and managing

contracts on behalf of the Requesting Agency’s requirements for products or

services.

Select the ‘Yes’ checkbox if the GT&C will accommodate Assisted

Acquisitions.

Note: If ‘Yes’ is selected, items 17 and 18 may be completed to provide

further detail.

Select the ‘No’ checkbox if the GT&C will not accommodate Assisted

Acquisitions.

ESTIMATED AGREEMENT AMOUNT

9.

Total Direct Cost Amount

Enter the total agreed-upon direct cost amount for providing the products

and/or services.

Note: This amount must be greater than or equal to $0.00

Total Overhead Fees and

Charges Amount

Enter the total agreed upon overhead fees and charges for providing the

products and/or services above and beyond direct costs.

*Total Estimated Amount

This is a calculated field that adds Total Direct Cost plus the Total Overhead

Fees and Charges Amount. The Total Estimated Amount does not represent

any reportable obligations or receivables. This is an agreed upon

estimated/projected amount for the duration of the agreement. Agencies may

or may not choose to enforce this amount. Actual amounts will be captured on

the 7600B form.

G

Enforce Total Remaining

Amount

Identifies if G-Invoicing should enforce the total value of orders to remain

below the Total Amount on the GT&C. If "Yes" is selected, G-Invoicing will

not allow Order total to exceed the GT&C total. This is an optional field for

agreements outside of G-Invoicing.

Page 5 of 7

FS Form 7600A Department of the Treasury | Bureau of the Fiscal Service Revised March 2022

ADDITIONAL AGREEMENT INFORMATION

10.

Explanation of Overhead Fees

and Charges

This is a general explanation of how the overhead fees and charges are

calculated.

This provides helpful information to the Requesting Agency on the cost of the

overhead/fees which they are required to pay within their reimbursable

agreement, especially if an agency cannot specifically break out the fees from

the direct costs.

Note: This field may contain up to 4000 alphanumeric characters.

11.

Requesting Scope

Enter the high-level scope of the work to be performed under this GT&C for

all related Orders. Specific details about what is being purchased and related

funding is captured on each Order.

Note: This field may contain up to 4000 alphanumeric characters.

12.

Requesting Roles

Enter the respective roles and responsibilities that the Requesting Agency must

carry out to ensure the effective management and fulfillment of GT&C

requirements.

Note: This field may contain up to 4000 alphanumeric characters.

13.

Servicing Roles

Enter the respective roles and responsibilities that the Servicing Agency must

carry out to ensure the effective management and fulfillment of GT&C

requirements.

Note: This field may contain up to 4000 alphanumeric characters.

14.

Restrictions

Enter the unique requirements and/or mission specific restrictions related to

the GT&C.

Note: This field may contain up to 4000 alphanumeric characters.

15.

Assisted Acquisition Small

Business Credit Clause

The default language for this clause will be included on the form. Agencies

may update this text as necessary. If this clause does not apply to the

agreement, agencies may remove the text and include N/A.

16.

Disputes

Note: This is a static text field that does not require data entry.

17.

Requesting Assisted

Acquisitions

Enter the Requesting Agency’s lists or references of Organizations (Offices,

Bureaus, Divisions, etc.) that are authorized to request acquisition assistance

for the GT&C.

Note: This field may contain up to 4000 alphanumeric characters.

18.

Servicing Assisted

Acquisitions

Enter the Servicing Agency’s lists or references of Organizations (Offices,

Bureaus, Divisions, etc.) that are authorized to provide acquisition assistance

for the GT&C.

Note: This field may contain up to 4000 alphanumeric characters.

19.

Requesting Clauses

Enter any additional Requesting Agency provisions of the agreement. This

field is used to capture more detail for the GT&C.

Note: This field may contain up to 4000 alphanumeric characters.

20.

Servicing Clauses

Enter any additional Servicing Agency provisions of the agreement. This field

is used to capture more detail for the GT&C.

Note: This field may contain up to 4000 alphanumeric characters.

Page 6 of 7

FS Form 7600A Department of the Treasury | Bureau of the Fiscal Service Revised March 2022

21.

Agency Additional

Information

Additional, optional text field to include any information related to this GT&C

not covered in other areas of the form. If including supplemental documents

and/or attachments, those could be listed out in this field.

Note: This field may contain up to 255 alphanumeric characters. This

information can be included in the application by way of an attached file.

There is no data field in the G-Invoicing application to capture this

information.

MODIFY GT&C

22.

Modification Comments

(If Applicable)

Enter an effective modification date for the GT&C (yyyy/mm/dd)

Enter any comments associated with why the GT&C has been modified.

CLOSE GT&C

23.

Closing Comments

(If Applicable)

Enter an effective closing date for the GT&C (yyyy/mm/dd)

Enter any comments associated with why the GT&C has been closed.

REJECT GT&C

24.

Rejection Comments

(If Applicable)

Enter an effective rejection date for the GT&C (yyyy/mm/dd)

Enter any comments associated with why the GT&C has been rejected.

PREPARER INFORMATION

25.

*Preparer Name

Enter the name of the person who prepared (initiated) the GT&C. This is

derived from the user's login credentials within the application.

*Preparer Phone

Enter the phone number of the person who prepared (initiated) the GT&C.

This is derived from the user's login credentials within the application.

*Preparer Email

Enter the email address of the person who prepared (initiated) the GT&C. This

is derived from the user's login credentials within the application.

AGREEMENT APPROVALS

By signing this agreement, you authorize the General Terms and Conditions as stated, and that the scope of the work can

be fulfilled. By signing, you agree to periodically review the terms and conditions of the agreement and make any

necessary modifications to the GT&C and any affected Order(s).

REQUESTING/SERVICING INITIAL APPROVALS

26.

*Approver’s Name

Enter the name of the Requesting/Servicing Agency's official Initial Approver

of the GT&C.

*Signature

This is the actual signature of the Requesting/Servicing Agency’s official

Initial Approver of the GT&C.

Title

Enter the title of the Requesting/Servicing Agency's official Initial Approver of

the GT&C.

*Email

Enter the email of the Requesting/Servicing Agency's official Initial Approver

of the GT&C.

*Phone

Enter the phone number of the Requesting/Servicing Agency’s official Initial

Approver of the GT&C.

Fax

Enter the fax number of the Requesting/Servicing Agency's official Initial

Approver of the GT&C.

*Date (yyyy/mm/dd)

Enter the date the Requesting/Servicing Agency's official Initial Approver

signed the GT&C.

Page 7 of 7

FS Form 7600A Department of the Treasury | Bureau of the Fiscal Service Revised March 2022

REQUESTING/SERVICING FINAL APPROVALS

27.

*Approver Name

Enter the name of the Requesting/Servicing Agency's official Final Approver

of the GT&C.

*Signature

This is the actual signature of the Requesting/Servicing Agency’s official Final

Approver of the GT&C.

Title

Enter the title of the Requesting/Servicing Agency's official Final Approver of

the GT&C.

*Email

Enter the email of the Requesting/Servicing Agency's official Final Approver

of the GT&C.

*Phone

Enter the phone number of the Requesting/Servicing Agency’s official Final

Approver of the GT&C.

Fax

Enter the fax number of the Requesting/Servicing Agency's official Final

Approver of the GT&C.

*Date (yyyy/mm/dd)

Enter the date the Requesting/Servicing Agency's official Final Approver

signed the GT&C.