CBC | APRIL 2019

Brewery Records,

Reports, and Returns

1

CHARYL SJOWALL

Investigator

MISSY KELLER

Tax Specialist

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

CBC | APRIL 2019

Records, Reports & Returns

Records

Operations

Report

Excise Tax

Return

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

3

CBC | APRIL 2019

Required Records | Purpose

• Captures each day’s brewery operations

• Source documents for all entries on the Brewers Reports and

Excise Tax Returns

• What a TTB auditor reviews to support your tax liability and

compliance

• See 27 CFR part 25 – Beer

– Subpart U

• Sections 25.291 - 25.301

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

4

CBC | APRIL 2019

Records | Basic Info

27 CFR 25.291

• Brewers are required to:

– maintain daily records that capture brewery operations

– make required daily transactions by the close of the next business

day

– maintain records at the brewery and make them available for

inspection by TTB

– Retain required records for 3 years

• If certain requirements are met, electronic records may be

retained on equipment located off the brewery premises

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

5

CBC | APRIL 2019

Daily Records | General

27 CFR 25.291

• There is generally no required format for required records

• Records may be self-created spreadsheets/documents,

invoices, computer-generated summaries, commercial or

business documents, bills of lading, credit memos, or TTB

required forms

• Records must accurately and clearly reflect the details of

each operation and/or transaction, and must contain all the

necessary data

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

6

CBC | APRIL 2019

Daily Records of Operations & Daily Summaries

8

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

25.292 has two parts:

(a): Daily Records

(b): Daily Summaries

25.292(a) basically

has five subject areas:

1. materials & production

2. packaging

3. removals

4. returns

5. other

Beer * = beer & cereal beverage

CBC | APRIL 2019

Daily Records of Operations

27 CFR 25.292(a)(1) – (19)

Most Commonly Used Records:

• Raw materials received (used for beer production)

• Beer produced by fermentation

• Beer transferred to/from packaging (bottling and/or racking)

• Beer packaged (bottled and/or racked)

• Beer removed for consumption or sale – beer transferred to serving/tax-

determined tanks, or packaged and transferred to a cooler/taxpaid

storage

• Beer returned to brewery

• Beer lost due to breakage, theft, or destroyed

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

9

NOTE: when used here, “Beer” means “beer or cereal beverage”

CBC | APRIL 2019

Daily Summary Records

27 CFR 25.292(b)(1)–(6)

• Each day, brewers must also summarize a few of the daily

records:

– Beer packaged (bottled and/or racked)

– Beer removed for consumption or sale

– Beer returned to the brewery from which removed

– Beer returned after removed from another brewery owned by the

brewer

– Brewing materials, beer in process, and finished beer on hand

• You may maintain daily summary records on the associated daily

records

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

10

CBC | APRIL 2019

Example Production Record – Batch Record /

Brewing Log

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

11

CBC | APRIL 2019

Example Materials Received/Used Record

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

12

27 CFR 25.292(a)(1)(2) & (b)(6)

CBC | APRIL 2019

Example Packaging Record

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

13

CBC | APRIL 2019

Example Removal Record (Brewpub)

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

14

Finished beer

transferred (removed)

from a fermenter to a

serving tank/tax-

determined tank

CBC | APRIL 2019

Example Removal Record

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

15

Packaged beer removed

from bonded storage area,

and sold or delivered to

retailers/the public

CBC | APRIL 2019

Example Returns to Brewery Record

• Lost due to

breakage, theft,

etc.

• Destroyed

• Returned to

brewery

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

16

CBC | APRIL 2019

Beer Removed Without Payment of Tax

27 CFR 25.292(a)(9)–(11)

• Beer may be removed without tax payment ONLY when:

– Transferred in bond to another brewery

– Unfit for beverage use

– Used for analysis or testing

– Transferred to a distilled spirits plant

– Exported/used as supplies for vessels and aircraft

– For personal use: only sole proprietorships and partnerships. The annual

limit is 100 gallons per household with one adult or 200 gallons for

households with two or more adults (27 CFR 25.207)

• See 27 CFR Subpart L 25.181 – 207 for details on these kinds of removals

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

17

CBC | APRIL 2019

Beer Removed Without Payment of Tax

Consumed on Premises - 27 CFR 25.292(a)(9)–(11)

Quarterly Report:

Lines 11 – 14:

removed without

payment of tax

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

18

CBC | APRIL 2019

Beer Removed Without Payment of Tax

Exports - 27 CFR 25.292(a)(9)

• Beer Exported – for details see 27 CFR part 28

– Direct export without payment of tax

• Industry Circular 2004-3 Alcohol and Tobacco Export Documentation

Procedures

• TTB Form 5130.12 - Beer for Exportation

– Export tax paid with benefit of drawback

• TTB F 5130.6 - Drawback on Beer Exported

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

19

CBC | APRIL 2019

Inventory Records

27 CFR 25.294

Monthly Physical Inventory

• Required every month

• May be taken within 7 days of the end of the month

• Must include the following information

– Date taken

– Quantity of beer on hand

– Losses, gains, shortages

– Signature under penalty of perjury

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

20

CBC | APRIL 2019

Example Inventory Record

Larger Breweries Reporting on TTB Form 5130.9

21ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

CBC | APRIL 2019

Example Inventory Record

Smaller Breweries Reporting on TTB Form 5130.26

22ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

NOTE to Small breweries/brewpubs:

A similar format could also be used for

your Daily Summary of Daily

Production Records/ Brew Logs

27 CFR 25.292(a)(2) or (b)(5)

CBC | APRIL 2019

Common Issues: Loss vs. Shortage

27 CFR 25.292(a)(16)

• Loss: beer lost due to a known event like breakage, spillage

or theft

– Losses are NOT taxed

• Shortage: missing quantity of beer disclosed by physical

inventory count/unexpected

– Shortages MAY be taxed

– Brewer must submit a claim and provide a plausible explanation for

the shortage, identify/address defects, or tax may be assessed

• For details on filing claims see 27 CFR 25.283

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

23

CBC | APRIL 2019

Common Issues: Recording Beer Destructions

27 CFR 25.292(a)(14)

• Destructions ON Brewery Premises

– BEER NOT TAX PAID / TAX DETERMINED

• Note the batch record or prepare a destruction record as detailed in §25.225

• Prior notice and reporting is not required as per §25.221

– BEER TAX PAID / TAX DETERMINED

• Prepare a destruction record as detailed in §25.225

• May file a claim for credit of taxes paid

• For details on destructions see 27 CFR Subpart N 25.221–25.225

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

24

CBC | APRIL 2019

Common Issues: Recording Beer Destructions

27 CFR 25.292(a)(14)

• Destructions OFF Brewery Premises:

– Submit Notice of Intent of Destruction on brewery letterhead and fax it

to the NRC: (202) 453-2979

– For credit on taxes paid, within 6 months show as adjustment on the tax

return and/or file a claim

• For details on destructions, see 27 CFR subpart N: 25.221–25.225

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

25

CBC | APRIL 2019

Common Issues: Recording Returns

27 CFR 25.292(a)(12)(13)

• Removed from/returned to same brewery:

– May take an offset against that day’s removals

• Removed from/returned to a different brewery, same

ownership:

– May file a claim for refund of tax or make a decreasing adjustment

on the tax return – but may not take an offset

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

26

27 CFR 25.212 & 25.213

CBC | APRIL 2019

Records | Best Practices

• Familiarize yourself with 27 CFR 25.292 and 25.294

• Build recordkeeping duties into the daily work schedule

• Keep detailed records: who, what, when, where, why, and how

much

• Be vigilant about recording production, removals, returns,

destructions, losses and shortages

• IN SUMMARY: record all operations and transactions at the

brewery as soon as possible

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

27

CBC | APRIL 2019

Records, Reports & Returns

Records

Operations

Report

Excise Tax

Return

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

28

CBC | APRIL 2019

Beer Barrel Equivalency

• 1 barrel = 31 gallons

• Barrels are the standard unit for tax and reporting

• Taxable removals in kegs must be computed as barrels by

using the tables found in 27 CFR 25.156

• Taxable removals in bottles and cans must be computed as

barrels by using the tables found in 27 CFR 25.158

• If beer is to be removed in OTHER sizes, the brewer shall

notify the NRC in advance and request to be advised of the

fractional barrel equivalent

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

29

CBC | APRIL 2019

Beer Barrel Equivalency

• Example: Barrel equivalent factor for 24/12 = 0.07258

– 24 oz. bottles

– 12 bottles per case

– 75 cases removed x 0.07258 = 5.4435 beer barrels

– Use 5.44 beer barrels to compute tax

• You must compute to 5 decimal places on removal records

– The sum of the quantities computed for any one day will be rounded to

2 decimal places and the tax will be calculated and paid on the rounded

sum

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

30

CBC | APRIL 2019

Operations Report

• Reports are due the 15

th

day following the close of the

reporting period

• You must file a report even if there was no activity during

period

• File quarterly if your tax liability does not exceed $50,000 in

the current or prior calendar year

• File monthly if your tax liability is more than $50,000 in the

current or prior a calendar year

• There is no annual filing option for reports

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

31

CBC | APRIL 2019

Operations Reports

• TTB Form 5130.26 – Quarterly Brewer’s Report of Operations

(if eligible)

- OR -

• TTB Form 5130.9 - Brewer’s Report of Operations

• Note: Instructions are available for each form:

– TTB Form 5130.26i and TTB Form 5130.9i

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

32

CBC | APRIL 2019

Records, Reports & Returns

Records

Operations

Report

Excise Tax

Return

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

37

CBC | APRIL 2019

Tax Rates for Domestic Beer

40ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

* Additional rules regarding controlled groups and single taxpayers apply

Tax Rates for Domestic Beer Removed During Calendar Years 2018 and 2019*

Beer Produced by the Brewer

Beer Not Produced

by the Brewer

Domestic Brewer who

brews 2,000,000 barrels

or less per calendar

year

First 60,000 BBLs

Over 60,000 up to

2,000,000

All BBLs

$3.50 $16.00

$18.00

Domestic Brewer who

brews more than

2,000,000 barrels per

calendar year

First 6,000,000 BBLs Over 6,000,000 BBLs

$16.00 $18.00

CBC | APRIL 2019

When is There Beer Tax Liability?

“Tax is hereby imposed on all beer brewed or produced and

removed for consumption or sale within the U.S. or imported

into the U.S.”

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

41

26 U.S.C. 5051(a)

CBC | APRIL 2019

Excise Tax Return Filing Frequency

• Annually: You may file 1 tax return per year if you are liable

for $1,000 or less of tax on beer in the current and prior

calendar year

• Quarterly: You may file quarterly if you are liable for $50,000

or less of tax on beer in the current and prior calendar year

– Quarters end March, June, September, December

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

42

NOTE: Additional rules apply to controlled groups and multiple breweries with the same EIN

27 CFR 25.164

CBC | APRIL 2019

• Semi-Monthly: You must file a tax return two times per

month if you are liable for more than $50,000 in beer tax in

the current and prior calendar year

– The return periods are:

• 1

st

through the 15

th

• 16

th

through the end of month

– Special rule for September — there is a third return period

• 1

st

through the 15th

• 16

th

through the 25th*

• 26

th

through the 30th*

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

43

Excise Tax Return Filing Frequency

27 CFR 25.164

* See 27 CFR 25.164a(a)(1) for return periods if required to pay by EFT

CBC | APRIL 2019

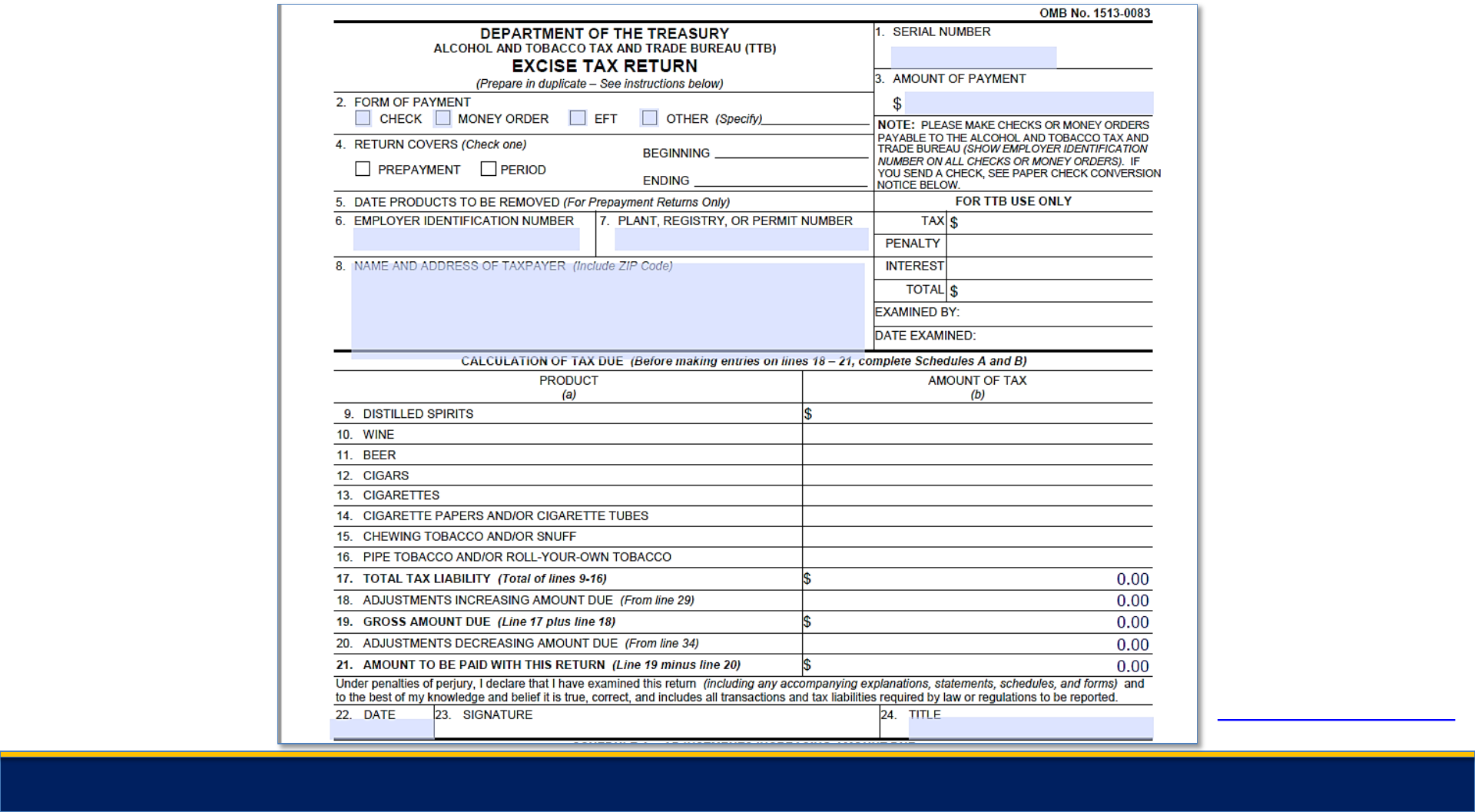

Excise Tax Return - TTB Form 5000.24

• Tax returns (and payment, if any) are due the 14

th

day after

the close of the tax period

– If the due date falls on a weekend or legal holiday, the due date is

the immediately preceding business day

• Due date schedule for each year is available on our website

– https://ttb.gov/tax_audit/fed_ex_tax_due.shtml

• You must file a return even if you have $0 taxes due

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

44

27 CFR 25.164

CBC | APRIL 2019

Email Reminders for Filing Tax Returns and

Reports

• Stay current with due dates by subscribing to receive

automated email reminders about when to file tax returns

and reports of operations

• Visit https://www.ttb.gov/news/automated-reminders-

filing.shtml

to sign up for email reminders

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

45

CBC | APRIL 2019

Tax Calculation

46ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

Excise Tax

Return

?

Operations

Report

CBC | APRIL 2019

47

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

CBC | APRIL 2019

Example Reconciliation of Tax Returns to

Report of Operations

48ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

Removed for Consumption or Sale (bbls) Tax Rate

Total Tax

Kegs

500

Cases 700

Tavern 900

2100 3.50 7350.00

Less Returns as Offsets

Cases 200 3.50 700.00

6,650.00

S/N 2019-1 6,650.00

Not e:

Adjustments to tax liability are a separate matter

Report of Operations

Tax Returns

Rec onc iliation Report of Operat ions to T ax Returns

1/1/2019-3/31/2019

CBC | APRIL 2019

Tax Return – TTB Form 5000.24

49ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

2019-1

03/31/2019

01/01/2019

CBC | APRIL 2019

Tax Return – TTB Form 5000.24

50ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

04/08/2019

CBC | APRIL 2019

Tax Return – TTB Form 5000.24

51ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

CBC | APRIL 2019

Pay.gov

• You may electronically file tax returns, file operations reports,

and pay taxes through

Pay.gov

– Secure

– Convenient and fast

– Free

– Checks entries and totals for accuracy

• For more information on how to register, go to

• https://www.ttb.gov/epayment/epayment.shtml

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

52

CBC | APRIL 2019

Mailing Address for Returns & Payments

• If filing by mail, please be sure to use the correct address

• Late returns or payment are subject to penalties and interest

• DO NOT mail returns or payments to the National Revenue

Center in Cincinnati, Ohio

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

53

TTB

Excise Tax

P.O. Box 790353

St. Louis, MO 63179-0353

CBC | APRIL 2019

• If filing operations reports by mail, please be sure to use the

correct address

Mailing Address for Operations Reports

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

54

Director, National Revenue Center

TTB

550 Main St, Suite 8002

Cincinnati, OH 45202-5215

CBC | APRIL 2019

55

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU | TTB

Summary & Questions